Abstract

Taking a socially proactive stance that aligns with their economic imperatives has led multinational corporations (MNCs) to focus on social innovation that tackles environmental challenges (or eco-innovation hereafter). Their knowledge of eco-innovation is important to emerging markets that are facing severe environmental challenges and to emerging market firms (EMFs) whose eco-innovation activities face resource and knowledge constraints. MNCs, through their foreign direct investment (FDI) activities in host emerging markets, can divulge economic, knowledge and environmental values of eco-innovation, helping EMFs to improve their eco-innovation through knowledge spillover channels. Taking the value-based approach, we draw on the eco-innovation research and the MNC/FDI spillovers literature to develop hypotheses on the relationship between regional knowledge spillovers of MNCs and the eco-innovation of EMFs in a multi-dimensional task environment characterized by munificence, complexity and dynamism. Our empirical examination is based on a sample of Chinese manufacturing firms from 2003 to 2013. We find support for hypotheses that regional knowledge spillovers of MNCs enhance the positive effects of munificence and mitigate the negative effects of complexity and dynamism on the eco-innovation of EMFs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Multinational corporations (MNCs) are increasingly chartered by their stakeholders to address social imperatives and to contribute to the United Nation’s Sustainable Development Goals (SDGs) (van Zanten & van Tulder, 2018). Taking a socially proactive stance that aligns to economic imperatives has led MNCs to focus on social innovation that tackles environmental challenges (or eco-innovation hereafter) (Kolk & Pinkse, 2008; Solis-Navarrete et al., 2021). MNCs are an important driving force of eco-innovationFootnote 1 (Castellani et al., 2022; Marin & Zanfei, 2019). They conduct eco-innovation both at home and globally (Marin & Zanfei, 2019) and MNC subsidiaries are shown to engage in more eco-innovation than their domestic counterparts (Amendolagine et al., 2023). The eco-innovation-related knowledge transferred from MNCs to subsidiaries through foreign direct investment (FDI), and these subsidiaries’ eco-innovation in the host countries gives rise to knowledge spillovers. Knowledge spillovers are pertinent to emerging markets that face severe environmental challenges, and their eco-innovation effort is confronted with knowledge constraints (Cecere et al., 2014; Kiefer et al., 2019). MNCs can divulge economic, knowledge and environmental values of eco-innovation to emerging market firms (EMFs). Utilizing knowledge spillover channels, EMFs can appreciate and appropriate the values associated with MNCs’ eco-innovation and engage in their value creation through eco-innovation.

However, prior firm-level studiesFootnote 2 have paid limited attention to the impact of MNC knowledge spillovers on eco-innovation of EMFs with the exception of Ha and Wei (2019) and Wang et al. (2023). Based on institutional theory, Ha and Wei (2019) examine MNC eco-innovation spillovers, both directly and being contingent on domestic institutions. Combining natural-resource-based view (NRBV) and institutional-based view (IBV), Wang et al. (2023) focus on the direct effects and the moderated effects by environmental regulations and pollution intensity. Complementing these two studies, we take the value-based approach and view the decision of EMFs to conduct eco-innovation by leveraging MNC knowledge spillovers as a function of the values they attach to the value creation and value appropriation activities. We focus on regional spillovers because MNC knowledge spillovers tend to be localized, centering around a region that provides economic and social infrastructure to support these spillovers (Driffield, 2006; Hamida, 2013). Furthermore, we examine MNC eco-innovation spillovers in tandem with the organizational task environment characterized by munificence, complexity and dynamism (Dess & Beard, 1984) because firms are highly dependent on their environment for resources, information, and opportunities that can be explored and exploited for eco-innovation.

Investigating economic, knowledge and environmental values as the motivating factors for EMFs to seek knowledge spillovers of MNCs (value appropriation) for eco-innovation (value creation), we formulate the baseline hypothesis on the positive relationship between regional MNC knowledge spillovers and eco-innovation of EMFs. Subsequently, we propose that MNC knowledge spillovers enhance the positive effects of munificence and mitigate the negative effects of complexity and dynamism on the eco-innovation of EMFs through both motivating and enabling mechanisms.

We test these hypotheses on a large sample of Chinese manufacturing firms from 2003 to 2013. China provides an appropriate empirical setting because of the country’s significant deterioration of ecological environment and fast growth of eco-innovation activities, as well as her leading position as FDI recipient for past decades. China pledged to peak carbon emissions by 2030 and to reach carbon-neutral by 2060 (Wei et al., 2022); and eco-innovation holds the key to achieve these targets, whereas the role of regional MNC knowledge spillovers and its interplay with environmental factors in fostering eco-innovation are a critical aspect. Our empirical evidence lends support to hypotheses, pointing to the significant role played by MNC knowledge spillovers in shaping eco-innovation of EMFs in a multi-dimensional environment.

This research makes two main contributions. First, our conceptual model provides a new perspective on the intersection between social innovation and MNC research where “[t]here is a lack of theory development”, as noted in the Focal Issue Call for Papers (CfP) on MNCs and Social Innovation in Emerging Markets by Adomako et al., (2024). The social innovation literature and the MNC/FDI spillover literature have largely been developed in parallel. The former tends to focus on “agentic centered perspective” and “structuralist perspective” (Cajaiba-Santana, 2014), whereas the latter has mostly taken the lens of resource-based approach (for reviews, see Crespo & Fontoura, 2007, Perri & Peruffo, 2016, Spencer, 2008) and more recently the combination of NRBV and IBV (Wang et al., 2023). Although “[T]he ultimate goal of economic activities is generating value” (Chesbrough et al., 2018: 936), the value perspective is overlooked by both research streams. Taking the value-based approach to develop our conceptual model, we offer a fresh perspective on both research streams, build a direct link between the two, and reveal the value enhancement effects of MNC knowledge spillovers in shaping the underpinnings of the relationship between organizational environment and corporate eco-innovation.

Our second contribution lies in establishing the role of MNC knowledge spillovers in interacting with environmental factors on eco-innovation of EMFs. This aligns with the specific question raised in the CfP on “what mechanisms affect the process” of MNC eco-innovation spillovers (Adomako et al., 2024). While there has been substantial research attention to knowledge spillover effects of MNCs and suggestions that contextual conditions may influence such effects (Crespo & Fontoura, 2007), current considerations do not include environmental conditions that bring imperative aspects with implications on MNC eco-innovation spillovers. On the other hand, organizational environment characterized by munificence, dynamism and complexity has been highlighted to present direct effects on corporate environmental practices (Chen et al., 2017) and eco-innovation adoption (Rothenberg & Zyglidopoulos, 2007) and moderated effects of environmental management on environmental performance (Hartmann & Vachon, 2018). However, there is no research on the eco-innovation (or innovation) effects of their interplay with regional MNC knowledge spillovers. Our findings on the interplay between MNC knowledge spillovers and environmental factors accentuate the instrumental role of regional knowledge spillovers of MNCs in fostering eco-innovation of EMFs within a multi-dimensional environment.

2 Literature Review and Hypotheses Development

2.1 Social Innovation and Eco-innovation by MNCs

Social innovation is a recent approach to address the complex “grand challenges”Footnote 3 (Avelino et al., 2019). However, as the research on social innovation is gaining momentum over the past two decades, so is the proliferation of its definitions (for reviews, see Cajaiba-Santana, 2014, Dionisio & de Vargas, 2020, Solis-Navarrete et al., 2021). Social innovation has been defined to consist new ideas (e.g., narratives, rules, knowledge and expectations) being associated with social goals, innovative activities and services fulfilling social needs, novel solutions (e.g., products, processes, services or models) meeting dual objectives of social needs and effective resource utilization and new/improved capability building, and social practice changes producing transformation in social relations, systems and structures to solve social problems. Despite multiple definitions, they all converge on taking the “social” as object of innovation and addressing societal challenges as the main purpose. In their efforts to analyze the scope and boundaries of social innovation, Solis-Navarrete et al. (2021: 5) argue that eco-innovation “can be considered a SI (social innovation) due to the positive externalities generated and the improvements from a vision of sustainable development.”. Eco-innovation plays a key role in tackling one of the societal challenges, i.e., climate change and clean growth.

