Abstract

Globalization has considerably increased the movement of people and goods around the world, which constitutes a key channel of viral infection. Increasingly close economic links between countries speeds up the transfer of goods and information, and the knock-on effect of economic crises, but also the transmission of diseases. Foreign direct investment (FDI) and trade establish clear ties between countries of origin and destination, and it is along these chains that contagious phenomena can unfold. In this paper, we investigate whether countries’ centrality in both global production and trade network corresponds to higher COVID-19 infection and mortality rates. Merging data on EU-27 greenfield FDI and international trade with data on COVID-19 infections and deaths, we find that countries mostly exposed to the COVID-19 outbreak are those characterized by a higher eigenvector centrality. This result is robust to the use of an alternative measure of network centrality and to the inclusion of other possible confounding factors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

From the early days of the outbreak in Wuhan, it was clear that a local event could have global economic consequences. The Hubei region, with its population of 60 million, is an important industrial district where semi-processed parts are manufactured for the automotive and electronics industries. The stoppage of its production lines rippled along the global value chain (GVC). Meanwhile, the lockdown imposed in China led to a freezing of business investments and a reduction in Chinese household consumption, with a significant impact on Chinese imports. This local crisis turned into a worldwide event also through the global production and trade networks, causing delays in the supply of goods, raw materials, and semifinished products, and high price volatility. International trade and FDI represent two of the most relevant channels to link countries. While the former involves the movement of goods and services across borders, the latter is more (but not only) related to the movement of capital assets, mainly financial and technological. Indeed, as the main channel through which multinational enterprises spread their business worldwide, FDIs are also the tool to build, expand, and restructure the global production network of a company. Such a network is not only characterized by client–supplier subcontracting relationships but also by a dense exchange of intra-industry and intra-firm trade flows between multinational affiliates, partners, and suppliers, which also imply the movement of knowledge, management, skills, and people. In this respect, research in transport economics shows that FDIs are attracted by the availability, and quality, of infrastructures, and by the possibility for large multinationals to access primary international airports (Bannó and Redondi 2014; Carod et al. 2010), a fact that links the operations underlying cross-border investments to the need to engage in face-to-face contacts within business groups, managers, entrepreneurs, and companies’ staff (Hoare 1975; Doeringer et al. 2004).

Therefore, countries are physically linked not only by the movement of final goods but also by the trade of intermediate components, semifinished products, capital equipment, and people underlying the structure of their global production networks. In this respect, OECD (2020) reports that about 70% of international trade today involves GVCs and multinational enterprises so we can consider FDIs and international trade are more complementary than substitute channels, which stimulate each other (Fontagné 1999). A second reason to look at cross-border FDI is that the corresponding network is less dense than the international trade network. In other words, the relationships among countries are less frequent than those underlying commercial trade, the network of which is almost complete (De Benedictis and Tajoli 2011; Antonietti et al. 2022).

For this reason, we do expect that country centrality in both the FDI and the trade network matters in explaining the early diffusion of COVID-19 across European countries. Since proximity (connection) is the key to understanding the transmission of shocks, network analysis represents an ideal tool to define, and interpret, the structure of the links across countries. Specifically, we surmise that countries that have a central position in the global production and trade networks are also those most exposed to the risk of contagion and death. In doing so, we also show that network centrality provides additional information than the simple volume of trade and FDI flows when measuring the determinants of COVID-19 diffusion. We argue that what matters is not only, or not much, the value of imports, exports, and cross-border capital investments but, rather, the importance (i.e., the position) that a country has in the network of these transactions: a more central position implies a higher exposure to goods, people, and capital flows, implying a higher risk of contagion.

We answer our research question by merging different data sources. The first is fDi markets, a database administered by the Financial Times, which contains information on worldwide cross-border greenfield FDI projects. The second is the BACI database on international trade flows retrieved from CEPII. The third is the World Bank’s World Development Indicators database, providing additional macroeconomic information on countries. The fourth is the European Centre for Disease Prevention and Control (ECDPC), which provides publicly available data on countries’ COVID-19 infection and mortality rates. With these data, we run a series of linear regressions to check whether the daily diffusion of COVID-19 infections and deaths is affected by the degree of a country’s centrality in either the trade or the FDI network, once controlling for the total trade and (greenfield) FDI flows, for other possible macroeconomic factors, and for an alternative measure of network centrality. In doing so, we focus on EU-27 countries because they were the first—after China—to be scourged by the first wave of the pandemic in February–March 2020.Footnote 1

We find that, ceteris paribus, a greater centrality in both the global FDI and the trade network corresponds to higher infection and mortality rates in the European Union’s countries. This result holds once controlling for the total trade and FDI inflows and outflows of each European country, and once including a series of possible macroeconomic confounding factors such as imports from the EU, China, and the rest of the world, total air travel flows, tourism inflows, quality of health facilities, share of elderly population, and average Winter temperature.

