Abstract

This study provides comprehensive descriptive evidence on the occurrence, size, and reporting by managers and the financial press of debt value adjustments due to a change in own credit risk (DVAs). The study is motivated by a public debate about DVAs in which critics describe them as “counterintuitive” and claim that managers disclose DVA information strategically to make firms “look good”. Analyzing a sample of 405 firm-quarters of 19 US financial firms that report DVAs between 2007 and 2014, I found that positive and negative DVAs appear similarly often and with similar magnitude. I further found that managers provide more information on large negative DVAs compared to positive DVAs. Managers also provide more DVA information when they have strategic incentives to do so. Examining newspaper articles on 202 firm-quarters, I found that the financial press is more likely to cover large positive DVAs and DVAs about which managers provided more information. Analyzing the articles’ content, I found that the press is more likely to provide new DVA information if managers’ press releases contain little information. The findings are in line with popular claims of asymmetric DVA reporting by managers. They are further consistent with the financial press acting as a counterweight to such asymmetric reporting.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This study provides comprehensive descriptive evidence on the occurrence, size, and reporting by managers and the financial press of debt value adjustments due to a change in own credit risk (DVAs). Under US GAAP and IFRS accounting regulation, DVAs cause net income gains when a firm’s credit risk deteriorates and net income losses when a firm’s credit risk improves. This characteristic has stirred an ongoing public debate. Critics perceive DVAs as “counterintuitive” and call them “some fuzzy math” (Dash 2009), “one of the more ridiculous concepts that’s ever been invented in accounting” (Rapoport 2012), a “mess” (Tchir 2012) or an “abomination” (Keoun and Henry 2010). They state that DVAs’ introduction in accounting was the result of lobbying efforts by big banks (Keoun 2008) who “were looking for ways to find profits” (Rice 2012). Moreover, critics accuse managers of asymmetric DVA reporting, i.e., highlighting DVA losses but downplaying DVA gains, in an attempt “to trick the media and investors” (Milstead 2012). Potentially incentivized by the debate, international financial accounting regulators shifted DVAs’ recognition from net income to other comprehensive income in future periods (FASB 2016; IASB 2014).

Opinions on DVAs in the prior academic literature vary. Theoretical literature warns that DVAs could be “counterintuitive” (Chasteen and Ransom 2007) and even “dangerous” (Lipe 2002). Recent experimental literature finds that investors have difficulties interpreting firms’ performance and risk if DVAs influence net income (Gaynor et al. 2011; Lachmann et al. 2015). At the same time, recent empirical studies do not find that DVAs’ perceived "counterintuitiveness" results in adverse capital market effects. Instead, the evidence suggests that investors perceive DVAs as value-relevant (Chung et al. 2017), that investors understand the relation between DVAs and incomplete fair value accounting (Cedergren et al. 2015), and that DVAs do not increase information asymmetry between investors (Schneider and Tran 2015; Fontes et al. 2018).

Yet, the young stream of DVA literature provides little evidence on basic characteristics of DVAs such as their occurrence, size, and reporting. The scarce evidence in this regard comes mostly in the form of scaled measures (see, e.g., Schneider and Tran 2015; Fontes et al. 2018) or from potentially incomplete samples (Cedergren et al. 2015; Chung et al. 2017). Prior evidence on DVAs’ reporting stems from only two studies. Bischof et al. (2014) found for a European sample that the majority of observed analysts explicitly exclude DVAs from earnings. Eichner and Mettler (2014) found low DVA disclosure quality in the annual reports of European firms in the year 2012. Motivated by the public DVA debate, the recent changes in DVA accounting regulation, and the somewhat varying opinions on DVAs in prior literature, I seek to add to these findings by giving comprehensive descriptive evidence on DVAs’ occurrence, size, and reporting by managers and the financial press.

Analyzing 405 firm-quarters of 19 DVA-reporting US financial firms between 2007 and 2014, I found that DVAs that increase net income (positive DVAs) and DVAs that decrease net income (negative DVAs) occur about equally often and on average with similar size, which does not support public concerns that managers use DVAs to systematically inflate their profits. Still, DVAs’ impact on net income can be significant, as they are on average 93.7% as large as the contemporaneous net income in the sample. Analyzing managers’ DVA reporting in the corresponding quarterly earnings press releases, I found that managers mention DVAs in most firm-quarters (60.5%) but rarely give directional information that could help unravel DVAs’ perceived counterintuitiveness (26.4%). I further found that managers present certain pieces of DVA information, e.g., DVAs’ sign and origin, more frequently for large negative than for positive DVAs. I also found weak evidence that managers give more DVA relational information when they have strategic incentives to do so, for example, when negative DVAs turn a net profit into a loss. These findings are consistent with claims from the DVA debate that managers report negative, income-decreasing DVAs more transparently than positive DVAs which improve firms’ performance figures.

Analyzing 173 financial press articles, I found that the press covers DVAs in 18.5% of the sample firm-quarters. The probability for press coverage is higher for large positive DVAs consistent with the press providing counterweight to managers’ emphasis on negative DVAs. Still, I also found a higher chance of press coverage of DVAs when managers give more DVA information and when managers place DVA information on the first page of their press releases, in line with the financial press picking up spin from managers’ DVA reporting (see Sadique et al. 2008). Nevertheless, the finding could also reflect that the press disseminates the information that managers highlight because it is most valuable for investors (Bowen et al. 2005).

Analyzing the content of the financial press articles, I found that the probability for new DVA information by the press is higher when the corresponding press releases contain little DVA information. The press is also more likely to give new information on large positive DVAs than on large negative DVAs. The findings are in line with the financial press possibly assuming a “watchdog” role in two regards: First, the press adds new DVA information when DVA information by managers is scarce. Second, the press is more likely to supply original information about positive, income-increasing DVAs that could potentially mislead investors towards a too positive evaluation of firms’ performances.

Taken together, the findings contribute to the young DVA literature by giving thorough descriptive evidence on DVAs, thereby enhancing our knowledge of an unusually controversial accounting item. By evaluating public claims, the results also contribute to the DVA debate. Finally, the findings add to the literature on the financial press by giving insights into the press’ reporting of an “obscure” (Sorkin 2012) financial accounting item.

The results should be of interest to international accounting standard setters. For example, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) take an active role in the public DVA debate acknowledging that DVAs are “controversial” (Rapoport and Lucchetti 2011) and “potentially misleading” (IASB 2009). The regulation of DVA accounting is a central topic for both standard setters and, as said, was recently changed in both accounting sets (FASB 2016; IASB 2014a). The results should also yield valuable insights to other stakeholders concerned with DVAs such as investors, researchers, managers, financial analysts, financial journalists and rating agencies.

The paper proceeds as follows. The next section outlines the theoretical background on DVA accounting regulation, the public DVA debate, and prior literature. Section 3 details the sample selection and data collection. Section 4 presents results on DVAs’ occurrence, size, and reporting by managers. Section 5 presents results on DVAs’ reporting by the financial press and Sect. 6 concludes.

2 Debt value adjustments: theoretical background, the public debate, and prior literature

2.1 Debt value adjustments due to a change in own credit risk (DVAs)

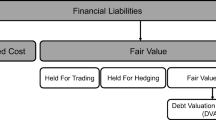

In February 2007, the Financial Accounting Standards Board (FASB) issued the Statement of Financial Accounting Standards No. 159 (FAS 159), “The Fair Value Option for Financial Assets and Financial Liabilities” (new codification since 2009: ASC Topic 825-10). The therein codified fair value option for financial liabilities (FVOL) permits firms to measure financial liabilities at fair value, i.e., at (hypothetical) market values (FASB 2006). Firms can elect the FVOL for an instrument only at specified “election dates”, for example, the day of an item’s first recognition. The option can only be applied to entire instruments (not to portions) and cannot be revoked (FASB 2007). Besides the election dates, as a one-time measure, FAS 159 allowed firms to apply the FVOL to eligible items at the standards’ effective date, which was the fiscal year beginning after November 15, 2007, or in the fiscal year before that as early adoption.

In each interim or annual financial statement, FAS 159 requires firms to disclose their reasons for electing the fair value option for each item. Firms also need to disclose which balance sheet items contain liabilities for which the FVOL has been elected. FAS 159 further requires firms to disclose gains and losses from fair value changes for each income statement line item included in earnings. Generally, gains and losses from changes in fair values for which the FVOL has been elected do not need to be disclosed separately from other fair value changes in the same line item. As an exception, firms need to separately disclose gains and losses from fair value changes that are attributable to changes in firms’ own credit risk. For example, if a firm’s ability to meet its outstanding debt decreases, the market value of its issued debt decreases simultaneously. On the other hand, if markets assume that a firm’s solvency improved, its liabilities’ market values increase. Such value changes are called DVAs—debt valuation adjustments due to a change in own credit risk.

