Abstract

In a Cournot duopoly with indirect tax evasion, this paper counter-intuitively shows that, in the presence of positive competitive wages, a higher indirect taxation may increase expected profits. This result is likely to occur if the market size (or alternatively, if the cost pressure exerted by wages) is adequately large and the detection probability is not too high, and it is equivalent irrespective of firms optimally choosing either the tax base to disclose to the tax authority or the amount of evasion tout-court.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Within public economics, the issue of tax evasion has never been more prominent than it currently is. In the last decades, at least since the pioneering work of Allingham and Sandmo (1972), the economic literature on tax evasion has developed as a branch of the public finance. However, scholars have mainly focused on individuals’ direct taxes, while the research on indirect taxes lags behindFootnote 1 despite their increasing relevance in the public tax revenue as well as in tax evasion. Merely limiting to the sales tax examined in this paper, data reveal that the revenues raised from general consumption taxes are about 30% of total tax revenues (with the VAT representing 20.2% of them) in the OECD countries (OECD, 2022) and 26.8% for European Union member countries in 2020 (European Commission, 2022a).

VAT evasion has impressive dimensions; therefore, it represents a huge public finance worry (Keen & Smith, 2006). The European Commission (2022b) has pointed out that—mostly because of tax evasion—the VAT gap of the EU27 in 2019 and 2020 is, as a percentage of the VAT total tax liability, on average 9.1% and 6.9% for the median country; however, those figures range from 35.7% for Romania to 1.3% of Finland.

Moreover, the literature investigating the incentives for tax-evading firms under different market structures has been prevalently concentrated on perfect competition (Cremer & Gahvari, 1992, 1993, 1999; Hashimzade et al., 2010; Panteghini, 2000; Virmani, 1989), and on monopoly (Kreutzer & Lee, 1986, 1988; Lee, 1998; Marrelli, 1984; Wang, 1990; Wang & Conant, 1988; Yaniv, 1996). Oligopolistic markets, like those considered in this work, have been investigated by Marrelli and Martina (1988), Goerke and Runkel (2006, 2011), Bayer and Cowell (2009), Besfamille et al., (2009a, 2009b) and Fanti and Buccella (2021, 2022).

In particular, Marrelli and Martina (1988) build a model in which firms choose tax evasion in terms of taxes not paid. In case of detection, firms incur a fine that includes the tax plus the tax evaded which is multiplied for a penalty rate larger than one. The main result is that the more markets are competitive, the lower is the amount of the tax evaded, both in symmetric and asymmetric duopolies with non-excessive differences in production costs.

Instead, Goerke and Runkel (2011) assume that firms evade in terms of undeclared sales; the fine that tax authorities impose is an increasing, convex function of revenues evaded. The authors conclude that no clear-cut relation exists between market competition and evasion activities: positive if demand is inelastic, negative if elastic.

In line with the methodology of Goerke and Runkel (2011), Fanti and Buccella (2021, 2022) further investigate the nexus between market competition and the tax evasion of firms in a duopoly with differentiated goods under both Cournot and Bertrand competition. Their key result is to show that a negative or a positive relation between competition and tax activities depends on the source of the competitive pressure (that is, a marginal cost increase, higher product substitutability or a change in the competition mode) and the pre-existing level of competition.Footnote 2

This paper focuses on the interaction between the labour market (labour as input), in our context assumed to be perfectly competitive (wages as given), and product market with quantity competition. Previous contributions have also analyzed the interaction between the inputs markets and the Cournot equilibrium, see inter alias Szidarovszky and Yakowitz (1977), Chang and Tremblay (1991), Okuguchi (1998), Chen and Zhao (2014), among others.

Because the link between tax evasion—particularly as regards the indirect taxation—and labour markets has not been so far explored in depth in oligopolistic contexts, the aim of this paper is to contribute to this discussion in this precise field of the public finance literature. We present a stylized model in which firms compete in output under the burden of a sales tax, taking as given labour wages, extending the economic analysis of tax compliance in a simple one-stage game. The main findings are as follows.

