Abstract

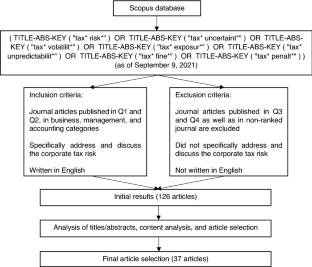

Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

Similar content being viewed by others

Data Availability

All articles included in this review are accessible through the Scopus database.

References

Abernathy JL, Finley AR, Rapley ET, Stekelberg J (2021) External auditor responses to tax risk. J Accounting, Audit Financ 36:489–516. https://doi.org/10.1177/0148558X19867821

Alsadoun N, Naiker V, Navissi F, Sharma DS (2018) Auditor-provided tax nonaudit services and the implied cost of equity capital. Audit A J Pract Theory 37:1–24. https://doi.org/10.2308/ajpt-51866

Arlinghaus BP (1998) Goal setting and performance measures. Tax Exec 50:434–441

Armstrong CS, Blouin JL, Jagolinzer AD, Larcker DF (2015) Corporate governance, incentives, and tax avoidance. J Account Econ 60:1–17. https://doi.org/10.1016/j.jacceco.2015.02.003

Atwood TJ, Lewellen C (2019) The Complementarity between tax avoidance and manager diversion: evidence from tax haven firms. Contemp Account Res 36:259–294. https://doi.org/10.1111/1911-3846.12421

Atwood TJ, Drake MS, Myers JN, Myers LA (2012) Home country tax system characteristics and corporate tax avoidance: International evidence. Account Rev 87:1831–1860. https://doi.org/10.2308/accr-50222

Austin CR, Wilson RJ (2017) An examination of reputational costs and tax avoidance: evidence from firms with valuable consumer brands. J Am Tax Assoc 39:67–93. https://doi.org/10.2308/atax-51634

Beasley MS, Goldman NC, Lewellen CM, McAllister M (2021) Board risk oversight and corporate tax-planning practices. J Manag Account Res 33:7–32. https://doi.org/10.2308/JMAR-19-056

Beck PJ, Lisowsky P (2014) Tax uncertainty and voluntary real-time tax audits. Account Rev 89:867–901. https://doi.org/10.2308/accr-50677

Beer S, de Mooij RA, Liu Li (2019) International corporate tax avoidance: a review of the channels, magnitudes, and blind spots. J Econ Surv. https://doi.org/10.1111/joes.12305

Blouin J (2014) Defining and measuring tax planning aggressiveness. Natl Tax J 67:875–899. https://doi.org/10.17310/ntj.2014.4.06

Borthick AF, Smeal LN (2020) Data analytics in tax research: analyzing worker agreements and compensation data to distinguish between independent contractors and employees using irs factors. Issues Account Educ 35:1–23. https://doi.org/10.2308/issues-18-061

Brown JL, Drake KD, Martin MA (2016) Compensation in the post-FIN 48 period: the case of contracting on tax performance and uncertainty. Contemp Account Res 33:121–151. https://doi.org/10.1111/1911-3846.12152

Campbell JL, Cecchini M, Cianci AM (2019) Tax-related mandatory risk factor disclosures, future profitability, and stock returns. Rev Account Stud 24:264–308. https://doi.org/10.1007/s11142-018-9474-y

Campbell JL, Goldman NC, Li B (2021) Do financing constraints lead to incremental tax planning? evidence from the pension protection act of 2006. Contemp Account Res 38:1961–1999. https://doi.org/10.1111/1911-3846.12679

Casino F, Dasaklis TK, Patsakis C (2019) A systematic literature review of blockchain-based applications: current status, classification and open issues. Telemat Informatics 36:55–81. https://doi.org/10.1016/j.tele.2018.11.006

Chang H, Dai X, He Y, Wang M (2020) How internal control protects shareholders’ welfare: evidence from tax avoidance in China. J Int Account Res 19:19–39. https://doi.org/10.2308/jiar-19-046

Chen W (2020) Tax risks control and sustainable development: evidence from China. Meditari Account Res. https://doi.org/10.1108/MEDAR-05-2020-0884