There is a significant body of literature on eco-innovation (for reviews, see Barbieri et al., 2016, Bitencourt et al., 2020, Dangelico, 2016, del Río et al., 2016, He et al., 2018, Hojnik & Ruzzier, 2016, Liao et al., 2018, Tariq et al., 2017). However, it has paid limited attention to the role of MNC/FDI (Wang et al., 2023). As grand challenges in general, and environmental challenges in particular, are a global phenomenon, MNCs seem apt to the task of addressing these challenges. Not only are they leaders in eco-innovation, but also, they conduct eco-innovation in host as well as home countries (Castellani et al., 2022; De Marchi et al., 2022; Kawai et al., 2018; Konara et al., 2021; Marin & Zanfei, 2019; Noailly & Ryfisch, 2015). This gives them the means to make a positive impact on environmental performance of the host countriesFootnote 4 broadly and eco-innovation of EMFs specifically. Furthermore, MNCs are under pressure to undertake eco-innovation and transfer innovative outputs to host countries as they are perceived to be responsible for troubling social, economic, and environmental issues and “to be prospering at the expense of the broader community” (Dionisio & de Vargas, 2020: 1). They are increasingly subject to the scrutiny of global monitors and the media and are held to higher standards by host country governments and local stakeholders (Kim et al., 2016; King & Shaver, 2001).

Owing to the public goods nature of eco-innovation knowledge, it may not be totally internalized by MNCs despite their efforts in protecting these proprietary knowledge, thus it can spill over to EMFs, i.e. the so-called MNC knowledge spillovers which are defined as informal flows of knowledge from MNCs and their subsidiaries to domestic firmsFootnote 5 (Perri & Peruffo, 2016). Research on the geography of organizational knowledge has consistently revealed that knowledge spillovers in general tend to be localized because tacit knowledge is spatially sticky, requiring in-person interactions and oral communications; and knowledge creation and diffusion activities are more accessible when communication costs are lower (Driffield, 2006; Hamida, 2013; Keller, 2004; Spithoven & Merlevede, 2023). Furthermore, regions nurture economic infrastructure, e.g., industrial clusters and localized labor pool, which induces the accumulation, creation, and diffusion of tacit knowledge across the horizontal and vertical dimensions of sectors (Ning et al., 2016; Wang & Wu, 2016). Regions facilitate the cultivation of social infrastructure, e.g., networks and communities, through which shared socio-cognitive frameworks among firms and agents are formulated for knowledge creation and diffusion (Sajarattanochote & Poon, 2009; Wang & Wu, 2016). Finally, many of the environmental challenges are inherently tied to local resource endowments such as water and land, consequently regions may act as the crucible where knowledge of MNCs would be appropriated to forge localized solutions through eco-innovation. In this paper, we thus emphasize the regional dimension of MNC knowledge spillovers.

2.2 The Value-based Approach on Regional Knowledge Spillover Effects of MNCs on Eco-innovation of EMFs

The value-based approach has its origin in economics initiated by the work of Brandenburger and Stuart Jr (1996). It has since been further conceptualized and developed in the business and management field (e.g., Barney et al., 2021, Bowman & Ambrosini, 2000, Cabral et al., 2019, Lepak et al., 2007). Although a few innovation studies have applied this theoretical lens (Chesbrough et al., 2018; Jacobides et al., 2006; Sjödin et al., 2020), they have not paid much attention to eco-innovation which has different value configuration from conventional innovation. Additionally, no study on MNC/FDI knowledge spillover is theoretically underpinned by this approach. A novelty of our paper therefore is to take the value-based approach to examine the impact of MNC knowledge spillovers on eco-innovation of EMFs.

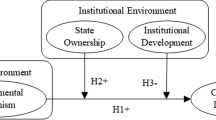

The premise of our approach is that value is the motivating factor for eco-innovation, and the knowledge spillover effects of MNCs on eco-innovation of EMFs are a combination of value appropriation and creation process, as depicted in Fig. 1. Value creation refers to a firm’s attempt to increase values through engaging in a resource-deployment process, e.g., innovation, whereas value appropriation/capture concerns a firm’s effort in appropriating or capturing values created internally or externally through knowledge spillovers (Bowman & Ambrosini, 2000; Chesbrough et al., 2018; Lepak et al., 2007; Volschenk et al., 2016).

There are three types of values associated with eco-innovation: economic value, knowledge value and environmental value (Niesten & Jolink, 2020). The classic economic theorizing has centered on economic value, defined as the net rent earning capacity that can be gained through exploiting new market opportunities (Brandenburger & Stuart Jr., 1996). Knowledge value results from the innovative nature of technologies and is less tangible than economic value (Niesten & Jolink, 2020). Like conventional innovation, eco-innovation has both economic value and knowledge value. What is unique about eco-innovation lies in environmental value which refers to the positive contributions of eco-innovation to ecological environment such as air, water, and biodiversity (Niesten & Jolink, 2020; Volschenk et al., 2016). Capitalizing on knowledge value and environmental value can create economic value (Berrone et al., 2013; Eiadat et al., 2008). However, not all knowledge value and environmental value can be internalized. This leads to “double externality” which undermines private cost bearing due to relatively higher environmental benefits to society (De Marchi, 2012; Kawai et al., 2018).

The value-based approach is important to eco-innovation in emerging markets that, by and large, lag behind developed countries (Latupeirissa & Adhariani, 2020, OECD, 2022, Santos et al., 2019). With eco-innovation being a relatively new concept and the dominant paradigm of eco-product and eco-process being underdeveloped in emerging markets, EMFs face significant resource and knowledge constraints, particularly path dependency nature of technological development, limitations in the eco-technological trajectories, and unsophisticated stakeholder environment towards proactive environmental strategies including eco-innovation (Cecere et al., 2014; De Marchi et al., 2022; Kiefer et al., 2019; Maksimov et al., 2022; Rennings, 2000). The old technological paradigm is usually insensitive to environmental issues and/or even has detrimental environmental effects. However, conducting eco-innovation to attain knowledge value requires significant internal R&D investment, as well as the co-evolution, coopetition in industry dynamics; and to realize economic and environmental value often involves not only educating customers but also fending off organizational resistance (Maksimov et al., 2022; Wang et al., 2023). MNCs present economic, knowledge and environmental values of eco-innovation to EMFs, which may stimulate the latter’s eco-innovation efforts.

When undertaking FDI in host countries, MNCs transfer firm-specific assets (FSAs) including advanced technologies to their subsidiaries so that the latter can have competitive advantages and overcome the liability of foreignness. This knowledge transfer process is value bearing as the tangible effects go beyond MNC subsidiaries and it generates knowledge spillovers on EMFs. Many studies have examined the MNC/FDI spillover effects, but they mostly focus on productivity improvement of EMFs (for reviews, see Crespo & Fontoura, 2007, Görg & Greenaway, 2004, Perri & Peruffo, 2016, Rojec & Knell, 2018, Smeets, 2008, Spencer, 2008). We conducted a systematic literature review (see Appendix A). It shows that there are only a few studies on MNC/FDI innovation spillovers and much less on eco-innovation spillovers. Drawing on this stream of research, we take the value-based approach to explore the relationship between MNC knowledge spillovers and eco-innovation of EMFs.

The theoretical rationale for eco-innovation spillovers can be associated with four channels: demonstration, labor mobility, intra and inter-industry linkages and intra-industry competition (Spencer, 2008); and the first three channels are also connected to institutional isomorphism (Wang et al., 2023). Economic, knowledge and environmental values are of pivotal significance in MNC knowledge spillovers. Through demonstration, labor mobility, and linkages channels, these values are motivating factors for EMFs to seek regional knowledge spillovers of MNCs (value appropriation) for eco-innovation (value creation). Although the competition channel presents both negative and positive effects, from the value-based approach, economic value embodied in MNCs’ eco-innovation presents an incentive for EMFs to engage in eco-innovation.

