Abstract

The main aim of this paper is to investigate the micro and macro predictors of Portuguese willingness to pay (WTP) more taxes to bolster funds channelled to the National Health Service (NHS). An online questionnaire was used to collect data from 584 Portuguese citizens. The statistical analysis was performed through the application of logistic regressions. The research shows that willingness to support increasing taxes depended on socioeconomic, behavioural, and psychological factors. The WTP more taxes to finance the NHS were associated with younger ages, life satisfaction and dispositional optimism, satisfaction with the NHS performance, current perceived risk exposure, and risk orientation. Identifying and understanding the main influencing factors associated with WTP more taxes for NHS is essential to assist policy-makers in developing healthcare reforms. Decision-makers may take this opportunity to improve the NHS since those who ultimately benefit from the measures can provide an additional source of health financing.

Similar content being viewed by others

1 Introduction

Health systems in advanced economies are at serious risk of becoming unsustainable. Pandemic ocurrences such as the current COVID-19, expected changes in the demographic structure and disease patterns, increasing user expectations, and technological advances contribute to an unstoppable growth in healthcare spending. Thus, mainly in publicly funded healthcare systems, it is necessary to preserve the support for the solidarity system in the upcoming decades. This support is, however, based on the condition that the population is willing to pay increased taxes. What factors determine that individuals agree to allocate a more significant portion of their income to a public fund? Identifying the factors that strengthen and weaken the public’s ability to pay more taxes is important.

Taxation is one of modern society’s most fundamental and dominant concepts (Gaisbauer et. al., 2015). Many studies find strong public support for the role of government in socialized health systems (Vilhjalmsson 2016). However, most people do not like paying taxes and may dislike taxes for economic or political reasons. For many, taxes are described as a loss of financial freedom without a fair return (Tudorică and Vătavu 2020). Some researchers explained the willingness to pay (WTP) more taxes through tax morale (Torgler 2001). Tax morale measures individual attitudes and can be defined as a moral obligation to pay taxes, a belief in contributing to society by paying taxes (Torgler and Schneider 2007). Knowing citizens’ political preferences is fundamental in a democratic system since political authorities should use them as guidelines to define specific policies. According to Mooney (2003), listening to the informed community voice and acting in accordance is fundamental to promoting socially efficient and equitable healthcare changes.

In recent years, some empirical evidence emerged concerning the determinants of the public’s WTP more taxes for the health system. Most of these studies were, however, conducted in countries with social insurance systems like Germany (Hajek et al. 2020), in developing countries without a comprehensive health insurance system (Al-Hanawi et al. 2018; Bwalya 2020), or in post-communist-countries (Habibov et al. 2017, 2018, 2019). The results show that people’s preferences for paying more taxes are multi-dimensional. There needs to be more attention given to factors influencing the willingness to pay taxes in a socialized health system with universal coverage like the National Health System (NHS), where all residents are automatically enrolled in publicly financed healthcare.

The present article contributes to the literature by exploring the linkage between WTP more taxes to reinforce the Portuguese NHS with micro and macro factors (explained in detail in the next section). To the author’s knowledge, no such studies have been conducted in Portugal.

Some key characteristics of the Portuguese healthcare system are worth noting. The Portuguese NHS was created in 1979 and is a universal tax-based welfare system. The Portuguese Constitution defines health as a universal right and a state responsibility. One principle underpinning NHS is the universal right to comprehensive health care at all levels of complexity (primary, secondary, and tertiary). The provision of health care is granted by public entities and complemented by private partners. In the last economic recession, the NHS was a target of cuts imposed by the country's international creditors. During the Economic and Financial Adjustment Programme, the NHS budget reverted to the level recorded in 2005 (Simões et al. 2017). In 2017, the public share of health expenditure was 66.3% of total health financing, considerably lower than the EU average of 79.3%. Due to this, the private funding and out-of-pocket healthcare costs for patients increased (OECD 2019). Moreover, the tax revenue is exceptionally high in Portugal. In 2018, the tax revenue reached 36.8% of the GDP, and the projection for 2021 points to a slight increase to 36.9% GDP (Pordata, 2021a). Finally, it is worth saying that Portugal is one of the most aged countries in the world, with 22% of the population aged over 65 (Pordata, 2021a), and it is predicted that in 2050, Portugal will be the oldest country in the European Union (Eurostat 2019). Changes in the population age structure undoubtedly have consequences for health and long-term care systems while affecting the ability to generate the revenues needed for health. The index assessing the sustainability of the Portuguese NHS for 2020–21 registered a decrease from 101.7 to 83.9 points due to the effect of the pandemic (Nova-IMS 2021).

Due to its chronic underfunding, understanding WTP more taxes to improve the public health service is especially important in Portugal. Thus, policymakers should carefully assess the degree of support for willingness to contribute more towards improving health care and should evaluate the factors influencing the WTP. Greater knowledge about these factors will allow for a more thorough calibration of reforms, leading to greater success. Given the present challenges governments face, studies of this nature can be valuable to promote decision-makers to shape better communication policies with taxpayers to reinforce their confidence in political institutions, praising the essential contribution of their efforts to maintaining a universal health system.

2 Factors influencing citizens’ WTP more taxes to improve NHS—Conceptual framework and research hypothesis

Empirical research shows that individuals exhibit heterogeneous preferences regarding the WTP taxes to improve public healthcare. These attitudinal differences are justified by economic (Allingham and Sandmo 1972; Yitzhaki 1974), political, behavioural, and psychological reasons (Andreoni et al. 1998). Based on the existing literature, this section will discuss the main micro and macro predictors of the WTP more taxes to improve the health system.

2.1 Satisfaction with the NHS

The literature on support for public healthcare presents two opposite theories to explain the association between WTP and satisfaction with the health system (Kumlin 2007; Habibov 2016). The first perspective states that dissatisfaction with performance undermines normative support for government intervention and welfare spending (Kumlin 2007). Lower satisfaction with the health system weakened public service support and may even increase the demand for private health insurance—individuals redirect their contributions from the state to themselves. Such attitude can ultimately result in a vicious cycle of degradation of the quality of the NHS—an unsatisfactory perception of the performance of the NHS, weak willingness to pay taxes to support it, and, in turn, lower levels of taxation further constrain the public healthcare system and limit its capacity to increase the quality of services leading to even greater levels of dissatisfaction. The opposite perspective holds that lower satisfaction may strengthen the WTP to improve health services (Edlund 2006; Edlund and Johansson 2013). A lower performance of the NHS can be seen as an issue of lack of resources, and therefore, citizens may be willing to pay more taxes to support the NHS. Despite the opposite orientations, both theories are empirically supported in the literature (Edlund 2006; Habibov et al. 2019). Thus, it is difficult to predict the effect of satisfaction with the NHS performance and citizens’ willingness to pay more taxes to support health.

