Abstract

This study comprehensively reviews the relationship between green finance and sustainable development, specifically focusing on combatting climate change and achieving carbon neutrality. Utilizing a narrative review methodology, the study examines a range of scholarly articles and publications to identify key themes, findings, and future directions in green finance. The review emphasizes the crucial role of substantial investments in green and low-carbon initiatives to address climate change effectively and promote sustainable economic growth. It highlights the necessity of robust regulatory frameworks that facilitate the availability of green finance and the integration of carbon–neutral practices. Additionally, the paper explores the potential of impact investing, wherein investors accept lower financial returns in exchange for non-financial benefits in green finance. It underscores the influential role of institutional ownership in guiding companies toward enhanced environmental and social performance. Moreover, integrating environmental, social, and governance (ESG) factors in investment decisions is critical for sustainable finance. Addressing the intersection of climate change and risk management, the review highlights the implications of environmental risks on financial decision-making. Effective communication strategies can raise public awareness and support for climate policies. The study concludes by calling for collaboration, further research, and policy measures to advance green finance and foster sustainable economic growth. It recommends aligning financial incentives with sustainable outcomes, fostering transparency, and incorporating social equity in green finance initiatives to contribute towards achieving sustainable development goals and promoting a greener future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the rapidly evolving global landscape, the imperative of sustainable development and the urgent need to combat climate change cannot be overstated (Radu et al. 2013). Green finance, which centers around environmentally friendly investments and practices, has emerged as a pivotal instrument in achieving carbon neutrality and greening sustainable economic growth (Bhatnagar et al. 2022). This article aims to comprehensively review the intricate relationship between green finance and sustainable development.

The advancement of green finance is indispensable in attaining sustainable development goals and addressing pressing environmental challenges (Goel et al. 2022). This review critically examines the existing literature on the nexus between green finance and sustainable development, particularly emphasizing the prospective implications for the finance industry.

The reviewed scholarly papers significantly contribute to our understanding of the importance of substantial investments in green and low-carbon initiatives in combating climate change and achieving carbon neutrality. They accentuate the need for robust regulatory frameworks that facilitate the increased availability of green finance and the integration of carbon–neutral practices. A thorough analysis of prominent institutions like the Green Climate Fund is included in this study, which emphasizes the importance of ensuring that climate funding initiatives are scaled up by diversifying funding sources and mitigating conventional finance risks (Cevik and Jalles 2022).

The papers also discusse how green financing impacts decarbonization efforts and emphasizes the need for further research to increase our understanding of their effectiveness (Al Mamun et al. 2022). The study also highlights the significance of investors' preferences for sustainable investments, emphasizing the influence of social choices on economic decision-making. They underscore the indispensability of transparency, standardization, and social equity in shaping the contours of green finance (Aramonte and Zabai 2021).

A comprehensive analysis of the interaction between green finance and sustainable development is also included in the review, including topics such as sustainable development goals, financial institutions' pivotal role, and the impact of environmental policies on research and development funding. The papers underscore the enduring positive effects of green finance on sustainable growth, necessitating the formulation of precise definitions, relevant studies, and tax policies to expedite the adoption of green financing and enhance climate change mitigation (NACI, S., 2021).

Additionally, the potential for impact investing as a driver for green finance is meticulously explored. The papers underscore investors' willingness to accept lower financial returns for non-financial benefits and the instrumental role of institutional ownership in steering firms toward enhanced environmental and social performance. The articles accentuate the critical importance of impact investing and sustainable finance in fulfilling ecological responsibilities while drawing attention to the scope of insensitivity in sustainable investing (Edmans and Kacperczyk 2022).

It explores how environmental, social, and governance (ESG) factors affect investment decisions in green finance (Jagannathan et al. 2017). The papers underline the pivotal role of robust ESG practices and disclosure in bolstering risk-adjusted returns (Azarow et al. 2021). Given the increasing prominence of green finance and sustainable investing, incorporating ESG criteria when constructing investment portfolios is paramount.

Moreover, the intersection of climate change and risk management is a salient aspect investigated in the review. The study emphasizes the ramifications of environmental risks for financial decision-making and the indispensability of environmentally conscious investing. Effective communication strategies are instrumental in raising public awareness and garnering support for climate policies. Political uncertainty is critical in investment decisions, particularly for industries grappling with stranded assets (Khatibi et al. 2021).

Lastly, the papers underscore the indispensable role of green finance in fostering sustainable economic growth and tackling climate change. The potential for aligning financial incentives with sustainable outcomes is highlighted, necessitating active monitoring and engagement with portfolio companies on environmental issues (Starks 2021). Implementation challenges and the need for comprehensive and comparable data on green financing activities are also addressed, providing crucial insights into the instrumental role of green finance in advancing sustainable economic development.

2 Research methodology

In conducting a comprehensive review on the topic of “Advancing Green Finance: A Review of Sustainable Development and the Future Directions,” a Narrative review method was used.

We conducted extensive research to identify scholarly articles, publications, and research papers on green finance, sustainable development, and their future implications. Various sources, such as online databases and academic platforms, were utilized to compile relevant information on the subject.

Texts were chosen for their pertinence and contributions to the research subject. Reviewed works from peers that offered valuable perspectives on the correlation between green finance, sustainable development, and forthcoming prospects were incorporated into the examination.

We analyzed and synthesized the selected literature to identify key findings, themes, and trends related to green finance and sustainable development. According to the review, shared viewpoints were identified, areas of study were lacking, policy recommendations were made, and implications for future research were identified.

The findings from the analyzed literature were organized into distinct sections to provide a structured overview of the subject matter. These sections included topics such as “Green Finance and Low Carbon Initiatives” and “Green Finance and Sustainable Development”. The narrative review synthesized the collective findings of the selected literature, highlighting the significance of green finance in achieving sustainable development goals and addressing climate change. It emphasized the role of financial institutions, policy recommendations, impact investing, ESG criteria, risk management, renewable energy, and the challenges and opportunities associated with implementing green finance initiatives.

The findings of this narrative review contribute to our understanding of green finance, sustainable development, and its implications for the financial industry, corporate behavior, and the environment. They provide valuable insights for investors, policymakers, and researchers seeking to promote sustainable investments and drive green finance initiatives.

Researchers worldwide have been actively exploring the realms of green finance and sustainable development in response to the pressing challenges posed by climate change and environmental degradation. To analyze the trends in research focused on this crucial subject, we evaluated an available selection of references used in this research. We organized the keyword research into various groups and subgroups based on the keywords used. This interpretation aims to provide valuable insights into the distribution of keywords, highlighting their significance and implications for the overall research in this field. By emphasizing green finance and sustainable development, policymakers, investors, and stakeholders can make informed decisions to advance a greener and more sustainable future.

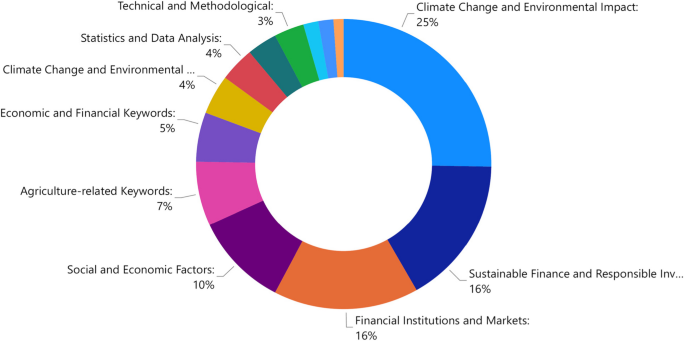

A thorough examination of the articles’ keywords identified primary groups, as demonstrated in Fig. 1. This visual representation highlights the most frequently used subjects in the papers and their corresponding frequencies.

