Abstract

Sustainability is now a priority issue that governments, businesses and society in general must address in the short term. In their role as major global institutional investors and risk managers, insurance companies and pension funds are strategic players in building socio-economic and sustainable development. To gain a comprehensive understanding of the current state of action and research on environmental, social and governance (ESG) factors in the insurance and pension sectors, we conduct a systematic literature review. We rely on the PRISMA protocol and analyze 1 731 academic publications available in the Web of Science database up to the year 2022 and refer to 23 studies outside of scientific research retrieved from the websites of key international and European organizations. To study the corpus of literature, we introduce a classification framework along the insurance value chain including external stakeholders. The main findings reveal that risk, underwriting and investment management are the most researched areas among the nine categories considered in our framework, while claims management and sales tend to be neglected. Regarding ESG factors, climate change, as part of the environmental factor, has received the most attention in the literature. After reviewing the literature, we summarize the main sustainability issues and potential related actions. Given the current nature of the sustainability challenges for the insurance sector, this literature review is relevant to academics and practitioners alike.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change, social inequality, and corporate governance are some of the biggest challenges facing society today. These concerns are part of what is known as the environmental, social and governance (ESG) factors, which shed light on the obligations of companies and governments to the community in building a sustainable economy. In addition, and as original motivation, ESG factors are important to insurance companies and pension funds when assessing the associated financial risks and opportunities in their firms. As an illustration of the alarming state on the environmental front, the latest report from the Intergovernmental Panel on Climate Change (IPCC, see [67]) has revealed that “there is at least a 50 percent probability that global warming will reach or exceed 1.5 \(^{\circ }\)C in the short term, even under the very low greenhouse gas emissions scenario, requiring immediate action to combat climate change.” Although it is difficult to develop detailed scenarios and models, the insurance industry can easily envision the impact that natural disasters will have on their risk management and underwriting in the future. Similarly, social and governance concerns have also been thrust into the spotlight by spectacular scandals in many industries, to a point that, as defined by the UN Environment Programme (UNEP), insurance companies and pension funds play a key role in acting on ESG issues [86].

Based on the extant academic literature and recent publications outside of scientific research, the objective of this work is to provide a comprehensive understanding of what is currently being done on sustainability in the insurance and pension sectors. To this end, we analyze 1 731 academic publications available through the Web of Science database using the PRISMA protocol for systematic literature review. We supplement this corpus with 23 publications retrieved from (insurance) organizations’ websites. We introduce a framework guided by the Principles for Sustainable Insurance (PSI) and the value chain of insurance companies (primary activities), insurance strategy (supporting activity), and external stakeholders and reporting to classify the literature. Our main results include a current review of the state of research and an overview on the sustainability issues and related actions along the categories of our framework.

Perceptions on sustainability have evolved over the past decade. When the topic of sustainable development emerged in the 1970s, it focused primarily on environmental issues. The first world conference on the environment was held in Stockholm in 1972 and established the UNEP as a global agency to manage the environmental agenda [94]. Many conferences later, an important initiative was launched by the UN, the so-called Millennium Development Goals [93] in 2000, encompassing eight major goals related to social and environmental issues to be achieved by 2015. However, practical standards and guidelines have only been developed since 2015. Two landmark events demonstrated the importance of finding appropriate solutions to current global challenges in 2015. These are the Paris agreement on Climate and the UN Sustainable Development Goals (SDGs, see [46]). While the first aims to limit global warming to 1.5 \(^{\circ }\)C [20], the SDGs have at their core 17 goals that members are expected to achieve by 2030. They address, social and environmental issues such as, no poverty, zero hunger, clean water and sanitation, responsible consumption and production, and climate action, among others. While until 2000, there were few initiatives and standards to assess sustainability challenges, we observe that in recent years, and especially since 2015, there has been an increasing number of developments committed to sustainable development.

In recent years, the need for addressing ESG challenges has increased dramatically. Although insurance companies and pension funds are not directly linked to any of the sustainability dimensions, awareness has changed recently. The insurance business processes including risk and investment management are strongly linked to ESG factors, and many companies have embarked on a journey for sustainability adaptation. In the present study we review the existing academic publications and study the research concerned with sustainability in the insurance sector. We find that the environmental aspect has received the most attention, especially in the underwriting and investment areas, which underlines that climate change is a key concern of the industry. On the other hand, we find that areas related to insurers’ activities along claims processing are less researched in academia, while the area of sales and marketing receives the lowest attention outside the academic world. Overall, the main issues that we identify include a lack of appropriate integration of sustainability in the strategy and operations as well as the absence of standardized quantitative indicators. The actions proposed in the literature indicate embedding ESG issues into all processes.

This work is organized as follows: in Sect. 2, we lay out the relationship between insurance and sustainability and discuss the challenges the sector faces in addressing sustainability issues. In Sect. 3, we discuss the literature review methodology, statistics on the corpus of literature, and introduce our classification framework along the insurance value chain. In Sect. 4, we review key aspects of the retrieved literature based on the proposed classification framework and discus the main sustainability issues and potential related actions. We conclude in Sect. 5.

2 Sustainability in insurance

Insurance is an essential pillar of global economic activity. Through their investments, but also given their exposure to losses and claims payments as well as in their role as risk managers, insurance companies and pension funds are concerned by the ESG factors. Therefore, it is important to understand and develop viable solutions to cope with the sustainability challenges but also to take advantage of market opportunities [47]. In this section, we describe the relationship between industry and sustainability, discuss the current state of the sector and key challenges, and provide selected insights into current practices in the area of sustainability.

ESG factors have established as a standard for describing sustainability issues and as target challenges when paving the way for achieving higher levels of sustainability in financial markets. As investors and risk managers, insurers and pension funds play a key role in ensuring sustainable development [6]. Insurers are exposed to sustainability issues on both underwriting and investment sides. Pricing, underwriting and claims management activities are concerned by increasing risks, for example from natural catastrophes. Given the size and duration of their institutional investment portfolios, insurers and pension funds are at the forefront of responsible investment.

In this context, it is important to take a closer look at the individual ESG factors. Concerning the environmental factor (E), we distinguish the effects associated to the two sides of the balance sheet, assets and liabilities. On the liabilities side, insurance is a leading sector in climate change adaptation [43]. Indeed, the sector provides financial resilience to extreme natural events and expertise for risk assessment [32]. For example, insurance companies have already developed products and services that help to reduce greenhouse gas emissions. These products and services include risk transfer solutions for weather-related risks, crop insurance, microinsurance for small farmers, and renewable energy products [32]. On the assets side of the balance sheet, beyond the mere environmentally friendly investing, insurance-linked securities have gained notoriety as protection against insured losses (cf. catastrophe bonds, [59]).

Regarding the social (S) factor, insurers and pension funds are particularly concerned. On the one hand, they must care about workers’ pensions and therefore include workers’ rights, social inclusion, gender equality, child labor, and other SDGs. On the other hand, as principal asset owners, they should invest responsibly and “green”. One of the actions that have been carried out in this field are the microinsurance solutions to fight poverty in low-income countries [50]. In addition, the consideration of sustainable investments by pension funds has increased [1]. Finally, governance (G) is a key factor not only for the insurance sector, but also for all other sectors, since it does not differ significantly from company to company, especially in the financial sector. A better management strategy for a resilient and sustainable business requires a comprehensive approach in which the relationships with stakeholders, in particular customers, governments, and regulators, and all business activities in the value chain are organized and managed in a responsible manner [86]. Therefore, factors such as board diversity, corruption, and bribery, and improving internal controls and risk management are some themes that the insurance industry is already aware of an implementing [29].

