Abstract

This study proposes a new approach for testing for random walk behavior in daily Bitcoin returns (19/07/2010–03/03/2022) by contextualizing the Dickey-Fuller test in time-frequency space using continuous complex wavelet transforms. By splitting our full sample into smaller sub-sample periods segregated by Bitcoin halving dates, we find that Bitcoin returns are most predictable or least market efficient (i) at higher frequency or short-run cycles of between 2 and 16 days, (ii) between November-February months, (iii) during ‘bubble’ periods, (iv) across the consecutive halving dates, (v) during the ‘Black Swan event’ caused by financial market turmoil arising from the COVID-19 pandemic, and (vi) subsequent to the announcements of new COVID-19 variants. Altogether, our findings have important policy implications for different stakeholders in Bitcoin markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The pseudonymous person(s) Satoshi Nakamoto developed Bitcoin as an open source software code that implements a decentralized peer-to-peer system for electronic transactions and its design is “…based on cryptographic instead of proof, allowing two willing parties to transact directly with each other without the need for a trusted third party…” (Nakamoto, 2009). Naturally, earlier academic work on Bitcoin, and the development of cryptocurrency markets, was mainly centered around research in fields of computer sciences (Merediz-Sola & Bariviera, 2019) but quickly attracted interest amongst financial economists and regulatory authorities following the exponential growth of Bitcoin prices, trade volume and market capitalization experienced over the last decade or so (Smith & Kumar, 2018; Corbert et al., 2019).

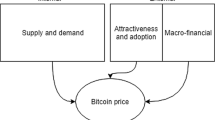

The growing consensus within the economics paradigm is that Bitcoin bears certain characteristics of traditional financial assets. For instance, Baur et al., (2018) find that Bitcoin has financial features of a speculative asset as opposed to a medium of exchange and performs poorly as a unit of account or store of value because of its high volatility. Other authors find that Bitcoin can be used for hedging purposes against equity assets (Garcia-Jorcano & Benito, 2020), currencies (Urquhart & Hanxiong, 2019; Bedi & Nashier, 2020) and commodities such as gold (Pal & Mitra, 2019) and oil (Symitsi & Chalvatzis, 2019). Moreover, in similarity to other traditional financial assets, Bitcoin is affected by policy announcements (Pyo & Lee, 2020), social media (Shen et al., 2019; Kraaijeveld. and De Smedt, 2020; Geugan & Renault 2021), google trends/investor sentiments (Urquhart, 2018; Shen et al., 2019; Bouri & Gupta, 2021) and has been punctuated by episodes of bubble-like behavior (Chaim & Laurini, 2019; Xiong et al. 2020; Hafner 2020; Kyriazis et al., 2020; Moosa, 2020; Enoksen et al., 2020).

Due to its similarity to financial assets, Bitcoin has inherited some of the classical academic debates on assets markets, chief among these is the efficient market hypothesis (EMH), which questions whether financial markets are informationally efficient or not. Fama (1970) identifies three forms of information (i.e. private, public and historic) which rational participants can use to influence market efficiency. Markets are considered to be informational efficient if new information is immediately absorbed into asset prices and cannot be used for predicting purposes. From the Bitcoin literature, most studies focus on weak form market efficiency, that is, determining whether market participants can use historic information from the Bitcoin time series to predict future returns and thus ‘beat the market’. These studies employ a wide range of statistical tools to determine whether Bitcoin returns evolve as a random walk/martingale process (efficient) or stationary/long-memory process (inefficient) (see Merediz-Sola & Bariviera, 2019; and Corbert et al. 2019, for indepth reviews).

