Abstract

Does informative advertising increase price or does it decrease price? The answer to this empirical question is mixed and not conclusive, despite its significance for public policy and marketing. Using the tools of experimental economics, we seek answer to this empirical question in this paper. Our experiments constitute the first laboratory test of the effect of informative advertising in a horizontally differentiated market. Study 1 shows that informative advertising can lead to higher prices if consumer valuations are low. Study 2, on the other hand, points to the possibility that informative advertising can lead to lower prices if consumer valuations are high. Thus, these studies provide evidence on the causal relationship between price and advertising and more importantly clarify the conditions under which we may observe divergent results. Furthermore, our experimental analysis is the first to study competition involving multiple firms (n = 7) in a horizontally differentiated market using the spokes framework.

Similar content being viewed by others

Notes

In their model, consumers are distributed on a plane along different taste dimensions (spokes), each firm directly competes with every other firm in the market (nonlocal competition) and the market can be partially covered.

At this point, it is useful to clarify why it is not possible to find a consumer for whom product j is the first preferred product and her second preferred product is not available (See Fig. 2). As the number of products available in the market is n ≥ 2 and n − 1 of these products are equally likely to be the second preferred product in the consideration set of the consumer located at (l j , x), some second preferred product will be available for this consumer.

In our experiment, we did not provide any financial incentive for participants to truthfully reveal their expectations. Such an incentive has to be in addition to the profits earned in a trial, and it may add a layer of complexity to an already complicated game and potentially impede comprehension. Thus in our experiment, it is quite possible that after gaining experience, a participant could enter a random number as her expectation, and yet set her price to maximize actual profits (rather than the expected profits displayed by the calculator). Thus, although the calculator is at the disposal of participants, they can choose not to use it. Thus, we only tracked the actual prices and profits, not the expectations. As we discuss later, we can infer each participant’s expectations about competitors’ prices from her price.

For example, in their experiment, the observed prices were on average 52.17 though the equilibrium prediction was 76.5 (see p. 47). Their experiments studied oligopolies of three, four, or five players; and in general cooperative plays decreased as the number of competitors increased. In our games, as there are seven players in each oligopoly, it reduces further the likelihood of cooperation. While Huck et al. [19] and [20] test the predictions of Cournot and Bertrand competition using an aggregate demand formulation, we examine price competition in a horizontally differentiated market.

Please see Amaldoss and He [2] for a proof.

References

Ackerberg D (2003) Advertising, learning, and consumer choice in experience good markets: an empirical examination. Int Econ Rev 44(3):1007–1040

Amaldoss W, He C (2010) Product variety, informative advertising and price competition. J Mark Res 47 (1):146–156

Amaldoss W, He C (2009) Direct-to-consumer advertising of prescription drugs: a strategic analysis. Mark Sci 28(3):472– 487

Amaldoss W, Jain S (2005) Pricing of conspicuous goods: a competitive analysis of social effects. J Mark Res 42(1):30–42

Anderson SP, de Palma A (2006) Market performance with multiproduct firms. J Ind Econ 54(1):95–124

Benham L (1972) The effect of advertising on the price of eyeglasses. J Law Econ 15(2):337–52

Blumenthal D (1983) Beauty: looking good in eyeglasses. N Y Times. June 5

Brown-Kruse J, Cronshaw M, Shenk D (1993) Theory and experiments on spatial competition. Economic Enquiry 31:139–165

Brown-Kruse J, Shenk D (1993) Location, cooperation and communication. Int J Ind Organ 18:59–80

Cady JF (1976) An estimate of the price effects of restrictions on drug price advertising. Econ Inq 14(4):493–510

Camerer C, Ho TH (1999) Experience-weighted attraction learning in normal form games. Econometrica 67:837–874

Carare O, Haruvy E, Prasad A (2007) Hierarchical thinking and learning in rank order contests. Exp Econ 10(3):305–316

Chen Y, Riordan M (2007) Price and variety in the spokes model. Econ J 117(522):897–921

Connor M, Peterson E (1992) Market-structure determinants of national brand-private label price differences of manufactured food products. J Ind Econ 40(2):157–171

Farris PW, Reibstein DJ (1979) How prices, ad expenditures, and profits are linked. Harv Bus Rev:173–184

Grossman GM, Shapiro C (1984) Informative advertising with differentiated products. Rev Econ Stud 51 (1):63–81

