Abstract

Cities around the world face major challenges caused by the extensive use of private cars. To counteract these problems, a new paradigm is necessary which promotes alternative mobility services. ‘Smart mobility’ refers to a new mobility behaviour that makes use of innovative technical solutions, such as the IT-supported combination of different alternative mobility services during a trip from an origin to a destination. Unfortunately, relatively few customers use apps that provide recommendations for smart mobility and there is limited knowledge about the desires, priorities and needs of potential customers. To fill this gap, we use conjoint analysis to explore differences in smart mobility app preferences across groups of people with varying mobility behaviour. Our study also considers the effect of age and place of residence on preference structures. Our results show, for example, that only car drivers do not consider the price of the smart mobility app to be particularly important for their selection decision.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Big cities and towns around the world are challenged to change the mobility behaviour of their citizens and of commuters from rural areas away from predominantly private car use and toward using alternative mobility services such as public transport or bike- and car-sharing. Such a new mobility behaviour paradigm would help cities address important challenges, including traffic congestion and insufficient parking, as well as air and noise pollution (Benevolo et al. 2016; Schreieck et al. 2018b; Willing et al. 2017a, 2017b). Given that the percentage of the worldwide population living in urban areas is expected to increase from 50% in 2015 to 66% by 2050 (United Nations Department of Economic and Social Affairs 2015), these challenges are pressing.

One opportunity to support behavioural changes is enabled through ongoing technical progress and the proliferation of information technology (IT). In the recent past, particularly the smartphone has fundamentally changed the provision of services, including mobility services. The use of smartphone apps makes alternative mobility services such as car-sharing (Firnkorn and Müller 2011; Hildebrandt et al. 2015), bike-sharing (Shaheen et al. 2010), or ride-sharing (Rayle et al. 2014; Teubner and Flath 2015) easier and more comfortable to use. As a result, the importance of private car ownership and the emotional attachment to the car in particular among 18–24-year-olds is declining (Bratzel 2018; Circella et al. 2017; Kuhnimhof et al. 2012; Umweltbundesamt 2019). However, alternative mobility services continue to have some weaknesses which limit their contribution to the realisation of a new mobility behaviour paradigm. For example, the fact that public transport is a station-based service that does not provide transport from an origin to a final destination, and the fact that trains, buses and trams are often overcrowded, especially during rush hours, can be seen as weaknesses.

Smart mobility apps are a special category of smartphone apps that can help to mitigate the weaknesses of alternative mobility services and thus to increase their attractiveness. According to Willing et al. (2017a, p. 271) “long-distance travel booking was the forerunner […], with many established web-based offerings, such as online travel agencies (e.g. Expedia) and flight comparison websites (e.g. Kayak), mostly due to homogeneous supply. Short-distance urban travel [‘mobility’ would be a more precise term], however, has recently become more diverse”. Smart mobility app users are provided with individualized, context-aware, and dynamic recommendations for bundling mobility services for a trip from origin to final destination (Schulz et al. 2018). In doing so, individual customer needs and priorities, such as information about the fastest, cheapest, or most environmentally friendly bundle of mobility services are taken into account (Albrecht and Ehmke 2016; Schulz et al. 2019). To be effective, smart mobility apps must account for unforeseen events like short-term cancellations or delays automatically and in real-time, adapting recommended bundles dynamically. Such features would save customers time and energy by eliminating the need to search and compare myriad mobility service offerings, combine options and adapt their trip in response to unexpected changes. Ideally, customers should be able to book and pay for bundles or at least individual tickets using their smartphone (Willing et al. 2017a, 2017b).

Unfortunately, in reality, smart mobility apps do not provide this level of functionality. A number of studies (e.g., Albrecht and Ehmke 2016; Schulz et al. 2018; Schulz and Überle 2018; Willing et al. 2017a, 2017b) show that only few mobility providers cooperate with the providers of smart mobility apps. This has many negative effects. For example, if providers of smart mobility apps cannot access mobility provider data, their apps can only recommend a small share of all possible bundles of mobility services. In addition, the lack of provision of real-time position data limits dynamic adaptation. Furthermore, mobility providers often do not allow providers of smart mobility apps to charge customers for tickets on a ‘one-click’ basis.

To date, it is unclear how the shortcomings of smart mobility apps affect their value to customers. Previous research often takes a provider perspective by focusing on individual services, while neglecting the actual customer need for bundled services. This applies to different fields of service, such as education, finance, health, and in particular mobility (Alt et al. 2019; Willing et al. 2017a, 2017b). Willing et al. (2017b, p. 178) point out a potential way to close this research gap, stating that “researchers can help to identify and define what constitutes a good intermodal [i.e., combination of single-trip multiple mobility services] value proposition regarding platform [i.e., a smart mobility app] design”. To date, only few studies have analysed the preference structure of potential customers, and thus how a smart mobility app should support the bundling of mobility services. Stopka (2014), for example, analyses data collected in focus group interviews with eight participants, which is not large enough to ensure representativeness. Grotenhuis et al. (2007) determine the preferences of Dutch people via a survey with multiple-choice questions. But this method is not recommended in analysing preferences (Backhaus et al. 2015). Understanding customer preference structures can help make smart mobility apps more attractive for potential customers and, hence, contribute to the reduction of private car use.

From a theoretical point of view, the shift from buying and using a private car to using a bundle of mobility services (supported by a smart mobility app) represents a shift from a goods-dominant (G-D) towards a service-dominant (S-D) logic. S-D logic literature assumes that (potential) customers evaluate the value during use, for instance, on the basis of flexibility and ease-of-use provided by smart mobility apps (Gilsing et al. 2018; Vargo et al. 2008).

Based on previous research (e.g., Circella et al. 2017; Kuhnimhof et al. 2012; Umweltbundesamt 2019), age likely significantly influences potential customer preference structures. Insights into age-related differences may help providers better tailor smart mobility apps, especially for the younger generation, which is more open to app-based mobility services (Bratzel 2018; Rayle et al. 2014). Similarly, for example, due to lower availability of alternative mobility services and often longer commuting distances, people living in rural areas likely have different preferences than people living in urban areas (Kloas et al. 2001; Umweltbundesamt 2019). A better knowledge of the preference structures and differences among potential customers can help providers develop successful business models and monetarization strategies for smart mobility apps. Research in this area is still in its infancy (Schreieck et al. 2018a). To fill the described research gap, we pose the following research questions:

RQ1: To what extent do preference structures for a smart mobility app vary across potential customers grouped by mobility behaviour?

RQ2: What effect do age and place of residence have on these preference structures?

To answer these research questions, we conducted three consecutive studies. In a first step, we analysed the customer reviews of existing smart mobility apps in order to identify relevant attributes and attribute levels. Then we conducted a pre-test with nine potential customers and one expert to identify a number of key attributes and attribute levels feasible for conjoint analysis. Finally, we conducted a conjoint analysis with 523 people living in Germany.

The paper is structured as follows: First we introduce the service-dominant (S-D) logic perspective as a means to better understanding how specific customer value is co-created in the case of smart mobility apps. Then we present different possible criteria for identifying target groups in the context of smart mobility apps. Next we present conjoint analysis as a method to analyse customer value and to gain insight into customers’ smart mobility app preferences. Subsequently, we discuss the results, implications and limitations of our work and provide recommendations for future research. The article ends with a conclusion.

Conceptual foundations

The service-dominant logic perspective and its concept of value co-creation

The shift in mobility behaviour from the use of the private car to smart mobility entails a shift from a goods-dominant (G-D) towards a service-dominant (S-D) logic. The traditional G-D logic adopts a company and output-centric perspective (Vargo and Lusch 2004). It is assumed that a company focuses on the exchange of (physical) resources and primarily manufactured things. Economic value is created for the company during the transfer of ownership of goods (value-in-exchange) (Gilsing et al. 2018). The economic value is therefore determined by the company and the customer is only the recipient of the goods (Vargo and Lusch 2004; Vargo et al. 2008). However, emerging trends in the mobility sector show that “customers [are] increasingly mov[ing] away from a goods-dominant perspective (e.g. buying a car)” and considering instead “the value (e.g., the flexibility and ease-of-use) offered by [, e.g.,] car sharing applications that provide a similar mode of transportation” (Gilsing et al. 2018, p. 2).

