Abstract

The world’s dependency on cobalt mines in Congo and cobalt refineries in China is seen as serious security issues with potentially dangerous implications for the energy transition. However, Chinese refineries have a similar supply security issue as most of its cobalt concentrates are imported. Most supply security studies take a country perspective on market concentration and supply risks. However, control of the mines and refineries lies with the producing companies, not the governments of the countries where they are located. This paper analyses the corporate structure of the cobalt industry at the mine and the refinery stages over a longer time period to establish changes in the level of corporate concentration and to put the situation in 2018 in perspective. The level of corporate concentration at the mine stage is low and does not raise concerns for market failures or a lack of competitiveness. Corporate concentration of refined cobalt depends on the Chinese government’s influence over Chinese production: if the state control over individual refineries is assumed to be strong, the corporate concentration is high. Mine stage supply security could be strengthened by improving the general political stability in the DRC to make the country more attractive for investors other than the present ones. Increased local beneficiation would strongly benefit Congo and reduce China’s influence. This is a long and complicated process and its success is not at all certain. At the refinery stage, the solution is much easier: reliability of supply could be improved by constructing refineries in countries outside China.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The weekly magazine The Economist of 3rd of April 2021 carried two articles under the joint heading “The scramble for commodities”. The first stated a general trend: “Governments race to obtain minerals vital to economic and military security”. The second focused on cobalt and is summarised “The electric-car boom sets off an ugly dash for cobalt in Congo”. These articles reflect the present strong geopolitical focus on cobalt and the Democratic Republic of Congo (DRC) (The Economist 2021).

The demand for cobalt is forecasted to grow dramatically by 200–500% during the next 20–30 years compared with the late 2010s (Alves Dias et al. 2018; Hund et al. 2020). Cobalt is instrumental in the transition to a fossil-free future as a vital raw material in most batteries for electric vehicles and other usages. In 2000, 9% of cobalt use was in batteries, 33% nickel alloys and 16% in hard materials (carbides). Only 20 years later, the usages had changed fundamentally to 57% batteries, 13% alloys and 8% hard materials (Cobalt Development Institute n.d.; Cobalt Institute n.d.). Given the high importance of the green energy transformation for the mitigation of climate change, it is clear why the world’s dependency on cobalt mines in the DRC and cobalt refineries in China is seen as a security issue with potentially dangerous implications for the energy transition: will there be sufficient cobalt supply to cover demand? Will the supply be produced sustainably and without human rights violations? Will prices be predictable and stable? (See for example Al Barazi 2018, Rachidi et al. 2021, Shi et al. 2022, Hensel 2011, Sun et al. 2019.)

Given the dominance of a few countries in cobalt mine production over the years and its crucial importance for the green energy transition, several studies have dealt with the cobalt country concentration from a number of starting points (Hensel 2011, Shedd et al. 2017, Gulley et al. 2019, Al Barazi 2018, Alves Dias et al. 2018, Helbig et al. 2018, van den Brink et al. 2020, Campbell 2020, SGU 2021, Hale et al. 2022). Some of these studies use the Herfindahl–Hirschman Index (HHI) to quantify the country concentration. They conclude that the concentration measured on a country level is high, indicating a high supply risk.

Most of these studies focus on the high degree of country concentration at the mining stage with DRC dominating and the refining stage where China is the largest producer. The producing entities, however, are companies, not countries. Companies make the decisions on how much to produce and where to invest, which mergers and acquisitions to pursue and other issues crucial for the supply security of cobalt. The host countries of mining and refining companies have generally only limited influence on such decisions. If a few large companies dominate supply, the lack of competition can lead to market failures. The decisions made by these companies have decisive impacts on the lives and livelihoods of their employees and all people living in the mining areas, the environment, and the security of supply for consumers. The crucial importance of the corporate structure and the corporate concentration are not covered by a country-focused analysis, and such an approach is missing in the studies cited above.Footnote 1

It is necessary to value risk in relation to country because governments can shift policies or withdraw licences. However, this is not sufficient to understand the full supply risks. Not all companies within a specific country perceive the market in the same way, nor do they generally act in a coordinated and unified way. For example, Glencore might well act differently from China Molybdenum even though both companies operate mines in the DRC. Furthermore, companies may have operations in several countries and control a larger production share than what a country perspective reveals. Understanding supply risk thus involves more than just knowledge of production by country. This is not to say that it is unimportant to monitor the country concentration of a specific industry. We want to underline the necessity to expand the scope to study both, countries and individual companies.

van den Brink et al. (2020) apply their HHI analysis at the level of individual mines. This can be important from a risk perspective, i.e. what will happen if a certain mine closes. However, our paper focuses on corporate concentration and corporations’ potential market power; thus, production and market shares will be analysed by individual corporations. This is in line with the approach of Helbig et al. (2018), who give a snapshot of the corporate structure in the early 2010s. Their conclusion is that the corporate concentration level for cobalt is not particularly high compared to other metal markets. This paper will analyse cobalt production since the start of industrial production to establish the changes in the corporate concentration over time and thus put the situation in 2018 in perspective.

This paper supplements the country-focused picture of the supply structure of cobalt with a review of the corporate structures of the global cobalt industry and an update of earlier studies to 2018. We use the HHI to measure corporate concentration by individual companies and, for comparison, by country The analysis is done for every tenth year in the period 1975–2018 in order to track changes over time. The paper starts with a historic background on cobalt demand and supply through the ages and a literature review of the cobalt market and its corporate concentration. The data used and our method of establishing corporate control are detailed, followed by a presentation of our results. State control and the role of Chinese companies are sub-topics. Based on the results of our analysis some policy implications are discussed.

Geography of production

Cobalt has been used for thousands of years to give glass a beautiful blue colour. The locations of the ancient deposits are not known today (Enghag 2004). Already at the end of the fifteenth century, German miners in the Erzgebirge were aware of an ore that they expected to be rich in silver, but from which it was impossible to smelt and obtain a useful product. This mineral—and later the metal it contained—was called Kobold after the evil spirits of the underworld believed to cause the problems: the “Kobolds” in German (Rössing 1901) (Fig. 1). Only a century later, people discovered that this supposedly worthless mineral contained the same substance that coloured glass, and mining began to take off. Cobalt blue pigment was also used to dye fabrics and other material.