Hotelling H (1929) Stability in competition. Econ J 39(153):41–57

Ho T-H, Zhang J (2008) Designing pricing contracts for boundedly rational customers: does the framing of the fixed fee matter?. Manag Sci 54(4):686–700

Huck S, Normann HT, Oechssler J (1999) Learning in Cournot Oligopoly—an experiment. Econ J 109 (454):C80—C95

Huck S, Normann HT, Oechssler J (2000) Does information about competitors’ actions increase or decrease competition in experimental oligopoly markets? Int J Ind Organ 18(1):39–57

Krishna A, Unver U (2008) Improving the efficiency of course bidding at business schools: field and laboratory studies. Mark Sci 27(2):262–282

Krishnamurthi L, Raj SP (1985) The effect of advertising on consumer price sensitivity. J Mark Res 22 (2):119–129

Lim N, Ho TH (2007) Designing price contracts for boundedly rational customers: does the number of blocks matter? Mark Sci 26(3):312–326

Milyo J, Waldfogel J (1999) The effect of price advertising on prices: evidence in the wake of 44 Liquormart. Am Econ Rev 89(5):1081–1096

Nedungadi P (1990) Recall and consumer consideration sets: influencing choice without altering brand evaluations. J Consum Res 17(Dec):263–276

Nickell S, Metcalf D (1978) Monopolistic industries and monopoly profits or, are Kellogg’s cornflakes overpriced? Econ J 88(350):254–268

Selten R, Apesteguia J (2005) Experimentally observed imitation and cooperation in price competition on the circle. Games and Economic Behavior 51(1):171–192

Salop S (1979) Monopolistic competition with outside goods. Bell J Econ 10(1):141–156

Soberman D (2004) Research note: additional learning and implications on the role of informative advertising. Manag Sci 50(12):1744–1750

Tucker C, Zhang J (2009) Growing two sided networks by advertising the user base: a field experiment. Mark Sci. Forthcoming

Wang Y, Krishna A (2006) Time-share allocations: theory and experiment. Manag Sci 52(8):1223–1238

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

In this appendix, we derive the aggregate demand function and equilibrium price. We then provide proofs to the theoretical predictions and claims (numerical examples) presented in the paper. The appendix is organized as follows. We first derive the aggregate demand, and the equilibrium price for the case where consumer valuations are low (Lemma 1). Next, we show that price can increase with advertising reach when consumer valuations are low (Prediction 1). We then derive the equilibrium point predictions for Study 1 (Claim 1). Turning attention the case where consumer valuations are high, we derive the equilibrium price (Lemma 2), show that price increases decreases with advertising reach (Prediction 2), and then derive the equilibrium point predictions for Study 2 (Claim 2).

We derive the demand for firm j, j ∈ {1, … , n}, for any given price profile (p 1, p 2,…, p n ). Based on product availability and information (see Fig. 2 on page 8), we can classify consumers into four relevant segments as we described below. To eliminate the trivial cases, we assume \(\frac {v-p_{j} }{t}>\frac {1}{2}\ \)and \(\frac {\left \vert p_{k}-p_{j}\right \vert }{t}\leq 1\).

Segment 1

Firm j’s product is the local product and hence the first preferred product in the consideration set of a consumer in this group. The probability that a consumer is aware of her first preferred product j is ϕ. Any nonlocal product about which the consumer is informed could be the second preferred product in her consideration set. Thus, the second preferred product in the consideration set, namely k ≠ j where k ∈ {1, … , n}, is drawn from the set of products to which an individual consumer has been exposed through advertising. The joint probability that the consideration set of a consumer located on spoke l j includes products j and k is given by \(\frac {1}{n-1}\phi \left [ 1-\left (1-\widehat {\phi }\right )^{n-1}\right ] \).Footnote 5 The density of such consumers is \(\frac {2}{N}\), and the demand from this group of consumers is given by:

Segment 2

Firm j’s product is the first preferred product in the consideration set of a consumer in this group also. However, the consumer is uninformed about their second preferred product. In this case, the probability that the consumer located on spoke l j only considers product j is given by \(\phi \left (1-\widehat {\phi }\right )^{n-1}\). The demand from this group of consumers is given by

Next, we turn attention to cases where firm j’s product is the second preferred product in the consideration sets of consumers. As the number of products available in the market is n ≥ 2 and n − 1 of these products are equally likely to be the second preferred product in the consideration set of the consumer located at (l j , x), some second preferred product will always be available for the consumer at (l j , x). However, consumers may be uninformed about their second preferred products.

