Abstract

We study a connections model where the strength of a link depends on the amount invested in it and is determined by an increasing strictly concave function. The revenue from investments in links is the value (information, contacts, friendship) that the nodes receive through the network. First, assuming that links are the result of investments by the node-players involved, there is the question of stability. We introduce and characterize a notion of marginal equilibrium, where all nodes play locally best responses, and identify different marginally stable structures. This notion is based on weak assumptions about node-players’ information and is necessary for Nash equilibrium and for pairwise stability. Second, efficient networks in absolute terms are characterized. Efficiency and stability are shown to be incompatible, but partial subsidizing is shown to be able to bridge the gap.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper seeks to contribute to the literature on economic models of strategic network formation. In this line of work, an increasing flow of research has been produced by game-theorists and economists in general since Myerson (1977) and Aumann and Myerson (1988).Footnote 1 In the wake of these pioneering papers in the field, two seminal influential models of network formation are Jackson and Wolinsky’s (1996) connections model and Bala and Goyal (2000) non-cooperative two-way flow model. In both models, networks are the result of creating links between pairs of individuals, by bilateral agreements in the former and unilateral decisions in the second, enabling value to flow through the resulting network. In both models, the cost of a link and its strength or quality (i.e. its decay factor) are exogenously given, giving rise to two-parameter models. The simplicity of these basic models imposes some rigidity: Necessarily bilateral formation and compulsory equal share of the fixed cost of each link in Jackson and Wolinsky’s model; and unilateral formation requiring full-covering of that fixed cost by its creator in Bala and Goyal’s model, and a fixed level of quality for the resulting link in both. The point of this paper is to provide and develop a more flexible connections model in both link formation and link performance.

In Olaizola and Valenciano (2020) we characterize efficient networks in a model of network formation where links are the result of investments and the quality of the connection through a link is never perfect and depends on the amount invested in it. A link-formation technology determines the quality of the resulting link as an increasing function of the investment and is the only exogenous ingredient in the model. In this paper we study a variation of this model where we assume a decreasing returns link-formation technology. Formally, a decreasing returns link-formation technology is a differentiable, increasing, strictly concave function whose range is [0, 1) , i.e. however much is invested in a link, connection is never perfect. As in the seminal models, the revenue from investment in links is the value that the nodes receive through the resulting network. This value is usually interpreted as information, and the strength of a link as the fidelity of transmission through it, although other interpretations are possible as argued below.

We first consider a decentralized context where links are formed according to a decreasing returns technology available to all players, and each link is the result of investments by the node-players that it connects, whose investments are assumed to be perfect substitutes. In this game-theoretic scenario the question of stability in the underlying network-formation game arises. We introduce a notion of marginal equilibrium of a classical flavor which is natural in this marginalist model but new in networks literature to the best of our knowledge. In a marginal equilibrium every player is playing a locally best response. More precisely, an investment profile is a marginal equilibrium if the investment vector of every player in the links in which he/she is involved is locally optimal, in the sense that sufficiently small changes of these investments do not increase his/her payoff. Necessary and sufficient conditions for marginal stability are established by imposing that the marginal benefit of the investment of any player in each of his/her links must be zero. The characterizing conditions that result from this classical economic principle have a clear intuitive interpretation and enable us to identify a variety of marginally stable architectures and their precise structures. At the same time, given that marginal stability is weaker than Nash-stability, these conditions are necessary for Nash equilibrium. Moreover, a suitable adaptation of Jackson and Wolinsky’s pairwise equilibrium notion to this setting turns out to entail also marginal stability as a necessary condition.

The question of efficiency is then addressed building on Olaizola and Valenciano (2020). It is established that the only possible non-empty efficient architectures in absolute terms for a decreasing returns link-formation technology are the complete network and the all-encompassing star, whose precise structures are also established. The family of decreasing returns link-formation technologies which have one of these non-empty structures as efficient is also characterized.

A comparison of the results on efficiency and stability yields the conclusion that non-empty efficient structures are not stable, not even marginally, and vice versa. Conditions for optimality and marginal stability are based on the same economic principle: imposing zero marginal benefit, but social (i.e. aggregate) benefit for efficiency, and individual benefit for stability. In order to achieve efficiency the strength of a link must maximize its contribution to the aggregate payoff, while from the point of view of either player involved in its support it must maximize his/her payoff at least locally in the case of marginal stability, hence the incompatibility. Nevertheless, it is proven that subsidizing the cost of each link bridges the gap between efficiency and marginal stability.

The rest of the paper is organized as follows. Section 2 briefly reviews some related literature. Section 3 introduces the model. In Section 4 marginal stability is presented and characterized. Section 5 addresses the question of efficiency. Section 6 is devoted to a discussion of the notion of marginal equilibrium; Sect. 6.1 discusses its relation with other stability notions; Sect. 6.2 examines the incompatibility of efficiency and stability and shows how a partial subsidy can bridge the gap; Sect. 6.3 sketches the extension of results for other decreasing returns technologies where players’ efforts are not perfect substitutes. Finally, Sect. 7 summarizes the results and suggests some possible extensions of the model. All proofs are relegated to an “Appendix”.

2 Related literature

In this brief review we concentrate mainly on papers published after the seminal connections models of Jackson and Wolinsky (1996) and Bala and Goyal (2000), where agents derive utility from their direct and indirect connections, and focus on those most closely related to the model studied in this paper.Footnote 2 Apart from other differences between our model and those commented below, there is one that applies to all of them: in our approach to stability the central concept is that of marginal equilibrium.

Bloch and Dutta (2009) introduce endogenous link strength in a connections model by replacing Jackson and Wolinsky’s discrete technology by a non-decreasing returns technology. They assume that the strength of a link connecting i and j where i invests \(x_{i}^{j}\) and j invests \( x_{j}^{i}\) is \(\phi (x_{i}^{j})+\phi (x_{j}^{i})\), with \(\phi \) non-decreasing, convex and s.t. \(\phi (0)=0\) and \(\phi (X)<1/2\), where X is the total endowment of each player. Thus there is no explicit cost of linking, but the budget constraint implies an opportunity cost. They prove that if \(\phi \) is strictly convex, the only Nash stable network is a star where all nodes invest all their resources in a single link. They also prove that the unique efficient network is a star, which is symmetric if \( \phi \) is linear. We instead assume technology to be a concave function of the joint investments of the players (i.e. we assume decreasing returns), whose efforts are assumed to be perfect substitutes, and have no budget constraint, hence the different results. In our model the complete network can also be efficient and a stable star must be periphery-sponsored. Deroian (2009) studies a similar model, but with directed communication, i.e. where links are directed, and proves that, as in Bloch and Dutta (2009), in equilibrium agents concentrate their investment on a single link and the complete wheel is the only efficient architecture and the unique Nash-stable architecture. Also in the wake of Bloch and Dutta (2009), So (2016) assumes that technology is an additively separable function of players’ investments, which are limited by a budget. But unlike Bloch and Dutta, so assumes that the strength of a link connecting i and j where i invests \(x_{i}^{j}\) and j invests \( x_{j}^{i}\) is \(\phi (x_{i}^{j})+\phi (x_{j}^{i})\), with \(\phi \) increasing and strictly concave, while in our model the strength is a function of \( x_{i}^{j}+x_{j}^{i}\), that is, players’s efforts (i.e. investments) are perfect substitutes. She obtains sufficient conditions for the symmetric complete network to dominate all star networks and for the symmetric star and the complete network to be Nash-stable, but no characterization is provided.

Other models with endogenous link strength less closely related to ours are the following. In Cabrales et al. (2011) players choose a level of socialization effort which is distributed across all possible bilateral interactions in proportion to the partner’s socialization effort. In Feri and Meléndez-Jiménez’s (2013) dynamic model the choice of whom to link to and a coordination game determines the strength of the links. In Harmsen-van Hout, Herings and Dellaert’s (2013) model individuals derive social value from direct connections and informational value from direct and indirect connections, but the more links an individual sustains the weaker they are. Boucher (2015) considers a model where individuals with a limited budget derive utility from self-investment and from direct connections, assuming the utility of a direct link to be a convex function of the investments of the two players involved, whose distance also enters as an argument in their utility. In Salonen (2015), Baumann (2021) and Griffith (2019) individuals with limited resources derive utility from self-investment and from direct connections, but assuming that the utility of a link is a strictly concave function of the investments of the two players. Ding (2019) considers a constant elasticity of substitution link-formation technology that nests unilateral and bilateral network formation.

3 The model

3.1 Preliminaries

An undirected weighted network (shortened in what follows to a network) is a pair (N, g) where \(N=\{1,2,\ldots ,n\}\) with \(n\ge 3\) is a set of nodes and g is a set of links specified by a symmetric adjacency matrix \(g=(g_{ij})_{i,j\in N}\) of real numbers \( g_{ij}\in [0,1)\), with \(g_{ii}=0\) for all i. Alternatively, g can be specified as a map \(g:N_{2}\rightarrow [0,1)\), where \(N_{2}\) denotes the set of all subsets of N with cardinality 2. When no ambiguity arises we omit N and refer to g as a network. In what follows \( {\underline{ij}}\) stands for \(\{i,j\}\) and \(g_{{\underline{ij}}}\) for \( g(\{i,j\}) \) for any \(\{i,j\}\in N_{2}\).Footnote 3 When \(g_{{\underline{ij}}}>0\) it is said that a link of weight or strength \(g_{{\underline{ij}}}\) connects i and j. \(N^{d}(i;g):=\{j\in N:g_{{\underline{ij}}}>0\}\) denotes the set of neighbors of node i. A path connecting nodes i and j is a sequence of distinct nodes of which the first is i, the last is j, and every two consecutive nodes are connected by a link. If i and j are two consecutive nodes in a path p, we write \(ij\in p\) or \({\underline{ij}}\in p\). \(\mathcal {P}_{ij}(g)\) denotes the set of paths in g connecting i and j.\(\ N(i;g)\) denotes the set of nodes connected to i by a path. A network is connected if any two nodes are connected by a path. A subnetwork of a network (N, g) is a network \((N^{\prime },g^{\prime })\) s.t. \(N^{\prime }\subseteq N\) and \(g^{\prime }\subseteq g\). A component of a network (N, g) is a maximal connected subnetwork. An isolated node (i.e. not connected to any other) is a trivial component. A network has a cycle if there are two nodes connected by two distinct paths.