For most of the eighteenth century, the mines in Saxony and Bohemia dominated the market (Cobalt Development Institute). In the 1770s, a cobalt-rich deposit was found in Modum, Norway. Production grew quickly and the company Blaafarveværket becomes a major supplier of cobalt and cobalt dyes. In the late 1830s, the Modum works produced as much as 80% of the world’s supply. In 1845, a consortium called Blaufarbenwerke was founded by the most important cobalt producers in Saxony. In 1855, this group acquired the Norwegian company and reached nearly a monopoly status. The expensive cobalt dyes, however, came under heavy pressure from cheaper synthetic products such as ultramarine, and the consortium including the operations in both Saxony and Norway soon went bankrupt (Blaafarveværket).

Between 1890 and 1915, the French colony New Caledonia was the new world-leading producer of cobalt (Imperial Institute 1925). Some of the lateritic nickel ores on the island contained as much as 5% cobalt. Small-scale operations dug into the hillsides, and when production was stopped in 1927, ores had been exported containing around 5000 t of cobalt (Bird et al. 1984).

From 1904, a new mining town was mushrooming in the wilderness of northeast Ontario. Very rich cobalt-containing silver ores had been found. The booming town was called Cobalt, and as many as 40 small mining enterprises were soon started (Town of Cobalt). Already in the late 1910s, production started to decline as the richest deposits were depleted. Still in the early 1930s, however, Canadian cobalt production was between 200 and 300 t annually,Footnote 2 roughly a third of total world production (Tyler and Petar 1933). Over the lifetime of all the mines, some 12,000 t of cobalt was mined in the area.

Union Minière du Haut-Katanga (UMHK), founded in 1906, took over the leadership of the global cobalt industry after the gradual demise of the many companies in Cobalt town. It was a joint venture between private capital and the colonial Belgian state with its mines in Congo. The Belgian bank Société General effectively controlled Union Minière, as it was also called, from its foundation until well after the Congolese independence in 1960 (Kalunga 2014).

Through history, cobalt has been mined in only a few countries. Saxony, Norway, New Caledonia, and Canada were successively the dominating mining countries, followed by Congo since the 1920s (Tyler and Petar 1933). The absolute production volumes have always been small, increasing from 5–10 kt (thousand tons) annually in the early 1900s and around 30 kt at the end of the century and growing rapidly to around 150 kt in the late 2010s.

The geology and mineralogy of cobalt are such that the metal occurs mainly together with copper or nickel (Slack et al. 2017). There is at present only one mine, Bouazzer in Morocco, where cobalt is the main product. In all other mines, cobalt is a by-product. Therefore, production volumes are largely determined and limited by the production of the main metals. There is further only a limited number of nickel and copper deposits with a sufficient cobalt content to warrant extraction. Cobalt deposits are unevenly distributed, and around half of them are found in the Democratic Republic of Congo (DRC), which also has the deposits with highest cobalt content (USGS 2021). Over 60% of global cobalt mine production in 2018 took place in the DRC. Mines in Congo have been the main global source for cobalt for the past 100 years, except during the years of war in the DRC. In these periods, there was no leading producing country. Mines in Australia, Canada, Russia, and Zambia were all more or less equally important. The mine and refinery production by country since 1975 are given in Figs. 2 and 3.

Methods and data

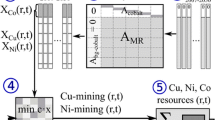

We study corporate concentration in the global cobalt industry in the periods 1975–2018. Our analysis covers the industry at two stages: mine and refinery (Fig. 4).

Source: Lundhaug 2021. Note: The arrows indicate where we measure mine and refinery production, the latter is the sum of primary and secondary production

Cobalt production system.

The period analysed was mainly determined by the availability of corporate control data. It captures the phase in which the structures set by the colonial past of the dominating country of production, Congo, were broken down. We used information from Raw Materials Data (RMD) from 1975 to 2014 (RMD 2014). RMD further has information about mergers and acquisitions, which we used to identify changes of ownership of mines. For 2018 we compiled production and ownership data from corporate sources (Annual reports of Glencore, Lundin, Vale, Norilsk and others) and from established standard sources for country mineral production (British Geological Survey (BGS), World Mining Data (WND), US Geological Survey (USGS)). We also used special studies on the cobalt market such as Al Barazi (2018), Gulley et al. (2019) to supplement the standard global country sources.

All the flows analysed were converted to metal content to enable mass balance checks and comparisons between individual mines and countries. The refinery production includes the cobalt metal content of a range of cobalt products such as pure cobalt metal, cobalt oxides and other simple chemical compounds.

Cobalt production

Most data on country production of cobalt at the mine and refinery stages, including Chinese production, was obtained from the sources mentioned above. In the case of the DRC, production figures are not fully reliable due to difficulties in estimating the small-scale artisanal production volumes (Ericsson et al. 2020). We used the earlier estimates from our 2020 study as a starting point and corroborated them with additional figures from Lundhaug (Lundhaug 2021).

The three main sources for country statistics mentioned above, BGS, USGS and WMD differ in their total world production figures for some years. We collated the country figures from all available sources, added up corporate production figures and arrived at the total production figures in Table 1. Global production numbers obtained by summing up company statistics were validated by comparing with global production figures derived from national statistics. The coverage is defined as the ratio between production identified by company in all countries and total world production. The uncertainties of the production figures are also obvious when calculating this coverage. At the mine stage, data coverage for company-level analysis was > 90% for any year; for the remaining production, controlling entities could not be identified. At the refinery stage, coverage was > 100% for some years, indicating that there are some remaining errors in the base data. Probably, the total world production figures are too low but there might also be other unidentified problems. In spite of these obvious but nevertheless relatively small differences (< 5% of the total world production of refined cobalt production), we consider our figures sufficiently accurate for our conclusions to be reasonably reliable.

Corporate control

Who controls a company, its owners, its management, its lenders? Ownership is the most basic and direct form of control; however, control can be exercised in many other ways. In this and our previous studies of metals markets, we define control in the mining industry in the following way: “To be in control is to have the possibility to act decisively on strategically important issues rather than day-to-day influence over a company. Such issues include the broad policies of a company, decisions on large investments, buying or selling of subsidiaries, and authority to appoint or dismiss top management” (Tegen 1994; Ericsson and Tegen 1988).

A straightforward approach to determine corporate control would be to assume that control is proportional to the fraction of the shares of the different shareholders. However, this accounting overestimates the control of small shareholders who might not exercise any control while it underestimates the control of the large shareholders. Furthermore, it does not provide a satisfactory answer to entities with unidentified shareholders. To avoid this problem, we compare the relative size of the identified shareholders. For example, if there are two identified shareholders with each holding 20% of the shares and the remaining 60% is held by small or unidentified owners, the two companies are each given a control share of 50% of the production (total production shared in the same relation as their respective shareholding 20/20). In this way, no production is left without a controlling entity.Footnote 3

The Herfindahl–Hirschman Index is a measurement of market concentration. It was first proposed independently by Hirschman (1945) and Herfindahl (1950). Consider a market where n companies are operating, and the market share of the ith company is si; the HHI is then defined as the sum of the squares of all the market shares:

While the index can use market shares expressed as fractions of the whole market, most common and applied within this study is to express it using percentages (i.e. 0 < si ≤ 100) then 0 < HHI ≤ 10,000. The HHI takes into account the relative size distribution of the firms in the market. It approaches zero when a market is occupied by a large number of equally small firms, and it reaches its maximum of 10,000 points when a market is controlled by a single firm. The HHI increases both as the number of firms in the market decreases and as the disparity in market share between those firms increases.

