Abstract

This paper analyzes the coordination challenge a partial cartel faces when payoff asymmetries between potential cartel insiders and potential cartel outsiders are large. We introduce two experimental treatments: a standard treatment where a complete cartel can be supported in a Nash equilibrium and a modified treatment where a complete cartel and a partial cartel can both be supported in a Nash equilibrium. To assess the role of communication both treatments are additionally run with a “chat option,” yielding four treatments in total. Our results show that subjects frequently reject the formation of partial cartels in the modified treatments. In all treatments with communication subjects are more likely to form complete cartels than partial cartels. The implications of these results are important for antitrust: payoff asymmetries between cartel members and outsiders may jeopardize the formation of partial cartels. Yet complete cartels may be formed instead, if institutional mechanisms with frequent communication are used to form cartels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

When the Supreme Court of the United States ruled the Sugar Institute illegal in 1936, it terminated one of the most stable cartels in the history of US antitrust. As opposed to other large cartels such as the Folic Acid cartel or the Vitamin B6 cartel, which collapsed under the competitive pressure of emerging Chinese cartel outsiders, the Sugar Institute was characterized by a long-lasting “external stability.” “Internal stability” was secured through an internal court system, which ensured that members would stick to the cartel or be sanctioned internally. The cartel also dealt with free-riding by the outside firm Hershey, that profited from the cartel price without participating. Genesove and Mullin (1999) outline that sugar refiners from Florida suggested that the cartel should either force the outside firm Hershey to stop its “unethical” behavior or convince it to join them. Thereby the Sugar Institute overcame a significant coordination challenge. As d’Aspremont et al. (1983) stated “...however by free-riding, fringe firms enjoy higher profits than cartel members.” This raises the question: How can firms coordinate the formation of partial cartels when the latter would be better off if they were the free-riding outsider?

In this paper, we experimentally analyze the effectiveness of an institutional structure (Selten 1973) to form cartels as described in the Sugar Institute case. More precisely, we investigate the conditions under which subjects may form a partial cartel. We study whether they would accept a situation of asymmetric payoffs as described by d’Aspremont et al. (1983). A partial cartel is defined as a situation in which a stable cartel is formed by a subset of all firms interacting in a market. In this experiment, we focus on a design which is a modified version of a two-stage mechanism introduced by Kosfeld et al. (2009). This mechanism was adapted to a cartel environment in Clemens and Rau (2019), facilitating the formation of an “internally” and “externally” stable partial cartel. In the first stage, it allows potential cartel members to figure out the potential cartel insiders and cartel outsiders before ultimately implementing the cartel in the second stage. Undesirable constellations, where outsiders may free-ride at the expense of cartel insiders, can be prevented by renouncing the formation of the partial cartel. Our paper thereby contributes to the experimental literature on partial cartels, which has provided only limited evidence on this subject.Footnote 1

Our paper provides important insights for antitrust policy. Although the Sherman Antitrust Act led to the adoption of more aggressive enforcement of antitrust policies, cartels are still a severe problem in the USA (Levenstein & Suslow, 2016). The US Department of Justice (henceforth “DOJ”) underlines that: “Appropriate sanctions for cartel activity in any particular case depend on a variety of factors, the most important of which is the severity of the offense [...]. Since the purpose of the sanction is to deter the offense, the ideal measure of offense severity arguably is the gain to the defendants from the unlawful cartel activity.”Footnote 2 Although the DOJ acknowledges that the gains of the cartel activity should serve as a measure of the sanctions, they point at the difficulties of estimating the damage: “But basing sanctions on gain or harm would require costly efforts to estimate such effects. Such efforts, however, should be avoided because they would seriously undermine the efficiency of the legal system.”Footnote 3 Consequently, the US Sentencing Guidelines set the cartel fine based on the annual turnover of the products covered by the cartel activity over the period it occurred, irrespective of whether the cartel created any harm.

Our experimental results highlight that potential payoff asymmetries, resulting from a partial cartel, may prevent cartelists from forming the cartel and ultimately from implementing the cartel strategy at all. More precisely, our findings emphasize that even when cartel formation is attempted and, therefore, sanctionable by antitrust laws free-riding by outsiders may ultimately jeopardize the formation of the cartel, resulting in limited harm for consumers.Footnote 4 This yields an important insight for antitrust authorities and the DOJ: If a partial cartel was instigated but yet failed to emerge because it was subject to excessive free-riding behavior by outsiders, the harm resulting from the cartel is limited. When setting the fine for a cartel, antitrust authorities should therefore take into consideration that partial cartels may ultimately have failed in overcoming the coordination challenge. Moreover, our results suggest that communication is not the only factor determining the success of cartels. Our results show that the combination of communication and an institutional sanctioning mechanism yields cartelization rates between 83 and 97%, which largely exceed those cartelization rates where the success of the cartel relies solely on communication.Footnote 5

2 Related literature

The predominant experimental literature on endogenous cartels focuses on the disruptive effect of antitrust policies, such as leniency (see Apesteguia et al., 2007; Bigoni et al., 2012; Feltovich & Hamaguchi, 2018; Hinloopen & Soetevent, 2008), the role of communication in the formation of collusive agreements (see Andersson & Wengström, 2007; Cooper & Kühn, 2014; Fonseca & Normann, 2012; Haan et al., 2009) or the impact of market structure on collusion (see Dufwenberg & Gneezy, 2000; Fonseca et al., 2018; Huck et al., 2004, 2001). Our paper contributes to the experimental literature on endogenous cartels, though it focuses on the impact of free-riding cartel outsiders on the stability and the decision to form a cartel. Consequently, our experiment is directly related to the classical literature on cartel stability. Few experiments focus on the emergence of partial cartels. Gomez-Martinez (2017) analyzes whether partial cartels emerge in an experimental setting and what their effect may be on subsequent mergers. Moreover, Odenkirchen (2018) studies umbrella pricing by outside firms whenever a partial cartel is formed.

