Abstract

We investigate fat tails and network interconnections of crude oil, gold, stock, and cryptocurrency using seven Bayesian vector heterogeneous autoregression fashions. In this paper, we incorporate parameter uncertainty by using Bayesian VAR models for estimation. To make rational investment decisions, we decompose a network of financial assets and commodity prices into various time horizons to obtain essential insight and knowledge. During the short, medium, and long run, this paper differentiates dynamically between network interlinkages between these markets. We found some noteworthy results in our study. In the first place, network interlinkages exhibit remarkable differences over time. Interlinkages between networks are increased in the short term, medium term, and long term due to transient events occurring in markets during the study period. As a result of the ongoing COVID-19 epidemic, the long-term ties within the system are significantly impacted. Additionally, based on net directional linkages, each market’s role shifts (from sending to receiving shock and vice versa) before the pre-COVID-19 pandemic course, whereas they remain persistent during COVID-19. Observations of short- and medium-term trends reveal that three markets, namely, crude oil, gold, and stock, receive shocks, which are transmitted to these markets by the cryptocurrency market. In terms of long-horizon measures, the results indicate that the gold and cryptocurrency markets persist as shock transmitters. Our findings are critical since policymakers can also design appropriate policies to reduce the vulnerabilities of such markets and prevent risk spread and instability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During the first days of December 2019, Wuhan, China, witnessed the discovery of a virus and disease called coronavirus 19 (COVID-19). Nonetheless, the World Health Organization officially confirmed it for the first time on December 31, 2019. The COVID-19 crisis was declared a global health emergency by the WHO only 1 month after the Emergency Committee met for the second time. As of 11 March 2020, the World Health Organization labeled the virus as a worldwide epidemic due to its spread throughout the globe. Panic and fear gripped the global economy. A 40% drop in the Dow Jones Industrial Average Index has occurred since February 19, 2020, to March 23, 2020, from 29.348 to 18.591. In the same period, S&P 500 (which dropped from 3.386 to 2.237) and indices around the world displayed a similar pattern. A 36% drop in Bitcoin’s price occurred in March 2020, and crude oil prices dropped to a depressed price shortly afterward. Financial catastrophes have not been this bad since the 2008 global financial meltdown, according to many academics.

Energy efficiency and pollution emission reduction are considered integral components of sustainable growth in modern economies (Arslan et al. 2022; Azam et al. 2023; Jackman and Moore 2021; Khan et al. 2022). Based on a database of thirty International Energy Agency (IEA) members, Khan and Hou (2021a, b) demonstrate the critical role that environmental sustainability plays in pollution reduction. Furthermore, environmental sustainability is one of the most important factors in the pursuit of sustainable development goals (Hassan et al. 2022; Khan et al. 2022). Energy security and environmental sustainability play a critical role in alleviating poverty (Taghizadeh-Hesary et al. 2022) and sustainable economic growth (Arslan et al. 2022). In the literature, there is a vast number of empirical studies on determinants of environmental sustainability, such as the role of green innovation (Zakari et al. 2022a); abundant energy resources (Zakari et al. 2022c) and alternative and nuclear energy (Khan et al. 2022); economic growth, international trade, and clean energy investment (Lyu et al. 2021); industrial value-added, capital formation, urbanization, population growth, and biocapacity (Yang and Khan 2021); the energy consumption and tourism growth (Khan and Hou 2021a); or the partnership between countries (Tawiah et al. 2021). A recent study has highlighted the importance of sustainable consumption and production of oil in promoting environmental performance (Hassan and Rousselière 2022; Zakari et al. 2022b). While both determinants and influences of environmental sustainability have attracted much attention from scholars, many aspects of environmental sustainability still require further investigation.

It is extremely vital to comprehend how the value of an underlying asset may fluctuate during an uncertain situation. Behavior of investors, speculative trading decisions, and hedging decisions can be influenced by these predictions about future financial conditions and asset market movements. Uncertain and unpredictable events such as COVID-19 are believed to affect the crude oil, stock, digital currency, and gold market significantly, elevating their volatility. Furthermore, the interlinkages of different markets across time horizons can also be useful for forecasting and portfolio management as agents make decisions based on various time horizons (Barunik et al. 2016). Speculation or hedging purposes might require information pertaining to daily or weekly time frames, for example. In contrast, a risk-averse investor seeking a long-term investment goal will seek information over several months or years in order to guide their investment decisions.

In the literature, metric measures of the relationship, for example, correlation and copulas, as well as Gaussian approximation approach are used to model relationships; nonetheless, neither of these models can adequately represent financial or asset price data, which frequently exhibit scattering and extreme values (Creal et al. 2011). Metrics based on correlation, such as those proposed by Engle and Kelly (2012), follow a pairwise linear model, whereas Acharya et al. (2017) argue that the latter models are Gaussian and linear. As an anomaly, Calabrese and Osmetti (2019) developed a model of copulas that quantifies non-linear tail dependency and accounts for systemic risk. The study as a whole, however, only examines relationships between variables across horizons, as Ellington (2021) pointed out. To fill the gaps, this study applies Bayesian vector heterogeneous autoregressive (BVHAR) methods that are responsible for heteroskedasticity, sequential correlation, and fat tails. The interrelationships among volatility in multiple markets, including crude oil, stock, gold, and cryptocurrency, are what concerns us. The ultimate objective of this study is to determine what effect alternative error covariance patterns have on the markets’ returns relationships. The alternative purpose of the study is to examine how such network interlinkages can be applied by decision-makers. As in Ellington (2021), we employ approaches that are suitable for stochastic volatility, serial dependence, and non-Gaussian errors to derive network interconnections from gradient decompositions in order to obtain only forward-looking networks. By interpreting the variance decomposition matrix of forecast error as an adjacency matrix, Baruník and Křehlík (2018) propose a new paradigm for analyzing financial relationships derived from vector autoregressions (VARs). As in Chan (2020), Corsi’s (2009) heterogeneous autoregression (HAR) is extended to embedded Bayesian multivariate situations using adjustable error covariance structures. As a result of our empirical approach, network interlinkages derived from VAR models are altered, allowing us to correct the persistence inherent in financial and asset price time series.

Four different strands of literature are cited in our paper. In the first place, our work relates to those that utilize diverse approaches to measure network interlinkages. Accordingly, some researchers, including Baruník et al. (2020), rely upon VAR models. On the other hand, others such as Diebold and Yilmaz (2009) and Engle et al. (2012) refer to volatility spillovers as network interactions. Specifically, Barbaglia et al. (2020) utilize VARs with Gaussian error distributions. By using elastic, non-Gaussian error distributions in solely prospective networks, the study contributes to understanding persistence in financial time series.

It is also related to empirical investigations on links between networks and spillovers of volatility (Diebold and Yilmaz 2014; Engle et al. 2012). Alternatively, most studies analyze ex-post volatility, which measures network interlinkages using historical data. As stated by Baruník et al. (2020), focusing on forward-looking volatility metrics provides more insight. The reason for this is that they provide a more accurate forecast of future price movements for the underlying asset. In previous studies, Gaussian error distributions have been abstracted within Diebold and Yilmaz (2014). The only exception is the study of Barbaglia et al. (2020), which employs ex-post volatility. Comparatively to the basic model in the literature, the model with an error covariance structure that incorporates the concept of serial dependence, fat tails, and stochastic variability is examined in this paper.