2.2 Private health insurance

It is difficult to predict the impact of owing private health insurance in the WTP to reinforce the funds channelled to the NHS. Respondents who voluntarily contribute to health insurance may feel insecure about the ability of the NHS to attend to their potential needs. Thus, as they have already spent money on a self-protection health scheme, they may be less willing to pay additional taxes to finance the public health system. In other words, both the tax and the private health insurance may be vying for resources within the same mental account, and thus, citizens won't have the mental "budget" to spend on taxes if it has already been spent on private health insurance. This kind of decision involving individual cognitive operations to organize and evaluate financial activities has been recognized in the literature on mental accounting (for a review, see Thaler 1999). Indeed, the present paper deals with the willingness to pay more taxes to support the NHS which requires knowing how citizens mentally construe their finances in their mind, therefore how these mental accounts lead to them seeing different types of activities and expenditures as parts of certain "funds". In this regard, we hypothesize that owing private health insurance influence negatively the WTP more taxes for health.

2.3 Dispositional effects

2.3.1 Dispositional optimism

The role of personality traits in shaping how people think, feel, and behave has long been recognized in psychology (Corr and Matthews 2009). Dispositional optimism is a personality trait that remains relatively stable over one’s lifespan (Carver et al. 2010) an enduring facet of personality (Carver and Scheier 2014), and strongly affects people’s mental, physical, economic, and social state (Carver et al. 2010; Hecht 2013). Dispositional optimism has been shown to widely reverberate into people’s lives, influencing many important decisions (Puri and Robinson 2007; Dohmen et al. 2019). Provided that pessimistic and optimistic people differ in their ability and capacity to make plans and set future goals (Segerstrom et al. 2017), being confident about the future will permit subjective well-being increments (Oriol et al. 2020). This leads to hope for a better future and makes people stronger and more proactive, with benefits in economic terms (Bhandari et al. 2021). Optimists have a more proactive problem-solving attitude (Carver et al 2010; Hecht 2013), which, in the healthcare context, revealed that they prefer higher investments in prevention than treatments (Luyten et al. 2019). There is an increasing literature about the influence of optimism on health such as people’s beliefs that treatments work, people’s likelihood of getting ill and people’s physical and mental well-being (Conversano et al., 2010; Gassen et al. 2021; Hanoch et al. 2023).

Recently, attention has been paid to how prospective variables like optimism relate to prosociality (Baumsteiger 2017). Prosociality is the tendency to engage in generous behaviours for the benefit of others, even when costly for oneself (Penner et al. 2005). As taxation redirects personal income towards public goods shared by fellow citizens, people who recognize the prosocial nature of taxes may find taxes less averse or even worthwhile (Thornton et al. 2019). Past research demonstrates that people are more willing to pay taxes to provide essential services for themselves and fellow citizens when they recognize how their assistance positively impacts the recipient. Baumsteiger (2017) concludes that optimism predicts positive effects that indicate prosocial intentions.

Optimists usually have better connections but also try to have good relationships (Segerstrom 2007; Carver and Scheier 2014). This is because optimism allows us to mobilize positive affective resources that act as drivers and motivational mechanisms for transcending self-interest (Carver and Scheier 2014).

Based on this literature, we hypothesize that dispositional optimism could be an important driver of the willingness to pay more taxes to grant support for the NHS.

2.3.2 Risk orientation

The theory of choice under uncertainty implies that risk preferences should strongly affect an individuals’ choice in various contexts. Differences in risk attitudes across individuals may explain differences in behaviours. Risk orientations refer to individuals’ attitudes toward taking or avoiding risk when deciding how to proceed in a situation with uncertain outcomes (Rohrmann 2005) or the general degree of comfort with facing uncertain gains or losses (Ehrlich and Maestas 2010). In this regard, people are risk averse (risk acceptant) whenever confronted with a choice between a sure option and a lottery of an equal expected value, prefer the former (the latter). There is an extensive literature on risk orientation. The expected utility model explains such choices through the curvature of the utility function. Psychological empirical literature shows that peoples’ orientation toward risk deviates from many axioms of utility theory being framed (Tversky and Kahneman 1981) and heuristic dependent (Kahneman et al. 1982), while other ideas point that such individual risk preferences are related to motivations such as the desire of security (Lopes 1987) or affective states (Isen 2001). Moreover, mounting evidence demonstrates that individuals’ risk orientation varies across domains, such as health, gambling risks or investment risks (Prosser and Wittenberg 2007). These empirical advances suggest that, like dispositional optimism, risk orientation is a stable personality trait (Nicholson et al. 2005; Rohrmann 2005). Notwithstanding, the overwhelming evidence shows that individuals vary substantially in the way they deal with risk, there are still few studies that have explored how risk preferences shape civil societies opinion on public policies (Ehrlich and Maestas 2010; Milita et al. 2020), and no studies have evaluated whether personal risk orientation affects willingness to pay taxes for a particular public service—health. In this context, we consider risk orientation a personality trait and expect risk-averse (acceptant) individuals to be more (less) resistant to uncertain conditions. Thus, as risk-averse individuals are probably concerned about their potential need for health care, combined with the belief that they are more exposed to health problems, increases their perceived need for the NHS, making them more WTP taxes to strengthen the health system.

Based on this exposition, we hypothesize that risk-averse (acceptant) individuals will be more (less) WTP taxes for health.

2.4 Situational effects—Perceived financial risk exposure

Attitudes toward paying taxes are shaped by the individual's perceptions regarding their economic insecurity and surrounding national economic conditions. These situational factors, known as perceived risk exposure, have recently deserved special attention in the literature as critical influences in formulating welfare policy attitudes (Ehrlich and Maestas 2010; Milita et al. 2020). As done elsewhere (Milita et al. 2020), it is essential to distinguish perceived risk exposure from a personal pocketbook perspective—egocentric and from a national economic perspective—sociotropic. According to many authors (Lockerbie 2006, for a review), egocentric and sociotropic reflects self-interest and collectively oriented concerns, respectively. While egocentric risk exposure uses individual personal indicators to evaluate financial risk, sociotropic focuses on collective financial risk by using joint financial indicators. To these the national economy is a collective good. A sociotropic evaluation is an equivalent of other-regarding or public regarding evaluation. Contrary to sociotropic, egocentric are more focused on themselves.

Empirical research reveals a positive influence of both situational effects on support for paying more taxes. Some studies found evidence of the validity of the rational choice theory, according to which individuals are more willing to support spending on welfare if they believe that they (or someone they know) will benefit from the program (Hausermann et al., 2016). Other research found that, in periods of economic downturn (upturn), commonly accompanied by reductions (increase) in earned income and increases (decrease) in job insecurity, the willingness of citizens to contribute to government taxes may be significantly reduced (improved) (Dallinger 2010).

In this study, we will follow the approach used elsewhere (Milita et al. 2020). The authors show that situational effects of risk exposure (egocentric and/or sociotropic) are moderated by a dispositional element of risk orientation. Thus, individuals’ response to situational effects is shaped by stable aspects of their personality (Gerber et al. 2010). Therefore, citizens’ perceived risk exposure and orientation are conditional influences on policy opinion instead of independent and addictive factors. In our study, we go a bit further by considering the egocentric perspective in two different times: at present and in the future, which will be denoted as egocentric at present and egocentric in the future. We want to test if individuals’ risk orientation moderates their risk perception. We hypothesize that an increase in perceived risk exposure (either egocentric or sociotropic) will lead risk-averse (acceptance) individuals to be more (less) willing to pay additional taxes.

