Abstract

Motivated by the debate about the introduction of the fair value option for (financial) liabilities (FVOL) and the requirement to recognize and separately disclose in financial statements debt valuation adjustments (DVAs), this study explores what we can learn about a firm’s credit risk from DVAs. Using a sample of US bank holding companies that elect the FVOL, we show that DVAs generally cannot be explained by the same factors that explain contemporaneous changes in bank’s credit quality. We further find that DVAs can explain future changes in credit risk when the fair value of liabilities is based on managerial inputs (Level 3). Overall our results suggest that managers have an information advantage in estimating credit risk and that DVAs provide inside information to the market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The introduction of the fair value option for (financial) liabilities (FVOL) has been one of the most controversial issues in the fair value accounting project. An entity electing the FVOL, either under SFAS No. 159 “The Fair Value Option for Financial Assets and Financial Liabilities—Including an amendment of FASB Statement No. 115” (Financial Accounting Standards Board 2007) or IFRS 9 “Financial instruments” (International Accounting Standards Board 2014), is required to measure financial liabilities at fair value and to recognize and separately disclose in the financial statements debt valuation adjustments (DVAs). DVAs represent changes in the fair value of the financial liabilities measured under the fair value option (FVO) that result from the change in the firm’s ability to settle these liabilities in full. Therefore an entity recognizes a loss (negative DVAs) when its credit risk decreases and a gain (positive DVAs) when its credit risk increases.

The FVOL was introduced to simplify the use of hedge accounting, enabling the firms to eliminate or reduce accounting mismatch that arises from the measurement of assets at fair value. However, the recognition of DVAs in the financial statements stirred the debate regarding its effect on the usefulness and informativeness of accounting numbers. On the one hand, critics argue that the resulting gains and losses are counterintuitive to the way in which gains and losses are typically viewed and difficult to explain to investors (Lipe 2002; Chasteen and Ransom 2007). As the market value of liabilities decreases when the entity’s credit quality deteriorates, a gain is recognized when a bad economic event occurs. Similarly, a loss is recognized when a good economic event occurs. On the other hand, Barth et al. (2008) argue that DVAs are consistent with debtholders partially absorbing shocks to the firm’s value (Merton 1974).

A number of empirical studies investigate the effects of DVAs recognition. Barth et al. (2008) find that the effect of changes in a firm’s credit risk on equity returns is attenuated by the presence of debt. They conclude that DVAs should be candidates for inclusion in accounting income if the objective is the faithful representation of the firm’s liabilities and economic performance. Fontes et al. (2018) find that fair value measurement of assets is associated with noticeably lower information asymmetry and that this reduction is larger when banks also recognize DVAs. This finding is consistent with DVAs providing investors with important information on how gains and losses are shared between equityholders and debtholders. In line with this finding, Cedergren et al. (2019) find that DVAs are positively related to equity returns for banks with low level of unrecognized assets.

Assuming DVAs correctly reflect credit risk changes, the above studies provide insight into the value and informational asymmetry implications of DVAs. We contribute to the debate in this accounting policy area by investigating 1) whether reported DVAs reflect changes in credit spreads captured by the market and 2) whether DVAs convey incremental information about an entity’s credit risk, beyond information that can be inferred from the market. Accounting standards have introduced the FVOL to faithfully reflect the effect of changes in entity’s market value on the value of equity and debt. However, it has been argued that firms may opt for opportunistic election of the FVOL (Liu et al. 2011; Wu et al. 2016; Dong et al. 2020). As both FASB and IASB have invested considerable time and resources in introducing and amending the FVOL accounting standard, Footnote 1 providing evidence on whether the adoption of the FVOL leads to more informative financial statements is important.

For the implementation of this study, we use a sample of US bank holding companies. We focus on banks as they are the main users of financial instruments for which the FVOL is applicable. Therefore the effects of DVAs recognition and disclosure are expected to be more pronounced, compared to industries that make more limited use of financial instruments. We focus on a single country to ensure that our results are not driven by potential differences in institutional environments. Our sample covers the period 2007–2017 and includes 38 unique banks that elect the FVOL.

We convert the reported DVAs into changes in credit spreads (DVA-estimated changes in credit spreads) rather than using gains/losses. This allows us to understand better the magnitude of these changes and to use the regression model specifications developed in the literature. We first examine whether DVA-estimated changes in credit spreads can be explained by the same factors that determine changes in CDS and bond spreads. Our results show that, on average, DVAs cannot be explained by the same factors that explain changes in market-based measures of credit risk. This finding may reflect the use of FVOL for opportunistic reasons, or it may reflect the role of DVAs in providing inside information on expected cash flows not captured by the market.

To investigate whether incremental information about the entity’s credit risk is conveyed, we use information on the fair value level of liabilities under the FVO. This enables us to distinguish between DVAs that reflect mainly market information and those that reflect private managerial information about the credit risk of a bank. Here we find that changes in bond and CDS spreads are statistically significant in explaining DVA-estimated changes in the credit spread for banks that report liabilities at fair value Levels 1 and 2. These results are consistent with the idea that Level 1 and 2 reporters use market inputs to estimate their DVAs. For Level 3 reporters, we find that lagged DVA-estimated changes in credit spreads are a significant determinant of changes in bond and CDS spreads.

Our results support the view that managers have an information advantage in estimating DVAs and that fair value measurements based on managerial inputs offer additional information about the credit risk of the bank holding companies. However, these results cannot rule out the use of FVOL for opportunistic reasons. Our results are also particularly relevant to practitioners. Although the DVAs are criticized as counterintuitive to the way in which gains and losses are typically viewed, we show that, when liabilities are measured at fair value Level 3, DVAs provide financial statement users with useful information in predicting credit risk. Our results provide a better understanding of how managers use their discretion in computing Level 3 fair values and contribute to the debate about the role of fair value accounting in generating financial information that is useful for decision-makers (Koonce et al. 2011; Blankespoor et al. 2013; Fontes et al. 2018).

Although the US bank holding companies setting offers several advantages, there are caveats that should be considered when interpreting the results of this study. First, our findings may not generalize to industries with more limited use of the FVOL. Second, our relatively small sample size precludes an exploration of cross-sectional variation across reporting levels or of whether DVAs can predict default better than market-based measures of credit risk. Third, our results are based on a period that DVAs are presented in net income. For fiscal years beginning after Dec. 15, 2017 DVAs are presented in other comprehensive income. In theory, whether the same item appears in net income or in other comprehensive income should not make a difference in terms of valuation (Biddle and Choi 2006; Chambers et al. 2007). However, it is an empirical question whether this change in reporting would lead to changes in the behavior of managers or investors in respect to DVAs and particularly when liabilities are measured at fair value Level 3. Footnote 2

The remainder of the paper is organized as follows. Section 2 provides information on the recognition and disclosure of DVAs, presents the related literature, and outlines our research questions. Section 3 discusses the sample and research design. Section 4 presents our results, while Section 5 concludes.

