Abstract

When analyzing the influence of taxation on agency conflicts between firm owners and managers, one can draw on theoretical principal–agent literature from various research fields. In recent years, this interdisciplinary research has grown significantly covering research with regards to optimal compensation, investment decisions, tax avoidance and transfer pricing while analyzing the effects of corporate income taxes, wage taxes, bonus taxes and shareholder taxes. Our paper provides a comprehensive review of analytical literature that studies the influence of taxation on agency conflicts between firm owners and managers. Above and beyond summarizing research findings, we discuss how taxes are commonly implemented in agency models, derive empirical predictions, and identify research gaps for future tax research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Conflicts of interest between firm owners and firm management caused by the separation of ownership and control are among the most important and well explored issues within business economics. However, despite the fact that contracting parties, both shareholders and managers, are subject to taxation, tax considerations have been notably absent from the theoretical principal–agent literature. This is surprising given the many instances in which taxes influence decision making. Taxation reduces the benefit that shareholders and managers receive from their contractual relationship. A contractual agreement may even be prevented due to the presence of taxation, for instance, if the manager’s expected utility drops below his reservation utility. Furthermore, taxes change the information content and incentive effect of managerial performance measures. An after-tax performance measure motivates the manager to engage in tax avoidance activities but is also noisier than pre-tax compensation as it is influenced by tax legislation such as tax rate changes. Transfer prices, used for the purpose of internal coordination and control, are affected by taxation as well as they are a determining factor for the allocation of taxable income in multinational firms.

Recently, maybe as a response to a call for more theoretical guidance (e.g., Shackelford and Shevlin 2001; Hanlon and Heitzman 2010), the role of taxation in relation to agency conflicts between firm owners and managers has received increasing attention.Footnote 1 Due to the interdisciplinary nature of taxation and diverse backgrounds of researchers, the investigated research questions are manifold and the approaches on how to implement taxation are heterogeneous.

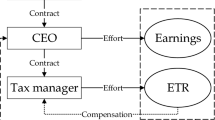

We provide a comprehensive review of the analytical principal–agent literature that analyzes the effects of taxation on agency conflicts between firm owners and managers. More precisely, we discuss literature that studies the influence of taxation on corporate and managerial decision making in a principal–agent framework where the principal can be interpreted as the firm owner(s) and the agent(s) can be interpreted as the manager(s) who act(s) on behalf of the firm owner(s). In doing so, we explicitly abstract from discussing papers in which the incentives between firm owners and managers are perfectly aligned. We do not discuss literature that focuses on optimal public spending, welfare effects, or on the social implications of taxation. While we do not restrict our attention to any specific research field, we find that most articles satisfying our criteria are related to (managerial) accounting and finance. A common theme that runs throughout this review is the question of how taxation affects risk-sharing between firm owners and managers.

Our study provides valuable information for adopting a multilateral tax planning perspective as proposed by Scholes et al. (2009), according to which effective tax planning requires an understanding of the tax implications on all contracting parties (here firm owners and managers). We show that there are various motivations for studying the effects of taxation on the agency relationship between firm owners and managers. We provide the reader with an overview of tax-related research questions that have been analyzed by the use of principal–agent models and summarize the associated results organized by tax type and research area. Furthermore, we present an illustrative tax modeling example using the LEN model framework, derive empirical predictions, identify research gaps and offer many avenues for future research. In doing so, we formulate predictions only for those analytical results that we find particularly promising for future empirical research. When deriving empirical predictions, we also discuss selective empirical literature as it relates to each prediction.

Throughout this review, the following themes recur. First, scholars use two distinct modeling approaches: Some scholars implement and study the effects of only one tax type. This is particularly the case when consequences of tax law changes are analyzed. Other scholars implement several tax types to analyze whether and how those tax types distort the agency conflict. Second, taxation is modeled in a simplified manner. For instance, tax rates of all types are usually implemented as proportional tax rates and the manager’s reservation utility is assumed to be independent of taxation. Third, we find that the statement by Shackelford and Shevlin (2001) regarding empirical tax research: “Instead of a trunk with major branches, the tax literature grew like a wild bush, springing in many directions [...]” (p.324) also applies to the set of papers analyzed in this review. In this set of papers, scholars elaborate on the effects of four distinct tax types: corporate income taxes, wage taxes, bonus taxes, and shareholder taxes. With regard to corporate income taxation, the investigated topics include the consequences on compensation contracts, tax avoidance (and tax evasion), investment and capital structure, and transfer pricing. For all other tax types, we find studies with respect to compensation as well as investment and capital structure issues.

To the best of our knowledge, this is the first literature review that discusses the implementation and consequences of taxation in principal–agent models. Most prior tax literature reviews focus upon empirical research. To mention just a few: Shackelford and Shevlin (2001) review tax and non-tax trade-offs, asset prices, and multi-jurisdictional commerce. Graham (2003) surveys tax research related to capital structure, payout policy, compensation strategy, risk management, and the form of organizations. Expanding on the results of Shackelford and Shevlin (2001) while shifting the focus on the interdisciplinary nature of tax research, Hanlon and Heitzman (2010) review four areas of inquiry: corporate income tax avoidance, investor-level taxes and asset prices, the informational role of accounting for income taxes, and investment and capital structure decisions. Looking at previous theoretical literature reviews discussing principal–agent models, we find that authors mention taxation issues only in passing, if at all. The center of attention usually lies in illustrating how agency theory can be applied to different research areas such as managerial accounting (Baiman 1982, 1990), accounting (Lambert 2001), or supply chain management (Fayezi et al. 2012).

The paper proceeds as follows. Section 2 describes the methodology used to identify the relevant studies for our review. A table at the end of Sect. 2 depicts the number of studies grouped by tax type, broad research topic, and publication period. Section 3 illustrates how taxes are typically implemented in principal–agent models by the use of a LEN model. In Sects. 4 to 7, we present and discuss the results for each of the four identified tax types: corporate income taxes (Sect. 4), wage taxes (Sect. 5), bonus taxes (Sect. 6), and shareholder taxes (Sect. 7). Sections are split into the thematic subsections: compensation, investment and capital structure, tax avoidance, transfer pricing, and future research.Footnote 2 For convenience, tables at the end of each subsection provide a summary of the reviewed papers and include a brief description of the model, the tax-related research question(s), and the associated result(s). The paper is organized such that readers interested only in the empirical predictions derived from the analytical results can skip straight to them as they are numbered and highlighted throughout the text. Section 8 concludes with a discussion of further unanswered research questions and an outlook into future tax research.

2 Methodology

To identify relevant literature, we reviewed tax articles published in top journals, tax survey papers and textbooks. Additionally, we conducted several database searches using the databases “Academic Search Premier”, “Business Source Premier” and “EconLit” provided by EBSCO. Our queries used the keywords “moral hazard”, “adverse selection”, “principal-agent”, “agency theory”, “agency model”, “optimal compensation” and “asymmetric information” in combination with the keyword “tax” in all titles and abstracts of the database content. This procedure resulted in a data set with slightly over 600 articles.

To derive the final set of papers, we excluded articles that do not utilize an analytical model to address their research question. Furthermore, since the focus of this review is on business, we excluded all papers that focus on social welfare issues, the social implications of taxes, the effects of taxation on the education system, as well as optimal public spending problems. This elimination process reduced the pool of papers to about one-fourth of the initial size. In this refined data set, we limited our scope to principal–agent models that analyze the relationship between firm owners and managers who act on behalf of the firm owners. After those refining steps, we were left with 45 articles. Table 1 provides an overview of all articles grouped by tax types and shows how the number of contributions increases over time.