First, the demonstration channel is expected to generate positive effects on EMFs’ eco-innovation. Through demonstrating the application of advanced environmental knowledge and latest green technologies, knowledge value of eco-innovation of MNCs is revealed to EMFs. This spillage provides invaluable inputs to eco-innovation of EMFs and offers them learning opportunities through learning-by-watching, learning-by-doing or reverse engineering. However, what is more important in the context of emerging markets is the demonstration of the economic and environmental values of eco-innovation. From the institutional perspective, this can stimulate mimetic isomorphism. The peculiarities of eco-innovation present significant barriers. Take clean energy project finance as an example, Emodi et al. (2022)’s systematic review of 45 studies identifies 36 barriers that fall into the broad groups of business/market; construction, technical and operational; environmental; financial; legal and ownership rights; policy and regulatory; and political and social barriers. This leads to underinvestment in eco-innovation. Observing the economic value of eco-innovation helps EMFs overcome barriers by modelling MNCs’ strategies and practices so as to reduce uncertainty and respond to ambiguity (Galbreath, 2019; Liao, 2018). Similarly, environmental value of eco-innovation helps to improve firms’ corporate image and recognizing the potential of internalizing environmental value for marketing incentivizes the imitation of MNCs by EMFs (Berrone et al., 2013; Eiadat et al., 2008; Marco-Lajara et al., 2023). The demonstration channel is likely to have more pronounced effects from the regional perspective because geographical proximity facilitates organizational learning, knowledge acquisition and the exchange of novel ideas (Driffield, 2006; Hamida, 2013).

Second, regional MNC knowledge spillovers may be realized through labor mobility whereby trained and skilled personnel who once worked for MNC subsidiaries move to EMFs or set up their own enterprises. Knowledge associated with FSAs embedded in these people may enhance their new organizations’ eco-innovation. The more complex the new piece of knowledge, the more important personal contact is in terms of recognizing and realizing their associated economic, knowledge and environmental values. Inter-personal communication and interaction facilitate the knowledge recipient’s understanding of these values and improve knowledge absorption and knowledge diffusion (Liu et al., 2015). Furthermore, the labor turnover channel can serve as a mimetic and/or normative process. These former employees of MNCs can increase the awareness of environmental issues, environmental practices and the associated market and technical opportunities explored by MNCs in the new organizations. Their imprinting in MNCs also creates a cognitive and normative frame that influences their perspectives on organizational goals and means for achieving the goals. They, thus, can work as a conduit to stimulate the appreciation and appropriation of the values of the MNCs’ knowledge, influencing EMFs to engage in eco-innovation (Ha & Wei, 2019).

Third, EMFs’ intra- and inter-industry linkages with MNCs and their subsidiaries can take place through both backward linkages when MNC subsidiaries transact with suppliers and forward linkages when MNC subsidiaries do businesses with local customers. Domestic suppliers may conduct more eco-innovation when MNCs and their subsidiaries impose requirements on the environmental quality and standards of inputs and endorse environmentally friendly production processes through coercive and normative isomorphism (Chiarvesio et al., 2015; Christmann & Taylor, 2001; Galbreath, 2019; Li, 2014; Wu & Ma, 2016). To benefit from the improved performance of intermediate input suppliers, MNCs and their subsidiaries may also provide technical assistance or event engage in joint eco-innovation with EMFs to generate new economic, knowledge and environmental values. Forward linkages may contribute to the knowledge stock of domestic distribution and sales organizations as interactions with and purchasing from MNCs offer these firms opportunities to learn about economic, knowledge and environmental values of eco-innovation. This interaction also exerts normative influences on EMFs through the effects of a shared discursive and cognitive frame and the stimulation of similar worldviews. The linkage channel along the regional dimension is likely to have stronger effects because shorter distance between MNCs and their upstream suppliers and downstream customers facilitates the spontaneous exchange of ideas and the flow of tacit knowledge and minimizes transaction costs and the risk of communication breakdown (Driffield, 2006; Gong, 2023; Hamida, 2013; Ning et al., 2016).

Finally, the intra-industry competition can be a double-edge sword on eco-innovation. Eco-innovation, like conventional innovation, carries high degrees of uncertainty, risks, and costs, and eco-innovators must bear high unpredictability in economic profit. Competitive pressures from MNC subsidiaries therefore may force EMFs to cut back investments in risky projects such as eco-innovation (Perri & Peruffo, 2016). However, from the value perspective, these competitive pressures may force EMFs to focus on economic value creation through eco-innovation. There is strong evidence on the positive relationship between firm performance and eco-innovation, as revealed by Hizarci-Payne et al. (2021) whose meta-analysis synthesizes evidence based on 70 primary studies. Thus, through the competition channel, there is still scope for EMFs to benefit from economic value associated with eco-innovation generated by other firms. MNC knowledge spillovers may motivate EMFs to undertake eco-innovation for the benefits of economic value.

Because our focus is on the regional dimension of MNC spillovers that includes both intra- and inter-industry spillovers, it would be reasonable to expect their dominant positive geographical effects, thus the negative competition effects being outweigh by the combined positive effects through the channels of demonstration, labor mobility, linkages and competition. Empirically, there are only two firm-level studies on the eco-innovation spillovers of MNCs, Ha and Wei (2019) and Wang et al. (2023). Examining Korean firms, Ha and Wei (2019) find direct positive effects at the industry level. Wang et al. (2023) show that the positive direct effects of MNC/FDI knowledge spillovers on Chinese firms are confined at the city level, not the industry level. A related study by Ha (2021) reveals that the positive eco-innovation effects of MNC knowledge spillovers work through the mediating channel of attention field. Broadly, there are studies on the innovation spillovers of MNCs/FDI which do not differentiate eco-innovation and conventional innovation (see a summary of findings in Table A1). Although the findings are mixed, a majority lean towards the positive effects and such effects are pronounced in studies that have a focus on regional spillovers. In view of the theoretical rationale presented above and on balance of the evidence of the positive MNC eco-innovation spillovers albeit in a small number of studies, and that on regional innovation spillovers of MNCs/FDI, we propose:

H1: Regional MNC knowledge spillovers positively impact on the eco-innovation of EMFs.

2.3 The Moderating Role of MNC Knowledge Spillovers in the Eco-innovation Effects of Task Environment

Organizational task environments encompass external conditions within which firms operate (Dill, 1958). Since the seminal research of Dess and Beard (1984), a body of work has examined organizational environment characterized by munificence, dynamism and complexity. This includes studies that have highlighted their direct effects on corporate environmental practices (Chen et al., 2017) and eco-innovation (Rothenberg & Zyglidopoulos, 2007) and moderated effects of environmental management on environmental performance (Hartmann & Vachon, 2018). However, as our systematic literature review shows that organizational task environment has not been examined in the research on MNC knowledge spillovers for innovation (see Table A1). Building on Sect. 2.2, below we shall develop hypotheses on the interplay between MNC knowledge spillovers and organizational environment. While munificence offers opportunities and dynamism and complexity present threats to EMFs’ eco-innovation, through motivating and enabling mechanisms, MNC knowledge spillovers shape the effects of these environmental factors.

2.3.1 Munificence, MNC Knowledge Spillovers, and Eco-innovation

Munificence refers to the abundance of critical resources that can support sustainable growth and provide organizational slack within an industry (Dess & Beard, 1984; Dess & Origer, 1987). The prior literature suggests that munificence impacts on firm strategies and performance (Fainshmidt et al., 2019; Goll & Rasheed, 2005; Rothenberg & Zyglidopoulos, 2007). High levels of munificence provide firms with confidence and energy to adopt proactive environmental strategies (Aragón-Correa & Sharma, 2003; Rueda-Manzanares et al., 2008) and make it easier and cheaper for them to obtain needed resources for long-term, risky, value-creation activities, such as eco-innovation (Martinez-del-Rio et al., 2015), whereas firms in low munificent environments characterized as “shortage of resources, stagnating or declining demand, and environmental threats” (Goll & Rasheed, 2005: 1007) tend to “avoid excessive risk taking and pay greater attention to the conversation of resources” (Goll & Rasheed, 2005: 1008).

