Abstract

Reducing education costs is a crucial policy element with broad support in the U.S. However, is lowering the cost of learning a panacea for eliminating income inequality? In this paper, I theoretically examine the relationship between income inequality and the cost of education by building a three-stage overlapping generation model with two sectors and two education systems. In contrast to conventional studies treating education as a unified concept or in hierarchical order, I consider two types of education, each targeting the training of workers for different roles in production. Workers who decide to spend time learning and improving creativity skills can work to produce intermediate goods used in current production and illuminate future production technology. Coders who produce industrial robots are one example of workers who receive this type of education. The other type of education only improves workers’ efficiency and helps them become experts in positions. For instance, office clerks who receive computer training can become more productive in dealing with their daily tasks. I pick a reasonable set of parameters, and the simulation result implies that reducing the cost of practical training may end up enlarging income inequality. The key is whether the effect resulting from the wage gap between jobs (wage effect) dominates the effect of changing the share of workers in jobs (composition effect). Reducing the cost of learning creativity encourages marginal experts to learn creativity and marginal basic workers to receive training, leading to declining wage gaps and income inequality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Is lowering the cost of learning a panacea for eliminating income inequality? The answers are highly debatable in economics and vary across countries and time. Back to Schultz (1963), investing in education is seen as a means to reduce income inequality by enhancing human capital. There are a bunch of empirical findings that support this positive relationship. See Gregorio and Lee (2002), Sylwester (2002) and Coady and Dizioli (2018) for a broad range of countries; Abdullah et al. (2015) for Africa, for example. However, it is essential to note that the relationship between education and income inequality is complex. According to Knight and Sabot (1983), education expansion increases the proportion of educated workers (composition effect). However, it may lead to a decline in wage premiums (wage effect), resulting in an ambiguous effect on inequality. Moreover, in some cases, education may primarily serve as a signal rather than directly reducing inequality (Spence 1973). Some empirical findings support that education may have little or even a detrimental effect on income inequality (see Battistón et al. 2014 for most countries in Latin America; Rodríguez-Pose and Tselios 2009 for regions in the European Union; etc.). Ram (1989) reviews previous theoretical and empirical papers and reaches the same conclusion.

However, the current studies either treat education as a homogeneous concept or categorize it in a hierarchical manner (e.g., Rodríguez-Pose and Tselios 2009; Abdullah et al. 2015) without considering its categorization based on the labor market objectives. Different jobs require specific and distinct skill sets in today’s technologically advanced world with rapidly evolving knowledge. Some jobs demand creative problem-solving abilities, while others focus on repetitive tasks. As a result, different types of education and training are required and established. This paper theoretically examines the relationship between the cost of training and income inequality, considering the two types of training based on the type of workers they nurture.

Following Becker and Tomes (1979)’s string of thoughts, the income inequality in the economy is composed of inter-generational and within-cohort income differences. In this paper, I establish a three-period overlapping generation model to discuss the inter-generational income differences. In this paper, I do not focus on on-the-job training. I assume that individuals make education decisions when young, work during middle age, and retire in old age. To account for the within-cohort differences, I assume individuals are heterogeneous in endowed learning ability and choose education and occupation endogenously.

Before delving into the detailed model setup, it is worthwhile to elucidate the concept of training and the associated costs in this paper. In this context, the cost of receiving training incurs not only financial expenses but also consumes considerable time and effort, especially in an economy characterized by rapid knowledge iteration. With the higher skill requirements in the labor market, the costs of training increase when the teaching effectiveness remains constant. The reason is that acquiring the necessary knowledge and qualifications can become more challenging and time-consuming.

In this paper, I classify two types of training based on workers’ roles in production. The economy features two representative firms producing two types of final goods, requiring workers in three distinct types of occupations.Footnote 1 The first type of occupation demands workers capable of performing simple, repetitive tasks without extensive training or professional knowledge, referred to as basic workers. For instance, a janitor falls into this category. The other types of occupations require a certain level of extensive experience or training for more efficient work than basic workers. An example is the first-line supervisor, who is considered an expert due to the extensive knowledge required for the role. Candidates often undergo training and promotion from within similar fields. The type of education that increases workers’ production efficiencies is called practical training in this paper. A janitor, for example, can choose to receive practical training to learn structural cleaning techniques and be promoted to a first-line supervisor role, directly overseeing and coordinating the work activities of cleaning personnel. Basic workers and experts serve as inputs in the production of one type of final goods referred to as “non-automatable” goods in my model, such as service goods. The last group of occupations requires workers with solid professional foundations to explore cutting-edge technology or knowledge. Those are workers who receive the second type of education to enhance their creativity so they can produce intermediate goods used in current production and illuminate future production technology. For instance, coders who produce industrial robots are one example of workers who receive this type of education. Hence, the second type of final goods is called “automatable” goods because production requires intermediate goods (e.g., robots) produced by creative workers (e.g., coders) and physical capital (e.g., machines). Unlike “non-automatable” goods, “automatable” goods do not require labor in production directly. For example, cars can be considered “automatable” goods due to the widespread use of robots and machines in their production.