Today, the growing trend towards addressing sustainability issues in insurance is unmistakable, as many companies and governments are promoting sustainable development as a major issue worldwide. Since 2000, there have been number of initiatives addressing sustainable development, and highlighting the growing role of insurance in this area [6]. One of the key global initiatives developed explicitly for the insurance industry is the PSI published by the UNEP Finance Initiative [86]. The main objective of the principles is to take a strategic approach to conducting the insurer’s key activities in a responsible manner, and to manage and assess risks and opportunities related to ESG issues in order to be a sustainable company. Currently, several global and national organizations are advocating for sustainability issues. Standards and principles have been developed for the insurance sector for both the asset and liability sides of the balance sheet.

However, despite the importance placed on sustainability globally and the increasing development of initiatives and frameworks for managing ESG issues, there are some challenges raised by practitioners and academics. First, one of the biggest challenges is the access to reliable data. For example, in many regions there is limited access to hazard and exposure data to assess physical climate risks [37]. Another major challenge is the need for a regulatory framework for financial markets. Due to unclear and fragmented regulations, it is difficult for primary insurers to access reinsurance and for investors to evaluate opportunities [32]. Furthermore, regarding environmental issues, specific challenges relate to the liability side of the balance sheet, for example, modeling of various adverse scenarios, sustainable reinsurance structures, and development of climate-related mortality tables [64]. In lower income countries, these challenges are complemented by a lack of insurance awareness, limited acceptance of natural catastrophe insurance, and the absence of domestic insurance [32]. On the asset side, challenges include the need for more green bonds and issuers, the development of new green financial instruments, the need for policy incentives to encourage green investment on a large scale, the failure to price carbon and natural resources, and the need for better climate risk reporting standards [32]. Insurers are increasingly recognizing environmental issues as part of their enterprise risk management [54]. More recently, events like the Covid-19 pandemic and social movements, such as the #MeToo movement against sexual harassment in 2017 and the #BlackLivesMatter movement that resurged in 2020 after George Floyd’s murder, have exposed social failures, and shed light on the poor social practices of some companies and governments, forcing them to initiate change. More specifically, in terms of governance, major challenges are, for example, the diversity of board members and workforce. Diversity and inclusion are important sustainability issues, but they also present opportunities to enhance the reputation and strengthen relationships with employees [29]. Finally, the unclear general definitions of sustainability in the insurance sector also pose risks for defining management roles and responsibilities [29]. Given the multiple facets of sustainability issues, we systemically review the academic literature in the sequel to derive a more comprehensive picture on the issues and related actions.

3 Literature review: methodology and statistics

In this section, we first present the search strategy and collection of publications leading to the corpus of selected academic papers and studies outside of scientific research that we call “practitioner” publications. We lay out the inclusion and exclusion criteria used in our review protocol (see Sect. 3.1). Then, we describe the overall statistics on the corpus of academic literature in Sect. 3.2. In Sect. 3.3, we propose a framework to classify the publications along the insurance value chain and external stakeholders. We present in Sect. 3.4 statistics on the academic publications based on the classification introduced in Sect. 3.3. Finally, we present the statistics on the practitioner publications in Sect. 3.5.

3.1 Review strategy and data collection

We have conducted a literature review to identify and classify existing academic research on sustainability in insurance. For the review, we follow the Preferred Reporting Items for Systematic Reviews and Meta-Analyses protocol (PRISMA, see [62]). Our review is based on a search of the Web of Science Core Collection database for academic publications and of relevant organizations’ websites for practitioner publications. We proceeded in three phases by first running a general query for academic publications, then a complementary manual search, and finally a search for practitioner publications. A flowchart and synopsis of the three phases of our review protocol is presented in Fig. 1.

The PRISMA review protocol used in the first phase consists of three key steps for the first phase. In the first step (identification), we consider all database records and restrict our search by using filters and keywords. Our query process included all years through December 2022 and academic publications recorded by Web of Science. We included English language documents and limited the keywords search to the abstract. The reason for using selected keywords is to consider the concept of sustainability, which refers specifically to insurance and relates to the ESG factors. For the selection, we used the keywords “insur*”, “pension*”, “actuar*”, “sustainab*”, “esg”, “environment*”, “soci*”, “govern*”, and “climate change” in the search string, where the asterisk (*) is a placeholder for any number of other characters. The keywords “insur*”, “pension*”, and “actuar*” make us include all insurance, pension, or actuarial science related publications. The terms “sustainab*” and “esg” have been added to filter for sustainability topics, while the words “environment*”, “soci*”, “govern*”, and “climate change” more precisely relate to the environmental, social and governance topics.Footnote 1 Our search retrieves a total of 1 731 publications.

In the second step, we scan the resulting records and exclude records in specific fields of research that do not relate to our topic (e.g., health fields like emergency medicine, rheumatology, obstetrics gynecology, geriatrics gerontology, surgery, and tropical medicine, and other fields like religion, philosophy, zoology, and government law). We review the titles and abstracts of the remaining records, and exclude 1 453 articles that do not relate to the insurance industry and sustainability issues. After this step, we remain with a total of 278 results. In a third step, we perform a screening of the full texts, which yields 28 publications. The inclusion criteria relate to articles in the insurance industry as a main player in sustainability, i.e., publications should address questions at the crossroads of insurance and sustainable business or ESG factors. We then conduct a forward and backwardFootnote 2 literature search for the citing and cited references related to the 28 records and select a total of four and 11 articles, respectively. This leads us to 43 records. Finally, we manually conducted a second phase of search, capturing any insurance-related publications that were not included in the first phase due to the specificity of keywords. A total of eight publications have been added to our final corpus, resulting in a total number of 51 academic publications. In the third phase, we consider studies from relevant organizations from the last three years (2020–2022) and exclude short summaries that are less than five pages long. For our search, we consider the most relevant international and European organizations working in the field of sustainability in insurance. These organizations include programs of the United Nations, standard setters, regulatory authorities, insurance think tanks, insurance companies, and actuarial associations. We categorize the publications into four distinct types according to the organizations’ characteristics, i.e., “United Nations”, “Regulators”, “Insurance” and “Actuarial”. In the United Nations group we retain four publications, in the regulators type we select a total of six records, in the insurance group we select eight publications, and in the actuarial group we consider five records. This gives a total number of 23 practitioner studies. We present more details on the origins of the practitioner studies in Sect. 3.5.

3.2 Statistics on the corpus of academic literature

The 51 publications included in the final corpus stem from 28 journals. The Geneva Papers on Risk and Insurance—Issues and Practice (14), Sustainability (3), and Business Strategy and the Environment, Corporate Social Responsibility and Environmental Management, Journal of Business Ethics, Journal of Cleaner Production, Natural Hazards and Science (2), are the journals with the highest number of articles that have published research on sustainability in insurance through 2022 (see Table 1). Of the 14 articles in the Geneva Papers on Risk and Insurance—Issues and Practice, 10 studies address climate change, and four articles treat sustainability issues in general. The authors appearing most frequently are Mills (single author of [52,53,54,55]) and Johannsdottir (author and coauthor of [42,43,44,45]) with four appearances each, all focusing on climate change and environmental sustainability. We note that among the 51 articles in our final corpus, 43 records focus on insurance companies, while the other eight articles discuss pension fund matters.