S-D logic originated in marketing (Vargo and Lusch 2004), but scholars in a wide variety of research fields (e.g., Hearn et al. 2007; Jarvis et al. 2014; Storbacka et al. 2016), including service science (Maglio et al. 2009; Spohrer and Maglio 2010, etc.) and information systems (IS) (e.g., Brust et al. 2017; Giesbrecht et al. 2017; Lusch and Nambisan 2015; Schmidt-Rauch and Schwabe 2014) have taken an S-D logic perspective, including several studies focusing on the mobility sector (e.g., Gilsing et al. 2018; Schulz et al. 2020b; Schulz and Überle 2018; Turetken et al. 2019). One of the key assumptions of S-D logic is that service is the basis of exchange (Vargo et al. 2008). Service-for-service exchange between different actors leads to the formation of a service ecosystem that represents “a relatively self-contained, self-adjusting system of mostly loosely coupled social and economic (resource-integrating) actors connected by shared institutional logics and mutual value creation” (Lusch and Nambisan 2015, p. 161). In the case of smart mobility, the service ecosystems encompass a great number of actors, for example, mobility providers and regional authorities (Schulz et al. 2020a; Schulz and Überle 2018). The service-for-service exchange between their actors is facilitated by a service platform (Lusch and Nambisan 2015), such as a smartphone app.

In contrast to G-D logic, in S-D logic no differentiation is made between companies and customers with regard to resource integration and exchange of services (Vargo and Lusch 2004; Vargo and Lusch 2016). In other words, all actors in the service ecosystem are involved in value co-creation (Vargo and Lusch 2017). Customers act as co-creators of value, for instance, by providing smartphone data on whether a bus is delayed or overcrowded (Schreieck et al. 2018a). However, value co-creation can be constrained by conflicting institutions and institutional arrangements (Akaka et al. 2013; Koskela-Huotari et al. 2016; Schulz et al. 2020a), which reflect “humanly devised rules, norms, and beliefs” (Vargo and Lusch 2017, p. 49).

S-D logic assumes that “value is always uniquely and phenomenologically determined by the beneficiary” (Vargo et al. 2008, p. 148). Hence, the principle of value-in-exchange (G-D logic) is replaced by the principle of ‘value-in-use’ (Vargo and Lusch 2004) or ‘value-in-context’ (Chandler and Vargo 2011; Vargo and Lusch 2017; Vargo et al. 2008). Both principles are based on the assumption that service providers, based on their individual resources (e.g., capabilities, competences, knowledge, skills), can only make a value proposition. Afterwards, the value proposition is accepted or rejected by potential customers (Vargo et al. 2008). For instance, in the context of a smart mobility app, some potential customers may accept the value proposition from a provider and exchange smartphone data and money. In other cases, potential customers will reject the smart mobility app and perhaps choose an alternative. When evaluating and choosing between the value propositions of providers, potential customers are not guided by the intrinsic characteristics of smart mobility apps, but by how well these smart mobility apps create value for them in getting from an origin to a destination (Gilsing et al. 2018).

Identifying target groups for smart mobility

Segmenting the market into different “groups of [potential] customers with distinctly similar needs, service requirements and behaviour” (Hinkeldein et al. 2015, p. 180) can provide valuable insights about how smart mobility apps should be designed. As Hunecke et al. (2010, p. 4) – and similarly Semanjski and Gautama (2016) – highlight, a “knowledge about the motivational basis of target groups can be used to design interventions to promote sustainable behavior more efficiently”. There are many segmentation criteria, which can be assigned to four classes: (1) mobility behaviour, (2) socio-demographic, (3) spatial, and (4) attitudinal criteria (Haustein and Hunecke 2013). Table 1 shows exemplary criteria for each class which has already been used in previous studies (e.g., Haustein and Hunecke 2013; Hinkeldein et al. 2015; Hunecke et al. 2010; Schwanen and Mokhtarian 2005; Semanjski and Gautama 2016). None of the classes or criteria can be regarded as absolutely superior. Attitudinal criteria, for example, have the disadvantage of lower reliability concerning measurability (Haustein and Hunecke 2013).

Segmentation can be conducted either a priori or post hoc. In an a priori approach, participants of a study are classified into target groups according to one or more predefined criteria (Haustein and Hunecke 2013). For example, Kawgan-Kagan (2015) differentiates between female and male early adopters of car-sharing services, and subsequently compares them on the basis of further segmentation criteria, such as socio-demographic and attitudinal criteria. In contrast, in the case of a post hoc approach, the target groups are created by drawing on the empirical data (Haustein and Hunecke 2013). Both segmentation approaches can also be combined. For instance, Siren and Haustein (2013) divide the predefined target group of baby boomers into three clusters, which significantly differ in terms of mobility behaviour and living conditions. In the following, we provide detailed information on three segmentation criteria (1) types of mobility services, (2) age, and (3) place of residence, which we will use in our study. The latter two criteria are considered particularly relevant for identifying the needs and expectations of participants for new IT services in a mobility context (Tuominen et al. 2007) such as smart mobility apps.

The mobility behaviour of the population can be characterized by the types of mobility services which are used over a certain period of time (Haustein and Hunecke 2013). Since the overall goal of this study is to provide smart mobility apps that in particular contribute to switch from private car use to the use of alternative mobility services, this is the core segmentation criterion. Previous literature (for an overview, see Grison et al. 2017) highlights that the route choice, and thus the linked choice of mobility services, depends individually on a high number of factors, including cost, travel time, and transfer characteristics. In the case of public transport, most of the routes require transfers “which are negatively perceived because they involve waiting time, walking, uncertainty, and loss of control over the trip” (Grison et al. 2017, p. 25). Similar barriers can be expected in terms of necessary transfers between all possible mobility services. Chowdhury and Ceder (2013) show that the choice of public transport routes that include transfers can be promoted if, for example, the waiting time, reliability of connection, or information is improved. On the other hand, individual mobility behaviour depends on routine and experience with mobility services, such as public transport (Grison et al. 2016). In turn, it is to be expected that the target groups created by mobility behaviour will have different preference structures for a smart mobility app.

Apart from gender, age is one of the two most frequently chosen socio-demographic segmentation criteria (Haustein and Hunecke 2013). In previous studies, the authors have analysed the mobility behaviour and the preference structures of different age groups, such as seniors (Alsnih and Hensher 2005), millennials (Circella et al. 2017), and baby boomers (Siren and Haustein 2013). Especially among the younger age groups, new lifestyles and more widely varying mobility behaviours distinguish them from other age groups. Younger generations acquire their driving licence at a later date, often do not own a car, and if they own a car, they drive less (e.g., Bratzel 2018; Circella et al. 2017; Kuhnimhof et al. 2012; Umweltbundesamt 2019). Not surprisingly, young people, in particular those who live in urban areas, are early adopters of shared mobility services (Bratzel 2018; Rayle et al. 2014). (Urban) millennials also more frequently adopt apps, for example, to obtain information about the mobility services to use for a trip, or for real-time navigation (Circella et al. 2017). In addition, an age-related segmentation of potential customers of smart mobility apps appears useful as the foundations for non-private car-based mobility are laid during earlier stages of life (Umweltbundesamt 2019). The early stages of life involve a number of events, such as moving house, starting studies and getting a first job, which are considered to have a high potential to influence the mobility behaviour (Chatterjee and Scheiner 2015).

“Where one lives also affects how travel is conducted” (Alsnih and Hensher 2005, p. 2). Different spatial criteria can be used for a corresponding segmentation (Schwanen and Mokhtarian 2005). One criterion is the place of residence, for instance, differentiating between urban, suburban, and rural areas (Haustein and Hunecke 2013). Outside of urban areas, access to public transport is often limited, which reinforces the preference for the private car (Alsnih and Hensher 2005). The effect of place of residence on mobility behaviour has also been confirmed in a number of German studies (e.g., Bratzel 2018; Scheiner and Holz-Rau 2013; Umweltbundesamt 2019). For example, Kloas et al. (2001) show that the transport volume in towns is 46 km higher per capita per week than in city centres. As a result, it can be assumed that preferences for smart mobility apps vary depending on the place of residence.