As Merton (1974) explains, DVAs represent wealth redistributions between the shareholders and the debtholders of the firm that issued the debt. This is because a firm’s debt implies an option for the shareholders to put the firm’s assets to the debtholders for an amount equal to the debt’s face value. This option is an economic asset to the firm and the asset’s value depends on the value of the firm’s debt (Barth and Landsman 1995). For example, a decrease in the value of a firm’s assets in principle causes a decline in net income. Still, the corresponding increase in the firm’s own credit risk means that the value of the shareholders’ put option increases which, in turn, causes a wealth transfer from debtholders to shareholders that partly mitigates the decline in net income. Or, to quote Barth and Landsman (1995): “Effectively, the debtholder contractually has committed to accept an interest rate that subsequently proves to be economically too low.” Another way to rationalize DVAs’ wealth redistribution effect is to consider that, for example, a decrease in the market value of a firm’s debt lets shareholders repurchase the debt at a lower price on secondary markets.

DVAs are recognized in firms’ income statements and thereby increase or decrease firms’ net income in fiscal years beginning before December 15, 2017. After a recent amendment to ASC 825, DVAs will instead be recognized in other comprehensive income in fiscal years beginning after this date (FASB 2016).

2.2 The public DVA debate

Since DVAs’ introduction in accounting, they are center of a public debate. The focal point of the debate is a unique characteristic of DVAs that critics perceive as counterintuitive: the fact that economically unfavorable increases in firms’ own credit risk lead to positive DVAs which increase net income. If the firm’s credit risk decreases, on the other hand, it recognizes a loss from DVAs. Critics often voice three related concerns about this characteristic.

A first concern is that investors are unable to differentiate between earnings from DVAs and core earnings. Critics suspect that, as a consequence, investors’ view on the actual firm performance could be blurred, e.g., in cases in which large DVA gains turn a firm’s net loss into a net gain. Associations with DVAs from financial media expressing this concern are “counterintuitive”, “artificial”, “phantom revenue” (Keoun 2008), “ludicrous” (Goff 2011), “accounting fiction”, “paper profits” (Burne 2011), “unnatural” (Pollack 2011), “weird” (Hofman 2011), an “abomination” (Keoun and Henry 2010), “accounting voodoo” (Carver 2012b), “bizarre”, “Alice in Wonderland-ish” (Rice 2012), “schmee-VA”, an “accountancy spider’s web (…) as dusty and all-enswathing as Miss Havisham’s boudoir” (DVA, CVA, schmee-VA! 2013), or just “some fuzzy math” (Dash 2009). FASB member Donald M. Young dissented with the issuance of FAS 159 because DVAs “could mislead users and potentially misrepresent or conceal operating performance issues” (FASB 2007). Other participants of the debate argue that DVAs bring clarity for investors. They point out that DVAs enable firms to “show investors changes in the fair value” (Elstein 2012) of liabilities and thereby “offer a clearer picture of [their] actual value” (Phillips 2009).

A second concern in the debate is that managers deliberately use DVAs to improve earnings and other performance measures. Bob Rice, the founder of Tangent Capital Partners LLC, argues in an interview that the FASB introduced DVAs “because frankly the banks and their accountants were looking for ways to find profits” (Rice 2012). Analyst Meredith A. Whitney said in 2009 that banks use DVAs as a tool for a “great whitewash” to create the impression that banks are stabilizing after the financial crisis (Dash 2009). Other critics that share this point of view see DVAs as “accounting tactics—gimmicks” (Dash 2009), “accounting tricks”, or even a “shameful scam” that banks deploy “to boost their profits” (Carver 2012a). Still other voices in the DVA debate contradict this view. For example, Joyce Frost, a co-founder of Riverside Risk Advisors LLC, states that DVAs are “not something banks decided to use to boost their earnings” (Burne 2011). Another expert argues that “shareholders cannot push for more of a mark-to-market world, but then cherry-pick when they want to include the mark-to-market” (Burne 2011).

A third concern by critics related to the first two is that managers give DVA information selectively, potentially to shape investors’ perceptions of the firms’ performances. David Milstead from the Canadian newspaper The Globe and Mails says that “banks have been more than happy to highlight these [DVA] losses in their earnings releases, while being a lot more circumspect when valuation gains boost earnings”. Quoting another critic, he adds that this “makes it look like they are trying to trick the media and investors and make the story better than it is” (Milstead 2012). An article in the UK magazine Euroweek states that “when the DVA strip-out makes the bank look good, it is more likely to end up in the press release headlines than when it does not” (DVA, CVA, schmee-VA! 2013). Similarly, Rolf Benders says in the German newspaper Handelsblatt that managers only complain about DVAs’ artificiality in quarters in which DVAs reduce banks’ profits but less so when the DVAs result in gains (Benders 2012). Laurie Carver, Senior Staff Writer at Risk magazine argues that “[b]anks downplay [DVAs] in their earnings report” (Carver 2012b). Financial executive Bob Pozen disagrees: “When reporting earnings, financial firms have been clearly laying out what part of their earnings come from DVA” (Pozen 2011). Other experts say that managers make their reporting transparent by excluding DVAs from reported figures (Goff 2011) although still others claim that managers just do so “to avoid the public reputation risk” (Castagna 2012). Another, less common concern relates to the role of the financial press. Bob Rice said in 2012 that “[m]ost mainstream media is only now picking up on the basic idea that these [DVAs] are really irrelevant” (Rice 2012). In contrast, Bob Pozen stated in 2011 that “the media has reported earnings explaining that profits from DVA are an ‘accounting gain’ rather than true earnings” (Pozen 2011). I give further evidence on the DVA debate in Appendix 1.

In conclusion, DVAs’ critics make various claims in the DVA debate. Still, empirical research that evaluates these claims is very scarce. This study attempts to address this scarcity.

2.3 Prior literature

The relatively young research on DVA accounting consists of theoretical, experimental, and empirical studies. In a theoretical study, Lipe (2002) is the first to document a counterintuitive DVA result in a “what-if” scenario and concludes that DVAs are potentially “dangerous”. Chasteen and Ransom (2007) state that DVAs are “counterintuitive” and suggest an alternative approach for liability measurement that excludes DVAs. In an experiment among 184 Certified Public Accountants, Gaynor et al. (2011) find that over 70% wrongly interpret DVA gains as a signal for decreased credit risk and DVA losses as a signal for increased credit risk. Lachmann et al. (2015) conducted an experiment with 93 auditors. They find that participants are more likely to misinterpret a firm’s performance if net income includes DVAs relative to a firm’s performance where DVAs are disclosed in other comprehensive income.

In an empirical study before DVAs’ introduction in accounting, Barth et al. (2008) find that the decrease (increase) in a firm’s equity value associated with an increase (decrease) in the credit risk of the firm is mitigated by a higher debt-to-assets ratio. This suggests that investors price the wealth transfer from debtholders to shareholders that DVAs represent correctly when firms do not recognize DVAs. Chung et al. (2017) find that investors potentially misprice DVAs but perceive them as value-relevant. Cedergren et al. (2015) add to the latter finding by showing that investors also understand the offsetting relation between DVAs and corresponding changes in unrecognized intangible assets. Schneider and Tran (2015) find that information asymmetries between investors are not higher for firms that recognize DVAs compared to other FVOL adopting firms. Finally, Fontes et al. (2018) find that fair value measurement of banks’ assets is associated with lower information asymmetry among investors and that this reduction is noticeably larger when banks also recognize DVAs.

Regarding the reporting of DVAs, Bischof et al. (2014) find that a majority of financial analysts discuss DVAs’ impact on performance figures in analyst reports and often exclude them from performance figures. Eichner and Mettler (2014) find low DVA disclosure quality in annual reports of European firms in the year 2012.

Overall, the findings from theoretical, experimental, and empirical DVA literature are not necessarily inconclusive. Still, they seemingly show somewhat different opinions from researchers on DVAs’ usefulness. In any case, prior DVA literature offers informative insights into DVAs’ properties from different viewpoints. Still, no research yet gives comprehensive descriptive evidence on basic characteristics of DVAs such as their occurrence, their size, and their reporting. In light of DVAs’ topicality and the young but growing DVA literature, such evidence should make a valuable contribution to this literature and to the DVA debate.

Additionally, thorough descriptive evidence on DVAs’ reporting by the financial press should contribute to the literature of the financial press as an information intermediary (Bushee et al. 2010). In particular, descriptive evidence on the financial press’ DVA reporting should contribute to the literature on the financial press’ coverage of firms’ accounting practices (Foster 1987, 1979; Miller 2006) and firms’ reporting practices (Koning et al. 2010).

