Abstract

This paper put’s forward a working conceptualisation for how the size of firms which die influences firm interrelationships where firm deaths influence future firm births. Two conceptual arguments are developed to explain the role of firm size in influencing future firm births; the resource argument and the consumer demand argument. This relationship is also empirically tested using a multilevel model to examine the relationship between the death of differently-sized firms and future firm births in European NUTS 3 regions. Findings suggest that only the deaths of larger firms appears to increase future firm births. The resource-based argument is used to explain this finding whereas the consumer demand-based argument is used to explain why the death of smaller firms seems to reduce future firm births. The dataset used in this paper’s estimation captures a large amount of activity across 14 countries and 502 NUTS 3 regions from 2008 to 2019.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper contributes towards the firm interrelationship literature which examines how firm births/deaths influence future firm births/deaths (Johnson and Parker 1994). Specifically, this paper looks at instances where firm deaths influence future firm births. There are two conceptual underpinnings to this type of firm interrelationship; the multiplier and competition effect (Dejardin 2004). The multiplier effect occurs if firm deaths reduce future firm births while the competition effect occurs if firm deaths increase future firm births (Nyström 2007). Currently, the firm interrelationship literature has two gaps in it—one theoretical, one empirical. The first gap is the lack of a working conceptualisation for the role which firm size plays in influencing multiplier and competition effects (O'Leary et al. 2023a). The second gap, outlined by Audretsch et al. (2019), is due to a dichotomy in entrepreneurial research where studies either analyse the national or regional determinants of entrepreneurship, but not both. Currently, no empirical firm interrelationship studies control for both national and regional factors. This paper fills both of these gaps.

Firm interrelationship research should be aware of the influence which firm size plays in influencing competition and multiplier effects. Conceptually, the competition effect whereby firm deaths can increase future firm births is dependent on the resources and employees a firm has when it dies (O'Leary et al. 2023b). This is because when a firm dies, its resources and employees get released back into the economy where they can be seized upon by future alert entrepreneurs (Adomako et al. 2018). Logically, the number of resources and employees a firm has depends on its size. This paper looks to examine how the death of differently-sized firms affects future firm births and also provides a working conceptualisation which demonstrates why firm size influences multiplier and competition effects. Additionally, the empirical contribution this paper provides is important because both regional and national factors are well-established determinants of firm births (Audretsch et al. 2012; North 1990).

This paper uses a uniquely assembled Eurostat dataset which captures a large amount of activity across 14 countries and 502 NUTS 3 regions from 2008 to 2019. Given the nested structure of the data used, a multilevel model is opted for to analyse firm births across European regions and countries. Given the role which firm births play in determining economic growth (Doran et al. 2016, 2018), the findings of this paper can also be considered of broad interest to policy makers for European regions as well as academics concerned with firm births and firm interrelationships. The remainder of the paper will be structured as follows: Sect. 2 will provide necessary theoretical discussion for this paper, Sect. 3 will go through the data and method of estimation for the paper before Sect. 4 discusses the results, and finally Sect. 5 provides concluding remarks.

2 Literature review

Johnson and Parker (1994) explain that firm deaths can result in either reductions in future firm births via multiplier effects or increases in future firm births via competition effects. Multiplier effects can be explained by firm deaths reducing employment/consumer demand and as a result, fewer firm births occurring (O’Leary et al. 2023a). Alternatively, competition effects can be explained by firm deaths resulting in a reallocation and freeing up of resources/employees which increases firm births (Carree and Dejardin 2020). If a large firm dies more people/resources could be made unemployed and/or reallocated into the economy, thus potentially increasing the likelihood of competition effects occurring. Alternatively, more unemployed people could also lead to greater reductions in consumer demand and end up intensifying multiplier effects. Based off of the above discussion, we can identify the two opposing arguments for how firm size might influence multiplier and competition effects; the resource argument and the consumer demand argument. These will both be explored below.

2.1 The resource argument: competition effect

Below in Eq. (1) a region’s rate of firm births, \(FB_{r}\), is said to be a function of a times \( R_{r}\). Here, \(R_{r}\) represents the available resources within region r and a is a constant factor which influences the firm birth rate in region r and can be thought of as representing various economic, government, and social variables apart from available resources.

