Abstract

The recent economic and financial turmoil raises the question on how global economic growth affects agricultural commodity markets and, hence, food security. To address this question, this paper assesses the potential impacts of faster economic growth in developed and emerging economies on the one hand and a replication of the recent economic downturn on the other hand. The empirical analysis uses AGLINK-COSIMO, a recursive-dynamic, partial equilibrium, supply–demand model.

Simulation results demonstrate that higher economic growth influences demand more than supply, resulting in higher world market prices for agricultural commodities. Emerging economies tend to import more and to stock less in order to cover their demand needs, while the rest of the world increases its exports. The modelled faster economic growth also helps developing countries to improve their trade balance, but does not necessarily give them the incentive to address domestic food security concerns by boosting domestic consumption. A replication of an economic downturn leads to lower world prices, and while the magnitude of the effects decreases over time, markets do not regain their baseline levels within a 5-year period. Due to the lower world market prices, developing countries import more and increase their per capita food calorie intake. However, as developing countries become more import dependent, this also implies that they become more vulnerable to disruptions in agricultural world markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The global food price crisis in 2008 and subsequent food price spikes brought the topic of food security back to the top of the international agenda. Critical questions have been raised on how the poor (particularly those who are net importers, and hence depend on food purchases from abroad) can secure their consumption needs (FAO 2009; Brinkman et al. 2010). A great deal of effort has been devoted to analysing the main causes of the food price spike. Even though researchers put different weights on the relative importance of underlying factors, it is now well understood that the food price spike was caused by a combination of several factors that created a ‘perfect storm’ which simultaneously affected both supply and demand: poor harvests in various parts of the world, subsequent export restrictions for several agricultural commodities by some countries, increasing crude oil prices, increasing biofuel usage, decreasing crop yield growth rates, global stock declines of several agricultural commodities, decreasing interest rates, increasing investment in commodity funds (speculation), and the depreciation of the US dollar (Headey and Fan 2008; Trostle 2008; Baffes and Haniotis 2010; Gilbert 2010; Naylor and Falcon 2010).

In 2011 food prices spiked again, with the World Bank food price index reaching the peak of 2008 in early 2011, potentially threatening food security once more (World Bank 2012). However, most of the public and policy attention to the global food security situation had already been pushed aside, as turbulences in the global financial system and the overall global economy made ‘economic crisis’ a term that entered everyday vocabulary. The recent financial and economic crisis hit developing countries as well as developed ones. While many countries started to show signs of recovery, the ongoing crisis in some countries in the Eurozone, worries about fiscal sustainability in the USA and other countries, and the rapid spreading of contagion fears and accompanying trade and financial spillovers still threaten global economic recovery (IMF 2013). This also illustrates that in the present global economic environment, local problems can become global ones very quickly, making it even more difficult to conduct forecasts regarding the development of economic growth.

Assumptions on the development of economic growth form the basis for commodity market outlooks. In such outlooks it is usually assumed that economic growth follows a stable path in the medium-term. The World Bank (2013a) suggests that the effects of the 2008 economic crisis are not played out yet and projects global GDP (expressed in real terms) to increase by a modest 2.4 % in 2013, with GDP growing by 5.1 % in developing countries and 1.3 % in high-income countries. The agricultural commodity outlook of FAPRI (2012) assumes real GDP growth of 2.0 % in 2020, while the agricultural outlook of OECD-FAO (2012) is set on a two speed economic recovery, assuming that developing and emerging countries will show quicker recovery signs than developed ones. Expectations on economic growth are always subject to uncertainties, but in the short run, more changes in the economic environment are likely to take place (World Bank 2013a).

The overall economic condition and economic growth are reflected in the demand for commodities and in input prices, and hence entail rather strong implications for developments on agricultural commodity markets. For example, increases in GDP are associated with increasing income per capita and changes in diets, often reflected in stronger demand for higher value-added goods (like livestock products) and resulting in increased consumption and, consequently, higher prices. In a dynamic framework this can trigger a response on the supply side, which could in turn drive prices downwards. In an analogous way the reverse effects can be expected in the event of a downwards economic shock (Abbott and McCalla 2002; Timmer 2002; Diaz-Bonilla and Robinson 2010; FAO, WFP and IFAD 2012). However, there is still little consensus on whether the effects of economic growth on food consumption can outweigh its impacts on production, and there is hardly any empirical evidence on the magnitude of these effects.

Against this background, this paper analyses how negative and positive shocks in the economic growth of major economies can affect agricultural commodity markets and food security. Food security is generally considered to comprise four pillars: availability (whether enough food is physically available either through domestic production or imports), access (physically and economically; relates to incomes, expenditure, markets and prices), utilization (health and nutritional diet concerns) and stability (whether a state of food insecurity is transitory or permanent) (FAO 1996, 2009; Pinstrup-Andersen 2009). Focusing on the pillar of food availability and on aspects of access (expenditure and prices) this paper addresses the following questions: What are the impacts of a faster economic growth of developed and emerging economies on global agricultural commodity markets and food security? Conversely, what are the impacts of a temporary economic crisis on agricultural markets and food security, and how long does it take for the markets to regain their pre-distortion equilibrium?

To answer these questions we use the dynamic, partial equilibrium model AGLINK-COSIMO to simulate different scenarios on exogenously assumed economic growth paths over the next 10 years. Building on the OECD-FAO agricultural outlook (OECD-FAO 2012), we simulate one faster economic growth scenario and assess if demand reactions are indeed bigger than supply adjustments, and if so, what the effect on agricultural prices would be. In a second scenario, we simulate a reoccurrence of the 2008–2009 economic crisis with regard to negative shocks in GDP growth rates and assess how prices develop, what the effects on commodity balances are, how long it takes for agricultural markets to return to their initial equilibrium, and how this affects global food security.

The remainder of the paper is organised as follows. Section 2 describes the AGLINK-COSIMO model and the underlying assumptions of the simulated scenarios. Section 3 reports the results with regard to changes in commodity balances, market prices and in specified food security indicators. Section 4 discusses the results and section 5 concludes the paper.