3 Sample selection and data collection

I give descriptive evidence on DVAs’ occurrence, size, and reporting by managers for all firm-quarters of US financial firms that reported DVAs and published quarterly earnings press releases between 2007 and 2014. I combine two identification strategies from the recent literature on FVOL adoption (Cedergren et al. 2015; Wu et al. 2016; Chung et al. 2017). First, I used data from regulatory FRY9C reports of 8,558 bank holding companies. I require firms to file a gain or loss on fair value liabilities in the sample period. This is true for 94 firms. I excluded 41 firms for which I cannot retrieve a CIK code. For the remaining 53 firms, I collected all 10-Q and 10-K filings from SEC Edgar in the sample period. Performing a thorough manual search of these filings, I found 11 firms that report DVAs.

Second, I considered all 5757 financial firms covered by Compustat in fiscal years between 2007 and 2014. I identify 207 financial firms as adopters of the fair value option because they have the item “Adoption of Accounting Changes” equal to “FS159” in any year within the sample period. Next, I eliminate 47 firms without fair value liabilities and then 65 firms without fair value changes reported in earnings. Next, I eliminate 10 firms without CIK identifier and 31 firms whose 10-K and 10-Q filings I already searched in the first part of the identification process. For the remaining 54 firms, I collected all available 10-K filings and searched them for key terms related to DVAs. I found such terms in filings of 41 firms. I did a thorough manual search of all annual and quarterly filings of these firms and hereby find 9 more firms that report DVAs in the sample period. Finally, I exclude one firm that does not file quarterly earnings press releases with the SEC in the sample period. In total, my sample comprises 19 DVA-reporting firms.

My initial sample of firm-quarters consists of the 540 firm-quarters of these 19 firms for which I can collect the respective financial report (10-Q or 10-K filing) between 2007 and 2014 from SEC Edgar. I exclude 20 firm-quarters without 8-K reports. Finally, I exclude 115 firm-quarters without FVOL adoption. In total, my sample consists of 405 firm-quarters in which DVA-reporting US financial firms adopted the FVOL and released a quarterly earnings press release. Table 1, Panel A summarizes the sample selection.

I further give evidence on DVAs’ reporting by the financial press in US newspapers. Again, I run a twofold approach. First, I collect all articles that cover the 405 sample firm-quarters from The Wall Street Journal, The New York Times, The Washington Post, and USA Today. Doing an extensive manual search, I found 125 articles with DVA information. Second, I conduct a search of DVA-related key terms in The Wall Street Journal and all US newspapers included in the Nexis database. Hereby, I found 55 more articles with DVA information. I exclude seven articles that I cannot link to my sample firm-quarters. In total, I use 173 articles with DVA information for my tests, covering 75 distinct firm-quarters. Table 1, Panel B provides an overview of the articles distribution over time and across newspapers. Appendix 2 provides a detailed description of the sample selection.

4 DVAs’ occurrence, size, and reporting by managers

4.1 Characteristics of DVA-reporting firms

Prior literature remains silent on the characteristics of DVA-reporting firms. To give insights, I compared financial characteristics of DVA reporters with those of FVOL adopters that do not report DVAs and with those of non-FVOL adopters. I used data from the fourth quarter of 2006, because it is the effective date for firms’ decisions whether to adopt early the FVOL and the last quarter whose accounting data is unaffected by this choice.Footnote 1 My research setting for this test follows Guthrie et al. (2011). Appendix 3, Panel A presents definitions of the used variables and Table 2 presents descriptive statistics. Comparing FVOL adopters that do not report DVAs with non-FVOL adopters, I found FVOL adopters to be significantly larger in terms of total assets and total liabilities. For example, the average total assets of FVOL adopters without DVAs are $69.06 billion while the average total assets of non-FVOL adopters are $26.07 billion. This is consistent with larger US financial institutions that are more engaged in complex activities, for example, hedging activities, having a higher demand for an adoption of the FVOL to ease these activities (Guthrie et al. 2011). FASB’s reason for the issuance of the FVOL was to relieve firms from the burden to follow complex hedge accounting provisions for derivatives (FASB 2007). In line with this, I found that FVOL adopters are significantly more likely to use derivatives before the introduction of the FVOL than non-adopters (46% compared to 20%). In contrast, FVOL adopters and non-FVOL adopters are not significantly different concerning their average ratio of instruments for which the fair value option is eligible in my sample.

Comparing DVA-reporting FVOL adopters with FVOL adopters that do not report DVAs, I found that DVA-reporters are significantly larger. For example, the median of total assets of DVA-reporters is $182.20 billion compared to $8.86 billion of other FVOL adopters. DVA-reporters also have significantly more fair value liabilities, in absolute terms and relative to total liabilities (according to a Wilcoxon rank-sum test). The finding is consistent with DVA-reporters applying the FVOL to larger portions of liabilities. This is plausible as FAS 159 requires reporting only of material DVAs (FASB 2007) and DVAs’ size depends on the size of debt for which the FVOL has been elected, amongst other factors. The large majority of DVA-reporters use derivatives (84%), significantly more than other FVOL adopters (46%). Both, the ratio of instruments for which the fair value option is eligible and the return on equity are not significantly different between DVA-reporters and other FVOL adopters.

In conclusion, DVA-reporters seem to be systematically different from other FVOL adopters and from non-FVOL adopters in several aspects. DVAs appear to concern mainly few, very large and complex US financial institutions that apply the FVOL extensively. For example, five of the largest six US bank holding companies are among the 19 DVA-reporters.Footnote 2

4.2 DVAs’ occurrence and size

Table 3, Panel A depicts descriptive statistics on DVAs’ occurrence and size. The mean of quarterly DVAs is $6.91 m (median: –$0.20 m). Negative DVAs appear in 50.6% of the firm-quarters. The largest negative DVA in the sample is –$3,600 m, the largest positive DVA is $4,506 m. The mean of absolute quarterly DVAs is $285.42 m (median: $66.30 m). The mean ratio of absolute quarterly DVAs to absolute quarterly net income is 93.7% (median: 8.6%). Only 12 of the 405 firm-quarters have a DVA of zero (2.96%, untabulated). Taken together, the descriptive evidence is consistent with DVAs causing losses about equally often as gains. Further, the low mean of DVAs is consistent with positive and negative DVAs being on average similarly large. Hence, the findings do not support concerns from the public DVA debate that DVAs are an “accounting trick” (Carver 2012a) used “to find profits” (DVA, CVA, schmee-VA! 2013). Still, the results do not rule out that managers could profit from DVAs because prior literature suggests that investors perceive positive and negative DVAs differently (Gaynor et al. 2011). In any case, the findings are consistent with a regular and notable impact of DVAs on firms’ results and therewith further motivate the following analyses on DVAs’ reporting by managers and the financial press.

4.3 DVA reporting by managers

4.3.1 Measures of DVA reporting quality

To explore managers’ reporting of DVAs, I analyze the DVA information in quarterly earnings press releases. Quarterly earnings press releases are a direct way of managers to communicate with financial markets and among the most common and important instruments of voluntary disclosure (Davis et al. 2012; Davis and Tama-Sweet 2012). Compared to financial reports, they are unaudited and less regulated, and therefore, allow for a higher level of discretion on form and content (Henry 2008). Also, as shown in Sect. 2.2, public criticism often targets managers’ DVA reporting in earnings press releases.

I checked the press releases for several DVA disclosures and constructed respective binary variables (see similar: Baumker et al. 2014). Ment, indicates that the quarterly earnings press release mentions DVAs. Sign indicates that the press release contains information on the DVAs’ sign (i.e., whether DVAs are positive or negative). Size indicates that the press release contains the DVAs’ size as an absolute or per share figure.Footnote 3 Due indicates that the press release contains information explaining that DVAs stem from a change in debt value or from a change in credit risk. Dir indicates that the press release contains directional information on DVAs. For example, in firm-quarters with negative DVAs, Dir indicates that the press release contains the information that the negative DVAs stem from an increase in own debt’s value and/or that they stem from a decrease in the firm’s own credit risk. According to experimental evidence, this information helps investors unravel the criticized “counterintuitiveness” of DVAs (Gaynor et al. 2011).

Comment indicates that the press release provides an evaluative comment on DVAs. For example, in Morgan Stanley’s press release of the first quarter of 2009, its CEO John J. Mack says „[i]n fact, Morgan Stanley would have been profitable this quarter if not for the dramatic improvement in our credit spreads—which is a significant positive development, but had a near-term negative impact on our revenues.” Excl indicates that the press release provides a non-GAAP performance figure that excludes DVAs or a description of a scenario that excludes DVAs, for example, “excluding DVAs, net income increased”. Prior literature considers such non-GAAP figures as information on the excluded items’ transitoriness (Curtis et al. 2014; Baumker et al. 2014).

