Abstract

Foreign direct investment (FDI) flows from developed to developing countries may increase carbon emissions in developing countries as developing countries are seen as pollution havens due to their lenient environmental regulations. On the other hand, FDI flows from the developed world may improve management practices and advanced technologies in developing countries, and an increase in FDI flows reduces carbon emissions. Most of the existing studies examine the relationship between FDI flows and carbon emissions by using aggregate FDI flows; however, this paper contributes to the literature by analyzing the impact of FDI flows on carbon emissions in Brazil, Russia, India, China, and South Africa (BRICS) between 1993 and 2012 using bilateral FDI flows from eleven OECD countries. According to our empirical results, from which OECD country FDI flows to BRICS countries matters for carbon emissions in BRICS countries. Our results confirm that FDI flows to BRICS countries from Denmark and the UK increase carbon emissions in BRICS countries, confirming the pollution haven hypothesis. On the other hand, FDI that flows from France, Germany, and Italy reduced carbon emissions in the BRICS countries, confirming the pollution halo effect. FDI flows from Austria, Finland, Japan, Netherlands, Portugal, and Switzerland have no significant impact on carbon emissions in BRICS countries. The BRICS countries should promote clean FDI flows by reducing environmental damages, and investing countries should be rated based on their environmental damage in the host countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Economic growth, access to energy, and action for climate change have been some of the priority areas for sustainable development and are integral parts of the United Nations’ Sustainable Development Goals. However, the movement of foreign direct investment (FDI) from developed to developing countries due to less strict environmental laws, cheap labor, and natural resources continue to pressure the climate change goals. Even though FDI flows to the developing countries lead to knowledge spillovers (Branstetter 2006; Xu and Sheng 2012; Paul and Feliciano-Cestero 2021), improved institutional quality in some regions in the host country (Long et al. 2015), and economic growth (Osei and Kim 2020), FDI flows to these countries also increase environmental degradation in developing countries (see, e.g., Hanif et al. 2019, Nawaz et al. 2021; among many others; see also below for further discussion).

The pollution haven hypothesis (PHH) argues that due to weak environmental regulations in host countries, some industries with high contamination and consumption levels will be transferred from other countries through FDI and trade, causing a significant increase in pollutant emissions (see, e.g., Savona and Ciarli 2019; Stef and Jabeur 2020). Most existing studies find a positive association between FDI flows and environmental degradation, which suggest a confirmation of the PHH (see, e.g., Sapkota and Bastola 2017; Hanif et al. 2019; Salehnia et al. 2020; among others). However, recent studies argued that FDI flows could also reduce CO2 emissions due to improvements in management practices and technologies (see, e.g., Zhu et al. 2016; Huang et al. 2017; Wang et al. 2019). FDI flows reducing environmental damage is known as the pollution halo effect (PHE). Finally, a stream of literature found no significant relationship between FDI flows and environmental degradation (see, e.g., Shao et al. 2019; Danish and Ulucak 2022). A detailed summary of more recent literature on the relationship between FDI and environmental quality is presented in Table 1.

Brazil, Russia, India, China, and South Africa (BRICS) are the fastest growing economies in the world, accounting for 42% and 24% of the world’s population and production (GDP), respectively, and 45% of the world’s CO2 emissions in 2018 (World Bank 2021). Economic growth and heavy reliance on fossil fuels during the production process make BRICS countries the most significant contributors to CO2 emissions and climate change (Chaudhry et al. 2022; Khan et al. 2020; Shao et al. 2019). Therefore, examining the impact of FDI flows on CO2 emissions in BRICS countries is essential.

The existing studies examining the PHH for the BRICS countries employ panel data or time series methods. Those using panel data methods find either support for the PHH (Balsalobre-Lorente et al. 2022a; Chaudhry et al. 2022; Khan et al. 2020; Rana and Sharma 2019; Ren et al. 2014; Wang and Chen 2014; Zakarya et al. 2015) or no support for the PHH (Shao et al. 2019; Danish and Ulucak 2022) or support PHE (see, e.g., Tamazian et al. 2009; Wang et al. 2019). By contrast, PHH is tested using time series or spatial methods for each BRICS country. Using the autoregressive distributed lag cointegration (ARDL) approach, Sun et al. (2017) provide support for the PHH in China. However, Huang et al. (2017) find evidence for the PHE when Chinese provincial data is used through spatial econometric methods. In sum, depending on the methodology employed and the period analyzed, there is a mixed set of findings on the effect of FDI flows on CO2 emissions in BRICS countries.

