Abstract

This study provides a literature review of the interplay between social networks and taxes. Social network analysis allows researchers to explore the relational factors between nodes (agents and firms) and ties (their relationships between one another). Social networks explain how information flows, resulting in tax behavioural adoption. We analyse 33 papers from the Scopus database and identify a number of tax aspects associated with social networks. We find that tax aspects are a relational factor allowing for the formation of social networks. Simultaneously, tax aspects are a consequence of social networks. The importance of social network interplay and taxes is explained through various theoretical perspectives. We contend that extant research provides various perspectives, but that it needs further exploration to gain a deeper understanding of the association between social networks and taxes. Accordingly, we present avenues for future research.

Similar content being viewed by others

Data Availability

All articles reviewed are accessible through the Scopus database.

Notes

“Board social capital” is the social network of established relationships both within and outside a board of directors (Jebran et al. 2021).

Pass-through entities are embedded through acquisition in the form of partnerships and LLCs (Limited Liability Companies) that do not pay taxes but pass their profits or losses through to the owner (Agarwal et al., 2022).

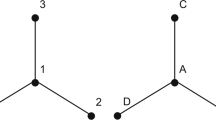

“Outdegree-centrality” is a social network variable describing the number of ties held by a firm. In Park et al. (2014), it refers to firms investing substantial amounts of shareholdings in other affiliates.

References

Agarwal A, Chen S, Mills L (2021) Entity structure and taxes: an analysis of embedded pass-through entities. Acc Rev 96(6):1–27. https://doi.org/10.2308/TAR-2019-0498

Akbari F, Salehi M, Vlashani MAB (2018) The effect of managerial ability on tax avoidance by classical and bayesian econometrics in multilevel models: evidence of Iran. Int J Emerg Market 13(6):1656–1678. https://doi.org/10.1108/IJoEM-09-2017-0367

Alstadsæter A, Kopczuk W, Telle K (2019) Social networks and tax avoidance: evidence from a well-defined norwegian tax shelter. Int Tax Public Finance 26(6):1291–1328. https://doi.org/10.1007/s10797-019-09568-3

Amara I, Khlif H (2020) A review of the influence of political connections on management’s decision in non-US settings. J Financial Report Acc 18(4):687–705. https://doi.org/10.1108/JFRA-03-2020-0075

Antinyan A, Horváth G, Jia M (2020) Curbing the consumption of positional goods: behavioral interventions versus taxation. J Economic Behav Organ 179:1–21. https://doi.org/10.1016/j.jebo.2020.08.018

Arel-Bundock V (2017) The unintended consequences of bilateralism: Treaty shopping and international tax policy. Int Org 71(2):349–371. https://doi.org/10.1017/S0020818317000108

Bianchi PA, Falsetta D, Minutti-Meza M, Weisbrod E (2019) Joint audit engagements and client tax avoidance: evidence from the italian statutory audit regime. J Am Taxation Association 41(1):31–58. https://doi.org/10.2308/atax-52151

Bird RM (2018) Are global taxes feasible? Int Tax Public Finance 25(5):1372–1400. https://doi.org/10.1007/s10797-018-9487-2

Bona-Sánchez C, Pérez-Alemán J, Santana Martín DJ (2020) Political ties and corporate tax burden in Spain. Revista Esp de Financiacion y Contabilidad 49(1):74–93. https://doi.org/10.1080/02102412.2019.1573049

Bonacich P, Lloyd P (2001) Eigenvector-like measures of centrality for asymmetric relations. Social Networks 23(3):191–201. https://doi.org/10.1016/S0378-8733(01)00038-7

Borgatti SP, Foster PC (2003) The network paradigm in organizational research: a review and typology. J Manag 29(6):991–1013. https://doi.org/10.1016/S0149-2063(03)00087-4

Borgatti SP, Halgin DS (2011) On network theory. Organ Sci 22(5):1168–1181. https://doi.org/10.1287/orsc.1100.0641

Borgatti SP, Brass DJ, Halgin DS (2014) Social network research: confusions, criticisms, and controversies. Res Sociol Organ 40:1–29. https://doi.org/10.1108/S0733-558X(2014)0000040001

Borgatti SP, Johnson JC, Everett MG (2018) Analyzing social networks. Sage Publication

Briseño-García A, Bryan William H, Arango-Herera E (2022) Do birds of a feather certify together? The impact of board interlocks on CSR certification homophily. J Bus Res 144:336–344. https://doi.org/10.1016/j.jbusres.2022.01.080