While a precise correspondence between a numeric value and a qualitative indication of market concentration is not possible, some guidelines have been published. The US Department of Justice and the Federal Trade Commission (2010), for example, generally classify markets into three typesFootnote 4:

-

Unconcentrated Markets: HHI below 1500

-

Moderately Concentrated Markets: HHI between 1500 and 2500

-

Highly Concentrated Markets: HHI above 2500

The European Commission (2004) also applies the HHI to evaluate market concentration and assess horizontal mergers, however, using a slightly different approach.

Since the percentage value of each participant within a specific market is increased to the power of two in order to establish the HHI value, entrants with a smaller market share have limited impact on the total HHI value. Furthermore, the impact of smaller firms on the HHI value diminishes fast with falling market shares. Thus, while formally required to establish a full HHI value, in reality, knowledge of all participants is not necessary, as long as the largest actors within a market are known together with knowledge of the size of the total market so that a combined market share of the smallest participants can be established.

The measurement of corporate control in China’s cobalt industry is challenging for two main reasons. Firstly, it is difficult to untangle the ownership situation in Chinese mining and refining companies. For example,,are there possibly companies that have ownership in several individual mines and hence different companies or mines which at first glance might seem independent actually have the same owner? Secondly, it is not clear how strong Chinese state control over Chinese companies is. Should all production be considered under the control of the State of China, or should each company be considered to be in control as is assumed by the method we use for all other companies? Here, we assumed that Chinese companies in China are fully controlled by the Chinese government. Hence, we considered the Chinese government to be the only controlling entity. We do this mainly because we want to make sure that we are not underestimating the level of the HHI when calculating corporate control. At the same time, we are aware that this probably overestimates the control and power of the Chinese government over global cobalt production.

Results

Corporate concentration of cobalt production at the mine and refinery stages have developed in a similar way, albeit on different levels (Table 2). In 1975, the cobalt market was moderately concentrated and highly concentrated at the mine and the refinery stage, respectively. Towards the end of the twentieth century and early 2000s, corporate concentration reduced at both stages only to start rising again in the 2010s.

At the mine stage, corporate concentration reached the 2500 limit for a highly concentrated industry according to the US authorities only in 1985. In 1975, the index was 1934, which is in the 1500–2500 band for a moderately concentrated market. The 2018 HHI for mined cobalt is below 1000 and hence does not give rise to any worries about a corporate monopoly situation.

The refinery production has always been much more concentrated and has only been below 2500 in 1995, 2005 and 2014. In 2018, the HHI for refinery production of cobalt was almost 4000, high above the 2500 limit for a highly concentrated market.

The HHI on a country basis varies in a similar way over time as does the corporate HHI: a dip in the late 1990s and early 2000s when production in the Congo was low. But the dominance of DRC as a producing country is always visible with the concentration in 1985 reaching almost 3000 and above 4000 in 2018. These figures do not show the relative size of the various producers in the DRC. Hence, the concentration is exaggerated.

State control

State-owned companies dominated mine production from 1975 to 1995 with a peak around 85% of total world production being state-controlled in the mid-1980s. Since then, state control has declined and was 11% in 2018 (Table 3). If Chinese domestic production is included, the figure increases to around 17%. The Congolese Gecamines has been the dominant state company and, besides the Cuban state-owned producer Cubaniquel, the only state-owned company which has been active all through the period. Today Gecamines is back among the major controlling companies holding minority interests in several mines (Fig. 5). In the last couple of years, the Finnish government has once again become active and, as part of its ambitions to become a leading country in facilitating the transition to a fossil-free future, invested in new cobalt mine capacities through its wholly owned Terrafame Oy company (Terrafame).

Corporate control of cobalt mining 1975–2018. Sources: RMD updated to 2018 by authors. Notes: The fields are roughly proportional to the market shares to give an idea of the changing corporate structure and the geography of production. The same colour is kept when a mine has changed owners. The companies included in Others are given in Annex

In parallel, the share controlled by private or public companies has increased from 24% in 1975 to 77% in 2018 with a dip in 1985 at only 13%. In 2018, Chinese companies controlled 24% of the world mine production, excluding domestic Chinese production. If this production (9 kt or 6%) is also included, the figure increases to 30%. The sum of production controlled by the five Chinese companies with major mine production outside China (24%) is smaller than the single largest producer in the world, Glencore, at 25%. The share controlled by Chinese companies includes an assumption that Huayo controls 12 kt of cobalt produced by small-scale miners in DRC. If their influence over the artisanal miners cannot be considered full control, the Chinese share drops by 7–8%. It is obvious that also in cobalt, the Chinese mining sector is fragmented (Ericsson et al. 2020). There are four companies active in Chinese domestic cobalt production (one large and three small) according to Chinese statistics (China 2015). If we assume that all of their production is controlled by one company only (instead of four), the maximum contribution to HHI is 36 (6 × 6) which is an insignificant addition compared to the total figure of 905 (Table 2).

The general observation by "The Economist" of governments racing to obtain minerals can thus not be confirmed by our results for cobalt. State control over cobalt mining has declined even when taking possible indirect Chinese government control into account. For cobalt refining, the situation depends entirely on how the government’s control over Chinese companies’ production is viewed.

Three periods

The period from 1975– 2018 can be divided into three main stages, which help understanding the dynamics:

-

Era of state control, early 1970s to mid-1990s

-

Privatisation period, mid-1990s to around 2010

-

Dominance of trading companies and entrance of Chinese companies, 2010 and onwards

Era of state control

The nationalisation of mining companies in Africa after the independence of former Belgian Congo in 1960 and Northern Rhodesia (nowadays Zambia) in 1964 increased state control over cobalt production to two thirds of world production in 1975. In 1966, Union Minière was nationalised and later reorganised as Gécamines (Générale des Carrières et des Mines), a 100% state-owned company in the Congo (Kalunga 2014, Gibbs 1997, Radmann 1978). The Zambian government nationalised 51% of the domestic copper industry in 1970. In 1979, this number was increased to 60%. In 1982, the two companies taken over from the previous owners, Nchanga Consolidated Copper Mines and Roan Consolidated Copper Mines, were merged into Zambia Consolidated Copper Mines (ZCCM) (Radetzki 1985). In addition to these two major companies, there were smaller state-owned entities such as the Cuban company Cubaniquel, Moroccan Managem, operating the Bouazzer mine, the Finnish state mining and smelting company Outokumpu and several mines in the Soviet Union. The French cobalt producing companies Société Le Nickel/Eramet, operating mines in New Caledonia and a refinery in France, were nationalised by the socialist government in 1982 (RMD, Cohen 2010).