3 Taxes in agency models: an illustration

This section briefly illustrates how taxes are typically implemented in agency models. For this purpose, we extend the LEN model which is frequently used in the executive compensation literature to include taxation.Footnote 3 We initially introduce the LEN model without taxes to then illustrate the impact of taxation first by implementing wage tax only (unilateral approach) and subsequently by implementing multiple taxes affecting both contracting parties (multilateral approach).

In the standard LEN model, a risk neutral principal (which we interpret in the following as corporate shareholders) hires a risk and effort averse agent (a corporate manager) to run operations by providing unobservable costly effort, a. The agent’s effort level increases the firm’s outcome, \(x=a+\varepsilon\), which is subject to a normally distributed noise term, \(\varepsilon\). The noise term has an expected value of zero and variance \(\sigma ^2\), \(\varepsilon \sim N(0,\sigma ^2)\), which represents environmental factors unrelated to the provided effort level. The agent’s effort costs, C(a), increase and are strictly convex in the effort level. This reflects the intuition that exerting a low effort level is less costly than exerting a high effort level and that it is less demanding to provide an additional unit of effort for low effort than for high effort levels. For simplicity we assume that the costs of effort can be described by a quadratic cost function, \(C(a)=\frac{1}{2}a^2\), and reflect the physical or mental costs incurred by the agent. Consequently, the effort costs are in the following not directly affected by taxation. To induce effort, the principal offers the agent a performance based compensation, \(s=f+vx\), which consists of a fixed payment, f, and a variable payment, vx, with incentive rate, v, and performance measure, x.Footnote 4

The agent aims to maximize his or her certainty equivalent,

in which \(\alpha\) denotes the agent’s coefficient of absolute risk aversion.Footnote 5 The agent’s certainty equivalent equals expected compensation, E[s], less a risk premium, \(\frac{\alpha }{2}Var[s]\), and the cost of effort, \(\frac{1}{2}a^2\). The risk premium enters the certainty equivalent as the agent is risk-averse, and thus must be reimbursed by the principal if the compensation contract imposes incentive risk on him or her.Footnote 6

The principal aims to maximize the expected net outcome, \(\Pi\), which equals the expected outcome less the expected compensation, \(\Pi =E[x-s]\). In doing so, the principal has to ensure that the agent accepts the contract offer (participation constraint) which is the case if the agent’s certainty equivalent is not below his or her reservation utility \(U_0\),

where the dagger symbol (\(\dagger\)) denotes optimality. Additionally, the principal anticipates that the agent chooses the effort level to maximize his or her certainty equivalent (incentive compatibility constraint),

Summarized, the principal’s optimization problem is given by

Note that the principal can always increase the outcome by reducing the compensation until the agent’s certainty equivalent meets the reservation utility. That is, in equilibrium, the participation constraint is binding, and thus the net expected compensation equals the risk premium plus the cost of effort plus the reservation utility, \(E[s]=\frac{\alpha }{2}Var[s]+\frac{1}{2}a^2+U_0\). Solving the optimization problem to determine the optimal effort level, \(a^\dagger\), and the optimal incentive rate, \(v^\dagger\), yields

The optimal effort level equals the incentive rate. The optimal incentive rate decreases in the variance of the performance measure, \(\sigma ^2\), and the agent’s degree of risk aversion, \(\alpha\).Footnote 7

We now discuss the implementation of a single tax rate, the wage tax rate. The consequences of a single tax rate are often studied when researchers are interested in the consequences of tax law amendments. For instance, the implementation of wage taxation allows us to analyze how changes in the wage tax rate, \(\tau _w\), affect effort decisions and incentive systems (e.g., Katuscak 2004). If the compensation is subject to wage taxation, the agent receives a net income equal to \((1-\tau _w)s\) and the resulting certainty equivalent is

Note that the wage tax rate has a linear impact on the expected compensation and a quadratic impact on the risk premium. The expected compensation of the agent is exactly reduced by the fraction that is transferred to the public purse. The reduction in the risk premium is because wage taxation reduces the variance of the agent’s compensation. In the presence of wage taxation, the variance of the agent’s net compensation is equal to \((1-\tau _w)^2v^2\sigma ^2\). Recall that the cost of effort is not affected by wage taxation.

The principal’s objective function, \(\Pi\), is not directly influenced by the introduction of wage tax as the principal still pays the pre-tax compensation, s, to the agent. Replacing \(CE(\cdot )\) with \(CE_\tau (\cdot )\) in the above optimization problem, (P), and solving it yields

The optimal incentive rate is the same as above but its effect on the agent’s effort level is now influenced by the wage tax rate. The equilibrium effort level is less than in the absence of taxes and decreases in the wage tax rate. This reflects the substitution effect of wage taxation, according to which tax payers substitute leisure for work as wage taxation reduces their return to effort and thus makes leisure more attractive. In this setting, an increase to the wage tax rate would negatively affect the agent’s effort decision but not his incentive rate and thus would harm the firm.

We further extend the example to incorporate multiple tax types affecting both contracting parties. Researchers usually implement several tax types at the same time if they are interested in understanding the overall influence of taxation on optimal effort and contracting decisions, while accounting for interactions between tax types (e.g., Koethenbuerger and Stimmelmayr 2014). In the following, we implement wage taxes, \(\tau _w\), corporate income taxes, \(\tau _c\), and dividend taxes, \(\tau _d\). Furthermore, we illustrate the effect of placing corporate income tax deductibility limitations on managerial compensation which is a frequently discussed legislative instrument to influence the design of compensation contracts.Footnote 8 The fraction of the agent’s compensation that is not corporate tax-deductible is denoted by \(k\in [0,1]\). For this setup, the principal’s objective function is given byFootnote 9

The dividend tax rate, \(\tau _d\), reduces the principal’s outcome proportionally, an increase in the corporate income tax rate, \(\tau _c\), reduces the expected net income, \((1-\tau _c)E[x-s]\), and increases the costs associated with the limited deductibility, \(\tau _ckE[s]\). As before, the wage tax rate, \(\tau _w\), does not directly affect the principal’s objective. The incentive compatibility and participation constraints are the same as in the previous setting. Replacing \(\Pi _\tau\) and \(CE_\tau (\cdot )\) for \(\Pi\) and \(CE(\cdot )\) in the original optimization problem, (P), and solving it for the optimal effort decision and the optimal incentive rate yields

Wage taxes have the same effect as before, i.e., wage taxes weaken the impact of the incentive rate on the agent’s effort level. In addition, corporate income taxes influence the optimal incentive rate. An increase in the corporate income tax rate reduces incentives. The intuition behind this result is that an increase in the level of corporate income taxation impacts the benefit and cost associated with the agent’s effort choice. It reduces the principal’s outcome and increases the cost of compensation as part of the agent’s compensation is not tax-deductible. Due to the latter effect, an increase in the corporate income tax rate increases the marginal cost of the agent’s effort to the principal, and thus decreases the optimal incentive rate, as well as the agent’s equilibrium effort level. Note that corporate income taxation does not influence the optimal incentive rate if the agent’s compensation is fully corporate income tax-deductible, \(k=0\). Dividend taxation has only a scaling effect on the principal’s objective function. That is, any effort that maximizes the principal’s outcome before dividend tax maximizes also the principal’s outcome after dividend tax. Consequently, dividend tax reduces the principal’s outcome without affecting the effort and contracting decisions.

Throughout this example, we use a couple of simplifications that are common in the papers we reviewed. First, we implement all tax types as proportional taxes. This is reasonable for corporate income taxes and dividend taxes which are proportional in most countries. However, as for wage taxation, progressive tax schemes are prevailing in practice. Second, we do not consider the possible impact of (wage) taxation on the agent’s reservation utility \(U_0\). Third, the above model is a single-period model, and thus does not allow for analyzing typical multi-period tax issues like tax loss carryforwards.

