Abstract

Relying on the upper-echelons perspective, this paper investigates the effect of financial managers’ characteristics on the level of organizational ambidexterity reached in German Mittelstand firms. These firms are often depicted as highly innovative and able to compete on worldwide markets despite significant resource constraints. We theorize that skilled financial managers are very important in making the optimal use of Mittelstand firms’ scarce resources and, in particular, for balancing exploitation and exploration, thus reaching high levels of ambidexterity. Our findings from a survey of German Mittelstand firms broadly confirm our expectations and show that financial managers’ individual entrepreneurial behavior correlates positively with the firms’ level of organizational ambidexterity. In addition, we find that firms with financial managers having enjoyed business education are more likely to reach high levels of ambidexterity if these financial managers are heavily involved in strategy development. Overall, these results indicate that well-suited financial managers are an important human resource for Mittelstand firms. In addition, our findings are among the first to show that financial managers not only influence finance and accounting choices, but also innovation-related outcomes such as organizational ambidexterity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ambidexterity—defined as “exploit(ing) existing assets … in a profit-producing way and simultaneously … explor(ing) new technologies and markets” (O’Reilly and Tushman 2011, p. 5)—comes with both great opportunities and challenges for firms. One major difficulty when aiming for ambidexterity is to allocate resources properly in a way that supports both exploitation and exploration activities (Levinthal and March 1993). Pursuing activities of both types is far from trivial as “exploration and exploitation are fundamentally different logics that create tensions” and “compete for firms’ scarce resources” (He and Wong 2004, p. 482). Consequently, the more resource-restricted a firm is, the more difficult it is to allocate resources to contradictory strategies (Karhu and Ritala 2020) and hence, to achieve high levels of organizational ambidexterity (OA) (Voss and Voss 2013). However, there are firms that are highly innovative despite such resource constraints—amongst them, German Mittelstand firms. These Mittelstand firms frequently are small- or medium-sized (Berghoff 2006) and “out-‘innovate’ and outcompete” their larger competitors despite resource constraints (De Massis et al. 2018, p. 126). This approach renders many German Mittelstand firms so-called hidden champions, meaning that they are innovative worldwide market leaders in their market segments but often not well known by the public (Simon 1996).

Earlier research suggests that individual managers can play an important role in fostering exploration and exploitation simultaneously despite resource constraints (e.g., Cao et al. 2010; Sinha 2019; Strobl et al. 2020). Accordingly, the more recent ambidexterity research has increasingly focused on individual actors and their roles in reaching high levels of ambidexterity (e.g., Cao et al. 2010; Huang et al. 2021; Kiss et al. 2020; Kortmann 2015; Mammassis and Kostopoulos 2019; Li 2013; Lubatkin et al. 2006; Maine et al. 2021; Mihalache et al. 2014; Smith and Umans 2015; Uman 2013; Umans et al. 2020).Footnote 1 However, it appears that a vital type of actors has so far been mostly overlooked: financial managers (FMs). To achieve high levels of OA, a firm needs managers who are able to allocate resources in a way that fosters OA (Mueller et al. 2020). FMs usually oversee firms’ finance and accounting functions and may hold positions such as chief financial officer, chief accountant, or financial controller (e.g., Hiebl and Mayrleitner 2019; Mian 2001; Watson 1994; Wolf et al. 2020). Apart from their fiduciary duties regarding firms’ accounting systems, FMs are also involved in strategic and operational decision-making (Chen et al. 2021; Indjejikian and Matějka 2009; Wolf et al. 2020). Whereas traditionally, firms’ FMs were often seen as an obstacle to achieving innovation (Tyler and Steensma 1995; Wolf et al. 2020), more recent evidence indicates that they can play an important role in developing corporate strategy, including innovation (e.g., Baxter and Chua 2008). Such research indicates that the right FM can foster innovation and, by association, OA. The reasoning behind this is that the allocation of financial resources—a task where FMs are usually heavily involved in (Mian 2001)—in a way that both exploration and exploitation can be achieved is a key challenge in achieving ambidexterity (March 1991; Rogan and Mors 2014). Therefore, we assume that FMs do not per se foster or hinder ambidexterity, but rather that their abilities to interpret a firm’s ambidextrous strategy and help allocate resources for suitable explorative and exploitative projects define their impact on the level of OA. In line with earlier research (e.g., Chen et al. 2021), we argue that such abilities of FMs are reflected by their respective characteristics. In this paper, we therefore address the following research question:

How do FMs’ characteristics influence the level of OA in Mittelstand firms?

In addressing this research question, we depart from earlier research on Mittelstand firms and family firms that has shown that such firms are on average more exploitation-oriented and less exploration-oriented. This assessment is due to these firms’ widespread lack of financial resources and their associated skepticism toward investing in explorative innovation that usually comes with more risk regarding financial returns (De Massis et al. 2018; Eggers et al. 2013; Heider et al. 2021; Hiebl 2015). In consequence, we conclude that the prime way for Mittelstand firms to reach higher levels of OA is investing more in explorative innovation and thus better balancing out exploration and exploitation. We thus expect that appropriate FMs could tip the balance of usually exploitation-oriented Mittelstand firms toward more of an exploration orientation and thus OA. To unveil FMs’ influence on OA, we focus on FMs’ age, education, sex, tenure, and individual entrepreneurial behavior (IEB) because prior research links these characteristics to risk-taking, innovation and, in particular, ambidexterity (please refer to the hypothesis development section for a more detailed review on the past literature linking such traits to risk-taking, innovation, and ambidexterity). Moreover, extant literature shows that fostering ambidexterity requires an understanding of complex and at times contradictory information (Cao et al. 2009). Apparently, managers not only need to be open to ambidexterity but also need to understand the strategic requirements of firms aiming for high levels of ambidexterity. Consequently, we assume that involving FMs in strategy development helps these managers understand the resource demands resulting from firms aiming for high levels of ambidexterity. In our empirical analyses, we therefore incorporate FMs’ involvement in strategy development as a moderating factor in the relationship between their individual characteristics and the firms’ level of OA.

Our study contributes to the literature in three primary ways. First, our findings contribute to the OA literature by showing that FMs are important but thus far under-estimated human actors in reaching ambidexterity. By focusing on whether these managers’ characteristics are important in explaining Mittelstand firms’ levels of ambidexterity, we follow earlier studies’ example and use a person-centric perspective on innovation and—in particular, OA (e.g., Richter et al. 2012). Second, we contribute to evolving Mittelstand theory, which assumes that a lack of financial resources is one of the main obstacles that Mittelstand firms face when aiming for innovation (De Massis et al. 2018). Our findings indicate that the right FMs can be vital players helping Mittelstand firms to overcome these obstacles despite the firms’ lack of financial resources. Third, we contribute to the literature on FMs. Whereas FMs’ influence on financial accounting choices is well documented (for reviews, see Abernethy and Wallis 2019; Hanlon et al. 2021; Plöckinger et al. 2016), we still know little about the non-financial outcomes of their work, such as their impact on firms’ ambidexterity and innovation. These contributions hold important implications for practice. In particular, we highlight the important role that Mittelstand firms’ FMs can play in reaching OA in a resource-constrained setting. These firms should thus seek to employ FMs with an entrepreneurial mind-set and involve them in the firms’ strategy development processes. The FMs might seek insights into their firms’ operations and capabilities to be able to contribute better to strategy, innovation, and ambidexterity.

2 Theoretical background and hypotheses

Research on OA investigates several resource-related issues, especially conflicts regarding the distribution of scarce resources to simultaneously pursuing explorative and exploitative projects (e.g., Gedajlovic et al. 2012; March 1991). Such research suggests that simultaneously achieving exploration and exploitation is particularly challenging for resource-constrained organizations. We expect that Mittelstand firms also experience these challenges, since they are usually regarded as highly resource constrained (De Massis et al. 2018). In particular, we expect that pursuing explorative activities is more challenging for Mittelstand firms than pursuing exploitative ones since resource constrained firms might not have the slack resources required to take on the risk of explorative strategies (Fourné et al. 2019). We thereby build on previous literature, which suggests that resource constraints negatively affect an organization’s ability to innovate (Gibbert et al. 2014). That is, when resources are strongly constrained, firms are usually more likely to invest their scarce resources in exploitative—and hence less risky (e.g., Rogan and Mors 2014; Swift 2016)—activities than in riskier explorative ones. This notion receives further support by the fact that most Mittelstand firms are family-owned (Berghoff 2006; De Massis et al. 2018; Decker and Günther 2017). Family firms, in particular older ones, are often risk-averse due to their desire to preserve the firm for following generations and not wanting to risk the firm’s viability (e.g., Kraiczy et al. 2015). Consequently, family firms—which many Mittelstand firms are—are suggested to lack exploration rather than exploitation (Hiebl 2015). Hence, we assume that FMs providing more financial resources to explorative activities will increase the level of ambidexterity in Mittelstand firms since funding exploitative activities is rather common in these firms anyway.

