Abstract

Our paper seeks to evaluate the role of development financing institutions (DFIs) in fostering renewable energy transformations. Whereas the conventional approach to renewable energy finance emphasizes the bankability of individual projects, we advance an alternative approach for the role of DFIs in overcoming system-level constraints to enhance renewable energy transformations. We identify four constraints, namely, the incumbent entrenchment of fossil fuels, unmet energy demand of energy-intensive industries, weak production capacity of renewable energies, and lack of supporting infrastructure. We argue that DFIs can potentially address these constraints by setting a mission-driven vision, acting as honest brokers to overcome the incumbent entrenchment, scaling up renewable energy financing to make the cost of renewable energies more competitive, incubating nascent renewable energies, and financing supporting infrastructure. We then select representative DFIs to evaluate the role of DFIs in fostering renewable energy transformations. We find that most sampled DFIs have recently prioritized financing renewable energy, supported pilot projects to achieve demonstration effects, and made investments in complementary infrastructure. Yet few DFIs have achieved the economies of scale to bring down the renewable energy price or shape the policy environment in favor of renewable energy in a manner that can trigger significant transformational change.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A swift and radical transformation towards renewable energy systems is needed to achieve the goal of the Paris Agreement on Climate Change to limit the average global temperature increases to well below 2 °C in the present century compared with preindustrial levels (UNEP, 2018). By 2030, global emissions of greenhouse gases (GHGs) must drop by 45 percent from 2010 levels to stay on a 1.5° path. The costs of inaction may be as high as 4 percent of GDP (Intergovernmental Panel on Climate Change [IPCC] 2018; UNEP 2018). Renewable energy must be scaled up at least six times faster for the world to meet the decarbonization and climate mitigation goals set out in the Paris Agreement. The International Renewable Energy Association (IRENA) holds that keeping the global temperature increase below 2 °C is technically feasible if the total share of renewable energy rises from around 18 percent of total final energy consumption (in 2015) to around two-thirds by 2050 (IRENA 2018).

Yet the business-as-usual scenario predicts a modest growth of renewable energy to merely one-quarter of total final energy consumption (IRENA 2018). Private sectors alone are not ready to provide a large amount of investment in a relatively short time to make the accelerated deployment of renewable energies feasible. The IRENA estimates that cumulative investment of US$ 120 trillion must be made between 2015 and 2050 in low-carbon technologies, averaging around 2 percent of the period’s average global GDP per year, to achieve a profound transformation of the global energy system towards clean energies (IRENA 2018). Yet private capital is often reluctant to finance “high-risk and high capacity intensity” renewable energies, especially in developing countries (Mazzucato and Semieniuk 2018).

Scholars have highlighted that the literature on low-carbon transformation lacks a full understanding of the financial component of such transformations, and notes that is in need of significant study (Steffen and Schmidt, 2021). To address market failures, development financing institutions (DFIs) are well positioned to finance the rapid, large-scale deployment of renewable energies. DFIs are public financial institutions created and steered by governments to fulfill public policy objectives, including both multilateral development banks (MDBs) and national development banks (NDBs). Worldwide, there are over 520 DFIs from about 150 countries, which collectively hold roughly US$ 23.2 trillion in total assets (Xu et al. 2021). Unlike the profit-maximizing commercial banks, DFIs are mandated to address market failures such as positive and negative externalities. Moreover, DFIs often enjoy sovereign creditworthiness, which enables them to issue long-term bonds on capital markets at a relatively low price. Thus, compared with commercial banks that take household deposits and lend on shorter time horizons, bond-issuing DFIs are more suited to provide higher-risk and longer-term finance.

Currently, DFIs have focused on searching for and investing in “bankable” individual power plants in a manner that can attract private capital at the project level. In other words, it examines how DFIs can help make individual renewable energy projects bankable to crowd-in private capital (Gabor 2021; World Bank 2012, 2020). An Inter-American Development Bank report examines how DFIs use financial instruments such as guarantees and grants to mobilize private capital (Smallridge et al. 2013). Indeed, a group of MDBs reached a consensus on the shared methodology on assessing the private financing mobilized by an MDB, which must be assessed on a project-by-project basis (MDBs and DFIs 2021). Since 2016, MDBs and DFIs have reported annually in joint reports on their mobilization of private capital but at most have mobilized a paltry $185 billion annually (CPI 2021). Many DFIs are developing project preparation platforms such as SOURCE (in which all the major MDBs and some NDBs take part), which attempts to generate strong and green “bankable projects.” Such a project-based approach is useful, but, alone, it is far from scale and is not transforming energy economies.

Although the project-based approach has merits, it is limited in understanding the role of DFIs can play in overcoming systemic challenges that may go beyond specific projects. The central research question of our paper is the extent to which DFIs alleviate system-level constraints to foster renewable energy transformations. From a system-level perspective, we theorize four constraints: first, on the energy supply side, the preponderant share of fossil fuels in the energy supply system may result in the “incumbent entrenchment” challenge, which would create barriers to the entry of renewable energies; second, on the energy demand side, if renewable energies are more expensive and unstable than conventional fossil fuels, countries with huge energy demand would face a significant challenge in transiting towards renewable energy systems while enhancing the international competitiveness of their industries; third, weak production capacity of renewable energies would constrain their deployment and hinder renewable energy transformations; and fourth, the lack of supporting infrastructure makes the large-scale deployment of renewable energies infeasible. We further theorize that the severity of the above constraints may vary across countries at different income levels. For instance, the incumbent entrenchment is more severe in developed countries. Unmet energy demand and weak production capacity are more acute challenges in developing countries. Though the lack of supporting infrastructure may be equally severe across countries, developing countries must build new infrastructure whereas developed countries must replace old infrastructure. We argue that DFIs can potentially address the above challenges by setting a mission-driven vision, acting as honest brokers to overcome the incumbent entrenchment, scaling up renewable energy financing to make the cost of renewable energies more competitive, incubating renewable energies, providing affordable long-time capital to purchase foreign renewable energy technologies, and financing supporting infrastructure.

We then select nine MDBs and six NDBs from both developed and developing countries to evaluate the role of DFIs in fostering renewable energy transformations. Based on the first-hand data collection from two rounds of intensive focal group discussions with over 20 energy experts from the 15 selected DFIs, we arrive at the following key findings. First, most sampled DFIs have recently prioritized financing renewable energy to align their strategies with the Paris Agreement. Indeed, international climate agreements have urged national governments to deploy DFIs to step up their efforts to achieve nationally determined contributions (NDCs) under the United Nations Framework Convention on Climate Change (UNFCCC). Second, compared with NDBs, MDBs are better able to shape policy environment in favor of renewable energies through policy dialogues with national governments. Meanwhile, MDBs attempt to lead by example by terminating fossil fuel financing and putting a price on carbon on their project approval procedure. Yet it is too early to tell whether they can achieve the demonstration effect among other finance providers. Third, DFIs have attempted to scale up renewable energy financing, but only a few can reach economies of scale to bring down the price of renewable energies. Fourth, DFIs have supported pilot renewable energy projects to achieve demonstration effects to facilitate commercialization of nascent renewable energy technologies. Fifth, MDBs have tried to provide cheap loans denominated in local currencies to enable developing countries to import renewable energy technologies abroad; however, the scale is limited, owing to their concerns of foreign exchange risks given that they mainly raise funds in hard currencies in full-fledged capital markets in developed countries. Finally, DFIs have made investments in complementary infrastructure to facilitate the deployment of renewable energies in national grids.