Specification of the modelling approach and the simulation scenarios

AGLINK-COSIMO is a global recursive-dynamic, partial equilibrium, supply–demand model of world agricultural markets developed by the OECD SecretariatFootnote 1 and the FAO (see OECD 2006). AGLINK-COSIMO covers annual supply, demand and prices for the principal agricultural commodities (all major temperate zone agricultural commodities as well as rice and vegetable oils) produced, consumed and traded in each of the countries represented in the model. Biofuels (ethanol and biodiesel) are modelled in detail only for the USA, the EU, Brazil and Canada.Footnote 2 The model is based on the following assumptions:

-

World markets are competitive and neither buyers nor sellers have monopoly power on the market. The market price is determined via global or regional equilibrium in supply and demand.

-

AGLINK–COSIMO is not a spatial model and therefore importers do not distinguish the origin of commodities (transport costs are not included).

-

Commodities are considered as homogeneous, but prices are cleared domestically and standard trade functions are used to model trade policies. Thus the model represents imports and exports of a country separately.

-

AGLINK–COSIMO is a partial equilibrium model focusing on agricultural commodities. Non-agricultural markets are not modelled.

AGLINK-COSIMO is used for policy analysis and the preparation of medium-term outlooks on the development of agricultural commodity markets. The projection period used in AGLINK-COSIMO is 10 years on an annual basis and assumes a current policy framework, normal weather conditions, and given and expected yield growth rates. The model provides a consistent analysis framework and uses external sources for the assumptions on macroeconomic developments like GDP growth, exchange rates, world oil prices, population growth, etc. (OECD-FAO 2012).

The model includes country specific information on agricultural, biofuel and trade policies. It incorporates, for example, import and export duties, market intervention and supply management policies, as well as biofuel mandates and budgetary support measures. This information is updated annually by the OECD and FAO secretariats, and thus allows an examination of agricultural markets in a setting that reflects up-to-date policy developments. However, the model does not take into account ad-hoc changes in policy mechanisms or goals that may occur under volatile market situations, climate change or financial market instability in the medium-run. Furthermore, it does not explicitly incorporate risk aversion of producers and consumers that may arise in the context of volatile commodity markets. Finally, the model version used in this paper does not employ any stochastic simulation method.

Consumer demand is assumed to react to consumer price changes of the current year, with the responsiveness being higher in developing countries compared to developed ones (i.e. demand becomes more inelastic as income rises). On average for all commodities considered in the model, the own-price elasticity of demand is about −0.65 in low-income countries and −0.3 in developed ones (Thompson et al. 2012). Looking across markets, food demand for meat and dairy products has a more elastic reaction to income changes than do staple foods (on average the respective elasticities are around 0.4 and 0.2 for red meat and coarse grains, respectively) (OECD-FAO 2012). The elasticities are kept constant for the simulation period of 10 years but are revised regularly by the OECD and FAO secretariats.

For the purpose of this paper the model was adapted and three indices have been developed to better depict food security and food availability issues in developing and least developed countries: (i) a food bill index, which measures the food expenditure on wheat, coarse grains, rice, vegetable oil and meat and is given as the product of food consumption and domestic consumer prices; (ii) a food import bill index, which is supplementary to the first index and reports the cost of food imports in USD; and (iii) a food calories per capita index, which reports the consumed food calories per capita for crops; thus covering only staple foodFootnote 3. All three indices are calculated for Least Developed Countries (LDCs) and low- to middle-income countries. The first two indices are reported in nominal terms and indicate the actual expenditure consumers are faced with. If the food bill index is growing more in real terms than income (expressed in real GDP growth) this indicates that consumers spend a larger share of their income for the purchase of food, which may have negative implications for the poor as the share of food expenditure in their income is already high. The food import bill index is particularly relevant for net importing countries facing balance of payment constraints (for example foreign currency availability, insufficient reserves), and a rise of this index implies that these countries may need to take out loans to finance purchases of imported food, or that they risk currency depreciation which would further increase domestic food prices.

In addition to these indices we also calculate the following three ratios, which help to visualise the reaction in agricultural markets to the macroeconomic shocks (FAO 2001): (i) import dependency ratio (IDR), which is the share of imports over total domestic supply, with the latter being defined as domestic production plus imports minus exports; the IDR expresses how much of the available domestic food supply comes from the country’s own production and how much has been imported; (ii) self-sufficiency ratio (SSR), which is calculated as the share of domestic production over total domestic use and expresses the magnitude of production in relation to domestic utilization; and (iii) stock-to-use ratio, which is given as ending stocks over domestic consumption and indicates the level of carryover stock for the given commodity.

The indices and the ratios have to be seen in a partial equilibrium context. Impacts on other aspects of the economy, which may affect the development of agriculture (e.g. a movement of production towards other sectors or to crops not modelled in AGLINK-COSIMO), are not taken into account, implying that non-agricultural relative prices remain constant.

Three simulation scenarios were constructed. All scenarios assume the same development of agricultural policies and trade measures for the period 2012–2021 (OECD-FAO 2012), but they differ with regard to the assumed macroeconomic developments. For the baseline (reference) scenario, standard macroeconomic assumptions on economic growth and exchange rate developments are taken from OECD-FAO (2012). The short-run global economic outlook is rather weak, but economic recovery is expected to start during 2013, led by Asian countries that are projected to have the highest annual GDP growth. In general, the reference scenario assumes a two-speed growth dichotomy over the projection period, with relatively weak medium-term income and employment growth in developed countries, and much stronger growth in emerging and developing countries. Emerging economies are assumed to remain the high economic growth leaders, while average GDP growth in OECD countries is expected to improve to above 2 % per year and economic growth in the LDCs is expected to moderate slightly to 5.8 % per year. Table 1 summarises the assumed real GDP growth rates in the baseline for emerging markets as well as the USA and the EU.

Further exogenous developments are also set out as in OECD-FAO (2012). It is assumed that the world price for crude oil will increase over the simulation period from USD 79.5Footnote 4 per barrel in 2010 to USD 142 in 2021. Population growth is assumed to slow over the projection period, increasing on average by 1.02 % per year. Even though the slowdown in population growth is expected to occur in all regions, developing countries will still experience the fastest population growth, with Africa’s population growing at over 2 % per year and thus more than double that of any other region (OECD-FAO 2012).