4 Corporate income taxes

Whenever firms generate profits, a significant fraction is transferred to the public purse through corporate income taxation.Footnote 10 For example, in 2016 central government statutory corporate tax rates in the OECD ranged between 8.5% in Switzerland and 35% in the US (OECD 2016a). This transfer distorts economic activity as corporations adjust their decision making to maximize after-tax shareholder profits. We find that corporate taxation has received considerably more attention than other forms of taxation discussed later in this paper. In this section, we discuss tax effects on issues of compensation, investments, capital structure, tax avoidance, and transfer pricing.

4.1 Corporate taxes and compensation

Generally, there is no need for the principal to consider corporate income taxation in the design of compensation contracts as long as it does not impact the agent’s expected utility or the costs incurred by the agent. In this case, any contract that maximizes pre-tax profit also maximizes after-tax profit, i.e., corporate income taxation acts merely as a scaling variable on the principal’s objective and does not distort incentives (e.g., Katuscak 2004).Footnote 11

However, if corporate tax affects the agent’s expected utility the principal adjusts managerial incentive contracts. Ewert and Niemann (2012) demonstrate that using a performance measure based on after-tax earnings instead of pre-tax earnings leads to a lower effort level of the agent as he or she anticipates the reduction in the compensation. To counterbalance this effect, the principal boosts incentives and offers the agent a higher bonus which increases with the corporate tax rate. In equilibrium, the opposing effects of the pay-performance sensitivity and the after-tax performance measure on the manager’s effort level exactly offset one another. Thus, the agent’s equilibrium effort level does not depend on whether the compensation is based on after- or pre-tax earnings. The results in Ewert and Niemann (2012) allow for the following empirical prediction:

Prediction 1 (Pay-performance sensitivity and after- vs. pre-tax performance measures)

The pay-performance sensitivity is higher for compensation contracts based on after-tax performance measures than for compensation contracts based on pre-tax performance measures.

Prior empirical research by Phillips (2003) and Gaertner (2014) finds a negative relation between the use of after-tax incentives and effective tax rates, showing that after-tax performance measures encourage managers to engage in tax avoiding activities. The above prediction extends this literature by saying that the intensity of incentives depends on whether the firm uses after- or pre-tax performance measures. In other words, the type of the performance measure is a determinant of the incentive intensity.

Incentives are further affected by corporate taxation if the manager’s compensation is not fully tax-deductible. Limitations placed on the tax deductibility of managerial compensation can be used by tax authorities to influence the design of compensation contracts. Section 162(m) of the IRC, for instance, limits the tax deductibility of non-performance based compensation of the CEO (plus the next four highest compensated executives) to one million dollars. The intention behind this regulation is that an upper bound on the tax deductibility of non-performance based compensation should increase pay-for-performance. If a part of the manager’s salary is non-deductible, the costs incurred by the agent depend on the corporate tax rate. Halperin et al. (2001) study the consequences of a tax deductibility limit on fixed salary in a binary agency model and show that the marginal cost of inducing effort is reduced compared to the case where the manager’s salary is fully tax-deductible. This results in a higher equilibrium effort level as the marginal benefit from the manager’s effort is the same, independent of whether the salary is fully or only partially tax-deductible. The increase in the optimal effort level implies a reduction of the fixed salary and an increase in the variable salary.

While Halperin et al. (2001) conclude that their results demonstrate a closer linkage between manager compensation and performance, Göx (2008) argues that an increase in variable pay does not necessarily imply improved incentives but may instead reward the manager for luck. Assuming that the firm’s cash flow is not only generated by the agent’s effort but also by a measurable and uncontrollable event, Göx (2008) shows in a LEN model that the measurable random factor is not fully filtered out from the performance measure if the manager’s fixed salary is only partially tax-deductible. Instead, the increase in variable pay consists of an increase in the weight put on the measurable random factor which the author interprets as reward for luck.Footnote 12 The equilibrium effort level can increase or decrease depending on whether the marginal increase of the manager’s expected variable pay caused by an increase in the pay-performance sensitivity exceeds the marginal risk premium or not.

Recent discussions in Europe, particularly in Germany, motivated Voßmerbäumer (2012) to analyze how tax deductibility limits placed on total managerial compensation influence incentives. While using a LEN framework similar to the illustrative example in Sect. 3, he finds that tax deductibility limitations unambiguously decrease equilibrium effort, pay-performance sensitivity as well as the manager’s total compensation.Footnote 13 Bauer and Kourouxous (2017) show that those results also hold when the manager is additionally tasked with a risky investment decision. In comparison to the models in which the tax deductibility limit only affects the fixed salary component, here the principal has no incentive to substitute fixed salary with variable salary. From these results, the following empirical predictions can be derived:

Prediction 2 (Limited corporate tax deductibility and pay-performance sensitivity)

A decrease in the tax deductibility of total compensation reduces pay-performance sensitivity.

Prediction 3 (Limited corporate tax deductibility and total compensation)

A decrease in the tax deductibility of total compensation reduces total compensation.

While empirical researchers have studied the impact of limiting corporate tax deductibility of fixed salaries on the level and composition of pay thoroughly (e.g., Hall and Liebman 2000; Rose and Wolfram 2000; Perry and Zenner 2001), empirical evidence related to Predictions 2 and 3 on limited tax deductibility of total compensation is still missing.

Limits to the tax deductibility of managerial compensation can also apply to other compensation instruments such as stock option plans. Niemann and Simons (2003) show that limiting the corporate tax deductibility of stock option plans can distort the decision to implement such a plan. Taxation encourages the implementation of stock option plans if the corporate tax rate exceeds the tax rate for the manager’s exercise gain. In this case, compensating the manager in options is less costly than allowing him or her to participate in the tax reimbursement. Put differently, corporate taxes can favor the implementation of a stock option plan because the part of the tax shield on managerial compensation that is attributable to the manager (who is at the same time a shareholder) serves as a substitute for compensation. This result leads to the following empirical prediction:

Prediction 4 (Stock option plans and corporate vs. capital gains taxation)

Stock option plans are less prevalent in countries where the corporate tax rate is below the capital gains tax rate than in countries where the corporate tax rate exceeds the capital gains tax rate.

Another scenario in which corporate taxation influences managerial effort and compensation design choices occurs if separate accounting is replaced by a common consolidated corporate tax base (CCCTB) in combination with formulary apportionment as recommended by the European Commission recently.Footnote 14 Due to the CCCTB which comprises the profits of all subsidiaries, the incentive problems of headquarters of multinational enterprises (principal) to motivate subsidiary managers in different tax jurisdictions become intertwined. The interdependence of the agents’ effort decisions gives the principal the opportunity to benefit from tax rate differentials by profit shifting. By inducing a lower (higher) level of effort from agents who are responsible for a subsidiary in a high-tax (low-tax) country, the principal increases profits. In short, formulary apportionment leads to effort and hence compensation shifting from high-tax to low-tax countries which results in an increased profit (Martini et al. 2016). The implied effect on observed compensation levels is summarized by the following empirical prediction:

Prediction 5 (Formulary apportionment and compensation)

The compensation of subsidiary managers in low-tax countries is higher than the compensation of subsidiary managers in high-tax countries if firms are subject to formulary apportionment.

First evidence in support of this prediction is documented by Eichfelder et al. (2015) who analyze a local business tax in Germany which is set at the municipal level.