Upper echelons theory suggests that firms’ organizational choices can be predicted from the firms’ top managers and their characteristics (Abatecola and Cristofaro 2020; Carpenter et al. 2004; Hambrick and Mason 1984; Hambrick 2007). In line with this notion, past research highlights the importance of top managers’ characteristics when aiming for ambidexterity (e.g., Huang et al. 2021; Kiss et al. 2020; Li 2013; Lubatkin et al. 2006; Mammassis and Kostopoulos 2019; Smith and Uman 2015; Strobl et al. 2020; Wilms et al. 2019). Such research often analyzes the role of CEOs as top managers and their impact on the level of OA. These studies indicate that managers can be a make-or-break factor when aiming for ambidexterity. For instance, Venugopal et al. (2019, p. 587) assume that top managers “could facilitate a social climate conducive for ambidexterity in two ways—one as visible role models […] Second, as strategic decision-makers.” Although these studies point toward an increasing interest in the impact of individual actors such as CEOs and their characteristics on OA, they may have left out important further players, especially in resource constrained Mittelstand firms: FMs. These managers can be part of the top management team, but do not necessarily have to be (Doron et al. 2019; Watson 1994).

Given their important influence in investment decisions (e.g., Hiebl et al. 2017; Mian 2001), we expect the role of FMs to be of particular importance in firms with limited resources such as Mittelstand firms because such companies might be tempted to avoid more innovative strategies as they appear too risky. This is in line with Eggers et al. (2013) who have shown that, generally speaking, firms are hesitant to invest money in riskier projects when resources are scare. Hence, evolving Mittelstand theory assumes that a lack of financial resources poses a threat for achieving innovation in Mittelstand firms (De Massis et al. 2018). In addition to a lack of financial resources, a lack of managerial skills can be a barrier to achieving OA in resource-constrained firms (Güttel et al. 2015; Andrade et al. 2021), or putting it differently: Firms with well-qualified managers can gain a competitive advantage when pursuing a highly ambidextrous orientation (cf. Clauss et al. 2021; Mueller et al. 2020). When aiming for ambidexterity, managing scarce financial resources properly is decisive for Mittelstand firms. In line with upper-echelons thinking (Hambrick and Mason 1984), we assume that the way FMs’ may influence resource allocation decisions follows from their individual characteristics and that some characteristics likely foster ambidextrous resource allocation, whereas others limit such a resource allocation. Building on extant upper echelons research, we narrow our broad research question presented above down to six hypotheses, which we illustrate in Fig. 1 and outline below.

In keeping with prior research relying on the upper-echelons perspective (Carpenter et al. 2004; Hambrick 2007; Hambrick and Mason 1984), the first four hypotheses focus on the relation between FMs’ demographic characteristics and Mittelstand firms’ level of OA. Specifically, we included FMs’ age, sex, educational background, and professional experience since these FM characteristics have frequently been found to be related to organizational outcomes (cf. Abernethy and Wallis 2019; Hanlon et al. 2021; Hiebl 2014; Plöckinger et al. 2016). At the same time, all these characteristics have been found to relate to innovation outcomes at the firm level or innovative practices being adopted (e.g., Abatecola and Cristofaro 2020; Carpenter et al. 2004; Hambrick 2007; Hiebl 2014). The fact that OA can also be considered to be an innovation outcome or orientation (e.g., Cao et al. 2009; O’Reilly and Tushman 2011) further reinforces the selection of these four FM characteristics. In addition, to account for calls to more closely consider psychological upper-echelons characteristics (e.g., Abatecola and Cristofaro 2020; Abernethy and Wallis 2019; Neely et al. 2020), we additionally study FMs’ level of IEB since such entrepreneurial behavior can also be expected to relate to innovation, as detailed below.

The first of the above-mentioned FM characteristics that we analyze is age, as it appears to be an important driver of innovation. Extant research shows that as people grow older, they are less open to change and less likely to take risks (e.g., Hambrick and Mason 1984; Querbach et al. 2020). This lower likelihood to take risks and encourage change appears to influence managers’ decision-making processes regarding innovation. For instance, Vaccaro et al.'s (2012) results, along with those of Qian et al. (2013), show that a CEO’s age negatively correlates with the level of innovation in the CEO’s firm. We, therefore, assume that this pattern will also occur in how FMs may influence the resource allocation process. We expect that younger FMs are more likely to influence resource allocation in an ambidextrous manner, whereas older FMs might be more risk-averse and prefer to advocate an exploitative resource allocation strategy, which would result in lower levels of OA. We thus expect a negative relation between an FM’s age and the firm’s level of OA:

H1:

Mittelstand firms with younger FMs are more likely to achieve high levels of OA.

In addition, the literature has extensively discussed the impact of a manager’s level of (business) education (e.g., Barker and Mueller 2002; Goll and Rasheed 2005). There are two main streams within this literature. The first argues that central actors’ formal education, in general, is positively linked to receptivity to innovation (Hambrick and Mason 1984). This argumentation builds on an assumed positive relationship between a person’s educational level and his or her ability to cope with ambiguity and complexity (Goll and Rasheed 2005). The second stream argues that whereas a high level of education in general increases an individual’s openness to innovation, business-educated individuals might show inherently different mindsets from graduates from other fields. Individuals aiming for a degree in business-related fields might be more conservative and risk-averse and tend to avoid losses rather than risking a lot (Barker and Mueller 2002). Consequently, we expect that business-educated managers are likely to prefer funding exploitative investments, whereas they might be reluctant to push for allocating funds to explorative ones, which may hamper achieving high levels of ambidexterity. While internationally, business-educated FMs are the norm (e.g., Datta and Iskandar-Datta 2014), in German firms, many FMs have their educational background in fields such as engineering and science, having moved into financial management positions later in their careers (Schäffer et al. 2008). This is why we expect considerable variance of FMs’ educational background in Mittelstand firms and hypothesize:

H2:

Mittelstand firms with FMs holding business degrees are less likely to achieve high levels of OA.

As a third characteristic of FMs, we analyze the FM’s sex. Past research has shown that female managers are less risk-seeking than their male counterparts (Huang and Kisgen 2013). Generally speaking, the less incremental innovations are, the more they are associated with risks (Díaz-García et al. 2013). We therefore assume that male FMs are more likely to advocate allocating resources to riskier, innovative ventures, whereas female FMs might not support capital allocation decisions that would provide money for activities that have a higher likelihood of failing. Consequently, we assume that female FMs are associated with lower levels of exploration. In addition to this notion, past research on OA has hypothesized that female managers might face greater obstacles when aiming for ambidexterity, particularly since many still face problems being accepted in leadership roles (Eagly and Carli 2003; Jansen et al. 2008) and hence lack the power to push through innovation projects. Consequently, it appears that female financial managers are less likely to foster ambidextrous resource allocations. Following this reasoning, Hypothesis 3 is as follows:

H3:

Mittelstand firms with male FMs are more likely to achieve high levels of OA.

The last demographic characteristic of the FMs that we assume to be of relevance is tenure. Long-tenured managers may have higher organizational power due to their long presence in the firm and hence might be in a better position to help implement an ambidextrous strategy. However, past research has indicated that long-tenured executives are inclined to hold on to established routines, whereas managers with a shorter tenure are more open to changing the status quo (Heavey and Simsek 2014). This is in line with Hambrick and Fukutomi (1991, p. 723), who have argued that managers are “most open-minded about how the organization should be run at the outset of their tenures, and they become increasingly close-minded … as their tenures continue.” In line with this notion, we assume that FMs with longer tenures are less likely to advocate allocating resources to explorative activities. Put differently, we expect a negative relationship between an FM’s tenure and the firm’s level of OA. Thus, our fourth hypothesis is as follows:

H4:

Mittelstand firms with FMs with a shorter tenure are more likely to achieve high levels of OA.