The last strand involves the quantification of systemic risk and the contagions of financial asset and commodity price volatility, such as Barigozzi et al. (2021) and Yang and Zhou (2017). As a rule, this research estimates volatility spillover or systemic risk across time, which leads to a couple of problems. Firstly, non-parametric estimates impede analysis and complicate calculations since random sampling must be used. Secondly, because these time-domain metrics are averaged over multiple frequencies, they may fail to reveal any frequency-specific relationships. The paper is aimed at expanding the literature in the following ways: (i) we incorporate parameter uncertainty by using Bayesian VAR models for estimation; and (ii) to make rational investment decisions, we decompose a network of financial assets and commodity prices into various time horizons to obtain essential insight and knowledge.

To the best of our knowledge, we are the first to examine the impact of the global uncertainty on the short-run and long-run interconnectedness of volatility of crude oil (WTI), gold, and the stock market. The effects the global uncertainty on the financial market have recently captured academics’ attention in published works. In this article, we are concerned about the impact of the global uncertainty on the volatility of the oil, gold, and cryptocurrency market. Early in March 2020, geopolitical tensions between Saudi Arabia and Russia contributed to price shocks (Corbet Larkin et al. 2020), which might be reflected by the risk component of oil price shocks (Akramc 2020). Our research focuses on the effect of the Ukraine-Russia conflict shocks on the oil industry in the context of the interrelated oil, commodities, and financial markets.

Second, we adopt BVAR to distinguish dynamically between network interlinkages between these markets in the short, medium, and long run. We use this empirical method owing to its many benefits. In particular, this pragmatic approach does not diminish our observation. In addition, the existence of an outlier does not significantly alter our findings; however, our method gives a superior response to parameter changes. The most crucial aspect of our technique is calculating the net pairwise connectivity, which identifies transmission pathways between these commodities and financial markets.

The remaining sections of the study will be shown as the following structure. The Literature review section provides further information about the interlinkages among these markets. Summary statistics and data will be the focus of the Data and methodology section, which presents the methodology. In the Results section, we analyze the research findings, while the Conclusion and policy implications section summarizes the findings.

Literature review

Khan and Hou (2021a) assert that economic growth is often exchanged for environmental sustainability. The quality of the environment is adversely affected by economic development (Khan, Hou, Le, et al. 2021). Khan, Hou, Irfan, Zakari, and Le et al. (2021) demonstrate that there is a strong positive correlation between energy consumption and economic growth, both in the short run and the long run. An analysis of the impacts of natural resources, energy consumption, and certain economic and social factors on environmental quality is presented by Khan, Hou, and Le (2021). New evidence on the association between energy intensity, financial development, and ecological sustainability has been found recently in Asia–Pacific Economic Cooperation countries by Khan et al. (2022) and in OECD countries by Khan, Zakari, Ahmad, et al. (2022). Despite the fact that previous studies have examined both causes and influences of environmental sustainability, they have not fully accounted for the attendants of ecological sustainability. Likewise, there are channels through which the effects of environmental sustainability or other factors on the environment can be expressed or mitigated. The most recent studies have focused more on the interconnection between different markets to explain the source of volatility in a typical market (Adekoya et al. 2022; Antonakakis et al. 2022; Asai et al. 2020; Chatziantoniou et al. 2022; Ha et al., 2022; Le 2022).

Research on linkages among markets, financial assets, and goods on the same market is growing increasingly popular, as indicated in the literature. As a result, based on previous research, Corbet et al. (2019) concluded that cryptocurrencies are valued as tangible financial assets, regardless of the likelihood of illegal usage and the presence of poor or unskilled trading platforms. Also, Kyriazis (2019) examined previous research results on cryptocurrency market fluctuations and spillover effects. Interconnections between the top five digital currencies were analyzed using directional copula dependence by Hyun et al. (2019). Models of GARCH and Bayesian stochastic volatility were utilized by Kim et al. (2021) to examine the connections between different cryptocurrencies as well as to provide evidence of those.

Several previous studies have explored the relationships among various markets as well. Klein et al. (2018) investigated the temporal correlation of gold and Bitcoin based on BEKK-GARCH. The relationship cryptocurrency has with financial assets such as Gold Bullion LBM, S&P US Treasury bond, and the Standard & Poor 500 Composite Index is also examined by Aslanidis et al. (2019). Based on the VARMA-DCC-GJR-GARCH methodology, Guesmi et al. (2019) show that investing in cryptocurrencies can provide investors with additional diversification and hedging opportunities. Cryptocurrencies were also examined as hedges or diversifiers in other empirical studies. Different times and assets are associated with the cryptocurrency market, which determines the function of cryptocurrencies in hedge and diversification strategies. In light of this, Selmi et al. (2018) assessed the effectiveness of gold and BTC in specific market scenarios as hedges or diversifiers. Thus, Bitcoin has become a protection net for downturns in economics and politics. Bitcoin is considered the new gold by Klein et al. (2018). Accordingly, Guesmi et al. (2019) suggest that Bitcoin may lower risks if it is introduced only to three investment types: stocks, gold, and oil. For the purpose of differentiating between gold price shocks and crude oil price shocks, Canh et al. (2019) examined whether cryptocurrencies would dominate the market with the largest capitalization. Their findings revealed little correlation to economic variables, limiting financial investors' diversification. As Bouri et al. (2017) argue, Bitcoin is an effective way to protect against uncertainty, even though unpredictability may harm Bitcoin’s profitability. In an economic downturn, Bouri et al. (2018) considered Bitcoin as a viable tool for diversification. Besides precious metals, Kurka (2019) identified no evidence that digital currency is linked to other traditional assets. A subsequent claim by Smales (2019) is that Bitcoin returns are irrelevant to those of commodities and financial assets. He also stated that Bitcoin’s market stability is crucial to considering cryptocurrencies a safe haven. In regards to hedging oil-related risks, Das et al. (2020) found that Bitcoin does not offer any advantages over gold, commodities, or the U.S. dollar. Fundamentals and core risks of oil risks as well as market conditions strongly determine this type of hedging capability. In bullish and bearish market conditions, Symitsi and Chalvatzis (2019) demonstrate how Bitcoin positively influences the diversification of portfolios.

A key aspect of financial and economic disruptions is the interaction and response between cryptocurrencies and various assets (such as crude oil) (Charfeddine and Kahia 2019). Investments in cryptocurrencies can be managed more effectively with cryptocurrency assets. Even though the use of cryptocurrencies as hedging tools may not be successful, the potential for them to serve as diversifiers is worth considering, according to the study. According to Jareno et al. (2020), Bitcoin appears to be valuable in uncertain economic times because of the gold-Bitcoin connection. It was investigated in Hussain and Dogan’s (2021) study how cryptocurrency might be implemented as a hedge and a shelter in the event of adverse market events. Although gold has a more stable diversity than Bitcoin, both Bitcoin and gold’s performance swings when it comes to hedging or safe haven (Sharif et al. 2020). Lastly, Rehman and Vo (2020) show that precious metals may be a more significant long-term diversification option than copper in the short run.

