Abstract

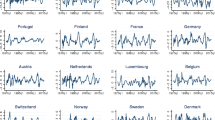

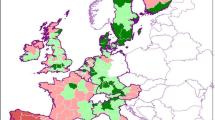

Most studies of business cycle synchronization in the EMU identify a core set of counties with high synchronization and a periphery set of countries with low synchronization. Using a structural VAR with model uncertainty, we identify spillover effects from shocks that originate in the United States, the EMU, and the rest of the world to test whether external influences can explain the existence of the core and periphery. Most countries typically found in the core respond to external spillovers in similar ways, leading to more synchronized business cycles. The response to external influences in the countries traditionally found in the periphery, on the other hand, help explain their exclusion from the core.

Similar content being viewed by others

Notes

Variables ordered early in the VAR are assumed to have no contemporaneous effects on the variables ordered below it. Variables listed below are assumed to contemporaneously affect those variables ordered above them.

We have also run this experiment using a rest of the world variable excluding European countries. The effects of United States and EMU shocks on individual members are similar across specifications. The effects of rest of the world shocks, on the other hand, are smaller and less significant in the specification excluding European countries. These results are available upon request.

References

Allen, F., & Gale, D. (2000). Financial contagion. Journal of Political Economy, 108, 1–33.

Artis, M., & Zhang, W. (1999). Further evidence on the international business cycle and the ERM: is there a European business cycle? Oxford Economic Papers, 51, 120–132.

Artis, M., Krolzig, H., & Toro, J. (2004). The European business cycle. Oxford Economic Papers, 56(1), 1–44.

Baxter, M., & Kouparitsas, M. (2005). Determinants of business cycles comovement: a robust analysis. Journal of Monetary Economics, 52, 113–157.

Bayoumi, T., & Swiston, A. (2009). Foreign entanglements: estimating the sources and size of spillovers across industrial countries. IMF Staff Papers, 56, 353–383.

Berger, H., & Harjes, T. (2009). Does global liquidity matter for monetary policy in the euro area? International Finance, 12(1), 33–55.

Darvas, Z., & Szapáry, G. (2008). Business cycles synchronization in the enlarged EU. Open Economic Review, 19, 1–19.

Dées, S. & Vansteenkiste, I. (2007). The transmission of US cyclical developments to the rest of the world. European Central Bank Working Paper Series No. 798.

de Haan, J., Inklaar, R., & Jong-A-Pin, R. (2008). Will business cycles in the euro area converge? A critical survey of empirical research. Journal of Economic Surveys, 22(2), 234–273.

Elbourne, A. & de Haan, J. (2004). Asymmetric monetary transmission in EMU: The robustness of VAR conclusions and Cecchetti’s legal family theory. CESIFO Working Paper No. 1327.

European Commission. (1990). One market, one money: an evaluation of the potential benefits and costs of forming an economic and monetary union. European Economy, 44.

Favero, C., & Giavazzi, F. (2008). Should the euro area be run as a closed economy? American Economic Review-Papers and Proceedings, 98(2), 1–8.

Fidrmuc, J. (2004). The endogeneity of the optimum currency area criteria, intra-industry trade, and the EMU enlargement. Contemporary Economic Policy, 22(1), 1–12.

Frenkel, J., & Nickel, C. (2005). How symmetric are the shocks and the shock adjustment dynamics between the euro area and central and eastern European countries. Journal of Common Market Studies, 43(1), 53–74.

Frankel, J., & Rose, A. (1998). The endogeneity of the optimum currency area criteria. The Economic Journal, 108, 1009–1025.

Garnier, J. (2003). Has the similarity of business cycles in Europe increased with the monetary integration process? A use of the classical business cycles. EUI Working Paper No. 2003/12.

Imbs, J. (2004). Trade, finance, specialization, and synchronization. The Review of Economics and Statistics, 86(3), 723–734.

Kose, M., Otrok, C., & Whiteman, C. (2003). International business cycles: world, region, and country-specific factors. American Economic Review, 93, 1216–1239.

Lumsdaine, R., & Prasad, E. (2003). Identifying the common component of international economic fluctuations: a new approach. The Economic Journal, 113, 101–127.

Mansour, J. (2003). Do national business cycles have an international origin? Empirical Economics, 28, 223–247.

Mink, M. J., Jan P. A. M., & de Haan, J. (2007). Measuring Synchronicity and Co-Movement of Business Cycles with an Application to the Euro Area. CESifo Working Paper Series No. 2112.

Mundell, R. (1961). The theory of optimal currency areas. American Economic Review, 51(4), 657–665.

Neri, S. & Nobili, A. (2006). The transmission of monetary policy shocks from the US to the euro area. Temi di discussion del Servizio Studi No. 606.

Savva, C., Neanidis, K., & Osborn, D. (2010). Business cycle synchronization of the euro area with the new and negotiating member countries. International Journal of Finance and Economics, 15, 288–306.

Schneider, M. & Fenz, G. (2008). Transmission of business cycle shocks between the US and the euro area. Oesterreichische National Bank Working Paper Series No. 145.

Taylor, J. (2008). The financial crisis and the policy responses: An empirical analysis of what went wrong. Keynote Address at Bank of Canada, November 2008.

Wynne, M., & Koo, J. (2000). Business cycles under monetary union: a comparison of the EU and US. Economica, 67, 347–374.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jones, J., Collins, N. & Sribnick, L. External Influences on Business Cycle Synchronization in the Euro Area. Int Adv Econ Res 18, 28–39 (2012). https://doi.org/10.1007/s11294-011-9339-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-011-9339-7