In the U.S., reducing education costs is a key element of policy with broad support. However, my paper argues that the impact of policy on income inequality depends on the targeted type of education. The paper calibrates the U.S. data and simulates the consequences of reducing two types of education costs on income inequality. The results demonstrate that reducing the cost of learning creativity reduces income inequality while reducing the cost of practical training may end up enlarging income inequality. I focus on within-group income inequality, as the simulated income differences between middle-aged and older workers with similar learning abilities do not change remarkably with reduced education costs. The reduction in the cost of learning creativity attracts more experts to become creative workers and also attracts basic workers to receive practical training. Moreover, the wage gap between basic and creative workers shrinks, leading to a decline in within-cohort and overall income inequality. However, reducing practical training costs makes becoming experts an attractive option to both marginal basic workers and marginal creative workers. So, assuming prices do not change when the training costs decline, the share of experts increases, and both the numbers of basic and creative workers shrink. However, the widening wage gap between creative workers and basic workers attracts workers to become creative workers. Thus, only the share of basic workers declines, and the numbers of experts and creative workers rise. Therefore, the effect of the declining cost of practical training on income inequality depends on the predominance of the composition effect and wage effect.

This study presents a novel explanation of the relationship between education and income inequality without asserting the superiority or universality of different educations. Existing literature examines the complex relationship from two perspectives. One perspective focuses on the different returns on education. According to Mincer (1974), encouraging individuals to pursue higher education may exacerbate income inequality, as the returns to higher education remain relatively higher than that on compulsory education. Other studies highlight the influence of learning ability and parental investment on educational choices. For instance, Yang and Qiu (2016) analyzes the impact of innate ability, compulsory education (grades 1–9), and non-compulsory education (grades 10–12 and higher education) on income inequality in China, emphasizing the significance of family investment in early education as a determinant of income inequality. Similarly, Prettner and Schaefer (2021) emphasizes the importance of inheritance flows on education choices and income inequality. This paper does not explicitly model a joint family utility function but assumes resource transfer from middle-aged to young individuals. The second perspective focuses on the signaling theory. For example, Hendel et al. (2005) explores the signaling role of education combined with households’ credit constraints, suggesting that affordable borrowing or lower tuition can encourage high-ability individuals to leave the unskilled pool, thereby increasing the skill premium. However, these studies generally consider education in a hierarchical order and do not discuss the types of training that lead to different job choices at the same stage of life. This paper fills this gap in the existing literature. It addresses the importance of skill selection in light of labor market polarization, as highlighted by studies such as Autor and Dorn (2013), Deming (2017), and Deming and Kahn (2018). For instance, Autor and Dorn (2013) emphasizes the reallocation of low-skill workers to service occupations due to the reduced cost of automating routine and codifiable job tasks, leading to earnings growth at the extremes of the income distribution. By incorporating different types of education based on the skills they develop, this paper contributes to understanding the relationship between education and income inequality.

The paper is organized as follows. Section 2 introduces the model setup and some preliminary theoretical results. Section 3 introduces calibration strategies and presents simulation results. Section 4 provides the concluding remarks.

2 The model

I develop a three-stage overlapping generation model featuring endogenous education and occupation choices in the economy with two final goods. All markets are perfectly competitive, and there are no uncertainties. The model incorporates three key features. Firstly, the economy includes two representative firms producing different goods, and each requires different types of workers in the production technology. Secondly, I introduce two education types that are aligned with the skills they impart. Individuals can opt for (1) no education, (2) practical training, or (3) training in creativity skills. Individuals with perfect foresight choose the types of education they pursue during their youth. Different educational backgrounds lead to distinct roles in production, resulting in different labor incomes when they are middle-aged - the only working period in my model. Thirdly, individuals are heterogeneous in my model. Individuals differ in their endowed learning ability \(z \sim F(\cdot )\). This endowed learning ability does not play a role if individuals choose not to receive education. Thus, the model allows me to discuss the behaviors of workers who receive different types of education across cohorts and how the change in the cost of each type of education impacts them. The model details are introduced in the following sections.

2.1 Firms and technologies

In this economy, two representative firms produce two types of final goods. The first type, referred to as “automatable” goods (e.g., cars), involves tasks in production that do not require manual labor. The firm producing “automatable” goods depends on physical capital and intermediate goods produced by creative workers as inputs. For instance, coders write programs to develop software, and machines are operated on assembly lines to produce the goods. The production of “automatable” goods (\(Y_t\)) at time t follows the Cobb-Douglas production function:

where \(D_Y\) represents total factor productivity in “automatable” goods production, \(K_t\) denotes the physical capital stock at time t, and \(A_t\) denotes the stock of intermediate goods produced by creative workers at time t. Here, \(\alpha\) is the output elasticity of capital, with \(0< \alpha < 1\). In each period t, the production of intermediate goods (\(A_t\)) by creative workers follows a linear fashion:

where \(e^A e^{z^i}\) represents the productivity of a creative worker i after receiving training in creativity. \(\bar{z}_{t-1}\) denotes the threshold value of endowed learning ability that divides experts and creative workers for those born at time \(t-1\) and work in period t. This threshold value changes over time in the short run but remains a fixed number in the steady state.

The second type of goods is “non-automatable” goods, such as service goods, where production is dependent only on labor directly. “Non-automatable” goods are produced by workers who do not receive training in creativity skills. I assume the “non-automatable” goods production function is linear, where basic workers and experts are perfect substitutes, and the only difference between basic workers and experts is their productivity. For instance, certified massage therapists can undergo practical training, obtain a license, and transform into licensed massage therapists. Their treatments improve as they acquire knowledge in areas such as anatomy and physiology, ultimately passing the bodywork licensing exam administered by states. In the production function of “non-automatable” goods, I exclude physical capital, as it typically plays a minor role in production. For example, a massage therapist relies more on massage skills than machines to treat customers. Thus, I assume the production function of the “non-automatable” goods is

where \(D_S\) denotes the total factor productivity in the production of “non-automatable” goods, and \(G_t\) is the number of basic workers without training. The endowed learning ability thresholds, \(\underline{z}_{t-1}\) and \(\bar{z}_{t-1}\), represent the minimum and maximum values for individuals working at time t. Detailed explanations and closed-form expressions for these thresholds are provided in Sect. 2.2.1.

2.1.1 Firm’s problem

“Automatable” Goods. I assume the “automatable” good is the numeraire. Given all the prices, the representative firm that produces “automatable” goods solves the following maximization problem to determine the capital demand and intermediate goods demand,

where \(m_t\) is the price of the intermediate goods, and \(r_t\) is the rental rate of physical capital. The demands for capital and intermediate goods can be expressed in the following first-order conditions,

“Non-automatable” Goods. Given all prices, the representative firm producing the “non-automatable” good maximizes profit by determining the demand for basic workers and experts:

where \(q_t\) represents the price of the “non-automatable” goods, and \(w_t^G\) is the wage of a basic worker. Given the linear production function, the existence of equilibrium requires the cost of hiring one basic worker and one expert to be equal, clearing the two labor markets,

2.2 Individuals

The economy is populated by overlapping generations of agents, each living for three periods. Within each generation, a continuum of individuals with different learning abilities is born. In this paper, I assume the endowed learning ability of individual i is drawn from a uniform distribution \(z^i \sim U(0,1)\) for simplicity. For each period, the economy includes individuals with the same endowed learning ability but born in different generations. In other words, in period t, the economy includes individuals with the same \(z^i\) but born in generations \(t-2, t-1, t\). For simplicity, I use subscripts y, m, and o to denote whether the individual is young, middle-aged, or old, respectively, and use t to indicate the current time of the economy.

Individuals in this model value the consumption of two goods throughout their lifetime with a logarithmic utility function. For each individual i born in generation t, the utility is defined as:

where \(0<\kappa <1\), and c, s denote the consumption of “automatable” goods and “non-automatable” goods separately. \(c^i_{y,t}, s^i_{y,t}\) show the consumption of “automatable” goods and “non-automatable” goods for individual i born in generation t during their young age at time t. Similarly, \(c^i_{m,t+1}, s^i_{m,t+1}\) represent the consumption of “automatable” goods and “non-automatable” goods for the same individual during their middle age at time \(t+1\). Finally, \(c^i_{o,t+2}, s^i_{o,t+2}\) signify the consumption of “automatable” goods and “non-automatable” goods for individual i during their old age at time \(t+2\).

Individuals own the factors of production in this economy. They supply physical capital and labor to the firms through factor markets. The physical capital market allows individuals to transfer resources to the next period. Since I assume individuals are heterogeneous, they can engage in borrowing and lending through the trading of one-period capital. In the paper, I assume “automatable” goods can be consumed or invested in each period, but “non-automatable” goods can only be consumed. The conversion rate between “automatable” goods and physical capital is one.

In this model, Individuals endogenously make educational choices when they are young. I assume the young have no initial endowment on the physical capital, so they have to borrow from the capital market in that period to fulfill the needs of consumption and education. Let \(f^i_t\) denote the fixed cost of learning, \(b^i_{y,t+1}\) as the amount of acquired physical capital stock for the agent i in period t when young. The subscript \(t+1\) signifies that the return will be repaid in period \(t+1\). Here, \(b^i_{y,t+1}<0\) because the young are borrowing capital. Then, the budget constraint for the individual i born in generation t when young is

where

Agents are assumed to work full-time and can only work when they are in middle age. Based on their educational choices when young, individuals work in different occupations when they are in middle age. Those who receive no education when young become basic workers in middle age to produce the“non-automatable” goods with productivity normalized to one. For the individual i who receives practical training when young becomes an expert in middle age to produce the “non-automatable” goods with productivity \(e^H e^{z^i}\), and individual i receives training in creativity skill when young becomes a creative worker to produce the intermediate goods in “automatable” goods production with productivity \(e^A e^{z^i}\). Let \(I^i_{t+1}\) denotes the labor income for individual i born in generation t in the middle age, where

Furthermore, in the economy at time \(t+1\), middle-aged workers are required to repay \(r_{t+1}\) units of interest for each unit of capital borrowed at youth. An individual i born in generation t also engages in the investment of physical capital since it serves as their sole source of income in old age. The physical capital depreciates at the rate of \(\delta\) (\(0<\delta <1\)). Let \(b^i_{m,t+2}\) represent the physical capital stock that will yield the capital return for the individual when they reach old age. Therefore, this middle-aged individual will invest \(b^i_{m,t+2}-(1-\delta )b^i_{y,t+1}\) units of physical capital. Thus, the budget constraint for the middle-aged individual i born in generation t is

When the individual i who was born at generation t becomes old, the only source of income comes from the physical stock of capital. The budget constraint for this individual when old is

2.2.1 Individual’s problem

For each individual i born in generation t, the agent solves the following maximization problem:

s.t.

The intertemporal budget constraint for this individual can be summarized as follows:

where \(\tilde{r} = r-\delta\). From the intertemporal budget constraint, the lifetime disposable income matters for allocations across the life cycle. The lifetime disposable income is the subtraction of the present value of income and educational costs. Since \(f^A > f^H\), the wage of creative workers should be greater than the wage of experts, which requires \(e^A m_{t+1}> e^H w_{t+1}^G\), to ensure the existence of equilibrium. Let me denote \(z_{1,t} = \frac{(1+\tilde{r}_{t+1})(f^A-f^H)}{e^Am_{t+1}-e^H w^G_t}\), \(z_{2,t} = \frac{w^G_t + (1+\tilde{r}_{t+1})f^A}{e^Am_{t+1}}\), \(z_{3,t} = \frac{w^G_t +(1+\tilde{r}_{t+1})f^H}{e^H w^G_t}\).