The theoretical literature on cartel stability determines the necessary market conditions that guarantee the emergence of stable cartels and their respective subsets of partial cartels. In what follows, we discuss the relevant theoretical literature. The seminal contribution by d’Aspremont et al. (1983) shows that a partial cartel emerges when a competitive fringe free-rides on the decision to form a cartel. Accordingly, the existence of partial cartels with a free-riding fringe is established by Donsimoni (1985) in the context of cost heterogeneity, for price leadership (e.g., Donsimoni et al., 1986), for quantity leadership (e.g., Shaffer 1995), and in a dynamic capacity-constrained price game (e.g., Bos & Harrington, 2010). Most of these papers, however, focus on the structure and size of the cartel, neglecting the coordination challenge firms face in the formation of these cartels.

A notable exception is the theoretical work of Selten (1973) who introduces an institutional cartel framework, where firms decide on the formation of a cartel at the first stage before binding themselves to the agreement, if they successfully bargain over the cartel agreement. Our experimental work contributes to this theoretical literature on cartel stability. By focusing on the behavioral implications of free-riding cartel outsiders on cartel formation, we analyze a phenomenon which was theoretically identified by d’Aspremont et al. (1983), Hviid (1992), and Thoron (1998).Footnote 6 However, the topic has so far not been assessed in any detail.

To analyze the emergence of partial and complete cartels, our experimental setting introduces an institutional framework as in Thoron (1998) and Selten (1973). This institutional framework was used in the context of public-good provision by Kosfeld et al. (2009). In this contribution, an experimental analysis on the formation of an endogenous institution, which sanctions free-riding in the context of a public-good game, is provided. The institution not only binds its participants to contribute their entire endowment to the public good, it also identifies free-riders who “remain free” to contribute whatever they want to the public good.

The institutional design developed in Kosfeld et al. (2009) was implemented in an experimental study on the leniency program by Clemens and Rau (2019). This study focuses on the behavior of hardcore cartels for a Cournot market, where subjects decide whether to participate in a cartel or not in the first stage, as in Selten (1973) and Thoron (1998). At the second stage, subjects were informed of the size of the cartel and were given the possibility to unanimously form the cartel. When a cartel was formed, cartel members were bound to the cartel strategy, while outsiders played best responses. The mechanism shares some features with threshold public-good games on minimal contribution sets (MCS) (Erev & Rapoport, 1990). A similar characteristic of these games is that subjects also make binary decisions to decide whether to participate. If a certain threshold of participants is met, the public good is provided. By contrast, the mechanism used in Clemens and Rau (2019) focuses on a more complex setting based on Cournot payoffs. In this setting, cartel members still receive payoffs if fewer firms participate in the cartel than are needed for the welfare-increasing provision point.

In this paper, we use the same institutional hardcore cartel setting as in Clemens and Rau (2019), since this design facilitates the identification of cartel outsiders. Yet we do not analyze antitrust policies but focus on the effect of free-riding behavior on cartel formation. More precisely, excluding antitrust policies allows us to focus on the direct effects of payoff asymmetries on coordination challenges for the formation of partial cartels. In contrast to standard threshold public good games, our cartel setting also yields insights on market outcomes regarding the occurrence of partial cartels.

We are in line with Clemens and Rau (2019), Selten (1973), and the theoretical contribution of Okada (1993), since the cartel members are bound to the cartel strategy. This approach is in line with the empirical literature by Genesove and Mullin (2001), Harrington Jr (2005), and Levenstein and Suslow (2006) who confirm that price enforcement by the cartel not only prevents cheating but also ensures that cartels survive. Moreover, we abstract from ex-post defection, as Clemens and Rau (2019) show that including defection in the set-up does not significantly alter any results in the setting we use.

Our experiment includes a communication phase and is, therefore, related to the experimental literature on the role of communication in cartels (e.g., Andersson & Wengström, 2007; Cooper & Kühn, 2014; Fonseca & Normann, 2012). The communication option allows us to understand the underlying motivations of colluding subjects, i.e., whether they care about payoff asymmetries between subjects inside and outside partial cartels. Therefore, we evaluate communication following the approaches used in the experimental papers by Kimbrough et al. (2008), Andersson and Wengström (2007), and Clemens and Rau (2019) to infer whether or not payoff asymmetries between cartel members and cartel outsiders influence the formation of partial cartels.

3 Experimental design

In our experimental treatments we introduce a two-stage mechanism, where in each period the same four subjects are matched in a market. The two-stage mechanism works as follows:

Stage one: Subjects state simultaneously by either clicking on a yes- or on a no- button, whether they want to participate in a cartel or not. If they click “yes,” they become a “possible insider.” Otherwise, they become “ultimate outsiders.”