More recent literature exploring the PHH and PHE aims to explore more disaggregated data by examining provincial data and bilateral trade flows. For example, Ahmad et al. (2021) document that FDI flows heterogeneously influenced CO2 emissions across Chinese provinces. For different regions of China, either PHH or PHE was confirmed, which verifies the presence of aggregation bias. On the other hand, Cai et al. (2018) calculated the carbon emissions due to exports and imports in China and highlighted that China had become a pollution haven for 22 developed countries, while 19 developing countries have become China’s pollution haven. As highlighted by Ahmad et al. (2021), the studies that employ aggregate FDI flows in their analysis may suffer from aggregation bias. Therefore, this study examines the impact of FDI flows on CO2 emissions in BRICS countries between 1993 and 2012 using bilateral FDI flows from eleven OECD countries to BRICS countries.

This paper aims to contribute to the literature in various ways. Firstly, rather than using aggregate FDI flows to examine the impact of FDI flows on carbon emissions in BRICS countries, we use disaggregated FDI flows to investigate whether there is any support for PHH or PHE depending on which OECD country FDI flows to BRICS counties. For instance, Sun et al. (2017) illustrate that China is a pollution haven when the aggregate FDI flows to China are examined. However, it is possible that the FDI flows from some countries may lead to technological improvements and confirm PHE. Alternatively, some other countries may consider BRICS countries as pollution havens and FDI flows from these countries may increase CO2 emissions in BRICS countries. Therefore, we overcome the potential aggregation bias by using bilateral FDI flows to BRICS countries. Secondly, by using disaggregated FDI flows data, we can shed light on why existing studies may have found mixed results about the impact of FDI flows on CO2 emissions in BRICS countries. Thirdly, some of the existing studies do not tackle the potential endogeneity problem. However, endogeneity is a serious concern as some studies found that CO2 emissions in BRICS countries may lead to higher FDI flows (e.g., Shao et al. 2019). Therefore, this paper employs a general method of moments (GMM) to account for potential endogeneity and does not suffer from biases that arise due to the endogeneity problem.

The remainder of the paper is organized as follows. “Methodology” section provides details of the methodology and data. “Empirical analysis” section offers the empirical findings, and “Robustness analysis” section provides robustness analysis. Finally, “Conclusions and policy implications” section provides conclusions and policy recommendations.

Methodology

Model and variables

The goal is to explore the role of net FDI inflows from each selected OECD country in explaining the CO2 emissions in the BRICS countries. The model specification yields:

where CO2 is carbon emissions per capita, FDI denotes net FDI inflows from each OECD country to the BRICS countries, GDPY is GDP per capita, ENUSE shows energy use, TR denotes trade activities, POP is total population, URBPOP denotes urban population, and REN is renewable energy consumption. The model also accounts for country and time fixed effects, αi and βt, respectively. In a panel framework, the error terms, \({v}_{i,t}\), are uncorrelated. They are assumed to be independently distributed across countries with a zero mean. To avoid the presence of potential endogeneity issues, we estimate the dynamic panel data model using the general method of moments (GMM) estimation recommended by Arellano and Bover (1995) and Blundell and Bond (1998). The presence of endogeneity potentially could come through reverse causality between carbon emissions and any of the covariates. For instance, Shao et al. (2019) found that the CO2 emissions in BRICS countries explain the FDI flows and trade openness using the vector error correction model. Al-Mulali and Ozturk (2016) also found that the relationship between CO2 emissions and GDP per capita is bidirectional. Along the same lines, Tang and Tan (2015) found bidirectional causation between CO2 emissions and energy consumption in Vietnam. Overall, the existing literature found reverse causality between carbon emissions and other covariates. Therefore, we use the GMM estimation method to tackle potential endogeneity problems (see also He 2006; Du et al. 2012; Ren et al. 2014; Li et al. 2016; Hove and Tursoy 2019; Mahadevan and Sun 2020; Singhania and Saini 2021, among others, for the use of GMM methods to overcome endogeneity problem when pollution is used as a dependent variable). In addition, the empirical analysis will use a non-causality test developed by Dumitrescu and Hurlin (2012). This test can be used when T > N (with T being the number of observations and N the number of countries considered), which is our case here. The corresponding Wald statistic is defined as follows: ZN,T = √N/2 K (WN,T − K), where K is the number of lags in the corresponding VAR model, and:

where Wi,T stands for the individual Wald statistical values for cross-section units.

