Abstract

We develop a simple OLG model to analytically show that aging leads to increased educational efforts through a general equilibrium effect. The mechanism is that scarcity of raw labor increases the return of human relative to physical capital. While a reduction in the birth rate is shown to unambiguously increase educational efforts, increases in the survival rate have ambiguous effects. Falling birth rates also increase capital per worker, but the effects of rising survival rates are again ambiguous. We conclude that our model is a useful laboratory to highlight potentially offsetting effects in models with endogenous education and overlapping generations.

Similar content being viewed by others

Change history

13 June 2019

Equation (25b) on p. 711 of the published version of the paper

13 June 2019

Equation (25b) on p. 711 of the published version of the paper

Notes

To see why this assumption is useful, assume that bequests are distributed to the young. Then, transfers are given by

$$ tr_t = (1-\lambda)\frac{a_{t-1,0} (1+r_t) (1-s_t) N_{t-1,0} }{ N_{t,0}} = (1-\lambda)a_{t-1,0} (1+r_t) \frac{1-s_t}{\gamma^N_t}. $$As a t − 1,0 shows up in the above equation, the analysis would involve a second-order difference equation for k t , which would tremendously reduce analytical tractability. Assuming that bequests are distributed to the young and old will obviously cause the same problem.

This has already been shown by Hu (1999).

While we explicitly model this inter-generational transfer system as a pension system, it may also be interpreted as a metaphor for a more general intergenerational transfer system, e.g., a health care system.

Notice that these definitions are not the same as what is referred to as defined contribution and defined benefit systems in the literature.

As can be immediately observed from Eq. 14, the overall effect of increasing survival on savings is unambiguously positive. However, it is larger for λ = 0 than for λ = 1.

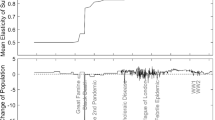

Our population data are based on the Human Mortality Database (2008).

The alternative would be to calibrate γ N with the gross growth rate of the working age population ratio. This would require setting γ N = 1.06. The implied oadr is then 0.66, and hence, this alternative would overestimate the actual old-age dependency.

Alternative calibration targets are, e.g., the fraction of the old (age 60 and older) in the population who work, which is 5.4% in the data. In our model, this implies ω = 0.12 and e = 0.0077 (0.31 years of education). The choice of this alternative measure does not change our conclusions (results available upon request).

The data we use can be found in Tables A1.1a, A1.3a, and X1.1c. See also the same publication for more detailed information on the educational systems and definitions.

For the sake of brevity, simulation results with varying α and β are not displayed but are available upon request.

To see what happens for λ ≠ 1, define μ ≡ φ/ ξ and \(\mu' \equiv \partial \mu / \partial s\). Then, the corresponding term is

$$ \frac{\partial \phi}{\partial s}\frac{1}{\gamma^A}=\omega\frac{1+ge(e)}{1-e}\left(\alpha + \mu' \frac{1-\alpha}{\beta}\right)- \frac{\gamma^N}{s^2\beta}(\alpha+(1-\alpha)\mu\tau) + \mu'\frac{\gamma^N(1-\alpha)\tau}{s\beta}, $$where it is obvious that the last two terms are negative (μ > 0 and μ′ < 0) but the sign of the term in the first bracket is ambiguous again. Thus, by setting λ = 1 (perfect annuity markets), which implies \(\frac{\varphi}{\zeta}=1\), we know that ϕ′|0 ≤ λ < 1 < ϕ′|λ = 1 holds.