There has been an increase in recognition of cryptocurrency as a form of asset that can be employed for both defensive and diversifying purposes. Consequently, extreme conditions, for example, those caused by medical emergencies, are more sought after. An analysis of portfolio performance containing financial instruments (like equities and bonds), a digital asset, and precious metals is undertaken by González et al. (2021). Because of this, while cryptocurrencies are capable of managing the risk and uncertainty associated with diversifying portfolios, few of them have proved to be effective in more extreme scenarios. Although gold remained stable, it was ineffective at limiting risk during the COVID-19 economic recession. As a final point, investors can diversify their portfolios by investing in cryptocurrencies despite the lower returns they offer. According to Shahzad et al. (2021), there were significant crypto-spillovers caused by the COVID-19 epidemic, under moderate or high volatility assumptions. Due to the lack of volatility in cryptocurrencies or experiencing significant volatility in the prior period of COVID-19, Yousaf and Ali (2020) suggest that investors can make the most of their time by analyzing three primary cryptocurrencies simultaneously. In contrast to the time of COVID-19, the pairings between cryptocurrencies now have more robust connections. Thus, hedging efficacy increased during COVID-19, demonstrating cryptocurrency’s usefulness as a hedging tool, diversifier, and risk reducer. COVID-19’s influence on cryptocurrencies’ risk and uncertainty is also explored in Iqbal et al. (2021). Researchers discovered that COVID-19 and digital currency returns show an asymmetric relationship. Furthermore, they found that cryptocurrencies such as Bitcoin can be utilized as a hedging mechanism during periods of economic uncertainty as a way to mitigate COVID-19's negative impacts. As Yarovaya et al. (2021) point out, it is determined by either bearish or bullish capacity on the day of the market. Despite this, COVID-19 did not improve the phenomenon of herding in Bitcoin markets. In addition, Yarovaya et al. (2021) found that the comparison of some features of COVID-19 with those of previous crises led to recommendations for study topics in the future. In 2020, Corbet, Hou, and colleagues demonstrated how cryptocurrency could be used to diversify while serving as a powerful investment shelter in the case of a pandemic. The researchers concluded that these assets are perceived to be amplification devices as opposed to safeguards or refuges against financial and economic volatility. In Conlon and McGee’s (2020) view, the S&P 500 and Bitcoin have both declined, making Bitcoin an unattractive and doubtful investment during market downturns.

Interlinkages between networks have also been studied during uncertain times such as COVID-19. In the COVID-19 epidemic, Umar and Gubareva (2021) investigated the relationship between returns and fluctuations of three leading monetary units: the pound, the euro, and the yuan. The pattern was more obvious during early waves, but minor variations were seen in the subsequent waves (Umar et al., 2021). As a result of wavelet coherence analysis, Karamti and Belhassine (2021) examined and incorporated financial contagion into pandemic fear regarding U.S. stock markets and global markets during pandemics. There was a positive correlation among Bitcoin prices and the US COVID-19 fear index in the cryptocurrency market. The following wave, however, saw the fear index influence the Bitcoin market, as stated by Karamti and Belhassine (2021).

Cryptocurrencies and other asset types were evaluated using a variety of approaches in a previous study. VAR methods were applied by Conlon and McGee (2020), while VAR-GARCH methods were used by Symitsi and Chalvatzis (2019). Also selected are a number of BEKK models. Klein et al. (2018) and Tu and Xue (2019) used BEKK-GARCH models, while Katsiampa (2019) used bivariate diagonal BEKK models. GARCH-MIDAS had been considered by many academics (Walther et al. 2019). Even with a large amount of study data, wavelet-based models have gained popularity (Sharif et al., 2020). There are also several quantile approaches that are considered, including the cross-spectral quantile approach (Rehman and Vo, 2020) and the regression-based quantile model (Jareño et al. 2020). The use of ARDL (Ciaian et al. 2018) and NARDL (Bouri et al. 2018; Demir et al. 2021) models in conjunction with GARCH by Corbet et al. (2019) and stochastic models with multiple factors (Shi et al., 2020) has recently been reported. DCC models have been used by different scholars in this study, including Kumarasinghe and Athambawa (2020) and Charfeddine et al. (2020), as well as DCC-MGARCH simulations, such as Canh et al. (2019), and VARMA-DCC-GARCH methods, such as Guesmi et al. (2019), whereas Koutmos (2018) adapted Diebold and Yilmaz’s (2012) method and followed it. As a result of the combination of a parameter-variable vector autoregression (TVP-VAR) connectivity method with joint spillover analysis proposed by Balcilar et al. a key objective of the research is to determine how volatility shocks produced on one market are transferred to others (2021). Net pairwise connectivity, which identifies transmission channels between commodity markets and financial markets, is the most significant benefit of our approach.

Data and methodology

Sample data

Throughout the paper, we rely on a set of regularly updated datasets containing prices for gold, crude oil prices, the corresponding index, and the price of the most popular virtual currency (in our analysis, Bitcoin (BTC) is selected based on its crypto-market capitalization), S&P 500 index that is mainly designed to give an indication of equity markets in the USA. The data is collected from January 1, 2018, to August 1, 2021. Our attention is mostly paid to the period marked by the event that COVID-19 pandemic crisis spread quickly in the globe. The statistical description of and contemporaneous correlations for these four prices are displayed in panels A and B of Table 1, correspondingly. As reported in panel A, means and medians of these four prices range from nearly 4.0 to 9.0. Their standard deviations range from 0.3 to 0.7, in which the old and stock markets exhibit the lowest values, and the cryptocurrency is the most volatile market. Different from other markets, the oil price has the negative and greatest skewness. Its kurtosis is significantly larger than that of different markets. By contrast, the gold price has the lowest skewness and kurtosis values. As stated in panel B, the relationship between petroleum and gold is considerable as well as negative. In contrast, correlations between other markets are positive, with SP500 and BTC demonstrating the most considerable correlation.

Ellington (2021) suggested that it is necessary to consider serial dependence and/or heavy tails when we model linkages among prices of commodity and financial goods. Table 1 provides the first insights on correlations of four commodity and financial goods prices. Moreover, these prices display a high level of persistency kurtosis values.

Estimations from Bayesian vector heterogeneous autoregressions

In this paper, we follow Ellington (2021) to employ a mixed fashion of the heterogeneous autoregressive (HAR) approach initially developed by Corsi (2009) coupled with Bayesian estimation developed by Chan (2020). This approach is best suited to our needs due to the following reasons. First, while this method significantly reduces computation time, the persistence inherent in price levels is captured appropriately. Second, by using the proposed method, the Kronecker structures can be imposed to model serially dependent error terms and non-Gaussian, heteroskedastic, which better consider parameter and uncertainty based on the empirical database. Specifically, let \({X}_{s}\) be an n × 1 vector of variables that is monitored over s = 1, …, S time scales. The HAR (VHAR) description can be expressed as follows:

where \({a}_{0}\) is a vector of constants, and A’s are n × n coefficient matrices, which respectively illustrate autocorrelated relationships each day, every week, and every month. The lagged vectors of \({X}_{s}\) are \({X}_{(s-1|t-k)}= \frac{1}{k}\sum_{i=1}^{k}{X}_{s-j}\) that consists of three price components in the short, medium, and long runs.