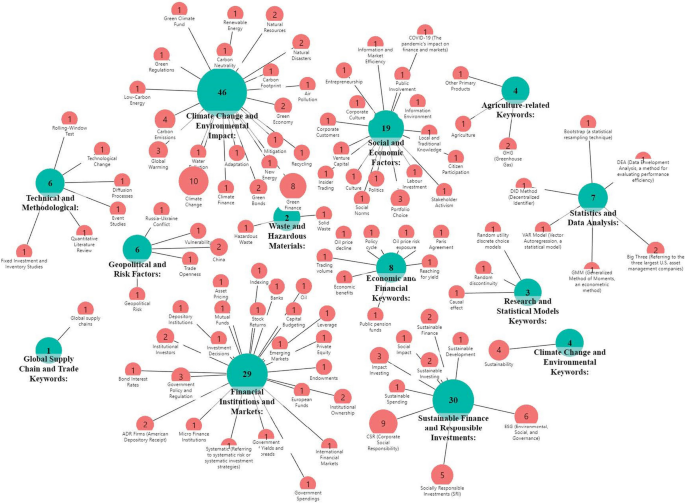

Furthermore, Fig. 2 presents a word cloud diagram visually depicting the initial grouping to facilitate a more exhaustive analysis of the subjects addressed in the literature.

The haste over climate change must be managed by low-carbon initiatives and green financing, as highlighted by keywords such as "Climate Change," "Carbon Emissions," and "Global Warming." Supporting climate-related projects is emphasized by instruments like "Green Bonds" and the "Green Climate Fund." There is an emphasis on renewable energy and low-carbon energy, indicating a growing concern with investing in sustainable energy sources. Answerable investing, as indicated by CSR and ESG, shows the increasing consideration of environmental and social factors in investment decisions.

Furthermore, "Impact Investing" and "Sustainable Investing" support the trend of seeking socially responsible investment opportunities, while "Sustainable Development" and "Sustainable Finance" play a vital role in supporting economic growth and achieving developmental goals. The multifaceted role of financial institutions in promoting green finance and sustainable investments is highlighted by keywords related to various financial instruments and entities. The importance of balancing financial performance and risk management within green finance is indicated by "Stock Returns" and "Leverage." Additionally, investor preferences and social choices are influential factors in shaping green finance, as suggested by "Portfolio Choice." Workforce participation and public engagement are essential for the success of green finance initiatives. Geopolitical risks, mainly related to "China" and the "Russia-Ukraine Conflict," impact global green finance and sustainable development efforts, requiring consideration in sustainability planning. Lastly, "Trade Openness" highlights the significance of international trade policies in influencing green finance practices, emphasizing the importance of global cooperation in addressing sustainability challenges.

Figure 3 provides a detailed description of the subgroups. This keyword analysis offers insightful information on the most important trends and issues concerning climate change, green finance, Sustainable finance, ESG, CSR etc. Nevertheless, the findings can be reorganized and expanded upon as follows to enhance the description of the results:

A comprehensive analysis of keywords in references reveals the diverse and extensive coverage of green finance and sustainable development topics in research. The concentration of keywords in specific groups indicates a strong focus on climate change, environmental impact, responsible investing, financial institutions, and social and economic factors within green finance. By considering these trends and interpretations, stakeholders can make informed decisions and contribute to a greener and more sustainable future.

3 Research perspectives and progresses

3.1 Green finance and low carbon initiatives

The collective findings of these papers contribute to our understanding of the relationship between green finance and low carbon initiatives. They underscore the importance of substantial investments in green and low-carbon initiatives to achieve carbon neutrality and combat climate change. The papers suggest policy recommendations to strengthen the regulatory framework for green finance, increase its availability, and incorporate carbon–neutral practices. Investor preferences for sustainable investments highlight the influence of social choices on economic decisions, emphasizing the importance of transparency, standardization, and social equity.

3.1.1 Fostering green finance and low-carbon development

Kong's (2022) research shows that carbon neutrality is crucial to climate change. New energy is necessary to promote carbon neutrality. He explains the meaning and significance of new energy in transitioning to carbon neutrality. Investing in green and low-carbon initiatives is essential to developing environmentally friendly energy sources.

The research examines China's growth patterns and critical green finance features. The author presents several policy recommendations focusing on the advantages of carbon–neutral practices in green finance. As part of these recommendations, the framework for sustainable financial regulation needs to be strengthened. In addition, they include creating an environment conducive to green finance development in China by expanding sustainable financial services.

This paper presents policy recommendations for fostering green finance in China. Kong (2022) also analyzes the United States' strategies and experiences promoting low-carbon development and suggests countermeasures for China's growth. The proposed actions include enhancing the top-level design and regulatory policy system, improving the energy structure, increasing the share of clean energy, improving industrial facilities, lowering energy consumption in critical industries, establishing a comprehensive zero-carbon technology system, promoting low-carbon research and development, and identifying low-carbon development paths appropriate for the region.

Kong's study on the relationship between green finance and low-carbon development explains the novel energy concept and its role in carbon neutrality. Kong's study on green finance and low-carbon development focuses on China. The report also discusses the current state of green finance in China, highlighting the benefits of carbon neutrality. The study's policy recommendations to strengthen the regulatory framework for green finance and expand its availability in China offer essential guidance for policymakers and stakeholders.

3.1.2 The role of the Green Climate Fund

The article by Amighini et al. (2022) addresses the current state and potential future climate finance strategies, specifically focusing on the Green Climate Fund (GCF). The authors assert that further research is required on the GCF's appropriation distribution tactics, even though they agree that most political and academic emphasis has been on increasing money for the GCF.

The authors propose that to increase the GCF's efficacy, it should shift away from exclusively providing public money for non-bankable projects and instead concentrate on channeling both public and private sources of finance and de-risking more conventional forms of finance. The authors claim the strategy would allow the GCF to scale up climate funding and improve its appeal to investors.

Nevertheless, non-bankable projects may be more crucial to meeting the needs of developing countries, especially in sectors or regions without private investment. As a multilateral fund, the GCF should focus not on attracting private investment but on the needs of developing countries and the public good. Therefore, the GCF may still need to fund non-bankable projects critical to climate adaptation and mitigation in developing countries, even if they require help attracting private investment.

Nonetheless, supporters of this argument may point out that the GCF could do more to leverage private investment and mobilize capital to address the needs of developing countries. By providing de-risking mechanisms and supporting innovative approaches, the GCF could encourage private investment in low-carbon and climate-resilient projects and help mobilize the necessary resources to address climate change.

The paper critically discusses potential future climate finance strategies, focusing on the Green Climate Fund. While there are differing opinions on the most effective approach for the GCF, the authors provide practical assistance to the ongoing debate on mobilizing resources to address climate change.