References

Attanasio OP (1999) Consumption. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, chap 11. Elsevier, Amsterdam, pp 741–812

Barro RJ, Sala-i-Martin X (2003) Economic growth. MIT, Cambridge

Ben-Porath Y (1967) The production of human capital and the life cycle of earnings. J Polit Econ 75(4):352–365

Blanchard OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93(2):223–247

Boucekkine R, de la Croix D, Licandro O (2002) Vintage human capital, demographic trends, and endogenous growth. J Econ Theory 104:340–375

Bouzahzah M, de la Croix D, Docquier F (2002) Policy reforms and growth in computable OLG economies. J Econ Dyn Control 26:2093–2113

Browning M, Hansen LP, Heckman JJ (1999) Micro data and general equilibrium models. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, chap 8. Elsevier, Amsterdam, pp 543–633

de la Croix D, Licandro O (1999) Life expectancy and endogenous growth. Econ Lett 65:255–263

Cutler D, Deaton A, Lleras-Muney A (2006) The determinants of mortality. J Econ Perspect 20(3):97–120

Diamond PA (1965) National debt in a neoclassical growth model. Am Econ Rev 55(5):1126–1150

Echevarria CA, Iza A (2006) Life expectancy, human capital, social security and growth. J Public Econ 90:2324–2349

Eckstein Z, Mira P, Wolpin KI (1999) A quantitative analysis of swedish fertility dynamics. Rev Econ Dyn 2:137–165

Flora P, Kraus F, Pfenning W (1983) State economy and society in western Europe 1815–1975, vol 1. St. James, Chicago

Foster AD, Rosenzweig MR (1996) Technical change and human-capital returns and investments: evidence from the green revolution. Am Econ Rev 86(4):931–953

Fougère M, Mérette M (1999) Population ageing and economic growth in seven OECD countries. Econ Model 16:411–427

Hansen GD, Imrohoroğlu S (2008) Consumption over the life cycle: the role of annuities. Rev Econ Dyn 11:566–583

Heijdra BJ, Romp WE (2009) Human capital formation and macroeconomic performance in an ageing small open economy. J Econ Dyn Control 33:725–744

Hu SC (1999) Economic growth in the perpetual-youth model: implications of the annuity market and demographics. J Macroecon 21(1):107–124

Human Mortality Database (2008) University of California, Berkeley (USA), and Max Planck Institute for Demographic Research (Germany). www.mortality.org

Hurd MD (1990) Reseach on the elderly: economic status, retirement, and consumption and saving. J Econ Lit 28(2):565–637

Kalemli-Ozcan S, Ryder HE, Weil DN (2000) Mortality decline, human capital investment, and economic growth. J Dev Econ 62:1–23

Ludwig A, Schelkle T, Vogel E (2008) Demographic change, human capital and welfare. MEA Discussion Paper

Mincer J (1995) Economic development, growth of human capital, and the dynamics of the wage structure. J Econ Growth 1:29–48

OECD (2008) Education at a glance. OECD, Paris

Ram R, Schultz TW (1979) Life span, health, savings, and productivity. Econ Dev Cult Change 27(3):399–421

Sadahiro A, Shimasawa M (2002) The computable overlapping generations model with endogenous growth mechanism. Econ Model 20:1–24

The World Bank (2004) World development indicators 2004. The World Bank, Washington, DC

Willis R (1986) Wage determinants: a survey and reinterpretation of human capital earnings function. In: Ashenfelter O, Layard R (eds) Handbook of labor economics, chap 10. Elsevier, Amsterdam, pp 525–602

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32(2):137–150

Zhang J, Zhang J, Lee R (2001) Mortality decline and long-run economic growth. J Public Econ 80:485–507

Acknowledgements

We thank Wolfgang Kuhle, Thomas Schelkle, and two anonymous referees for helpful comments. Financial support by the State of Baden-Württemberg and the German Insurers Association (GDV) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendices

Appendix

1.1 A Proofs

Proof of Proposition 1

We have that

which, by Eq. 22, can be rewritten as

We first work on the left-hand side (LHS) of Eq. 32. Using Eq. 23, we get

Next, we focus on the right-hand side (RHS) of Eq. 32). Using Eqs. 5, 9, and 20 in Eq. 14 and bringing the terms involving a t,0 to the LHS of the resulting expression, we get

Bringing the term postmultiplying a t,0 to the RHS, replacing r t and w t with their marginal products from Eq. 18, and dividing by A t + 1 gives

where

Next, use the equation above and combine it with Eq. 33 to get

Multiply the above by α(1 + βs t + 1) and simplify to get

The expression for e t immediately follows from replacing wages and interest rates by their respective counterparts from Eqs. 18a and 18b. Using \(\hat{\rho}=\frac{1}{\beta s_{t+1}}-1\) proves the claim in the proposition.□