When the codomain of g is \(\{0,1\}\) instead of [0, 1), i.e. \(g_{ {\underline{ij}}}\) only takes the values 0 or 1, we say that g is a graph and it can be specified as a set of links \( S\subseteq N_{2}\). In particular, the non-weighted underlying graph \(S_{g}\) of a weighted network g is \(S_{g}:=\{{\underline{ij}}\in N_{2}:g_{ {\underline{ij}}}>0\}\). When a given graph \(S\subseteq N_{2}\) constrains the construction of a network which must have it as its underlying graph, we call S an infrastructure.

The empty network/graph is the one for which \(g_{{\underline{ij}}}=0\) for all \({\underline{ij}}\in N_{2}\). A complete network/graph is one where \(g_{{\underline{ij}}}>0\) for all \({\underline{ij}}\in N_{2}\). A subcomplete network/graph has only one non-trivial component which is a complete subnetwork, i.e. \(g_{{\underline{ij}}}>0\) if and only if \(\underline{ ij}\in M_{2}\) for some \(M\subseteq N\). A star network/graph is one with only one non-trivial component with k nodes (\( 3\le k\le n\)) and \(k-1\) links in which one node (the center) is connected by a link with each of the other \(k-1\) nodes. A tree network/graph is one with only one non-trivial component and no cycles. A tree, a star network/graph is said to be all-encompassing if \(k=n\).

3.2 The model

As in the seminal connections models of Jackson and Wolinsky (1996) and Bala and Goyal (2000), we consider a set of nodes or players, each of them endowed with a value \(v>0\) imperfectly transmitted to any node directly or indirectly connected with it. There are two main interpretations of this value. One has already been mentioned: any node is endowed with valuable information. An alternative interpretation is that each node is a valuable contact. The main difference between our model, briefly sketched in the introduction and to be formalized in detail now, and the seminal models concerns link formation. In Olaizola and Valenciano (2020), a link-formation technology is a non-decreasing map \(\delta : \mathbb {R} _{+}\rightarrow [0,1)\) s.t. \(\delta (0)=0.\) If c is the amount invested in a link to connect two nodes, \(\delta (c)\) is the strength of the resulting link. If value is interpreted in terms of information, the strength of a link is the level of fidelity of the transmission of information through it. More precisely, \(\delta (c)\) is the fraction of information flowing through the link that remains intact. If value is interpreted in terms of value of a contact, then the strength of a link is the “strength of a tie” (Granovetter 1973), i.e. a measure of the quality/intensity/reliability of a contact or relationship. Under this interpretation, the model can be seen as a simplified, stylized model of a contact network. Flow occurs only through links invested in (\(\delta (0)=0\)), but perfect connection between different nodes is never reached (\(0\le \delta (c)<1\)). In this paper we assume a decreasing returns link-formation technology.

Definition 1

A decreasing returns link-formation technology (DR-technology for short) is a differentiable map \(\delta : \mathbb {R} _{+}\rightarrow [0,1)\) s.t. \(\delta (0)=0\), and satisfies the following conditions:

(C.1) \(\delta ^{\prime }(c)>0\), for all \(c\ge 0\), i.e. it is increasing.

(C.2) It is strictly concave.

Assuming smoothness of \(\delta \) makes it possible to use differential calculus, which allows for a relatively simple formal marginal analysis without getting involved in more sophisticated technical issues. C.2 amounts to assuming technology to be decreasing returns.

We consider the following model based on this basic ingredient. A set \( N=\{1,2,\ldots ,n\}\) of nodes or players can be connected by links formed according to a given decreasing returns link-formation technology \(\delta \). Players can invest in links with other nodes. An investment profile is specified by a matrix \(\mathbf {c}=(c_{ij})_{i,j\in N}\), where \(c_{ij}\ge 0\) (with \(c_{ii}=0\)) is the investment of player i in the link connecting players i and j, and determines a link-investment vector \( \overline{\mathbf {c}}:\)

which in turn, through the link-formation technology available, \(\delta \), yields a weighted network denoted by \(g^{\mathbf {c}}\) or by \(g^{\overline{\mathbf {c}}}\), where

Thus players’ efforts are perfect substitutes.Footnote 4 Let \(\mathcal {P}_{ik}(g^{\mathbf {c}})\) denote the set of paths in \(g^{\mathbf {c}}\) connecting i and k. For a path \(p\in \mathcal {P}_{ik}(g^{\mathbf {c}})\), let \(\delta (p)\) denote the product of the strengths of each link in that path, i.e. if \( p=ii_{2}i_{3}\ldots i_{m}k\), then \(\delta (p)=\delta (c_{\underline{ii_{2}} })\delta (c_{\underline{i_{2}i_{3}}})\ldots \delta (c_{\underline{i_{m}k}})\). Thus, player i values information/contact from/with k via p by \(v\delta (p).\) As in Jackson and Wolinsky (1996) and Bala and Goyal (2000), we assume that player i’s valuation of the information/contact from/with \(k\ne i\), denoted by \(I_{ik}(g^{\mathbf {c}}),\) is that which is routed via the best possible route from k, that is

where \({\overline{p}}_{ik}\) is an optimal path connecting i and k, i.e. \({\overline{p}}_{ik}\in \arg \max _{p\in \mathcal {P}_{ik}(g^{ \mathbf {c}})}\delta (p)\) (if no path connects i and k we set \(\delta ( {\overline{p}}_{ik})=0\)). Under the interpretation of value as information, the optimal path represents the channel that transmits information most accurately.Footnote 5 Under the interpretation of contact as the source of value, the optimal path represents the most reliable (maybe indirect) via of contact. Then i’s overall revenue from \(g^{\mathbf {c}}\) is

Thus, i’s payoff is the value received by i minus i’s investment:

and the net value of the network resulting is the aggregate payoff, i.e. the total value received by the nodes minus the total cost of the network:

In this setting two main issues arise. A game in strategic form, where a strategy of a player i is a vector of investments (\(\mathbf {c} _{i}=(c_{ij})_{j\in N}\), with \(c_{ii}=0\)) and the payoff function is given by (1), is implicitly defined. Thus the question of stability arises: What structures are stable and under what conditions? The notions usually applied in a context such as this are Nash equilibrium or pairwise equilibrium. Nevertheless, we devote preferential attention to a weaker notion of stability new in this context: marginal equilibrium. A second issue is the question of efficiency: What structures are efficient in the sense of maximizing the net value given by (2) and under what conditions?

We address the question of stability first and then look at efficiency. Thus we deal with a model with three primitives, the number of nodes/players n, the value v (of information or contact) at each node, and the link-formation technology represented by function \(\delta .\)Footnote 6

4 Stability

We consider the situation where nodes are players who form links by investing in them and using an available DR-technology. An investment profile \(\mathbf {c}=(c_{ij})_{i,j\in N}\) (an \(n\times n\) matrix with zeros in the main diagonal) where \(c_{ij}\ge 0\) is the investment of player i in the link connecting players i and j, actually represents a strategy profile, where its i-row, \(\mathbf {c}_{i}=(c_{ij})_{j\in N}\) with \(c_{ii}=0 \), is the strategy of player i, whose payoff is given by

This situation raises the question of stability. We consider a weak form of stability which is, as far as we know, new in network literature, but quite natural in the context of this “marginalist” model. Moreover, in addition to its interest per se, its characterization provides necessary conditions for stronger notions of stability as later discussed in Sect. 6.1.

If \(\mathbf {c}=(c_{ij})_{i,j\in N}\) is an investment profile and \(\mathbf {c} _{i}^{\prime }=(c_{ij}^{\prime })_{j\in N}\) an investment vector of player i, let \((\mathbf {c}_{-i};\mathbf {c}_{i}^{\prime })\) denote the investment profile that results from replacing row i in \(\mathbf {c}\) by \(\mathbf {c} _{i}^{\prime }\).

Definition 2

An investment profile \(\mathbf {c}=(c_{ij})_{i,j\in N}\) is marginally stable (or a marginal equilibrium) if for some \(\varepsilon >0\) the following holds: for all \(i\in N\) and all \(\mathbf {c}_{i}^{\prime }=(c_{ik}^{\prime })_{k\in N}\) s.t. \(c_{ik}^{\prime }>0\) only if \(c_{{\underline{ik}}}>0\) and \( \left| c_{ik}-c_{ik}^{\prime }\right| <\varepsilon \) for all k, \(\Pi _{i}^{\delta }(\mathbf {c})\ge \Pi _{i}^{\delta }(\mathbf {c}_{-i}; \mathbf {c}_{i}^{\prime }).\)

In other words, an investment profile is marginally stable if the investments of every node in its links are locally optimal, in the sense that sufficiently small changes in its investments in the links in which it is involved do not increase its payoff.

It is worth emphasizing the interest of this weak notion of equilibrium per se. In this model, Nash equilibrium poses enormous computational and informational difficulties. Apart from the computational difficulties of calculating best responses in a complex network, it requires a huge amount of information. Moreover, if the network is the means of transmission of information, how do players know about the revenue from links with players with whom they are not directly or even indirectly connected? If players are only aware of the marginal contribution of their investments in links in which they are actually involved (a much weaker assumption about their information) a marginal equilibrium means that no player receives signals inducing him/her to change his/her investments and the situation will remain unchanged. If the model is interpreted as a simplified, stylized homogeneous model of a contact or social network, it is reasonable to assume that users may have the sensibility required to feel whether or not it is worth increasing or decreasing the strength of a link, while in such a context the idea of computing a best response seems quite unrealistic.

Note that the clause “s.t. \(c_{ik}^{\prime }>0\) only if \(c_{ {\underline{ik}}}>0\)” restricts responses to existing links. In other words, the creation of new links is not a response w.r.t. which a marginal equilibrium must be immune. A stronger variant of Definition 2 closer to Nash equilibrium, but still weaker, is obtained by eliminating this clause.

Definition 3

An investment profile \(\mathbf {c}=(c_{ij})_{i,j\in N}\) is strongly marginally stable (or a strong marginal equilibrium) if for some \( \varepsilon >0\) the following holds: for all \(i\in N\) and all \(\mathbf {c} _{i}^{\prime }=(c_{ik}^{\prime })_{k\in N}\) s.t. \(\left| c_{ik}-c_{ik}^{\prime }\right| <\varepsilon \) for all k, \(\Pi _{i}^{\delta }(\mathbf {c})\ge \Pi _{i}^{\delta }(\mathbf {c}_{-i};\mathbf {c} _{i}^{\prime }).\)

Although strictly speaking one should refer to stability of investment profiles, we often express our results in terms of the resulting networks. Thus a “(strongly) marginally stable network” should be read as a weighted network that results from a (strongly) marginally stable investment profile. The following lemma shows that the two notions are equivalent for connected networks, where any node i is indirectly connected with every other node j with which i has no direct link. In such case, that player has no marginal incentive to invest c in creating a direct link as far as \(\delta (c)<\delta ({\overline{p}}_{ij})\).

Lemma 1

Let \(\mathbf {c}=(c_{ij})_{i,j\in N}\) be an investment profile. If \(g^{ \mathbf {c}}\) is connected, then \(\mathbf {c}\) is strongly marginally stable if and only if it is a marginal equilibrium.

It is convenient to introduce some notation in order to formulate and prove the following characterization establishing necessary and sufficient conditions for an investment profile to be marginally stable. Note that expression (3) of the payoff of a player i, involves the choice of an optimal path \({\overline{p}}_{ik}\) for each \(k\in N(i;g^{\mathbf {c }})\). We denote by \(\overline{\varvec{p}}_{i}=\{{\overline{p}}_{ik}:k\in N(i;g^{\mathbf {c}})\}\) any particular choice of such optimal paths. If \( {\overline{p}}_{ik}\) is an optimal path that contains link ij, we make use of the notation:

We have then the following characterizing result making use of Kuhn-Tucker’s conditions:

Theorem 1

Under a DR-technology \(\delta \), for an investment profile \(\mathbf {c}^{ \mathbf {*}}=(c_{ij}^{\mathbf {*}})_{i,j\in N}\) to be marginally stable the following conditions are necessary and sufficient. For all \( i,j\in N\) \((i\ne j)\) s.t. \(c_{{\underline{ij}}}^{\mathbf {*}}>0,\)

(i) If \(c_{ij}^{\mathbf {*}}>0\) any optimal path connecting i and k that contains link ij is the only optimal path connecting them and

(ii) If \(c_{ij}^{\mathbf {*}}=0,\ \)

Part (i) establishes that, in a marginal equilibrium, if i sees k through an optimal path in which he/she invests it cannot be the case that i sees k also through another optimal path. In other words, in a marginally stable profile, the optimal paths in which a player invests form a unique tree rooted at that node. As to (5), it is the result of requiring the marginal benefit of the investment of any player in each of the links that he/she invests in to be zero. Condition (5), resulting when \(c_{ij}^{*}>0\), has a clear interpretation: If player i invests in a link with j, the denominator of the fraction in formula (5) that yields \(\delta ^{\prime }(c_{{\underline{ij}} }^{*})\) is v times the sum of the fidelity levels through all subpaths up to j of optimal paths containing link \({\underline{ij}}\) through which player i receives value. In other words, it is the actual amount of value that reaches j on its optimal way to i. Thus this sum is a measure of the importance of link \({\underline{ij}}\) to player i: the greater this amount, the smaller \(\delta ^{\prime }(c_{ {\underline{ij}}}^{*})\), i.e. the greater \(c_{{\underline{ij}}}^{*}\) and \(\delta (c_{{\underline{ij}}}^{*})\).

Condition (ii) means a lack of incentives to invest in a link entirely supported by the other player. Condition (6) ensures that not investing in link \({\underline{ij}}\) is optimal for i because player j is investing in the link the amount that player i would be willing to invest for all the value that he/she can receive through link \( {\underline{ij}}\) or even more.Footnote 7

Equation (5) and inequality (6), which are necessary conditions for an investment profile \(\mathbf {c}^{*}\) to be marginally stable, involve only the resulting investment vector \(\overline{ \mathbf {c}}^{*}\), not directly the investment profile \(\mathbf {c}^{*} \). Nevertheless parts (i) and (ii) actually involve \( \mathbf {c}\), because which condition ((5) or (6)) applies for a link \({\underline{ij}}\) depends on whether \(c_{ij}^{*}>0\) or \(c_{ij}^{*}=0\). A direct consequence of these conditions is the following important conclusion.

Corollary 1

Under a DR-technology \(\delta \), if two players are connected by a link in the network resulting from a marginally stable investment profile but do not receive the same amount of valuable information/contact through that link, all the investment in that link is made by the player who receives more through it.

As for strong marginal equilibrium we have

Proposition 1

Under a DR-technology \(\delta \), an investment profile \(\mathbf {c}^{\mathbf { *}}=(c_{ij}^{\mathbf {*}})_{i,j\in N}\) is a strong marginal equilibrium if and only if in addition to conditions (i) and (ii) of Theorem 1, either \(\delta ^{\prime }(0)\le \frac{1}{v+K}\), where K is the value received by the node that receives the greatest amount of value in \(g^{\mathbf {c}^{\mathbf {*}}}\), or \(g^{\mathbf {c}^{\mathbf {*}}}\) is connected.

The characterizing conditions of Theorem 1 along with Corollary 1 can be applied to establish whether a certain infrastructure can be sustained in marginal equilibrium in the sense of the following definition.

Definition 4

Given an infrastructure \(S\subseteq N_{2}\), an investment profile \(\mathbf {c= }(c_{ij})_{i,j\in N}\) sustains S in marginal equilibrium if it supports S and \(\mathbf {c}\) is a marginal equilibrium. When such \(\mathbf {c}\) does exist we say that infrastructure S is sustainable in marginal equilibrium.

Based on Theorem 1 and Corollary 1 it can be established that certain infrastructures, such as subcomplete networks, complete networks, stars, trees, and circles, are sustainable in marginal equilibrium and such profiles can be characterized.Footnote 8 For instance, a subcomplete network is marginally stable if and only if all links receive the same joint investment \({\widehat{c}}_{eq}\), s.t.

A star connecting p (\(3\le p\le n\)) nodes is marginally stable if and only if it is periphery-sponsored and all links receive the same joint investment \(c_{p,eq}^{*}\), s.t.

Conditions which, for the complete and the all-encompassing star to be marginally stable, become

To illustrate this we give in appendix the proof of the following result for the case of a tree.

Proposition 2

Under a DR-technology \(\delta \) continuously differentiable s.t. \(\delta ^{\prime }(0)>\frac{1}{v}\), any tree is sustainable in marginal equilibrium, and any all-encompassing tree infrastructure is sustainable in strong marginal equilibrium.

As mentioned in the proof, by Corollary 1, in the marginally stable profile \( \mathbf {c}\) s.t. \(g^{\mathbf {c}}\) is a tree, peripheral or terminal nodes must pay the full cost of their links, and the cost of any link where the nodes that it connects do not receive the same amount of value through it must be paid for fully by the node who receives more through it.Footnote 9

5 Efficiency

We now turn our attention to the question of efficiency.

Definition 5

An investment profile \(\mathbf {c=}(c_{ij})_{i,j\in N}\) is efficient if \( v(g^{\overline{\mathbf {c}}})\ge v(g^{\overline{\mathbf {c}}^{\prime }}),\) for all \(\mathbf {c}^{\prime }\mathbf {=}(c_{ij}^{\prime })_{i,j\in N}.\)

In the model the net value of a network \(g^{\mathbf {c}}\), given by (2), that results from an investment profile \(\mathbf {c} =(c_{ij})_{i,j\in N}\), depends entirely on the investment vector \(\overline{ \mathbf {c}}=(c_{{\underline{ij}}})_{{\underline{ij}}\in N_{2}}\), where \(c_{ {\underline{ij}}}:=c_{ij}+c_{ji}\). In other words, given that players’ efforts are perfect substitutes, the question of efficiency depends entirely on the investments in every link, but it is immaterial who pays for them. Thus the answer to the question of efficiency is the same, regardless of whether the investments are made by node-players in a decentralized way or by a central planner. When \(\mathbf {c=}(c_{ij})_{i,j\in N}\) is efficient, we indistinctly say that investment vector \(\overline{\mathbf {c}}=(c_{{\underline{ij}}})_{ {\underline{ij}}\in N_{2}}\) or network \(g^{\overline{\mathbf {c}}}\) is efficient. For this reason we give preference in this section to expressing results in terms of investment vectors \(\overline{\mathbf {c}}=(c_{\underline{ ij}})_{{\underline{ij}}\in N_{2}}\) and the resulting network \(g^{\overline{ \mathbf {c}}}\).

In Olaizola and Valenciano (2020) it is proved that for any link-formation technology \(\delta \), i.e. any \(\delta : \mathbb {R} _{+}\rightarrow [0,1)\) non-decreasing and s.t. \(\delta (0)=0\), in a connection model like the one considered here, the only possibly efficient non-empty networks are the all-encompassing star, the complete network and, under certain tie-conditions, also a whole range of intermediate particular nested split graph structures.Footnote 10 This conclusion thus also applies to DR-technologies. However, the following characterizing result for DR-technologies emerges, which refines Olaizola and Valenciano (2020) in three ways: First, it establishes that DR-technologies rule out the possibility of tie-conditions; second, it provides marginal conditions for the only two possibly non-empty architectures to be efficient; and third, it provides a precise characterization of the DR-technologies for which there exists a non-empty efficient network.

Theorem 2

Under a DR-technology \(\delta \): (i) The only non-empty possibly efficient networks are the optimal complete network and any optimal all-encompassing star. In either case all links receive the same investment, \({\widehat{c}}_{ef}\) for the complete and \(c_{ef}^{*}\) for the star, where

(ii) The empty network is efficient if and only if \(\delta (c)\le \varphi _{n}(c)\) for all c, with \(\varphi _{n}\) given by

Otherwise, either the optimal complete network or any optimal all-encompassing star is efficient.

(iii) Whatever the DR-technology, for n big enough either the optimal complete network or any optimal all-encompassing star is efficient.

Conditions of optimality (10) are the result of imposing the marginal contribution of the investment in every link to the net value of a complete network and a star network to be zero. Note that there is only one optimal complete network, but there are n optimal all-encompassing stars. Function \(\varphi _{n}(c),\) defined by (11), sets a precise bound below which a technology is poor enough to make unprofitable the formation of any network.Footnote 11 Namely, for any DR-technology worse than \(\varphi _{n}\) , i.e. whose graph is below (i.e. never above) that of \(\varphi _{n}\), and only for such DR-technologies, no network yields a positive net value. In this case the empty network is efficient.Footnote 12 Otherwise, either the optimal complete network or any optimal all-encompassing star is efficient, but only exceptionally a tie may occur and both be efficient. Which of them is efficient in this case depends on which net value is greater, that of the optimal complete network or that of an optimal star. That is to say, this entirely depends on

However, this comparison involves \(\delta ({\widehat{c}}_{ef})\), \(\delta (c_{ef}^{*})\), v and n, where \({\widehat{c}}_{ef}\) and \(c_{ef}^{*}\) are determined by (10), and does not admit a simple geometric interpretation.Footnote 13 Note that the optimal complete network yields a positive net value if and only if \(\delta ^{\prime }(0)>1/2v\), which does not depend on the number of nodes, while an optimal all-encompassing star yields a positive net value if and only if \(\delta (c)>\varphi _{n}(c)\) for some c, which actually depends on n. For sufficiently good technologies the complete network is efficient.Footnote 14 Part (iii) means that for however bad technologies, for a sufficiently large number of nodes an all-encompassing star network becomes efficient.

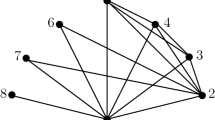

Figure 1 illustrates this, showing the graph of function \(\varphi _{n}\) for \( v=1\) and different numbers of nodes: \(n=5,12,22\) and 42. The greater the number of nodes, the lower the graph of this function is, i.e. the worse the technology must be to make any star unprofitable. Two dashed lines represent the graphs of two DR-technologies: \(\delta _{1}(c)=\frac{c}{1+c}\) and \( \delta _{2}(c)=\frac{c}{2+2c}\). Obviously, technology \(\delta _{2}\) is worse than \(\delta _{1}\). Thus, for instance, for \(n=5\) no symmetric star or complete network yields a positive net value under \(\delta _{2}\), while under \(\delta _{1}\) there exist both optimal complete and star networks and one of them will be efficient. For \(n=22\) there exist both optimal complete and star networks under both technologies, \(\delta _{1}\) and \(\delta _{2}\).

From the point of view of inequality, the only two efficient structures are extremely opposed: In the complete network all nodes receive the same amount of valuable information/contact, while in the all-encompassing star it is all but one: The center, which receives the maximal amount.

6 Discussion

In our opinion, the notion of marginal stability, beyond its character of necessary for both Nash equilibrium and pairwise equilibrium as shown in 6.1, is a reasonable and tractable notion of stability based on weak assumptions about players’ information. The multiplicity of architectures that can be sustained in marginal equilibrium can be seen as a great drawback. This seems disappointing because of the difficulty of making crisp predictions. Nevertheless, there may be some prejudice in the wishful expectation of a few stable outcomes. Is it reasonable to expect it in complex situations? A look at the variety of architectures of actual networks arising from different contexts and applications suggests the opposite.

A property worth noting of marginal equilibria is its resilience in response to shocks such as deletion of nodes under certain conditions. For instance, a marginally stable star network ceases to be so if a spoke vanishes. Nevertheless, by diminishing the investments of the remaining spokes a new marginal equilibrium sustaining the new star with one arm less can be obtained surely if \(\delta ^{\prime }(0)>\frac{1}{v}\) or, otherwise, if the number of nodes is big enough. A similar situation occurs by the elimination of a node in a tree network. This yields a network with a number of tree components equal to the degree of the node eliminated: namely, in general, some isolated nodes and some tree networks of smaller diameters. In a circle network the elimination of a node yields a line (particular case of a tree). In all these cases some of the resulting components can possibly be sustained in marginal equilibrium by readjusting the investments of the nodes. In the case of a marginally stable subcomplete network the elimination of a node yields a new marginally stable subcomplete network with a node less.

The variety of graph architectures that can be shown to be sustainable in marginal equilibrium can be misleading, conveying the impression that every graph is sustainable. This is not so as the following example shows. Consider a star with a sufficient number, p, of nodes and a technology \( \delta \) such that \(\delta ({\widehat{c}}_{eq})\) and \(\delta (c_{p-1,eq}^{*})\), s.t. (8), verify

Then, the graph that results from adding to a star graph of p nodes a link connecting two spokes is not sustainable in marginal equilibrium because whatever the investments of those two spokes in the link that connects them, both nodes would have an incentive to diminish their investment in that link.

6.1 Marginal stability versus other stability notions

Nash equilibrium is the stability concept applied in Bala and Goyal (2000) network formation model, where players form links (of fixed cost and strength) unilaterally. The notion applies naturally also in the current model: An investment profile is Nash-stable if no player is interested in changing his/her investments unilaterally. Formally:

Definition 6

An investment profile \(\mathbf {c}=(c_{ij})_{i,j\in N}\) is Nash-stable if for all i and \(\mathbf {c}_{i}^{\prime }=(c_{ij}^{\prime })_{j\in N}\)

Obviously, strong marginal stability, which is a “local” version of Nash equilibrium, is a weaker notion than Nash-stability, and consequently than marginal stability too.

In Jackson and Wolinsky (1996) all links have the same strength and the same cost, which must be equally split between the two players that they connect. Their pairwise-stability requires that no node should have an incentive to withdraw support from any of its links, and no pair of nodes can benefit by forming a new one. Assuming that players can freely invest in links, which seems a most reasonable assumption in the current setting (while the only options in Jackson and Wolinsky (1996) are to invest or not to invest), a suitable adaptation of the pairwise stability notion of Jackson and Wolinsky (1996) to the current and more flexible model is the following:

Definition 7

An investment profile \(\mathbf {c}=(c_{ij})_{i,j\in N}\) is pairwise-stable if:

(i) for all \(i\in N,\) and all \({\underline{ij}}\in N_{2}\) s.t. \( c_{{\underline{ij}}}>0,\) node i cannot improve its payoff by increasing or decreasing its investment in link ij, and

(ii) for all \({\underline{ij}}\in N_{2}\) s.t. \(c_{{\underline{ij}} }=0,\) no pair of investments of i and j in linking i and j can improve the payoff of one of them without diminishing the payoff of the other.

As can easily be checked, condition (i) in Definition 7 implies conditions (i) and (ii) of Theorem 1, which that theorem establishes as necessary and sufficient for marginal stability.Footnote 15 Therefore, this natural adaptation of pairwise stability in our setting implies marginal stability. Moreover, condition (i) along with condition (ii) in Definition 7 implies also strong marginal stability. It may seem surprising that a notion of stability at “link level”, refines a notion of Nash stability at “strategy level” even if only locally. The explanation lies in the non-discrete character of the technology, which allows players more than just invest or not to invest, which leads to the natural reformulation of pairwise stability proposed. Inverting the point of view, as pointed out in Footnote 15, a weaker formulation of marginal stability at only “link level” is equivalent to marginal equilibrium under DR-technologies.

Consequently, the characterizing conditions for marginal stability established in Theorem 1 are necessary conditions for Nash equilibrium and pairwise stability.