In summary, the corporate taxation impacts compensation and incentives if it affects the manager’s utility. This is particularly the case if the manager’s compensation is based on after-tax performance measures or if the salary is subject to deductibility limitations for tax purposes. However, the corporate tax does not only affect the design of incentive contracts but can also influence the fundamental decision of whether a performance-based contract is superior to a fixed salary contract. If losses and profits are taxed asymmetrically, fixed salaries become less attractive as loss-offset restrictions can exacerbate the inefficient risk allocation between principal and agent (Niemann 2011). Table 2 provides an overview of the articles discussing the effects of corporate taxation on the design of compensation schemes.

4.2 Corporate taxes, investment decisions and capital structure

When determining the optimal investment level, economic theory usually proposes an increase in the investment level until the marginal benefit is equal to the marginal cost of the investment. Corporate taxes interact with both sides of this equation. On one hand, taxes make investments less desirable as they reduce corporate profits, on the other hand, allowances for tax deductible depreciation and investment tax credits have a positive effect on investment incentives.Footnote 15 Corporate taxes further affect investment decisions by influencing the underlying capital structure, predominantly via the tax-debt shield. Nevertheless, many researchers following the paradigm of Modigliani and Miller regard taxation as a market imperfection that can be omitted when analyzing investment decisions. In many instances, omitting taxation may be a useful simplification for the design of tractable models. At the same time, this omission does not go without problems as taxation itself can be a determining factor for investment abandonments, delays, changes to the financial repackaging of investments, and to the way investments are accounted for.Footnote 16

Most principal–agent models used to analyze the effect of taxation on investment decisions and capital structure depend on the interaction between the tax-debt shield and some form of uncertainty regarding the investment outcome. This includes the risk of going out of business, risk due to moral hazard, and risk associated with consecutive contracting. For instance, in the presence of bankruptcy risk, the tax benefit associated with high debt to equity ratios is counterbalanced by the firm’s potential inability to uphold long-term work contracts. Jaggia and Thakor (1994) show that the latter causes managers to provide insufficient effort in the development of their firm-specific skills. The resulting spillover effect of corporate taxation on the manager’s acquisition of firm-specific skills can be summarized as follows:

Prediction 6 (Corporate taxes and firm-specific skills)

An increase in the corporate tax rate reduces managerial effort to acquire firm-specific skills.

Similarly, Berk et al. (2010) show that low debt levels consistent with those in practice can be fully attributed to the human costs associated with financial distress. The human costs of financial distress include cuts to the overall level of employee compensation and the inability to find adequate replacement jobs in the case of layoffs. In this situation, managers limit the use of debt to mitigate their exposure to bankruptcy risk. In contrast to Jaggia and Thakor (1994), the approach chosen by Berk et al. (2010) provides an explanation for the empirically observed low debt levels without relying on moral hazard regarding the acquisition of firm-specific skills by managers.

Another explanation for the low debt levels observed in practice is presented by Morellec (2004). He argues that when control is separated from ownership, the firm’s optimal investment decision depends upon the interplay between taxation, bankruptcy costs, managerial empire building incentives and corporate control mechanisms. In this setting, the benefit drawn from a high leverage ratio is counterbalanced by the anticipated risk of going out of business as well as the threat of losing control of the firm’s investment policy once the debt level exceeds a threshold. This trade-off can further depend on a variety of firm and manager characteristics. Bhagat et al. (2011) show that total debt declines with the manager’s ability, as highly skilled CEOs exploit the tax advantage of debt to a lesser extent.Footnote 17 Other factors that influence the usage of the tax-debt shield are the manager’s inside equity stake, the firm’s long-term risk, as well as the firm’s short-term risk. Driven by the same trade-off argument between bankruptcy costs associated with higher debt levels and the tax advantage of debt, Carlson and Lazrak (2010) find that the optimal capital structure depends on the composition of managerial pay. The model mechanics are closely related to Morellec (2004). Here, the manager first chooses the debt level of the firm and subsequently controls for the volatility of the liquidating pre-tax payment which influences firm value since it is anticipated by the shareholders. Seetharaman et al. (2001) show that the trade-off between debt level and managerial ownership is progressively weakened by increasing marginal tax rates on corporate profits as both mechanisms represent alternative solutions to reduce agency costs between managers and shareholders. When debt increases, managerial ownership declines, which in turn increases agency costs. At high tax rates the tax-debt shield benefit becomes large and dominates the use of managerial ownership as a mechanism to control for agency costs. From this result, we derive the following empirical prediction:

Prediction 7 (Corporate taxes and managerial ownership)

An increase in the corporate tax rate reduces managerial ownership.

Another strand of literature analyzes the use of leverage as a signaling vehicle to communicate investment quality or financial strength. In this context, the use of equity is viewed as a positive signal to investors. Here, the role of corporate taxation is threefold. First, it affects the firm’s signaling costs as it creates a disadvantage for the use of equity. Second, it reduces the profitability of investment projects, and third, it reduces risk by making the government a silent partner of the investment. In two subsequent papers (Cheong 1998, 1999), Cheong finds that if the quality difference between high and low quality firms is sufficiently large then the high quality firms can achieve a unique optimal capital structure which is characterized by a low debt to equity ratio. Taxation raises the debt to equity ratio, but is not a determining factor for the type of equilibrium achieved in this model. Similarly, Kale and Noe (1991) examine debt to equity ratios under asymmetric information regarding the quality of investment opportunities. In the presence of a tax benefit to debt financing, they demonstrate that a separating equilibrium in which higher quality firms will issue equity and lower quality firms will issue debt may exist. By issuing equity instead of debt, the firm forgoes the debt-tax advantage and benefits by reducing the risk of being misclassified as a low quality firm. This result shows that the pecking order theory, according to which firms always prefer debt over equity financing, does not always hold.Footnote 18

Independent of the financing structure, corporate taxation influences delegated investment decisions if the agent’s compensation is based on after-tax performance measures. As empirical evidence shows, after-tax performance measures motivate agents to take the tax consequences of their decisions into account.Footnote 19 In a single-period LEN model with a delegated risky investment decision, compensating the manager based on after-tax residual income reduces ex-ante the volatility of the salary and the agent responds to the after-tax compensation scheme by choosing a higher level of the risky investment than when compensation is based on pre-tax performance measures (Bauer and Kourouxous 2017).

While all of the above papers analyze corporate tax rate changes, changes to the tax base can also be important for investment decisions. When analyzing the effect of corporate taxation on a delegated portfolio investment decision in which the manager is compensated based on a pre-tax performance contract, Niemann (2008) finds that a preferential tax base for the high risk project increases investment in high risk projects, while a preferential tax rate has no such effect. This result leads to the following empirical prediction:

Prediction 8 (Risky investment projects and preferential tax base)

Managers invest more in risky projects if the tax system has a preferential tax base for high-risk projects.

Specific tax regulations that affect investment decisions are deductibility provisions on either financing or investment expenses. This is demonstrated by Koethenbuerger and Stimmelmayr (2014) who consider interactions between taxes paid on corporate profits and taxes paid on shareholder dividends. In line with intuition, they find that higher corporate tax rates increase the value of deductibility provisions. Moreover, after-tax profits associated with high quality investments are reduced, which undermines managerial incentives to invest in the interest of the shareholders. Incentive alignment can only be achieved when the investment expenses are fully tax-deductible. Table 3 provides an overview of the articles discussing the effects of corporate taxation on investment and capital structure decisions.