2.5 Health status

The WTP for health care is often considered from the perspective of future healthcare utilization (Nabyonga-Orem et al. 2015). According to the self-interest perspective, attitudes toward the welfare state are increasingly determined by personal interests rather than the collective values of universalism and solidarity. Therefore, the lower the perceived risk of future public healthcare utilization, the less likely an individual will be to pay to improve public healthcare. Consequently, lower self‐assessed health will be associated with greater support for more NHS taxes. We hypothesize that low/high self-rated health strengthens/weakens the WTP to improve public health.

2.6 Political orientation

Political ideology may explain preferences for supporting more or fewer taxes (Kaltenthaler and Ceccoli 2008; Jæger 2008). According to the Power Resources Theory, support for the welfare state is guided by a class interest in a struggle between capital and labour and the corresponding political ideologies. Thus, lower classes, socioeconomic status, and left-wing political ideology are key factors underlying more significant support for welfare programs (Korpi and Palme 2003). Although some evidence denotes an association between left–right division and specific preferences for social security expenditures (Jaeger, 2008), research concerning the linkage between ideology and tax policy is lacking (Franko et al. 2013; Fernández-Albertos and Kuo 2018). Individuals with a left-wing orientation are expected to be more concerned with equality and solidarity and, therefore, strongly support a higher level of government intervention. In turn, it is expected that those on the left spectrum of politics have a higher tolerance for government taxation, mainly if they are directed toward improving public services. Conversely, individuals who adhere to a right-wing ideology advocate private initiative and individual freedom and emphasize personal responsibility for providing their healthcare needs. Therefore, it is expected that right-leaning politically-oriented individuals are less supportive of government taxes. We hypothesize that left (right)-wing political orientation strengthens (weakens) the WTP more taxes for health.

2.7 Life Satisfaction

Life satisfaction or subjective well-being (SWB) is a person’s cognitive and affective evaluation of their life (Oishi et al. 2021). Recent data (OECD 2020) revealed that the life satisfaction average score of OECD citizens (on a scale from 0 to 10) is 6.5, while in Portugal reached 5.4. It has been recognized that an individual’s happiness level can influence economic decisions, including consumption, behaviour at work, investment decisions, and political behaviour (Frey and Stutzer 2002). Moreover, optimism often creates positive expectations for what will happen and anticipates positive outcomes (Scheier and Carver 1985; Peters et al. 2016). Then, it is considered an important indicator to promote SWB (Alarcon et al. 2013; Carver and Scheier 2014), as confirmed by several empirical studies (Duy and Yildiz 2017; Oriol et al. 2020). Much literature investigates the relationship between public goods and life satisfaction, but research concerning the opposite direction is lacking (Frey and Stutzer 2002; Tudorică and Vătavu 2020). Nevertheless, life satisfaction was found to have a significant positive effect on taxpayers' tax morale in Asian countries (Torgler 2004), Latin America (Torgler 2005), and Portugal (Sá et al. 2015). Therefore, we hypothesize that: (i) Individuals’ satisfaction with life influences their willingness to pay higher taxes for the NHS and (ii) Dispositional optimism reinforces the positive effect of life satisfaction on willingness to pay more taxes.

2.8 Demographic characteristics—gender, age, educational attainment, and income

There is no consensus in the literature about the effect of demographic characteristics on support for government healthcare funding. The self-interest perspective argues that women and older people may be more supportive of public financing because they use healthcare more or expect greater use in the future and because women are ideologically farther to the left (Vilhjalmsson 2016). Some claim men are more WTP because they are usually the main income-earning, while older people are expected to pay less because they are inactive in the workforce and have other social commitments (Al-Hanawi, 2018). The level of monthly earnings may be an important predictor of WTP more taxes to support NHS. However, there is yet to be a consensus as to the direction of this influence. Some claim that wealthier citizens prefer investing additional portions of their income in private insurance rather than contributing towards improving public health care (Aizuddin et al. 2012). For others, the wealthiest individuals would have more disposable income to pay extra taxes if those taxes are used to fund their specific preferences, such as public welfare and healthcare (Olsen et al. 2014; Vilhjalmsson 2016). Regarding education, the most prevalent idea states that more educated taxpayers are more WTP greater taxes to support NHS because they understand better the link between tax-system and social expenditures (Edlund and Sveva, 2013).

A summary of the hypothesis can be found in the Appendix, Table 5.

3 Method

3.1 Data collection

Data were collected through a self-reported online questionnaire. The questionnaire was available for four months in 2019 on social networks (Facebook, Linkedin, Twitter, and Google Plus). The inclusion criteria were Portuguese adults with residence in Portugal and aged 18 years and older. The questionnaire was tested through a previous sample (with different qualifications, professions, and ages) to verify and analyze the overall degree of issue understanding and answer variability. The validity and reliability test returned high internal reliability (Cronbach's alpha = 0.972). All potential participants were informed about the purpose of this research and the expected duration of participation. Anonymity was granted, participation was voluntary, and written informed consent was mandatory.

3.2 Data measurement

3.2.1 Dependent variable

The outcome variable in the present study is binary and reflects whether respondents would pay more taxes to increase the NHS budget. Respondents were asked: ‘Would you be willing to pay more taxes to increase the budget allocated to the National Health Service?’ Respondents who agreed to pay more taxes were assigned a value of ‘1’ while a value of 0’’ denoted those who refused to pay more taxes.

3.2.2 Independent variables

To measure overall satisfaction with the NHS performance, we asked respondents how they rated the functioning of the NHS. The question was measured through a 5-point ordinal scale ranging from 1—very bad to 5 very good. We re-encoded this variable on a 3-point scale that aggregates satisfaction and dissatisfaction: 1—very bad/bad, 2- fair, and 3—good/very good. To report the effect of self-rated health, we used an ordinal scale ranging from 1—‘bad’ to 4—‘very good’.

Holding private health insurance was measured through a binary variable. The perceived risk exposure was captured through three indicators that measured: (i) current self-rated financial insecurity—Egocentric at Present (EgP); (ii) future perceived financial insecurity—Egocentric in Future (EgF) and (iii)perception concerning the health of the national economy—Sociotropic Risk Exposure (SRE). We used questions designed elsewhere to measure EgP and SRE (Milita et al. 2020) and developed a new question to capture EgF. The question regarding EgP was measured through a 5-point ordinal scale by asking respondents whether the state of their current finance is 1—‘quite comfortable’, 2—‘comfortable’, 3—‘fair’, 4—‘hard’, or 5—very hard’. The questions concerning EgF and SRE were measured using to a 3-point ordinal scale. Respondents were asked whether they believe their financial situation is going to 1 –' get better', 2—'stay the same' or 3—'get worse' and whether they believe the economy is going to 1—' get better', 2—'stay the same' or 3—' get worse'.

To capture the effect of self-rated health, we asked respondents to report their health status according to 4 categories that ranged from1—‘Bad’ to 4—‘Very good’.