The general consensus derived from literature is that Bitcoin is only market (in)efficient over certain time periods (i.e. time-varying efficiency), as insinuated by the adaptive market hypothesis (AMH) of Lo (2004), although these studies identify different time periods or structural break points when the Bitcoin market switches from being inefficient to market efficient or vice versa (Urquhart, 2016; Nadarajah & Chu, 2017; Bariviera et al., 2017; Bariviera, 2017; Tiwari et al., 2018; Jiang et al., 2018, Alvarez-Ramirez et al., 2018; Zhang et al., 2018; Vidal-Tomas et al., 2018; Khuntia & Pattanayak 2018; Aggarwal, 2019; Chu et al., 2019; Sensoy, 2019; Tran & Leirvik, 2020; Vidal-Tomas, 2020; Wu & Chen, 2020; Lopez-Martin et al., 2021; Manahov & Urquhart, 2021; Yaya et al., 2021). There also exists a smaller and more recent strand of studies (Corbet & Paraskei, 2020; Naeem et al., 2021) which identify a different mechanism for asymmetric behavior in the Bitcoin returns in which market efficiency switches between bear and bulls markets. These later studies insinuate asymmetric cyclical behavior in market efficiency for Bitcoin returns which differ from the time-varying dynamics identified in other literature.

Our study proposes a novel method of simultaneously examining time-varying and cyclical-varying dynamics in the random walk model of Bitcoin prices as a means of testing for market efficiency. Using continuous wavelet transforms, we develop a random walk testing procedure for Bitcoin returns in a time frequency domain which are consistent with the assumptions underlying the traditional Dickey-Fuller test for (non)stationarity. The mathematical precision wavelets present in capturing the temporal and spectral dynamics in the co-movement between a pair of time series allows us to gain new insights to random walk behavior of Bitcoin time series as we are able to capture different cycles of weak-form market efficiency/inefficiency across different time periods. Notably, similar wavelet coherence techniques have been widely applied in the cryptocurrency literature to examine the time-frequency co-movement between Bitcoin and gold (Kang et al., 2019), Bitcoin returns and volatility (Qiao e al., 2020), Bitcoin and COVID-19 health statistics (Goodell & Goutte, 2021) and Bitcoin and COVID-19 fear index (Rubbanly et al., 2021).

The main contribution of our study is that it harmonizes ‘bits-and-pieces’ of seemingly contradictory empirical evidences found in the previous literature which have investigated the efficiency of Bitcoin markets. Firstly, our study demonstrates that the Bitcoin market has been alternating between efficiency and in(efficiency) more frequently yet irregularly than previously studies suggested. Secondly, we find that Bitcoin returns are more predictable or market inefficient during November to February periods every year which reflect calendar effects anomalies recent confirmed by Kaiser (2019), Baur et al., (2019), Kinateder & Papavassiliou (2021) and Qadan et al., (2021). Thirdly, we find that Bitcoin markets are most inefficient during periods in which Bitcoin markets experience bubble build-ups and crashes. Fourthly, our study is consistent with literature which suggest that predictability in Bitcoin markets is more prominent over the short-run or at high-frequency oscillations (Kakinaka & Umeno, 2021). Fifthly, consistent with more recent literature, we find that COVID-19 pandemic has an adverse impact on market efficiency of Bitcoin markets (Manif et al., 2020; Kakinaka & Umeno 2021; Naeem et al., 2021).

We also present novel evidence suggesting that overall market efficiency in Bitcoin markets has been progressively diminishing across the Bitcoin halving dates in which the supply of the cryptocurrency is consecutively halved in four-year cycles. Moreover, our study further finds that during the post-2021 period, whom Rouatbi et al., (2021) dub the ‘immunization period of the COVID-19 pandemic’, Bitcoin has been become more frequently market inefficient as more variants of the diseases have been announced by the health community. Altogether, this study not only adds new knowledge to the scientific literature but also has important implications for different stakeholders in Bitcoin markets.

The rest of the study is structured as follows. The next section presents the empirical data and study outlines the empirical approach of the study. The third section presents the empirical results whilst section four concludes the study.