Proof of Proposition 2

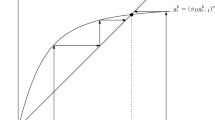

First, given that the function g(e) satisfies the lower Inada condition with lime →0 g′(e) → ∞, the solution with zero education is excluded for ω ∈ (0,1]. Second, having full educational investment (i.e., e = 1), labor supply and, thus, wage income of the young generation are zero. By the lower Inada condition of the utility function, we have that c t,0 > 0 for positive wages. Consequently, savings in the first period would be negative, as would be the capital stock of the economy. Thus, if there is an equilibrium with finite and positive capital stock, education will always be lower than unity.

To show that education always converges to the steady state solution, use Eq. 24a in Eq. 24b and rewrite the resulting expression as

where

\(\Delta_t \equiv e_t-e_{t+1}(k^*)\) is defined as measuring the distance between e t and e t + 1, which is ultimately a function of the steady state capital stock. Thus, Δ t measures the change in education between t and t + 1 outside the steady state. Rearranging gives

Taking the derivative of e t with respect to the distance to the steady state gives

Therefore, if education is, e.g., below its new steady state level after an exogenous shock (i.e., Δ t < 0), e t will always converge monotonically to the new steady state value.□

Proof of Proposition 3

Existence:

Using Eq. 22 and the assumption of constant population growth, we have

where \(\tilde{a}_{t,0}\) is Eq. 22 divided by A t to transform a t,0 into savings per efficient worker. Define the function

where d(·) is the change in the capital stock per effective worker. Given that we use log-utility, e t ∈ (0,1), and a Cobb–Douglas production function, it holds that

where \(\tilde{w_t}\) denotes wages scaled by the level of technology. All we have to show is that d(·) has opposite signs for k t + 1 going to zero and infinity. Then, by continuity of d(·), there is at least one capital stock satisfying d(·) = 0. This holds since

and, taking the limits, gives

for sufficiently small k t + 1. For uniqueness, it is sufficient to show that \(\partial d(w_t,r_{t+1})/\partial k_{t+1}>0\) for all k, i.e., that for a given wage rate, d(w t ,r t + 1) is nondecreasing in the capital stock. Taking Eq. 25a and recalling that \(\partial e/\partial k>0\) establishes the result. By using Eq. 26b, it is clear that a unique solution for the capital stock automatically gives a unique e.□

Proof of Proposition 4

From Eq. 26, define

where

and ϕ is as in Eq. 27a and φ is as in Eq. 27b.

-

1.

For the case where \(\tau = \bar{\tau}\), we can ignore that τ is related to γ N and s by the steady state version of Eq. 21. The general problem with two implicitly defined endogenous variables can be written as

$$ \begin{bmatrix} \displaystyle\frac{\partial k}{\partial X} \\[12pt] \displaystyle\frac{\partial e}{\partial X} \end{bmatrix} = - \begin{bmatrix} \displaystyle\frac{\partial F_1}{\partial k} & \displaystyle\frac{\partial F_1}{\partial e} \\[12pt] \displaystyle\frac{\partial F_2}{\partial k} & \displaystyle\frac{\partial F_2}{\partial e} \end{bmatrix}^{-1} \begin{bmatrix} \displaystyle\frac{\partial F_1}{\partial X} \\[12pt] \displaystyle\frac{\partial F_2}{\partial X} \end{bmatrix} = - A^{-1} \begin{bmatrix} \displaystyle\frac{\partial F_1}{\partial X} \\[12pt] \displaystyle\frac{\partial F_2}{\partial X}, \end{bmatrix} $$(42)where X is any variable from the vector of exogenous variables {γ N ,s,ω,}, and therefore,