For simplicity, the VHAR model can be written as a VAR(22) with no constraints imposed on any autoregressive matrix. Hence, the VAR(3) structure can be presented as follows:

where \({c}_{0}\) is a vector including constants terms, and \({\mathbf{C}}_{i}\), i = {1, 5, 22}, are n × n coefficient matrices, which this paper refers to as the first, fifth, and twenty-second lags of \({X}_{s}\), correspondingly. Now let \({Z}_{s}^{^{\prime}}=(1, {X}_{s-1}^{^{\prime}}, {X}_{s-5}^{^{\prime}}, {X}_{s-22}^{^{\prime}})\) be a k × 1 vector of a constant and lags with k = 1 + np. The reduced form is given as

where C \({({C}_{0}, {\mathbf{C}}_{1}, {\mathbf{C}}_{5}, {\mathbf{C}}_{22})}^{^{\prime}}\) is of dimension k × n and the dimensions of matrices X, Z, and \({\varvec{V}}\) are respectively T × n, T × k, and T × n. The n × n covariance matrix of the VAR model is \({\varvec{\Sigma}}\). More specifically, \(\mathbf{V}\) is vec(\(\mathbf{V}\)) \(\sim\) N(0, \({\varvec{\Sigma}}\) \(\otimes\) \({\mathbf{I}}_{\mathbf{T}}\)) where vec(\(\mathbf{V}\)) includes the columns of \(\mathbf{V}\) and \({\mathbf{I}}_{\mathbf{T}}\) that represents T-dimensional identity matrix; the Kronecker product is captured by \(\otimes\).

It is worth noting that we can obtain the covariance structures at cross-sections and serials of X individually by replacing \({\mathbf{I}}_{\mathbf{T}}\) with a T × T covariance matrix \(\Phi\). To be specific, \({\varvec{\Sigma}}\) captures the cross-sectional analysis of covariance and \(\Phi\) reflects the sequential variance structure. Therefore, we write

We can select distinct covariance structures for \(\Phi\) in models (1) and (2). In this regard, seven fashions with various covariance structures are employed in our paper, comprising (i) a Bayesian VHAR with innovations following a t-distribution (BVHAR-t) as in Chiu et al. (2017); (ii) a Bayesian VAR with a common stochastic volatility component (BVHAR-CSV) as in Mumtaz and Theodoridis (2018); (iii) a Bayesian VHAR with MA(1) errors (BVHAR-MA(1)) as in Dimitrakopoulos and Kolossiatis (2020); (iv) a Bayesian VHAR with t-errors and a common stochastic volatility component (BVHAR-t-CSV) as in Ellington (2021); (v) a Bayesian VHAR with MA(1) errors following a t-distribution (BVHAR-t-MA(1)) as in Ellington (2021); (vi) a Bayesian VHAR with MA(1) errors and a common stochastic volatility component (BVHAR-CSV-MA(1)) as in Ellington (2021); and (vii) a Bayesian VHAR with MA(1) errors following a t-distribution and a common stochastic volatility component (BVHAR-t-CSV-MA(1)) as in Ellington (2021). We follow Chan (2020) and Ellington (2021) to employ model priors for all parameters. We utilize a 252-day rolling window to estimate these seven model fashions.

Tracking network interlinkages in VHARs

By determining the variance of forecast error variance decomposition matrix, Baruník and Krehlík (2018) devised network measures from VAR models. Then, Pesaran and Shin (1998) developed these measures by using generalized forecast error variance decompositions (GFEVDs). Time series are assumed to be uncorrelated, meaning that \(\Phi\) = \({\mathrm{I}}_{\mathrm{T}}\). Rather than that, these measures are modified for a more general structure on \(\Phi\) in this paper. For a matrix A,\({(A)}_{j,k}\), presents the jth row and kth column. \({(B)}_{j}\) presents the full jth row of B, and ΣB presents all elements added together in A, since we can write \({X}_{\mathrm{s}}\) as C(L)\({X}_{\mathrm{s}}\) = \({v}_{\mathrm{s}}\) with C(L)\(=[{\mathbf{I}}_{\mathrm{n}}- {\mathbf{C}}_{1} {L}_{1}-\dots - {\mathbf{C}}_{\mathrm{p}} {L}_{\mathrm{p}}]\) being an \(n\times n\) matrix lag-polynomial. We also assume that the base of the VAR polynomial do not lie inside the unit circle to achieve the MA(∞) representation,\({X}_{\mathrm{s}} =\Theta (\mathrm{L}){v}_{\mathrm{s}}\), where C(L) = \({[\Theta \left(\mathrm{L}\right)]}^{-1}\).

In some exercises, we assume that the errors have an MA(1) representation, with \({v}_{s}= {\epsilon }_{t}+\uppsi {\epsilon }_{t-1}, {\epsilon }_{t} \sim N (0,{\varvec{\Sigma}})\). Therefore, we can indicate that \(\mathrm{var} \left({v}_{s}\right)=(1+ {\Theta }^{2}){\varvec{\Sigma}}\), where we define \(\widetilde{{\varvec{\Sigma}}}\) = cΣ, with c = \((1+ {\Theta }^{2})\). With our setup, the covariance matrix of the forecast error conditional on information at time \(s-1\) can be presented as follows:

Forecast error covariance matrix based on shocks occurring now and in the future to the jth equations can be defined by using the conditional forecast error, which can be written as follows:

And if we assume a normal distribution, we have

The covariance matrix is written as

The unscaled Q-step ahead prediction error variance of the jth variable in relation to the change in the kth variable is

We can obtain a way of expressing the GFEVD as in Pesaran and Shin (1998):

where \({\widetilde{\sigma }}_{kk}= {(\widetilde{{\varvec{\Sigma}}})}_{k, k}, {{\varvec{\Theta}}}_{q}\) denotes the n × n matrix of MA coefficients at lag q. \({({{\varvec{\Psi}}}_{Q})}_{j, k}\) represents the contribution of variable k to the forecast error variance of variable j at horizon Q.Footnote 1 The power spectrum, \({\mathbf{S}}_{y}(\omega )\), is incorporated to investigate systems that diverse horizons form. We denote ω as the frequency component and \(i= \sqrt{-1}\); then, the spectral density captures the Fourier transform of the infinite MA specification:

We can define the generalized causation spectrum over frequency components using the above representation ω ∈ [− π, π] and function of weighting to have a spectral specification of variance decompositions from variable j to k in \({X}_{s}\). We can prove the presence of measures specific to horizons. We then present the generalized causation spectrum and weighting function as follows:

and we define the variance decomposition matrix in terms of its spectral representation given as

If we sum all horizons, we can obtain \({\left({{\varvec{\Psi}}}_{Q}\right)}_{j, k}\).