Brown JL (2011) The spread of aggressive corporate tax reporting: a detailed examination of the corporate-owned life insurance shelter. Acc Rev 86(1):23–57. https://doi.org/10.2308/accr.00000008

Brown JL, Drake KD (2014) Network ties among low-tax firms. Acc Rev 89(2):483–510. https://doi.org/10.2308/accr-50648

Caiazza R, Simoni M (2019) Directorate ties: a bibliometric analysis. Manag Decis 57(10):2837–2851. https://doi.org/10.1108/MD-01-2018-0085

Cao S, Fang Z, Pu W, Ruan YY (2021) Vertical interlock and firm value: the role of corporate innovation. Emerg Markets Finance Trade 58(4):1061–1077. https://doi.org/10.1080/1540496X.2021.1927699

Carpenter MA, Li M, Jiang H (2012) Social network research in organizational contexts: a systematic review of methodological issues and choices. J Manag 38(4):1328–1361. https://doi.org/10.1177/0149206312440119

Casi E, Spengel C, Stage BMB (2020) Cross-border tax evasion after the common reporting standard: game over? J Public Econ 190. https://doi.org/10.1016/j.jpubeco.2020.104240

Cen L, Maydew EL, Zhang L, Zuo L (2017) Customer–supplier relationships and corporate tax avoidance. J Financ Econ 123(2):377–394. https://doi.org/10.1016/j.jfineco.2016.09.009

degl’Innocenti DG, Rablen MD (2020) Tax evasion on a social network. J Economic Behav Organ 169:79–91. https://doi.org/10.1016/j.jebo.2019.11.001

Dominguez D, Pantoja O, Pico P, Mateos M, Alonso-Almeida MM, Gonzales M (2020) Panama Paper’s offshoring network behavior. https://doi.org/10.1016/j.heliyon.2020.e04293. Heliyon

Drake KD, Lusch SJ, Stekelberg J (2019) Does tax risk affect investor valuation of tax avoidance? J Account Auditing Finance 34(1):151–176. https://doi.org/10.1177/0148558X17692674

Dyreng S, Maydew EL (2008) Long-run corporate tax avoidance. Acc Rev 83(1):61–82. https://doi.org/10.2308/accr.2008.83.1.61

Dyreng SD, Hanlon M, Maydew EL (2010) The effects of executives on corporate tax avoidance. Acc Rev 85:1163–1189. https://doi.org/10.2308/accr.2010.85.4.1163

Dyreng SD, Hanlon M, Maydew EL, Thornock JR (2017) Changes in corporate effective tax rates over the past 25 years. J Financ Econ 124(3):441–463. https://doi.org/10.1016/j.jfineco.2017.04.001

Fassin Y (2021) Does the Financial Times FT50 journal list select the best management and economics journals? Scientometrics 126:5911–5943. https://doi.org/10.1007/s11192-021-03988-x

Fernando GA, Antoine M (2022) The network structure of global tax evasion evidence from the Panama papers. J Economic Behav Organ 197:660–684. https://doi.org/10.1016/j.jebo.2022.03.024

Freeman LC (1978) Centrality in social networks conceptual clarification, 1 edn. Social Networks

Gallemore J, Labro E (2015) The importance of the internal information environment for tax avoidance. J Account Econ 60(1). https://doi.org/10.1016/j.jacceco.2014.09.005

González-Martel C, Hernández JM, Manrique-de-Lara-Peñate C (2021) Identifying business misreporting in VAT using network analysis. Decis Support Syst 141. https://doi.org/10.1016/j.dss.2020.113464

Guenther DA, Wilson RJ, Wu K (2019) Tax uncertainty and incremental tax avoidance. Acc Rev 94(2):229–247. https://doi.org/10.2308/accr-52194

Hanlon M, Heitzman S (2010) A review of tax research. J Account Econ 50(2–3):127–178. https://doi.org/10.1016/j.jacceco.2010.09.002

Hasan I, Hoi CKS, Wu Q, Zhang H (2017) Does social capital matter in corporate decisions? Evidence from corporate tax avoidance. J Accounting Res 55(3):629–668. https://doi.org/10.1111/1475-679X.12159

Hashimzade N, Myles GD, Page F, Rablen MD (2015) The use of agent-based modelling to investigate tax compliance. Economics of Governance 16(2):143–164. https://doi.org/10.1007/s10101-014-0151-8