Theoretically, it should be assumed that the value of \(R_{r}\) would have a positive relationship with \(FB_{r}\) because employees and capital are essential inputs for entrepreneurship (Audretsch and Keilbach 2004). Furthermore, we can assume that \(R_{r}\) would increase if firms were to die because the industrial economics literature stipulates that firm deaths release resources back into the economy (Brown et al. 2013; Austin and Rosenbaum 1990). Once these resources become available they can then be seized upon by alert aspiring entrepreneurs (Kirzner 1999), resulting in an increase in firm births. Logically, it should be the case that the death of larger firms would increase \(R_{r}\) by more than the death of smaller firms because they should have more employees and resources. Thus, it could be assumed that the likelihood of firm deaths increasing future firm births is higher if the firms which are dying are larger firms. Accordingly, the following hypothesis is proposed.

H1: Competition effects should occur after the death of larger firms.

2.2 The consumer demand argument: multiplier effect

The multiplier effect can be considered present if firm deaths were to lead to reductions in future firm births (Dejardin 2004). Firm deaths can lead to reductions in future firm births via income effects (Gajewski and Kutan 2018). This is because firm deaths would lead to increased unemployment which would be associated with reductions in income and consumer demand. Accordingly, lower levels of consumer demand could result in lower revenues for firms which could deter future firm births (O’Leary et al. 2023b). Given that larger firms employ more individuals, it should be the case that the death of larger firms creates more unemployment than the death of smaller firms. Correspondingly, the larger levels of unemployment should result in greater reductions in consumer demand which should decrease the likelihood of firm births. Thus, it could be assumed that the likelihood of firm deaths reducing future firm births is higher if the firms which are dying are larger firms. Accordingly, the following hypothesis is proposed.

H2: Multiplier effects should occur after the death of smaller firms.

2.3 Other determinants of firm births

The rate of firm births within a region is not just determined by firm interrelationships. Economic activity and demographic factors like population are considered key inputs of business creation (O’Leary et al. 2023c; Nica 2021). This is because economic and demographic activity can indicate the level of demand and labour which are available for firms. Additionally, national-level factors like institutional/government policies can also play a role in determining entrepreneurship (North 1990). More specifically, government policies relating to taxation can play a big role in determining business creation because greater levels of tax on profits can represent a barrier to entry and a higher cost of doing business for firms (Da Rin et al. 2011). Similarly, greater rates of government spending on unemployment benefits can negatively affect business creation because it may reduce the cost associated with unemployment and remove the push-factor motivation which pushes unemployed individuals to pursue entrepreneurship (Hean and Chairassamee 2023; O’Leary 2022). Finally, national efforts to attract foreign direct investment can help increase rates of business creation through positive employment effects increasing aggregate demand which functions as a pull-factor motivation for entrepreneurs (Carree and Dejardin 2020).

3 Data and methods

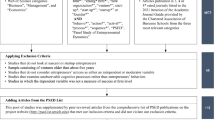

The regional data used for this paper is taken from Eurostat and pertains to 14 European countries and 502 NUTS3 regions from 2008 to 2019 and has 1197 valid observations post-estimation. The 14 countries included in the estimation are Austria, Bulgaria, Croatia, Denmark, Estonia, Finland, France, Hungary, Italy, Lithuania, Netherlands, Portugal, Romania, and Spain. Summary statistics for the raw data in the model can be seen below in Table 1. Regional variables include firm death variables and control variables to account for regional GDP and population. As is done by O'Leary et al. (2023a) and Doran et al. (2018), natural logs of the GDP, population, and unemployment spending variable are used in the estimation to reduce the variation which exists between this variable among other countries. Additionally, the dataset has national-level control variables taken from the World Bank online database which account for unemployment benefit spending per inhabitant, taxation on profit, and the percentage of GDP which is derived from foreign direct investment. Summary statistics on these variables are also presented in Table 1. Regional variables were downloaded from Eurostat individually and then merged into one master dataset where after the World Bank national-level control variables were merged in as well.