Our paper makes two original contributions to the literature. First, theoretically, we draw on the insights of structuralism on structural change to theorize the role of DFIs in overcoming constraints at the system level. This helps go beyond project-level challenges by examining the understudied constraints at the system level. Second, empirically, we study the whole spectrum of DFIs, including MDBs and NDBs from both developed countries and developing countries. The existing literature has primarily focused on a single DFI (Griffith-Jones 2016; Delina 2011) or a few DFIs from developed countries (Geddes et al. 2018). Few researchers have studied a wide range of DFIs from both developed and developing countries.

The rest of the paper proceeds as follows. Following this brief introduction, the “Financing Renewable Energy Transformations: Related Literature” section reviews the related literature on the renewable energy transformation. The “Theorizing the Role of DFIs in Renewable Energy Transformations” section theorizes the role of DFIs in fostering renewable energy transformations. The “Methodology” section presents the methodology on case selection and focal group discussions. The “Evaluating the Role of DFIs in Fostering Renewable Energy Transformation” section presents the empirical results on the extent to which sampled DFIs are poised for working towards renewable energy transformations. Finally, the “Conclusion” section concludes with key findings.

Financing Renewable Energy Transformations: Related Literature

Our paper draws on the strand of literature on barriers to renewable energy transformation. Painuly (2001) enumerates the barriers to renewable energy penetration in broad categories such as market distortions (e.g., subsidies to conventional energy), economic and financial obstacles (e.g., high upfront capital costs), and institutional constraints (e.g., lack of a legal/regulatory framework). Cohen (2015) elaborates on three barriers to renewable energy transformation: (1) technologies are not mature; (2) infrastructure needs to be designed for distributed generation; and (3) complicated political challenges limit long-term energy policies. Goldthau and Sovacool (2012) highlight that path dependency makes the future transition to renewable energies difficult. Liao et al. (2021) argue that limited systematic knowledge about clean energy transitions hinders conceptual development and effective policies for improved access to and more widespread adoption of clean energy. In the “Theorizing the Role of DFIs in Renewable Energy Transformations” section, we build on the above insights of the existing literature to further explore the extent to which barriers may vary across different countries.

Our paper is also related to the literature on financing renewable energy transformation, which is understudied and understood (Naidoo 2020; Steffen and Schmidt 2021). The existing literature shows that private sector and national governments are not sufficient to address these gaps in renewable energy financing. Private capital flows are immense in scale but have proven biased toward short-term gains, flowing in “surges” and unstable “sudden stops” to emerging market and developing countries rather than long-term needs in infrastructure and human capital formation (Barton and Wiseman 2013; Ocampo 2017; Rey 2016; Rezec and Scholtens 2017). Specifically, regarding cleaner energy and infrastructure, Bhattacharya et al. (2019) estimated that private foreign direct investment in cleaner energy is less than US$ 40 billion annually. Despite the emergence of the global green bond market, it is primarily concentrated in advanced economies (Flammer 2021). Up to 2019, the cumulative issuance was only US$ 754 billion, dwarfed by the enormous demand of green finance (Climate Bonds Initiative 2019). Public investment by national governments also tends to be biased toward short-term electoral cycles rather than longer-term infrastructure needs (IMF 2017). Our paper contributes to the literature by examining why and how DFIs may fill the financing gap.

Finally, our paper directly contributes to the nascent literature on the role of DFIs in achieving renewable energy transformation. Mazzucato and Penna (2016) argue that DFIs can “shape and create” markets rather than merely fix their failures. DFIs can play a “mission-oriented” role, making key investments in new sectors to address “grand societal challenges” such as climate change. Furthermore, Mazzucato and Semieniuk (2018) find that public financial actors invest in renewable energy portfolios with higher risk technologies, creating a direction to crowd in private capital. Griffith-Jones (2016) conducts a single-case study of Germany’s KfW, which plays a key role domestically and internationally in supporting energy revolution by funding major investments in renewable energy and energy efficiency. Delina (2011) presents the trend of clean energy financing by Asian Development Bank. Geddes et al. (2018) examine the role of three DFIs from high-income countries—the Clean Energy Finance Corporation (CEFC) in Australia, the Kreditanstalt für Wiederaufbau (KfW) in Germany, and the Green Investment Bank (GIB) in the UKFootnote 1—in providing low-carbon energy finance at the project level. They find that state investment banks provide capital, deploy financial instruments for de-risking, perform a trust creation and signaling role by drawing on their reputation for expertise, and play a first-mover role by supporting risky innovative projects to create a track record. OECD (2017) focuses on DFIs with a mandate focusing mainly on mobilizing private low-carbon and climate-resilient investment. The International Development Finance Club (IDFC) has mapped the scale of green finance from 27 IDFC members since 2011. The total green finance commitments of IDFC members were $197 billion in 2019, representing approximately 25% of total new commitments. Moreover, finance for green energy accounted for a lion’s share of the total green finance commitments (IDFC, 2020). The existing literature has primarily focused on the catalytical role of DFIs in mobilizing private capital to finance renewable energies by conducting single-case studies or examining DFIs primarily from high-income countries. Our paper builds on the above analysis to further investigate the broader role of a wider spectrum of DFIs from both developed countries and developing countries in fostering renewable energy transformations, which will be elaborated in the “Theorizing the Role of DFIs in Renewable Energy Transformations” section.

Theorizing the Role of DFIs in Renewable Energy Transformations

This section presents an analytical framework for motivating and evaluating the role of DFIs in fostering the renewable energy transformation. We draw on structuralist theories of development for such an endeavor. Put succinctly, we argue that stepwise investments that alter the “composition” of energy and industrial technologies and the “technology” must fundamentally change to further increase the “scale” of economic activity in a manner that increases standards of living across the world without the major economic costs associated with overshooting Paris targets. Although a key underpinning of such a transformation will be the acceleration of renewable energies throughout the entire global energy and industrial system, investment and policy focused on that sector alone will not trigger the needed major transformation in the time necessary for the transition. Coordinated investments and policies are required in distribution, transmission, industrial, and financial markets to facilitate the rapid diffusion of renewable energies to underpin the transition. The private sector is essential to the transition but will only follow if DFIs charged with leading the transition make major catalytic investments with long-run and patient capital formation.