Stage two: All subjects are informed of the total number of possible insiders and outsiders. Only possible insiders decide whether they want to participate by clicking “yes.” They are shown the possible payoffs for the case of participation or non-participation and the resulting payoffs for outsiders. The agreement becomes binding if and only if all possible insiders click “yes.” Otherwise, it is rejected and all subjects receive the Nash profits. Finally, payoffs are shown to the subjects, who are subsequently informed of the cartel formation.Footnote 7

In our chat treatments, we apply the same two-stage mechanism though with a slight modification: subjects communicate in a free-form chat for 60 s before stage one starts.Footnote 8 Applying free-form communication potentially provides additional insight on the coordination challenge (Dijkstra et al., 2021). Consequently we analyze the protocols of the different chats in Sect. 6.3.

3.1 Treatments

We run two treatments with standard Cournot payoffs: without chat (SEC) and with chat (SECC). Two further treatments test a modified payoff structure without chat (MEC) and with chat (MECC). Table 1 provides an overview of the payoffs in SEC/SECC and MEC/MECC for a symmetric Cournot game with four competitors. In the treatments, subjects earn Talers with an exchange rate of 1 Taler \(=\) €0.02.Footnote 9 We modify the payoffs for a three-member cartel from 59 to 70 Talers in the modified treatments. In Sect. 4.1 we show that this modification is crucial to assess the formation of partial cartels, as it changes the payoff structure such that the formation of partial cartels can be sustained by a Nash equilibrium. The modification is implemented to compare the coordination challenges for complete cartels with the coordination challenge for partial cartels, ensuring that the experimental framework and conditions of both treatments are yet similar enough.Footnote 10 Moreover, cartel members’ payoffs are determined by the assumption that joint profits are maximized. We assume that outsiders best respond.

3.2 Experimental procedures

In all treatments of the experiment, we applied fixed matching and repeated the game for 10 periods. Hence, a matched group of four subjects forms one independent observation. In the experiment, we focus on the mean rate of cartelization in the 10 periods of a matched group. In MEC and SEC, we have seven independent observations for each treatment, whereas we have four in MECC and three in SECC. We ran two sessions from MEC and SEC, respectively, whereas we had one session from each of the two communication treatments. The 60-minutes experiment was conducted at the University of Düsseldorf. Subjects were paid for every round and they received their exact earnings. A total of 84 subjects from various fields participated in this experiment and earned €16.96 on average. The experiments were programmed in z-Tree (Fischbacher, 2007) and subjects were recruited with ORSEE (Greiner, 2015).

4 Model and propositions

We consider a symmetric Cournot market with four competitors and a demand function of \(P(Q_{i})=50-\sum _{i=1}^{4}Q_{i}\). Every competitor faces the marginal cost of \(c=10\).

With Cournot competition, the profits of every competitor correspond to

If m competitors decide to form a cartel the insiders’ profits correspond to

the outsiders’ profits are given by:

We now inspect whether our cartel mechanism facilitates the formation of a cartel by characterizing all Nash equilibria for which cartels are formed.

4.1 Propositions for SEC/SECC

We first characterize the Nash equilibria with standard payoffs in the Cournot game which supports the formation of a cartel.

Proposition 1

With standard payoffs, a cartel is formed in a Nash equilibrium if and only if the cartel is complete. Moreover, the complete cartel can be supported in a subgame perfect equilibrium.

All proofs of the propositions are provided in Appendix 1. Proposition 1 shows that the cartel mechanism can sustain a cartel under the condition that all competitors participate in the cartel. Yet there also exist Nash equilibria for which no cartel is implemented for any number of possible insiders. Our experimental approach thus provides an insight on whether this cartel-formation challenge can be solved by potential cartel members.

4.2 Propositions for MEC/MECC

We now characterize the Nash equilibria for which a cartel is formed with modified payoffs in the Cournot game.

Proposition 2

With modified payoffs, a cartel is formed in a Nash equilibrium if and only if it includes \(\ge 3\) members. Moreover, both the three-member cartel and the complete cartel can be supported in a subgame perfect equilibrium.

As in the case of standard payoffs, the cartel mechanism succeeds by allowing the subjects to successfully implement a cartel, as long as three or more possible insiders participate at the first stage. Yet, with modified payoffs, the formation of a cartel yields additional coordination challenges.Footnote 11 First, subjects need to agree on the size of the cartel, as it could include either three members (partial cartel) or four members (complete cartel). As in the case of standard payoffs we also obtain an equilibrium for which no cartel is implemented for any number of possible insiders. Note that there also exists a mixed-strategy equilibrium in which subjects participate with a positive probability. Due to the fixed matching of groups, the finite repetition of our experiment, and the multiple Nash equilibria of the game, a “folk theorem” supports behavior that is not the result of a Nash equilibrium (see Benoit & Krishna, 1985).Footnote 12 A “stick and carrot” strategy could be implemented for sufficiently patient subjects that would yield an outcome in which the complete cartel is played for the first periods while the partial cartel is implemented for the remaining periods and deviation is met with the rejection of cartel formation. Whether such strategies are implemented remains an empirical question which we try to tackle through our experiment.

5 Hypotheses

Based on our propositions and the results from the experimental literature, we now formulate hypotheses on the outcomes of the different treatments. All hypotheses refer to the average rate of established cartels of the match groups in the 10 periods. Following Proposition 1, we expect that whenever cartels are formed these cartels will be complete, i.e., encompass all subjects in the SEC treatment. Proposition 2 states for MEC that only cartels with at least three members are formed. Therefore, we expect that partial cartels will predominantly occur in the treatment with modified payoffs. This leads to our first hypothesis regarding the occurrence of treatment effects for partial cartels.

Hypothesis 1

The average share of partial cartels will be higher in MEC than in SEC.