3.1.3 Assessing the impact of green financing on decarbonization efforts

The international community has recently focused on promoting green finance to address environmental protection, climate change, and sustainable development. Nevertheless, from an ecological standpoint, scholars have mainly evaluated the elements and forces behind green financing. Jia (2023) seeks to assess how green funding affects economies' efforts to reduce their carbon footprints, particularly in the People's Republic of China, the Russian Federation, and the United States.

The study examines green bonds as these countries' most common green finance tool for decarbonization. The report concludes that green money has not significantly affected these countries' decarbonization efforts. Even if businesses and government organizations have made strides, the study contends that further research is necessary to fully grasp how well green financing works to encourage decarbonization and how businesses and government organizations fit into this process.

The study's findings do not prove that green bond issuance reduces corporate carbon intensity. Furthermore, it is unknown if the existing green bond financing mechanism speeds the shift to a low-carbon economy. Overall, the study emphasizes the need for more investigation and assessment of green finance's efficiency in advancing decarbonization. Understanding how institutions and government organizations suit this technique is vital, as is identifying valuable tools and methods for promoting sustainable development policy.

There has been recognition of the value of green finance in tackling environmental protection, climate change, and sustainable development, but more research is needed to determine its effectiveness. Jia's analysis shows how green financing affects the decarbonization of the US, China, and Russian economies. Further research is required to identify practical strategies and tools for promoting sustainable development policies.

3.1.4 The impact of sustainable spending on investment behavior

Campbell and Sigalov (2022) explore how sustainable spending affects "reaching for yield" in their model of "reaching for yield." Although green finance or sustainable investing is not explicitly mentioned in the paper, the idea of sustainable spending aligns with the views of sustainable finance, which encourages investments that support sustainable development while still yielding financial rewards. The concept of sustainable spending may be used by investors who prioritize sustainable financing to direct their investment choices, such as investing in green initiatives or businesses with robust ESG practices. This study provides insight into how investors react to changes in interest rates and risk premiums. It does not consider how investing in green projects may affect risk-taking and has other limitations. Despite these limitations, it offers a valuable framework for understanding investors' behavior in response to changes in interest rates and risk premiums in a sustainable investing context.

3.1.5 Investor preferences and sustainable investments

Green finance is crucial for achieving Sustainable Development Goals (SDGs), as Rogelj et al. (2016) argue. They conduct two field surveys with a pension fund that grants its members a vote on its sustainable investment policy to determine whether individuals are willing to support sustainable investments even if they negatively impact their financial performance. After observing the pension fund's increased focus on sustainability, most participants still support more sustainable investments. The authors conclude that social preferences significantly influence economic decisions and propose a simple method for institutional investors to cater to the social importance of their clients. Investor willingness to invest in sustainable projects, transparency, and standardization of sustainability reporting influence green finance's effectiveness in achieving Sustainable Development Goals (SDGs). Transparency, standardization, and social equity are essential to create a sustainable and equitable future. With green finance, sustainable development projects and investments can be financed and invested, contributing to global sustainability efforts.

3.2 Green finance and sustainable development

Diverse topics and studies are covered in this section about Green Finance and Sustainable Development. Green finance is discussed as it relates to sustainable development goals, the role of financial institutions, environmental policies' impact on R&D investment, and the enhancement of climate finance. The papers emphasize the need for precise definitions and relevant studies to promote green financing and climate change mitigation. Further research into climate finance, focusing on extreme weather risks, divestment, and stranded assets, is also recommended.

3.2.1 Causal relationship between green finance and sustainable development

Wang et al. (2022) use the bootstrap rolling-window Granger causal relationship test to globally assess the causal relationship between green finance (GF) and sustainable development (SD). The outcomes of the empirical analysis indicate that GF has positive impacts on SD in various sub-periods. However, the study needs to reach a consistent conclusion on the influence of sustainable development on green finance.

Green finance has emerged as a new financial tool for promoting sustainable development, but its precise impact has yet to be proven. The study aims to fill this gap by performing a practical analysis of the effects of multiple stakeholders on SD through their participation in GF projects. The results show a dynamic causal connection between GF and SD in different subsample intervals, but the direction of this connection could be more consistent. The study suggests that policymakers promote green finance and its contribution to sustainable development through government guidance, improved GF classification and evaluation, and better information disclosure.

3.2.2 The impact of environmental policy on R&D investment

Brown et al. (2022) explore the impact of environmental policy on the research and development (R&D) investments of polluting firms. The study highlights the potential of tax policy to incentivize technological innovation towards cleaner production methods, providing evidence for the link between market-based environmental approaches and technical change.

The study suggests that further research is necessary to investigate the interaction of pollution taxes and research subsidies on technology investment decisions, the influence of other legal and institutional determinants on R&D investment, and how policy-induced investments in modern technology affect the level of noxious manufacturing emissions in high-pollution firms. In green finance, emissions taxes may encourage investment in green finance impacted this discovery emphasizes the importance of enabling investments in clean technologies, particularly within sectors that use environmentally harmful production methods. By advocating and funding the adoption of clean technologies, green finance can play a vital role in reducing the detrimental effects of pollution on the environment and fostering sustainable development.

3.2.3 Enhancing climate finance

The article by Hong et al. in 2020 highlights the significance of conducting further research in climate finance. The researchers emphasize the need for improved modeling and sharing of extreme weather risks using remote sensing and machine learning. They also stress the importance of divestment and stranded assets and how they can potentially influence the cost of capital for energy companies, leading to significant stranded asset risk. Municipal finance is also discussed, in which rating agencies consider incorporating climate change resilience measures into municipal bond ratings. As a last point, the article suggests exploring the impediments to corporate and financial innovation related to climate change, including the nature and impact of green bonds. The report emphasizes how financial economists must understand and address the risks associated with climate change and its potential implications for financial stability. As part of green finance, it is crucial to consider the effects of climate change on investments, financial stability, and innovation in the financial sector.

3.2.4 The impact of government expenditure on green economic performance

Feng et al. (2022) investigate the link between government expenditure and green economic performance in countries participating in China’s Belt and Road Initiative (BRI). The authors employ data envelopment analysis (DEA) and system GMM techniques to analyze panel data from 2008 to 2018 in selected BRI countries. The study findings indicate that government expenditure significantly impacts green economic performance, with public spending on human capital and renewable energy leading to a productive green economy. The paper also includes policy recommendations to support BRI countries in achieving their green development goals, such as allowing green infrastructure projects to attract more private green finance and investment.

The study does, however, have specific areas for improvement. For instance, because the research solely focuses on BRI countries, the conclusions cannot be generalized to other regions or nations. Moreover, the study’s DEA and GMM techniques should fully capture the relationship between government expenditure and green economic performance complexities. Nonetheless, the study contributes a valuable statistical analysis using panel data and econometric methods, and the policy recommendations provide practical implications for BRI countries and decision-makers.

3.3 The potential of impact investing for green finance

The articles in this section explore the potential of impact investing for green finance. They examine various aspects of impact investing, including the willingness of investors to accept lower financial returns for non-financial benefits, the role of institutional ownership in promoting firms' environmental and social performance, scope insensitivity in sustainable investing, and the power of institutional shareholders in driving sustainable investments.