In this section, we first trace the theoretical foundations of structuralism and its recent development, then theorize the constraints on renewable energy transformation in countries at different income levels, and finally propose the role of DFIs in enhancing renewable energy transformation.

Composition, Technology, and Transformation: Theoretical Antecedents

Our framework is essentially an extension and combination of structuralist economic theories that consider fundamental change in the structure of economic activity as the key to economic progress and green growth and that recognize that the private sector alone will not make the necessary transition.

The necessary transition is to promote structural transformation in a manner that generates carbon dioxide emissions consistent with pathways well below 2.0 °C and strives for 1.5 °C pathways. To maintain economic growth, significant changes will be required in the composition and technique of economic activity (Grossman and Krueger 1995). Pollution is a function of the scale, composition, and technology effects of the economic process. If overall pollution or carbon emissions per unit of output are left unchanged, the scale effect of economic activity expansion will increase carbon emissions commensurate with the amount of economic growth. However, scale effect can be counteracted through the composition and technology effects. If the composition effect applies—changes toward less-carbon-intensive industries—overall carbon emissions can still fall with increases in economic growth. Moreover, the amount of carbon emissions can fall through the technique effect: carbon emissions per unit of output will decrease through technological innovation.

The dilemma now is that scientists have proven that there is not “room” in the global carbon dioxide budget for each country in the world to go through an eventual process of an “environmental Kuznets curve” where pollution per unit output increased in the early stages of development as nations industrialized and then tapered off as they experienced structural changes towards services and underwent technological innovation towards cleaner energies and energy efficiency in the economic process (Grossman and Krueger 1995). In both already industrialized and newly industrialized countries, there will need to be a rapid phaseout of fossil-fuel-intensive industry and activity and replacement with new investments for cleaner, more efficient economic activity (IPCC 2018; UNEP 2018).

Renewable energy transformation will take a “big push” of coordinated and simultaneous investments not only in renewable energies but also in their diffusion, transmission, and application by producers and consumers alike. The core antecedent for such an approach was developed by coordinated investments across sectors to accelerate the industrialization process defined by Rosenstein-Rodan (1943). In a classic work drawing on the experiences of Eastern Europe, he argued that coordinated investments in numerous complementary sectors could generate markets for one another and unlock the industrialization process in a transformational manner whereby the demand spillovers of simultaneous activity would produce increasing returns to scale that would trigger longer-term growth and lower prices. Because of coordination failures, the private sector would be unable to direct such a transformational and coordinated investment. Thus, the state is essential for making investments in infrastructure, energy, research, logistics, and other areas where the accumulated social returns outweigh the private ones. Without such a substantial coordinated investment, countries would not be able to industrialize.

Structuralist approaches to industrialization and development have varied and prevailed in this tradition for decades, especially in but not limited to Latin America (Taylor 2004). Recently, Justin Yifu Lin has begun to develop New Structural Economics (NSE). Like the original structuralism, NSE focuses its analysis on the need for structural (compositional) change and examines the determinants of economic structure and its evolution. Unlike the classical structuralism that prescribes heavy government intervention across multiple sectors regardless of specific countries’ comparative advantages, NSE emphasizes the synergies between an effective market and a facilitating government, focusing on building upon those sectors where a nation has a comparative advantage. As far as DFIs are concerned, NSE perceives them as a potent public policy instrument for addressing market failures to fill financing gaps. Furthermore, NSE attempts to endogenize industrial structures and corresponding institutional arrangements (such as financial systems) for countries at different levels of development by taking factor endowment structures (i.e., what an economy at any specific time has, including labor, capital, and land) as the starting point of analysis (Lin 2012). Pertaining to renewable energy, then, many developing countries may be poised to have favorable conditions for green structural transformation given their factor abundance in “land” in the form of abundant wind, solar, and other renewable energy potential. However, a country may also face constraints in terms of labor or capital scarcity. For a country to climb the industrial and technological ladder, a host of changes and investments must take place to unlock these constraints. In addition to addressing the constraints of scarce factor endowments, simultaneous improvements in education, financial and legal institutions, and infrastructure are needed to maximize potential comparative advantages in clean energy. Such changes often involve positive externalities and cannot be provided by private sectors alone. Hence, governments must play a facilitating role in solving the coordination problem. An effective government facilitation requires a diagnosis of constraints on the path to renewable energy transformation, which will be examined in the following part.

Constraints to Renewable Energy Transformations

This part aims to identify constraints to renewable energy transformations and explore the most critical ones for countries at different development stages. We classify countries according to their income levels including low-income countries (LICs), lower-middle-income countries (LMICs), upper-middle-income countries (UMICs), and high-income countries (HICs). The reason income levels matter is that there are substantial differences in factor endowment (i.e., labor, capital, and land), energy intensity of industrial structures, and production capacity of renewable energies across countries at different stages of development, which have implications for the key impediments to their renewable energy transformations.

From a system-level perspective, achieving renewable energy transformations requires overcoming constraints that may go beyond project-level impediments. Taking national energy systems as a whole, we must examine the structure of the existing energy supply, the energy intensity of current and prospective industrial structure, the domestic capacity for producing and innovating clean energies, and the corresponding nationwide infrastructure for storing, transmitting, and distributing clean energies. In the following paragraphs, we will elaborate on each system-level constraint.

First, on the energy supply side, if fossil fuels predominate the existing energy mix, scaling up clean energies would encounter the resistance from incumbent fossil fuel interests. Such resistance may be further exacerbated by massive subsidies for fossil fuels (IRENA 2018). The IMF estimates that global fossil fuel subsidies are close to US$ 1 trillion (Coady et al. 2015). Moreover, the prices of incumbent fossil fuels are further distorted downward because countries fall short of absorbing the social and environmental costs of the production of fossil fuels. Subsidization and the lack of correction for externalities can lead to significant levels of market power on behalf of incumbent fossil fuels, which can allow the firms in these sectors to pose significant barriers to entry for clean energies (Bhattacharya et al. 2015). We call this constraint “incumbent entrenchment.”

Incumbent entrenchment is likely to be more severe as countries move to the more advanced stage of development, as fossil fuels often play an increasingly significant role in the existing energy supply in more advanced countries.Footnote 2 Figure 1 and Fig. 2 show that fossil fuel energy consumption as a percentage of the total is as high as 80–90 percent in UMICs and HICs, whereas it is as low as 20 percent in LICs. By contrast, renewable energies account for a lion’s share of nearly 80 percent of total energy consumption in LICs and 33 percent in LMICs and merely account for about 10 percent in UMICs and HICs.

Second, on the energy demand side, if the energy demand is high, it would be more challenging for countries to transition towards renewable energy systems without undercutting the international competitiveness of their industries when the price of clean energies is more prohibitive, and the supply of clean energies is unstable. For instance, the upfront capital costs of building and installing solar and wind farms are significantly higher than for conventional energy sources. Building and installation costs for wind power can be 20–70 percent higher than for natural gas plants, and solar can be twice the cost (IRENA 2018). Even though the recent years have witnessed rapid declines in solar energy prices and continuing reductions in the costs of wind energy, the energy supply may be unstable owing to the lack of storage technology.