The data used for this paper pertains to NUTS 3 regions nested within European countries. Therefore, a multilevel method of estimation is opted for to include more than one level of dependence and include random slopes and intercepts for country and region (Moffatt 2020). Similar to O’Leary et al. (2023a) where firm births is related to explanatory variables at the country and regional level. See Eqs. (2) through (5) for empirical notation.

where \(FB\) is the firm birth rate in region r and year t. \(FD\), \(FD0\), \(FD1/9\), and \(FD10UP\) are the death rates for total firms, firms with zero employees, firms with one to nine employees, and firms with ten or more employees respectively in region r, and year t-1. These variables are the key variables in the analysis as their sign will indicate the role which firm size plays in influencing multiplier and competition effects. All firm death variables are lagged by 1 year to capture the intertemporal effect between firm deaths and future firm births. Following from other firm interrelationship studies like O’Leary et al. (2023b), Arcuri et al. (2019), and Calá et al. (2016), a 1-year lag length is opted for so as to maximise the number of regions, countries, observations, and periods of change available in which to assess how firm deaths in year t-1 can affect firm births in year t. \(\varepsilon \) is the error term and \(X_{rct} \) represents a matrix of fixed control variables for region r and country c in year t. The \(\lambda_{t}\) variable above represents time fixed effects which are included in each of the models for estimation. \(\mu_{c}\) and \(\mu_{r}\) are the random intercepts included in the models for country and region.

4 Results

The results for the estimation for the models represented in Eqs. (2), (3), (4), and (5) are presented below in Table 2. As is noted below Table 2 each model is statistically significant and the correlation matrix presented in Appendix 2 shows no sign or indication of multicollinearity issues given no variable has a correlation score of 0.80 or above with another variable in the model (Gujarati 2014). Robust standard errors are used to mitigate against potential issues of heteroscedasticity as is done by (Crowley and Doran 2019).

The results of the estimation find that increases in the total and the zero employee firm death rates all decrease the future firm birth rate. Meaning multiplier effects are observed whereby firm deaths decrease future firm births. This could be explained by the deaths of these firms reducing employment, income, and consumer demand which could reduce the number of firms which are set up given lower levels of demand (O’Leary et al. 2023b). The results from the model relating to Eq. 3 (the zero employee firm death rate) provides support for hypothesis 2 (H2: Multiplier effects should occur after the death of smaller firms). Alternatively, the deaths of these firms may also induce signalling effects whereby business closures communicate the difficulty associated with operating a business which in turn reduces firm births (Dejardin 2004). Interestingly, increases in the ten or more employee firm death rate appear to increase future firm births. Meaning competition effects are observed after the death of larger firms. This provides support for hypothesis 1 (H1: Competition effects should occur after the death of larger firms.) which could be explained by the resource argument laid out in sub-Sect. 2.1 above. Additionally, there is evidence found to suggest unemployment benefit spending can decrease future firm births.

5 Conclusion

This paper uses a multilevel estimation to examine the role which firm size plays in influencing firm interrelationships. Specifically, it examines how the death of differently-sized firms impacts future firm birth rates. Results indicate that only the death of firms with ten or more employees produces competition effects (increases in future firm births); whereas the death of smaller firms produces multiplier effects (increase in future firm deaths). Two conceptual arguments are developed and laid out to explain why the death of differently-sized firms may have differing impacts on future firm births. These are the resource argument and the consumer demand argument. Additionally, national factors appear to influence regional firm birth rates. For example, spending on unemployment benefits appears to decrease future rates of regional firm births.

Despite making two significant contributions to the firm interrelationship literature, this paper is not without its own limitations. As such, recommendations for future research will now be discussed. Firstly, the specific type of firm interrelationship which is examined in this paper is where firm deaths can influence future firm births. However, the literature on firm interrelationships also provides theoretical reasons and empirical evidence to show that firm deaths can also influence future firm deaths (Arcuri et al. 2019; Johnson and Parker 1994). Future research could look to examine how the death of differently-sized firms influences future firm death rates, but may have to adopt a methodology which could account for potential issues of simultaneity endogeneity which could arise from using explanatory variables which are highly correlated with the dependent variable (Abdallah et al. 2015). Secondly, future research could look to expand the category of firm size in relation to the firm death variables. This paper only looks at the death of firms which have 0 employees, 1–9 employees, and 10 or more employees. This means that the analysis can isolate the effect of zero-employee firms and micro-sized firms (less than ten employees), but small (10–49 employees), medium (50–249 employees) and large firms (250+ employees) are all grouped together as one. There would be value in identifying if it is the death of small, medium, or large firms which increase future firm births.