3.3.1 Sacrificing returns for environmental and social impact in green finance

The study by Barber et al. (2021) investigates the willingness of investors to accept lower financial returns for the non-financial benefits of impact investing, particularly in dual-objective venture capital (VC) funds. The study finds that impact investors sacrifice returns, with impact funds earning 4.7 percentage points lower IRRs than traditional VC funds. The study shows that impact investors will forego up to 3.7 percentage points in expected excess IRR. The cost of capital for portfolio companies is lower for impact funds, leading to increased access to capital and growth opportunities. The findings have important implications for green finance. They suggest investors are willing to trade financial returns for positive environmental or social impact. That specific category of investors has higher WTP for such effects, which could guide the development of green finance strategies and policies.

3.3.2 The role of ownership in firms' environmental and social performance

Dyck et al. (2019) examines the relationship between institutional ownership and firms' environmental and social (E&S) performance, with implications for green finance and sustainable investment practices. Investing institutions can promote sustainable practices by pressing firms to improve their E&S records, resulting in a shift towards socially responsible investing. In addition, the study emphasizes the influence of cultural factors on economic decision-making and the potential effectiveness of green finance initiatives.

However, the study has limitations, including not considering governance practices and using proprietary E&S scores from data providers. The study provides valuable insights into the role of institutional investors in promoting E&S practices. It highlights the need for further research to explore how green finance can leverage institutional investors for sustainable business practices.

3.3.3 The impact of institutional shareholders on CSR and sustainability

Chen et al. (2020) investigate how institutional shareholders impact corporate social responsibility (CSR) and sustainability in portfolio firms. Institutional shareholders can positively influence CSR commitments, particularly in financial material categories, and generate real social impact through CSR-related proposals. The study's robust evidence suggests that institutional shareholders play a crucial role in promoting environmental responsibility and sustainable practices in businesses. The study's findings have important implications for green finance as investors increasingly demand sustainability commitments. However, the study does not explore the potential unintended consequences of institutional shareholder influence and focuses on the U.S. market. Nonetheless, the study offers practical suggestions for investors and asset managers seeking to integrate ESG factors into their investment strategies. In conclusion, institutional shareholders will become more influential in driving environmental sustainability and green finance.

3.3.4 The impact of corporate green bonds on environmental performance

Flammer's 2021 study examines the prevalence and impact of corporate green bonds, whose proceeds finance climate-friendly projects. Researchers found that green bonds are increasingly prevalent in industries where the environment is critical to firm operations. Furthermore, Flammer's analysis reveals that companies improve their environmental performance post-issuance, with higher ecological ratings and lower CO2 emissions, and experience increased ownership by long-term and green investors. The findings suggest that corporate green bonds are not merely a tool for greenwashing, as improvements in environmental performance are observed following their issuance. Overall, Flammer's study sheds light on the potential benefits of corporate green bonds for both companies and investors, as well as the importance of private governance in the green bond market and is related to the development of green finance.

3.4 Corporate social responsibility and governance

In this section, the reviewed articles study corporate social responsibility (CSR), environmental externalities, and governance. The studies reveal that the political environment, legal origins, and corporate governance drive CSR policies and practices. The articles collectively suggest that incorporating environmental considerations into CSR policies is essential for long-term financial performance and promoting sustainability, making CSR a critical aspect of green finance.

3.4.1 The influence of political environment on corporate social responsibility

Di Giuli et al.’s (2014) study examines the relationship between a company’s political environment and corporate social responsibility (CSR) policies. According to the researchers, firms with Democratic founders, CEOs, and directors, as well as those headquartered in Democratic states, tend to score higher on CSR ratings than their Republican counterparts. Moreover, Democratic-leaning firms spend about 10% more of their net income on CSR than Republican-leaning firms. However, no evidence indicates firms recover these expenditures through increased sales. The study suggests that social responsibility may benefit stakeholders. Nevertheless, it comes at the expense of firm value since higher CSR ratings are linked to lower stock returns and lower returns on assets.

This study has implications for green finance and highlights how important a company’s political environment is to drive its CSR policies. Companies with a more robust Democratic political environment tend to be more socially responsible, which could be helpful for investors seeking to identify socially responsible companies for investment purposes. The study also emphasizes the need for companies to incorporate environmental considerations into their CSR policies, especially for long-term financial performance.

3.4.2 Corporate governance and environmental externalities

In 2020, Shive et al. researched the relationship between corporate governance and environmental externalities, explicitly focusing on greenhouse gas emissions. The article focuses on the relationship between corporate governance, environmental externalities, and green finance. The research conducted by Shive and Forster (2020) reveals that private firms are less likely to pollute and incur penalties from regulatory bodies than public firms. The study also shows that mutual fund ownership and better board oversight may decrease externalities within public firms. These findings have important implications for green finance, as variables that drive differences in emissions among public firms may carry over to an international setting.

The authors discuss the potential trade-off between prosocial behavior and profitability in reducing greenhouse gas emissions. They highlight the importance of considering the long-term benefits of prosocial behavior for the firm and suggest that engaging institutional investors in addressing climate risks and promoting ESG practices may help shift the equilibrium level of prosocial behavior towards more sustainable practices. The article concludes that green finance, including ESG adoption and engagement, can effectively promote sustainable practices among firms and investors.

3.4.3 Legal origins and corporate social responsibility

Liang and Renneboog (2017) explore the relationship between legal origins and corporate social responsibility (CSR) ratings. Their paper highlights that legal sources significantly determine cross-country differences in CSR ratings. Specifically, companies from civil law countries have higher CSR ratings than those from common law countries, which the researchers argue is due to the greater emphasis on stakeholder rights and social control in civil law legal systems.

Companies from civil law countries may be more likely to prioritize environmental concerns and engage in sustainable business practices, which has implications for green finance. Additionally, companies from civil law countries may be more responsive to ecological crises, address environmental risks, and promote sustainability. Environmental, social, and governance (ESG) factors are increasingly important in green finance. While the study has limitations, such as the lack of causality and potential endogeneity issues, it provides valuable insights into the relationship between legal origins and CSR ratings. It highlights the importance of considering lawful sources in understanding a company's commitment to sustainability and environmental responsibility.

3.4.4 CSR Disclosure and Implications for green finance

Chowdhury et al. (2021) investigate the competitiveness of foreign firms listed on U.S. capital markets in providing better corporate social responsibility (CSR) disclosure and the potential for such transparency to give them a competitive advantage over their U.S. counterparts. By utilizing environmental, social, and governance disclosure scores, the study reveals that foreign firms disclose more CSR information than comparable U.S. firms, particularly in the environmental and social dimensions. Additionally, foreign stocks exhibit lower idiosyncratic volatility, better liquidity, and higher institutional ownership than equivalent U.S. stocks, potentially because of their higher level of CSR disclosure. The authors highlight the increasing importance of CSR to investors worldwide and the positive correlation between a multinational company's degree of multinationalism and corporate social performance.

The study underlines the necessity for foreign firms listed on U.S. markets to effectively communicate their CSR-related initiatives to U.S. investors to enhance their reputations, visibility, and competitiveness. However, the authors note that while foreign firms listed on U.S. markets are sufficiently transparent in disclosing their CSR activities to U.S. investors, they must also better communicate their governance-related initiatives to remain competitive. A higher level of disclosure for all three primary areas of CSR activities benefits foreign firms listed on U.S. markets.