Research methodology

Choice-based conjoint (CBC) analysis

Conjoint analysis can be used to evaluate how potential customers view the value proposition offered by a provider of a smart mobility app, as well as their decision to accept or reject this value proposition. The theoretical basis for conjoint analysis was developed by scholars in the field of psychology (Luce and Tukey 1964). Today, conjoint analysis is used and well established in numerous research fields, including IS (e.g., Bajaj 2000; Berger et al. 2015; Mihale-Wilson et al. 2019; for an overview see Naous and Legner 2017; Roßnagel et al. 2014). In order to use conjoint analysis, several assumptions must be made (Backhaus et al. 2015; Hair Jr. et al. 2014). The most important assumption is that conclusions about the usefulness of individual attributes and their attribute levels can be drawn based on the evaluation of whole products or services (i.e., smart mobility apps). This is known as the decompositional approach.

For each attribute level, an estimated empirical value indicates the value for potential customers. The totality of these part-worths constitutes the potential customers’ preference structure (Berger et al. 2015). The difference between the attribute level with the highest estimated part-worth and the attribute level with the lowest estimated part-worth reflects the importance of each attribute. When the difference is set in relation to the sum of the differences, the result indicates the relative importance of the attribute in the overall preference structure (Backhaus et al. 2015; Hair Jr. et al. 2014). In the decompositional approach, the total value of a smart mobility app can be calculated by adding up the estimated part-worths of its attribute levels (Hair Jr. et al. 2014). This means that the estimated part-worths of different attributes can be in a compensatory relationship to each other (Berger et al. 2015). For example, a fee-based smart mobility app (lower part-worth at the attribute app price) can provide a higher total value to potential customers compared to a free smart mobility app, and therefore be more attractive, by providing real-time information (as opposed to static information) and/or one-click booking (as opposed to being forwarded to the website).

In the course of time, the basic form of conjoint analysis has been further developed and different advanced forms have been introduced in scientific research (Hair Jr. et al. 2014). In the beginning, the most common form – so-called preference-based conjoint analysis or traditional conjoint analysis (TCA) – was to present potential customers a number of artificially constructed products or services that they have to rank or rate according to their preferences (Backhaus et al. 2015). However, both valuation methods require high mental effort on the part of participants. As a consequence, the obtained results often do not correspond to the actual preferences of potential customers (Berger et al. 2015). In order to better estimate the preferences and, thus, to more closely mimic the buying decisions of potential customers, their discrete choices can be analysed (Backhaus et al. 2015). Important contributions to the discrete choice analysis have been made by, among others, Luce (2005) and McFadden (1980). Louviere and Woodworth (1983) integrated discrete choice theory and conjoint analysis. Choice-based conjoint (CBC) analysis is now the most frequently applied form of conjoint analysis (Sattler and Hartmann 2008).

CBC analysis is a suitable and established methodology for analysing the preferences of potential customer groups for smart mobility apps. Previous studies have, for example, examined the differences in preferences between smartphone owners and non-owners with regard to newspaper subscription (Berger et al. 2015). Such insights can also help to develop monetization strategies for smart mobility apps (by including both free and non-free smart mobility apps in the choice tasks).

Implementation

Our research focuses on analysing potential customers’ preferences for smart mobility apps. In order to conduct a well-grounded CBC analysis (Study 3), we carried out two preliminary studies. In Study 1, we identified a pool of attributes and their attribute levels that might be important from a customer perspective. In Study 2, we reduced the pool of attributes and attribute levels to a number feasible for CBC analysis and tested our questionnaire. Fig. 1 provides an overview of the three studies.

Study 1: Identification of attributes and attribute levels

To get a complete picture of the relevant attributes and attribute levels, we initially analysed the customer reviews provided for the smart mobility apps ‘Ally’, ‘fromAtoB’, ‘Moovel’, and ‘Qixxit’ in the Android Google Play Store (https://play.google.com) in the period from 2016 to 2017. We chose these particular smart mobility apps based on the overview provided by Albrecht and Ehmke (2016). The rationale for choosing these smart mobility apps were (1) the focus on the same geographical area (German-speaking Europe); (2) ‘Moovel’ (Daimler AG) and ‘Qixxit’ (Deutsche Bahn AG) are operated by large German companies, while ‘Ally’ and ‘fromAtoB’ are offered by start-ups; and (3) they have a varying focus on mobility within and between cities.

We coded our data using NVivo 10. Our analysis of negative customer reviews revealed the weaknesses of the smart mobility apps, such as the lack of integration of regional mobility providers, or the lack of ticket purchasing capability. This approach ensures that relevant attributes and attribute levels which are currently not addressed by the smart mobility apps are taken into account. Such an analysis is necessary as CBC analysis requires that “the range (low to high) of the [attribute] levels [is] set somewhat outside existing values but not at an unbelievable level” (Hair Jr. et al. 2014, p. 363). Based on scientific literature (e.g., Albrecht and Ehmke 2016; Schulz et al. 2018; Willing et al. 2017a), and on our practical experience, we added existing attributes and attribute levels from smart mobility apps. Some of them may appear standard at first if mobility services that are provided in large German cities and the related IT are chosen as reference. However, in towns and rural areas, for example real-time information and mobile tickets are often not available (Ministerium für Verkehr Baden-Württemberg 2020; Schulz et al. 2018).

Study 2: Pre-test of attributes and attribute levels

Using QuestionPro software, we then created an initial version of the questionnaire, including the choice sets, following the process steps recommended by Backhaus et al. (2015) for implementing and conducting a CBC analysis. The part of the questionnaire that encompasses the choice sets started with a short explanation of the choice decision. We used ten choice sets, eight of which were randomly designed by the software and differed from participant to participant (QuestionPro 2019). The other two choice sets were two identical fixed choice sets, or so-called ‘holdouts’, which were identical for each participant and necessary to measure reliability and validity (Backhaus et al. 2015; Hair Jr. et al. 2014). During one choice task, three different smart mobility apps were presented to the participants and a ‘none of the above’ option was included to reflect reality more closely (Backhaus et al. 2015). This fourth option permitted participants to choose a private car or any other available option or app, for instance, from a bike- or car-sharing company. A randomly designed choice set is shown in Fig. 2.

We conducted a pre-test to determine how relevant the attributes and their attribute levels are in choosing a smart mobility app, and to check if these and the supplementary questions are clearly described. Since CBC analysis should be limited to six attributes (Hair Jr. et al. 2014), our goal was to identify the six most important ones. For this purpose, we randomly selected six attributes and implemented them in QuestionPro. At the end of each pre-test, the participant was given a list of further attributes and attribute levels currently not implemented and invited to select the six most important attributes in total. Table 2 lists the attributes and attribute levels considered less important and thus not included in the final CBC analysis, as well as the corresponding original references.

Regardless of the participants’ selection, the app price was included as an attribute, as it plays a unique role in the CBC analysis (Hair Jr. et al. 2014). Previous studies focusing on the analysis of the willingness to pay for a (smart) mobility app, respectively, on the services provided (e.g., real-time information, alternative planning options), provide divergent results (for an overview see Pronello et al. 2017). The results of Pronello et al. (2017) show that the majority of the study participants are not willing to pay for a smart mobility app for the city of Lyon, France. One reason for this is the availability of free information on the market. The participants who were willing to pay a fee are mainly highly-educated car users travelling for work. In contrast to this, Molin and Timmermans (2006) and Zografos et al. (2012) demonstrate an increasing willingness to pay if additional services, for example, real-time information are made available. In addition, Pronello and Camusso (2015) show that German participants prefer a one-off payment for a public transport app providing real-time information, while Italian participants prefer a monthly fee.

The attribute levels of the attribute ‘app price’ were determined based on the prices for mobility apps in the Android Google Play Store. Many of the mobility apps in focus are free of charge since they are offered by mobility providers, such as public transport companies, to make their transport service more attractive. In contrast, several smart mobility apps, such as ‘Ally’ and ‘fromAtoB’, are offered by companies which do not themselves provide a transport service. For this reason, they must generate revenue via the smart mobility app (e.g., offering a fee-based app, selling advertising, charging a commission from mobility providers). Participants were invited to recommend improvements to the questionnaire description and justified improvements were made. The pre-test was conducted with nine potential customers and one expert from the mobility field.