To analyse how economic shocks may influence agricultural commodity markets and global food availability, two macroeconomic scenarios have been developed, assuming different economic growth paths for the countries listed in Table 1. These countries are selected because they are the main agricultural commodity price makers in the world markets, and in addition, historical changes in GDP growth have been the highest in these countries.

Scenario 1 simulates faster economic growth compared to the reference scenario over the projection period. In order to be able to introduce correlated adjustments, especially with regard to exchange rate developments, the scenario replicates a historic situation by using the annual GDP growth rates of the year 2006. The year 2006 has been selected because it was characterised by high global economic growth.

Scenario 2 simulates a downward shock in economic growth in 2016. The point of reference for the economic shock is the recent economic downturn of 2008–2009, and the scenario uses respective GDP growth and takes the correlated effects on exchange rates into account. Regarding crude oil prices, the shock repeats the absolute difference in world crude oil prices between 2008 and 2009.

Figure 1 illustrates the assumptions of all three scenarios exemplified on the Brazilian GDP index. An analogous pattern is followed for the rest of the countries under consideration (see Table 1).

Simulation results

World market prices

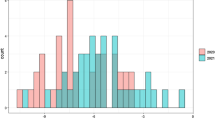

Figures 2 and 3 depict the effects of the macroeconomic shocks on world market prices for crop and livestock commodities, respectively.

The results of Scenario 1 show that higher economic growth in emerging economies, the EU and the USA can indeed alter the picture of agricultural markets and can lead to higher world market prices. The simulated faster economic growth stimulates demand and the increase in consumption is higher than the production response. At the end of the simulation period, wheat and coarse grains prices are almost 50 % higher, and rice prices almost 40 % higher than the prices in the reference scenario. The increase is even greater for oilseeds (+59 %) and vegetable oil (+52 %). The developments in livestock and dairy markets follow a similar path, with the effects being stronger for meat (beef and veal prices +58 %, pork prices +44 %) than for dairy products (butter prices +37 %, skim milk powder prices +36 %).

In Scenario 2, the simulated shock on economic growth and the related reduction of crude oil prices negatively affect demand in the year the shock was introduced (i.e. year 2016), which in turn results in lower world market prices for agricultural commodities. The supply response to lower market prices is seen in the next year (2017), but the effects are diverse among the markets. Cereals are projected to be more affected, not only because cereal markets are generally more reactive to price developments but also because the simulated shock involved countries that are price-makers in cereal markets. Furthermore, the shock in crude oil price affects the biofuel market, and hence the feedstocks (i.e. the shock induces a temporary reduction of biofuel consumption, followed by a temporary reduction of feedstock demand for biofuel use). From 2018 onwards the markets start returning to their pre-shock levels, with cereals again being more reactive. Nonetheless, by 2021 world market prices for cereals are still about 6 % below the baseline, while those for oilseeds and livestock commodities are down about 5 %.

Trade effects, domestic supply, demand and stocks

Looking at world markets, faster economic growth as simulated in Scenario 1 results in higher consumption and domestic production worldwide, whereas the effects of the negative economic shock simulated in Scenario 2 show a more diverse picture with regard to supply and demand. In both scenarios, major adjustments take place in the trade flows. Table 2 summarises the net export effects of all three scenarios on staple food and livestock commodities.Footnote 5 Scenario results are presented for the years 2021 and 2016 (the latter to demonstrate the impact of the negative economic shock in the year the shock actually takes place). As we focus on the effect of macroeconomic shocks on food security, we present results for China, India, grouped LDCs and other low-income countries.Footnote 6

Faster economic growth as simulated in Scenario 1 increases production in all low-income countries (including LDCs), allowing them to boost their exports and reduce their dependency on imports. By 2021, their import dependency ratio decreases by up to 40 percentage points for oilseeds and by nearly 15 percentage points for cereals, vegetable oil and dairy products. African LDCs expand their coarse grains exports so much that their net trade status changes and they become net exporters of 7.1 million tonnes by 2021 (compared to net imports of 0.6 million tonnes in the reference scenario).

In China and India, developments in domestic agricultural markets are particularly determined by the countries’ respective (trade) policies (Baldwin and Bonarriva 2013). In China, imports of agricultural products are subject to the value-added tax, levied at a rate of 13 %. In addition, there are tariff rate quotas for wheat, sugar and rice (OECD 2013). In Scenario 1, the consumption increases for wheat, coarse grains and rice in China due to faster economic growth are smaller than the increase in domestic production, which improves China’s net trade position in these commodities. This holds particularly for wheat, where net imports decrease by 31 % compared to the reference scenario. By contrast, consumption of beef meat and dairy products rises more than domestic production, which further deteriorates China’s net trade position. In India, the government intervenes in the markets for wheat, coarse grains and rice mainly via minimum support prices, flexible setting of tariffs up to a high most-favoured nation level and stock management (DAC India 2012; Shreedhar et al. 2012). To satisfy increased domestic consumption triggered by faster economic growth (Scenario 1), net imports in India increase considerably by 2021, especially for wheat (+122 % compared to the reference scenario) and coarse grains (+258 %) while net exports decrease, especially for rice (−90 %) and beef meat (−37 %). The domestic production response is impeded by India’s policy of minimum support prices, which are fixed by the government and can be expected to be set at a binding low level to counter the increased world market prices; however stocks are projected to increase, which is attributable to India’s stocking policy.

The self-sufficiency ratio increases due to the simulated faster economic growth in all low-income countries, with oilseeds and wheat in American low-income countries increasing the most by 2021 (+17 and +16 percentage points respectively) and wheat in non-African LDCs (+16 percentage points) compared to the reference scenario (Table 3). However, in most low-income and least developed countries, and for most commodities, the increase is not so high as for them to become self-sufficient (i.e. the self-sufficiency ratio remains below 100 %). In China and India, the self-sufficiency ratios of staple food, meat and dairy products decline slightly by 2021 (by about 1 percentage point). Although effects are strongly driven by different domestic policies in these two countries, scenario results confirm that consumption increases more than domestic production and is met by higher imports.