In addition to these demographic characteristics, the management literature has discussed the importance of behavioral characteristics such as entrepreneurial behavior (Gedajlovic et al. 2012; Volery et al. 2015). Managers who show such entrepreneurial behavior are assumed to support both explorative and exploitative activities (Gedajlovic et al. 2012; Strobl et al. 2020; Volery et al. 2015). Past research has suggested that the senior top managers of a firm—in particular via their risk-tasking behavior—play an important role in fostering innovations as they need to be “willing to make resource commitments towards projects that bear uncertainty and exhibit a reasonable danger of costly failure” (Hughes et al. 2018, p. 597). We therefore expect that FMs who are more entrepreneurial are more likely to advocate allocating resources to both riskier explorative activities and less risky exploitative ones, whereas managers who are not very entrepreneurial might refrain from funding explorative ones and focus on the safe bet, meaning mostly funding exploitative activities. It can thus be assumed that Mittelstand firms with FMs with high levels of IEB achieve higher levels of ambidexterity. Hence, Hypothesis 5 is as follows:

H5:

Mittelstand firms with FMs with higher levels of IEB are more likely to achieve high levels of OA.

We assume that these characteristics are important on their own, but also argue that the effects proposed in H1 to H5 might be more pronounced when FMs are closely involved in the firm’s strategy development. Past research has highlighted the importance of the participation of the organization’s members in strategic planning to ensure that organizational members have a shared understanding of the company’s strategy and allocate resources accordingly (Kohtamäki et al. 2012). Allocating resources in a way that supports an ambidextrous strategy requires an understanding of the strategic contradictions of ambidexterity, which involve complex and paradoxical information and decision alternatives (Cao et al. 2009). Therefore, we assume that the more FMs are involved in strategy development, the better they are able to understand such strategic contradictions, and hence allocate scarce resources more effectively. In addition, Bouncken et al. (2021) argue that organizational resource allocations are influenced by the level of attention that managers attach to specific investments. It can thus be assumed that FMs can more effectively draw the remaining top managers’ attention to balancing exploitative and explorative investments, the more they are involved in strategy development (cf. Erhart et al. 2017). Thus, FMs’ individual characteristics can be expected to unfold more influence if these FMs are strongly involved in strategy development. Taken together, these notions suggest that the effects outlined in H1 to H5 are stronger for FMs highly involved in strategy development. Therefore, Hypothesis 6 is as follows:

H6:

The relationships proposed in H1 to H5 are more pronounced if FMs are more involved in strategy development.

3 Methodology

3.1 Sample and Research Design

To test our hypotheses, we first collected archival data (e.g., size and industry) from non-listed German firms that employed between 50 and 3,000 employees. The upper limit of 3,000 employees resembles the definition of Mittelstand firms used by De Massis et al. (2018) and initially suggested by Becker et al. (2008). We excluded firms from the financial sector from data collection because OA in the banking context differs from OA in non-banking firms (Monferrer Tirado et al. 2019). We then contacted the highest-ranked FMs of the firms with the request to participate in a survey using a structured questionnaire.

The survey data collection proceeded in two waves. The first wave took place between March and December 2018 and generated 167 responses. Following methodological advice on conducting surveys (e.g., Chidlow et al. 2015; Edwards et al. 2002; Hiebl and Richter 2018; Pielsticker and Hiebl 2020), we tried to establish a precontact with FMs first. That is, we invited the highest-ranked FMs by email and/or telephone to participate in the survey. The second wave took place between June and July 2019 and generated an additional 66 responses. In both waves, we provided extensive information in the cover letter that the survey was aimed at the highest ranked FM and incorporated a filter question at the beginning of the survey in which the respondents had to confirm that they held such a role in their firm. Additionally, we asked the respondents to declare their exact job title to further corroborate their role in their firm.

In sum, we collected 233 questionnaires. In a follow-up step, we removed 102 cases in total. In one case, a respondent stated that her position was “assistant to CEO” instead of a leading financial management position, hence we dropped this questionnaire from further analysis. We excluded one further case because the firm had more than 3,000 employees and could no longer be regarded as a Mittelstand firm, as defined above. Finally, we removed three firms with fewer than 50 employees since many such small firms do not have separate FM positions (Grusky 1961). Hence, in small firms, it might be possible that the owner manager or other members of the top management team perform tasks of the FM (e.g., Hiebl and Mayrleitner 2019) and we would not be able to differentiate our findings on the impact of FM characteristics from previous research on the impact of CEO characteristics.

For the 228 remaining cases, 97 of the questionnaires included non-randomly occurring missing values regarding a substantial number of constructs. That is, our missing data analysis indicated that these 97 respondents consistently did not fill out any item for at least the four constructs that were positioned last in the questionnaire, which indicates a pattern of missing values (Enders 2010).Footnote 2 We thus removed these 97 cases where all items for four or more constructs were missing. For the remaining 131 cases, we replaced the missing values using mean replacement imputation for the non-binary variables and median replacement for the binary variables (Enders 2010; Hair et al. 2014).

Therefore, the total number of cases for the main regression analyses (Models 1 and 2) is 131. Although both Model 1 and Model 2 are quite complex and build on 13 to 18 independent variables, our sample size of 131 cases is sufficient as Hair et al. (2014) suggest that the sample size should be at least five times the number of independent variables. In our case, this translates into a threshold of 90 observations, which we surpass.

Survey research is associated with several potential biases, such as non-response bias and common method bias. Regarding responses in general, it was not possible to compute a precise response rate for this paper because most of the contact information we received were general email addresses (e.g., office@firm.de) instead of FMs’ personal email addresses. Hence, we do not know how many FMs have actually received the invitation to participate in the survey, as it is likely that not all invitations sent to general email addresses were forwarded to the FMs. To address non-response bias, recent studies compare the respondents’ characteristics with those of actual non-respondents (e.g., Van Doorn et al. 2013). Among them, Bedford et al. (2016), Van Doorn et al. (2013), and Roberts (1999) propose that for such a comparison, firm size and industry are well-suited characteristics. Consequently, we compared the firm size and industry affiliation of the firms in a random sample of 233 non-respondents with those of our respondents’ firms but found no significant differences. Hence, we assume that for our survey, non-response bias is not a major problem.

To avoid common method bias as much as possible and similar to comparable survey studies (e.g., Anwar et al. 2021; Aschauer et al. 2015; Muñoz-Pascual et al. 2021), we followed the procedures suggested by Podsakoff et al. (2003). First, we ensured the respondents that we guaranteed their anonymity. Second, we separated the items on the dependent and independent variables in the questionnaire by not putting the respective questions next to each other. Third, we used pre-tested, established construct measurements, and performed several pre-tests before sending the questionnaire to the actual respondents to avoid potential problems resulting from the items themselves. Fourth, we employed constructs that are not very likely to give the respondents a reason to believe that some answers are more desirable than others (Nederhof 1985). In addition, we explicitly told the respondents that there were no superior answer options. Moreover, many of our constructs are not perceptions but “hard facts,” such as FMs’ age or tenure. In line with many other innovation-focused survey studies (e.g., Kortmann 2015), we also conducted Harman’s single-factor test. From this test, eight factors emerged with eigenvalues > 1, which each explain at most 11.5 percent of total variance. Therefore, our data do not seem to suffer from common method bias.

3.2 Measures

3.2.1 Independent variables: FM characteristics

We measure FM Age and FM Tenure in years. FM Business Degree (0 = does not hold a business degree, 1 = holds a business degree) and FM Sex (0 = female, 1 = male) both are dichotomous variables. In terms of psychological characteristics, we measure FM IEB based on a construct by Sieger et al. (2013) (see Appendix Table 7 for details on the confirmatory factor analysis). For the hypotheses tests, we compute a mean score of all six IEB-related items.

3.2.2 Dependent variable: level of OA

We base our measurement of OA on a 12-item construct by Lubatkin et al. (2006) (see Appendix Table 9 for details) and measure each item on a 7-point Likert scale. To test the construct’s convergent validity, we use a principal component analysis with oblimin rotation, as proposed by Bedford et al. (2019). After excluding items EXPLOR 4 and EXPLOI 3 due to high cross-loadings, the items loaded on three factors. The items EXPLOR 1, 2, 3, 5, and 6 form one factor representing an explorative orientation. The exploitation orientation is split into two factors, with the first factor consisting of EXPLOI 1 and 2, that is, the items concerned with the firms’ products or services, while EXPLOI 4, 5, and 6—the items regarding the firms’ customers and their satisfaction—loaded on the second factor. We first computed the mean value of the items EXPLOR 1, 2, 3, 5, and 6. Next, we computed the means of both exploitation-related factors and then calculated the average of both exploitation factors’ means. A graphical summary of the items used for the computation of both exploration and exploitation can be obtained from Fig. 2.