$$ \begin{bmatrix} \displaystyle\frac{\partial k}{\partial X} \\[12pt] \displaystyle\frac{\partial e}{\partial X} \end{bmatrix} = - | A |^{-1} \begin{bmatrix} \displaystyle\frac{\partial F_2}{\partial e} & -\displaystyle\frac{\partial F_1}{\partial e} \\[12pt] -\displaystyle\frac{\partial F_2}{\partial k} & \displaystyle\frac{\partial F_1}{\partial k} \end{bmatrix} \begin{bmatrix} \displaystyle\frac{\partial F_1}{\partial X} \\[12pt] \displaystyle\frac{\partial F_2}{\partial X}, \end{bmatrix} $$(43)and rearranging gives

$$ \begin{bmatrix} \displaystyle\frac{\partial k}{\partial X} \\[12pt] \displaystyle\frac{\partial e}{\partial X} \end{bmatrix} = - | A |^{-1} \begin{bmatrix} \displaystyle\frac{\partial F_2}{\partial e}\displaystyle\frac{\partial F_1}{\partial X} & -\displaystyle\frac{\partial F_1}{\partial e}\displaystyle\frac{\partial F_2}{\partial X} \\[12pt] -\displaystyle\frac{\partial F_2}{\partial k} \displaystyle\frac{\partial F_1}{\partial X} & + \displaystyle\frac{\partial F_1}{\partial k}\displaystyle\frac{\partial F_2}{\partial X} \end{bmatrix} $$(44)Since \(\tau = \bar{\tau}\), we get

$$ \frac{\partial F_1}{\partial k} = -1 < 0 $$(45a)$$ \frac{\partial F_1}{\partial e} = \frac{1}{1-\alpha} \Omega^{1/(1-\alpha)-1} \displaystyle\frac{\partial \Omega}{\partial e} < 0 $$(45b)$$ \frac{\partial F_2}{\partial k} = c \left( \frac{s}{\zeta} \right)^{\frac{1}{1-\psi}} \displaystyle\frac{1-\alpha}{1-\psi} k^{\frac{1-\alpha}{1-\psi}-1} > 0 $$(45c)$$ \frac{\partial F_2}{\partial e} = -1 < 0, $$(45d)whereby the sign in Eq. 45b follows from \(\frac{\partial \Omega}{\partial e} < 0\). Consequently,

$$ | A | = \underbrace{\frac{\partial F_1}{\partial k} \frac{\partial F_2}{\partial e}}_{=1} - \underbrace{\frac{\partial F_1}{\partial e} \frac{\partial F_2}{\partial k}}_{<0} > 0. $$(46)-

a.

To determine the effect of a changing population growth rate γ N on k and e, we have to replace X by γ N in Eq. 42, which gives

$$ \frac{\partial F_1}{\partial \gamma^N} = \frac{1}{1-\alpha} \Omega^{1/(1-\alpha)-1} \frac{\partial \Omega}{\partial \gamma^N} < 0 $$(47a)$$ \frac{\partial F_2}{\partial \gamma^N} = 0, $$(47b)whereby Eq. 47a follows from \(\frac{\partial \Omega}{\partial \gamma^N} < 0\), cf. Eqs. 40 and 27a. To get an intuitive idea of what is determining the sign, note that we can write

$$ \frac{\partial \Omega}{\partial \gamma^N}=\frac{\partial \varphi/\partial \gamma^N \phi -\varphi \partial \phi/\partial \gamma^N}{\phi^2}=-\frac{\varphi \partial \phi/\partial \gamma^N}{\phi^2}<0 $$(48)since φ is independent of γ N and ϕ is a positive function of γ N, cf. Eqs. 26a and 27. Thus, γ N has a direct effect on k but only an indirect effect on e via changing relative prices (this is the reason why \( \partial F_2/\partial \gamma^N=0\)). Formally, we have

$$ \frac{\partial k}{\partial \gamma^N} = - |A|^{-1} \left( \underbrace{\frac{\partial F_2}{\partial e} \frac{\partial F_1}{\partial \gamma^N}}_{>0}-\underbrace{\frac{\partial F_1}{\partial e} \frac{\partial F_2}{\partial \gamma^N}}_{=0}\right) < 0 $$(49a)$$ \frac{\partial e}{\partial \gamma^N} = -|A|^{-1} \left( - \underbrace{\frac{\partial F_2}{\partial k} \frac{\partial F_1}{\partial \gamma^N}}_{<0} + \underbrace{\frac{\partial F_1}{\partial k} \frac{\partial F_2}{\partial \gamma^N}}_{=0}\right) < 0. $$(49b) -

b.