Experiments on antitrust analyzing the effects of communication confirm the pro-collusive effect of a chat option (Fonseca & Normann, 2012; Cooper & Kühn, 2014). Along the same lines, Pogrebna et al. (2011) present evidence that cheap-talk announcements of contributions also increase cooperation in voluntary contribution games. Thus, we expect that subjects should be more willing to form cartels in the treatments where communication is possible. Moreover, Masclet et al. (2003) show that the chat room can be used to sanction non-cooperators, which lowers the number of free-riders. In the context of our experiment, we might, therefore, observe that subjects prevent the formation of partial cartels and encourage other subjects to form a complete cartel instead. Following Masclet et al. (2003), the emergence of partial cartels with a free-riding cartel outsider could potentially occur less frequently in MECC. Moreover, subjects may overcome free-riding by coordinating the formation of complete cartels, which is Pareto superior to the situation without a cartel. The findings on the coordination-enhancing effects of communication establish Hypothesis 2.

Hypothesis 2

(a) The average share of complete cartels will be higher in MECC than in MEC.

Hypothesis 2

(b) The average share of complete cartels will be higher in SECC than in SEC.

Inequity aversion may be an important factor influencing behavior in oligopoly experiments (İriş & Santos-Pinto, 2014). That is, experiments highlight that when payoff asymmetries exist, disadvantaged subjects sanction others who earn higher profits (e.g., Armstrong & Huck, 2014; Huck et al., 2001). As a consequence, we expect in the treatments where partial cartels may occur (MEC and MECC) that these cartels will be less often accepted than complete cartels. This leads to Hypothesis 3.

Hypothesis 3

On average, in MEC and MECC, partial cartels will be accepted less often than complete cartels.

6 Results

In this section, we present our main results. We report two-sided p-values, if not otherwise stated. The non-parametric tests focus on the average rate of established cartels in the 10 periods of each match group. We acknowledge that our results in the communication treatments are of an exploratory nature due to the small number of independent observations in SECC and MECC. Thus, we refrain from reporting non-parametric tests for these treatments.

Focusing on SEC and MEC, our results show an overall low average rate of cartelization (SEC: 26%; MEC: 20%). It turns out that communication increases average cartelization rates for standard payoffs (SECC: 97%) and for modified payoffs (MECC: 83%). In SECC, this high rate of cooperation is in line with data from a companion paper (Clemens & Rau, 2019), where we find that the rate of cartelization (82%) is high when subjects face a similar treatment.Footnote 13

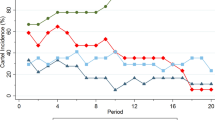

Next, we turn to our hypotheses to shed more light on the types of established cartels. Figure 1 focuses on the average rate of established complete and partial cartels (3-firm and 2-firm cartels) in the 10 periods of our treatments.

In MEC, 7% of the market outcomes involve complete cartels, whereas 13% involve partial cartels. In SEC, partial cartels occur only in 1% of the cases. The difference is significant (Mann–Whitney test, \(p = 0.027\)). This confirms Hypothesis 1. By contrast, in SEC, 24% of the time we observe complete cartels, whereas partial cartels only occur 1% of the time (Wilcoxon matched-pairs test, \(p = 0.031\)).

In MECC, most market outcomes (73%) result in complete cartels encompassing four subjects. By contrast, complete cartels arise less often in MEC (11%). This is in line with Hypothesis 2a. In SECC, more market outcomes (97%) lead to complete cartels than in SEC (24%). This supports Hypothesis 2b. The finding suggests that communication may enhance coordination. In MECC, the communication option helps subjects to coordinate the formation of complete cartels, which are characterized by symmetric payoffs. The communication option apparently helps to overcome a situation where potential free-riders may enjoy high outsider payoffs (Masclet et al., 2003). To provide a better understanding of the time dynamics we present an overview of the development of the cartel types in Fig. 2 (see Appendix 2). In MEC, it turns out that the frequency of cartel compositions does not change over time. By contrast, in SEC we find evidence of a slight increase over time of the complete-cartel composition. In both communication treatments (SECC and MECC) we observe no conspicuous time trends, except an end-game effect in periods 9 and 10.

6.1 Acceptance of cartel compositions

Table 2 summarizes the number of proposed, accepted, and rejected compositions. It also presents the acceptance rates conditional on potential cartel compositions and treatments. The table focuses on complete and partial cartels at the second stage of our mechanism. The means are derived at the group level, i.e., for each of the markets in our treatments.

The complete cartel is accepted more often than the partial cartel. Remarkably, in the modified treatments the three-firm cartel is rejected more than half the time (MEC: 56%; MECC: 60%), although cartel members would have generated a higher payoff by accepting it. In SEC, where the three-firm cartel would be inefficient, it is almost always rejected (97% of times). Overall, it can be seen that three- and two-firm cartels are rejected most of the time in the treatments with standard and with modified payoffs.

Table 3 presents random-effects probit regressions, which are clustered at the group level. All regressions report average marginal effects. We control for time effects and include dummies for cartel compositions.

We use dummies which are positive when firms try to form the two-firm cartel (Two-firm composition) or the complete cartel (Complete composition). We omit the case of the three-firm composition, as it is our reference group. In SEC, the two-firm composition is omitted, as it perfectly predicts cartel acceptance. This only occurred eight times and it was never accepted by subjects. Model (1) presents the data of MEC and model (2) presents the data of SEC.

For both treatments, we find that Complete composition is positive and highly significant. Thus, in MEC and SEC, the complete composition is significantly more often accepted than the three-firm composition. This supports Hypothesis 3. Moreover, the significant negative effect of Period shows that without chat, fewer cartels are accepted over time.