To identify and analyze the most relevant topics, we have examined the frequency of keywords in the corpus overarching the years from 2003 (oldest publication) to end of 2022. In a first step, we report the most frequent topics based on the author’s keywords field in the 51 publications. To form the topics, we have clustered keywords with similar or related meanings. For example, the topic “insurance” includes the keywords insurance, insurer, insure, and insurers; “environmental” includes the keywords of environment, green, and environmental. The term “investment” refers to investing, investment, and invest; “sustainability” includes sustain, sustainability, and sustainable words. Among the six most frequent topics, we find that “insurance” ranks first with 37 occurrences. The topic “climate change” ranks second with 19 occurrences. The topics “sustainability”, and “risk” rank third and fourth with 17 and 16 repetitions respectively. The topics “adaptation” and “social” rank fifth and sixth with 13 records each. The frequency analysis of the 20 most frequent topics that we report in Fig. 2 provides insight into what has been of most interest to research over the past two decades. Besides “insurance”, the keywords climate change, sustainability, social and environmental appear most frequently, which was to be expected given the search query for the selection of records. In order of appearance, climate change issues come first, followed by social and governance issues. We also observe that many keywords are related to the main characteristics of insurance such as risk, mitigation, and strategy.

Number of occurrences of the 20 most frequent topics in the keywords. Note: The topic “insurance” includes the keywords, insurance, insure, insurer and insurers; “environmental” term includes environmental, environment and green; “investment” includes investing, investment and invest; “sustainability” includes sustainability, sustain and sustainable

In a second step, we have linked the topic of each academic publication to the three ESG factors: the environmental factor includes topics related to climate change such as natural disasters, pollution, and natural resources; the social factor considers topics related to human rights, gender equality, labor standards, and other issues affecting society; the governance factor includes topics related to corporate governance, board composition, corruption, and bribery. The (general) keywords “ESG” and “sustainable development” are assigned to all three categories. In Fig. 3, we present the resulting number of records by ESG factor and by year. On the first hand, we observe occurrences of publications regarding the environmental factor in almost all years. Moreover, the number of records seems to be increasing over the (most recent) years, from two records in 2003 to five records in 2022. On the second hand, regarding the governance and social factors, most records are found between 2017 and 2022 (although there are also some records in 2005 and 2010). We observe that a certain number of publications appeared in the years after 2007 relating to the publication of the climate change synthesis report by the IPCC [41]. Further, the increase of the number of records from 2017 onwards can be linked to the rising awareness in the scientific community after the Paris agreement [20] and the development of the UN SDGs in 2015 [46]. In addition, we note that all records are either devoted exclusively to the environmental factor or address the three, environmental, social, and governance, factors together. Thus, social and governance factors have never been treated alone in academic publications.

Overall, we observe that there has been a lot of interest in researching environmental issues. This is primarily due to the insurance industry’s concern about the increase in natural disasters and associated risks. Furthermore, climate change is currently given great importance at the international level, and both public and private organizations are actively involved in promoting awareness of environmental issues. On the other hand, ESG practices have come to the forefront in recent years and have become a standard for achieving sustainability in financial markets. For example, ESG investing aims to meet the needs of investors and the public by incorporating long-term financial risks into investments decisions [11]. Therefore, an undeniable increasing trend for research on the insurance industry sustainability issues can be expected in the coming years.

At this stage, the statistics on the collected literature have helped us to get a first impression on the topics that got the most attention from academic research. In the following, we propose a classification framework along the insurance value chain to explore in greater detail the focus of the publications in our corpus.

3.3 Classification along the insurance value chain

To study the research areas covered by the retrieved corpus of literature and to more systematically assess extant research and potential gaps, we introduce a classification of key insurance sector activities guided by the PSI [86] and using previous works linking an insurer’s value chain processes to sustainable development (see, e.g., [45, 81]). The first principle of the PSI encompasses the strategy and the operations of an insurance company. Principles 2 and 3 address external stakeholders of the insurance industry, namely, clients, suppliers, investors, governments and regulators. Furthermore, the fourth principle relates to the accountability and reporting of insurers. We distinguish supporting activities, primary activities, and external stakeholders and reporting. We provide further background information on the nine categories when discussing the literature in Sect. 4.1.

As illustrated in Fig. 4, we consider a framework based on nine main categories, including the value chain and relevant externalities. As a key representative for supporting activities in an insurance company we consider the company strategy (1). In the primary activities (operations), we consider product and service development (2), sales and marketing (3), risk management and underwriting (4), claims management (5), and investment management (6). Insurance companies are liable to several external stakeholders including clients, suppliers and investors (7) and the government and regulatory bodies (8) linked to their accountability and reporting (9). The proposed framework allows us to review which insurance activities are more researched (and concerned) with ESG issues (see Sect. 3.4 and Table 2).

3.4 Statistics on the academic publications along the value chain categories

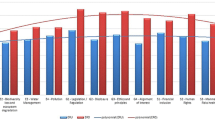

In Table 2 we report the number of publications of the final corpus that we have classified in each of the nine categories introduced in Sect. 3.3 (see Fig. 4). Thereby a publication may refer to one or more categories. Additionally, in each category we consider the three ESG factors to quantify the number of records relating to each factor (E, S, or G). This split provides insights on which share of the extant literature covers these specific topics.

The categories receiving the highest attention from academic research include the risk management and underwriting (4), the investment management (6) and the government and regulatory bodies (8). In each of these categories, we record over 20 publications, with most of them related to environmental issues. The categories company strategy (1) and product and service development (2) rank fourth and fifth in terms of number of publications. All the other activities receive much less attention, in particular sales and marketing (3) and claims management (2) with merely three and two records, respectively. We observe that in most categories academic research focuses primarily on environmental factors (E). In Table 3 we summarize the academic publications included in each category. More details and a complete classification of the 51 academic publications in the final corpus are provided in Table 7 in the Appendix. The summary table includes information on the regions where the study was conducted, the research method used, and the key contents and main results for each publication. Furthermore, for each publication we indicate the relevant categories (1 to 9) and ESG factors to which it refers.

The statistics reported in Table 2 highlight an important academic research gap, particularly in the categories sales and marketing and claims management where the number of publications is low. However, our statistics also show that the environmental issue has received the most attention over the past two decades, particularly regarding risk management and underwriting. Social and governance factors are less studied, although they get some attention in relation with investment management.

3.5 Statistics on practitioner publications along the value chain categories

In this section, we first summarize the 23 practitioner studies along the nine categories of the insurance value chain (see Sect. 3.3). In analogy to Table 2 for the academic publications, we report in Table 4 the number of records in practitioner studies in each category and ESG factor. We observe that, as with the academic publications, the risk management and underwriting (4) category is the most discussed in practitioner publications. In the sales and marketing (3) category, we found only one study dealing with the environmental topic. However, we can also observe that categories that have been less researched in academia, such as claims management (5), clients, suppliers and investors (7), and accountability and reporting (9) are of great interest to practitioners. In addition, we note that environmental risks are the most studied by practitioners when compared to social and governance risks. We provide more details on the selected practitioner publications in Table 8 in the Appendix.

As mentioned in Sect. 3 , we have categorized the practitioner contributions into four distinct types. For the United Nations group, we have identified the UNEP Finance Initiative PSI, the global framework for insurance-specific treatment of ESG issues, with four publications. For the group of regulators and standard setters, we have considered the main body in Europe for insurance companies and pension funds, the European Insurance and Occupational Pensions Authority (EIOPA) with three publications, an international body, the International Association of Insurance Supervisors (IAIS) with one publication, and the insurance-specific network dealing with sustainability issues, the Sustainable Insurance Forum (SIF) with two publications. We excluded national regulatory bodies whose ESG related publications typically take the form of directives. The “insurance” group encompasses records from the main public organizations, private companies (e.g., Swiss Re, Allianz, Munich Re, AXA, Zurich, Aviva, Generali) and think tanks. After review, we included the Geneva Association (GA) with four publications, the Chief Risk Officers Forum (CRO Forum), and Swiss Re with two publications in our corpus. In the actuarial group, we have considered the International Actuarial Association (IAA) with four publications and the Actuarial Association of Europe (AAE) with one publication. In Table 5, we provide an overview of the publications and the classification along the nine value chain categories.