First, provided that certain conditions are satisfied, in the presence of strictly positive competitive wage rates, high indirect tax rates may, rather counter-intuitively, increase profits. Second, the interesting finding of the relation “more taxation-higher profits” is more likely obtained if the market size is sufficiently large and the likelihood of the detection probability is not too high. The driving force of this results is that, when the cost pressure exerted by wages is adequately high, higher tax rates intuitively reduce the firms’ sales declaration.

The remainder of the paper is organized as follows. Section 2 presents the model and characterizes the market equilibrium and the tax effects in the case of competitive labour market. Section 3 shows an equivalence result as a robustness check. Section 4 closes the paper summarizing the findings and outlining future research.

2 The model

A standard Cournot duopoly with homogeneous goods is considered in which firms must pay an ad valorem sales tax that, however, firms may partially evade. The (inverse) demand function is assumed linear:

where \(p\) is the price of goods and \(Q = q_{i} + q_{j}\) denotes the industry output. The parameter \(t \in (0,1)\) defines the sales tax rate. Firm i’s authentic tax base is \(pq_{i}\). To evade indirect taxes, firms undervalue their sales volume: firm i discloses as tax base to the tax authority \(a_{i} \in [0,p\,q_{i} ]\). Therefore, the amount \(pq_{i} - a_{i}\) is firm i’s unreported revenues, and its tax bill equals \(t\,a_{i}\). The tax authority detects evasion with a probability \(y \in (0,1)\). If evasion is detected, in addition to taxes on the entire sales revenues, \(pq_{i}\), firm i must pay a penalty function \(P(pq_{i}-a_{i})\) which depends on evaded revenues,Footnote 3 and whose analytical expression is

The expected penalty,\(yP(pq_{i} - a_{i} )\), is a measure of the expected cost of tax avoidance. In this model, the detection probability, \(y\), is assumed constant; on the other hand, the penalty function, P, is quadratic, therefore strictly increasing and convex in evaded revenues. Consequently, given the convexity of P and the constant value of \(y\), the expected penalty, \(yP\), is increasing and convex in evaded sales as well.

In general, tax authorities design four forms of penalty: automatic financial, automatic nonfinancial, criminal financial, and criminal nonfinancial (Tait, 1988). The form of the penalty function P can be justified as follows (Goerke & Runkel, 2011, p. 716, F in their terminology): “The penalties generally increase with the severity and extent of insufficient tax payments, supporting our assumption that F is increasing in evaded revenues. Moreover, many penalty schemes involve prison sentences for severe tax evasion activities. If F reflects not only monetary but also non-monetary penalties, such prison sentences suggest that F will be convex.”

Numerous countries, in fact, contemplate in their legislations the presence of penalties whose properties are in line with the penalty function the model proposes. Furthermore, countries such as Denmark and Spain (and Ireland as regards interests to be paid for late tax payments) have financial penalties increasing in the amount of evaded taxes (see OECD, 2009, 2011, 2013).Footnote 4

Let us assume that firms use only labour as input for production, and workers are hired in a competitive labour market, in which the exogenous, uniform wage is given by \(w > 0\), the per-worker wage paid by firm i. Firms exhibit a constant returns technology,

which represents the number of workers employed by the firm i to produce qi output units. Firm i’s cost function is \(wq_{i}\). Given the constant returns technology, marginal costs are constant. Firm i’s expected net profits are given by.