The results of Scenario 2 show that a one-time downward economic shock, taking place in a single year (2016) and only in emerging economies, the EU and the USA, is sufficient to affect world agricultural markets considerably, resulting in a temporary decrease of consumption worldwide, followed by reductions in domestic agricultural production. The specific effects are different among countries and markets, but scenario results indicate that due to lower commodity prices, LDCs and low-income countries increase their net imports or decrease their net exports (the effects are most pronounced for cereals). Consequently, the import dependency ratio of LDCs and low-income countries increases, especially for staple food. By 2021, the highest changes in the import dependency ratio compared to the reference scenario are increases of 25 and 21 percentage points for oilseeds and coarse grains in non-African LDCs and of 18 percentage points for coarse grains in African LDCs.

With declines in production and increased import dependency, LDCs and low-income countries are generally slightly less self-sufficient by 2021, with the effects being more visible for beef meat and vegetable oil in low-income countries. Compared to the reference scenario, the highest reduction of the self-sufficiency ratio is a decrease of 5.2 percentage points for beef meat in American low-income countries. The scenario results suggest that the lower agricultural commodity prices affect the producers in LDCs and low-income countries more than the consumers, as the reduction in domestic production causes their consumption needs to be met by higher imports. On the other hand, self-sufficiency in China and India is hardly affected by the economic shock (see Table 2).

Scenario results indicate that apart from re-distribution of trade, short-term changes in stocks in particular contribute to the re-balancing of the markets (see Table 4). As mentioned above, faster economic growth (Scenario 1) leads to higher consumption and production worldwide, but demand increases more than supply, implying that ending stocks decrease so that rising worldwide consumption can be met. The decrease in stocks is most pronounced in the early years of faster economic growth and then almost levels out as production further responds to the increasing demand. However, despite the improvement in self-sufficiency, stock-to-use ratios for staple food commodities in LDCs and in low-income countries are still about 1 percentage point lower in 2021 compared to the reference scenario. Even though this seems like only a small change, it has to be noted that ending stocks for most commodities are already relatively low in the reference scenario (except for wheat in non-African LDCs), and for beef and other meat products stock-to-use ratios are close to 0 %. By contrast, the one-time downward economic shock in Scenario 2 leads to an immediate improvement of the stock-to-use ratios of all commodities in LDCs and low-income countries in the year the shock takes place (2016). The improvement in each regional aggregate is most pronounced for cereals and in particular for those cereals where the stock-to-use ratios already had the highest pre-shock levels. However, the improvements in the stock-to-use ratios are only temporary and fade away over the projection period, and by 2021 the stock-to-use ratios for most commodities are even slightly below their respective levels in the reference scenario.

In China and India, the changes in the stock-to-use ratio are generally below 1 percentage point in Scenario 2, both during the year of the shock (2016) and by the end of the simulation period (2021). The faster economic growth in Scenario 1 also leads to generally lower stock-to-use ratios in China. By contrast, in India stock-to-use ratios increase. This rise is most pronounced in wheat, with an increase of 5.9 percentage points compared to the baseline in 2021. As explained above, both countries have specific domestic policies in place that aim to stabilise domestic markets. In the case of India, these policies not only impede production but also restrain exports when commodity prices are high, which leads to increasing stocks in Scenario 1.

Food security and food availability indices

Figure 4 presents the development of the three food security and food availability indices. The food bill index shows how expensive it will become for consumers to buy food, while the food import index shows how expensive it will be to import food.

Faster economic growth as simulated in Scenario 1 results in increasing prices for agricultural commodities and hence in increased costs to buy food when the expenditure is related both to domestic market prices (food bill index) and to world market prices (food import index). Despite the decreased imports and the decreased import dependency ratio, expenditure on imported food at world market prices increases more than expenditure in domestic markets. This can be particularly relevant for net importing countries facing balance of payment constraints (for example foreign currency availability), as a rise in the food import bill index suggests that these countries may need to take out loans to be able to finance the purchases of imported food. By 2021 the increase of the food import bill index is between 7 and 30 % in most of the LDCs and low-income countries, with the increase being the highest for China (+63 %). India is the only country where the food bill index decreases, which is related to India’s trade policy and indicates that it becomes cheaper for the Indian consumers to buy food.

Following Dorward (2013) we deflated the food bill index by the consumer price index (taken from OECD-FAO 2012) of each country to calculate the index in real terms and we compared the annual growth of this index with the annual income growth (indicated by the assumed real GDP growth). The results suggest that income grows more than food expenditure, with the difference being more noticeable in China and India (in both countries income grows by around 8 percentage points more than food expenditure) and less in non-African developing and least developed countries (where income growth is around 2 percentage points higher than growth in food expenditure). Thus, food expenditure is not projected to grow more than income in Scenario 1, implying that consumers should be able to finance purchases of food as long as they do not change their non-staple food expenditure patterns.

While the consumed calories per capita for crops continuously increases for India (+3.1 % by 2021), they steadily decrease in LDCs and low-income countries, albeit at a relatively low magnitude (between −0.4 % in American low-income countries and −1.1 % in Asian low-income countries). The increase in India reflects the effects on domestic markets and in particular the above discussed domestic market interventions for cereals. Furthermore, the modelled faster economic growth also turns into reductions in consumed crop calories per capita in China (−1.2 % by 2021). Thus, even though the modelled faster economic growth leads to production increases in China, all LDCs and low-income countries, this increase is not translated into higher intake of crop food calories per capita. In addition, in China and in LDCs the simulated increase in economic development also leads to a certain increase in beef meat consumption, but on average this increase in beef meat calories does not compensate for the decrease in staple food calories, resulting in a net decrease in food calorie intake.

The economic downturn as simulated in Scenario 2 results in relatively small changes in all three food security and food availability indices. Compared to the reference scenario, indices are lower regarding the domestic food bill and the food import bill, which is due to the slightly lower prices in both world and domestic markets. The effects are most pronounced in the year of the shock, and indices tend to return close to the reference level by 2021.

The highest changes in the food bill index compared to the reference scenario are projected for American low-income countries and the smallest changes are projected for India (−3 % and −0.4 % in 2016, which turns into −1.5 % and +0.4 % respectively by 2021). Despite the simulated economic downturn, the growth of the food bill index in real terms remains around 4 percentage points below real GDP growth rates in LDCs, 5 percentage points in developing countries and 6 and 7 percentage points in China and India, respectively. This implies that income grows more than staple food expenses, such that purchases of staple foods should not be threatened unless consumers change their consumption patterns and increase expenditures on non-staple foods.