Proposition 1

(Occupational & Educational Choices) If \(z_{1,t}>z_{2,t}\), agents with \(z^i \in \left( \ln (z_{1,t}), 1 \right]\) invests in creativity and become creative workers; agents with \(z^i \in \left[ \ln (z_{3,t}), \ln (z_{1,t})\right]\) are experts with training; and agents with \(z^i\in \left[ 0, \ln (z_{3,t}) \right)\) receive no education and become basic workers. If \(z_{1,t} \le z_{2,t}\), agents with \(z^i \in \left( \ln (z_{2,t}), 1 \right]\) receive training in creativity and become creative worker; and agents with \(z^i \in \left[ 0, \ln (z_{2,t}) \right]\) receive no education and become basic workers.

Proof

See Appendix A.1. \(\square\)

Thus, if \(z_{1,t}>z_{2,t}\), \(\bar{z}_t = \ln (z_{1,t})\) and \(\underline{z}_t = \ln (z_{3,t})\) (case 1). Otherwise, \(\bar{z}_t =\underline{z}_t = \ln (z_{2,t})\) (case 2). This proposition posts constraints in parameter values, which I use in the calibration section. For the individual i born in generation t, the demands of two types of goods in each period satisfy,

The supply of capital for the individual when young is

The supply of capital for the middle-aged individual is

2.3 Markets clear conditions

This economy has two labor markets, two goods markets, and one capital market. I denote \(G_{t}\) as the demand of basic workers, \(H_{t}\) as the demand of experts by the firm produces “non-automatable” goods at time t, and \(E_{t}\) as the demand of creative workers by the firm produces “automatable” goods at time t. \(C_{y,t}, C_{m,t}, C_{o,t}, S_{y,t}, S_{m,t}, S_{o,t}\) as total consumption of “automatable” goods and “non-automatable” by the young, middle-aged and old individuals at time t respectively. I denote \(B_{m,t}, B_{y,t}\) as the supply of the aggregate capital from young and middle-aged workers in period t, respectively. The market equilibrium conditions can be shown as follows.

Labor Markets.

Goods Markets.

Capital Market.

2.4 Equilibrium

A sequential markets equilibrium consists of allocations \(\{ c^{i}_{m,1},s^{i}_{m,1}, c^{i}_{o,1}, s^{i}_{o,1}, c^{i}_{o,2}, s^{i}_{o,2}\), \(b^{i}_{y,1}, b^{i}_{m,1}, b^{i}_{m,2},\{c^{i}_{y,t},s^{i}_{y,t}, c^{i}_{m,t+1},s^{i}_{m,t+1}, c^{i}_{o,t+2}, s^{i}_{o,t+2}, f^{i}_t, b^{i}_{y,t+1}, b^{i}_{m,t+2}\}_{i}\), \(K_t, A_t, Y_t, S_t, G_t, H_t, E_t\} _{t=1}^{\infty}\) and prices \(\left\{ w^G_t,m_t,q_t,r_t\right\} _{t=1}^\infty\), such that:

-

1.

Given \(\{w^G_t,m_t,q_t,r_t\}_{t=1}^\infty\), each generation determines optimal consumption bundles and capital investments across the life cycle, educational and occupational choices as mentioned in Sect. 2.2.1.

-

2.

Given \(\{w^G_t,m_t,q_t,r_t\}_{t=1}^\infty\), two representative firms determine labor demand and capital demand, as mentioned in Sect. 2.1.1.

-

3.

Goods markets, labor markets, and capital markets are clear in each period as mentioned in Sect. 2.3.

In this paper, I focus on the analysis of the steady-state equilibrium. The steady-state equilibrium conditions are summarized in Appendix A.2.

3 Simulation

3.1 Calibration strategy

To conduct numerical analyses, I begin by selecting a model parameterization as detailed below. The model’s steady-state equilibrium is calibrated to the U.S. average statistics from 2002 to 2020. In this model, workers live for three periods, equating each to 25 years to align with real-life data.

There are three types of occupations in the model, and I characterize detailed occupations in Standard Occupational Classification (SOC) into three categories manually based on their job requirements. Basic workers perform simple, repetitive tasks without extensive training, including roles like hand makers, attendants, and helpers. Experts, requiring practical training, manage and adapt to job responsibilities through extensive experience or professional knowledge, often bringing some levels of innovation to their roles; this category includes occupations such as managers, administrators, and superintendents. Creative workers engage in roles that demand a solid professional base and creativity to explore frontier technologies and knowledge, such as directors, artists, and scientists. The appendix A.4 details these categories and lists specific job titles within each.

I obtain employment and mean hourly wage data for each occupation from the U.S. Occupational Employment and Wage Statistics (OEWS) program. By calculating the average employment share and hourly wage for each occupational category, it is found that 18% of workers are basic workers, 70% are experts, and 12% are creative workers (\(G = 0.18, H = 0.70\), \(E = 0.12\)), with basic workers earning an average hourly wage of $13.29 (\(w^G = 13.29\)). Additionally, I compute the wage premium of experts over basic workers and the wage premium of creative workers over experts, finding the latter exceeds one, indicating \(e^A m> e^H w^G\ \text {and}\ f^A> f^H\). These wage premiums, however, are not used for calibration but to check the model’s fit.