6.2 Number of potential insiders

In this subsection, we analyze whether coordination problems can explain the low degree of cartelization in MEC. It is likely that the “tempting” outsider payoffs may drive these problems in the modified treatment. Therefore, we study whether the number of potential insiders is smaller in the MEC treatment, as compared to the other treatments.

We find that in MEC, the average number of potential insiders (2.04) is significantly smaller than in SEC (Mann–Whitney test, \(p = 0.023\)). It is smaller in each of the 10 periods. This result potentially provides an explanation for the low rate of cartelization in this treatment. The small number of insiders leads at best to partial cartels, which are rejected, as subjects potentially dislike the payoff asymmetry in partial cartels. In SEC, the number of insiders is higher (3.03) than in MEC, but it is still rather low. Therefore, we do not observe many cartels. Overall, we do not find any significant time dynamics in the treatments (see Fig. 3 in Appendix 2). Moreover, the number of insiders is comparably high in the communication treatments, showing that the coordination problems are solved when subjects communicate and agree to form symmetric complete cartels. To provide a better understanding of subjects’ coordination process, we analyze their communication behavior in the next subsection.

6.3 Analysis of the chat protocols

We briefly discuss the most important insights of the chat protocols. First, we follow Andersson and Wengström (2007) by accounting for the number of “collusive agreements” which were sent in the chat. We count each input, which was transmitted as a message.Footnote 14 A message is classified as a “collusive agreement” whenever subjects proposed an agreement to form a cartel and this was not rejected by others (see Table 4 in Appendix 2 for a detailed overview).Footnote 15 Second, we contrast the most interesting content of the chat messages in the two treatments. This is inspired by the analyses of Kimbrough et al. (2008) and Fonseca and Normann (2012).

Focusing on the number of messages sent, we find that in both treatments most discussions take place as early as the first period and sharply decline thereafter. Over time, we find in MECC a constantly high fraction (mean 78%) of collusive agreements, whereas in SECC (mean 39%) this pattern only arises at the beginning.

Turning to the content of the chats (see Appendix 2 for representative sample protocols), we find that in SECC subjects discuss from the very beginning that cooperation increases joint payoffs. By contrast, we observe that in MECC the discussions are more centered around fairness issues. More precisely, the chat is used to discuss the monetary trade-off of forming partial cartels and that this would lower joint payoffs. Interestingly, subjects use the communication option to prevent free-riding behavior, i.e., they state that partial cartels will not be accepted because of fairness issues. In this respect, they emphasize the importance of coordinating to form complete cartels, which maximizes joint payoffs. Thus, collusive behavior is induced by fairness considerations (İriş & Santos-Pinto, 2014). The finding that subjects establish complete cartels, highlights the role of reassurance in the modified treatment, as this helps to coordinate on higher joint outcomes (Crawford, 1998; Masclet et al., 2003). The results explain why in MECC most cartels are complete. Thus, the chat protocols highlight that subjects’ behavior is motivated by fairness issues rather than by an execution of a strategy in repeated games as suggested by a “folk theorem.”

7 Discussion

This paper is the first to assess experimentally the behavioral implications of payoff asymmetries in partial cartels. Although this phenomenon has been identified by d’Aspremont et al. (1983), Hviid (1992), and Thoron (1998), the subject has so far been left untouched by the cartel literature. In this article, we provide experimental evidence on an interesting setting where multiple pure-strategy equilibria occur, which may lead to coordination problems. Our experimental data show that partial cartels with large payoff asymmetries between insiders and outsiders are rarely formed, although the formation of such partial cartels is supported by a Nash equilibrium in our experimental setting. Moreover, the formation of partial cartels is often rejected by the potential cartel members. Instead, we observe that subjects often form a complete cartel, which does not generate any payoff asymmetries. Our results show that payoff asymmetries between inside and outside firms can potentially complicate the formation of partial cartels, as subjects frequently do not accept them. Hence, these findings highlight that payoff asymmetries between cartel insiders and cartel outsiders potentially jeopardize the formation of partial cartels.

The results of our paper provide further insight into the impact of outside firms on the stability of partial cartels. Connor (2006) describes how the increasing competitive pressure exerted by cartel outsiders ultimately destabilized some of the global bulk vitamins cartels. An obvious explanation for the destabilization of these cartels is that the aggressive expansion by the fringe made the cartels unprofitable and thus unsustainable. Our paper shows that cartels which yield large payoff asymmetries between insiders and outsiders may yet fail to emerge despite of their profitability. Thus, fringe firms may disrupt cartels not only by making the latter unprofitable. Excessive free-riding behavior by cartel outsiders at the expense of the potential cartel members may be a source of instability for partial cartels, even if the implementation of the latter would still be profitable.

Yet, if cartels are organized as an endogenous institution, this inherent instability can be overcome: a combination of communication with an institutional structure, as seen in the Sugar Institute case, induces the formation of complete cartels. Antitrust authorities should thus focus on markets where institutional cartel structures are easily implemented or alternatively focus on those markets that have a history of endogenous hardcore cartel formation. Finally, we acknowledge that more data on the effects of our mechanism will be needed for a deeper exploration of the dynamics of communication.

Notes

See for example European Commission, Case COMP/C.37.750/B2 Brasseries Kronenbourg, Brasseries Heineken, where the European Commission sanctioned Kronenbourg and Heineken for attempting to form the “French beer cartel” although the cartel was never implemented and, therefore, failed to create any damage.