Chen W (2021) Too far east is west: tax risk, tax reform and investment timing. Int J Manag Financ 17:303–326. https://doi.org/10.1108/IJMF-03-2020-0132

Chen S, Chen X, Cheng Q, Shevlin T (2010) Are family firms more tax aggressive than non-family firms? J Financ Econ 95:41–61. https://doi.org/10.1016/j.jfineco.2009.02.003

Chen H, Yang D, Zhang X, Zhou N (2020) The moderating role of internal control in tax avoidance: evidence from a COSO-Based internal control index in China. J Am Tax Assoc 42:23–55. https://doi.org/10.2308/atax-52408

Chen JZ, Hong HA, Kim J-B, Ryou JW (2021a) Information processing costs and corporate tax avoidance: evidence from the SEC’s XBRL mandate. J Account Public Policy 40:49. https://doi.org/10.1016/j.jaccpubpol.2021.106822

Chen TY, Chen Z, Li Y (2021b) Restrictions on managerial outside job opportunities and corporate tax policy: evidence from a natural experiment. J Account Public Policy. https://doi.org/10.1016/j.jaccpubpol.2021.106879

Chen X, Cheng Q, Chow T, Liu Y (2021c) Corporate in-house tax departments. Contemp Account Res 38:443–482. https://doi.org/10.1111/1911-3846.12637

Chyz JA, Gaertner FB (2018) Can paying “too much” or “too little” tax contribute to forced CEO turnover? Account Rev 93:103–130. https://doi.org/10.2308/accr-51767

Clark WR, Clark LA, Raffo DM, Williams RI (2021) Extending Fisch and Block’s (2018) tips for a systematic review in management and business literature. Manag Rev Q 71:215–231. https://doi.org/10.1007/s11301-020-00184-8

Cooper M, Nguyen QTK (2020) Multinational enterprises and corporate tax planning: a review of literature and suggestions for a future research agenda. Int Bus Rev 29:101692. https://doi.org/10.1016/j.ibusrev.2020.101692

De Simone L, Nickerson J, Seidman J, Stomberg B (2020) How reliably do empirical tests identify tax avoidance? Contemp Account Res 37:1536–1561. https://doi.org/10.1111/1911-3846.12573

Demeré P, Donohoe MP, Lisowsky P (2020) The economic effects of special purpose entities on corporate tax avoidance. Contemp Account Res 37:1562–1597. https://doi.org/10.1111/1911-3846.12580

Dhawan A, Ma L, Kim MH (2020) Effect of corporate tax avoidance activities on firm bankruptcy risk. J Contemp Account Econ 16:100187. https://doi.org/10.1016/j.jcae.2020.100187

Donelson DC, Glenn JL, Yust CG (2021) Is tax aggressiveness associated with tax litigation risk? evidence from D&O insurance. Rev Account Stud. https://doi.org/10.1007/s11142-021-09612-w

Downes JF, Kang T, Kim S, Lee C (2019) Does the mandatory adoption of IFRS improve the association between accruals and cash flows? Evidence from accounting estimates. Account Horizons 33:39–59. https://doi.org/10.2308/acch-52262

Drake KD, Lusch SJ, Stekelberg J (2017) Does tax risk affect investor valuation of tax avoidance? J Accounting, Audit Financ 34:151–176. https://doi.org/10.1177/0148558X17692674

Dwivedi A, Dwivedi P, Bobek S, Sternad Zabukovšek S (2019) Factors affecting students’ engagement with online content in blended learning. Kybernetes 48:1500–1515. https://doi.org/10.1108/K-10-2018-0559

Dyreng SD, Hanlon M, Maydew EL (2010) The effects of executives on corporate tax avoidance. Account Rev 85:1163–1189. https://doi.org/10.2308/accr.2010.85.4.1163

Dyreng SD, Hanlon M, Maydew EL (2019) When does tax avoidance result in tax uncertainty? Account Rev 94:179–203. https://doi.org/10.2308/accr-52198

Faúndez-Ugalde A, Mellado-Silva R, Aldunate-Lizana E (2020) Use of artificial intelligence by tax administrations: an analysis regarding taxpayers’ rights in Latin American countries. Comput Law Secur Rev 38:105441. https://doi.org/10.1016/j.clsr.2020.105441