Afterwards, scaling \({{\varvec{\Psi}}}_{d}\) such that \({({\widetilde{{\varvec{\Psi}}}}_{d})}_{j, k}= {({{\varvec{\Psi}}}_{d})}_{j, k}/\boldsymbol{ }\sum_{{\varvec{k}}}{({{\varvec{\Psi}}}_{H})}_{j, k}\) delivers the adjacency matrix, \({\widetilde{{\varvec{\Psi}}}}_{d}\) over horizon band d. We define connectiveness at horizon d as

Equation (3) allows us to capture the forecast error variance’s contribution stemming from all shocks within the designed structure, but excluding our own shocks. It implies a horizon of interest that considers system-wide connectivity.

\({\widetilde{{\varvec{\Psi}}}}_{d}\) also helps us to derive the direction of interconnections across horizons. Typically, to and from interlinkages are presented as follows:

Equation (4) captures the contribution of asset j to the variance of other variables at horizon d, while Eq. (5) means out-degrees. It is clear that asset j’s variance results from shocks arising in other variables at horizon d. We take the differentiation between (4) and (5) to calculate the net directional linkages at horizon d as follows:

Hence, the positive values mean that variables exchange shocks, while negative values, if they have sufficient shock transmission capacity, indicate the variable is the shock receiver.Footnote 2

Results

Model selection

As a start, we will compare six models by averaging and medianing their log marginal likelihoods as in Chan (2020). Table 2 presents these statistics. According to Ellington’s (2021) study, as these statistics increase, the model’s fit is better. It is important to take into account serial correlation, stochastic volatility, and heavy tails. According to our findings, network measures derived from BHVAR-t-CSV-MA(1) or BHVAR-t-CSV have the most significant values of log marginal likelihoods. Additionally, it is important to make comparisons between networks formed from BHVAR-CSV and BHVAR-CSV-MA(1).Footnote 3

Network linkages

Time-horizon linkages

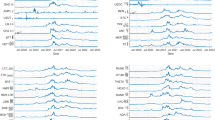

In the following analysis, the particular network interlinkages were obtained from in Eq. (3), in which d refers to short-run (from 1 day to 1 week), medium run (1 week to 1 month), and long-term (larger than 1 month) horizons. The one standard deviation and the posterior median percentile in terms of specific network interlinkage metrics are shown in Fig. 1. Network’s short-, medium-, and long-term interlinkages are displayed in the top, middle, and bottom panels. Three key findings have been identified. In the first place, the long-run interlinkages show the most strength, and they gradually increase from 2020 to 2021 before gradually declining towards the end of the sample. As a second point, based on error bands, we report significant differences between interlinkages that occur over the short run and those that occur over the long run. This significant difference emerges during the COVID-19 pandemic (prior to January 1, 2020). In the third place, January 2019 is the month when there is a peak in short- and medium-run interlinkages. The trend also declined at the end of 2021, after experiencing considerable surges within 2021. COVID-19 pandemic strains spread through the global economy again at the start of 2021, with severe consequences for a number of economies. Consequently, the world economy becomes extremely volatile during that time. Under uncertain conditions, short- and medium-term interconnections between markets will probably become stronger. As a temporary pandemic subsides in 2021, these interlinkages become weakened slightly.

Diverse time-horizon specific network interlinkage measures. Notes: we plot the one standard deviation and the median quartiles of the distribution after posterior estimation of interlinkage statistics specifying for horizons. System interlinkages at short horizons (from 1 day to 1 week), at mid-horizons (from 1 week to 1 month), and at long horizons (larger than 1 month) are respectively displayed at the top, middle, and bottom panels

Specifically, network interconnections exhibit considerable differences at different time horizons. Over the short, medium, and long term, transient market events increase network interlinkages. Due to a persistent COVID-19 health crisis, Baumeister et al. (2020) pointed out that long-term network interlinkages are more prominent.

Net-directional linkages

In the following step, we will study the net-directional connections between commodity prices and financial goods prices at different time horizons. Initially, we focus on the short run and the medium run. Short-run net-directional interlinkages, as shown in Figs. 2 and 3, are posterior medians and one standard deviation percentiles. It is noteworthy that the positive (negative) values of series j indicate its role as a shock transmitter (receiver). It is important to emphasize a few points here. Since the start of 2019, crude oil and stocks have acted as shock receivers from other markets, while gold and cryptocurrencies act as shock transmitters. Nonetheless, between January 2019 and January 2020, gold and cryptocurrency markets played a smaller role. As a contrast, crude oil and stock played significant roles at the time, but in opposing ways. Specifically looking at the times when COVID-19 struck the globe, we find that the oil market, gold market, and equity markets are shock receivers. These markets are being affected by shocks transmitted by the cryptocurrency market.

Afterwards, we examine the long-horizon net-directional linkages shown in Fig. 4. Throughout the study period, both the stock and cryptocurrency markets demonstrate relatively similar time dynamics. Pre-COVID-19, their roles changed. As the year 2020 begins, the stock and cryptocurrency markets appear continuously as shock receivers and transmitters, correspondingly. It is more probable that petroleum was acting as a means of transmitting shocks before the COVID-19 pandemic began in 2020. It has become a shock receiver since that date, however. In the midst of the illness crisis of COVID-19, gold served as a vital shock transmitter. These results support those of Ren and Lucey (2022), who found a tenuous link between clean energy and cryptocurrencies, indicating that clean energy may someday be employed as a hedging and diversification strategy for cryptocurrencies. The growth of some commodity markets has been noted before in conjunction with various financial crises (2007–2009), as indicated by Balcilar et al. (2021) and Zhang and Broadstock (2020).

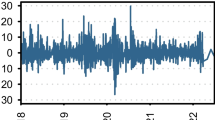

Robustness check

In order to verify our findings, we take logs of all series and analyze them as described in the Net-directional linkages section. Additionally, for some markets, we try to add more assets (e.g., adding more cryptocurrencies, using other stock indexes). A few of our results are reported in the Appendix, and the others can be provided upon request in order to save space. Generally, we find the same conclusions as we did previously, indicating the conclusions regarding dynamic network interlinkages are valid and robust.

Conclusion and policy implications

This paper is aimed at exploring fat tails and connections between four different markets, which include gold, stocks, crude oil, and digital currency, in a sevenfold Bayesian vector heterogeneous autoregression model. It differentiates between short-run, medium-run, and longer-run network interlinkages among these markets. In the period from January 1, 2018, to December 31, 2021, data are collected daily on petroleum benchmark (WTI) prices, prices of gold, S&P500 indexes, and BTC values. The following two points deserve special attention. As a first step, it is crucial that the four markets are interconnected in the long run. Additionally, the pattern of long-run network interlinkages differs from the pattern of short-run and medium-run interlinkages. As the COVID-19 pandemic spreads across the globe, these distinctions become more evident. During uncertain times, network interlinkages among various types of markets are also likely to increase in size. Second, market directional links indicate a shift in roles (from shock transmitter to shock receiver) before the COVID-19 pandemic, whereas these roles persist during the COVID-19 pandemic. The short- and medium-horizon measures indicate that precious metals, crude oil, and equity markets are shock receivers, while the cryptocurrency market transmits shock influences. Cryptocurrency and gold markets are persistently shock transmitters, according to long-horizon measures.