Regarding the food import bill, the magnitude of the reduction is highest for China (about −6 % from 2016 throughout to 2021), and the lowest for African low-income countries (−5 % in 2016 and still −2 % in 2021). The lower food import bill index should especially benefit net importing countries in financing food purchases and thus should contribute positively to food availability.

As a consequence of the lower food (import) bill, the intake of crop food calories per capita slightly increases, but this positive effect tapers off by the end of the projection period in 2021.

Discussion of results and how food security can be reinforced

To improve the understanding of the impact of changing macroeconomic development paths on food security, the results of the scenarios have to be discussed in the context of the microeconomic situation of individual food security. This also allows a comparison of our results with findings of other studies and a discussion of the policy implications for the reinforcement of food security.

As mentioned above, in Scenario 1 the effects of the modelled higher economic growth on demand outweigh those in supply. Consequently, ending stocks fall, leading to lower stock-to-use ratios worldwide. In this context, it should be noted that lower stocks generally imply a higher vulnerability to increasing commodity prices, and low stocks were also pointed out as one of the causes of the food price spike in 2008 (Headey and Fan 2008; Trostle 2008; Baffes and Haniotis 2010; Naylor and Falcon 2010). The projected lower stocks are particularly concerning in the context of food security in net importing countries if, contrary to our scenario assumptions, leading exporting countries would experience major harvest failures over the projection period, as this could temporally lead to further increases in world market prices. Such developments were observed during the last decade when availability of grain exports of Russia, Ukraine and Kazakhstan (which are major players on the international grain markets) were repeatedly diminished by harvest failures and even further reduced by the introduction of subsequent export restrictions in these countries (Headey 2011; Rutten et al. 2013; Fellmann et al. 2014).

With respect to the issue of lower stock-to-use ratios, our scenario results bring the discussion on food reserves into focus. The need and usefulness of an international institutional arrangement for food reserves was recently highlighted by von Braun (2009) and von Braun and Torero (2009). The implementation of an independent global buffer stock (von Braun 2009; von Braun and Torero 2009) could be considered as the most straightforward approach to deal with the problems of low stocks at an international level. However, such an institutional arrangement may be flawed by several obstacles regarding its practical implementation, especially with regard to identifying appropriate price triggers (Wright 2009; Gilbert 2011; Tangermann 2011). In practical terms, the implementation of an independent international emergency food reserve for humanitarian assistance seems more promising, as it could specifically be designed to mitigate food shortages in LDCs and low-income countries in case of food price spikes (von Braun and Torero 2009; FAO et al. 2011; Tangermann 2011). However, our simulation results show that if economic growth would develop as in Scenario 1 (i.e. at a constantly faster rate than that assumed in the reference), then agricultural commodity prices would also constantly increase. This indicates that in this case an emergency food reserve would also most likely not be an appropriate tool, as it would be meant to bring only short-term relief to food availability constraints in times of temporary prices spikes, but not to counter continuously increasing agricultural commodity prices. In this context, a global framework of food stamp schemes specifically designed to target vulnerable low-income consumers in developing countries could be a promising alternative (Josling 2011). Within this framework, food stamp schemes should be voluntarily implemented and governed at the national level but under common international rules, with the latter facilitating the possibility to finance the schemes from international sources. Such schemes would be generally beneficial in times of both low and high food prices, but when prices are high they would provide an especially useful additional mechanism for increasing international support (Josling 2011).

Regarding the specific risk of increasing agricultural commodity prices for net importing countries, the FAO (2010) and Tangermann (2011) discuss the possibility of establishing and funding a Food Import Financing Facility. Furthermore, several authors highlight the use of futures contracts or options (as well as forward contracting) as tools to manage price risks (e.g. Sarris et al. 2005; Sarris 2010; Gilbert 2011; Tangermann 2011). However, with regard to stock holding, Gilbert (2011) points out that futures and options may solve global stockholding only to the extent that price risk is insurable and therefore can be offset. Moreover, Gilbert specifically emphasizes that access to futures markets should not be taken for granted, and can be especially problematic for LDCs (Gilbert 2011). Therefore, international assistance could be provided to support and/or facilitate the use of international commodity exchanges in developing countries. However, it is important to recognize that futures contracts and options do not guarantee the actual delivery, by the supplier of the commodity to the place/country where it is needed. In this context Sarris (2010) and Tangermann (2011) discuss the implementation of an International Grain Clearing Arrangement, which would have the objective of guaranteeing grain import contracts between private and public agents, which would hold physical reserves.

Regardless of an increased use of commodity exchanges or the implementation of food stamp schemes (or any other food safety net), a productive and growing domestic agricultural sector is imperative to alleviating pressures of rising food prices in the long-term. Accordingly, investments in agricultural research and development are still considered to be among the most efficient and effective measures to improve domestic food security in developing countries in the long term (see e.g. Evenson and Fuglie 2010; Alwang and Norton 2011; Anderson et al. 2013).

Faster economic growth only in emerging markets, the EU and the USA as simulated under Scenario 1 results in higher consumption, which drives world market prices for all agricultural commodities upwards. The higher prices trigger an increase in worldwide production. However, the production increase is not as high as the consumption increase, so world market prices remain high. Thus, countries that are net importers of agricultural commodities are most hit by increased prices due to economic growth as modelled in Scenario 1. The scenario results indicate that the modelled faster economic growth also induces substantial production increases in LDCs and low-income countries. However, the consumption increases in these countries are of a lower magnitude than the production increases. This implies that the modelled faster economic growth can help low-income countries to improve their trade balance but does not necessarily give them the incentive to address domestic food security concerns by boosting domestic consumption. Moreover, even though the increased domestic production improves self-sufficiency and reduces LDCs’ and low-income countries’ import dependency, these countries remain substantial net importers. With increases in their food import bill between 7 % and 30 %, the final rise in the food bill ranges between 7 % and 22 % by 2021 compared to the reference scenario. As a consequence, the consumed staple food calories per capita decrease by up to 1.1 % over the projection period. The main reason of this decrease is the higher cost of staple foods.