Study 3: CBC analysis

All attributes and attribute levels of the final CBC analysis as well as their origin are shown in Table 3. The first attribute level of each attribute serves as the basis category and its part-worth is set to 0. The part-worths for the other attribute levels are estimated and indicate the difference to the basis category (Backhaus et al. 2015). For example, how potential customers value the consideration of a large share of companies (˃ 66%) and their mobility services, and thus the related possibility to adapt the bundles, for instance in case of cancellations or delays, compared to the situation where only a low share of companies (˂ 33%) is taken into account. The potential customers also completed the other parts of the questionnaire used to collect information about the person (e.g., gender, age, salary) and their mobility (commuting distance, use of public transport, etc.).

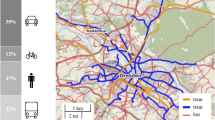

Data collection started in July and lasted until December 2018. The data collection focused only on Germany. Like most cities in industrialized countries, German cities suffer from problems caused by the predominant use of private cars. There is both the need and the will to address the problems. For example, due to exceeding legal limits for nitrogen oxides, courts have imposed driving bans for diesel cars in certain zones in several cities (ADAC 2019). This makes Germany a well-suited study target. The results of mobility studies in Germany (e.g., Bratzel 2018; Kuhnimhof et al. 2012; Umweltbundesamt 2019) indicate that especially for the younger generation (in particular for 18–24-year-olds), the importance of private car ownership and the emotional attachment to the car is declining, which leads to an increase in demand for mobility services. The trend towards the use of mobility services, in particular multiple mobility services in combination, is further supported by the pre-existing infrastructure, high public pressure, and legal conditions in Germany (Marx et al. 2015; Willing et al. 2017b).

To attract participants for our study, we relied heavily on Facebook. The studies by Baltar and Brunet (2012) and Kosinski et al. (2015) show that using Facebook for data collection provides the advantage of a high response rate and high data quality compared to traditional sampling strategies. We posted a short description of our study and the link to the questionnaire in applicable groups, such as those dealing with the current traffic situation in a specific region, or concepts for future mobility. Such random selection of groups helps us to mitigate a potential representation bias (Baltar and Brunet 2012). The approach also enabled us to attract participants from all over Germany with a range of mobility behaviours. In order to increase the willingness to participate, Amazon gift coupons (two each valued at 20 Euro, 50 Euro, and 75 Euro) were raffled among all participants. We collected 523 fully completed questionnaires. The comparison of the two identical holdout choice tasks showed that 155 participants chose two different smart mobility apps. In order to ensure consistency, these questionnaires were removed from the sample (Orme 2015), leaving 368 questionnaires for the estimation of the part-worths.

Data analysis

We analysed our data using SPSS. In a first step, we split our sample into three groups – mix, public transport, and private car – with regard to the mobility behaviour of the participants. This split of the sample offers two main advantages. First, practitioners can focus on the preference structure of participants who predominantly use the private car in order to address the associated mobility challenges. Second, through group comparisons, we can forecast how the preference structure of these participants might change if they switch to and become more familiar with alternative mobility services.

-

1)

‘Mix’ (n = 143): Participants who already use at least two of the following mobility services per month: public transport, car-sharing, bike-sharing, carpooling, or taxi. Some of them also use a private car during this period. Based on their experience with the use of different mobility services, these participants are best suited to assess the attributes and attribute levels of a smart mobility app. Due to their current mobility behaviour, they also seem to be the most likely buyers of smart mobility apps.

-

2)

‘Public transport’ (n = 142): Participants who regularly use public transport (bus, subway, tram, and train), and are familiar with its weaknesses, such as a long walking time and a lack of flexibility (Grison et al. 2017), which often result from the station-based nature of the mobility service and fixed timetables. Some participants also used a private car to better satisfy their mobility needs.

-

3)

‘Private car’ (n = 79): Participants who use a private car and, in part, also one mobility service other than public transport, such as occasionally calling a taxi. The smart mobility app might help remove barriers, for example for public transport use, which are faced by these participants. For instance, a monthly flat-rate can replace the complexity that is induced by the price models of the different mobility providers.

Participants (n = 4) who could not be assigned to any of the three groups were removed from the final analysis.

In a second step, we further subdivided the three groups according to the age and the place of residence of the participants. Bratzel (2018) finds that for ‘under-25-year-olds’, especially if they live in a city, private car ownership is less important, and that they are more open to app-based mobility services than people who are ‘at least 25 years old’. This group belongs to the digital native generation, who “are assumed to be inherently technology-savvy” and therefore easily accept new IT (Wang et al. 2013, p. 409). For these reasons, people under 25 years old are an attractive target group for a smart mobility app. However, focusing solely on this group would cause some limitations. For example, about 60% of the German population is 25 years old or older (Statistische Ämter des Bundes und der Länder 2018). In order to alleviate the problems caused by the predominant use of private cars, it is therefore important to attract over-25-year-olds to smart mobility apps as well. Since they are comparatively less open for a change of mobility behaviour and to using smart mobility apps, it is important to know their preference structures. Furthermore, much remains unknown about how the preferences of under-25-year-olds change over time. Perhaps their preference structures will, over time, change to those of today’s over-25-year-olds.

We also distinguished between people living in a ‘big city’ (a city with at least 100,000 inhabitants), a ‘town’ (a town with at least 2000 inhabitants), and a ‘rural area’, based on the classifications provided by the Statistisches Bundesamt (2018, 2011). The rationale for this split is that the range of mobility services and mobility providers for each mobility service available ranges depending largely on the population of the place of residence. If the number of participants in a group was at least 30, we assume a normally distributed sample in accordance with the central limit theorem (Ofungwu 2014).

Because SPSS does not provide a direct procedure for conducting CBC analysis, we applied Cox regression analysis, which is generally used for survival analysis. A stratified Cox regression maximizes the likelihood function, so-called maximum-likelihood method. This method can also be applied to estimate the part-worths in case of CBC analysis (Backhaus et al. 2015). The likelihood function as well as the underlying value and choice model are described in detail in the Supplementary Material. Using a likelihood-ratio test, we assessed the quality of each regression model (Backhaus et al. 2015). We also tested the predictive validity of the estimated part-worths by determining the corresponding hit rate. The hit rate reflects how well participants’ choices can be correctly predicted using the estimated part-worths (Backhaus et al. 2015; Berger et al. 2015). To predict the choice decisions based on the estimated part-worths, we used the logit choice model, which is usually applied in CBC analysis (Backhaus et al. 2015). In order to analyse whether the estimated part-worths differed significantly between two groups of participants, we performed a t-test for independent samples (Ofungwu 2014).

Results

Sample description

The demographics of the participants are shown in Table 4. Of the participants, 60.71% were female and 39.29% were male. The participants were between 18 and 66 years old, with an average age of 25.51 years. About two-thirds of the participants (66.76%) had a monthly net income under 1300 Euro. In comparison, the average monthly net income in 2018 in Germany was 1948 Euro (Statistisches Bundesamt 2019). One reason why the average net income of our participants was below the average net income in Germany is because students were overrepresented. Another reason is that women, who are also overrepresented in our sample, earn on average less than men (Statistisches Bundesamt 2016). Approximately one third of the participants commutes less than 6 km, one third between 6 and 20 km, and one third at least 21 km. The average commute distance in Germany in 2016 was 16.91 km (Tautz 2017). Our sample included an approximately equal number of people who do not commute to work and people who commute long distances to work, potentially between a rural area and a city.

The preference structure of participants with different existing mobility behaviour

To assess the preference structure of all three participant groups with different existing mobility behaviour, we apply Cox regression analysis. The likelihood-ratio test performed with SPSS resulted for all three regression models in a p value of 0.000%. In other words, each of the regression models is highly statistically significant. In addition, we tested the predictive validity of the estimated part-worths by determining the respective hit rate. They were for the different participant groups as follows: Group 1 (mix): 47.03%; group 2 (public transport): 48.77%; and group 3 (private car): 45.73%. These hit rates indicate a good degree of predictive validity compared with a hit rate of 25% in the case of random choice. The results are also comparable with those of other studies conducting CBC analysis (e.g., Kanuri et al. 2014; Wlömert and Eggers 2016).