Theoretical improvements

In our research, we are the first to offer a unique deep explanation of the interconnectedness between these commodities and financial and energy markets, specifically in chaotic events like the COVID-19 epidemic in the short-, medium-, and long-run. Using the special method, the short-, medium-, and long-run pairwise connectedness estimate spread channels between various markets. We contribute crucial information and warnings about the spread of uncertain occurrences and policies for regulators and investors.

Practical applications

Findings from our study have important consequences for financial institutions and government agencies, as well as practices from the contagions in different markets, as well as their interconnectedness on the policy front. Policymakers can also design appropriate policies to reduce the vulnerabilities of such markets and prevent risk spread and instability if they know the crucial antecedents of contagions among them, including oil, gold, commodities, and cryptocurrencies. Based on our findings, there are strong links between the four market segments, which emphasizes investor risks associated with low and high diversification. As a result of our results, it is becoming increasingly clear that unpredictable events, such as the current COVID-19 outbreak, are interconnected. It is evident that a sudden change in a traditional market impacts a network as a whole, suggesting that investors and managers should be more cautious in managing the investment portfolio, which includes gold, oil in future contracts, stocks, and cryptocurrency. An early warning signal would be the contagions of uncertainty and risk that should be considered when making an investment decision. In addition, this paper’s findings can also be useful in enhancing public welfare, which is a direct result of financialization, oil, cryptocurrency, and gold. The crucial insights that there are ambiguities and risks in the energy sector must be applied to finance markets, reversely. Consequently, designing policies to enhance the welfare of a vulnerable group must take these factors into account.

Limitations and directions for future research

The outcomes of the research still have three limitations. Prior to all else, it is important to highlight that we cannot find any general principle or pattern that applies to all cases on how risk occurrences impact total, net, or pairwise spillovers in the short, medium, and long run. Second, the extent of the spread is significant from the standpoint of indicator association. If the spread is large, changes and shocks brought on by other indicators will majorly influence a particular market system. The government must take a variety of steps to lessen the negative consequences of outside shocks. Authorities should concentrate on frequency-specific danger sources. In the integration of global regulatory guidelines for different metrics, more focus should be made on reducing the negative consequences of long-term fluctuation spread and short-term return spread. Last but not least, considering that many researchers consider the spillover influence across several metrics, evaluating the portfolio advantages of diversity is a substantial extension. In the meanwhile, we placed it on the back burner.

Data availability

Data available on request due to privacy/ethical restrictions.

Notes

Note that we the lag number used in MA representation to Q = 100 horizons. Other values of Q are also considered, such as Q = {150, 200, 250} for the robustness checks.

The results from these models can be provided by authors upon the request.

References

Acharya VV, Pedersen LH, Philippon T, Richardson M (2017) Measuring systemic risk. Rev Financ Stud 30(1):2–47. https://doi.org/10.1093/rfs/hhw088

Adekoya OB, Oliyide JA, Yaya OS, Al-Faryan MAS (2022) Does oil connect differently with prominent assets during war? Analysis of intra-day data during the Russia-Ukraine saga. Resour Policy 77:102728. https://doi.org/10.1016/j.resourpol.2022.102728

Akram QF (2020) Oil price drivers, geopolitical uncertainty and oil exporters’ currencies. Energy Econ 89:104801. https://doi.org/10.1016/j.eneco.2020.104801

Antonakakis N, Cunado J, Filis G, Gabauer D, de Gracia FP (2022) Dynamic connectedness among the implied volatilities of oil prices and financial assets: new evidence of the COVID-19 pandemic. Int Rev Econ Finance. https://doi.org/10.1016/j.iref.2022.08.009

Arslan HM, Khan I, Latif MI, Komal B, Chen S (2022) Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: new insights from China. Environ Sci Pollut Res 29(39):58746–58761. https://doi.org/10.1007/s11356-022-19952-y

Asai M, Gupta R, McAleer M (2020) Forecasting volatility and co-volatility of crude oil and gold futures:effects of leverage, jumps, spillovers, and geopolitical risks. Int J Forecast 36(3):933–948. https://doi.org/10.1016/j.ijforecast.2019.10.003

Aslanidis N, Bariviera AF, Martínez-Ibañez O (2019) An analysis of cryptocurrencies conditional cross correlations. Financ Res Lett 31:130–137. https://doi.org/10.1016/j.frl.2019.04.019

Azam W, Khan I, Ali SA (2023) Alternative energy and natural resources in determining environmental sustainability: a look at the role of government final consumption expenditures in France. Environ Sci Pollut Res Int 30(1):1949–1965. https://doi.org/10.1007/s11356-022-22334-z

Balcilar M, Gabauer D, Umar Z (2021) Crude oil futures contracts and commodity markets: new evidence from a TVP-VAR extended joint connectedness approach. Resour Policy 73:102219. https://doi.org/10.1016/j.resourpol.2021.102219

Barbaglia L, Croux C, Wilms I (2020) Volatility spillovers in commodity markets: a large t-vector autoregressive approach. Energy Econ 85:104555. https://doi.org/10.1016/j.eneco.2019.104555

Barigozzi M, Hallin M, Soccorsi S, von Sachs R (2021) Time-varying general dynamic factor models and the measurement of financial connectedness. J Econ 222(1, Part B):324–343. https://doi.org/10.1016/j.jeconom.2020.07.004

Baruník J, Křehlík T (2018) Measuring the frequency dynamics of financial connectedness and systemic risk*. J Financial Econ 16(2):271–296. https://doi.org/10.1093/jjfinec/nby001

Barunik J, Krehlik T, Vacha L (2016) Modeling and forecasting exchange rate volatility in time-frequency domain. Eur J Oper Res 251(1):329–340. https://doi.org/10.1016/j.ejor.2015.12.010

Baruník J, Bevilacqua M, Tunaru R (2020) Asymmetric network connectedness of fears. Rev Econ Stat 1–41. https://doi.org/10.1162/rest_a_01003

Bouri E, Gupta R, Tiwari AK, Roubaud D (2017) Does bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Financ Res Lett 23:87–95. https://doi.org/10.1016/j.frl.2017.02.009

Bouri E, Gupta R, Lau CKM, Roubaud D, Wang S (2018) Bitcoin and global financial stress: a copulabased approach to dependence and causality in the quantiles. Q Rev Econ Finance 69:297–307. https://doi.org/10.1016/j.qref.2018.04.003

Calabrese R, Osmetti SA (2019) A new approach to measure systemic risk: a bivariate copula model for dependent censored data. Eur J Oper Res 279(3):1053–1064. https://doi.org/10.1016/j.ejor.2019.06.027

Canh NP, Binh NQ, Thanh SD (2019) Cryptocurrencies and investment diversification: empirical evidence from seven largest cryptocurrencies. Theoretical. Econ Lett 9(3):Article 3. https://doi.org/10.4236/tel.2019.93031