4.3 Corporate taxes and tax avoidance

The importance of investigating corporate tax avoidance in agency settings draws from the issue that the separation of ownership and control often implies a separation of tax avoidance action from its consequences (e.g., tax savings and legal penalties). At this point, we briefly define the term tax avoidance as used throughout this review. Following the conceptual definition of Hanlon and Heitzman (2010), we define tax avoidance as the reduction of explicit taxes. This definition comprises legal tax planning activities as well as illegal evasion activities.Footnote 20 Corporate tax avoidance is also an important and frequently investigated motive for transfer pricing decisions of multinational firms. However, as transfer pricing decisions also have various other effects (e.g., on the internal coordination of firms), we discuss the literature regarding transfer pricing separately in the subsequent Sect. 4.4.

Theoretical research on tax evasion has grown in different directions including research on black markets, audit behavior of tax authorities, and issues regarding the design of a welfare maximizing tax system.Footnote 21 Tax evasion, in particular the amount of evaded income, depends crucially on how the liability is distributed between the contracting parties. Biswas et al. (2013) show that in a situation where the manager’s non-observable task is to disguise the principal’s tax evasion activities, the amount of tax evasion as well as the firm’s profit can only be maximized if the manager is not liable for those activities. Shifting the liability to the manager leads to a reduction in managerial compensation, lower levels of tax evasion, and lower managerial effort. Chen and Chu (2005) show that a risk-averse manager does not deviate from the efficient, non-observable productive effort level as long as the manager is not liable for tax evasion committed by the principal. However, if the manager is liable for the principal’s tax evasion, he or she exerts an inefficiently low effort level. This efficiency loss can be explained by the risk premium the manager demands ex-ante as compensation for the liability risk associated with tax evasion. In line with this result, Crocker and Slemrod (2005) illustrate that penalizing the manager is more effective in reducing tax evasion than penalizing the principal. In their model, the manager is responsible for claiming tax base reductions from the tax authorities while being privately informed about the permissible level of tax base reductions that can be claimed. The informational asymmetry between the contracting parties hinders the principal from fully transferring any penalties resulting from the manager’s misconduct back to the manager. The results of Biswas et al. (2013) and Crocker and Slemrod (2005) allow for the following empirical prediction:

Prediction 9 (Liability and tax evasion)

A liability shift for corporate tax evasion from shareholders to managers decreases the level of corporate tax evasion.

Factors that influence both the illegal as well as the legal side of tax avoidance, include the design of the firm’s incentive system and the firm’s corporate governance structure. For instance, in a situation where the manager is able to both avoid taxes and divert earnings, Desai and Dharmapala (2006) discuss the link between incentive compensation, corporate governance and the reduction of explicit taxes. The model predicts a reduction in tax avoidance as a response to higher incentive compensation if diversion and tax sheltering have sufficiently large complementary effects with respect to their costs. Additionally, managers of firms with strong corporate governance should exhibit more tax avoidance in reaction to increased incentive compensation due to the limited possibility to divert earnings. Similarly, Ewert and Niemann (2014) find that raising the manager’s incentive rate can increase corporate tax avoidance activities. They use a multi-task LEN model in which the manager exerts productive effort and effort in tax avoidance activities both aimed at increasing the corporation’s uncertain after-tax cash flow. If the principal cannot compensate the manager for productive effort and tax avoidance activities separately, a higher pay-performance sensitivity leads to an increase in effort for both tasks. This result can be translated into the following empirical prediction regarding the relationship between after-tax pay-performance sensitivity and corporate tax avoidance:

Prediction 10 (Tax avoidance and pay-performance sensitivity)

The level of corporate tax avoidance increases in the pay-performance sensitivity of the manager’s compensation.

Empirical evidence in support of this prediction is provided by Rego and Wilson (2012) who use pay-performance sensitivity as a control variable when investigating the relationship between CEO/CFO equity risk incentives and corporate tax aggressiveness. Also, Armstrong et al. (2012) provide empirical results on the relationship between the incentive compensation of tax directors and corporate tax planning. They find that incentive compensation is negatively associated with a firm’s GAAP effective tax rate, but has no relationship to cash effective tax rates, the book–tax gap, or measures of tax aggressiveness. In the empirical part of their analysis Desai and Dharmapala (2006) find a negative relation between incentive compensation and tax avoidance and attribute this result to a sub-sample of poorly governed firms. Table 4 provides an overview of the articles on corporate tax avoidance.

4.4 Corporate taxes and transfer pricing

The price at which goods and services are transferred internally within a firm can influence the allocation of taxable profits between firm divisions located in different tax jurisdictions. This is particularly true if the firm uses one set of books, that is, it applies the same price for the purpose of internal coordination and external taxation. In such a situation, diverging tax rates can distort transfer prices as firms have an incentive to shift profits from high-tax to low-tax jurisdictions.Footnote 22 This effect persists in the presence of agency conflicts between firm owner(s) and division manager(s).Footnote 23 For instance, Li and Balachandran (1996) show that corporate taxes remain a determining factor in the computation of transfer prices that are charged by the headquarters to their foreign divisions where each division manager has private information regarding marginal production costs, and is compensated based upon division profit. Despite the direct impact of transfer prices on the divisions’ taxable profits, the firm will not shift all profits to the low-tax jurisdiction. This is due to the implementation of a mechanism that ensures that each division manager reveals the true costs to the headquarters, and therefore constrains the possible range of transfer prices. Similarly, Choi and Day (1998) show that incentive contracts for divisional managers that solely depend on the managed division’s profit may prevent the realization of the optimal tax minimizing transfer price if changes to the transfer price influence the allocation of risk between divisions. Instead, compensating managers based on the performance of every division disentangles tax minimization from risk sharing and allows for the implementation of transfer prices that induce the maximum permissible amount of profit shifting.

Smith (2002) shows that a firm can also maximize profit shifting if it is able to use two separate sets of books. Here, the firm can set different transfer prices for internal coordination purposes and external tax purposes. He uses a multi-task LEN model where each division manager has the possibility to perform two independent tasks. The first increases the profit of the whole firm, the other only increases the profit of the manager’s own division. In the main analysis, the division manager’s compensation is based on the pre-tax profit of the division. The use of two different transfer prices, however, may be too costly for the firm if tax authorities do not accept two separate sets of books and the expected consequences of a detection are sufficiently adverse.Footnote 24 If the firm is forced to use the same transfer price for each purpose, corporate taxes affect the transfer price ambiguously and the effect depends on the relative productivity of the tasks involved. Theoretical results regarding the relationship between profit shifting and the one set of books vs. two sets of books approach are summarized by the following prediction:

Prediction 11 (Profit shifting and one set of books vs. two sets of books)

Firms that use one set of books for external tax and internal coordination purposes shift profits less aggressively from high-tax to low-tax countries than firms that use two separate sets of books.

Despite having two separate sets of books, profit shifting becomes more difficult if the firm has to comply with a specific arm’s length transfer price. The arm’s length standard is commonly used by tax authorities to determine the intra-firm profit allocation that would have occurred if two unrelated income maximizing parties would have agreed upon a transaction.Footnote 25 When tax authorities rigorously enforce compliance with the arm’s length standard, setting a deviant transfer price becomes less attractive for the firm and therefore the scope for profit shifting is limited. Elitzur and Mintz (1996) investigate a special case where the firm has no opportunity to let the tax-related transfer price diverge from the arm’s length transfer price, which is determined by a comparable profit measure.Footnote 26 The division manager, who is able to increase production quantities by an unobservable continuous effort is compensated based upon the division’s after-tax profit. Despite the irrelevance of the internal transfer price for the allocation of taxable profits, it increases in the effective tax rate for the production division. This is, because the tax rate acts similarly to a cost markup for the production division.