3.4.5 CSR, social capital, and firm performance

In their study, Lins et al. (2017) examine the relationship between corporate social responsibility (CSR), social capital, and firm performance during the 2008–2009 financial crisis. During the crisis, firms with high social capital, measured by CSR intensity, outperformed firms with low social capital by at least four percentage points. Building firm-specific social capital through CSR can be considered an insurance policy that pays off when investors and the overall economy face a severe crisis of confidence. The findings also indicate that social and financial capital can be important determinants of firm performance and identify circumstances under which CSR can benefit. From a green finance perspective, the study highlights the importance of CSR activities that contribute to environmental sustainability in building social capital and fostering trust between a firm and its stakeholders.

3.4.6 Supply chain collaboration and green finance

Dai et al. (2021) emphasize the critical role of supply chain collaboration in promoting sustainable business practices, a subject closely related to green finance. The study highlights the importance of the active roles played by large corporations in their suppliers’ CSR initiatives and standards. It notes that collaborative CSR efforts between suppliers and customers improve both parties' operational efficiency and firm valuation. The study also found that customers tend to establish relationships with socially and environmentally responsible firms, influencing their suppliers' CSR practices through positive assortative matching and decision-making processes. However, the study also highlights the challenges of promoting sustainability across global supply chains, particularly in specific socio-cultural and institutional environments. Overall, the study provides valuable insights into the role of supply chain collaboration in promoting sustainable business practices, which represent an essential aspect of green finance.

3.5 ESG and sustainable investing

This section discusses the importance of ESG criteria in investment decisions and how they impact green finance. These articles emphasize the importance of impact investing and sustainable finance in achieving environmental responsibility and a sustainable future. As a result, they emphasize the potential risk of greenwashing and the need to address scope insensitivity in sustainable investing. Furthermore, they advocate for adopting cleaner technologies and market-based environmental policies. To drive green finance initiatives and promote sustainable investments, the findings have practical implications for investors, asset managers, and policymakers.

3.5.1 Insights for responsible investing and the ESG-efficient frontier

The research conducted by Pedersen et al. (2021) presents a theory that establishes a connection between the ESG scores of stocks and their ability to provide insights into firm fundamentals and influence investor preferences. Integrating ESG factors into the portfolio construction process makes it possible to enhance risk-adjusted returns and gain a framework for assessing the costs and benefits of responsible investing through the ESG-efficient frontier. This valuable tool enables investors to optimize their portfolios to attain financial and environmental objectives. Given the increasing significance of green finance, which aims to foster environmentally sustainable economic growth, the ESG-efficient frontier holds excellent relevance. However, it is worth noting that the study primarily concentrates on the financial aspects of ESG investing, potentially overlooking its broader social and environmental impacts. Nevertheless, the ESG-efficient frontier remains invaluable for investors and researchers delving into responsible investing.

3.5.2 The impact of sustainable investing on asset prices and corporate behavior

The study by Pástor et al. (2021) examines the impact of sustainable investing on asset prices and corporate behavior through an equilibrium model that considers financial objectives and ESG criteria. The study shows that green assets have lower expected returns but can outperform brown assets when positive shocks hit the ESG factor, indicating that investors may need to adopt a longer-term perspective and be willing to accept lower returns in exchange for a positive social impact. The study also demonstrates that sustainable investing can lead firms to become greener and induce more real investment by green firms and less by brown firms, thus highlighting the positive social impact of sustainable investing. The study's findings are highly relevant to green finance, as they indicate a demand for green finance products and services that cater to investors with strong ESG preferences. In addition, the study highlights the challenges associated with sustainable investing, such as adopting a longer-term perspective and balancing financial returns with social impact. Overall, the study provides valuable insights into the potential benefits and challenges associated with sustainable investing and its impact on the financial industry, corporate behavior, and the environment, thereby emphasizing the importance of considering ESG criteria in investment decisions.

3.5.3 The impact of CSR performance on market quality

Clancey-Shang and Fu (2022) investigate how the market quality diverges between high-ESG and low-ESG firms in the stock market in response to the Russia-Ukraine conflict. Using an event-study approach, the study finds that better CSR performance alleviates the market quality deterioration associated with the outbreak of the conflict for US-listed foreign firms. Such an effect is insignificant for domestic U.S. firms. The study also finds that foreign firms experience more severe market quality deterioration than their U.S. counterparts. The findings support the theories and observations that better CSR performance leads to improved market turmoil and helps alleviate the decline of the information environment at times of great political uncertainty. The study contributes to understanding the association between CSR and market quality, particularly during significant geopolitical events.

This study supports the idea that companies with strong ESG practices and disclosure may be more attractive to investors seeking to invest in sustainable and environmentally friendly companies. This is particularly relevant given the increasing interest in green finance and sustainable investing, whereby investors increasingly seek to invest in companies that prioritize environmental and social responsibility. Companies prioritizing ESG practices and disclosure may benefit from increased investor demand and improved stock market performance.

3.5.4 Externalities of financial constraints

The study by Xu and Kim (2022) examines the impact of financial constraints on corporate environmental policies and finds that firms facing such conditions tend to increase their toxic emissions due to weighing the costs of abatement against potential legal liabilities. The study highlights the negative externalities of financial constraints, such as environmental pollution and public health costs, and recommends implementing non-random auditing policies to incentivize firms to adopt environmentally sustainable practices. This study is relevant to green finance, which aims to promote sustainable development by providing incentives for environmentally sustainable practices, even in the face of financial constraints. However, the study's limitations include potential data representativeness issues and a need to consider probable innovations in environmentally sustainable practices.

3.5.5 Banks' influence on corporate ESG policies

The study by Houston and Shan (2022) explores the connection between banking relationships and corporate ESG policies. The study reveals that banks are crucial in promoting ESG policies among their borrowers. According to the study, those who borrow from banks with better ESG profiles are more likely to improve their ESG performance over time. Furthermore, banks' influence is concentrated on environmental and social issues that focus the spotlight on lenders, leading to severe reputational and financial consequences. These findings have significant implications for green finance, indicating that banks' ESG policies may influence lending decisions toward companies with similar ESG profiles. This research highlights the role of banks in promoting sustainable finance practices. Companies prioritizing ESG considerations may have a competitive advantage in accessing green finance from banks.

3.5.6 ESG preferences and stock performance

The study by Bansal et al. (2022) focuses on socially responsible investing (SRI) stocks and their performance during different economic periods. The researchers find that high-rated SRI stocks outperform low-rated ones during favorable economic conditions and underperform during unfavorable conditions, indicating that investor demand for SRI is wealth dependent. This study's findings provide insights into how investors' ESG preferences can impact the market, leading to variations in abnormal returns. This information may be relevant to investors who prioritize ESG factors in their investment choices and help to guide their decisions.

Socially responsible investing (SRI) is one aspect of sustainable investing that considers environmental, social, and governance (ESG) factors in investment decision-making. Investors who prioritize ESG factors in their investment choices may be interested in the findings of this article as it provides insights into the performance of SRI stocks during different economic times. Additionally, the report suggests that demand-driven preference shifts toward SRI may be a factor in the variation of abnormal returns, indicating that investors' ESG preferences can influence the market. Therefore, understanding the market demand for sustainable investments helps to guide investors’ decisions and impacts the flow of capital toward more sustainable investments.