He G, Ren HM, Taffler R (2019) The impact of corporate tax avoidance on analyst coverage and forecasts. Rev Quant Financ Acc 54(2):447–477. https://doi.org/10.1007/s11156-019-00795-7

Hong S (2018) Tax treaties and foreign direct investment: a network approach. Int Tax Public Finance 25(5):1277–1320. https://doi.org/10.1007/s10797-018-9489-0

Hong S (2021) Tax treaties and foreign equity holding companies of multinational corporations. RMS 16(2):483–520. https://doi.org/10.1007/s11846-021-00448-x

Jebran K, Chen S, Zhang R (2021) Board social capital and stock price crash risk. Rev Quant Financ Acc 58(2):499–540. https://doi.org/10.1007/s11156-021-01001-3

Jiang Y, Zhao Y (2020) Financial fraud contagion through board interlocks: the contingency of status. Manag Decis 58(2):280–294. https://doi.org/10.1108/MD-12-2018-1355

Jiang C, Kubick TR, Miletkov MK, Wintoki MB (2018) Offshore expertise for onshore companies: Director connections to island tax havens and corporate tax policy. Manage Sci 64(7):3241–3268. https://doi.org/10.1287/mnsc.2017.2776

Jones C, Temouri Y, Cobham A (2018) Tax haven networks and the role of the big 4 accountancy firms. J World Bus 53(2):177–193. https://doi.org/10.1016/j.jwb.2017.10.004

Khurana IK, Moser WJ, Raman KK (2018) Tax Avoidance, Managerial Ability, and Investment Efficiency. Abacus 54(4):547–575. https://doi.org/10.1111/abac.12142

Kelchtermans S, Neicu D, Teirlinck P (2020) The role of peer effects in firms’ usage of R&D tax exemptions. J Bus Res 108:74–91. https://doi.org/10.1016/j.jbusres.2019.09.059

Kilduff M, Tsai W (2003) Social networks and organizations. SAGE Publication, London

Kim C, Zhang L (2016) Corporate political connections and tax aggressiveness. Contemp Acc Res 33(1). https://doi.org/10.1111/1911-3846.12150

Koester A, Shevlin T, Wangerin D (2016) The role of managerial ability in corporate tax avoidance. Manage Sci 63(10):3285–3310. https://doi.org/10.1287/mnsc.2016.2510

Kubick TR, Li Y, Robinson JR (2020) Tax-savvy executives. Rev Acc Stud 25(4):1301–1343. https://doi.org/10.1007/s11142-020-09543-y

Lamb NH, Roundy P (2016) The “ties that bind” board interlocks research: a systematic review. Manage Res Rev 39(11):1516–1542. https://doi.org/10.1108/MRR-02-2015-0027

Lassoued N, Attia MBR (2014) Benefits and costs of political connections: evidence from Tunisia. Int J Accounting Auditing and Performance Evaluation 10(3). https://doi.org/10.1504/IJAAPE.2014.064235

Lin KZ, Mills LF, Zhang F, Li Y (2017) Do political connections weaken tax enforcement effectiveness? Contemp Acc Res 35(4):1941–1972. https://doi.org/10.1111/1911-3846.12360

Lismont J, Cardinaels E, Bruynseels L, de Groote S, Baesens B, Lemahieu W, Vanthienen J (2018) Predicting tax avoidance by means of social network analytics. Decis Support Syst 108:13–24. https://doi.org/10.1016/j.dss.2018.02.001

Liu W, Sidhu A, Beacom AM, Valente TW (2017) Social Network Theory. The International Encyclopedia of Media Effects. Wiley, pp 1–12. https://doi.org/10.1002/9781118783764.wbieme0092

Martinus K, Sigler T, Iacopini I, Derudder B (2019) The role of tax havens and offshore financial centers in Asia-Pacific networks: evidence from firm-subsidiary connections. Asian Bus Manage 18(5):389–411. https://doi.org/10.1057/s41291-018-00051-1

Miranda-Lopez J, Orlova S, Sun L (2018) CEO network centrality and corporate cash holdings. Rev Quant Financ Acc 53(4):967–1003. https://doi.org/10.1007/s11156-018-0772-z

Neuman SS, Omer TC, Schmidt AP (2020) Assessing tax risk: practitioner perspectives. Contemp Acc Res 37(3):1788–1827. https://doi.org/10.1111/1911-3846.12556

OECD (2020) Tax challenges arising from digitalisation – economic impact assessment. OECD. https://doi.org/10.1787/0e3cc2d4-en