As an overall measure of disclosure quality, quantity and of reporting emphasis, AggInfo is an aggregated “checklist” measure equal to the sum of Ment, Sign, Size, Due, Dir, Comment, and Excl (see e.g., Hail 2002; Botosan 1997). Finally, FirstPageMent indicates that the press release gives DVA information or a non-GAAP figure excluding DVAs on its first page. Prior literature finds that managers place items prominently in press releases to emphasize them (see e.g., Bowen et al. 2005; Guillamon-Saorin et al. 2012). I provide an example for the measures’ codifications in Appendix 4 and a discussion of the measures in the conclusion of the paper.

4.3.2 Descriptive statistics

Table 3, Panel B shows descriptive statistics of the disclosure measures. Managers mention DVAs in 60.5% of the quarterly earnings press releases in the sample. They give DVAs’ sign, size, and the fact that DVAs arise from changes in debt and credit risk similarly often (57.3, 53.8, and 57.3%). In contrast, they give directional DVA information that explains DVAs’ “counterintuitivity” in only 26.4% of the press releases. They give evaluative comments on DVAs in 3.0% and a non-GAAP figure excluding DVAs in 41.0% of the press releases. An average press release contains 2.99 of the seven investigated pieces of information (median: 4). Finally, managers give DVA information on the first page of 28.6% of the press releases.

In sum, the descriptive evidence of managers’ DVA disclosures is not consistent with managers providing DVA disclosures very continuously but it is also not consistent with DVA disclosures by managers being very scarce. Rather, managers’ DVA reporting in quarterly earnings press releases varies which further motivates the following analysis on its determinants.

4.3.3 Determination analyses

I examine potential determinants of managers’ provision of DVA information using multivariate regression analyses. This allows for a better identification of the association between the provision of information and individual factors as it simultaneously controls for the association of the information’s provision with other factors in the model. Motivated by claims from the DVA debate that managers report DVAs asymmetrically and strategically, I investigate whether DVA relational information in quarterly earnings press releases is associated with DVAs’ size and sign (Schrand and Walther 2000) and with strategic incentives to give more information (Marques 2010; Baumker et al. 2014). I use probit models for regressions with binary dependent variables and OLS models for regressions of AggInfo. The regression model is:

where Disclosure represents the different measures of DVA information: Ment, Sign, Size, Due, Dir, Comment, Excl, AggInfo, and FirstPageMent. AbsDVA is the absolute amount of DVAs scaled by the natural log of total assets. NegDVA is a binary variable indicating that DVAs are negative in the firm-quarter. Incentive is a binary variable indicating the presence of at least one of two possible strategic incentives for managers to report/emphasize DVAs. In line with prior literature, I consider the following two incentives: 1. net income is negative while net income excluding DVAs is positive and 2. net income is below last year’s net income while net income excluding DVAs is above last year’s net income excluding DVAs (Marques 2010). Unlike prior literature (e.g., Baumker et al. 2014), I do not consider a missed mean consensus analyst forecast due to DVAs as an incentive because the majority of analysts exclude DVAs from their forecasts (Bischof et al. 2014). Pages is the natural log of the number of pages in the quarterly earnings press releases. I include it to control for firms’ transparency in the respective quarter. Quarter is a time trend variable (see Woolridge 2013) increasing with equal steps from 1 (first quarter of 2007) to 32 (fourth quarter of 2014).Footnote 4 I include it to control for a potentially increasing DVA awareness over time. TA is the natural log of total assets and controls for various factors associated with firms’ size. I used robust standard errors that are clustered by firms (White 1980). Table 3, Panel C shows descriptive statistics of the independent variables. It shows, for example, that a strategic incentive for managers to report/emphasize DVAs is present in 8.6% of the 405 firm-quarters.

Table 3, Panel D shows the corresponding correlation coefficients. Most DVA reporting measures are positively correlated with DVAs’ size (AbsDVA). In contrast, DVA’s sign is not significantly correlated with the DVA reporting measures except for Excl. Many DVA reporting measures are highly correlated with each other (e.g., Ment, Sign, Size, and Due) indicating that managers often provide this DVA information in concert.

Table 4, Panel A shows the regression estimations of the determinants models of managers’ DVA reporting. The coefficient on AbsDVA is significantly positive in all models except for Model 6 and 7. Similarly, the sum of the coefficients AbsDVA and AbsDVA*NegDVA is positive and significant in all models but Model 7 as the results of Chi-squared/F-tests show. These findings are consistent with managers giving more DVA information for both, larger positive DVAs and larger negative DVAs, in quarterly earnings press releases. The coefficient on AbsDVA*NegDVA is significantly positively associated with four disclosure measures in the regression models (Ment, Sign, Due, and Comment). This finding indicates that managers give this information on DVAs more often for larger negative DVAs than for larger positive DVAs.

Figure 1 illustrates this finding. It displays the predictive probabilities that managers mention DVAs for different sizes of negative and positive DVAs (filled circles). The predictive probability for DVA reporting by managers is mostly larger for negative DVAs than for positive DVAs. The gap is largest for small to medium DVAs. For the largest DVAs, the gap narrows again until the predictive probability for managers’ DVA reporting is about 100% for both, positive and negative DVAs.

DVA Reporting Conditional on DVAs’ Size and Sign. This figure shows predictive probabilities of DVA reporting conditional on DVAs’ size (AbsDVA), conditional on whether DVAs are positive or negative, and conditional on whether the reporting is by managers or the financial press. The predictive probabilities for managers’ DVA reporting are obtained from regression model (1), Table 4, Panel A: \(\begin{aligned} {\text{Ment}}_{\text{it}} & = \beta_{0} + \beta_{1} {\text{AbsDVA}}_{\text{it}} + \beta_{2} {\text{AbsDVA}}_{\text{it}} *{\text{NegDVA}}_{\text{it}} + \beta_{3} {\text{NegDVA}}_{\text{it}} \\ & \quad \quad \, + \beta_{4} {\text{Incentive}}_{\text{it}} + \beta_{5} {\text{Pages}}_{\text{it}} + \beta_{6} {\text{Quarter}}_{\text{it}} + \beta_{7} {\text{TA}}_{\text{it}} + \varepsilon_{\text{it}} \\ \end{aligned}\). The predictive probabilities for the press’ DVA reporting are obtained from regression model (1), Table 5: \(\begin{aligned} {\text{Coverage}}_{\text{it}} & = \beta_{0} + \beta_{1} {\text{AbsDVA}}_{\text{it}} + \beta_{2} {\text{AbsDVA}}_{\text{it}} *{\text{NegDVA}}_{\text{it}} + \beta_{3} {\text{NegDVA}}_{\text{it}} \\ & \quad \quad \, + \beta_{4} {\text{AggInfo}}_{\text{it}} + \beta_{5} {\text{FirstPageMent}}_{\text{it}} + \beta_{6} {\text{AbsNI}}_{\text{it}} + \beta_{7} {\text{NegNI}}_{\text{it}} \\ & \quad \quad \, + \beta_{8} {\text{AbsNI}}*{\text{NegNI}}_{\text{it}} + \beta_{9} {\text{Pages}}_{\text{it}} + \beta_{10} {\text{Quarter}}_{\text{it}} + \beta_{11} {\text{TA}}_{\text{it}} + \varepsilon_{\text{it}}. \\ \end{aligned}\) The regression models have standard errors that are heteroskedasticity robust and clustered by firms. Predictive probabilities are evaluated with covariates fixed at their means. Bars reflect the number of observations within a specific range of AbsDVA. Definitions of variables are reported in Appendix 3, Panel B

The coefficient on Incentive is positive and significant in Model 7 (Excl). This is consistent with managers providing non-GAAP figures excluding DVAs more often when they have a strategic incentive, for example, when the non-GAAP figure shows a profit while GAAP income is a loss. On average, the presence of a strategic incentive increases the likelihood for managers’ reporting of a non-GAAP figure excluding DVAs by 84.7%.Footnote 5 The coefficient on Pages is significantly positive in several models indicating a higher likelihood for DVA information in longer earnings press releases. The coefficient on Quarter is significant in Model 7, consistent with more frequent reporting of non-GAAP figures excluding DVAs over time.

In Model 9, the coefficient on AbsDVA and the joint coefficient of AbsDVA + AbsDVA*NegDVA show that DVA reporting on a press release’s first page is more likely for larger positive and negative DVAs. The significantly positive coefficient on Quarter is in line with more prominent DVA reporting by managers over time.