The introduction of a downwards economic shock as in Scenario 2 results in lower consumption in the year of the shock, followed by reduced production in the next year. Cereal markets demonstrate a more elastic reaction to price responses than processed food markets and livestock commodities. This leads on the one hand to relatively higher reductions of world market prices for cereals compared to livestock commodities, but on the other hand cereal markets also experience a quicker return to their initial baseline levels. However, the simulation results demonstrate that it takes more than 5 years for the markets to recover and absorb the demand shock. As a consequence of the decreases in world market prices, LDCs and low-income countries increase their imports of agricultural commodities, hence altering their import dependency ratio. Nonetheless, as the costs for food imports decrease, the actual food bill also declines, which makes it cheaper for consumers in LDCs and low-income countries to buy food, and results in a slightly higher food calorie intake per capita. Thus, regarding food security the scenario results indicate that, at least in the short to middle run, LDCs and low-income countries would actually be better off with the simulated downward shock. On the other hand, with slightly decreased self-sufficiency and stock-to-use ratios (and especially as they become more dependent on food imports), this also implies that LDCs and low-income countries become more vulnerable to disruptions in the world market and increasing agricultural commodity prices, particularly in the case of abrupt food price spikes. Correspondingly, the results of Scenario 2 underline the aforementioned need for food safety nets and investments in a productive and growing domestic agricultural sector in developing countries.

For the simulation scenarios, we introduced both the positive and negative economic shocks only in emerging countries, the EU and the USA. However, it is worth noting that many developing countries are financially and commercially integrated into global economic developments, and thus growth in developing countries is linked to growth in developed countries (Lewis 1980; Goldstein and Kahn 1982; Diaz-Bonilla and Robinson 2010). Therefore it can be expected that the modelled changes in economic growth would also have positive (Scenario 1) or negative (Scenario 2) spillover effects on economic growth rates in developing countries. In the case of positive spillover effects and positive economic growth in developing countries, this would result in higher developing country incomes, which could offset the impact of the rising food bill.

It should also be noted that the modelled price changes for agricultural commodities have ambiguous effects on poverty and hunger. For example, while rising prices increase the cost for consumers they also increase the income of farmers (who actually represent a majority of the world’s poor). Thus the final effect of changing agricultural prices on food security depends on whether a household/country is a net seller/exporter or net buyer/importer (FAO, WFP and IFAD 2011; Dorward 2012; Swinnen and Squicciarini 2012). One might also argue that in our analysis we focus on food availability and access on a country (or even more aggregated) level, but that it is actually the household/individual level that is decisive with regard to food security. However, most developing countries are net food importers (Valdés and Foster 2012) and likewise, the urban poor and the majority of rural poor people in developing countries are net food buyers with a high share of food expenditure and a rather inelastic demand for food (Compton et al. 2010; FAO, WFP and IFAD 2011; Dorward 2012). Therefore our simulation results not only give a good indication on how macroeconomic shocks generally affect food security on the aggregate country level but also point to the effects on poor net buyers of food. Accordingly, it can be expected that poor net food buyers in LDCs and low-income countries are most affected by the modelled higher agricultural commodity prices in Scenario 1 and the respective decrease in intake of food calories per capita. For this reason, our results support findings from other studies (like e.g. Brinkman et al. 2010; Christian 2010; Filipski and Covarrubias 2012) that highlight the negative effects of the high food prices in 2008 on food security, especially with regard to reduced access to nutritious food in developing countries.

Conclusions and final remarks

In agricultural commodity market outlooks it is usually assumed that there will be a smooth and steady path of recovery out of the recent economic crisis. However, there is increased uncertainty that such a smooth recovery will actually occur. This paper assesses how upward and downward shocks in economic growth would impact the developments on agricultural commodity markets in the period 2012–2021. In one scenario, we analyse how higher economic growth in emerging markets, the EU and the USA affect agricultural markets. In a second scenario, the effect of the reoccurrence of an economic downturn as experienced during 2008 and 2009 in the same set of countries on the initially projected developments on agricultural commodity markets is assessed. The analysis uses the partial equilibrium recursive dynamic model AGLINK-COSIMO.

The focus of this paper is on the macroeconomic level, such that other important factors that determine agricultural commodity prices and supply and demand are not assessed. Yield fluctuations caused by weather can have especially significant localised effects and provoke famines in the affected regions. Furthermore, harvest failures in major grain-exporting countries can also lead to large world market price swings, with particularly adverse effects for net importing countries. This implies that yield uncertainties, although not covered in this paper, are often more important for temporary and/or regional food security crises than macroeconomic developments.

The macroeconomic environment needs to be judged based on whether it favours or dampens the risk of food security crises. Our scenario results show that the modelled faster economic development (Scenario 1) has larger effects on agricultural markets and food security than the modelled temporary economic shock (Scenario 2). In addition, Scenario 1 leads to generally higher prices (ranging between 36 % and 59 %, depending on the commodity), which favours farmers but at the same time has adverse effects on consumers, especially in net food-importing countries. Nevertheless, the higher economic growth can be expected to lead to average income increases and make it easier for the urban poor to purchase food. Of course the latter effect largely depends on how economic growth affects income and income distribution. The observed decrease of stock-to-use ratios in Scenario 1—albeit small and between 1 and 3 percentage points (compared to the reference scenario)—indicates that agricultural markets might be more under stress and prone to temporary and/or regional food security crises. On the other hand, it could be expected that in a faster-growing world economy, fewer people are at risk. The implications of the temporary economic shock simulated in Scenario 2 are more difficult to judge as the crisis would lower food prices, but income would also likely fall. Thus, it generally depends on the severity and length of the shock, but the scenario results indicate that the effects of a one-year shock are still not completely worn off after a 5-year period, with world market prices for cereals being about 6 % lower, and those for oilseeds and livestock commodities about 5 % below the reference scenario.