Chan JCC (2020) Large Bayesian VARs: a flexible Kronecker error covariance structure. J Bus Econ Stat 38(1):68–79. https://doi.org/10.1080/07350015.2018.1451336

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energ 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

Charfeddine L, Benlagha N, Maouchi Y (2020) Investigating the dynamic relationship between cryptocurrencies and conventional assets: implications for financial investors. Econ Model 85:198–217. https://doi.org/10.1016/j.econmod.2019.05.016

Chatziantoniou I, Abakah EJA, Gabauer D, Tiwari AK (2022) Quantile time–frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. J Clean Prod 361:132088. https://doi.org/10.1016/j.jclepro.2022.132088

Chiu C-W (Jeremy), Mumtaz H, Pintér G (2017) Forecasting with VAR models: fat tails and stochastic volatility. Int J Forecast 33(4):1124–1143. https://doi.org/10.1016/j.ijforecast.2017.03.001

Ciaian P, Rajcaniova M, Kancs d’A (2018) Virtual relationships: short- and long-run evidence from BitCoin and altcoin markets. J Int Financ Mark Inst Money 52:173–195. https://doi.org/10.1016/j.intfin.2017.11.001

Corbet S, Lucey B, Urquhart A, Yarovaya L (2019) Cryptocurrencies as a financial asset: a systematic analysis. Int Rev Financ Anal 62:182–199. https://doi.org/10.1016/j.irfa.2018.09.003

Corbet S, Larkin C, Lucey B (2020) The contagion effects of the COVID-19 pandemic: evidence from gold and cryptocurrencies. Financ Res Lett 35:101554. https://doi.org/10.1016/j.frl.2020.101554

Corsi F (2009) A simple approximate long-memory model of realized volatility. J Financial Econ 7(2):174–196. https://doi.org/10.1093/jjfinec/nbp001

Creal D, Koopman SJ, Lucas A (2011) A dynamic multivariate heavy-tailed model for time-varying volatilities and correlations. J Bus Econ Stat 29(4):552–563. https://doi.org/10.1198/jbes.2011.10070

Demir E, Simonyan S, García-Gómez C-D, Keung LC, M. (2021) The asymmetric effect of bitcoin on altcoins: evidence from the nonlinear autoregressive distributed lag (NARDL) model. Financ Res Lett 40(101754). https://doi.org/10.1016/j.frl.2020.101754

Dimitrakopoulos S, Kolossiatis M (2020) Bayesian analysis of moving average stochastic volatility models: modeling in-mean effects and leverage for financial time series. Economet Rev 39(4):319–343. https://doi.org/10.1080/07474938.2019.1630075

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets*. Econ J 119(534):158–171. https://doi.org/10.1111/j.1468-0297.2008.02208.x

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econ 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Engle R, Kelly B (2012) Dynamic Equicorrelation. J Bus Econ Stat 30(2):212–228. https://doi.org/10.1080/07350015.2011.652048

Engle RF, Gallo GM, Velucchi M (2012) Volatility spillovers in east Asian financial markets: a mem-based approach. Rev Econ Stat 94(1):222–223. https://doi.org/10.1162/REST_a_00167

Ellington M (2021) Fat tails, serial dependence, and implied volatility index connections. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2021.09.038

González M, de la O, Jareño F, Skinner FS (2021) Asymmetric interdependencies between large capital cryptocurrency and gold returns during the COVID-19 pandemic crisis. Int Rev Financ Anal. https://doi.org/10.1016/j.irfa.2021.101773

Guesmi K, Saadi S, Abid I, Ftiti Z (2019) Portfolio diversification with virtual currency: evidence from bitcoin. Int Rev Financ Anal 63:431–437. https://doi.org/10.1016/j.irfa.2018.03.004

Hassan M, Rousselière D (2022) Does increasing environmental policy stringency lead to accelerated environmental innovation? A Research Note. Appl Econ 54(17):1989–1998

Ha LT (2022) Are digital business and digital public services a driver for better energy security? Evidence from a European sample. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17843-2

Hussain M, Dogan E (2021) The role of institutional quality and environment-related technologies in environmental degradation for BRICS. J Clean Prod 304:127059. https://doi.org/10.1016/j.jclepro.2021.127059

Hyun S, Lee J, Kim J-M, Jun C (2019) What coins Lead in the cryptocurrency market: using copula and neural networks models. J Risk Financ Manag 12(3):Article 3. https://doi.org/10.3390/jrfm12030132

Iqbal N, Fareed Z, Wan G, Shahzad F (2021) Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. Int Rev Financ Anal 73:101613. https://doi.org/10.1016/j.irfa.2020.101613

Jackman M, Moore W (2021) Does it pay to be green? An exploratory analysis of wage differentials between green and non-green industries. J Econ Dev 23(3):284–298. https://doi.org/10.1108/JED-08-2020-0099

Jareño F, González M de la O, Tolentino M, Sierra K (2020) Bitcoin and gold price returns: a quantile regression and NARDL analysis. Resour Policy 67:101666. https://doi.org/10.1016/j.resourpol.2020.101666

Karamti C, Belhassine O (2021) COVID-19 pandemic waves and global financial markets: evidence from wavelet coherence analysis. Financ Res Lett 102136. https://doi.org/10.1016/j.frl.2021.102136

Khan I, Hou F (2021a) The dynamic links among energy consumption, tourism growth, and the ecological footprint: the role of environmental quality in 38 IEA countries. Environ Sci Pollut Res 28(5):5049–5062. https://doi.org/10.1007/s11356-020-10861-6

Khan I, Hou F (2021b) The impact of socio-economic and environmental sustainability on CO2 emissions: a novel framework for thirty IEA countries. Soc Indic Res 155(3):1045–1076. https://doi.org/10.1007/s11205-021-02629-3

Khan I, Hou F, Irfan M, Zakari A, Le HP (2021a) Does energy trilemma a driver of economic growth? The roles of energy use, population growth, and financial development. Renew Sust Energ Rev 146:111157. https://doi.org/10.1016/j.rser.2021.111157

Khan I, Hou F, Zakari A, Tawiah VK (2021b) The dynamic links among energy transitions, energy consumption, and sustainable economic growth: a novel framework for IEA countries. Energy 222:119935. https://doi.org/10.1016/j.energy.2021.119935

Khan I, Tan D, Hassan ST, Bilal (2022) Role of alternative and nuclear energy in stimulating environmental sustainability: impact of government expenditures. Environ Sci Pollut Res 29(25):37894–37905. https://doi.org/10.1007/s11356-021-18306-4

Khan I, Hou F, Zakari A, Irfan M, Ahmad M (2022) Links among energy intensity, non-linear financial development, and environmental sustainability: new evidence from Asia Pacific economic cooperation countries. J Clean Prod 330:129747. https://doi.org/10.1016/j.jclepro.2021.129747

Kim J-M, Jun C, Lee J (2021) Forecasting the volatility of the cryptocurrency market by GARCH and stochastic volatility. Mathematics 9(14):Article 14. https://doi.org/10.3390/math9141614