For instance, in Bertrand markets without an institutional sanctioning mechanism, Hinloopen and Soetevent (2008) find a cartelization rate of 60% only.

As outlined in the related literature section, we abstract from ex-post defection, as Clemens and Rau (2019) show that including defection in this set-up does not significantly alter any results.

The chat lasts for 90 seconds in the first period such that subjects can learn how to use the chat. In the chat window, subjects are referred to as “firm 1,” “firm 2,” “firm 3,” and “firm 4.” The names do not change during the experiment.

The word “Taler” is the German equivalent for Experimental Currency Unit (ECU).

Alternatively, the two-stage mechanism could have been implemented in a Cournot market with five subjects. In a Cournot market consisting of five subjects, a partial cartel including four members is sustained by a Nash equilibrium when our two-stage mechanism is implemented. Yet, increasing the number of participants from four to five fundamentally changes the coordination challenge in an oligopoly experiment, as Huck et al. (2004) show.

Note that the first challenge is to form a cartel at all, given that there also exists Nash equilibria where no cartel is formed for any number of possible insiders.

We would like to thank an anonymous referee for pointing this out.

The data of this treatment is well-powered (9 independent observations) and the main difference is that there exists an antitrust authority which may detect and fine cartels at a given likelihood. The lower rate of cartelization could potentially be caused by the presence of the antitrust authority.

In this respect, we did not count the exact number of words. When subjects only submitted a single word (such as “yes” or “no”) with the “enter” key, we also counted this as a message.

As opposed to Andersson and Wengström (2007) the agreement to form a cartel in a chat does not constitute a collusive agreement per se. In their set-up chat is costly, whereas it is free in our set-up. In our framework although chat does not bind subjects to the collusive strategies it cannot be seen as a cheap-talk agreement. The reason is that our game is repeated and subjects that lie in the chat can easily be punished by other subjects in future periods.

References

Andersson, O., & Wengström, E. (2007). Do antitrust laws facilitate collusion? Experimental evidence on costly communication in duopolies. Scandinavian Journal of Economics, 109(102), 321–339.

Apesteguia, J., Dufwenberg, M., & Selten, R. (2007). Blowing the whistle. Economic Theory, 31(1), 143–166.

Armstrong, M., & Huck, S. (2014). Behavioral economics as applied to firms: A primer. Competition Policy International 6.

Benoit, J.-P., & Krishna, V. (1985). Finitely repeated games. Econometrica, 53, 905–922.

Bigoni, M., Fridolfsson, S.-O., Le Coq, C., & Spagnolo, G. (2012). Fines, leniency, and rewards in antitrust. RAND Journal of Economics, 43(2), 368–390.

Bos, I., & Harrington, J. E. (2010). Endogenous cartel formation with heterogeneous firms. RAND Journal of Economics, 41(1), 92–117.

Clemens, G., & Rau, H. A. (2019). Do discriminatory leniency policies fight hard-core cartels? Journal of Economics & Management Strategy, 28(2), 336–354.

Connor, J.M. (2006). The great global vitamins conspiracies. SSRN Working Paper.

Cooper, D., & Kühn, K.-U. (2014). Communication, renegotiation, and the scope for collusion. American Econommic Journal: Microeconomics, 6(2), 247–78.

Crawford, V. (1998). A survey of experiments on communication via cheap talk. Journal of Economic theory, 78(2), 286–298.

d’Aspremont, C., Jacquemin, A., Gabszewicz, J. J., & Weymark, J. A. (1983). On the stability of collusive price leadership. Canadian Journal of Economics, 16, 17–25.

Dijkstra, P. T., Haan, M. A., & Schoonbeek, L. (2021). Leniency programs and the design of antitrust: experimental evidence with free-form communication. Review of Industrial Organization, 59, 1–24.

Donsimoni, M.-P. (1985). Stable heterogeneous cartels. International Journal of Industrial Organization, 3(4), 451–467.

Donsimoni, M.-P., Economides, N. S., & Polemarchakis, H. M. (1986). Stable cartels. International Economic Review, 27, 317–327.

Dufwenberg, M., & Gneezy, U. (2000). Price competition and market concentration: An experimental study. International Journal of Industrial Organization, 18(1), 7–22.

Erev, I., & Rapoport, A. (1990). Provision of step-level public goods: The sequential contribution mechanism. Journal of Conflict Resolution, 34(3), 401–425.

Feltovich, N., & Hamaguchi, Y. (2018). The effect of whistle-blowing incentives on collusion: An experimental study of leniency programs. Southern Economic Journal, 84(4), 1024–1049.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Fonseca, M. A., Li, Y., & Normann, H.-T. (2018). Why factors facilitating collusion may not predict cartel occurrence—experimental evidence. Southern Economic Journal, 85(1), 255–275.

Fonseca, M. A., & Normann, H.-T. (2012). Explicit vs. tacit collusion—the impact of communication in oligopoly experiments. European Economic Review, 56(8), 1759–1772.

Genesove, D., & Mullin, W. (1999). The sugar institute learns to organize information exchange. In N. R. Lamoreaux, D. M. G. Raff, & P. Temin (Eds.), Learning by doing in markets, firms, and countries. University of Chicago Press.

Genesove, D., & Mullin, W. P. (2001). Rules, communication and collusion: Narrative evidence from the sugar institute case. American Economic Review, 91, 379–398.

Gomez-Martinez, F. (2017). Partial cartels and mergers with heterogeneous firms: Experimental evidence. Working paper.