Federico C, Thompson T (2019) Do IRS computers dream about tax cheats? artificial intelligence and big data in tax enforcement and compliance. J Tax Pract Proced 21:35–39

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106. https://doi.org/10.1007/s11301-018-0142-x

Frank MM, Lynch LJ, Rego SO (2009) Tax reporting aggressiveness and its relation to aggressive financial reporting. Account Rev 84:467–496. https://doi.org/10.2308/accr.2009.84.2.467

Ftouhi K, Ghardallou W (2020) International tax planning techniques: a review of the literature. J Appl Account Res 21:329–343. https://doi.org/10.1108/JAAR-05-2019-0080

Gallemore J, Labro E (2015) The importance of the internal information environment for tax avoidance. J Account Econ 60:149–167. https://doi.org/10.1016/j.jacceco.2014.09.005

Gallemore J, Maydew EL, Thornock JR (2014) The reputational costs of tax avoidance. Contemp Account Res 31:1103–1133. https://doi.org/10.1111/1911-3846.12055

Görlitz A, Dobler M (2021) Financial accounting for deferred taxes: a systematic review of empirical evidence. Manag Rev Q. https://doi.org/10.1007/s11301-021-00233-w

Guenther DA, Matsunaga SR, Williams BM (2017) Is tax avoidance related to firm risk? Account Rev 92:115–136. https://doi.org/10.2308/accr-51408

Guenther DA, Wilson RJ, Wu K (2019) Tax uncertainty and incremental tax avoidance. Account Rev 94:229–247. https://doi.org/10.2308/accr-52194

Guggenmos RD, Van der Stede WA (2020) The effects of creative culture on real earnings management. Contemp Account Res 37:2319–2356. https://doi.org/10.1111/1911-3846.12586

Hamann PM (2017) Towards a contingency theory of corporate planning: a systematic literature review. Manag Rev Q 67:227–289. https://doi.org/10.1007/s11301-017-0132-4

Hamilton R, Stekelberg J (2017) The effect of high-quality information technology on corporate tax avoidance and tax risk. J Inf Syst 31:83–106. https://doi.org/10.2308/isys-51482

Hanlon M, Heitzman S (2010) A review of tax research. J Account Econ 50:127–178. https://doi.org/10.1016/j.jacceco.2010.09.002

Hanlon M, Maydew EL, Saavedra D (2017) The taxman cometh: does tax uncertainty affect corporate cash holdings? Rev Account Stud 22:1198–1228. https://doi.org/10.1007/s11142-017-9398-y

Hardeck I, Harden JW, Upton DR (2019) Consumer reactions to tax avoidance: evidence from the United States and Germany. J Bus Ethics 170:75–96. https://doi.org/10.1007/s10551-019-04292-8

He G, Ren HM, Taffler R (2019) The impact of corporate tax avoidance on analyst coverage and forecasts. Rev Quant Financ Account 54:447–477. https://doi.org/10.1007/s11156-019-00795-7

Herron R, Nahata R (2020) Corporate tax avoidance and firm value discount. Q J Financ. https://doi.org/10.1142/S2010139220500081

Higgins D, Omer TC, Phillips JD (2015) The influence of a firm’s business strategy on its tax aggressiveness. Contemp Account Res 32:674–702. https://doi.org/10.1111/1911-3846.12087

Hoopes JL, Mescall D, Pittman JA (2012) Do IRS audits deter corporate tax avoidance? Account Rev 87:1603–1639. https://doi.org/10.2308/accr-50187

Inger KK, Vansant B (2019) Market valuation consequences of avoiding taxes while also being socially responsible. J Manag Account Res 31:75–94. https://doi.org/10.2308/jmar-52169

Jackson M (2015) Book-tax differences and future earnings changes. J Am Tax Assoc 37:49–73. https://doi.org/10.2308/atax-51164

Jacob M, Schütt HH (2020) Firm valuation and the uncertainty of future tax avoidance. Eur Account Rev 29:409–435. https://doi.org/10.1080/09638180.2019.1642775