I rerun the analyses including firm indicators. Thereby, I control for time-invariant firm characteristics that are associated with the propensity to give DVA information. This leads to different sample sizes for the models as some firms never give specific DVA information. Table 4, Panel B shows the results.Footnote 6 The prior results largely persist. In particular, the coefficients on AbsDVA*NegDVA keep their signs and statistical and economic significance. The coefficient on Incentive is significantly positive in Model 5 (Dir) and Model 6 (Comment).

In Model 9 (FirstPageMent), the coefficient on Incentive is positive and weakly significant, consistent with more prominent DVA reporting in press releases when strategic incentives for such emphasis are present.

In conclusion, the findings from my regression analyses on the determinants of managers’ DVA reporting are consistent with claims from the public DVA debate that managers give specific DVA information more often on large negative DVAs than on large positive DVAs. I also find that managers seem more likely to give rather profound disclosures (i.e., directional DVA information, evaluative comments, and non-GAAP figures excluding DVAs) in the presence of strategic incentives, i.e., when DVAs cause net losses or results that compare unfavorably to last year’s results. Finally, I found weak evidence that such situations also incentivize managers to place DVAs more prominently in press releases.

5 Financial press’ DVA reporting

5.1 Determinants of DVAs’ coverage by the financial press

To give evidence on DVA relational information by the financial press, I conducted two sets of determination analyses. In this section, I investigate determinants of the press’ decision to cover a firm-quarter with an article containing DVA information. Table 1, Panel B provides an overview of the distribution of 173 financial press articles with DVA information that I found in US financial newspapers over time and across newspapers. Because some firm-quarters are covered by more than one article, the 173 articles cover only 75 of my 405 sample firm-quarters (18.5%). This indicates a rather selective than broad DVA reporting by the financial press and further motivates my analysis on the determinants of DVAs’ press coverage.

I consider DVAs’ size (AbsDVA) and sign (NegDVA) and managers’ DVA reporting (AggInfo, FirstPageMent) as potential determinants of the press’ decision to cover DVAs. Bischof et al. 2014 do a similar analysis on financial analysts’ DVA coverage. I used the following probit regression model:

where Coverage is a binary variable indicating that a firm-quarter is covered by at least one financial press article with DVA information. AbsNI is the absolute value of quarterly net income and NegNI is a binary variable indicating a negative quarterly net income. I add the latter two variables to control for situations in which large DVAs cause extreme income figures and thereby indirectly drive press coverage of the firm-quarter. Again, I include Pages to control for firms’ transparency in the respective quarter, Quarter to control for a time-trend, and TA for firm-size related effects. I use robust standard errors that are clustered by firms.

Table 3, Panel D shows the respective correlation coefficients. Coverage is positively correlated with AbsDVA, in line with a higher likelihood of press coverage when DVAs are large. Coverage is also positively correlated with all measures of managers’ DVA reporting, consistent with an association between managers’ and the press’ DVA reporting.

Table 5 shows the results of the regression estimations on the determinants of financial press’ DVA coverage. In Model 1, the coefficient on AbsDVA is significantly positive. This indicates more press coverage of larger positive DVAs. In contrast, the joint coefficient on AbsDVA + AbsDVA*NegDVA is not different from zero (p value: 0.684). This is not consistent with more press coverage of larger negative DVAs. Figure 1 illustrates the predictive probabilities that the press covers DVAs for different sizes of negative and positive DVAs (hollow circles). It shows that the probability of press coverage of positive DVAs increases with increasing DVAs’ size. In comparison, the probability of press coverage of negative DVAs increases less and is consistently below the probability of press coverage of equally large positive DVAs. Figure 1 further highlights the difference between managers’ DVA reporting as discussed in Sect. 4.3 (filled circles) and the press’ DVA reporting. While managers are more likely to mention negative DVAs than positive DVAs in earnings press releases, the press is more likely to cover positive DVAs than negative DVAs in press articles.

The coefficient on AggInfo is significantly positive. This is in line with more press’ DVA coverage when managers give more DVA information in quarterly earnings press releases. The coefficient on FirstPageMent is significantly positive, too. This implies more DVA coverage by the press when managers place DVAs prominently in earnings press releases. The significantly positive coefficient on AbsNI*NegNI indicates more press’ DVA coverage in firm-quarters with higher net losses. Finally, the significantly positive coefficients on Quarter and TA imply more DVA coverage by the press over time and for larger firms. I rerun the analysis including firm indicators (Model 2). This decreases the sample size as some firms never receive DVA press coverage. The coefficients on my main variables stay unchanged except for the now significantly negative coefficient on AbsDVA*NegDVA. This is consistent with the financial press covering large positive DVAs more than large negative DVAs. Managers’ prominent placement of DVAs on press releases’ first page increases the predictive probability for their press coverage from 22.1 to 61.0%. I repeated both analyses including Ment to control for the possibility that press’ DVA coverage is mainly driven by managers’ decision whether to report DVAs (Model 3 and 4). The results stay virtually unchanged.

In conclusion, findings from my analyses on the determinants of DVA coverage by the financial press are in line with the financial press being more likely to cover large positive DVAs relative to large negative DVAs. This is consistent with the financial press providing some counterweight to asymmetric DVA reporting by managers who rather emphasize negative DVAs. It is also consistent with prior literature that finds that “bad news” receive more press coverage, as larger positive DVAs reflect higher increases in credit risk (Gaa 2008). Still, possibly contrasting a “watchdog role” of the press, the findings are also in line with findings from prior literature that the financial press potentially follows managers’ reporting spin as DVA coverage is associated with managers’ reporting emphasis on DVAs in press releases (Ahern and Sosyura 2014; Dyck and Zingales 2003). To the extent that managers’ asymmetric DVA reporting follows informative motives rather than strategic motives, however, this finding is consistent with the press disseminating valuable DVA information by managers (Bushee et al. 2010).

5.2 Determinants of new DVA information by the financial press

In this section, I investigate the determinants of “new” DVA information by the financial press, i.e., information beyond managers’ DVA disclosures. Some of the 173 sample articles contain information on more than one firm-quarter. I “split” such articles in two or more “article-firm-quarters”. For example, if an article gives DVA information on three different firm-quarters, I split this article in three article-firm-quarters. Thereby, I am able to compare the DVA information on each firm-quarter in the article with the DVA information in the respective firm-quarters’ earnings press-releases. In total, I split the 173 articles in 202 article-firm-quarters, i.e., 202 non-distinct firm-quarters on which a financial press article gives DVA information. Table 1, Panel C and Appendix 5 give further details.

Hand-collecting the contents of DVA information from the press articles, I build NewInfo: a binary variable indicating that for a given article-firm-quarter, the press article gives DVA information that the firm’s quarterly earnings press release does not give. Appendix 5 details the coding of NewInfo.

Table 6, Panel A shows descriptive statistics for the article-firm-quarters. I found that the press gives new DVA information in 20.8% of the article-firm-quarters. Untabulated results show that the most common forms of new DVA information by the press are non-GAAP figures excluding DVAs and evaluative comments on DVAs. In contrast, I only found three instances in which an article mentions DVAs that the corresponding firm press release does not mention and only one article that provides a DVA’s size that is not given in the respective press release.

Panel B of Table 6 shows the respective correlation coefficients. NewInfo is negatively correlated with AggInfo and FirstPageMent, consistent with the financial press providing more new information if managers give less information. In contrast, NewInfo is not correlated with DVAs’ size (AbsDVA) or DVAs’ sign (NegDVA).

To test for the determinants of new DVA information by the press, I use the following probit regression model:

where NewInfo is a binary variable indicating new DVA information by the press. I use AbsDVA, NegDVA, and their interaction to test if new DVA information by the press is associated with DVAs’ size and sign. I use AggInfo and FirstPageMent to test the association between the press’ DVA reporting and managers’ DVA reporting. Finally, I include Pages, Quarter, and TA to control for overall transparency, time-trends, and firm-size related factors. I used robust standard errors that are clustered by firms. Appendix 1, Panel B summarizes the variables for this test.

Panel C of Table 6 shows the results of the regression estimations. In Model 1, the coefficient on AbsDVA is significantly positive. This is consistent with the financial press being more likely to give new information for large positive DVAs. The insignificant joint coefficient of AbsDVA + AbsDVA*NegDVA (p value: 0.372) implies that this association, in contrast, does not hold for large negative DVAs. In line with the correlation analysis, the coefficient on AggInfo is significantly negative. This is consistent with the financial press being more likely to give new DVA information when managers give fewer DVA disclosures. The coefficient on FirstPageMent is significantly negative on a low level, providing weak evidence that a prominent placement of DVAs in earnings press releases is associated with less new DVA information by the press.