2 Background and hypothesis development

2.1 Fair value option for liabilities and debt valuation adjustments

Financial liabilities are measured at either amortized cost or fair value. Those that can be measured at fair value include financial liabilities held for trading, derivatives, or other financial instruments that qualify for hedge accounting treatment as well as financial liabilities for which entities elect the FVO (see Fig. 1). Entities elect the FVOL on an instrument-by-instrument basis, a decision that is irrevocable at inception or at FVO adoption if inception is prior to this adoption. DVAs are recognized and disclosed for financial liabilities measured under the FVO. For our sample period, entities report their DVAs in net income.

DVAs are estimated using a range of valuation techniques. Kengla and De Jonghe (2012) present survey results on how DVAs are estimated for 19 financial institutions. They find that four use CDS spreads, four use primary issuances data (based on the latest issuances), four use secondary market data (e.g. bond spreads), and five use curves set internally by treasury or asset-liability management departments. The remaining two use a combination of information including observable inputs and internal data.

Financial liabilities under the FVO are disclosed according to the three-level fair value measurement hierarchy (Financial Accounting Standards Board 2006). Since financial reports provide little information on how DVAs are estimated, Footnote 3 these levels help financial statement users distinguish the reliability of the valuation inputs. Level 1 fair value estimates are based on quoted prices for identical assets or liabilities in active markets. Level 2 estimates are based on quoted market prices for similar assets or liabilities and inputs other than quoted prices, for example, interest rates and yield curves. Level 3 estimates are based on unobservable entity-supplied inputs for the asset/liability. The FASB requires an entity to use market inputs whenever these can be obtained without undue cost and effort.

2.2 Related literature

Our paper contributes to two streams of literature. The first examines the informational effects and value implications of DVAs recognition. Within this area, Lipe (2002) finds that ratios computed using net income adjusted by DVAs do not faithfully depict the negative performance of a firm in financial distress. In another study, Gaynor et al. (2011) find that DVA-related disclosures are insufficient to avoid misleading interpretations of a firm’s financial condition. Specifically, they find that certified public accountants (CPAs) cannot associate a gain (loss) arising from changes in the fair value of liabilities with an increase (decrease) in credit risk. Using archival data, Schneider and Tran (2015) find that European banks that recognize DVAs exhibit lower bid-ask spread compared to non-adopters of the FVOL, consistent with the FVOL mitigating information asymmetry. Finally, Fontes et al. (2018) show that fair value measurement of assets is associated with noticeably lower information asymmetry and that this reduction is more than twice as large when banks also recognize DVAs.

Examining the value relevance of DVAs, Chung et al. (2017) report a positive relationship between DVAs and current period stock returns. Cedergren et al. (2019) find that, when the level of unrecognized assets is low, DVAs are positively associated with stock returns. However, this relation becomes less positive as the level of unrecognized assets increases, eventually becoming negative. This result suggests that investors understand the role of unrecognized assets in assessing the value relevance of DVAs.

In a study closely related to ours, Dong et al. (2020) find that DVAs are positively associated with changes in bond spreads and that abnormal DVAs are negatively associated with pre-managed earnings, consistent with firms exercising discretion over DVAs to smooth earnings. Our study extends their insights by examining whether DVAs provide information to the market about a firm’s credit risk.

The second stream of related literature investigates the value and risk relevance of the three fair value levels. Song et al. (2010) find that the association between share prices and fair values of assets and liabilities is higher for Levels 1 and 2 than for Level 3 fair values. This result suggests that investors place less weight on fair values based on unobservable inputs. The fair value hierarchy is also shown to influence information asymmetry between the managers of a firm and the external capital market participants. Magnan et al. (2015) report that Level 3 fair values increase forecast dispersion, while Riedl and Serafeim (2011) find that firms with greater exposure to Level 3 assets have higher equity betas. In line with these results, Iselin and Nicoletti (2017) find that banks change the asset composition of their portfolios to avoid disclosing Level 3 assets.

While the above studies suggest that fair values based on inputs corresponding to higher levels in the fair value hierarchy are more useful, this is not always the case. For example, Altamuro and Zhang (2013) find that Level 3 mortgage servicing rights better reflect the risk of the underlying servicing portfolios than do Level 2 mortgage servicing rights, indicating that managers have an information advantage in estimating the fair value of these instruments. Furthermore, Lawrence et al. (2016) find similar share price association across fair value levels for a sample of closed-end funds where all assets are measured at fair value. Our study contributes to this stream of research by examining the credit risk informativeness of DVAs across the different fair value levels.

2.3 Research questions

Most of the previous studies on the effects of DVA recognition and the associated disclosures assume that DVAs correctly reflect (or at least are positively correlated with) changes in the credit quality of an entity or that the DVAs reflect changes in credit spreads captured by the market. This paper contributes to the debate in this accounting policy area by investigating 1) whether DVAs accurately reflect changes in credit spreads captured by the market and 2) whether they provide incremental information about an entity’s credit risk beyond information that can be inferred from the market.

First, we investigate whether DVA-estimated changes in credit risk can be explained by the same factors that explain changes in CDS and bond spreads. Our findings here indicate whether DVAs reflect the market information on the credit quality of an entity. Our expectation is that, since DVAs incorporate both market and private managerial information, DVA-estimated changes in credit risk are not necessarily explained by the same factors that explain market-based measures of credit risk changes.

Second, we use information on the fair value level of liabilities under the FVO to distinguish between public and private information incorporated in DVAs. We expect changes in bond and CDS spreads to be more significant in explaining DVA-estimated changes in credit spreads when financial liabilities under the FVO are measured at Levels 1 and 2, as DVAs reflect mainly market information. We further expect DVA-estimated changes in credit spreads to predict future changes in CDS and bond spreads when financial liabilities under the FVO are measured at Level 3, as DVAs reflect private information about the credit quality of the entity.