Like conventional innovation, firms have to commit substantial resources to the development of eco-innovation (Dangelico, 2016; He et al., 2018; Liao & Liu, 2021). Eco-innovation, however, is also associated with complexity and ambiguity in means and ends (DiMaggio & Powell, 1983). Its financial benefits may be long-term and its impact on short-term profitability could be negative (Aragón-Correa & Sharma, 2003; McWilliams & Siegel, 2001). These bring complications to firms’ eco-innovation commitment. In high munificent environments, not only abundant resources may act as a buffer, allowing firms to explore change options such as experimenting and exploring eco-innovation, but also there are ample opportunities for firms to recognize and realize economic value of eco-innovation and turn knowledge and environmental values of eco-innovation into economic profit. The eco-friendly activities are also likely to be supported by stakeholders, which can help firms to acquire knowledge and environmental value-added assets for eco-innovation (Chen et al., 2017; Delmas & Toffel, 2004; Dögl & Behnam, 2015), achieve high operational efficiency and long-term financial performance (Aguilera-Caracuel & Ortiz-de-Mandojana, 2013; Russo & Fouts, 1997), and build a strong reputation (Brammer & Pavelin, 2006; Chen et al., 2017). In contrast, lower levels of munificence constitute a harsh business environment where limited economic activities make it difficult for firms to generate an income stream, putting them in a “defending position” by adopting conservative strategies and cutting back or avoiding activities “not immediately contributing to their productive capacities, such as environmental innovations” (Rothenberg & Zyglidopoulos, 2007: 41). Thus, we expect the positive effects of munificence on eco-innovation of EMFs.

H2: Munificence positively impacts on the eco-innovation of EMFs.

We posit that MNC knowledge spillovers strengthen the positive eco-innovation effects of munificence through motivating and enabling mechanisms. First, as argued above, munificence acts as catalyst for firms, both MNCs and EMFs, to pursue growth and embrace eco-innovation that generate economic, knowledge and environmental values. Munificence propels MNC subsidiaries to explore local market opportunities by transferring knowledge to and conducting eco-innovation. Through spillover channels, eco-innovation activities of MNC subsidiaries, that are embedded with value-creating tacit knowledge, present to EMFs new areas of opportunities, and munificent environments allow EMFs to design the strategy and develop the capacity to identify and recognize economic, knowledge and environmental values associated with these emerging opportunities. The substantial influx of MNC knowledge spillovers within munificent environments effectively bridges the resource and knowledge gap faced by EMFs, inspiring them to appropriate values from MNCs and creating values by conducting eco-innovation so as not to miss the “next big thing”. The positive eco-innovation spillover effects are likely to hold even when EMFs encounter severe competitive pressures from MNCs, because intensive competition with MNCs also provides greater opportunities for EMFs to grasp the fundamentals of competition and being competitive, motiving them to appreciate the values of MNC knowledge spillovers. Therefore, the competition channel underscores the necessity of harnessing the abundant resources within the munificent environment to engage in value-creating eco-innovation endeavors.

Second, MNC knowledge spillovers in munificent environments act as an enabling factor and provide means for EMFs to appropriate these values for eco-innovation. Although munificence allows EMFs to mobilize resources towards eco-innovation, it is the MNC knowledge spillovers that guide their path. By virtue of the favorable economic conditions in munificent environments, EMFs can engage in experiential learning and pursue duplicate/creative imitations, which can then be incorporated in their own eco-innovations. Thus, MNC knowledge spillovers empower EMFs to fully capitalize on the eco-innovation opportunities created by the munificent environments. In contrast, if MNC knowledge spillovers are low, EMFs may opt to allocate limited resources available to pursue other differentiation strategies than eco-innovation. They are also under less pressure to conduct eco-innovation in responding to the challenges of ecological environment. Munificence and MNC knowledge spillovers together offer a synergistic influence on the eco-innovation of EMFs. Thus, the higher the level of munificence in the industrial environment, the greater the opportunities for EMFs to appreciate the economic, knowledge and environmental values of MNC knowledge spillovers for eco-innovation benefits.

H3: MNC knowledge spillovers strengthen the positive effects of munificence on the eco-innovation of EMFs.

2.3.2 Complexity, MNC Knowledge Spillovers, and Eco-innovation

Complexity describes the heterogeneity of environmental factors (e.g., differences in competitive tactics, customer tastes, product lines, and channels of distribution) with which firms need to contend (Dess & Beard, 1984; Dess & Origer, 1987). Higher levels of complexity in an industrial environment make it harder for a firm to “keep track of heterogeneous actors and a range of activities, linkages and interactions outside its boundaries” (Anderson & Tushman, 2001: 691) and for managers to determine “the key factors strategically important for success” (Aragón-Correa & Sharma, 2003: 79). Although in a complex setting, firms need sophisticated, complex organizational resources and capabilities to act as a competitive advantage to combat complex situations, this in turn can trigger conventional innovation (Xue et al., 2012). Paradoxically, such resources and capabilities are difficult to create, administer and implement for environmental strategy and practices (Aragón-Correa & Sharma, 2003; Chen et al., 2017; Rueda-Manzanares et al., 2008). Considering the resources and knowledge constraints for eco-innovation by EMFs, it is probable that, even the economic, knowledge and environmental values associated with eco-innovation are recognized, complexity would pose an obstacle rather than a catalyst for value creation activities of eco-innovation. Furthermore, as mentioned above, eco-innovation in emerging markets often requires technological regime change, new development in systems, processes and products that involve many stakeholders within and across organizations and at multiple levels (e.g., employees, shareholders, suppliers, customers, local communities, and environmental agencies) and systematic and coordinated investment in building green capabilities (Hart, 1995; Maksimov et al., 2022). Such radical changes are difficult to make in a complex environment especially when firms face resource and knowledge constraints. Consequently, they may have the will to pursue eco-innovation, but may lack the knowledge-related means to realize it. Instead, firms often take conservative strategies by focusing on small adjustments (Aragón-Correa & Sharma, 2003; Lin et al., 2016). Thus, we expect the negative effects of complexity on eco-innovation of EMFs.

H4: Complexity negatively impacts on the eco-innovation of EMFs.

However, we posit that MNC knowledge spillovers mitigate the negative eco-innovation effects of complexity through motivating and enabling mechanisms. First, EMFs operating in a complex environment have to maintain a high level of sensitivity to their surroundings, constantly gathering and processing information, making flexible and agile use of internal and external resources, keeping a wide range of fallback options available and a larger solution space open, and adjusting and aligning strategies and operations with the external environment (Hartmann & Vachon, 2018). MNCs, being an important stakeholder in their business environment and an important player in their innovation eco-system, are no doubt monitored by EMFs. As knowledge transferred by MNCs to their local subsidiaries and the host country operations of MNC subsidiaries can bring about technological regime changes and contribute to new development in systems, processes and products in emerging markets, their eco-innovation activities and the associated economic, knowledge and environmental values naturally are scrutinized by EMFs in a complex environment as a target for imitation so as to maintain competitive parity. From the MNCs’ perspective, their copious repertories of eco-innovation knowledge give them competitive advantage to overcome liability of foreignness in the host markets (Aragón-Correa & Sharma, 2003). The embedded values associated with such knowledge are transferred to local subsidiaries to deal with complex environments. With higher scope of MNC knowledge spillovers in such environments, EMFs are motivated to undertake eco-innovation to create upside opportunities and growth options. This may remain to be the case under the condition of strong competitions from MNCs, because the intricate relationship between complexity and competition forms a landscape that reinforces EMFs’ motivation to develop competitive advantages through appreciating the values of MNC knowledge spillovers. Thus, the competition channel acts as a catalyst, pushing EMFs to seek inspiration from MNCs and undertake eco-innovation so as to avoid falling behind.

Second, MNC knowledge spillovers in complex environment provide means to EMFs to undertake eco-innovation through easing resource and knowledge constraints. As noted by Rosenbusch et al. (2011), resource and differentiation requirements tend to be high in complex environments. Through all four spillover channels, MNC knowledge can contribute to EMFs’ creation of sophisticated, complex organizational resources and capabilities for eco-innovation. The demonstration, linkage and labor mobility channels also offer them prospects to further understand how to administer and implement these resources and capabilities in eco-innovation activities to reduce casual ambiguity and uncertain returns. Undertaking eco-innovation through proactively appropriating MNC knowledge to different contexts will enable EMFs to transform upside opportunities and growth options associated with complex environment and place them in a better competitive position.

H5: MNC knowledge spillovers mitigate the negative effects of complexity on the eco-innovation of EMFs.