LICs and LMICs are often endowed with rich labor and poor capital and hence have comparative advantages in light manufacturing sectors. As they accumulate more capital, they are likely to move into more energy-intensive and capital-intensive industries in UMICs. As countries move to the more advanced stage of development, service sectors that are less energy intensive will account for a substantial share in their GDP. In other words, the energy demand may exhibit an inverted U shape across different development stages. Figure 3 shows that compared with HICs, energy use per $1000 GDP is much higher in UMICs and LIMCs. If in the foreseeable future clean energies are more expensive and unstable than conventional fossil fuels, developing countries would face a significant challenge in transitioning to clean energy systems while enhancing the international competitiveness of their industries.

Third, weak renewable energy production capacity would constrain their deployment and hinder renewable energy transformations. Given that renewable energies are relatively new technologies despite the increased technology innovation (Bayer et al. 2013), there is relative uncertainty about the creditworthiness of nascent renewable energies because, by definition, they lack an established credit history (Henriques and Sadorsky 2008; Sadorsky 2012). UMICs and HICs are often better positioned to make technology breakthroughs in renewable energies, as is evident in the recent innovations in solar power in Europe and the USA. They must overcome uncertainties to incubate frontier renewable energy technologies. By contrast, LICs and LMICs are often price-takers because they must borrow to import renewable energies from abroad. There is evidence of a learning curve in terms of the necessary skills needed to build, operate, and maintain renewable energy facilities, given that much of the technology is imported from abroad (Bhattacharya et al. 2015; Martino 1998; Mondal et al. 2010; Sen and Ganguly 2017; World Bank 2012). Yet foreign borrowings are often denominated in hard currency. As a result, they suffer from foreign exchange risks and related balance of payments concerns.

Finally, the lack of supporting infrastructure makes large-scale deployment of renewable energies unfeasible. Solar and wind technologies are smaller in scale versus the relatively larger fossil fuel-based technologies. Given that they can be distributed in nature, countries may not have the supporting infrastructure for wind and solar, such as storage technology, transmission lines, and adaptation to a broader energy grid. This constraint is equally severe for both developed countries and developing countries. The nuanced difference is as follows: for developing countries, the challenge is to build new supporting infrastructure; and for developed countries, the challenge is to replace old infrastructure with new.

The Role of DFIs in Fostering Renewable Energy Transformations

To overcome the constraints identified earlier, DFIs are well positioned to play a critical role in fostering renewable energy transformations. Apart from making individual projects bankable, DFIs have the potential of fostering renewable energy transformations at the system level. Specifically, DFIs can potentially address the constraints by setting a mission-driven vision, acting as honest brokers to overcome the incumbent entrenchment, scaling up renewable energy financing to make the cost of renewable energies more competitive, incubating renewable energies, and financing supporting infrastructure.

First, unlike profit-maximizing commercial banks, public policy-oriented DFIs can set a mission-driven vision for renewable energy transformations at the national or economy level. This may help to break the business-as-usual inertia to speed up the large-scale deployment of renewable energies.

Second, as honest brokers, DFIs can help to shape public policies that help to overcome the incumbent entrenchment challenge. DFIs are honest brokers because they are public financial institutions at the intersection of government agencies and financial institutions. They can proactively shape public policies in favor of renewable energies. They can also produce the demonstration effect by excluding fossil fuels in their own portfolio and calculating the social costs of fossil fuels when considering projects through shadow pricing methods to induce other financial providers to follow suit.

Third, DFIs can scale up renewable energy investments to make the price of renewable energies more competitive to ensure that renewable energy transformations will not undercut the international competitiveness of energy-intensive industries in global markets. Overall investment size matters, as economies of scale can help make the price of renewable energies as cheap as—and even more competitive than—conventional fossil fuels.

Fourth, regarding the constraints on weak production capacity of renewable energies, DFIs can provide high-risk capital to help more advanced countries to incubate frontier renewable energies. DFIs can also help to provide low-cost and long-term capital denominated in local currency to help less developed countries to import renewable energy technologies without undermining their balance-of-payment problems, if their domestic production capacity is weak.

Finally, DFIs can help make corresponding investments in energy transmission and distribution lines and other complementary infrastructure. DFIs can provide corresponding financing to develop transmission and distribution lines, constructed industrial parks to produce renewable energies, and supported complementary technological innovation such as smart grids and energy storage that help facilitate the integration of renewable energies into the national energy system.

Methodology

Case Selection

To ensure that our samples are as representative as possible, we have selected samples of both MDBs and NDBs. MDBs include both the advanced economies-led ones such as the World Bank Group (WBG), Asian Development Bank (ADB), Inter-American Development Bank (IDB), Banque Africaine de Développement (AfDB; African Development Bank), the European Bank for Reconstruction and Development (EBRD), and the European Investment Bank (EIB); and the emerging economies-led ones such as البنك الإسلامي للتنمية (IsDB; Islamic Development Bank), Asian Infrastructure Investment Bank (AIIB), and New Development Bank (BRICS-NDB). NDBs include both DFIs from advanced economies, including the Kreditanstalt für Wiederaufbau (KfW; Credit Institute for Reconstruction) of Germany and Agence Française de Développement (AFD; French Development Agency) of France, and those from developing and emerging economies, including 国家开发银行 (CDB, China Development Bank), Development Bank of South Africa (DBSA), Banco Nacional de Desenvolvimento Econômico e Social (BNDES; Brazilian National Bank for Economic and Social Development), and Nacional Financiera (NAFIN; Mexican Development Bank). Although the selected samples are not representative of the whole DFI group, they do aim to cover both geographical regions and development stages to the greatest extent. Our sample covers both big NDBs and small ones and ranges from traditional Northern-led MDBs to emerging Southern-led MDBs. For the basic information on sampled DFIs, see Tables 1 and 2 in the Appendix.

Focal Group Discussion

To collect firsthand data, we organized two successive focal group discussions in June 2017 and June 2018, respectively. Participants were leading energy experts (such as the chief of the energy sector group and senior energy policy specialists) from 15 DFIs, and over 20 energy experts joined the in-depth focal group discussions. The reason we chose focal group discussions as our main data collection methodology is that focus groups facilitate in-depth exploration of respondents’ nuanced perspectives on complex issues—which defy a convenient yes or no answer—by allowing participants to build on one another’s ideas in interactive conversation (Kitzinger and Barbour 1999). Yet, a potential limitation of focus group discussions is that peer pressure might unduly influence responses or that more influential participants, especially from renowned international development institutions such as the World Bank, might drown out the voices from Southern-led DFIs. Beyond careful facilitation, we mitigated these effects by requesting, in advance, written answers to the list of discussion questions from experts. In addition, we provided simultaneous interpretation on-site to enable experts who are not proficient in English to express their ideas more conveniently.