Data

The data for all the variables, except bilateral FDI flows, are obtained from the World Development Indicators (World Bank 2021). The bilateral FDI flows from eleven OECD to BRICS countries are obtained from OECD (2021) and are measured in US dollars. Bilateral FDI flows per capita are obtained by dividing aggregate bilateral FDI flows by the total population. The bilateral FDI flows data is available between 1985 and 2013; however, most data before 1993 and 2013 had missing values. Therefore, our analysis covers the period between 1993 and 2012 to capture as many OECD countries as possible in the study. The OECD countries used in this analysis are Austria, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Portugal, Switzerland, and the UK.

As a determinant of environmental degradation, the existing literature accounts for the population size (see, e.g., Wang et al. 2015; Zhu et al. 2016), urbanization (see, e.g., Al-Mulali and Ozturk 2015; Anwar et al. 2022; Chien et al. 2022; Dong et al. 2020; Hossain 2011; Murshed et al. 2021; Nadeem et al. 2020; Sarkodie and Ozturk 2020), trade openness (see, e.g., Al-Mulali and Ozturk, 2015; Hossain 2011; Kolcava et al. 2019; Le et al. 2016; Lin, 2017; Shahbaz et al., 2017; Zhang, 2020), energy consumption and renewable energy consumption (see, e.g., Ambe 2021; Charfeddine and Kahia 2019; Chen et al. 2022; Godil et al. 2020; Rahman et al. 2022; Shahnazi and Shabani 2021; Sharif et al. 2019; Usman and Balsalobre-Lorente 2022), and economic development or growth (see, e.g., Doğan et al. 2022; Jahanger et al. 2022; Karahasan and Pinar 2022; Sharif et al. 2020a; Sharif et al. 2020b; Suki et al. 2020).

As our dependent variable, we use CO2, which is carbon dioxide emissions (measured in metric tons) per capita. We also use the following independent variables in our study. FDI denotes net FDI inflows per capita from the OECD country to the BRICS countries. GDPY is GDP per capita (constant 2010 US$), ENUSE is the total energy consumption (measured in kg of oil equivalent) per capita. TR is the trade openness measure, which is the sum of exports and imports as a percentage of GDP. POP is the total population of the respective BRICS country. URBPOP is the urban population and is measured as the percentage of the population living in the urban areas. Finally, REN is the renewable energy consumption, which is measured as the renewable energy consumption as a percentage of total final energy consumption.

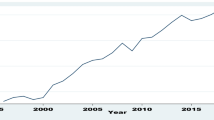

Table 2 offers the descriptive statistics for each variable and net FDI flows per capita from each OECD country to BRICS countries. For a given average year and BRICS country, net FDI flows per capita to BRICS countries were higher from the UK, France, Japan, and Germany (i.e., $1255, $426, $380, and $355, respectively), and were lower from Denmark, Finland, and Portugal (i.e., $27, $42, and $61, respectively).Footnote 1 The urbanization rates also showed an increasing trend in each BRICS country. The percentages of the urban population were 76%, 73%, 26%, 29%, and 54% in 1993, and were 85%, 74%, 32%, 52%, and 63% in 2012 in Brazil, India, Russia, China, and South Africa, respectively. Similarly, there has been an increasing trend in trade openness across all the BRICS countries. Renewable energy as a percentage of the total final energy consumption decreased in all of the BRICS countries between 1993 and 2012. The percentages of renewable energy consumption in the energy mix were 48%, 57%, 4%, 32%, and 19% in 1993, and were 44%, 39%, 3%, 12%, and 11% in 2012 in Brazil, India, Russia, China, and South Africa, respectively. Furthermore, there has been a clear increasing trend in the CO2 emissions per capita, GDP per capita, and energy consumption between 1993 and 2012.

Empirical analysis

This section examines the causal relationship between net FDI flows from each OECD country to BRICS countries and the CO2 emissions in BRICS countries. However, we first need to conduct some tests to identify the presence of cross-sectional dependence. Studies examining the factors contributing to CO2 emissions have extensively considered the potential cross-section dependence before their analysis (Churchill et al. 2018; Belaïd and Zrelli 2019; Dogan et al. 2020; Munir et al. 2020, among others). Therefore, we first explore the degree of residual cross-sectional dependence through the cross-sectional dependence (CD) statistic proposed by Pesaran (2004). The results are reported in Table 3, and we reject the null hypothesis of cross-sectional independence for all the variables.