4 Results and discussion

In this section, we review the retrieved publications and discuss their contents. In Sect. 4.1, we first describe the relevance to sustainability of each framework category (Fig. 4) and put the existing research, including both academic and practitioner publications, in context. In Sect. 4.2, we summarize the main results of the extant literature in terms of issues and related actions (see Table 6), and, in the light of the findings, we discuss the current state of the insurance industry with regards to sustainability issues.

4.1 Review of the literature

Company strategy. As a first step towards becoming a sustainable company, the strategy must be well defined and include sustainability at all levels of the organization. With the goal of identifying and monitoring ESG issues in business operations, insurers need consistent corporate strategy at the board and executive levels. The strategy must integrate sustainability into all business areas and the corporate culture, and determine appropriate quantitative indicators to measure progress [81].

Research related to sustainable strategies is found in the area of corporate sustainability, which refers to companies addressing sustainability issues, including economic, environmental, and social factors (see, e.g., [68] for a systematic literature review). Corporate governance is important for the strategy to develop well-structured frameworks [44, 99]. For example, in the case of socially responsible pension funds and with the demand for sustainable development, institutional shareholders care more about social and environmental values, which they transfer to corporate governance [2].

In addition, the literature emphasizes the importance of using green technologies [9, 50] as the main strategy for climate adaptation. Environmental sustainability and climate change actions need to be integrated into the insurers’ core business [45]. Altarhouni et al. [3] insist that all actors of the insurance sector, including insurers, reinsurers and pension funds, should develop strategies to reduce environmental degradation by investing in clean energy sources. Furthermore, corporate social responsibility (CSR) has been identified as a key practice for the strategy of insurance companies and pension funds [38, 78]. The insurance industry can play a pioneering role in CSR. Insurance companies typically have incorporated social and ethical issues into their business activities, but not environmental issues, so that many insurers do not realize their full potential for a more sustainable industry [76]. The article by Ho et al. [38] describes that for Taiwanese insurance companies, managerial practices are the most significant dimension of CSR, with corporate strategies and commitments the most important criteria. However, we note that the strategy area is not well documented in our final corpus, particularly regarding social and governance factors.

Product and service development. In our framework, we consider the development of products and services as the first operations activity of an insurer. Our literature review highlights that it is necessary to distinguish between the products and services offered by insurance companies in developing countries and in developed countries. For example, in developing countries, climate-related microinsurance products are more in demand by policyholders than most of such products in the traditional market [54]. In addition, there is also a growing demand for weather-related and nature-aligned products in developed countries. These insurance products can also reduce underwriting losses, stimulate the growth of insurance assets, and help restore damaged natural capital [8]. Such propositions include crop parametric products for drought risks based on a soil moisture index and property (flood) parametric products based on an excess rainfall index [83]. Regarding social issues, the world is experiencing an aging population, especially in Europe. Given the pressure on public budgets, it is likely that society and governments will be very receptive to more creative and affordable insurance and pension propositions. There are already examples of interactions between governments, individuals, and private companies, such as insurers and asset managers working together on the definition of the pan-European personal pension product (PEPP), a voluntary personal pension scheme, complementary to state-based and occupational pensions, that offers EU citizens a new option to save for retirement [16].

Therefore, the development of sustainable products and services provides opportunities and challenges for the core insurance business [58]. For instance, one challenge is to design and price products that consider climate risks and stakeholders. For insurance companies, this may mean raising premiums or excluding coverage in areas at elevated risk for climate-related events such as floods or bushfires. On the other hand, there is an opportunity to develop products that align policyholder interests with behaviors that lead to better climate outcomes. This could be achieved by introducing incentives that eliminate or control risks, low-carbon annuity products, or providing capital for initiatives that address climate risks [96].

One of the main goals of sustainable insurance is to develop products and services that reduce risks and have a positive impact on ESG issues. Possible actions suggested by the PSI include offering microinsurance to developing countries where access to insurance is limited and supporting programs on risk, insurance, and ESG issues [86]. Some insurance companies have developed “green” insurance products and features. Examples include the coverage for electric and hydrogen vehicles, discounts for low- and zero-emission vehicles, and for policyholders who use public transportation, repair rather than replace, and coverage for sharing mobility [81]. Other examples contributing to environmental sustainability include electric cars and renewable energy solutions [45]. The insurance industry has developed products such as environmental pollution liability insurance in response to the rise of liabilities it has faced over time [92]. Insurance companies that find the best solutions with innovative and sustainable products and services will lead the insurance markets in the future.

Sales and marketing. The least researched category with merely three retrieved academic publications and one practitioner study in our literature review is sales and marketing. Nevertheless, the associated operational processes are key for sales promotion, advertising, channel relationships and distribution. Indeed, an appropriate marketing strategy can make customers aware of sustainability issues and provide them with the best option for their expectations. To meet the requirements of a sustainable company, PSI suggests, first, educating sales staff about ESG issues and, second, integrating key messages responsibly into campaigns and social media [86]. The sales and marketing team must understand and explain the (sustainability) benefits and costs of each product offered by the company. For example, promoting an insurer’s efforts to mitigate weather disasters is an important tool in a marketing strategy to strengthen customer loyalty [49, 95].

Currently, insurance companies are already actively promoting extreme weather risk management to raise awareness of how the industry is responding to the impacts of climate change [95]. However, there is a potential risk to insurers’ reputations if false advertising, known as “greenwashing”, is used as in marketing campaigns [29]. In addition, the lack of common definitions and standards for measuring the contribution of products and services to climate change mitigation and adaptation may increase the risk of greenwashing [23]. One suggestion to avoid the image of using greenwashing as marketing is to apply standards, best practice and established measures (see, e.g., the Science-Based Target initiative, SBTi, [73], and [81]).

Risk management and underwriting. Actuaries play an active role in risk management and underwriting. In this category, we focus on liability and underwriting in the context of insurance companies’ and pension funds’ risk management. The extant literature focuses primarily on environmental issues, highlighting the interest in developing measures to manage, measure and mitigate the increase in natural disasters.

In their role as risk managers, insurance companies provide expertise in catastrophe risk modeling, risk assessment, and preventive measures [32]. An alarming figure that illustrates the importance of underwriting is that the economic cost of weather damage alone could exceed USD 1 trillion by 2040 worldwide [21]. Thus, underwriters are facing huge challenges, mainly because catastrophe models are not well calibrated, premiums are too low, risk exposures are extremely high, and the climate protection gap is growing. However, increasing insurance coverage alone is not enough to close the protection gap, as the increasing frequency and severity of certain natural events could make some risks uninsurable. Measures that can be implemented include proactive mitigation initiatives for buildings, localization of risks, and optimized levels of insurance coverage [26]. Another survey study on flood damages in the United Kingdom reports insurance losses from floods of GBP 1.7 billion in 2007 [7]. To respond to these challenges, the academic literature has studied several actions. For instance, Begum et al. [9], discusses how green technology strategies can help to reduce the impact of natural disasters in Malaysia. In addition, Botzen et al. [12] suggests that increasing crop insurance policies is a business opportunity to cover drought losses in the Netherlands. Toward best practices, Mills [54] indicates that appropriate risk management in businesses requires a reassessment of existing risk management tools in response to environmental issues. On a broader level, Glaas et al. [30] shows the importance of government involvement for insurer stability and risk prevention measures.