Our analysis contributes to two types of literature. One is on the dark side of globalization, as a vehicle for systemic risk transmission. In this respect, we show that economic ties among countries could rise not only the risk of financial shocks, as in 2007–2008, but also health risks related to the outbreak of viruses. The other one is the literature on COVID-19 diffusion, to which we add the contribution of network analysis for identifying possible additional drivers of the pandemic.

The rest of the paper develops as follows. Section 2 discusses the literature developed around the role of networks in explaining systemic risk and the role of trade and FDI in the diffusion of COVID-19. Section 3 presents the data and the methods used to compute our network centrality measures (Sect. 3.1), some descriptive statistics, and the econometric approach adopted (Sect. 3.2). Section 4 presents the main results and robustness checks. Section 5 concludes. Additional materials and robustness tests are available in Appendix.

2 Related literature

Network analysis has been used in various fields of economic theory and is establishing itself as a key tool for understanding connections between agents. In the empirical literature, it has been applied to study the structure and functioning of the credit market (De Masi et al. 2011; Battiston et al. 2012), the interbank market (Iori et al. 2008), financial investments (Garlaschelli et al. 2005), and world trade (Fagiolo et al. July 2009; De Benedictis and Tajoli 2011, 2018; Abbate et al. 2018), and to delineate the structure of global value chains (Criscuolo and Timmis 2017). Scholars have applied network theory to FDI in order to: investigate agglomeration phenomena (Alfaro and Chen 2014); examine the relationship between FDI and migration (Garas et al. 2016), or between FDI and trade (Metulini et al. 2017); and match ownership with firms’ control all over the world (Rungi et al. 2017). Focusing on firms, De Masi et al. (2013), and Joyez (2017, 2019) reconstruct FDI networks to identify firms’ strategies in Italy and France, respectively, while De Masi and Ricchiuti (2018, 2020) extend their analysis to firms based in Europe.

Moreover, the literature associates systemic risk (in our case, a health risk) with the topology of networks. In its various formulations, systemic risk refers to the existence of a domino effect: an initial cause (the emergence of a virus) generates a series of negative effects (on public health). This risk may or may not be facilitated by the structure of the network that links various actors (such as countries, companies, and even products) one to each other. For our purposes, systemic risk refers to a situation in which instability in one country leads to instability in another (Recchioni and Tedeschi 2017; Berardi and Tedeschi 2017). There are two phenomena related to systemic risk that have already been studied extensively in the analysis of networks: the propagation of damage through the network; and the spread of epidemics. Zhao et al. (2004) show that scale-free networks exhibit exceptional resistance to random damage but can suffer badly from intentional attacks. Pastor-Satorras and Vespignani (2001) also demonstrate that scale-free networks facilitate the propagation of infections, bugs, and fake news. These different effects stem from the diffusion and propagation properties of scale-free networks, and particularly from the hierarchies within them. Once central hubs (nodes with many connections) have been affected, an infection will spread to the more peripheral nodes of the network, with a clear cascade effect. This idea has already been used in economics, mainly to analyze how network topology has a systemic impact on credit–debit chains and the interbank network (Berardi and Tedeschi 2017; Grilli et al. 2014; Lenzu and Tedeschi 2012), and other financial networks (Hautsch et al. 2015; Acemoglu et al. 2015).

The literature has also dealt with the relationship between health risks and the connections between actors. Brockmann and Helbing (2013) examine how a disease spreads throughout the transport networks. Instead of considering a mere geographical distance, they analyze the effects of an “effective distance”: two places are closer if the link between them is stronger. Using data concerning three different epidemics (SARS in 2003, H1N1 in 2009, and the outbreak of Escherichia coli in Germany in 2011), they show how a network’s topology can help predict the arrival of disease and facilitate or impede the contagion. Along the same lines, Ruan et al. (2015) also show that the infrastructure of a network matters. The speed with which one city can be reached from another is more important than the geographical distance between the two. The spread of an epidemic then depends both on this speed and on the frequency of travel from one place to the other. In other words, the structure of the network determines the pattern of the epidemic’s diffusion.

Over the course of 2020, the arrival of COVID-19 made it necessary to analyze in more depth how epidemics spread, to identify the most effective containment policies. Kraemer et al. (2020) use human mobility data (the travel network) to examine the effectiveness of measures adopted in China to contain the spread of the virus. They find that both travel restrictions and mobility controls substantially mitigated the diffusion of the epidemic. In a similar vein, Chinazzi et al. (2020) look at how restricting people’s movements affected the spread of COVID-19 in China. Using a network model, they show that locking down early in the outbreak could reduce (or delay) the spread of the disease both nationally and internationally.

Recently, other scholars have found a relationship between international trade and the COVID-19 outbreak (Fernández-Villaverde and Jones 2020; Bontempi and Coccia 2021; Bontempi et al. 2021; Antonietti et al. 2022), mainly at the level of single countries, such as Italy or the USA, or regions within countries. No study yet has, instead, focused on European countries, despite Europe being, after China, the first continent that has been hit by the COVID-19 pandemic in early 2020. Moreover, all the studies have looked at the role of international trade in favoring the spread of the virus, although, as argued in Sect. 1, the connections among countries can be due to other activities, such as cross-border capital movements, transfer of production, and the underlying face-to-face exchanges of people and staff.