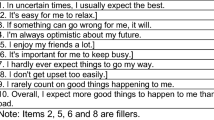

To measure dispositional optimism, all respondents provided answers to the revisedFootnote 1 life orientation test (LOT-R) (Scheier et al. 1994). The scale of LOT-R comprises ten items: three measure optimism (OPT), three measure pessimism (PES), and four are filler items to distinguish the underlying purpose of the test. Respondents must answer on a 5-point Likert scale ranging from 1—‘strongly disagree’ to 5—‘strongly agree’. This scale was tested by previous studies documenting its reliability and validity (see Carver et al. 2010, for a review). We summed the scores of the items under consideration to obtain the OPT and PES scores. The scale and descriptive statistics are described in Appendix, Table 6, respectively.

To analyze the risk-orientation, we asked respondents how comfortable they are in taking a risk when making financial career or other life decisions (Maestas and Pollock 2010). The answers were collected on a 7-point ordinal scale, where 1 (totally comfortable) represents extreme risk acceptance, and 7 (totally uncomfortable) represents extreme risk aversion. Respondents with values between 1 and 3 were considered risk-acceptance, while those between 5 and 7 were risk-averse. Risk-neutrals were the respondents, scoring 4. We re-encoded this variable so that lower scoring (1, 2, and 3) equals greater risk acceptance (3 = 1; 2 = 2 and 1 = 3), and higher scores (5, 6, and 7) equals greater risk aversion (7 = 1; 6 = 2 and 5 = 3). Risk acceptance ranges from 1 to 3, with higher values denoting greater risk acceptance and ‘0’ indicating that respondents are either risk-averse or risk-neutral. Similarly, risk aversion ranges from 1 to 3, with higher values meaning greater risk aversion and ‘0’ denoting that respondents are either risk-acceptance or risk-neutral.

The effect of political ideology was measured by asking respondents directly about their political preference according to 3 categories: 0—‘None’, 1- ‘Left’, and 2—‘Right’. The effect of self-rated life satisfaction was collected by asking respondents to rate their satisfaction with life according to 3 categories: 1—‘Not Satisfied’, 2—‘More/Less Satisfied’, and 3—‘Satisfied/Very Satisfied’. Finally, a section collected respondents’ demographic characteristics, namely gender, age, education, and monthly income.

A detailed description of the variables used in this study can be found in the Appendix, Table 5.

3.3 Analytical approach

Descriptive statistics and logistic regressions were performed using STATA16. Logit models were used to control for respondents’ sociodemographic characteristics and to explore the influence of the explanatory variables on respondents’ willingness to pay more taxes to strengthen the NHS financially. Therefore, we estimate three regression models—one model for each Financial Risk Exposure variable (EgP, EgF, and SRE).

Binary response models, like the Logit model, are usually expressed as linear functions of a set of repressors’ (see appendix Table 5). The estimates of Y given X are conditional probabilities of the event Y occurring (i.e. when it is 1). Therefore, the conditional probabilities are expected to lie between 0 and 1. The underlying logit model is given by Eqs. 1 and 2.

and

where P is the probability that the outcome variable—WTP more taxes for health, equals 1, while the independent variables (X) are detailed in the theoretical framework. Results are interpreted considering marginal effects, that allow us to read the slope of the probability curve relating x to Pr(y = 1|x), holding all other variables constant.

4 Results

4.1 Descriptive analysis

Descriptive statistics of the dependent and independent variables are summarized in Table 4 in the Appendix. A sample of 584 Portuguese citizens filled out the questionnaire. The survey was set up so that people had to answer each question. For this reason, 721 people started to answer the questionnaire, but only 584 completed it.

From the top panel of Table 4, we can conclude that the majority of respondents (61.8%) were female, had higher education (67.5%) (graduation or MSc or Ph.D.), earned less than 2000€ a month(88%) and the predominant age of respondents ranges between 35 and 44 years.

Roughly half of the respondents had no political preference, and most (66.6%) had private health insurance. Most respondents (74%) considered themselves in good or very good health and were more or less satisfied with their life (60%), while 37.8% felt even very satisfied.

Optimism and risk acceptance prevail among the respondents (54.8%). Most respondents recognize being in an economically comfortable (33.4%) or fair (49.7%) situation and even expect their situation to improve (44% of respondents) or to stay the same (39%) in the future. However, most respondents (52%) expect the general economy to ‘get worse’.

The descriptive analysis of the dependent variable shows that tax policy associated with improvements in healthcare is popular among citizens since almost two-thirds of respondents were willing to pay more taxes to reinforce the NHS.

4.2 Explanatory analysis

Tables 1, 2 and 3 summarize the econometric estimated outputs (logit coefficients in odd columns and marginal effects in even columns) of the WTP more taxes to improve the NHS for each perceived risk exposure—Egocentric at present, Egocentric in Future and Sociotropic, assuming different model specifications. The independent variables were used interchangeably for a robustness check to infer their specific impacts.

Results in Table 1 comprise the determinants of an individual’s WTP more taxes for the NHS with the variable Egocentric at present—EgP—used as a regressor. The results suggest that age, current financial security, and satisfaction with the performance of the NHS are statistically significant predictors of the WTP more taxes for the NHS. Being older and having a comfortable economic situation decreases respondents dispositional to pay additional taxes to support the health system by 0.257 percentage points (p.p.) and by 0.084p.p., respectively, while being satisfied with the NHS performance increases the availability to support additional taxes for health by 0.052 p.p.

The self-reported exposure to risk at present loses significance when dispositional effects (risk aversion and optimism/pessimism) are removed (columns 7 and 8). Although the results indicate no statistically significant interaction between present risk exposure and one’s orientation to risk, risk preferences are somewhat important. While, EgP is statistically significant in explaining WTP when risk aversion is considered, the personality trait of risk tolerance needs to be altogether with optimism/pessimism for the perceived risk exposure at present to maintain their significant explanation of WTP. On the other hand, life satisfaction becomes statistically significant in predicting WTP more taxes only when optimism/pessimism and risk seeking are included in the regression (from column 5 onward). Greater life satisfaction increases the availability to support the NHS between 0.079 and 0.081p.p. Thus, optimistic self-awareness and risk acceptance impact life satisfaction, leading to a higher WTP for the healthcare system.

Table 2 presents the estimates of the determinants of respondents’ WTP more taxes for health assuming the perceived personal risk exposure in the future—EgF. The results denote that age, life satisfaction, and satisfaction with the NHS were statistically significant in predicting WTP more taxes for NHS. As previously stated, younger respondents, those more satisfied with their lives and with the NHS performance, were more available to support increasing taxes to support the NHS than older (by 0.266p.p), than those less satisfied with life (by 0.087p.p.), and those less satisfied with the NHS performance (by 0.054p.p.). However, self-awareness of life satisfaction is a significant determinant independent of the control variable considered in the analysis.

Table 3 summarizes the results for the factors influencing respondents’ WTP more taxes for health, assuming the evolution of the country’s economic situation—Sociotropic—SRE. Again, age increases lead to lower WTP, and both life satisfaction and healthcare quality perceived by individuals lead to higher WTP taxes to support the NHS, wherein the marginal effects associated with these variables are more significant than they were for each self-perceived individual risk exposure.