I rerun the estimation including firm indicators (Model 2).The coefficient on AbsDVA*NegDVA is significantly negative suggesting more new information on large positive DVAs than on large negative DVAs by the press. Still, the average likelihood for new DVA information by the press is 20.3% higher for negative DVAs than for positive DVAs. This underlines that a press’ tendency to give more new information on positive DVAs than on negative DVAs is mainly visible for large DVAs. I found that the within-firm-quarter variance of NewInfo is larger for firm-quarters with positive DVAs, because in firm-quarters with negative DVAs, the newspapers in the sample often uniformly do not give new information; nevertheless, the difference between the variances is statistically insignificant (untabulated).

Figure 2 illustrates the predictive probabilities for new DVA information by the press for different sizes of negative and positive DVAs. In line with the findings mentioned above, the likelihood that the press provides new DVA information is higher for negative than for positive DVAs when DVAs are small. Still, the probability of new information on negative DVAs by the press decreases with DVAs’ size, potentially because managers already provide comprehensive disclosures for large negative DVAs (see Sect. 4.3). In contrast, the likelihood that the press provides new information on positive DVAs increases with DVAs’ size. Consequently, for larger DVAs, the probability for new DVA information by the press is higher for positive than for negative DVAs.

New DVA Information by the Press Conditional on DVAs’ Size and Sign. This figure shows predictive probabilities of new DVA information in a financial press article conditional on DVAs’ size (AbsDVA) and conditional on whether DVAs are positive or negative. The predictive probabilities are obtained from regression model (2), Table 6, Panel C: \(\begin{aligned} {\text{NewInfo}}_{\text{it}} & = \beta_{0} + \beta_{1} {\text{AbsDVA}}_{\text{it}} + \beta_{2} {\text{AbsDVA}}_{\text{it}} *{\text{NegDVA}}_{\text{it}} + \beta_{3} {\text{NegDVA}}_{\text{it}} \\ & \quad \quad + \beta_{4} {\text{AggInfo}}_{\text{it}} + \beta_{5} {\text{FirstPageMent}}_{\text{it}} + \beta_{9} {\text{Pages}}_{\text{it}} + \beta_{10} {\text{Quarter}}_{\text{it}} + \beta_{11} {\text{TA}}_{\text{it}} + \varepsilon_{\text{it}} \\ \end{aligned}\). The regression model includes firm indicators and has standard errors that are heteroskedasticity robust and clustered by firms. Predictive probabilities are evaluated with covariates fixed at their means. Bars reflect the number of observations within a specific range of AbsDVA. Definitions of variables are reported in Appendix 3, Panel B

The negative coefficient on Pages provides weak evidence that the press enhances DVA information more often for less transparent firms. The coefficient on AggInfo keeps its sign and significance. To make sure that the coefficient is not mainly driven by observations where managers give thorough information and the financial press, therefore, has little opportunities to add information, I re-estimate Model 1 and 2 excluding observations where AggInfo is above 4 (Model 3 and 4). I found that the coefficients on my test variables mostly do not change.

Taken together, the findings are consistent with the financial press providing new DVA information more often on large positive, income-improving DVAs and when managers give little information. The findings are in line with the financial press enhancing managers’ DVA information and providing some counterweight to asymmetrical managerial DVA reporting, consistent with prior literature (Koning et al. 2010).

6 Conclusion

Based on a sample of 405 firm-quarters and 202 article-firm-quarters of US financial firms that report DVAs between 2007 and 2014, I give comprehensive descriptive evidence on the occurrence, size, and reporting by managers and the financial press of controversial debt value adjustments due to a change in own credit risk (DVAs). I found that DVAs occur mainly for few, very large US financial firms who apply the fair value option for liabilities thoroughly. For these firms, I found that DVAs occur regularly and that DVA gains and DVA losses occur about equally often and on average with comparable size. I further found that managers mention DVAs in 60.5% of their quarterly earnings press releases but scarcely give directional DVA information that could help unravel DVAs’ perceived “counterintuitiveness” (26.4%). Consistent with claims from the public DVA debate, I found that managers give specific DVA information more often for large negative DVAs than for large positive DVAs. Also, I found evidence that managers give rather profound DVA information more often when they have strategic incentives to do so. Concerning financial press’ DVA reporting, I found that the press potentially acts as a counterweight to this behavior by covering large positive DVAs more often than large negative DVAs. However, I also find evidence that the press’ decision to cover DVAs follows the emphasis that managers put on DVAs. Finally, I found that the financial press possibly enhances investors’ understanding of DVAs by providing new DVA information on income-increasing DVAs and when managers’ DVA reporting is scarce. The evidence provides insights into the properties and the informational environment of a novel accounting item that is the subject of a public debate.

My findings have several limitations. First, the findings are purely descriptive and should not be interpreted as causal relations. Second, there is no evidence of the “optimal” level of DVA information by managers or the financial press. Therefore, while the found reporting behavior by managers and the press is consistent with evidence from prior literature, it could still follow different incentives. Third, my text-based measures of DVA information underlie inherent limitations. Foremost, they are subjective by nature. In addition, the aggregating measures (AggInfo and NewInfo) weigh pieces of information equally that are likely of different importance and do not consider that the aggregated pieces of information might be complements or substitutes (Leuz and Wysocki 2016). Finally, DVAs are innately a small-sample story and while the firms in the sample arguably cover a large share of the financial firms’ market, the evidence in this paper only represents 19 firms and their press coverage.

Notes

As data for one firm from the sample of DVA-reporters is missing for the fourth quarter of 2006, I use the earliest data available for this firm instead, i.e., data from the fourth quarter of 2008. The results are not sensitive to the exclusion of this firm.

Specifically: JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., the Goldman Sachs Group Inc., and Morgan Stanley. See https://www.ffiec.gov/nicpubweb/nicweb/HCSGreaterThan10B.aspx. Accessed 26 April 2017.

In some quarterly press releases, I found that managers report DVAs’ size aggregated with other amounts such as credit value adjustments (from counterparty risk changes) or certain fair value adjustments on derivatives. Such “mixed” reporting potentially weakens the test results for this measure. The results from my tests are not sensitive to the exclusion of the Size variable. For details, see Appendix 3, Panel B.

An alternative test specification includes quarter indicators instead of Quarter. The results of my tests are not sensitive to this specification choice.

I estimate differences in likelihoods as the relative change in predictive probabilities with covariates fixed at their means. For example, the increase in the likelihood for managers to provide a non-GAAP figure excluding DVAs (Excl) when they have a strategic incentive to do so is (68.7–37.2%)/37.2% = 84.7%.

I caution to interpret the results of all probit models in this paper that include firm indicators with care, because they inherently suffer from the incidental parameter problem (see Lancaster 2000 for a survey of the problem).

The data is available from http://www.newyorkfed.org/research/banking_research/datasets.html (Accessed 26 April 2017).

The corresponding number of non-financial firms that adopted the fair value option in the sample period is 134.

References

Ahern, Kenneth R., and Denis Sosyura. 2014. Who Writes the News? Corporate Press Releases during Merger Negotiations. The Journal of Finance 69 (1): 241–291.

Appelbaum, Binyamin. 2009. Bank of America’s Profit Mainly Due to Recent Deals. The Washington Post.

Associated Press. 2011. Morgan outpaces rivals in third quarter. The Washington Post.

Barth, Mary E., Leslie D. Hodder, and Stephen R. Stubben. 2008. Fair Value Accounting for Liabilities and Own Credit Risk. The Accounting Review 83 (3): 629–664.

Barth, Mary E., and Wayne R. Landsman. 1995. Fundamental Issues Related to Using Fair Value Accounting for Financial Reporting. Accounting Horizons 9 (4): 97–107.

Baumker, Michael, Philip Biggs, Sarah E. McVay, and Jeremy Pierce. 2014. The Disclosure of Non-GAAP Earnings Following Regulation G: an Analysis of Transitory Gains. Accounting Horizons 28 (1): 77–92.

Beck, Rachel. 2009. Accounting tricks boost bank profits. St. Paul Pioneer Press.

Benders, Rolf. 2012. Quartalswahnsinn mit Methode. Handelsblatt.

Bischof, Jannis, Holger Daske, and Christoph J. Sextroh. 2014. Fair Value-Related Information in Analysts’ Decision Process: evidence from the Financial Crisis. Journal of Business Finance and Accounting 41 (3–4): 363–400.

Botosan, Christine A. 1997. Disclosure level and the cost of equity capital. The Accounting Review 72 (3): 323–349.

Bowen, Robert M., Angela K. Davis, and Dawn A. Matsumoto. 2005. Emphasis on Pro Forma versus GAAP Earnings in Quarterly Press Releases: determinants, SEC Intervention, and Market Reactions. The Accounting Review 80 (4): 1011–1038.