To determine how important the individual attributes of a smart mobility app are to participants, we calculated the relative importance of the attributes. As depicted in Table 5, our results show that, for the participants in group 1, the ‘app price’ (32.99%) is the most important attribute followed by ‘time-table information’ (18.31%). The other attributes are in descending order: ‘Share of companies’ (16.75%), ‘booking’ (16.12%), ‘type of company’ (10.14%), and ‘price model’ (5.69%). Since we can assume that this participant group can best assess the actual requirements for a smart mobility app based on their previous experience with a number of different mobility services (e.g., public transport, car-sharing, or taxi), it serves as the reference group. A comparison with group 2 reveals, in particular, the lower relative importance of the attributes ‘price model’ (1.84%) and ‘type of company’ (1.68%). In contrast, the ‘app price’ (36.89%) is of even greater significance. When comparing the results for group 1 and 3, it is particularly noticeable that the latter attaches a much greater relative importance to the attribute ‘time-table information’ (27.51%), whereas they consider the attribute ‘app price’ (19.96%) less important.

The estimated part-worths indicate which attribute level of each attribute the participants prefer. In interpreting the results, it is important to understand that the absolute value of the estimated part-worths has no meaning. Of interest are only the differences between the different estimated part-worths of an attribute (Backhaus et al. 2015). Table 6 shows that, in particular, the estimated part-worths of the attribute levels of the attributes ‘type of company’ and ‘price model’ are not significant in the majority of cases. The mean differences were computed based on group 1 as reference. On the basis of the mean differences and the standard deviations (SD), we carried out two t-tests, which showed that the estimated part-worths differ significantly, with the exception of the attribute level ‘one-click booking’. For instance, we observed that the participants belonging to group 3 assigned significantly lower negative values to the ‘3 Euro’ and ‘5 Euro’ attribute level of the attribute ‘app price’. Hence, a price increase only leads to a comparatively small decline in value.

The effect of age on the preference structure

To analyse the effect of age on the preference structure of the participants, we further divided the three participant groups into two age groups (under-25-years-old and at least 25 years old) following the lead of previous studies (e.g., Bratzel 2018; Wang et al. 2013) identifying under-25-year-olds as more likely customers of smart mobility apps. Using the likelihood-ratio test, each of the regression models can be considered highly significant with a p value of 0.000%. The hit rate for the assessment of predictive validity varies between 46.67% for group 4 (private car and ˂ 25 years old) and 53.13% for group 3 (public transport and ˂ 25 years old). The other hit rates are 48.15% for group 1 (mix and ≥ 25 years old) as well as 49.44% for group 2 (mix and ˂ 25 years old). The results for the remaining two groups are provided in the Supplementary Material.

A comparison of the participant groups 2 and 3 shows that their relative importance for the attributes is very similar (see Table 7). Only the attribute ‘type of company’, which is more than twice as important for participants from group 2, varies considerably (10.22% to 4.32%). In contrast, the results for the relative importance of the attributes for group 4 are very different. In particular, the attribute ‘app price’ with a relative importance of only 17.70% no longer occupies a prominent position among the attributes. On the other hand, especially the relative importance of the attributes ‘time-table information’ (27.09%) and ‘price model’ (10.25%) increases compared with the reference group 2. In order to determine the effect of age, we calculate the relative importance of attributes for group 1. The results show that older participants attach less importance to the attribute ‘app price’ (19.76%), but a higher relative importance to the attributes ‘booking’ (19.78%) and ‘price model’ (11.24%).

The results for the estimated part-worths, their standard deviation (SD), and each calculated mean difference of the estimated part-worths for performing t-tests are depicted in Table 8. The mean differences were calculated with group 2 as reference group. The results show that group 2 has a significantly lower estimated part-worth for the attribute level ‘mixed information’ (0.225) compared to groups 3 and 4 (public transport: 0.524, and private car: 0.441). The situation is identical for ‘real-time information’, with an estimated part-worth of 0.463 compared to 0.621 and 0.666. The effect of age on the preference structure of participants is further revealed by comparing groups 1 and 2. For example, group 1 with the older participants has a significantly higher estimated part-worth than group 2 in the case of ‘real-time information’ (0.624 compared to 0.463) and ‘one-click booking’ (0.588 compared to 0.375).

The effect of place of residence on the preference structure

To determine the effect of place of residence on the preference structure, we focus on the comparison of participants who use multiple mobility services and live either in a big city (group 1) or town (group 2). The reason for this selection is that the range of mobility services available (e.g., car-sharing, subway) in Germany tends to vary depending on the size of the city/town, and thus probably also influences the preference structure. In addition, we examine the participants who predominantly use a private car and live in a rural area (group 3) because these participants contribute to mobility problems, such as traffic congestion and lack of parking spaces if their place of work is in a city or town. The likelihood-ratio test resulted each in a p value of 0.000%. The hit rates are: 48.63% for group 1, 46.76% for group 2, and 49.58% for group 3. The results for all other groups are made available in the Supplementary Material.

For each of the three groups, the attributes’ relative importance is shown in Table 9. In comparing groups 1 and 2, especially large differences in relative importance for the attributes ‘type of company’, ‘booking’, and ‘app price’ were observed. The results for group 3 are comparable with the results for the analysis without considering the effect of the place of residence on the preference structure (see Table 5).

Table 10 provides an overview of the estimated part-worths for the three groups. The results show that, with the exception of two cases, the estimated part-worths for the attribute levels for the attributes ‘type of company’ and ‘price model’ are not significant. The mean differences were calculated based on group 1 as reference. The t-test carried out demonstrates that there are also no significant differences between groups 1 and 2 with regard to ‘mixed information’ and ‘real-time information’. However, the estimated part-worths for group 3 are significantly higher (0.488 and 0.693) than those of group 1. In addition, there are significant differences between groups 2 and 3 vis-à-vis group 1 with regard to the attribute level ‘one-click booking’. While the participants of group 3 have significantly lower negative estimated part-worths for both attribute levels (‘3 Euro’ and ‘5 Euro’) of the attribute ‘app price’ than the participants belonging to group 1, this is only the case for ‘5 Euro’ for the participants of group 2.

Discussion

Theoretical implications

We contribute to the IS and S-D logic literature (e.g., Brust et al. 2017; Schulz et al. 2020b) by analysing the preference structures of potential customers for smart mobility apps using CBC analysis. The intended behaviour change away from using a private car (G-D logic) towards using alternative mobility services requires the adoption of the S-D logic perspective with its concept of value co-creation (Gilsing et al. 2018; Vargo and Lusch 2004). S-D logic literature highlights the central role of the customer as co-creator of value (Vargo and Lusch 2017), and that the value is uniquely determined by each individual beneficiary (Vargo et al. 2008). Companies, such as providers of smart mobility apps, can only make value propositions that are accepted or rejected by potential customers (Vargo et al. 2008). However, to date, there are only a few studies (Grotenhuis et al. 2007; Stopka 2014) with methodological shortcomings that examine the preference structures of potential customers for smart mobility apps. The results of our preliminary studies and the CBC analysis provide detailed insights into the attributes, the attribute levels, the relative importance of attributes, and the estimated part-worth for each attribute level on which the choice of three participant groups with different existing mobility behaviour is based. For instance, we observed that the participants who predominantly use a private car attach much less relative importance to the attribute ‘app price’ than the other participant groups. In addition, they assigned significantly lower negative part-worths to the ‘3 Euro’ and ‘5 Euro’ attribute level compared to participants who use two or more different mobility services per month. These examples illustrate how our approach helps illuminate factors that motivate different potential customers to enter into a value co-creation relationship.