The results also suggest that holding perceived macroeconomic insecurity constant, an increase in risk aversion (acceptance) leads to a decrease (increase) in WTP. Moreover, there is a significant interaction between respondents’ perceived macroeconomic in security and risk orientation—pr5 and pr6 (columns 3–10). An increase in macroeconomic risk exposure leads risk-averse respondents to increase (0.076p.p. or 0.078p.p.) their WTP more taxes for the NHS (columns 3–6) while lead risk-acceptance respondents to decrease (0.064p.p. or 0.062p.p.) their availability to pay additional taxes (column 7–10). To better understand this last result, Fig. 1 presents the conditional relationship between respondents’ perceived risk exposure at the macroeconomic level and their risk orientation. Higher values of each risk orientation indicate that an individual is increasingly risk-averse or risk-acceptance.

5 Discussion

In Portugal, all residents have access to healthcare through the NHS, financed mainly through taxes. Understanding the viability of this socialized health system requires detailed information about Portuguese willingness to pay for that scheme. The present study explored some factors that influence the WTP more taxes to support the NHS in a sample of Portuguese taxpayers. There are very few studies that have investigated this issue, which limits the comparison of our results. Furthermore, some of the explanatory variables we use were never explored in this context, making comparisons unfeasible.

Our results indicate that most respondents were willing to pay additional taxes to support the NHS. In general, we find support for the hypothesis that socioeconomic, behavioural, and psychological variables influence respondents’ taxpayers to contribute even more to maintain a solidarity health system. Logistic regressions showed that an increasing WTP more taxes to finance the NHS was associated with younger ages, happiness, satisfaction with the NHS performance, current perceived risk exposure, and risk orientation. Therefore, three hypotheses received complete support through our empirical analysis. The more satisfied the respondent is with their life, the more available they are for additional funding, consistent with previous studies (Sá et al. 2015; Al-Hanawi, 2018;). Respondents’ support for paying additional taxes is tied to their perceived exposure to risk. Individuals with a relatively more comfortable economic situation (less exposure to risk) at present (egocentric perspective) revealed more availability to contribute a larger share of their income toward reinforcing the NHS. Although there’s no other study exploring the association between perceived risk exposure and WTP more taxes for the NHS commonly empirical studies found that wealthy individuals are more willing to contribute to public health services (Azar et al. 2018; Habibov et al. 2018; Maldonado et al. 2019). Notwithstanding, none of the levels of net monthly income was statistically significant in explaining WTP, which is somewhat weird, especially since empirical evidence shows household income as a significant predictor of willingness to contribute to public health (Al-Hanawi, 2018; Hajek et al. 2020).

We find evidence that underlying personality traits—risk orientation, moderate respondents’ perceived sociotropic risk exposure and, consequently, shape their WTP more taxes for the health system, consistent with a previous study (Milita et al. 2020). Our findings support a statistically significant interaction between macroeconomic perceived risk exposure and respondent’s risk orientation. Indeed, for risk-acceptant (risk-averse) respondents, an increase in Perceived Sociotropic Risk Exposure is associated with a significant decrease (increase) in their propensity to support the NHS through taxes. While the only study on this subject (Milita et al. 2020) finds a conditional relationship between individual exposure to risk from an egocentric and sociotropic perspective, we only find it for the latter. We may speculate about this result. One possible reason for not finding an interaction between egocentric exposure and risk preferences may lie in the fact that the majority of respondents revealed that they not only currently have a comfortable financial situation and expect to maintain it in the future, but they expressed themselves pessimistic about the future economic situation of the country. Thus, it may lead to the idea that taxes are small for those with comfortable financial positions but large for those with a smaller purse, which may distort the size of the risk. Recent research more generally related to wealth and risk orientation finds that risk aversion changes with wealth, decreasing as wealth increases (Huber et al. 2023).

Furthermore, we find no evidence of a direct influence of risk orientation and WTP more taxes for health. Although no study has yet (that we are aware of) investigated the effect of risk preferences on WTP taxes for health, regarding tax compliance in general, empirical evidence denotes that individuals more prone to assume risks were less compliant with their duty to pay taxes (Zhang et al. 2016).

The respondents’ satisfaction with NHS was positively related to their willingness to pay more taxes for health. More satisfied respondents revealed more willingness to increase through taxes the NHS funding. Although similar results were found for UK citizens (Morris et al. 2023), other international studies in several countries reveal support for this relationship and its opposite (Edlund 2006; Habibov et al. 2019). Having private health insurance was not statistically significant in influencing the WTP more taxes for health. Conflicting findings are shown in empirical studies. While Al-Hanawi (2018) found no relation between private health insurance and WTP more taxes for health, Hajek et al. (2020) found a negative relation. The hypothesis regarding the influence of self-rated health status found no support in our analysis. Also, Vilhjalmsson (2016) found no significant association between self‐assessed health and the WTP for public healthcare. Habibov et al. (2018) found partial support in Eastern Europe, and Habibov et al. (2017) found a negative association in post-communist countries.. The Portuguese respondents’ political orientation was not found to influence their WTP more taxes for health. This finding was expected since almost half the sample revealed no political preference. However, empirical evidence showed that in post-communist, Southern Europe, and Eurasian countries, adhering to left-leaning ideological positions strengthened support for public health care (Habibov et al. 2017, 2018).

Our results found no statistically significant support for the hypothesis concerning the influence of dispositional optimism in WTP more taxes for public health. Still, we found a positive interaction between dispositional optimism and SWB, consistent with other studies (Oriol et al., 2019). The influence of personality on WTP for health services still needs to be investigated. To our knowledge, only one study tested the effect of personality (through the five big traits) on WTP for health insurance in Germany (Hajek et al. 2020) and found only one associated with openness to experience. More recently, a study investigated the role of unrealistic absolute optimism in the willingness to pay for medical services and found that unrealistic absolute pessimism, rather than unrealistic absolute optimism, was associated with greater WTP for medical treatments (Hanoch et al. 2023). From demographic characteristics, only age was identified as a significant predictor for WTP more taxes to improve NHS. According to our results, younger respondents were more willing to contribute extra income to improve the NHS than the elderly, as reported elsewhere (Habibov et al. 2017; Maldonado et al. 2019; Hajek et al. 2020). Robust research evidence explaining why younger are more willing to pay additional taxes for the NHS is lacking. However, we can speculate as follows. According to economic psychology taxpayers’ voluntary compliance may be influenced by knowledge, attitudes, moral appeals, fairness and democracy (Kirchler et al. 2010). The difference in WTP taxes for health between younger and older can be explained by seeing the need of parents or grandparents for health care, which pushes them to contribute with taxes to ensure that the system has resources that allow them to be properly treated. Furthermore, young people may have more knowledge and, consequently, be more aware of the underfunding of the SNS, which has worsened with the population ageing. Education is not a predictor of the WTP in our study, confirming previous findings (Javan-Noughabi et al. 2017) and contrasting with others (Al-Hanawi, 2018; Habibov et al. 2018; Maldonado et al. 2019).s

Some strengths and limitations of this study are worth noting. To the best of our knowledge, the present study is the first that analyzes the Portuguese WTP more taxes to support the NHS. Additionally, this study incorporates new explanatory variables that have not yet been studied in the context of WTP more taxes for health. The results should be interpreted with appropriate caution, given some study limitations. First, the sample does not represent the Portuguese population, preventing the generalization of the findings. According to recent data, in 2020, there was a predominance of female inhabitants in Portugal (52.8%), the modal age of the population was between 45 and 49 years, and only 21.2% of the population had higher education (Pordata, 2021b). Thus, our sample was better educated than the general population, and females are overrepresented. Second, the data were collected through an online questionnaire. The mode of administrating the questionnaire has significant repercussions for the subsequent respondents' sample. The online survey method enables many responses to be collected quickly and cheaply. Still, it raises concerns about the data quality and denies the researcher a representative population sample. Even so, many studies find an overall, broadly similar response throughout all the different survey administration modes (Rowen et al. 2016). Besides this sampling limitation, there are concerns about exploring the WTP more taxes for health from individuals under a universal coverage health system since they are coercively demanded to pay for the system. We contend that the positive contribution of this study overcomes these drawbacks.