At this time, the largest company outside the state sphere was Anglo American through its remaining minority holdings in the Zambian copper/cobalt mines after the nationalisations. In addition, there were a number of smaller companies operating in Australia, Canada, New Caledonia, the Philippines, and Zimbabwe.

At the end of this period, the cobalt industry was highly concentrated both at the mine and the refinery stage. Governments controlled most of the cobalt production and the private sector’s influence and importance were limited.

Privatisation period

Gradually, during the end of the 1980s and early 1990s, copper production, and as a result also cobalt output in the Congo (Zaire) and Zambia, declined due to mismanagement, political instability, a decay in infrastructure and lack of investments in state-owned companies (Mazalto 2009). The Congo Wars aggravated the problems and reduced production further. Because of its by-product status, cobalt production was to a large degree depending on the level copper production. In 1986, copper production in the Congo peaked just above 500 kt only to implode to 35 kt 10 years later. Consequently, cobalt production fell from 20 kt in 1985 to 4 kt in 1995 and only slowly recovered to 6 kt in 2005. In Zambia, the fall of copper production was less dramatic: it was only reduced by some 10% from around 510 kt in the mid-1980s to 465 kt in 2005. Cobalt production could be maintained at a level between 5 and 6 kt in this period. It is interesting to note that in both DRC and Zambia, cobalt production did not sink as much as copper production in relative terms.

In 1981, a new Mining Act was promulgated in the DRC and private investment was permitted in the mining sector. Private companies could however only obtain mineral rights if they partnered with a state-owned company or negotiated a special agreement with the government. In this situation, the Swedish mining magnate Adolf Lundin flew into Kinshasa in 1996 to announce the rebirth of the DRC’s mining industry(Eriksson 2003). Lundin secured the rights to the Tenke-Fungurume mine. This mine had been known since the early twentieth century, but its ores were not as rich as other deposits in the Congo at the time and its development was postponed. Only in the early 1970s was the project revitalised by a joint venture led by Anglo American together with Japanese and other investors. Towards the end of the decade, the project was however abandoned (Eriksson 2003). Lundin brought Phelps Dodge as the major partner in 2005 and its ownership in Tenke passed on to Freeport McMoran when it acquired Phelps Dodge. Tenke-Fungurume was developed into a world class copper mine and the second largest producer of cobalt in the world. Production started in 2008.

The first decade of the twenty-first century was another turbulent period in the DRC. Poor governance facilitated for companies willing to use corrupt practices and to take the risks involved to acquire mining rights only to sell them soon afterwards (Burgis 2015). The number of companies active in the DRC’s mining sector increased and hence, the HHI fell and bottomed out around 300–400, almost full competition. The number of actors increased also at the refinery stage and corporate concentration fell to its lowest level for many decades, just below 1000.

There were privatisations also in other countries. The mines of ZCCM were privatised in 1996 and the Zambian government kept only a minority stake. The Moa nickel mine in Cuba was partly privatised (50%) in 1995 when Canadian company Sherritt International Corp became the operator of the mine. Norilsk Nickel in Russia had also been privatised in the early 1990s following the sellout of former Soviet state-owned companies. The holdings by the French government were reprivatized beginning already in the end of the 1980s when a conservative government was voted into power. There is still, however, a mixed ownership of Eramet with both state entities and private capital as shareholders (Cohen 2010). The state share is nevertheless not sufficient for us to consider Eramet among the state-controlled companies in 2018.

The Canadian company Inco was the largest public cobalt company controlling 3.5 kt or 12% of world production in 1995. However, this large share is mostly a reflection of the low output from the DRC rather than an increased production in the Canadian mines. After the Second Congo War ended in 2003, mining in the DRC restarted with a variety of different private actors (Burgis 2015). In 2005, world production of cobalt had risen to 55 kt, of which 18 kt in the DRC. Inco still produced some 4–5 kt cobalt from its Canadian mines, and thus controlled 9% of world production, and remained the number one controlling public company.

Glencore entered the cobalt industry in 1997 by acquiring the Murrin Murrin deposit in Australia and later in 2000 the Nkana and Mufulira mines and the Nkana refinery in Zambia. In 2005, Glencore controlled 8% of the global mine production of cobalt. In 2004, Vedanta took control of the Konkola mines in Zambia and in 2005 controlled 4% of cobalt mine production (RMD 2014).

Trading company growth and entry of Chinese companies

In 2006/2007, the cobalt price surged with the increased demand from China and reached a peak in 2007. Global interest in cobalt mining grew. With the start of Tenke-Fungurume and Mutanda mines in 2009, together with the mine in Kolwezi owned by Euroasian Natural Resources Corporation (ENRC), and other mines, production in the DRC had increased to almost 100 kt in 2010. The Congo once again was by far the most important cobalt-producing country.

Glencore, originally a commodity trading company prepared to take the high risks of operating in the DRC, had already established itself as an important actor in the cobalt industry around the turn of the century (Löf, Ericsson 2019). Glencore increased its control in the first decade of the twenty-first century mainly by expanding production in the DRC. In the 2010s, some of the major internationally active companies, such as ENRC and Lundin and its partner in Tenke-Fungurume, the FMX company, left DRC. Glencore and new actors, mainly Chinese companies, took over the space left empty. Together with its operations in other parts of the world, Glencore in 2018 controlled 25% of the global cobalt industry at the mine stage and is by far the most important cobalt mining company. In 2021, the opportunities in the battery metals cobalt and nickel lured another trading company, Trafigura, to enter these markets and to acquire Vale’s nickel/cobalt mines in New Caledonia (Trafigura 2021).

Chinese control

Chinese companies, even those listed on a stock exchange, are in general less transparent in their reporting than their transnational peers. Although we were able to identify owners and determine production volumes of the mines controlled by Chinese companies in the DRC, we have not managed to obtain the same level of detail for Chinese domestic production. Depending on which source is used for total Chinese mine production (WMD and USGS both gives 3100 t), the coverage ranges from 60% (three producers with total production of 1870 t) to over 80% (BGS total Chinese production at 2241 t and the same 3 companies’ total). According to Chinese statistics there should be one “large company” mining cobalt in China and three “small” mines which indicates that there is one producer missing, but this does not affect the HHI as much as the fact that the total production volume in China varies by 50% between the standard sources.