Next, a second-generation panel unit root test, the Pesaran (2007) panel unit root test, is used to determine the degree of integration of the respective variables. The null hypothesis suggests a presence of a unit root. The results are reported in Table 4 and support the presence of a unit root across all variables, and the non-stationarity of these variables in their first differences is rejected. Moreover, concerning the FDI flows from each OECD country to BRICS countries, the unit root test of the generalized least squares (GLS), recommended by Elliott et al. (1996), is used and the results are shown in Table 4. The findings indicate that the respective variables are stationary in their levels.

Table 5 reports the baseline empirical results of the static GMM model. The regression analysis includes the same control variables (i.e., GDPY, ENERGYUSE, TRADE, POP, URBPOP, REN) and lagged CO2 emissions per capita in the BRICS countries. The only variable that varies across different columns of Table 5 is the FDI inflows per capita from each OECD country to the BRICS countries. Columns 1–11 report the FDI flows from the respective OECD countries to the BRICS countries. The estimates document a negative and statistically significant impact of FDI flows on CO2 emissions in the BRICS countries if the FDI flows are from France, Germany, and Italy. The technical effect of the FDI flows from these countries (i.e., better management practices and environment-friendly technologies used in the production) dominates the factor endowment effects (Zugravu-Soilita 2017). However, the impact of FDI flows on CO2 emissions is positive and statically significant if FDI flows are from Denmark and the UK. The finding concerning FDI flows from the UK is in line with that recommended in the literature. Mulatu (2017) examines the UK-based multinational activity in 64 countries over the period 2002–2006 and finds that FDI flows from the UK target relatively more polluting industries in countries with lax environmental regulations. Finally, the effect of the FDI flows from Austria, Finland, Japan, Netherlands, Portugal, and Switzerland on CO2 emissions is statistically insignificant. These findings explain why current literature finds mixed results concerning the effect of FDI flows on environmental degradation in the BRICS countries. As the existing research papers use aggregate FDI flows in their analysis, they suffer from aggregation bias (Ahmad et al. 2021).

Regarding the remaining determinants of CO2 emissions in BRICS countries, the estimates document that income per capita, energy use, trade, and urban population exert a positive and statistically significant impact on CO2 emissions across most of the specifications. However, the population size is insignificant in most of the specifications. These findings are in line with the current literature. Lagged CO2 emissions are positive, which is the case for the literature using the GMM estimation methods (Ren et al. 2014; Li et al. 2016; Hove and Tursoy 2019; Singhania and Saini 2021). CO2 emissions increase with the increased GDP per capita (Baloch et al. 2020; Chaudhry et al. 2022; Ren et al. 2014; Shao et al. 2019), trade openness (Rana and Sharma 2019; Ren et al. 2014), increased energy consumption (Chaudhry et al. 2022; Khan et al. 2020; Li et al. 2016), increased urbanization (Al-Mulali and Ozturk 2015; Anwar et al. 2022; Behera and Dash 2017; Murshed et al. 2021; Nadeem et al. 2020), and decreased renewable energy consumption (Balsalobre-Lorente et al. 2022b, a; Djellouli et al. 2022; Murshed et al. 2021; Sharif et al. 2019).

Finally, specific diagnostics are also reported in Table 5. The AR(2) test results suggest that the null hypothesis is rejected, indicating no second-order serial correlation. Furthermore, difference-in-Hansen is the test of the validity of GMM instruments. The difference-in-Hansen test rejects the null hypothesis, and therefore findings support the validity of the instruments used.

Robustness analysis

The dynamic model

This section repeats the baseline analysis, but the dynamic version of Eq. (1) is considered in which certain lags of the controls covariates are used in the estimation. The number of lags is determined through the Akaike criterion. The new findings are reported in Table 6 and provide robust support to those reported previously. The analysis in Table 6 also includes the first lags of the FDI flows, GDP per capita, and trade openness in certain specifications. Lagged FDI flows from Denmark and the UK lead to increased CO2 emissions, confirming the PHH. The coefficients of lagged FDI flows from France, Italy, and Germany are also negative and statistically significant, confirming the PHE. In contrast, the remaining results align with the ones reported in Table 5. Finally, the diagnostics tests confirm the validity of the instruments.