The interaction between corporate taxes and the optimal transfer price also influences the effort decisions of division managers. The theoretical results regarding this effect are mixed. Elitzur and Mintz (1996) show that as long as the internal transfer price is not used for profit shifting, corporate tax has no impact on the manager’s equilibrium effort level as the principal compensates the manager for any tax induced utility reductions. In contrast to this result, Choi and Day (1998) find that with continuous effort and divisional performance measures, the amount of effort exerted by the sales division managers is decreasing in the corporate tax differential between tax jurisdictions. This effect stems from the increasing distortion of the transfer price by the firm’s incentives for profit shifting, which exposes the manager to increased compensation risk. Further, corporate taxes impact the effort exerted by the production division manager in a more subtle way. Due to the higher transfer price which is induced by profit shifting, the production manager is willing to provide higher effort whenever the production division lies in the low tax jurisdiction. This willingness can be mitigated or even reversed when the production risks in both divisions are negatively associated with one another. Smith (2002) finds a similar result in a setting where the manager of the production division engages in two tasks. The first determines the production division’s profit, the other determines the firm’s sales revenue (and thus the distribution division’s profit). In this case, the transfer price determines the allocation of income as well as the allocation of the production division manager’s effort between the two tasks. The ex-ante trade-off between motivating the production division manager to provide effort that increases the expected income in the lower tax jurisdiction, and allocating realized income ex-post can lead to a counterintuitive relation between the optimal transfer price and tax rate changes. If the tax rate increases in the distribution division’s tax jurisdiction it can be optimal to decrease the transfer price. Intuitively, an increase in this tax rate decreases the value of effort provided in the task. In turn, this increases the distribution division’s profit relative to the value of effort provided in the task and increases the production division’s profit. The optimal transfer price is therefore reduced to induce the production division manager to work less on the task that increases the distribution division’s profit.

The transferred production quantity is unambiguously affected by corporate taxes. Despite very different settings, the results in both Li and Balachandran (1996) and Elitzur and Mintz (1996) show that the transferred quantity decreases for higher corporate tax rates independently of the prevailing tax rate differential or the tax rates’ effects on the transfer price. Although not addressing the question of transferred quantity directly, the same result can also be obtained in the first-best case of Smith (2002).Footnote 27 Table 5 provides an overview of the articles analyzing the consequences of corporate taxation on transfer pricing decisions.

4.5 Future research

To date, we find only a handful of papers that include concrete tax law features in their analysis.Footnote 28 We believe that the analysis of more specific tax law regulations may be an interesting avenue for future research as they relate to the agency conflict between firm owners and managers. For instance, consider special tax law provisions regarding severance payments compared to other forms of managerial remuneration. Accounting for such tax features can be important, as prior theoretical literature indicates that severance payments are a critical component of managerial compensation contracts, particularly in turbulent times when CEO turnover decisions occur more frequently.Footnote 29 Another interesting topic might be divergent tax bases that distort optimal decision making as they create profit shifting incentives. Recently, the European Commission put forward a series of ideas geared towards the removal of tax-related business obstacles. These ideas ultimately aim at the introduction of a Common Corporate Consolidated Tax Base (CCCTB).Footnote 30 The CCCTB would directly affect the corporate tax burden of multinationals and thereby also influence the managerial behavior. While Martini et al. (2016) provide first answers to questions related to this topic, we think that future literature could expand on this.

Corporate taxation also plays a key role when thinking about whether to merge operations of two company entities that are engaged in risky investment projects. In this context, corporate taxes encourage debt as interest is paid from pre-tax corporate earnings, while at the same time too much debt can cause an underinvestment problem.Footnote 31 Combining operations can reduce the variance of the total investment outcome, which helps in resolving the underinvestment problem. Conversely, a disadvantage may arise when the risk associated with each project differs significantly from one to the other. In this case, keeping the projects separate allows each firm to adjust its leverage more adequately than in the joint operation case. So far, the discussion here has been limited to agency conflicts between debtholders and shareholders while the interests of managers and firm owners have been assumed to be aligned.Footnote 32 However, since decision rights are usually delegated to management and managerial incentives depend on the organizational structure (e.g., its impact on risk), the inclusion of this agency conflict may potentially alter the results of previous publications.

Further, with respect to transfer pricing, legislative guidelines tend to limit the range of admissible transfer prices to avoid profit shifting from high to low tax jurisdiction and enable competition on an equal footing. When companies use one set of books those legislative guidelines can influence divisional efficiency, organizational structure, internal coordination, as well as strategic interaction with market competitors. That said, it is noteworthy that tax implications of specific transfer pricing rules (cost based, market based, etc.) relative to the application of the arm’s-length principle and its influence on optimal decision making are mostly unexplored.

Another interesting avenue for future research are multi-period settings as several interesting tax-related issues such as depreciation schedules, tax loss carry-forwards, and deferred taxes arise only in multi-period settings.Footnote 33 As many decisions with respect to these issues are delegated to managers, we believe that multi-period models would generate new insights. In particular, compensation schemes could be affected by inter-temporal tax issues as they usually have a direct impact on the performance measure.

Finally, with regards to tax avoidance, we find that most research articles attribute the decision right relative to the avoided tax amount quite heterogeneously to either one of the contracting parties. However, there is a lack of knowledge as to under what circumstances it is actually beneficial for the principal to delegate this decision. Also, when delegating decision rights, it is not clear how an optimal selection process to find an appropriate agent that evades the optimal amount in accordance with the principal’s interest should look. Also related to tax avoidance, it would be interesting to know whether the manager’s evasion behavior with respect to his or her personal income provides relevant information about decisions on corporate tax avoidance within the firm.Footnote 34 Despite the fact that individuals and in particular managers are usually assumed to be risk-averse, there is plenty of evidence that individuals engage in the risky activity of tax avoidance or even tax evasion.Footnote 35 Occasionally, top managers such as the former CEO of Deutsche Post, Klaus Zumwinkel, or more recently the former general manager of the Bundesliga club FC Bayern Munich, Uli Hoeness, are convicted of tax evasion.

5 Wage taxes

Wage taxes are the largest source of fiscal revenue among all income tax types. Since virtually every working person gives up a part of remuneration in the form of wage taxation, it has a huge impact on individual performance as well as on the demanded level and structure of pay. Wage tax schemes in most countries are progressive and include tax allowances which vary depending upon factors such as marital status and number of children. In 2015, the average tax burden (excluding employee contributions) of an average income single-person household in the OECD ranged from 0% in Chile to 36.1% in Denmark, whereas a single-earner family household with two children pays on average −4.7% (reimbursement) on wage income in the Czech Republic and 32.2% in Denmark (OECD 2016c, Table 3.4). The existing body of principal–agent literature on wage taxation focuses on two major effects of wage taxes: the effects on compensation and the effects on the firm’s investment decisions.

5.1 Wage taxes and compensation

It is often argued that wage taxation creates a disincentive for people to work. The intuition behind this argument is that an increase in the level of wage tax reduces the opportunity cost of work and induces people to substitute work with leisure time (substitution effect). The negative effect of a higher marginal wage tax rate on the optimal effort level is documented by Katuscak (2004) who implements wage tax in a continuous moral hazard model and finds that a higher marginal wage tax rate decreases the equilibrium level of managerial effort. This result is confirmed by all studies that use the LEN framework to analyze the effect of wage taxation and holds for all effort types that are desired by the principal (for a multi-task model see, for example, Ewert and Niemann 2014). In the standard LEN model, an increase in the level of wage tax decreases the incentives implemented by the compensation contract and consequently lowers the manager’s willingness to provide effort (for details see Sect. 3).Footnote 36 However, the negative effect of wage taxation on effort is not universal. Halperin et al. (2001) implement wage tax in a binary model and find that the optimal effort level is not affected by wage taxation. In their model, wage taxation affects the manager’s compensation depending on whether a high or low outcome is observed in the same way, i.e., wage taxation has only a scaling effect on the managerial salary. Consequently, wage taxation does not influence the preferences of the manager on whether to provide high or low effort.