3 Sample selection and research design

3.1 Sample selection

To examine our research questions, we use a sample of US bank holding companies that file quarterly FR Y-9C reports with the Federal Reserve. We focus on financial companies, as DVAs are particularly relevant in this industry. Footnote 4 We restrict our sample to bank holding companies, as their regulatory filings provide detailed, standardized disclosures related to their election of the FVOL and DVAs. Our sample period spans the first quarter of 2007 to the fourth quarter of 2017. We begin with 2007, as the FASB allowed for early adoption of SFAS No.159 (ASC 825) on eligible financial instruments that year, although the effective date of the standard is Jan. 1, 2008, for regular adopters. Footnote 5

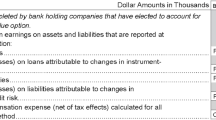

In our sample, bank holding companies that elect the FVOL are required to report two data items in their quarterly FR Y-9Cs. One is total gains/losses on liabilities under the FVO (BHCKF553), and the second is gains or losses on liabilities under the FVO attributable to changes in own credit risk (BHCKF554). We obtain this information from the Bank Regulatory database. Footnote 6 We require that banks report BHCKF553 or BHCKF554 at least once over our sample period. This process provides us with a starting sample of 85 bank holding companies. For some bank-quarters, data on DVAs are missing from the database. For these, we hand-collect DVAs from the 10Q/10 K filings. Footnote 7 An example of such a disclosure is provided in Appendix 1 Figs 2 and 3. DVAs reported in the Bank Regulatory database occasionally differ from those in the 10Q/10 K filings. Footnote 8 In line with Cedergren et al. (2019), we use entries from the 10Q/10 K filings in these cases, as the information in these filings is more likely to be scrutinized by auditors.

We also require that the bank holding companies in our sample be publicly traded with available data to compute our explanatory variables and that they have a positive book value of liabilities (Eom et al. 2004). This requirement reduces our sample to 46 unique banks. Finally, we require that firms provide information on the fair value and principal value of liabilities under the FVO, which we hand-collect from financial reports. This process yields a sample of 887 bank-quarter observations, representing 38 unique banks. The sample selection process is summarized in Table 1.

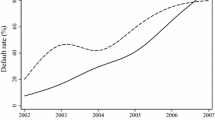

Table 8 in Appendix 2 provides information on the number of bank-quarters for which negative, zero, or positive DVAs are reported each year. Out of the 887 bank-quarter observations, banks report positive (negative) DVA in 171 (176) quarters. Footnote 9 The table also reports the mean value of quarterly DVA by year and the price of the Bloomberg Barclays Bank Corporate Index as an inverse proxy for aggregate bank credit risk. That is, a decrease in the price of the Index indicates an increase in banks’ credit risk. Accordingly, more banks are expected to report positive DVAs in those periods. In line with our expectations, the mean DVA is strongly negatively correlated with the relative changes in the index, with the correlation coefficient equal to −0.89. Consistent with that result, the number of quarters in which positive (negative) DVAs are reported is also negatively (positively) correlated with the index changes.

In more than half of the quarters, banks report a zero DVA. Credit risk is potentially continuously changing for a firm. Therefore we might expect to see non-zero DVAs reported in all bank-quarters. In reality, a reported zero DVA simply indicates that the effect of own credit risk changes on the fair value of liabilities is immaterial to the financial statements. Therefore reported zero DVA is, in principle, informative to the market, as it means, at least for the banks with a sufficient proportion of liabilities under FVO, that the management considers the change in the credit risk of the entity since the last reporting period to be very small. Table 9 in Appendix 2 provides information on the number of quarters where negative, zero, or positive DVAs are reported per bank in our sample.

3.2 DVA-estimated changes in credit spreads

As mentioned, for our analyses, we convert reported DVA amounts into DVA-estimated changes credit spreads. Converting DVAs into changes in credit spreads, rather than reporting them as dollar gains/losses, provides a unit-free standardized measure that is directly comparable across different observations, as it takes into account relevant credit information embedded in a bond’s yield as well as its maturity and coupon structure. Since DVA-estimated changes in credit spread are interpreted in the same way as changes in market-based credit spreads, these can be directly used in regression model specifications developed to investigate the determinants of changes in credit spreads. To convert the reported DVAs, we use information on an entity’s liabilities under the FVO obtained from their financial reports.

The amount or type of liabilities under the FVO can change from one reporting period to the next, because new liabilities may occur or some liabilities may extinguish. Therefore we need to rely on information from the same reporting period in constructing our measure. We use \( {\hat{FVL}}_t \) to denote the hypothetical value of liabilities under the FVO at the end of quarter t, in the absence of changes in own credit risk. DVAt is the change in the fair value of liabilities due to fluctuations in creditworthiness in quarter t, while FVLt is the actual fair value of liabilities under the FVO at the end of the same quarter after DVAs are considered. Because a negative DVA (loss) indicates an increase in the value of liabilities, while a positive DVA (gain) indicates a decrease, the actual fair value of liabilities at time t (FVLt), equals the value of liabilities in the absence of own credit risk changes (\( {\hat{FVL}}_t \)) minus DVAt:

Since FVLt and DVAt are provided in financial reports, we can use Eq. (1) to estimate\( {\hat{FVL}}_t \). If DVAt is zero, the actual fair value of liabilities equals the hypothetical fair value of liabilities (\( FV{L}_t={\hat{FVL}}_t \)). If credit quality increases, the credit spread decreases, and the entity incurs a loss, indicated by a negative DVA. In this case, the actual fair value of liabilities will be higher than the hypothetical fair value of liabilities (\( FV{L}_t>{\hat{FVL}}_t\Big) \). This is because the cash flows of liabilities are discounted at a lower rate than they would have been in the absence of credit quality improvement. By contrast, if credit quality decreases, the actual fair value will be lower than the hypothetical fair value (\( FV{L}_t<{\hat{FVL}}_t\Big) \).

Next we estimate the discount rate applied to obtain the actual fair value of liabilities and the hypothetical fair value of liabilities in the absence of changes in own credit risk. To do so, we assume that liabilities under the FVO consist of one type of bond that pays a coupon semi-annually. Based on the bond valuation formula:

where yt \( \hat{\Big({y}_t} \)) is the semi-annually compounded actual (hypothetical under no own credit risk changes) yield to maturity, and B is the face value of liabilities under FVO. To estimate the respective yields (\( {y}_t,{\hat{y}}_t \)), we hand-collect information on the face value (B) and price-weighted average maturity (T) of FVLt from financial reports. Footnote 10 As a coupon rate (c), we use the price-weighted average coupon rate on straight coupon bonds issued by the bank. Footnote 11

The yield to maturity is equal to the risk-free rate plus the credit spread. Given that the risk-free rate (r) for a given quarter is the same for both FVLt and \( {\hat{FVL}}_t \), the DVA-estimated change in credit spread (Delta_DVA_CS) is given by the difference between the actual and hypothetical yield to maturity:

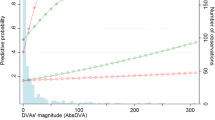

Appendix 3 Fig. 4 and Table 10 provides further details including the time line of accounting and market information as well as a numerical example to illustrate how the DVA-estimated change in in credit spread is calculated.