Panel non-causality test

The panel non-causality test developed by Dumitrescu and Hurlin (2012) is performed in this part. Under the null hypothesis, it is assumed that there is no causality from one variable to another. Under the alternative hypothesis, there exists a causal relationship from one variable to another only for a subgroup of individuals, with the coefficients differing across groups.

The causality results are reported in Table 7. The cases of FDI flows from Austria, Denmark, Finland, France, Germany, Italy, and the UK document univariate causality from FDI flows to CO2 emissions. For the remaining cases of FDI flows from the rest of the OECD countries, the non-causality hypothesis is accepted. In other words, the findings confirm the results obtained with the static and dynamic GMM models. In other words, our findings confirm the PHH hypothesis if FDI flows are from Denmark and the UK, and the PHE hypothesis if FDI flows are from France, Germany, and Italy.

Conclusions and policy implications

There has been an increased debate on the PHH and PHE to examine the effect of FDI flows on the environmental quality in recipient countries, with much of the research exploring the role of different characteristics of the recipient countries. However, the role of the investing countries on the environment quality in the recipient countries has received little attention. This paper contributes to the existing literature by examining the effect of FDI flows from eleven OECD countries on CO2 emissions in the BRICS countries. We found that from which country FDI flows matter for the environmental degradation in recipient countries. The findings suggested that while FDI flows from Denmark and the UK led to increased CO2 emissions in the BRICS countries, FDI flows from France, Germany, and Italy decreased CO2 emissions in these countries. The findings were robust to the estimation model selection (i.e., static and dynamic GMM estimation method and panel Granger non-causality test). Overall, the results highlighted that the FDI flows coming from different OECD countries had a heterogeneous effect on the environmental quality in the BRICS countries, and the importance of examining the PHH and PHE by using the disaggregated data as the aggregated data may shadow some of the existing mechanisms in place.

The findings of this paper have important policy implications. Both investing and recipient countries have their roles to play in combating climate change. More specifically, the recipient countries should adjust their degree of stringency of environmental regulations disallowing themselves to be “pollution havens” and more so if the FDI flows from a set of countries. Furthermore, beyond the performance of the recipient countries, international agencies could publish a rating system of the investing countries based on the environmental performance of their investors abroad. This concept is closely associated with the donor ratings in international aid effectiveness literature (see, e.g., Roodman 2012; Minasyan et al. 2017). Providing such a rating system may expose investors that target other countries as pollution havens and could pressure these investors to alter their behavior and reduce the negative implications of their investments in recipient countries.

This paper has some limitations. Firstly, our empirical analysis covers FDI flows from each of the eleven OECD countries to BRICS countries to examine the effect of FDI flows on CO2 emissions in BRICS countries between 1993 and 2012. In other words, the empirical analysis of this paper has limited country and period coverage. Future studies could expand the country coverage to examine the implications of the FDI flows from different countries for environmental degradation in recipient countries. Secondly, a future study could cover recent years to investigate whether the impact of FDI flows from other countries had different effects in more recent periods. Thirdly, even though this paper examines the FDI flows from each OECD country to BRICS countries, the FDI flows data could further be disaggregated to examine the implications of the FDI flows to different sectors. For instance, Cansino et al. (2021) examined Spanish FDI flows to various industries and found that the pollution haven hypothesis is not confirmed when aggregate FDI flows from Spain are used, but PHH is confirmed in primary and manufacturing sectors. Therefore, a future study could examine whether the FDI flows to different sectors from developed to developing countries result in environmental degradation in the recipient country or not.

Data availability

Notes

To obtain a balanced data set, if FDI flows from OECD countries to BRICS countries were missing in a given period, average FDI flows between preceding and succeeding years are used to interpolate the missing data.

