Abstract

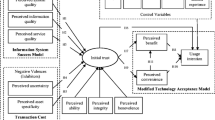

Due to the high uncertainty and perceived risk associated with using mobile payment, it is critical to building users’ initial trust in order to facilitate their adoption and usage. Drawing on both perspectives of self-perception-based and transference-based factors, this research examined initial trust in mobile payment. Self-perception-based factors include ubiquitous connection and effort expectancy, whereas transference-based factors include structural assurance and trust in online payment. The results indicated that both perspectives of factors affect initial trust, which further affects performance expectancy and usage intention. Thus, service providers need to build users’ initial trust in order to facilitate their usage of mobile payment.

Similar content being viewed by others

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411–423.

Beldad, A., de Jong, M., & Steehouder, M. (2010). How shall I trust the faceless and the intangible? A literature review on the antecedents of online trust. Computers in Human Behavior, 26(5), 857–869.

Benamati, J. S., Fuller, M. A., Serva, M. A., & Baroudi, J. A. (2010). Clarifying the integration of trust and TAM in e-commerce environments: Implications for systems design and management. IEEE Transactions on Engineering Management, 57(3), 380–393.

Chandra, S., Srivastava, S. C., & Theng, Y.-L. (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis. Communications of the Association for Information Systems, 27, 561–588.

Chen, Y.-H., & Barnes, S. (2007). Initial trust and online buyer behavior. Industrial Management & Data Systems, 107(1), 21–36.

CNNIC. (2013). 32nd Statistical survey report on the internet development in China, China Internet Network Information Center.

Delgado-Ballester, E., & Hernandez-Espallardo, M. (2008). Effect of brand associations on consumer reactions to unknown on-line brands. International Journal of Electronic Commerce, 12(3), 81–113.

Fuller, M. A., Serva, M. A., & Benamati, J. (2007). Seeing is believing: The transitory influence of reputation information on e-commerce trust and decision making. Decision Sciences, 38(4), 675–699.

Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in online shopping: An integrated model. MIS Quarterly, 27(1), 51–90.

Gefen, D., Straub, D. W., & Boudreau, M. C. (2000). Structural equation modeling and regression: Guidelines for research practice. Communications of the Association for Information Systems, 4(7), 1–70.

Hampton-Sosa, W., & Koufaris, M. (2005). The effect of Web site perceptions on initial trust in the owner company. International Journal of Electronic Commerce, 10(1), 55–81.

Hong, S.-J., Thong, J. Y. L., Moon, J.-Y., & Tam, K. Y. (2008). Understanding the behavior of mobile data services consumers. Information Systems Frontier, 10(4), 431–445.

Hu, X., Wu, G., Wu, Y., & Zhang, H. (2010). The effects of Web assurance seals on consumers’ initial trust in an online vendor: A functional perspective. Decision Support Systems, 48(2), 407–418.

Hwang, Y., & Lee, K. C. (2012). Investigating the moderating role of uncertainty avoidance cultural values on multidimensional online trust. Information & Management, 49(3–4), 171–176.

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310–322.

Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311.

Koufaris, M., & Hampton-Sosa, W. (2004). The development of initial trust in an online company by new customers. Information & Management, 41(3), 377–397.

Kuan, H.-H., & Bock, G.-W. (2007). Trust transference in brick and click retailers: An investigation of the before-online-visit phase. Information & Management, 44(2), 175–187.

Lee, K. C., Chung, N., & Lee, S. (2011). Exploring the influence of personal schema on trust transfer and switching costs in brick-and-click bookstores. Information & Management, 48(8), 364–370.

Lee, T. (2005). The impact of perceptions of interactivity on customer trust and transaction intentions in mobile commerce. Journal of Electronic Commerce Research, 6(3), 165–180.

Li, X., Hess, T. J., & Valacich, J. S. (2008). Why do we trust new technology? A study of initial trust formation with organizational information systems. The Journal of Strategic Information Systems, 17(1), 39–71.

Li, Y.-M., & Yeh, Y.-S. (2010). Increasing trust in mobile commerce through design aesthetics. Computers in Human Behavior, 26(4), 673–684.

Lin, H.-F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252–260.

Lowry, P. B., Vance, A., Moody, G., Beckman, B., & Read, A. (2008). Explaining and predicting the impact of branding alliances and web site quality on initial consumer trust of e-commerce web sites. Journal of Management Information Systems, 24(4), 199–224.

Luo, X., Li, H., Zhang, J., & Shim, J. P. (2010). Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision Support Systems, 49(2), 222–234.

Malhotra, N. K., Kim, S. S., & Patil, A. (2006). Common method variance in IS research: A comparison of alternative approaches and a reanalysis of past research. Management Science, 52(12), 1865–1883.

Mallat, N. (2007). Exploring consumer adoption of mobile payments—a qualitative study. The Journal of Strategic Information Systems, 16(4), 413–432.

