Abstract

In politics and business the special role of innovative businesses whose research and development activities expedite technological progress has received steady attention. Especially small and medium sized businesses (SMEs) have initiated promising innovation projects. However, when analysing these projects our research must take into account that SMEs cannot be viewed as a homogeneous business category. Moreover, financing their innovations, SMEs are subject to unique issues. To shed light on these problems, this study will develop an index measuring degrees of innovation. It allows the 171 sample companies to be categorised into three groups: non-innovative, moderately innovative or highly innovative. A multinomial logistic regression is used to examine the quality of this typology. In addition, group-specific differences in the financing mix are demonstrated. Finally, from a theoretical point of view, the implications of the pecking order theory are basically validated. On the other hand, the concept of the financial growth cycle does not deliver satisfactory results.

Similar content being viewed by others

References

Arrow KJ (1962) Economic welfare and the allocation of resources for invention. In: Nelson RR (ed) The rate and direction of inventive activity. Princeton University Press, New Jersey, pp 609–625

Audretsch DB (1995) Innovation, growth and survival. Int J Ind Organ 13(4):441–457

Audretsch DB, Lehmann EE (2004) Financing high-tech growth: the role of banks and venture capitalists. Schmalenbach Bus Rev 56(4):340–357

Autio E (1997) New, technology-based firms in innovation networks symplectic and generative impacts. Res Pol 26:263–281

Backes-Gellner U, Werner A (2007) Entrepreneurial signaling via education: a success factor in innovative start-ups. Small Bus Econ 29:173–190

Backhaus K et al (2008) Multivariate Analysemethoden—Eine anwendungsorientierte Einführung, 12th edn. Springer, Berlin

Baker BO et al (1966) Weak measurements vs. strong statistics: an empirical critique of S.S. Stevens’s proscriptions on statistics. Edu Psych Meas 26:291–309

Bartelsman E et al (2004) Microeconomic evidence of creative distruction in industrial and developing counties. World Bank Policy Research Paper No. 3463, New York

Berger AN, Udell GF (1995) Relationship lending and lines of credit in small firm finance. J Bus 68:351–381

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Financ 22:613–673

Berggren B, Olofsson C, Silver L (2000) Control aversion and the search for external financing in Swedish SMEs. Small Bus Econ 15(3):233–242

BMWi (2007) Gründerzeiten, Informationen zur Existenzgründung und—sicherung, Berlin

Bortz J (1989) Statistik für Sozialwissenschaftler. Springer, Berlin

Bortz J, Döring N (1995) Forschungsmethoden und Evaluation, 2. Auflage, Berlin

Bortz J, Schuster C (2010) Statistik für Human- und Sozialwissenschaftler, 7. Aufl. Springer, Berlin

Bozkaya A, De La Potterie B (2008) Who Funds Technology-Based Small Firms? Evidence From Belgium. Econ Innov New Technol, Taylor and Francis J 17(1–2):97–122

Cainelli G et al (2006) Innovation and economic performance in services—a firm-level analysis. Camb J Econ 30:435–458

Carpenter RE, Petersen BC (2002) Is the growth of small firms constrained by internal finance? Rev Econ Stat 84(2):298–309

Chittenden F, Hall G, Hutchinson P (1996) Small firm growth, access to capital markets and financial structure: review of issues and an empirical investigation. Small Bus Econ 8:59–67

Cuervo-Cazurra A, Un A (2010) Why some firms never invest in formal R&D. Strateg Manag J 31(7):759–779

Czarnitzki D, Hottenrott H (2010) Financing constraints for industrial innovation: What do we know? Leuven

Denis DJ (2004) Entrepreneurial finance: an overview of the issue and evidence. J Corp Financ 10:301–326

Dosi G (1990) Finance, innovation, and industrial change. J Econ Behav Organ 13:299–319

Ehrhard N, Müller K (2007) Business Angel-Finanzierung in Deutschland—Ein Marktüberblick. Finanz Betrieb 9:65–71

Elsas R, Florysiak D (2008) Empirical capital structure research: new ideas, recent evidence, and methodological issues. In: Breuer W, Gurtler M (eds) 50 years after MM: recent developments in corporate finance. Gabler, Wiesbaden

Fontes M, Coombs R (2001) Contribution of new-technology-based firms to the strengthening of technological capabilities in intermediate economies. Res Policy 30:79–97

Freel M (2007) Are small innovators credit rationed? Small Bus Econ 28:23–35

Fryges, H. et al (2007) Hightech-Gründungen und Business Angels, Bundesministerium für Wirtschaft und Technologie. (BMWi) (Hrsg.), Berlin

Gompers PA, Lerner J (2003) Equity financing. In: Acs ZJ, Audretsch DB (eds) Handbook of entrepreneurship research. Kluwer Academic Publishers, Dordrecht

Gottschalk S et al (2007) Start-Ups zwischen Forschung und Finanzierung: Hightech Gründungen in Deutschland, Mannheim

Grabherr O (2001) Risikokapitalinstrumente im unternehmerischen Wachstumszyklus. In: Wilfried S (eds) Venture capital und private equity: Erfolgreich wachsen mit Beteiligungskapital, Köln, pp 29–42

Grinstein A, Goldman A (2006) Characterizing the technology firm: an exploratory study. Res Policy 35:121–143

Hagedoorn J, Cloodt M (2003) Measuring innovative performance—Is there an advantage in using multiple indicators? Res Policy 32:1365–1379

Hall BH (2002) The financing of research and development. Oxf Rev Econ Policy 18(1):35–51

Hall BH et al (2009) Innovation and productivity in SMEs: empirical evidence for Italy. Small Bus Econ 33:13–33

Harhoff D (1998) Are there financing constraints for R&D and investment in German manufacturing firms? Annales D’Economie Et De Statistique Nr 49/50

Heidenreich M (2009) Innovation patterns and location of European low- and medium-technology industries. Res Policy 38:483–494

Huang C et al (2010) How firms innovate: R&D, non-R&D, and technology adoption, UNU-Merit Working Paper No. 2010-027, Maastricht

Hughes A (2002) Innovation and business performance: small entrepreneurial firms in the UK and the EU. New Econ 8(3):157–163

Hyytinen A, Pajarinen M (2002) Financing of technology intensive small business: some evidence from the ICT industry, The Research Institute of the Finnish Economy, Discussions paper No. 813

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behaviour, agency costs and ownership structure. J Financ Econ 3:305–360

KfW (2007) Mittelstands- und Strukturpolitik, KfW Diskussionspapier Nr. 39. Frankfurt am Main

KfW (2008) Der informelle Beteiligungskapitalmarkt in Deutschland. WirtschaftsObserver online, KfW Diskussionspapier Nr. 41, Frankfurt am Main

Kirner E et al (2007) Innovationspfade von low-, medium- und High-Tech-Unternehmen in der deutschen Industrie. In: Abel J, Hirsch-Kreinsen H (eds) Lowtech Unternehmen am Hightech-Standort. Sigma, Berlin, pp 165–192

Kirner E et al (2009) Innovation paths and the innovation performance of low-technology firms—An empirical analysis of German industry. Res Policy 38:447–458

Kleinknecht A (2000) Indicators of manufacturing and service innovation—their strengths and weaknesses. In: Metcalf JS, Miles I (eds) Innovation system and the service economy. Boston, pp 169–186

Kleinknecht A et al (2002) The non-trivial choice between innovation indicators. Econ Innov New Technol 11(2):109–121

Krohmer O (2010) Zur Verdrängungswirkung staatlicher FuE-Förderung. In: ifo Dresden berichtet 1/2010, S. 49–51

Mohnen P, Mairesse J (2002) Accounting for innovation and measuring innovativeness: an illustrative framework and an application. Am Econ Rev Papers Proc 92(2):226–230

Metzger G et al (2008) High-Tech-Gründungen in Deutschland-Trends, Strukturen, Potentiale, Diskussionspapier des ZEW, Mannheim

Manual Oslo (2005) Guidelines for collecting and interpreting innovation data, 3rd edn. OECD, Oslo

Meyer JR, Kuh E (1957) The investment decision: an empirical study, Cambridge

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5:146–175

Myers SC (1984) The capital structure puzzle. J Financ 34:575–592

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Nassimbeni G (2001) Technology, innovation capacity and the export attitude of small manufacturing firms: a logit/tobit model. Res Policy 30:245–262

Nelson RR (1959) The simple economics of basic scientific research. J Policy Econ 49:297–306

NIW/ISI (2006): Neuabgrenzung der Wissenswirtschaft—forschungsintensive Industrien und wissensintensive Dienstleistungen, elektronisch erreichbar unter. http://www.bmbf.de/de/7687.php, abgerufen am 04.05.2011

NIW/ISI/ZEW (2010), Listen wissens- und technologieintensiver Güter und Wirtschaftszweige. http://www.e-fi.de/fileadmin/Studien/Studien_2010/StuDIS_19-2010.pdf, abgerufen am 16.12.2011

Norton E (1990) Similarities and differences in small and large corporation beliefs about capital structure policy. Small Bus Econ 2(3):229–245

Oakey, R (1984), Innovation and regional growth in small high-technology firms: evidence from Britain and the USA, Reg Stud, 18

Oakey R (1995) High technology new firms: variable barriers to growth. Paul Chapman Publishing, London

OECD (2002) Frascati Manual—proposed standard practice for surveys on research and experimental development. OECD, Paris

Rammer C et al (2011) Innovationen ohne Forschung und Entwicklung, Eine Untersuchung zu Unternehmen, die ohne eigene FuE-Tätigkeit neue Produkte und Prozesse einführen. Studien zum deutschen Innovationssystem Nr. 15, Mannheim

Rammer C (2011) Bedeutung von Spitzentechnologien, FuE-Intensität und nicht forschungsintensiven Industrien für Innovationen und Innovationsförderung in Deutschland. ZEW, Mannheim

Rammer C et al (2009) Innovation success of non-R&D-performers: substituting technology by management in Smes. Small Bus Rev 33:35–58

Salomo S et al (2008) Innovation field orientation and its effect on innovativeness and firm performance. J Prod Innov Manag 25(6):560–576

Schumpeter JA (1934) Theorie der wirtschaftlichen Entwicklung. Leipzig

Sohl JE (2008) Angel investors steady but more cautious in first half of 2008. Analysis Report Q1/2 2008, Washington

Spithoven A et al (2009) Building absorptive capacity to organise inbound open innovation in traditional industries. Technovation 30:130–141

Totterdell P et al (2002) An investigation of the contents and consequences of major organizational innovations. Int J Innov Manag 6:343–368

Walker EW, Petty JW (1978) Financial differences between large and small firms. Financ Manag 7(4):61–68

Author information

Authors and Affiliations

Corresponding author

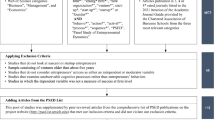

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Hummel, D., Karcher, B. & Schultz, C. The financial structure of innovative SMEs in Germany. J Bus Econ 83, 471–503 (2013). https://doi.org/10.1007/s11573-013-0662-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-013-0662-8

Keywords

- Small and medium-sized business financing

- SMEs

- Degree of innovation

- Innovation financing

- Financing of innovative businesses