Abstract

A cognitive approach for explaining venture creation decisions offers great insights into entrepreneurship research. Examining venture creation decisions from a perspective that considers the cognitive states and perceptions of entrepreneurs further informs the critical role of cognitive constructs in entrepreneurial decision-making. This study provides empirical evidence for a theory of overconfidence that explains why some choose to become entrepreneurs. It explores the interconnections between overconfidence, risk perceptions, and venture creation decisions. More specifically, the growing importance of overconfidence in entrepreneurship encourages an examination of its association with venture creation decisions. Additionally, this research seeks to establish risk perceptions as a mediator for that relationship. Examining these relationships through a psychological perspective contributes to a growing body of entrepreneurial cognition research. This study makes a contribution by providing substantiation for the relationship between overconfidence and venture creation decisions. Equally important, the empirical evidence in this study is the first to provide support for the partially mediating role of risk perceptions. The findings presented here help to provide some insights into understanding why entrepreneurs tend to be more overconfident than non-entrepreneurs, particularly, since overconfidence is positively associated with the decision to start a new venture.

Similar content being viewed by others

References

Alicke, M. D., & Govorun, O. (2005). The better-than-average effect. In M. D. Alicke, D. Dunning, & J. Krueger (Eds.), The self in social judgment (pp. 85–106). New York: Psychology Press.

Anderson, C., Brion, S., Moore, D. A., & Kennedy, A. (2012). A status-enhancement account of overconfidence. Journal of Personality and Social Psychology, 103(4), 718–735.

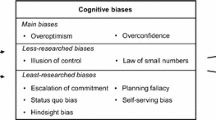

Barnes, J. H., Jr. (1984). Cognitive biases and their impact on strategic planning. Strategic Management Journal, 5, 129–137.

Baron, R. A. (1998). Cognitive mechanisms in entrepreneurship: why and when entrepreneurs think differently than other people. Journal of Business Venturing, 13, 275–294.

Baron, R. A. (2004). The cognitive perspective: a valuable tool for answering entrepreneurship’s basic ‘why’ questions. Journal of Business Venturing, 19(2), 221–239.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182.

Barr, P. S., Stimpert, J. L., & Huff, A. S. (1992). Cognitive change, strategic action, and organizational renewal. Strategic Management Journal, 13, 15–36.

Bazerman, M. H. (1984). Judgment in managerial decision-making (2nd ed.). New York: Wiley.

Bazerman, M. H. (1998). Judgment in managerial decision-making (4th ed.). New York: Wiley.

Bazerman, M. H. (2001). Judgment in managerial decision-making (5th ed.). New York: Wiley

Bernardo, A. E., & Welch, I. (2001). On the evolution of overconfidence and entrepreneurs. Journal of Economics & Management Strategy, 10(3), 301–330.

Buehler, R., Griffin, D., & Ross, M. (1994). Exploring the “planning fallacy”: why people underestimate their task completion times. Journal of Personality and Social Psychology, 67, 366–381.

Busenitz, L. (1999). Entrepreneurial risk and strategic decision-making. Journal of Applied Behavioral Science, 35, 325–340.

Busenitz, L. W., & Barney, J. B. (1997). Biases and heuristics in strategic decision-making: differences between entrepreneurs and managers in large organizations. Journal of Business Venturing, 12(1), 9–31.

Busenitz, L. W., & Lau, C. M. (1997). A cross-cultural cognitive model of new venture creation. Entrepreneurship Theory and Practice, 25–39.

Camerer, C., & Lovallo, D. (1999). Overconfidence and excess entry: an experimental approach. American Economic Review, 89(1), 306–318.

Cardon, M., Foo, M., Shepherd, D., & Wiklund, J. (2012). Exploring the heart: entrepreneurial emotion is a hot topic. Entrepreneurship: Theory and Practice, 36(1), 1–10.

Cassar, G. (2010). Are individuals entering self-employment overly optimistic? An empirical test of plans and projections on nascent entrepreneur expectations. Strategic Management Journal, 31, 822–840.

Chrisman, J. J., Bauerschmidt, A., & Hofer, C. W. (1999). The determinants of new venture performance: an extended model. Entrepreneurship Theory and Practice, 5–29.

Cooper, A. C., Dunkelberg, W. C., & Woo, C. Y. (1988). Entrepreneurs’ perceived chances for success. Journal of Business Venturing, 3(2), 97–108.

Daft, R. L., & Weick, K. E. (1984). Toward a model of organizations as interpretation systems. Academy of Management Review, 9(2), 284–295.

Duhaime, I., & Schwenk, C. R. (1985). Conjectures on cognitive simplification in acquisition and divestment decision making. Academy of Management Review, 10, 287–295.