Segment 3

The first preferred product (variety) k preferred by consumers in this group is not produced by any of the n firms, and product j is the second preferred product in their consideration set. The demand from this group of consumers is given by

The region \(\frac {1}{2}<\frac {v-p_{j}}{t}<1\) corresponds to the situation where consumers always derive positive surplus from purchasing their first preferred product but the valuation is not high enough for some consumers to obtain positive surplus from purchasing their second preferred product. By contrast, when \(\frac {v-p_{j}}{t}\geq 1\), consumers derive positive surplus from purchasing both their first and second preferred products.

Segment 4

Consumers in this segment are uninformed of their first preferred product and product j is the second preferred product in their consideration set. The demand from this group of consumers is given by

When consumer valuations are low (that is, \(\frac {1}{2}<\frac {v-p_{j}}{t}<1\)), the demand function for firm j’s product is given by

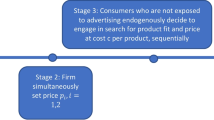

We assume that firms set their prices simultaneously and focus on symmetric pure strategy equilibrium.

When consumer valuations are sufficiently high (i.e., \(\frac {v-p_{j}}{t}\geq 1\)), the demand function for firm j’s product is given by

Lemma 1

When \(\frac {1}{2}<\frac {v-p_{j}}{t}<1\), the equilibrium price is

Proof

Using the demand function given in (4) and the cost function A(ϕ;α) = α ϕ 2, we obtain the following profits for firm j:

Using the first-order condition \(\frac {\partial \pi _{j}}{\partial p_{j}}\) = 0 and noting that in the symmetric pure strategy equilibrium, \( p_{j}^{\ast }=p_{k}^{\ast }\) and \(\phi =\widehat {\phi }\), we solve for the optimal price and find that \(p_{j}^{\ast }\) is as given in (6). □

Prediction 3

When consumer valuations are low, (that is, \(\frac {1}{2}<\frac {v-p_{j}}{t}<1\)), equilibrium price can increase with advertising reach.

Proof

When consumer valuations are low, the equilibrium price is given by (6). It follows that

The case when N = 8 and n = 7 forms the basis for the experimental investigations presented in the paper. For this case, we have:

Similarly, we can establish the comparative statics for any given n and N. For a more general proof, readers are referred to Amaldoss and He [2]. □

Claim 1

When v = 1.2, N = 8, n = 7, t = 1, α = 0.1, the symmetric pure strategy equilibrium price is 39.12 cents if ϕ = 0.1. The equilibrium price increases to 45.82 cents when advertising reach rises to ϕ = 0.5.

On substituting v = 1.2, N = 8, n = 7, t = 1, α = 0.1, and ϕ = 0.1 into (6), we have \(p_{j}^{\ast }=39.12\) cents. The equilibrium price increases further to 45.82 cents when advertising reach rises to ϕ = 0.5.

Note that in equilibrium when ϕ = 0.1, we have \(\frac {v-p_{j}}{t}=0.809\) ; and similarly when ϕ = 0.5 we obtain \(\frac {v-p_{j}}{t}=0.742\). Thus in both treatments \(\frac {1}{2}<\frac {v-p_{j}}{t}<1\).

Lemma 2

When \(\frac {v-p_{j}}{t}\geq 1\) , the equilibrium price is

Proof

On inserting firm j’s demand given in Eq. 5 and the cost function A(ϕ;α) = α ϕ 2 into the profit function, we can express firm j’s profits as:

Solving \(\frac {\partial \pi _{j}}{\partial p_{j}}\) =0 and noting that in the symmetric pure strategy equilibrium, \(p_{j}^{\ast }=p_{k}^{\ast }\) and \(\phi =\widehat {\phi }\), we obtain \(p_{j}^{\ast }\) as given in Eq. 10. □

Prediction 4

When consumer valuations are sufficiently high (i.e., \(\frac {v-p_{j}}{t}\geq 1\)), price decreases with advertising reach.

Proof

When consumer valuations are high, the equilibrium price is given by Eq. (10). Therefore, we obtain:

Note that the denominator of \(\frac {\partial p^{\ast }}{\partial \phi }\) is positive for ϕ ∈ (0, 1). It can be shown that the numerator is always negative for any ϕ ∈ (0, 1). Therefore, it follows that \(\frac {\partial p^{\ast }}{\partial \phi }<0\). □

Claim 2

When v = 10, N = 8, n = 7, and α = 1, the symmetric pure strategy equilibrium price is 61.20 dimes if ϕ = 0.2. The equilibrium price p ∗ reduces to 23.04 dimes when advertising reach increases to ϕ = 0.5.