Our research shows the effect of age and place of residence on the preference structures of potential smart mobility app customers. According to S-D logic (Akaka et al. 2013; Koskela-Huotari et al. 2016; Schulz et al. 2020a; Vargo and Lusch 2017; Vargo et al. 2015), value co-creation can be constrained by conflicting institutions and institutional arrangements (rules, norms, and beliefs). Literature on digital natives (e.g., Wang et al. 2013) suggests that especially older generations have problems accepting new IT, such as a smart mobility app, which indicate conflicting institutions and institutional arrangements that affect their (mobility) behaviour. In contrast, the 18–24-year-olds are much more open-minded towards app-based mobility services (Bratzel 2018; Rayle et al. 2014). In addition, this age group considers private car ownership less important than other age groups, and they are less emotionally attached to cars (Circella et al. 2017; Kuhnimhof et al. 2012; Umweltbundesamt 2019). The results of our CBC analysis show that age differences also influence preference structures for smart mobility apps. For example, for participants under 25 years old who use at least two mobility services per month, the ‘app price’ has a very high relative importance (41.70%) in comparison with participants who are at least 25 years old (19.76%). Interestingly, this result is not reflected in the relative importance for the attribute ‘price model’ (2.36% compared to 11.24%). When looking at the further results for those two groups, it is particularly noticeable that the younger participants have significant lower estimated part-worths for the attribute levels ‘real-time information’ and ‘one-click booking’. One possible explanation is that digital natives tend to find it easy to use various apps simultaneously to find an alternative mobility service in case of a delay or in order to purchase tickets from individual mobility providers.

Earlier studies (e.g., Bratzel 2018; Umweltbundesamt 2019) suggest that the place of residence has an effect on the preference structures of potential customers. The results of our CBC analysis reveal, in particular, that participants using at least two mobility services and who live in a town attribute the greatest relative importance to the attribute ‘type of company’ (16.50%). In addition, they are the only group who has a significant estimated part-worth for the attribute level ‘all’ (0.462). A possible reason for this might be that in big German cities public transport already includes a larger range of mobility services, potentially including subway and tram. Moreover, big cities usually have a close-knit network of transport stations that provides access to a variety of public transport services. As a consequence, this group may attribute less relative importance to alternative mobility services such as bike-sharing. In contrast, several mobility services (e.g., car- and ride-sharing) are often scarce or not present in rural areas, which could explain the lack of significance for the group of participants who currently drive a private car.

With regard to ‘mixed information’ and ‘real-time information’ of the attribute ‘time-table information’ no significant differences could be identified between participants who use at least two mobility services and live in big cities or towns. However, the group of participants who currently predominantly use a private car and live in a rural area attributed significantly higher estimated part-worths to these attribute levels. This could be explained by the fact that these participants have to wait a long time due to low timetable density and lack of alternative mobility services if, for example, they miss their bus due to a train delay.

In the case of the attribute level ‘one-click booking’, participants who use multiple mobility services and live in a town display a significantly lower estimated part-worth (0.348) than those who live in a big city. One possible reason could be that there is a higher number of mobility services as well as more mobility providers for each mobility service in big cities. As a result, this participant group must use a variety of apps from different mobility providers, which they would not have to do using one-click booking. In contrast, the group of participants who predominantly use a private car and live in a rural area has a significantly higher estimated part-worth (0.687). One reason for this could be that these participants can benefit most from this simplified form of ticket purchase due to their lack of experience. Another reason could be that these participants often can only buy paper-based tickets (Schulz et al. 2018) and now would have the opportunity to purchase digital tickets through the smart mobility app. Overall, the results of our CBC analysis indicate that the focus on a specific urban area, as commonly chosen in the smart city literature (e.g., Brauer et al. 2015; Yadav et al. 2017), is often too narrow to fully address the mobility challenges, as commuters from rural areas that predominantly use a private car have divergent needs and preferences.

Practical implications

One practical implication of our study pertains to how providers of smart mobility apps can better put value co-creation with potential customers into practice. Previous studies (Albrecht and Ehmke 2016; Alt et al. 2019; Willing et al. 2017a, 2017b) show that smart mobility is currently more of a vision than a reality, since the smart mobility apps have a number of limitations. For example, only a small number of mobility providers and their mobility services are taken into account. While there are first insights about why mobility providers do not cooperate (e.g., Schulz et al. 2018; Schulz et al. 2020b; Schulz and Überle 2018), the resulting consequences for the attraction of potential customers had been unclear due to methodological shortcomings of previous studies (Grotenhuis et al. 2007; Stopka 2014). The results of our CBC analysis can help providers design a smart mobility app that is attractive to potential customers. For instance, providers can compensate for a relatively low value due to a small proportion of mobility providers by improving the remaining attributes, such as by implementing one-click booking. A higher overall value also always goes hand in hand with a higher willingness to pay (Berger et al. 2015). In turn, this could make mobility providers more willing to cooperate with providers of smart mobility apps, which could further increase value co-creation.

Second, our results have implications for improving the business model of providers of smart mobility apps. According to Willing et al. (2017b, p. 178), IS research can help to create a new mobility paradigm by adopting a business model perspective to evaluate “the quality and the success factors of the different intermodal solutions”. Our CBC analysis reveals the preference structures of potential customers and thus the success factors of a smart mobility app. The results also confirm that there are significant group differences with regard to the age and the place of residence of potential customers. Providers of smart mobility apps can thus develop a sustainable business model by offering a high value proposition to a specific target group, and thus differentiate themselves from competitors. For example, our study indicates that potential customers under 25 years old who use at least two mobility services can be offered a flat-rate, while people over 25 years old should be offered a fixed price. The target group’s preference structure also has implications for the relevance of activities and resources. For instance, it is less important for a business model targeting big city dwellers who use at least two mobility services to cooperate with different types of companies (e.g., bike-sharing and taxi), than for a business model targeting town dwellers. Hence, this research contributes to the emerging literature on business models in the smart mobility domain (Gilsing et al. 2018; Turetken et al. 2019).

Finally, we contribute to research on monetarization strategies for smart mobility apps, which is still in its infancy. Based on interviews with three experts, Schreieck et al. (2018a) recommend that customers should be subsidized, for example through a service free of charge or a welcome bonus, while city administrations should be charged. By integrating the ‘app price’ attribute into our CBC analysis, we show when it is possible to charge customers and when it makes more sense to charge city administrations. City administrations should be charged when the sum of the estimated part-worths would be negative or zero at the choice of a specific price. Especially in the case of participants who predominantly use a private car, the relative importance for the attribute ‘app price’, as well as the corresponding estimated part-worths for ‘3 Euro’ and ‘5 Euro’ are relatively low, so charging the customer is conceivable.

Limitations and further research

Although we conducted our study with the greatest possible care, it has some limitations which should be addressed by future research. First of all, our analyses are limited to Germany. Several authors have concluded that Germany represents a suitable environment due to its pre-existing infrastructure, high public pressure, and legal conditions (Marx et al. 2015; Willing et al. 2017b). In addition, attitudes toward private car ownership are changing among the younger generations (Bratzel 2018; Kuhnimhof et al. 2012; Umweltbundesamt 2019). Nevertheless, our results should be verified in other countries to account for country-specific and cultural factors.

Second, in order to attract participants for our study, we relied heavily on Facebook. This results in a bias towards young people. We did, however, ensure that every group contained at least 30 participants, the prerequisite for expecting a normal distribution (Ofungwu 2014). In addition, the sample was also split according to age, which enables us to take into account the greater participation of younger people. In other group comparisons, however, an age bias could exist, which makes further studies necessary. From a practical point of view, the focus on younger people offers an important advantage, since foundations for the implementation of non-private car-based mobility are laid during the early stages of life (Umweltbundesamt 2019).

Third, in addition to age, we rely on the types of mobility services that are used by the participants in a certain period of time (Haustein and Hunecke 2013), and the place of residence (Alsnih and Hensher 2005; Haustein and Hunecke 2013) to define potential customer groups. However, besides these criteria, there are numerous other segmentation criteria (see Table 1) which can be used in future work. Especially the use of the criterion ‘trip purpose’ (Semanjski and Gautama 2016; Xiao et al. 2016) promises new and deeper insights into the preference structures of potential customers for a smart mobility app. A corresponding indication can be found in the results of Pronello et al. (2017) according to which participants with a lower share of trips to work and a higher share for leisure and shopping trips are unwilling to pay for a smart mobility app. In contrast, in particular participants who use their private car for driving to work are willing to pay for a smart mobility app.