Evaluating the Role of DFIs in Fostering Renewable Energy Transformation

In this section, we describe our analysis of the extent to which sampled DFIs are adopting transformative approaches to renewable energy transformations. Below we summarize our key findings on the role of the selected nine MDBs and six NDBs in fostering renewable energy transformation.

Mission-Driven Vision and Policy Planning

To evaluate the extent to which proactive mission-oriented vision and policy planning promote renewable energy transformation, we focus on whether DFIs have an institutional guideline or specific targets on renewable energy in their portfolios. For NDBs, we also examine whether their countries have ratified the Paris Agreement and whether their countries have rules of guidance or national targets on renewable energies.

At the global level, international climate negotiations have heightened the necessity of channeling financial flows to achieve a renewable energy transformation. In particular, the Paris Agreement states, in Article 2 (c), that it aims to strengthen the global response to the threat of climate change by “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development” (United Nations, 2015). Furthermore, international climate agreements have compelled countries to emission reduction targets. The Kyoto Protocol, formally adopted in December 1997 and entered into force in 2005, legally binds developed countries to emission reduction targets. The Paris Agreement (Article 4, paragraph 2) requires each Party to prepare, communicate, and maintain successive NDCs that it intends to achieve. Parties shall pursue domestic mitigation measures, with the aim of achieving the objectives of such contributions (United Nations, 2015). These international agreements have urged national governments to deploy DFIs to step up their efforts to achieve NDCs.

For MDBs, most have formulated an energy policy or corporate strategy that emphasizes the importance of renewable energies. All sampled MDBs announced a joint framework for aligning their activities with the goals of the Paris Agreement in December 2018 (World Bank 2018). Although almost all the sampled MDBs have committed a certain percentage of their balance sheet to climate mitigation and adaptation, which often includes a sizable amount of renewable energies, and have started at least one funding window to this end, few have set specific targets on renewable energies. More must be done to turn a strategy into a concrete roadmap and action plan. For instance, although IDB launched the Integrated Strategy for Climate Change Adaptation and Mitigation, and Sustainable and Renewable Energy, the Office of Evaluation and Oversight regarded it as “more of a conceptual document and an institutional confirmation of an evolving new area of engagement than a strategy to prioritize and guide this work” (IDB 2013).

At the national level, China, Brazil, France, Mexico, Germany, and South Africa have all ratified the Paris Agreement, prioritized renewable energies, and set national targets. NDBs are at the forefront of fulfilling national goals, but few set specific targets on renewable energies. As members of the International Development Finance Club, sampled NDBs pledged in December 2017 to align their financial flows with the objectives of the Paris Agreement.

In summary, most sampled MDBs and NDBs have prioritized renewable energies in line with the Paris Agreement and/or national sustainable development strategies, but few have turned a mission-driven vision into milestones and a roadmap for concrete action.

Honest Broker Overcoming the Incumbent Entrenchment

To evaluate the extent to which DFIs help overcome the incumbent entrenchment, we first examine whether sampled DFIs have fostered certain policy changes in favor of renewable energies or made the demonstration effect by adopting shadow carbon pricing to internalize the negative externalities of fossil fuel energies and forbidding themselves from financing fossil fuel.

First, we find that MDBs are more successful in fostering policy changes in favor of renewable energies than NDBs. Based on our interviews, most NDBs have participated in the consultation on the policy making of such energies. However, most are more focused on implementing national energy polices than shaping them. By comparison, MDBs tend to pay more attention to policy dialogues with national governments to shape the policy. For example, the International Finance Corporation (IFC) at the WBG actively participated in providing comments and feedback on Mexico’s new electricity law and its regulations. At the request of the Secretariat of Energy, IFC helped draft the power purchase agreement for the first renewable power auction under the new Renewable Electricity Law in Argentina.

Second, we find that most MDBs have attempted to lead by example to encourage other financers to exclude fossil fuels and put a price on carbon of conventional energy investments, though few NDBs have done so. But it is still too early to tell whether DFIs can achieve the demonstration effect to affect the behaviors of other finance providers. Most MDBs have begun to exclude fossil fuel exploration and power generation from their portfolios. Many MDBs have decided that they will incentivize keeping fossil fuels in the ground and banned financing for upstream oil, gas, or coal by a certain date. Almost all the MDBs, with the exception of IsDB and BRICS-NDB, have ruled out financing coal-fired power plants except in exceptional circumstances.Footnote 3 Furthermore, most MDBs have also begun programs to calculate the social costs of fossil fuels when considering projects through shadow pricing methods (OECD 2017). WBG, EIB, EBRD, and ADB all have various shadow pricing schemes that put a price on carbon and therefore alter the cost–benefit analyses for certain potential investments. By contrast, few NDBs have done so.

Scaling Up Renewable Energy Investments

To evaluate the scale of renewable energy financing by DFIs, we first look at a rough indicator for their relative size in their respective economies: that is, total assets of DFIs as a percentage of national GDP (applied to NDBs only). CDB possessed total assets of US$ 2.6 trillion in 2020, accounting for about 18 percent of GDP in China. KfW and BNDES are also significant players, accounting for 17 percent of GDP in Germany and 10 percent in Brazil respectively. By comparison, AFD, DBSA, and NAFIN account for only about 2–3 percent of national GDP.

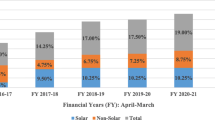

Then, we examine the investment in green energies and/or climate finance in comparison with investment demands. Though many of the NDBs have not made specific targets, they are paying increasing attention to renewable energies. IDFC has systematically tracked the green finance commitments of its members and released the scale of green energy and mitigation of GHGs of sampled NDBs (IDFC 2020, 13). Although, in absolute terms, such investments are high, this falls short of the estimated demands. For instance, ADB invested about US$ 1.2 billion per year during 2013–2017, dwarfed by the investment needs of nearly US$ one trillion per year in developing Asia.

Apart from renewable energy financing by DFIs themselves, we examine how DFIs leverage private capital to maximize the total renewable energy investments. No public information has been found on the targeted leverage ratio in our samples, but we do find information about measures taken by these DFIs to attract private capital to flow into renewable energy. For example, the WBG-IFC puts a priority on renewable energy, focusing on “first-of-a-kind projects” that demonstrate technical feasibility, crowd in private capital, and foster key policy reforms (IFC 2019a). ADB attracts private sector investment by improving project design and structure, addressing risk variables and risk perception, and promoting policy and institutional reforms in developing member countries.Footnote 4 Once the South African government took the decision to open up a portion of the national energy supply grid to private investors, DBSA played an important role in structuring a competitive renewables program to enable developers to make proposals under the Renewable Energy Independent Power Producers Program (DBSA 2019, 28). DBSA, in partnership with the South African national environmental affairs department, has established and now manages a special fund as a national mechanism to provide catalytic finance to facilitate green investments. DBSA sought accreditation from the Green Climate Fund,Footnote 5 which uses scarce public resources to improve the risk–reward profile of low-emission, climate-resilient investment and crowd-in private finance.