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. The Academy of Management Review, 20(3), 709–734.

McKnight, D. H., Choudhury, V., & Kacmar, C. (2002). Developing and validating trust measures for e-commerce: An integrative typology. Information Systems Research, 13(3), 334–359.

Nicolaou, A. I., & McKnight, D. H. (2006). Perceived information quality in data exchanges: Effects on risk, trust, and intention to use. Information Systems Research, 17(4), 332–351.

Nunnally, J. C. (1978). Psychometric theory. New York: McGraw-Hill.

Pavlou, P. A., & Gefen, D. (2004). Building effective online marketplaces with institution-based trust. Information Systems Research, 15(1), 37–59.

PewInternet. (2012). The future of money: Smartphone swiping in the mobile age.

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: Problems and prospects. Journal of Management, 12(4), 531–544.

Schierz, P. G., Schilke, O., & Wirtz, B. W. (2010). Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic Commerce Research and Applications, 9(3), 209–216.

Shin, D. H. (2010). Modeling the interaction of users and mobile payment system: Conceptual framework. International Journal of Human-Computer Interaction, 26(10), 917–940.

Sia, C. L., Lim, K. H., Lee, M. K. O., Huang, W. W., & Benbasat, I. (2009). Web strategies to promote Internet shopping: Is cultural-customization needed? MIS Quarterly, 33(3), 491–512.

Song, J., & Zahedi, F. M. (2007). Trust in health infomediaries. Decision Support Systems, 43(2), 390–407.

Stewart, K. J. (2003). Trust transfer on the World Wide Web. Organization Science, 14(1), 5–17.

Straub, D., Boudreau, M.-C., & Gefen, D. (2004). Validation guidelines for IS positivist research. Communications of the Association for Information Systems, 13, 380–427.

Thatcher, J. B., McKnight, D. H., Baker, E. W., Arsal, R. E., & Roberts, N. H. (2011). The role of trust in post-adoption IT exploration: An empirical examination of knowledge management systems. IEEE Transactions on Engineering Management, 58(1), 56–70.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478.

Venkatesh, V., Thong, J. Y. L., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157–178.

Yoon, C. (2009). The effects of national culture values on consumer acceptance of e-commerce: Online shoppers in China. Information & Management, 46(5), 294–301.

Acknowledgments

This work was partially supported by grants from the National Natural Science Foundation of China (71371004, 71001030), and a grant from Zhejiang Provincial Key Research Base of Humanistic and Social Sciences in Hangzhou Dianzi University (ZD04-201301)

Author information

Authors and Affiliations

Corresponding author

Appendix: Measurement Scale and Items

Appendix: Measurement Scale and Items

Ubiquitous connection (UC) (adapted from Lee [21])

-

UC1:

I can conduct mobile payment from anywhere.

-

UC2:

I can conduct mobile payment at anytime.

-

UC3:

If needed, I can conduct mobile payment at anytime from anywhere.

Effort expectancy (EFE)(adapted from Venkatesh et al. [43])

-

EFE1:

Learning to use mobile payment is easy for me.

-

EFE2:

Skillfully using mobile payment is easy for me.

-

EFE3:

I find that mobile payment is easy to use.

Structural assurance (SA) (adapted from McKnight et al. [30])

-

SA1:

I feel confident that encryption and other technological advances on the mobile Internet make it safe for me to use mobile payment.

-

SA2:

I feel assured that legal and technological structures adequately protect me from payment problems on the mobile Internet.

-

SA3:

Mobile Internet is a robust and safe environment in which to use mobile payment.

Trust in online payment (TOP) (adapted from Kim et al. [17])

-

TOP1:

Online payment always provides accurate financial services.

-

TOP2:

Online payment always provides reliable financial services.

-

TOP3:

Online payment always provides safe financial services.

Initial trust in mobile payment (TMP) (adapted from Kim et al. [17])

-

TMP1:

Mobile payment always provides accurate financial services.

-

TMP2:

Mobile payment always provides reliable financial services.

-

TMP3:

Mobile payment always provides safe financial services.

Performance expectancy (PEE) (adapted from Venkatesh et al. [43])

-

PEE1:

Mobile payment improves my living and working efficiency.

-

PEE2:

Mobile payment increases my living and working productivity.

-

PEE3:

I find that mobile payment is useful.

Usage intention (USE) (adapted from Lee [21])

-

USE1:

Given the chance, I intend to use mobile payment.

-

USE2:

I expect my use of mobile payment to continue in the future.

-

USE3:

I have intention to use mobile payment.

Rights and permissions

About this article

Cite this article

Zhou, T. An Empirical Examination of Initial Trust in Mobile Payment. Wireless Pers Commun 77, 1519–1531 (2014). https://doi.org/10.1007/s11277-013-1596-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11277-013-1596-8