2.3.3 Dynamism, MNC Knowledge Spillovers, and Eco-innovation

Dynamism indicates the rate of unpredictable changes in industry recipes, the degree of fluctuation in market demand, and the level of probability of environmental shocks (Dess & Beard, 1984; Dess & Origer, 1987). Scholars have debated on how dynamism and corporate innovation are connected. On the one hand, higher levels of dynamism in an industrial environment would bring more pressures and challenges to corporate innovation as the basis of success in the industry is continuously altered (Hitt et al., 2021; Sirmon et al., 2007). They are therefore more likely to take a wait-and-see attitude towards innovation, sticking to existing technologies rather than creating anything new. On the other hand, high speed of technological changes and consumer demands necessitates innovation because it implies short product life cycle and rich technological opportunities (Chen et al., 2017; Rothenberg & Zyglidopoulos, 2007; Xue et al., 2012). Innovative firms are more likely to stay ahead in competition especially if they work on future dominant designs that imply a winner-takes-all race for successful innovation. However, for eco-innovation of EMFs, we advance that negative effects of dynamism dominate. While high levels of dynamism imply high potential returns for innovation, they also imply firms need to innovate rapidly as existing technologies and knowledge bases are constantly at the risk of erosion (Rothenberg & Zyglidopoulos, 2007). In the absence of MNC knowledge spillovers, EMFs are likely to be locked-in their existing technological trajectories and trapped in an escalating cycle of innovation based on natural resource-intensive activities. With resources being mostly devoted to path-dependent non-eco-innovation, path-creation eco-innovation is naturally negatively connected with dynamism in emerging markets.

H6: Dynamism negatively impacts on the eco-innovation of EMFs.

However, MNC knowledge spillovers can mitigate the negative eco-innovation effects of dynamism through providing information that incentivizes EMFs to undertake eco-innovation and offering means to do so. When the embedded economic, knowledge and environmental values associated with the MNC knowledge are transferred to local subsidiaries of MNCs to deal with the challenges in dynamic environments and overcome liabilities of foreignness, MNCs effectively play the role of intermediaries who bring in diversity in cognitive schemas in relation to eco-innovation, break existing technological paths, and construct and champion new ones (Thrane et al., 2010). Such information shapes and redefines innovation landscape. Accordingly, when confronted with massive eco-innovation related knowledge and new information related to values of MNC knowledge spillovers, EMFs are propelled to focus attention and resources on eco-innovation so as not to risk becoming obsolescence in dynamic environments. The competition channel of MNC knowledge spillovers amplifies EMFs’ motivation for eco-innovation as intertwined forces of dynamism and competition create a symbiotic relationship that pushes EMFs towards value-creating eco-innovation activities which allow them to carve out a unique position so as to stand out in crowed markets. MNC knowledge spillovers thus incentivize EMFs to focus on change options by undertaking eco-innovation to remain competitive. MNC knowledge spillovers further offer means for EMFs to undertake eco-innovation through providing access to resources, alleviating knowledge constraints, and pointing to the direction of travel, as argued above.

H7: MNC knowledge spillovers mitigate the negative effects of dynamism on the eco-innovation of EMFs.

3 Data and Empirical Strategy

3.1 Data Sources and Sample

The empirical analysis is based on two firm-level databases, complemented with city-level and provincial-level data. The first firm-level database on patents is from China’s National Intellectual Property Administration (CNIPA). The second on Chinese manufacturing firms is Annual Industrial Enterprises Survey (AIES) compiled by the National Bureau of Statistics (NBS), covering all firms with an annual turnover of more than RMB 5 million from 1998 to 2013 in China. Both databases have been widely used in existing studies including recent ones in different disciplines, e.g., Dong et al. (2022) in International Business Review, Fan et al. (2023) in Journal of Economic Behavior & Organization, Li et al. (2022) in Energy Economics, Tian (2022) in Review of Economics and Statistics, Wang et al. (2023) in Journal of Product Innovation Management, and Wu et al. (2022) in Technological Forecasting and Social Change. Data are cleaned via extensive checks for nonsense observations, outliers, coding mistakes and the likeFootnote 6. After merging the firm-level databases, we winsorize the observations using a 5% tail wherever appropriate to reduce the influence of outliers. The city-level and provincial-level data were obtained from the CEIC databaseFootnote 7 that contains economic, institutional and geographic information for Chinese cities and provinces. After combining the firm-level data with the city-level and provincial-level data and constructing task environmental variables of Munificence, Dynamism and Complexity (see below), we have an unbalanced panel dataset of 284,396 firms spanning the period of 2003–2013. Variable definitions and measurement are explained in Sect. 3.3 and summarized in Table 1.

3.2 Econometric Model and Method

We model a knowledge production function for EMFs:

where Eco-innovationit is eco-innovation of EMF i in industry j, city k, at time t. 𝑿𝑖𝑡 is a vector of control variables. We lagged all the explanatory, moderating and control variables by one year to allow for some time in the realization of their effects on eco-innovation of EMFs. ηi, ϕk, θkand νt capture firm-, industry-, province- and year-fixed effects, respectively. ι is error term.

The empirical literature on the knowledge production function is extensive and the primary theoretical foundation comes from the firm-level study by Griliches (1979). This conceptual framework links productivity, observable inputs and knowledge capital with R&D output, i.e., patents. We have followed the same logic by including Labor productivity as a control variable. We use Firm size and Profitability as proxies for observable inputs because larger firms and more profitable firms tend to have more internal inputs. That’s, they control for internal inputs that can be leveraged for knowledge production. FDI knowledge spillovers capture knowledge capital, thus they are external inputs for knowledge production. They are also a learning mechanism through which domestic firms acquire knowledge for eco-innovation activities as discussed in the previous sections. Furthermore, we include Export orientation as a control variable because learning-by-exporting is another learning mechanism for domestic firms’ eco-innovation.

To ameliorate the potential issue of multicollinearity, that’s, the collinearity between the interaction terms and their constituent parts, we employed the mean-centering approach. To mitigate the concerns of endogeneity, we adopt two strategies. The first is to use lagged variables and control for fixed-effects (Bascle, 2008; Reeb et al., 2020). The second is to employ 2SLS regression technique in the robustness check. The instrumental variable for FDI spillovers variable is the distance from shoreline (Distance). The review studies on the determinants of FDI have found both geographical distance and coastal host locations are two robust factors influencing MNCs’ FDI location choice (e.g., Blonigen & Piger, 2014, Chanegriha et al., 2017). As we are studying FDI within one host country, it is plausible to expect that the distance between cities and the shoreline is positively related to the location choice of FDI as the closer to shoreline, the lower the costs for FDI entry and operations (Chen et al., 2022). On the other hand, this distance variable is not necessarily related to eco-innovation. Thus, the variable meets the criteria of the instrument variable. Statistical tests confirm the instrument validity.

3.3 Variables

3.3.1 Dependent Variable

Following existing studies, e.g., Castellani et al. (2022), Marin and Zanfei (2019), Noailly and Ryfisch (2015), and Wang et al. (2023), we adopt green patent-based measures for eco-innovation. Green patent refers to invention, utility model and appearance design that use green technologies. We identify green patent by following the patent search strategy developed by Haščič and Migotto (2015), combined with the “IPC Environmental Inventory” provided by the World Intellectual Property Organization (WIPO)Footnote 8.

3.3.2 Explanatory and Moderating Variables

We measure MNC knowledge spillovers using FDI presence (FDI spillovers) which is a widely accepted measure (for systematic review and meta-analysis, see Meyer & Sinani, 2009, Perri & Peruffo, 2016, Rojec & Knell, 2018). We focus on the regional dimension of FDI spillovers, i.e., the concentration of FDI eco-innovation activities undertaken by foreign invested enterprises (FIEs) in Chinese cities, because existing research shows that MNC knowledge spillovers tend to be localized (Wang et al., 2023) and it is within cities that FIEs and EMFs co-locate and have closer interactions, sharing information, knowledge and space for business transactions and factor mobility. Following existing studies (e.g., Javorcik, 2004, Qu et al., 2013, Wang & Wu, 2016), in the main analysis, FDI presence (FDI spillovers) is measured by the share of green patents owned by FIEs in the city within which they locate, weighted by output share and averaged over all firms in the city. For robustness check we use employment share as weights instead (e.g., Aitken & Harrison, 1999, Vujanović et al., 2022).

where Yfkt is either output or employment of firm f in city k at time t; and Ωkt is the set of firms in city k at time t.

