Summary

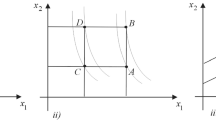

First-order risk aversion happens when the risk premiumπ a decision maker is willing to pay to avoid the lottery\(t \cdot \tilde \varepsilon , E[\tilde \varepsilon ] = 0\), is proportional, for smallt, tot. Equivalently,\(\partial \pi /\partial t|_{ t = 0^ + } > 0\). We show that first-order risk aversion is equivalent to a certain non-differentiability of some of the local utility functions (Machina [7]).

Similar content being viewed by others

References

Chew, S. H., Nishimura, N.: Differentiability, comparative statics, and non-expected utility preferences. Journal of Economic Theory56, 294–312 (1992)

Epstein, L. G.: Behavior under risk: Recent developments in theory and applications. In: Laffont, J. J. (ed.) Advances in Economic Theory. Cambridge: University Press 1993

Epstein, L. G., Zin, S. E.: ‘First-order’ risk aversion and the equity premium puzzle. Journal of Monetary Economy26, 387–407 (1990)

Epstein, L. G., Zin, S. E.: The independence axiom and asset returns. NBER Technical Working Paper No. 109, 1991

Gul, F.: A theory of disappointment aversion. Econometrica59, 667–686 (1991)

Loomes, G., Segal, U.: Observing orders of risk aversion. Journal of Risk and Uncertainty9, 239–256 (1994)

Machina, M. J.: Expected utility analysis without the independence axiom. Econometrica50, 277–323 (1982)

Machina, M. J.: Comparative statics and non-expected utility preferences. Journal of Economic Theory47, 393–405 (1989)

Montesano, A.: The risk aversion measure without the independence axiom. Theory and Decision24, 269–288 (1988)

Pratt, J.: Risk aversion in the small and in the large. Econometrica32, 122–136 (1964)

Segal, U., Spivak, A.: First-order versus second-order risk aversion. Journal of Economic Theory51, 111–125 (1990)

Author information

Authors and Affiliations

Additional information

We are grateful to the Social Sciences and Humanities Research Council of Canada for financial support and to Kim Border, Larry Epstein, Mark Machina and Joe Ostroy for helpful discussions and suggestions.

Rights and permissions

About this article

Cite this article

Segal, U., Spivak, A. First-order risk aversion and non-differentiability. Econ Theory 9, 179–183 (1997). https://doi.org/10.1007/BF01213452

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01213452