The literature offers various options for computing a score for OA that ranges from multiplying exploitation and exploration to adding both scores—both often referred to as the combined OA perspective—to subtracting them from one another, usually referred to as the balanced OA perspective (Junni et al. 2013). Combined OA measures incorporate the joint magnitude of both perspectives, whereas the balanced perspective aims to measure the distance between a firm’s levels of exploration and exploitation (Cao et al. 2009). Accordingly, recent studies combine the balanced and the combined OA perspectives (e.g., Bedford et al. 2019; Cao et al. 2009). In line with this latter approach, we adopt the measurement by Bedford et al. (2019) and calculate OA scores as follows:

The advantage of Bedford et al.’s (2019) approach is that high scores in our OA measure are thus achieved when exploitation and exploration are not only balanced at any given level, but when both exploration and exploitation reach relatively high levels (Bedford et al. 2019). Nevertheless, in our below robustness checks, we also adopt an alternative measure of OA that relies on the mere product of exploitation and exploration.

3.2.3 Moderator: FM involvement in strategy development

We measure FM Involvement in Strategy Development based on a multi-item construct by Erhart et al. (2017) that encompasses seven items (INVOLV 1 to INVOLV 7; see Appendix Table 8 for details). The first four items load on one factor and the last two items load on a second factor. The first factor is more process-related (i.e., administration/coordination of the strategy process), whereas the second factor is more strongly related to strategic content. This is in line with the long-standing distinction in strategic management theory between strategy “content … and the organizational processes by which such strategy content was determined” (Schendel 1992, p. 2). We assume that involvement in content-related strategy development is more important for helping FMs understand strategic ambiguities. Hence, we compute the variable “FM Involvement in Strategy Development” as the mean value of the second set of items (INVOLV 6 and 7). As detailed in Appendix Table 8, one item (INVOLV 5) needed to be removed due to high cross-loadings.

3.2.4 Control variables

We control for family ownership since past research shows that family influence is an important and significant context factor for OA (Arzubiaga et al. 2019; del Pilar Casado-Belmonte et al. 2021; Goel and Jones 2016; Hughes et al. 2018). Respondents’ self-assessments are a common method of operationalizing family-firm status (Diéguez-Soto et al. 2015; Michiels et al. 2021; Roffia et al. 2021; Steiger et al. 2015). We thus base the dichotomous variable “Family Firm” on whether the responding FMs’ considered their firm to be a family firm or not (0 = no family firm, 1 = family firm). Controlling for past performance and firm size is necessary because past research links the capability to be innovative and achieve ambidexterity to organizational performance (e.g., Jansen et al. 2005; Junni et al. 2013; Liu et al. 2011) and firm size (e.g., He and Wong 2004; Li 2013; Voss and Voss 2013; Zhang et al. 2017). We measure firm size using archival data on the number of employees. In turn, using self-reported performance evaluations is well established in the ambidexterity literature (e.g., Zhang et al. 2017). We thus measure past performance based on Eddleston and Kellermanns’ (2007) self-assessment of three indicators (SUBJPERF 1 to 3), which we combined by averaging the individual scores. The underlying items for the measurement of subjective performance and the results from the factor analysis can be obtained from Appendix Table 11. Following He and Wong (2004), we also control for firms’ industry. We rely on archival industry data, which we code into a dichotomous variable (0 = non-manufacturing firms, 1 = manufacturing firms). Additionally, we controlled for environmental uncertainty, which past research has linked to both explorative and exploitative activities (Liu et al. 2011) and ambidexterity (Andrade et al. 2021). We measure environmental uncertainty following Govindarajan (1984) and Gul and Chia (1994) with three items, which we combine by averaging the individual scores (for details on the confirmatory factor analysis, see Appendix Table 10). Furthermore, we control for venture capital financing, which research links with higher levels of OA (Hiebl 2015), by including a dichotomous variable (0 = firm has never received venture capital, 1 = firm has received venture capital). Finally, we control for firms’ strategic orientation because strategy is often linked to firms’ level of innovativeness and OA (Kortmann 2015). Following Bedford et al. (2016), we measure strategic orientation as a dichotomous variable that captures the responding FMs’ assessment of their firms’ main strategy (0 = defender strategy, 1 = prospector strategy).

4 Results

4.1 Descriptive statistics and correlations

Table 1 reports the descriptive statistics on our variables and Table 2 the correlations. Table 1 indicates that in our sample, 50 percent of all firms can be considered family firms. This percentage is low when compared with the general assumption that by far most Mittelstand firms are family firms (e.g., De Massis et al. 2018; Pahnke and Welter 2019). However, it is well established that the share of family firms decreases with increasing firm size (Klein 2000). Since we exclude firms with less than 50 employees, we expected a somewhat lower share of family firms in our sample. Other survey studies on Mittelstand firms also report similar shares of family firms (e.g., Decker and Günther 2017). We thus regard our sample as prototypical for the German Mittelstand.

Although some variables correlate significantly (see Table 2), no absolute value is larger than 0.7, or the commonly used threshold indicating multicollinearity (Hair et al. 2014). As a further test, we include variance inflation factors (VIFs) in all of our ordinary least squares (OLS) regression models. All of the VIFs are (well) below two and thus below the commonly used threshold of 10, which indicates serious multicollinearity (Hair et al. 2014). Therefore, we see no indications of multicollinearity issues in our data.

4.2 Regression analyses

Table 3 reports the results of our main OLS regression analyses.Footnote 3 Model 1 only includes the direct effects, whereas Model 2 additionally includes the interaction effects. For the computation of the interaction terms, the independent variables and moderator variable were mean centered before multiplication (Aiken and West 1991; Field 2018).

We find no statistically significant relationships between FM Age (H1), FM Business Degree (H2), FM Sex (H3), or FM Tenure (H4) and OA, hence we reject H1 to H4. However, we find a significant positive relationship between the FM IEB and OA, as proposed in H5, which thus is confirmed.

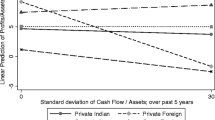

When considering the moderating effect of FM Involvement in Strategy Development as included in Model 2, for the relationship between FM Business Degree and OA, we find a significant positive moderation effect. Hence, H6 is partially supported. To analyze this moderation effect in more detail, we plot the interaction in Fig. 3. In addition, we conducted a simple slope test based on the mean-centered variables, as suggested by Aiken and West (1991) and Dawson (2014). This analysis confirmed that both slopes in Fig. 3 were significantly different from 0 (p = 0.000).

The solid line in Fig. 3 illustrates the relationship between FM Business Degree and the level of OA when the FM’s involvement in strategy development is low. The dashed line in Fig. 3 illustrates the same relationship between FM Business Degree and OA when the strategy involvement of the FM is high. According to this plot, for Mittelstand firms employing FMs without a business degree, their involvement in strategy development hardly affects the respective firm’s level of OA. By contrast, Fig. 3 suggests that for FMs with business degrees, their involvement in strategy development has a much larger effect on the level of OA. Compared with FMs without business degrees, it seems that the level of OA primarily benefits from business-educated FMs if they are heavily involved in strategy development. Based on this plot, H6 receives support in that the relationship between FM Business Degree and the Mittelstand firm’s level of OA seems more pronounced for business-educated FMs.

4.3 Robustness checks

4.3.1 Results without imputed data

In addition to the analysis of our main regression models that can be obtained from Table 3, we estimated a third and a fourth OLS model based on a dataset in which all the cases with missing values were removed from further analysis instead of replacing the missing values using data imputation. Although this approach leads to a significantly lower sample size (n = 101), the significant findings in these two models (see Table 4) confirm the results of the dataset used for Model 1 and Model 2. That is, the imputed data did not materially affect our results.

