Abstract

In addition to economic risks, the economic success of investments often critically depends on the uncertain results of future political regime switches. Therefore, it is essential that policy makers, who design tax schemes or subsidy payments, understand the combined effects of risk and ambiguity on an investor’s investment behavior given subjective estimations and individual preferences. Using a practical example from the shipping industry, we set up a real options model that takes into account two sources of uncertainty, economic risk as well as political uncertainty regarding an imminent regime switch. We calculate the option value of the investment possibility subjectively estimated by the investor and derive the optimal investment-timing strategy. Furthermore, we analyze both the sole as well as the combined influence of economic risk, the investor’s subjective assessment of political risk and political ambiguity on both the option value and the investment-timing strategy.

Similar content being viewed by others

Notes

See e.g. EME Research Group (2013) for a brief definition.

An alternative interpretation of the modulation of political uncertainty indicates that the decision-maker at first considers a set of possible probability distributions and then in a second step consolidates them into a single probability distribution following his ambiguity preference. The degree of ambiguity is determined by the spread of the set of possible probability distributions. Of course, this set has to be defined, which can be done by specifying a certain probability distribution and a spread around it, as we do it. The degree of political risk is defined by the spread of the possible values of the consolidated probability distribution in the alternative interpretation which is equal to the degree of political risk in our model.

For example, Yun and Baker (2009) and Patiño-Echeverri et al. (2007) deal with the investment into new power plants if carbon emissions are costly. Similarly, Insley (2003) and Abadie and Chamorro (2008) apply the real options methodology to investments that reduce carbon emissions. Kumbaroğlu et al. (2008) set light on the diffusion of renewable energies under uncertainty. Cortazar et al. (2013) determine when it is optimal to invest in emission reducing technologies if the emission of pollutants is costly or restricted. Bastian-Pinto et al. (2009) and Pederson and Zou (2009) deal with investments in the production of biofuel, where input prices and sales prices are evolving stochastically over time.

There is strong empirical evidence that commodity prices show a mean-reverting behavior (see e.g Schwartz 1997).

This assumption can be economically justified because due to blending obligations the largest proportion of biofuel is blended to standard fuels in lower concentration (E10, etc.) and therefore the prices of biofuel track the standard fuel price (see Tao and Aden 2009). Furthermore, we assume, that the slightly worse efficiency of biodiesel compared to standard diesel is already considered in ξ.

In contrast to the other two important option valuation techniques, i.e. risk-neutral pricing and the contingent-claims approach, the dynamic programming approach does not depend on the investor’s ability to replicate the company’s cash flows. Thus, it is a suitable tool to determine especially the value of real options as pricing real options is usually biased by incompleteness (usually the investment opportunity is not traded on the market and cannot be perfectly replicated by existing assets). Furthermore, contrarily to the contingent claims approach or the risk-neutral pricing approach dynamic programming requires assumptions about the risk-preferences of the decision-maker. In order to avoid the complicated use of more complex risk-preferences we made the assumption of risk-neutrality. Furthermore, this assumption supports the analysis of different possible ambiguity-preferences of the decision-maker.

To assure the tractability of the model we simplify the political process by assuming that coalition negotiations and the legislative process do not require time and that laws come into force immediately. Furthermore, we assume that the topic of biofuel subsidies will only be of interest in this election (and not in following ones) and that the election date is fixed.

It should be noted that by applying this approach we make use of the assumption of a risk-neutral decision-maker. In particular, under risk-neutrality it does not matter if all possible probability distributions are consolidated to a single distribution first, which then is used for further calculation, or if the expected utilities of the possible distributions are determined first, which then are consolidated to a single expected utility.

Due to a slightly lower efficiency of biodiesel compared to ordinary diesel (approximately 10 %) we get \(\xi = 0.024.\)

We especially thank the DMS (Deutsche Möbelspedition) for providing all relevant data.

Thus, we get x = 46.800 and I v ≈ 10.000.

Obviously, the non-scheduled elections of September 2005 initiated by chancellor Schröder in May 2005 could not have been predicted in 2004. Hence, T = 2.

In 2006 the new government formed by the grand coalition indeed decided to phase out the tax advantage.

The Crank-Nicolson method (see Crank and Nicolson 1947) is a numerically stable method to determine the solution of a partial differential equation. It is especially suited to numerically solve the heat equation and related problems. The Crank-Nicolson method is combining the Euler method and the Backwards Euler method and therefore is an implicit method of second degree.

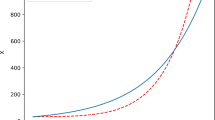

It is noteworthy to state that economic risk is induced by σ > 0 and is only mitigated by an increase in κ. In the case of σ = 0 there is no economic risk regardless of the size of κ. Hence, we will in the following concentrate on the influence of σ when referring to economic risk.

In the given practical example x(t) is monotonically increasing over time. However, if x(t) would be decreasing over time the deterministic change in x(t) would favor earlier investment.

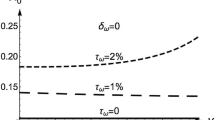

Thereby, we will perform a mean-preserving spread, i.e. we will always hold \(\frac{{\omega_{pos} + \omega_{neg} }}{2}\) constant when increasing \(\Delta \omega = \omega_{neg} - \omega_{pos}\).

References

Abadie LM, Chamorro JM (2008) European CO2 Prices and Carbon Capture Investments. Energy Econ 30(6):2992–3015

Baecker PN, Hommel U (2004) 25 Years Real options approach to investment valuation: review and assessment. Zeitschrift Für Betriebswirtschaft, 74(Ergänzungsheft 3):1–53

Bamberg G, Coenenberg AG, Krapp M (2012) Betriebswirtschaftliche Entscheidungslehre, 15th edn. Franz Vahlen, München

Bastian-Pinto C, Brandão L, Lemo Alves M (2009) Valuing the switching flexibility of the ethanol-gas flex fuel car. Ann Oper Res 176(1):333–348

Chakravarty S, Roy J (2009) Recursive expected utility and the Separation of attitudes towards risk and ambiguity: an experimental study. Theor Decis 66(3):199–228

Chevalier-Roignant B, Flath CM, Huchzermeier A, Trigeorgis L (2011) Strategic investment under uncertainty: a synthesis. Eur J Oper Res 215(3):639–650

Cohen M, Jaffray J-Y, Said T (1985) Individual behavior under risk and under uncertainty: an experimental study. Theor Decis 18(2):203–228

Cohen M, Tallon J-M, Vergnaud J-C (2011) An experimental investigation of imprecision attitude and its relation with risk attitude and impatience. Theor Decis 71(1):81–109

Cortazar G, Schwartz ES, Salinas M (2013) Evaluating environmental investments: a real options approach. Manag Sci 44(8):1059–1070

Crank J, Nicolson P, Hartree DR (1947) A practical Method for Numerical Evaluation of Solutions of Partial Differential Equations of the Heat-Conduction Type. Math Proc Cambridge Philos Soc 43(1):50–56

Dixit AK, Pindyck RS (1994) Investment under Uncertainty. Princeton University Press, Princeton

Driouchi T, Trigeorgis L, Gao Y (2014) Choquet-based European option pricing with Stochastic (and fixed) strikes. OR Spectrum (forthcoming)

Ellsberg D (1961) Risk, Ambiguity, and the Savage Axioms. Q J Econ 75(4):643–669

EME Research Group (2013) Ultralanglebige Investitionen: definition und Problembeschreibung

Etner J, Jeleva M, Tallon J-M (2012) Decision Theory Under Ambiguity. J Econ Surv 26(2):234–270

Ghirardato P, Maccheroni F, Marinacci M (2004) Differentiating ambiguity and ambiguity attitude. J Econ Theory 118(2):133–173

Gierl H (2006) Präferenzen bei Ergebnisambiguität. Zeitschrift Für Betriebswirtschaft 76(11):1187–1216

Gilboa I, Schmeidler D (1989) Maxmin Expected Utility with Non-Unique Prior. J Math Econ 18(2):141–153

Hallegatte S, Shah A, Lempert R, Brown C, Gill S (2012) Investment decision making under deep uncertainty. Application to Climate Change

Heath C, Tversky A (1991) Preference and belief: ambiguity and competence in choice under uncertainty. J Risk Uncertain 4(1):5–28

Hurwicz L (1951) Optimality criteria for decision making under ignorance (No. 370). Cowles Commission Discussion Paper

Insley MC (2003) On the Option to Invest in Pollution Control under a Regime of Tradable Emissions Allowances. Can J Econ 36(4):860–883

Julio B, Yook Y (2012) Political Uncertainty and Corporate Investment Cycles. J Finance 67(1):45–83

Keck S, Diecidue E, Budescu DV (2014) Group decisions under ambiguity: convergence to neutrality. J Econ Behav Organ 103:60–71

Knight FH (1921) Risk, Uncertainty and Profit. Houghton Mifflin, Boston

Kumbaroğlu G, Madlener R, Demirel M (2008) A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ 30(4):1882–1908

Lauriola M, Levin IP (2001) Relating individual differences in attitude toward ambiguity to risky choices. J Behav Decis Making 14(2):107–122

Lin TT, Ko CC, Yeh HN (2007) Applying real options in investment decisions relating to environmental pollution. Energy Policy 35(4):2426–2432

McDonald R, Siegel D (1986) The value of waiting to invest. Q J Econ 101(4):707–727

Miao J, Wang N (2011) Risk, uncertainty, and option exercise. J Econ Dyn Control 35(4):442–461

Nishimura KG, Ozaki H (2007) Irreversible investment and Knightian uncertainty. J Econ Theory 136(1):668–694

Patiño-Echeverri D, Morel B, Apt J, Chen C (2007) Should a Coal-Fired Power Plant be Replaced or Retrofitted? Environ Sci Technol 41(23):7980–7986

Pederson G, Zou T (2009) Using real options to evaluate ethanol plant expansion decisions. Agric Financ Rev 69(1):23–35

Pindyck RS (2002) Optimal timing problems in environmental economics. J Econ Dyn Control 26(9–10):1677–1697

Sarkar S (2000) On the Investment-Uncertainty Relationship in a Real Options Model. J Econ Dyn Control 24(2):219–225

Schmeidler D (1989) Subjective probability and expected utility without additivity. Econometrica 57(3):571–587

Schwartz ES (1997) The stochastic behavior of commodity prices: implications for valuation and hedging. J Finan 52(3):923–973

Tao L, Aden A (2009) The Economics of Current and Future Biofuels. Vitro Cell Dev Biol Plant 45(3):199–217

Trigeorgis L (1999) Real options: managerial flexibility and strategy in resource allocation, 4th edn. MIT Press, Cambridge

Trojanowska M, Kort PM (2010) The worst case for real options. J Optim Theory Appl 146(3):709–734

Yates JF, Zukowski LG (1976) Characterization of ambiguity in decision making. Behav Sci 21(1):19–25

Yun T, Baker RD (2009) Analysis of a power plant investment opportunity under a carbon neutral world. Invest Manag Financ Innov 6(4):155–163

Acknowledgments

We thank the editor Wolfgang Breuer, two anonymous reviewers, Claus Lange of the H. E. Herbst Gmbh, Wilko Rohlfs and the other participants of the Conference “Ultra-long investments—A new research field?” (November 28th–30th, 2013, Aachen, Germany) as well as the participants of the “18th Annual International Conference on Real Options—Theory meets Practice” (July 23rd–26th, 2014, Medellin, Colombia) for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Welling, A., Lukas, E. & Kupfer, S. Investment timing under political ambiguity. J Bus Econ 85, 977–1010 (2015). https://doi.org/10.1007/s11573-015-0771-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-015-0771-7

Keywords

- Optimal investment timing

- Real options

- Ambiguity

- Political uncertainty

- Regime switching

- Green investments