Klein T, Pham Thu H, Walther T (2018) Bitcoin is not the new gold – a comparison of volatility, correlation, and portfolio performance. Int Rev Financ Anal 59:105–116. https://doi.org/10.1016/j.irfa.2018.07.010

Kumarasinghe W, Athambawa H (2020) The impact of digitalization on business models with special reference to management accounting in small and medium enterprises in Colombo District. Int J Sci Technol Res 9:6654–6665

Kurka J (2019) Do cryptocurrencies and traditional asset classes influence each other? Financ Res Lett 31:38–46. https://doi.org/10.1016/j.frl.2019.04.018

Kyriazis NA (2019) A survey on empirical findings about spillovers in cryptocurrency markets. J Risk Financ Manag 12(4):170

Le TH (2022) Connectedness between nonrenewable and renewable energy consumption, economic growth and CO2 emission in Vietnam: new evidence from a wavelet analysis. Renew Energy 195:442–454. https://doi.org/10.1016/j.renene.2022.05.083

Le HT, Hoang DP, Doan TN, Pham CH, To TT (2021) Global economic sanctions, global value chains and institutional quality: Empirical evidence from cross-country data. J Int Trade Econ Dev 0(0):1–23. https://doi.org/10.1080/09638199.2021.1983634

Lyu L, Khan I, ZakariBilal A (2021) A study of energy investment and environmental sustainability nexus in China: a bootstrap replications analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16254-7

Mumtaz H, Theodoridis K (2018) The changing transmission of uncertainty shocks in the U.S. J Bus Econ Stat 36(2):239–252. https://doi.org/10.1080/07350015.2016.1147357

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Rehman MU, Vinh Vo X (2020) Cryptocurrencies and precious metals: a closer look from diversification perspective. Resour Policy 66:101652. https://doi.org/10.1016/j.resourpol.2020.101652

Selmi R, Mensi W, Hammoudeh S, Bouoiyour J (2018) Is bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Econ 74:787–801. https://doi.org/10.1016/j.eneco.2018.07.007

Shahzad SJH, Bouri E, Kang SH, Saeed T (2021) Regime specific spillover across cryptocurrencies and the role of COVID-19. Financ Innov 7(1):5. https://doi.org/10.1186/s40854-020-00210-4

Sharif A, Aloui C, Yarovaya L (2020) COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Financ Anal 70:101496. https://doi.org/10.1016/j.irfa.2020.101496

Smales LA (2019) Bitcoin as a safe haven: is it even worth considering? Financ Res Lett 30:385–393. https://doi.org/10.1016/j.frl.2018.11.002

Symitsi E, Chalvatzis KJ (2019) The economic value of bitcoin: a portfolio analysis of currencies, gold, oil and stocks. Res Int Bus Financ 48:97–110. https://doi.org/10.1016/j.ribaf.2018.12.001

Tawiah VK, Zakari A, Khan I (2021) The environmental footprint of China-Africa engagement: an analysis of the effect of China – Africa partnership on carbon emissions. Sci Total Environ 756:143603. https://doi.org/10.1016/j.scitotenv.2020.143603

Taghizadeh-Hesary F, Zakari A, Yoshino N, Khan I (2022) Leveraging on energy security to alleviate poverty in Asian economies. Singapore Econ Rev:1–28. https://doi.org/10.1142/S0217590822440015

Tu Z, Xue C (2019) Effect of bifurcation on the interaction between bitcoin and Litecoin. Financ Res Lett 31. https://doi.org/10.1016/j.frl.2018.12.010

Umar Z, Gubareva M (2021) The relationship between the Covid-19 media coverage and the environmental, social and governance leaders equity volatility: a time-frequency wavelet analysis. Appl Econ 53(27):3193–3206. https://doi.org/10.1080/00036846.2021.1877252

Umar Z, Jareño F, González M de la O (2021) The impact of COVID-19-related media coverage on the return and volatility connectedness of cryptocurrencies and fiat currencies. Technol Forecast Soc Chang 172:121025. https://doi.org/10.1016/j.techfore.2021.121025

Walther T, Klein T, Bouri E (2019) Exogenous drivers of bitcoin and cryptocurrency volatility – a mixed data sampling approach to forecasting. J Int Financ Mark Inst Money 63:101133. https://doi.org/10.1016/j.intfin.2019.101133

Yang Z, Zhou Y (2017) Quantitative easing and volatility spillovers across countries and asset classes. Manag Sci 63(2):333–354. https://doi.org/10.1287/mnsc.2015.2305

Yang X, Khan I (2021) Dynamics among economic growth, urbanization, and environmental sustainability in IEA countries: the role of industry value-added. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16000-z

Yarovaya L, Matkovskyy R, Jalan A (2021) The effects of a “black swan” event (COVID-19) on herding behavior in cryptocurrency markets. J Int Financ Mark Inst Money 75:101321. https://doi.org/10.1016/j.intfin.2021.101321

Yousaf I, Ali S (2020) The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Rev 20:S1–S10. https://doi.org/10.1016/j.bir.2020.10.003

Zhang D, Broadstock DC (2020) Global financial crisis and rising connectedness in the international commodity markets. Int Rev Financ Anal 68:101239. https://doi.org/10.1016/j.irfa.2018.08.003

Zakari A, Khan I, Tan D, Alvarado R, Dagar V (2022a) Energy efficiency and sustainable development goals (SDGs). Energy 239:122365. https://doi.org/10.1016/j.energy.2021.122365

Zakari A, Khan I, Tawiah V, Alvarado R, Li G (2022b) The production and consumption of oil in Africa: the environmental implications. Resour Policy 78:102795. https://doi.org/10.1016/j.resourpol.2022.102795

Zakari A, Li G, Khan I, Jindal A, Tawiah V, Alvarado R (2022c) Are abundant energy resources and Chinese business a solution to environmental prosperity in Africa? Energy Policy 163:112829. https://doi.org/10.1016/j.enpol.2022.112829

Funding

This paper was supported by National Economics University.

Author information

Authors and Affiliations

Contributions

Le Thanh Ha contributed to all stages of preparing, drafting, writing, and revising this review article. The author listed has made a substantial, direct, and intellectual contribution to the work during different preparation stages. The author read, revised and approved the final version of this manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The author declares no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Please see Figs. 5, 6, 7 and 8.

Horizon specific network interlinkage measures. Notes: we plot the posterior median and one standard deviation percentiles of the posterior distribution of horizon specific network interlinkage measures, \({D}_{d}\). Network interlinkage at short horizons (from 1 day to 1 week), at medium horizons (from 1 week to 1 month), and at long horizons (larger than 1 month) are respectively displayed at the top, middle, and bottom panel

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ha, L.T. An application of Bayesian vector heterogeneous autoregressions to study network interlinkages of the crude oil and gold, stock, and cryptocurrency markets during the COVID-19 outbreak. Environ Sci Pollut Res 30, 68609–68624 (2023). https://doi.org/10.1007/s11356-023-27069-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27069-z

Keywords

- Bayesian vector heterogeneous autoregressions

- Network interlinkages

- Crude oil, Gold, Stock and cryptocurrency

- COVID-19