4.3.2 Alternative measurement for the level of OA

In addition, we estimate a fifth and a sixth OLS model (see Table 5) to ensure that our findings of the main OLS models (those incorporating imputed data) are robust toward an alternative specification of the level of OA. Here, we rely on the same procedures to establish a firm’s level of exploration and exploitation, but we measure the level of OA as the mere product of exploration and exploitation:

That is, this way of measuring the level of OA does not account for the balance between exploration and exploitation, which is why we followed the more recent approach by Bedford et al. (2019) that incorporates such balance in our main analysis above. However, the mere product of exploration and exploitation is an often-used way of measuring OA, too (e.g., Clauss et al. 2021; Gibson and Birkinshaw 2004; Mihalache et al. 2014), which is why we also tested this alternative measure. Indeed, the regression results in Table 5 show that the significant findings from our main analysis are robust to this different operationalization of the level of OA. While Model 6 in Table 5 indicates two additional significant FM characteristics (FM Sex and FM Tenure) as predictors of the level of OA, we continue to rely on our main results above for the discussion that follows since the dependent variable used in our main analyses incorporates not only exploration and exploitation, but also the balance between these two innovation modes and thus better reflects recent advances in measuring the level of OA (cf. Bedford et al. 2019).

4.3.3 CEO characteristics

As a third robustness check, we estimate a seventh OLS model (see Table 6) that captures the impact of CEO characteristics on OA because many prior studies link the level of OA to CEO characteristics (for a review, see Junni et al. 2015).

With this additional analysis, we want to ensure that the influence of FM characteristics is driving the level of OA, and not (only) CEO characteristics. Therefore, we asked the responding FMs to provide information also on the CEOs’ age, business education, sex, and tenure. Since we did not send the survey to the CEOs directly, we did not ask for information on CEOs’ IEB, as it would have hardly been possible for the FMs to estimate CEOs’ IEB. We did also not ask for the CEOs’ involvement in strategy development because CEOs are typically highly involved in strategy development anyway.

Table 6 shows that in our data, neither CEO age, business degree, sex, nor tenure are significantly linked with OA. Ideally, we would have included these CEO variables as additional control variables in Models 1 and 2, which, however, is impossible as our data on CEO characteristics includes many cases of non-randomly missing data (see Table 6 only relying on 73 cases), which impedes imputing such CEO data for inclusion in our main analyses. This small number of observations on CEO characteristics also limits the statistical power of the regression model presented in Table 6, but we still include this model to show that CEO characteristics do not seem to have a material effect on OA in our data.

5 Discussion and implications

5.1 Discussion

A summary of our findings as mapped on our initial conceptual model can be found in Fig. 4. These findings show that the FMs’ IEB correlates positively with Mittelstand firms’ level of OA. Whereas according to our data, the educational background of the FMs itself is unrelated to the level of OA, the interaction between FMs’ educational background and their involvement in strategy development is. The interaction plot suggests that in order to achieve high levels of OA, it is particularly important that Mittelstand firms involve FMs with a business degree in strategy development. One reason for this observation might be that FMs without a business degree often come from an engineering or science background (Schäffer et al. 2008) and thus may generally be more prone to innovative ideas than FMs with a background in business. Hence, compared with Mittelstand firms with business-educated FMs, for Mittelstand firms employing FMs without a business degree, the involvement of FMs in strategy development hardly influences the FMs’ ability to understand the ambiguities associated with an ambidextrous strategy. Thus, our findings indicate that irrespective of their involvement in strategy development, FMs without a business degree can serve as important human resources for Mittelstand firms in reaching high levels of OA.

Summary of hypotheses tests and effect sizes mapped on conceptual Model. Notes: Standardized betas (β) and p values are displayed here as of our main analyses presented in Table 3. Significant effects are printed in bold. For the significant interaction term between Financial Manager Business Degree and Financial Manager Involvement in Strategy Development, only the moderation arrow is printed in bold to represent the confirmation of the moderation hypothesis H6. To facilitate readability, the direct effects of control variables and the moderator variable on the dependent variable are not included in this figure

In turn, FMs with a business degree are more likely to serve as human resources for reaching high levels of OA in Mittelstand firms when heavily involved in strategy development. One reason for this might be that FMs from business backgrounds show greater difficulties in managing the contradictory demands of an ambidextrous strategy because they might be less familiar with the operations of the firm than FMs from a non-business (e.g., technical) background. Lubatkin et al. (2006, p. 647) argue that in particular in smaller firms with fewer hierarchical levels, the involvement of managers in both strategy and operations could help them to “directly experience the added dissonance of competing knowledge demands inherent in the pursuit of an ambidextrous orientation.” However, our findings might indicate that this assumption is too general. We find that managers who have a better understanding of their firms’ operations—as is likely to be the case for FMs with backgrounds in fields other than business—do not benefit much from being involved in strategy development. Although the existing ambidexterity literature indicates that top management team heterogeneity helps managers to cope with the contradictory demands associated with ambidexterity (e.g., Cao et al. 2009), our findings show that a particular player—the FM—can either foster ambidexterity or not, depending on his or her entrepreneurial behavior, educational background, and involvement in strategy development.

Besides these significant results, some insignificant ones are also noteworthy. In our main analyses, we do not find significant relationships between FMs’ age, sex, and tenure and Mittelstand firms’ level of OA. Therefore, our results do not confirm findings from the finance and accounting literature that document significant influences of these FM characteristics on finance and accounting choices (Abernethy and Wallis 2019; Hanlon et al. 2021; Plöckinger et al. 2016). However, many of these finance and accounting studies do not include direct measurements of FMs’ entrepreneurial behaviors but rather draw on Hambrick and Mason’s (1984) original arguments that suggest characteristics such as age and tenure as (rough) proxies for managers’ risk-taking and innovative behavior. Our IEB measure captures such similar behavior. Consequently, our non-findings on FMs’ age, tenure, and sex may also result from our use of the IEB scale, which more directly and thus better captures managers’ entrepreneurial mindset and thus outshines the potential effect of FMs’ higher age or tenure (see also Table 2: the correlations between IEB and business education, and age are non-significant).Footnote 4 Our study therefore reinforces recent calls in the management and accounting literature for employing psychological constructs of managers’ attitudes and beliefs rather than drawing on demographic proxies when studying the impact of managers on organizational choices (e.g., Abatecola and Cristofaro 2020; Abernethy and Wallis 2019; Hanlon et al. 2021; Neely et al. 2020). Likewise, these results indicate that future studies on FMs might also benefit from drawing on such psychological constructs to gain a more precise understanding of the influences of this important class of managers.

5.2 Theoretical implications

Our findings contribute to the OA literature by showing that important actors (i.e., FMs) have so far been largely overlooked. Our findings suggest that especially in firms with scarce resources such as Mittelstand firms, FMs can be either an important supporter or obstacle when aiming for ambidexterity. Therefore, firms aiming for ambidexterity are well advised to not only choose their FMs wisely but also to incorporate them—especially the business-educated ones—in strategy development.

In addition—as already briefly outlined above—our findings contribute to the evolving Mittelstand literature. Mittelstand firms’ smaller size is often related with a lower level of resources to achieve ambidexterity (De Massis et al. 2018; Voss and Voss 2013; Zhang et al. 2017). That is, the ambidexterity literature has long assumed that simultaneously pursuing exploration and exploitation would not be feasible for smaller firms, as only larger ones possess the resources required for creating ambidextrous orientations (Voss and Voss 2013). Our findings contrast this assumption and contribute to this literature by providing quantitative empirical evidence that in resource-constrained Mittelstand firms, well-suited FMs can help their firms to achieve OA.

Lastly, we contribute to the literature on FMs. More traditionally, research on these individuals links their employment and their characteristics with finance-related outcomes such as financial accounting choices (Abernethy and Wallis 2019; Hanlon et al. 2021; Plöckinger et al. 2016). While some studies link FMs to innovation-related outcomes, such outcomes mostly refer to innovative accounting or finance choices (e.g., Naranjo-Gil et al. 2009), but not to innovation at the overall organizational level. Additionally, there is literature that sees FMs as an obstacle to organizational innovation (Tyler and Steensma 1995). Our findings show, however, that under certain circumstances, FMs can also support innovation-related organizational goals such as increasing the level of OA. Furthermore, our results provide valuable insights into the conditions for this relationship by highlighting the role of involving FMs in strategy development. For research on the impact of FMs, our findings also imply that more direct, psychological measures of their attitudes and beliefs may allow for more precise insights into their influence on organizational choices.

