Abstract

New products without historical demand information or slow-moving items with little such information cause difficulties in defining inventory management policies facing demand uncertainty. The classical approach using the Normal distribution for describing the random demand during lead time might lead to a degraded level of customer service. But the choice for other types of distributions is also no option, so it is realistic that the full functional form of the distribution is unknown, but the decision-maker has some but not incomplete information on the demand distribution during lead time. As the distribution is only partially specified, several distributions satisfy the known information. Customer service measures therefore also take values in an interval between a lower and an upper bound. In this paper, upper and lower bounds are determined for two performance measures: the number of stock-out units and the stock-out probability per replenishment cycle, given incomplete information about the demand distribution, that is only the first two moments and the range, are known. Based on these results, the optimal inventory level given the desired maximum number of stock-out units or the desired maximum stock-out probability is calculated for the case where only the first two moments are known. The results of our approach are compared to the more traditional approach where a Normal distribution of demand during lead time is assumed. Comparisons with the Gamma, Uniform and symmetric triangular distribution are made. Furthermore, the robustness of our bounds to uncertainty in the parameters is tested.

Similar content being viewed by others

References

Bartezzaghi E, Verganti R, Zotteri G (1999) Measuring the impact of asymmetric demand distributions on inventories. Int J Prod Econ 60–61:395–404

De Schepper A, Heijnen B (1995) General restrictions on tail probabilities. J Comput Appl Math 64:177–188

De Vylder EF, Goovaerts M (1982) Upper and lower bounds on stop-loss premiums in case of known expectation and variance of the risk variable. Mitteilungen der Vereinigung Schweizer Versicherungsmathematiker 1:149–164

Diks EB, De Kok A, Lagodimos AG (1996) Multi-echelon systems:a service measure perspective. Eur J Oper Res 95:241–263

Federgruen A (1993) Centralized planning models for multi-echelon inventory systems under uncertainty. In: Graves S, Rinnooy Kan A, Zipkin P (eds) Handbook in operations research and management science. North-Holland, Amsterdam, vol 4

Fisher M, Raman A (1996) Reducing the cost of demand uncertainty through accurate response to early sales. Oper Res 44(1):87–99

Fortuin L (1980) Five popular distribution density functions: a comparison in the field of stock-control models. J Oper Res Soc 31(10):937–942

Gallego G, Moon I (1993) The distribution free newsboy problem: review and extensions. J Oper Res Soc 44(8):825–834

Gaur V, Kesavan S, Raman A, Fisher M (2007) Estimating demand uncertainty using judgmental forecasts. Manufact Service Oper Manage 9(4):480–491

Heijnen B, Goovaerts MJ (1989) Best upper bounds on risks altered by deductibles under incomplete information. Scand Actuarial J 4(5):23–46

Janssens GK, Ramaekers K (2008) On the use of bounds on the stop-loss premium for an inventory management decision problem. J Interdisciplin Math 11(1):115–126

Li Q, Xu H, Zheng S (2008) Periodic-review inventory systems with random yield and demand: bounds and heuristics. IIE Trans 40:434–444

Moe W, Fader P (2001) Modeling hedonic portfolio products: a joint segmentation analysis of music cd sales. J Mark Res 38(3):376–385

Moe W, Fader P (2002) Using advance purchase orders to forecast new product sales. Mark Sci 21(3):347–364

Naddor E (1978) Sensitivity to distributions in inventory systems. Manage Sci 24(16):1769–1772

Ozer O, Xiong H (2008) Stock positioning and performance estimation for distribution systems with service constraints. IIE Trans 40:1141–1157

Perakis G, Roels G (2008) Regret in the newsvendor model with partial information. Oper Res 56(1):188–203

Ramaekers K, Janssens GK (2007) On the choice of a demand distribution for inventory management models. Eur J Ind Eng 2(4):479–491

Shanker K (1981) Exact analysis of a two-echelon inventory system for recoverable items under batch inspection policy. Naval Res Logist Q 28:579–601

Silver EA, Pyke DA, Peterson R (1998) Inventory management and production planning and scheduling. Wiley, New York

Vairaktarakis GL (2000) Robust multi-item newsboy models with a budget constraint. Int J Prod Econ 66(3):213–226

Vereecke A, Verstraeten P (1994) An inventory management model for an inventory consisting of lumpy items, slow movers and fast movers. Int J Prod Econ 35:379–389

Walker J (2000) Decision support for the single-period inventory problem. Ind Manage Data Syst 100(2):61–67

Yano C, Lee H (1995) Lot-sizing with random yields: a review. Oper Res 43:311–334

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Number of stock-out units

1.1.1 Upper bounds

As already stated before, the problem is to find:

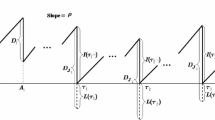

where \(\Upphi\) is the class of all distribution functions with range [0,b] and moments μ1 and μ2 and where f(x) = (x − d)+.