For refinery production, the situation is less satisfactory. Total Chinese production in 2017 is 69,600 t (BGS) and according to Al Barazi (2018) over 19,000 t cannot be identified on a company basis, which is around 28% of the total. There are no official figures about the number of cobalt refineries in China. When using the Al Barazi data from 2017 that identifies eight Chinese companies and their production volumes of refined cobalt, the HHI is 691 (even assuming that all unidentified production is controlled by two entities each of which would become the second largest producer in China within their type of refined product—which is highly unlikely to be the case) instead of 3250 if all the refined domestic Chinese production is considered to be controlled by one entity, i.e. the Chinese central government. Al Barazi presents a picture of a much less concentrated industry than when assuming full government control over all companies.

In our calculations, we have assumed that Chinese domestic production is tightly controlled by central authorities, and we have added up all production to be controlled by one entity, the Chinese state, when calculating the HHI. Production from overseas mines, mainly in the DRC, has been treated in the same way as production controlled by transnational peers, i.e. each company is considered a separate entity.

Some guidance as to how control is exerted by the Chinese state can be found in the careful analysis of the Chinese rare earth industry by Shen et al. (2020). They point out that high production volumes and low prices in China indicate that the six major company groups compete intensively in spite of the fact that Chinese companies together control a dominant share of world production. In addition, there are hundreds of small rare earth producers run by private entities that also actively participate in the market. There are no indications that the cobalt market in China should behave differently.

The opposite view is that Chinese government coordinates production and the independence of Chinese producers is strictly limited. The true picture is probably found somewhere between these two extremes as pointed out by Shen et al. (2020) for rare earths and probably as valid also for cobalt: “Reality is more complicated and worthy of additional study.”.Footnote 5

Discussion

The Herfindahl Hirschmann Index is applied by academics and regulators alike as a measure of corporate concentration. Our calculations for the cobalt market follow standard procedures but we have met two issues which could tentatively affect our results:

-

Level of artisanal cobalt mining in the DRC and the control over this production

-

How independent are Chinese companies in relation to the Chinese state

We have compared and evaluated figures for artisanal cobalt production in the DRC from different sources. We have also taken a mass balance approach by starting with the refined cobalt production going backwards (Lundhaug private communication 2021) and in this way arrived at a figure for artisanal production. Our conclusion is that the figures presented in Table 3 are reasonably accurate. At their highest level between 2005 and 2014, artisanal miners accounted for 20% of the total world production declining to around 12% in 2018. We assumed that control of the artisanal production is dispersed among small companies and individuals. If artisanal production were larger than estimated, the HHI would decrease marginally from an already low level as market shares of individual identified companies would decline. If artisanal production were lower, the HHI would increase marginally. In neither case would the changes affect our conclusions. The maximum HHI would be reached if all artisanal production is controlled by one entity. With this assumption, HHI would differ by 324 (18 × 18) in 2005, in 2014 by 324 (18 × 18) and in 2018 36 (6 × 6).Footnote 6 These numbers are of course highly theoretical, and it is not possible for one company to take control over all the tens of thousands of artisanal miners in the DRC. Furthermore, these differences in the calculated HHI depending on how the production volumes by artisanal miners are controlled would not alter our conclusion that cobalt mining is an unconcentrated market as even with these additions to the total sum of squares the HHI is still in all cases well below the 1500 threshold to a moderately concentrated market. If the assumption is made that all productions by Chinese companies, whether from mines in China or outside China, are fully controlled by the Chinese state, the HHI would increase to 1260 still below the threshold. Our results are similar to those of van den Brink et al. (2020); although when we assume that all Chinese refineries are state controlled, we conclude that the corporate concentration in cobalt refining is highly concentrated rather than the picture of an unconcentrated market presented by them. This conclusion is also supported by the fact that the Chinese government considers cobalt a “strategic mineral” (Andersson 2020).

Corporate concentration varies considerably depending on the assumptions made for the control of production by Chinese companies, both domestically and internationally. In order not to underestimate the corporate concentration, we assumed that all Chinese companies with production in China are in fact controlled by the State of China. Should one adopt the opposite view that each Chinese company, owning one or more refineries, is the controlling entity, the 2018 HHI value would fall drastically to an unconcentrated level around 1200. It is reasonable to believe that neither of these extremes reflect the true situation, but the corporate concentration in Chinese refinery cobalt production is somewhere in between. At the mine stage, this issue has negligible influence on corporate concentration levels as the production controlled by Chinese entities in China is marginal.

The corporate concentration in the cobalt market at the mine stage is low and the corporate structure does not pose any major concerns about the functioning of the market.Footnote 7 Historically, both the corporate and the country concentration have been on higher levels than today. Corporate concentration reached a peak in the mid-1980s but has since then declined. At the refinery stage, the cobalt market has always been highly concentrated except during the period of the Congolese wars and the demise of state-controlled production in the DRC. The concentration level has increased over the past 15 years and is approaching the high level of the 1970s.

Cobalt production, from what is today DRC, has dominated global supply for roughly 100 years. In 1985, 50% of the total world production originated in DRC. In 2018, its share had increased to around 60%. When calculating the usual HHI based on corporate control, the tendency has however been the opposite, decreasing concentration. The number of producers and their market shares, in DRC and elsewhere, has increased. Both perspectives are necessary to better understand supply risks, price stability highlighted in the “Introduction” section. Our findings support a more balanced view on the risk of security of supply problems for cobalt by taking also the corporate structures into account and not only the geography of production.

The legislative powers of mineral rich countries could in theory be used to nationalise and/or pass other legislation which could affect the security of supply for customers. In DRC and Zambia, the negative effects of nationalisations in the early days of independence are however still in fresh political memory. A political will to raise royalties or increase the state’s income from cobalt mining could easily, and probably rightly so, develop. Such measures could however hit back and in the longer run decrease state income rather than the opposite, if production is lowered or relocated to other countries. This is not to say that the fiscal and legal system in a country is without importance but simply that governments in Africa are likely to think twice when considering legislation which could affect levels of mine production.

To a large extent, this increase is due to Chinese companies entering the market. But even if we would assume that all the production by Chinese companies also outside is fully controlled by the Chinese State, the HHI would only increase to 1571 which is considered to be moderately concentrated.

The corporate structure in the cobalt market has historically been shaped by a combination of the following factors:

-

There are only a limited number of geological deposits of commercial interest.