Food security depends on the availability of food (whether enough food is physically available either through domestic production or imports) and on access to food (which is related to prices). Our analysis sheds light on effects of positive and negative economic shocks on agricultural commodity prices and food availability with regard to both domestic production and the role of trade to balance food surpluses and deficits. The simulations show that there is no homogeneous reaction to economic shocks among individual countries. The changes in domestic production and consumption are limited while changes in imports, exports and ending stocks are more visible. These developments would be higher if the simulations on economic growth would cover more countries. Returning to the question of the title of the paper, the results demonstrate that both positive and negative shocks in global economic growth indeed affect agricultural commodity markets and food security. The precise magnitude of the effects, and thus the answer to the question of whether the effects turn out to be really ‘shocking’, clearly depends on the magnitude of the introduced economic shock. However, in the light of ongoing discussions on global food security, the findings of the paper cast doubt on whether all countries, and in particular developing ones, have the capacity to cope with changes on agricultural markets induced by economic shocks.

Notes

The results of any analysis based on the use of the AGLINK-COSIMO model by parties outside the OECD are outside the responsibility of the OECD Secretariat. Conclusions derived by third-party users of AGLINK-COSIMO should not be attributed to the OECD or its member governments.

We concentrate on staple foods because in terms of energy intake they are the most important component in the average diet in developing countries.

All prices are nominal prices.

Regarding livestock commodities we present the results for butter and beef meat, as they are the most important dairy and meat products in terms of both traded volume and value in most developing and least developed countries.

References

Abbott, P., & McCalla, A. (2002). Agriculture in the macroeconomy: theory and measurement. In B. L. Gardner & G. C. Rausser (Eds.), Handbook of agricultural economics, volume 2 (Part A, agriculture and its external linkages, chapter 32, pp. 1213–1686).

Alwang, J., & Norton, G. W. (2011). What types of safety nets would be most efficient and effective for protecting small farmers and the poor against volatile food prices? Food Security, 3(Suppl. 1), S139–S148.

Anderson, K., Jha, S., Nelgen, S., & Strutt, A. (2013). Re-examining policies for food security in Asia. Food Security, 5(2), 195–215.

Baffes, J. & Haniotis, T. (2010). Placing the 2006/08 Commodity Price Boom into Perspective. Policy Research Working Paper 5371, Washington DC: The World Bank.

Baldwin, K. & Bonarriva, J. (2013). Feeding the Dragon and the Elephant: How Agricultural Policies and Trading Regimes Influence Consumption in China and India. Journal of International Commerce and Economics, Published electronically http://www.usitc.gov/journals/Feeding_the_Dragon_and_the_Elephant.pdf.

Blanco Fonseca, M., Burrel, A., Gay, S. H., Henseler, M., Kavallari, A., M’barek, R., Perez Dominguez, I. & Tonini, A. (2010): Impacts of the EU biofuel target on agricultural markets and land use: a comparative modelling assessment. JRC Reference Report. Institute for Prospective Technological Studies, Joint Research Centre, European Commission.

Brinkman, H. J., de Pee, S., Sanogo, I., Subran, L., & Bloem, M. W. (2010). High food prices and the global financial crisis have reduced access to nutritious food and worsened nutritional status and health. Journal of Nutrition, 140(1), 53S–161S.

Christian, P. (2010). Impact of the economic crisis and increase in food prices on child mortality: exploring nutritional pathways. Journal of Nutrition, 140(1), 177S–181S.

Compton, J., Wiggins, S., & Keats, S. (2010). Impact of the global food crisis on the poor: What is the evidence? London: Overseas Development Institute.

Diaz-Bonilla, E., & Robinson, S. (2010). Macroeconomics, macrosectoral policies, and agriculture in developing countries. In P. Pingali & R. Evenson (Eds.), Handbook of agricultural economics, Vol. 4 (chapter 61, pp. 3035–3213).

Dorward, A. (2012). The short- and medium-term impacts of rises in staple food prices. Food Security, 4(4), 633–645.

Dorward, A. (2013). Agricultural labour productivity, food prices and sustainable development impacts and indicators. Food Policy, 39, 40–50.

Evenson, R., & Fuglie, K. (2010). Technological capital: the price of admission to the growth club. Journal of Productivity Analysis, 33(3), 173–190.

FAO (1996). Rome Declaration on World Food Security and World Food Summit Plan of Action. Rome: Food and Agriculture Organisation of the United Nations, http://www.fao.org/DOCREP/003/W3613E/W3613E00.HTM. Accessed 01 August 2013.

FAO (2001). Food balance sheets, a handbook. Rome: Food and Agriculture Organisation of the United Nations.

FAO (2009). Declaration of the world summit on food security, WSFS 2009/2. Rome: Food and Agriculture Organisation of the United Nations.

FAO (2010). Management of wide international commodity price movements – national and international experiences and policy responses. Document CCP 10/4. Rome: Food and Agriculture Organisation of the United Nations.

FAO, WFP, & IFAD (2011). The state of food insecurity in the world: How does international price volatility affect domestic economies and food security? Rome: Food and Agriculture Organisation of the United Nations.

FAO, WFP, & IFAD (2012). The state of food insecurity in the world: Economic growth is necessary but not sufficient to accelerate reduction of hunger and malnutrition. Rome: Food and Agriculture Organisation of the United Nations.

FAO et al. (2011). Price Volatility in Food and Agricultural Markets: Policy Responses. Policy Report including contributions by FAO, IFAD, IMF, OECD, UNCTAD, WFP, the World Bank, the WTO, IFPRI and the UN HLTF. http://www.fao.org/fileadmin/templates/est/Volatility/Interagency_Report_to_the_G20_on_Food_Price_Volatility.pdf. Accessed 04 March 2013.

FAPRI (2012). U.S. Baseline Briefing Book, Projections for Agricultural and Biofuel Markets. FAPRI-MU Report #01-12, Food and Agricultural Policy Research Institute, University of Missouri. http://www.fapri.missouri.edu/outreach/publications/2012/ FAPRI_MU_Report_01_12.pdf. Accessed 10 October 2012.

Fellmann, T., Helaine, S., Nekhay, A. (2014). Harvest failures, temporary export restrictions and global food security: the example of limited grain exports from Russia, Ukraine and Kazakhstan. Food Security, doi:10.1007/s12571-014-0372-2.

Filipski, M., & Covarrubias, K. (2012). Distributional impacts of commodity prices in developing countries. In: OECD, agricultural policies for poverty reduction (pp. 61–88). Paris: OECD Publishing.