The variables– Munificence, Dynamism, and Complexity are operationalized following the commonly used procedure first proposed by Dess and Beard (1984) and widely used in the literature (e.g., Brauer & Wiersema, 2012, Chen et al., 2017, Hartmann & Vachon, 2018, Misangyi et al., 2006, Rosenbusch et al., 2011).

As environmental munificence reflects the industry’s capacity to support growth, following existing studies (e.g., Brauer & Wiersema, 2012, Chen et al., 2017, Dess & Beard, 1984, Hartmann & Vachon, 2018), Munificence is measured through obtaining the coefficient (α1) of the regression model of industry sales against time (see Eq. 3).

where yjt denotes the average sales of the two-digit industry j in year t (in log form) and ɛ is error term. Munificence takes a1 values (multiplied by 100) that are determined by the preceding five years. For example, Munificence for the year 2003 is based on the regression of industry sales for a 5-year period of 1998–2002.

As environmental complexity reflects the level of heterogeneity in an industry, following existing studies (Dess & Beard, 1984, Hartmann & Vachon, 2018), Complexity is measured by dividing the average sales of industry j in city k at time t (in log form) (yjkt) by the mean values of industry sales at time t (in log form) (\( {\stackrel{-}{y}}_{jt}\)). As high values are an indication of high geographical concentration of industrial activities (Dess & Beard, 1984), i.e., low complexity, we reverse-coded the variable to facilitate interpretation.

As environmental dynamism reflects the instability or volatility in the industry environment, following existing studies (e.g., Brauer & Wiersema, 2012, Dess & Beard, 1984, Misangyi et al., 2006, Rothenberg & Zyglidopoulos, 2007), Dynamism is measured as the dispersion around the regression line from Eq. 3 by dividing the standard error of the coefficient α1 (mjt) by the mean values of industry sales (in log form) at time t (in log form) (\( {\stackrel{-}{y}}_{jt}\)) to adjust for absolute industry scale (Eq. 4).

3.3.3 Control Variables

To control firm-level effects, we use Export-orientation, Firm size, Labor productivity, Profitability, and firm-fixed effects. Variable definitions and measurement are summarized in Table 1. At the provincial level, we include Environmental regulation proxied by the sulfur dioxide (SO2) removal rate. The Chinese central government has set specific SO2 emission reduction targets at the provincial level and different provincial governments also have different levels of environmental policy enforcement (Li et al., 2022). Additionally, we manage the potential confounding factors that underline both FDI spillovers and Eco-innovation of EMFs using a set of industry-, province- and year-fixed effects. The industry- or province-fixed effects control for all time-invariant industry- or province-specific factors that could influence the level of inward FDI activities and the eco-innovation of EMFs in that industry or province, respectively. The year-fixed effects capture time-variant factors such as unobservable time-sensitive changes in the business environment.

4 Empirical Findings

Table 2 presents correlation coefficients which are low between variables. The variance-inflation factors range from 1.01 to 1.45, well below the threshold level of 10. Both indicate that multicollinearity is not a major concern.

Table 3 presents regression results. Model (1) includes control variables and main explanatory variables– FDI spillovers, Munificence, Complexity and Dynamism. Models (2) to (4) include the interaction terms of FDI spillovers with Munificence, Complexity and Dynamism, respectively. Model (5) is the full model including all variables. Across models (2)-(5), the coefficients on FDI spillovers are positive and statistically significant, suggesting the positive relationship between MNE knowledge spillovers and eco-innovation of EMFs. Thus, H1 is supported. This finding aligns with Ha and Wei (2019) and Wang et al. (2023) that focus explicitly on eco-innovation and a majority of studies on innovation that do not explicitly differentiate eco- and non-eco-innovation, as shown in Table A1.

In models (1)-(5), the coefficients on Munificence are all positive and statistically significant, indicating the positive link between Munificence and Eco-innovation. This provides evidence to support H2. In models (2) and (5), the coefficients on FDI spillovers and its interaction term with Munificence are positive and statistically significant (0.017, p < 1% in model 3; 0.020, p < 1% in model 6), revealing that MNC knowledge spillovers strengthen the positive effects of munificence on EMFs’ eco-innovation, thus H3 is supported.

In models (1)-(5), the coefficients on Complexity and Dynamism are all negative and statistically significant, indicating the negative effects of complexity and dynamism on eco-innovation, respectively. H4 and H6 are, thus, supported. The coefficients on the interaction term of FDI spillovers and Complexity are positive and statistically significant (2.485, p < 1% in model 4; 1.756, p < 1% in model 6) and those on the interaction term of FDI spillovers and Dynamism are also positive and statistically significant (0.323, p < 1% in model 5; 0.417, p < 1% in model 6). These results suggest that MNC knowledge spillovers mitigate the negative effects of complexity and dynamism on EMFs’ eco-innovation, thus H5 and H7 are supported.

In relation to control variables, the findings on Export-orientation, Firm size, Labor productivity, Profitability, and Environmental regulation, are fairly consistent across all models. Export-oriented firms face regulatory pressures when exporting to other countries, they need to “quickly adapt and align their standards” such as from “green labeling to end of life movement of e-waste” (Nguyen et al., 2023: 5), these necessitate them to invest and engage in eco-innovation. In terms of firm size, our results are in line with two recent meta-analyses by Bitencourt et al. (2020) and Liao and Liu (2021), indicating a positive effect of firm size on eco-innovation. Both labor productivity and profitability also play a positive role for EMFs’ engagement in eco-innovation. Finally, our findings confirm the importance of environmental regulation in the eco-innovation of EMFs. Although complying with environmental regulation may add additional costs on firms, it may serve as an incentive mechanism, encouraging firms to engage in eco-innovation to satisfy stakeholders expectations, to develop competitive advantages, and to acquire reputational benefits (Eiadat et al., 2008; Li et al., 2022; Wang et al., 2023).

4.1 Robustness Check and Further Analysis

To check the robustness of our results, we employ an IV estimation approach and an alternative measure of FDI spillovers (Employment). The findings are shown in Tables 4 and 5 respectively. They are broadly in line with those presented in Table 3. The only exception is that, although the interaction term of FDI spillovers and Dynamism remains the negative sign, the coefficients become statistically insignificant in models (4) and (6) of Table 5.

We have also added Table 6 to see whether the hypothesized relationships hold when industries are differentiated to high-polluting and low-polluting industries. We use dummy variable– Pollution– to indicate whether a firm is in a high-polluting industry designated by the Ministry of Ecology and Environment of China. The Ministry issued the Guidelines on Environmental Information Disclosure of Listed Companies and identified 16 industries as highly polluting industries, namely thermal power, steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrifaction, building material, papermaking, brewing, pharmacy, fermentation, textile, tanning, and mining.

Table 6 includes two models. Model (1) includes three three-way interaction variables to Model (5) of Table 3 and the dummy variable Pollution. The dummy variable is statistically insignificant, and Model (2) presents the estimation results without this dummy variable. The results of the two columns are very similar. H1, H2, H4, and H6 remain supported for both high-polluting and low-polluting industries. As the two-way interaction of FDI spillovers and Munificence and the three-way interaction of FDI spillovers, Munificence and Pollution are positive and statistically significant, suggesting H3 remains to be supported and the positive interactive effects of MNC knowledge spillovers and munificence on eco-innovation are more pronounced for firms in high-polluting than those in low-polluting industries. Similarly, as both the two-way interaction of FDI spillovers and Complexity and the three-way interaction of FDI spillovers, Complexity and Pollution are positive and statistically significant, H5 is also supported and the positive interactive effects of MNC knowledge spillovers and complexity on eco-innovation are also greater for firms in high-polluting than those in low-polluting industries. Finally, the two-way interaction of FDI spillovers and Dynamism is positive and statistically significant and the three-way interaction of FDI spillovers, Dynamism and Pollution is negative and statistically insignificant, indicates that H7 is only supported for firms in low-polluting industries. The positive MNC knowledge spillover effects on eco-innovation is not strong enough to offset the negative effects of dynamism on eco-innovation in high-polluting industries. A possible explanation to this finding is that high levels of dynamism require firms to innovate rapidly if their core competence is innovation oriented. This can be a significant challenge for firms in high polluting industries since they are more capital-intensive than those in low polluting industries (Cole & Elliott, 2005), thus they face great financial pressures to appreciate and appropriate eco-innovation values revealed by MNCs for the benefit of eco-innovation.