2 Data and preliminary analysis

Our study uses daily data of Bitcoin closing prices in US$ (pt) collected from 19th July 2010 to 3rd March 2022, sourced from COINDESK and we compute the returns (rt) on Bitcoin as rt = log(pt) – log (pt−1). As a preliminary exercise, we compute the summary statistics and perform the ADF and DF-GLS unit root tests on Bitcoin prices and returns. Moreover, for comparative purposes we spilt our full sample into four smaller sample which are segregated by the Bitcoin halving dates of 28th October 2012, 8th July 2016 and 11th May 2020. We consider these dates as relevant break points as they describe the ‘halving mechanism’ of issuing new bitcoins in four cycles until its diminish in 2040 and these dates represent an important technical aspect in the functioning of Bitcoin (Meynkhard, 2019; Eksi & Schreiti, 2022). To validate these break points, we perform Chow test at each of the three halving dates and report statistics of 321.35 (3.38), 1559.25 (1.96) and 9362.07 (0.28) for Bitcoin prices (returns), respectively. We therefore conclude on observing statistically significant breaks for all halving dates for the case of Bitcoin prices whereas those for Bitcoin returns are only significant at the first halving date.

Table 1 reports the descriptive statistics and unit root tests for Bitcoin prices and returns series and based on the results we summarize four important stylized facts which may be difficult to observe from the time series plots presented in Figs. 1 and 2, respectively. Firstly, we note that the averages and volatilities of Bitcoin price (returns) has been increasing (decreasing) across consecutive halving sub-sample periods with the sole exception of the case of Bitcoin returns between 3rd and 4th sub-samples which experience increases in average values. Secondly, Bitcoin prices have been progressively decreasing from a positive skew in the first three sub-samples to a negative skew in the 4th sub-sample whilst Bitcoin returns sharply changed from positive to negative skew between the 1st and 2nd subsamples and thereafter has progressively moved towards being positively skewed in the last sub-sample period. Thirdly, both Bitcoin prices and returns are characterized by relatively larger fat tails in all subsamples although kurtosis values progressively become smaller across the sub-sample periods. Lastly, we find that whilst both ADF and DF-GLS tests confirm unit root process (stationary) in Bitcoin prices (returns) across all sub-samples except for the DF-GLS test on the full sample and 1st subsample for Bitcoin returns which confirms a unit root process in the series.

Overall, we treat our findings from Table 1 as providing preliminary evidence of time-varying weak-form market efficiency as advocated by the AMH, particularly for the DF-GLS tests which indicate that Bitcoin returns have evolved from being efficient for periods prior to the first halving period and yet turns inefficient in subsequent subsamples. In the next section, we outline our main empirical framework which uses continuous wavelet tools to model a Dickey-Fuller type test for random walk behavior in Bitcoin returns across a time-frequency plane.

3 Empirical approach

Our empirical approach is centered on the random walk test of Dickey and Fuller (1979) who proposed testing for random walk behavior in a bi-variate regression of a time series (yt) regressed on it’s own first lag (yt−1) i.e.

And evaluating whether the coefficient on yt−1 is significantly different from unity i.e. H0: β = 1, implying that the returns series evolve as a random walk, whereas the series is stationary if 0 < |β| <1 or a white noise if β = 0. Econometrically, the null hypothesis of unit root behaviour can also be specified as:

And from Eq. (2) it easy to see that the null hypothesis holds only if cov(yt, yt−1) = var(yt) which implies that the var(yt) and var(yt−1) are equal. Alternatively, the null hypothesis can be re-written in terms of the autocorrelation coefficient between yt and yt−1 as:

Where Eq. (3) only holds if standard deviation (and consequentially variances) of yt and yt−1 are equal. In our study we propose a random walk test of correlation between yt and yt−1 over time and frequency domain using continuous wavelets to transform the time series, Δyt and yt−1. These wavelets or ‘daughter wavelets’ we transform the time series into a two-dimensional time-frequency space originate from an analytical or mother wavelet by dilation and translation i.e.