Apart from mobilizing private capital, DFIs have tried to scale up their total renewable energy investments by collaborating among themselves. MDBs have pooled their resources together through co-financing. For instance, AIIB have co-financed renewable energy projects with the WBG, ADB, and other well-established MDBs. Furthermore, on-lending is a useful channel of collaboration between MDBs and NDBs. Given that renewable energy projects are often small in scale and disbursed geographically, MDBs have provided on-lending to local financial institutions, including NDBs, to finance small-scale projects to reduce the transaction cost (Muñoz et al. 2020). Co-financing is another means of MDB–NDB collaboration. NAFIN collaborated with IFC and IDB to make the anchor investment of the first wind energy project in 2010, which provided key security for other investors and paved the way for the rest of the financing package.

The decade 2010–2020 saw a significant reduction in renewable power generation costs. IRENA (2021) reports that the competitiveness of solar (concentrating solar power, utility‑scale solar photovoltaic) and offshore wind joined onshore wind in the same range of costs as for new capacity fired by fossil fuels, calculated without financial support. The sharp reduction in the renewable energy prices has been driven by steadily improving technologies, economies of scale, competitive supply chains, and improving developer experience.

Incubator of Renewable Energy Technologies

Incubating nascent renewable technologies entails high-risk and large-scale capital. This role is particularly relevant for more advanced countries at the technological frontier. We find that DFIs can make first-of-the-kind investments to overcome the first-mover challenge. For instance, KfW has provided “massive and exclusive financial support” in the initial phase to solar PV during its introduction to the German energy market, which has catalyzed a greater contribution by the private sector (Griffith-Jones 2016). The KfW’s work to fund offshore wind farms is seen as relieving a bottleneck in the private credit markets that prevented wind farm investors from obtaining the necessary start-up capital (Cochran et al. 2014; Enting 2013; Griffith-Jones 2016; Gumb 2012). CDB piloted the forest-solar complementary power in the City of Jiangshan of Zhejiang Province and supported the project with RMB 212 million (US$ 31 million) to achieve the demonstration effect (CDB 2016). Taking the Longyangxia Solar-Hydro 320 MW Photovoltaic Power Station as another example, the project has been one of the largest photovoltaic power projects in the world and the first solar–hydro hybrid photovoltaic power project in China. The project has a total installed capacity of 320 MW and a total investment estimation of 3.73 billion RMB (US$ 542 million), and the Bank committed 2.98 billion RMB (US$ 433 million) in loans. Furthermore, MDBs have played a catalytic role in supporting pilot projects to achieve the demonstration effect in developing countries. ADB has piloted the emerging “floating” solar photovoltaic technology with huge potential for scaling up and replication in Central and West Asian countries, where solar potential is untapped owing to lack of technical skills and knowledge of new technologies, costs, benefits, and financing options. WBG-IFC has financed first-of-their-kind initiatives, making the case that renewable energy is a commercially viable option for developing countries such as India (IFC 2019b). As one of the first solar power companies in the country, Azure Power, initially supported by the IFC, played a catalytic role in building a vibrant market for solar power (IFC 2019b).

Providing Affordable Long-Term Finance to Purchase Foreign Technologies

Weak renewable energy production capacity is a key constraint faced by less developed countries that are poor in capital but abundant in labor. DFIs may help to alleviate this constraint by providing affordable long-term finance to purchase foreign renewable energy technologies. We find that loans from DFIs and MDBs in particular are usually below market rate, because most DFIs rely on sovereign creditworthiness to raise funds from capital markets at a relatively low borrowing cost. This helps poor countries to import foreign renewable energy technologies to compensate for their weak domestic production capacity. Most such loans are denominated in hard currency, as MDBs and DFIs from HICs often borrow at full-fledged capital markets in Europe and the USA and would like to hedge against foreign exchange risks. In normal times, MDBs help developing countries with sufficiently large capital markets to develop hedging tools to hedge against foreign exchange risks. However, such loans may create balance-of-payment problems for poor countries with underdeveloped capital markets, especially given the fact that most renewable energy projects cannot generate foreign reserves. Although MDBs try to issue local currency bonds to enable them to provide loans denominated in local currency, the scale is relatively limited because the borrowing cost in local capital markets is often higher than that in the full-fledged capital markets.Footnote 6

Financing Supporting Infrastructure

Renewable energies cannot be deployed at large scale if complementary infrastructure is not in place. To evaluate whether DFIs have taken a coordinated approach to fostering clean energy transformation, we examine whether DFIs have made corresponding financing to develop transmission and distribution lines, constructed industrial parks to produce renewable energies, and supported complementary technological innovation such as smart grids and energy storage that help facilitate the integration of renewable energies into the national energy system.

Based on our analysis, some DFIs have already started to take a coordinated approach. For instance, IDB has planned ahead on how to develop the necessary transmission infrastructure (Paredes and Juan Roberto 2017). IDB also used the Smart Fund program to conduct demonstrations and innovative programs promoting smart grids and energy storage in Barbados (IDB 2019). ADB has undertaken the Gujarat Solar Power Transmission Project in India to develop the transmission infrastructure for the evacuation of power in a reliable manner from the Charanka Solar Park in Patan, Gujarat (ADB 2011). ADB has also developed and financed a large solar park, the first of its kind in Cambodia under a public–private partnership modality, which will be constructed near the demand center of Phnom Penh and will include advanced features such as a solar resource forecasting system and short-term energy storage for output smoothing.Footnote 7 KfW is promoting a transmission infrastructure project connecting a pumped-storage power station to the existing grid so that it can be brought online in South Africa (KFW 2019).

Conclusion

Renewable energy transformation is the key to achieving the Paris Agreement of climate change. We go beyond the prevailing project-level approach by emphasizing that DFIs must tackle system-level constraints to enable a rapid and substantial deployment of renewable energies in the national energy system. Drawing on the structuralist theories in the field of economics, we theorize the overall system-level approach needed to invest in such a transformation and the severity of four constraints that hinder the renewable energy transformation. First, the incumbent entrenchment is more severe in more advanced countries, as fossil fuels play a more preponderant role in national energy supply systems. Second, the unmet energy demand is a more difficult constraint in less developed countries, as their industrial structure is often more energy intensive, and high renewable energy prices may undercut their international competitiveness. Third, weak renewable energy production capacity may be a more acute constraint in less developed countries, because they are price takers and may have to borrow in hard currency to purchase renewable energy technologies abroad. This may trap them in balance-of-payment problems if renewable energy projects cannot generate foreign reserves. By contrast, developed countries may have to incubate new renewable energies at the technological frontier. Finally, financing supporting infrastructure is an equally severe constraint for both developed and developing countries, though the former needs to build new ones whereas the latter has to replace old infrastructure.