5.3 Managerial implications

In terms of practical implications, we highlight the important role that FMs can play in reaching OA in a resource-constrained setting. According to our findings, Mittelstand firms should seek to employ FMs with an entrepreneurial mind-set because these managers can help them in implementing innovation strategies. Moreover, if FMs have a business education, Mittelstand firms should involve them in the firms’ strategy processes to foster their understanding of how firms’ can simultaneously pursue explorative and exploitative initiatives. To help FMs playing such a role, Mittelstand firms might either put high emphasis on selecting FMs that suit this role or support their FMs in gaining relevant knowledge and skills to contribute effectively and efficiently to strategy development processes (e.g., Goretzki and Messner 2019; Goretzki et al. 2013). This is particularly important because earlier studies indicate that access to diverse knowledge is an important resource in the context of innovation (e.g., Richter et al. 2012). Not least, increased knowledge in risk management techniques may well equip FMs in selecting the most promising and least risky endeavors, promising high levels of OA (cf. Gurd and Helliar 2017). Likewise, the literature on entrepreneurial learning (e.g., Cope 2005; Politis 2005) and management learning (e.g., Kempster and Cope 2010) suggests that entrepreneurial behavior can be learned to a certain extent. Similar to Emsley (2005), we see no reasons why FMs could not learn such behavior or be trained in this regard. For instance, to enable FMs adopt the entrepreneurial spirit of many Mittelstand firms, such firms could more extensively draw on knowledge management systems to transfer entrepreneurial knowledge gained by the founders to employed managers such as FMs (e.g. Cardoni et al. 2019). As reported by Goretzki et al. (2013), another key step to move FMs in Mittelstand firms from their more traditional roles to entrepreneurial orientation may be the construction and legitimization of a new FM role philosophy, which was found in their case study to be more inspiring and motivating than just suggesting to adopt new, and potentially more innovative finance and accounting techniques.

Moreover, our results offer guidance for FMs and especially for those holding business degrees. Our results indicate that FMs not holding business degrees are associated with high levels of ambidexterity irrespective of their involvement in strategy development. Above, we theorize that this finding is likely to be due to FMs without business degrees having deep knowledge of their firms’ operations due to their educational background. Following this line of thought, FMs with business degrees might strive for closer insights into their firms’ operations and associated capabilities (cf. Emsley 2005; Lambert and Sponem 2012). Thereby, they might develop a better understanding of the strategic demands associated with ambidexterity and could be better able to contribute to their firms reaching high levels of OA.

6 Limitations and future research

Our study has some limitations. First, as is common with cross-sectional studies, we can only ascertain correlations between FM characteristics and OA, but not the direction of such effects. However, we think that in particular regarding the significant interaction effect, the risk of the effect’s direction being the opposite is low.

Second, we sent our survey to the highest-ranked FMs only and not simultaneously to the respective firms’ CEOs. Although it would have been interesting to analyze also the CEOs’ IEB, the impact of the CEO on ambidexterity is well documented, as outlined above. Our focus was, however, to analyze the impact of FMs’ characteristics. Future research might incorporate these effects together, to illuminate whether and in which ways CEOs’ and FMs’ respective influences on OA interact. Future research may also consider Mittelstand firms’ heterogeneity. For instance, owner-managed Mittelstand firms with a rather patriarchal and autocratic culture (Berghoff 2006) can be expected to involve FMs less than more democratically oriented firms. CEO characteristics such as their leadership style might thus allow Mittelstand firms to reap more or less strongly FMs’ potentially beneficial influence on reaching high levels of OA.

Third, more recent reviews of the upper-echelons perspective suggest that studies of senior executives should consider their psychological characteristics rather than more easily observable demographics when explaining (financial) managers’ behavior (cf. Abatecola and Cristofaro 2020; Abernethy and Wallis 2019; Hanlon et al. 2021; Neely et al. 2020), such as their risk-taking. We therefore acknowledge that future research could benefit from using more complex measures of executives’ cognitive base instead of demographic proxies, which might no longer properly reflect the complex and diverse cognitive bases of contemporary executives. Likewise, the utilization of biological sex in our study as a demographic characteristic is common (e.g., Abernethy and Wallis 2019; Hanlon et al. 2021; Plöckinger et al. 2016) but can be problematic since it might be unable to correctly represent the respondent’s perceived sex in all cases (e.g., Westbrook and Saperstein 2015). We therefore encourage future survey researchers to include non-binary gender options, as recommended by recent survey studies (e.g., Westbrook and Saperstein 2015).

Fourth, our main analyses draw on a rather small sample of 131 cases. Although this sample size can be considered to be suitable for the number of independent variables in our regression models (see Sect. 3.1), we acknowledge that our results would benefit from corroboration based on larger sample sizes. Such corroboration could also be performed in the form of replication studies in other geographical settings. In this study, we focused on the particular context of German Mittelstand firms, which frequently—but not exclusively—are small to medium-sized, non-listed family firms facing resource constraints. Consequently, and given the idiosyncrasies of German Mittelstand firms (e.g., Berghoff 2006; De Massis et al. 2018; Heider et al. 2021; Pahnke and Welter 2019), our results might not generalize beyond this setting and future research is necessary to replicate our findings for other types of resource-constrained firms from other cultural or institutional contexts.

Finally, we acknowledge that prior research has found that performance measurement and management systems are related to firms’ achieved level of OA (e.g., Bedford et al. 2019; Cardoni et al. 2020; Chang and Hughes 2012; Gschwantner and Hiebl 2016). We therefore encourage future research taking into account the role of performance measurement and management systems and their role in the relationship between FM characteristics and OA.

Notes

See Junni et al. (2015) for a review on the impact of top management characteristics on ambidexterity.

As is usual in management and organization studies (e.g., Aguinis et al. 2021), we also performed Little’s missing completely at random (MCAR) test, and thus a more formal test to assess the randomness of missing values. Surprisingly, the MCAR test did not indicate that our data would not be missing randomly, which is why we could have kept the MCAR assumption. At the same time, we refrained from using all cases before imputation since for 97 cases, we would have needed to impute all items for at least four constructs used in this study. This is why we used the more restrictive criterion for excluding cases before imputing missing data. We nevertheless also tested our regression models when using all cases for imputation and the significant results are the same as reported below.

As an alternative to OLS regressions for testing moderation effects, we additionally used a partial least squares (PLS) structural equation model to test our conceptual model (cf. Nitzl 2016; Nitzl and Chin 2017). To this end, we used Smart PLS software (Ringle et al. 2015). All the significant results from the OLS regression analysis were confirmed by the structural equation model. Hence, our results seem to hold regardless of which of these two potential statistical methods is used.

We also run a regression model (untabulated) with the four demographic FM characteristics (age, business degree, sex, tenure), but without the IEB and Strategy Involvement variables to test whether these latter two characteristics may crowd out demographic proxies for FMs’ cognitive base. However, for this additional model without psychological constructs, the four demographic variables again did not show a significant relationship with OA. This observation suggests that the demographic proxies do not represent FMs’ entrepreneurial behavior well.

References

Abatecola G, Cristofaro M (2020) Hambrick and Mason’s “Upper Echelons Theory”: evolution and open avenues. J Manag Hist 26:116–136

Abernethy MA, Wallis MS (2019) Critique on the “Manager Effects” research and implications for management accounting research. J Manag Account Res 31:3–40

Aguinis H, Hill NS, Bailey JR (2021) Best practices in data collection and preparation: recommendations for reviewers, editors, and authors. Organ Res Methods 24:678–693

Aiken LS, West SG (1991) Multiple regression: testing and interpreting interactions. Sage, New York

Andrade J, Franco M, Mendes L (2021) Technological capacity and organisational ambidexterity: the moderating role of environmental dynamism on Portuguese technological SMEs. RMS 15:2111–2136

Anwar M, Clauss T, Issah WB (2021) Entrepreneurial orientation and new venture performance in emerging markets: the mediating role of opportunity recognition. Rev Manag Sci. https://doi.org/10.1007/s11846-021-00457-w

Arzubiaga U, Maseda A, Iturralde T (2019) Exploratory and exploitative innovation in family businesses: the moderating role of the family firm image and family involvement in top management. RMS 13:1–31

Aschauer E, Moro A, Massaro M (2015) The auditor as a change agent for SMEs: the role of confidence, trust and identification. RMS 9:339–360

Barker VL III, Mueller GC (2002) CEO characteristics and firm R&D spending. Manage Sci 48:782–801

Baxter J, Chua WF (2008) Be(com)ing the chief financial officer of an organisation: experimenting with Bourdieu’s practice theory. Manag Account Res 19(3):212–230

Becker W, Staffel M, Ulrich P (2008) Mittelstand und Mittelstandsforschung. Bamberger Betriebswirtschaftliche Beiträge 153.