Insurers’ risk management requires immediate action to address the consequences of climate change, at the global and local levels due to the increase in extreme natural disasters and the associated risk of increasing insurance losses [37, 61, 63, 72]. In addition, the increase of natural catastrophes does not only come with an increased risk in terms of frequency and severity, but the frequency of these events is more unpredictable over time [65]. Moreover, the consideration of comprehensive ESG risk assessments beyond the pure environmental aspects is critical when the developing risk management and underwriting. One of the keys to sustainable development in insurance risk management is technological innovation [19]. By developing and providing knowledge to mitigate losses through risk engineering and insuring sustainable technologies, the sector can play an important role [79]. In addition, especially in the case of climate change, the use of specific financial instruments such as cat bonds and catastrophe risk swaps are important tools for disaster risk management [85].

With respect to sustainability risks, risk management and underwriting are a top business priority and must be addressed by actuaries. According to the PSI, appropriate processes to identify and assess ESG issues should be incorporated into the portfolio, the modeling, and all analyses done within the company [86]. The top priority in risk management is to invest in the mitigation of losses. Mitigation and prevention of disasters can range from reducing risk exposure to creating institutions for better response, such as land use and emergency planning [50]. An interesting five-step roadmap for risk management, aimed primarily at small and medium-sized insurance companies, has been proposed by Stricker et al. [81], and consists of integrating sustainability into risk assessments, reviews of risk objectives, setting tolerance levels, risk monitoring and reporting, and external environment monitoring.

Claims management. Given the share of an insurer’s costs related to claims, claims management is fundamental to insurers and presents potential opportunities. However, claims management has not been largely studied from a sustainability perspective: only two publications appear in our literature review. The article by Sato and Seki [72] discusses the case of Japan and emphasizes that insurance companies must have a well-structured claims assessment process that promotes precautionary measures within the company. This is critical to minimize losses from natural disasters and to improve claims payments. Two examples for moving towards a greener industry in claims management are the use of image recognition technologies in claims assessments, such as photos of local repair companies, and the creation of a greenhouse gas emissions inventory for all operations and processes in claims management [81].

To achieve sustainable insurance, a comprehensive claims management strategy including stakeholders, namely, the customers, must be on the agenda of insurance companies. A critical part of an insurer’s value chain is managing the total cost of risk from claims. Root cause analysis, repairing a loss, and improving claims management strategies are examples of better practices. In recent years, the number of climate-related claims has increased [96]. In terms of physical risk, worker’s compensation claims are a relevant example since climate can affect mortality and morbidity risks at work. It takes longer for claims to develop, and new sources of risk may emerge. Reserving methods may be affected by changes in claims payment patterns that are difficult to determine from historical data [57]. One of the main concerns for insurers is damage to their reputation in terms of how well they can insure sustainability risks, keep them affordable, and provide good service after catastrophic losses. One solution is smart claims payments to “build back better” after a disaster. This approach could increase the resilience of society and better align the interests of insurers and customers [4]. Another solution is the use of remote sensing, which simplifies existing processes such as claims management. For example, remote sensing-based flood detection can provide access to timely insights for claims developments. Furthermore, the use of technologies from remote sensing satellites can help assess the risk of subsidence, by measuring soil movement, and identify claims for property insurance [83].

Investment management. Insurance companies and pension funds are among of the largest institutional investors in the global economy. Therefore, investment management is a relevant lever for addressing sustainability issues. Importance also comes with the long-term investment horizon. Our literature review shows that insurers’ investment practices are well researched. Moreover, there is an undeniable growing interest in considering ESG investment practices in the insurance industry [2]. So-called “sustainable investing” is of great importance for the sector and investors’ interest has increased in recent years [28].

Several studies highlight the benefits of ESG investments with a positive impact on investment decisions, such as the National green technology policy in Malaysia [9]. Similarly, appropriate solutions addressing climate change provide profitable investment opportunities [80]. Nevertheless, climate change also comes with higher risks, for example, regarding real estate investments. For this reason, life insurance companies, which mainly own long-term assets, are more affected by climate change than property insurance companies [69]. Among the investment strategies, ESG integration and impact investing are the two most frequently mentioned in recent years [28]. Five main mitigation measures are proposed in pension fund sustainability reports: divestment, direct engagement, carbon footprint calculation, investing in green options, and participating in climate-related coalitions. Long-term sustainable investments are likely to be beneficial and successful, especially in the area of retirement insurance [60]. As a result, some companies have already incorporated exclusion criteria in their portfolio strategies to respond to environmental risks [15]. However, the use of these measures has been counterproductive in some pension funds in taming the fossil fuel sector. For instance, some pension funds practice industry-wide divestment, such as from tobacco and nuclear weapons, although they rarely target the fossil fuel sector. Other pension funds practice conditional divestment, where they only divest from a company as a last resort if a set of criteria is not met [70]. In addition, the incorporation of ESG practices into the investment management of pension funds and insurance companies, essentially socially responsible and environmental investing, is increasingly required by the market and should be considered a priority in decision making [54]. On the opportunity side, a proposed solution to climate change, especially for large insurers, is to fund client projects that improve resilience [80].

One of the most important guidelines related to sustainability in investments are the principles for responsible investment [88], whose defined goal is to achieve sustainable global finance by incorporating ESG factors into investment portfolios. In addition, standards have been developed, particularly on the social factor such as, socially responsible investing, which includes social factors as well as areas like community investment and shareholder advocacy [31]. Investors have used ESG information mainly through ratings, which help transform ESG data into investment products for decision making. Nonetheless, ESG practices are gaining traction in the insurance sector, with further development of ratings required [11]. Existing data providers in the market include Bloomberg, Morningstar, Thompson Reuters, MSCI, and Sustainalytics, which tend to focus on financial institutions. They consider some of the key criteria within the three ESG factors. For example, environmental factors include carbon emissions, pollution, and natural resource use; social factors include health and diversity issues, human rights, privacy, and community engagement. Under the corporate governance factor, we find, among other things, corporate ethics, board independence and shareholder rights. Many of the largest pension funds are actively working to improve their ESG practices, however there is still room for improvement. Overall, integrating ESG issues into investment management is critical to achieving better long-term investment returns and addressing climate risks [51].

Clients, suppliers and investors. External stakeholders include clients, suppliers and investors. Principle 2 of the PSI specifically addresses these crucial players in the insurance industry. Our literature review highlights that long-term relationships with policyholders and customers are one of the most important mechanisms for insurers to pursue an integrated sustainability strategy [71]. The practice of CSR engagement by insurers has recently had a positive impact on customer behavior [49]. Regarding the environmental factor, incentives for customers with ESG commitment lead them to consider greener options in the insurance industry [97]. For example, insurance companies in Massachusetts have offered discounts of 10% to customers who complete a free six-hour course on weatherizationFootnote 3 and home repairs [52].

Customers are also concerned about the social factor. On the one hand, for example, pension funds get involved by, e.g., informing pension fund members about where their funds are invested and whether they are invested considering ESG issues. In non-life insurance, policyholders expect that coverage will continue to be available and affordable, and that claims will be settled at an elevated level after a catastrophe event. However, sustainability risks can disrupt this and negatively impact clients and potentially lead to reputational risks for insurers [4]. On the other hand, insurers should promote corporate commitment to sustainability issues through marketing strategies to attract more policyholders and raise awareness in the global community. Thereby, it is important to act responsibly on all ESG issues. Based on guidance from the PSI, a number of actions have been proposed, such as starting a dialogue with policyholders and suppliers about the benefits of ESG management and the company’s sustainability expectations and encouraging policyholders and suppliers to use relevant ESG disclosures [86]. Insurers have to work together with their clients, suppliers, and investors to contribute to a sustainable business.