Onu D, Oats L (2016) Paying tax is part of life”: social norms and social influence in tax communications. J Economic Behav Organ 124:29–42. https://doi.org/10.1016/j.jebo.2015.11.017

Park KJ, Lim J, Kim KY (2014) The Effect of the Relationships between Affiliated Firms on Direction of Income shifting within business groups. J Appl Bus Res. https://doi.org/10.19030/jabr.v30i3.8567

Park J, Ko CY, Jung H, Lee, YS (2015) Managerial ability and tax avoidance: evidence from Korea. Asia-Pacific Journal of Accounting and Economics 23(4):449–477. https://doi.org/10.1080/16081625.2015.1017590

Petkova K, Stasio A, Zagler M (2020) On the relevance of double tax treaties. Int Tax Public Finance 27(3):575–605. https://doi.org/10.1007/s10797-019-09570-9

Platikanova P (2017) Investor-legislators: Tax holiday for politically connected firms. Br Acc Rev 49(4):380–398. https://doi.org/10.1016/j.bar.2017.05.003

Rawlings G (2011) Intangible nodes and networks of influence: the ethics of tax compliance in australian small and medium-sized enterprises. Int Small Bus J 30(1):84–95. https://doi.org/10.1177/0266242610380816

Rivadeneyra I, Suthers DD, Juarez R (2022) Mobile money networks with tax-incentives. Humanit Social Sci Commun 9(1). https://doi.org/10.1057/s41599-022-01075-x

Rossing CP (2013) Tax strategy control: the case of transfer pricing tax risk management. Manage Acc Res 24(2):175–194. https://doi.org/10.1016/j.mar.2013.04.008

Rothengatter MR (2005) Social networks and tax (non-)compliance in a multicultural nation: emerging themes from a focus-group study among ethnic minorities in Australia. Int J Entrepreneurial Behav Res 11(4):280–314. https://doi.org/10.1108/13552550510603306

Sadiq K, Sawyer AJ, Mccredie B (2019) Jurisdictional responses to base erosion and profit shifting: a study of 19 key domestic tax systems. https://www.researchgate.net/publication/330954834

Sandmo A (2005) The theory of tax evasion: A retrospective view. National Tax Journal, 58(4) Retrieved from: https://www.jstor.org/stable/pdf/41790296.pdf

Smith M, Sarabi Y (2021) What do interlocks do” revisited – a bibliometric analysis. Manage Res Rev 44(4):642–659. https://doi.org/10.1108/MRR-05-2020-0258

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222. https://doi.org/10.1111/1467-8551.00375

van ‘t Riet M, Lejour A (2018) Optimal tax routing: network analysis of FDI diversion. Int Tax Public Finance 25(5):1321–1371. https://doi.org/10.1007/s10797-018-9491-6

Wang F, Xu S, Sun J, Cullinan CP (2019) Corporate tax avoidance: a literature review and research agenda. J Economic Surveys 34(4):793–811. https://doi.org/10.1111/joes.12347

Wasserman S, Faust K (1994) Structural analysis in the social sciences: Social network analysis methods and applications. Cambridge University Press, New York

Weyzig F (2013) Tax treaty shopping: structural determinants of Foreign Direct Investment routed through the Netherlands. Int Tax Public Finance 20(6):910–937. https://doi.org/10.1007/s10797-012-9250-z

Xiao Y, Watson M (2019) Guidance on conducting a systematic literature review. J Plann Educ Res 39(1):93–112. https://doi.org/10.1177/0739456X17723971

Yang S, Keller FB, Zheng L (2017) Social network analysis: methods and examples. Sage Publication, London

Yang C, Chen X, Chen X (2021) Vertical interlock and stock price crash risk. Pac Basin Finance J 68. https://doi.org/10.1016/j.pacfin.2020.101387

Zhou B, Lu X, Holme P (2020) Universal evolution patterns of degree assortativity in social networks. Social Networks 63:47–55. https://doi.org/10.1016/j.socnet.2020.04.004

Acknowledgements

We would like to thank the editor and the anonymous reviewer for their valuable comments and suggestions. All authors would like to thank Dr. Mashiur Rahman for the valuable guidance.

Funding

The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors report no potential conflict of interests.

Ethics approval and consent to participate

The authors declare that the ethical and professional principles for this study have been followed accordingly.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Burhan, A.H.N., Che Azmi, A. & Hanifa, M.H. The interplay of social networks and taxes: a systematic literature review. Manag Rev Q (2023). https://doi.org/10.1007/s11301-023-00358-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11301-023-00358-0