References

Abdallah, W., Goergen, M., O’Sullivan, N.: Endogeneity: how failure to correct for it can cause wrong inferences and some remedies. Br. J. Manag. 26, 791–804 (2015). https://doi.org/10.1111/1467-8551.12113

Adomako, S., Danso, A., Boso, N., Narteh, B.: Entrepreneurial alertness and new venture performance: facilitating roles of networking capability. Int. Small Bus. J. 36, 453–472 (2018). https://doi.org/10.1177/0266242617747667

Arcuri, G., Brunetto, M., Levratto, N.: Spatial patterns and determinants of firm exit: an empirical analysis on France. Ann. Reg. Sci. 62, 99–118 (2019). https://doi.org/10.1007/s00168-018-0887-0

Audretsch, D.B., Keilbach, M.: Does entrepreneurship capital matter? Entrep. Theory Pract. 28, 419–430 (2004). https://doi.org/10.1111/j.1540-6520.2004.00055.x

Audretsch, D.B., Falck, O., Feldman, M.P., Heblich, S.: Local entrepreneurship in context. Reg. Stud. 46, 379–389 (2012). https://doi.org/10.1080/00343404.2010.490209

Audretsch, D.B., Belitski, M., Desai, S.: National business regulations and city entrepreneurship in Europe: a multilevel nested analysis. Entrep. Theory Pract. 43, 1148–1165 (2019). https://doi.org/10.1177/1042258718774916

Austin, J.S., Rosenbaum, D.I.: The determinants of entry and exit rates into US manufacturing industries. Rev. Ind. Organ. 5, 211–223 (1990). https://doi.org/10.1007/BF02229762

Bartlett, M.: Some evolutionary stochastic processes. J. Royal Stat. Soc. Ser. B Methodol. 11, 211-229 (1949). https://doi.org/10.1111/j.2517-6161.1949.tb00031.x

Bollen, K.A., Kirby, J.B., Curran, P.J., Paxton, P.M. & Chen, F.: Latent variable models under misspecification: two-stage least squares (2SLS) and maximum likelihood (ML) estimators. Sociol Method Res. 36, 48–86 (2007). https://doi.org/10.1177/0049124107301947

Brown, J.P., Lambert, D.M., Florax, R.J.: The birth, death, and persistence of firms: creative destruction and the spatial distribution of US manufacturing establishments, 2000–2006. Econ. Geogr. 89, 203–226 (2013). https://doi.org/10.1111/ecge.12014

Calá, C.D., Manjón-Antolín, M., Arauzo-Carod, J.M.: Regional determinants of firm entry in a developing country. Pap. Reg. Sci. 95, 259–280 (2016). https://doi.org/10.1111/pirs.12128

Carree, M., Dejardin, M.: Firm entry and exit in local markets: ‘Market pull’ or ‘unemployment push’ effects, or both? Int. Rev. Entrep. 18, 371–386 (2020)

Crowley, F., Doran, J.: Automation and Irish towns: Who’s most at risk? CORA (2019). https://hdl.handle.net/10468/7653

Da Rin, M., Di Giacomo, M., Sembenelli, A.: Entrepreneurship, firm entry, and the taxation of corporate income: Evidence from Europe. J. Public Econ. 95, 1048–1066 (2011). https://doi.org/10.1016/j.jpubeco.2010.06.010

Dejardin, M.: Sectoral and cross-sectoral effects of retailing firm demographies. Ann. Reg. Sci. 38, 311–334 (2004). https://doi.org/10.1007/s00168-004-0197-6

Doran, J., McCarthy, N., O’Connor, M.: Entrepreneurship and employment growth across European regions. Reg. Stud. Reg. Sci. 3, 121–128 (2016). https://doi.org/10.1080/21681376.2015.1135406

Doran, J., McCarthy, N., O’Connor, M.: The role of entrepreneurship in stimulating economic growth in developed and developing countries. Cogent Econ. Financ. 6, 1442093 (2018). https://doi.org/10.1080/23322039.2018.1442093

Eurostat: Structural business statistics (sbs) - Reference Metadata in Euro SDMX Metadata Structure (ESMS) (2023). https://ec.europa.eu/eurostat/cache/metadata/en/sbs_esms.htm

Gajewski, P., Kutan, A.M.: Determinants and economic effects of new firm creation: evidence from Polish regions. East. Eur. Econ.. Eur. Econ. 56, 201–222 (2018). https://doi.org/10.1080/00128775.2018.1442226

Gujarati, D.: Econometrics by Example. Bloomsbury Publishing, London (2014)

Hean, O., Chairassamee, N.: The effects of the COVID-19 pandemic on US entrepreneurship. Lett. Spat. Resour. Sci. 16, 1 (2023). https://doi.org/10.1007/s12076-023-00327-x

Johnson, P., Parker, S.: The interrelationships between births and deaths. Small Bus. Econ. 6, 283–290 (1994). https://doi.org/10.1007/BF01108395