-

Cobalt is a by-product; hence developments in the copper and nickel markets have influenced also cobalt production.

-

The corporate structure of these two industries, in particular the producer cartels in the period between the two world wars, also affected the cobalt industry (Declercq 2020).

-

The political situation in Congo, the dominating source of mine production for the past 100 years, from a brutal colonial rule over a difficult transition after independence to a damaging war period and at present a weak state and poor governance structures.

-

The demand structure with relatively small volumes and major fluctuations in demand.

Four of the factors are still at play. Only the interwar period cartels in copper and nickel have lost their importance. The huge demand projected to be created by the transition to a fossil-free energy future has triggered an increased interest in cobalt mining. A number of new companies, such as Cobalt Blue Holdings Broken Hill project in Australia, Dumont Nickel project in Canada, Capstone Copper Santo Domino project in Chile and Polymet Mining NorthMet project in USA, have been set up (annual reports). To facilitate new projects, potential deposits were catalogued in state-funded efforts (see Horn et al. 2021 for a summary of European deposits). Furthermore, the potential to produce cobalt together with other metals from deep seabed resources have been alluring since the 1970s (Löf et al. 2022). If these new companies and projects, whether on land or in the deep seas, succeed and start cobalt production, their presence would counteract the corporate concentration process seen in the past decade. But none of the new ventures can be expected to add new capacity within less than 5 years or more. To be successful and profitable, all these projects must compete with the established mines in the DRC, which have the advantage of high-quality ores and already available investments in plants and infrastructure.

Corporate concentration of mine production has increased slightly until 2018 from a low in 2014 but is still at an unconcentrated HHI level of 905. An indication of future developments is obtained if possible capacity additions until 2026 in the DRC announced by companies are added up. They total 83 kt including only additions planned by existing producers. If it is further assumed that capacity in the rest of the world will be kept at today’s levels,Footnote 8 it is possible to estimate a hypothetic HHI for 2026. Glencore plans accounts for around 40% of the total additions, ENRC some 25%, Chemaf 18% and Jinchuan, the only Chinese company that has announced any expansion plans, 3% of the total capacity additions. These figures suggest that corporate concentration according to HHI will increase, but that it will still be lower than the 1500 threshold for a moderately concentrated market.

The political and economic situation in DRC, the dominating cobalt mining country, is immensely complex and serious after 150 years of mismanagement. First during the Belgian colonial rule and later after independence, serious political problems and civil war have followed. Mineral raw materials, mainly copper and cobalt, continue to be of crucial importance to the economy of the DRC (Ericsson et al. 2020). The Congolese ores are of high quality and give strong competitive advantages over mines in other countries with lower quality ores. To continue to develop these ores and start local beneficiation is the most obvious way to secure sufficient production of cobalt into the future while at the same time supporting economic development in the DRC. An attempt such as the proposed Transboundary Battery Industry Special Economic Zone in the Copperbelt is one example of such ideas (UNECA 2021). If these projects succeed, not only would they benefit the DRC and Zambia but also contribute to the improvement of the stability of supply for importing countries in Europe, North America and China. Industrialised countries worrying about the security of cobalt supply should rather give long-term support to the development of cobalt from DRC than try to develop mines in other countries with lower quality ores and hence slimmer chances to become profitable. By improving the political stability in the DRC, business risks would sink and new investments by others than those companies present could be made. This is obviously easier said than done, but it is a long-term proposal that would be possible with proper support and that should not be discarded without a proper analysis.

The high corporate concentration of refined cobalt production is a problem depending on how the corporate control chain in China works. The reliance on Chinese refineries is however a problem with a much easier and quicker solution than the problems in the DRC have. Developing refineries in suitable countries would be possible within the next decade, provided that suitable support measures are introduced. This would be possible in particular since the demand for refined products is forecasted to increase. Such refineries could further stabilize the situation in the DRC by offering a long-term contract to the DRC miners.

Conclusions

In order to understand the supply risks of cobalt and other metals, it is necessary to monitor both the corporate concentration and the geography of production.

The levels of corporate concentration at the mine stage are low and do not raise concerns for market failures or a lack of competitiveness. Historically, the corporate concentration has been much higher than today. Depending on how the corporate control chain in China over domestic producers works, the high corporate concentration of refined cobalt production is a problem.

The possibilities to support socio-economic development and general political stability in the DRC by coordinated efforts in all aspects of mining, working conditions, environmental impact, use of child labour, regulatory practices, tax payments, corruption, etc., should be studied. Initially, a study should be made of how much European security of supply could increase by local European mine production compared with production from mines in a gradually more stable DRC. Strong European support for the proposed Special Economic Battery Zone would be another useful proposition.

At the refinery stage, the corporate concentration is high if Chinese control is assumed to be fully centralized to Beijing. Given the expected strong growth of the market for refined cobalt products, the potential to initiate refined cobalt production in countries outside China should be carefully analysed.

Data Availability

Not applicable.

Notes

The topic of corporate concentration in the mining industry attracted considerable attention in the 1960s and 1970s during the decolonialisation process, the Club of Rome prophecy of resource scarcity and the oil price shocks. Various aspects of the threats and possibilities of mineral resources for economic and social development were studied. See for example Hollander and Tegen (1979), Hveem (1978), McDivitt and Manners (1974), Dobozi (n.d.), Tanzer (1980), Sames (1974). Since then, interest in the corporate concentration of the mining sector has waned. Similar aspects of the global food system have recently been studied by Jennifer Clapp (2021) and in an earlier paper also the extractive industries are mentioned (Clapp and Purugganan 2020).

Production figures given throughout the paper refer to contained cobalt unless otherwise specified.

See more details in Ericsson et al. 2020.

It is interesting to note that the Department only applies this definition to corporate market concentration and does not mention countries or other aspects of concentration at all.

The sentence is taken from an extended discussion about Chinese companies and the relation to central government in Beijing; please see Ericsson et al. 2020.

For the years 2005 and 2014, the total volume of artisanal production in DRC is squared, but for 2018, we had already allotted 10 kt to Chinese Huayou; hence, the total volume to be added is 20 − 10 = 10 kt which equals a market share of 6%.

The effects of the changes in corporate concentration over the years on cobalt prices would be an interesting topic for research which is however outside this study.

If production in the rest of the world grows, the HHI numbers will be slightly reduced.