To derive the analogous steps for differentiation of Eq. 39 with respect to s, replace the terms in Eq. 47 by

$$ \frac{\partial F_1}{\partial s} = \displaystyle\frac{1}{1-\alpha} \Omega^{1/(1-\alpha)-1} \frac{\partial \Omega}{\partial s} \gtrless 0 $$(50a)$$ \frac{\partial F_2}{\partial s} = c k^{\frac{1-\alpha}{1-\psi}} \displaystyle\frac{\partial \frac{s}{\zeta}}{\partial s} \geq 0. $$(50b)giving

$$ \frac{\partial k}{\partial s} = - |A|^{-1} \left( \underbrace{\frac{\partial F_2}{\partial e} \frac{\partial F_1}{\partial s}}_{\gtrless0}-\underbrace{\frac{\partial F_1}{\partial e} \frac{\partial F_2}{\partial s}}_{\leq0}\right) \gtrless0 $$(51a)$$ \frac{\partial e}{\partial s} = -|A|^{-1} \left( - \underbrace{\frac{\partial F_2}{\partial k} \frac{\partial F_1}{\partial s}}_{\gtrless0} + \underbrace{\frac{\partial F_1}{\partial k} \frac{\partial F_2}{\partial s}}_{\leq0}\right) \gtrless0. $$(51b)Intuitively, the ambiguity of \(\frac{\partial e}{\partial s}\) results from the fact that, holding k constant, e is increasing in s as long as λ > 0 (direct effect), but the capital stock may increase or decrease in s for given education e. As e increases in k monotonically, the ambiguity of \(\frac{\partial k}{\partial s}\) translates into the ambiguity of \(\frac{\partial e}{\partial s}\) (indirect effect of s on e).

Arguing formally, the ambiguity of \(\frac{\partial k}{\partial s}\) comes from

$$ \frac{\partial \Omega}{\partial s}=\frac{\partial (\varphi/\phi)}{\partial s}= \alpha(1-\alpha)\beta(1-\tau)\frac{\varphi'\phi-\varphi \phi'}{\phi^2} \gtrless 0, $$(52)where \(\phi'=\partial \phi/\partial s\) and \(\varphi' = \partial \varphi/\partial s\), cf. Eq. 26a. It can be shown that φ′ > 0. Consequently, the sign of \(\frac{\partial \phi}{\partial s}\) determines the sign of \(\frac{\partial F_1}{\partial s}\) (and thus, \(\frac{\partial \Omega}{\partial s}\)), and therefore, the sign of Eq. 50a is unambiguous only if \(\frac{\partial \phi}{\partial s}<0\).

To see what determines the sign of ϕ′, observe from Eq. 27a that s enters in three places: (1) s pre-multiplies the term \(\omega \frac{1+g(e)}{1-e}\); (2) s decreases the effective discount rate \(\hat{\rho}\); and (3) s increases the annuity factor, ζ, as long as λ < 1. Consequently, ϕ increases in s by effect 1, whereas it decreases in s by the effects 2 and 3. We can therefore study an upper bound of ϕ′ by setting λ = 1 so that effect 3 is not at work.

This helps to clarify the interaction at the cost of introducing a special case. Using \(\hat{\rho}=\frac{1}{\beta s}-1\) in Eq. 27a and taking the derivative of the resulting equation with respect to s gives

$$ \frac{\partial \phi}{\partial s} \frac{1}{\gamma_A}=\omega \alpha \frac{1+g(e)}{1-e}-\frac{\gamma^N}{s^2\beta}\left[1-(1-\alpha)\frac{}{}(1-\tau)\right]\gtrless 0, $$which is ambiguous.Footnote 12 The right part of this equation consists only of exogenous variables. The left part involves the endogenous education decision e for which no closed-form solution is available. Thus, it is not possible to show analytically that the derivative has an unambiguous sign. However, constructing a few special cases clarifies under which conditions \(\frac{\partial \phi}{\partial s}<0\) may hold.