Kirzner, I.M.: Creativity and/or alertness: a reconsideration of the Schumpeterian entrepreneur. Rev. Austrian Econ. 11, 5–17 (1999)

Le Gallo, J., Paez, A.: Using synthetic variables in instrumental variable estimation of spatial series models. Environ. Plan. A 45, 2227–2242 (2013). https://doi.org/10.1068/a45443

Moffatt, P.: Experimetrics: econometrics for experimental economics. Bloomsbury Publishing (2020)

Nica, M.: Economic development and business creation. Econ. Chang. Restruct. 54, 219–239 (2021). https://doi.org/10.1007/s10644-020-09274-9

North, D.C.: Institutions, Institutional Change and Economic Performance. Cambridge University Press (1990)

Nyström, K.: Interdependencies in the dynamics of firm entry and exit. J. Ind. Compet. Trade 7, 113–130 (2007). https://doi.org/10.1007/s10842-006-0027-x

O’Leary, D.: Unemployment and entrepreneurship across high-, middle-and low-performing European regions. Reg. Stud. Reg. Sci. 9, 571–580 (2022). https://doi.org/10.1080/21681376.2022.2118072

O’Leary, D., Doran, J., Power, B.: A multilevel approach to firm interrelationships across European regions. Eur. Plann. Stud. (2023a). https://doi.org/10.1080/09654313.2023.2226700

O’Leary, D., Doran, J., Power, B.: The role of relatedness in firm interrelationships. J. Econ. Stud. 51, 36–58 (2023b). https://doi.org/10.1108/JES-12-2022-0631

O’Leary, D., Doran, J., Power, B.: Urbanisation, concentration and diversification as determinants of firm births and deaths. Reg. Stud. Reg. Sci. 10, 506–528 (2023c). https://doi.org/10.1080/21681376.2023.2204143

World Bank: The World Bank Data Bank (2023). https://databank.worldbank.org/home.aspx

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author would like to declare that they have no financial or non-financial interests which are directly or indirectly related to this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Variable descriptions

Variable | Definition |

|---|---|

Regional variables | |

Firm birth rate | The firm birth rate is defined as the number of new business births which occur within region r in year t over the total number of businesses within that same region from the year t-1 |

Zero employee firm death rate | This is the number of firms with zero employees which die within region r in year t over the total number of businesses within that same region from the year t-1 |

1–9 employee firm death rate | This is the number of firms with between 1 and 9 employees which die within region r in year t over the total number of businesses within that same region from the year t-1 |

10+ employee firm death rate | This is the number of firms with 10 or more employees which die within region r in year t over the total number of businesses within that same region from the year t-1 |

Log of GDP per inhabitant | The natural log of GDP per capita in NUTS 2 regions. Regional gross domestic product (million PPS) per inhabitant in NUTS 2 regions |

Log of population | The crude rate of total change is the ratio of the population change during the year (the difference between the population sizes on 1 January of two consecutive years) to the average population in that year. The value is expressed per 1000 persons |

National variables | |

Log of spending on unemployment benefits | Log of Euro per inhabitant (at constant 2010 prices) spent on unemployment benefit payments |

Total Tax contributions on profit | Amount of taxes payable by businesses after accounting for allowable deductions and exemptions as a share of commercial profits |

Foreign direct investment | Foreign direct investment as a percentage of GDP |

Appendix 2: Correlation matrix

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1 | Total Firm Death Ratet−1 | 1.00 | |||||||||||

2 | 0 Employee Firm Death Ratet−1 | 0.74 | 1.00 | ||||||||||

3 | 1–9 Employee Firm Death Ratet−1 | 0.32 | 0.21 | 1.00 | |||||||||

4 | 10 + Employee Firm Death Ratett−1 | 0.16 | 0.06 | 0.48 | 1.00 | ||||||||

5 | Log of GDP per inhabitant | 0.11 | 0.02 | − 0.06 | − 0.06 | 1.00 | |||||||

6 | Log of population | 0.11 | 0.02 | − 0.06 | − 0.06 | 1.00 | 1.00 | ||||||

7 | Log of spending on unemployment benefits | − 0.53 | − 0.28 | − 0.61 | − 0.44 | 0.04 | 0.04 | 1.00 | |||||

8 | Total tax contributions on income/profit | − 0.34 | − 0.34 | − 0.45 | − 0.48 | 0.29 | 0.29 | 0.54 | 1.00 | ||||