The first term in brackets in Eq. (4) is firm i’s profits if tax evasion is detected, while the second term represents profits if such an evasion remains undetected. Firm i maximizes \(\pi_{i}\), simultaneouslyFootnote 5 choosing output \(q_{i}\) and declared revenues \(a_{i}\), taking as given the rival firm’s output. The first-order conditions for an interior solution are, as regards declared revenues

and, exploiting (5), as regards output

From (6), by substituting its counterpart for firm j, we get the equilibrium output and declared sales revenue, respectively, by firm i,

From (8), it is easy to see that, with a linear demand, the possibility and the degree of tax-shifting would depend on the level of costs.Footnote 6 Then, making use of (7), (8) and (9), profits are:

The condition ensuring that an interior solution for a does exist, i.e., \(a \in (0,pq)\), which guarantees positive declared revenue, is

This means that a market size (i.e., a value of z) sufficiently large, as generally assumed in Cournot duopoly models, always ensures an economically meaningful value of the declared tax base. The next proposition shows the effect of the taxation on profits and evasion with competitive labour markets.

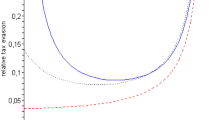

Proposition 1.

(a) Expected net profits can be increasing with an increasing tax rate; (b) the declared tax base decreases with an increasing tax rate if and only if the competitive wage is adequately high.

Proof:

See the Appendix.

The rationale for the profit increasing effect of higher taxes occurring only when y is sufficiently low is as follows. First, notice that, when the cost pressure exerted by wages is adequately high, higher tax rates intuitively reduce the firms’ sales declaration (see the Appendix), while they do not affect price and output (see Eqs. (7) and (8)). Second, it is easy to observe from that the tax induced reduction of the declared sales has a twofold effect on profits. On the one hand, it reduces profits through the penalty effect, and this reductive effect is higher the higher is the probability (y) of being detected. On the other hand, it increases the profit through the reduction of the tax burden in the case in which tax evasion is undetected, whose probability is inversely related to y.

3 An equivalence result

In the previous section, it has been assumed that duopolistic firms’ decision variable is the declared revenue, \(a\). Let us now consider instead that the firms’ decision variable is unreported sales, defined as \(e\). In the present framework, the firms’ quantity and evasion decisions are taken on their own. To see this fact clearly, Eq. (4) can be re-arranged as follows to expresses the objective of firm i in terms of unreported sales and quantity

where \(\pi_{i}^{f} = [(1 - t)p - w_{i} ]q_{i}\) are the profits when the firm behaves fairly term, and \(\pi_{i}^{c} = (1 - y)te_{i} - y\frac{{e_{i}^{2} }}{2}\) are the extra profits (or loss) due to the cheating activity, with \(e_{i}\) representing the unreported sales. This denotes that the choices relative to \(\pi_{i}^{f}\) and \(\pi_{i}^{c}\) are independent: the latter term indicates that the deliberate evasion actions mean audit activities by tax administration should be directed to put in place strategies and structures to ensure that non-compliance with tax law is kept to a minimum (OECD, 2004). Moreover, the two firms’ evasion decisions are independent of each other. Irrespective of the strategic quantity/price choices, the optimal unreported sales of firm i leads to \(e_{i} = e^{*} = \frac{(1 - y)t}{y} \ge 0\), which implies \(\pi_{i}^{c} = \frac{{t_{{}}^{2} }}{2}(1 - y)^{2}\), with \(\frac{{\partial \pi_{i}^{c} }}{\partial t} = \frac{t}{y}(1 - y)^{2} \ge 0\), i.e., an increase in the tax rate increases cheating profits. Provided that the condition \(pq_{i} \ge e^{*}\) is satisfied (to guarantee that the declared revenue is positive), the price and quantities prevailing are identical to those when firms do not misreport their revenues. Firms independently set their unreported sales to maximize the extra profit. As a consequence, maximization of the fair profits lead to the equilibrium quantity and price as in (7) and (8), profits \(\pi_{i}^{f} = \frac{(1 - t)}{9}\left( {z - \frac{w}{1 - t}} \right)^{2}\), and \(\frac{{\partial \pi_{i}^{f} }}{\partial t} = \frac{{w^{2} - z^{2} (1 - t)^{2} }}{{9(1 - t)^{2} }} \le 0\) since \(t \le 1 - \frac{w}{z}\). The key point is to know how and when an increase of the tax rate can increase the overall profit of the firms. One can easily check that differentiation of the overall profits with respect to tax rate exactly replicate the result in Proposition 1.