Joshi P, Outslay E, Persson A et al (2020) Does public country-by-country reporting deter tax avoidance and income shifting? evidence from the European banking industry. Contemp Account Res 37:2357–2397. https://doi.org/10.1111/1911-3846.12601

Kanagaretnam K, Lee J, Lim CY, Lobo GJ (2016) Relation between auditor quality and tax aggressiveness: implications of cross-country institutional differences. Audit A J Pract Theory 35:105–135. https://doi.org/10.2308/ajpt-51417

Karjalainen J, Kasanen E, Kinnunen J, Niskanen J (2020) Dividends and tax avoidance as drivers of earnings management: evidence from dividend-paying private SMEs in Finland. J Small Bus Manag. https://doi.org/10.1080/00472778.2020.1824526

Keding C (2021) Understanding the interplay of artificial intelligence and strategic management: four decades of research in review. Manag Rev Q 71:91–134. https://doi.org/10.1007/s11301-020-00181-x

Khan M, Srinivasan S, Tan L (2017) Institutional ownership and corporate tax avoidance: new evidence. Account Rev 92:101–122. https://doi.org/10.2308/accr-51529

Khurana IK, Moser WJ (2013) Institutional shareholders’ investment horizons and tax avoidance. J Am Tax Assoc 35:111–134. https://doi.org/10.2308/atax-50315

Kim J, McGuire ST, Savoy S et al (2019) How quickly do firms adjust to optimal levels of tax avoidance? Contemp Account Res 36:1824–1860. https://doi.org/10.1111/1911-3846.12481

Koester A, Shevlin T, Wangerin D (2016) The role of managerial ability in corporate tax avoidance. Manage Sci 63:3285–3310. https://doi.org/10.1287/mnsc.2016.2510

Kovermann JH (2018) Tax avoidance, tax risk and the cost of debt in a bank-dominated economy. Manag Audit J 33:683–699. https://doi.org/10.1108/MAJ-12-2017-1734

Kovermann J, Velte P (2019) The impact of corporate governance on corporate tax avoidance—A literature review. J Int Accounting, Audit Tax 36:100270. https://doi.org/10.1016/j.intaccaudtax.2019.100270

Kubick TR, Lockhart GB (2016) Do external labor market incentives motivate CEOs to adopt more aggressive corporate tax reporting preferences? J Corp Financ 36:255–277. https://doi.org/10.1016/j.jcorpfin.2015.12.003

Kubick TR, Masli ANS (2016) Firm-level tournament incentives and corporate tax aggressiveness. J Account Public Policy 35:66–83. https://doi.org/10.1016/j.jaccpubpol.2015.08.002

Law KKF, Mills LF (2017) Military experience and corporate tax avoidance. Rev Account Stud 22:141–184. https://doi.org/10.1007/s11142-016-9373-z

Lennox C, Lisowsky P, Pittman J (2013) Tax aggressiveness and accounting fraud. J Account Res 51:739–778. https://doi.org/10.1111/joar.12002

Lin X, Liu M, So S, Yuen D (2019) Corporate social responsibility, firm performance and tax risk. Manag Audit J 34:1101–1130. https://doi.org/10.1108/MAJ-04-2018-1868

Moore RD (2021) The concave association between tax reserves and equity value. J Am Tax Assoc 43:107–124. https://doi.org/10.2308/JATA-17-109

Neubig T, Sangha B (2004) Tax risk and strong corporate governance. Tax Exec 56:114–119

Neuman SS, Omer TC, Schmidt AP (2020) Assessing tax risk: practitioner perspectives. Contemp Account Res 37:1788–1827. https://doi.org/10.1111/1911-3846.12556

Nguyen JH (2020) Tax avoidance and financial statement readability. Eur Account Rev 30:1043–1066. https://doi.org/10.1080/09638180.2020.1811745

Nobes C (2020) On theoretical engorgement and the myth of fair value accounting in China. Accounting, Audit Account J 33:59–76. https://doi.org/10.1108/AAAJ-11-2018-3743

Olsen KJ, Stekelberg J (2016) CEO narcissism and corporate tax sheltering. J Am Tax Assoc 38:1–22. https://doi.org/10.2308/atax-51251