Dunning, D., Heath, C., & Suls, J. M. (2004). Flawed self-assessment: implications for health, education, and the workplace. Psychological Science in the Public Interest, 5, 69–106.

Edleman, L., & Yli-Renko, H. (2010). The impact of environment and entrepreneurial perceptions on venture-creation efforts: bridging the discovery and creation views of entrepreneurship. Entrepreneurship Theory and Practice, 833–856.

Einhorn, H. J., & Hogarth, R. M. (1978). Confidence in judgment: persistence in the illusion of validity. Psychological Review, 85(5), 395–416.

Estes, W. K. (1975). Handbook of learning and cognitive processes (vol. 1 ed.). Hillsdale: Lawrence-Erlbaum.

Fiske, S. T., & Taylor, S. E. (1991). Social cognition (2nd ed.). New York: McGraw-Hill.

Forbes, D. P. (2005). Are some entrepreneurs more overconfidence than others? Journal of Business Venturing, 20, 623–640.

Forlani, D., & Mullins, J. (2000). Perceived risks and choices in entrepreneurs’ new venture decisions. Journal of Business Venturing, 15, 305–322.

Galasso, A., & Simcoe, T. S. (2011). CEO overconfidence and innovation. Management Science, 1469–1484.

Gartner, W. (1985). A conceptual framework for describing the phenomenon of new venture creation. Academy of Management Review, 10(4), 696–706.

Gervais, S., Heaton, J. B., & Odean, T. (2011). Overconfidence, compensation contracts, and capital budgeting. Journal of Finance, 5, 1735–1777.

Griffin, D. W., & Varey, C. A. (1996). Towards a consensus on overconfidence. Journal of Organizational Behavior and Human Decision Processes, 65(3), 227–231.

Hayton, J., & Cholakova, M. (2012). The role of affect in the creation and intentional pursuit of entrepreneurial ideas. Entrepreneurship: Theory and Practice, 36(1), 41–67.

Hayward, M. L., Shepherd, D., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52(2), 160–172.

Hoelzl, E., & Rustichini, A. (2005). Overconfidence: do you put your money on it? The Economic Journal, 115, 305–315.

Janney, J. J., & Dess, G. G. (2006). The risk concept for entrepreneurs reconsidered: new challenges to the conventional wisdom. Journal of Business Venturing, 21(3), 385–400.

Kahneman, D., & Lovallo, D. (1993). Timid choices and bold forecasts: a cognitive perspective on risk taking. Management Science, 39(1), 17–31.

Keh, H. T., Foo, D. M., & Lim, B. C. (2002). Opportunity evaluation under risky conditions: the cognitive processes of entrepreneurs. Entrepreneurship, Theory and Practice, 125–148.

Klayman, J., Soll, J., Gonzalez-Vallejo, J., & Barlas, S. (1999). Overconfidence: it depends on how, what and whom you ask. Organizational Behavior and Human Decision Processes, 79, 216–247.

Knight, F. H. (1921). Risk, uncertainty, and profit. Boston: Houghton Mifflin.

Koellinger, P., Minniti, M., & Schade, C. (2007). “I think I can, I think I can”: overconfidence and entrepreneurial behavior. Journal of Economic Psychology, 28, 502–527.

Kreye, M. E., Goh, Y. M., Newnes, L. B., & Goodwin, P. (2012). Approaches to displaying information to assist decisions under uncertainty. Omega International Journal of Management Science, 40(6), 682–692.

Krueger, J. I., & Wright, J. C. (2011). Measurement of self-enhancement (and self-protection). In M. D. Alicke & C. Sedikides (Eds.), Handbook of self-enhancement and self-protection (pp. 472–494). New York: Guilford Press.

Kydd, C. T. (1989). Cognitive biases in the use of computer-based decision support systems. Omega International Journal of Management Science, 17(4), 335–344.

Lichtenstein, M. B., & Brush, C. G. (2001). How do “resource bundles” develop and change in new ventures? A dynamic model and longitudinal exploration. Entrepreneurship Theory and Practice, 37–58.

Linan, F., Santos, F. J., & Fernandez, J. (2011). The influence of perceptions on potential entrepreneurs. International Entrepreneurship and Management Journal, 7(3), 373–390.

Lowe, R. A., & Ziedonis, A. A. (2006). Overoptimism and the performance of entrepreneurial firms. Management Science, 52(2), 173–186.

MacCrimmon, K. R., & Wehrung, D. A. (1990). Characteristics of risk-taking executives. Management Science, 36(4), 422–435.

Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. Journal of Finance, 60(6), 2661–2700.