3.5.7 Constructing climate change hedge portfolios

Engle et al. (2020) introduce a novel approach to constructing climate change hedge portfolios using the textual analysis of newspapers to extract climate news innovations and third-party ESG scores to model climate risk exposures. This methodology could help investors manage climate risk in their portfolios and invest in companies better prepared to address climate change. The study suggests that more and better-quality data improve the methodology and encourage exploration by adding more assets to hedge portfolios. The study also highlights the importance of developing alternative definitions of climate change risks to better manage diverse types of climate risks. This methodology provides valuable insights for investors seeking to manage climate risk exposure in their portfolios. It highlights the potential of textual analysis and ESG scores to build effective climate change hedge portfolios in green finance.

3.6 Climate change and risk management

The papers discussed in this section shed light on the critical intersection of climate change and risk management, emphasizing the implications of environmental risks for financial decision-making. These articles cover diverse topics, including the importance of green finance, climate risk disclosure for institutional investors, and the relationship between abnormal temperatures, climate change awareness, investor behavior, and economic activity. The findings underscore the need for environmentally conscious investing and effective communication strategies to increase public awareness and support for climate policies. Evaluating climate risk and political uncertainty is crucial when making investment decisions, particularly for fossil fuel companies facing financial troubles due to stranded assets. These studies provide valuable insights into the role of finance in addressing climate change and promoting sustainable economic growth, underscoring the urgency of mitigating environmental risks.

3.6.1 The impact of abnormal local temperatures on climate change and markets

The study by Choi et al. (2020) explores the links between abnormal local temperatures, climate change awareness, investor behavior, and economic activity. Analyzing data from seventy-four cities, the study finds that people's attention to climate change increases during abnormally warm months, mainly when the temperature is in the city's top quintile. Furthermore, investors revise their beliefs about global warming during hot months, with stocks with lower climate sensitivities outperforming those with higher climate sensitivities. The study suggests that abnormal local temperatures serve as “wake-up calls” for investors to focus on climate change risks. Public awareness and education on climate risk are essential to increase the efficacy of climate policies and campaigns. The study's findings have implications for investors and policymakers, as the study suggests a shift towards more environmentally conscious investing and highlights the importance of effective communication strategies to increase public awareness and support for climate policies.

3.6.2 The impact of green finance on low-carbon energy, sustainable development

Ionescu (2021) presents a well-executed empirical study that evaluates the impact of green finance on low-carbon energy, sustainable economic development, and climate change mitigation during the COVID-19 pandemic. The study uses data from reputable sources such as NGFS and the UN and analyzes the transition to a low-carbon sustainable economy through various analyses and estimates.

The study presents a valuable statistical data analysis, including descriptive statistics compiled from the completed surveys. However, more information on the limitations and areas for improvement in future research could be provided to improve the study. Additionally, the study would benefit from a more detailed explanation of the weighting variables used in the data to aid readers' understanding.

Explaining the research model and methods used to analyze and estimate the data in greater detail would also enhance the study’s transparency and replicability. Also, the study should detail how the findings may affect policy and practice. Readers can apply the results in real-world scenarios to mitigate climate change and promote sustainable economic development. Lastly, the study highlights future opportunities for green finance, but it can be improved by providing stakeholders with recommendations on taking advantage of them.

Ionescu’s study provides a valuable empirical analysis of the impact of green finance on low-carbon energy, sustainable economic development, and climate change mitigation during the COVID-19 pandemic. The study uses data from reputable sources and provides a statistical analysis; however, it could be enhanced by providing more excellent details concerning the research model and methods, implications and limitations of the findings, and the weighting variables used on the data.

3.6.3 Impact of climate risk beliefs

Bakkensen and Barrage (2022) highlight the impact of climate risk beliefs on coastal housing markets and the implications for green finance. The study reveals a significant prevalence of flood risk misperceptions among coastal residents, which leads to overvalued coastal housing prices. The paper suggests that accurate and transparent information about climate risks is critical for efficiently pricing coastal assets, and green finance can support such information disclosure and improve market efficiency.

Furthermore, the study underscores the need for policies incentivizing climate risk mitigation and adaptation. Green finance supports these policies by financing low-carbon and resilient infrastructure projects and developing innovative financial instruments promoting climate resilience. Overall, the paper highlights the complex interplay between climate risk beliefs, market dynamics, and policy outcomes and emphasizes the role of green finance in addressing these challenges.

3.6.4 Navigating environmental and economic sustainability through green transformation risks and fostering finance

Green finance, the strategic integration of environmental considerations into financial decisions, is a pivotal instrument for advancing sustainability (Wang et al. 2022). This critical shift entails embracing transformation risks, encompassing uncertainties linked to policy shifts, technological disruptions, market dynamics, and regulatory adjustments (Wang et al. 2022) (Chenet et al. 2021). By harmonizing green finance with supportive policies, the potency of sustainable initiatives can be significantly elevated (Chen et al. 2023). The research underscores the imperative for financial markets to duly account for climate transition risks and opportunities (Chenet et al. 2021). Addressing transformation risks through coordinated policy frameworks emerges as a paramount strategy for fostering triumphant, enduring environmental and economic metamorphosis (Chen et al. 2023) (Xiong et al. 2023).

Schumacher et al.'s (2020) article delves into the role of sustainable finance and investment in Japan, particularly its potential to mitigate escalating climate risks. The study analyzes the symbiotic relationship between sustainable finance and climate risk mitigation, spotlighting asset pricing dynamics within sustainable equity portfolios and their ramifications for the financial sector. Although the article refrains from providing an explicit outline of transformation risks, it systematically assesses the opportunities and obstacles to sustainable investments within Japan's financial landscape amid climate risks. This exploration underscores the invaluable contribution of sustainable finance to curtailing climate risks and nurturing a more resilient financial framework.

Within the article, various climate-related risks—from physical to transitional—emanate within sustainable finance and the journey toward a zero-carbon economic trajectory. These risks encompass disclosures concerning climate-related risks, exposure to physical climate hazards, and climate-related transitional risks stemming from regulatory reactions, technological advancements, and evolving societal dynamics. Transitional risks arising during the transition to low-carbon economies can lead to stranded assets, affecting sectors such as coal power, manufacturing, and agriculture. Additionally, the Japanese economy faces risks from imported transitional effects due to its reliance on foreign commodities. Legal and fiduciary obligations tied to climate risks are prominently highlighted, with boards compelled to factor in these risks. The Japanese financial sector, owing to its holdings, is subject to policy, legal, technological, market, and reputational risks. This extensive array of risks underscores the complexities and deliberations in aligning financial systems with sustainability objectives.

3.7 Renewable energy and sustainable economic growth

The papers under discussion in this section highlight the critical role of green finance in fostering sustainable economic growth and addressing climate change. Specifically, they emphasize how large investors, such as the Big Three asset managers, can leverage their influence to encourage portfolio companies to reduce carbon emissions, thereby highlighting the potential of aligning financial incentives with sustainable outcomes. Furthermore, the paper stresses the need for active monitoring and engagement with portfolio companies on environmental issues to ensure the success of green financing initiatives.

While recognizing Green Finance's opportunities, the paper also highlights its implementation challenges. There is a need for more comprehensive and comparable data on green financing activities across different regions and industries. We gain valuable insights into how green finance can contribute to sustainable economic development and climate mitigation. The public and private sectors can benefit from research and efforts to promote green finance.