Additionally, I derive total labor income from the wages and salaries reported in the National Income and Product Accounts (NIPA) by the U.S. Bureau of Economic Analysis (BEA).Footnote 2 In the model, I assume the middle-aged population supplies the total time endowment for work, and the overall population in each generation is normalized to 1 in the economy. Consequently, the income in the model is interpreted as per-hour income. Thus, I divide the total wages and salaries by the total hours worked each year. The total hours worked data is obtained from the Bureau of Economic Analysis (BEA). I find the total labor income is $35.34 (\(TotLI = 35.34)\). Utilizing occupational employment shares, I then calculate the learning ability threshold values, \(\underline{z} = G = 0.18\), and \(\bar{z} = 1-E = 0.88\).

I categorize parameters into two groups: fixed and free. Fixed parameters are derived directly from data or are widely accepted in the literature. Free parameters are determined iteratively by substituting data values into theoretical moments. Table 1 lists all parameters in the model and calibrated values.

Fixed Parameter. I set the discount factor to \(\beta = 0.99^{25} = 0.778\), following precedents in literature such as Hurd (1990) and Ludwig and Vogel (2010). Considering the annual capital depreciation rate of 0.05, as cited by Kulish et al. (2010) and equating one period in the model to 25 years, I adjust the depreciation rate to \(\delta = 1-(1-0.05)^{25} = 0.723\). Furthermore, I normalize the total factor productivity for “non-automatable” goods DS to one.

Free Parameter. Due to the indistinguishability of individuals’ outcomes from the costs of two types of education (\(f^A\) and \(f^H\)) and the productivity enhancer difference between them (\(e^H\) and \(e^A\)), I equate \(e^H\) to \(e^A\). Using the obtained data and equilibrium conditions, I can calibrate values of all parameters as listed in Table 1. I first assume \(e^H\) is known, and the calibration process unfolds through three nested loops to determine the capital income (rK), the total education spending (\(TotEdu= f^HH+f^AE\)), and the net interest rate (\(\tilde{r}\)). The methodology and rationale for solving these three variables are discussed in the subsequent paragraphs.

To calibrate \(\alpha\), which signifies the capital income share in total “automatable” goods production, I compute \(\alpha = \frac{rK}{Y} = \frac{rK}{rK+mA}\), with \(mA = TotLI-qS\). Here, TotLI represents the total labor income, and qS shows the income from “non-automatable” goods, equating to the labor income of both basic workers and experts. For a given level of \(e^H\), I can compute \(qS = w^GG+e^Hw^G(e^{\bar{z}}- e^{\underline{z}})\) by using available data. Therefore, by determining rK, the calibrated value of \(\alpha\) can be obtained.

Then, to calibrate the set \(\{\kappa , f^H, f^A, D_Y\}\), the focus narrows to solving for total education spending (\(TotEdu= f^HH+f^AE\)), and net interest rate (\(\tilde{r}\)). \(\kappa\) represents the proportion of consumption expenditure on “non-automatable” goods relative to total consumption, calculated as \(\kappa = \frac{qS}{qS+TotC}\). Determining \(\kappa\) requires the total consumption on “automatable” goods TotC. For a given level of \(\{e^H, rK, \tilde{r}, TotEdu\}\), I obtain \(K = \frac{rK}{r} = \frac{rK}{\tilde{r}+\delta }\). From the “automatable” goods resource constraint, the total number of consumption on the “automatable” goods is \(TotC = Y - \delta K - TotEdu\), with \(Y = mA + rK\) reflecting the competitive market condition.

Thus, I get the calibrated value of \(\kappa = \frac{qS}{qS+TotC}\). Moreover, I compute the cost of practical training \(f^H = \frac{(e^H e^{\underline{z}}-1)w^G}{1+\tilde{r}}\) from the basic worker labor market clear condition (Eqn. (A6)), and the cost of receiving training in creativity skill \(f^A = \frac{TotEdu - f^H H}{E}\) from the definition of total spending on education in the economy. Lastly, the total factor productivity in “automatable” goods production,\(D_Y\), is determined as \(D_Y = \frac{Y}{K^\alpha A^{1-\alpha }}\), where \(A = e^H(e-e^{\bar{z}})\).

The following process illustrates how I solve these three key variables through a structured three-layer loop process for a given level of \(e^H\):

Outer Loop: This step focuses on determining capital income (rK) by satisfying the capital market equilibrium condition (Eqn. (A10));

Middle Loop: The objective here is to find the total education spending (TotEdu) using the labor market clear condition for creative workers (Eqn. (A8));

Inner Loop: This loop involves calculating the net interest rate (\(\tilde{r}\)) to satisfy the “automatable” goods market clear condition (Eqn. (A9)).

I calibrate the value of \(e^H = 1.620\) to ensure the existence of an equilibrium where \(e^Am > e^Hw^G\), \(f^A > f^H\), and the capital income share \(\alpha\) are all consistent with the data.Footnote 3

Model Fit. I compute the effective hourly wage from the model for different types of workers and compare it with those from OEWS hourly wage information, which are the untargeted data moments in the calibration. All wages are deflated using 2012 PCE. Table 2 presents the wage premium of the other two types of workers to experts from model and data. From the table, the model generates similar relative wage premiums of basic and creative workers to experts as in the data. Additionally, the model’s calibrated ratio of total educational spending to GDP is approximately 7.11%, aligning closely with the OECD’s reported educational spending to GDP ratio in the U.S. of about 6.1%.Footnote 4 Thus, I conclude that the model fits the data sufficiently.

3.2 Simulated income inequality

In this paper, I focus on the effect of changing educational costs on long-term income inequality. The total income consists of labor and capital income, and I rule out young workers in the income inequality analysis since they have zero income. In the model, only middle-aged workers can work and gain labor income, and the total income of the old is capital income only. This paper investigates two types of education, illustrating how identical cost reductions may have distinct effects on income inequality measurements. I explore the consequences of the income Gini index and the income decile ratio in subsequent sections.