Mitchell, R. K., Buseniz, L. W., Lant, T., McDougall, P. P., Morse, E. A., & Smith, J. B. (2002). Toward a theory of entrepreneurial cognition: rethinking the people side of entrepreneurship research. Entrepreneurship Theory and Practice, 93–104.

Mitchell, R. K., Buseniz, L. W., Lant, T., McDougall, P. P., Morse, E. A., & Smith, J. B. (2004). The distinctive and inclusive domain of entrepreneurial cognition research. Entrepreneurship Theory and Practice, 505–518.

Mitchell, R. K., Buseniz, L. W., Bird, B., Gaglio, C. M., McMullen, J. S., Morse, E. A., & Smith, J. B. (2007). The central question in entrepreneurial cognition research 2007. Entrepreneurship Theory and Practice, 1–27.

Moore, D. A., & Cain, D. M. (2007). Overconfidence and underconfidence: when and why people underestimate (and overestimate) the competition. Organizational Behavior Human Decision Processes, 103(2), 197–213.

Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502–517.

Neisser, U. (1967). Cognitive psychology. New York: Appleton-Century-Crafts.

Nutt, P. C. (1986). Decision style and strategic decisions of top executives. Technological Forecasting and Social Change, 30, 39–62.

Nutt, P. C. (1993). Flexible decision styles and the choices of top executives. Journal of Management Studies, 30(5), 695–721.

Oskamp, S. (1965). Overconfidence in case-study judgments. Journal of Consulting Psychology, 29, 261–265.

Palich, L., & Badgy, D. (1995). Using cognitive theory to explain entrepreneurial risk-taking: challenging conventional wisdom. Journal of Business Venturing, 10(6), 425–438.

Penrose, E. G. (1959). The theory of the growth of the firm. New York: Wiley.

Petrakis, P. E. (2007). The effects of risk and time on entrepreneurship. International Entrepreneurship and Management Journal, 3(3), 277–291.

Podoynitsyna, K., Van der Bij, H., & Song, M. (2012). The role of mixed emotions in the risk perception of novice and serial entrepreneurs. Entrepreneurship: Theory and Practice, 36(1), 115–140.

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: problems and prospects. Journal of Management, 12, 531–544.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88, 879–903.

Russo, J. E., & Schoemaker, P. J. (1992). Managing overconfidence. Sloan Management Review, 23, 7–17.

Sarasvathy, S. D., Menon, A. R., & Kuechle, G. (2011). Failing firms and successful entrepreneurs: serial entrepreneurship as a temporal portfolio. Small Business Economics, 1–16.

Scheier, M. R., & Carver, C. S. (1985). Optimism, coping, and health: assessment and implications of generalized outcome expectancies. Health Psychology, 4, 219–247.

Schenkel, M. T., Matthews, C. H., & Ford, M. T. (2009). Making rational us of ‘irrationality’? Exploring the role of need for cognitive closure in nascent entrepreneurial activity. Entrepreneurship & Regional Development, 21(1), 51–76.

Schwenk, C. R. (1984). Cognitive simplification processes in strategic decision-making. Strategic Management Journal, 5(2), 111–128.

Schwenk, C. R. (1986). Information, cognitive biases, and commitment to a course of action. Academy of Management Review, 11, 298–310.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Shaver, K. G., & Scott, L. R. (1991). Person, process, choice: the psychology of new venture creation. Entrepreneurship: Theory and Practice, 16(2), 23–39.

Simon, H. A. (1955). A behavioral model of rational choice. Quarterly Journal of Economics, 69(1), 99–118.

Simon, H. A. (1976). Bounded rationality and organizational learning. Organization Science, 2(1), 125–134.

Simon, M., & Houghton, S. (2003). The relationship between overconfidence and the introduction of risky products: evidence from a field study. Academy of Management Journal, 46(2), 139–149.

Simon, M., & Shrader, R. (2012). Entrepreneurial actions and optimistic overconfidence: the role of motivated reasoning in new product introductions. Journal of Business Venturing, 27(3), 291–309.

Simon, M., Houghton, S., & Aquino, K. (2000). Cognitive biases, risk perception, and venture formation: how individuals deice to start companies. Journal of Business Venturing, 15(2), 113–134.

Sitkin, S., & Pablo, A. (1992). Reconceptualizing the determinants of risk behavior. Academy of Management Review, 17(1), 9–38.

Sitkin, S., & Weingart, L. (1995). Determinants of risky decision-making behavior: a test of the mediating role of risk perceptions and propensity. Academy of Management Journal, 38(6), 1573–1592.

Steen, E. V. (2011). Overconfidence by Bayesian-rational agents. Management Science, 884–896.