Browdie, Brian. 2012. FASB May Do Away with Adjustments for Changes in Debt Value: Report. American Banker.

Burne, Katy. 2011. How Weakening Credit Strengthens Banks’ Results–and Vice Versa. Wall Street Journal Online. http://www.wsj.com/articles/SB10001424052970204346104576637042309269366. Accessed 26 April 2017.

Bushee, J. Brian, John E. Core, Core, Wayne Guay, J.W. Sophia, and Hamm. 2010. The role of the business press as an information intermediary. Journal of Accounting Research 48 (1): 1–19.

Carver, Laurie. 2012a. DVA: a ‘shameful scam’. Risk.

Carver, Laurie. 2012b. Show me the money. Risk.

Castagna, Antonio. 2012. The impossibility of DVA replication. Risk.

Cedergren, Matthew C., Changling Chen, and Kai Chen. 2015. The Implication of Unrecognized Intangible Assets on the Relation between Market Valuation and Debt Valuation Adjustment. Working Paper, SSRN.

Chasteen, Lanny G., and Charles R. Ransom. 2007. Including Credit Standing in Measuring the Fair Value of Liabilities-Let’s Pass This One to the Shareholders. Accounting Horizons 21 (2): 119–135.

Chung, Sung Gon, Gerald J. Lobo, and Kevin Ow Yong. 2017. Valuation Implications of FAS 159 Reported Gains and Losses from Fair Value Accounting for Liabilities. Working Paper, SSRN.

Craig, Susanne. 2011. Goldman Posts Loss, Signaling A Wall St. Shift. The New York Times

Currie, Antony, and Ian Campbell. 2010. Morgan Stanley’s Painful Setback. The New York Times.

Currie, Antony, and Rob Cox. 2010. Morgan Stanley Sees Less Risk Pay. The New York Times.

Curtis, Asher B., Sarah E. McVay, and Benjamin C. Whipple. 2014. The Disclosure of Non-GAAP Earnings Information in the Presence of Transitory Gains. The Accounting Review 89 (3): 933–958.

Dash, Eric. 2009. After Year of Heavy Losses, Citigroup Finds a Profit. New York Times (Online). http://www.nytimes.com/2009/04/18/business/18bank.html. Accessed 26 April 2017.

Davis, Angela K., Jeremy M. Piger, and Lisa M. Sedor. 2012. Beyond the Numbers: measuring the Information Content of Earnings Press Release Language. Contemporary Accounting Research 29 (3): 845–868.

Davis, Angela K., and Isho Tama-Sweet. 2012. Managers’ Use of Language Across Alternative Disclosure Outlets: earnings Press Releases versus MD&A. Contemporary Accounting Research 29 (3): 804–837.

Davis, Paul. 2010. Bankers Kill The ‘Noise’, Earn Good Feedback. American Banker.

DeCambre, Mark. 2012. JPMorgan trading loss could hit $6B. The New York Post.

DVA, CVA, schmee-VA! Tidy up those results. 2013. Euroweek.

Dyck, Alexander, and Luigi Zingales. 2003. The media and asset prices. Working Paper.

Eavis, Peter. 2008. Heard on the Street - Doubt Delivers for Morgan Stanley. Wall Street Journal.

Eavis, Peter. 2009a. BofA Spoils the Banking Party. Wall Street Journal.

Eavis, Peter. 2009b. Debt-Defying Quirk Could Haunt Banks. Wall Street Journal.

Eavis, Peter. 2015. Bank of America Profit Falls 11%, Hurt by Consumer Loans and Investment Banking. The New York Times.

Eichner, Korbinian, and Hannes Mettler. 2014. The quality and drivers of own credit risk measurement disclosures for fair value Liabilities by European Banks. Working Paper, SSRN.

Elstein, Aaron. 2012. Banks profiting by losing; Accounting quirk allows massively odd gains, but benefits are typically short-lived. Crain’s New York Business.

Engelberg, Joseph E., and Christopher A. Parsons. 2011. The Causal Impact of Media in Financial Markets. The Journal of Finance 66 (1): 67–97.

Enrich, David. 2009. Citi Swings To a Profit, But Defaults Rack Units. Wall Street Journal.

Fang, Lily, and Joel Peress. 2009. Media Coverage and the Cross-section of Stock Returns. The Journal of Finance 64 (5): 2023–2052.

Financial Accounting Standards Board (FASB). 2006. Fair Value Measurements. Norwalk: FASB.

Financial Accounting Standards Board (FASB). 2007. The Fair Value Option for Financial Assets and Financial Liabilities. Norwalk: FASB.

Financial Accounting Standards Board (FASB). 2016. Financial Instruments—Overall (Subtopic 825-10) FASB. CT: Norwalk.

Fontes, Joana Cardoso, Argyro Panaretou, and Ken Peasnell. 2018. The Impact of Fair Value Measurement for Bank Assets on Information Asymmetry and the Moderating Effect of Own Credit Risk Gains and Losses. The Accounting Review In-Press.

Foster, George. 1979. Briloff and the Capital Market. Journal of Accounting Research 17 (1): 262–274.

Foster, George. 1987. Rambo IX: Briloff and the Capital Market. Journal of Accounting, Auditing and Finance 2 (4): 409–430.

Gaa, Charles. 2008. Good News is No News: Asymmetric Inattention and the Neglected Firm Effect. Working Paper.

Gaynor, Lisa Milici, Linda McDaniel, and Teri Lombardi Yohn. 2011. Fair value accounting for liabilities: the role of disclosures in unraveling the counterintuitive income statement effect from credit risk changes. Accounting, Organizations and Society 36 (3): 125–134.

Goff, Sharlene. 2011. Barclays calls for clarity on fair value debt. Financial Times Online. https://next.ft.com/content/5414c254-0def-11e1-9d40-00144feabdc0. Accessed 26 April 2017.

Gogoi, Pallavi. 2009. BofA stock dives despite good earnings report; Investors fear quarter’s gains won’t be repeated. USA Today

Guillamon-Saorin, Encarna, Beatriz García Osma, and Michael John Jones. 2012. Opportunistic disclosure in press release headlines. Accounting and Business Research 42 (2): 143–168.

Guthrie, Katherine, James H. Irving, and Jan Sokolowsky. 2011. Accounting choice and the fair value option. Accounting Horizons 25 (3): 487–510.

Hail, Luzi. 2002. The impact of voluntary corporate disclosures on the ex-ante cost of capital for Swiss firms. European Accounting Review 11 (4): 741–773.

Healy, Jack, and Louise Story. 2009. Bank report fails to stem new unease in markets. The New York Times.

Henry, Elaine. 2008. Are Investors Influenced By How Earnings Press Releases Are Written? Journal of Business Communication 45 (4): 363–407.

Hofman, Abigail. 2011. Abigail with attitude. Euromoney.

International Accounting Standards Board (IASB). 2009. Credit risk in liability measurement: staff paper accompanying discussion paper DP/2009/2. London: IASB.

International Accounting Standards Board (IASB). 2014. IASB completes reform of financial instruments accounting. London: Press Release, IASB.

Keoun, Bradley. 2008. Wall Street Says − 2 + − 2 = 4 as Liabilities Get New Bond Math. New York: Bloomberg.

Keoun, Bradley, and David Henry. 2010. Bank Profits Depend on Debt-Writedown ‘Abomination’ in Forecast. Bloomberg. http://www.bloomberg.com/news/articles/2010-07-11/bank-earnings-depending-on-debt-writedown-abomination-in-latest-forecast. Accessed 26 April 2017.

Koning, Miriam, Gerard Mertens, and Peter Roosenboom. 2010. The impact of media attention on the use of alternative earnings measures. Abacus 46 (3): 258–288.

Lachmann, Maik, Ulrike Stefani, and Arnt Wöhrmann. 2015. Fair value accounting for liabilities: presentation format of credit risk changes and individual information processing. Accounting, Organizations and Society 41: 21–38.

Lancaster, Tony. 2000. The incidental parameter problem since 1948. Journal of Econometrics 95 (2): 391–413.

Landy, Heather. 2009. Valuation adjustments endanger 2Q earnings. American Banker.

Landy, Heather. 2011. 4Q RESULTS: At Citi, an EPS Miss Is News Again. American Banker.

Leuz, Christian, and Peter D. Wysocki. 2016. The economics of disclosure and financial reporting regulation: evidence and suggestions for future research. Journal of Accounting Research 54 (2): 525–622.

Lipe, Robert C. 2002. Fair valuing debt turns deteriorating credit quality into positive signals for boston chicken. Accounting Horizons 16 (2): 169–181.