Inserting v = 10, N = 8, n = 7, α = 1, and ϕ = 0.2 into (10), we obtain \(p_{j}^{\ast }=61.20\) dimes. The equilibrium price \(p_{j}^{\ast }\) reduces to 23.04 dimes when advertising reach increases to ϕ = 0.5.

Also in equilibrium, \(\frac {v-p_{j}}{t}\) is 3.88 when ϕ = 0.2, and it becomes 7.7 when ϕ = 0.5. Thus, in both treatments \(\frac {v-p_{j}}{t} >1 \).

Simplified Expected Demand

When consumer valuation is low, the demand function given in Eq. 4 can be simplified as follows to obtain the expected demand of firm j:

Thus, we can project the demand for a given store’s product if we know the focal firm’s price and the average price of all other competing firms. In our experimental investigation, we used this simplification to help our participants appreciate the profit implications of their price and the likely average price of their competitors.

When consumer valuation is high, the demand function given in Eq. 5 can be further simplified to obtain the following expected demand of firm j:

Instructions for Participants

3.1 Instructions for Study 1

We invite you to participate in a decision making experiment concerning competition between seven stores (firms). You will be asked to make several decisions, and then you will be paid according to your earnings. The earnings depend on your decisions as well as the decisions of your competitors. Below, we discuss the market in which you will compete and then provide detailed instructions on the decision task.

Market

There are eight streets that radiate from the center of a town and each street is half a mile. A store is located at the end of seven of these streets. All the stores sell similar quality products and its value to you is 1.2. There is a 10 % chance that a consumer is aware of a store?s product and its price, and the cost having this level of advertising reach is 0.001. Consumers are located along all the streets. You can visualize the market as follows:

The first preferred product of a consumer in this market is the product sold by the store located in the same street in which the consumer resides. The second preferred product of a consumer could be any of the other products of which the consumer becomes aware of through advertising. Consumers will compare the cost of buying these two products and then make their purchase decision. In some cases, consumers may have to make a choice between buying nothing or buying the only product that they know of. It costs money for a consumer to travel from her house to the store. The travel cost is less if a customer is located close to the store, but more if the customer is farther away from the store. The travel cost in dollars is equal to the distance traveled in miles from her residence to the end of the street where the store is located. Now depending on the travel cost and the prices at the stores, each customer decides whether or not to purchase the product. If a consumer decides to purchase, then she will choose the store from which to purchase the product. Note that the purchase decision is based on the total cost of purchase (travel cost + product price). In this experiment, you will play the role of one of the seven competing store managers and have to set a price for your store?s product. At the beginning of each trial, you will be asked to indicate your price and the expected average price of all the other stores. Note that it may seem difficult for you to set the price, because it is difficult to understand how your prices affect your sales and in turn your profits (after deducting the cost of advertising). We have simplified your decision task by providing you a calculator that will compute the likely sales and display the likely profits based on your price and what you think will be the average price of your competitors. Thus, in a given trial based on the prices that you enter, the computer will project (display) the likely profits. It is quite possible that your competitors may not behave as you have predicted. After viewing the likely profits, you can choose to revise your price as well as the expected average price of competitors and understand how the new prices affect the likely profits. After all the players confirm their prices, the computer will display the actual profits. Your goal is to maximize your store?s profits. Note that you will compete with a different set of competitors in each trial. You will not know the identity of your competitors in any of the trials. Similarly, your competitors will not know your identity. Thus, players remain anonymous in this game

Detailed Instructions

In order to help you compute the likely profits for given levels of prices, we are proving you with a calculator. All you need to do is enter into the calculator the following information:

-

your price level, and

-

the expected average price of your competitors

Using these two numbers, the calculator will let you know your likely profits and your competitors? expected profits. You can keep refining your entries, till you are comfortable with your price. Note that your profits will depend on your competitors? actual price (rather than the price that you expected the competitors to charge). So your likely profits will be close to actual profits to the extent your expectation about the average price of your competitors is accurate. The computer screen will look as follows:

After all the players have confirmed their prices, the computer will assess the actual profits of each firm. Then the results will be displayed as follows:

To familiarize you with the structure of the game, you will play three practice trials. If you have any questions about the instructions, please raise your hand and the supervisor will answer your questions. After all the participants become familiar with the structure of game, you will play 35 actual trials and your compensation will depend on the profits that you earn in each of these 35 trials.