9 | FDI as % of GDP | 0.07 | 0.00 | 0.09 | 0.03 | 0.02 | 0.02 | − 0.13 | − 0.21 | 1.00 | |||

10 | Year | − 0.10 | − 0.22 | − 0.23 | − 0.05 | 0.00 | 0.00 | 0.03 | − 0.02 | 0.19 | 1.00 | ||

11 | Country | 0.35 | 0.41 | 0.20 | − 0.04 | 0.25 | 0.25 | − 0.29 | 0.12 | 0.17 | − 0.09 | 1.00 | |

12 | Region | 0.38 | 0.40 | 0.16 | − 0.11 | 0.17 | 0.17 | − 0.43 | 0.08 | 0.17 | 0.07 | 0.76 | 1.00 |

Appendix 3: Increased lag length multilevel estimation

Variables | (Eq. 2) | (Eq. 3) | (Eq. 4) | (Eq. 5) |

|---|---|---|---|---|

Firm birthst | Firm birthst | Firm birthst | Firm birthst | |

Total firm Death ratet−1 | − 0.0134 | |||

(0.0194) | ||||

Total firm Death ratet−2 | 0.1459*** | |||

(0.0158) | ||||

Total firm Death ratet−3 | − 0.0154 | |||

(0.0135) | ||||

0 Employee firm death ratet-1 | − 0.0651*** | |||

(0.0219) | ||||

0 Employee firm death ratet−2 | 0.0766*** | |||

(0.0169) | ||||

0 Employee firm death ratet−3 | − 0.0675*** | |||

(0.0138) | ||||

1–9 Employee firm death ratet−1 | 0.1003* | |||

(0.0532) | ||||

1–9 Employee firm death ratet−2 | 0.7022*** | |||

(0.0517) | ||||

1–9 Employee firm death ratet−3 | 0.4152*** | |||

(0.0583) | ||||

10+ Employee firm death ratett−1 | 2.5488*** | |||

(0.7935) | ||||

10+ Employee firm death ratett−2 | − 1.9017*** | |||

(0.6802) | ||||

10+ Employee firm death ratett−3 | 5.1355*** | |||

(0.6165) | ||||

Observations | 940 | 940 | 920 | 920 |

number of countries | 11 | 11 | 11 | 11 |

Appendix 4: Two stage least squares estimation

A potential issue which could hinder the inference of causality in firm interrelationship studies is simultaneity endogeneity between legged firm deaths and firm births (O’Leary et al. 2023b). The conceptual basis for firm interrelationships is that firm births can impact firm deaths and vice versa (Johnson and Parker 1994). Given this, it is possible that there is a correlation between the lagged firm death rates used as explanatory variables and the firm birth rates used as dependent variables. If this was the case, then the estimates could be rendered bias and single equation methods such as two stage least squares (2SLS) could be considered preferable to a standard linear estimation (Bollen et al. 2007). To mitigate against this O’Leary et al. (2023a; b) create synthetic instrumental variables for their lagged firm death explanatory variables using the Bartlett (1949) three group method where the variable is transformed into an ordered variable coded as − 1, 0, or 1 depending on whether it falls in the lower, middle, or upper end of the distribution for the variable. The result is an instrumental variable which is still correlated with the endogenous allowing it to remain a decent estimator, but less correlated with the dependent variable which mitigates against the issues of simultaneity endogeneity (Le Gallo and Páez 2013). This synthetic instrumental variable is then used as a key explanatory variable in a 2 stage least squares estimation.

Synthetic instrumental variables are created using the Bartlett (1949) three group method for each of the lagged firm death rate variables. Then these instrumental variable are used as a key explanatory variable in two stage least squares estimations to compare them to the results already acquired from my initial multilevel estimations. These are presented below and as can be seen, are in line with the initial results. Similarly to the initial multilevel model estimations, the results regarding the lagged total firm death rate, the zero employee firm death rate, and the one-to-nine employee firm death rate are also all negative—although it is now the zero employee firm death rate which is insignificant rather than the one-to-nine employee firm death rate. Additionally, the results of the relating to the ten plus employee firm death rate is positive—same as in the multilevel estimation.

Appendix 5: Results of Wooldridge test for serial autocorrelation

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

O’Leary, D. Firm interrelationships: the role of firm size. Lett Spat Resour Sci 17, 17 (2024). https://doi.org/10.1007/s12076-024-00380-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12076-024-00380-0