Abstract

Agricultural conservation easements consist of deed restrictions that landowners voluntarily place on their farm real estate for any number of reasons including the permanent restriction of development. Purchase of Agricultural Conservation Easement (PACE) programs exist in many States and are used to ensure farm real estate is available for future agricultural use as well as a policy mechanism to control development. Much like the landowner’s development option, preservation is a real option exercised at the discretion of the landowner. An analytic contingent claims model is presented to value the landowner’s preservation option. An empirical analysis of the model indicates that the option to delay preservation can have significant value.

Similar content being viewed by others

Notes

The terms conservation easement and farm real estate preservation are used interchangeably in this paper. However, it is the purchase of the former through a State or local program that constitutes the latter. Within the context of farm real estate preservation, sometimes the purchase of a conservation easement is referred to as the purchase of development rights.

Pennsylvania’s Agricultural Conservation Easement Purchase Program, for example, requires the State and the landowner to each hire an appraiser to determine farm real estate market and agricultural use values. The average market value and average use value are then determined using each appraiser’s opinion on value and the payoff to the landowner is the difference between the two averages.

For example, \( dv = {\alpha_v}vdt + {\sigma_v}vd{\omega_v} \) and it is also assumed that the income from undeveloped farm real estate is proportional to the market value of farm real estate rather than the value of developed real estate as in Quigg (1993).

References

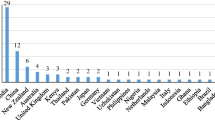

American Farmland Trust (2007) Status of state PACE programs. AFT Fact Sheet, Northampton

Bulan L, Mayer C, Somerville C (2009) Irreversible investment, real options, and competition: evidence from real estate development. J Urban Econ 65:237–251

Capozza D, Li Y (1994) The intensity and timing of investment: the case of land. Am Econ Rev 84:889–904

Capozza D, Li Y (2001) Residential investment and interest rates: an empirical test of land development as a real option. Real Estate Econ 29:503–519

Capozza D, Li Y (2002) Optimal land development decisions. J Urban Econ 51:123–142

Dixit A, Pindyck R (1994) Investment under uncertainty. Princeton University Press, NJ

Holland A, Ott S, Riddiough T (2000) The role of uncertainty in investment: an examination of competing investment models using commercial real estate data. Real Estate Econ 28(1):33–64

Munneke H, Trefzger J (1998) Nonlinear effects in easement valuation. J Real Estate Res 16(2):219–228

Pennsylvania Agricultural Statistics, 1996–2007, USDA-NASS: Pennsylvania Field Office

Quigg L (1993) Empirical testing of real-option pricing models. Journal of Finance 48(2):621–640

Schatzki T (2003) Options, uncertainty and sunk costs: an empirical analysis of land use change. J Environ Econ Manage 46(1):86–105

Schwartz E, Torous W (2007) Commercial office space: testing the implications of real options models with competitive interactions. Real Estate Econ 35(1):1–20

Towe C, Nickerson C, Bockstael N (2008) An empirical examination of the timing of land conversions in the presence of farmland preservation programs. Am J Agric Econ 90(3):613–626

Williams J (1991) Real estate development as an option. J Real Estate Finance Econ 4:191–208

Author information

Authors and Affiliations

Corresponding author

Additional information

Any errors or omissions are the sole responsibility of the author.

Rights and permissions

About this article

Cite this article

Stokes, J.R. The value of the option to preserve farm real estate. J Econ Finan 36, 162–175 (2012). https://doi.org/10.1007/s12197-010-9138-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-010-9138-7