Abstract

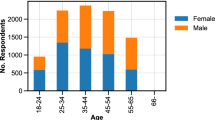

Making use of unique balanced panel data for the German chemical sector from the years 2008 to 2011, we explore the extent to which managers’ compensation was affected by the economic crisis and the extent to which it increased afterwards. Carrying out longitudinal analyses, we find that, on average, bonus payments (in contrast to fixed salaries) decrease considerably during the crisis. The economic upturn in 2011 then leads to an average increase in variable payments and total compensation to even above the pre-crisis level. Changes in bonus payments are negatively correlated over time. We find considerable differences across employees with respect to changes in bonus payments. Fixed salary changes are much more homogeneous over the period of crisis. We explore determinants of compensation changes and find that changes in compensation have a strong relationship with employees’ age, firm size and hierarchical level. Our findings hint at the relevance of an incentive perspective. We also examine that certain parts of managers seem to have more power to influence their compensation than others.

Similar content being viewed by others

Notes

Pooled OLS regression as well as fixed effects regression results on the logarithm of compensation components as dependent variables confirm our results (available upon request).

Contrary to our results, Kampkötter and Sliwka (2011) show bonus payments of non-executive bank managers at higher hierarchical levels to be more negatively affected by the financial crisis indicating a positive relationship between financial performance and variable payments.

The detailed results are provided by the authors on request.

References

Arrow KJ (1985) The economics of agency. In: Pratt JW, Zeckhauser RJ (eds) Principals and agents: the structure of business. Havard Business School Press, Boston, pp 37–51

Babecky J, Du Caju P, Kosma T, Lawless M, Messina J, Room T (2010) Downward nominal and real wage rigidity: survey evidence from European firms. Scand J Econ 112(4):884–910

Baker GP, Gibbs M, Holström B (1994) The wage policy of a firm. Q J Econ 109(4):921–955

Bauer T, Bonin H, Goette L, Sunde U (2007) Real and nominal wage rigidities and the rate of inflation: evidence from West German micro data. Econ J 117(524):508–529

Baumgarten S (2009) Germany extends subsidised short-time working to 24 months http://www.icis.com/resources/news/2009/05/21/9218527/germany-extends-subsidised-short-time-working-to-24-months. Accessed 10 June 2014

Bebchuk LA, Fried JM (2003) Executive compensation as an agency problem. J Econon Perspect 17(3):71–92

Becker GS (1964) Human capital: a theoretical and empirical analysis with special reference to education. University of Chicago Press, Chicago

Berle AA, Means GC (1932) The Modern Corporation and Private Property. Harcourt, Brace & World, New York

Bewley TF (1999) Why wages don’t fall during a rescession. Harvard University Press, Cambridge

Brenke K, Rinne U, Zimmermann KF (2011) Short-time work: the German answer to the Great Recession. IZA discussion paper no. 5780

Brenner S, Schwalbach J (2003) Management quality, firm size and managerial compensation: a comparison between Germany and the UK. Schmalenbach Bus Rev 55:280–293

Card D, Hyslop D (1997) Does inflation grease the wheels of the labor market? In: Romer C, Romer D (eds) Reducing inflation: motivation and strategy. Chicago University Press, Chicago, pp 71–113

Dohmen TJ (2004) Performance, seniority, and wages: formal salary systems and individual earnings profiles. Labour Econ 11(6):741–763

Elston JA, Goldberg LG (2003) Executive compensation and agency costs in Germany. J Bank Financ 27:1391–1410

Erkens D, Hung M, Matos P (2009) Corporate governance in the 2007–2008 financial crisis: evidence from the financial institutions worldwide. University of Southern California working paper

Fabbri F, Marin D (2012) What explains the rise in CEO pay in Germany? A panel data analysis for 1977–2009. IZA discussion paper no. 6420

Fahlenbrach R, Stulz RM (2011) Bank CEO incentives and the credit crisis. J Financ Econ 99:11–26