References

Ahmad M, Jabeen G, Wu Y (2021) Heterogeneity of pollution haven/halo hypothesis and environmental Kuznets curve hypothesis across development levels of Chinese provinces. J Clean Prod 285:124898

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389

Al-Mulali U, Ozturk I (2016) The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. Renew Sustain Energy Rev 54:1622–1631

Ambe JN (2021) Renewable energy as a determinant of inter-country differentials in CO2 emissions in Africa. Renew Energy 172:1225–1232

Anwar A, Sinha A, Sharif A, Siddique M, Irshad S, Anwar W, Malik S (2022) The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: evidence from selected Asian countries. Environ Dev Sustain 24:6556–6576

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68:29–51

Assamoi GR, Wang S, Liu Y, Gnangoin YTB (2020) Investigating the pollution haven hypothesis in Cote d’Ivoire: evidence from autoregressive distributed lag (ARDL) approach with structural breaks. Environ Sci Pollut Res 27:16886–16899

Baloch MA, Ozturk I, Bekun FV, Khan D (2020) Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30(1):176–184

Balsalobre-Lorente D, Driha OM, Halkos G, Mishra S (2022a) Influence of growth and urbanization on CO2 emissions: the moderating effect of foreign direct investment on energy use in BRICS. Sustain Dev 30(1):227–240

Balsalobre-Lorente D, Ibáñez-Luzón L, Usman M, Shahbaz M (2022b) The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew Energy 185:1441–1455

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sustain Energy Rev 70:96–106

Belaïd F, Zrelli MH (2019) Renewable and non-renewable electricity consumption, environmental degradation and economic development: evidence from Mediterranean countries. Energy Policy 133:110929

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143

Branstetter L (2006) Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. J Int Econ 68:325–344

Caetano RV, Marques AC, Afonso TL, Vieira I (2022) A sectoral analysis of the role of foreign direct investment in pollution and energy transition in OECD countries. J Environ Manage 302:114018

Cai X, Che X, Zhu B, Zhao J, Xie R (2018) Will developing countries become pollution havens for developed countries? An empirical investigation in the Belt and Road. J Clean Prod 198:624–632

Cansino JM, Carril-Cacia F, Molina-Parrado JC, Román-Collado R (2021) Do environmental regulations matter on Spanish foreign investment? A multisectorial approach. Environ Sci Pollut Res 28:57781–57797

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

Chaudhry IS, Yin W, Ali SA, Faheem M, Abbas Q, Farooq F, Rahman SU (2022) Moderating role of institutional quality in validation of pollution haven hypothesis in BRICS: a new evidence by using DCCE approach. Environ Sci Pollut Res 29:9193–9202

Chen C, Pinar M, Stengos T (2022) Renewable energy and CO2 emissions: new evidence with the panel threshold model. Renew Energy 194:117–128

Chien F, Hsu C-C, Ozturk I, Sharif A, Sadiq M (2022) The role of renewable energy and urbanization towards greenhouse gas emission in top Asian countries: evidence from advance panel estimations. Renew Energy 186:207–216

Churchill SA, Inekwe J, Ivanovski K, Smyth R (2018) The environmental Kuznets curve in the OECD: 1870–2014. Energy Econ 75:389–399

Danish, Ulucak R (2022) Analyzing energy innovation-emissions nexus in China: a novel dynamic simulation method. Energy 244:123010

Djellouli N, Abdelli L, Elheddad M, Ahmed R, Mahmood H (2022) The effects of non-renewable energy, renewable energy, economic growth, and foreign direct investment on the sustainability of African countries. Renew Energy 183:676–686

Doğan B, Chu LK, Ghosh S, Truong HHD, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656

Dogan E, Ulucak R, Kocak E, Isik C (2020) The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci Total Environ 723:138063

Dong Q, Lin Y, Huang J, Chen Z (2020) Has urbanization accelerated PM2.5 emissions? An empirical analysis with cross-country data. China Econ Rev 59:101381

Du L, Wei C, Cai S (2012) Economic development and carbon dioxide emissions in China: provincial panel data analysis. China Econ Rev 23(2):371–384

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Godil DI, Yu Z, Sharif A, Usman R, Khan SAR (2020) Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: a path toward sustainable development. Sustain Dev 29(4):694–707

Gorus MS, Aslan M (2019) Impact of economic indicators on environmental degradation: evidence from MENA countries. Renew Sustain Energy Rev 103:259–268

Guzel AE, Okumus İ (2020) Revisiting the pollution haven hypothesis in ASEAN-5 countries: new insights from panel data analysis. Environ Sci Pollut Res 27:18157–18167

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60(1):228–245

Hove S, Tursoy T (2019) An investigation of the environmental Kuznets curve in emerging economies. J Clean Prod 236:117628

Hossain MS (2011) Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 39:6991–6999

Huang J, Chen X, Huang B, Yang X (2017) Economic and environmental impacts of foreign direct investment in China: a spatial spillover analysis. China Econ Rev 45:289–309