3.7.1 The influence of large investors on carbon emissions

The article by Azar et al. (2021) contributes to the historical development of green finance by showing how large investors such as the Big Three can influence portfolio companies to reduce their carbon emissions, which is crucial for sustainable economic growth. Green finance emphasizes the importance of monitoring portfolio companies' environmental performance and engaging with them. This study proves that green finance can mitigate climate change and facilitate sustainable economic growth.

The study by Azar et al. (2021) shows that the Big Three's engagement efforts with individual firms are related to CO2 emissions, and they focus on large firms in which they hold a significant stake. Low carbon emissions are also associated with higher ownership among the Big Three. To achieve sustainable economic growth, large investment institutions such as the Big Three can significantly impact firms' efforts to reduce carbon emissions. The study highlights the potential financial incentives for the Big Three to engage with firms on environmental issues, including the belief that reducing CO2 emissions enhances the value of their portfolios, attracting or retaining investment clients who care about the environment, and climate risk implications for portfolio firms.

The study's authors warn that their data do not prove that corporate CO2 emissions are directly affected by the Big Three. It will take more research to establish a causal connection. Additionally, the researchers point out that the Big Three are not necessarily monitoring society at the optimal level. However, the analysis shows that green financing can help enhance long-term economic growth and slow global warming.

3.7.2 Advancing green finance, sustainability, and carbon emission risk for economic growth

Green finance is crucial in promoting sustainable economic growth and mitigating climate change, and renewable energy, CO2 emissions, and research and development are essential factors in advancing green financing efforts. However, green finance research also has limitations and areas for improvement.

In terms of the theoretical framework, more research is needed to understand the mechanisms through which financial incentives can be aligned with sustainability outcomes. Green finance in different regions and industries also requires more comprehensive and comparable data on green financing activities across other countries and sectors. Finally, in terms of green finance and sustainability, there is a need for more research on the social impact of green financing and the potential trade-offs and unintended consequences of green financing initiatives.

Bolton and Kacperczyk (2021) provide crucial evidence to investors already demanding compensation for exposure to carbon emission risk. The findings might not apply to businesses in other nations, and the link between carbon emissions and stock returns is only sometimes causative. Additionally, not all investors may be accounting for carbon risk, underscoring the significance of enlightening investors about the hazards of climate change, and urging them to consider the long-term risks associated with carbon-intensive equities. The report emphasizes the value of ongoing analysis and initiatives to advance sustainability and green finance.

3.7.3 Green finance, geopolitical risk, and chinese investments in renewable energy

Li et al. (2022) explain how geopolitical risk, volatility, and green finance affect Chinese investments in renewable energy sources. To grasp the essence of the geopolitical risk concept, this review turns to Caldara and Iacoviello's work in 2022. They define geopolitical risk as the interplay of threats, realizations, and escalations of adverse geopolitical events. This term encompasses conflicts, terrorism, and tensions among states and political actors, affecting the stability of global relations. Caldara and Iacoviello's insights underpin the construction of an index that quantifies these risks by analyzing news articles. The Geopolitical Risk (GPR) index quantifies the prevalence of articles discussing adverse geopolitical events and threats every month. Guided by the definition of geopolitical risk and insights from geopolitical literature, this curated vocabulary captures various dimensions. This index is a valuable tool for researchers to dissect and analyze the nuanced components of geopolitical risk, offering insights into different facets and allowing for detailed exploration at monthly and daily frequencies.

Li et al.'s study showcases, environmental financing (in the form of ecological bonds) and green laws like environmental taxes have a significant and beneficial impact on encouraging investment in renewable energy sources in China. The report emphasizes the need to support green businesses in China to stimulate long-term investment in renewable energy sources. The study also demonstrates that green rules mitigate the link between green funding and investments in renewable energy. The study uses a variety of benchmarks to analyze micro- and macro-level data thoroughly and uses regression estimation techniques.

However, the study's generalizability is constrained because it exclusively focuses on China, and the findings might only apply to some nations or locations. The analysis only analyzes the brief period from 2015 to 2020, which may not reflect long-term trends and changes in the link between green finance, volatility, geopolitical risk, and investments in renewable energy sources. The research may only have considered pertinent variables that might affect investments in renewable energy sources, such as technological advances, the state of the economy, and changes in legislation.

The authors could consider extending the research period to capture long-term trends and changes in the association between volatility, geopolitical risk, and investments in renewable energy sources to enhance the analysis. The authors may broaden the study's scope to incorporate more nations or areas to make the results more universally applicable. Finally, to address potential biases and enhance the accuracy of the findings, the authors may consider using various data sources and methodologies.

3.8 Oil price, trade and green finance

This section explores two studies that provide valuable insights into the relationship between green finance and critical economic factors. These studies contribute to understanding the interplay between oil price fluctuations, labor investment, trade openness, green finance, and natural resource utilization. They underscore the importance of considering environmental factors and the need for comprehensive analysis and contextual information in examining these relationships. The findings highlight the potential of green finance in promoting sustainable investment practices and improving natural resource utilization while also calling for further research and the integration of green finance and trade openness to enhance sustainability.

3.8.1 Oil price fluctuations and labor investment

Liu et al. (2022) examine the impact of the 2014–2015 oil price decline on Chinese firms' labor investments. They find that firms in industries with significant negative oil price risk exposure increased their employment levels by 16.4% after the oil price plummeted. Oil price fluctuations are essential for the Chinese government and its enterprises when making economic decisions related to the labor force. This study illustrates the need to consider the impact of oil prices on firms' labor investments when making investment decisions, which could be relevant to green finance. As well as promoting sustainable investment, green finance can facilitate the transition to a low-carbon economy by incorporating environmental factors such as oil prices.

3.8.2 Trade openness and natural resource utilization

The study by Wu (2022) provides valuable insights into the relationship between trade openness, green finance, and natural resource utilization in China. The vector autoregression (VAR) model analyzes data from 1981 to 2020. The findings reveal that natural resource use significantly impacts trade openness and green financing, and coal and oil consumption demonstrate particularly negative influences on green finance. Furthermore, the study suggests that gas consumption may promote sustainable trade. However, the study could benefit from providing more contextual information about the nation being analyzed and considering other factors that may influence trade openness and green financing.

Moreover, the study's generalizability could be enhanced by extending the analysis to other nations or regions to establish the universal relationship between trade openness and green financing. Furthermore, while the study suggests that green finance does not significantly impact natural resource use, it recommends that green funding be made more practical if it aligns more closely with trade openness. The study could elaborate further on how green finance and trade openness can be better integrated to improve natural resource utilization and sustainability.

It provides valuable insight into the relationship between Chinese trade openness, green financing, and natural resource utilization. A more detailed context and consideration of other factors that may affect this relationship would enhance the generalizability of the study. Extending it to other nations or regions would increase its generalizability.

4 Future directions in green finance

4.1 Recommendations for expanding the scope based on literature review

We propose recommendations for expanding the research scope and exploring critical areas of investigation in this research review to enhance our understanding of green finance and its role in addressing climate change and decarbonization.

-

Research emerging markets' efforts and challenges in promoting green finance, identifying strategies to attract sustainable investments, and supporting climate-related projects.

