Abstract

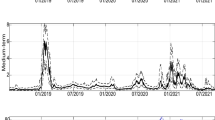

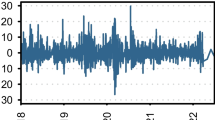

We investigate the directional volatility and return network connectedness among stock, commodity, bond, currency and cryptocurrency markets. The period of study covers Feb 2006 until August 2018. We utilize and expand Diebold and Yilmaz (2014 2015) connectedness measurement; accordingly, in the variance decomposition structure, we use Hierarchical Vector Autoregression (HVAR) to estimate high dimensional networks more accurately. Our empirical results show that markets are highly connected, especially during 2008–2009. Asian stock markets are the net receiver of shocks, while European and American stock markets are the net transmitter of shocks to other markets. The pairwise connectedness results suggest that among stock markets, DAX-CAC 40, FTSE 100-CAC 40 and S&P 500-S&P_TSX index are more integrated through connectedness than the others. For other markets, WTI crude oil — Brent crude oil, 30-Year bond and 10-Year bond, Dollar Index futures-EUR/USD have notable connections. In terms of cryptocurrencies, they contribute insignificantly to other markets and are highly integrated with each other. Gold and cryptocurrencies seem to be good choices for investors to hedge during a crisis.

Similar content being viewed by others

References

Abbas G, Hammoudeh S, Shahzad SJ, Wang S, Wei Y (2019). Return and volatility connectedness between stock markets and macroeconomic factors in the G-7 countries. Journal of Systems Science and Systems Engineering 28(1): 1–36.

Acharya VV, Pedersen LH, Philippon T, Richardson M (2017). Measuring systemic risk. The Review of Financial Studies 30(1): 2–47.

Adrian T, Brunnermeier MK (2011). CoVaR. National Bureau of Economic Research.

Ahmad W, Mishra AV, Daly KJ (2018). Financial connectedness of BRICS and global sovereign bond markets. Emerging Markets Review 37: 1–16.

Antonakakis N, Kizys R (2015). Dynamic spillovers between commodity and currency markets. International Review of Financial Analysis 41: 303–319.

Barbaglia L, Croux C, Wilms I (2020). Volatility spillovers and heavy tails: A large t-Vector AutoRegressive approach. Energy Economics 85: 104555.

Barigozzi M, Hallin M (2017). A network analysis of the volatility of high dimensional financial series. Journal of the Royal Statistical Society: Series C (Applied Statistics) 66(3): 581–605.

Belke A, Dubova I (2018). International spillovers in global asset markets. Economic Systems 42(1):3–17.

Billio M, Getmansky M, Lo AW, Pelizzon L (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of financial economics 104(3): 535–559.

Boon LN, Ielpo F (2014). Determining the maximum number of uncorrelated strategies in a global portfolio. Journal of Alternative Investments 16(4): 8.

Chen Y, Li W, Qu F (2019). Dynamic asymmetric spillovers and volatility interdependence on China’s stock market. Physica A: Statistical Mechanics and Its Applications 523: 825–838.

Cimini R (2015). Eurozone network “Connectedness” after fiscal year 2008. Finance Research Letters 14: 160–166.

Dao TM, McGroarty F, Urquhart A (2019). The Brexit vote and currency markets. Journal of International Financial Markets, Institutions and Money 59: 153–164.

Demirer M, Diebold FX, Liu L, Yilmaz K (2018). Estimating global bank network connectedness. Journal of Applied Econometrics 33(1): 1–15.

Diebold FX, Yilmaz K (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28(1): 57–66.

Diebold FX, Yilmaz K (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics 182(1): 119–134.

Diebold FX, Yilmaz K (2015). Financial and Macroeconomic Connectedness: A Network Approach to Measurement and Monitoring. Oxford University Press, USA.

Ebrahimi SB, Seyedhosseini SM (2015). Robust Mestimation of multivariate FIGARCH models for handling volatility transmission: A case study of Iran, United Arab Emirates and the global oil price index. Scientia Iranica 22(3): 1218–1226.

Ferrario A, Guidolin M, Pedio M (2018). Comparing in-and out-of-sample approaches to variance decomposition-based estimates of network connectedness an application to the Italian banking system.

Forbes KJ, Rigobon R (2002). No contagion, only interdependence: Measuring stock market comovements. The Journal of Finance 57(5): 2223–2261.

Greenwood-Nimmo M, Nguyen VH, Rafferty B (2016). Risk and return spillovers among the G10 currencies. Journal of Financial Markets 31: 43–62.

Hsu NJ, Hung HL, Chang YM (2008). Subset selection for vector autoregressive processes using Lasso. Computational Statistics & Data Analysis 52(7): 3645–3657.

Jeong D, Park S (2018). The more connected, the better? Impact of connectedness on volatility and price discovery in the Korean financial sector. Managerial Finance 44(1): 46–73.

Ji Q, Bouri E, Lau CK, Roubaud D (2018). Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis. 63: 257–272.

Ji Q, Geng JB, Tiwari AK (2018). Information spillovers and connectedness networks in the oil and gas markets. Energy Economics 75: 71–84.

Kang SH, Lee JW (2019). The network connectedness of volatility spillovers across global futures markets. Physica A: Statistical Mechanics and Its Applications 526: 120756.