Jahanger A, Usman M, Murshed M, Mahmood H, Balsalobre-Lorente D (2022) The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: the moderating role of technological innovations. Resour Policy 76:102569

Karahasan BC, Pinar M (2022) The environmental Kuznets curve for Turkish provinces: a spatial panel data approach. Environ Sci Pollut Res 29:25519–25531

Khan ZU, Ahmad M, Khan A (2020) On the remittances-environment led hypothesis: empirical evidence from BRICS economies. Environ Sci Pollut Res 27:16460–16471

Kolcava D, Nguyen Q, Bernauer T (2019) Does trade liberalization lead to environmental burden shifting in the global economy? Ecol Econ 163:98–112

Le T-H, Chang Y, Park D (2016) Trade openness and environmental quality: international evidence. Energy Policy 92:45–55

Li T, Wang Y, Zhao D (2016) Environmental Kuznets curve in China: new evidence from dynamic panel analysis. Energy Policy 91:138–147

Lin F (2017) Trade openness and air pollution: city-level empirical evidence from China. China Econ Rev 45:78–88

Long C, Yang J, Zhang J (2015) Institutional impact of foreign direct investment in China. World Dev 66:31–48

Mahadevan R, Sun Y (2020) Effects of foreign direct investment on carbon emissions: evidence from China and its Belt and Road countries. J Environ Manage 276:111321

Minasyan A, Nunnenkamp P, Richert K (2017) Does aid effectiveness depend on the quality of donors? World Dev 100:16–30

Mulatu A (2017) The structure of UK outbound FDI and environmental regulation. Environ Resour Econ 68:65–96

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:104571

Murshed M, Ahmed R, Kumpamool C, Bassim M, Elheddad M (2021) The effects of regional trade integration and renewable energy transition on environmental quality: evidence from South Asian neighbors. Bus Strateg Environ 30(8):4154–4170

Nadeem AM, Ali T, Khan MTI, Guo Z (2020) Relationship between inward FDI and environmental degradation for Pakistan: an exploration of pollution haven hypothesis through ARDL approach. Environ Sci Pollut Res 27:15407–15425

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manage 242:131–141

Nathaniel S, Aguegboh E, Iheonu C, Sharma G, Shah M (2020) Energy consumption, FDI, and urbanization linkage in coastal Mediterranean countries: re-assessing the pollution haven hypothesis. Environ Sci Pollut Res 27:35474–35487

Nawaz SMN, Alvi S, Akmal T (2021) The impasse of energy consumption coupling with pollution haven hypothesis and environmental Kuznets curve: a case study of South Asian economies. Environ Sci Pollut Res 28:48799–48807

OECD (2021) FDI flows by partner countries. https://stats.oecd.org/index.aspx?DataSetCode=FDI_FLOW_PARTNER (accessed 17 April 2021)

Osei MJ, Kim J (2020) Foreign direct investment and economic growth: is more financial development better? Econ Model 93:154–161

Pao H-T, Tsai C-M (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36(1):685–693

Paul J, Feliciano-Cestero MM (2021) Five decades of research on foreign direct investment by MNEs: an overview and research agenda. J Bus Res 124:800–812

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. IZA Discussion Paper No. 1240. https://docs.iza.org/dp1240.pdf

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22:265–312

Rahman MR, Sultana N, Velayutham E (2022) Renewable energy, energy intensity and carbon reduction: experience of large emerging economies. Renew Energy 184:252–265

Rana R, Sharma M (2019) Dynamic causality testing for EKC hypothesis, pollution haven hypothesis and international trade in India. J Int Trade Econ Dev 28(3):348–364

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134

Roodman D (2009) A note on the theme of too many instruments. Oxford Bull Econ Stat 71:135–158

Roodman D (2012) An index of donor performance. Working paper 67 (October 2012 edition). Center for Global Development. Washington, DC. https://www.cgdev.org/publication/index-donor-performance-working-paper-67-revised-october-2012 (accessed 25 May 2021).