6.2 Efficiency versus stability

In view of the results on efficiency and on stability we have the following.

Proposition 3

Under a DR-technology, efficiency and Nash or pairwise stability or even marginal stability are incompatible, unless \(\delta ^{\prime }(0)\le \frac{1 }{2v}\), in which case the empty network is efficient, Nash-stable and pairwise stable.

From the results in Sects. 4 and 5 it follows that \({\widehat{c}}_{eq}< {\widehat{c}}_{ef}\) and \(c_{eq}^{*}<c_{ef}^{*}\), and consequently a non-empty efficient network requires link-investments which are not stable because they give players the opportunity of free riding by taking advantage of externalities, even if responses are restricted to being profitable only marginally. The same occurs in the seminal discrete models of Jackson and Wolinsky (1996) and Bala and Goyal (2000). The robustness of this incompatibility, now in a much more flexible model, may seem somewhat surprising. Nevertheless, the reason is clear. Similarity and difference between (10) and (9), both stem from the same source. Conditions for optimality and marginal stability are based on the same economic principle: imposing zero marginal benefit, but social (i.e. aggregate) benefit for efficiency, and individual benefit for stability. From the point of view of efficiency the strength of a link must maximize its contribution to the aggregate payoff, while from the point of view of either player involved in its support it must maximize his/her payoff at least locally in the case of marginal stability, hence the incompatibility.

Nevertheless, in a mixed environment, a central planner can make efficiency and marginal equilibrium compatible by subsidizing each dollar invested by a player with another dollar.

Proposition 4

Under a DR-technology, if the amount invested by any player in each of his/her links is subsidized with the same amount, efficiency can be sustained in marginal equilibrium.

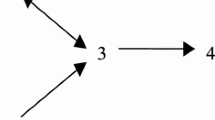

Notice that from the point of view of players the effect of this subsidy is like replacing the actual technology \(\delta \) by a better technology \( \delta _{1},\) s.t. \(\delta _{1}(c)=\delta (2c)\), also a DR-technology. In fact, more generally, subsidies of the form \(\delta _{\lambda }(c)=\delta ((1+\lambda )c)\), i.e. of \(\lambda \) dollars per dollar invested, with \( \lambda \) ranging from 0 to 1, bridge the gulf between marginal equilibrium and efficiency. Figure 2 shows the graphs of technology \(\delta (c)=\frac{c}{2c+2}\) and that of \(\delta _{1}(c)=\delta (2c)=\frac{c}{2c+1}\), superimposed over those of \(\varphi _{n}\) for \(n=5,12,22\) and 42 (as in Fig. 1).

6.3 Extension to other decreasing returns technologies

It has been assumed that players’ efforts are perfect substitutes, but, as is mentioned in Footnote 4, the main results remain true under other assumptions.

Consider first decreasing marginal rate of substitution of players’ efforts. Namely, assume that the strength of a link is given by \(g_{ij}^{\mathbf {c} }=\lambda (c_{ij},c_{ji})\), where function \(\lambda : \mathbb {R} _{+}^{2}\rightarrow [0,1)\) is differentiable, with both partial derivatives positive (therefore increasing in both arguments), strictly concave in \( \mathbb {R} _{++}^{2}\), symmetric (i.e. \(\lambda (x_{1},x_{2})=\lambda (x_{2},x_{1})\)), with decreasing marginal rate of substitution \(\frac{\partial \lambda /\partial x_{1}}{\partial \lambda /\partial x_{2}}\), and s.t. \(\lambda (0,x)=\lambda (x,0)=0\). Theorem 2 can be extended for such technologies. Just define \(\delta (c):=\lambda (\frac{c}{2},\frac{c}{2})\), which is the greatest strength of a link achievable with budget c, i.e. the greatest value of \(\lambda (c_{ij},c_{ji})\) with \(c_{ij},c_{ji}\) s.t. \( c_{ij}+c_{ji}\le c\). Therefore a necessary condition for a network to be efficient is that the cost of every link is equally split between the two players it connects. In other words, in an efficient network the strength of a link of cost c must be \(\delta (c)\). Such \(\delta \) satisfies all the conditions of a DR-technology as specified in Definition 1. Then Theorem 2 and formulae (10) and (11) extend immediately. As to marginal stability, Theorem 1 can also be adapted, while Corollary 1 ceases to hold: now if two players are connected by a link in the network resulting from a marginally stable investment profile but do not receive the same amount of valuable information/contact through that link, the greatest part of the investment in that link is made by the player who receives more through it, but never all the investment.

Consider now complementarity of players’ efforts. Assume a technology \( \lambda (c_{ij},c_{ji})=\phi (\min \{c_{ij},c_{ji}\}),\) with \(\phi : \mathbb {R} _{+}\rightarrow [0,1)\) differentiable, strictly concave and s.t. \( \phi (0)=0\) and \(\phi ^{\prime }(c)>0\) for all \(c\ge 0\). Then, again, efficiency of a network requires that the cost of each link is equally split, and Theorem 2 extends as in the previous case. Note that in this case \(\lambda \) is not differentiable, but has directional derivatives in all directions in all points in \( \mathbb {R} _{++}^{2}\) and Theorem 1 can be adapted. Note that marginal stability implies that the cost of any link is equally split.

7 Concluding remarks

We have developed a marginalist decreasing returns connections model which is a natural extension of the seminal discrete connections models of Jackson and Wolinsky (1996) and Bala and Goyal (2000). The basic logic is the same, payoff = valuable information/contact − investment, but it is based on a non-discrete, smooth decreasing returns link-formation technology, which is the only exogenous ingredient in the model.

We introduce a notion of marginal equilibrium, natural in this marginalist model and new in the networks literature to the best of our knowledge, and obtain necessary and sufficient characterizing conditions for this weak notion of stability (Theorem 1). In a marginal equilibrium, the optimal paths or channels for information or contact which each player pays for form a well-defined tree, i.e. a multiplicity of such optimal paths is incompatible with marginal stability. Moreover, this along with the other characterizing conditions (Theorem 1 and Corollary 1) enables a variety of graph architectures or infrastructures sustainable in marginal equilibria to be identified, such as subcomplete graphs, stars, trees and circles, and determine the investment profiles that sustain them in marginal equilibrium.

As to Nash-stability and the suitable adaptation of pairwise-stability to the model proposed here, no characterization has been obtained. This is not surprising given that there is no characterization either in the discrete binary models of Jackson and Wolinsky (1996) and Bala and Goyal (2000). Nevertheless, marginal stability has been proved necessary for both notions of stability.

The characterization of efficient networks for DR-technologies is solved by Theorem 2, which establishes that the only possible non-empty efficient structures are symmetric all-encompassing stars and complete networks, and characterizes the family of DR-technologies which admit one of these non-empty structures as efficient. This result shows the somewhat surprising robustness of the result on efficiency in the seminal discreet two-parameter connections model of Jackson and Wolinsky (1996).

Finally, the conditions for efficiency (Theorem 2) and stability, even if only marginal (Theorem 1), lead to the conclusion that they are incompatible and make it transparent why. Conditions for efficiency and for marginal stability are based on the same economic principle: imposing zero marginal benefit, but social (i.e. aggregate) benefit for efficiency, and individual benefit for stability. Nevertheless, it is shown that subsidizing up to a dollar per dollar invested by each player would bridge the gap between efficiency and marginal stability.

There are several lines of further research that might be of particular interest. First, although Theorem 1 gives necessary and sufficient conditions for marginal equilibrium, no complete characterization of the architectures sustainable in marginal equilibrium has been provided. Second, exploring the impact of assuming heterogeneity, in technology and/or in individual values.Footnote 16 Third, enriching the model by introducing some dynamics. This seems especially desirable related to marginal stability. If nodes are only sensitive to the marginal value of their investments in actual links how does a network form? This calls for a random ingredient, be it in the prior formation of an infrastructure or in that of the network itself, where stochastic stability can be studied (see Feri 2007). A feature worth further examination which also calls for a dynamic model is that of marginal equilibrium resilience in response to shocks, such as deletion of nodes.

Notes

This means leaving aside a number of important papers, such as those in the wake of Ballester et al. (2006).

With this convention \(x_{{\underline{ij}}}\equiv x_{{\underline{ji}}}\), while \( x_{ij}\ne x_{ji}\) in general.

This assumption is natural in this model and can be found in other contexts (see e.g. Bramoullé and Kranton 2007). A more complex alternative would be to assume \(g_{ij}^{\mathbf {c}}=\delta (c_{ij},c_{ji})\) with \(\delta \) concave, but efforts are not perfect substitutes. Section 6.3 sketches the extension for such technologies.

This interpretation is consistent with the assumption that the information received through worse paths is redundant and consequently ignored.

It can be assumed w.l.o.g. that \(v=1\), which slightly simplifies the presentation. However, it is preferable not to do so and to keep this otherwise hidden parameter explicit. If investments in links are made by a planner, this value can be interpreted as a subjective evaluation by the planner w.r.t. which the efficiency objective is specified. Nevertheless, the reader may choose to ignore all occurrences of v by assuming \(v=1\).