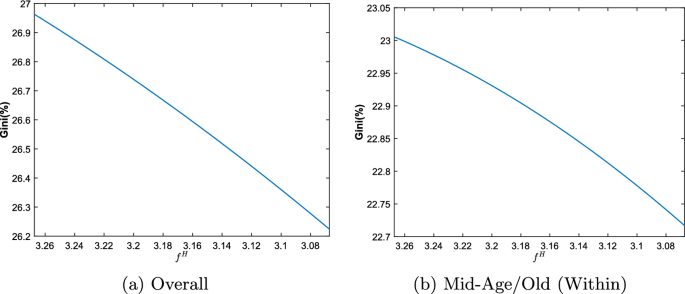

Scenario 1: Decrease \(f^H\) when \(f^A\) is fixed

In the first scenario, suppose the government decides to only reduce the cost of receiving expert training range from \([f^H_{ss}-0.2, f^H_{ss}]\), where \(f^H_{ss}\) is the calibrated steady-state cost of practical training. The simulated pattern of the steady-state Gini index for income is shown in Fig. 1. The solid line in Fig. 1a represents the total income inequality in the economy with both middle-aged and old workers. The line in Fig. 1b shows the income inequality among middle-aged workers or among old workers. From a theoretical perspective, the Gini coefficient of income distribution is expected to be equivalent between middle-aged and elderly workers in this model, given that the income of middle-aged workers is several times greater than that of elderly workers. Thus, two within inequality curves are the same (See Appendix A.3 for proof).

Figure 1 shows that reducing the cost of practical training leads to a decrease in both within-group inequality and overall income inequality. Total inequality surpasses within-group inequality due to the existing income dispersion between middle-aged and elderly workers. However, the decline in the cost of practical training does not seem to impact between-group inequality.

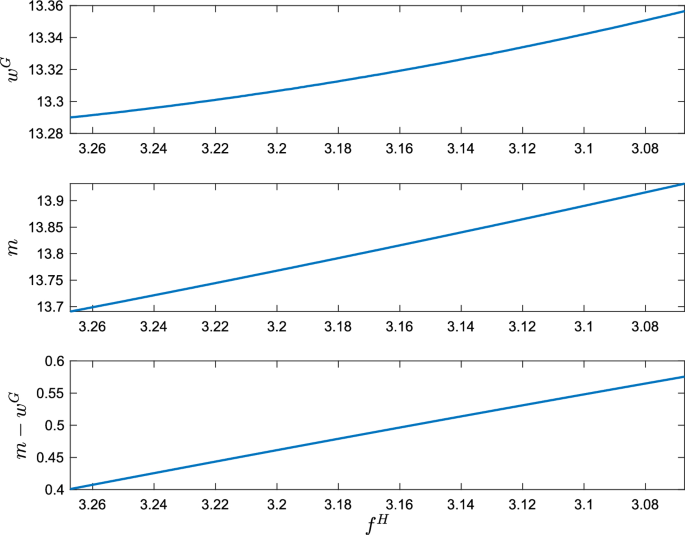

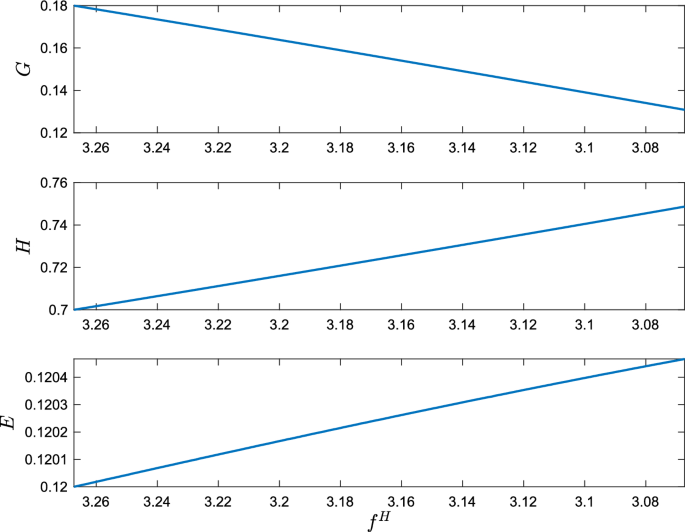

To analyze the shifts in within-group inequality associated with changes in \(f^H\), I examine wage and occupational distribution patterns, illustrated in Figs. 2 and 3. A relative decline in practical training costs draws individuals with endowed learning abilities across both thresholds towards experts, reducing the shares of basic and creative workers, assuming fixed prices. However, an increasing wage gap between creative and basic workers incentivizes a shift towards creative workers. Consequently, the proportion of basic workers decreases, while the numbers of experts and creative workers rise. Thus, despite the growing wage disparity, the composition effect leads to reduced income Gini index with further decreases in the cost of practical training.