Because \(\frac{{\partial \pi_{i}^{f} }}{\partial w} \le 0\) and \(\frac{{\partial^{2} \pi_{i}^{f} }}{\partial t\partial w} > 0\), the higher is the average wage, the lower is the fair profit, and the less it decreases with respect to the tax rate; while the extra profit is unaffected by wage rates. More generally, if the input is provided by an upstream supplier (firm, or union in the case of labour) which exerts market power, this may lead to tax evasion based on cheating profit maximization, looking like an aboveground activity of the firms which tends to dominate the output fixing for high values of the wages.Footnote 7

4 Conclusions

This paper investigates a unionized Cournot duopoly model with evasion of indirect taxes. The main finding is that, rather counter-intuitively, a higher indirect taxation may increase profits in the presence of competitive labour markets. In particular, the result of “more taxation and higher profits” can be obtained if the cost pressure of wages (alternatively, if the market size) is adequately large and the likelihood of the detection probability is not too high. Moreover, we have shown that our findings are equivalent irrespective of firms optimally choosing either the tax base to disclose to the tax authority or the amount of evasion tout-court.

One must be aware of the extremely simplified nature of the model employed, based on a set of specific assumptions such as a convex penalty rate function, and linear demand schedule. In future research, those caveats need to be relaxed. For instance, different penalty functions, the presence of differentiated goods, and a general demand function call for additional robustness check of our results.

Data availability

Data sharing is not applicable to this article as no new data were created or analyzed in this study.

Notes

As Bayer and Cowell (2009, p. 1131) suggest “The behaviour of firms is sometimes glossed over in the economic analysis of tax policy. In the analysis of tax compliance, it is often omitted altogether.”.

It may be assumed, alternatively, that the penalty is a function of taxes evaded rather than undeclared revenues. However, the equilibrium results are qualitatively the same because the tax rate is assumed constant.

From a theoretical point of view, in a similar context, Hashimzade et al. (2010) conceive a penalty function \(\Phi = \phi E^{\gamma }\) in which \(\phi > 0\) is a constant scale parameter, and \(\gamma > 0\) a government’s choice parameter. When \(\gamma \ge 1\), the punishment is convex. The authors obtain that “If the objective of the government is to control fraud it therefore has to choose a convex penalty with \(\gamma > 1\)”.

Note that the findings of the paper remains unaltered if choices are sequential (i.e., first the declared revenue, and then output).

With a non-linear demand, the results concerning tax-shifting in non-competitive markets are less general (see Hindriks and Myles, 2006).

We are extremely grateful to an anonymous referee for having suggested the discussion in this Section.

References

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1, 323–338.

Bayer, R., & Cowell, F. A. (2009). Tax compliance and firms’ strategic interdependence. Journal of Public Economics, 93, 1131–1143.

Besfamille, M., De Donder, P. and Lozachmeur, J.-M. (2009a). The political economy of the (weak) enforcement of sales tax. CEPR Discussion Paper 7108

Besfamille, M., De Donder, P., & Lozachmeur, J.-M. (2009b). Tax enforcement may decrease government revenue. Economics Bulletin, 29, 2665–2672.

Chang, Y. M., & Tremblay, V. J. (1991). Oligopsony/oligopoly power and factor market performance. Managerial and Decision Economics, 12(5), 405–409.

Chen, Z., & Zhao, B. (2014). Unemployment and product market competition in a Cournot model with efficiency wages. Canadian Journal of Economics/revue Canadienne D’économique, 47(2), 555–579.