Bedford DS, Malmi T, Sandelin M (2016) Management control effectiveness and strategy: An empirical analysis of packages and systems. Acc Organ Soc 51:12–28

Bedford DS, Bisbe J, Sweeney B (2019) Performance measurement systems as generators of cognitive conflict in ambidextrous firms. Acc Organ Soc 72:21–37

Berghoff H (2006) The end of family business? the Mittelstand and German capitalism in transition, 1949–2000. Bus Hist Rev 80:263–295

Bouncken RB, Kraus S, Roig-Tierno N (2021) Knowledge-and innovation-based business models for future growth: digitalized business models and portfolio considerations. RMS 15:1–14

Cao Q, Gedajlovic E, Zhang H (2009) Unpacking organizational ambidexterity: dimensions, contingencies, and synergistic effects. Organ Sci 20:781–796

Cao Q, Simsek Z, Zhang H (2010) Modelling the joint impact of the CEO and the TMT on organizational ambidexterity. J Manag Stud 47:1272–1296

Cardoni A, Dumay J, Palmaccio M, Celenza D (2019) Knowledge transfer in a start-up craft brewery. Bus Process Manag J 25:219–243

Cardoni A, Zanin F, Corazza G, Paradisi A (2020) Knowledge management and performance measurement systems for SMEs’ economic sustainability. Sustainability 12:2594

Carpenter MA, Geletkanycz MA, Sanders WG (2004) Upper echelons research revisited: antecedents, elements, and consequences of top management team composition. J Manag 30:749–778

Casado-Belmonte MDP, Capobianco-Uriarte MDLM, Martínez-Alonso R, Martínez-Romero MJ (2021) Delineating the path of family firm innovation: mapping the scientific structure. Rev Manag Sci 15:2455–2499

Chang YY, Hughes M (2012) Drivers of innovation ambidexterity in small-to medium-sized firms. Eur Manag J 30:1–17

Chen CX, Nasev J, Wu SY-C (2021) CFO overconfidence and cost behavior. J Manag Account Res. https://doi.org/10.2308/JMAR-18-055

Chidlow A, Ghauri PN, Yeniyurt S, Cavusgil ST (2015) Establishing rigor in mail-survey procedures in international business research. J World Bus 50:26–35

Clauss T, Kraus S, Kallinger FL, Bican PM, Brem A, Kailer N (2021) Organizational ambidexterity and competitive advantage: the role of strategic agility in the exploration-exploitation paradox. J Innov Knowl 6:203–213

Cope J (2005) Toward a dynamic learning perspective of entrepreneurship. Entrep Theory Pract 29:373–397

Datta S, Iskandar-Datta M (2014) Upper-echelon executive human capital and compensation: generalist vs specialist skills. Strateg Manag J 35:1853–1866

Dawson JF (2014) Moderation in management research: what, why, when, and how. J Bus Psychol 29:1–19

De Massis A, Audretsch D, Uhlaner L, Kammerlander N (2018) Innovation with limited resources: management lessons from the German Mittelstand. J Prod Innov Manag 35:125–146

Decker C, Günther C (2017) The impact of family ownership on innovation: evidence from the German machine tool industry. Small Bus Econ 48:199–212

Díaz-García C, González-Moreno A, Saez-Martinez FJ (2013) Gender diversity within R&D teams: its impact on radicalness of innovation. Innovation 15:149–160

Diéguez-Soto J, López-Delgado P, Rojo-Ramírez A (2015) Identifying and classifying family businesses. RMS 9:603–634

Doron M, Baker CR, Zucker KD (2019) Bookkeeper-controller-CFO: the rise of the chief financial and chief accounting officer. Account Hist J 46:43–50

Eagly AH, Carli LL (2003) The female leadership advantage: an evaluation of the evidence. Leadersh Q 14:807–834

Eddleston KA, Kellermanns FW (2007) Destructive and productive family relationships: a stewardship theory perspective. J Bus Ventur 22(4):545–565

Edwards P, Roberts I, Clarke M, DiGuiseppi C, Pratap S, Wentz R, Kwan I (2002) Increasing response rates to postal questionnaires: systematic review. BMJ 324:1183

Eggers F, Kraus S, Hughes M, Laraway S, Snycerski S (2013) Implications of customer and entrepreneurial orientations for SME growth. Manag Decis 51:524–546

Emsley D (2005) Restructuring the management accounting function: a note on the effect of role involvement on innovativeness. Manag Account Res 16:157–177

Enders CK (2010) Applied missing data analysis. Guilford Press

Erhart R, Mahlendorf MD, Reimer M, Schäffer U (2017) Theorizing and testing bidirectional effects: the relationship between strategy formation and involvement of controllers. Acc Organ Soc 61:36–52

Field A (2018) Discovering statistics using IBM SPSS statistics, 5th edn. Sage, New York

Fourné SP, Rosenbusch N, Heyden ML, Jansen JJ (2019) Structural and contextual approaches to ambidexterity: a meta-analysis of organizational and environmental contingencies. Eur Manag J 37:564–576

Gedajlovic E, Cao Q, Zhang H (2012) Corporate shareholdings and organizational ambidexterity in high-tech SMEs: evidence from a transitional economy. J Bus Ventur 27:652–665

Gibbert M, Hoegl M, Valikangas L (2014) Introduction to the special issue: financial resource constraints and innovation. J Prod Innov Manag 31:197–201

Gibson CB, Birkinshaw J (2004) The antecedents, consequences, and mediating role of organizational ambidexterity. Acad Manag J 47:209–226

Goel S, Jones RJ III (2016) Entrepreneurial exploration and exploitation in family business: a systematic review and future directions. Fam Bus Rev 29:94–120

Goll I, Rasheed AA (2005) The relationships between top management demographic characteristics, rational decision making, environmental munificence, and firm performance. Organ Stud 2:999–1023

Goretzki L, Messner M (2019) Backstage and frontstage interactions in management accountants’ identity work. Acc Organ Soc 74:1–20

Goretzki L, Strauss E, Weber J (2013) An institutional perspective on the changes in management accountants’ professional role. Manag Account Res 24:41–63

Govindarajan V (1984) Appropriateness of accounting data in performance evaluation: an empirical examination of environmental uncertainty as an intervening variable. Acc Organ Soc 9:125–135

Grusky O (1961) Corporate size, bureaucratization, and managerial succession. Am J Sociol 67:261–269

Gschwantner S, Hiebl MR (2016) Management control systems and organizational ambidexterity. J Manag Control 27:371–404

Gul FA, Chia YM (1994) The effects of management accounting systems, perceived environmental uncertainty and decentralization on managerial performance: a test of three-way interaction. Acc Organ Soc 19:413–426

Gurd B, Helliar C (2017) Looking for leaders: ‘Balancing innovation, risk and management control systems. Br Account Rev 49:91–102

Güttel WH, Konlechner SW, Trede JK (2015) Standardized individuality versus individualized standardization: the role of the context in structurally ambidextrous organizations. RMS 9:261–284

Hair JF, Black WC, Babin BJ, Anderson RE (2014) Multivariate data analysis. Pearson New International Edition, Essex

Hambrick DC (2007) Upper echelons theory: An update. Acad Manag Rev 32:334–343

Hambrick DC, Fukutomi GDS (1991) The seasons of a CEO’s tenure. Acad Manag Rev 16:719–742

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manag Rev 9(2):193–206

Hanlon M, Yeung K, Zuo L (2021) Behavioral economics of accounting: a review of archival research on individual decision makers. Contemp Account Res. https://doi.org/10.1111/1911-3846.12739

He ZL, Wong PK (2004) Exploration vs. exploitation: an empirical test of the ambidexterity hypothesis. Organ Sci 15:481–494

Heavey C, Simsek Z (2014) Distributed cognition in top management teams and organizational ambidexterity: the influence of transactive memory systems. J Manag 43:919–945

Heider A, Gerken M, van Dinther N, Hülsbeck M (2021) Business model innovation through dynamic capabilities in small and medium enterprises–evidence from the German Mittelstand. J Bus Res 130:635–645

Hiebl MR (2014) Upper echelons theory in management accounting and control research. J Manag Control 24:223–240

Hiebl MR (2015) Family involvement and organizational ambidexterity in later-generation family businesses: a framework for further investigation. Manag Decis 53:1061–1082

Hiebl MR, Mayrleitner B (2019) Professionalization of management accounting in family firms: the impact of family members. RMS 13:1037–1068

Hiebl MR, Richter JF (2018) Response rates in management accounting survey research. J Manag Account Res 30:59–79

Hiebl MR, Gärtner B, Duller C (2017) Chief financial officer (CFO) characteristics and ERP system adoption. J Account Organ Chang 13:85–111