The influence of wage tax regimes on pay-performance sensitivities is closely related to the wage tax effect on managerial effort. In the standard LEN model, the optimal pay-performance sensitivity is not affected by wage taxation when wage tax is modeled with a proportional tax rate. Ewert and Niemann (2012) show that this result carries over to an extended scenario with two periods and two action choices. However, if the wage tax burden is modeled as a function of gross pay with a progressive marginal tax rate, the optimal pay-performance sensitivity varies with the marginal wage tax rate. In this case, an increase in the marginal tax rate implies an increase in the pay-performance sensitivity (Brunello et al. 2011). Based on the tax-related results regarding pay-performance sensitivities in the LEN model, Martini and Niemann (2015) analyze the effects of taxation on a human resource assignment decision. In their model, the principal is faced with the decision to assign two agents to two jobs that are associated with a foreign subsidiary of a multinational enterprise. The authors show that the assignment decision depends on whether the credit or the exemption method is applied to eliminate double taxation. In the binary model of Halperin et al. (2001), both components of the manager’s compensation, variable and fixed salary, increase with the level of wage taxation. An increase in wage taxation forces the principal to provide higher total compensation to ensure that the manager accepts the contract. Niemann (2011) finds that this effect does not depend on whether profits and losses are taxed in the same way and shows that the wage tax penalizes performance-based contracts more heavily than fixed-salary schemes.

While most authors endogenize the question of whether the principal or the agent bears the wage tax burden, exogenously given sharing rules that split the wage tax burden in some fashion between the principal and the agent are common practice. Gupta and Viauroux (2009) try to shed light on the question of why many countries establish such sharing rules. They introduce a parameter \(\gamma \in [0,1]\) for the share of the tax burden that is paid by the employee in their model and show that exogenous sharing-rules restrict the principal’s ability to trade-off risk sharing versus incentives. The agent’s effort is maximized when the agent’s share of the wage tax is minimized, \(\gamma =0\), and the expected wage is maximized if the agent’s share of the wage tax is maximized, \(\gamma =1\). Gupta and Viauroux (2009) conclude that they cannot find any justification to split the wage tax burden between the principal and the agent as in their model an interior share \(\gamma \in (0,1)\) does not maximize any of the considered outcomes.

When analyzing how competition for productive agents can interact with the firm’s incentive schemes undermining work ethics, Bénabou and Tirole (2016) find that wage taxation reduces the misallocation of effort that arises due to market frictions. The reason for this is that wage tax decreases the compensation differential between low and high productivity agents. Consequently, the incentive for agents with a low productivity to mimic highly productive agents is reduced and the misallocation of effort is mitigated. Krenn (2017) shows that the interaction of competition for highly skilled CEOs and incentive schemes directly depends upon the wage tax rate if two principals located in different tax jurisdictions compete for a single agent. In his model, wage taxation affects the agent’s reservation utility, and thus the principal’s contract offer to the agent. A sufficiently large tax rate differential leads to a competitive advantage for the principal located in the tax jurisdiction with the lower wage tax rate. As a result, the principal in the low tax jurisdiction is able to outperform the rival firm in the high tax jurisdiction and hires the agent. This result highlights the implication of wage taxes on the ability of firms within a country to attract highly skilled CEOs:

Prediction 12 (Wage taxes and highly skilled CEOs)

A decrease in the wage tax rate of a country increases the number of highly skilled CEOs.

The existing empirical literature related to Prediction 12 confirms the impact of wage taxes on firms and countries competing for talented and highly skilled employees. Kleven et al. (2013) find that the mobility of professional football players in Europe responds to tax incentives. Further, Kleven et al. (2014) provide evidence that a preferential wage tax scheme for highly paid foreigners in Denmark had a significant positive impact on the amount of these foreigners. However, this prediction has not yet been examined specifically with respect to CEOs.

With regard to the taxation of non-monetary compensation, Voßmerbäumer (2013) shows that it can be more efficient to use the true cost of workplace benefits to determine the tax base instead of the agent’s willingness to pay. This result stems from the model characteristic that the agent’s personal disutility from work is not only convex and increasing in effort (a standard assumption in all LEN models), but also decreasing in benefits. As long as the cost of the benefits does not depend on the agent’s work intensity, taxing the benefits at cost is more efficient than taxing them at the agent’s utility equivalent. Table 6 provides an overview of the articles that analyze the effects of wage taxation on the design of compensation schemes.

5.2 Wage taxes, investment decisions and capital structure

Given the extensive attention to tax effects on investment decisions in the academic literature, the consequences of wage taxation remained remarkably unexplored until recently. When studying the role of wage taxation on a multinational enterprise’s profit, Egger and Radulescu (2011) find that the firm facing the decision of where to locate headquarters will—all other things being equal—choose the country with the lowest level of wage taxation. The intuition is straightforward, the detrimental effect of wage taxation on effort leads to higher production costs and reduces efficiency given a fixed gross wage. Bauer and Kourouxous (2017) show that an investment-enhancing effect can occur in a situation where a risky investment decision is delegated to a risk-averse agent. If the risk of the investment increases with the investment level, a tax on the agent’s compensation affects the consequences of the different attitudes towards investment risk of the principal and the agent. Intuitively, an increase in the wage tax rate reduces the agent’s compensation risk and enables him or her to bear more investment risk, which results in an increase in the optimal investment level. The positive effect of wage taxes on risky investments is summarized by the following empirical prediction:

Prediction 13 (Wage taxes and risky investment projects)

An increase in the wage tax rate increases the level of investment in risky projects.

Table 7 summarizes the articles on wage taxation and investment decisions.

5.3 Future research

Despite the fact that progressive wage taxation is prevailing in practice, researchers usually implement wage taxes with proportional tax rates. We believe that modeling wage taxation as a progressive tax rate would yield interesting insights on the manager’s behavior as it induces risk aversion.Footnote 37 As the different risk attitudes of firm owner and manager are one of the key drivers in most of the discussed papers, neglecting the progressive structure of wage taxation limits the information value of the obtained risk-sharing results.

With respect to the design of compensation contracts, we encourage researchers to relax the assumption that manager salaries consist exclusively of a fixed and a variable part. The different tax effects on salary components such as incentive stock options, severance payments or pensions on both the headquarters’ and the manager’s objective could yield additional insights for the design of optimal compensation packages in the presence of wage taxation. We also encourage researchers to study the possible consequences of the compensation risk reducing effect of wage taxation on the manager’s risk-taking behavior. Similar to the substitution with investment risk (Bauer and Kourouxous 2017), the decreased compensation risk could also be replaced with detection or litigation risk. If this is true, the costs for motivating the manager to engage in risky activities such as earnings management or tax evasion (e.g., Crocker and Slemrod 2005) would depend on wage taxes.

Another interesting question that warrants attention is how wage taxation influences the manager’s reservation utility. Nearly all authors assume that the reservation utility is not affected by wage taxation (for an exception see Krenn 2017). However, neglecting wage tax effects on the reservation utility is problematic, for example, when the model includes multiple agents. In a scenario with more than one agent, agents may face different participation constraints due to different wage tax rates applicable to each agent. Different participation constraints in turn influence the principal’s preferences. Therefore, we expect that the consideration of wage taxation on the manager’s reservation utility will yield new insights, in particular, when analyzing hiring decisions.

It further appears that so far researchers have focused mainly on the effects of wage taxation on incentives and compensation schemes. It might be worth extending this field of research. For example, with regard to transfer pricing, we do not find a single contribution that accounts for the agent’s wage tax even though this type of tax directly impacts the manager’s utility. As wage taxes reduce the agent’s effective share when participating in the firm’s profit, they influence the principal’s trade-off between tax benefits and incentive alignment, which in turn can distort the transfer pricing decision.