-

For ω → 0, the left part converges to zero (e also converges to zero), and thus, \(\frac{\partial \phi}{\partial s}<0\).

-

For ω = 1, which implies that τ = 0, we have

$$ \frac{\partial \phi}{\partial s} \frac{1}{\gamma_A}=\alpha \left(\frac{1+g(e)}{1-e} -\frac{\gamma^N}{s^2 \beta} \right) \gtrless 0. $$ -

For ξ → 0 or ψ → 0, we have that e → 0, which means that

$$ \frac{\partial \phi}{\partial s} \frac{1}{\gamma_A}=\omega \alpha -\frac{\gamma^N}{s^2\beta}\left[1-(1-\alpha)\frac{}{}(1-\tau)\right]\gtrless 0. $$

Summarizing the arguments made so far, the sign of \(\frac{\partial \phi}{\partial s}\) is negative (implying that k is increasing in s) if

-

Returns to education are low (low ξ and/or ψ)

-

The horizon over which the benefits can be reaped is short (low ω)

-

The discount factor β is low (i.e., high discount rate)

-

The population growth rate γ N is high

-

The survival probability s is low

-

-

c.

Changing the planning horizon ω gives

$$ \frac{\partial F_1}{\partial \omega} = \displaystyle\frac{\partial \Omega}{\partial \omega} < 0 $$(53a)$$ \frac{\partial F_2}{\partial \omega} = \displaystyle\frac{1}{1-\psi}\omega^{\frac{\psi}{1-\psi}} \left( \xi \psi \frac{\gamma^A }{\alpha }\right)^{\frac{1}{1-\psi}} \left( \frac{s}{\zeta} \right)^{\frac{1}{1-\psi}} k^{\frac{1-\alpha}{1-\psi}} >0, $$(53b)and therefore,

$$ \frac{\partial k}{\partial \omega} = - |A|^{-1} \left(\underbrace{\frac{\partial F_2}{\partial e} \frac{\partial F_1}{\partial \omega}}_{ > 0} - \underbrace{\frac{\partial F_1}{\partial e} \frac{\partial F_2}{\partial \omega}}_{<0} \right) < 0 $$(54a)$$ \frac{\partial e}{\partial \omega} = - |A|^{-1} \left(- \underbrace{\frac{\partial F_2}{\partial k} \frac{\partial F_1}{\partial \omega}}_{<0} + \underbrace{\frac{\partial F_1}{\partial k} \frac{\partial F_2}{\partial \omega} }_{<0} \right) \gtrless 0. $$(54b)Some intuition as to why the sign of \(\partial e/\partial \omega\) is indeterminate can be gained by writing out Eq. 54b and inserting the derivatives from above, which gives

$$ \frac{\partial e}{\partial \omega}=|A|^{-1} \left(\frac{s}{\zeta}\right)^{\frac{1}{1-\psi}} \frac{k^{\frac{1-\alpha}{1-\psi}}}{1-\psi}\left( (1-\alpha)\frac{\partial \Omega}{\partial \omega}k^{-1}+\omega^{-1}\right). $$Hence, the ambiguity is caused by the negative effect of rising labor market participation on the capital stock (\(\partial \Omega/\partial \omega<0\)) and the positive counterbalancing effect of more education (ω − 1) due to a higher lifetime labor supply ω.

On the contrary, the reason why the sign of \(\partial k/\partial \omega\) can always be determined is that the effects of ω on k and e work into the same direction. Writing out Eq. 54a and simplifying yields

$$ \frac{\partial k}{\partial \omega}=|A|^{-1}\left( \frac{\partial \Omega}{\partial \omega}-\frac{1}{1-\psi}\omega^{-1}e\right)<0, $$where \(\partial \Omega/ \partial \omega<0\) captures the direct effect of more labor and the second part captures the additional effect of changing education.

-

a.

-

2.