Where τ is the translation parameter controlling the width of the wavelet, s is the scaling parameter controlling the length of the wavelet and s− 0.5 is a normalizing factor which ensures that the daughter wavelets and the mother wavelets keep the same ‘energy’. The continuous wavelet transforms (CWT) of the time series yt and yt−1 with respect to ψ, is obtained by comparing the time series with the family of wavelet daughters:

Where * denotes a complex conjugation. Whilst there exist many variations of ‘wavelet families’ to choose from, we make use to the ‘Morlet wavelet’ which has optimal joint time-frequency concentration and is defined as:

,

To ensure that the parameterization of the Morlet wavelet depicts an inverse relation between wavelet scales and the frequencies, f\(\approx {s}^{-1}\), the Morlet is set at 2π so that the wavelet scale, s, is equal to the Fourier period. The wavelet power spectrum (WPS) of the time series, which measures the variance of the series across a time-frequency plane, can be defined as Wy(t)y(t) = |Wy(t)|2 and Wy(t−1)y(t−1) = |Wy(t−1)|2, respectively. From the WPS of the series, the Cross-Wavelet Power Spectrum (CWPS), which is analogous to the autocovariance between y(t) and y(t-1) in time-frequency domain, is given as (WPS)y(t−1)y(t) = Wy(t−1)y(t) = |Wy(t−1)y(t)|. Finally, wavelet coherence, which is analogous to the correlation between y(t-1) and y(t) across time and frequency, is computed as the ratio of the cross spectrum to the product of the spectrums of the individual series i.e.

Where S is a smoothing operator in both time and scale. To distinguish between negative and positive correlation between a pair of time series as well as identifying lead-lag causal relationships between the variables, we make use of phase difference dynamics we are defined as:

Where φx,y is parametrized in radians, bound between π and -π. If φx,y ∈ (0, \(\frac{}{2}\)) and φx,y ∈ (0, \(-\frac{}{2}\)), then the series are said to be in-phase (positive correlation) with y leading x in the former and x leading y in the latter. Conversely, If φx,y ∈ (\(\frac{}{2}\), π) and φx,y ∈ (\(-\frac{}{2}\), \(-\)π), then the series are said to be in an anti-phase (negative correlation) with x leading y in the former and y leading x in the latter. A phase-difference of zero implies co-movement between the pair of series at the specified frequency.

4 Results

To facilitate the analysis of our empirical findings from our main wavelet analysis, we split our data into year timeframes corresponding to the Bitcoin halving dates which are presented in 4 interconnected wavelet coherence plots in Figs. 3, 4, 5 and 6. One notable advantage with wavelet coherence analysis, is that the results are not altered by narrowing or widening the time window in the analysis. This differs from conventional regression analysis where results for the full sample differ from those of the sub-samples and hence previous studies have exercised caution in selecting break-dates used to sample-split the data (Wu & Chen, 2020). Nevertheless, the reasoning for employing different sub-periods in our analysis is to ‘zoom in’ closer into the wavelet coherence plots and observe monthly effects which would be otherwise difficult to do using the entire sample period as a time window. Moreover, there are no previous studies which have used Bitcoin halving periods as structural breakpoints in the previous literature focused on examining bitcoins market efficiency.

The wavelet coherence plots describe the time frequency dynamics between the time series are visual presented using ‘heat maps’ and ‘arrow orientation’. On one hand, the heat maps show the strength of the co-movement of the time series at different frequencies across the time domain. The warm contours in the heat maps indicate strong correlation whilst cooler colors represent weaker co-movement between the series. On the other hand, the arrows in the heat map indicate the phase dynamics between the series being predictable if synchronizations are anti-phase (negative) denoted by arrow orientation \(\downarrow\), \(\leftarrow\) and \(\nwarrow\). The faint white lines surrounding the color contours represent the 5% significance level.