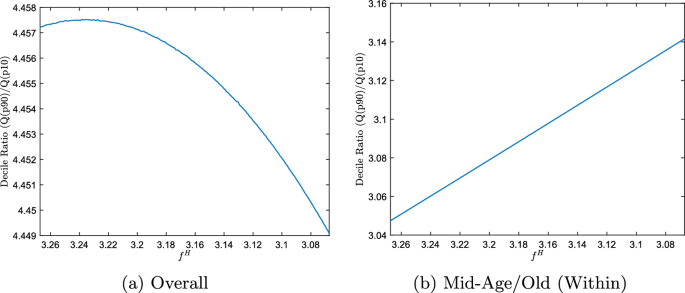

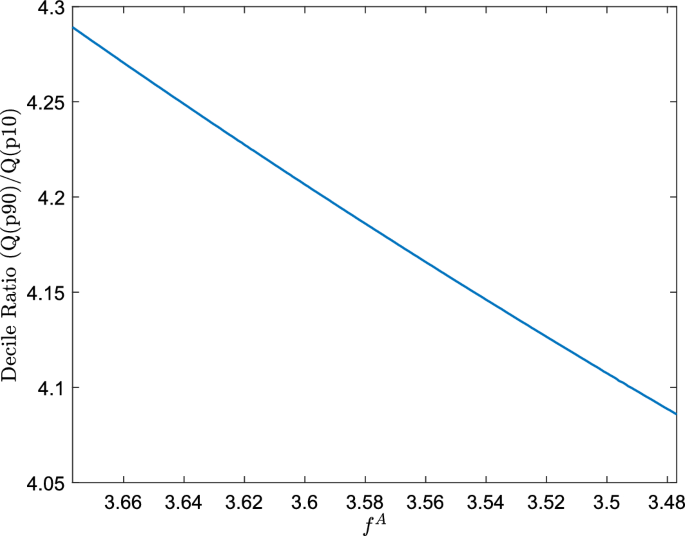

The findings suggest that reducing the cost of practical training could lead to higher income inequality when measured by the income decile ratio. This rise is primarily attributed to the widening wage gap between creative and basic workers, which amplifies within-group income inequality among middle-aged workers. Figure 4 captures the variations in overall (Fig. 4a) and within-group (Fig. 4b) income decile ratios as a result of decreasing costs for practical training.

Scenario 2: Decrease \(f^A\) when \(f^H\) is fixed

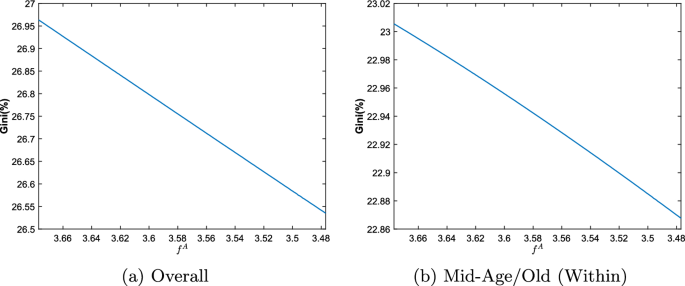

In this scenario, I simulate the long-term consequences when the government decides to reduce the cost of creativity education from \([f^A_{ss}-0.2,f^A_{ss}]\), where \(f^A_{ss}\) is the calibrated steady-state cost of creativity training. Figure 5 depicts the resulting change in the steady-state income Gini index. It demonstrates that both the overall income Gini across middle-aged and elderly workers and the within-group inequality decrease as the cost of investing in creativity is reduced. Similar to the first scenario, the reduction in educational costs on creativity training does not appear to affect the between-group income Gini.

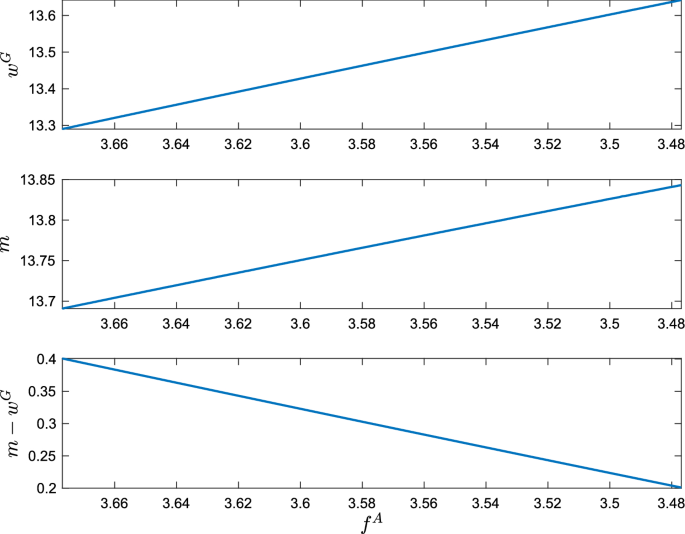

Similar to the analysis in the first scenario, I present the wage and occupational distribution patterns in Figs. 6 and 7. According to Figs. 6 and 7, although the wages of basic workers and the price of intermediate goods both increase, the differences in wage gaps decline when the cost of investing in creativity declines. Moreover, the decline in the cost of investing in creativity results in fewer basic workers but more experts and creative workers. Thus, the within-age group inequality decreases because both wage gaps decrease and shares of low-wage earners (basic workers) decline. The finding also implies that altering the income inequality measure to the income decile ratio could also lead to a decline in income inequality. Figure 8 captures the variations in the overall income decile ratio as a result of decreasing costs for creativity skill training.

4 Conclusion

This paper shows how lowering costs for different types of education can affect income inequality in various ways. Reducing costs for practical training, which focuses on repetitive tasks, may actually make income inequality worse. I construct a three-period overlapping generation model without considering family utility function but incorporating two types of education for workers in different roles. Individuals are in the process of receiving training in their youth, actively producing different types of goods in middle age, and retiring in old age.