Government and regulatory bodies. Climate change is an example showcasing the need for insurance companies, governments, and society to develop sustainable solutions together [36, 42]. Regulation can boost the sustainability agenda and change the way business is done. Regulating the integration of ESG factors can help to reduce risks and better manage sustainability (cf. the current efforts by the EIOPA to explicitly integrate sustainability in the solvency regulation, see [22]). Thereby, regulatory bodies improve the monitoring of sustainability issues. In addition, governments, along with insurers and society, are important players in promoting ESG issues, especially in areas where more capital is needed, as in the case of extreme weather events [54]. Governments can influence private insurance companies in adapting to sustainability with a longer-term perspective. For example, the Norwegian government has initiated an approach to public-private compensation of insurers for costly extreme events, called the Norwegian natural perils pool [30]. The Swiss natural perils pool (“Elementarschaden-Pool”) also intends to optimize risk diversification and risk exposure among the participating insurers covering 90% of the natural perils market [82]. In Europe, however, only a quarter of climate-related and extreme event losses have been insured over the past 40 years, revealing a climate protection gap [26]. Other factors in which governments can be involved include providing a water management solution and establishing monitoring systems for extreme natural events [85]. Another example of government involvement can be found in the United Kingdom, where the government works with private insurers to provide flood insurance [95].

Two important actions proposed by the PSI include dialogue with intergovernmental and nongovernmental institutions to promote sustainable development, and support for policy, regulatory, and legal bodies that enable risk mitigation and better management of ESG issues [86]. Policy options that the state can use include motivating technology developers to behave prudently by creating a liability regime, encouraging innovation ideas by creating non-liability regimes and effectively allocating risk to third parties, promoting insurance in the risk market by setting liability limits, and promoting social equity by making insurance mandatory [19].

Accountability and reporting. The literature shows that it is of utmost importance to publicly disclose the actions on the relevant challenges in terms of ESG factors [38]. Currently, insurance companies and pension funds, particularly in Europe, have begun to report annually on their progress and actions related to environmental and sustainability issues. Since 2015, numerous standards and regulatory measures have been developed for sustainability, sustainable finance, and climate-related disclosures. An analysis by the UNEP has found that around 25% of these measures address disclosure of ESG factors, sustainability, and climate risks [39]. One of the most influential organizations on climate issues is the Task Force on Climate-related Financial Disclosures (TCFD), which recommends climate reporting based on four main pillars (governance, strategy, risk management, and metrics and targets, see [18]). In sustainability reporting, one of the main guidelines used in practice are those of the Global reporting initiative, whose standards aim to strengthen sustainability and transparency in the insurance market. Another practice increasingly used in the insurance industry is CSR reporting. The European Commission adopted the Corporate Sustainability Reporting Directive (CSRD) in April 2021, which replaces the Non-Financial Reporting Directive (NFRD) and broadens the scope of reporting requirements. The CSRD mandates companies to furnish information that enables an understanding of the impact of sustainability-related issues on the company and its effects on people and the environment [17, 74].

Potential actions suggested by the PSI include monitoring and measuring the company’s progress in addressing ESG issues, participating in relevant reporting frameworks, and engaging in dialogue with regulators and rating agencies to gain a mutual understanding of the value of disclosure. Reporting has become increasingly important in recent years. Annual reporting on progress and actions on ESG issues is the means to inform policymakers and society on how the company is responding to sustainability issues [86]. Therefore, information disclosure, reporting, accountability, and transparency are key to achieve sustainable insurance and must be a priority for the industry today.

4.2 Discussion of sustainability issues and related actions

To complement the literature review presented in Sect. 4.1, we propose a summary of the main findings in Table 6: we lay out the main sustainability issues and some potential related actions per category that appear in the final corpus of literature.

As sustainable insurance has become a key objective, it is undeniable that insurance companies and pension funds must act responsibly to respond to the ESG challenges of our time. Building socio-economic resilience is at the core of the insurance business. Companies need (to develop) well-structured risk management and adaptation strategies [32]. They also need to understand the exclusion and inclusion criteria for ESG investments and manage them in a sustainable manner. In addition, our literature review has revealed that specific attention must be paid to insurance activities such as sales and marketing, claims management, and clients, suppliers and investors, as there is a lack of research in these areas. When considering the publications, we also observe that most of the articles focus on developed countries and issues from climate change. We also find some specific actions and proposals that the insurers have incorporated into their strategy and operations. Academic research shows that the issues of sustainability and insurance are growing and are important to both researchers and practitioners. Indeed, there is no doubt that numerous challenges arise when developing adaptation.

We have seen a lot of attention paid to sustainability in financial markets. Insurance companies are conducting ESG assessments, largely due to pressure from the society, their customers and regulators. At the time of writing, several initiatives and principles have become available and insurance companies must achieve a net-zero greenhouse gas emissions commitment by 2050 [89]. However, understanding the definitions and the lack of data, regulations, standards, and best practices make it difficult for insurers to achieve the goal.

Small and medium-sized insurance companies need to put sustainability on their agenda and start the transition by implementing actions and measures that will help the entire sector become a sustainable business. Furthermore, not only small and mid-sized insurers, but all actors need to consider the complex sustainability journey when outlining the path to implementation. A comprehensive roadmap for green insurance along the value chain, particularly for small and medium-sized insurers, is proposed by Stricker et al. [81], which identifies five key steps in each area of the insurer value chain. The steps include insuring green attributes in the product and service development category, integrating sustainability into risk management and underwriting, and inventorying greenhouse gas emissions in the claims management area.

Our study on the current state of literature reveals number of elements hindering the sustainable development in insurance. First, we note that the insurance sector depends on external factors beyond its control, such as regulatory frameworks and shareholder decisions. In addition, there are few data sets, metrics, and theories to model ESG risks. Furthermore, the insurance industry needs a detailed roadmap and process for implementing sustainability that is not yet well defined. For example, while the measures proposed in the PSI provide general guidance on the four principles, they say little about how they should be implemented in practice, particularly with regard to the first principle for company strategy, claims management and sales and marketing. Another limitation relates to the different ESG assessments. For example, different investors approach ESG factors differently; some companies have already fully integrated ESG factors, while others are just beginning to implement them. Moreover, ESG assessments are valued differently by different investors and agencies [98]. Finally, the definition of sustainability must be reliable and endure over time. As a prominent example of that uncertainty, we note that the scope of green energy in Europe has recently changed, and, under the EU Taxonomy, nuclear energy has been classified as green [40].

5 Conclusion

In this work, we present the results of a systematic literature review on sustainability in insurance companies and pension funds. Our results provide an overview of the main sustainability issues and related actions along the key insurance activities. Guided by the PSI and the insurance value chain, the review and the summary findings are structured along nine categories relating to the company strategy, six core operations (product and service development, sales and marketing, risk management and underwriting, claims management, investment management), and clients, suppliers and investors, government and regulatory bodies, as well as accountability and reporting. Although academic research has seen important developments in recent years, we have identified gaps, for example in the areas of claims management and marketing. Throughout the publications, we observe that the academic community acknowledges that acting on sustainability issues is not only a stake in the future, but a real challenge in the present for the insurance sector.