Stevenson, H. H., & Gumpert, D. E. (1985). The heart of entrepreneurship. Harvard Business Review, 63(2), 85–94.

Sutcliffe, K. M. (1994). What executives notice: accurate perceptions in top management teams. Academy of Management Journal, 37(5), 1360–1378.

Svenson, O. (1981). Are we all less risky and more skillful than our fellow drivers? Acta Psychologica, 47(2), 143–148.

Thomas, J. B., & McDaniel, R. R., Jr. (1990). Interpreting strategic issues: effects of strategy and the information-processing structure of top management teams. Academy of Management Journal, 33(2), 286–306.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: heuristics and biases. Science, 185(4157), 1124–1131.

Vogt, W. P. (2007). Quantitative research methods for professionals. Boston: Pearson.

Weick, K. E. (1995). Sensemaking in organizations. Newbury Park: Sage Publications.

Welpe, I. E., Sporrle, M., Grichnik, D., Michl, T., & Audretsch, D. B. (2012). Emotions and opportunities: the interplay of opportunity evaluation, fear, joy, and anger as antecedent of entrepreneurial exploitation. Entrepreneurship: Theory and Practice, 36(1), 691–696.

Willimams, E. F., & Gilovich, T. (2008). Do people really believe they are above average? Journal of Experimental Social Psychology, 44, 1121–1128.

Zacharakis, A., & Shepherd, D. (2001). The nature of information and overconfidence on venture capitalists’ decision making. Journal of Business Venturing, 16, 311–332.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Surveys

Overconfidence survey items

-

1.

How many patents did the U.S. Patent and Trademark Office issue in 1990?

Low estimate: ____________________ High estimate: ____________________

-

2.

How many of Fortune’s 1990 “Global 500,” the world’s biggest industrial corporations (in sales), were Japanese?

Low estimate: ____________________ High estimate: ____________________

-

3.

How many passenger arrivals and departures were there at Chicago’s O’Hare airport in 1989?

Low estimate: ____________________ High estimate: ____________________

-

4.

What was the total audited worldwide daily circulation of the Wall Street Journal during the first half of 1990?

Low estimate: ____________________ High estimate: ____________________

-

5.

How many master’s degrees in business and management were conferred in the United States in 1987?

Low estimate: ____________________ High estimate: ____________________

-

6.

How many passenger deaths occurred worldwide in scheduled commercial airliner accidents in the 1980’s?

Low estimate: ____________________ High estimate: ____________________

-

7.

What is the shortest navigable distance (in statute miles) between New York City and Istanbul?

Low estimate: ____________________ High estimate: ____________________

-

8.

What was General Motors’ total worldwide factory sales of cars and trucks (in units) in the 1980’s?

Low estimate: ____________________ High estimate: ____________________

-

9.

How many German automobiles were sold in Japan in 1989?

Low estimate: ____________________ High estimate: ____________________

-

10.

What was the total U.S. merchandise trade deficit with Japan (in billions) in the 1980’s?

Low estimate: ____________________ High estimate: ____________________

Risk perception survey items

I believe that…

-

1.

The probability of the business’ product introduction doing poorly is very high.

-

2.

The amount the business could lose by introducing new products is substantial.

-

3.

There is great uncertainty when predicting how well the business will do with new product introductions.

-

4.

The overall riskiness of the business’ product introduction is high.

-

5.

Overall, I would label the option of introducing new products as something negative.

-

6.

I would label introducing new products as a potential loss.

-

7.

Introducing a new product will have negative ramifications for the business’ future.

-

8.

There is high probability of the business losing a great deal by introducing new products.

Risk propensity survey items

Select the alternative that you would feel most comfortable with:

-

1.

-

a)

an 80 % chance of winning $400, or

-

b)

receiving $320 for sure

-

a)

-

2.

-

a)

receiving $300 for sure, or

-

b)

20 % chance of winning $1,500

-

a)

-

3.

-

a)

an 90 % chance of winning $200, or

-

b)

receiving $180 for sure

-

a)

-

4.

-

a)

receiving $160 for sure, or

-

b)

10 % chance of winning $1,600

-

a)

-

5.

-

a)

an 50 % chance of winning $500, or

-

b)

receiving $250 for sure

-

a)

Venture creation decision survey items

-

1.

I would start this business.

-

2.

I would forgo other career choices to start this business.

-

3.

I would quit my job to start this business.

Rights and permissions

About this article

Cite this article

Robinson, A.T., Marino, L.D. Overconfidence and risk perceptions: do they really matter for venture creation decisions?. Int Entrep Manag J 11, 149–168 (2015). https://doi.org/10.1007/s11365-013-0277-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-013-0277-0