In case \(\varrho=\bar{\varrho}\), there is a direct (d) and an indirect effect in the partial derivatives of Ω, \(\frac{\partial \Omega}{\partial X}=(\frac{\partial \Omega}{\partial X})^d+\frac{\partial \Omega}{\partial \tau}\frac{\partial \tau}{\partial X}\). Observe from Eq. 21 that

$$ \frac{\partial \tau}{\partial s}=\frac{\gamma^N\bar{\rho} (1-\omega)}{(s(\bar{\rho}(1-\omega)+\omega)+\gamma^N)^2}>0 $$(55)$$ \frac{\partial \tau}{\partial \gamma^N}=-\frac{s\bar{\rho}(1-\omega)}{(s(\bar{\rho}(1-\omega)+\omega)+\gamma^N)^2}<0 $$(56)$$ \frac{\partial \tau}{\partial \omega}=-\frac{s\bar{\rho}(s+\gamma^N)}{(s(\bar{\rho}(1-\omega)+\omega)+\gamma^N)^2}<0 $$(57)Therefore, for given γ N, s, and ω, the strength of the indirect effect increases in \(\bar{\varrho}\). Note that changing the adjustment rule of the social security system affects only F 1 because there is no direct effect of τ on the education decision in steady state. Due to the additional indirect effect, it is not possible any more to determine the sign of the derivatives. We can only say whether the effects become smaller or larger, compared to the \(\tau=\bar{\tau}\) case.

-

a.

The difference between the two social security scenarios if γ N changes and τ adjusts is given by

$$ \frac{\partial F_1}{\partial \gamma^N}=\Omega^{1/(1-\alpha)-1}\alpha\beta \left(\frac{\partial \varphi/\phi}{\partial \gamma^N} (1-\tau)-\frac{\varphi}{\phi}\frac{\partial \tau}{\partial \gamma^N}\right), $$(58)with

$$ \frac{\partial \phi}{\partial \gamma^N} = \gamma^A \left(\alpha (2+ \hat{\rho} ) + \varphi \frac{(1-\alpha)}{\zeta} (1+ \hat{\rho})\left(\tau+ \gamma^N\frac{\partial \tau}{\partial \gamma^N}\right) \right)>0, $$(59)where the difference to the \(\tau=\bar{\tau}\) scenario is only the term \(\gamma^N\frac{\partial \tau}{\partial \gamma^N}\). Using Eq. 56 implies that

$$ \left.\frac{\partial F_1}{\partial \gamma^N}\right|_{\rho=\bar{\rho}}> \left.\frac{\partial F_1}{\partial \gamma^N}\right|_{\tau=\bar{\tau}}, $$(60)which proves that

$$ \left. \frac{\partial k}{\partial \gamma^N} \right|_{\varrho=\bar{\varrho}} > \left. \frac{\partial k}{\partial \gamma^N} \right|_{\tau=\bar{\tau}} \; \text{ and } \; \left. \frac{\partial e}{\partial \gamma^N} \right|_{\varrho=\bar{\varrho}} > \left. \frac{\partial e}{\partial \gamma^N} \right|_{\tau=\bar{\tau}}. $$(61) -

b.

To see how changes in the survival rate affect k and e with fixed replacement rate, we have to evaluate

$$ \frac{\partial F_1}{\partial s}=\Omega^{1/(1-\alpha)-1}\beta\alpha \left( \frac{\partial \varphi/\phi}{\partial s}(1-\tau)-\frac{\varphi}{\phi}\frac{\partial \tau}{\partial s}\right). $$(62)The right part in the parentheses is obviously negative. To obtain the total effect, we have to evaluate \(\frac{\partial (\varphi/\phi)}{\partial s}\). Since φ does not vary with τ, there is no indirect effect. Thus, we again only have to evaluate the change in ϕ, including now the change in the contribution rate τ. Again, differentiating Eq. 27a with respect to s gives