From Figs. 3, 4, 5 and 6, we generally observe periodic significant anti-phase synchronizations between previous Bitcoin returns and current returns indicating the Bitcoin returns are stationary only during certain periods of the different years and we note certain similarities in cyclical oscillations in all four subsample periods. For instance, we observe that higher frequency synchronization of between 2 and 16 days are most prominent in all plots. This finding fits well with some recent literature which similarly finds more inefficiency over short-run cycles (Kakinaka & Umeno, 2021). We also observe that in all sub-samples, the most consistent co-movements are observed in the November to February periods at frequency oscillations of 2–16 days, with reflects ‘month-of-the-year’ effects similarly found by Kaiser (2019), Baur et al., (2019), Kinateder & Papavassiliou (2021) and Qadan et al., (2021). Moreover, in all sub-sample periods we observe additional cycles of predictability or market inefficiency around periods of observed bubble ‘build-up and burst’ behavior in Bitcoin prices and during these periods we observe strong frequency synchronizations ranging up to oscillations as high as 32-day cycles. These include periods of the first Bitcoin bubble between April 2011 and July 2011; the second bubble between January 2013 and April 2013; the third bubble in Mt. Gox between November 2013 and February 2014; the fourth bubble between November 2017 and December 2018; and the more recent ‘Black Friday cryptocrash’ between October 2020 and January 2021 (Kyriazis et al., 2020; Enoksen et al., 2020).

Altogether our findings bind together ‘bit-and-pieces’ of previous empirical literature on Bitcoin market (in)efficiency in a harmonious way. For instance, our findings correspond to those of Urquhart (2016), Zhang et al., (2018) and Bariviviera (2018) who find evidence of Bitcoin being less inefficient between 2011–2014 period as well as those of Sensoy (2019) and Tran & Leirvik (2020) who find improved efficiency from 2016 onwards particularly in 2017–2019 period. Our findings can also concur with those of Tiwari et al., (2018), Kristoufek & Vosvrda (2019) and Alvarez-Ramirez & Rodriguez (2021) who find Bitcoin is inefficient during April-August 2013, August-November 2016, January 2015-June 2017, January 2016-March 2017, respectively, and also partially correspond to the findings of Wu & Chen (2020) who find efficiency between 2014–2016. Similarly, our findings are also in line with Yaya et al., (2021) recent findings of Bitcoin being more inefficient during the pre-crash period of August 2015 – October 2017 compared to the post-crash period of October 2017-November 2018. Finally, our findings are also in line with the more recent findings of Manif et al. (2020), Kakinaka & Umeno (2021), Naeem et al., (2021) and Alvarez-Ramirez & Rodriguez (2021), who similarly observe that the pandemic affected market efficiency, particularly during the initial global outbreak of the virus in March – April 2020.

Moreover, our empirical analysis contributes new knowledge to the existing literature on Bitcoin market efficiency in two main ways. Firstly, we find that market efficiency in Bitcoin has been affected by the halving periods of Bitcoin supply which have progressively diminished market efficiency, in the weak-form sense. This finding is novel since previous studies have not used examined Bitcoin market efficiency in context of it’s halving dates. Secondly, our study uses longer and more recent empirical data which has allowed us to examine market efficiency for periods corresponding to the more recent ‘Black Friday cryptocrash’ experienced between October 2020 and January 2021, the immunization period of post 2021 identified in Rouatbi et al., (2021); as well as the announcement of five different COVID-19 variants (alpha, beta, gamma, delta and omicron) between December 2020 and November 2021. Our study shows that despite the rollout of mass vaccinations in early 2021, Bitcoin has become more frequently market inefficient has more variants of the disease have been announced.

5 Conclusions

This paper presents a new approach for examining market efficiency in Bitcoin markets by contextualizing the conventional Dickey-Fuller tests for random walk behavior in a time-frequency domain using continuous wavelet tools. Using Bitcoin daily returns computed over the period 19/07/2010 to 31/10/2021 and we find (i) Bitcoin is more predictable over short-frequency oscillations of 2–16 days, (ii) Bitcoin markets are affected by monthly calendar effects and are more predictable between December and February, (iii) Bitcoin is less efficient during months of bubble build up and bursts, (iv) Bitcoin has progressive become progressively market inefficient across the consecutive halving dates, and (v) Since the COVID-19 related ‘Black Swan’ event in March 2020, market efficiency in Bitcoin has progressively deteriorated despite the recent rollout of mass vaccination and overall improvement in COVID-19 global health status.