In follow-up research, it would be useful to expand this study to a representative sample of the Portuguese population. Moreover, it would be interesting to conduct international comparative research in European countries with an NHS, like the United Kingdom, Spain, Italy, and non-European countries like Brazil, using a common study design to explore cultural differences. Since the current COVID-19 pandemic challenged the functioning of the NHS and people’s mentality about health systems, it would also be interesting to repeat this study nowadays, after the COVID-19 pandemic, and compare the results of both studies.

6 Conclusion

The literature suggests several often conflicting explanations regarding WTP more taxes to improve public healthcare. Our findings supported the idea that people’s valuations of universal healthcare should be studied as a multi-dimensional phenomenon. According to our results, the many respondents who were available to pay additional taxes to reinforce the NHS may suggest that individuals accept current contributions to the NHS and would probably accept higher taxes (contributions). Policy-makers should be aware that there is potential to increase NHS funding but should be mindful of and pay special attention to the factors that condition these citizens’ availability. Among these factors, an individuals’ age, satisfaction with life and with the NHS and perceived exposure to risk at present (in terms of financial insecurity) appear to be critical characteristics in explaining financial support for the NHS. Also, the support for financing NHS is tied to respondents’ risk orientation when combined with the overall evolution of the economy. These findings suggest political room to promote tax reforms to increase healthcare expenditures. Hence, one of the main ways to bolster public support for financing public health care during the reform should be to identify the tangible improvements in health care delivery that could increase satisfaction with health care as a primary result. Reducing waiting time and increasing the number of doctors and nurses may be a priority in Portugal. Moreover, creating economic conditions that foster peoples’ financial security, in particular, and develop social conditions that promote peoples’ well-being and happiness, in general, would also be a significant driver of strengthening the NHS.

The findings of the present study suggest an opportunity for the political power to enact measures that ensure the long-term viability of the NHS and that follow taxpayers’ preferences for whom they are intended.

Data availabity

The data that support the findings of this study are available from the corresponding author upon request.

Notes

This revised version of the former LOT (Scheier & Carver 1985) focuses more on the conceptual core of the trait—expectations about one’s future.

References

Aizuddin A, Sulong S, Aljunid S (2012) Factors influencing willingness to pay for healthcare. BMC Public Health 12(Suppl 2):A37. https://doi.org/10.1186/1471-2458-12-S2-A37

Alarcon G, Bowling N, Khazon S (2013) Great expectations: a meta analytic examination of optimism and hope. Person Individ Differ 54:821–827. https://doi.org/10.1016/j.paid.2012.12.004

Al-Hanawi M, Vaidya K, Alsharqi O, Onwujekwe O (2018) Investigating the willingness to pay for a contributory national health insurance scheme in Saudi Arabia: a cross-sectional stated preference approach. Appl Health Econ Health Policy 16:259–271. https://doi.org/10.1007/s40258-017-0366-2

Allingham M, Sandmo A (1972) Income tax evasion: a theoretical analysis. J Public Econ 1:323–338. https://doi.org/10.1016/0047-2727(72)90010-2

Andreoni J, Erard B, Feinstein J (1998) Tax compliance. J Econ Literat 36:818–860

Azar A, Maldonado L, Castillo J, Atria J (2018) Income, egalitarianism and attitudes towards healthcare policy: a study on public attitudes in 29 countries. Public Health 154:59–69. https://doi.org/10.1016/j.puhe.2017.09.007

Baumsteiger R (2017) Looking forward to helping: the effects of prospection on prosocial intentions and behavior. J Appl Soc Psychol 47:505–514. https://doi.org/10.1111/jasp.12456

Bhandari A, Borovicka J, Ho P (2021) Macroeconomic effects of household pessimism and optimism. Richmond Fed Economic Brief, Federal Reserve Bank of Richmond, 21(3), January. https://www.richmondfed.org/publications/research/economic_brief/2021/eb_21-03

Bwalya J (2020) Are people in the SADC region willing to pay more tax to fund public healthcare? Develop Southern Africa 37(4):601–616. https://doi.org/10.1080/0376835X.2019.1674638

Carver C, Scheier M (2014) Dispositional optimism. Trend Cognit Sci 18:293–299

Carver C, Scheier M, Segerstrom S (2010) Optimism. Clin Psychol Rev 30:879–889. https://doi.org/10.1016/j.cpr.2010.01.006

Conversano C, Rotondo A, Lensi E, Della Vista O, Arpone F, Reda MA (2010) Optimism and its impact on mental and physical well-being. Clin Pract Epidemiol Ment Health 14(6):25–29. https://doi.org/10.2174/1745017901006010025

Corr P, Matthews G (2009) The Cambridge handbook of personality psychology. Cambridge University Press

Dallinger U (2010) Public support for redistribution: what explains cross-national differences? J Eur Soc Policy 20(4):333–349. https://doi.org/10.1177/095892871037

Dohmen T, Quercia S, Willrodt J (2019) Willingness to Take Risk: The Role of Risk Conception and Optimism. SOEP papers on Multidisciplinary Panel Data Research 1026, DIW Berlin, The German Socio-Economic Panel (SOEP)

Duy B, Yildiz M (2017) The mediating role of self-esteem in the relationship between optimism and subjective well-being. Curr Psychol 38:1456–1463. https://doi.org/10.1007/s12144-017-9698-1

Edlund J (2006) Trust in the capability of the welfare state and general welfare state support: Sweden 1997–2002. Acta Sociologica 49(4):395–417. https://doi.org/10.1177/000169930607168

Edlund J, Johansson S (2013) Exploring the ‘something for nothing’ syndrome: confused citizens or free riders? Eviden Sweden. Scandinavian Politic Stud 36(4):293–319

Edlund J, Sevä I (2013) Exploring the ’Something for Nothing’Syndrome: confused citizens or free riders? Evidenc Sweden Scandinavian Politic Stud 36(4):293–319. https://doi.org/10.1111/j.1467-9477.2012.00300.x

Ehrlich S, Maestas C (2010) Risk orientation, risk exposure and policy opinion: the case of free trade. Polit Psychol 31(5):657–684. https://doi.org/10.1111/j.1467-9221.2010.00774.x