Fehr E, Falk A (1999) Wage rigidity in a competitive incomplete contract market. J Polit Econ 107(1):106–134

Finkelstein S, Hambrick DC (1989) Chief executive compensation: a study of the interaction of markets and political processes. Strateg Manag J 10:121–134

Gregg P, Jewell S, Tonks I (2012) Executive pay and performance: did bankers’ bonuses cause the crisis? Int Rev Financ 12(1):89–122

Grund C, Kräkel M (2012) Bonus payments, hierarchy levels, and tenure: theoretical considerations and empirical evidence. Schmalenbach Bus Rev 64:102–124

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3:305–360

Jensen MC, Murphy KJ (1990) Performance pay and top-management incentives. J Polit Econ 98(2):225–264

Kampkötter P (2014) Non-executive compensation in German and Swiss Banks before and after the financial crisis. Eur J Financ (forthcoming)

Kampkötter P, Sliwka D (2011) Die Wirkung der Finanzkrise auf Bonuszahlungen in deutschen Banken und Finanzdienstleisungsinstitutionen. In: Die Unternehmung. Swiss Journal of Business Research and Practice 65 Sonderedition 1:151–164

Kräkel M, Schöttner A (2012) Internal labor markets and worker rents. J Econ Behav Organ 84(2):491–509

Lazear EP (1979) Why is there mandatory-retirement. J Polit Econ 87(6):1261–1284

Lindbeck A, Snower DJ (1989) The insider–outsider theory of employment and unemployment. MIT Press, Cambridge

Merck Annual Report (2009) Economic situation http://merck.online-report.eu/2009/ar/managementreport/economicsituation.html. Accessed 19 May 2014

Milkovich GT, Newman JM (1996) Compensation. Irwin, Chicago

Mincer J (1974) Schooling, experience, and earnings. Columbia University Press, New York

Nash D (2003) Determinants of the use of financial incentives in investment banking. ESCR Center of Business Research working paper no. 256

Nastansky A, Lanz R (2010) Bonuszahlungen in der Kreditwirtschaft: Analyse, Regulierung und Entwicklungstendenzen. Discussion paper no. 41, ISSN:0949-068X, Universität Potsdam

O’Farrrell R (2010) Wages in the crisis. European Trade Union Institute (ETUI) working paper no. 2010.03

OECD (2010) OECD economic surveys: Germany. OECD Publishing. http://dx.doi.org/10.1787/eco_surveys-deu-2010-de

Oi WY, Idson TL (1999) Firm-size and wages. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 3. North Holland, Amsterdam, pp 2166–2214

Ortin-Angel P, Salas-Fumas V (1998) Agency-theory and internal-labor-market explanations of bonus payments: empirical evidence from Spanish firms. J Econ Manag Strategy 7(4):573–613

Ross SA (1973) The economics theory of agency: the Principal’s problem. Am Econ Rev 63:134–139

Stiglitz JE (1986) Theories of wage rigidity. In: Butkiewicz JL, Koford KJ, Miller JB (eds) Keynes’ economic legacy: contemporary economic theories. Praeger Publishers, New York, pp 153–206

VCI (2010) Chemical indutry.https://www.vci.de/Downloads/PDF/VCI-Jahrespressekon-ferenz%20am%2014.%20Dezember%202010.pdf. Accessed 19 May 2014

VCI (2011) Chemical industry. https://www.vci.de/Downloads/BP2011EN.pdf. Accessed 19 May 2014

Westergard-Nielsen N, Neamtu I (2012) How are firms affected by the crisis and how do they react? IZA Discussion paper no. 6671

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Fig. 6 and Tables 5, 6, 7, 8.

Rights and permissions

About this article

Cite this article

Grund, C., Walter, T. Management compensation and the economic crisis: longitudinal evidence from the German chemical sector. Rev Manag Sci 9, 751–777 (2015). https://doi.org/10.1007/s11846-014-0136-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-014-0136-6