Abstract

Managers often make decisions in situations involving risk and uncertainty. To ensure the prosperity of the company, neutral behavior is desirable in such situations. However, when evaluating future-oriented managerial actions, cognitive biases can arise that are manifested as aversions towards risky and uncertain situations, leading to non-optimal decisions. In an online experiment with a convenience sample of 298 US participants, we investigate deviations from risk- and uncertainty-neutral managerial decisions and apply neutrality-promoting behavioral interventions in a business venture setting. We find that using a recommendation nudge before as well as after making an initial decision improves individual performance to achieve higher neutrality levels. In sum, we show that in managerial decision-making processes, where experience, time, and information are often lacking, simple decision-making aids lead to better decisions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Managerial decisions are often characterized by situations in which risk or uncertainty prevails (Collis 1992; March and Shapira 1987), such as possible investments, innovation developments, or HR policies (Hoskisson et al. 2017). Related literature distinguishes risky decisions from uncertain decisions based on the information the decision-maker has regarding an expected result (Keynes 1937; Knight 1921). Where risky decisions can still be weighed up to some extent (e.g., introducing new software in the organization that has been considered helpful by employees in other organizations; however it is not clear how your employees will react to the introduction), the outcome of decisions under uncertainty is wholly unknown (e.g., introducing new software in the organization where no data of general employee satisfaction with the software exists) and therefore implies a status of ambiguity for (certain parts of) the decision (Klibanoff et al. 2005).

In this paper, we focus on middle and lower management decisions. We distinguish these from top management decisions as follows: Top management decisions are more entrepreneurial and greatly impact the firm’s future. The number of this decision type is rather small. The majority of managerial decisions are middle and lower management decisions that are more operational and individually have only a small impact on the firm’s development. Since these decisions are made by different people in different sections and influenced by different market developments, we assume that they are uncorrelated. In middle and lower management decisions, managerial risk neutrality or managerial uncertainty neutrality in the sense of making decisions that maximize expected profits or gains for the shareholder is essential for ensuring the future prosperity of the organization (Sauner-Leroy 2004) and defending its position as an incumbent against disruptive market developments (Christensen 1997; Markides 2006). Compared to a situation, in which the managers make either risk-averse or uncertainty-averse decisions, even if some managers in a company fail with their risky or uncertain decision, the losses can be compensated by higher profits from other managers.

Despite given advantages of neutrality among managers, we do observe aversive behavior in management decisions.Footnote 1 For example, managers may follow a majority opinion because they want to belong to a (risk-avoiding) group even though they might choose to take a risk independently, they fear personal consequences if a project fails, they do not have the time to weigh decisions and therefore shy away from risk, or their organization does not create incentives for risk-taking (Gigerenzer 2014). Aversive behavior is present across all corporate hierarchies, from top to lower management (Glaser et al. 2016; González et al. 2013; MacCrimmon and Wehrung 1990; Milidonis and Stathopoulos 2014). In light of this, we see the need for research to enhance our understanding of how to create more neutral behavior in management practice that is grounded in rational, less emotional, or biased decision making (Lovallo et al. 2020).

Building on principal-agent theory (Ross 1973; Rees 1985a, b; Eisenhardt 1989), the manager can be seen as the potentially biased, aversive agent of the shareholder. The shareholder is the principal suffering from being unable to enforce neutral behavior, for example, due to a lack of observability (Holmström 1979) or an insufficient structure of incentives (Mirrlees 1976). Early work on the principal-agent theory also argues that a problem in the principal-agent relationship can affect economic welfare (Mirrlees 1974). To be able to satisfy the shareholders’ claim for neutral managerial behavior (Lovallo et al. 2020), managerial decision-making should be as unbiased and as neutral as possible.

There is a large body of literature on how the contract between the principal and the agent in firms can be organized more efficiently, for example, through incentivizing or monitoring the agent, in order to align interests between the principal and the agent (Miller 2005; Sappington 1991). In a systematic literature review, Hoskisson et al. (2017) highlight research that addresses managerial risk-taking subject to compensation incentives or monitoring. Lovallo et al. (2020) discuss how managers can become less aversive in investment decisions. They provide impulses for steering risk perception away from career-related consequences that lead to risk aversion out of fear of misjudgements and suggest that managers need to behave more like CEOs who are more risk-neutral when managing a portfolio.

Based on our review of the literature on principal-agent relationships and managerial behavior under risk and uncertainty, we argue that an untested, efficient method to make managers behave more neutrally can be drawn from nudging theory and its experimental approach. As nudges are simple to implement and cost-effective (Benartzi et al. 2017), they guide behavior in a desired direction without restricting the decision-maker’s individual freedom of choice (Sunstein 2019). In this respect, nudging can be understood as a method for helping individuals to act as if they had almost unlimited time, information, and cognitive skills at their disposal when making decisions (Jolls et al. 1998; Sunstein and Thaler 2003). Using nudging in a managerial environment under risk or uncertainty seems reasonable because the shareholders want to influence the managers’ decisions while they retain their freedom of choice. This renders nudging to be less restrictive than a fixed set of rules or specific incentive structure, allowing the managers to react to unforeseen situations freely. Therefore, nudges allow for a behavioral intervention towards more neutrality while keeping a manager fully functional so that the manager can still respond appropriately if neutrality should not be the desirable behavior in a given situation. Since the effect of nudges highly depends on the context (Hauser et al. 2018; van Kleef and van Trijp 2018), we maintain the distinction between risky and uncertain domains and investigate the effect of nudging in both domains.

Research on decision aids for establishing neutrality in risk and uncertainty decision-making constitutes a current research gap. For instance, Zhang and Cueto (2017) deduce from their systematic literature review that in addition to entrepreneurship research, general management research also lacks evidence of debiasing methods, e.g., how decision aids can reduce cognitive biases such as risk aversion. Our research sheds light on behavioral interventions, i.e., a specific type of nudging, that are meant to help guide managers toward more neutral behavior that has a profit-enhancing effect on decisions in business venture settings featuring risk or uncertainty.

To investigate the specific decision by a manager in such a business venturing situation featuring either risk or uncertainty, we merge behavioral economics with managerial research. We extend the unframed risk and uncertainty setting of Barham et al. (2014), who measure aversions with standard multiple price list tasks (Holt and Laury 2002), with a business-venture-frame featuring either risk or uncertainty, and compare two nudge treatments, i.e., two implementations of a pro-neutrality recommendation, against a control condition. Altering the multiple price list method to a business management scenario allows us to map a more realistic behavior and contribute to the further development of management theory concerning judgment and decision-making. In addition, it is is essential to investigate the effectiveness of nudges in specific contexts as the context is a known potential moderator of their effect (Hauser et al. 2018; van Kleef and van Trijp 2018).

2 Hypotheses development

There is comprehensive literature emphasizing that managers are only human and therefore their behavior and decision-making are not flawless (Teal 1996). Risk and more so uncertainty represent situations that are difficult to anticipate and cannot easily be practiced (Thaler and Sunstein 2008), which is why managers often have to apply rules of thumb to navigate their business decisions (Mousavi and Gigerenzer 2014). Although it is often unavoidable and efficient to use intuition and heuristics (Gigerenzer 2007), overly relying on “gut feelings” may lead to judgment deviating from neutrality based on rapid but not necessarily well-considered final evaluations (Kahneman 2003). In addition, literature shows that aversive behavior emerges when decisions involve uncertainty or high complexity (Schwenk 1984; Simon et al. 2000). Moreover, humans in general are aversive towards risk and uncertain decisions (Holt and Laury 2002; Dohmen et al. 2011), which is reflected in managerial aversive behavior (Hoskisson et al. 2017). Such aversive behavior may be due to fear of loss (“Losing a little is worse than winning a lot.”) (Kahneman and Tversky 1979), aversion to future regret over potential decisions (“I wish I hadn’t made this investment back then.”) (Zeelenberg and Beattie 1997), or avoiding blame for an action (“I don’t want to be held responsible if this investment doesn’t pay off.”) (Hood 2007). Literature suggests that aversive behavior is more pronounced in low and middle management than in top management (Gigerenzer 2014), which is in line with the findings by Eijkelenboom et al. (2019), who report that the level of responsibility triggers a behavioral shift, while participants still show aversive behavior on average. In summary, a managerial decision may consciously or unconsciously exhibit aversive behavior.

We suggest that nudges improve managerial decisions by inducing less aversive behavior towards risk and uncertainty. Nudging is particularly suited to this case because it preserves the manager’s freedom of decision and does not act “hard” on the manager through incentives, but only steers the manager gently in one direction. At the same time, however, the manager can react to any change at will without fearing any disadvantages. In this respect, recommendation nudges have proven to be effective nudges that contain information a subject must otherwise acquire through additional efforts, such as through learning or experience. Beyond that, recommendations can also help make information easier to process through supplementary labels or symbols (see more on recommendations in the form of evaluative and descriptive labels in a meta-analysis on nudging by Cadario and Chandon 2020). Studies that utilize recommendations across disciplines indicate positive effects for highlighting positive product attributes to reduce hidden costs (Newell and Siikamäki 2014), for emphasizing losses of the non-preferred alternative versus gains in enrollment programs (Keller et al. 2011), for disclosing information for a more rational approach when lending money (Bertrand and Morse 2011), or for promoting collaboration in a public good game (Barron and Nurminen 2020). As described above, business venturing situations can feature either risk or uncertainty. Hauser et al. (2018) and van Kleef and van Trijp (2018) argue that context—in our case the business venturing situation itself—and, more importantly, the underlying informational context (implying risk or uncertainty) may well moderate the effect of a nudge intervention. Given that managerial decisions regarding risk and uncertainty might be based on aversions, we put forward the following hypotheses for these two different, potentially moderating domains:

Hypothesis 1a

A pro-neutrality recommendation that is provided before making the decision promotes risk-neutral behavior in managerial situations under risk.

Hypothesis 1b

A pro-neutrality recommendation that is provided before making the decision promotes uncertainty-neutral behavior in managerial situations under uncertainty.

The above-shown hypotheses build on a pro-neutrality recommendation that is provided and received before the manager makes up her mind, so before making a decision. However, the decision-making in a management context cannot solely be shaped by an external recommendation, e.g., by collaborators or informational updates, before coming to a conclusion, but also while in the process of making the decision (Simon 1987). Especially in a high-risk setting, managers may use external feedback to re-evaluate the situation and compare their evaluation with an external reference point to arrive at a less aversive judgment (Harvey and Fischer 1997; Lim and O’Connor 1995). Moreover, sometimes a recommendation might become available only after the manager started thinking about the decision at hand. Building on previous evidence concerning a positive effect of recommendations, we pose the following hypotheses. Again, we distinguish between the two domains that are common in business venturing—risk and uncertainty—as such context dependencies are argued to be potential moderating forces (Hauser et al. 2018; van Kleef and van Trijp 2018):

Hypothesis 2a

A pro-neutrality recommendation that is provided after making an initial decision promotes risk-neutral behavior in managerial situations under risk.

Hypothesis 2b

A pro-neutrality recommendation that is provided after making an initial decision promotes uncertainty-neutral behavior in managerial situations under uncertainty.

We additionally investigate the tendency to stick with the status quo when facing risky or uncertain outcomes (Samuelson and Zeckhauser 1988). A status quo bias can manifest itself in managerial decisions as follows. First, managers prefer to operate within known approaches and would rule out all alternative routes towards the new venture from the outset (Nebel 2015). Second, once managers have gained access to a successful strategy, there may be no need for them to make variations to, for example, their product portfolio or to change their business strategy—they ignore further opportunities as well as risks and trust in their functioning modus operandi (Biyalogorsky et al. 2006; Silver and Mitchell 1990). We argue that a status quo bias is higher for risky and uncertain decisions where preferences have evolved due to the cognitive or emotional effort that went into the judgment than for decisions that have not yet been concluded because of the comparative lack of such efforts (Kahneman et al. 1991). For this reason, we assume that the influence of the pro-neutrality recommendation is stronger when provided before making the decision than when it becomes available after an initial decision. Thus, we formulate the following hypotheses, which are again split by the two domains we are investigating:

Hypothesis 3a

A pro-neutrality recommendation that is provided before making the decision has a stronger effect in promoting risk-neutral behavior than a pro-neutrality recommendation that is provided after making an initial decision in managerial situations under risk.

Hypothesis 3b

A pro-neutrality recommendation that is provided before making the decision has a stronger effect in promoting uncertainty-neutral behavior than a pro-neutrality recommendation that is provided after making an initial decision in managerial situations under uncertainty.

3 Experimental design

3.1 General overview

Our online experiment consists of two tasks (Task 1 and Task 2) from which one is randomly selected to be payoff relevant for the subject. Task 2 features an additional control and is described in Sect. 3.5. Task 1 is our main behavioral measure. It resembles a managerial decision and allows for deviating from the rational optimum and therefore enables us to investigate the neutrality-promoting effect of pro-neutrality recommendations in managerial situations under risk and uncertainty. For this, we utilize a multiple price list featuring either risk or uncertainty (for a similar experimental measure, see Barham et al. 2014; for multiple price lists featuring risk and uncertainty, see Moore and Eckel 2006; Ross et al. 2012; for the original multiple price list see Holt and Laury 2002).Footnote 2 In addition to mirroring a managerial decision, we add a business venture frame to our experiment. With our experimental approach, we are therefore able to answer whether pro-neutrality recommendations are feasible for promoting neutral behavior of managers in business venture situations featuring either risk or uncertainty.

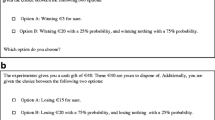

We test two different treatments against the corresponding control group in two types of business venturing contexts. These treatments are a pro-neutrality recommendation nudge that is placed before an initial business venturing decision is made (Pre-Recommendation) and a recommendation nudge that is placed after the subjects in the manager role have made an initial decision (Post-Recommendation). For these treatment manipulations, a number of potential interpretations are apparent. First, the different timing of the recommendation might describe two distinct types of employees. A more outspoken and pro-active employee might provide her recommendation—which is rational due to her being an expert and not directly dependent on the outcome—before the decision-maker, here the manager, starts making up her mind. A less outspoken, maybe even passive, employee might provide her recommendation later when she realizes that an (initial) decision was made and her recommendation is either useful now or not at all. Second, the different types of recommendations might also reflect the level of hierarchy in a company. On the one hand, a flat organization that works like a start-up company might trigger earlier recommendations from employees to decision-makers. On the other hand, a distribution of power favoring high-power figures, i.e., founders, executives, or managers, and featuring a low-powered workforce might negatively influence employee’s willingness to pro-actively provide recommendations, especially when the boss’ decision (or opinion) is still unknown to the employee (Huang et al. 2005). In addition to the level of intervention (none, before an initial decision, after an initial decision), we distinguish between the two domains Risk and Uncertainty because the effects of recommendations might differ due to their context-dependency (for a model explaining that the context and other factors are potentially influencing the effect of nudges, see Hauser et al. 2018). Together with the corresponding reference groups, this yields six groups in total in our 3x2 between-subject design. Table 1 shows an outline of these groups. Each subject participates in one of these groups and therefore faces a decision either under risk or under uncertainty and makes the decision with no recommendation, a pro-neutrality recommendation prior to starting the decision-making, or a pro-neutrality recommendation after an initial decision.

3.2 Technical realization of the managerial decision

We start by describing Baseline Risk. Every participant plays the role of a manager and has to decide in which design she wants to offer her products on the market.Footnote 3 She has to decide simultaneously between a traditional and a modern design for 11 distinct products, respectively. The traditional design is well established on the market such that the manager knows the exact price that the customers are willing to pay. Therefore, deciding for the traditional design yields a sure payoff of \(\$2.00\). The decision for the modern design involves risk instead. Since the design has not been tested on the market, the manager does not know how the customers will respond. For reasons of simplicity, we assume that the customers can only react in two ways: they either prefer the modern design, resulting in the willingness to pay a high price for the product, or they prefer the traditional design, which results in a lower price. Based on market analysis, both outcomes occur with an equal probability of \(50\%\). To visualize this in our framed experiment, we provide subjects with the information that out of 100 customers, 50 are willing to pay a high price and 50 are willing to pay a low price. Of these 100 customers, one is randomly chosen to be the one that is determining the payoff in the scenario. In the case of a customer that is willing to pay a high price being chosen, the subject earns \(\$4.00\). If, however, the low-paying customer is selected, she earns between \(\$2.00\) and \(\$0.00\). This value differs between the 11 products, e.g., for product 1, the payoff for a low-paying customer is \(\$2.00\), while for product 11, this payoff is decreased to \(\$0.00\). A full representation of the multiple price list can be found in Appendix A.Footnote 4 If Task 1 is the payoff-relevant task, one of the 11 products and the corresponding subject’s decision are randomly selected to be payoff relevant.

The above-described design provides us with a unique switching point for each subject or no switching point at all if a subject always opts for the modern design.Footnote 5 For the analysis, we assume that each subject has constant relative risk aversion (CRRA) and the isoelastic utility function \(u(\pi ) = \frac{\pi ^{1-\gamma }-1}{1-\gamma }\) for \(\gamma \ne 1\) and \(u(\pi ) = ln (\pi )\) for \(\gamma = 1\) with \(\pi\) denoting the payoff and \(\gamma\) the CRRA coefficient (Arrow 1971; Pratt 1964). Depending on the unique switching point, we assign a CRRA coefficient to each subject that will be used as the main dependent variable in our analysis. In particular, we follow Barham et al. (2014) and set the CRRA coefficient to the lower bound of the resulting interval.Footnote 6 In addition to the CRRA coefficient, we can also deploy the unique switching point as the dependent variable in our analysis. For this, we reverse the coding of the switching point to be able to compare the results easily.Footnote 7 Table 2 gives an overview of the dependence of the switching point, the CRRA coefficient, and the reversed switching point.

3.3 Implementation of the recommendation nudge in Risk

In both of our two groups Pre-Recommendation Risk and Post-Recommendation Risk, we implement the same recommendation nudge. Subjects are recommended to choose the modern design for products 1–10 and the traditional design for product 11. We justify this with the greater expected payoff that the modern design yields compared to the traditional design for the first ten products. For product 11, the expected payoffs are equal, and we therefore recommend the safer option. With this, the recommendation describes the most neutral decision as being the recommended one, making it a pro-neutrality recommendation in this setting. To ensure that the subjects understand this correctly, the recommended choices are also labeled and framed.Footnote 8 In Pre-Recommendation Risk, the pro-neutrality recommendation is placed right at the beginning of the experiment before an initial decision is made by the subject. In Post-Recommendation Risk, the subjects play Baseline Risk until submitting their choices. After this, the pro-neutrality recommendation is implemented, and they are asked to re-evaluate their initial decision. Everything else is unchanged compared to Baseline Risk. Figure 1 shows a general overview of the whole experiment, including the placement of the recommendations within Task 1.

3.4 Realization of Uncertainty

In the three remaining groups Baseline Uncertainty, Pre-Recommendation Uncertainty, and Post-Recommendation Uncertainty, we only make one change compared to their respective equivalent in the Risk domain. We include ambiguity by using an unknown probability distribution for the customer’s willingness to pay if the subject decides for the modern design instead of the equal probabilities of \(50\%\). To visualize this in our framed experiment, we do not provide the subjects with information about how many out of 100 customers are willing to pay a high price and how many are willing to pay a low price. Calculating the expected profits by integrating all possible distributions of probabilities yields the same value as in the Risk domain.Footnote 9 Following Barham et al. (2014), Gilboa and Schmeidler (1989), and Klibanoff et al. (2005), we calculate a coefficient for uncertainty aversion similar to the CRRA coefficient \(\gamma\) in Risk. This coefficient can be interpreted as the sum of risk aversion and ambiguity aversion (for a formal proof of this, see Barham et al. 2014). We use this coefficient as the main dependent variable for the Uncertainty domain in our analysis. For the sake of simplicity and to avoid confusion in our parametric and non-parametric testings, we also use the term CRRA coefficient and denote it by \(\gamma\) when we are referring to the coefficient for uncertainty aversion shown in the decisions.

3.5 Additional controls

As described in the general overview, in addition to the main experiment in Task 1, we use Task 2 to measure a subject’s mathematical abilities with an alteration of the Berlin Numeracy Test (Cokely et al. 2012). We adapt the items with regard to the presentation and wording, but not to the actual mathematical skills needed, to avoid cheating. We control for numeracy due to previous findings of it being correlated with a person’s risk aversion (e.g., Riepe et al. 2022; Park and Cho 2019). If Task 2 is payoff relevant, the subject’s performance in the Numeracy test is paid. For each correct item, subjects receive \(\$1.00\). Therefore, the potential payoff of Task 2 ranges from \(\$0.00\) to \(\$4.00\).

In addition to the two incentivized tasks, we add controls at two points in our experiment. First, after Task 1, we ask the subjects to rate how confident they are about decisions that are comparable to the decision they have just made as the confidence level might be relevant for the effectiveness of nudging (Löfgren and Nordblom 2020). In addition, we ask about their general preference for rational or intuitive reasoning (Butler et al. 2014). Second, we implement five additional questionnaires as post-experimental control measures. We use the general risk aversion scale (Dohmen et al. 2011) to elicit the subjects’ propensity to take risks. We control for personal attitude towards entrepreneurship and perceived behavioral control regarding entrepreneurial capacity (Liñán and Chen 2009) to look for possible differences between people with positive entrepreneurial attitudes versus less entrepreneurial attitudes in terms of neutral behavior (Koudstaal et al. 2016). Further self-measures include tolerance for ambiguity (Herman et al. 2010; for the original scale, see Budner 1962) and dispositional resistance to change with measures of routine-seeking behavior, emotional reaction to change, short-term focus, and cognitive rigidity (Oreg 2003). The experiment concludes with a set of sociodemographic questions.

3.6 Subjects and setting

We collected data from 298 subjects. Due to randomization, 93 subjects participated in Baseline (Risk: 47, Uncertainty: 46), 105 in Pre-Recommendation (Risk: 53, Uncertainty: 52), and 100 in Post-Recommendation (Risk: 49, Uncertainty: 51). Of the 293 subjects that answered our question in regard to their gender, \(54\%\) reported to be female (Binomial probability test: \(p=.129\)). Average age in years is 33.08 (\(SD=11.27\)). Data collection took place in November 2020 using Qualtrics for realizing the experiment and Prolific (Palan and Schitter 2018) for recruiting and paying subjects. We limited the sample to US-citizens with a high school degree or a higher educational level who were born in the United States of America. The median subject took 11.91 minutes to finish the experiment. The average payoff was \(\$2.51\) (\(SD=1.27\)) including a \(\$1.00\) show-up fee. The minimum payoff was \(\$1.00\), the maximum \(\$5.00\). Having calculated the average cost per observation, we projected that we would be able to carry out six treatments within our budget for about 50 subjects per treatment.

4 Results

We test whether a pro-neutrality recommendation before making an initial decision (Pre-Recommendation) and after making an initial decision (Post-Recommendation) is effective in promoting more neutral behavior in decisions involving Risk or Uncertainty. As described above, we define these two domains as involving either known or unknown probabilities. We test in both domains as these are the most relevant cases of business venturing involving more or less informative insights into the market and its structures. Each subject in our experiment participated in one of three levels of the intervention (Baseline with no intervention, Pre-Recommendation with a pro-neutrality recommendation before making an initial decision, or Post-Recommendation with the pro-neutrality recommendation after an initial decision). Likewise, the subject only participated in one of the two domains (Risk or Uncertainty). In both of the Post-Recommendation groups, we also collected the initial decision, which is the Baseline situation. Therefore, our experimental design allows us to investigate the effect of the Pre-Recommendation between-subject in comparison to the respective Baseline groups and the respective pooled groups that consist of Baseline and the initial decisions in Post-Recommendation (Baselinepooled groups) using non-parametric testing. In addition, the Post-Recommendation can be compared between-subject to the Baseline group and within-subject to the initial decision in Post-Recommendation. Furthermore, using parametric testing, Pre-Recommendation and Post-Recommendation can also be compared to Baselinepooled. In addition to testing for an effect of the pro-neutrality recommendation before and after making an initial decision, we also compare the effectiveness between the two with non-parametric and parametric testing.

For the following analysis, we use the CRRA coefficient calculated as described in Appendix B. The CRRA coefficient allows us to measure the subject’s deviation from strict rationality in the specific situation. In other words, the CRRA coefficient provides us with a measure on how far off the subject is compared to neutrality. In our experimental design, the CRRA coefficient ranges from \(-0.09\) (risk-loving) to 0 (risk-neutral) to 3.76 (very risk-averse).Footnote 10 We observe a mean CRRA coefficient of 1.06 (\(SD=1.11\)) in Baselinepooled Risk and 1.09 (\(SD=1.10\)) in Baselinepooled Uncertainty.Footnote 11

4.1 Effect of recommendations under Risk

Introducing a Pre-Recommendation decreases the mean CRRA coefficient to 0.71 (\(SD=1.05\)) under Risk. The difference is statistically highly significant (Mann–Whitney test: \(z=2.734\), \(p=.006\)) compared to Baselinepooled Risk (mean CRRA coefficient of 1.06). For a Post-Recommendation under Risk , we find a mean CRRA coefficient of 0.60 (\(SD=0.87\)). The difference is highly significant for both between-subject compared to Baseline Risk (Mann–Whitney test: \(z=3.459\), \(p<.001\)) as well as within-subject compared to the initial Baseline-like decisions in this group (Wilcoxon signed-rank test: \(z=-3.444\), \(p<.001\)). Figure 2 shows the corresponding mean CRRA coefficient of Baselinepooled, Pre-Recommendation, and Post-Recommendation in a risky environment.

We find accompanying support by means of a parametric analysis. Results of random effects generalized least squares regressions with clustered standard errors and the CRRA coefficient as the dependent variable are presented in Table 3.Footnote 12 We use three models. Model 1 features the effect of the two types of a pro-neutrality recommendation in a risky environment with no additional controls. Model 2 adds additional questionnaires including the incentivized numeracy task as controls. Model 3 additionally adds sociodemographic information as controls. The results support our non-parametric findings. A Pre-Recommendation under Risk reduces the CRRA coefficient significantly (Model 3: \(b=-0.484\), \(p=.035\)) on average controlling for additional personality characteristics by means of additional questionnaires and sociodemographic information. Likewise, but smaller in size, a Post-Recommendation under Risk lowers the CRRA coefficient significantly (Model 3: \(b=-0.222\), \(p<.001\)) on average. Therefore, these results support that there is a change in behavior towards more risk neutrality if a pro-neutrality recommendation is provided under Risk. We conclude that a Pre-Recommendation as well as a Post-Recommendation affect the behavior towards a more risk-neutral decision in an environment featuring Risk. We support Hypothesis 1a and 2a.

Result 1a

A pro-neutrality recommendation that is provided before making the decision promotes risk-neutral behavior in managerial situations under Risk.

Result 2a

A pro-neutrality recommendation that is provided after making an initial decision promotes risk-neutral behavior in managerial situations under Risk.

We do not find that any of our controls including the incentivized numeracy task relevantly temper with the effect of the two types of a pro-neutrality recommendation. Therefore, we cannot support previous findings by Riepe et al. (2022) and Park and Cho (2019) that claim numeracy is associated with a significantly different level of risk-averse behavior. Of the other additional questionnaires, only the general risk aversion scale (Dohmen et al. 2011) and the tolerance for ambiguity (Herman et al. 2010) turn out to significantly influence the behavior. A higher self-reported willingness to take risks and a higher self-reported tolerance for ambiguity are significantly associated with more neutral behavior. Both results are in line with previous findings (Dohmen et al. 2011; Black et al. 1999). In addition, we find that a higher self-reported age as well as lower self-reported educational level are associated with more neutral behavior in our experiment.

4.2 Effect of recommendations under Uncertainty

We now turn our attention to the effect of the two types of a pro-neutrality recommendation in an environment featuring uncertainty. The relevant comparison is the CRRA coefficient in Baselinepooled Uncertainty (\(M=1.09\), \(SD=1.10\)). We find that a Pre-Recommendation decreases the mean CRRA coefficient to 0.63 (\(SD=0.86\)) under Uncertainty. The difference to Baselinepooled Uncertainty is statistically highly significant (Mann–Whitney test: \(z=3.176\), \(p=.002\)). In regard to a Post-Recommendation under Uncertainty, we can report a mean CRRA coefficient of 0.88 (\(SD=1.28\)). The difference is highly significant both between-subject compared to Baseline Uncertainty (Mann–Whitney test: \(z=2.769\), \(p=.006\)) as well as within-subject compared to the initial Baseline-like decisions in this group (Wilcoxon signed-rank test: \(z=-3.087\), \(p=.002\)). Figure 3 shows the corresponding mean CRRA coefficient of Baselinepooled, Pre-Recommendation, and Post-Recommendation in an uncertain environment.

In the same fashion as before, we can support these findings with a parametric analysis. The results of random effects generalized least squares regressions with clustered standard errors and the CRRA coefficient as the dependent variable are presented in Table 4.Footnote 13 Again, we use three models. Model 4 features the effect of the two types of a pro-neutrality recommendation in an uncertain environment with no additional controls. Model 5 adds the additional questionnaires as controls. Model 6 additionally adds sociodemographic information as controls. The results support our non-parametric findings. A Pre-Recommendation under Uncertainty affects the CRRA coefficient negatively and significantly (Model 6: \(b=-0.539\), \(p=.005\)) on average controlling for additional factors as discussed above. Likewise, but smaller in size, a Post-Recommendation under Uncertainty reduces the CRRA coefficient significantly (Model 6: \(b=-0.170\), \(p<.001\)). Therefore, these results support that there is a change in behavior towards more uncertainty neutrality if a pro-neutrality recommendation is provided under Uncertainty. We conclude that a Pre-Recommendation as well as a Post-Recommendation affect the behavior towards a more uncertainty-neutral decision in an environment featuring Uncertainty. We support Hypothesis 1b and 2b.

Result 1b

A pro-neutrality recommendation that is provided before making the decision promotes uncertainty-neutral behavior in managerial situations under Uncertainty.

Result 2b

A pro-neutrality recommendation that is provided after making an initial decision promotes uncertainty-neutral behavior in managerial situations under Uncertainty.

The additional controls we applied show similar results in the domain Uncertainty to those in the domain Risk. First, we can again note that additional controls do not relevantly affect the effect we find for both recommendations. Second, the individual performance in the numeracy task is not associated with a relevant shift in behavior. Third, we again find that a higher self-reported willingness to take risks is associated with more neutral behavior. We find no such correlation for individual self-reported tolerance for ambiguity in the uncertain domain. Fourth, while education seems to have no effect under Uncertainty , a higher age is again associated with more neutral behavior. Fifth, under Uncertainty , we find that personal attitude towards entrepreneurship seems to stimulate aversive behavior in our experiment.

4.3 Comparison of the effectiveness

In Hypothesis 3a and 3b, we argued that the effect of a Post-Recommendation might be smaller than the effect of a Pre-Recommendation because the initial decision might cause a status quo bias or interfere with the recommendation through another channel. We find mixed evidence of whether this is true. First, using Spearman’s rank correlation, we can identify a relationship between the level of intervention (Baseline \(\rightarrow\) Post-Recommendation \(\rightarrow\) Pre-Recommendation) and the corresponding level of aversive behavior measured by the CRRA coefficient under Risk (\(r_s=-0.278\), \(p=.001\)) and under Uncertainty (\(r_s=-0.276\), \(p=.001\)).Footnote 14 Therefore, more neutral behavior is found if the pro-neutrality recommendation is provided before making the decision than if it is provided after making an initial decision and, likewise, more neutral behavior is found if the pro-neutrality recommendation is provided after making an initial decision than if it is not provided at all. Second, the estimated effects of a Pre-Recommendation are higher than those of a Post-Recommendation under Risk (Model 3: \(\vert b_{\textsc { Pre-Recommendation}}=-0.484\vert >\vert b_{\textsc { Post-Recommendation}}=-0.222\vert\)) and under Uncertainty (Model 6: \(\vert b_{\textsc { Pre-Rec}}=-0.481\vert >\vert b_{\textsc { Post-Rec}}=-0.171\vert\)). However, the difference between the two effects turns out to be only weakly significant in the domain Uncertainty (Wald test for Pre-Recommendation = Post-Recommendation in Model 6: \(\chi ^2=3.50\); \(p=.062\)) and not significant in the domain Risk (Model 3: \(\chi ^2=1.85\); \(p=.174\)).Footnote 15 Third, using pairwise testing between Pre-Recommendation and Post-Recommendation yields a lack of significance for the difference under Risk (Mann–Whitney test: \(z=0.253\), \(p=.800\)) and under Uncertainty (\(z=-0.213\), \(p=.831\)). Overall, we lack consistent evidence for supporting Hypothesis 3a and 3b. We find almost no evidence supporting Hypothesis 3a and weak evidence supporting Hypothesis 3b. So, there is limited evidence that a Post-Recommendation suffers from the initial decision under Uncertainty and therefore lacks the same level of neutrality-promoting effect as the Pre-Recommendation in this domain. One potential reason for why we might not be able to detect the difference correctly is the scale of our experimental measure. It seems plausible that a more nuanced scale, e.g., a continuous measure, is required to detect the small differences between the two types of a pro-neutrality recommendation. On the other hand, our result can also be interpreted in the sense that the difference in effect size between the two nudges is potentially caused by a moderating effect of the context, i.e., the domain (Risk or Uncertainty ) of the business venturing option (for a more detailed discussion on moderating effects for nudging, see Hauser et al. 2018; van Kleef and van Trijp 2018).

Result 3a

A pro-neutrality recommendation that is provided before making the decision might have the same effect in promoting risk-neutral behavior than a pro-neutrality recommendation that is provided after making an initial decision in managerial situations under Risk.

Result 3b

A pro-neutrality recommendation that is provided before making the decision might have a stronger effect in promoting uncertainty-neutral behavior than a pro-neutrality recommendation that is provided after making an initial decision in managerial situations under Uncertainty.

4.4 Additional findings

In this paper, we find support for nudges being effective in shifting behavior towards more neutrality. More precisely, our analysis offers evidence for the effectiveness of a pro-neutrality recommendation that is provided before making the decision (Pre-Recommendation) as well as a pro-neutrality recommendation that is provided after making an initial decision (Post-Recommendation). We find that both of these recommendations are effective in promoting more neutral behavior.Footnote 16 However, one might argue that we have to differentiate a nudge-based behavioral shift as we hypothesized it in this paper from a change in the person’s aversion.

Personality traits, including aversions to risk and uncertainty, are said to be constant over time and therefore relatively stable (Frey et al. 2017). As stated before, we measure general risk aversion with the questionnaire by Dohmen et al. (2011) and tolerance for ambiguity with the questionnaire by Herman et al. (2010). We find that general risk aversion and ambiguity tolerance show some association with the observed behavior and the level of aversiveness in it (Task 1 of the experiment, measured with an adaptation of the multiple price list by Barham et al. 2014). However, while the two types of a pro-neutrality recommendation have proven to be effective in shifting behavior towards neutrality, there is no evidence that the Pre-Recommendation tempers with the subject’s risk aversion (Mann–Whitney test under Risk : \(z=-0.519\), \(p=.604\); under Uncertainty : \(z=0.179\), \(p=.858\)) or ambiguity tolerance (under Risk : \(z=0.955\), \(p=.340\); under Uncertainty : \(z=-0.907\), \(p=.365\)). Likewise, there is no such evidence in regard to the Post-Recommendation for general risk aversion (under Risk : \(z=0.355\), \(p=.722\), under Uncertainty : \(z=-0.995\), \(p=.320\)) or tolerance for ambiguity (under Risk : \(z=1.143\), \(p=.253\), under Uncertainty : \(z=0.282\), \(p=.778\)). Figures 4 and 5 show the corresponding means in each group in each domain and overall in each domain.

We also investigated the difference between the effect of a Pre-Recommendation and a Post-Recommendation. In similar fashion, we find no evidence that there is relationship between the placement of the nudge (Baseline \(\rightarrow\) Post-Recommendation \(\rightarrow\) Pre-Recommendation) and general risk aversion (Spearman’s rank correlations under Risk: \(r_s=0.044\), \(p=.594\); under Uncertainty: \(r_s=-0.019\), \(p=.819\)) or ambiguity tolerance (under Risk : \(r_s=-0.082\), \(p=.322\); under Uncertainty: \(r_s=0.073\), \(p=.377\)). Lastly, we can also apply ordinary least squares regressions to investigate in the fashion of our parametric analysis above whether there is an effect of recommendations on general risk aversion or tolerance for ambiguity. Again, we find no significant effect of pro-neutrality recommendations on self-reported risk aversion or ambiguity tolerance. Our finding here is in line with what Hauser et al. (2018) argue about nudges having an effect in specific situations rather than a general effect.

Result 4

A pro-neutrality recommendation promotes neutral behavior without tempering with the underlying personality traits, i.e., risk aversion and ambiguity tolerance.

In line with previous findings by Barham et al. (2014), Holm et al. (2013), and Koudstaal et al. (2016), we find only a very small difference between the two domains Risk and Uncertainty. This holds true for the analysis of the effects of nudging as well as the investigation into whether the recommendations shift behavior or temper with the personality traits. We can also conduct non-parametric testing and conclude that there is no significant difference in behavior between Risk and Uncertainty. More precisely, we find no evidence for a significant difference between the domains (Mann–Whitney test between domains overall: \(z=-0.146\), \(p=.884\); in Baseline: \(z=0.052\), \(p=.958\); in Pre-Recommendation: \(z=0.105\), \(p=.917\); in Post-Recommendation: \(z=-0.442\), \(p=.658\)). This lack of support for a significant difference might again be attributed to the measure itself. A more nuanced measure might be better suited to detect very small differences. However, it also implies that the effects of pro-neutrality recommendations are indeed strong as we are able to clearly identify them and that the lack of supporting evidence for a difference in the effect between a Pre-Recommendation and Post-Recommendation might indeed be attributed to the measure and its scale rather than an actual lack of difference in effect size.

Although there is a large and growing literature on gender differences in risk preferences (Byrnes et al. 1999; Croson and Gneezy 2009), we find no significant differences between men and women based on the CRRA coefficient in the relevant subgroups. More specifically, there is no significant difference between men and women in Baselinepooled or when implementing a Pre-Recommendation or a Post-Recommendation for both decisions under Risk and Uncertainty. All non-parametric analyses on gender differences yield \(p>.5\).

5 Discussion and implications

Our findings show that a pro-neutrality recommendation nudge takes effect in decisions occurring in managerial activities by suppressing risk and uncertainty aversion. More precisely, we observe a behavioral shift towards more neutrality and, therefore, better individual performance if a pro-neutrality recommendation is provided in a situation modeling a business venturing endeavor featuring either risk or uncertainty.

We use an example of a framed managerial decision-making process, where time, information, and experience are often lacking, to show how simple decision aids lead to more effective judgment. That said, behavioral interventions prompt subjects in business venture situations to assess risk or uncertainty much better through advice or supplementary information than when they make decisions without help, i.e., only on their own initiative. Building on McKelvie et al. (2011), if higher risk taking is advisable, such interventions lead to the individual’s increased willingness to take and face risks in business activities. Indeed, our experimental results provide evidence of significantly increased, rational risk-taking. A potential channel for this finding is the nudge’s ability to boost risk savviness. The literature on heuristics and intuition suggests that risks and uncertainties can be controlled by acquiring risk savviness (Gigerenzer 2014). If nudges, i.e., here pro-neutrality recommendations, are accepted as sources of information, correction, or feedback, the effect of risk savviness in a given situation can be boosted. We show that a pro-neutrality recommendation remains an effective intervention when an initial decision (without this or any other decision aid) has been taken. Therefore, in uncertain situations that cannot be practiced regularly and which might be met with a “good guess” initially, managers can still be affected by a such a recommendation. Our results also show that a status quo preference, i.e., the retention of strategies averse to uncertain outcomes, can be corrected by a nudge towards more innovative activities, typically characterized as risk-inherent. One might argue that management training involves building up risk savviness and therefore renders nudges, of which we tested one potential materialization in this paper, either less useful or not necessary at all. However, Fairlie and Holleran (2012) point out that such training benefits individuals with a higher tolerance for risk more than individuals with higher risk aversion. In addition, they find no support for a long-lasting effect of risk-taking training. Managers might be unable to transfer their learning from one situation to another. Therefore, nudging, for example, in the form of a well-compiled and well-placed recommendation, might still be the most cost-efficient tool available (for a detailed overview of cost-efficiency of nudging, see Benartzi et al. 2017). This argument is enforced when one considers that nudges are a proven tool for providing and transmitting information that would have otherwise been overlooked or ignored in business decisions (Pellegrini et al. 2016; Zichella 2020).

In practical terms, we argue that managers benefit from employing flat hierarchies to encourage employees to voice their opinions as well as from consulting external experts to receive information and corrective advice. Based on our experimental findings, we believe that such measures are effective in fostering more neutral and therefore more beneficial decision-making. Even if the current form of organization does not lead to bad decisions per se, a transformation that increases the flow of information in the form of pro-neutrality recommendations might still generate better decision-making (Cabantous et al. 2010). A potential measure is to designate an employee to explicitly focus her time on providing neutral input or guidance for decisions under risk and uncertainty.

Our results partly suggest a potentially higher effect of a pro-neutrality recommendation that is provided prior to an initial decision—more so for situations featuring uncertainty. Again, in practical terms, we suggest implementing a system that uses consciously guided timing for when a pro-neutrality recommendation (from an employee or external source) is provided to the manager or decision-maker in uncertain situations. Easier to implement is a “take the decision when all recommendations are provided” rule. We argue that managers are better served to take a decision after their employees or external sources have had enough time to provide neutral input. Summing up our results, managers benefit from more and potentially better-timed, well-crafted recommendations with neutral, benefit-increasing content.

6 Limitations and further research

Our research and the experimental method as a whole have their limitations. For example, Bolton et al. (2012), Graf-Vlachy (2019), and Remus (1986) point out and find that student samples are a valid source to investigate cognitive biases and allow us to abstract the findings towards a general population and managerial literature. Still, some might argue that the external validity of our findings are limited. Future research could replicate our results using a manager sample. In addition, we used an incentivized, online experiment. Online experiments lack the same level of high control administered by the experimenter in a laboratory experiment. Therefore, this form of data collection is potentially vulnerable to high variations. Future research could test the robustness of our results by repeating the study using a laboratory experiment—either with a student or even a manager sample. Furthermore, although we conducted an incentivized experiment with fairly high payoffs per hour, we paid out small amounts in total due to the short duration of our experiment. It may be worthwhile to investigate the effect of increased payments to render a status quo preference more attractive. Since nudges can affect situations in varying degrees according to their perceived importance and the decision-maker’s self-confidence (Löfgren and Nordblom 2019, 2020), further research could test the effectiveness of the behavioral interventions in both field and laboratory experiments with high stakes in the form of high payoffs or real-life consequences.

Further opportunities for advancing the impact of nudging include understanding the underlying processes that cause suboptimal behavior. For instance, managers may exhibit biases when making decisions on behalf of others due to their sense of responsibility and accountability towards employees, leading to a preference for minimizing potential losses over maximizing potential gains (for an overview of the effect of decision-making for others, see Polman and Wu 2020). By emphasizing the potential benefits of a decision, a behavioral intervention could neutralize the perception of risk. Additionally, the specific decision environment can also play a role in shaping risk aversion levels (see, e.g., Gioia 2017), such as the presence of stakeholders or colleagues. To mitigate such social pressure, a behavioral intervention could involve changing the presence of peers and evaluating the impact on the decision outcome.

Testing nudges in managerial activities featuring a varying degree of risk would advance research on debiasing and interlock management theory and practice more closely with methods from the behavioral sciences. Another research avenue would be applying games or tasks other than the multiple price list used here in order to tackle the potential issue of the scale that comes with the multiple price list. One example is the Becker–DeGroot–Marschak mechanism (Becker et al. 1964). However, there are voices questioning the incentive compatibility of this measure (Horowitz 2006) and about its complexity compared to a multiple price list (Asioli et al. 2021).

In Sect. 5, we proposed potential practical implications regarding the organization of a company and especially its rules on how to provide and use recommendations. Further research using field experimental approaches might prove fruitful in determining their effectiveness. In sum, we are convinced that insights and methods from behavioral economics are well suited to test hypotheses within managerial decision-making processes that hold consequences and implications for both researchers and practitioners.

Data availability statement

The datasets generated by the experimental research during and/or analyzed during the current study are available in the OSF repository, https://osf.io/wsuax/.

Notes

For reasons of readability, we substitute risk neutrality as well as uncertainty neutrality with “neutrality” and risk aversion as well as uncertainty aversion with “aversion”. Likewise, we use “aversive behavior” for behavior showing risk aversion or uncertainty aversion and “neutral behavior” for behavior showing risk neutrality or uncertainty neutrality.

In our experiment and the relevant literature, “design” encompasses all core features that the product has (Utterback and Abernathy 1975).

To clarify, each subject plays the game for herself, i.e., neither her decision influences the payoff of any other subject, nor does any decision of other subjects influence her payoff. In addition, all subjects are informed about all rules at the beginning of the experiment and all relevant features are common knowledge.

For reasons of consistent rationality, we allow the subject to switch between the product from the modern design to the traditional design only once, i.e., from right to left in our multiple price list.

The derivation of the CRRA coefficients from the respective switching point can be found in Appendix B.

Note that the CRRA coefficient decreases when switching at a higher product number, while the switching point obviously increases. It is helpful to reverse the switching point to gain estimates that have equal signs. Technically speaking, this is necessary because the level of shown risk aversion in the decision decreases with switching in a lower row.

See the instructions in Appendix C for a graphical representation.

Note that no information about the distribution of probabilities is known to the subjects other than that it is unknown. Because of this, we make the assumption that an uncertainty-neutral participant assumes a uniform distribution over the probabilities. This leads to a neutral participant assigning a probability of \(50\%\) on average to each of the two outcomes.

Of our 298 subjects, 271 provided a decision for which we can calculate the CRRA coefficient. For a detailed explanation, see Appendix B.

We find no evidence that the decisions in the Baseline groups differ significantly from the initial, Baseline-like decisions in Post-Recommendation Risk (Mann–Whitney test: \(z= 1.598\), \(p=.110\)) or Post-Recommendation Uncertainty (\(z=1.084\), \(p=.279\)). Therefore, we are using the Baselinepooled groups for our analysis if feasible. The presented results in our work do not differ significantly when using the Baseline groups instead of the Baselinepooled groups. Likewise, the presented results do not differ significantly when using the switching point of the subject in the multiple price list instead of the CRRA coefficient based on the switching point as presented in the main body of this paper.

For further robustness, we used the reversed switching point as the dependent variable ranging from rather risk-loving to highly risk-averse between 0 and 11. We present the results of the random effects ordered probit regressions with clustered standard errors using the switching point in Table 5. All effects regarding the Pre-Recommendation and Post-Recommendation under Risk are supported as stated here.

As before, for further robustness, we used the reversed switching point as the dependent variable. We present the results of the random effects ordered probit regressions with clustered standard errors using the switching point in Table 6. All effects regarding the Pre-Recommendation and Post-Recommendation under Uncertainty are supported as stated here.

Results of non-parametric Jonckheere-Terpstra tests for ordered alternatives confirm these trends for Risk (\(J = 2148.5\), \(J* = -3.180\) (corrected for ties), \(p=.002\)) and Uncertainty (\(J = 2402.5\), \(J* = -3.139\) (corrected for ties), \(p=.002\)).

We cannot support the significance of the difference in the domain Uncertainty when using a Wald test in Model 12 (replication of Model 6 with the switching point instead of the CRRA coefficient as the dependent variable) presented in Table 6.

For an overview of our findings in regard to the hypothesized effects, see Appendix E. Additional analyses with interactions are in Appendix F.

References

Arrow KJ (1971) The theory of risk aversion. In: Arrow KJ (ed) Essays in the theory of risk bearing (90ff). Pennsylvania State University, North-Holland

Asioli D, Mignani A, Alfnes F (2021) Quick and easy? Respondent evaluations of the Becker-DeGroot-Marschak and multiple price list valuation mechanisms. Agribusiness 37(2):215–234. https://doi.org/10.1002/agr.21668

Barham BL, Chavas J-P, Fitz D, Salas VR, Schechter L (2014) The roles of risk and ambiguity in technology adoption. J Econ Behav Organ 97:204–218. https://doi.org/10.1016/j.jebo.2013.06.014

Barron K, Nurminen T (2020) Nudging cooperation in public goods provision. J Behav Exp Econ. https://doi.org/10.1016/j.socec.2020.101542

Becker GM, Degroot MH, Marschak J (1964) Measuring utility by a single-response sequential method. Behav Sci 9(3):226–232. https://doi.org/10.1002/bs.3830090304

Benartzi S, Beshears J, Milkman KL, Sunstein CR, Thaler RH, Shankar M, Tucker- Ray W, Congdon WJ, Galing S (2017) Should governments invest more in nudging? Psychol Sci 28(8):1041–1055. https://doi.org/10.1177/0956797617702501

Bertrand M, Morse A (2011) Information disclosure, cognitive biases, and payday borrowing. J Financ 66(6):1865–1893. https://doi.org/10.1111/j.1540-6261.2011.01698.x

Biyalogorsky E, Boulding W, Staelin R (2006) Stuck in the past: why managers persist with new product failures. J Mark 70(2):108–121. https://doi.org/10.1509/jmkg.70.2.108

Black JS, Morrison AJ, Gregersen HB (1999) Global explorers: the next generation of leaders. Routledge, London

Bolton GE, Ockenfels A, Thonemann UW (2012) Managers and students as newsvendors. Manage Sci 58(12):2225–2233. https://doi.org/10.1287/mnsc.1120.1550

Budner S (1962) Intolerance of ambiguity as a personality variable. J Pers 30(1):29–50. https://doi.org/10.1111/j.1467-6494.1962.tb02303.x

Butler JV, Guiso L, Jappelli T (2014) The role of intuition and reasoning in driving aversion to risk and ambiguity. Theor Decis 77(4):455–484. https://doi.org/10.1007/s11238-013-9407-y

Byrnes JP, Miller DC, Schafer WD (1999) Gender differences in risk taking: a meta-analysis. Psychol Bull 125(3):367–383. https://doi.org/10.1037/0033-2909.125.3.367

Cabantous L, Gond J-P, Johnson-Cramer M (2010) Decision theory as practice: crafting rationality in organizations. Organ Stud 31(11):1531–1566. https://doi.org/10.1177/0170840610380804

Cadario R, Chandon P (2020) Which healthy eating nudges work best? A meta-analysis of field experiments. Mark Sci 39(3):465–486. https://doi.org/10.1287/mksc.2018.1128

Christensen CM (1997) The innovator’s dilemma: when new technologies cause great firms to fail. Harvard Business School Press, Boston

Cokely ET, Galesic M, Schulz E, Ghazal S (2012) Measuring risk literacy: the Berlin numeracy test. Judg Dec Mak 7(1):25–47

Collis D (1992) The strategic management of uncertainty. Eur Manag J 10(2):125–135. https://doi.org/10.1016/0263-2373(92)90060-H

Croson R, Gneezy U (2009) Gender differences in preferences. J Econ Lit 47(2):448–474. https://doi.org/10.1257/jel.47.2.448

Dohmen T, Falk A, Huffmann D, Sunde U, Schupp J, Wagner GG (2011) Individual risk attitudes: measurement, determinants, and behavioral consequences. J Eur Econ Assoc 9(3):522–550. https://doi.org/10.1111/j.1542-4774.2011.01015.x

Drichoutis AC, Lusk JL (2016) What can multiple price lists really tell us about risk preferences? J Risk Uncertain 53(2–3):89–106. https://doi.org/10.1007/s11166-016-9248-5

Eijkelenboom GG, Rohde I, Vostroknutov A (2019) The impact of the level of responsibility on choices under risk: the role of blame. Exp Econ 22(4):794–814. https://doi.org/10.1007/s10683-018-9587-y

Eisenhardt KM (1989) Agency theory: an assessment and review. Acad Manag Rev 14(1):57–74. https://doi.org/10.2307/258191

Fairlie RW, Holleran W (2012) Entrepreneurship training, risk aversion and other personality traits: evidence from a random experiment. J Econ Psychol 33(2):366–378. https://doi.org/10.1016/j.joep.2011.02.001

Frey R, Pedroni A, Mata R, Rieskamp J, Hertwig R (2017) Risk preference shares the psychometric structure of major psychological traits. Sci Adv. https://doi.org/10.1126/sciadv.1701381

Gigerenzer G (2007) Gut feelings: the intelligence of the unconscious. Viking, London

Gigerenzer G (2014) Risk savvy: how to make good decisions. Viking, London

Gilboa I, Schmeidler D (1989) Maxmin expected utility with non-unique prior. J Math Econ 18(2):141–153. https://doi.org/10.1016/0304-4068(89)90018-9

Gioia F (2017) Peer effects on risk behaviour: the importance of group identity. Exp Econ 20(1):100–129. https://doi.org/10.1007/s10683-016-9478-z

Glaser L, Stam W, Takeuchi R (2016) Managing the risks of proactivity: a multilevel study of initiative and performance in the middle management context. Acad Manag J 59(4):1339–1360. https://doi.org/10.5465/amj.2014.0177

González M, Guzmán A, Pombo C, Trujillo M-A (2013) Family firms and debt: risk aversion versus risk of losing control. J Bus Res 66(11):2308–2320. https://doi.org/10.1016/j.jbusres.2012.03.014

Graf-Vlachy L (2019) Like student like manager? Using student subjects in managerial debiasing research. RMS 13(2):347–376. https://doi.org/10.1007/s11846-017-0250-3

Harvey N, Fischer I (1997) Taking advice: accepting help, improving judgment, and sharing responsibility. Organ Behav Hum Decis Process 70(2):117–133. https://doi.org/10.1006/obhd.1997.2697

Hauser OP, Gino F, Norton MI (2018) Budging beliefs, nudging behaviour. Mind Soc 17:15–26. https://doi.org/10.1007/s11299-019-00200-9

Herman JL, Stevens MJ, Bird A, Mendenhall M, Oddou G (2010) The Tolerance for Ambiguity Scale: towards a more refined measure for international management research. Int J Intercult Relat 34(1):58–65. https://doi.org/10.1016/j.ijintrel.2009.09.004

Holm HJ, Opper S, Nee V (2013) Entrepreneurs under uncertainty: an economic experiment in China. Manage Sci 59(7):1671–1687. https://doi.org/10.1287/mnsc.1120.1670

Holmström B (1979) Moral hazard and observability. Bell J Econ 10(1):74–91. https://doi.org/10.2307/3003320

Holt CA, Laury SK (2002) Risk aversion and incentive effects. Am Econ Rev 92(5):1644–1655. https://doi.org/10.1257/000282802762024700

Hood C (2007) What happens when transparency meets blame-avoidance? Public Manag Rev 9(2):191–210. https://doi.org/10.1080/14719030701340275

Horowitz JK (2006) The Becker-DeGroot-Marschak mechanism is not necessarily incentive compatible, even for non-random goods. Econ Lett 93(1):6–11. https://doi.org/10.1016/j.econlet.2006.03.033

Hoskisson RE, Chirico F, Zyung JD, Gambeta E (2017) Managerial risk taking: a multitheoretical review and future research agenda. J Manag 43(1):137–169. https://doi.org/10.1177/0149206316671583

Huang X, Van de Vliert E, Van der Vegt G (2005) Breaking the silence culture: stimulation of participation and employee opinion withholding cross-nationally. Manag Organ Rev 1(3):459–482. https://doi.org/10.1111/j.1740-8784.2005.00023.x

Jolls C, Sunstein CR, Thaler R (1998) A behavioral approach to law and economics. Stanford Law Rev 50(5):1471–1550

Kahneman D (2003) Maps of bounded rationality: psychology for behavioral economics. Am Econ Rev 93(5):1449–1475. https://doi.org/10.1257/000282803322655392

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–292. https://doi.org/10.2307/1914185

Kahneman D, Knetsch JL, Thaler RH (1991) Anomalies: the endowment effect, loss aversion, and status quo bias. J Econ Perspect 5(1):193–206. https://doi.org/10.1257/jep.5.1.193

Keller PA, Harlam B, Loewenstein G, Volpp KG (2011) Enhanced active choice: a new method to motivate behavior change. J Consum Psychol 21(4):376–383. https://doi.org/10.1016/j.jcps.2011.06.003

Keynes JM (1937) The general theory of employment. Q J Econ 51(2):209–223. https://doi.org/10.2307/1882087

Klibanoff P, Marinacci M, Mukerji S (2005) A smooth model of decision making under ambiguity. Econometrica 73(6):1849–1892. https://doi.org/10.1111/j.1468-0262.2005.00640.x

Knight FH (1921) Risk, uncertainty and profit. Houghton Mifflin Company, Boston

Koudstaal M, Sloof R, van Praag M (2016) Risk, uncertainty, and entrepreneurship: evidence from a lab-in-the-field experiment. Manage Sci 62(10):2897–2915. https://doi.org/10.1287/mnsc.2015.2249

Lim JS, O’Connor M (1995) Judgemental adjustment of initial forecasts: its effectiveness and biases. J Behav Decis Mak 8(3):149–168. https://doi.org/10.1002/bdm.3960080302

Liñán F, Chen Y-W (2009) Development and cross-cultural application of a specific instrument to measure entrepreneurial intentions. Entrep Theory Pract 33(3):593–617. https://doi.org/10.1111/j.1540-6520.2009.00318.x

Löfgren Å, Nordblom K (2019) A theoretical framework explaining the mechanisms of nudging (CeCAR). Working Pap Ser WP. https://doi.org/10.13140/RG.2.2.29260.46728

Löfgren Å, Nordblom K (2020) A theoretical framework of decision making explaining the mechanisms of nudging. J Econ Behav Organ 174:1–12. https://doi.org/10.1016/j.jebo.2020.03.021

Lovallo D, Koller T, Uhlander R, Kahneman D (2020) Your company is too risk-averse. Harv Bus Rev 98(2):104–111

MacCrimmon KR, Wehrung DA (1990) Characteristics of risk taking executives. Manage Sci 36(4):422–435. https://doi.org/10.1287/mnsc.36.4.422

March JG, Shapira Z (1987) Managerial perspectives on risk and risk taking. Manage Sci 33(11):1404–1418. https://doi.org/10.1287/mnsc.33.11.1404

Markides C (2006) Disruptive innovation: in need of better theory. J Prod Innov Manag 23(1):19–25. https://doi.org/10.1111/j.1540-5885.2005.00177.x

McKelvie A, Haynie JM, Gustavsson V (2011) Unpacking the uncertainty construct: implications for entrepreneurial action. J Bus Ventur 26(3):273–292. https://doi.org/10.1016/j.jbusvent.2009.10.004

Milidonis A, Stathopoulos K (2014) Managerial incentives, risk aversion, and debt. J Financ Quantit Anal 49(2):453–481. https://doi.org/10.1017/S0022109014000301

Miller GJ (2005) Solutions to principal-agent problems in firms. In: Ménard C, Shirley MM (eds) Handbook of new institutional economics. Springer, Cham, pp 349–370. https://doi.org/10.1007/0-387-25092-1_15

Mirrlees JA (1974) Notes on welfare economics, information, and uncertainty. In: Balch MS, McFadden D, Wu S (eds) Essays on economic behavior under uncertainty. North-Holland Publishing Company, North-Holland, pp 243–258

Mirrlees JA (1976) The optimal structure of incentives and authority within an organization. Bell J Econ 7(1):105–131. https://doi.org/10.2307/3003192

Moore E, Eckel C (2006) Measuring ambiguity aversion. https://www.researchgate.net/publication/228790553_Measuring_ambiguity_aversion. Retrieved 23 May 2022

Mousavi S, Gigerenzer G (2014) Risk, uncertainty, and heuristics. J Bus Res 67(8):1671–1678. https://doi.org/10.1016/j.jbusres.2014.02.013

Nebel JM (2015) Status quo bias, rationality, and conservatism about value. Ethics 125(2):449–476. https://doi.org/10.1086/678482

Newell RG, Siikamäki J (2014) Nudging energy efficiency behavior: the role of information labels. J Assoc Environ Resour Econ 1(4):555–598. https://doi.org/10.1086/679281

Oreg S (2003) Resistance to change: developing an individual differences measure. J Appl Psychol 88(4):680–693. https://doi.org/10.1037/0021-9010.88.4.680

Palan S, Schitter C (2018) Prolific.ac-a subject pool for online experiments. J Behav Exp Financ 17:22–27. https://doi.org/10.1016/j.jbef.2017.12.004

Park I, Cho S (2019) The influence of number line estimation precision and numeracy on risky financial decision making. Int J Psychol 54(4):530–538. https://doi.org/10.1002/ijop.12475

Pellegrini MM, Ciappei C, Zollo L, Boccardi A (2016) Finding the extraordinary and creating the unexpected: Gnome and genius combined in an exceptional ethical heuristic. J Manag Dev 35(6):789–801. https://doi.org/10.1108/JMD-09-2015-0130

Polman E, Wu K (2020) Decision making for others involving risk: a review and meta-analysis. J Econ Psychol 77(102184):007. https://doi.org/10.1016/j.joep.2019.06

Pratt JW (1964) Risk aversion in the small and in the large. Econometrica 32(1/2):122–136. https://doi.org/10.2307/1913738

Rees R (1985) The theory of principal and agent. Part I. Bull Econ Res 37(1):3–26. https://doi.org/10.1111/j.1467-8586.1985.tb00179.x

Rees R (1985) The theory of principal and agent. Part II. Bull Econ Res 37(2):75–97. https://doi.org/10.1111/j.1467-8586.1985.tb00185.x

Remus W (1986) Graduate students as surrogates for managers in experiments on business decision making. J Bus Res 14(1):19–25. https://doi.org/10.1016/0148-2963(86)90053-6

Riepe J, Rudeloff M, Veer T (2022) Financial literacy and entrepreneurial risk aversion. J Small Bus Manage 60(2):289–308. https://doi.org/10.1080/00472778.2019.1709380

Ross SA (1973) The economic theory of agency: the principal’s problem. Am Econ Rev 63(2):134–139

Ross N, Santos P, Capon T (2012) Risk, ambiguity and the adoption of new technologies: Experimental evidence from a developing country. Trienn Conf 5:5. https://doi.org/10.22004/ag.econ.126492

Samuelson W, Zeckhauser R (1988) Status quo bias in decision making. J Risk Uncertain 1(1):7–59. https://doi.org/10.1007/BF00055564

Sappington DEM (1991) Incentives in principal-agent relationships. J Econ Perspect 5(2):45–66. https://doi.org/10.1257/jep.5.2.45

Sauner-Leroy J-B (2004) Managers and productive investment decisions: the impact of uncertainty and risk aversion. J Small Bus Manag 42(1):1–18. https://doi.org/10.1111/j.1540-627X.2004.00094.x

Schwenk CR (1984) Cognitive simplification processes in strategic decision-making. Strateg Manag J 5(2):111–128. https://doi.org/10.1002/smj.4250050203

Silver WS, Mitchell TR (1990) The status quo tendency in decision making. Organ Dyn 18(4):34–46. https://doi.org/10.1016/0090-2616(90)90055-T

Simon HA (1987) Making management decisions: the role of intuition and emotion. Acad Manag Perspect 1(1):57–64. https://doi.org/10.5465/ame.1987.4275905

Simon M, Houghton SM, Aquino K (2000) Cognitive biases, risk perception, and venture formation: how individuals decide to start companies. J Bus Ventur 15(2):113–134. https://doi.org/10.1016/S0883-9026(98)00003-2

Sunstein CR (2019) Nudging: a very short guide. Bus Econ 54(2):127–129. https://doi.org/10.1057/s11369-018-00104-5

Sunstein CR, Thaler RH (2003) Libertarian paternalism is not an oxymoron. Univ Chicago Law Rev 70(4):1159–1202. https://doi.org/10.2307/1600573

Teal T (1996) The human side of management. Harv Bus Rev 74(6):35–44

Thaler RH, Sunstein CR (2008) Nudge: improving decisions about health, wealth, and happiness. Yale University Press, Yale

Utterback JM, Abernathy WJ (1975) A dynamic model of process and product innovation. Omega 3(6):639–656. https://doi.org/10.1016/0305-0483(75)90068-7

van Kleef E, van Trijp HCM (2018) Methodological challenges of research in nudging. In: Ares G, Varela P (eds) Methods in consumer research: new approaches to classic methods. Woodhead Publishing, London, pp 329–349. https://doi.org/10.1016/B978-0-08-102089-0.00013-3

Zeelenberg M, Beattie J (1997) Consequences of regret aversion 2: additional evidence for effects of feedback on decision making. Organ Behav Hum Decis Process 72(1):63–78. https://doi.org/10.1006/obhd.1997.2730

Zhang SX, Cueto J (2017) The study of bias in entrepreneurship. Entrep Theory Pract 41(3):419–454. https://doi.org/10.1111/etap.12212

Zichella G (2020) Surprisingly stable: an experiment on willingness to bear uncertainty in individuals with and without entrepreneurial intentions. J Manag Dev 39(9/10):989–1011. https://doi.org/10.1108/JMD-01-2019-0013

Acknowledgments

The authors are grateful for the helpful comments they received on earlier versions of this paper at the Annual Meeting of the Academy of Management 2021. The authors also acknowledge the insightful and constructive comments provided by the Editor-in-Chief, Wolfgang Breuer, and the reviewers during the revision process, which significantly improved the paper. The authors extend their gratitude to Suzanne Weinberger, who has diligently proofread and improved the quality of this work.

Funding

Open Access funding enabled and organized by Projekt DEAL. This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors. Declarations of interest: none. The authors confirm that all data generated or analyzed during this study are included in this published article.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors. Declarations of interest: none.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Multiple price list

Product | Traditional design | Modern design | |

|---|---|---|---|

High price | Low price | ||

1 | \(\$2.00\) | \(\$4.00\) | \(\$2.00\) |

2 | \(\$2.00\) | \(\$4.00\) | \(\$1.60\) |

3 | \(\$2.00\) | \(\$4.00\) | \(\$1.30\) |

4 | \(\$2.00\) | \(\$4.00\) | \(\$1.00\) |

5 | \(\$2.00\) | \(\$4.00\) | \(\$0.80\) |

6 | \(\$2.00\) | \(\$4.00\) | \(\$0.70\) |

7 | \(\$2.00\) | \(\$4.00\) | \(\$0.60\) |

8 | \(\$2.00\) | \(\$4.00\) | \(\$0.50\) |

9 | \(\$2.00\) | \(\$4.00\) | \(\$0.40\) |

10 | \(\$2.00\) | \(\$4.00\) | \(\$0.20\) |

11 | \(\$2.00\) | \(\$4.00\) | \(\$0.00\) |

Appendix B: CRRA coefficient

Calculation of CRRA coefficient

For this example of how to calculate the CRRA coefficient from the switching point, we assume that a participant switches from the modern design to the traditional design at product 5. We know now that the utility from deciding for the traditional design for product 5 must be at least as high as that for deciding for the modern design while it is the reverse for product 4, i.e.: