Abstract

Why do some nonprofits signal their respect for accountability via unilateral website disclosures? We develop an Accountability Index to examine the websites of 200 U.S. nonprofits ranked in the Chronicle of Philanthropy’s 2010 “Philanthropy 400.” Our intuition is that nonprofits recognize that the “nondistributional constraint” by itself may not generate sufficient trust. We expect nonprofits’ incentives for website disclosures will be shaped by their organizational and sectoral characteristics. Our analyses suggest that nonprofits appearing frequently in newspapers disclose more accountability information while nonprofits larger in size disclose less. Religion-related nonprofits tend to disclose less information, suggesting that religious bonding enhances trust and reduces incentives for self-disclosure. Nonprofits in the health sector disclose less information, arguably because governmental regulations in which they are embedded reduce marginal benefits from voluntary disclosures. Education nonprofits, on the other hand, tend to disclose more accountability information perhaps because they supply credence goods.

Résumé

Pourquoi certaines organisations sans but lucratif manifestent-elles leur respect de la responsabilité par le biais de communications unilatérales sur leur site Web ? Nous développons un indice de responsabilité afin de procéder à l’étude des sites de 200 organisations sans but lucratif américaines classifiées dans la Chronique de la philanthropie 2010, « Philanthropie 400 » . Notre intuition est que ces organisations ont conscience que « l’exclusion d’une distribution » n’est pas en elle-même susceptible de susciter une confiance suffisante. Nous estimons que les motivations des organisations sans but lucratif en faveur de communications via leur site Web seront élaborées en fonction de leurs caractéristiques organisationnelles et sectorielles. Nos analyses suggèrent que les organisations sans but lucratif qui sont fréquemment mentionnées dans la presse communiquent plus d’informations de responsabilité alors que certaines organisations de plus grande taille limitent ces divulgations. Les œuvres de bienfaisance de nature confessionnelle ont tendance à communiquer moins d’informations, ce qui semble indiquer que le lien religieux optimise la confiance et minimise les incitations en faveur d’une communication spontanée. Les organisations sans but lucratif dans le secteur de la santé divulguent moins d’informations, sans doute parce que les réglementations gouvernementales dont elles relèvent limitent les bénéfices marginaux des communications volontaires. Les organisations éducatives ont par contre tendance à divulguer plus d’informations de responsabilité, peut-être parce qu’elles assurent la fourniture de biens de confiance.

Zusammenfassung

Warum belegen einige Nonprofit-Organisationen ihre Anerkennung der Rechenschaftspflicht durch einseitige Bekanntgaben auf ihren Websites? Wir entwickeln einen Rechenschaftsindex, um die Websites von 200 Nonprofit-Organisationen in den USA zu untersuchen, die 2010 in der Rangliste „Philanthropy 400“des Chronicle of Philanthropy aufgeführt waren. Unsere unmittelbare Erkenntnis ist, dass sich Nonprofit-Organisationen darüber bewusst sind, dass das so genannte „Non-Distributional Constraint“- das Verbot der Gewinnausschüttung an Personen, die die Organisation kontrollieren - allein unter Umständen nicht ausreicht, um Vertrauen zu gewinnen. Wir gehen davon aus, dass die Anreize für Informationsoffenlegungen auf den Websites der Nonprofit-Organisationen von ihren Organisations- und Sektormerkmalen abhängig sind. Unsere Analysen deuten darauf hin, dass Nonprofit-Organisationen, die häufig in Zeitungen thematisiert werden, ausgiebigere Rechenschaftsberichte ablegen, während größere Nonprofit-Organisationen weniger Informationen preisgeben. Nonprofit-Organisationen im religiösen Bereich neigen dazu, weniger Informationen offenzulegen, was darauf schließen lässt, dass eine religiöse Bindung das Vertrauen fördert und die Anreize für eine Selbstauskunft mindert. Nonprofit-Organisationen im Gesundheitswesen geben weniger Informationen bekannt, wohl weil die für sie geltenden Regierungsvorschriften marginale Vorteile einer freiwilligen Offenlegung reduzieren. Nonprofit-Organisationen im Bildungsbereich hingegen neigen dazu, mehr Informationen offenzulegen, vielleicht weil sie Vertrauensgüter anbieten.

Resumen

¿Por qué algunas organizaciones sin ánimo de lucro señalan su respeto a la rendición de cuentas mediante divulgaciones unilaterales en páginas Web? Desarrollamos un Índice de Rendición de Cuentas para examinar las páginas Web de 200 organizaciones sin ánimo de lucro estadounidenses clasificadas en el “Philanthropy 400” de 2010 del Chronicle of Philanthropy. Intuimos que las organizaciones sin ánimo de lucro reconocen que la “restricción de no distribuir beneficios” por sí misma puede no generar suficiente confianza. Suponemos que los incentivos de las organizaciones sin ánimo de lucro para realizar divulgaciones en páginas Web se basarán en sus características organizativas y sectoriales. Nuestro análisis sugieren que las organizaciones sin ánimo de lucro que aparecen frecuentemente en periódicos divulgan más información sobre rendición de cuentas, aunque las organizaciones sin ánimo de lucro de tamaño más grande divulgan menos. Las organizaciones sin ánimo de lucro relacionadas con la religión divulgan menos información, lo que sugiere que la vinculación religiosa aumenta la confianza y reduce los incentivos de auto-divulgación. Las organizaciones sin ánimo de lucro en el sector sanitario divulgan menos información. Podría decirse que esto se debe a que las reglamentaciones gubernamentales en las que están integradas reducen los beneficios marginales de las divulgaciones voluntarias. Las organizaciones educativas sin ánimo de lucro, por otro lado, tienden a divulgar más información sobre rendición de cuentas quizás debido a que suministran bienes de confianza.

Chinese

为什么一些非营利组织要通过网页单方面披露的方式表示他们对责任的尊重?我们设计了“责任指数”,从2010年《慈善纪事》(Chronicle of Philanthropy)排名前400位的慈善组织中,选取200家美国非营利组织,对其网页进行检测。 凭直觉,我们认为,非营利组织认识到其自身的“禁止分配原则”(non-distributional constraint)并无法产生足够的信任。我们预测,网络披露的成因,将由非营利组织的组织与部门特性决定。通过分析,我们发现,经常出现在报纸上的非营利组织,披露更多责任信息,而规模较大的非营利组织则披露得较少。与宗教相关的非营利组织通常披露较少的信息,意味着宗教关系加强了信任,从而降低了自我披露的动力。医疗卫生领域的非营利组织也披露较少的信息,或许这是因为政府对其规管降低了其自愿披露的边际效益。相反,教育领域的非营利组织则通常披露更多责任信息,或许这是由于其提供的服务属于信任品(credence goods)。

Arabic

لماذا بعض المنظمات الغير ربحية تشير إلى إحترامها للمساءلة عن طريق الكشف عن الموقع من جانب واحد ؟ نحن نضع فهرس المساءلة لفحص مواقع 200من المنظمات الأمريكية غير الربحية تم تصنيفها في وقائع العمل الخيري عام 2010 “العمل الخيري 400”. توقعنا أن المنظمات الغير ربحية تدرك أن “ القيود الغير توزيعية “ في حد ذاتها قد لا تولد الثقة الكافية. نتوقع أن الحوافز الغير ربحية لإفصاحات الموقع سوف يتم تشكيلها من قبل الخصائص التنظيمية والقطاعية. تحليلاتنا تشير إلى أن المنظمات الغير ربحية التي تظهر بشكل متكرر في الصحف تكشف عن مزيد من معلومات المساءلة بينما المنظمات الغير ربحية التي في حجم أكبر تكشف عن أقل. المنظمات الغير ربحية ذات الصلة بالدين تميل إلى الكشف عن معلومات أقل ، مما يوحي بأن الترابط الديني يعزز الثقة و يقلل الحوافز للكشف عن الذات. المنظمات الغير ربحية في القطاع الصحي تكشف عن معلومات أقل ، يمكن القول بسبب اللوائح الحكومية التي هي جزء لا يتجزأ تقلل من الفوائد الهامشية من الإفصاحات التطوعية. منظمات التعليم الغير ربحية ، من ناحية أخرى ، تميل إلى الكشف عن مزيد من معلومات المساءلة ربما لأنها تقوم بتوريد سلع المصداقية .

Similar content being viewed by others

Notes

We would also like to point out that in addition to some differences in our statistical approaches, Gálvez Rodríguez et al. (2012) study a sample of 130 Spanish NGOs that have voluntarily subscribed to the Lealtad Foundation’s Standards of Transparency and Best Practices (http://www.fundacionlealtad.org/web/jsp/english/transparency.jsp). These NGOs voluntarily submit information to the foundation for assessment, thus “intentionally subject[ing] themselves to an accountability mechanism” (p. 69). In contrast, our nonprofit sample is taken from the Chronicle of Philanthropy’s list of largest nonprofits. These nonprofits may or may not have subscribed to a voluntary program on transparency which would shape their website disclosures. Hence, we believe we have a more representative sample and there is less chance of a selection bias in our approach. We believe our findings are generalizable across the sample of large nonprofits in the United States.

The IRS defines religious organizations not required to file Form 990 in the following way:

“1. A church, an interchurch organization of local units of a church, a convention or association of churches, or an integrated auxiliary of a church as described in Regulations section 1.6033-2(h) (such as a men’s or women’s organization, religious school, mission society, or youth group). 2. A church-affiliated organization that is exclusively engaged in managing funds or maintaining retirement programs and is described in Rev. Proc. 96-10, 1996-1 C.B. 577. 3. A school below college level affiliated with a church or operated by a religious order described in Regulations section 1.6033-2(g)(1)(vii). 4. A mission society sponsored by, or affiliated with, one or more churches or church denominations, if more than half of the society’s activities are conducted in, or directed at, persons in foreign countries. 5. An exclusively religious activity of any religious order described in Rev. Proc. 91-20, 1991-1 C.B. 524.”

From http://www.oneworldtrust.org/csoproject/cso/initiatives/352/gri_ngo_sector_supplement (Accessed 14 Feb 2013).

Each indicator does not by itself constitute an analytic dimension. Several indicators might reflect the same dimension. If we give the same weight to each indicator, then we may be overstating the importance of dimensions which are reflected in multiple indicators (see Appendix 1). Therefore, we re-estimated our models using a different Index score (out of 100), which weights each dimension equally regardless of the number of indicators it comprises. Results were similar to the original results (available from the authors).

Similar data had been collected from a smaller sample at the beginning of the project (summer 2010), and a great majority of nonprofits’ accountability disclosures did not change during the period.

LexisNexis Academic is a database available to students and faculty from subscribing colleges. It provides access to full-text articles from more than 2,500 local, national, and international newspapers and to wire services (as well as magazines and journals).

Since some cases do not appear in newspapers at all, we add a dummy variable which equals 1 when a logged value is available and 0 when it is not (see LogBound() in [R]).

We want to reiterate that nonprofits classified as “religion-related” by NTEE codes are not the same as the “religious organizations” which are not required to file Form 990 with the IRS. The nonprofits included here perform religious activities, but are not churches (or affiliated with churches), and thus have to file Form 990 each year.

We also estimated a simpler binomial model for comparison. The coefficients were extremely similar, but the standard errors were underestimated as expected (available from the authors).

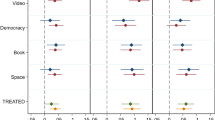

Traditional regression tables are available from the authors.

90 % confidence interval between 0.59 and 1.40.

90 % confidence interval between 0.04 and 0.09.

90 % confidence interval between −0.72 and −0.09.

90 % confidence interval between −0.16 and −0.02.

Results are available from the authors. We conducted a variety of robustness checks to determine if the results we presented above are robust to alternative specifications of our key variables. We replaced logged total revenue with two alternative measures for nonprofit size: average number of employees (2007–2009) and number of volunteers (2009). We also re-estimated all of our models using the median of our independent and control variables rather than their mean for 2007–2009. Finally, we estimated the models for each year separately. None of these alternative specifications of the models produced meaningful changes in the results.

References

Adams, C. A., Hill, W., & Roberts, C. B. (1998). Corporate social reporting practices in Western Europe: Legitimating corporate behaviour? British Accounting Review, 30, 1–21.

Amirkhanyan, A. A., Kim, H. J., & Lambright, K. T. (2009). Faith-based assumptions about performance: Does church affiliation matter for service quality and access? Nonprofit and Voluntary Sector Quarterly, 38, 490–521.

Barrett, M. (2001). A stakeholder approach to responsiveness and accountability in non-profit organisations. Social Policy Journal of New Zealand, 1(17), 36–51.

Bloodgood, E. A., Tremblay-Boire, J., & Prakash, A. (2013). National styles of NGO regulation. Nonprofit and Voluntary Sector Quarterly. doi:10.1177/0899764013481111.

Boris, E. T., & Steuerle, C. E. (2006). Scope and dimensions of the nonprofit sector. In W. W. Powell & R. Steinberg (Eds.), The nonprofit sector: A research handbook (2nd ed.). New Haven: Yale University Press.

Brown, N., & Deegan, C. (1998). The public disclosure of environmental performance information—A dual test of media agenda setting theory and legitimacy theory. Accounting and Business Research, 29, 21–41.

Brown, L. D., & Moore, M. H. (2001). Accountability, strategy, and international nongovernmental organizations. Nonprofit and Voluntary Sector Quarterly, 30, 569–587.

Burger, R., & Owens, T. (2010). Promoting transparency in the NGO sector. World Development, 38, 1263–1277.

Chaudhri, V., & Wang, J. (2007). Communicating corporate social responsibility on the Internet: A case study of the top 100 information technology companies in India. Management Communication Quarterly, 21, 232–247.

Cho, C. H., & Roberts, R. W. (2010). Environmental reporting on the internet by America’s Toxic 100: Legitimacy and self-presentation. International Journal of Accounting Information Systems, 11, 1–16.

Christensen, R. A., & Ebrahim, A. (2006). How does accountability affect mission? The case of a nonprofit serving immigrants and refugees. Nonprofit Management and Leadership, 17, 195–209.

Cooley, A., & Ron, J. (2002). The NGO scramble: Organizational insecurity and the political economy of transnational action. International Security, 27, 5–39.

Cormier, D., & Magnan, M. (1999). Corporate environmental disclosure strategies: Determinants, costs and benefits. Journal of Accounting, Auditing and Finance, 14, 429–451.

Dainelli, F., Manetti, G., & Sibilio, B. (2012). Web-based accountability practices in non-profit organizations: The case of national museums. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations. doi:10.1007/s11266-012-9278-9.

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48, 147–160.

Dolšak, N., & Houston, K. (2013). Newspaper coverage and climate change legislative activity across US states. Global Policy. doi:10.1111/1758-5899.12097.

Dubnick, M., & Frederickson, H. G. (Eds.). (2011). Accountable governance. Armonk: M. E. Sharpe.

Dumont, G. (2013). Nonprofit virtual accountability: An index and its application. Nonprofit and Voluntary Sector Quarterly, 42, 1049–1067.

Ebrahim, A. (2003). Accountability in practice: Mechanisms for NGOs. World Development, 31, 813–829.

Ebrahim, A. (2005). Accountability myopia: Losing sight of organizational learning. Nonprofit and Voluntary Sector Quarterly, 34, 56–87.

Ebrahim, A., & Weisband, E. (Eds.). (2007). Global accountabilities: Participation, pluralism, and public ethics. Cambridge: Cambridge University Press.

Esrock, S. L., & Leichty, G. B. (1998). Social responsibility and corporate web pages: Self-presentation or agenda-setting? Public Relations Review, 24, 305–319.

Flack, T., & Ryan, C. M. (2003). Accountability of Australian nonprofit organisations: Reporting dilemmas. Journal of Contemporary Issues in Business and Government, 9, 75–88.

Froelich, K. A. (1999). Diversification of revenue strategies: Evolving resource dependence in nonprofit organizations. Nonprofit and Voluntary Sector Quarterly, 28, 246–268.

Frumkin, P., & Kim, M. T. (2001). Strategic positioning and the financing of nonprofit organizations: Is efficiency rewarded in the contributions marketplace? Public Administration Review, 61, 266–275.

Gálvez-Rodríguez, M. M., Caba-Pérez, M. C., & López-Godoy, M. (2012). Determining factors in online transparency of NGOs: A Spanish case study. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 23(6), 661–683.

Gandía, J. L. (2009). Internet disclosure by nonprofit organizations: Empirical evidence of nongovernmental organizations for development in Spain. Nonprofit and Voluntary Sector Quarterly. doi:10.1177/0899764009343782.

Gibelman, M., & Gelman, S. R. (2004). A loss of credibility: Patterns of wrongdoing among nongovernmental organizations. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 15, 355–381.

Global Reporting Initiative. (2006). G3 sustainable reporting guidelines. Retrieved November 14, 2010, from http://www.globalreporting.org/ReportingFramework/G3Guidelines/.

Gordon, T., Knock, C., & Neelv, D. (2009). The role of rating agencies in the market for charitable contributions: An empirical test. Journal of Accounting and Public Policy, 28, 469–484.

Grant, R., & Keohane, G. (2005). Accountability and abuses of power in world politics. American Political Science Review, 99, 29–43.

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8, 47–77.

Gray, R., Javad, M., Power, D. M., & Sinclair, C. D. (2001). Social and environmental disclosure and corporate characteristics: A research note and extension. Journal of Business Finance & Accounting, 28, 327–356.

Greenlee, J., Fischer, M., Gordon, T., & Keating, E. (2007). An investigation of fraud in nonprofit organizations: Occurrences and deterrents. Nonprofit and Voluntary Sector Quarterly, 36, 676–694.

Grønbjerg, K. A. (1993). Understanding nonprofit funding. San Francisco: Jossey-Bass.

Gunningham, N., Kagan, R., & Thornton, D. (2003). Shades of green. Stanford: Stanford University Press.

Hansmann, H. B. (1980). The role of nonprofit enterprise. Yale Law Journal, 89, 835–901.

Healy, P. M., & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1), 405–440.

Hooghiemstra, R. (2000). Corporate communication and impression management—New perspectives why companies engage in corporate social reporting. Journal of Business Ethics, 27, 55–68.

Kang, S., & Norton, H. E. (2004). Nonprofit organizations’ use of the World Wide Web: Are they sufficiently fulfilling organizational goals? Public Relations Review, 30, 279–284.

Kearns, K. (1996). Managing for accountability. San Francisco: Jossey-Bass Publishers.

Kearns, K., Park, C., & Yankoski, L. (2005). Comparing faith-based and secular community service corporations in Pittsburgh and Allegheny County, Pennsylvania. Nonprofit and Voluntary Sector Quarterly, 34, 206–231.

Keating, E. K., & Frumkin, P. (2003). Reengineering nonprofit financial accountability: Toward a more reliable foundation for regulation. Public Administration Review, 63, 3–15.

Kilby, P. (2006). Accountability for empowerment: Dilemmas facing non-governmental organizations. World Development, 34, 951–963.

King, G. (1989). Unifying political methodology. Ann Arbor: University of Michigan Press.

King, G., Tomz, M., & Wittenberg, J. (2000). Making the most of statistical analyses: Improving interpretation and presentation. American Journal of Political Science, 44, 341–355.

Knutsen, W. L., & Brower, R. S. (2010). Managing expressive and instrumental accountabilities in nonprofit and voluntary organizations: A qualitative investigation. Nonprofit and Voluntary Sector Quarterly, 39, 588–610.

LeRoux, K. (2009). Managing stakeholder demands balancing responsiveness to clients and funding agents in nonprofit social service organizations. Administration & Society, 41, 158–184.

Maignan, I., & Ralston, D. A. (2002). Corporate social responsibility in Europe and the U.S.: Insights from businesses’ self-presentations. Journal of International Business Studies, 33, 497–514.

McCubbins, M., & Schwartz, T. (1984). Congressional oversight overlooked: Police patrols versus fire alarms. American Journal of Political Science, 28, 16–79.

Meyer, J., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83, 340–363.

Mitchell, G. E., & Schmitz, H. P. (2013). Principled instrumentalism: A theory of transnational NGO behavior. Review of International Studies. doi:10.1017/S0260210513000387.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Towards a theory of stakeholder salience. Academy of Management Review, 22, 853–886.

Murtaza, N. (2011). Putting the lasts first: The case for community-focused and peer-managed NGO accountability mechanisms. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 22, 1–17.

Nah, S., & Saxton, G. D. (2013). Modeling the adoption and use of social media by nonprofit organizations. New Media & Society, 15, 294–313.

Neu, D., Warsame, H., & Pedwell, K. (1998). Managing public impressions: Environmental disclosures in annual reports. Accounting, Organizations and Society, 23, 265–282.

O’Connor, M. K., & Netting, F. E. (2008). Faith-based evaluation: Accountable to whom, for what? Evaluation and Program Planning, 31, 347–355.

O’Donovan, G. (1999). Managing legitimacy through increased corporate reporting: An exploratory study. Interdisciplinary Environmental Review, 1, 63–99.

O’Dwyer, B., & Unerman, J. (2007). From functional to social accountability: Transforming the accountability relationship between funders and non-governmental development organisations. Accounting, Auditing & Accountability Journal, 20, 446–471.

O’Dwyer, B., & Unerman, J. (2008). The paradox of greater NGO accountability: A case study of Amnesty Ireland. Accounting, Organizations and Society, 33, 801–824.

Ortmann, A., & Schlesinger, M. (1997). Trust, repute and the role of non‐profit enterprise. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 8, 97–119.

Patten, D. M. (1991). Exposure, legitimacy, and social disclosure. Journal of Accounting and Public Policy, 10, 297–308.

Patten, D. M. (1992). Intra-industry environmental disclosures in response to the Alaskan oil spill: A note on legitimacy theory. Accounting, Organizations and Society, 17, 471–475.

Patten, D. M. (2002). Give or take on the Internet: An examination of the disclosure practices of insurance firm Web innovators. Journal of Business Ethics, 36, 247–259.

Pfeffer, J., & Salancik, G. (1978). The external control of organizations. New York: Harper & Row.

Pollach, I. (2003). Communicating corporate ethics on the World Wide Web: A discourse analysis of selected company web sites. Business and Society, 42, 277–287.

Prakash, A., & Gugerty, M. (2010). Trust but verify? Voluntary regulation programs in the nonprofit sector. Regulation & Governance, 4, 22–47.

Raggo, P. (2011). Accountability beyond accounting. Paper presented at the 11th biennial Public Management Research Association conference. Maxwell School of Citizenship and Public Affairs, Syracuse University, Syracuse.

Roberts, R. W. (1992). Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Accounting, Organizations and Society, 17, 595–612.

Saxton, G. D., & Guo, C. (2011). Accountability online: Understanding the web-based accountability practices of nonprofit organizations. Nonprofit and Voluntary Sector Quarterly, 40, 270–295.

Sell, S. K., & Prakash, A. (2004). Using ideas strategically. International Studies Quarterly, 48, 143–175.

Spar, D., & Dail, J. (2002). Of measurement and mission: Accounting for performance in non-governmental organizations. Chicago Journal of International Law, 3, 171–182.

Townsend, J. G., Porter, R., & Mawdsley, E. E. (2002). The role of the transnational community of non-governmental organisations: Governance or poverty reduction? Journal of International Development, 14, 829–839.

Ullmann, A. A. (1985). Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms. Academy of Management Review, 10, 540–557.

Wapner, P. (2002). Defending accountability mechanisms in NGOs. Chicago Journal of International Law, 3, 191–205.

Waters, R. D. (2007). Nonprofit organizations’ use of the internet: A content analysis of communication trends on the internet sites of the philanthropy 400. Nonprofit Management and Leadership, 18, 59–76.

Acknowledgments

Financial support for this research was provided by the Social Sciences and Humanities Research Council of Canada (SSHRC). We would like to thank Chris Adolph for his helpful comments. We also want to thank Emily Fondaw and Phi Cong Hoang for their excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tremblay-Boire, J., Prakash, A. Accountability.org: Online Disclosures by U.S. Nonprofits. Voluntas 26, 693–719 (2015). https://doi.org/10.1007/s11266-014-9452-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11266-014-9452-3