Alternatively, Theorem 1 can be reformulated like this:

Theorem 1 (reformulated) Under a DR-technology \( \delta \), an investment profile \(\mathbf {c}^{\mathbf {*} }=(c_{ij}^{\mathbf {*}})_{i,j\in N}\) is marginally stable if and only if for all \(i,j\in N\) \((i\ne j)\) s.t. \(c_{ {\underline{ij}}}^{\mathbf {*}}>0,\)

$$\begin{aligned} \delta ^{\prime }(c_{{\underline{ij}}}^{*})\le \frac{1}{v\sum _{k\in N(i;g^{\mathbf {c}^{\mathbf {*}}})\text { }s.t.\text { }{\underline{ij}}\in {\overline{p}}_{ik}}\delta ({\overline{p}}_{ik}^{ij})}\quad \text {\textit{and}} \quad c_{ij}^{\mathbf {*}}(\delta ^{\prime }(c_{{\underline{ij}}}^{*})- \frac{1}{v\sum _{k\in N(i;g^{\mathbf {c}^{\mathbf {*}}})\text { }s.t.\text { } {\underline{ij}}\in {\overline{p}}_{ik}}\delta ({\overline{p}}_{ik}^{ij})})=0 \end{aligned}$$and whenever \(c_{ij}^{\mathbf {*}}>0\) any optimal path connecting i and k that contains link ij is the only optimal path connecting them.

The proofs, which we omit here to shorten the paper, can be found in the working paper version of this work (https://mpra.ub.uni-muenchen.de/107585/). It follows immediately that any graph which has trees, circles, stars, and subcomplete graphs as non-trivial components can also be sustained in marginal equilibrium. Moreover, it can be checked that other structures sustainable in marginal equilibrium can be obtained by combining them, for instance a circle in which each node is connected with the same number of peripheral nodes, each of which supports its link.

Even if condition \(\delta ^{\prime }(0)>\frac{1}{v}\) does not hold, a tree infrastructure continues to be sustainable in marginal equilibrium for a sufficiently high number of nodes that it connects. In fact, this condition enables the results of Proposition 2 (first part) to be proved for any number of nodes. The symmetry of the star enables the precise smaller bound for \(\delta ^{\prime }(0)\) to be calculated, while a similar refinement of this bound for an arbitrary tree would require specific study.

A precise formulation of the tie-conditions for this exception to occur is needed to prove the characterizing result. This is given in the proof of Theorem 2.

Notice that, as it can be easily checked, \(\varphi _{n}(0)=0,\) \(\varphi _{n}^{\prime }(c)>0,\) \(\varphi _{n}{}^{\prime \prime }(c)<0\), and consequently function \(\varphi _{n}\) meets all but one of the conditions for a DR-technology as per Definition 1: for a big enough c (for \(c>nv\), in fact) \(\varphi _{n}(c)>1\). In other words, constraint \( \delta (c)\le \varphi _{n}(c)\) is actually active as far as \(\varphi _{n}(c)<1,\) i.e. for \(c\in (0,nv)\) (note that \(\varphi _{n}(nv)=1\) for all n).

Although not necessarily the only efficient one. It may be the case that optimal all-encompassing stars or the optimal complete network yields also a zero net value.

In Jackson and Wolinsky’s (1996) discrete model with 3 parameters, \(n,\delta \) and c (they assume \(v=1)\) expression (12) becomes

$$\begin{aligned} \frac{n(n-1)}{2}(2v\delta -c) > rless (n-1)(2v\delta +(n-2)v\delta ^{2}-c)), \end{aligned}$$which has a simple geometric interpretation describing the regions of values of the parameters where which of the two architectures is efficient.

Although not always comparable in this sense, technology \(\delta _{1}\) is obviously better than technology \(\delta _{2}\) if \(\delta _{1}(c)>\delta _{2}(c)\) \((\forall c\ge 0)\). For a sufficiently good technology, strong enough links are sufficiently cheap to make the complete network efficient.

This means that a weaker formulation of marginal equilibrium requiring that for some \(\varepsilon >0,\) no node can improve its payoff by increasing or decreasing its investment in any of its links by less than \(\varepsilon \) turns out to be equivalent to Definition 2 for DR-technologies.

Olaizola and Valenciano (2021) introduces heterogeneity in values of the nodes in a model where links are of fixed strength and fixed cost à la Jackson-Wolinsky, but where players can freely share the cost of each link, and characterizes efficient networks (a class of nested split graph networks) and introduce an adapted notion of pairwise stability.

Just note that by the chain rule

$$\begin{aligned} \left. \frac{\partial }{\partial c_{ij}}(\delta (c_{ij}+c_{ji}^{*}))\right| _{c_{ij}=c_{ij}^{*}}=\left. \delta ^{\prime }(c_{ij}+c_{ji}^{*})\cdot 1\right| _{c_{ij}=c_{ij}^{*}}=\delta ^{\prime }(c_{{\underline{ij}}}^{*}). \end{aligned}$$We call it “virtual” because the actual payoff would be that received through the possibly new i’s optimal paths. It is the sum of a positive linear combination of concave functions and a linear function.

Note that vector-valued map

$$\begin{aligned} \mathbf {c}=(c_{ij})_{j\in N^{d}(i;g^{\mathbf {c}^{*}})}\mapsto (\delta _{ik}(\mathbf {c}))_{k\in N(i;g^{(\mathbf {c}_{-i}^{*};\mathbf {c}_{i})})}, \end{aligned}$$where \(\delta _{ik}(\mathbf {c}_{i}):=\max _{p\in \mathcal {P}_{ik}(g^{(\mathbf { c}_{-i}^{*};\mathbf {c}_{i})})}\delta (p)\), is continuous because its coordinate functions \(\delta _{ik}(\mathbf {c}_{i})\) are continuous. Consequently, for \(\mathbf {c}\) sufficiently close to \(\mathbf {c}^{*}\) paths in \(\overline{\varvec{p}}_{i}\) continue to be optimal.

References

Aumann R, Myerson R (1988) Endogenous formation of links between players and coalitions: an application of the Shapley value. In: Roth A (ed) The Shapley value. Cambridge University Press, Cambridge, pp 175–191

Bala V, Goyal S (2000) A non-cooperative model of network formation. Econometrica 68:1181–1229

Ballester C, Calvó-Armengol A, Zenou Y (2006) Who’s who in networks. Wanted: the key player. Econometrica 74:1403–1417

Baumann L (2021) A model of weighted network formation. Theor Econ 68(15):1–23

Bloch F, Dutta B (2009) Communication networks with endogenous link strength. Games Econom Behav 66:39–56

Boucher V (2015) Structural homophyly. Int Econ Rev 56(1):235–264

Bramoullé Y, Kranton R (2007) Public goods in networks. J Econ Theory 135:478–494

Bramoullé Y, Galeotti A, Rogers BW (eds) (2015) The Oxford handbook on the economics of networks. Oxford University Press, Oxford

Cabrales A, Calvó-Armengol A, Zenou Y (2011) Social interactions and spillovers. Games Econom Behav 72:339–360

Deroian F (2009) Endogenous link strength in directed communication networks. Math Soc Sci 57:110–116

Ding S (2019) The formation of links and the formation of networks, Unpublished Working Paper

Feri F (2007) Stochastic stability in networks with decay. J Econ Theory 135:442–457

Feri F, Meléndez M (2013) Coordination in evolving networks with endogenous decay. J Evol Econ 23:955–1000

Goyal S (2007) Connections. An introduction to the economics of networks. Princeton University Press, Princeton

Granovetter MS (1973) The strength of weak ties. Am J Sociol 78(6):1360–1380

Griffith A (2019) A continuous model of strong a weak ties. Unpublished working paper

Harmsen-van Hout MJW, Herings PJ-J, Dellaert BGC (2013) Communication network formation with link specificity and value transferability. Eur J Oper Res 229:199–211

Jackson M (2008) Social and economic networks. Princeton University Press, London

Jackson M, Wolinsky A (1996) A strategic model of social and economic networks. J Econ Theory 71:44–74

Myerson R (1977) Graphs and cooperation in games. Math Oper Res 2:225–229

Olaizola N, Valenciano F (2020) Characterization of efficient networks in a generalized connections model with endogenous link strength. SERIEs 11(3):341–367

Olaizola N, Valenciano F (2021) Efficiency and stability in the connections model with heterogenous nodes. J Econ Behav Organ 189(5):490–503

Olaizola N, Valenciano F (2016) A marginalist model of network formation. Working paper, Ikerlanak IL 99/16

Salonen H (2015) Reciprocal equilibria in link formation games. Czech Econ Rev 9:169–183

So CK (2016) Network formation with endogenous link strength and decreasing returns to investment. Games MDPI Open Access J 7(4):1–9

Vega-Redondo F (2007) Complex social networks. Econometric society monographs. Cambridge University Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

At the root of this paper is the unpublished working paper “A marginalist model of network formation” (Olaizola and Valenciano 2016). However, the content of the current paper is much richer in results and has been refined in accuracy, rigor and generality. Moreover, the study of stability is centered on an entirely new notion of “marginal” equilibrium, which was absent in the old working paper.

We thank Coralio Ballester, Arnold Polanski, two anonymous referees and the editor for their helpful comments. This research is supported by the Spanish Ministerio de Economía y Competitividad under project PID2019-106146GB-I00 and by the Basque Government Departamento de Educación, Política Lingüística y Cultura funding for Grupos Consolidados IT1367-19.