Eurostat (2019) Ageing Europe LOOKING AT THE LIVES OF OLDER PEOPLE IN THE EU. Population and social conditions Collection: Statistical books. https://ec.europa.eu/eurostat/documents/3217494/10166544/KS-02-19%E2%80%91681-EN-N.pdf/c701972f-6b4e-b432-57d2-91898ca94893

Fernández-Albertos J, Kuo A (2018) Income perception, information, and progressive taxation: evidence from a survey experiment. Politic Sci Res Methods 6:83–110. https://doi.org/10.1017/psrm.2015.73

Franko W, Tolbert C, Witko C (2013) Inequality, self-interest, and public support for “robin hood” tax policies. Polit Res Q 66(4):923–937. https://doi.org/10.1177/1065912913485441

Frey B, Stutzer A (2002) What can economists learn from happiness research? J Econ Literat 40(2):402–435. https://doi.org/10.1257/002205102320161320

Gaisbauer H, Schweiger G, Sedmak C (2015) Outlining the Field of Tax Justice. In: Gaisbauer H, Schweiger G, Sedmak C (eds) Philosophical Explorations of Justice and Taxation. Ius Gentium: Comparative Perspectives on Law and Justice, vol 40. Springer, Cham. https://doi.org/10.1007/978-3-319-13458-1_1

Gassen J, Nowak T, Henderson A, Weaver S, Baker E, Muehlenbein M (2021) Unrealistic optimism and risk for COVID-19 disease. Front Psychol. https://doi.org/10.3389/fpsyg.2021.647461

Gerber A, Huber G, Doherty D, Dowling C, Ha S (2010) Personality and political attitudes: relationships across issue domains and political contexts. Am Polit Sci Rev 104(1):111–133. https://doi.org/10.1017/S0003055410000031

Habibov N (2016) Effect of corruption on healthcare satisfaction in post-soviet nations: a cross-country instrumental variable analysis of twelve countries. Soc Sci Med 152:119–124. https://doi.org/10.1016/j.socscimed.2016.01.044

Habibov N, Cheung A, Auchynnikava A (2017) Does social trust increase willingness to pay taxes to improve public healthcare? Cross-sectional cross-country instrumental variable analysis. Soc Sci Med 189:25–34. https://doi.org/10.1016/j.socscimed.2017.07.023

Habibov N, Auchynnikava A, Luo R, Fan L (2018) Who wants to pay more taxes to improve public health care? Int J Health Plann Manag 33:e944–e959. https://doi.org/10.1002/hpm.2572

Habibov N, Luo R, Auchynnikava A (2019) The Effects of healthcare quality on the willingness to pay more taxes to improve public healthcare: testing two alternative hypotheses from the research literature. Ann Glob Health 85(1):131. https://doi.org/10.5334/aogh.2462

Hajek A, Enzenbach C, Stengler K, Glaesmer H, Hinz A, Rohr S, Stein J, Riedel-Heller S, Konig H (2020) Determinants of willingness to pay for health insurance in Germany—results of the population-based health study of the Leipzig research centre for civilization diseases (LIFE-Adult-Study). Front Public Health 8:456

Hanoch Y, Simuzingili M, Barnes A (2023) The role of unrealistic absolute optimism in willingness to be treated and pay for medical services. Decision 10(1):44–60. https://doi.org/10.1037/dec0000184

Häusermann S, Kurer T, Schwander H (2016) Sharing the risk? households, Labor market vulnerability, and social policy preferences in Western Europe. J Polit 78(4):1045–1060

Hecht D (2013) The neural basis of optimism and pessimism. Exp Neurobiol 22:173–199. https://doi.org/10.5607/en.2013.22.3.173

Isen A (2001) An influence of positive affect on decision making in complex situations: theoretical issues with practical implications. J Consum Psychol 11(2):75–85. https://doi.org/10.1207/S15327663JCP1102_01

Jæger M (2008) Does left–right orientation have a causal effect on support for redistribution? Causal analysis with cross-sectional data using instrumental variables. Int J Publ Opin Res 20(3):363–374. https://doi.org/10.1093/ijpor/edn030

Javan-Noughabi J, Kavosi Z, Faramarzi A, Khammarnia M (2017) Identification determinant factors on willingness to pay for health services in Iran. Heal Econ Rev 7(1):1–6. https://doi.org/10.1186/s13561-017-0179-x

Kahneman D, Slovic P, Tversky A (1982) Judgment under uncertainty: heuristics and biases. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9780511809477

Kaltenthaler K, Ceccoli S (2008) Explaining patterns of support for the provision of citizen welfare. J Eur Publ Policy 15(7):1041–1068. https://doi.org/10.1080/13501760802310561

Kirchler E, Muehlbacher S, Kastlunger B, Wahl I (2010) Why pay taxes? A review of tax compliance decisions. In: Alm J, Martinez-Vazquez J, Torgler B (eds) Developing alternative frameworks for explaining tax compliance. Routledge, pp 15–31

Korpi W, Palme J (2003) New politics and class politics in the context of austerity and globalization: welfare state regress in 18 countries, 1975–95. Am Polit Sci Rev. https://doi.org/10.1017/S0003055403000789

Kumlin S (2007) Overloaded or undermined: European welfare states in the face of performance dissatisfaction. In: Svallfors S (ed) The Political Sociology of the Welfare State. Stanford University Press, Stanford, CA

Lockerbie B (2006) Economies and politics: egocentric or sociotropic? Am Rev Polit 27:191–208

Lopes L (1987) Between hope and fear: the psychology of risk. Adv Exp Soc Psychol, Acad Press 20:255–295. https://doi.org/10.1016/S0065-2601(08)60416-5

Luyten J, Kessels R, Desmet P, Goos P, Beutels P (2019) Priority-setting and personality: effects of dispositional optimism on preferences for allocating healthcare resources. Soc Just Res 32:186–207. https://doi.org/10.1007/s11211-019-00329-5

Maestas C., Pollock W. (2010) Measuring generalized risk orientation with a single survey item. SSRN: https://ssrn.com/abstract=1599867

Maldonado L, Olivos F, Castillo J, Atria J, Azar A (2019) Risk exposure, humanitarianism and willingness to pay for universal healthcare: a cross-national analysis of 28 countries. Soc Just Res 32:349–383. https://doi.org/10.1007/s11211-019-00336-6

Milita K, Bunch J, Yeganeh S (2020) It could happen to you: How perceptions of personal risk shape support for social welfare policy in the American states. J Publ Policy 40(4):535–552. https://doi.org/10.1017/S0143814X19000138

Mooney G (2003) Economics, Medicine and Health Care, 3rd ed., Prentice Hall

Morris J, Schlepper L, Dayan M, Jefferies D, Maguire D, Merry L, Wellings D (2023) Public satisfaction with the NHS and social care in 2022 Results from the British Social Attitudes survey. The King’s Fund. https://www.kingsfund.org.uk/sites/default/files/2023-03/Public%20satisfaction%20with%20the%20NHS%20and%20social%20care%20in%202022_FINAL%20FOR%20WEB.pdf