In terms of ESG factors, the environmental factor is the most prevalent across all categories in our literature. On the liability side, insurance companies are directly affected by climate change risks. For the risk management and underwriting operations, many academics call for more metrics and models to manage ESG risks. On the other hand, on the asset side, insurers and pension funds can actively influence the future through their institutional investments and related engagements. We observe that both insurance companies and pension funds focus mainly on environmental and social factors in their sustainable investments. Despite their interest in governance issues and although it is a fundamental part of corporate strategy, the fact that governance is not insurance-specific and more difficult to measure could be the reason there are only few publications addressing this issue in the insurance literature. In addition, in our literature review, we note that the governance factor is usually not discussed alone, but together with one or two factors, i.e., environmental, or social factors. This is particularly the case in the practitioner studies. Overall, we find that more detailed sustainability roadmaps need to be developed and guidelines require more thorough integration. The latter thoughts should also include areas such as claims management and sales and marketing. Accountability and reporting, an area that has seen significant developments recently, is of great interest to practitioners, and there is no doubt that academic publications on this topic will also increase in the coming years.

While the present contribution provides a review of the existing literature, further research should be considered as an extension. First, many of the current models in risk management and underwriting do not yet incorporate ESG factors, leaving room for future research and requiring engagement from actuaries. Second, specifically for the environmental factor, further studies can be conducted on the impact of climate change-related risks on pricing, underwriting, risk management, and solvency. Finally, more research is also required on the impact and implementation of specific social and governance factors. This will be particularly relevant since their modeling and measurement in practice is more difficult.

Data Availability

Not applicable.

Notes

The exact query is as follows: AB=((“insur*" OR “pension*" OR “actuar*") AND (“sustainab*" OR “esg") AND (“environment*" OR “soci*" OR “govern*" OR “climate change")).

In forward tracking we consider the publications that have cited a given record; in backward tracking we analyze the references cited in a given record.

Courses on weatherization provide basic knowledge of building science related to airflow, heat flow and moisture flow, combustion safety and testing. They are designed in accordance with guidelines specified by the U.S. Department of Energy, see https://www.greentrainingusa.com/doe-weatherization-installer-1-and-2-training.html.

References

Alda M (2019) Corporate sustainability and institutional shareholders: the pressure of social responsible pension funds on environmental firm practices. Bus Strategy Environ 28(6):1060–1071

Alda M (2020) ESG fund scores in UK SRI and conventional pension funds: are the ESG concerns of the SRI niche affecting the conventional mainstream? Finance Res Lett 36:101313

Altarhouni A, Danju D, Samour A (2021) Insurance market development, energy consumption, and Turkey’s CO\(_2\) emissions. New perspectives from a bootstrap ARDL test. Energies 14(23):7830

Armengol Vivas C, Crugnola-Humbert J, Krylowicz T, Modisett M, Schiller F, Zelinkova J (2022) Sustainability issues and reputational risk for insurance companies and pension funds, Technical Report. Actuarial Association of Europe

Autenne A, Degoli MC, Hartmann-Cortés K (2021) Introduction to the special issue on sustainable pensions: do sustainable pensions require sustainable investments? Eur J Soc Secur 23(3):191–199

Bacani B, McDaniels J, Robins N (2015) Insurance 2030—harnessing insurance for sustainable development

Ball T, Werritty A, Geddes A (2013) Insurance and sustainability in flood-risk management: the UK in a transitional state. Area 45(3):266–272

Baral P (2021) Nature-related risks in the global insurance sector, Technical Report. Sustainable Insurance Forum

Begum RA, Komoo I, Pereira JJ (2011) Green Technology for Disaster Risk Reduction. Green Technology for Disaster Risk Reduction 1(2011):279–282

Benali N, Feki R (2017) The impact of natural disasters on insurers’ profitability: evidence from property/casualty insurance company in United States. Res Int Bus Finance 42:1394–1400

Boffo R, Patalano R (2020) ESG investing: practices, progress and challenges

Botzen WJ, van den Bergh JC, Bouwer LM (2010) Climate change and increased risk for the insurance sector: a global perspective and an assessment for the Netherlands. Nat Hazards 52(3):577–598

Bourtembourg J, Languedoc L, Overton G, Ramella M (2021) The impact of climate change on the financial stability of the insurance sector, Technical Report. International Association of Insurance Supervisors

Brogi M, Cappiello A, Lagasio V, Santoboni F (2022) Determinants of insurance companies’ environmental, social, and governance awareness. Corp Soc Responsib Environ Manag (March):1–13

Chiaramonte L, Dreassi A, Paltrinieri A, Piserà S (2020) Sustainability practices and stability in the insurance industry. Sustainability 12(14):5530

CRO Forum (2020) Imagine all the people: demographics and social change from an insurance perspective, Technical Report

CRO Forum (2021) Mind the sustainability gap: integrating sustainability into insurance risk management, Technical Report

Crugnola-Humbert J, Fiallos S, Fleming D, Latham A, Cynthia Yuan X (2022) Climate-related disclosures and risk management: standards and leading practices, Technical Report. International Actuarial Association

Dahlström K, Skea J, Stahel WR (2003) Innovation. Insurability and sustainable development: sharing risk management between insurers and the state. Geneva Pap Risk Insur Issues Pract 28(3):394–412

Delbeke J, Runge-Metzger A, Slingenberg Y, Werksman J (2019) The Paris Agreement

Dlugolecki A (2008) Climate change and the insurance sector. Geneva Pap Risk Insur Issues Pract 33(1):71–90

EIOPA (2019) Opinion on sustainability within solvency II. EIOPA

EIOPA (2021) Report on non-life underwriting and pricing in light of climate change, Technical Report

EIOPA (2022) European insurers’ exposure to physical climate change risk, Technical Report

EIOPA (2022) Guidance on the integration of sustainability preferences in the suitability assessment under the insurance distribution directive, Technical Report

EIOPA (2022) The dashboard on insurance protection gap for natural catastrophes in a nutshell, Technical Report

Garayeta A, De la Peña JI, Trigo E (2022) Towards a global solvency model in the insurance market: a qualitative analysis. Sustainability 14(11):6465

Gatzert N, Reichel P (2022) Sustainable investing in the US and European insurance industry: a text mining analysis. Palgrave Macmillan, London

Gatzert N, Reichel P, Zitzmann A (2020) Sustainability risks and opportunities in the insurance industry. Zeitschrift für die gesamte Versicherungswissenschaft 109(5):311–331

Glaas E, Keskitalo ECH, Hjerpe M (2017) Insurance sector management of climate change adaptation in three nordic countries: the influence of policy and market factors. J Environ Plan Manag 60(9):1601–1621

Glac K (2009) Understanding socially responsible investing: the effect of decision frames and trade-off options. J Bus Ethics 87:41–55

Golnaraghi M (2018) Climate change and the insurance industry: taking action as risk managers and investors

Golnaraghi M, Geneva Association (2021) Insurance industry perspectives on regulatory approaches to climate risk assessment, Technical Report

Golnaraghi M, Geneva Association (2022) Anchoring climate change risk assessment in core business decisions in insurance, Technical Report

Golnaraghi M, Mellot A (2022) Nature and the insurance industry: taking action towards a nature-positive economy, Technical Report. The Geneva Association

Hawker M (2007) Climate change and the global insurance industry. Geneva Pap Risk Insur Issues Pract 32(1):22–28

Herweijer C, Ranger N, Ward RE (2009) Adaptation to climate change: threats and opportunities for the insurance industry. Geneva Pap Risk Insur Issues Pract 34(3):360–380