Appendix

Appendix

Lemma 1

Proof

It is obvious that strong marginal stability implies marginal stability. Assume that \(g^{\mathbf {c}}\) is connected and \(\mathbf {c}\) is marginally stable. Let \(\mathbf {c}_{i}^{\prime }=(c_{ik}^{\prime })_{k\in N}\), and let \( \mathbf {c}_{i}^{\prime \prime }\) be given by

and \(\mathbf {c}^{\prime \prime }=(\mathbf {c}_{-i};\mathbf {c}_{i}^{\prime \prime })\). For \(\mathbf {c}_{i}^{\prime }\) sufficiently close to \(\mathbf {c} _{i}\), the underlying graphs of \(g^{\mathbf {c}}\) and \(g^{\mathbf {c}^{\prime \prime }}\) are the same and s.t. \(\Pi _{i}^{\delta }(\mathbf {c})\ge \Pi _{i}^{\delta }(\mathbf {c}_{-i};\mathbf {c}_{i}^{\prime \prime })\) because \( \mathbf {c}\) is marginally stable. And for all j s.t. \(c_{{\underline{ij}}}=0\) and \(c_{ij}^{\prime }\ne 0\), as i and j are indirectly connected in \(g^{ \mathbf {c}}\) and \(g^{\mathbf {c}^{\prime \prime }}\), i and j receive an amount of value from each other through a path in \(g^{\mathbf {c}^{\prime \prime }}\). Thus, a sufficiently small investment \(c_{ij}^{\prime }\) in link \({\underline{ij}}\) (namely, as far as \(\delta (c_{ij}^{\prime })\) is smaller than the decay along that path) is sure to be unprofitable. Therefore, for \( \mathbf {c}_{i}^{\prime }\) sufficiently close to \(\mathbf {c}_{i}\),

\(\square \)

Theorem 1

Proof

(Necessity) We use the following notation in order to prove the theorem. If \(C_{i,j}^{g}\) is the set of nodes that are connected with i in g through optimal paths that contain link ij, i.e.

then, choose for each \(k\in C_{i,j}^{g}\) an optimal path \({\overline{p}}_{ik}\) s.t. \(ij\in {\overline{p}}_{ik}\) and define

Note that \(K_{i,j}^{g}\) does not depend on the choice of the \({\overline{p}} _{ik}\)’s such that \(ij\in {\overline{p}}_{ik}\) because if \({\overline{p}}_{ik}\) and \({\overline{q}}_{ik}\) are two different optimal paths containing ij, then \(\delta ({\overline{p}}_{ik})=\delta ({\overline{q}}_{ik})\) and consequently \(\delta ({\overline{p}}_{ik}^{ij})=\delta ({\overline{q}} _{ik}^{ij}) \).

Let \(\delta \) be a DR-technology and \(\mathbf {c}^{ \mathbf {*}}=(c_{ij}^{\mathbf {*}})_{i,j\in N}\) a marginally stable investment profile. Assume \(c_{{\underline{ij}}}^{\mathbf {*}}>0\) for some \( i,j\in N\) \((i\ne j)\).

(i) Assume that i invests in link ij, i.e. \(c_{ij}^{\mathbf { *}}>0\). Then link \({\underline{ij}}\) is part of at least one optimal path in \(g^{\mathbf {c}^{*}}\) for i’s information/contact, the one connecting i and j, otherwise i would increase its payoff by diminishing investment in it. Fix one of the, in principle, possible different but equivalent expressions on the right-hand side of (3). Then i’s payoff for this particular choice of optimal paths \( \overline{\varvec{p}}_{i}\) is given by the right-hand side of (3), which can be rewritten like this:

From the point of view of player i, with the investments by the other players \(j\ne i\) taken as given, the right-hand side of (13 ) depends on i’s admissible strategy \(\mathbf {c}_{i}\), and it is a differentiable function of as many variables as i has neighbors, \( (c_{ij})_{j\in N^{d}(i;g^{\mathbf {c}^{\mathbf {*}}})}\). Namely,

Thus the terms in (14) where \(c_{ij}\) enters are

with

Therefore, for the strategy of player i, \((c_{ij}^{*})_{j\in N}\), to be marginally stable given the investments made by the other players (which fully determine \(\delta ({\overline{p}}_{ik}^{ij})\) for all \(j\in N^{d}(i;g^{ \mathbf {c}^{\mathbf {*}}})\) and all \(k\in N(i;g^{\mathbf {c}^{\mathbf {*}}})\) s.t. \({\underline{ij}}\in {\overline{p}}_{ik}\)) the following must hold

A non-null partial derivative w.r.t. \(c_{ij}\) of (13) at \( \mathbf {c}^{*}\) means that slightly increasing (if it is \(>0\)) or decreasing (if it is \(<0\)) investment by i in link \({\underline{ij}}\) would increase i’s payoff (through the same available paths), which contradicts the marginal stability of \(\mathbf {c}^{*}\). ThereforeFootnote 17

must hold at \(c_{{\underline{ij}}}^{*}\), that is,

By construction, \(K_{i,j}(\overline{\varvec{p}}_{i})\le K_{i,j}^{g^{ \mathbf {c}^{\mathbf {*}}}}\), but note that if \(\mathbf {c}^{*}\) is marginally stable, then \(K_{i,j}(\overline{\varvec{p}}_{i})=K_{i,j}^{g^{ \mathbf {c}^{\mathbf {*}}}}\). Otherwise, a different choice of optimal paths \(\overline{\varvec{p}}_{i}^{\prime }=({\overline{p}}_{ik}^{\prime })_{k\in N(i;g^{\mathbf {c}^{\mathbf {*}}})}\) would yield \(K_{i,j}( \overline{\varvec{p}}_{i})\ne K_{i,j}(\overline{\varvec{p}} _{i}^{\prime })\) and then (15) would lead to a contradiction. Therefore (5) must hold.

This means that any optimal path \({\overline{p}}_{ik}\) containing a link \( {\underline{ij}}\) s.t. \(c_{ij}^{\mathbf {*}}>0\) has a positive impact on its cost, because \(\delta ({\overline{p}}_{ik}^{ij})\) is a summand in \( K_{i,j}^{g^{\mathbf {c}^{\mathbf {*}}}}\), the denominator in (5), so that \(\delta ^{\prime }(c_{{\underline{ij}}}^{*})\) decreases and \(c_{{\underline{ij}}}\) increases. Then, if an optimal path \( {\overline{p}}_{ik}\) contains \({\underline{ij}}\) and \(\delta ({\overline{p}} _{ik})=\delta ({\overline{q}}_{ik})\) for some other optimal path \({\overline{q}} _{ik}\) in \(g^{\mathbf {c}^{\mathbf {*}}}\), the optimality of \({\overline{p}} _{ik}\) would be superfluous because its marginal revenue for i is \(v\delta ({\overline{p}}_{ik})=v\delta ({\overline{q}}_{ik})\) at a cost that can be spared given that it is also received through \({\overline{q}}_{ik}\), i.e. a small decrease in \(c_{{\underline{ij}}}^{*}\) would increase i’s payoff, contradicting the marginal stability of \(\mathbf {c}^{\mathbf {*}}\). Thus, every optimal path that contains link \({\underline{ij}}\) and connects node i with another node must be the only optimal path connecting them. In other words, the optimal paths connecting one node with other nodes in which a node invests form a well-defined tree rooted at that node.

(ii) Assume now that \(c_{{\underline{ij}}}^{*}>0\) and \(c_{ij}=0,\) i.e. the link \({\underline{ij}}\) is entirely supported by j. A similar argument to the one used to prove part (i) leads in this case to the conclusion that

must hold at \(\mathbf {c}_{i}^{\mathbf {*}}\), whatever the choice of optimal paths \(\overline{\varvec{p}}_{i}=({\overline{p}}_{ik})_{k\in N(i;g^{\mathbf {c}^{\mathbf {*}}})}\). Otherwise player i’s payoff increases by investing in link \({\underline{ij}}\), which yields \(\delta ^{\prime }(c_{{\underline{ij}}}^{*})\le \frac{1}{vK_{i,j}(\overline{ \varvec{p}}_{i})}\). And choosing \(\overline{\varvec{p}}_{i}\) s.t. \( K_{i,j}(\overline{\varvec{p}}_{i})\) is maximal, i.e. \(K_{i,j}(\overline{ \varvec{p}}_{i})=K_{i,j}^{g^{*}}\), we have \(\delta ^{\prime }(c_{ {\underline{ij}}}^{*})\le \frac{1}{vK_{i,j}^{g^{*}}}.\)

Thus conditions (i) and (ii) are necessary for \(\mathbf {c} ^{\mathbf {*}}\) to be marginally stable.