Kim D, Wang Y, Zou J (2016). Asymptotic theory for large volatility matrix estimation based on high-frequency financial data. Stochastic Processes and their Applications 126(11): 3527–3577.

Koop G, Pesaran MH, Potter SM (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics 74(1): 119–147.

Lundgren AI, Milicevic A, Uddin GS, Kang SH (2018). Connectedness network and dependence structure mechanism in green investments. Energy Economics 72: 145–153.

Maghyereh AI, Awartani B, Bouri E (2016). The directional volatility connectedness between crude oil and equity markets: New evidence from implied volatility indexes. Energy Economics 57: 78–93.

Mensi W, Boubaker FZ, Al-Yahyaee KH, Kang SH (2018). Dynamic volatility spillovers and connectedness between global, regional, and GIPSI stock markets. Finance Research Letters 25: 230–238.

Mensi W, Hkiri B, Al-Yahyaee KH, Kang SH (2018). Analyzing time-frequency co-movements across gold and oil prices with BRICS stock markets: A VaR based on wavelet approach. International Review of Economics & Finance 54: 74–102.

Nicholson WB, Matteson DS, Bien J (2017). VARX-L: Structured regularization for large vector autoregressions with exogenous variables. International Journal of Forecasting 33(3): 627–651.

Nicholson WB, Wilms I, Bien J, Matteson DS (2018). High dimensional forecasting via interpretable vector autoregression. arXiv preprint arXiv: 1412.5250.

Nicholson W, Matteson D, Bien J (2019). BigVAR: Dimension reduction methods for multivariate time series. R Package Version: 1(4).

Parkinson M (1980). The extreme value method for estimating the variance of the rate of return. Journal of business: 61–65.

Pesaran HH, Shin Y (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters 58(1): 17–29.

Schwendner P, Schuele M, Ott T, Hillebrand M (2015). European government bond dynamics and stability policies: Taming contagion risks. Working Papers, 2015.

Shahzad SJ, Arreola-Hernandez J, Bekiros S, Rehman MU (2018). Risk transmitters and receivers in global currency markets. Finance Research Letters 25: 1–9.

Shahzad SJ, Arreola-Hernandez J, Bekiros S, Shahbaz M, Kayani GM (2018). A systemic risk analysis of Islamic equity markets using vine copula and delta CoVaR modeling. Journal of International Financial Markets, Institutions and Money 56: 104–127.

Sims CA (1980). Macroeconomics and reality. Econometrica: Journal of the Econometric Society: 1–48.

Singh VK, Nishant S, Kumar P (2018). Dynamic and directional network connectedness of crude oil and currencies: Evidence from implied volatility. Energy Economics 76: 48–63.

Song S, Bickel PJ (2011). Large vector auto regressions. arXiv preprint arXiv: 1106.3915.

Tibshirani R (1996). Regression shrinkage and selection via the Lasso. Journal of the Royal Statistical Society: Series B (Methodological) 58(1): 267–288.

Wei WW (2019). Dimension reduction in high dimensional multivariate time series analysis. Contemporary Biostatistics with Biopharmaceutical Applications: 33–59.

Wen T, Wang GJ (2020). Volatility connectedness in global foreign exchange markets. Journal of Multinational Financial Management: 100617.

Xiao X, Huang J (2018). Dynamic connectedness of international crude oil prices: The Diebold-Yilmaz approach. Sustainability 10(9): 3298.

Xu N, Tang X (2018). A causality analysis of societal risk perception and stock market volatility in China. Journal of Systems Science and Systems Engineering 27(5): 613–631.

Yi S, Xu Z, Wang GJ (2018). Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency. International Review of Financial Analysis 60: 98–114.

Yoon SM, Al Mamun M, Uddin GS, Kang SH (2019). Network connectedness and net spillover between financial and commodity markets. The North American Journal of Economics and Finance 48: 801–818.

Zhang D, Broadstock DC (2018). Global financial crisis and rising connectedness in the international commodity markets International Review of Financial Analysis: 101239.

Acknowledgments

The authors would like to thank the anonymous reviewers for their time and effort. Their constructive comments and helpful suggestions helped us to clarify the main paper’s research contributions and improve its quality.

Author information

Authors and Affiliations

Corresponding author

Additional information

Ehsan Bagheri received his M.S. degree in financial engineering from K. N. Toosi University of Technology. He earned his BSc in industrial engineering and embarked on his education with business and economic focus. During his postgraduate period, he has been recognized as one of the successful students in both theory and research. His research interests are in the field of risk assessment, econometrics, investment decision analysis and portfolio management.

Seyed Babak Ebrahimi is an assistant professor in Financial Engineering Department of Faculty of Industrial Engineering. He earned his MSc from Sharif University of Technology as a top student in the field of economics. During his undergraduate period, he was awarded as the best student in research in Industrial Engineering Department of Iran University of Science and Technology for three consecutive years. He was also the top young Iranian researcher in Science and Technology and was elected as the best Ph.D. graduate. His research interests include econometrics, microeconomics, time series analysis and pricing.

Rights and permissions

About this article

Cite this article

Bagheri, E., Ebrahimi, S.B. Estimating Network Connectedness of Financial Markets and Commodities. J. Syst. Sci. Syst. Eng. 29, 572–589 (2020). https://doi.org/10.1007/s11518-020-5465-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11518-020-5465-1