Cowell, F. A. (2004). Carrots and sticks in enforcement. In H. Aaron & J. Slemrod (Eds.), the crisis in tax administration (pp. 230–275). Brookings Institution Press.

Cremer, H., & Gahvari, F. (1992). Tax evasion and the structure of indirect taxes and audit probabilities. Public Finance/finance Publiques, 47, 351–365.

Cremer, H., & Gahvari, F. (1993). Tax evasion and optimal commodity taxation. Journal of Public Economics, 50, 261–275.

Cremer, H., & Gahvari, F. (1999). Excise tax evasion, tax revenue, and welfare. Public Finance Review, 27, 77–95.

European Commission. (2022a). Taxation Trends in the European Union (2022 ed.). Publications Office of the European Union.

European Commission. (2022b). VAT Gap in the EU-28, Report 2022. Publications Office of the European Union.

Fanti, L., & Buccella, D. (2021). Tax evasion and competition in a differentiated duopoly. Journal of Industrial and Business Economics, 48, 385–411.

Fanti, L., & Buccella, D. (2022). Indirect Taxation, Tax Evasion and Profits. Hacienda Pública Española/review of Public Economics, 242(3), 91–109.

Franzoni, L. A. (2008). Tax compliance (available at SSRN: http://ssrn.com/abstract=1271168)

Goerke, L., & Runkel, M. (2006). Profit tax evasion under oligopoly with endogenous market structure. National Tax Journal, 59, 851–857.

Goerke, L., & Runkel, M. (2011). Tax evasion and competition. Scottish Journal of Political Economy, 58, 711–736.

Hashimzade, N., Huang, Z., & Myles, G. D. (2010). Tax fraud by firms and optimal auditing. International Review of Law and Economics, 30, 10–17.

Hindriks, J., & Myles, G. D. (2006). Intermediate public economics. The MIT Press.

Keen, M., & Smith, S. (2006). VAT fraud and evasion: What do we know and what can be done? National Tax Journal, 59, 861–887.

Kreutzer, D., & Lee, D. R. (1986). On taxation and understated monopoly profits. National Tax Journal, 39, 241–243.

Kreutzer, D., & Lee, D. R. (1988). Tax evasion and monopoly output decisions: A reply. National Tax Journal, 41, 583–584.

Lee, K. (1998). Tax evasion, monopoly, and nonneutral profit taxes. National Tax Journal, 51, 333–338.

Marrelli, M. (1984). On indirect tax evasion. Journal of Public Economics, 25, 181–196.

Marrelli, M., & Martina, R. (1988). Tax evasion and strategic behaviour of the firms. Journal of Public Economics, 37, 55–69.

OECD. (2004). Compliance risk management: managing and improving tax compliance. https://www.oecd.org/tax/administration/33818656.pdf

OECD. (2009). Tax Administration in OECD and Selected Non-OECD Countries: Comparative Information Series (2008). OECD.

OECD. (2011). Tax Administration in OECD and Selected Non-OECD Countries: Comparative Information Series (2010). OECD.

OECD. (2013). Tax Administration 2013. Comparative Information on OECD and Other Advanced and Emerging Economies. Paris: OECD.

OECD. (2022). Consumption tax trends: VAT/GST and excise, core design features and trends. OECD.

Okuguchi, K. (1998). Existence of equilibrium for Cournot oligopoly-oligopsony. Keio Economic Studies, 35(2), 45–53.

Panteghini, P. M. (2000). Tax evasion and entrepreneurial flexibility. Public Finance Review, 28, 199–209.

Sandmo, A. (2005). The theory of tax evasion: A retrospective view. National Tax Journal, 58, 643–663.

Slemrod, J. (2007). Cheating ourselves: The economics of tax evasion. Journal of Economic Perspectives, 21, 25–48.

Szidarovszky, F., & Yakowitz, S. (1977). A new proof of the existence and uniqueness of the Cournot equilibrium. International Economic Review, 18(3), 787–789.

Tait, M. A. A. (1988). Value added tax: International practice and problems. International Monetary Fund.

Virmani, A. (1989). Indirect tax evasion and production efficiency. Journal of Public Economics, 39, 223–237.

Wang, L. F. S. (1990). Tax evasion and monopoly output decisions with endogenous probability of detection. Public Finance Quarterly, 18, 480–487.

Wang, L. F. S., & Conant, J. L. (1988). Corporate tax evasion and output decisions of the uncertain monopolist. National Tax Journal, 41, 579–581.

Yaniv, G. (1996). Tax evasion and monopoly output decisions: Note. Public Finance Quarterly, 24, 501–505.

Acknowledgements

The authors gratefully acknowledge an anonymous referee for valuable and constructive comments and suggestions on an earlier draft of the manuscript, which facilitated a considerable improvement in the quality of the article.

Funding

The authors declare that this study was not funded by any institution.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Proof of Proposition 1

Part (a)

(i) \(\frac{{\partial \pi_{i} }}{\partial t} = \frac{{w^{2} - z^{2} (1 - t)^{2} }}{{9(1 - t)^{2} }} + \frac{{t(1 - y)^{2} }}{y}\);

(ii) \(\frac{{\partial \pi_{i} }}{\partial t} \ge 0\; \Leftrightarrow \;y < y_{1}^{^\circ } \;or\;y > y_{2}^{^\circ }\),

where \(y_{1}^{^\circ } = 1 + \frac{{z^{2} }}{18t} - \frac{{\sqrt {\{ [(1-t)z]^{2} - w^{2} \} [(z^{2} + 36t)(1-t)^{2} + w^{2} ]} }}{18t}\),\(y_{{_{2} }}^{^\circ } = 1 + \frac{{z^{2} }}{18t} + \frac{{\sqrt {\{ [(1-t)z]^{2} - w^{2} \} [(z^{2} + 36t)(1-t)^{2} + w^{2} ]} }}{18t} > 1\);

(iii) \(y_{2}^{^\circ } > 1\); however, since \(y_{1}^{^\circ } < y^\circ \;if\;\frac{w}{1 - t} \le z < \frac{9t(1 - t)}{{2w}} - \frac{{3\sqrt {9t^{6} - 36t^{5} + 54t^{4} + (2w^{2} - 36)t^{3} + (9 - 4w^{2} )t^{2} + 2tw + w^{4} } - w^{2} }}{w(1 - t)}\) but \(y^\circ < y_{1}^{^\circ } \;if\;\frac{9t(1 - t)}{{2w}} - \frac{{3\sqrt {9t^{6} - 36t^{5} + 54t^{4} + (2w^{2} - 36)t^{3} + (9 - 4w^{2} )t^{2} + 2tw + w^{4} } - w^{2} }}{w(1 - t)} \le z\), there are pairs \((t,w)\) such that the condition \((1 - t)^{2} z^{2} \ge w^{2} \ge 9\left[ {\frac{{z^{2} }}{9} - \frac{{t(1 - y)^{2} }}{y}} \right](1 - t)^{2}\) is satisfied. Then, part a) of Proposition 1 is proved.

Part (b)

i) \(\frac{\partial a}{{\partial t}} = \overbrace {{ - \frac{1 - y}{y}}}^{audit\;effect} - \overbrace {{\frac{w[4w - (1 - t)z]}{{9(1 - t)^{3} }}}}^{market\;effect}\). The first effect, the audit effect, is always negative: the higher the probability of evasion detection is, the lower the undeclared sales are. The second effect, the market effect, is negative if and only if \(w \ge \frac{(1 - t)z}{4}\), that is, if the cost pressure of wages is high. Q.E.D.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Buccella, D., Fanti, L. & Gori, L. Competitive wages and tax evasion in a Cournot duopoly. Theory Decis (2024). https://doi.org/10.1007/s11238-024-09987-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s11238-024-09987-7