Table 2 Panel A presents the descriptive statistics for DVAs and our equation inputs. To provide an indication of the magnitude of DVAs, we provide the ratio of DVA to one-quarter lagged liabilities under the FVO (DVA/FVL_lag) as well as the ratio of DVA to one-quarter lagged assets (DVA/Asset_lag). The mean DVA is negative, for both the full sample of FVOL adopters and non-zero DVA reporters.

Panel B provides information on DVA-estimated changes in credit spreads and changes in CDS and bond spreads. Footnote 12 The average change in DVA-estimated credit spread for both the full sample and non-zero DVA reporters is negative. We obtain CDS and bond spreads from Thomson Reuters Datastream. For CDS spreads, we use spreads with identical maturities as the liabilities of the banks under FVO using linear interpolation. We identify CDS spreads for 13 banks in our sample, resulting in 379 quarterly observations.

For bond spreads, we identify publicly traded bonds without inherent option rights issued by banks in the sample from 1996, the first year that Datastream reports bond-related information, to 2017. A bond spread is defined as the corporate bond yield minus the yield of the benchmark Treasury rate. If there is no benchmark bond with the same maturity, then linear interpolation is used to estimate the yield of the equivalent benchmark. For bonds with a maturity longer (shorter) than the longest (shortest) benchmark bond, the equivalent benchmark yield is always the yield of the longest (shortest) Treasury bond. Using quarterly bond yield spreads for 2007 to 2017 yields a final sample of 1313 bonds from 27 bank holding companies and 21,514 quarterly changes in credit spreads. We define a change in a bond spread (Delta_Bond_CS) as the difference in spread between two consecutive quarters. We also estimate changes in bond spreads at the bank level (Delta_Bond_CS_Mean). Following Barth et al. (2012), we measure bank-level spread as the price weighted average spread of all bonds issued by the bank. To avoid the effect of outliers, we winsorize changes in bond spreads at the 1% and 99% (DeFond et al. 2011; Blankespoor et al. 2013). Footnote 13 Appendix 2 Table 9 provides information on the availability of CDS and bond data for the banks in our sample.

3.3 Research design

To investigate whether DVA-estimated changes in credit spreads (Delta_DVA_CS) can be explained by the same factors that explain changes in CDS or bond spreads, we estimate the following linear regression model:

Based on the literature (Collin-Dufresne et al. 2001; Barth et al. 2012; Correia et al. 2012; Correia et al. 2018), we expect changes in credit spreads to be positively associated with changes in leverage (Delta_Lev), asset volatility (Delta_Sigma), the probability or magnitude of downward jump (Delta_Jump), and book-to-market ratio (Delta_BTM). We expect that they are negatively associated with changes in business climate, as captured by S&P 500 returns (Delta_SP500), distance to default (Delta_D2D), and size (Delta_Size). Following Correia et al. (2018) and Correia et al. (2012), we also include equity return (MOMS) and the exponentially weighted cumulative return (MOML), to capture the response of credit markets to information in equity markets. Appendix 4 describes how we measure each explanatory variable.

Table 2 Panel C presents the descriptive statistics for our explanatory variables. Untabulated results show that the correlations between our control variables are relatively low, indicating no multicollinearity between them. To control for the panel data structure of our sample, we estimate regressions results adjusted to account for correlation within firm and quarter clusters and we include firm fixed effects in our regression models. Footnote 14

4 Empirical results

4.1 Determinants of DVA-estimated changes in credit spread

Table 3 presents the regression results for the determinants of DVA-estimated changes in credit spreads. From column (1), we can see that none of the explanatory variables is statistically significant in explaining DVA-estimated changes in credit spreads for our full sample. We further see that the adjusted R-squared is low, indicating limited explanatory power of the model. From column (2), we see that Delta_SP500 and Delta_Jump are significant in explaining DVA-estimated changes in credit spreads for our non-zero DVA reporters and that the adjusted R-squared increases to 27.60%.

To assess the explanatory power of the control variables in our model, we next run regressions on the changes in CDS and bond spreads and present the results in the last three columns of Table 3. Footnote 15 For the change in CDS spreads, only Delta_BTM is statistically significant. For the change and average change in bond spreads, the results in columns (5) and (6) show that most of the coefficients have the predicted sign and that a number of them are statistically significant. Note that, while the coefficients of Delta_SP500 and Delta_Jump in CDS spreads regressions are of the same or greater magnitude as in the DVA-estimated and bond spreads regressions, they are not statistically significant, possibly due to our smaller sample size. Footnote 16 We further see that the explanatory power of the model that explains changes in bond spreads is also higher compared to that in the first column, with an adjusted R-squared between 16.69% and 43.90%. Similar to the models of Blanco et al. (2005) and Collin-Dufresne et al. (2001), our models leave significant variance both in CDS and bond spread changes unexplained. According to Collin-Dufresne et al. (2001), this may be a result of spreads being driven by market-wide supply and demand shocks.

It is possible that our results are driven by the assumptions we make in estimating our dependent variable (Delta_DVA_CS). To check the robustness of the results to these assumptions, we use a number of alternative dependent variables and re-run our analysis. Specifically, we scale DVA_t by (1) lagged total assets, (2) lagged liabilities under the FVO, and (3) total liabilities. Using these alternative measures yields (untabulated) results similar to those presented in Table 3. We also investigate whether our results in the first two columns in Table 3 are driven by observations for which we do not have market-based measures of credit risk. Running regressions using subsamples of only those observations for which we have available changes in CDS spreads and only observations for which we have available changes in bond spreads yields similar findings.

Overall our results for the determinants of DVA-estimated changes in credit spreads show that reported DVAs, on average, are not explained by the factors that explain changes in credit spreads. This result can be driven by the fact that DVAs incorporate both market and private information on the credit risk of the entity. The use of private information in the estimation of DVAs can result in entities using FVOL for opportunistic behavior or to provide inside information on their credit standing. Indeed, Dong et al. (2020) provide evidence consistent with banks exercising discretion over DVAs to smooth earnings. While we cannot rule out this possibility, in the subsequent analysis, we focus on investigating whether DVAs reflect management’s assessment of the credit quality of the bank and thus provide inside information on its credit standing.

4.2 Fair value level

To investigate whether DVAs convey incremental information about an entity’s credit risk, we distinguish between public and private information incorporated in DVAs, using information on the fair value level of liabilities under the FVO. Table 4 provides information on the percentage of liabilities under the FVO by level (Panel A) as well as the number of observations classified as Level 1 and 2, or Level 3 reporters using different cutoffs (Panel B). Because only a small percentage of liabilities under the FVO are measured at Level 1, we group Level 1 and 2 reporters together in our analysis. For the results presented in this paper, a bank is considered to be a Level 1 and 2 (Level 3) reporter, if it reports 80% or more of its financial liabilities under the FVO at Levels 1 and 2 (Level 3) in a specific quarter. As the classification is done per quarter, a bank can be Level 1 and 2 reporter in one quarter and Level 3 in another. Appendix 2 Tables 8 and 9 provides this information for the banks in our sample. The conclusions do not change if we use a 100% or a 70% cutoff.