Overesch M, Wolff H (2021) Financial transparency to the rescue: effects of public country-by-country reporting in the European Union banking sector on tax avoidance. Contemp Account Res 38:1616–1642. https://doi.org/10.1111/1911-3846.12669

Plečnik JM, Wang S (2021) Top management team intrapersonal functional diversity and tax avoidance. J Manag Account Res 33:103–128. https://doi.org/10.2308/jmar-19-058

Powers K, Robinson JR, Stomberg B (2016) How do CEO incentives affect corporate tax planning and financial reporting of income taxes? Rev Account Stud 21:672–710. https://doi.org/10.1007/s11142-016-9350-6

Rasel MA, Win S (2020) Microfinance governance: a systematic review and future research directions. J Econ Stud 47:1811–1847. https://doi.org/10.1108/JES-03-2019-0109

Rego SO, Wilson R (2012) Equity risk incentives and corporate tax aggressiveness. J Account Res 50:775–810. https://doi.org/10.1111/j.1475-679X.2012.00438.x

Saavedra D (2019) Is tax volatility priced by lenders in the syndicated loan market? Eur Account Rev 28:767–789. https://doi.org/10.1080/09638180.2018.1520641

Schweikl S, Obermaier R (2020) Lessons from three decades of IT productivity research: towards a better understanding of IT-induced productivity effects. Manag Rev Q 70:461–507. https://doi.org/10.1007/s11301-019-00173-6

Taylor G, Richardson G (2013) The determinants of thinly capitalized tax avoidance structures: evidence from Australian firms. J Int Accounting, Audit Tax 22:12–25. https://doi.org/10.1016/j.intaccaudtax.2013.02.005

Taylor G, Richardson G (2014) Incentives for corporate tax planning and reporting: empirical evidence from Australia. J Contemp Account Econ 10:1–15. https://doi.org/10.1016/j.jcae.2013.11.003

Taylor G, Richardson G, Al-Hadi A (2018) Income-shifting arrangements, audit specialization and uncertain tax benefits, international tax risk, and audit specialization: evidence from US multinational firms. Int J Audit 22:1–19. https://doi.org/10.1111/ijau.12117

Towery EM (2017) Unintended consequences of linking tax return disclosures to financial reporting for income taxes: Evidence from schedule UTP. Account Rev 92:201–226. https://doi.org/10.2308/accr-51660

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222. https://doi.org/10.1111/1467-8551.00375

Wang F, Xu S, Sun J, Cullinan CP (2020) Corporate tax avoidance: a literature review and research agenda. J Econ Surv 34:793–811. https://doi.org/10.1111/joes.12347

Watrin C, Burggraef S, Weiss F (2019) Auditor-provided tax services and accounting for tax uncertainty. Int J Account. https://doi.org/10.1142/S1094406019500112

Wilde JH, Wilson RJ (2018) Perspectives on corporate tax planning: observations from the past decade. J Am Tax Assoc 40:63–81. https://doi.org/10.2308/ATAX-51993

Wunder HF (2009) Tax risk management and the multinational enterprise. J Int Accounting, Audit Tax 18:14–28. https://doi.org/10.1016/j.intaccaudtax.2008.12.003

Ying T, Wright B, Huang W (2017) Ownership structure and tax aggressiveness of Chinese listed companies. Int J Account Inf Manag 25:313–332. https://doi.org/10.1108/IJAIM-07-2016-0070

Acknowledgments

We would like to thank the editor and the anonymous reviewer for their helpful and valuable comments and recommendations. The authors would like to thank the Department of Accounting Faculty of Economics and Business Universitas Gadjah Mada and the Department of Fiscal Administration Faculty of Administrative Sciences Universitas Indonesia for supporting this study.

Funding

There is no funding for the research project.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We reported no potential conflict of interest.

Ethics Approval

We declared that the principles of ethical and professional conduct have been followed.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Saragih, A.H., Ali, S. Corporate tax risk: a literature review and future research directions. Manag Rev Q 73, 527–577 (2023). https://doi.org/10.1007/s11301-021-00251-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-021-00251-8