Fourth, the choice of CBC analysis as method of investigation causes some limitations. We assume that the acquisition of a smart mobility app will lead to a decline in the use of the private car and instead will promote the use of alternative mobility services. However, while CBC analysis is the best method to mimic the real choice decision of potential customers (Backhaus et al. 2015; Berger et al. 2015), it does not allow conclusions to be drawn about the use of the smart mobility app after the purchase. Future research should therefore examine continued use patterns across different groups of buyers. In addition, the relationship between the use of the smart mobility app and a possible behavioural change should be explored. In particular, long-term studies should be carried out as mobility behaviour changes over time.

While the focus of the present study is on determining the preference structure for different groups of potential customers, future work may use CBC analysis to determine their willingness to pay for smart mobility apps (Naous and Legner 2017). Furthermore, the focus of CBC analysis is on the attributes and attribute levels of the smart mobility apps, in other words, on how techno-economic characteristics affect choice decision (Naous and Legner 2017). The results of Schikofsky et al. (2020) show, however, that in the present context the intention to adopt a smart mobility app might also depend on further motivational factors, such as hedonic motives (e.g., fun, pleasure), perceived usefulness (e.g., perceived efficiency and performance) and perceived ease of use. Hence, in order to understand the acceptance of smart mobility apps in it’s entirely, the results of the present study should be used to inform further research that adopts the Technology Acceptance Model (TAM). An interdisciplinary overview of the different methods usable for the analysis of technology acceptance is provided by Head and Ziolkowski (2012).

Sixth, we are subject to some limitations in the interpretation of the results of our CBC analysis. Potential customers are often already more or less tied to a specific mobility provider by a customer loyalty program (e.g., a discount card), or at least influenced in their choice by previous experience with a mobility provider and its mobility service. Due to the high complexity, our CBC analysis does not take into account the corresponding relationships. Future research could use experiments for such investigations. In addition, our results show that the attribute levels of ‘price model’ in general have no significant effect on the choice decision. Future studies should examine whether dynamic pricing can be used to increase the use of mobility services and the revenues they generate.

Conclusion

Achieving smart mobility, defined as the IT-supported bundling of different mobility services to get from origin to destination, is seen as an important contribution to reducing the predominant use of the private car, and to solving associated mobility-related challenges. Our approach is novel in that we analyse the preference structures of different potential customer groups for a smart mobility app. In particular, we take into account the effect of potential customers’ age and place of residence. A CBC analysis and the necessary preliminary studies were carried out in Germany. Our results indicate, among other things, that the app price is often the most important attribute affecting whether individuals choose one smart mobility app over another. In the group of participants who predominantly use a private car, however, the app price does not play a significant role, regardless of age and place of residence.

References

ADAC (2019). Dieselfahrverbot: Alle Fragen und Antworten. URL: https://www.adac.de/rund-ums-fahrzeug/abgas-diesel-fahrverbote/fahrverbote/dieselfahrverbot-faq/. Accessed 29 Jan 2019.

Akaka, M. A., Vargo, S. L., & Lusch, R. F. (2013). The complexity of context: A service ecosystems approach for international marketing. Journal of International Marketing, 21(4), 1–20. https://doi.org/10.1509/jim.13.0032.

Albrecht, L., & Ehmke, J. F. (2016). Innovative Services in der Mobilitätsbranche: Eine Marktanalyse Multimodaler Mobilitätsmanager. Ilmenau: Multikonferenz Wirtschaftsinformatik.

Alsnih, R. & Hensher, D, A. (2005). Travel behaviour of seniors in an aging population: An exploratory study of trip chains and modal preferences in the greater metropolitan area of Sydney. Road and Transport Research, 14(4), 60–72.

Alt, R., Ehmke, J. F., Haux, R., Henke, T., Mattfeld, D. C., Oberweis, A., Paech, B., & Winter, A. (2019). Towards customer-induced service orchestration - requirements for the next step of customer orientation. Electronic Markets, 29(1), 79–91. https://doi.org/10.1007/s12525-019-00340-3.

Backhaus, K., Erichson, B., & Weiber, R. (2015). Fortgeschrittene Multivariate Analysemethoden: Eine anwendungsorientierte Einführung. Berlin: Springer Gabler.

Bajaj, A. (2000). A study of senior information systems managers’ decision models in adopting new computing architectures. Journal of the Association for Information Systems, 1(1), 1–58. https://doi.org/10.17705/1jais.00004.

Baltar, F., & Brunet, I. (2012). Social research 2.0: Virtual snowball sampling method using Facebook. Internet Research, 22(1), 57–74. https://doi.org/10.1108/10662241211199960.

Benevolo, C., Dameri, R. P., & D’Auria, B. (2016). Smart mobility in smart city: Action taxonomy, ICT intensity and public benefits. In T. Torre, A. M. Braccini, & R. Spinelli (Eds.), Empowering organizations: Enabling platforms and artefacts (pp. 13–28). Cham: Springer.

Berger, B., Matt, C., Steininger, D. M., & Hess, T. (2015). It is not just about competition with “free”: Differences between content formats in consumer preferences and willingness to pay. Journal of Management Information Systems, 32(3), 105–128. https://doi.org/10.1080/07421222.2015.1095038.

Bratzel, S. (2018). Junge Generation und die Mobilität der Zukunft. URL: https://www.auto-institut.de/index_htm_files/Pressemitteilung_Mobilitaet_Junge%20Generation.pdf. Accessed 16 Dec 2018.

Brauer, B., Eisel, M., & Kolbe, L. M. (2015). The state of the art in smart city research - a literature analysis on green IS solutions to foster environmental sustainability. Singapore: Pacific Asia Conference on Information Systems.

Brust, L., Breidbach, C. F., Antons, D., & Salge, T. O. (2017). Service-dominant logic and information systems research: A review and analysis using topic modeling. Seoul: International Conference on Information Systems.

Chandler, J. D., & Vargo, S. L. (2011). Contextualization and value-in-context: How context frames exchange. Marketing Theory, 11(1), 35–49. https://doi.org/10.1177/1470593110393713.

Chatterjee, K. & Scheiner J. (2015). Understanding changing travel behaviour over the life course: Contributions from biographical research. Windsor: International Conference on Travel Behaviour Research.

Chowdhury, S., & Ceder, A. (2013). A psychological investigation on public-transport users’ intention to use routes with transfers. International Journal of Transportation, 1(1), 1–20. https://doi.org/10.14257/ijt.2013.1.1.01.

Circella, G., Alemi, F., Tiedeman, K., Berliner R, M., Lee, Y., Fulton, L., Mokhtarian, P, L. & Handy, S. (2017). What affects millennials’ mobility? Part II: The impact of residential location, individual preferences and lifestyles on young adults’ travel behavior in California. https://escholarship.org/uc/item/5kc117kj.

Firnkorn, J., & Müller, M. (2011). What will be the environmental effects of new free-floating car-sharing systems? The case of Car2Go in Ulm. Ecological Economics, 70(8), 1519–1528. https://doi.org/10.1016/j.ecolecon.2011.03.014.

Giesbrecht, T., Schwabe, G., & Schenk, B. (2017). Service encounter thinklets: How to empower service agents to put value co-creation into practice. Information Systems Journal, 27(2), 171–196. https://doi.org/10.1111/isj.12099.

Gil, A., Calado, H., & Bentz, J. (2011). Public participation in municipal transport planning processes – The case of the sustainable mobility plan of Ponta Delgada, Azores, Portugal. Journal of Transport Geography, 19(6), 1309–1319. https://doi.org/10.1016/j.jtrangeo.2011.06.010.

Gilsing, R., Turetken, O., Adali, O. E., & Grefen, P. (2018). A reference model for the design of service-dominant business models in the smart mobility domain. San Francisco: International Conference on Information Systems.

Grison, E., Gyselinck, V., & Burkhardt, J.-M. (2016). Exploring factors related to users’ experience of public transport route choice: Influence of context and users profiles. Cognition, Technology & Work, 18(2), 287–301. https://doi.org/10.1007/s10111-015-0359-6.

Grison, E., Burkhardt, J.-M., & Gyselinck, V. (2017). How do users choose their routes in public transport? The effect of individual profile and contextual factors. Transportation Research Part F: Traffic Psychology and Behaviour, 51, 24–37. https://doi.org/10.1016/j.trf.2017.08.011.