Marques, Ana. 2010. Disclosure strategies among S&P 500 firms: evidence on the disclosure of non-GAAP financial measures and financial statements in earnings press releases. The British Accounting Review 42 (2): 119–131.

Merton, Robert C. 1974. On the Pricing of Corporate Debt: the Risk Structure of Interest Rates. The Journal of Finance 29 (2): 449–470.

Miller, Gregory S. 2006. The Press as a Watchdog for Accounting Fraud. Journal of Accounting Research 44 (5): 1001–1033.

Milstead, David. 2012. U.S. bank earnings: Read between the lines; Beware the accounting machinations that big U.S. financial services firms try to highlight (or bury) when they sell their earnings tale. The Globe and Mail.

Murakami Tse, Tomoeh. 2010. Bank of America rebounds after consecutive losses; Merrill Lynch merger, gains in economy said to affect profitability. The Washington Post.

Phillips, Matt. 2009. Mark to Market Cuts Both Ways. Wall Street Journal.

Pollack, Lisa. 2011. How one bank’s default is the same bank’s gain. FT Alphaville. http://ftalphaville.ft.com/2011/10/13/701766/how-one-banks-default-is-the-same-banks-gain. Accessed 26 April 2017.

Pozen, Bob. 2011. Using debt value adjustment to inflate profits. Bobpozen.com. http://bobpozen.com/2011/11/using-debt-value-adjustment-to-inflate-profits. Accessed 26 April 2017.

Protess, Ben. 2012. Bank of America Posts A Profit, Though Slight. The New York Times.

Rapoport, Michael. 2012. Odd Debt Rule to Lose Bite. Wall Street Journal.

Rapoport, Michael, and Aaron Lucchetti. 2011. Accounting Quirk Juices Net. Wall Street Journal.

Reilly, David. 2011a. Dimon’s Reserve Spooks Banks. Wall Street Journal.

Reilly, David. 2011b. Goldman tells a tale of two banks. Wall Street Journal.

Rice, Bob. 2012. Bob’s Daily Buzzword: ‘Debt Valuation Adjustment’. Bloomberg. http://www.bloomberg.com/news/videos/b/1f98a609-bbbe-42a1-992c-512165fe8205. Accessed 26 April 2017.

Sadique, Shibley, Francis In and Madhu Veeraraghavana. 2008. The impact of spin and tone on stock returns and volatility: evidence from firm-issued earnings announcements and the related press coverage. Working Paper, SSRN.

Schneider, Felix, and Duc Hung Tran. 2015. On the relation between the fair value option and bid-ask spreads: descriptive evidence on the recognition of credit risk changes under IFRS. Journal of Business Economics 85 (9): 1049–1081.

Schrand, Catherine M., and Beverly R. Walther. 2000. Strategic benchmarks in earnings announcements: the selective disclosure of prior period earnings components. The Accounting Review 75 (2): 151–177.

Schwartz, Nelson D. 2011. JPMorgan Now Biggest Bank in US. The New York Times.

Schwartz, Nelson D. 2012a. Bank of America, Focusing Less on Retail, Leans on Trading for Profit. The New York Times

Sloan, Allan. 2013. Just plain cumbersome writing, whether it’s a law or a financial statement. The Washington Post.

Sorkin, Andrew R. 2012. The paradox of smaller wall street paychecks. The New York Times.

Tchir, Peter. 2012. Dumb and Dumber: The Debt Valuation Adjustment Mess We’re in Today. minyanville.com. http://www.minyanville.com/trading-and-investing/earnings/articles/DVA-debt-valuation-adjustment-morgan-stanley/4/19/2012/id/40511. Accessed 26 April 2017.

Tse, Murakami, and Tomoeh. 2009. Morgan Stanley posts first profit for 2009; Third-quarter earnings beat expectations but trail major rivals. The Washington Post.

Weinreich, Gil. 2012. Hussman Warns: ‘Run, Don’t Walk’ From Stock Markets! AdvisorOne.

White, Halbert. 1980. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48 (4): 817–838.

Woolridge, Jeffrey M. 2013. Introductory econometrics: a modern approach. OH: Mason.

Wu, Wei, Nicole Thibodeau, and Robert Couch. 2016. an option for lemons? The Fair value option for liabilities during the financial crisis. Journal of Accounting, Auditing and Finance 31 (4): 441–482.

Acknowledgements

For valuable comments, I thank Joerg-Markus Hitz, Nico Lehmann, Ulf Brueggemann, and participants at the Research Seminar in Finance, Accounting, and Tax, Goettingen University (December 2013), and the Annual Meeting of the European Accounting Association in Tallinn (May 2014).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Evidence on the DVA debate

To give insights into the DVA debate, I present narrative disclosures from the 173 sample newspaper articles (see Appendix 2). I found that the press often mildly criticizes DVAs by calling them “accounting items” without relation to fundamental value creation (e.g., Gogoi 2009; Murakami Tse 2010; Craig 2011). Also, the press commonly refers to DVAs as “one-time” gains or losses that “boosted” respectively “hit” net income (e.g., Murakami Tse 2009; Healy and Story 2009; Schwartz 2011; Schwartz 2012a). The press often uses nicknames for DVAs. For example, I found the expression “accounting quirk” in ten articles (untabulated, e.g., Eavis 2009b; Landy 2011). Another common name for DVAs in press articles is “paper profits” or “paper gains” (e.g., Eavis 2008; DeCambre 2012).

The press regularly states that DVAs can be “counterintuitive” (e.g., Eavis 2008; Landy 2009; Rapoport and Lucchetti 2011; Browdie 2012). Other times, the press implies that DVAs’ effects on net income can be confusing by referring to them as “weird results” (Phillips 2009), “ugly results” (Eavis 2009a), “obscuring” (Appelbaum 2009), “erratic” (Davis 2010), “noise” (Protess 2012), “a mirage” (Elstein 2012) “arcane” (Eavis 2015), or “fuzzy math” (Beck 2009). The press also targets the accounting rule itself by calling it “nonsensical” (Currie and Cox 2010) or “twisted” (Currie and Campbell 2010).

In a few articles, the press argues polemically against DVAs (“fundamentally unconscionable”, Landy 2009; “perverse practical impact”, Reilly 2011a; “I am not making this up”, Weinreich 2012). One article in the Washington Post rants lengthily on managers DVAs’ reporting in quarterly earnings press releases: “I still can’t translate [DVA] into language approaching English (…). [I]nvestor relations people [are] distributing gibberish and sowing confusion” (Sloan 2013).

Finally, I found sixteen articles (untabulated) that describe the logic behind DVAs and thereby give constructive criticism. The vast majority of these articles explain that as a consequence of, for example, an increase in own credit risk, banks book DVA gains because they could “theoretically buy the debt back at a lower cost” (Associated Press 2011). The journalists behind these articles argue that DVAs make “some sense” (Eavis 2008) “as they seem to offer a clearer picture of to the actual value of a company’s liabilities” (Phillips 2009) and that the regulation “was well intended” as it was “designed to let banks show investors changes in the fair value” (Elstein 2012). Three articles explicitly refer to the respective accounting standard, FAS 159 (Landy 2009; Enrich 2009; Browdie 2012). Five of these articles focus on DVAs as their main topic (Beck 2009; Landy 2009; Phillips 2009; Rapoport and Lucchetti 2011; Browdie 2012).

Appendix 2: Sample selection

To ensure a broad identification of DVA-reporting financial firms in the US in the sample period between 2007 and 2014, I combine two identification approaches from prior literature. In a first step, following Cedergren et al. (2015), I use data from regulatory FRY9C reports as provided by the “Bank Regulatory Database—Bank Holding Companies”. The restriction of my sample to firms from the financial industry is consistent with prior literature on DVAs (e.g., Schneider and Tran 2015; Cedergren et al. 2015). I considered all 8,558 bank holding companies with data available for the sample period between 2007 and 2014. I require firms to file a non-zero amount for one or both of the following items at least once in the sample period: net gains (losses) on fair value liabilities (BHCKF553) and estimated net gains (losses) on fair value liabilities attributable to changes in instrument-specific credit risk (BHCKF554). This is the case for 94 firms. Because the regulatory data from FRY9C filings is possibly not fully compliant with US-GAAP, I require accounting data from 10-K filings. Therefore, I used the New York Fed link data to match the firms’ RSSD IDs from the regulatory database with PERMCO identifiers.Footnote 7 This excludes 39 firms. Then, I match the retrieved PERMCOs with CIK identifiers through the “CRSP/Compustat Merged—Fundamentals Annual” database which excludes another two firms. For the remaining 53 firms, I used the CIK codes to collect all available 10-Q and 10-K filings from the SEC Edgar company filings database. Performing a thorough manual search of these filings, I found that 11 of the firms report DVAs in the sample period.