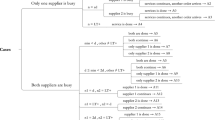

The two-point distribution that will be used depends on the position of the parameter d in the interval [0,b]. Three situations can be distinguished.

1.1.1.1 Parabola through (0,0) and (0′,f(0′))

There exists a two-point distribution with moments μ1 and μ2 in (0,0′). The formula for the parabola can be used with u = 0, v = 0′ and f(0) = 0.

To assure that g ≥ 0 on [0, d], we impose g′(0) ≥ 0, which means that

or

The best upper bound is q0'f(0′) or

1.1.1.2 Parabola through (r,0) and (r′,f(r′))

The formula for the parabola is used with v = r, u = r′, f(v) = 0 and f′(v) = 0. This gives us:

The condition g′(u) = f′(r′) leads to

or

A unique solution (r,r′) can be assured by imposing the condition

Under this condition, the best upper bound is qr'f(r′) or

1.1.1.3 Parabola through (b′,0) and (b,f(b))

In this case, we take u = b, v = b′, f(v) = 0 and f′(v) = 0 and obtain

To assure g ≥ f, we impose g′(b) ≤ f′(b) or

or

In that case, the upper bound is q b f(b) or

1.1.2 Lower bounds

The problem is to find:

where \(\Upphi\) is the class of all distribution functions with range [0,b] and moments μ1 and μ2 and where f(x) = (x − d)+.

Here, also three situations can be distinguished, depending on the position of d in the interval [0,b].

1.1.2.1 0 ≤ d ≤ b′

A solution is found when P is the straight line through (d, 0), (μ1, f(μ1)) and (b, f(b)). The three-point distribution will have masses:

The lower bound equals qμ_1f(μ1) + q b f(b) or

1.1.2.2 b′ < d < 0′

In this case, P is the parabola through (0, 0), (d,0) and (b, f(b)). The best lower bound is q b f(b) or

1.1.2.3 0′ ≤ d ≤ b

Here, a solution is found when P is the straight line through (0, 0), (μ, 0) and (d,0). The best lower bound is equal to 0.

1.2 Stock-out probability

When calculating bounds on tail probabilities [2], the problem is to find:

and

where \(\Upphi\) is the class of all distribution functions with range [0,b] and with moments μ1 and μ2 known and where

1.2.1 Upper bounds

1.2.1.1 0 ≤ d ≤ b′

A solution is found when P is the straight line through (b′,1) and (b,1). The upper bound is equal to qb'f(b′) + q b f(b) = 1.

1.2.1.2 b′ < d ≤ 0′

In this case, P is the parabola through (0, 0), (d, 1) and (b,1). According to Lemma 2, the three-point distribution in (0, d, b) will have masses:

The upper bound is q d f(d) + q b f(b) or

1.2.1.3 0′ < d ≤ b

Here, the solution is the parabola through (d′,0) and (d,1) and tangent tof(x) in d′. The best upper bound is q d f′(d) + qd'f(d′) or

1.2.2 Lower bounds

1.2.2.1 0 ≤ d ≤ b′

In this case, P is the parabola through (d,0) and d′,1) and tangent to f(x) at d′. The lower bound equals q d f(d) + qd'f(d′) or

1.2.2.2 b′ < d ≤ 0′

A solution is found when P is the parabola through (0, 0), (d,0) and (b,1). The masses of the three-point distribution give a lower bound of

1.2.2.3 0′ < d ≤ b

Here, P is the line through (0,0) and (0′,0). The lower bound is 0.

Rights and permissions

About this article

Cite this article

Ramaekers, K., Janssens, G.K. Service-oriented decisions on inventory levels in the case of incomplete demand information. Logist. Res. 5, 33–46 (2012). https://doi.org/10.1007/s12159-012-0076-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12159-012-0076-y