References

Al Barazi S (2018) Rohstoffrisikobewertung – Kobalt, DERA Rohstoffinformationen 36, available on-line. https://www.deutsche-rohstoffagentur.de/DE/Gemeinsames/Produkte/Downloads/DERA_Rohstoffinformationen/rohstoffinformationen-36.pdf?__blob=publicationFile&v=2

Alves Dias P, Blagoeva D, Pavel C, Arvanitidis N (2018) Cobalt: demand-supply balances in the transition to electric mobility, EUR 29381 EN. Publications Office of the European Union, Luxembourg. https://doi.org/10.2760/97710. Accessed June 2021

Andersson P (2020) Chinese assessments of “critical” and “strategi” raw materials: concepts, categories, policies, and implications. Extract Indust Soc 7:127–137

Blaafarveværket (no year). https://www.blaa.no/om-oss/. Accessed June 2021

Bird ECF, Dubois JP, Iltis JA (1984) The impacts of opencast mining on the rivers and coasts of New Caledonia, The United Nations University. https://archive.unu.edu/unupress/unupbooks/80505e/80505E03.htm. Accessed June 2021.

British Geological Survey (BGS) World Mineral Production 2020 and various other years, available on-line https://www2.bgs.ac.uk/mineralsuk/download/world_statistics/. Accessed June 2021.

Burgis T (2015) The looting machine – warlords, oligarchs, corporations, smugglers, and the theft of Africa's wealth Public Affairs, New York.

Campbell GA (2020) The cobalt market revisited. Miner Econ 33:21–28. https://doi.org/10.1007/s13563-019-00173-8

China (2015) Land and resources statistical yearbook 2015. Ministry of Land and Resources P.R.C.

Clapp J (2021) The problem with growing corporate concentration and power in the global food system. Nature Food 2:404–408. www.nature.com/articles/s43016-021-00297-7. Accessed Dec 2022

Clapp J and Purugganan J (2020) Contextualizing corporate control in the agrifood and extractive sectors. GLOBALIZATIONS 17(7):1265–1275. https://doi.org/10.1080/14747731.2020.1783814. Accessed Dec 2022

Cobalt development institute (no year, latest information in the publication is from 2001), Cobalt Facts.

Cobalt institute (no year). https://www.cobaltinstitute.org/about-cobalt/cobalt-life-cycle/cobalt-use/. Accessed May 2023.

Cohen P (2010) Lessons from the nationalization nation – state-owned enterprises in France. Dissent 57(1):15–20

Declercq R (2020) A transatlantic perspective on business collusion and the interwar copper industry (1918–1940). Scand Econ Hist Rev 68(3):204–221

Dobozi I (year unknown) Die Zukunft der multinationalen Unternehmen in der internationalen Rohstoffindustrie in Däubler W. and Wohlmuth K. eds. Transnationale Konzerne und Weltwirtschaftsordnung, Nomos Verlagsgesellschaft, Baden-Baden.

Enghag P (2004) Encyclopedia of the elements – technical data, history, processing, applications Wiley-VCH 2004.

Ericsson M, Tegen A (1988) The development of corporate concentration in the western world gold mining industry between 1975 and 1984 in Gulley D., Duby P. editors The changing world metals industries Gordon and Breach Science Publishers New York.

Ericsson M, Löf O (2017) Mining’s contribution to low- and middle income economies WIDER Working Paper 2017/148 available at UNU-WIDER : Working Paper : Mining’s contribution to low- and middle-income economies

Ericsson M, Löf A, Löf O (2020) Chinese control over African and global mining – past, present and future. Miner Econ 33:153–181

Eriksson R (2003) Adolf H Lundin – Med olja i ådrorna och guld i blick, Sellin Stockholm 2003.

European Commission (2004) Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings, Official Journal C 031, 05/02/2004 P. 0005 – 0018. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52004XC0205%2802%29. Accessed June 2021

Gibbs D (1997) International commercial rivalries & the Zaïrian copper nationalisation of 1967. Rev Afr Political Econ 72:171–184

Gulley AL, McCullough EA, Shedd KB (2019) China’s domestic and foreign influence in the global cobalt supply chain. Resour Policy 62(2018):317–323

Hale T, Trainer J, and Zhou Y (2022) A practical analysis to critical mineral supply chains for U.S: government agencies: a case study of cobalt, presentation to the 56th North-Central and 71st Annual meeting of the Geological Society of America. https://gsa.confex.com/gsa/2022NC/webprogram/Paper374649.html. Accessed Dec 2022

Helbig C, Bradshaw AM, Wietschel L, Thorenz A, Tuma A (2018) Supply risks associated with lithium-ion battery materials. J Clean Prod 172(2018):274–286. https://doi.org/10.1016/j.jclepro.2017.10.122

Hensel ND (2011) Economic challenges in the clean energy supply chain: the market for rare earth minerals and other critical inputs. Bus Econ 46:3

Herfindahl O (1950) Concentration in the U.S. steel industry, Dissertation. New York: Columbia University. https://archive.org/details/herfindahl-concentration-in-the-steel-industry-1950-publish/. Accessed Dec 2020

Hirschman A (1945) National power and the structure of foreign trade. University of California Press, California Library reprint series

Hollander E, Tegen A (1979) Mineralmakt – de transnationella företagens kontroll över världens icke-förnybara råvaror. Stockholm, Sekretariatet för framtidsstudier

Horn S, Gunn AG, Petavratzi E, Shaw RA, Eilu P, Törmänen T, Bjerkgård T, Sandstad JS, Jonsson E, Kountourelis S, Wall F (2021) Cobalt resources in Europe and the potential for new discoveries. Ore Geol Rev 130:103915. https://doi.org/10.1016/j.oregeorev.2020.103915

Hund K, D La Porta, TP Fabregas, T Laing, and J Drexhage (2020) Minerals for climate action: the mineral intensity of the clean energy transition. Washington, D.C.: World Bank Group. https://www.worldbank.org/en/topic/extractiveindustries/brief/climate-smart-mining-minerals-for-climate-action. Accessed Jun 2021

Hweem H (1978) The political economy of Third World producer associations, Oslo Universitetsforlaget

Imperial Institute (1925) Mineral industry of the British empire and foreign countries statistical summary 1913–1922, https://www2.bgs.ac.uk/mineralsuk/download/world_statistics/1910s/SS_1913_1922.pdf. Accessed June 2021

Kalunga KJ (2014) Production of nonferrous metals in the Katanga Region of the Democratic Republic of Congo: 1906–2012. Int J Econ and Mange 2014(3):2

Lundhaug M (2021) Private communication of internal report from Industrial Ecology Program Norwegian Institute of Science and Technology. Trondheim Norway

Löf A, Ericsson M (2019) Commodity trading: understanding the tax-related challenges for home and host countries. Winnipeg: International Institute for Sustainable Development. Accessible at https://www.iisd.org/system/files/publications/commodity-trading-challenges.pdf

Löf A, Ericsson M, and Löf O (2022) Marine mining and its potential implications for low- and middle-income countries, Wider working paper 2022. Accessible at https://www.wider.unu.edu/sites/default/files/Publications/Working-paper/PDF/wp2022-170-marine-mining-potential-implications-low-middle-income-countries.pdf

Mazalto M (2009) Governance, human rights and mining in the Democratic Republic of Congo in Campbell B. editor Mining in Africa – regulation and development Pluto Press.