-

Research innovative green financial instruments, evaluating their effectiveness in mobilizing capital for sustainable projects and promoting environmental sustainability.

-

Analyze how technology, including fintech and blockchain, can enhance transparency, efficiency, and accessibility in sustainable investments by advancing green finance.

-

Analyze the role of institutional investors in driving green finance initiatives, including their allocation strategies and ESG integrations.

-

Discover how green finance initiatives contribute to sustainable development and social inclusion, ensuring benefits reach marginalized communities.

-

Assess how green finance investments enhance resilience to climate change impacts through climate adaptation and mitigation projects.

-

Evaluating long-term financial returns, job creation, and economic growth of green finance initiatives.

-

Identify and overcome barriers to green finance adoption, proposing strategies for overcoming obstacles and accelerating sustainable financial adoption.

-

Compare Green Finance Initiatives Globally: Conduct a comparative analysis of green finance initiatives in different countries, sharing best practices and success factors to foster cross-border collaboration.

-

Research on the role of NGOs and civil society in green finance advocacy and environmental sustainability.

4.2 Exploring future imperatives

Informed by current research and its inherent gaps, this exploration delves into the terrain of future imperatives.as the blow suggestion:

-

Fostering Responsible Digital Transformation: As the financial sector embraces technological advancements like fintech and blockchain, there exists a pressing necessity to ensure that these innovations harmonize with the principles of green finance. Considering current research trends, an avenue of exploration lies in investigating how digital solutions can magnify the transparency and efficiency intrinsic to sustainable investments. Simultaneously, it is imperative to avert inadvertent environmental repercussions, notably excessive energy consumption and the proliferation of electronic waste.

-

Propelling Green Finance in Developing Economies: While nowadays, research in the green finance narrative briefly seems to pay attention to emerging markets, a more in-depth exploration within the precincts of the ongoing research process is indispensable. Unraveling the intricacies of economies' specific challenges while implementing green finance initiatives becomes paramount. These regions' distinctive socio-economic frameworks, intricate regulatory mazes, and labyrinthine financial architectures necessitate bespoke strategies that entice sustainable investments and support climate-oriented endeavors.

-

Weaving the Circular Economy Paradigm: Green finance stands poised as a pivotal force in shepherding the transition from a linear economic model to the regenerative circular paradigm. Embedded within the ongoing research process is the exploration of how financial tools and incentives can serve as catalysts for adopting circular economy practices—ranging from recycling to reutilization and waste minimization. This trajectory of inquiry unveils a novel avenue of exploration.

-

Ensuring the Endurance of Green Financial Instruments: While recent studies briefly acknowledge innovative green financial instruments, an ongoing research process could venture deeper into the terrain of their long-term viability. The focus here lies in deciphering how these instruments can dynamically adapt to the shifting currents of market conditions, technological advancements, and evolving environmental priorities—all while effectively upholding the mantle of sustainability.

-

Confluence of Biodiversity Preservation and Financial Dynamics: While the studies in this review focus primarily on carbon neutrality and climate dynamics, an intriguing domain to probe within the ongoing research process lies at the crossroads of green finance and biodiversity conservation. There lies an untapped potential to scrutinize how financial mechanisms can emerge as drivers that incentivize endeavors to safeguard and restore ecosystems, thereby safeguarding biodiversity and propagating sustainability.

-

Advancing Climate Equity through Green Finance: Imprinting the seal of priority upon marginalized and vulnerable communities within the ambit of green finance initiatives underscores its essence. The perspectives of current research in the green finance scope research process must pivot toward elucidating how the architecture of climate justice can be seamlessly integrated into the fabric of green finance projects, ensuring the just and equitable distribution of benefits.

-

Catalyzing Behavioral Change via Financial Education: The propagation of green finance necessitates a paradigm shift in individual and institutional behaviors. Today research in sustainability and green finance can delve into the efficacy of financial education programs in disseminating awareness about green finance, sculpting decision-making paradigms, and nurturing a cultural ethos steeped in sustainability.

-

Unveiling Ethical Considerations in Impact Investment: The potential ethical conundrums that linger within the domain of impact investing warrant comprehensive exploration. As part of the ongoing research process, delving into the ethical dilemmas that unfurl when investors accord primacy to non-financial gains presents an opportunity to navigate the delicate equilibrium between social and financial returns, all while upholding the tenets of ethical integrity.

4.3 Recommendations for expanding the scope based on keywords analysis

Based on the analysis of the keywords presented in Fig. 4, it is evident that various avenues for future research exist in this domain. Based on the keyword analysis of the paper, the following recommendations can be made:

-

The government, financial institutions, and businesses should prioritize funding for environmentally friendly projects to combat climate change and achieve carbon neutrality.

-

Establish robust regulatory frameworks that facilitate green finance and integrate carbon–neutral practices. Clear and supportive policies will foster the growth of sustainable finance.

-

Encourage the diversification of funding sources for climate-related projects, including the Green Climate Fund, to mitigate risks associated with conventional finance and attract more investments.

-

The fourth action is to conduct further research to understand better the effectiveness of green financing and its impact on decarbonization. This will help make better decisions and foster innovation in the field.

-

The emphasis must be placed on social equity and transparency in green finance initiatives. We should consider social preferences and the public's involvement when shaping financial practices.

-

Investing decisions should consider Environmental, Social, and Governance (ESG) factors to bolster risk-adjusted returns and promote responsible investing.

-

Financial institutions and industries can anticipate and mitigate potential losses related to environmental factors by evaluating and communicating climate risks and political uncertainties.

-

Aim to encourage impact investing, where investors accept lower financial returns for non-financial benefits. Institutional ownership can influence companies to improve their environmental and social performance.

-

Promote investments in renewable energy sources to achieve sustainable economic growth. Renewable energy projects contribute to reducing carbon emissions and advancing sustainability.

-

Policymakers and investors need to recognize the impact of geopolitics on green finance and sustainable development. Global cooperation and trade openness are essential for addressing sustainability challenges.

-

For sustainability projects to succeed, stakeholders, including financial institutions, governments, and the public, should work together to support green finance initiatives.

-

Make sure that comprehensive and comparable data are available on green financing activities. Access to accurate data will enable policy formulation and decision-making.

Our understanding of green finance and its role in promoting sustainable development can be advanced by implementing these recommendations and broadening the scope of research.

5 Conclusion

This comprehensive review indicates that green finance is crucial to advancing sustainable development and combating environmental issues. The examined literature underscores the importance of substantial investments in sustainable and low-carbon initiatives and the need for robust regulatory frameworks to facilitate green financial availability and the integration of carbon–neutral practices.

The reviewed studies highlight the positive impact of green financing on decarbonization efforts and call for further research to enhance our understanding of its effectiveness. The literature also explores the intersection of climate change and risk management, the impact of investor preferences on sustainable investments, and the significance of environmental, social, and governance (ESG) criteria in investment decisions. Green finance promotion involves a variety of suggestions. Enhancing the regulatory framework for green finance through incentives, regulations, and knowledge sharing is essential. It is possible to improve climate finance strategies by analyzing the benefits of carbon–neutral practices in green finance and evaluating institutions like the Green Climate Fund. In addition, it is essential to examine the impact of green financing on decarbonization efforts in various countries and the impact of sustainable spending on investment decisions.