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with orsee. Journal of the Economic Science Association, 1(1), 114–125.

Haan, M. A., Schoonbeek, L., & Winkel, B. M. (2009). Experimental results on collusion. Experiments and competition policy, 9.

Harrington, J. E., Jr. (2005). Optimal cartel pricing in the presence of an antitrust authority. International Economic Review, 46(1), 145–169.

Hinloopen, J., & Soetevent, A. R. (2008). Laboratory evidence on the effectiveness of corporate leniency programs. RAND Journal of Economics, 39(2), 607–616.

Huck, S., Muller, W., & Normann, H.-T. (2001). Stackelberg beats Cournot—on collusion and efficiency in experimental markets. Economic Journal, 111(474), 749–765.

Huck, S., Normann, H.-T., & Oechssler, J. (2004). Two are few and four are many: Number effects in experimental oligopolies. Journal of Economic Behavior & Organization, 53(4), 435–446.

Hviid, M. (1992). Endogenous cartel formation with private information. Canadian Journal of Economics, 972–982.

İriş, D., & Santos-Pinto, L. (2014). Experimental Cournot oligopoly and inequity aversion. Theory and Decision, 76(1), 31–45.

Kimbrough, E., Smith, V., & Wilson, B. (2008). Historical property rights, sociality, and the emergence of impersonal exchange in long-distance trade. American Economic Review, 98(3), 1009–1039.

Kosfeld, M., Okada, A., & Riedl, A. (2009). Institution formation in public goods games. American Economic Review, 99(4), 1335–1355.

Levenstein, M. C., & Suslow, V. Y. (2006). What determines cartel success? Journal of Economic Literature, 44, 43–95.

Levenstein, M. C., & Suslow, V. Y. (2016). Price fixing hits home: An empirical study of US price-fixing conspiracies. Review of Industrial Organization, 48(4), 361–379

Masclet, D., Noussair, C., Tucker, S., & Villeval, M.-C. (2003). Monetary and nonmonetary punishment in the voluntary contributions mechanism. American Economic Review, 93(1), 366–380.

Odenkirchen, J. (2018). Pricing behavior in partial cartels. Number 299. DICE Discussion Paper.

Okada, A. (1993). The possibility of cooperation in an n-person prisoners’ dilemma with institutional arrangements. Public Choice, 77(3), 629–656.

Pogrebna, G., Krantz, D. H., Schade, C., & Keser, C. (2011). Words versus actions as a means to influence cooperation in social dilemma situations. Theory and Decision, 71(4), 473–502.

Selten, R. (1973). A simple model of imperfect competition, where 4 are few and 6 are many. International Journal of Game Theory, 2(1), 141–201.

Shaffer, S. (1995). Stable cartels with a Cournot fringe. Southern Economic Journal, 61, 744–754.

Thoron, S. (1998). Formation of a coalition-proof stable cartel. Canadian Journal of Economics, 63–76.

Acknowledgements

We are especially grateful to Hans-Theo Normann for his input at various stages of this project. We are grateful to Irina Baye, Maria Bigoni, Tim Cason, Stephen Davies, Tomaso Duso, Dirk Engelmann, Joe Harrington, Justus Haucap, Jeroen Hinloopen, Michael Kosfeld, Andreas Landmann, Stephan Müller, Lambert Schoonbeek, Tobias Wenzel and Christian Wey for providing us with helpful comments. We thank Arno Riedl for providing us with experimental instructions. We are grateful to the editor Jörg Oechssler and two anonymous referees. We also want to thank the Düsseldorf Institue for Competition Economics (DICE), University of Düsseldorf for financial support.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The content of the article is of the author’s sole responsibility. It does not represent the views of Compass Lexecon.

Appendices

Appendix 1: Proofs

1.1 Proof of Proposition 1

Consider the strategic form of the two-stage cartel formation game, i.e., \(\langle N,(S_i),(\pi _i) \rangle\) with a set of players \(N=\{1,2,3,4\}\). There are five information sets where player i’s strategy has to prescribe an action. First, an action to be taken at the initial node. At the beginning of stage one the players choose simultaneously whether to become a potential insider (“in”) or not (“out”). Second, if a player chose “in” then he has to specify an action for each of the four possible information sets while no further action is specified when he plays “out”. Let \(I^i_j, j\in \{0,1,2,3\}\) denote the information sets where player i has to take an action at stage two, i.e., player i chose “in” and j other players also chose “in”. At each information set, player i can vote either in favor (“yes”) or against (“no”) the formation of a cartel. Thus, a strategy of a player is an element of \(\{{\text {in, out}}\}\times \text{\{"yes", "no"\}}^4\), where the first, second, third, and fourth entry in the stage-two part of the strategy corresponds to the action taken at the information set with \(j=0,\,j=1,\,j=2\,\)and\(\,j=3\), respectively.