McDivitt JF, and Manners Gerald (1974) Minerals and men – an exploration of the world of minerals and metals, including some of the major problems that are posed, University Press, Baltimore & London.

Rachidi NR, Nwaila GT, Zhang SE, Bourdeau JE, and Ghorbani Y (2021) Assessing cobalt supply sustainability through production forecasting and implications for green energy policies, Resources Policy. https://doi.org/10.1016/j.resourpol.2021.102423

Radetzki M (1985) State mineral enterprises – an investigation into their impact on international mineral markets, Resources for the Future, Washington D.C.

Radmann W (1978) The nationalization of Zaire’s copper: from Union Minière to Gecamines. Africa Today 25(4):25–47

Raw Materials Data (RMD), 2014 Stockholm.

Reichl C, Schatz M (2020) World mining data 2020, vol 35. Federal ministry of agriculture, regions and tourism, Vienna. https://www.world-mining-data.info/wmd/downloads/PDF/WMD2020.pdf

Rössing Adelbert (1901) Geschichte der Metalle, Verlag von Leonhard Simion Berlin.

Sames, Carl-Wolfgang (1974) Die Zukunft der Metalle, suhrkamp taschenbuch 157, Suhrkamp Verlag Frankfurt am Main.

SGU (2021) Mineralmarknaden 2020 – Tema: Kobolt. Periodiska publikationer 2021:1. Uppsala, Sveriges Geologiska Undersökning. Accessible on https://resource.sgu.se/dokument/publikation/pp/pp202101rapport/pp2021-1-rapport.pdf

Shedd KB, McCullough EA, Bleiwas DI (2017) Global trends affecting the supply security of cobalt. Min Eng Mag 69(12):37–42

Shen Y, Moomy R, Eggert RG (2020) China’s public policies toward rare earths, 1975–2018. Miner Econ 33:127–151

Shi Q, Sun X, Xu M, Wang M (2022) The multiplex network structure of global cobalt industry chain. Resour Policy. 76:102555. https://doi.org/10.1016/j.resourpol.2022.102555

Slack JF, Kimball E, and Shedd KB (2017) Cobalt, chap. F of Schulz KJ, DeYoung JH, Jr. Seal, RR II, and Bradley DC, eds., Critical mineral resources of the United States—economic and environmental geology and prospects for future supply: U.S. geological survey professional paper 1802 F1–F40. https://doi.org/10.3133/pp1802F

Sun X, Hao H, Liu Z, Zhao F, Song J (2019) Tracing global cobalt flow: 1995–2015. Resour Conserv Recycl 149:45–55

Tanzer M (1980) The race for resources – continuing struggles over minerals and fuels. Monthly Review Press, New York and London

Tegen A (1994) Western world gold industry: ownership and control 1993, Raw Materials Report 10(1): 17–24. https://static1.squarespace.com/static/5996f73a49fc2b25db3a28ed/t/646cd7ba93f2440cc325948e/1684854785123/Tegen%2C+Andreas+-+Western+world+gold+indudstry%3B+Ownership+and+control+1993%2C+RMR%2C+1993%2C+Vol10No1.pdf

Terrafame Oy website. https://www.terrafame.com/terrafame-ltd.html. Accessed June 2021

The Economist (2021) April 3rd-9th 2021, pages 59–62

Town of Cobalt, https://cobalt.ca/visitors/history/. Accessed June 2021.

Trafigura (2021) Vale sells New Caledonia nickel assets to Trafigura, https://www.mining.com/vale-sells-new-caledonia-nickel-assets-to-trafigura. Accessed June 2021.

Tyler MT, and Petar AV (1933) Minor metals in Kiessling, O. ed. Minerals yearbook 1932–33 US Bureau of Mines p. 355. https://digicoll.library.wisc.edu/cgi-bin/EcoNatRes/EcoNatRes-idx?id=EcoNatRes.MinYB193132. Accessed June 2021.

UNECA (2021) Independent special economic zones to steer DRC’s battery, electric vehicle value chain https://www.uneca.org/?q=stories/independent-special-economic-zones-to-steer-drc%E2%80%99s-battery%2C-electric-vehicle-value-chain. Accessed December 2022.

U.S. Department of Justice and the Federal Trade Commission (2010) Horizontal Merger Guidelines. https://www.justice.gov/sites/default/files/atr/legacy/2010/08/19/hmg-2010.pdf. Accessed June 2021

USGS (2021) U.S. geological survey, mineral commodity summaries, cobalt January 2021, and various other years, USGS, https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-cobalt.pdf. Accessed June 2021

Van den Brink S, Kleijn R, Sprecher B, Tukker A (2020) Identifying supply risks by mapping the cobalt supply chain. Resour Conserv Recycl 156:104743. https://doi.org/10.1016/j.resconrec.2020.104743

World Mining Data 2020 (2020) and various other years Federal Ministry Republic of Austria, Agriculture, Regions and Tourism. Accessible on https://www.world-mining-data.info/wmd/downloads/PDF/WMD2020.pdf

Annual reports of companies

https://capstonecopper.com/English/home/default.aspx. Accessed December 2022

https://cobaltblueholdings.com/. Accessed December 2022

https://dumontnickel.com/wp-content/uploads/2021/02/Dumont-Nickel-Project-Overview.pdf. Accessed December 2022

https://polymetmining.com/. Accessed December 2022

Acknowledgements

We want to thank Maren Lundhaug for her enthusiastic participation with important contributions during the early phases of this work.

Funding

Open access funding provided by Lulea University of Technology. Partial financial support for this work was received from the Polish National Agency for Academic Exchange (NAWA) as the part of the project “International cooperation for Rational Use of Raw Materials and Circular Economy” (COOPMIN) which is conducted in the Division of Strategic Research in the MEERI PAS (2019–2020), project no. PPI/APM/2018/1/00003.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Olof Löf and Magnus Ericsson. The first draft of the manuscript was written by Magnus Ericsson and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ericsson, M., Löf, A., Löf, O. et al. Cobalt: corporate concentration 1975–2018. Miner Econ 37, 297–311 (2024). https://doi.org/10.1007/s13563-023-00391-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-023-00391-1