Ho CC, Huang C, Ou CY (2018) Analysis of the factors influencing sustainable development in the insurance industry. Corp Soc Responsib Environ Manag 25(4):391–410

IAIS (2020) Issues paper on the implementation of the recommendations of the task force on climate-related financial disclosures, Technical Report. International Association of Insurance Supervisors and Sustainable Insurance Forum

Igini M (2022) Gas and nuclear turn green as EU Parliament approves new taxonomy. https://earth.org/gas-and-nuclear-turn-green-eu-taxonomy/

IPCC (2007) Climate change 2007: synthesis report. Contribution of working groups I, II and III to the fourth assessment report of the intergovernmental panel on climate change

Johannsdottir L (2014) The Geneva association framework for climate change actions of insurers: a case study of nordic insurers. J Clean Prod 75:20–30

Johannsdottir L, Davidsdottir B, Goodsite ME, Olafsson S (2014) What is the potential and demonstrated role of non-life insurers in fulfilling climate commitments? A case study of nordic insurers. Environ Sci Policy 38:87–106

Johannsdottir L, McInerney C (2018) Developing and using a five C framework for implementing environmental sustainability strategies: a case study of nordic insurers. J Clean Prod 183:1252–1264

Johannsdottir L, Olafsson S, Davidsdottir B (2015) Leadership role and employee acceptance of change implementing environmental sustainability strategies within nordic insurance companies. J Organ Change Manag 28(1):77–96

Johnston RB (2016) Arsenic and the 2030 agenda for sustainable development, arsenic research and global sustainability. In: Proceedings of the 6th international congress on arsenic in the environment, AS 2016, pp 12–14

Kanojia R (2014) Insurance and its role in sustainable development. Glob J Finance Manag 6(3):227–232

Keskitalo ECH, Vulturius G, Scholten P (2014) Adaptation to climate change in the insurance sector: examples from the UK, Germany and the Netherlands. Nat Hazards 71(1):315–334

Lee C-Y, Chang W-C, Lee H-C (2017) An investigation of the effects of corporate social responsibility on corporate reputation and customer loyalty—evidence from the Taiwan non-life insurance industry. Soc Responsib J 13(2):355–369

Linnerooth-Bayer J, Warner K, Bals C, Höppe P, Burton I, Loster T, Haas A (2009) Insurance. Developing countries and climate change. Geneva Pap Risk Insur Issues Pract 34(3):381–400

Meins P, Furlan T, Shier P (2020) Pension fund environmental, social and governance risk disclosures: developing global practice, Technical Report. International Actuarial Association

Mills E (2003) The insurance and risk management industries: new players in the delivery of energy-efficient and renewable energy products and services. Energy Policy 31(12):1257–1272

Mills E (2005) Insurance in a climate of change. Science 309(5737):1040–1044

Mills E (2009) A global review of insurance industry responses to climate change. Geneva Pap Risk Insur Issues Pract 34(3):323–359

Mills E (2012) The greening of insurance. Science 338(6113):1424–1425

Müller-Fürstenberger G, Schumacher I (2015) Insurance and climate-driven extreme events. J Econ Dyn Control 54:59–73

Musulin R, Dal Moro E, Gutterman S, Young E, Zalk T (2021) Climate-related scenarios applied to insurers and other financial institutions climate risk task force, Technical Report. International Actuarial Association

Nogueira FG, Lucena AFP, Nogueira R (2018) Sustainable insurance assessment: towards an integrative model. Geneva Pap Risk Insur Issues Pract 43(2):275–299

Nowak P, Romaniuk M (2013) Pricing and simulations of catastrophe bonds. Insur Math Econ 52(1):18–28

Owadally I, Mwizere J-R, Kalidas N, Murugesu K, Kashif M (2021) Long-term sustainable investment for retirement. Sustainability 13(9):5000

Pagano AJ, Feofilovs M, Romagnoli F (2018) The relationship between insurance companies and natural disaster risk reduction: overview of the key characteristics and mechanisms dealing with climate change. Energy Procedia 147:566–572

Page MJ, McKenzie JE, Bossuyt PM, Boutron I, Hoffmann TC, Mulrow CD, Shamseer L, Tetzlaff JM, Akl EA, Brennan SE, Chou R, Glanville J, Grimshaw JM, Hróbjartsson A, Lalu MM, Li T, Loder EW, Mayo-Wilson E, McDonald S, McGuinness LA, Stewart LA, Thomas J, Tricco AC, Welch VA, Whiting P, Moher D (2021) The PRISMA 2020 statement: an updated guideline for reporting systematic reviews. BMJ, 71

Paudel Y (2012) A comparative study of public-private catastrophe insurance systems: lessons from current practices. Geneva Pap Risk Insur Issues Pract 37(2):257–285

Pfeifer D (2021) The European way to sustainable insurance—the ESG challenge

Phelan L (2011) Managing climate risk: extreme weather events and the future of insurance in a climate-changed world. Australas J Environ Manag 18(4):223–232

Pierro R, Desai B (2008) Climate insurance for the poor: challenges for targeting and participation. IDS Bull 39(4):123–129

Pörtner H-O, Roberts DC, Tignor MM, Poloczanska E, Mintenbeck K, Alegría A, Craig M, Langsdorf S, Löschke S, Möller V, Okem A, Rama B (2022) Climate change 2022—impacts. adaptation and vulnerability—summary for policymakers. IPCC

Pranugrahaning A, Donovan JD, Topple C, Masli EK (2021) Corporate sustainability assessments: a systematic literature review and conceptual framework. J Clean Prod 295

Qing W, Liang L (2010) The strategy of Chinese insurance industry to address global climate change. In: Proceedings of the 2010 international symposium on low-carbon economy and technology science, vol 8, no 2, p 219

Rempel A, Gupta J (2020) Conflicting commitments? Examining pension funds, fossil fuel assets and climate policy in the organisation for economic co-operation and development (OECD). Energy Res Soc Sci 69

Risi D (2020) Time and business sustainability: socially responsible investing in swiss banks and insurance companies. Bus Soc 59(7):1410–1440

Sato M, Seki M (2010) Sustainable business. Sustainable planet a Japanese insurance perspective. Geneva Pap Risk Insur Issues Pract 35(2):325–335

SBTi (2021) SBTi corporate manual

Schanz K-U (2022) The role of insurance in promoting social sustainability, Technical Report. The Geneva Association

Schiller F, Crugnola-Humbert J (2022) The only constant is change: opportunities and challenges for actuaries in a changing world. Eur Actuar J 12(2):887–894

Scholtens B (2011) Corporate social responsibility in the international insurance industry. Sustain Dev 19(2):143–156

Sethi SP (2005) Investing in socially responsible companies is a must for public pension funds—because there is no better alternative. J Bus Ethics 56(2):99–129

Sievänen R, Rita H, Scholtens B (2017) European pension funds and sustainable development: trade-offs between finance and responsibility. Bus Strategy Environ 26(7):912–926

Stahel WR (2008) Global climate change in the wider context of sustainability. Geneva Pap Risk Insur Issues Pract 33(3):507–529

Stechemesser K, Endrikat J, Grasshoff N, Guenther E (2015) Insurance companies’ responses to climate change: adaptation. Dynamic capabilities and competitive advantage. Geneva Pap Risk Insur Issues Pract 40(4):557–584

Stricker L, Pugnetti C, Wagner J, Zeier Röschmann A (2022) Green insurance: a roadmap for executive management. J Risk Financ Manag 15(5):221

Swiss Insurance Association (2021) Affordable natural perils insurance thanks to the ES pool