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sustain Energy Rev 81(2):2002–2010

Salehnia N, Karimi Alavijeh N, Salehnia N (2020) Testing Porter and pollution haven hypothesis via economic variables and CO2 emissions: a cross-country review with panel quantile regression method. Environ Sci Pollut Res 27:31527–31542

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212

Sarkodie SA, Ozturk I (2020) Investigating the environmental Kuznets curve hypothesis in Kenya: a multivariate analysis. Renew Sustain Energy Rev 117:209481

Savona M, Ciarli T (2019) Structural changes and sustainability. A selected review of the empirical evidence. Ecol Econ 159:244–260

Shahbaz M, Nasreen S, Ahmed K, Hammoudeh S (2017) Trade openness–carbon emissions nexus: the importance of turning points of trade openness for country panels. Energy Econ 61:221–232

Shahnazi R, Shabani ZD (2021) The effects of renewable energy, spatial spillover of CO2 emissions and economic freedom on CO2 emissions in the EU. Renew Energy 169:293–307

Shao Q, Wang X, Zhou Q, Balogh L (2019) Pollution haven hypothesis revisited: a comparison of the BRICS and MINT countries based on VECM approach. J Clean Prod 227:724–738

Sharif A, Afshan S, Chrea S, Amel A, Khan SAR (2020a) The role of tourism, transportation and globalization in testing environmental Kuznets curve in Malaysia: new insights from quantile ARDL approach. Environ Sci Pollut Res 27:25494–25509

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020b) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cities Soc 57:102138

Sharif A, Raza SA, Ozturk I, Afshan S (2019) The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: a global study with the application of heterogeneous panel estimations. Renew Energy 133:685–691

Singhania M, Saini N (2021) Demystifying pollution haven hypothesis: role of FDI. J Bus Res 123:516–528

Stef N, Jabeur SB (2020) Climate change legislations and environmental degradation. Environ Resource Econ 77:839–868

Suki NM, Sharif A, Afshan S, Suki NM (2020) Revisiting the environmental Kuznets curve in Malaysia: the role of globalization in sustainable environment. J Clean Prod 264:121669

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454

Usman M, Balsalobre-Lorente D (2022) Environmental concern in the era of industrialization: can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162:112780

Wang DT, Chen WY (2014) Foreign direct investment, institutional development, and environmental externalities: evidence from China. J Environ Manage 135:81–90

Wang H, Dong C, Liu Y (2019) Beijing direct investment to its neighbors: a pollution haven or pollution halo effect? J Clean Prod 239:118062

Wang SX, Fu YB, Zhang ZG (2015) Population growth and the environmental Kuznets curve. China Econ Rev 36:146–165

Waqih MAU, Bhutto NA, Ghumro NH, Kumar S, Salam MA (2019) Rising environmental degradation and impact of foreign direct investment: an empirical evidence from SAARC region. J Environ Manage 243:472–480

World Bank (2021) World Development Indicators. https://databank.worldbank.org/source/world-development-indicators (accessed 15 April 2021)

Xu X, Sheng Y (2012) Productivity spillovers from foreign direct investment: firm-level evidence from China. World Dev 40(1):62–74

Zakarya GY, Mostefa B, Abbes SM, Seghir GM (2015) Factors affecting CO2 emissions in the BRICS countries: a panel data analysis. Procedia Econ Finan 26:114–125

Zhang Y (2020) Free trade and the environment – evidence from Chinese cities. Environ Dev Econ 25(6):561–582

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sustain Energy Rev 58:943–951

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Zhu L, Gan Q, Liu Y, Yan Z (2017) The impact of foreign direct investment on SO2 emissions in the Beijing-Tianjin-Hebei region: a spatial econometric analysis. J Clean Prod 166:189–196

Zugravu-Soilita N (2017) How does foreign direct investment affect pollution? Toward a better understanding of the direct and conditional effects. Environ Resource Econ 66:293–338

Author information

Authors and Affiliations

Contributions

Nicholas Apergis: conceptualization, formal analysis and investigation, validation, writing—original draft, writing—review and editing, supervision, and project administration. Mehmet Pinar: conceptualization, data curation, validation, writing—original draft, writing—review and editing, supervision, and project. Emre Unlu: conceptualization, data curation, validation, writing—original draft, writing—review and editing, supervision, and project.

Corresponding author

Ethics declarations

Ethics approval

This article does not require any ethical committee approval.

Consent to participate

All the authors consent to participate to the article.

Consent for publication

All the authors give the publisher consent to publish the article.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Apergis, N., Pinar, M. & Unlu, E. How do foreign direct investment flows affect carbon emissions in BRICS countries? Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environ Sci Pollut Res 30, 14680–14692 (2023). https://doi.org/10.1007/s11356-022-23185-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23185-4