Gilbert, C. L. (2010). How to understand high food prices. Journal of Agricultural Economics, 61(2), 398–425.

Gilbert, C. (2011). International agreements for commodity price stabilisation: An assessment. OECD Food, Agriculture and Fisheries Papers, no. 53. Paris: OECD Publishing.

Goldstein, M., & Kahn, M. (1982). Effects of slowdown in industrial countries on growth in non-oil developing countries. IMF Occasional Paper No. 12. Washington: International Monetary Fund.

Headey, D. (2011). Rethinking the global food crisis: the role of trade shocks. Food Policy, 36(2), 136–146.

Headey, D., & Fan, S. (2008). Anatomy of a crisis: the causes and consequences of surging food prices. Agricultural Economics, 39(Supplement s1), 375–391.

IMF (2013). World economic outlook. Hopes, realities, and risks. Washington: International Monetary Fund. Accessed 01 August 2013.

DAC India (2012). Agricultural Statistics at a Glance 2011. Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, http://agricoop.nic.in/. Accessed 01 August 2013.

Josling, T. (2011). Global Food Stamps: An Idea Worth Considering?. ICTSD Programme on Agricultural Trade and Sustainable Development, Issue Paper No. 36, Geneva: International Centre for Trade and Sustainable Development.

Lewis, A. W. (1980). The slowing down of the engine of growth. American Economic Review, 70(4), 555–564.

Naylor, R. L., & Falcon, W. P. (2010). Food security in an era of economic volatility. Population and Development Review, 36(4), 693–723.

OECD (2006). Documentation of the AGLINK Model. Working Party on Agricultrual Policies and Markets, AGR-CA-APM (2006)16/FINAL. Directorate for Food, Agriculture and Fisheries, Committee for Agriculture, Organisation for Economic Cooperation and Development, Paris.

OECD (2008). Biofuel support policies: An economic assessment. Organisation for Economic Cooperation and Development. Paris: OECD Publishing.

OECD (2013). Agricultural policy monitoring and evaluation: OECD countries and emerging economies, Organisation for Economic Cooperation and Development. Paris: OECD Publishing.

OECD-FAO (2012). OECD-FAO agricultural outlook 2012–2021. Organisation for Economic Cooperation and Development, and Food and Agricultural Organisation of the United Nations. Paris: OECD Publishing and FAO.

Pinstrup-Andersen, P. (2009). Food security: definition and measurement. Food Security, 1(1), 5–7.

Rutten, M., Shutes, L., & Meijerink, G. (2013). Sit down at the ball game: how trade barriers make the world less food secure. Food Policy, 38, 1–10.

Sarris, A. (2010). Hedging cereal import price risks and institutions to assure import supplies. FAO Commodity Market Review, 2009–2010, 140–179.

Sarris, A., Conforti, P., & Prakash, A. (2005). The use of organized commodity markets to manage food import price instability and risk. Commodities and Trade Division, FAO Commodity and Trade Policy Research Working Paper no. 16. Rome: FAO.

Shreedhar, G., Gupta, N., Pullabhotla, H., Ganesh-Kumar, A. & Gulati, A. (2012). A Review of Input and Output Policies for Cereals Production in India. IFPRI Discussion Paper 01159, International Food Policy Research Institute, Environment and Production Technology Division, New Delhi Office.

Swinnen, J., & Squicciarini, P. (2012). Mixed messages on prices and food security. Science, 335(6067), 405–406.

Tangermann, S. (2011). Policy Solutions to Agricultural Market Volatility: A Synthesis. ICTSD Programme on Agricultural Trade and Sustainable Development, Issue Paper No. 33, Geneva: International Centre for Trade and Sustainable Development.

Thompson, W., Smith, G., & Elasri, A. (2012). World wheat price volatility: Selected scenario analyses. OECD Food, Agriculture and Fisheries Papers, No. 59. Paris: OECD Publishing.

Timmer, C. P. (2002). Agriculture and economic devolpment. In B. L. Gardner & G. C. Rausser (Eds.), Handbook of agricultural economics, volume 2 (Part a, agriculture and its external linkages, chapter 29, pp. 1487–1546).

Trostle, R. (2008). Global Agricultural Supply and Demand: Factors Contributing to the Recent Increase in Food Commodity Prices. USDA/ERS Report WRS-0801, Washington DC: USDA.

UN (2013). Office of the High Representative for the Least Developed Countries (LDCs), Landlocked Developing Countries (LLDCs) and Small Island Developing States (SIDS). http://www.unohrlls.org/en/ldc/25/. Accessed 30 May 2013.

Valdés, A. & Foster, W. (2012). Net Food-Importing Developing Countries: Who They Are, and Policy Options for Global Price Volatility. ICTSD Programme on Agricultural Trade and Sustainable Development, Issue Paper No. 43, Geneva: International Centre for Trade and Sustainable Development.

von Braun, J. (2009). Addressing the food crisis: governance, market functioning, and investment in public goods. Food Security, 1(1), 9–15.

von Braun, J., & Torero, M. (2009). Implementing physical and virtual food reserves to protect the poor and prevent market failure. IFPRI policy brief 10. Washington DC: International Food Policy Research Institute.

World Bank (2012). Global monitoring report 2012: food prices, nutrition, and the millennium development goals. Washington DC: The World Bank.

World Bank (2013a). Global economic prospects: Assuring growth over the medium term, volume 6. Washington DC: The World Bank.

World Bank (2013b). Country and Lending Groups. http://data.worldbank.org/about/country-classifications/country-and-lending-groups. Accessed 30 May 2013.

Wright, B.D. (2009). International Grains Reserves and Other Instruments to Address Volatility in Grain Markets. World Bank Policy Research Working Paper No. 5028, Washington DC: The World Bank.

Disclaimer

The views expressed are purely those of the writers and may not in any circumstances be regarded as stating an official position of the European Commission.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Kavallari, A., Fellmann, T. & Gay, S.H. Shocks in economic growth = shocking effects for food security?. Food Sec. 6, 567–583 (2014). https://doi.org/10.1007/s12571-014-0368-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12571-014-0368-y