As noted earlier, you do not have to do any calculation using the parameters of the game. The calculator will do the calculations for you. Your goal is to maximize your earnings in each trial. At the end of 35 trials, your cumulative earnings will be converted to US dollars at the rate of 1 experimental dollar = US 2. In addition to this payment, you will receive a show-up fee of 10 for coming to the lab in time.

3.2 Instructions for Study 2

We invite you to participate in a decision making experiment concerning competition between seven stores (firms). You will be asked to make several decisions, and then you will be paid according to your earnings. The earnings depend on your decisions as well as the decisions of your competitors. Below, we discuss the market in which you will compete and then provide detailed instructions on the decision task.

Market

There are eight streets that radiate from the center of a town and each street is half a mile. A store is located at the end of seven of these streets. All the stores sell similar quality products and its value to you is $10. There is a 20 % chance that a consumer is aware of a store’s product and its price, and the cost of having this level of advertising reach is 0.04. Consumers are located along all the streets. You can visualize the market as follows:

The first preferred product of a consumer in this market is the product sold by the store located in the same street in which the consumer resides. The second preferred product of a consumer could be any of the other products of which the consumer becomes aware of through advertising. Consumers will compare the cost of buying these two products and then make their purchase decision. In some cases, consumers may have to make a choice between buying nothing or buying the only product that they know of. It costs money for a consumer to travel from her house to the store. The travel cost is less if a customer is located close to the store, but more if the customer is farther away from the store. The travel cost in dollars is equal to the distance traveled in miles from her residence to the end of the street where the store is located. Now depending on the travel cost and the prices at the stores, each customer decides whether or not to purchase the product. If a consumer decides to purchase, then she will choose the store from which to purchase the product. Note that the purchase decision is based on the total cost of purchase (travel cost + product price).

In this experiment, you will play the role of one of the seven competing store managers and have to set a price for your store’s product. At the beginning of each trial, you will be asked to indicate your price and the expected average price of all the other stores. Note that it may seem difficult for you to set the price, because it is difficult to understand how your prices affect your sales and in turn your profits (after deducting the cost of advertising). We have simplified your decision task by providing you a calculator that will compute the likely sales and display the likely profits based on your price and what you think will be the average price of your competitors. Thus, in a given trial based on the prices that you enter, the computer will project (display) the likely profits. It is quite possible that your competitors may not behave as you have predicted. After viewing the likely profits, you can choose to revise your price as well as the expected average price of competitors and understand how the new prices affect the likely profits. After all the players confirm their prices, the computer will display the actual profits.

Your goal is to maximize your store’s profits. Note that you will compete with a different set of competitors in each trial. You will not know the identity of your competitors in any of the trials. Similarly, your competitors will not know your identity. Thus, players remain anonymous in this game

Detailed Instructions

In order to help you compute the likely profits for given levels of prices, we are proving you with a calculator. All you need to do is enter into the calculator the following information:

-

your price level, and

-

the expected average price of your competitors

Using these two numbers, the calculator will let you know your likely profits and your competitors’ expected profits. You can keep refining your entries, till you are comfortable with your price. Note that your profits will depend on your competitors’ actual price (rather than the price that you expected the competitors to charge). So your likely profits will be close to actual profits to the extent your expectation about the average price of your competitors is accurate.

The computer screen will look as follows:

After all the players have confirmed their prices, the computer will assess the actual profits of each firm. Then the results will be displayed as follows:

To familiarize you with the structure of the game, you will play three practice trials. If you have any questions about the instructions, please raise your hand and the supervisor will answer your questions. After all the participants become familiar with the structure of game, you will play 35 actual trials and your compensation will depend on the profits that you earn in each of these 35 trials.

As noted earlier, you do not have to any calculation using the parameters of the game. The calculator will do the calculations for you. Your goal is to maximize your earnings in each trial. At the end of 35 trials, your cumulative earnings will be converted to US dollars at the rate of 10 experimental dollar = US $2. In addition to this payment, you will receive a show-up fee of $15 for coming to the lab in time.

Rights and permissions

About this article

Cite this article

Amaldoss, W., He, C. Does Informative Advertising Increase Market Price? An Experimental Investigation. Cust. Need. and Solut. 3, 63–80 (2016). https://doi.org/10.1007/s40547-016-0064-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40547-016-0064-5