From Table 4, we see that when we use the 80% cutoff, 433 bank-quarter observations are classified as Level 1 and 2, while 306 bank-quarter observations are classified as Level 3 reporters. Using our CDS subsample, we find that 228 bank-quarter observations are classified as Level 1 and 2, while 49 bank-quarter observations are classified as Level 3 reporters. Note that, if the inputs used to measure the fair value of liabilities under the FVO fall into different levels, then the level employed for measurement and presentation is based on the lowest level input. Therefore banks may have CDS spreads or traded bonds and yet report their liabilities at Level 3. Similarly, a Level 2 reporter may not have CDS spreads or traded bonds available but instead use quoted market prices for similar instruments issued by another company.

For Level 1 and 2 reporters, we expect DVA-estimated changes in credit spread to be better explained by the factors that explain market-based measures of changes in credit spreads than for Level 3 reporters, since market inputs are used in the estimation of DVAs. The results presented in Table 5 column (1) for Level 1 and 2 reporters indicate that DVA-estimated changes in credit spreads are still not well explained by the factors that explain market-based measures of changes in credit spreads. While the coefficients of Delta_SP500, Delta_Jump, and MOMS are significant, the adjusted R-squared is negative, indicating that the model contains terms that do not help predict the DVA-estimated changes in credit spreads. For Level 3 reporters, only Delta_BTM is significant in explaining DVA-estimated changes in credit spreads and again the adjusted R-squared is negative. Footnote 17

The Level 1 and 2 results can be largely driven by the Level 2 reporters, as only three banks (33 bank-quarters) report more than 80% of liabilities under the FVO at fair value Level 1. For the valuation of their liabilities under the FVO, Level 2 reporters use quoted market prices from similar traded instruments and inputs other than quoted prices. From the market, one can observe the credit spread of the instrument, which is driven not only by the credit risk of the company but also by other factors (as for example, liquidity and duration). If the characteristics of the liabilities under the FVO differ from the traded instruments, entities will adjust the credit spreads. Because of these adjustments and potential measurement error, the observed credit spreads can differ from the DVA-estimated credit spreads for Level 2 reporters.

In columns (3) through (11), we see that the coefficients on the changes in CDS spreads and bond spreads are statistically significant for Level 1 and 2 reporters. The adjusted R-squared also increases significantly. These results are consistent with the fact that market inputs are used to measure liabilities at fair value Level 1 and 2. We find no such evidence for Level 3 reporters.

Next we investigate whether reported DVAs convey private information about the credit quality of an entity, by examining whether DVAs predict future changes in credit spreads. Specifically, we include the following variables in our regression models: the contemporaneous DVA-estimated changes in credit spreads (Delta_DVA_CS_t), the one-quarter leading DVA-estimated change in credit spreads (Delta_DVA_CS_t + 1), and the one-quarter lagged DVA-estimated change in credit spreads (Delta_DVA_CS_t-1). Footnote 18 If managers provide private information to the market through DVAs and associated disclosures, we expect lagged DVA-estimated changes in credit spreads to be significant in explaining changes in CDS and bond spreads, particularly for Level 3 reporters, as fair values are based on managerial inputs. The number of observations decreases, as we need data on CDS spreads and bond spreads as well as one-quarter lead and lagged data on DVA-estimated changes in credit spreads.

From the results in Table 6, we see that the coefficient for the leading DVA-estimated change in credit spreads is not significant, indicating that future DVA-estimated changes in credit spreads and current market-based measures of changes in credit spreads are uncorrelated. The coefficient of the contemporaneous DVA-estimated change in credit spreads is consistently positive and significant for Level 1 and 2 reporters. This is in line with the results in Table 5 and is consistent with the use of market inputs used for the estimation of DVAs. For Level 3 reporters, we find that the lagged DVA-estimated changes in credit spreads are significant in explaining changes in the bond and CDS spreads. We further see a significant increase in the adjusted R-squared. Our findings support the conjecture that managers provide inside information to the market through DVAs and their associated disclosures.

We next use panel vector autoregressive model (Holtz-Eakin et al. 1988) to formally examine the joint evolution of the key variables. Results are presented in Table 7. Panel A presents results on changes in CDS spreads, while Panels B and C present results on changes in bond spreads. Using the model and moment selection criteria of Andrews and Lu (2001), we find that the optimal number of lags in the model is one (quarter), in line with the model presented in Table 6. Note that our requirement for one-quarter lagged data for both DVA-estimated changes in credit spreads and market-based measures of changes in credit spreads leads to a slightly different number of observations for this analysis.

From columns (2) and (3), we see that the lagged DVA-estimated changes in credit spreads have a positive effect on changes in market-based measures of changes in credit risk for Level 3 but not for Level 1 and 2 reporters. At the same time, the results in columns (4) through (6) show no support for the notion that changes in CDS and bond spreads lead DVA-estimated changes in credit spreads for Level 3 reporters. For Level 1 and 2 reporters, this relationship is significant in two out of three cases, consistent with earlier findings that credit risk information is incorporated in market spreads no later than in DVA-estimated spreads. Taken together, the results of this analysis confirm that DVA-estimated changes in credit spreads lead market-based measures of changes in credit spreads for Level 3 reporters.

Changes in both market and DVA-estimated credit spreads exhibit, most of the time, negative autocorrelation, which is consistent with mean reversion. This result may be driven by banks dynamically managing their risk exposure or mean reversion in the economic conditions affecting the banks in our sample. In addition, the non-synchronous trading effect associated with thinly traded bonds (Lo and MacKinlay 1990) as well as the bid-ask bounce (Roll 1984) are likely to contribute to the negative autocorrelation of market spreads. For DVA-estimated spreads, for which the market microstructure considerations do not play a role, the measurement error in inputs used to construct the spreads as well as a possible systematic managerial overreaction to news (Amihud and Mendelson 1987) are complementary explanations of their negative autocorrelation.