6 Bonus taxes

Excessive bonus payments contributed to the credit crisis in 2008 by encouraging executives, in particular within financial firms, to take unreasonable risks in pursuit of short term private benefits.Footnote 38 Consequently, governments in several countries took action to reduce the attractiveness of bonus payments. In doing so, some countries implemented a higher tax rate on bonus payments than on other compensation components. For example, France and the UK imposed a bonus tax of 50% on bonus payments paid in 2009. Moreover, the US and Ireland introduced a 90% bonus tax for financial institutions that received government help. In the following, we discuss the effect of bonus taxes on managerial compensation, firm investment, and capital structure.Footnote 39

6.1 Bonus taxes and compensation

When exploring the effect of bonus taxation on the design of compensation schemes, researchers focus upon the question of whether or not a tax on bonuses leads to a reduction in the variable component of the compensation plan as intended by regulators. While intuition suggests that an increase in the tax rate on the agent’s variable pay implies a shift in the compensation package to the fixed salary, researchers show that the effect is ambiguous.

When analyzing the consequences of a bonus tax within a LEN model, Radulescu (2012) finds that a bonus tax has, for the same reasons as wage tax, a negative effect on the agent’s effort level. She further shows that the effect of bonus taxes on the variable pay of the agent depends on the relationship between the agent’s risk aversion, firm value variance, and the slope of the marginal effort cost function. The ambiguity arises because an increase in the level of the bonus tax leads to two counteracting effects. On one hand, an increase in the bonus tax reduces the agent’s compensation risk and the risk premium, and thus the marginal cost of inducing effort. On the other hand, an increase in the bonus tax rate increases the gap between the gross bonus paid by the principal and the net bonus earned by the manager, which leads to a decrease in the marginal benefit. If the latter effect is dominated by the first effect, i.e., if risk is essential, which is the case when the risk aversion or the firm value uncertainty (e.g., due to business risk) are sufficiently large, the optimal pay-performance sensitivity increases in the bonus tax rate. Otherwise, bonus tax has a negative effect on the pay-performance sensitivity. The following prediction summarizes how bonus taxes should affect pay-performance sensitivity with different levels of business risk:

Prediction 14 (Bonus taxes and pay-performance sensitivity)

The pay-performance sensitivity of firms that are subject to high (low) business risk increases (decreases) in the bonus tax rate.

Radulescu (2012) is also able to show that the change in the variable part is accompanied by the expected substitution effect in the fixed salary, i.e., an increase (decrease) in the pay-performance sensitivity comes along with a decrease (increase) in the fixed salary. Dietl et al. (2013) extend this result by assuming a more general structure of the agent’s effort cost function and show that the substitution effect between fixed and variable pay does not occur in all instances. Depending on the effort cost function, an increase to the bonus tax rate can lead to an increase or decrease in both the variable and the fixed compensation component. Such an effect also arises in Radulescu (2012)’s model if the agent’s reservation wage decreases with the bonus tax.

Apart from the opportunity to tax the agent’s variable pay, regulators also discussed the introduction of a penalty tax on paid bonuses which is borne by the principal. Meißner et al. (2014) compare these two alternatives in a binary model with a risk-neutral agent. They find that both taxation methods can be implemented without distorting the incentives of the compensation contract, as long as the tax rate does not exceed a certain cut-off value. The range of tax rates that do not affect the incentives is greater for the penalty tax on paid bonuses than for the bonus tax on the variable salary. In this range, the bonus increases with the bonus tax rate to maintain the agent’s incentive to provide high effort if the agent bears the tax burden. In the case of a penalty tax on paid bonuses, the variable compensation component is not affected by the penalty tax. If the tax rate exceeds the cut-off value, the principal refrains from incentivizing a high effort level and does not offer a bonus to the agent.

However, an effect of bonus taxation contrary to its intention can also occur when the principal bears the tax burden. In a two-task LEN model, Dicken and Duerr (2014) assume that the productivity of one of the two tasks is uncertain. In this case, an increase in the level of bonus tax can motivate the manager to invest more effort in this uncertain task and hence exposes the firm to a higher level of risk. This increased level of effort is induced by a decrease in the pay-performance sensitivity, which can occur in this specific model setup as the agent’s equilibrium effort for the task with the uncertain productivity is quasiconcave in the pay-performance sensitivity due to the effort’s impact on the risk premium. Table 8 lists the articles that discuss the consequences of bonus taxation on compensation contracts.

6.2 Bonus taxes, investment decisions and capital structure

Bonus taxes can influence loan quality if the agent’s compensation depends on the expected loan repayment, for example, if the agent is an investment banker in a financial institution. When analyzing the relationship between management compensation, loan quality and securitization decisions in financial institutions, Inderst and Pfeil (2013) also discuss how a bonus tax on short-term compensation would alter the optimal decisions of a risk-neutral and impatient agent. In their model, the agent can receive compensation at two points in time. If the agent is compensated before the repayment of the loan is realized, the variable compensation is subject to a short-term bonus tax. The compensation that the agent receives after the loan repayment is not subject to the bonus tax, but discounted by the agent due to his or her impatience. Inderst and Pfeil (2013) show that in this scenario the effect of the bonus tax on the average loan quality is ambiguous. The loan quality increases if the agent’s discount rate exceeds a certain cut-off value and decreases if the discount rate falls below this cut-off value. In the first case, the bonus tax increases the agent’s incentive to provide costly effort in screening out bad loans. In the second case, the bonus tax increases the agent’s reluctance to screen out bad loans. Table 9 summarizes the above discussed article.

6.3 Future research

In contrast to the regulators’ intention to reduce corporate risk-taking by means of a bonus tax, von Ehrlich and Radulescu (2012) find evidence that the implementation of such a bonus tax actually increases corporate risk-taking. The authors argue that bonus taxes induce a shift from cash bonuses to equity compensation, and therefore foster risky decision making. It appears that bonus taxes motivate managers to engage in risky activities as they reduce the volatility of their variable compensation. Subsequently, the reduced compensation risk is substituted by other forms of risk such as investment risk. Further analytical research could contribute to strengthening the argument of von Ehrlich and Radulescu (2012).

Another interesting topic would be the development of multi-period models that allow for the comparison of bonus taxes with other instruments introduced to motivate managers to take a long-term view. One frequently discussed instrument is the backward-looking reassessment of manager performances (bonus–malus) as mentioned by the Committee on European Banking Supervisors’ Guidelines on Remuneration Policies and Practices in April 2012, which is already implemented by several companies (e.g., UBS).Footnote 40 A comparison would enable legislators to better understand the advantages and disadvantages of the available instruments and help them to achieve a better incentive alignment between managers and firm owners.

7 Shareholder taxes

Shareholder income is usually a result of dividend payments or stock price gains. In most countries, those forms of income are taxed at a flat capital gains tax rate, which can vary depending on the source of income and the duration of the investment. For example, in the United States, short-term capital gains are taxed as ordinary income at the regular wage tax rates, whereas long-term capital gains are not taxed at all or at a significantly reduced rate. Moreover, there is a wide variation in tax rate levels among countries. Within the OECD, tax rates on dividends, for instance, range from 0% to 53.53% at a personal level (OECD 2016b). Dividend taxation is essentially a second layer of taxation on corporate profits when distributed to investors and shareholders. The principal–agent literature that considers capital gains taxes studies mostly dividend taxation and finds effects on compensation, investment decisions and capital structure.

7.1 Shareholder taxes and compensation