5 Discussion and Conclusion

The accomplishment of the SDGs is a global priority, which requires social innovation to produce new products, processes, services, management systems and business models. This paper zooms in a specific type of social innovation– eco-innovation– and commits research efforts to understand the eco-innovation of EMFs in a multi-dimensional task environment being driven by MNC knowledge spillovers. Eco-innovation can bring economic, knowledge and environmental values to firms (see the meta-analysis by Hizarci-Payne et al., 2021). It also has social benefits in terms of promoting the construction of a greater societal awareness of sustainability and green economy, contributing sustainability values to the corporate image of the company, and driving sustainable or green consumption (Marco-Lajara et al., 2023). However, the development of eco-innovation needs new knowledge inputs that emerging markets are lacking and involves the shift of technological trajectories which is accompanied by complexity, uncertainty and ambiguity (De Marchi et al., 2022). The presence of MNCs confers knowledge spillovers to EMFs as MNCs are not only the source of knowledge and the target for learning and imitation owing to their leadership position in eco-innovation, but also an important stakeholder in the innovation eco-system and global value chain exerting institutional isomorphic pressures on these firms (Wang et al., 2023).

Taking the value-based approach, we view the eco-innovation effects of MNC/FDI knowledge spillovers as a combination of value appropriation and value creation process and develop a conceptual model to first explore how different economic, knowledge and environmental values underpinning MNC knowledge spillovers influence eco-innovation of EMFs, then study the value enhancement effects of MNC knowledge spillovers in the multi-dimensional task environment. Empirical findings based on the examination of Chinese manufacturing firms highlight the important role of regional MNC knowledge spillovers in facilitating eco-innovation of EMFs, particularly, their role in moderating the salience of the differential effects of munificence, complexity and dynamism.

Our theoretical arguments and supportive findings make important theoretical contributions to social innovation research in general and eco-innovation research in particular. While there is evidence that MNCs have an important role to play when tackling environmental challenges and propelling clean growth in the host emerging markets, existing research has largely focused on the environmental performance of MNC subsidiaries, their adoption of environmentally responsible management practices and the introduction of eco-innovation, with limited attention to MNC knowledge spillovers (De Marchi et al., 2022, Wang et al., 2023). Our examination of the interplay of MNC knowledge spillovers and organizational environment provides new insights for the eco-innovation of EMFs. Specifically, theory building by taking the value-based approach and emphasizing MNC knowledge spillovers as a boundary condition shaping the effects of organizational environment on eco-innovation responds to Filatotchev et al. (2022)’s call for “new theory building within an open systems perspective” (p. 1051) and “greater attention to the broader environmental context while not neglecting decision-making actors and their agency” (p. 1039). Our empirical evidence that environmental factors of munificence, complexity and dynamism have differential effects on eco-innovation confirms the prevalent argument regarding the importance of the environment to firm strategy. Findings on the interactive effects of MNC knowledge spillovers and environmental factors provide a more nuanced understanding in terms of how EMFs confronting munificent, complex or dynamic environments may benefit from MNC knowledge spillovers for eco-innovation.

Albeit noting the difference between eco-innovation and conventional innovation owing to the double-externality issue associated with the former, we cautiously suggest that our study may explain resolving conflicting evidence regarding the innovation effects of MNC knowledge spillovers by focusing more on the regional dimension of MNC knowledge spillover effects and its interplay with domestic firms’ environments. As shown in Table A1, most existing studies have emphasized intra- and/or inter-industrial dimensions, which downplays the evidence that knowledge spillovers tend to be localized and rely on economic and social infrastructure centered around that region for support (Driffield, 2006; Hamida, 2013; Sajarattanochote & Poon, 2009; Spithoven & Merlevede, 2023; Wang & Wu, 2016); and they have overlooked organizational environments within which firms make informed strategic choices, draw on resources for operations and seize opportunities for value appropriation and value creation (Chen et al., 2017; Dess & Beard, 1984; Oliver, 1997; Rothenberg & Zyglidopoulos, 2007).

This study has important policy implications. In general, emerging markets often have policies stimulating innovation broadly and eco-innovation specifically to promote economic growth and technological catch-up. They also implement FDI policies to attract MNCs in the hope that knowledge spillovers from MNCs will support this aim. However, the two sets of policies are often designed independently with little consideration of each other. Our findings point to the importance of more concerted, coordinated policy efforts on encouraging MNCs to transfer advanced environmental technologies and their local subsidiaries to engage in eco-innovation in emerging markets.

More specific to China, the governments have initiated policies to develop national and regional innovation systems since its opening up in 1978, but attention to eco-innovation is more recent. In the “14th Five-Year Plan (2021–2025)”, the most recent guidelines for national economic and social development planning, the central government included the proposal for developing eco-innovation to address environmental challenges. The central government has also been implementing the “Dual Carbon” policy (carbon peaking and carbon neutrality). The local governments at various levels have also increasingly paid attention to ecological issues, calling for eco-innovation of cities, industries, and firms, and promoting green, low-carbon and energy efficient patterns of economic development models. Our findings suggest that both the central and the local governments should facilitate the building and development of eco-innovation networks and systems with MNCs being an important player and a key stakeholder. The cooperation and communication between EMFs and MNCs in an eco-innovation network can help with resource and knowledge circulation and cross-fertilization of ideas, generating synergetic and beneficial effects on eco-innovation. With MNC knowledge spillovers, the negative eco-innovation effects associated with rapid changes in technology and market and heterogeneity of environmental factors can be somehow neutralized, countered and offset. Governments may also take actions in helping domestic industries and EMFs to enhance their absorptive capacity so as to leverage MNC knowledge spillovers for eco-innovation.

This study also has implications for managers and practitioners. It helps stakeholders who are concerned about environmental challenges and clean growth to better understand and advocate for eco-innovation by EMFs. For managers of EMFs, there is a need to understand the industrial context within which their organizations and MNCs interact. The intensification of interactions with MNC subsidiaries through both transactional and non-transactional relationships helps their eco-innovation, particularly if they operate in resource-rich, highly dynamic, or highly complex environments.

5.1 Limitations and Future Research

Our research is subject to several limitations. The first is related to how organizational environment is modelled. We focus on the task environment and restrict our hypotheses to munificence, complexity and dynamism. We have left out the institutional environment which is also an important part of firms’ operational environment (Oliver, 1997). Additionally, we adopt one objective indicator for each dimension of organizational environment due to data availability. Managers’ perceptions of organizational environment may impact on their strategies. Alternative subjective measures for different dimensions of organizational environment may provide further evidence for the interplay of MNC knowledge spillovers and organizational environment.

Second, although the use of green patent to measure eco-innovation has the advantage of being a continuous and relatively objective measure, the literature has noted various issues including different patenting behaviors in different organizations and in different industries, not all eco-innovation outcomes being patented, not all eco-innovations being patentable, and patented eco-innovation of different nature (radical vs. incremental) and of different quality (e.g., Dziallas & Blind, 2019, Taques et al., 2021). However, data for alternative eco-innovation measures such as green R&D investment are unavailable. Future studies therefore should test the validity of our findings using alternative measures of eco-innovation.

Third, like most studies on MNC knowledge spillovers, we referred to four spillover channels to explain the theoretical mechanism linking MNC knowledge spillovers and eco-innovation. Future research could directly and empirically assess these channels using more fine-grained research design and primary data. For example, research has established that knowledge spillovers of MNCs may be conditional on their country of origin, entry mode, mandate of MNC subsidiaries, and market orientation of MNC subsidiaries (Crespo & Fontoura, 2007; Rojec & Knell, 2018; Smeets, 2008).

Fourth, our study only focuses on the technological eco-innovation spillovers from MNCs. Since pollution reduction requires technological as well as organizational innovations by firms, future studies could examine the presence of MNCs on local firms’ engagement in both types of innovation activities simultaneously, accounting for organizational environment and firm capability as suggested by Hart and Dowell (2011).