4.3 Further sensitivity analyses

Finally, to investigate the robustness of our findings, we conduct several additional tests. If the banks that adopt the FVOL at Level 3 differ from the banks that adopt the FVOL at Levels 1 and 2, there is a selection bias. To control for the time invariant unobservable characteristics that affect the changes in credit spreads, we include in our main analyses bank fixed effects. To control for potential time-varying unobservable characteristics, we use the two-stage Heckman (1979) correction procedure. In the first stage, we use a probit model to explain the use of fair value Level 3 reporting (Altamuro and Zhang 2013; Iselin and Nicoletti 2017) and find that Level 3 reporting is associated with bank size, use of a Big Four auditor, use of FVO for assets, and the importance of liabilities under FVO. In the second stage, we add the self-selection parameter calculated from the probit model to our main regression models. Untabulated findings show that lagged DVA-estimated changes in credit spreads are still significant in explaining changes in market spreads for Level 3 reporters.

To test whether our results are influenced by the inclusion of early adopters, we re-run our analyses after deleting 2007 observations from the sample. Untabulated findings indicate that the inferences based on the main results remain valid. We also re-run our models using explanatory variables from the finance literature. Following Collin-Dufresne et al. (2001), we use changes in leverage, asset volatility, the probability or magnitude of a downward jump, spot rate, the slope of the yield curve, and business climate as an alternative set of control variables. The results from these analyses are in line with those of our main models.

5 Conclusions

Our paper lends insight to the debate on the introduction of the FVOL by examining whether reported DVAs reflect changes in credit spreads captured by the market and whether they contain incremental information about an entity’s credit risk. Using a sample of US bank holding companies, we find that, on average, DVAs cannot be explained by the same factors that determine changes in credit risk. This finding may reflect the use of the FVOL by managers for opportunistic reasons. However, it may also indicate that managers possess information about their institutions’ credit risk not fully embedded in market data.

To examine the latter conjecture, we investigate the ability of reported DVAs to predict future changes in credit spreads. We find that lagged DVA-estimated changes in credit spreads are significant in explaining changes in both CDS and bond spreads. This result is driven by banks that report liabilities at fair value Level 3, supporting the conjecture that managers provide inside information to the market through DVAs and their associated disclosures. Overall our results improve understanding of managerial decision-making with respect to fair value accounting and contribute insight to the debate about the role of fair value accounting for financial liabilities in generating decision-useful financial information. Our study also offers useful insights to practitioners, indicating that, when liabilities are measured at fair value Level 3, reported DVAs provide inside information about the credit quality of the banks.

Notes

For example, under SFAS No. 159, for fiscal years beginning after Dec. 15, 2017 DVAs are presented in other comprehensive income (ASC 825–10–45-5).

We identify a very small number of bank holding companies that measure liabilities under the FVO at fair value Level 3 in the 2018–2020 period. This precludes currently an analysis for the period after DVAs are presented in other comprehensive income.

When DVAs are significant, SFAS No. 159 (ASC 825) requires that entities disclose qualitative information about the reasons for instrument-specific credit risk changes as well as how DVAs are determined. However, when we read this information in the financial reports of the banks in our sample, we find that it is often very brief and that important steps in the calculation process are not provided. Therefore we conclude that it is difficult for financial statement users to understand how DVAs are estimated from reading these financial reports. For example, in the 2015 annual report (page 205), JP Morgan Chase & Co mentions the following on how DVAs are determined for long-term debt under the FVO: “Changes in value attributable to instrument-specific credit risk were derived principally from observable changes in the Firm’s credit spread.”

To investigate the use of FVOL by nonfinancial firms we collect data form 2009, the year with the highest number of FVOL adopters in our sample. We construct our nonfinancial firm sample using all firms that have available 10 K documents in EDGAR. After matching these firms with their data in the Compustat database, we identify 690 nonfinancial firms that mention the fair value option in their 10Ks. (We search their 10Ks for “fair value option” as well as different combinations of “SFAS No. 159” and “ASC 825”.) When we read the related parts of the 10Ks of those 690 firms, we identify only 11 firms that elect the FVOL. In the rest of the cases, firms mention that they do not elect the fair value option for any financial instruments or that they elect the option only for eligible financial assets. None of the 11 nonfinancial firms that elect the FVOL in 2009 reports a non-zero DVA.

Our results are robust to the exclusion of early adopters from our analysis.

The downloaded item on DVAs from the Bank Regulatory database reports the total DVAs since the beginning of the financial year. To obtain the quarterly DVAs, we take the difference between the two quarters.

Firms are required to report DVAs in their 10Q/K filings if these are material.

This is the case for only 6 bank-quarters, and our results are robust to the exclusion of these observations from our sample.

Most of the positive and negative (i.e., non-zero) DVAs are driven by large banks (banks with a book value of assets greater than $50 billion).

Face value is the sum of the principal value of long-term liabilities under the FVO and the book value of short-term liabilities under the FVO. We assume that the principal value of short-term liabilities equals their book value. If we do not have information about T for a given observation, we use the price-weighted average maturity of all bonds issued by the bank instead.

We obtain information on coupon rates from Datastream. For DVA reporters with no traded bonds, we collect information on coupon rates from financial reports, as this information is voluntarily disclosed by some of the banks. We have only two banks in our sample that are non-zero DVA-reporters with no traded bonds. (For zero DVA reporters, DVA-estimated changes in credit spreads are zero.) Our results are robust to the exclusion of these two banks from the analysis. We also calculate DVA-estimated changes in credit spreads assuming zero-coupon debt. Our results remain unchanged.

We use CDS spreads, as they are a cleaner measure of credit risk compared to bond spreads. Even though bond spreads are influenced by factors such as tax, liquidity, and duration, their inclusion increases our number of observations and allows us to check the robustness of our results.

Descriptive statistics confirm that there are some potentially non-valid observations in the data, resulting in extreme positive or extreme negative changes in credit spreads. These non-valid observations may be a result of error entry in the database, illiquid bonds, or bonds of very long or short maturity. Our results are robust to (1) using not winsorized data, (2) using the log form of bond spreads, and (3) deleting observations that are candidates for data errors (Bessembinder et al. 2006; Helwege et al. 2014).

In our main analysis, we do not include time fixed effects because macro economic variables do not vary enough over quarters and because of the small sample size for some of the analyses (Li and Prabhala 2007). The results are robust for our larger subsample of bond spreads when we (1) use time fixed effects and (2) include indicator variables for the first, second and third quarter.

An alternative market-based measure of changes in credit risk is changes in credit ratings. However, given the small number of changes in actual and estimated credit ratings in our sample, we cannot use this measure to conduct a meaningful analysis.

The unadjusted R-squared is positive but small for both Level 1 and 2 as well as Level 3 reporters.

The choice of one quarter as the length of a (single) lag is driven by the structure and limitations of our data. While market spreads can be measured almost continuously, we can measure DVA-estimated spreads with only a quarterly frequency as these are based on accounting data. The inferences of our results do not change if we use a one-month window for market spreads. We consider a one-month window after the end of the quarter as a reasonable approximation of the release of the DVAs information without imposing strict assumptions on the release date.

