Abstract

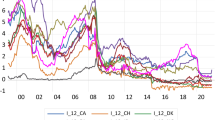

This paper provides a theory and evidence that the risk premium puzzle is viewed as a phenomenon pertaining to the unstable foreign exchange market. In an unstable market, revision error uncompensated by an initial risk premium accrues due to consumer expectation revision about the ex ante uncertainty of the exchange rate. The risk premium widely deviates from its initial level, depending on the frequency of the consumer expectation revision and the degree of risk aversion. Subsequent evidence shows the existence of the revision errors for the risk premium during the Asian currency crisis and the recent financial crisis periods.

Similar content being viewed by others

Notes

In matching sampling dates of the forward rate with those of the spot rate, lots of information on data may be lost. See Bekaert and Hodrick (1992).When data of forward rate were not available at the end of the month, this rate was sampled the day before the end of the month. Korean data were from the Korean Bank of Financial Settlement between January 1994 to August 1996, when there were no available market data.

The Phillips-Perron Zp-statistics for risk premium and the expected rate of appreciation were −4.80 and −12.83 for Japan, −4.97 and −8.98 for the U.K., −7.41 and −8.42 for Australia, −4.13 and −7.23 for Korea, −8.67 and −7.35 for Malaysia, −5.95 and −13.25 for Thailand. Its critical value is −2.86 at the 5% significance level.

References

Allayannis, G., & Ofek, E. (2001). Exchange rate exposure, hedging, and the use of foreign currency derivatives. Journal of International Money and Finance, 20(2), 273–296.

Baillie, R., & Bollerslev, T. (1990). A multivariate generalized ARCH approach to modeling risk premia in forward foreign exchange rate markets. Journal of International Money and Finance, 9(3), 309–324.

Bekaert, G., & Hodrick, R. (1992). Characterizing predictable components in excess returns on equity and foreign exchange market. Journal of Finance, 47(2), 467–509.

Bekaert, G. (1996). The time variation of risk and return in foreign exchange markets: a general equilibrium approach. Review of Financial Studies, 9(2), 427–470.

Bekaert, G., Hodrick, R., & Marshall, D. (1997). The implications of first-order risk aversion for asset market risk premiums. Journal of Monetary Economics, 40(1), 3–39.

Domowitz, I., & Hakkio, C. (1985). Conditional variance and the risk premium in the foreign exchange market. Journal of International Economics, 19(1), 47–66.

Dutton, J. (1993). Real and monetary shocks and risk premia in forward markets for foreign exchange. Journal of Money, Credit and Banking, 25(4), 731–754.

Easly, D., & O’Hara, M. (2004). Information and the costs of capital. Journal of Finance, 59(4), 1553–1583.

Engel, C. (1992). On the foreign exchange risk premium in a general equilibrium model. Journal of International Economics, 32(3), 305–319.

Engel, C. (1996). The forward discount anomaly and the risk premium: a survey of recent evidence. Journal of Empirical Finance, 3(2), 123–192.

Evans, M. D., & Lewis, K. (1995). Do long term swings in the dollar affect estimates of the risk premia? Review of Financial Studies, 8(3), 709–742.

Fama, E. F. (1984). Spot and forward exchange rates. Journal of Monetary Economics, 14(3), 319–338.

Frankel, J., & Froot, K. (1987). Using survey data to test standard propositions regarding exchange rate expectations. American Economic Review, 77(1), 133–153.

Gul, F. (1991). A theory of disappointment aversion. Econometrica, 59(3), 667–686.

Hodrick, R., & Srivastava, S. (1986). The covariance of risk premiums and expected future spot exchange rates. Journal of International Money and Finance, 5(1), 5–21.

Mehra, R., & Prescott, E. (1985). The equaity premium: a puzzle. Journal of Monetary Economics, 15(2), 145–161.

Muller, A. (2000). Hedging price risk when real wealth matters. Journal of International Money and Finance, 19(4), 549–560.

Segal, U., & Spivak, A. (1997). First order risk aversion and non-differentiability. Economic Theory, 9(1), 179–183.

Yee, K. (2006). Earnings quality and the equity risk premium: a benchmark model. Contemporary Accounting Research, 23(3), 833–877.

Acknowledgements

The author would like to thank the participants from the 69th International Atlantic Economic Society conference held on Prague, Czech March 26–29 2010. Many helpful and valuable comments were received from the editor and the anonymous referees in revising the paper. This research was supported from a Kyungpook national university research fund, 2009.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, H. Market Instability and Revision Error in Risk Premium. Int Adv Econ Res 17, 169–180 (2011). https://doi.org/10.1007/s11294-011-9299-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-011-9299-y