We argue that DFIs are well positioned to tackle the above constraints by taking a mission-driven vison and policy planning, acting as honest brokers to overcome the incumbent entrenchment, scaling up total renewable energy investments to achieve the economies of scale, incubating nascent renewable energy technologies to overcome the first-mover challenge, and making coordinated investments in complementary infrastructure.

To evaluate whether DFIs can foster renewable energy transformations, we selected 15 representative DFIs from both developed and developing countries. To collect the firsthand data, we organized two successive focal group discussions with over 20 energy experts from all sampled DFIs. We find that (1) most sampled DFIs have recently prioritized financing renewable energy to align their strategies with the Paris Agreement; (2) MDBs are better able to shape policy environment in favor of renewable energies through policy dialogues with national governments; (3) DFIs have attempted to scale up renewable energy financing, but only few can reach economies of scale to bring down the price of renewable energies; (4) DFIs help to incubate nascent renewable energy technologies by making the first-of-the-kind investments to overcome the first-mover challenge; (5) MDBs have tried to provide cheap loans denominated in local currencies to enable developing countries to import renewable energy technologies abroad, though limited in scale; and (6) DFIs have made investments in complementary infrastructure to facilitate the deployment of renewable energies in national grids.

In the future, DFIs will need to make more comprehensive investment plans to fundamentally alter the energy mix toward cleaner energy and take a system-level transformative approach to ensure that complementary infrastructure is in place, shape the policy environment in favor of renewable energies, providing the local currency-denominated financing to help less developed countries to better tackle the balance-of-payment problems, and scale up such efforts by orders of magnitude.

Notes

GIB was created by the UK government in 2012, but Macquarie, a diversified financial group, acquired GIB from the UK government in 2017 and renamed it Green Investment Group. Without government steering, Green Investment Group is not qualified as a DFI.

One exception is coal-rich poor countries, which may have already used the endowment of coal to meet the energy need.

However, none of the MDBs have attached such limits on corresponding infrastructure for oil and gas (Wright et al. 2018).

Interview, senior ADB management, 2018.

Established in 2010, the Green Climate Fund (GCF) is a new consortium for dedicated funding set up under the United Nations Framework Convention on Climate Change (UNFCCC) with the equal representation of developed and developing countries on its board.

Interview with the former Director of Financial Intermediation Division, 10 June 2020.

Interview, senior ADB management, 19 May 2018.

References

ADB. 2011. India: Gujarat Solar Power Transmission Project. Accessed August 1, 2019. https://www.adb.org/publications/india-gujarat-solar-power-transmission-project.

Barton, D., and M. Wiseman. 2013. Investing for the long term. McKinsey on Investing 1: 61–66.

Bayer, P., L. Dolan, and J. Urpelainen. 2013. Global patterns of renewable energy innovation, 1990–2009. Energy for Sustainable Development 17 (3): 288–295.

Bhattacharya, A., Oppenheim, J., & Stern, N. 2015. Driving sustainable development through better infrastructure: key elements of a transformation program. Global Economy & Development Working Paper 91. https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2015/07/Bhattacharya-et-al.-2015.pdf.

Bhattacharya, A., Gallagher, K. P., Muñoz Cabré, M., Jeong, M., & Ma, X. 2019. Aligning G20 infrastructure investment with climate goals and the 2030 agenda. Foundations Platform F20: A report to the G20.

Climate Bonds Initiative. 2019. Green bonds: the state of the market 2019. Accessed December 5, 2021. https://www.climatebonds.net/files/reports/cbi_sotm_2019_vol1_04d.pdf.

Climate Policy Initiative. 2021. The global landscape of climate finance 2021. Accessed January 10, 2022. https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/.

Coady, M. D., Parry, I. W., Sears, L., & Shang, B. 2015. How large are global energy subsidies?. International Monetary Fund.

Cochran, I., Romain Hubert, Virginie Marchal, Robert Youngman. 2014. Public financial institutions and the low-carbon transition: five case studies on low-carbon infrastructure and project investment. Paris, France: OECD Environment Working Papers, no. 72, OECD Publishing.

Cohen, S. 2015. What is Stopping the Renewable Energy Transformation and what can the US Government do? Social Research: An International Quarterly 82 (3): 689–710.

Delina, L.L. 2011. Clean energy financing at Asian development bank. Energy for Sustainable Development 15 (2): 195–199.

Enting, K. 2013. Mobilizing private sector investment: KfW case studies and conclusions. Accessed December 19, 2018. http://www.oecd.org/env/cc/CCXG%20March%202013%20Katrin%20Enting.pdf.

Flammer, C. 2021. Corporate green bonds. Journal of Financial Economics 142 (2): 499–516.

Gabor, D. 2021. The wall street consensus. Development and Change 52 (3): 429–459.

Geddes, A., T.S. Schmidt, and B. Steffen. 2018. The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany. Energy Policy 115: 158–170.

Goldthau, A., and B.K. Sovacool. 2012. The uniqueness of the energy security, justice, and governance problem. Energy Policy 41: 232–240.

Griffith-Jones, S. 2016. National development banks and sustainable infrastructure: the Case of KfW. Global Economic Governance Initiative Working Paper No. 6. https://www.bu.edu/pardeeschool/files/2016/07/GriffithJones.Final_.pdf.

Grossman, G.M., and A.B. Krueger. 1995. Economic growth and the environment. The Quarterly Journal of Economics 110 (2): 353–377.

Gumb, G. 2012. German approaches in promoting energy efficiency: KfW best practice experience. Workshop on Energy Efficiency. Accessed July 16, 2019. http://www.iea.org/media/workshops/2012/energyefficiencyfinance/2d1gumb.pdf.

Henriques, I., and P. Sadorsky. 2008. Oil prices and the stock prices of alternative energy companies. Energy Economics 30 (3): 998–1010.

IDB. 2013. IDB integrated strategy for climate change adaptation and mitigation, and sustainable and renewable energy. Background paper for the mid-term evaluation of IDB-9 commitments. Accessed May 15, 2019. https://publications.iadb.org/en/idb-9-idb-integrated-strategy-climate-change-adaptation-and-mitigation-and-sustainable-and.

IDB. 2019. Sustainable Energy Investment Program (SMART FUND II). Accessed August 1, 2019. https://www.iadb.org/en/project/BA-L1043.

IDFC. 2018. IDFC Green Finance Mapping Report. Accessed May 15 2019. https://www.idfc.org/wp-content/uploads/2018/12/idfc-green-finance-mapping-2017.pdf.

IDFC. 2020. IDFC Green Finance Mapping Report. Accessed December 5, 2021. https://www.idfc.org/wp-content/uploads/2020/11/idfc-2020-gfm-full-report_final-1.pdf.

IFC. 2019a. Private sector solutions for development: renewable energy. Accessed August 1, 2019a. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/featurestory_renewableenergy.

IFC. 2019b. India’s solar-energy market set to shine. Accessed August 1, 2019b. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/impact-stories/india-solar-energy-market-set-to-shine.

IMF. 2017. Fiscal politics. Washington, D.C.: IMF.

IPCC. 2018. Global warming at 1.5 degrees. United Nations. Accessed July 16, 2019. https://www.ipcc.ch/sr15/.

IRENA. 2018. Renewables 2018 global status report (GSR). Accessed July 16, 2019. http://www.ren21.net/status-of-renewables/global-status-report/.

IRENA. 2021. Renewable power generation costs in 2020. Accessed December 5, 2021. https://www.irena.org/publications/2021/Jun/Renewable-Power-Costs-in-2020.

KfW. 2019. Focus on renewable energy. Accessed August 1, 2019. https://www.kfw-entwicklungsbank.de/International-financing/KfW-Development-Bank/Topics/Energy/Fokus-Erneuerbare-Energien/.

Kitzinger, J., & Barbour, R. (Eds.). 1999. Developing focus group research: politics, theory and practice. Sage Publications.

Liao, C., J.T. Erbaugh, A.C. Kelly, and A. Agrawal. 2021. Clean energy transitions and human well-being outcomes in Lower and Middle Income Countries: A systematic review. Renewable and Sustainable Energy Reviews 145: 111063.

Lin, J. 2012. New structural economics: A framework for rethinking development and policy. Washington, D.C.: The World Bank.

Mazzucato, M., and Caetano C.R.. Penna. 2016. Beyond market failures: The market creating and shaping roles of state investment banks. Journal of Economic Policy Reform 19 (4): 305–326.

Mazzucato, M., and G. Semieniuk. 2018. Financing renewable energy: Who is financing what and why it matters. Technological Forecasting and Social Change 127: 8–22.

Multilateral Development Banks and Development Finance Institutions. 2021. Mobilization of Private Finance by Multilateral Development Banks and Development Finance Institutions 2019. https://www.adb.org/sites/default/files/institutional-document/672691/mobilization-private-finance-mdbs-dfis-2019.pdf.

Mondal, M.A.H., L.M. Kamp, and N.I. Pachova. 2010. Drivers, barriers, and strategies for implementation of renewable energy technologies in rural areas in Bangladesh—an innovation system analysis. Energy Policy 38 (8): 4626–4634.

Muñoz, Cabré M., K. Ndhlukula, T. Musasike, D. Bradlow, K. Pillay, K.P. Gallagher, Y. Chen, J. Loots, and X. Ma. 2020. Expanding renewable energy for access and development: The role of development finance institutions in Southern Africa. Global Development Policy Center: Boston University.

Naidoo, C.P. 2020. Relating financial systems to sustainability transitions: Challenges, demands and design features. Environmental Innovation and Societal Transitions 36: 270–290.

Ocampo, J.A. 2017. Resetting the international monetary (non) system. New York: Oxford University Press.

OECD. 2017. Investing in climate, investing in growth. Paris: OECD Publishing.

Painuly, J.P. 2001. Barriers to renewable energy penetration; a framework for analysis. Renewable Energy 24 (1): 73–89.

Rey, H. 2016. International channels of transmission of monetary policy and the Mundellian trilemma. IMF Economic Review 64 (1): 6–35.

Rezec, M., and B. Scholtens. 2017. Financing energy transformation: The role of renewable energy equity indices. International Journal of Green Energy 14 (4): 368–378.

Rosenstein-Rodan, P.N. 1943. Problems of industrialization of eastern and south-eastern Europe. The Economic Journal 53 (210/211): 202–211.

Sadorsky, P. 2012. Modeling renewable energy company risk. Energy Policy 40: 39–48.

Sen, S., and S. Ganguly. 2017. Opportunities, barriers and issues with renewable energy development–a discussion. Renewable and Sustainable Energy Reviews 69: 1170–1181.

Smallridge, D., Barbara Buchner, Chiara Trabacchi, María Netto, José Juan Gomes Lorenzo, and Lucila Serra. 2013. The role of national development banks in catalyzing international climate finance. Inter-American Development Bank.

Steffen, B., and T.S. Schmidt. 2021. Strengthen finance in sustainability transitions research. Environmental Innovation and Societal Transitions 41: 77–80.

Taylor, L. 2004. Reconstructing macroeconomics: Structuralist proposals and critiques of the mainstream. Harvard University Press.

UNEP. 2018. Emissions gap report. Nairobi, Kenya: United Nations Environment Program; 2018.

United Nations Inter-agency task force on financing for development. 2018. Financing for development progress and prospects 2018, 2018. New York: United Nations.

United Nations. 2015. Paris Agreement. Accessed September 15, 2021, https://unfccc.int/sites/default/files/english_paris_agreement.pdf.

World Bank. 2012. Financing renewable energy; options for developing financing instruments using public funds. Washington, DC: World Bank.

World Bank. 2018. Multilateral development banks (MDBs) announced a joint framework for aligning their activities with the goals of the Paris Agreement. Washington, DC: World Bank. Accessed May 13, 2019. https://www.worldbank.org/en/news/press-release/2018/12/03/multilateral-development-banks-mdbs-announced-a-joint-framework-for-aligning-their-activities-with-the-goals-of-the-paris-agreement.

World Bank. 2020. Sustainable Energy Finance Program. Washington, World Bank. Accessed July 27, 2020. https://projects.worldbank.org/en/projects-operations/project-detail/P098423?lang=en.

Wright, H., Hawkins, J. A. M. E. S., Orozco, D. I. L. E. I. M. Y., & Mabey, N. I. C. K. 2018. Banking on Reform: Aligning Development Banks with the Paris Climate Agreement. E3G..

Xu, J., and GALLANGER, K. P. 2017. Leading from the South: Development finance institutions and green structural transformation. Global Development Policy Center Policy Brief No. 3: Boston University.

Xu, J., R. Marodon, X. Ru, X. Ren, and X. Wu. 2021. What are public development banks and development financing institutions?——qualification criteria, stylized facts and development trends. China Economic Quarterly International 1 (4): 271–294.

Xu, J., Ren, X., & Wu, X. 2019. Mapping development finance institutions worldwide: definitions, rationales, and varieties, New Structural Economics Development Financing Research Report No. 1.

Acknowledgement

We would like to thank leading energy experts from development financing institutions to share their insights in focal group discussions.

Funding

This work was supported by the National Natural Science Foundation of China—Data Center for Management Science at Peking University (2017KEY06), the National Social Science Foundation (17BJL124), and Ford Foundation (128664; 135168; 139355).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Xu, J., Gallagher, K.P. Transformation Towards Renewable Energy Systems: Evaluating the Role of Development Financing Institutions. St Comp Int Dev 57, 577–601 (2022). https://doi.org/10.1007/s12116-022-09375-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12116-022-09375-8