Nabyonga-Orem J, Ayiko R, Govule P, Anguyo R, Katongole S, Dakoye D (2015) Communities’ willingness to pay for healthcare in public health facilities of Nakasongola District, Uganda. Int J Public Health Res 3:248–253

Nicholson N, Soane E, Fenton-O’Creevy M, William P (2005) Personality and domain-specific risk taking. J Risk Res 8(2):157–176. https://doi.org/10.1080/1366987032000123856

NOVA-IMS (2021) NOVA Information Management School—Indice Saúde Sustentável 2020/2021 Projeto Saúde Sustentável. Abbvie. https://www.abbvie.pt/content/dam/abbvie-dotcom/pt/Documents/%C3%8DndiceSa%C3%BAdeSustent%C3%A1vel_2021.pdf

OECD (2019) State of Health in the EU. Portugal. Country Health Profile 2019. European Observatory on Health Systems and Policies. https://www.oecd-ilibrary.org/docserver/85ed94fc-en.pdf?expires=1632236754&id=id&accname=guest&checksum=F71995B26D289B8597419998C15D628F

OECD (2020) Better life index. https://www.oecdbetterlifeindex.org/topics/life-satisfaction/

Oishi S, Diener E, Lucas R (2021) Subjective well-being: The science of happiness and life satisfaction. In: Snyder CR, Lopez SJ, Edwrads LM, Marques SC (eds) Handbook of positive psychology, 3rd edn. Oxford University Press

Olsen J, Kidholm K, Donaldson C, Shackley P (2014) Willingness to pay for public health care: a comparison of two approaches. Health Policy 70:217–228. https://doi.org/10.1016/j.healthpol.2004.03.005

Oriol X, Miranda R, Bazán C, Benavente E (2020) Distinct routes to understand the relationship between dispositional optimism and life satisfaction: self-control and grit, positive affect, gratitude, and meaning in life. Front Psychol 11:907. https://doi.org/10.3389/fpsyg.2020.00907

Penner L, Dovidio J, Piliavin J, Schroeder D (2005) Prosocial behavior: multilevel perspectives. Annu Rev Psychol 56:365–392. https://doi.org/10.1146/annurev.psych.56.091103.070141

Peters M, Vieler J, Lautenbacher S (2016) Dispositional and induced optimism lead to attentional preference for faces displaying positive emotions: an eye-tracker study. J Posit Psychol 11:258–269. https://doi.org/10.1080/17439760.2015.1048816

PORDATA (2021a) PORDATA—Fundação Francisco Manuel dos Santos. Contas Públicas. https://www.pordata.pt/Subtema/Portugal/Receitas+do+Estado-364

PORDATA (2021b) PORDATA—Fundação Francisco Manuel dos Santos. População.https://www.pordata.pt/Subtema/Portugal/Censos+da+Popula%c3%a7%c3%a3o-27

Prosser L, Wittenberg E (2007) Do risk attitudes differ across domains and respondent types? Med Decis Making 27(3):281–287

Puri M, Robinson D (2007) Optimism and economic choice. J Financ Econ 86:71–99. https://doi.org/10.1016/j.jfineco.2006.09.003

Rohrmann B (2005) Risk attitude scales: Concepts, questionnaires, utilizations. University of Melbourne, Australia, Melbourne

Rowen D, Brazier J, Keetharuth A, Tsuchiya A (2016) Comparison of modes of administration and alternative formats for eliciting societal preferences for burden of illness. Applied Health Econ Health Policy 14(1):89–104. https://doi.org/10.1007/s40258-015-0197-y

Sá C, Martins A, Gomes C (2015) Tax morale determinants in Portugal, European Scientific Journal, ESJ. Special Edition, pp 236–254. www.eujournal.org/index.php/esj/issue/view/198

Scheier M, Carver C (1985) Optimism, coping, and health: assessment and implications of generalized outcome expectancies. Health Psychol 4(3):219–247. https://doi.org/10.1037/0278-6133.4.3.219

Scheier M, Carver C, Bridges M (1994) Distinguishing optimism from neuroticism (and trait anxiety, self-mastery, and self-esteem): A reevaluation of the Life Orientation Test. J Pers Soc Psychol 67(6):1063–1078. https://doi.org/10.1037/0022-3514.67.6.1063

Segerstrom S (2007) Optimism and resources: effects on each other and on health over 10 years. J Res Person 41:772–786. https://doi.org/10.1016/j.jrp.2006.09.004

Segerstrom S, Carver C, Scheier M (2017) Optimism. In: The Happy Mind: Cognitive Contributions To Well-Being, eds M. D. Robinson and M. Eid (Cham: Springer International Publishing): pp 177–193. https://doi.org/10.1007/978-3-319-58763-9_11

Simões J, Augusto G, Fronteira I, Hernández-Quevedo C (2017) Portugal: health system review. Health Syst Transit 19(2):1–184

Thaler RH (1999) Mental accounting matters. J Behav Decis Mak 12(3):183–206. https://doi.org/10.1002/(SICI)1099-0771(199909)12:3%3c183::AID-BDM318%3e3.0.CO;2-F

Thornton E, Aknin L, Branscombe N, Helliwell J (2019) Prosocial perceptions of taxation predict support for taxes. PLoS ONE 14(11):e0225730. https://doi.org/10.1371/journal.pone.0225730

Torgler B (2001) Is tax evasion never justifiable? J Public Financ Public Choice 19(2–3):143–167. https://doi.org/10.1332/251569201X15668905707203

Torgler B (2004) Tax morale in Asina countries. J Asian Econ 15:237–266. https://doi.org/10.1016/j.asieco.2004.02.001

Torgler B (2005) Tax morale in Latin America. Public Choice 122(1–2):133–157. https://doi.org/10.1007/s11127-005-5790-4

Torgler B, Schneider F (2007) What shapes attitudes toward paying taxes? evidence from multicultural european countries. Soc Sci Q 88(2):443–470. https://doi.org/10.1111/j.1540-6237.2007.00466.x

Tudorică R, Vătavu S (2020) Are happier taxpayers willing to pay higher taxes? J Financ Stud, Inst Financ Stud 9(5):72–85

Tversky A, Kahneman D (1981) The framing of decisions and the psychology of choice. Science

Vilhjalmsson R (2016) Public views on the role of government in funding and delivering health services. Scand J Public Health 44(5):446–454

Yitzhaki S (1974) A note on income tax evasion: a theoretical analysis. J Public Econ 3:201–202

Zhang N, Andrighetto G, Ottone S, Ponzano F, Steinmo S (2016) Willing to pay? Tax compliance in Britain and Italy: an experimental analysis. PLoS ONE 11(2):e0150277. https://doi.org/10.1371/journal.pone.0150277

Acknowledgements

This work was supported by the UIDB/05105/2020 Program Contract, funded by national funds through the FCT I.P.

Funding

Open access funding provided by FCT|FCCN (b-on). This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Consent publication

The authors declare that this work is original and has not been published elsewhere nor is it currently under consideration for publication elsewhere.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pinho, M., Madaleno, M. Willingness to pay more health taxes? The relevance of personality traits and situational effects. Mind Soc (2024). https://doi.org/10.1007/s11299-023-00300-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11299-023-00300-7