The payoffs are as follows:

-

If no cartel is formed, each player earns the oligopoly profit of 64

-

If only one player forms a cartel each player earns the oligopoly profit of 64

-

If two players form a cartel, the two cartel insiders earn 50 each, while the two outsiders earn 100 each

-

If three players form a cartel, the three cartel insiders earn 59 each, while the outsiders earn 178 each

-

If all players form a cartel, each player earns 100

We focus on the characterization of the Nash equilibria where a cartel is formed and, therefore, disregard the case of a one-firm cartel, as by definition this is not a “collusive agreement,” i.e., a cartel. Consider first the case where two players vote “in” at the first stage and “yes” at the second stage. The two players play a strategy with \(({\text {in}},\cdot ,\text{yes}\cdot ,\cdot )\) while the remaining two players play \(({\text {out}},\cdot ,\cdot ,\cdot ,\cdot )\). The associated payoff for the cartel members is 50. Thus, each of the two players has an incentive to deviate and to renounce the formation of the cartel, either by choosing “out” at stage one or “no” at \(I^i_2\). With this deviation they can secure the oligopoly payoff of 64. Consider now the case where three players vote “in” at the first stage and “yes” at the second stage. The three players play a strategy with \(({\text {in}},\cdot ,\cdot ,\text{yes},\cdot )\) and the fourth \(({\text {out}},\cdot ,\cdot ,\cdot ,\cdot )\). The associated payoff for any cartel member is 59. Thus, each of the three players has an incentive to deviate and to renounce the formation of the cartel, either by choosing out at stage one or “no” at \(I^i_2\). Under this deviation, they can secure the oligopoly payoff of 64. Hence, no three-member cartel is formed in a Nash equilibrium. Finally, in the case where a complete cartel is formed, each player plays \(({\text {in}},\text{no, no, no, yes})\). This is clearly a Nash equilibrium as the cartel members’ payoffs are 100 while voting “no” at \(I^i_3\) or choosing “out” reduces payoffs to 64. Hence, with standard payoffs, a cartel is formed in a Nash equilibrium if and only if the cartel is complete. Moreover, a complete cartel formation can be supported in a subgame perfect equilibrium with the profile \((\text{in, no, no, no, yes})\).

1.2 Proof of Proposition 2

Consider the strategic form of the two-stage cartel formation game, \(\langle N,(S_i),(\pi _i) \rangle\) introduced in the proof for Proposition 1 with payoffs modified as follows:

-

If no cartel is formed, each player earns the oligopoly profit of 64

-

If only one player forms a cartel, each player earns the oligopoly profit of 64

-

If two players form a cartel, the two cartel insiders earn 50 each, while the two outsiders earn 100 each

-

If three players form a cartel, the three cartel insiders earn 70 each, while the outsiders earn 178 each

-

If all players form a cartel, each player earns 100

We again focus on the characterization of the Nash equilibria where a cartel is formed and, therefore, disregard one-member cartels as the latter cannot be considered a “collusive agreement,” i.e., a cartel. As the payoffs for the two-member cartel and the complete cartel are the same as for standard payoffs, the equilibrium strategies for both cases are the same as in the proof for Proposition 1. Consider now the case where three players vote “in” at the first stage and “yes” at the second stage. The three players play a strategy with \(({\text {in}},\cdot ,\cdot ,\text{yes},\cdot )\) and the fourth player \(({\text {out}},\cdot ,\cdot ,\cdot ,\cdot )\). The associated payoff for any cartel member is 70. This strategy set is a Nash equilibrium, as voting “no” instead at \(I^i_2\) would reduce payoffs from 70 to 64. Hence, with modified payoffs a cartel is formed in a Nash equilibrium if and only if it includes \(\ge 3\) members. As in the case with standard payoffs, a complete cartel formation can be supported in a subgame perfect equilibrium with the strategy profile \((\text{in, no, no, no, yes})\). Moreover, a partial three-member cartel can be supported in a subgame perfect equilibrium with the profile where three players play a strategy with \(({\text {in}},\cdot ,\cdot ,\text{yes},\cdot )\) and the fourth \(({\text {out}},\cdot ,\cdot ,\cdot ,\cdot )\).

Appendix 2: Supplementary Material

1.1 Chat protocols

In this section, we present some representative chat protocols to get an idea how subjects used this communication option to facilitate collusive behavior. We start with a first period example of SECC to show how subjects in market 1 highlighted the merits of collusion to increase joint payoffs:

Market 1, period 1: SECC

firm 2: Does everybody take part ?!

firm 1: Yes, sure

firm 3: Absolutely

firm 4: I recommend, that everybody always takes part. This will guarantee that everybody earns 20€ ...

firm 4: Yeah

firm 3: :)

firm 2: Yes

Similar evidence is found in MECC. In the modified treatment it turns out that subjects additionally discuss the trade-off of to initiate partial cartels. In the example, it can be seen how the chat is used to convince all subjects to overcome the temptation of trying to become the cartel deviator:

Market 2, period 1: MECC

firm 3: We should all participate in the agreement.

firm 2: Okay

firm 1: If all four firms bind themselves to participate in the market agreement, we will get the maximum payoff.

firm 2: Okay

firm 3: This will yield €20 for each of us.

firm 2: However, if someone defects he will get 178 ;–)

firm 3: Hey, we are a community.

firm 2: Ok, everybody participates

Moreover, subjects in MECC emphasize the role of fairness. Importantly, subjects point out that asymmetric payoff allocations are not accepted, which lowers payoffs. More precisely, subjects in the chat rebuke others for not taking part in the market agreement. This is illustrated by the next example:

Market 2, period 4: MECC

firm 1: What’s that? Who did that?

..

firm 2: Nobody did it...

firm 1: If somebody clicks no, then everybody will click no. This in turn leads to the smallest payoff for all of us

firm 2: This is bad for everybody

firm 3: Yes, you cannot avoid it. That’s the bad thing..

firm 1: Everybody would be worse off. Thus, we now should all take part

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Clemens, G., Rau, H.A. Either with us or against us: experimental evidence on partial cartels. Theory Decis 93, 237–257 (2022). https://doi.org/10.1007/s11238-021-09842-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-021-09842-z