The proxy is constructed from at- and out-of-the money puts (e.g., −0.5≤δ ≤ 0) and at- and in-the-money calls (e.g., 0.5≤δ ≤ 1) with the shortest maturity on the S&P 500 index futures. Then we fit the linear quadratic regression σ(SK) = α + β1SK+ β2SK2, where SK is the strike price and σ is the implied volatility for each strike price using the Black-Scholes model (Black and Scholes 1973). The estimated jump is defined as Jumpt = [σ(0.9F)-σ(F)], where F is the at-the-money strike price.

References

Altamuro, J., and H. Zhang. 2013. The financial reporting of fair value based on managerial inputs versus market inputs: Evidence from mortgage servicing rights. Review of Accounting Studies 18 (3): 833–858.

Amihud, Y., and H. Mendelson. 1987. Trading mechanisms and stock returns: An empirical investigation. Journal of Finance 42 (3): 533–553.

Andrews, D.W.K., and B. Lu. 2001. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. Journal of Econometrics 101 (1): 123–164.

Barth, M.E., L.D. Hodder, and S.R. Stubben. 2008. Fair value accounting for liabilities and own credit risk. The Accounting Review 83 (3): 629–664.

Barth, M.E., G. Ormazabal, and D.J. Taylor. 2012. Asset securitizations and credit risk. The Accounting Review 87 (2): 423–448.

Bessembinder, H., W.F. Maxwell, and K. Venkataraman. 2006. Market transparency, liquidity externalities, and institutional trading costs in corporate bonds. Journal of Financial Economics 82 (2): 251–288.

Bharath, S.T., and T. Shumway. 2008. Forecasting default with the Merton distance to default model. Review of Financial Studies 21 (3): 1339–1369.

Biddle, G.C., and J.H. Choi. 2006. Is comprehensive income useful? Journal of Contemporary Accounting & Economics 2 (1): 1–32.

Black, F., and M. Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81 (3): 637–654.

Blanco, R., S. Brennan, and I.W. Marsh. 2005. An empirical analysis of the dynamic relation between investment-grade bonds and credit default swaps. Journal of Finance 60 (5): 2255–2281.

Blankespoor, E., T.J. Linsmeier, K. Petroni, and C. Shakespeare. 2013. Fair value accounting for financial instruments: Does it improve the association between bank leverage and credit risk? The Accounting Review 88 (4): 1143–1177.

Cedergren, M.C., C. Chen, and K. Chen. 2019. The implication of unrecognized asset value on the relation between market valuation and debt valuation adjustment. Review of Accounting Studies 24 (2): 426–455.

Chambers, D., T.J. Linsmeier, C. Shakespeare, and T. Sougiannis. 2007. An evaluation of SFAS no. 130 comprehensive income disclosures. Review of Accounting Studies 12 (4): 557–593.

Chasteen, L.G., and C.R. Ransom. 2007. Including credit standing in measuring the fair value of liabilities–Let's pass this one to the shareholders. Accounting Horizons 21 (2): 119–135.

Chung, S.G., G. Lobo, and K. Ow Yong. 2017. Valuation implications of FAS 159 reported gains and losses from fair value accounting for liabilities. Working paper, Available at SSRN: https://ssrn.com/abstract=2978730. Accessed Sept. 2019.

Collin-Dufresne, P., R.S. Goldstein, and J.S. Martin. 2001. The determinants of credit spread changes. Journal of Finance 56 (6): 2177–2207.

Correia, M., J. Kang, and S. Richardson. 2018. Asset volatility. Review of Accounting Studies 23 (1): 37–94.

Correia, M., S. Richardson, and I. Tuna. 2012. Value investing in credit markets. Review of Accounting Studies 17 (3): 572–609.

DeFond, M.L., M. Hung, E. Carr, and J. Zhang. 2011. Was the Sarbanes-Oxley Act good news for corporate bondholders? Accounting Horizons 25 (3): 465–485.

Dong, M., L.C. Doukakis, and S.G. Ryan. (2020). Banks’ discretion over the debt valuation adjustment for own credit risk. Journal of Accounting, Auditing and Finance. https://doi.org/10.1177/0148558X20977978.

Eom, Y.H., J. Helwege, and J.-Z. Huang. 2004. Structural models of corporate bond pricing: An empirical analysis. Review of Financial Studies 17 (2): 499–544.

Financial Accounting Standards Board. 2006. Statement of financial accounting standards no. 157, fair value measurement. FASB.

Financial Accounting Standards Board. 2007. Statement of financial accounting standards no. 159, the fair value option for financial assets and financial liabilities - including an amandment of FASB statement no. 115. FASB.

Fontes, J.C., A. Panaretou, and K. Peasnell. 2018. The impact of fair value measurement for bank assets on information asymmetry and the moderating effect of own credit risk gains and losses. The Accounting Review 93 (6): 127–147.

Gaynor, G.M., L. McDaniel, and T.L. Yohn. 2011. Fair value accounting for liabilities: The role of disclosures in unraveling the counterintuitive income statement effect from credit risk changes. Accounting, Organizations and Society 36 (3): 125–134.

Heckman, J.J. 1979. Sample selection bias as a specification error. Econometrica 47 (1): 153–161.

Helwege, J., J.J. Huang, and Y. Wang. 2014. Liquidity effects in corporate bond spreads. Journal of Banking and Finance 45: 105–116.

Holtz-Eakin, D., W. Newey, and H.S. Rosen. 1988. Estimating vector autoregressions with panel data. Econometrica 56 (6): 1371–1395.

International Accounting Standards Board. 2014. International financial reporting standard 9: Financial instruments. IASB.

Iselin, M., and A. Nicoletti. 2017. The effects of SFAS 157 disclosures on investment decisions. Journal of Accounting and Economics 63 (2–3): 404–427.

Kengla, T., and F. De Jonghe. 2012. Reflecting credit and funding adjustments in fair value. Insight into practices. A survey. Ernst and Young Publications.

Koonce, L., K.K. Nelson, and C.M. Shakespeare. 2011. Judging the relevance of fair value for financial instruments. The Accounting Review 86 (6): 2075–2098.

Lawrence, A., S. Siriviriyakul, and R.G. Sloan. 2016. Who’s the fairest of them all? Evidence from closed-end funds. The Accounting Review 91 (1): 207–227.

Lee, J., A. Naranjo, and G. Velioglu. 2018. When do CDS spreads lead? Rating events, private entities, and firm-specific information flows. Journal of Financial Economics 130 (3): 556–578.