Grotenhuis, J.-W., Wiegmans, B. W., & Rietveld, P. (2007). The desired quality of integrated multimodal travel information in public transport: Customer needs for time and effort savings. Transport Policy, 14(1), 27–38. https://doi.org/10.1016/j.tranpol.2006.07.001.

Hair Jr., J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2014). Multivariate data analysis. Harlow: Pearson Education.

Haustein, S., & Hunecke, M. (2013). Identifying target groups for environmentally sustainable transport: Assessment of different segmentation approaches. Current Opinion in Environmental Sustainability, 5(2), 197–204. https://doi.org/10.1016/j.cosust.2013.04.009.

Head, M., & Ziolkowski, N. (2012). Understanding student attitudes of mobile phone features: Rethinking adoption through conjoint, cluster and SEM analyses. Computers in Human Behavior, 28(6), 2331–2339. https://doi.org/10.1016/j.chb.2012.07.003.

Hearn, G., Roodhouse, S., & Blakey, J. (2007). From value chain to value creating ecology: Implications for creative industries development policy. International Journal of Cultural Policy, 13(4), 419–436. https://doi.org/10.1080/10286630701683367.

Hildebrandt, B., Hanelt, A., Piccinini, E., Kolbe, L. M., & Nierobisch, T. (2015). The value of IS in business model innovation for sustainable mobility services - the case of carsharing (pp. 1008–1022). Osnabrück: International Conference on Wirtschaftsinformatik.

Hinkeldein, D., Schoenduwe, R., Graff, A., & Hoffmann, C. (2015). Who would use integrated sustainable mobility services – And why? Sustainable Urban Transport, 7, 177–203. https://doi.org/10.1108/s2044-994120150000007019.

Hunecke, M., Haustein, S., Böhler, S., & Grischkat, S. (2010). Attitude-based target groups to reduce the ecological impact of daily mobility behavior. Environment and Behavior, 42(1), 3–43. https://doi.org/10.1177/0013916508319587.

Jarvis, W., Halvorson, W., Sadeque, S., & Johnston, S. (2014). A large class engagement (LCE) model based on service-dominant logic (SDL) and flipped classrooms. Education Research and Perspectives, 41, 1–24.

Jittrapirom, P., Caiati, V., Feneri, A.-M., Ebrahimigharehbaghi, S., Alonso-González, M. J., & Narayan, J. (2017). Mobility as a service: A critical review of definitions, assessments of schemes, and key challenges. Urban Planning, 2(2), 13–25. https://doi.org/10.17645/up.v2i2.931.

Kanuri, V. K., Thorson, E., & Mantrala, M. K. (2014). Using reader preferences to optimize news content: A method and a case study. International Journal on Media Management, 16(2), 55–75. https://doi.org/10.1080/14241277.2014.943898.

Kawgan-Kagan, I. (2015). Early adopters of Carsharing with and without Bevs with respect to gender preferences. European Transport Research Review 7.

Kloas, J., Kuhfeld, H. & Kunert, U. (2001). Dynamik des Verkehrsverhaltens im Jahresvergleich. Analyse des Deutschen Mobilitätspanels 1994 bis 1999. Deutsches Institut für Wirtschaftsforschung. https://www.diw.de/documents/dokumentenarchiv/17/38797/diw_MOP_200111.pdf.

Kosinski, M., Matz, S. C., Gosling, S. D., Popov, V., & Stillwell, D. (2015). Facebook as a research tool for the social sciences: Opportunities, challenges, ethical considerations, and practical guidelines. American Psychologist, 70(6), 543–556. https://doi.org/10.1037/a0039210.

Koskela-Huotari, K., Edvardsson, B., Jonas, J. M., Sörhammar, D., & Witell, L. (2016). Innovation in service ecosystems—Breaking, making, and maintaining institutionalized rules of resource integration. Journal of Business Research, 69(8), 2964–2971. https://doi.org/10.1016/j.jbusres.2016.02.029.

Kuhnimhof, T., Armoogum, J., Buehler, R., Dargay, J., Denstadli, J. M., & Yamamoto, T. (2012). Men shape a downward trend in car use among young adults—Evidence from six industrialized countries. Transport Reviews, 32(6), 761–779. https://doi.org/10.1080/01441647.2012.736426.

Li, T., van Heck, E., & Vervest, P. (2005). How smart card technology could be used for dynamic pricing in transportation network? Hong Kong: International Conference on Electronic Business.

Louviere, J. J., & Woodworth, G. (1983). Design and analysis of simulated consumer choice or allocation experiments: An approach based on aggregate data. Journal of Marketing Research, 20(4), 350–367. https://doi.org/10.2307/3151440.

Luce, R. D. (2005). Individual choice behavior: A theoretical analysis. New York: Dover Publications.

Luce, R. D., & Tukey, J. W. (1964). Simultaneous conjoint measurement: A new type of fundamental measurement. Journal of Mathematical Psychology, 1(1), 1–27. https://doi.org/10.1016/0022-2496(64)90015-x.

Lusch, R. F., & Nambisan, S. (2015). Service innovation: A service-dominant logic perspective. MIS Quarterly, 39(1), 155–175. https://doi.org/10.25300/misq/2015/39.1.07.

Maglio, P. P., Vargo, S. L., Caswell, N., & Spohrer, J. (2009). The service system is the basis abstraction of service science. Information Systems and e-Business Management, 7(4), 395–406. https://doi.org/10.1007/s10257-008-0105-1.

Marx, R., de Mello, A. M., Zilbovicius, M., & de Lara, F. F. (2015). Spatial contexts and firm strategies: Applying the multilevel perspective to sustainable urban mobility transitions in Brazil. Journal of Cleaner Production, 108, 1092–1104. https://doi.org/10.1016/j.jclepro.2015.09.001.

McFadden, D. (1980). Econometric models for probabilistic choice among products. Journal of Business, 53(3), S13–S29. https://doi.org/10.1086/296093.

Mihale-Wilson, A. C., Zibuschka, J., & Hinz, O. (2019). User preferences and willingness to pay for in-vehicle assistance. Electronic Markets, 29(1), 37–53. https://doi.org/10.1007/s12525-019-00330-5.

Ministerium für Verkehr Baden-Württemberg (2020). Echtzeit und intermodale Reiseauskunft. URL: https://vm.baden-wuerttemberg.de/en/mobilitaet-verkehr/bus-und-bahn/digitalisierung-im-oepnv/echtzeit-und-intermodale-reiseauskunft/. Accessed 18 Apr 2020.

Molin, E. J. E., & Timmermans, H. J. P. (2006). Traveler expectations and willingness-to-pay for web-enabled public transport information services. Transportation Research Part C: Emerging Technologies, 14(2), 57–67. https://doi.org/10.1016/j.trc.2006.05.003.

Naous, D., & Legner, C. (2017). Leveraging market research techniques in IS – A review of conjoint analysis in IS research. Seoul: International Conference on Information Systems.

Ofungwu, J. (2014). Statistical applications for environmental analysis and risk assessment. Hoboken: John Wiley & Sons.

Orme, B. (2015). Including holdout choice tasks in conjoint studies. Sawtooth Software: Research Paper Series.

Pronello, C., & Camusso, C. (2015). User requirements for the design of efficient mobile devices to navigate through public transport networks. In N. Thomopoulos, M. Givoni, & P. Rietveld (Eds.), ICT for transport (pp. 55–93). Cheltenham: Edward Elgar Publishing.

Pronello, C., Duboz, A., & Rappazzo, V. (2017). Towards smarter urban mobility: Willingness to pay for an advanced traveller information system in Lyon. Sustainability, 9(10). https://doi.org/10.3390/su9101690.

QuestionPro (2019). Choice based conjoint web software. URL: https://www.questionpro.com/choicebased-conjoint-web-software.html (visited on 14-02-2019).

Rayle, L., Shaheen, S., Chan, N., Dai, D. & Cervero, R. (2014). App-based, on-demand ride services: Comparing taxi and ridesourcing trips and user characteristics in San Francisco.

Roßnagel, H., Zibuschka, J., Hinz, O., & Muntermann, J. (2014). Users’ willingness to pay for web identity management systems. European Journal of Information Systems, 23(1), 36–50. https://doi.org/10.1057/ejis.2013.33.