Finally, while our findings on the interplay of MNC knowledge spillovers and organizational environment on eco-innovation of Chinese firms are insightful, we must exercise caution when generalizing them across different countries. Although China is no doubt an emerging economy, she does stand out among emerging economies in terms of overall economic size, large pool of labor force, rapid economic growth, and state-led economic development. To what extent, these country-specific advantages and institutional supports contribute to their corporate eco-innovation cannot be examined in our single country context. It is essential to further assess the validity of our findings by providing comparative insights through studies of other emerging economies.

.

Notes

Eco-innovation, environmental innovation and green innovation are often used interchangeably in the literature.

We focus on studies that employ firm-level data. As noted in review articles of MNC/FDI spillovers (e.g., Görg & Greenaway, 2004, Keller, 2004, Rojec & Knell, 2018), the level of aggregation impacts on empirical findings of MNC/FDI spillover analysis: the higher level of aggregation tends to be associated with stronger evidence; and aggregate level studies often suffer from composition and aggregation biased. Thus, studies employ data at the country-, province-, city- or industry-level to study MNC/FDI spillovers are likely to produce biased results.

There are four key areas in grand challenges: artificial intelligence and data, ageing society, clean growth and the future of mobility (https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/664563/industrial-strategy-white-paper-web-ready-version.pdf).

There are two contrasting hypotheses related to the effects of FDI, and their economic agent– MNCs, on environmental performance of the host countries. The “pollution halo” hypothesis argues for the positive effects, whereas the “pollution haven” hypothesis the negative effects. The theoretical ambiguity has resulted in numerous quantitative studies with mixed findings. The two recently published meta-analysis studies aim to systematically analyze this large collection of findings. Demena and Afesorgbor (2020)’s research is based on 65 primary studies published between 2006 and 2018, covering multiple countries. Wei et al. (2022) focus only on one country– China and their sample includes 40 primary studies published between 2001 and 2020. Both papers find evidence to support the “pollution halo” hypothesis. This suggests that it is plausible to argue that EMFs learn from MNCs for eco-innovation activities.

This contrasts with the formal knowledge flow from MNCs to their subsidiaries (both wholly owned subsidiaries and international joint ventures) or international knowledge exchanges through inter-organizational collaborations such as international strategic alliances.

In particular, we dropped observations if they had missing values for key financial variables (such as total assets, fixed assets and industrial output) or if the number of employees was reported to be less than 10.

References

Adomako, S., Liu, X., Sarala, R.M., Ahsan, M., Lee, J. & Shenkar, O. (2024). Multinational corporations and social innovation in emerging markets. Management International Review. https://doi.org/10.1007/s11575-024-00540-w

Aguilera-Caracuel, J., & Ortiz-de-Mandojana, N. (2013). Green innovation and financial performance: An institutional approach. Organization & Environment, 26(4), 365–385.

Aitken, B. J., & Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605–618.

Amendolagine, V., Hansen, U. E., Lema, R., Rabellotti, R., & Ribaudo, D. (2023). Do green foreign direct investments increase the innovative capability of MNE subsidiaries? World Development, 170, 106342.

Anderson, P., & Tushman, M. L. (2001). Organizational environments and industry exit: The effects of uncertainty, munificence and complexity. Industrial and Corporate Change, 10(3), 675–711.

Aragón-Correa, J. A., & Sharma, S. (2003). A contingent resource-based view of proactive corporate environmental strategy. Academy of Management Review, 28(1), 71–88.

Avelino, F., Wittmayer, J. M., Pel, B., Weaver, P., Dumitru, A., Haxeltine, A., Kemp, R., Jørgensen, M. S., Bauler, T., Ruijsink, S., & O’Riordan, T. (2019). Transformative social innovation and (dis)empowerment. Technological Forecasting and Social Change, 145, 195–206.

Barbieri, N., Ghisetti, C., Gilli, M., Marin, G., & Nicolli, F. (2016). A survey of the literature on environmental innovation based on main path analysis. Journal of Economic Surveys, 30(3), 596–623.

Barney, J. B., Ketchen, D. J., & Wright, M. (2021). Resource-based theory and the value creation framework. Journal of Management, 47(7), 1936–1955.

Bascle, G. (2008). Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization, 6(3), 285–327.

Berrone, P., Fosfuri, A., Gelabert, L., & Gomez-Mejia, L. R. (2013). Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strategic Management Journal, 34(8), 891–909.

Bitencourt, C. C., de Oliveira Santini, F., Zanandrea, G., Froehlich, C., & Ladeira, W. J. (2020). Empirical generalizations in eco-innovation: A meta-analytic approach. Journal of Cleaner Production, 245, 118721.

Blonigen, B., & Piger, J. (2014). Determinants of foreign direct investment. Canadian Journal of Economics, 47(3), 775–812.

Bowman, C., & Ambrosini, V. (2000). Value creation versus value capture: Towards a coherent definition of value in strategy. British Journal of Management, 11(1), 1–15.

Brambilla, I., Hale, G., & Long, C. (2009). Foreign direct investment and the incentives to innovate and imitate. Scandinavian Journal of Economics, 111(4), 835–861.

Brammer, S. J., & Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. Journal of Management Studies, 43(3), 435–455.

Brandenburger, A. M., & StuartJr., H. W. (1996). Value-based business strategy. Journal of Economics & Management Strategy, 5(1), 5–24.

Brauer, M. F., & Wiersema, M. F. (2012). Industry divestiture waves: How a firm’s position influences investor returns. Academy of Management Journal, 55(6), 1472–1492.

Cabral, S., Mahoney, J. T., McGahan, A. M., & Potoski, M. (2019). Value creation and value appropriation in public and nonprofit organizations. Strategic Management Journal, 40(4), 465–475.

Cajaiba-Santana, G. (2014). Social innovation: Moving the field forward. A conceptual framework. Technological Forecasting and Social Change, 82, 42–51.

Castellani, D., Marin, G., Montresor, S., & Zanfei, A. (2022). Greenfield foreign direct investments and regional environmental technologies. Research Policy, 51(1), 104405.

Cecere, G., Corrocher, N., Gossart, C., & Ozman, M. (2014). Lock-in and path dependence: An evolutionary approach to eco-innovations. Journal of Evolutionary Economics, 24(5), 1037–1065.

Chanegriha, M., Stewart, C., & Tsoukis, C. (2017). Identifying the robust economic, geographical and political determinants of FDI: An Extreme bounds Analysis. Empirical Economics, 52(2), 759–776.

Chen, H., Zeng, S., Lin, H., & Ma, H. (2017). Munificence, dynamism, and complexity: How industry context drives corporate sustainability. Business Strategy and the Environment, 26(2), 125–141.

Chen, J., Tan, H., & Ma, Y. (2022). Distinguishing the complex effects of foreign direct investment on environmental pollution: Evidence from China. Energy Journal, 43(4), 1–19.

Chesbrough, H., Lettl, C., & Ritter, T. (2018). Value creation and value capture in open innovation. Journal of Product Innovation Management, 35(6), 930–938.

Chiarvesio, M., De Marchi, V., & Di Maria, E. (2015). Environmental innovations and internationalization: Theory and practices. Business Strategy and the Environment, 24(8), 790–801.

Christmann, P., & Taylor, G. (2001). Globalization and the environment: Determinants of firm self-regulation in China. Journal of International Business Studies, 32(3), 439–458.

Cole, M. A., & Elliott, R. J. (2005). FDI and the capital intensity of dirty sectors: A missing piece of the pollution haven puzzle. Review of Development Economics, 9(4), 530–548.

Corredoira, R. A., & McDermott, G. A. (2014). Adaptation, bridging and firm upgrading: How non-market institutions and MNCs facilitate knowledge recombination in emerging markets. Journal of International Business Studies, 45(6), 699–722.

Crescenzi, R., Gagliardi, L., & Iammarino, S. (2015). Foreign multinationals and domestic innovation: Intra-industry effects and firm heterogeneity. Research Policy, 44(3), 596–609.

Crespo, N., & Fontoura, M. P. (2007). Determinant factors of FDI spillovers– what do we really know? World Development, 35(3), 410–425.

Dangelico, R. M. (2016). Green product innovation: Where we are and where we are going. Business Strategy and the Environment, 25(8), 560–576.

De Marchi, V. (2012). Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Research Policy, 41(3), 614–623.

De Marchi, V., Cainelli, G., & Grandinetti, R. (2022). Multinational subsidiaries and green innovation. International Business Review, 31(6), 102027.