Li, K., and N.R. Prabhala. 2007. Self-selection models in corporate finance. In E.B. Eckbo (Ed.), Handbooks in Finance: Handbook of Empirical Corporate Finance (1st ed., pp 37–86). Elsevier.

Lipe, R.C. 2002. Fair valuing debt turns deteriorating credit quality into positive signals for Boston chicken. Accounting Horizons 16 (2): 169–181.

Liu, C.C., Y.L. Chang, and S.G. Ryan. 2011. Why banks elected SFAS no 159's fair value option: Opportunism versus compliance with the standards intent. Working paper, Available at SSRN: https://ssrn.com/abstract=1526648. Accessed Sept. 2019.

Lo, A.W., and A.C. MacKinlay. 1990. An econometric analysis of nonsynchronous trading. Journal of Econometrics 45 (1–2): 181–211.

Magnan, M., A. Menini, and A. Parbonetti. 2015. Fair value accounting: Information or confusion for financial markets? Review of Accounting Studies 20 (1): 559–591.

Merton, R.C. 1974. On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 29 (2): 449–470.

Riedl, E.J., and G. Serafeim. 2011. Information risk and fair values: An examination of equity betas. Journal of Accounting Research 49 (4): 1083–1122.

Roll, R. 1984. A simple implicit measure of the effective bid-ask spread in an efficient market. Journal of Finance 39 (4): 1127–1140.

Schneider, F., and D.H. Tran. 2015. On the relation between the fair value option and bid-ask spreads: Descriptive evidence on the recognition of credit risk changes under IFRS. Journal of Business Economics 85 (9): 1049–1081.

Song, C.J., W.B. Thomas, and H. Yi. 2010. Value relevance of FAS no. 157 fair value hierarchy information and the impact of corporate governance mechanisms. The Accounting Review 85 (4): 1375–1410.

Wu, W., N. Thibodeau, and R. Couch. 2016. The fair value option for liabilities: An option for lemons. Journal of Accounting, Auditing and Finance 31 (4): 441–482.

Acknowledgements

We are especially grateful to the editor, Scott Richardson, and the anonymous referee for suggestions that have greatly improved this paper. We also thank Scott Liao (discussant) and participants at the 2019 Lisbon Accounting Conference. We are also grateful to Ayung Tseng (discussant) and participants at the 2018 American Accounting Association Meeting and the 2018 European Accounting Association Meeting. We appreciate the exceptional research assistance provided by Dimitris Kanelis. Argyro Panaretou gratefully acknowledges research funding from the Lancaster University Management School Pump Project Scheme.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

This appendix provides an example of a DVA disclosure by JP Morgan Chase & Co in FR Y-9C and 10Q reports as of Sept. 31, 2015.

Appendix 2

Appendix 3

This appendix outlines the timeline according to which market and accounting information becomes available as well as a numerical example on how we calculate DVA-estimated changes in credit spreads. The example is based on the 10Q disclosures provided in Appendix 1 (JP Morgan Chase & Co), and the process is explained in Section 3.2.

Appendix 4

1.1 Variable Definitions

-

1.

Changes in leverage (Delta_Lev): Default is triggered when a firm’s leverage ratio becomes sufficiently high. Hence an increase in leverage is expected to increase credit spreads. We define leverage as the ratio of the book value of liabilities (LTQ) to the sum of the market value of equity (CSHOQ*PRCCQ) and the book value of liabilities (source: Compustat).

-

2.

Changes in asset volatility (Delta_Sigma): Since option value increases with volatility, we expect a positive relationship between changes in asset volatility and changes in credit spreads. We estimate equity volatility using the standard deviation of daily stock returns over the past 150 days. Then we use the Merton model to estimate the value and volatility of assets simultaneously. We assume a maturity of 0.25 years and use a three-month Treasury yield as a proxy for the risk-free rate (source: CRSP).

-

3.

Changes in business climate (Delta_SP500): Changes in credit spreads can be a result of changes in the expected recovery rate, even if the default probability remains the same. As the expected recovery rate is an increasing function of business climate, we expect business climate to negatively affect credit spreads. We use the quarterly S&P 500 returns from CRSP as a proxy for changes in the business climate (source: CRSP).

-

4.

Changes in the probability or magnitude of downward jump (Delta_Jump): Given the implied volatility smiles in observed option prices, the market seems to account for negative jumps in the value of the firm. Therefore an increase in the probability or the magnitude of a downward jump is expected to increase the credit spreads. We use changes in the slope of the implied volatility of options on the S&P 500 index future to capture the changes in the probability of such a jump (source: Datastream). Footnote 19

-

5.

Changes in the distance to default (Delta_D2D): An increase in the distance to default is expected to reduce credit spreads. We follow Bharath and Shumway (2008), section 2.3, and measure distance to default as [ln[(E + F)/F] + (μ - 0.5σ2)]]/σ, where E is the market value of equity (CSHOQ*PRCCQ), F is the face value of debt (DLC + 0.5DLTT) (source: Compustat), μ is the annual stock return computed using cumulative monthly returns (RET), and σ is an estimate of the volatility of the returns of the firm assets, measured as [E/(E + F)] × σ_E + [F/(E + F)] × (0.05 + 0.25 σ_E), where σ_E is the annualized standard deviation of stock returns (source: CRSP).

-

6.

Equity return (MOMS): To the extent that credit markets respond to information in the equity market, we expect changes in credit spreads to be inversely related to equity returns. In line with Correia et al. (2012), MOMSt is the monthly stock return (RET) at the end of the month prior to the start of quarter t (source: CRSP).

-

7.

Cumulative equity return (MOML): To capture the delayed response of credit markets to information in equity markets, we use the exponentially weighted (three-month half-life) cumulative return over the 11 months prior to the computation of MOMS (source: CRSP).

-

8.

Changes in book-to-market (Delta_BTM): Changes in the growth prospects of an entity are expected to affect credit risk. We use the ratio of book value of equity (CEQ) to market capitalization (CSHOQ*PRCCQ) as an inverse proxy for growth prospects (source: Compustat). An increase in the ratio signals a decrease in expected growth, leading to a potential increase in credit spreads.

-

9.

Changes in size (Delta_Size): Larger firms tend to be less risky and have a lower cost of capital as a result of, among other things, greater ability to diversify as well as better (cheaper) access to external financing. Therefore an increase in the firm size is expected to reduce its credit spreads. We measure firm size as the log of total assets (ATQ) (source: Compustat).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lin, W., Panaretou, A., Pawlina, G. et al. What can we learn about credit risk from debt valuation adjustments?. Rev Account Stud 28, 2556–2588 (2023). https://doi.org/10.1007/s11142-022-09705-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-022-09705-0