$$ \frac{\partial \phi}{\partial s} \frac{1}{\gamma_A}=\omega \alpha \frac{1+g(e)}{1-e}-\frac{\gamma^N}{s^2\beta}\left[1-(1-\alpha)\frac{}{}(1-\tau)\right] +(1-\alpha)\frac{\gamma^N}{s\beta}\frac{\partial \tau}{\partial s}< 0, $$where we see that the derivative is identical to the case with \(\tau=\bar{\tau}\), except for the last positive term. Using Eq. 52 and knowing that \(\partial \phi / \partial s\) evaluated with the indirect effect is larger (smaller in absolute value) gives

$$ \left. \frac{\partial \varphi/\phi}{\partial s}\right|_{\rho=\bar{\rho}} < \left. \frac{\partial \varphi/\phi}{\partial s}\right|_{\tau=\bar{\tau}}\quad \Rightarrow \quad \left.\frac{\partial F_1}{\partial s}\right|_{\rho=\bar{\rho}} < \left.\frac{\partial F_1}{\partial s}\right|_{\tau=\bar{\tau}}, $$(63)which implies that

$$ \left. \frac{\partial k}{\partial s} \right|_{\varrho=\bar{\varrho}} < \left. \frac{\partial k}{\partial s} \right|_{\tau=\bar{\tau}} \; \text{ and } \; \left. \frac{\partial e}{\partial s} \right|_{\varrho=\bar{\varrho}} < \left. \frac{\partial e}{\partial s} \right|_{\tau=\bar{\tau}}. $$(64) -

c.

Differences between the two social security scenarios if ω changes are given by

$$ \frac{\partial F_1}{\partial \omega}=\Omega^{1/(1-\alpha)-1}\beta\alpha \left( \frac{\partial \varphi/\phi}{\partial \omega}(1-\tau)-\frac{\varphi}{\phi}\frac{\partial \tau}{\partial \omega}\right). $$(65)Differentiating Eq. 27a with respect to ω gives

$$\begin{array}{lll} \frac{\partial \phi}{\partial \omega} = \gamma^A \left( \varphi \frac{(1-\alpha)}{\zeta} (1+ \hat{\rho}) \gamma^N\frac{\partial \tau}{\partial \omega} \right. \\ \qquad \quad \qquad \quad \,\; \left. + s \left( \alpha (2+ \hat{\rho} ) + \varphi \frac{1-\alpha}{\zeta} (1+ \hat{\rho} )\right) \frac{1+g(e)}{1-e} \right), \end{array}$$(66)where the difference is only the adjusting contribution rate \(\frac{\partial \tau}{\partial \omega}\). Using Eq. 57, it holds that

$$ \left.\frac{\partial F_1}{\partial \omega}\right|_{\rho=\bar{\rho}}> \left.\frac{\partial F_1}{\partial \omega}\right|_{\tau=\bar{\tau}} $$(67)proving that

$$ \left. \frac{\partial k}{\partial \omega} \right|_{\varrho=\bar{\varrho}} > \left. \frac{\partial k}{\partial \omega} \right|_{\tau=\bar{\tau}} \; \text{ and } \; \left. \frac{\partial e}{\partial \omega} \right|_{\varrho=\bar{\varrho}} > \left. \frac{\partial e}{\partial \omega} \right|_{\tau=\bar{\tau}}. $$(68)

-

a.

□

Proof of Proposition 5

The effect of the degree of annuitization (λ) on the capital stock and education decision is given by

Replacing the terms in Eq. 47 with the ones from above gives

Qualitatively, changing λ has the same effects in both social security scenarios because the availability of annuity markets does not interact with the adjustment of contribution or replacement rates.□

B Numerical results: no annuity markets

This appendix presents additional numerical results of our sensitivity analysis for the case of perfect annuity markets, cf. our discussion in Subsection 3.3.2. Calibration parameters are reported in Table 2. Results for the elasticities of e with respect to s and w are shown in the corresponding Figs. 5 and 6.

Rights and permissions

About this article

Cite this article

Ludwig, A., Vogel, E. Mortality, fertility, education and capital accumulation in a simple OLG economy. J Popul Econ 23, 703–735 (2010). https://doi.org/10.1007/s00148-009-0261-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-009-0261-8