Altogether, our study has implications for investors, market regulators, health practitioners and academics who have different interests in Bitcoin. Firstly, our results are relevant towards investors, fund managers and other market participants in Bitcoin markets who rely on technical analysis as their main trading strategy. Our study shows that strategies based on historic information can be developed to beat the market and obtain above-average returns. Secondly, our empirical evidence of increasing periodic informational inefficiency in Bitcoin implies that these markets may need formal regulation as there is currently no legal framework which can protect the safe investors from speculators whose behavior fuels overpricing in cryptomarkets and increases the risks associated with these assets. Thirdly, we show that whilst health outcomes are at least important for informational efficiency in Bitcoin markets, the recent mass vaccination of people around the world has not improved market efficiency in Bitcoin. Instead, our findings show that market inefficiency has been fueled by the announcement of new COVID-19 variants which, in turn, highlights the role that health practitioners can play in stabilizing the Bitcoin market by preventing future outbreaks of newer variants of the disease. Lastly, for academics, our study presents a novel empirical method for testing weak-form market efficiency in time-frequency space and has proven to be virtuous in knitting together ‘bits-and-pieces’ of seemingly contradictory empirical evidences by capturing the different periods of market (in)efficiency identified in previous studies in a harmonious manner. We propose that future research endeavors can focus on using similar wavelet coherence framework to test for time-varying and frequency varying market efficiency in other cryptocurrencies, financial assets, precious metals and commodity markets.

References

Aggarwal, D. (2019). Do Bitcoins follow a random walk model? Research in Economics, 73(1), 15–22

Alvarez-Ramirez, J., Rodriguez, E., & Ibarra-Valdez, C. (2018). Long-range correlations and asymmetry in the Bitcoin market. Physica A: Statistical Mechanics and Its Applications, 492, 498–955

Alvarez-Ramirez, J., & Rodriguez, E. (2021). A singular approach value decomposition approach for testing the efficiency of Bitcoin and Ethereum markets. Economics Letters, 206, e109997

Bariviera, A. (2017). The inefficiency of Bitcoin revisited: A dynamic approach. Economics Letters, 161, 1–4

Bariviera, A., Basgall, M., Hasperue, W., & Naiouf, M. (2017). Some stylized facts of the Bitcoin market. Physica A: Statistical Mechanics and its Applications, 484(15), 82–90

Baur, D., Hong, K., & Lee, A. (2018). Bitcoin: Medium of exchange or speculative asset? Journal of International Financial Markets Institutions and Money, 54, 177–189

Baur, D., Cahill, D., Godfrey, K., & Liu, Z. (2019). Bitcoin time-of-day, day-of-week and month-of-year effects in returns and trading volume. Finance Research Letters, 31, 78–92

Bedi, P., & Nashier, T. (2020). On the investment credentials of Bitcoin: A cross-currency perspective. Research in International Business and Finance, 51, e101087

Bouri, E., & Gupta, R. (2021). Predicting Bitcoin returns: Comparing the roles of newspaper- and internet search- based measures of uncertainty. Finance Research Letters, 38, e101398

Chaim, P., & Laurini, M. (2019). Is Bitcoin a bubble? Physica A: Statistical Mechanics and its Applications, 517, 222–232

Chu, J., Zhang, Y., & Chan, S. (2019). The adaptive market hypothesis in the high frequency cryptocurrency market. International Review of Financial Analysis, 64, 221–231

Corbet, S., LuceyB., Urquhart A. and, & Yarovaya, L. (2019). Cryptocurrencies as a financial asset: A systematic review. International Review of Financial Analysis, 62, 182–199