Huang J, Kisgen DJ (2013) Gender and corporate finance: are male executives overconfident relative to female executives? J Financ Econ 108:822–839

Huang S, Battisti M, Pickernell D (2021) CEO regulatory focus as the microfoundation of organizational ambidexterity: a configurational approach. J Bus Res 125:26–38

Hughes M, Filser M, Harms R, Kraus S, Chang ML, Cheng CF (2018) Family firm configurations for high performance: the role of entrepreneurship and ambidexterity. Br J Manag 29:595–612

Indjejikian R, Matějka M (2009) CFO fiduciary responsibilities and annual bonus incentives. J Account Res 47:1061–1093

Jansen JJP, Van den Bosch FAJ, Volberda HW (2005) Exploratory innovation, exploitative innovation, and ambidexterity: the impact of environmental and organizational antecedents. Schmalenbach Bus Rev 57:351–363

Jansen JJP, George G, Van den Bosch FAJ, Volberda HW (2008) Senior team attributes and organizational ambidexterity: the moderating role of transformational leadership. J Manage Stud 45:982–1007

Junni P, Sarala RM, Taras V, Tarba SY (2013) Organizational ambidexterity and performance: a meta-analysis. Acad Manag Perspect 27:299–312

Junni P, Sarala RM, Tarba SY, Liu Y, Cooper CL (2015) Guest editors’ introduction: the role of human resources and organizational factors in ambidexterity. Hum Resour Manage 54:1–28

Karhu P, Paavo R (2020) The multiple faces of tension: dualities in decision-making. RMS 14:485–518

Kempster S, Cope J (2010) Learning to lead in the entrepreneurial context. Int J Entrep Behav Res 16:5–34

Kiss AN, Libaers D, Barr PS, Wang T, Zachary MA (2020) CEO cognitive flexibility, information search, and organizational ambidexterity. Strateg Manag J 41:2200–2233

Klein SB (2000) Family businesses in Germany: significance and structure. Fam Bus Rev 13:157–182

Kohtamäki M, Kraus S, Mäkelä M, Rönkkö M (2012) The role of personnel commitment to strategy implementation and organisational learning within the relationship between strategic planning and company performance. Int J Entrep Behav Res 18:159–178

Kortmann S (2015) The mediating role of strategic orientations on the relationship between ambidexterity-oriented decisions and innovative ambidexterity. J Prod Innov Manag 32:666–684

Kraiczy ND, Hack A, Kellermanns FW (2015) What makes a family firm innovative? CEO risk-taking propensity and the organizational context of family firms. J Prod Innov Manag 32:334–348

Lambert C, Sponem S (2012) Roles, authority and involvement of the management accounting function: a multiple case-study perspective. Eur Account Rev 21:565–589

Levinthal DA, March JG (1993) The myopia of learning. Strateg Manag J 14:95–112

Li C (2013) How top management team diversity fosters organizational ambidexterity. J Organ Chang Manag 26(5):874–896

Liu H, Luo JH, Huang JXF (2011) Organizational learning, NPD and environmental uncertainty: an ambidexterity perspective. Asian Bus Manag 10:529–553

Lubatkin MH, Simsek Z, Ling Y, Veiga JF (2006) Ambidexterity and performance in small- to medium-sized firms: the pivotal role of top management team behavioral integration. J Manag 32:646–672

Maine J, Samuelsson EF, Uman T (2021) Ambidextrous sustainability, organisational structure and performance in hybrid organisations. Account Audit Account J. https://doi.org/10.1108/AAAJ-12-2019-4338

Mammassis CS, Kostopoulos KC (2019) CEO goal orientations, environmental dynamism and organizational ambidexterity: an investigation in SMEs. Eur Manag J 37:577–588

March JG (1991) Exploration and exploitation in organizational learning. Organ Sci 2:71–87

Mian S (2001) On the choice and replacement of chief financial officers. J Financ Econ 60:143–175

Michiels A, Arijs D, Uhlaner L (2021) Formal HRM in family SMEs: the role of family-centered goals and family governance. Rev Manag Sci. https://doi.org/10.1007/s11846-021-00509-1

Mihalache OR, Jansen JJP, Van den Bosch FAJ, Volberda HW (2014) Top management team shared leadership and organizational ambidexterity: a moderated mediation framework. Strateg Entrep J 8:128–148

Monferrer Tirado D, Moliner Tena MA, Estrada Guillén M (2019) Ambidexterity as a key factor in banks’ performance: a marketing approach. J Market Theory Pract 27:227–250

Mueller J, Renzl B, Will MG (2020) Ambidextrous leadership: a meta-review applying static and dynamic multi-level perspectives. RMS 14:37–59

Muñoz-Pascual L, Curado C, Galende J (2021) How does the use of information technologies affect the adoption of environmental practices in SMEs? a mixed-methods approach. RMS 15:75–102

Naranjo-Gil D, Maas VS, Hartmann FGH (2009) How CFOs determine management accounting innovation: an examination of direct and indirect effects. Eur Account Rev 18:667–695

Nederhof AJ (1985) Methods of coping with social desirability bias: a review. Eur J Soc Psychol 15:263–280

Neely BH Jr, Lovelace JB, Cowen AP, Hiller NJ (2020) Metacritiques of upper echelons theory: verdicts and recommendations for future research. J Manag 46:1029–1062

Nitzl C (2016) The use of partial least squares structural equation modelling (PLS-SEM) in management accounting research: directions for future theory development. J Account Lit 37:19–35

Nitzl C, Chin WW (2017) The case of partial least squares (PLS) path modeling in managerial accounting research. J Manag Control 28:137–156

O’Reilly CA III, Tushman ML (2011) Organizational ambidexterity in action: how managers explore and exploit. Calif Manage Rev 53:5–22

Pahnke A, Welter F (2019) The German Mittelstand: antithesis to Silicon Valley entrepreneurship? Small Bus Econ 52:345–358

Pielsticker DI, Hiebl MRW (2020) Survey response rates in family business research. Eur Manag Rev 17:327–346

Plöckinger M, Aschauer E, Hiebl MRW, Rohatschek R (2016) The influence of individual executives on corporate financial reporting: a review and outlook from the perspective of upper echelons theory. J Account Lit 37:55–75

Podsakoff PM, MacKenzie SB, Lee JY, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88:879–903

Politis D (2005) The process of entrepreneurial learning: a conceptual framework. Entrep Theory Pract 29:399–424

Qian C, Cao Q, Takeuchi R (2013) Top management team functional diversity and organizational innovation in China: the moderating effects of environment. Strateg Manag J 34:110–120

Querbach S, Bird M, Kraft PS, Kammerlander N (2020) When the former CEO stays on board: the role of the predecessor’s board retention for product innovation in family firms. J Prod Innov Manag 37:184–207

Richter AW, Hirst G, Van Knippenberg D, Baer M (2012) Creative self-efficacy and individual creativity in team contexts: cross-level interactions with team informational resources. J Appl Psychol 97:1282–1290

Ringle CM, Wende S, Becker J-M (2015) SmartPLS 3, Bönningstedt: SmartPLS, available at: www.smartpls.com

Roberts ES (1999) In defence of the survey method: an illustration from a study of user information satisfaction. Acc Finance 39:53–77

Roffia P, Moracchiato S, Liguori E, Kraus S (2021) Operationally defining family SMEs: a critical review. J Small Bus Enterp Dev 28:229–260

Rogan M, Mors ML (2014) A network perspective on individual-level ambidexterity in organizations. Organ Sci 25:1860–1877

Schäffer U, Zander BVK (2008) CFO-Karrieren im Wandel. Zeitschrift Für Control Manag 52:375–382

Schendel D (1992) Introduction to the summer 1992 special issue on “Strategy Process Research.” Strategy Manag J 13:1–4

Sieger P, Zellweger T, Aquino K (2013) Turning agents into psychological principals: aligning interests of non-owners through psychological ownership. J Manag Stud 50:361–388

Simon H (1996) You don’t have to be German to be a “hidden champion.” Bus Strateg Rev 7:1–13

Sinha S (2019) The emergent-strategy process of initiating organizational ambidexterity. J Strateg Manag 12:382–396

Smith E, Umans T (2015) Organizational ambidexterity at the local government level: the effects of managerial focus. Public Manag Rev 17:812–833

Steiger T, Duller C, Hiebl MRW (2015) No consensus in sight: an analysis of ten years of family business definitions in empirical research studies. J Enterpr Cult 23:25–62