3 Data and method

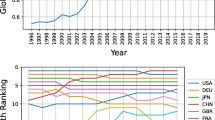

Our empirical application refers to 27 European Union countries,Footnote 2 for which we could combine different sources of data. One is the fDi Markets database administered by the Financial Times, which provides information on cross-border greenfield investment projects, covering all countries and sectors worldwide. From this database, we draw information on yearly outflows of greenfield FDI projects between 2003 and 2019. We use this dataset to compute the network centrality measures that we use as focal regressors in our econometric analysis, as described below. Bilateral trade flows are taken from the BACI database provided by CEPII and based on raw data from UN-Comtrade. We aggregate trade data at the origin–destination country level and use it build the World Trade Network (Cló et al. 2021; De Benedictis et al. 2014) on which we calculate centrality measures. To this end, we construct the world trade network and calculate two centrality measures (one global and one local) detecting key players (countries) within the network. Another source is the European Centre for Disease Prevention and Control (ECDPC), which provides daily data on COVID-19 infections and deaths since the beginning of the coronavirus pandemic in February 2020. Country-level information is based on reports from health authorities around the world and updated every day by a team of epidemiologists. These data are validated by means of an epidemic intelligence process.Footnote 3 For our purposes, we select a period that spans from March 11, 2020, to April 28, 2020. We choose March 11 as the starting date because by this time all the 27 European countries considered had recorded at least one infection. We choose April 28 as the end date to capture the first wave of SARS-CoV-2 diffusion (which lasted approximately from early March to late April 2020) before the lockdown measures adopted in many countries might have influenced the spread of the phenomenon. For our empirical analysis, we compute the rates of infection (INF/POP) and death (DEATH/POP), as the daily flows of infections and deaths, respectively, per million resident population. Figure 1 shows the daily evolution of these flows and the cumulative COVID-19 infections and deaths in our sample of countries.

The fourth source we use is the World Bank’s World Development Indicators (WDI) database, from which we draw data on a series of additional country-level variables potentially confounding the relationship between network centrality and the COVID-19 outbreak. Finally, the fifth source is the UNCTAD’s Annex Tables to the World Investment Report, which provide information on the annual value of greenfield FDI for all the countries in the world. First, we compute the total trade flows per capita (TRADE/POP) and the total greenfield FDI flows per capita (GREENFDI/POP) for each of the EU-27 countries in 2019. The former is computed as the sum of the value of imports and exports per resident population, using trade-related information provided by BACI and population data from the WDI. The latter is computed as the sum of inward (by destination) and outward (by source) greenfield FDI projects per resident population, using the information provided by UNCTAD. We use these variables to control for the size of trade and FDI flows and to compare their impact on COVID-19 diffusion with that of our trade and FDI network centrality.

A second set of variables is included to measure the intensity of the inward connections of our EU-27 countries originating from within and outside Europe. Among them, we include the value of imports per capita from, respectively, other European countries not belonging to EU-27 (IMPORTEU/POP), China (CHINA/POP), and other non-EU-27 countries excluding China (EXTRAEU/POP). Including these variables allows controlling for the fact that the country under observation is a big importer (relative to its size) of goods, especially from China, which is the country where the pandemic originated. To possibly control for other inward movements of people, we also include the number tourist arrivals per capita (TOUR/POP) and the number domestic and international air passengers (AIR/POP) carried by air carriers officially registered in the country. For both variables we use annual data for 2019. The third set includes variables that capture some socioeconomic characteristics of a country that can correlate with the COVID-19 early outbreak: the share of the resident population aged 65 years or more (POP65+); the stock of public health facilities, given by the total number of hospital beds per capita (HBEDS), including inpatient beds in public, private, general, and specialized hospitals and rehabilitation centers (Antonietti et al. 2021; Buja et al. 2022); the average temperature in February and March (TEMP), expressed in degrees Fahrenheit (TEMP). Table 1 shows their main summary statistics while in Appendix we report the correlation matrix.

3.1 Network and topology measurements

Network theory can shed light on links between entities (countries in our case) that traditional descriptive statistics do not capture. While a traditional analysis can clearly capture first-order measures, such as degree, other centrality measures (such as betweenness and eigenvector centrality) have no statistical equivalents in standard analyses. Hence, our interest in enriching the empirical setting with elements derived from network theory. In doing so, we do not want much to measure the intensity of the commercial transactions (imports, exports, FDIs) among states, but, rather, we want to capture how relevant is the position of each of them in the global networks, taking this latter as an indirect measure of the country’s exposure to health risks, or contagions. In this respect, it is worth stressing that our aim is not that of calibrating and estimating an epidemiological model (such as the SIR), but to study whether the initial position (i.e., centrality) of a country in, respectively, the FDI and trade networks is associated with a higher exposure to the risk of contagion, as mainly reflected by the infection and death rates.

De Masi and Ricchiuti (2020) reconstruct the development of the FDI network for the EU28 countries between 2003 and 2015. They link centrality measures obtained with macroeconomic variables to see whether the way the network’s architecture evolved could predict or follow changes in the of macroeconomic variables. Starting from their analysis, in this paper we use FDI outflow data to link production relationships between countries with their exposure to contagion. In our view, FDI naturally give rise to a network of reciprocal linkages and externalities (positive and/or negative) between a pair of countries, and these links could be a source of contagion. For example, when country A invests in country B, a series of transmission channels is triggered, primarily involving the transfer of machinery and equipment, and the movement of people. The greater a country’s centrality in the global production network, the higher the likelihood of this country establishing a wide range of production linkages with other countries, raising its exposure to such transmission channels (Bonadio et al. 2020; Eppinger et al. 2020; Hwang 2019; Sforza and Steininger 2020).

Following De Masi and Ricchiuti (2020), we define an FDI network for each year from 2003 to 2019 using fDi Markets database. In the present case, we calculate a network and all measurements for all countries. A link exists between country i and j if a firm based in i (j) invests in j (i)(i.e., it opens an affiliateFootnote 4). Links are weighted, the weights being the sum of affiliates opened in country j by firms based in i and vice versa in each year t, over the number of projects in the same year:

with the aim of capturing the worldwide relevance of FDI flows between the two countries.

In the same line, we also construct an indirect trade network for each year from 2003 to 2019, using bilateral trade flows between the country of origin and that of destination. The nodes (countries) are linked if country i and j trade. Links are weighted, and the weights are given by the ratio of trade flows (imports plus exports) between country i and j and the total world trade flows for each year t, thus capturing the importance that trade flow between the two countries has on the world trade flows:

Constructing the network enables us to compute a series of centrality measures, and thereby identify the core countries in the network. It is worth noting that the notion of hub crucially depends on a network’s topological characteristics and specificity. Different measures of centrality have been designed precisely to capture distinct aspects of the concept of a node’s centrality. The Degree is the simplest measure for identifying a hub in a network, since it is given by the number of links for each node. A generalization of the Degree is the eigenvector centrality (Newman 2010), which accounts for both the number of connections of each node and, recursively, the number of connections of neighbors. The neighbors centrality are weighted. Using matrix notation, the eigenvector centrality of a node i is:

where \(\lambda \) is the largest eigenvalue of the adjacency matrix. A higher score implies that the node (i.e., the country) is connected to many nodes that themselves have high eigenvector centrality scores. Since it quantifies the connections of a node with its neighbors that are themselves central, it can be interpreted as a measure of the power of a country in both the trade and FDI networks. It is worth noting that these global measures cannot be reduced to traditional statistical measurements, and this goes to show the greater explanatory power of network theory.

The maps in Fig. 2 show the average of eigenvector centrality, respectively, for the FDI (on the left) and trade (on the right) networks for 2019. For both measures, there is a core (UK, France, Germany, and, to lesser extent, Italy and Spain) and a clearly distinguishable periphery. We now test whether these correlations are robust to the inclusion of additional confounding factors and across different periods.

3.2 Econometric strategy

To test our hypothesis, we proceed with the following steps. First, we estimate the following baseline equation using a pooled OLS estimator:

where \(Y_{it}\) is either the number of people infected with COVID-19 per million population (i.e., the infection rate, INF/POP) of country i on day t, or, alternatively, the number of deaths per million population (i.e., the mortality rate, DEATH/POP) of country i on day t. These two dependent variables are regressed against a constant term \(\alpha _0\), a day trend t, its squared value \(t^2\), and a stochastic error component \(\epsilon \). In this way, through \(\alpha _1\), we estimate the speed of daily diffusion and mortality of the virus, while, through \(\alpha _2\), we test whether the diffusion of the pandemic follows a nonlinear trend.

As a second step, we re-estimate 1 on two distinct subsamples. To split the sample in two, we use our main explanatory variable, network centrality (using either the average 2003–19 FDI or the average 2003–19 international trade flows), and we compute its median value: Countries with a level of average network centrality above the median are separated from countries with a value of average network centrality below the median. After estimating 1 on these two distinct samples, we compare \(\alpha _1\) and \(\alpha _2\): If network centrality matters for explaining the dynamics of COVID-19 diffusion, we do expect \(\alpha _1\) and \(\alpha _2\) to be larger in the sample of countries with a value of NC above the median.

Then, as a third step, we assess to what extent the marginal effect of the day trend varies across the values of our two NC variables, once controlling for the total trade (TRADE/POP) and greenfield FDI (GREENFDI/POP) flows of each country. To do so, we augment 1 by interacting our main explanatory variable, NC, with the linear trend t as follows:

and plotting \(\beta _2\) at different points of the NC distribution. We do expect that the estimated coefficient of the linear trend increases with the level of the centrality of a country in its FDI or trade network. Finally, we test for the robustness of our estimates by including a series of additional regressors, measured in 2019, as in the following relation:

where X is a vector including the following variables: IMPORTEU/POP, CHINA/POP, EXTRAEU/POP, AIR/POP, TOUR/POP, HOSP, POP65+, and TEMP. In doing so, we check for the stability of \(\gamma _1\) to the inclusion of additional explanatory variables, and we also check which, among this latter, is significantly related to the COVID-19 infection and death rate. We also report the mean variance inflation Factor (VIF) statistics to check for potential multicollinearity. Moreover, to control for unobserved arbitrary within-group correlation, in each regression we cluster the standard errors at the country level.

4 Results

In Table 2, we show the output of the step 1 regressions, in which we estimate the speed of diffusion of the COVID-19 pandemic as modeled in Eq. (1). Columns 1 and 2 refer to a regression where the dependent variable Y is represented by the infection rate, INF/POP, while Columns 3 and 4 refer to a specification where Y is represented by the death rate, DEATH/POP.

The results in Columns 1 and 3 show that, on average, as the days go by, the rate of infection increases by a factor of roughly 0.4 and the rate of mortality by a factor of roughly 0.1, respectively. Columns 2 and 4 also show that the diffusion of COVID-19 follows a nonlinear pattern, similar to that shown in Fig. 1. Specifically, we find a maximum number of days of 28.6 for the infection rate and 38 for the death rate, their initial increase being quite rapid until, respectively, the 29th and the 37th day, followed by a subsequent smoother decrease (Table 3).

Table 4 reports the step 2 estimates of 1, where we have split the sample of countries with respect to the median value of the eigenvector centrality in the FDI and trade networks, respectively. The left panel shows the results concerning the infection rate, INF/POP. Comparing Column 1 with Column 3, we find that the estimated coefficient of the linear trend is almost seven times larger for countries with a high eigenvector centrality, meaning that, as expected, the speed of diffusion of the virus is much faster when countries have a highly central position in their FDI network. This result is confirmed when comparing Columns 2 and 4: the nonlinear pattern of diffusion of COVID-19 is faster in countries with an eigenvector centrality above the median, as shown by the larger estimated coefficients of the linear and the squared trend, and the higher value of the maximum, 29.3 days as compared to 26.8 days.

Similar results emerge from the right panel, concerning the death rate, DEATH/POP. Again, the estimated coefficient of the linear trend is nine times larger in Column 7 in comparison with Column 5, while the estimated coefficients in Column 8 reveal that the nonlinear trend of the virus in high-centrality countries is much steeper than that in low-centrality countries (Column 6). The maximum extension of the first wave of COVID-19 diffusion, instead, is higher in low-centrality countries (40 days) in comparison with high-centrality ones (36.5 days).

Table 4 shows that the previous results hold when we consider trade network centrality instead of FDI network centrality.

Figures 3 and 4 summarize these results in a graphic way. Figure 3 shows the linear evolution of the pandemic: the top panel shows the linear evolution of the pandemic according to the degree (low/high) of FDI network centrality, while the bottom panel shows the same trend according to the degree (low/high) of trade network centrality. In each panel, the left figure refers to the evolution of the infection rate, while the right figure to the evolution of the death rate. Figure 4, instead, shows the hump-shaped evolution of the infection (left figure) and death rate (right figure) with respect to the degree of FDI network centrality (top panel) and trade network centrality (bottom panel).

Table 5 shows the results of the step 3 regressions, where we test for the robustness of step 2 results by adding the total trade and FDI flows. Columns 1 and 3 show that both the number of infections per capita and the number of deaths per capita significantly increase with a country’s centrality in its global production network. Columns 2 and 4 show that these interaction effects are weaker when considering the trade network centrality. Interestingly, the estimated coefficient of GREENFDI/POP is never statistically significant, while that of TRADE/POP is positive and significant, but only in Columns 1 and 2, and does not cancel the role that \(\textrm{NC}_\textrm{TRADE}\) has on the speed of COVID-19 diffusion (see Fig. 5). This means that using the network analysis to compute a country’s centrality measures is probably more important than looking at the total volume of trade and FDI: In other words, what explains the diffusion of the pandemic is not much, or not only, the whole size of connections, but also the importance of each node in the network.

The results in Table 5, however, refer to the average effects at the mean of each variable. Instead, we are more interested in assessing the speed of COVID-19 diffusion along the distribution of our network centrality indicators. Figure 5 shows the average marginal effect (i.e., the estimated coefficient \(\beta _2\)) of the day trend at the 10th, 25th, 50th, 75th, and 90th percentile of the \(\textrm{NC}_\textrm{FDI}\) (top panel) and \(\textrm{NC}_\textrm{TRADE}\) (bottom panel) distributions. Again, in both panels, the figure on the left refers to INF/POP while the one on the right to DEATH/POP. Interestingly, and in line with step 2 results, we find that the speed of COVID-19 diffusion and mortality increases (and becomes more statistically significant) with a country’s centrality in both the FDI and the trade network. The difference in the \(\beta _2\) between the 10th and the 90th percentiles is larger when considering \(\textrm{NC}_\textrm{FDI}\) (left figures) than \(\textrm{NC}_\textrm{TRADE}\) (right figures). Specifically, from the top left figure, we find that the speed of infection is approximately 0 for very peripheral (p10) countries while rising to approximately 0.7 for very central (p90) ones. The role of \(\textrm{NC}_\textrm{TRADE}\) is smoother in the top right figure, as we pass from a speed of infection of roughly 0.3 (but not statistically significant) in peripheral (p10) countries to 0.5 in the most central (p90) ones. Similar results emerge when looking at the death rate. From both figures in the bottom panel, we observe that the speed of deaths increases with both \(\textrm{NC}_\textrm{FDI}\) and \(\textrm{NC}_\textrm{TRADE}\), with a 20% difference between very peripheral (p10) and very central (p90) countries.

Finally, we show whether the results are robust to the inclusion of a larger set of country-level controls. Table 6 reports the pooled OLS estimates of 3 where, in Columns 1 and 2, the dependent variable is INF/POP, while in Columns 3 and 4 is DEATH/POP. From Column 1 we find a positive and statistically significant (at the 10% level) coefficient of the interaction between the trend and \(\textrm{NC}_\textrm{FDI}\). In Column 2, the interaction between the trend and \(\textrm{NC}_\textrm{TRADE}\), instead, is positive but not statistically significant. Among the other regressors, we find that a higher volume of imports per capita from other European countries, a higher volume of air mobility, a higher share of the elderly population, and a warmer temperature do have a positive correlation with INF/POP, while the estimated coefficient of HBEDS is negative and significant, meaning that the infection rate increases where the availability, or the quality, of health facilities is lower. Interestingly, we do not find any statistically significant role for imports from China and for inward tourist flows. Similar results emerge from Columns 3 and 4. In both columns, the interaction term between time and network centrality is positive and significant. We also find that the death rate increases with a country’s exposure to imports from other European countries, or with a country’s lower availability of health facilities, and lower exposure to imports from the rest of the world. This evidence suggests that the early wave of the outbreak in EU-27 was favored, among others, by the economic links among neighboring European countries. Finally, the mean VIF statistics below the value of 5 show that multicollinearity is not an issueFootnote 5

As a robustness check (see Appendix, Table 8), we use an alternative measure of network centrality as a focal regressor, which is the local weighted clustering coefficient, where the weights are those defined above. The clustering coefficient (CLUSTERING) is a local measure of the density of connections around a vertex. It enables us to calculate the proportion of the neighbors closest to the node that are connected to one another (Brandes 2001). As for the eigenvector centrality, we compute our clustering metric using both FDI (CLUSTERING\(_\textrm{FDI}\)) and international trade (CLUSTERING\(_\textrm{TRADE}\)) data. The results from Table 8 are in line, but slightly weaker than those from Table 6. However, Fig. 6 shows that both the infection rate and the mortality rate of COVID-19 increase as much as a country’s position in both the FDI and the trade network becomes central.

5 Conclusions

Does being at the center of a global production, or trade, network make a country more vulnerable to COVID-19. In this paper, we try to answer this question by focusing on EU-27 countries and merging data from different sources on daily COVID-19 infection and mortality rates in March and April 2020, countries’ FDI and trade topology measurements and other macroeconomic characteristics. In doing so, again, we do not directly investigate the mechanisms of COVID-19 diffusion across countries, but, rather, we analyze the role of countries’ centrality in both the FDI and the trade network as an initial condition that might have shaped their different exposure to the pandemic.

Our estimates show that, ceteris paribus, increasing a country’s network centrality corresponds to a higher chance of its population becoming infected and killed by the coronavirus. These results are robust to the use of an alternative, local, network centrality indicator. The picture that emerges from our analysis is one where the outbreak originated in China, then spread to Europe, hitting particularly the countries that are the main hubs of the European production and trade networks, Our findings complement other recent evidence concerning globalization and the COVID-19 pandemic in showing that connections among countries can have a downside because of raising the exposure to a systemic risk such as that generated by the COVID-19 pandemic. Like other recent studies (Antonietti et al. 2022), we show that globalization can have a dark side that is connected to the spread of diseases. Much of the international trade and international business literature stresses that the possibility for countries to exchange goods, services, capital equipment, technology, but also people, and face-to-face contacts between managers and staff, as entailed in trade and FDI relationships, improves their connectivity, productivity, and wealth. The flip side of the coin is that these mechanisms can also increase their exposure to contagions, as the 2008 crisis has shown with respect to financial assets and the COVID-19 pandemic with respect to health-related issues. Our results provide some new insights into the determinants of the early diffusion of the pandemic. Recent studies have focused on specific characteristics of countries such as the level of wealth, pollution, quality of the health system, and the volume of international trade. We add that the speed of the pandemic was higher in countries that represent central nodes in the global production and trade networks. This can explain why Europe was the first region of the world to be severely hit by the virus, and why, within Europe, countries most exposed to trade and FDI such as Italy, Spain, France, and the UK, were the ones with the highest incidence of infections and deaths.

From a policy perspective, we believe our analysis underlines the importance of links between countries that the economy has created since the end of the last century. These ties, far from being only of an economic nature, have locally and globally relevant consequences. The indication that our work gives is that the most central countries in the network should not only be aware of the economic risks but also, and above all, of the noneconomic ones, specifically those related to public health. It is necessary to increase controls on the health side, to minimize the possibility that events, emerged from the other side of the globe, will spread everywhere.

Notes

The see which countries and regions were first and most hit by the pandemic see, for example, https://ourworldindata.org/coronavirus using Johns Hopkins University CSSE COVID-19 data.

We have excluded Luxembourg because, despite its very small size, it is an outlier for what concerns inward and outward FDI.

For more details, see: https://www.ecdc.europa.eu/en/covid-19/data-collection.

The fDi markets database refers to projects, but we prefer to use the term affiliates.

We have also added country-specific or region-specific dummies to control for unobserved time-invariant attributes. However, these dummies are highly correlated with our set of regressors, raising multicollinearity.

References

Abbate A, De Benedictis L, Fagiolo G, Tajoli L (2018) Distance-varying assortativity and clustering of the international trade network. Netw Sci 6:517–544

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105(2):564–608

Alfaro L, Chen M (2014) The global network of multidimensional firms. J Int Econ 94(2):263–276

Antonietti R, Falbo P, Fontini F (2021) The wealth of nations and the first wave of COVID-19 diffusion. Ital Econ J. https://doi.org/10.1007/s40797-021-00174-z

Antonietti R, Falbo P, Fontini F (2022) The world trade network: country centrality and the COVID-19 pandemic. Appl Netw Sci 7:18. https://doi.org/10.1007/s41109-022-00452-4

Bannó M, Redondi R (2014) Air connectivity and foreign direct investments: economic effects of the introduction of new routes. Eur Transp Res Rev 6:355–363

Battiston S, Puliga M, Kaushik R, Tasca P, Caldarelli G (2012) Debtrank: too central to fail financial networks, the fed and systemic risk. Sci Rep 2:541

Berardi S, Tedeschi G (2017) “From banks’’ strategies to financial (in)stability. Int Rev Econ Financ 47:255–272

Bonadio B, Zhen H, Levchenko A. A, Pandalai-Nayar N (2020) Global supply chains in the pandemic. NBER working paper 27224

Bontempi E, Coccia M (2021) International trade as critical parameter of COVID-19 spread that outclasses demographic, economic, environmental, and pollution factors. Environ Res 201:111514

Bontempi E, Coccia M, Vergalli S, Zanoletti A (2021) Can commercial trade represent the main indicator of the COVID-19 diffusion due to human-to-human interactions? A comparative analysis between Italy, France, and Spain. Environ Res 201:111529

Brandes U (2001) A faster algorithm for betweenness centrality. J Math Sociol 25(2):163–177

Brockmann D, Helbing D (2013) The hidden geometry of complex, network-driven contagion phenomena. Science 342(6164):1337–1342

Buja A, Paganini M, Fusinato R, Cozzolino C, Cocchio S, Scioni M, Rebba V, Baldo V, Boccuzzo G (2022) Health and healthcare variables associated with Italy’s excess mortality during the first wave of the COVID-19 pandemic: an ecological study. Health Policy. https://doi.org/10.1016/j.healthpol.2022.03.002

Carod JM, Solis D, Antolín M (2010) Empirical studies in industrial location: an assessment of their methods and results. J Reg Sci 50(3):685–711

Chinazzi M, Davis JT, Ajelli M, Giovannini C, Litvinova M, Merler S, Pastore y Piontti A, Mu K, Rossi L, Sun K, Viboud C, Xiong X, Yu H, Halloran ME, Longini IM, Vespignani A (2020) The effect of travel restrictions on the spread of the 2019 novel coronavirus (COVID-19) outbreak. Science 368(6489):395–400

Cló S, Marvasi E, Ricchiuti G (2023) State-owned enterprises in the global market: varieties of government control and internationalization strategies. Struct Change Econ Dyn 64:25–40

Criscuolo C, Timmis J (2017) The changing structure of global value chains: are central hubs key for productivity? OECD Working Paper

De Benedictis L, Tajoli L (2011) The World trade network. World Econ 34(8):1417–1454

De Benedictis L, Tajoli L (2018) Global and local centrality of emerging countries in the world trade network in networks of international trade and investment. In: Smith M, Amighini A, Gorgoni S (eds) Networks of international trade and investment. Vernon Press, Wilmington

De Benedictis L, Nenci S, Santoni G, Tajoli L, Vicarelli C (2014) Network analysis of world trade using the BACI-CEPII dataset. Glob Econ J 14(03n04):287–343

De Masi G, Ricchiuti G (2018) The network of European outward foreign direct investments. In: Smith M, Amighini A, Gorgoni S (eds) Networks of international trade and investment. Vernon Press, Wilmington

De Masi G, Ricchiuti G (2020) From FDI network topology to macroeconomic instability. J Econ Interac Coord 15(1):133–158

De Masi G, Fujiwara Y, Gallegati M, Greenwald B, Stiglitz JE (2011) Japanese financial credit networks. Evolut Inst Econ Rev 7(2):209–232

De Masi G, Giovannetti G, Ricchiuti G (2013) Network analysis of Italian foreign direct investments. Phys A 392:1202–1214

Doeringer P, Evans-Klock C, Terkla D (2004) What attracts high performance factories? Management culture and regional advantage. Reg Sci Urban Econ 34(5):591–618

Eppinger P, Felbermayr G, Krebs O, Kukharskyy B (2020) Covid-19 shocking global value chains. CESifo Working Paper No. 8572

Fagiolo G, Reyes JA, Schiavo S (2009) The evolution of the world trade web: a weighted-network analysis. J Evol Econ 20(4):479–514

Fernández-Villaverde J, Jones CI (2020) Macroeconomic outcomes and COVID-19: a progress report. Technical report, National Bureau of Economic Research Working Paper n. 20084

Fontagné L (1999) Foreign direct investment and international trade: complements or substitutes? OECD DSTI/DOC(99)3. OECD, Paris

Garas A, Lapatinas A, Poulios K (2016) The relation between migration and FDI in the OECD from a complex network perspective. Adv Complex Syst 19:1–20

Garlaschelli D, Battiston S, Castri M, Servedio VDP, Caldarelli G (2005) The scale-free topology of market investments. Phys A 350(2–4):491–499

Grilli R, Tedeschi G, Gallegati M (2014) Bank interlinkages and macroeconomic stability. Int Rev Econ Financ 34:72–88

Hautsch N, Schaumburg J, Schienle M (2015) Financial network systemic risk contributions. Rev Financ 19(2):685–738

Hoare A (1975) Foreign firms and air transport: the geographical effect of Heathrow airport. Reg Stud 9(4):349–367

Hwang H (2019) Germs, roads and trade: theory and evidence on the value of diversification in global sourcing, mimeo

Iori G, De Masi G, Precup O, Gabbi G, Caldarelli G (2008) A network analysis of the Italian overnight money market. J Econ Dyn Control 32(1):259–278

Joyez C (2017) On the topological structure of multinational network. Phys A 473:578–588

Joyez C (2019) Alignment of multinational firms along global value chains: a network-based perspective. GREDEG Working Papers 2019-05, Groupe de REcherche en Droit, Economie, Gestion (GREDEG CNRS), University of Nice Sophia Antipolis

Kraemer MU, Yang CH, Gutierrez B, Wu CH, Klein B, Pigott DM, Du Plessis L, Faria NR, Li R, Hanage WP (2020) The effect of human mobility and control measures on the COVID-19 epidemic in China. Science 368(6490):493–497

Metulini R, Riccaboni M, Sgrignoli P, Zhu Z (2017) The indirect effects of foreign direct investment on trade: A network perspective. World Econ 40(10):2193–2225

Newman MEJ (2010) Mathematics of networks: an introduction to the mathematical tools used in the study of networks, tools that will be important to many subsequent developments. In: Newman M (ed) Networks: an introduction. Oxford University Press, Oxford

OECD (2020) Trade policy implications of global value chains. Trade Policy Brief, OECD, Paris

Pastor-Satorras R, Vespignani A (2001) Epidemic spreading in scale-free networks. Phys Rev Lett 86(14):3200–3

Recchioni MC, Tedeschi G (2017) From bond yield to macroeconomic instability: a parsimonious affine model. Eur J Oper Res 262(3):1116–1135

Ruan Z, Wang C, Ming Hui P, Zonghua L (2015) Integrated travel network model for studying epidemics: Interplay between journeys and epidemic. Sci Rep 5:11401

Rungi A, Morrison G, Pammolli F (2017) Global ownership and corporate control networks. Working Papers 07/2017, IMT Institute for Advanced Studies Lucca

Sforza A, Steininger M (2020) Globalization in the Time of Covid19. Cesifo Working Papers 8184

Lenzu S, Tedeschi G (2012) Systemic risk on different interbank network topologies. Phys A Stat Mech Appl 391(18):4331–4341

Zhao L, Park K, Lai YC (2004) Attack vulnerability of scalefree networks due to cascading breakdown. Phys Rev E 70:035101

Funding

Open access funding provided by Università degli Studi di Padova within the CRUI-CARE Agreement. The authors received no specific funding for this work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors certify that they have no affiliations with or involvement in any organization or entity with any financial or non-financial interest in the subject matter or materials discussed in this manuscript

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Antonietti, R., De Masi, G. & Ricchiuti, G. Linking FDI and trade network topology with the COVID-19 pandemic. J Econ Interact Coord 18, 807–833 (2023). https://doi.org/10.1007/s11403-023-00393-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-023-00393-w