Corbet, S., & Paraskei, K. (2020). Asymmetric mean reversion of Bitcoin price returns. International Review of Financial Analysis, 71, e101267

Eksi, Z., & Schreiti, D. (2022). Closing Bitcoin trade optimally under partial information: Performance assessment of a stochastic disorder model. Mathematics, 10(1), e157

Enoksen, F., Landsnes, C., Lucivjanska, K., & Molnar, P. (2020). Understanding risk of bubbles in cryptocurrencies. Journal of Economic Behaviour and Organization, 176, 129–144

Garcia-Jorcano, L., & Benito, S. (2020). Studying the properties of the Bitcoin as a diversifying and hedging asset through a copula analysis: Constant and time-varying. Research in International Business and Finance, 54, e101300

Goodell, J., & Goutte, S. (2021). Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters, 38, e101625

Geugan, D., & Renault, T. (2021). Does investor sentiment on social media provide robust information for Bitcoin returns predictability. Finance Research Letters, 38, 101494

Hafner, C. (2020). Testing for bubbles in cryptocurrencies with time-varying volatility. Journal of Financial Econometrics, 18(2), 233–249

Kakinaka, S., & Umeno, K. (2022). Cryptocurrency market efficiency in short- and long-term horizons during COVID-19: An asymmetric multifractal analysis approach. Finance Research Letters, 46(A), 102319

Kinateder, H., & Papavassiliou, V. (2021). Calendar effects in Bitcoin returns and volatility. Finance Research Letters, 38, e101420

Kraaijeveld, O., & De Smedt, J. (2020). The predictive power of public Twitter sentiments for forecasting cryptocurrency prices. Journal of International Financial Markets, Institutions and Money, 65, (forthcoming)

Khuntia, S., & Pattanayak, J. (2018). Adaptive market hypothesis and evolving predictability of Bitcoin. Economic Letters, 167, 26–28

Jiang, Y., Nie, H., & Ruan, W. (2018). Time-varying long-term memory in bitcoin market. Finance Research Letters, 25, 280–284

Kaiser, L. (2019). Seasonality in cryptocurrencies. Finance Research Letters, 31, 232–238

Kang, S., Mcler, R., & Hernandez, J. (2019). Co-movements between Bitcoin and Gold: A wavelet coherence analysis. Physica A: Statistical Mechanics and Applications, 536(15), e120888

Kristoufek, L., & Vosvrda, M. (2019). Cryptocurrencies market efficiency ranking: Not so straightforward. Physica A: Statistical Mechanics and its Applications, 531, 120853

Kyriazis, N., Papadamou, S., & Corbet, S. (2020). A systematic review of the bubble dynamics of cryptocurrencies. Research in International Business and Finance, 54, e101254

Fama, R. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383–417

Lo, A. (2004). The adaptive market hypothesis: Market efficiency from an evolutionary perspective. The Journal of Portfolio Management, 5(30), 15–29

Lopez-Martin, C., Muela, S., & Arguedas, R. (2021). Efficiency in cryptocurrency markets: New evidence. Eurasian Economic Review, 11, 403–431

Manahov, V., & Urquhart, A. (2021). The efficiency of Bitcoin: A strongly typed genetic programming approach to smart electronic Bitcoin markets. International Review of Financial Analysis, 73, e101629

Merediz-Sola, I., & Bariviera, S. (2019). A bibliometric analysis of Bitcoin scientific production. Research in International Business and Finance, 50, 294–305

Meynkhard, A. (2019). Fair market value of bitcoin: halving effect. Investment Management and Financial Innovations, 16(4), 72–85

Moosa, I. (2020). The bitcoin: A sparkling bubble or price discovery? Journal of Industrial and Business Economics, 47, 93–113

Nadarajah, S., & Chu, J. (2017). On the inefficiency of Bitcoin. Economic Letters, 150, 6–9

Naeem, M., Bouri, E., Peng, Z., Shahzad, S., & Vo, X. (2021). Asymmetric efficiency of cryptocurrencies during COVID-19. Physica A; Statistical Mechanics and its Applications, 565(1), e125562

Pal, D., & Mitra, S. (2019). Hedging Bitcoin with other financial assets. Finance Research Letters, 30, 30–36

Pyo, S., & Lee, J. (2020). Do FOMC and macroeconomic announcements affect Bitcoin prices? Finance Research Letters, 37, e101386

Qadan, M., Aharon, D., & Eichel, R. (2021). Seasonal and calendar effects and the price efficiency of cryptocurrencies. Finance Research Letters, (forthcoming).

Qiao, X., Zhu, H., & Hau, L. (2020). Time-frequency co-movement of cryptocurrency return and volatility: Evidence from wavelet coherence analysis. International Review of Financial Analysis, 71, e101541

Rouatbi, W., Demir, E., Kizys, R., & Zaremba, A. (2021). Immunizing markets against the pandemic: COVID-19 vaccinations and stock volatility around the world. International Review of Financial Analysis, 77, e101819

Rubbanly, G., Khalid, A., & Samitas, A. (2021). Are cryptocurrencies safe-haven assets during COVID-19 pandemic? Evidence from a wavelet coherence analysis. Emerging Markets Finance and Trade, 57(6), 1741–1756

Shen, D., Urquhart, A., & Wang, P. (2019). Does twitter predict Bitcoin? Economics Letters, 174, 118–122

Sensoy, A. (2019). The inefficiency of Bitcoin revisited: A high-frequency analysis will alternative currencies. Finance Research Letters, 28, 68–73

Smith, C., & Kumar, A. (2018). Crypto-currencies – An introduction to not-so-funny moneys. Journal of Economic Surveys, 32(5), 1531–1559

Symitsi, E., & Chalvatzis, K. (2019). The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance, 48, 97–110

Tiwari, A., Jana, K., Das, D., & Roubaud, D. (2018). Informational efficiency of Bitcoin – An extension. Economic Letters, 163, 106–109

Tran, V., & Leirvik, T. (2020). Efficiency in the markets of cryptocurrencies. Finance Research Letters, 15, s101382

Urquhart, A. (2016). The inefficiency of Bitcoin. Economics Letters, 148(C), 80–82

Urquhart, A. (2018). What causes attention to Bitcoin. Economics Letters, 166, 40–44

Urquhart, A., & Hanxiong, Z. (2019). Is Bitcoin a hedge or safe haven for currencies? Intraday analysis. International Review of Financial Analysis, 63(C), 49–57

Vidal-Tomas, D. (2020). All the frequencies matter in the Bitcoin market: An efficiency analysis. Applied Economic Letters

Vidal-Tomas, D., & Ibanez, A. (2018). Semi-strong efficiency of Bitcoin. Finance Research Letters, 27(C), 259–265

Wu, L., & Chen, S. (2020). Long memory and efficiency of Bitcoin under heavy tails. Applied Economics, 52(48), 5298–5309

Xiong, J., Liu, Q., & Zhao, L. (2020). A new method to verify Bitcoin bubbles: Based on the production cost. The North American Journal of Economics and Finance, 51, e101095

Yaya, O., Ogbonna, A., Mudida, R., & Abu, N. (2021). Market efficiency and volatility persistence of cryptocurrency during pre- and post-crash periods of Bitcoin: Evidence based on fractional integration. International Journal of Finance and Economics, 26(1), 1318–1335

Zhang, W., Wang, O., Li, X., & Shen, D. (2018). Some stylized facts of the cryptocurrency market. Applied Economics, 50(55), 5950–5965

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that there is no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Phiri, A. Can wavelets produce a clearer picture of weak-form market efficiency in Bitcoin?. Eurasian Econ Rev 12, 373–386 (2022). https://doi.org/10.1007/s40822-022-00214-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-022-00214-8