The change in income inequality among middle-aged workers mainly determines the variations in total income inequality when the cost of education declines. When practical training costs decline, more middle-aged workers aim to become experts, positioning themselves in the middle-income range. This shift reduces the number of basic and creative workers, driving their wages up and widening the wage gap. This wage gap increase makes creative jobs more appealing, leading to a decrease in basic workers and an increase in experts and creative workers. This scenario suggests that changes in workforce composition (composition effect) are more influential than changes in wage differences (wage effect) in lowering the income Gini index as the cost of practical training decreases. However, if the widening pay gap (wage effect) takes precedence, income inequality could increase. This becomes apparent when measuring inequality differently, such as with the income decile ratio.

A reduction in the cost of creative training not only attracts experts to become creative workers but also attracts more workers to receive practical training. Hence, both the shares of higher-income and middle-income groups increase, and the wage gap between workers at both ends of the income distribution narrows. Therefore, both wage and composition effects explain the declining income inequality.

In this paper, I assume the type of education cost is a sunk resource and is determined exogenously. Suppose the policy goal is to reduce income inequality. In that case, the government should focus on reducing the cost of creative training or enhancing teaching effectiveness on creative training. For instance, the government can develop an institution to train more educators to provide creative training or encourage teaching innovation to enhance teaching effectiveness.

There are several limitations of the paper. Firstly, I assume that two types of education training exist: practical training and creative training. In the real world, some of the existing education training would involve both of them. As a result, it is common for individuals to obtain both creative training and practical training at the same time. However, there are still some educational programs that would focus on either one of them. For example, the coding program will focus on logical training, which can enhance workers’ ability to produce “automated” goods. Secondly, I assume individuals have perfect information for themselves and can foresee the future. Hence, they can decide on the type of education they want without any uncertainties. In the real world, individuals could have incentives to receive both creative training and practical training in order to diversify their human capital investments.

Data availability

All used data are public.

Notes

Refer to Appendix A.4 for additional details on these occupational types.

The data are collected from Table 2.1. Personal Income and Its Disposition, with wages and salaries deflated by PCE in 2012.

The calibrated value of \(e^H\) ranges from 1.429 to 1.620 to guarantee an equilibrium where \(e^Am > e^Hw^G\), and \(f^A > f^H\). When \(e^H=1.429\), the capital income share is almost 0. I pick \(e^H=1.60\) since the calibrated \(\alpha\) is closer to 0.3.

This total educational spending includes expenses from primary through tertiary education.

References

Abdullah A, Doucouliagos H, Manning E (2015) Does education reduce income inequality? A meta-regression analysis. J Econ Surv 29(2):301–316

Autor DH, Dorn D (2013) The growth of low-skill service jobs and the polarization of the US labor market. Am Econ Rev 103(5):1553–1597

Battistón D, García-Domench C, Gasparini L (2014) Could an increase in education raise income inequality? Evidence for Latin America. Latin Am J Econ 51(1):1–39

Becker GS, Tomes N (1979) An equilibrium theory of the distribution of income and intergenerational mobility. J Polit Econ 87(6):1153–1189

Coady D, Dizioli A (2018) Income inequality and education revisited: persistence, endogeneity and heterogeneity. Appl Econ 50(25):2747–2761

Deming D, Kahn LB (2018) Skill requirements across firms and labor markets: evidence from job postings for professionals. J Law Econ 36(S1):S337–S369

Deming DJ (2017) The growing importance of social skills in the labor market. Q J Econ 132(4):1593–1640

Gregorio JD, Lee J-W (2002) Education and income inequality: new evidence from cross-country data. Rev Income Wealth 48(3):395–416

Hendel I, Shapiro J, Willen P (2005) Educational opportunity and income inequality. J Public Econ 89(5–6):841–870

Hurd MD (1990) Research on the elderly: economic status, retirement, and consumption and saving. J Econ Lit 28(2):565–637

Knight JB, Sabot RH (1983) Educational expansion and the Kuznets effect. Am Econ Rev 73(5):1132–1136

Kulish M, Kent C, Smith K (2010) Aging, retirement, and savings: a general equilibrium analysis. BE J Macroecon 10(1)

Ludwig A, Vogel E (2010) Mortality, fertility, education and capital accumulation in a simple olg economy. J Popul Econ 23:703–735

Mincer JA (1974) Schooling and earnings. In: Schooling, experience, and earnings, pp 41–63. NBER

Prettner K, Schaefer A (2021) The u-shape of income inequality over the 20th century: the role of education. Scand J Econ 123(2):645–675

Ram R (1989) Can educational expansion reduce income inequality in less-developed countries? Econ Educ Rev 8(2):185–195

Rodríguez-Pose A, Tselios V (2009) Education and income inequality in the regions of the European union. J Reg Sci 49(3):411–437

Schultz TW (1963) The economic value of education. Columbia University Press, New York

Spence M (1973) Job market signaling. Q J Econ 87(3):355–374

Sylwester K (2002) Can education expenditures reduce income inequality? Econ Educ Rev 21(1):43–52

Yang J, Qiu M (2016) The impact of education on income inequality and intergenerational mobility. China Econ Rev 37:110–125

Acknowledgements

I gratefully acknowledge funding from Wenzhou Kean University, IRSP (Grant IRSPG202107). I thank Yang Xuan for the helpful discussions on earlier versions of this paper and her research assistant in calibration.

Funding

This research is funded by Wenzhou Kean University, IRSP (Grant IRSPG202107).

Author information

Authors and Affiliations

Contributions

The work is purely done by the author, and all faults are mine.

Corresponding author

Ethics declarations

Conflict of interest

The author has no relevant financial or non-financial interests to disclose.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Code availability

The codes can be applied upon request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chang, FH. The impact of education costs on income inequality. Int Rev Econ 71, 553–574 (2024). https://doi.org/10.1007/s12232-024-00452-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-024-00452-z