(Sufficiency) Assume conditions (i) and (ii) hold for an investment profile \(\mathbf {c}^{\mathbf {*}}=(c_{ij}^{\mathbf { *}})_{i,j\in N}\). Then i’s payoff for a particular choice of optimal paths \(\overline{\varvec{p}}_{i}\) (by (i) those containing links in which i invests are uniquely determined) is given by (13), that is

If \(\mathbf {c}_{i}=(c_{ij})_{j\in N}\) is an alternative admissible strategy of player i s.t. \(c_{ij}\ne 0\) only if \(c_{{\underline{ij}}}^{\mathbf {*} }\ne 0\), then i’s virtual payoff through the same paths is given by

which is a differentiable concave function of \((c_{ij})_{j\in N^{d}(i;g^{ \mathbf {c}^{\mathbf {*}}})}.\)Footnote 18 Moreover, the Kuhn-Tucker conditions for a maximum of \(\Pi _{i}^{\delta }(\mathbf {c}_{-i}^{*};\mathbf {c}_{i};\overline{\varvec{p }}_{i})\) constrained by \(c_{ij}\ge 0\) are

for all \(j\in N^{d}(i;g^{\mathbf {c}^{\mathbf {*}}}).\) Now if \( c_{ij}^{*}>0\) and (5) holds, given that any optimal path containing ij and connecting i with any node k is necessarily the only path connecting them, it must be \(K_{i,j}(\overline{\varvec{p}} _{i})=K_{i,j}^{g^{\mathbf {c}^{\mathbf {*}}}}.\) Then whenever \( c_{ij}^{*}>0\) condition (K-T.3) holds, condition (K-T.1) becomes \( v\delta ^{\prime }(c_{{\underline{ij}}})K_{i,j}^{g^{\mathbf {c}^{\mathbf {*} }}}-1+\lambda _{j}=0,\) which holds along with (K-T.2) and (K-T.4) with \( \lambda _{j}=0.\) Whereas if \(c_{ij}^{*}=0\) and \(\delta ^{\prime }(c_{ {\underline{ij}}}^{*})<\frac{1}{vK_{i,j}^{g^{*}}},\) (K-T.2) and (K-T.3) hold, while (K-T.1) and (K-T.4) hold with \(\lambda _{j}=-(v\delta ^{\prime }(c_{{\underline{ij}}})K_{i,j}^{g^{\mathbf {c}^{\mathbf {*} }}}-1)>0. \) Thus Kuhn-Tucker conditions for a maximum of \(\Pi _{i}^{\delta }( \mathbf {c}_{-i}^{*};\mathbf {c}_{i};\overline{\varvec{p}}_{i})\) constrained by \(c_{ij}\ge 0\) hold at \(\mathbf {c}_{i}^{*}\). Given that \( \Pi _{i}^{\delta }(\mathbf {c}_{-i}^{*};\mathbf {c}_{i};\overline{ \varvec{p}}_{i})\) is concave, these conditions are also sufficient for a maximum of virtual payoff through \(\overline{\varvec{p} }_{i}\). In short, the necessary conditions guarantee that the investments of node-player i in its actual links are optimal in order maximize its virtual payoff through paths in \(\overline{\varvec{p}}_{i}\). However, a change of i’s investments in the links with its neighbors may cause that some paths in \(\overline{\varvec{p}}_{i}\) cease to be optimal. Nevertheless, by continuity, i’s optimal paths continue to be optimal for sufficiently small changes of i’s investments in the links with its neighbors.Footnote 19 In other words, for small changes of investments of i in its links i’s virtual payoff through \(\overline{\varvec{p}}_{i}\) continue to be i’s actual payoff. Summing up, a sufficiently small change of investments of any node-player in the links with its neighbors is necessarily non-profitable. \(\square \)

Corollary 1

Proof

Let \(\mathbf {c}^{*}\) be a marginally stable investment profile and assume \(c_{{\underline{ij}}}^{*}>0\). Then if both invest in link \( {\underline{ij}}\) condition (5) must hold for i and j, and j and i, i.e. i and j can interchange roles in (5), which yields two expressions for \(\delta ^{\prime }(c_{{\underline{ij}}}^{*})\):

But this is possible only if the sums in both denominators are equal, in other words, only if both players, i and j, receive the same amount of value through link \({\underline{ij}}\). Otherwise, the two conditions are incompatible and stability is possible only if the player who receives more value through link \({\underline{ij}}\), say i, covers the whole investment, so that

In this way both conditions (5) and (6) hold. \(\square \)

Proposition 1

Proof

Conditions (i) and (ii) of Theorem 1 are equivalent to marginal stability. Assume now that \(\mathbf {c}^{\mathbf {*}}\) is strongly marginally stable, but \(g^{\mathbf {c}^{*}}\) is not connected and \(\delta ^{\prime }(0)>\frac{1}{v+K}\), where K is the value received by the node, say i, that receives the maximal amount of value. Then, if j is any node in a different component, any sufficiently small investment of j in a link with i is sure to increase j’s payoff, contradicting \( \mathbf {c}^{\mathbf {*}}\)’s strong marginal stability. Reciprocally, differentiability and strict concavity of \(\delta \) implies that \(\frac{\delta (c)}{c}<\delta ^{\prime }(0)\), and if i and j are in different components and \(\delta ^{\prime }(0)\le \frac{1}{v+K}\), where K is the value received by the node that receives the maximal amount of value, then \(\frac{\delta (c)}{c}<\delta ^{\prime }(0)\le \frac{1}{v+K}\) for all c, i.e. \((v+K)\delta (c)-c<0\), and also replacing K by the value received by the node that receives the maximal amount of value in the component of i or that of j. Consequently any investment in a link connecting them is not profitable for either of them. Whereas if \(g^{\mathbf { c}^{*}}\) is connected, by Lemma 1 it is also strongly marginally stable. \(\square \)

Proposition 2

Proof

Let \(\mathbf {c}=(c_{ij})_{i,j\in N}\) be an investment profile s.t. \(g^{ \mathbf {c}}\) is a tree and let \(T\subset N_{2}\) be the underlying graph. By Theorem 1, for \(\mathbf {c}\) to be marginally stable condition (5) must hold. That is, for each \({\underline{ij}}\in T\) s.t. \( c_{ij}>0,\)

If this condition holds and all links for which the two nodes that it connects are paid for by the node that receives more value through it, then condition (ii) of Theorem 1 is also satisfied. The first part of condition (i) of Theorem 1 holds necessarily due to the structure of a tree, where any two connected nodes are connected by only one path. Therefore it is enough to prove that there exists an investment vector \(\overline{\mathbf {c}}\) whose underlying graph is T and s.t. condition (5) holds. As \(\delta \) is continuously differentiable, strictly concave and increasing, \(\delta ^{\prime }\) is continuous and decreasing, and consequently invertible, moreover its inverse \(\delta ^{\prime -1}\) is continuous. Let then

be the function that maps any investment vector \(\overline{\mathbf {c}}=(c_{ {\underline{ij}}})_{{\underline{ij}}\in N_{2}}\) whose underlying graph is T and s.t. \(\delta ^{\prime -1}(\frac{1}{v})\le c_{{\underline{ij}}}\le \delta ^{\prime -1}(\frac{1}{v(n-1)})\) (i.e. \(\frac{1}{v(n-1)}\le \delta ^{\prime }(c_{{\underline{ij}}})\le 1/v\)) for all \({\underline{ij}}\in T\), into a T -vector \(\Phi (\overline{\mathbf {c}})=(\Phi _{{\underline{ij}}}(\overline{ \mathbf {c}}))_{{\underline{ij}}\in T}\) defined for each \({\underline{ij}}\in T\) by

Then \(\Phi \) is continuous and \(\Phi _{{\underline{ij}}}(\overline{\mathbf {c}} )\in [\frac{1}{(n-1)v},\frac{1}{v}]\) for all \({\underline{ij}}\in T\), because

Note that for each pair \(i,j\in N\) connected by the tree there is only one path connecting them in \(g^{\mathbf {c}}\), and consequently \(\delta ( {\overline{p}}_{ik}^{ij})\) is a product \(\Pi _{lm\in {\overline{p}}_{jk}}\delta (c_{{\underline{lm}}})\) of continuous functions. Thus each \(\Phi _{\underline{ ij}}(\overline{\mathbf {c}})\) is continuous and so is \(\Phi \) consequently. Note that although investments are not bounded, in a network with n nodes no link can support a flow of value greater than \((n-1)v\). Consequently, in a marginal equilibrium no link receives an investment c s.t. \(\delta ^{\prime }(c)<1/(n-1)v\). On the other hand, as no link transmits less than v, in marginal equilibrium no link receives an investment c s.t. \(\delta ^{\prime }(c)>1/v\). Thus denote by \(D^{-1}\) the continuous function

where  . Then the composition \( D^{-1}\circ \Phi \) is a continuous function that maps compact convex set

. Then the composition \( D^{-1}\circ \Phi \) is a continuous function that maps compact convex set  to itself, so there must be a fixed-point

to itself, so there must be a fixed-point  that is, s.t.

that is, s.t.

for all \({\underline{ij}}\in T\). Therefore, the investment profile where each link \({\underline{ij}}\) in the tree receives an investment of \(c\underline{_{ij}}\) and links for which the two nodes that it connects are paid for by the node that receives more value through it is a marginally stable investment whose underlying graph is T. By Lemma 1, if the tree is all-encompassing it will also be strongly marginally stable. \(\square \)

Theorem 2

In order to prove Theorem 2, we first obtain necessary conditions for efficiency constrained to supporting a given infrastructure. These conditions are used for the characterization of the only possibly efficient networks in absolute terms. Consider the situation where a given infrastructure specified by a set of feasible links S \(\supseteq \) N2 is to be supported optimally, i.e. maximizing its net value. We say that an investment profile \(c =(cij)i,j\in N\) supports infrastructure S if the underlying graph of gc is S, i.e. if cij > 0 if and only if \(\underline{ij} \in S\).

Definition 8

Given \(S\subseteq N_{2}\), an investment profile \(\mathbf {c=}(c_{ij})_{i,j\in N}\) (investment vector \(\overline{\mathbf {c}}=(c_{{\underline{ij}}})_{ {\underline{ij}}\in N_{2}})\) supports S efficiently if it supports S and \( v(g^{\overline{\mathbf {c}}})\ge v(g^{\overline{\mathbf {c}}^{\prime }}),\) for all \(\mathbf {c}^{\prime }\mathbf {=}(c_{ij}^{\prime })_{i,j\in N}\) which support S.

That is, investments are constrained to be made in all links in S and only in them, and the function to be maximized is

If \({\overline{p}}_{kl}\) is an optimal path connecting nodes k and l s.t. \( ij\in {\overline{p}}_{kl},\) we use the following notation, consistent with (4), which is a particular case of this one: