Abstract

New venture creation is a long and complex process that requires significant personal effort. In this study, we analyse how high growth expectations influence new venture creation in nascent entrepreneurs. In addition, we aim to investigate the impact of competitive innovation on new venture creation through the mechanism established between high growth expectations and entrepreneurial effort. Drawing on a sample of 495 nascent entrepreneurs from PSED II, our results show that high growth expectations indirectly influence the creation of a new firm through nascent entrepreneurial effort. Furthermore, the competitive innovation of nascent entrepreneurs exhibits a positive relationship with new venture creation, facilitated by the relationship between high growth expectations and entrepreneurial effort. These results contribute to a better understanding of the role that high growth expectations play in the nascent entrepreneurial process and how competitive innovation and growth expectations explain the creation of a new firm.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Entrepreneurship plays a key role in national economic growth (Pradhan et al., 2020), being one of the main sources of job creation, social development (Liñán et al., 2011; Ribeiro-Soriano, 2017), and innovation (Ferreira et al., 2017; Wennekers & Thurik, 1999). Moreover, high-growth firms contribute more to economic growth than small and medium-sized firms (Friar & Meyer, 2003; Muñoz-Bullón et al., 2019; Wong et al., 2005). Therefore, given that enterprise growth is a vital element of regional economic growth (Davidsson & Henrekson, 2002; Friar & Meyer, 2003; Martínez-Fierro et al., 2020), it is an important goal for policymakers (Fischer & Reuber, 2003; Lee et al., 2021; Lerner, 2010; Smallbone et al., 2002). Business growth has been defined in several ways, either as an improvement in organisational performance, measured by financial indicators (Robson & Bennett, 2000) or by an increase in the number of employees (e.g., Hanifzahed et al., 2018). Business growth has been associated with ambitious entrepreneurs or with high growth expectations (Hakkert & Kemp, 2006).

High growth expectations have attracted great interest in entrepreneurship (Hermans et al., 2015), and previous literature highlights the importance of having a better understanding of these expectations in entrepreneurs (Szerb & Vörös, 2021; Fuentelsaz et al., 2023; Poblete, 2018; Lecuna et al., 2017; Cassar, 2006; Wiklund & Shepherd, 2003). High growth expectations are defined as the entrepreneur's desire to increase the performance and growth of the firm, or otherwise, the preference to manage one with few resources and employees (Cassar, 2007). In the nascent entrepreneurship field, we still do not know how high growth expectations are directly related to outcome variables of the entrepreneurial process, such as the creation of a new firm or the abandonment of the process, because the results are not significant (Gartner & Liao, 2012). For this reason, it is necessary to know the implicit indirect mechanisms that explain this relationship.

Some studies (e.g., Estrin et al., 2022; Sims & Chinta, 2020) have analysed high growth expectations under the framework of expectancy theory (Vroom, 1964). Expectancy theory argues that expectations influence the effort that individuals put into achieving their goals (Renko et al., 2012), especially when they are engaged in business gestation (Laffineur et al., 2020). This theory provides a comprehensive framework for analysing the antecedents of new venture creation (Gatewood et al., 2002) because the creation of a new firm has been conceptualised as a process based on the effort-outcome model (Gatewood et al., 2002; Manolova et al., 2008). Based on the latter, we aim to clarify the role of growth expectations in the nascent entrepreneurial process, and how these expectations influence the new venture creation through the entrepreneurial effort induced by nascent entrepreneurs.

Concerning the relationship between high growth expectations and new venture creation, we found arguments both for and against in the previous literature. Recognizing this, Fuentelsaz et al. (2021) argue the importance of exploring other variables, such as innovation, to clarify the relationship between high growth expectations and the outcome variables of the entrepreneurial process. In a related vein, Muñoz-Bullón et al. (2019) highlight the importance of studying the role of innovation (development of new products and/or innovation processes) in the high growth expectations in nascent entrepreneurs and emphasize the need to develop a deeper discussion about the role that this relationship plays in the gestation process.

Recent studies (e.g., Estrin et al., 2022; Poblete, 2018; Saeedikiya et al., 2022) have corroborated that innovation (i.e., development of new products, services and/or processes) influences entrepreneurs' growth expectations, and this relationship has been established under the framework of expectancy theory (Estrin et al., 2022). However, how this relationship influences the new venture creation has not been analysed, this being our research gap. Specifically, in this study, we focus on the key role of competitive innovation. Competitive innovation is defined as the perceived importance of innovation to obtain a desirable competitive position for the new firm, and it is viewed as an important factor for the firm’s competitiveness in the gestation phase (BarNir, 2014).

Therefore, our main aim is to respond to the following research questions: What is the relationship between high growth expectations and new venture creation in nascent entrepreneurs through entrepreneurial effort? What is the effect of competitive innovation on new venture creation through the relationship between high growth expectations and entrepreneurial effort? To address the research questions, we draw on a sample of 495 nascent entrepreneurs from the Panel Study of Entrepreneurial Dynamics (PSED II).

This paper contributes to nascent entrepreneurship research in several ways. First, we contribute to a better understanding of the factors that affect the new venture creation in nascent entrepreneurs with growth expectations. Second, considering that it is not known whether high growth expectations influence the creation of a new firm, the present study clarifies the role it plays in the new venture creation process. Finally, the present study analyses how the relationship between competitive innovation and growth expectations (Estrin et al., 2022; Poblete, 2018; Saeedikiya et al., 2022) can help to explain the creation of a new firm. From a theoretical standpoint, we contribute to expectancy theory in the nascent entrepreneurship field, to clarify the mechanism that explains the new venture creation considering the high growth expectations. Drawing on expectancy theory, growth expectations can explain the entrepreneurial effort of nascent entrepreneurs, thereby increasing the likelihood of new venture creation. In addition, the relationship between innovation and high growth expectations has been built based on the expectancy theory (Estrin et al., 2022), and in the present study, we analyse how competitive innovation influences venture creation through the relationship between growth expectations and entrepreneurial effort.

Theoretical framework

The new venture creation process requires significant personal efforts and resources (Reynolds, 2007; Rotefoss & Kolvereid, 2005), and for this reason, nascent entrepreneurs must work hard and be persistent (e.g., Hopp & Stephan, 2012; Mohand-Amar et al., 2022; Reynolds & Curtin, 2008) to complete the many challenging tasks inherent in this process. Some studies (e.g., Laffineur et al., 2020; Renko et al., 2012; Vilanova & Vitanova, 2020) emphasize the importance of entrepreneurial effort in the start-up process because the creation of a new firm depends on the entrepreneurial effort that the nascent entrepreneur invests in the business gestation.

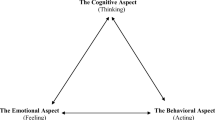

In the nascent entrepreneurship area, some authors (e.g., Renko et al., 2012), based on expectancy theory (Vroom, 1964), emphasize the importance of expectations for the successful creation of a new venture, because it is positively related to the entrepreneurial effort that a nascent entrepreneur invests in the start-up process. The effort a person puts into a given action will depend on the expectations. Expectancy theory has been used as a theoretical perspective in the study of entrepreneurial behavior (Gatewood, 2004) and assumes that the actions an individual takes will depend on personal beliefs about how their efforts will lead to a successful outcome. This theory explains human motivation based on three components: Expectancies (the belief that effort will lead to an outcome or performance), valence (interpreted as the desirability of results), and instrumentality (the belief that, if one meets performance expectations, the individual will receive a greater reward). Previous studies (e.g., Manolova et al., 2007) have considered expectancy theory to analyse high growth expectations on nascent entrepreneurs and how these influence the new venture creation process (e.g., Edelman et al., 2010).

Sims and Chinta (2020), drawing on expectancy theory, consider high growth expectations as a type of valence because these expectations reflect the entrepreneurs' desire for business growth. Based on this, growth expectations could be considered as a perception of desirability (Bulanova et al., 2016) that influences entrepreneurial effort (Hanifzahed et al., 2018). Entrepreneurial motivation is determined by perceived desirability (Ramawati et al., 2020), as it is reasonable to expect people to fight for those outcomes that they consider desirable (Segal et al., 2005). Furthermore, the effort-outcome model of expectancy theory (Gatewood, 1993; Gatewood et al., 2002; Vroom, 1964) helps to gain a better understanding of the motivational dynamics in the new venture creation process (Edelman et al., 2010), providing a comprehensive framework to understand the business gestation (Renko et al., 2012).

Recently, expectancy theory has been used to analyse the relationship between innovation and high growth expectations (e.g., Estrin et al., 2022). Based on this theory, innovation, i.e., the development of new products, services and/or processes, influences the high-growth expectations of entrepreneurs (Poblete, 2018), and for this, the innovation – orientation determines the high growth expectations in entrepreneurs (Lecuna et al., 2017).

In the entrepreneurship literature, high growth expectations have been defined in various ways. For example, Wiklund et al. (2003) define it as the entrepreneur's attitude towards growth, measured as the increase in the number of employees to be produced in the next five years or the desire to grow the firm in the future, to hire more employees in the next two years (Cliff, 1998; Kolvereid, 1992). In addition, Cassar (2007) defines it as the entrepreneur's growth intention by considering whether the entrepreneur wants the firm to be as large as possible, or otherwise, prefers to manage one with few resources and employees (Cassar, 2007); and Bulanova et al. (2016) define it as the entrepreneur's motivation to grow the firm.

Hypothesis development

High growth expectations and new venture creation

Previous studies (e.g., Gartner & Liao, 2012; Stewart & Roth, 2001), that have analysed the role of high growth expectations in the entrepreneurial process, argue that entrepreneurs with high growth aspirations have a higher propensity to take risks, and it is normal for them to decide to embark on large-scale projects (Stam et al., 2009). For this reason, entrepreneurs take several inappropriate risks (Stewart & Roth, 2001), even when the courses of action they execute are unsuccessful, thus producing an escalation of commitment (Staw, 1981) that is seriously detrimental to them (Brockner, 1992). High growth expectations produce a high optimism that encourages entrepreneurs to embark on challenging projects, which require a high commitment of both financial and personal resources (Hayward et al., 2006). This influences the higher exit rates from the entrepreneurial process (Hopenhayn & Vereshchagina, 2003; Zięba, 2017).

In the same vein, Fuentelsaz et al. (2021), based on the hubris theory of entrepreneurship (Hayward et al., 2006), corroborate that high growth expectations are related to higher entrepreneurial exit rates because high growth expectations could respond to overconfidence and arrogance of entrepreneurs. The hubris theory of entrepreneurship argues that entrepreneurs' overconfidence and arrogance can become negative factors in the decision-making process by relying on biased judgments. However, this theory suggests that overconfidence is favourable during the early stages of the entrepreneurial process, as it has a positive effect on the formation of new firms, although it then becomes a negative factor in the subsequent stages (Hayward et al., 2006, 2010). Therefore, entrepreneurs who tend to overestimate their capabilities and skills (Cassar, 2010; Mueller & Shepherd, 2016) will be more likely to abandon the entrepreneurial process (Poblete, 2022) after the creation of a new firm.

So far, the role of high growth expectations in the gestation process of a new firm has been scarcely addressed, and some authors (e.g., Gartner & Liao, 2012) found no significant relationship between how high growth expectations and new venture creation. However, the previous literature (e.g., Robinson & Marino, 2015; Trevelyan, 2008) suggests that optimism and overconfidence are beneficial when a person decides to become an entrepreneur. In line with this, Kraft et al. (2022), to clarify this discussion, have corroborated that overconfidence was positively associated with new venture creation. This finding fits well with the postulates established by the hubris theory of entrepreneurship, therefore, overconfidence favours the new venture creation at the early stage of the start-up process. Considering that entrepreneurs with high growth expectations tend to be overconfident (Fuentelsaz et al., 2021; Szerb & Vörös, 2021), in the present study, we hypothesise that such expectations have a positive effect on new venture creation:

-

H1: High growth expectations are positively related to new venture creation in the start-up process.

The entrepreneurial effort is particularly relevant when the entrepreneur is involved in the start-up process (Yang & Danes, 2015) because establishing a new venture requires tenacity (Reynolds & Curtin, 2008; Tietz et al., 2018) and those entrepreneurs who put effort and are tenacious in the pursuit of their goals, are more likely to succeed (Timmons et al., 2004). Therefore, entrepreneurs must invest significant effort in start-up activities to create a new firm (Laffineur et al., 2020). Some authors (e.g., Vilanova & Vitanova, 2020; Hopp and Sonderegger, 2015; Renko et al., 2012) argue that entrepreneurial effort, measured as the number of start-up activities executed in the gestation process, is positively related to new venture creation.

Some studies (e.g., Laffineur et al., 2020; Renko et al., 2012), which have been based on expectancy theory (Vroom, 1964), argue that entrepreneurs' expectations favour the creation of a new firm through the effort invested during the gestation process. In line with this, Davidsson et al. (2002) suggest that new venture creation is one of the main outcomes of entrepreneurial efforts, and this effort is closely related to the entrepreneur's expectations. Moreover, Hanifzahed et al. (2018) point out that managers' desire for entrepreneurial growth has a positive effect on the outcome they then achieve, as high growth expectations lead to greater effort to achieve the desired goal.

Sims and Chinta (2020), based on the expectancy theory, argue that high growth expectations reflect a type of valence because it reflects the entrepreneur's desire for firm growth. Expectancy theory (Vroom, 1964) argues if someone desires an outcome, he or she will invest the effort necessary to achieve it. Therefore, the nascent entrepreneur's ambition for business growth may increase the probability of a successful outcome through the effort associated with this ambition. Consequently, we propose that high growth expectations, i.e. the entrepreneur's intention to achieve growth, stimulate motivation and effort during the business gestation. These factors would increase the probability of entrepreneurial success.

Considering these arguments, in the present study, we propose that high growth expectations can be considered an important factor that drives the motivation of individuals through the effort invested during the business gestation, thereby increasing the likelihood of creating the new company. Therefore, high growth expectations would indirectly influence the new venture creation through the entrepreneurial effort invested in the start-up process. Based on this, we propose the following hypothesis:

-

H2: Entrepreneurial effort mediates the relationship between high growth expectations and new venture creation in the start-up process.

Competitive innovation, high growth expectations and new venture creation

Innovation activity can be conceptualized in many ways, such as the development of new products, services, or processes, the establishment of a new distribution channel, and a new organizational method, among others (Varadarajan, 2018; Baregheh et al., 2009). Previous literature argues that innovation plays a key role in the success of a new firm (Heunks, 1998; Rauch & Frese, 2007; Rosenbusch & Bausch, 2005). Innovation fosters business growth through improved productivity and economic profitability rates (Audretsch et al., 2014; Heunks, 1998; Spescha & Woerter, 2019) because product innovation will allow them to maintain a sufficient market share. This is mainly true for innovative start-ups, which are new ventures that create new products/services, patents, or proprietary knowledge, and this type of innovation is associated with greater potential returns and growth, thus increasing the competitiveness of the new firm (BarNir, 2014). Based on the latter, innovation is a key component of a firm’s competitiveness (Gunday et al., 2011), and it constitutes an essential driver for this competitiveness (Brancati et al., 2022). Therefore, competitive innovation, or the importance of innovation for the firm’s competitiveness, plays an important role in the entrepreneurial process (BarNir, 2014).

Some authors (e.g., Al-Mamary & Alshallaqi, 2022; Wurthmann, 2014) have confirmed that innovation favours the intention to create a new venture. Rosenbusch et al. (2011) argue that innovation has many benefits for new businesses, and it constitutes the best strategy when entrepreneurs start a new firm (Poblete, 2018; Stayton & Mangematin, 2019). Therefore, based on this, innovation not only favours the intention to create a new venture but also favours the firm creation when the entrepreneur decides to implement the business idea. In addition, Matthews and Brueggemann (2015) suggest that entrepreneurs need to learn competencies and skills related to innovation because it is one of the most important factors that guarantee the successful creation of new firms. Finally, BarNir (2014) argues that innovation plays a key role in the nascent entrepreneurial process because it determines the success of the new venture, especially when this innovation is considered a competitive strategy. Based on these considerations, we suggest that competitive innovation favours the successful creation of the new firm, therefore, we propose the following hypothesis:

-

H3: Competitive innovation is positively related to new venture creation in the start-up process.

Recent studies confirm the positive effect of innovation on the high growth expectations of nascent entrepreneurs (Saeedikiya et al., 2022) because ambitious entrepreneurship is strongly associated with innovation (Guerrero et al., 2024). Some authors (e.g., Estrin et al., 2022; Saeedikiya et al., 2022) explain this relationship under the postulates established by Schumpeter (1934) since entrepreneurs who innovate do so to achieve a leadership position in the market in which they operate. Therefore, the importance of innovation for the competitive advantage by nascent entrepreneurs can influence their high growth expectations. In line with this, Chrisman and Patel (2012) suggest that innovative options often appear feasible and desirable for entrepreneurs with high growth expectations, and previous authors (e.g., Terjesen & Szerb, 2008; Saeedikiya et al., 2022) have corroborated that innovation positively influences entrepreneurs' high growth expectations.

In addition, Estrin et al. (2022), based on expectancy theory (Manolova et al., 2007; Vroom, 1964;), suggest that innovation, specifically the development of new products, services or processes, is related to high growth aspirations of entrepreneurs. This relationship is influenced by beliefs about the potential that the new firm will have in the future (Capelleras et al., 2019; Levie & Autio, 2013). Similarly, McKelvie et al. (2017) argue that those firms that show a commitment to product and/or process innovation have a higher growth orientation. Indeed, Poblete (2022) argues innovation is often carried out by entrepreneurs blinded by their overconfidence, and this is a characteristic exhibited by those with high growth expectations (Fuentelsaz et al., 2021). In this regard, Szerb and Vörös (2021) argue that product novelty at the early stage of business gestation influences the growth expectations of nascent entrepreneurs. Finally, Lecuna et al. (2017) have corroborated that strategic orientation toward innovation influences high growth expectations, so, based on this argument, the importance of innovation for entrepreneurs determines their growth expectations.

Furthermore, Poblete (2018) corroborates a model that suggests that innovation acts as a motivating force that increases entrepreneurs' high growth expectations. Therefore, those entrepreneurs who are innovative in the entrepreneurial process will be more likely to have high growth expectations. This can be explained by the fact that entrepreneurs believe that, unless they do something innovative, they are unlikely to achieve high rates of expansion in their business, because the level of competition will be intense. Moreover, innovation generates optimism about the expected results for entrepreneurs. Drawing on expectancy theory, Poblete (2018) argues that the relationship established between innovation and high growth expectations is fundamentally based on expectations, which favour effort to achieve a given goal (Renko et al., 2012).

Taking into account the above considerations, in this study, we consider that the relationship established between competitive innovation and new venture creation can be explained through the mechanism established between high growth expectations and entrepreneurial effort. Consequently, the relationship between innovation and high growth expectations (e.g., Estrin et al., 2022; Poblete, 2018; Saeedikiya et al., 2022) would positively influence the new venture creation through the effort that such expectations induce, thus establishing a double mediation. In line with these arguments, we formulate the following hypothesis:

-

H4: Competitive innovation is indirectly related to new venture creation through the mediating effect of high growth expectations and entrepreneurial effort in the start-up process.

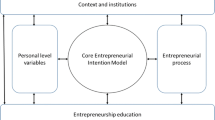

The hypotheses suggest that competitive innovation and high growth expectations influence the new venture creation in the start-up process (Fuentelsaz et al., 2021; Muñoz-Bullón et al., 2019). Figure 1 presents the relationships proposed in this study.

Methodology

Sample

The data for this empirical analysis were obtained from the Panel Study of Entrepreneurial Dynamics II (PSED II), part of a research programme aimed at enhancing understanding of the business start-up process (Reynolds & Curtin, 2008). The PSED II provides accurate and relevant data concerning the early stages of entrepreneurial activities (Martínez et al., 2011) and the mechanisms involved in nascent entrepreneurial activity (Reynolds, 2017). This research programme consists of two projects: PSED I, which began in 1998 and in which a total of 830 nascent entrepreneurs were selected with three annual follow-up interviews; and PSED II, which began in 2005, interviewing 1,241 nascent entrepreneurs, followed by five follow-up interviews, at yearly intervals. The initial sample of 1,241 nascent entrepreneurs was subjected to various selection criteria. In the first step, we selected nascent entrepreneurs who were actively involved in business gestation, that is, those who had previously carried out at least two activities involving the creation of a business (Reynolds, 2018). Subsequently, and following the approach described by Lichtenstein et al. (2007) and Honig and Hopp (2019), we included only those whose first business gestation activity took place during the 24 months prior to the interview. By applying this criterion, we avoided the risk of “semi-survivor bias” (Gartner & Carter, 2003), a condition that may arise when nascent entrepreneurs have been engaged in business gestation for long periods and cannot readily be compared with those who have less experience. It is assumed that those with longer experience are both less likely to create a company and less likely to abandon the project (Lichtenstein et al., 2007). As a result of this selection process, the final study sample consisted of 495 nascent entrepreneurs.

Regarding the description of the sample, 58.9% of the participants are men while 41.0% are women, 39.1% had a university education, while 20.2% had completed secondary education and 9.7% had higher professional training (associate degree); 86.26% were operating in the tertiary sector, 9.7% in the secondary sector and 3.8% in the primary sector, respectively. In addition, 53.1% had no previous experience and 33.3% perceived a high level of competition. Finally, 48.5% intended to carry out their project alone, without being part of a team.

Measurement of variables

Dependent variable

In line with previous studies on nascent entrepreneurship using PSED II data (eg., Gartner & Liao, 2012), new venture creation has been measured as a dichotomous variable, which was assigned the value 1 if the entrepreneur had successfully created the new venture, and 0 if he or she had abandoned the business gestation. We measure new venture creation from the harmonised PSED II dataset.Footnote 1

High growth expectations

Were assessed according to the items that have been used in the entrepreneurship literature. Thus, we followed Edelman et al. (2010), Cassar (2007) and Stewart et al. (1998), who used the following dichotomous measure - Which of the following two statements describes your preference for the future size of this business: (1) I want the business to be as large as possible (coded as 1); and (2) I want a size that I can manage myself or with few employees (coded as 0). These two questions are reported in the PSED II project and have been used by several authors to measure high growth expectations in nascent entrepreneurs (e.g., Edelman et al., 2010; Gartner & Liao, 2012).

Competitive innovation

To measure this variable with PSED II, we followed BarNir (2014). The measure reflects the importance of innovation for the entrepreneur's competitive advantage, and it is based on respondents' assessment of the following aspects for the new venture to be an effective competitor: being the first to market a new product (AF4); technical and scientific expertise (AF8); development of new and advanced process or product technology for the creation of goods and services (AF9); development of intellectual property such as patents, copyrights, or trademarks (AF10). These items are measured on a 5-point Likert-type scale ranging from 1 (strongly disagree) to 5 (strongly agree), and the Cronbach Alpha is 0.735. To obtain the measure, we have used the median of these three items.Footnote 2

Entrepreneurial effort

In line with previous studies of nascent entrepreneurship using PSED II data (Vilanova & Vitanova, 2020; Hopp & Sonderegger, 2015; Renko et al., 2012; Edelman & Yli-Renko, 2010), we measure entrepreneurial effort as the total number of activities performed by the nascent entrepreneur during the start-up process.

In this study, we include a set of control variables. Firstly, we included a set of socio-demographic variables (Cassar & Friedman, 2009): sex (1 male, 0 female), age, and education (continuous variables). PSED II shows that more than 45% of new firms are created by teams (Martínez et al., 2011). Accordingly, and considering also that this factor might determine the effort invested in the start-up process (Cerqueti et al., 2020) and business creation (Lukes & Zouhar, 2016), we considered whether the entrepreneur was conducting the venture gestation process alone or as part of an entrepreneurial team, by measuring the number of persons in the start-up team. Third, consistent with Vilanova and Vitanova (2020), Hechavarria et al. (2012), and Delmar and Shane (2003), we consider the perceived level of competition (assessed on three measures: high, medium, and low), assuming that a high level of competition is a potentially adverse factor for new venture creation (Khan et al., 2014). In addition, we consider previous entrepreneurial experience (measured as the number of previously created firms), as it may influence the effort an entrepreneur invests in the gestation process (Tietz et al., 2018). Finally, we included the sector activity undertaken which was measured through dummy variables for the primary, secondary, and tertiary sectors, taking the primary sector as the reference category.

Analysis and results

Table 1 shows the descriptive statistics and correlations, which show that new venture creation is positively correlated with entrepreneurial effort (p < 0.01) and with the educational level of the nascent entrepreneurs (p < 0.05). As for the independent variables, high growth expectations are positively correlated with entrepreneurial effort (p < 0.05) and competitive innovation (p < 0.01). In addition, high growth expectations are negatively correlated with age (p < 0.01) and perceived level of competition (p < 0.01). This latter is also negatively correlated with competitive innovation (p < 0.01).

Given the dependent variable is measured as a binary scale in the structural model, the proposed hypotheses were tested using generalised structural equation modelling (GSEM using Stata 16). Therefore, we specified that part of the GSEM model as a logit regression (e.g., Stephan et al., 2023). GSEMFootnote 3 is appropriate when we use SEM with continuous and discrete (e.g., binary and ordinary) variables (Honjo et al., 2022). All relationships are tested jointly, as GSEM simultaneously considers both direct (H1, H3) and indirect (H2, H4) effects of the structural model (Preacher et al., 2010).

The results are shown in Tables 2 and 3. Table 2 shows the results of the direct effects of the GSEM model (H1 and H3), estimating the probability of new venture creation in the gestation process (H1, H3). As the results show, high growth expectations do not directly influence the creation of the new firm in the start-up process (Exp = 0.844, p > 0.1), therefore, we cannot confirm hypothesis 1 (H1). In addition, competitive innovation is also not directly related to new venture creation (Exp = 0.890, p > 0.1), so we cannot confirm hypothesis 3 (H3) either.

As for the indirect relationships (H2 and H4), Table 3 shows the indirect effects of the high growth expectations and competitive innovation on new venture creation in nascent entrepreneurs. The results show that high growth expectations are indirectly related to new venture creation through the mediating effect of the entrepreneurial effort that the nascent entrepreneur invests in the start-up process (Exp = 1.400, CI: 0.994, 1.795), therefore, we accept hypothesis 2 (H2) of the present study. These results provide evidence for full mediation (Hair et al., 2017; Zhao et al., 2010), since as indicated above, the direct effect (H1) was non-significant. In concrete terms, the high growth expectations increase the probability of new venture creation by 40.0% through entrepreneurial effort that these expectations induce in nascent entrepreneurs.

Once we have found evidence of the existence of a mechanism between high growth expectations and entrepreneurial effort in determining the new venture creation in nascent entrepreneurs, we tested if this mechanism may act as a mediator between competitive innovation and the creation of a new firm. Regarding competitive innovation, while the direct effect is non-significant (H2), the results show a significant and positive double mediation effect (Exp = 1.326, CI: 1.003, 1.649). Therefore, competitive innovation is indirectly related to new venture creation through the indirect effect between high growth expectations and entrepreneurial effort, so we accept hypothesis 4 (H4). These results provide evidence that the effect is indirect and transmitted through the mechanism established between growth expectations and entrepreneurial effort. In concrete terms, competitive innovation increases the probability of new venture creation by 32.6%, through the mechanism triggered by high growth expectations (Fig. 2).

Discussion and implications

Discussion

The main objective of this study is to improve our understanding of the key role that competitive innovation plays in the nascent entrepreneurial process, and the mechanisms that it triggers through high growth expectations. This can help to a better understanding of nascent entrepreneurial dynamics because innovation favourably influences high-growth expectations (Estrin et al., 2022; Poblete, 2018). Regarding the relationship between growth expectations and new venture creation, there are arguments both for and against, and the previous literature suggests having a better understanding of these expectations in entrepreneurs (e.g., Fuentelsaz et al., 2023; Szerb & Vörös, 2021; Poblete, 2018; Lecuna et al., 2017).

Furthermore, in the field of nascent entrepreneurship, we have not found evidence about how high growth expectations determine the new venture creation in nascent entrepreneurs, and the discussion is not clear (Gartner & Liao, 2012). Therefore, in the present study, based on expectancy theory, we analyse how high growth expectations influence venture creation through entrepreneurial effort. Additionally, we explore how the relationship established between competitive innovation and high growth expectations explains the creation of a new firm, through the mechanism triggered by such expectations.

The results confirm that high growth expectations do not have a direct influence on new venture creation, which is consistent with the results obtained by Gartner and Liao (2012). However, we confirm that high growth expectations have a favourable indirect relationship with new venture creation through entrepreneurial effort. This result fits well with some authors (e.g., Fuentelsaz et al., 2021; Szerb & Vörös, 2021) that suggest that entrepreneurs with high growth expectations tend to be overconfident, and this overconfidence is favourable during the early stages of the entrepreneurial process (Hayward et al., 2006). In line with this, Kraft et al. (2022) have corroborated that overconfidence was positively associated with new venture creation.

Finally, competitive innovation does not influence directly new venture creation, however, it has an indirect influence through a double mediation between high growth expectations and entrepreneurial effort. This result is in line with previous authors (e.g., Estrin et al., 2022; Lecuna et al., 2017; Poblete, 2018; Saeedikiya et al., 2022) who suggest that innovation influences entrepreneurs' growth expectations. Furthermore, some authors (e.g., Fuentelsaz et al., 2021; Muñoz-Bullón, et al., 2019) have recommended considering innovation to explain the role that high growth expectations play in the entrepreneurial process and this study corroborates that the relationship between competitive innovation and high growth expectations explains the new venture creation through entrepreneurial effort.

Theoretical and practical implications

Theoretical implications

One of the main theoretical implications of this study is that we extend the use of expectancy theory to clarify the mechanism that explains the creation of a new venture by considering the role played by high growth expectations. Additionally, we analyze the effect that competitive innovation has on business creation through the mechanism triggered by such expectations. Although previous authors (e.g., Estrin et al., 2022; Poblete, 2018; Saeedikiya et al., 2022) have confirmed a positive relationship between innovation and high growth expectations, we still do not know if this relationship has any implications for the new venture creation in the start-up process.

In previous literature, the effect of high growth expectations and innovation on the entrepreneurial process has been explored separately. For example, Fuentelsaz et al. (2021) determined that high growth aspirations do not favor the survival of companies and make it difficult for entrepreneurs to re-enter the entrepreneurial process after leaving it (Fuentelsaz et al., 2023). Furthermore, Kraft et al. (2022) confirmed that overconfidence negatively influences entrepreneurial performance in later stages after creating a new venture and is also related to innovation. Although high growth expectations and overconfidence are related (Hayward et al., 2006), we still do not know how these expectations affect the creation of a new venture and how the relationship that it maintains with competitive innovation determines the favorable outcome of the gestation process.

Therefore, based on expectancy theory, in theoretical terms, we analyse how competitive innovation and high growth expectations influence new venture creation (Vroom, 1964). Therefore, with this study, we contribute to a better understanding of the nascent entrepreneurial process by clarifying the relationship between growth expectations and the creation of the new firm, where the effort triggered by these expectations favours the creation of the new firm. Moreover, Fuentelsaz et al. (2021) stress the need to have a deeper understanding of how high growth expectations influence the entrepreneurial process considering other types of variables such as innovation. The relationship established between competitive innovation and high growth expectations could offer a much deeper discussion of the role that these variables play in nascent entrepreneurial dynamics (Muñoz-Bullón et al., 2019).

Practical implications

In practical terms, our findings may be useful for those institutions responsible for designing policies and programs that foster long-term sustained growth by creating new firms. Our results show that competitive innovation determines high growth expectations in nascent entrepreneurs, which in turn favour the creation of a new firm through the effort that such expectations trigger. Therefore, fostering innovation in the early stages of the entrepreneurial process may be favourable for the nascent entrepreneur to achieve his or her goal of creating a new firm. However, in the later stages of the nascent entrepreneurial stage, growth expectations can be harmful, thereby favouring entrepreneurial exit (Fuentelsaz et al., 2021) due to the bias that they produce in decision-making (Hayward et al., 2006). Kraft et al. (2022) confirm that overconfidence, which is related to innovation, favours the creation of a new firm during the early stage of the entrepreneurial process, and although its effect becomes negative in the later stages of business creation. This is in line with Hyytinen et al. (2015), who found that innovation is negatively correlated with firm survival. Therefore, encouraging innovation cannot be considered insurance against failure, so some caution should be taken with the most optimistic entrepreneurs and training should be provided in this regard (Poblete, 2018).

Limitations and future lines of research

Previous studies consider that context plays a key role in shaping entrepreneurs' high-growth expectations. Government activity, as well as the regulatory and legal framework, influence the high growth expectations of entrepreneurs (Estrin et al., 2013; Troilo, 2011). In addition, the context not only influences entrepreneurs' high-growth expectations but also their competitive innovation. Koellinger (2008) argues that innovation depends both on individual factors, such as educational level, unemployment, and self-confidence, as well as on the environment in which the individual acts. Therefore, one of the limitations of this study is that it does not consider the role that contextual factors may play in the relationship between competitive innovation and high growth expectations in nascent entrepreneurs.

Finally, the limitations we present can be considered for the development of future lines of research. As an example, future research should focus on analysing how formal and informal institutions (North, 1991) influence the high growth expectations in nascent entrepreneurs. Furthermore, the effect of institutions on the relationship between competitive innovation and high growth expectations should also be analysed (e.g., Estrin et al., 2022; Poblete, 2018; Saeedikiya et al., 2022). In this paper, we corroborate that competitive innovation influences new venture creation through high growth expectations and entrepreneurial effort, and it would be interesting to test if the perception of the institutional context has any contingent effect on this mechanism. Finally, future research should consider the possible contingent role of some personal factors, such as entrepreneurial self-efficacy (Chen et al., 1998) or risk-taking propensity (e.g., Gartner & Liao, 2012).

Availability of data and materials

The datasets analyzed during the current study are available in the [Panel Study of Entrepreneurial Dynamics] repository, [http://www.psed.isr.umich.edu/psed/home].

Code availability

Not applicable.

Notes

Reynolds and Curtin (2008) recommend using the PSED project in conjunction with the PSED harmonized database, as the latter provides a set of harmonized measures of transitions and outcomes for all PSED II cases. The PSED harmonized provides standardized measures such as the conception point time, and outcome measures of the creation process, such as a new firm, still active in business gestation, or abandonment, among others.

In some cases, the nascent entrepreneur responds with "Not Relevant" to one of the three items that make up the measure. Therefore, we assigned a value of 0 to that item when calculating the mean of the three components.

When we use GSEM command in Stata, we cannot present standard goodness of fit measures. The main problem is that Stata does not calculate standard goodness of statistics for GSEM models because these standard goodness of fit measures are not appropriate for models with binary variables (Boudreaux et al., 2022).

References

Al-Mamary, Y. H., & Alshallaqi, M. (2022). Impact of autonomy, innovativeness, risk-taking, proactiveness, and competitive aggressiveness on students’ intention to start a new venture. Journal of Innovation & Knowledge, 7(4), 100239.

Audretsch, D. B., Coad, A., & Segarra, A. (2014). Firm growth and innovation. Small Business Economics, 43, 743–749.

Baregheh, A., Rowley, J., & Sambrook, S. (2009). Towards a multidisciplinary definition of innovation. Management Decision, 47(8), 1323–1339.

BarNir, A. (2014). Pre-venture managerial experience and new venture innovation: An opportunity costs perspective. Management Decision, 52(10), 1981–2001.

Boudreaux, C., Clarke, G., & Jha, A. (2022). Social capital and small informal business productivity: The mediating roles of financing and customer relationships. Small Business Economics, 59(3), 955–976.

Brancati, E., Brancati, R., Guarascio, D., & Zanfei, A. (2022). Innovation drivers of external competitiveness in the great recession. Small Business Economics, 58(3), 1497–1516.

Brockner, J. (1992). The escalation of commitment to a failing course of action: Toward theoretical progress. Academy of Management Review, 17(1), 39–61.

Bulanova, O., Isaksen, E. J., & Kolvereid, L. (2016). Growth aspirations among women entrepreneurs in high growth firms. Baltic Journal of Management, 11(2), 187–206.

Capelleras, J. L., Contin-Pilart, I., Larraza-Kintana, M., & Martin-Sanchez, V. (2019). Entrepreneurs’ human capital and growth aspirations: The moderating role of regional entrepreneurial culture. Small Business Economics, 52(1), 3–25.

Cassar, G. (2006). Entrepreneur opportunity costs and intended venture growth. Journal of Business Venturing, 21(5), 610–632.

Cassar, G. (2007). Money, money, money? A longitudinal investigation of entrepreneur career reasons, growth preferences and achieved growth. Entrepreneurship and Regional Development, 19(1), 89–107.

Cassar, G. (2010). Are individuals entering self-employment overly optimistic? An empirical test of plans and projections on nascent entrepreneur expectations. Strategic Management Journal, 31(8), 822–840.

Cassar, G., & Friedman, H. (2009). Does self-efficacy affect entrepreneurial investment? Strategic Entrepreneurship Journal, 3(3), 241–260.

Cerqueti, R., Lucarelli, C., Marinelli, N., & Micozzi, A. (2020). Teams in new ventures: Gender, human capital and motivation. International Journal of Gender and Entrepreneurship, 12(2), 145–171. https://doi.org/10.1108/IJGE-07-2019-0115

Chen, C. C., Greene, P. G., & Crick, A. (1998). Does entrepreneurial self-efficacy distinguish entrepreneurs from managers? Journal of Business Venturing, 13(4), 295–316. https://doi.org/10.1016/S0883-9026(97)00029-3

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal, 55(4), 976–997.

Cliff, J. E. (1998). Does one size fit all? Exploring the relationship between attitudes towards growth, gender, and business size. Journal of Business Venturing, 13(6), 523–542.

Davidsson, P., & Henrekson, M. (2002). Determinants of the prevalance of start-ups and high-growth firms. Small Business Economics, 19(2), 81–104.

Davidsson, P., Kirchhoff, B., & Hatemi–j, A., & Gustavsson, H. (2002). Empirical analysis of business growth factors using Swedish data. Journal of Small Business Management, 40(4), 332–349.

Delmar, F., & Shane, S. (2003). Does business planning facilitate the development of new ventures? Strategic Management Journal, 24(12), 1165–1185.

Edelman, L. F., Brush, C. G., Manolova, T. S., & Greene, P. G. (2010). Start-up motivations and growth intentions of minority nascent entrepreneurs. Journal of Small Business Management, 48(2), 174–196.

Edelman, L., & Yli-Renko, H. (2010). The impact of environment and entrepreneurial perceptions on venture-creation efforts: Bridging the discovery and creation views of entrepreneurship. Entrepreneurship Theory and Practice, 34(5), 833–856.

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2013). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28(4), 564–580.

Estrin, S., Korosteleva, J., & Mickiewicz, T. M. (2022). Schumpeterian entry: Innovation, exporting, and growth aspirations of entrepreneurs. Entrepreneurship Theory and Practice, 46(2), 269–296.

Ferreira, J. J., Fernandes, C. I., & Ratten, V. (2017). Entrepreneurship, innovation and competitiveness: What is the connection? International Journal of Business and Globalisation, 18(1), 73–95.

Fischer, E., & Reuber, A. R. (2003). Support for rapid-growth firms: A comparison of the views of founders, government policymakers, and private sector resource providers. Journal of Small Business Management, 41(4), 346–365.

Friar, J. H., & Meyer, M. H. (2003). Entrepreneurship and start-ups in the Boston region: Factors differentiating high-growth ventures from micro-ventures. Small Business Economics, 21(2), 145–152.

Fuentelsaz, L., González, C., & Maícas, J. P. (2021). High-growth aspiration entrepreneurship and exit: The contingent role of market-supporting institutions. Small Business Economics, 57(1), 473–492.

Fuentelsaz, L., González, C., & Mickiewicz, T. (2023). Entrepreneurial growth aspirations at re-entry after failure. International Journal of Entrepreneurial Behavior & Research, 29(2), 297–327.

Gartner, W. B., & Carter, N. M. (2003). Entrepreneurial behavior and firm organizing processes. In Handbook of entrepreneurship research (pp. 195–221). Boston, MA: Springer.

Gartner, W., & Liao, J. (2012). The effects of perceptions of risk, environmental uncertainty, and growth aspirations on new venture creation success. Small Business Economics, 39(3), 703–712.

Gatewood, E. J. (2004). Entrepreneurial expectancies. In W. B. Gartner, K. G. Shaver, N. M. Carter, & P. D. Reynolds (Eds.), The handbook of entrepreneurial dynamics: The process of business creation. Thousand Oaks, CA: Sage.

Gatewood, E. (1993). The expectancies in public sector venture assistance. Entrepreneurship Theory and Practice, 17(2), 91–95.

Gatewood, E. J., Shaver, K. G., Powers, J. B., & Gartner, W. B. (2002). Entrepreneurial expectancy, task effort, and performance. Entrepreneurship Theory and Practice, 27(2), 187–206.

Guerrero, M., Mickiewicz, T., & Qin, F. (2024). Entrepreneurial growth aspirations during the COVID-19 pandemic: The role of ICT infrastructure quality versus policy response. Entrepreneurship & Regional Development, 36(1–2), 55–75.

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662–676.

Hair, J. F., Jr., Sarstedt, M., Ringle, C. M., & Gudergan, S. P. (2017). Advanced issues in partial least squares structural equation modeling. Thousand Oaks, CA: SAGE publications.

Hakkert, R., & Kemp, R. G. M. (2006). An Ambition to Grow. EIM Business and Policy Research.

Hanifzadeh, F., Talebi, K., & Sajadi, S. M. (2018). The analysis of effect of aspiration to growth of managers for SMEs growth case study: Exporting manufacturing SMEs in Iran. Journal of Entrepreneurship in Emerging Economies, 10(2), 2053–5604.

Hayward, M. L., Forster, W. R., Sarasvathy, S. D., & Fredrickson, B. L. (2010). Beyond hubris: How highly confident entrepreneurs rebound to venture again. Journal of Business Venturing, 25(6), 569–578.

Hayward, M. L., Shepherd, D. A., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52(2), 160–172.

Hechavarria, D. M., Renko, M., & Matthews, C. H. (2012). The nascent entrepreneurship hub: Goals, entrepreneurial self-efficacy and start-up outcomes. Small Business Economics, 39(3), 685–701.

Hermans, J., Vanderstraeten, J., Van Witteloostuijn, A., Dejardin, M., Ramdani, D., & Stam, E. (2015). Ambitious entrepreneurship: A review of growth aspirations, intentions, and expectations. Entrepreneurial growth: Individual, Firm, and Region. pp. 127–160.

Heunks, F. J. (1998). Innovation, creativity and success. Small Business Economics, 10(3), 263–272.

Honig, B., & Hopp, C. (2019). Learning orientations and learning dynamics: Understanding heterogeneous approaches and comparative success in nascent entrepreneurship. Journal of Business Research, 94, 28–41.

Honjo, Y., Ikeuchi, K., & Nakamura, H. (2022). The mediating effect of financial motives in the association between entrepreneurial experience and subjective well-being: Evidence from Japan. Applied Research in Quality of Life, 17, 1043–1067.

Hopenhayn, H., & Vereshchagina, G. (2003). Risk taking by entrepreneurs. University of Rochester.

Hopp, C., & Sonderegger, R. (2015). Understanding the dynamics of nascent entrepreneurship-prestart-up experience, intentions, and entrepreneurial success. Journal of Small Business Management, 53(4), 1076–1096.

Hopp, C., & Stephan, U. (2012). The influence of socio-cultural environments on the performance of nascent entrepreneurs: Community culture, motivation, self-efficacy and start-up success. Entrepreneurship and Regional Development, 24(9), 917–945. https://doi.org/10.1080/08985626.2012.742326

Hyytinen, A., Pajarinen, M., & Rouvinen, P. (2015). Does innovativeness reduce startup survival rates? Journal of Business Venturing, 30(4), 564–581.

Khan, S. A., Tang, J., & Joshi, K. (2014). Disengagement of nascent entrepreneurs from the start-up process. Journal of Small Business Management, 52(1), 39–58.

Koellinger, P. (2008). Why are some entrepreneurs more innovative than others? Small Business Economics, 31(1), 21–37.

Kolvereid, L. (1992). Growth aspirations among Norwegian entrepreneurs. Journal of Business Venturing, 7(3), 209–222.

Kraft, P. S., Günther, C., Kammerlander, N. H., & Lampe, J. (2022). Overconfidence and entrepreneurship: A meta-analysis of different types of overconfidence in the entrepreneurial process. Journal of Business Venturing, 37(4), 106207.

Laffineur, C., Barbosa, S. D., Fayolle, A., & Montmartin, B. (2020). The unshackled entrepreneur: Occupational determinants of entrepreneurial effort. Journal of Business Venturing, 35(5), 105983.

Lecuna, A., Cohen, B., & Chavez, R. (2017). Characteristics of high-growth entrepreneurs in Latin America. International Entrepreneurship and Management Journal, 13, 141–159.

Lee, C. K., Cottle, G. W., Simmons, S. A., & Wiklund, J. (2021). Fear not, want not: Untangling the effects of social cost of failure on high-growth entrepreneurship. Small Business Economics, 57, 531–553.

Lerner, J. (2010). The future of public efforts to boost entrepreneurship and venture capital. Small Business Economics, 35(3), 255–264.

Levie, J., & Autio, E. (2013). Growth and Growth Intentions. White Paper, 1, 159–183.

Lichtenstein, B. B., Carter, N. M., Dooley, K. J., & Gartner, W. B. (2007). Complexity dynamics of nascent entrepreneurship. Journal of Business Venturing, 22(2), 236–261.

Liñán, F., Rodríguez-Cohard, J. C., & Rueda-Cantuche, J. M. (2011). Factors affecting entrepreneurial intention levels: A role for education. International Entrepreneurship and Management Journal, 7(2), 195–218. https://doi.org/10.1007/s11365-010-0154-z

Lukes, M., & Zouhar, J. (2016). The causes of early-stage entrepreneurial discontinuance. Prague Economic Papers, 2016(1), 19–36.

Manolova, T. S., Brush, C. G., & Edelman, L. F. (2008). What do women entrepreneurs want? Strategic Change, 17(3–4), 69–82.

Manolova, T. S., Carter, N. M., Manev, I. M., & Gyoshev, B. S. (2007). The differential effect of men and women entrepreneurs’ human capital and networking on growth expectancies in Bulgaria. Entrepreneurship Theory and Practice, 31(3), 407–426.

Martínez, M. A., Yang, T., & Aldrich, H. E. (2011). Entrepreneurship as an evolutionary process: Research progress and challenges. Entrepreneurship Research Journal, 1(1), 1–26. https://doi.org/10.2202/2157-5665.1009

Martínez-Fierro, S., Biedma-Ferrer, J. M., & Ruiz-Navarro, J. (2020). Impact of high-growth start-ups on entrepreneurial environment based on the level of national economic development. Business Strategy and the Environment, 29(3), 1007–1020.

Matthews, C. H., & Brueggemann, R. F. (2015). Innovation and entrepreneurship: A competency framework. New York: Routledge.

McKelvie, A., Brattström, A., & Wennberg, K. (2017). How young firms achieve growth: Reconciling the roles of growth motivation and innovative activities. Small Business Economics, 49(2), 273–293.

Mohand-Amar, S., Ruiz-Arroyo, M., & Fuentes-Fuentes, M. D. M. (2022). The relationship between cognitive and contextual factors: A self-regulatory mechanism underlying persistence in nascent entrepreneurs. Entrepreneurship Research Journal.

Mueller, B. A., & Shepherd, D. A. (2016). Making the most of failure experiences: Exploring the relationship between business failure and the identification of business opportunities. Entrepreneurship Theory and Practice, 40(3), 457–487.

Muñoz-Bullón, F., Sanchez-Bueno, M. J., & Nordqvist, M. (2019). Growth intentions in family-based new venture teams: The role of the nascent entrepreneur’s R&D behavior. Management Decision, 58(6), 1190–1209.

North, D. C. (1991). Institutions, transaction costs, and the rise of merchant empires. The Political Economy of Merchant Empires. https://doi.org/10.1017/CBO9780511665288.002

Poblete, C. (2018). Growth expectations through innovative entrepreneurship: The role of subjective values and duration of entrepreneurial experience. International Journal of Entrepreneurial Behavior & Research, 24(1), 191–213. https://doi.org/10.3389/fpsyg.2022.831058

Poblete, C. (2022). The joint effects of hubris, growth aspirations, and entrepreneurial phases for innovative behavior. Frontiers in Psychology, 13. https://doi.org/10.3389/fpsyg.2022.831058

Pradhan, R. P., Arvin, M. B., Nair, M., & Bennett, S. E. (2020). The dynamics among entrepreneurship, innovation, and economic growth in the Eurozone countries. Journal of Policy Modeling, 42(5), 1106–1122.

Preacher, K. J., Zyphur, M. J., & Zhang, Z. (2010). A general multilevel SEM framework for assessing multilevel mediation. Psychological Methods, 15(3), 209.

Ramawati, Y., Sudiro, A., & Rochman, F. (2020). Understanding entreprenuerial intention: A mediation effect of entreprenuerial motivation on perceived desirability to new venture creation intention. International Journal of Entrepreneurship, 24(4), 1–11.

Rauch, A., & Frese, M. (2007). Let’s put the person back into entrepreneurship research: A meta-analysis on the relationship between business owners’ personality traits, business creation, and success. European Journal of Work and Organizational Psychology, 16(4), 353–385.

Renko, M., Kroeck, K. G., & Bullough, A. (2012). Expectancy theory and nascent entrepreneurship. Small Business Economics, 39(3), 667–684.

Reynolds, P. D. (2007). Entrepreneurship in the United States: The future is now. New York: Springer Science & Business Media.

Reynolds, P. D. (2018). US PSED data sets. Business Creation (pp. 153–164). Edward Elgar Publishing.

Reynolds, P. D. (2017). When is a firm born? Alternative Criteria and Consequences. Business Economics, 52(1), 41–56.

Reynolds, P. D., & Curtin, R. T. (2008). Business creation in the United States. Foundations and Trends in Entrepreneurship, 4(3), 155–307. https://doi.org/10.1561/0300000022

Ribeiro-Soriano, D. (2017). Small business and entrepreneurship: Their role in economic and social development. Entrepreneurship & Regional Development, 29(2), 1–3.

Robinson, A. T., & Marino, L. D. (2015). Overconfidence and risk perceptions: Do they really matter for venture creation decisions? International Entrepreneurship and Management Journal, 11(1), 149–168.

Robson, P. J., & Bennett, R. J. (2000). SME growth: The relationship with business advice and external collaboration. Small Business Economics, 15(3), 193–208.

Rosenbusch, N., & Bausch, A. (2005). Does innovation really matter? a meta-analysis on the relationship between innovation and business performance. Babson Kauffman Entrepreneurship Research Conference. Wellesley.

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(4), 441–457.

Rotefoss, B., & Kolvereid, L. (2005). Aspiring, nascent and fledgling entrepreneurs: An investigation of the business start-up process. Entrepreneurship & Regional Development, 17(2), 109–127.

Saeedikiya, M., Li, J., Ashourizadeh, S., & Temiz, S. (2022). Innovation affecting growth aspirations of early-stage entrepreneurs: Culture and economic freedom matter. Journal of Entrepreneurship in Emerging Economies, 14(1), 45–64.

Schumpeter, J. (1934). The theory of economic development. Transaction Publishers.

Segal, G., Borgia, D., & Schoenfeld, J. (2005). The motivation to become an entrepreneur. International Journal of Entrepreneurial Behavior & Research, 11(1), 42–57.

Sims, R. L., & Chinta, R. (2020). The mediating role of entrepreneurial ambition in the relationship between entrepreneurial efficacy and entrepreneurial drive for female nascent entrepreneurs. Gender in Management: An International Journal, 35(1), 76–91.

Smallbone, D., Baldock, R., & Burgess, S. (2002). Targeted support for high-growth start-ups: Some policy issues. Environment and Planning C: Government and Policy, 20(2), 195–209.

Spescha, A., & Woerter, M. (2019). Innovation and firm growth over the business cycle. Industry and Innovation, 26(3), 321–347.

Stam, E., Suddle, K., Hessels, J., & Van Stel, A. (2009). High-Growth Entrepreneurs, Public Policies, and Economic Growth. In J. Leitao & R. Baptista (Eds.), Public Policies for Fostering Entrepreneurship: A European Perspective International Studies in Entrepreneurship series, 22 (pp. 91–110). New York, NY USA: Springer Science.

Staw, B. M. (1981). The escalation of commitment to a course of action. Academy of Management Review, 6(4), 577–587.

Stayton, J., & Mangematin, V. (2019). Seed accelerators and the speed of new venture creation. The Journal of Technology Transfer, 44(4), 1163–1187.

Stephan, U., Zbierowski, P., Pérez-Luño, A., Wach, D., Wiklund, J., Alba Cabañas, M., ... & Zahid, M. M. (2023). Act or wait-and-see? Adversity, agility, and entrepreneur wellbeing across countries during the Covid-19 pandemic. Entrepreneurship Theory and Practice, 47(3), 682–723.

Stewart, W. H., Jr., & Roth, P. L. (2001). Risk Propensity Differences Between Entrepreneurs and Managers: A MetaAnalytic Review. Journal of Applied Psychology, 86, 145–153.

Stewart, W. H., Watson, W. E., Carland, J. C., & Carland, J. W. (1998). A Proclivity for Entrepreneurship: A Comparison of Entrepreneurs, Small Business Owners, and Corporate Managers. Journal of Business Venturing, 14(2), 189–214.

Szerb, L., & Vörös, Z. (2021). The changing form of overconfidence and its effect on growth expectations at the early stages of startups. Small Business Economics, 57, 151–165.

Terjesen, S., & Szerb, L. (2008). Dice thrown from the beginning? An empirical investigation of determinants of firm level growth expectations. Estudios de economía, 35(2), 153–178.

Tietz, M. A., Lejarraga, J., & Pindard-Lejarraga, M. (2018). Getting your hopes up but not seeing them through? Experiences as determinants of income expectations and persistence during the venturing process. Journal of Small Business Management, 59(1), 136–161. https://doi.org/10.1111/jsbm.12472

Timmons, J. A., Spinelli, S., & Tan, Y. (2004). New venture creation: Entrepreneurship for the 21st century. New York, N.Y.: McGraw-Hill/Irwin.

Trevelyan, R. (2008). Optimism, overconfidence and entrepreneurial activity. Management Decision, 46(7), 986–1001.

Troilo, M. (2011). Legal institutions and high-growth aspiration entrepreneurship. Economic Systems, 35(2), 158–175.

Varadarajan, R. (2018). Innovation, innovation strategy, and strategic innovation. Innovation and Strategy: Review of Marketing Research, 15, 143–166.

Vilanova, L., & Vitanova, I. (2020). Unwrapping opportunity confidence: How do different types of feasibility beliefs affect venture emergence? Small Business Economics, 55(1), 215–236.

Vroom, V. H. (1964). Work and motivation. Wiley.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13(1), 27–56. https://doi.org/10.2307/40229031

Wiklund, J., Davidsson, P., & Delmar, F. (2003). What do they think and feel about growth? An expectancy–value approach to small business managers’ attitudes toward growth. Entrepreneurship Theory and Practice, 27(3), 247–270.

Wiklund, J., & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307–1314.

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, innovation and economic growth: Evidence from GEM data. Small Business Economics, 24(3), 335–350.

Wurthmann, K. (2014). Business students’ attitudes toward innovation and intentions to start their own businesses. International Entrepreneurship and Management Journal, 10(4), 691–711.

Yang, Y., & Danes, S. M. (2015). Resiliency and resilience process of entrepreneurs in new venture creation. Entrepreneurship Research Journal, 5(1), 1–30.

Zhao, X., Lynch, J. G., Jr., & Chen, Q. (2010). Reconsidering Baron and Kenny: Myths and truths about mediation analysis. Journal of Consumer Research, 37(2), 197–206.

Zięba, K. (2017). High growth aspirations of nascent entrepreneurs: Why do they fall? Studia i Materiały, 23, 94–102.

Funding

Funding for open access publishing: Universidad de Granada/CBUA. The authors gratefully acknowledge the financial support of the Spanish Ministry of Science and Innovation (COMPSOS Project PID2020-117313RB-I00), Ministry of Universities (FPU17/03638), the University of Granada and the Programa Operativo FEDER Andalucía (SOSTEMPRE Project B-SEJ-682-UGR20).

Author information

Authors and Affiliations

Contributions

Not applicable.

Corresponding author

Ethics declarations

Conflicts of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mohand-Amar, S., Fuentes-Fuentes, M. & Ruiz-Arroyo, M. The relationship between high growth expectations and new venture creation in nascent entrepreneurs: The key role of competitive innovation. Int Entrep Manag J (2024). https://doi.org/10.1007/s11365-024-00989-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s11365-024-00989-z