Abstract

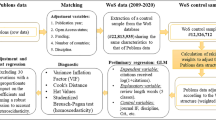

Many Accounting and Finance journals impose monetary charges on authors at the time of manuscript submission. Journals and editorial boards claim that these charges, otherwise known as submission fees, have a range of positive effects. We use the Principal of Double Effect, a long-standing ethical decision-making framework, to investigate the extent to which submission fees also have a secondary, unintended effect of marginalizing non-elite academics, particularly those with limited funding resources, from publishing in a high-status segment of this journal market. We show that submission fees are common among prestigious Accounting and Finance journals and act to segregate the publishing landscape with academics from institutions and countries with limited financial resources migrating to comparable-quality journals with lower or no submission fees, thereby reducing their opportunity set.

Similar content being viewed by others

Notes

Journal finances and journal business models is an active area of inquiry (e.g., Fyfe et al., 2017; McGuigan & Russell, 2008). Modes of revenue generation vary but cluster among disciplines, and typical sources of revenue include fees to authors (e.g., submission fees, open access fees, post-acceptance article handling fees) and fees to subscribers (e.g., institutional subscriptions), that are collected by the publisher.

There are a number of fees that a journal may choose to charge, with a common fee being an article handling fee or publication fee, which is charged to authors upon acceptance of the manuscript for publication. It is different than a submission fee in that it is only charged when the manuscript is accepted, whereas a submission fee is charged at the time of submission and does not guarantee manuscript acceptance.

An alternative explanation is that because authors appreciate the visibility they would receive in high prestige journals, prestige can give journals the option to charge submission fees without losing potential submissions. We thank the anonymous reviewer for this suggestion.

Conference paper submission fees are becoming more and more common in the areas of Accounting and Finance. For example, many American Accounting Association (AAA) sections now charge submission fees for conference papers, as do conferences organized by Financial Management Association and Southern Finance Association. While these fees are beyond the scope of the current study, we expect that the imposition of conference paper submission fees only acts to magnify the effect of journal submission fees on non-elite scholars.

Australian Business Deans Council (ABDC) is journal rankings list, which is evaluated using rigorous peer review process whereby the quality of journals is evaluated by peer judgements, citation rates, and impact factors in consultation with expert Accounting and Finance committees (ABDC, 2019). According to Hair et al. (2019), the latter metric is the most significant driver in determining the quality of the research outlet.

We acknowledge that publicly stated intent for implementing submission fees may not reflect actual intent. Our study relies on the journal’s stated intent instead of obtaining a measure of true intent.

Following Azar’s (2006) recommendations, the submission fees presented here are conservative representations of costs facing an author once one accounts for acceptance rates. For example, if an author sends a manuscript to an accounting journal with a submission fee of $500 and an acceptance rate of 10%, the author can expect to pay, on average, $500/10% = $5000 before the paper is accepted, and this also ignores any other fees (e.g., resubmission fees) that might be charged.

A line of scholarly research investigates the economic rationale and optimal pricing of reviewer compensation (see, for example, Cheah and Piasecki 2022).

Like Currie and Pandher (2011), we note that the Journal of Finance has a substantially lower submission fee ($300) than more expensive journals, such as Journal of Financial Economics and Review of Financial Studies, but has a higher journal impact factor. As Currie and Pandher (2011) note: “This suggests that [Journal of Financial Economics] and [Review of Financial Studies] may potentially expand their awareness to a wider set of active scholars by lowering their submission costs to scholars” (p. 12).

Unlike most other publishers, Emerald has a stated policy against charging author fees, except in the case of open access.

This is similar to recent work by Schwert (2020), which reports (in the online Appendix 6A) on the affiliations of those authors publishing in the Journal of Financial Economics over the period 1974–2020.

Given that 92% of top-tier (ABDC A*) Finance journals charge fees; the No/Low Fee Finance list was challenging to construct. While we selected journals with similar impact factors as other lists, the low fee Finance journals are comparatively more specialized in terms of scope. This, however, only points to further marginalization of research published in low fee Finance journals, since they tend to have a narrower research scope (e.g., Journal of Commodity Markets).

We exclude articles solely written by practitioners, since the focus of this article is on the effect of submission fees on academic authors.

While not displayed, the remaining three metrics also demonstrate a similar trend.

We thank an anonymous reviewer for this suggestion.

From publicly available data provided by The Accounting Review, it seems that the journal collected data in 1 year that covered authors who published in the journal over an eight year period (Volumes 84–91) and they have not conducted this kind of audit since.

References

ABDC. (2019). Australian Business Deans Council 2019 journal quality list review final report 6 December 2019. https://abdc.edu.au/wp-content/uploads/2020/03/abdc-2019-journal-quality-list-review-report-6-december-2019_2.pdf

Albanna, B., Handl, J., & Heeks, R. (2021). Publication outperformance among global South academics: An analysis of individual-level and publication-level predictors of positive deviance. Scientometrics, 126(10), 8375–8431. https://doi.org/10.1007/s11192-021-04128-1

Andrikopoulos, A., & Economou, L. (2015). Editorial board interlocks in financial economics. International Review of Financial Analysis, 37, 51–62. https://doi.org/10.1016/j.irfa.2014.11.015

Aquinas, T. (2006). Summa theologica Part II (Secunda secundae) (The Fathers of the English Dominican Province, Trans.). Project Gutenberg.

Argilés, J. M., & Garcia-Blandon, J. (2011). Accounting research: A critical view of the present situation and prospects. Revista de Contabilidad, 14(2), 9–34. https://doi.org/10.1016/S1138-4891(11)70026-7

Aulisio, M. P. (2004). Principle or doctrine of double effect. In S. G. Post (Ed.), Encyclopedia of bioethics. Macmillan Reference USA.

Azar, O. H. (2005). The review process in economics: Is it too fast? Southern Economic Journal, 72(2), 482–491. https://doi.org/10.2307/20062123

Azar, O. H. (2006). The academic review process: How can we make it more efficient? The American Economist, 50(1), 37–50. https://doi.org/10.1177/056943450605000103

Barkema, H. G., Chen, X. P., George, G., Luo, Y., & Tsui, A. S. (2015). West meets East: New concepts and theories. Academy of Management Journal, 58(2), 460–479. https://doi.org/10.5465/amj.2015.4021

Baruch, Y., & Hall, D. T. (2004). The academic career: A model for future careers in other sectors? Journal of Vocational Behavior, 64(2), 241–262. https://doi.org/10.1016/j.jvb.2002.11.002

Bedeian, A. G., Van Fleet, D. D., & Hyman, H. H. I. I. I. (2007). Scientific achievement and editorial board membership. Organizational Research Methods, 12, 211–238. https://doi.org/10.1177/1094428107309312

Bhattacharjee, Y. (2011). Saudi universities offer cash in exchange for academic prestige. Science, 334, 1344–1345. https://doi.org/10.1126/science.334.6061.1344

Black, E. L., Stainbank, L., Elnathan, D., Giner, B., Gray, S. J., Meljem, S., de Rivera, E., Noguchi, A., Sellhorn, T., & Wood, D. A. (2017). Usage of journal rankings: An international perspective. Journal of International Accounting Research, 16(3), 1–15. https://doi.org/10.2308/jiar-10571

Bourdieu, P. (1977). Outline of a theory of practice. Cambridge University Press.

Bourdieu, P. (1988). Homo academicus. Stanford University Press.

Bourdieu, P. (1997). The forms of capital. In A. H. Halsey, H. Lauder, P. Brown, & A. S. Wells (Eds.), Education: Culture, economy, society (pp. 46–58). Oxford University Press.

Brooks, C., Fenton, E., Schopohl, L., & Walker, J. (2019). Why does research in finance have so little impact? Critical Perspectives on Accounting, 58, 24–52. https://doi.org/10.1016/j.cpa.2018.04.005

Brooks, C., & Schopohl, L. (2018). Topics and trends in finance research: What is published, who publishes it and what gets cited? The British Accounting Review, 50(6), 615–637. https://doi.org/10.1016/j.bar.2018.02.001

Buchheit, S., Collins, D., & Reitenga, A. (2002). A cross-discipline comparison of top-tier academic journal publication rates: 1997–1999. Journal of Accounting Education, 20(2), 123–130. https://doi.org/10.1016/s0748-5751(02)00003-9

Burgess, T. F., & Shaw, N. E. (2010). Editorial board membership of management and business journals: A social network analysis study of the Financial Times 40. British Journal of Management, 21(3), 627–648. https://doi.org/10.1111/j.1467-8551.2010.00701.x

Cabell’s International. (2021). Cabell’s Journalytics. https://www2.cabells.com/about-journalytics

Cavanaugh, T. A. (2006). Double-effect reasoning: Doing good and avoiding evil. Clarendon Press.

Cheah, P. Y., & Piasecki, J. (2022). Should peer reviewers be paid to review academic papers? The Lancet, 399(10335), 1601. https://doi.org/10.1016/S0140-6736(21)02804-X

Chressanthis, G. A., & Chressanthis, J. D. (1994). The relationship between manuscript submission fees and journal quality. The Serials Librarian, 24(1), 71–86. https://doi.org/10.1300/J123v24n01_05

Cislak, A., Formanowicz, M., & Saguy, T. (2018). Bias against research on gender bias. Scientometrics, 115, 189–200. https://doi.org/10.1007/s11192-018-2667-0

Cotton, C. (2013). Submission fees and response times in academic publishing. American Economic Review, 103(1), 501–509. https://doi.org/10.1257/aer.103.1.501

Currie, R. R., & Pandher, G. S. (2011). Finance journal rankings and tiers: An active scholar assessment methodology. Journal of Banking & Finance, 35(1), 7–20. https://doi.org/10.1016/j.jbankfin.2010.07.034

Davies, S. W., Putnam, H. M., Ainsworth, T., Baum, J. K., Bove, C. B., Crosby, S. C., Côté, I. M., Duplouy, A., Fulweiler, R. W., Griffin, A. J., Hanley, T. C., Hill, T., Humanes, A., Mangubhai, S., Metaxas, A., Parker, L. M., Rivera, H. E., Silbiger, N. J., Smith, N. S., … Bates, A. E. (2021). Promoting inclusive metrics of success and impact to dismantle a discriminatory reward system in science. PLoS Biology, 19(6), e3001282. https://doi.org/10.1371/journal.pbio.3001282

de Jong, A., & Veld, C. (2020). Does the ABDC journal classification create unequal opportunities for Accounting and Finance academics? Retrieved from SSRN 3565550

DeFond, M. L. (2016). Annual report and editorial commentary for The Accounting Review. The Accounting Review, 91(6), 1817–1839. https://doi.org/10.2308/accr-10507

Dey, E. L., Milem, J. F., & Berger, J. B. (1997). Changing patterns of publication productivity: Accumulative advantage or institutional isomorphism? Sociology of Education, 70(4), 308–323. https://doi.org/10.2307/2673269

Engers, M., & Gans, J. S. (1998). Why referees are not paid (enough). The American Economic Review, 88(5), 1341–1349.

Fatt, C., Ujum, E., & Ratnavelu, K. (2010). The structure of collaboration in the Journal of Finance. Scientometrics, 85(3), 849–860. https://doi.org/10.1007/s11192-010-0254-0

Fiset, J., & Oldford, E. (2021). Facing ethical dilemmas in industrial-organizational psychology: The case for the principle of double effect. Industrial and Organizational Psychology, 14(3), 350–352. https://doi.org/10.1017/iop.2021.70

Fogarty, T. J., & Zimmerman, A. (2019). Few are called, fewer are chosen: Elite reproduction in US academic accounting. Critical Perspectives on Accounting, 60, 1–17. https://doi.org/10.1016/j.cpa.2018.09.001

Fotaki, M. (2013). No woman is like a man (in academia): The masculine symbolic order and the unwanted female body. Organization Studies, 34(9), 1251–1275. https://doi.org/10.1177/0170840613483658

Fuyuno, I., & Cyranoski, D. (2006). Cash for papers: Putting a premium on publication. Nature, 441, 792. https://doi.org/10.1038/441792b

Fyfe, A., Coate, K., Curry, S., Lawson, S., Moxham, N., & Røstvik, C. M. (2017). Untangling academic publishing: A history of the relationship between commercial interests, academic prestige and the circulation of research. Discussion Paper. University of St Andrews. https://eprints.bbk.ac.uk/id/eprint/19148/

Gendron, Y. (2018). On the elusive nature of critical (accounting) research. Critical Perspectives on Accounting, 50, 1–12. https://doi.org/10.1016/j.cpa.2017.11.001

Green, R., O’Hara, M., & Schwert, G. W. (2002). Joint editorial. The Review of Financial Studies, 15(2), ii–iv.

Gumport, P. J. (2005). Graduate education and research: Interdependence and strain. In P. G. Altbach, R. O. Berdahl, & P. J. Gumport (Eds.), American higher education in the twenty-first century: Social, political, and economic challenges (2nd ed.). Johns Hopkins University Press.

Hair, J., Wood, B., & Sharland, A. (2019). Toward a better understanding of the Australian Business Deans Council (ABDC) list and its rankings. International Journal of Educational Management, 33(4), 644–650. https://doi.org/10.1108/IJEM-11-2017-0300

Herron, T. L., & Hall, T. W. (2004). Faculty perceptions of journals: Quality and publishing feasibility. Journal of Accounting Education, 22(3), 175–210. https://doi.org/10.1016/j.jaccedu.2004.09.002

Jensen, M. C., Fama, E. F., Long, J. B., Ruback, R. S., Smith, C. W., Schwert, G. W., & Warner, J. (1986). A note on submission fees. Journal of Financial Economics, 17, 1–2.

Journal of Finance. (2020). Submission to the Journal of Finance. Retrieved from https://afajof.org/submissions/

Kapareliotis, I., & Miliopoulou, G. Z. (2019). Gender bias in academia: An attempt to render the intangible tangible. In Diversity within diversity management (Vol. 22, pp. 247–271). Emerald Publishing Limited. https://doi.org/10.1108/S1877-636120190000022013

Karakaya, F. (2013). Publish or perish, or pay to publish. Decision Line, 44(2), 6–7.

Ketchen, D., & Ireland, R. (2010). Upon further review: A survey of the Academy of Management Journal’s editorial board. The Academy of Management Journal, 53(2), 208–217. https://doi.org/10.5465/amj.2010.49387412

King, D. W. (2007). The cost of journal publishing: A literature review and commentary. Learned Publishing, 20(2), 85–106. https://doi.org/10.1087/174148507X183551

Kuo, H. S. (2020). The business of double-effect: The ethics of bankruptcy protection and the principle of double-effect. Journal of Religion and Business Ethics, 4(1), 11.

Lee, T. (1995). Shaping the US academic accounting research profession: The American Accounting Association and the social construction of a professional elite. Critical Perspectives on Accounting, 6(3), 241–261. https://doi.org/10.1006/cpac.1995.1023

Lee, T. (1997). The editorial gatekeepers of the accounting academy. Accounting, Auditing & Accountability Journal, 10(1), 11–30.

Leslie, D. (2005). Are delays in academic publishing necessary? American Economic Review, 95(1), 407–413. https://doi.org/10.1257/0002828053828608

Llorens, A., Tzovara, A., Bellier, L., Bhaya-Grossman, I., Bidet-Caulet, A., Chang, W. K., Cross, Z. R., Dominguez-Faus, R., Flinker, A., Fonken, Y., Gorenstein, M. A., Holdgraf, C., Hoy, C. W., Ivanova, M. V., Jimenez, R. T., Jun, S., Kam, J. W. Y., Kidd, C., Marcelle, E., … Dronkers, N. F. (2021). Gender bias in academia: A lifetime problem that needs solutions. Neuron, 109(13), 2047–2074. https://doi.org/10.1016/j.neuron.2021.06.002

Lundine, J., Bourgeault, I. L., Clark, J., Heidari, S., & Balabanova, D. (2019). Gender bias in academia. The Lancet, 393(10173), 741–743. https://doi.org/10.1016/S0140-6736(19)30281-8

Matherly, M., & Shortridge, R. T. (2009). A pragmatic model to estimate journal quality in accounting. Journal of Accounting Education, 27(1), 14–29. https://doi.org/10.1016/j.jaccedu.2009.07.001

McGuigan, G. S., & Russell, R. D. (2008). The business of academic publishing: A strategic analysis of the academic journal publishing industry and its impact on the future of scholarly publishing. https://digitalcommons.unl.edu/ejasljournal/105

Messick, D. M., & Bazerman, M. H. (1996). Ethical leadership and the psychology of decision making. MIT Sloan Management Review, 37(2), 9.

Moizer, P. (2009). Publishing in accounting journals: A fair game? Accounting, Organizations and Society, 34(2), 285–304. https://doi.org/10.1016/j.aos.2008.08.003

Monge, R., & Hsieh, N. H. (2020). Recovering the logic of double effect for business: Intentions, proportionality, and impermissible harms. Business Ethics Quarterly, 30(3), 361–387. https://doi.org/10.1017/beq.2019.39

Myers, K. R., Tham, W. Y., Yin, Y., Cohodes, N., Thursby, J. G., Thursby, M. C., Schiffer, P., Walsh, J. T., Lakhani, K. R., & Wang, D. (2020). Unequal effects of the COVID-19 pandemic on scientists. Nature Human Behaviour, 4(9), 880–883. https://doi.org/10.1038/s41562-020-0921-y

Oler, D. K., Oler, M. J., Skousen, C. J., & Talakai, J. (2016). Has concentration in the top accounting journals changed over time? Accounting Horizons, 30(1), 63–78. https://doi.org/10.2308/acch-51271

Osterloh, M., & Frey, B. S. (2015). Ranking games. Evaluation Review, 39(1), 102–129. https://doi.org/10.1177/0193841x14524957

Saunders, C. (2005). Editor’s comments: Between a rock and a hard spot. MIS Quarterly. https://doi.org/10.2307/25148700

Schwert, G. W. (1993). The Journal of Financial Economics: A retrospective evaluation (1974–1991). Journal of Financial Economics, 33(3), 369–424. https://doi.org/10.1016/0304-405X(93)90012-Z

Schwert, G. W. (2020). The remarkable growth in financial economics, 1974–2020 (No. w28198). National Bureau of Economic Research.

Shkulipa, L. (2021). Evaluation of accounting journals by coverage of accounting topics in 2018–2019. Scientometrics, 126(9), 7251–7327. https://doi.org/10.1007/s11192-021-03875-5

Solomon, D. J., & Björk, B. C. (2012). Publication fees in open access publishing: Sources of funding and factors influencing choice of journal. Journal of the American Society for Information Science and Technology, 63(1), 98–107. https://doi.org/10.1002/asi.21660

Starbuck, W. H. (2005). How much better are the most-prestigious journals? The statistics of academic publication. Organization Science, 16(2), 180–200. https://doi.org/10.1287/orsc.1040.0107

Stulz, R. M. (1992). Report of the managing editor of the Journal of Finance for the year 1991. Journal of Finance, 47, 1235–1246.

Swanson, E. P., Wolfe, C. J., & Zardkoohi, A. (2007). Concentration in publishing at top-tier business journals: Evidence and potential explanations. Contemporary Accounting Research, 24(4), 1255–1289. https://doi.org/10.1506/car.24.4.9

Teixeira, E. K., & Oliveira, M. (2018). Editorial board interlocking in knowledge management and intellectual capital research field. Scientometrics, 117(3), 1853–1869. https://doi.org/10.1007/s11192-018-2937-x

Thatcher, S. M. B. (2021). Editor’s comments: International inclusion of diverse voices and global perspectives at AMR. Academy of Management Review, 46(1), 1–5. https://doi.org/10.5465/amr.2020.0480

Trieschmann, J. S., Dennis, A. R., Northcraft, G. B., & Niemi, A. W., Jr. (2000). Serving multiple constituencies in business schools: MBA program versus research performance. Academy of Management Journal, 43(6), 1130–1141. https://doi.org/10.5465/1556341

Tully, P. A. (2005). The doctrine of double effect and the question of constraints on business decisions. Journal of Business Ethics, 58(1–3), 51–63. https://doi.org/10.1007/s10551-005-1383-x

Vogel, G. (2011). Open access gains support; fees and journal quality deter submissions. Science, 331(6015), 273. https://doi.org/10.1126/science.331.6015.273-a

Walzer, M. (2006). Just and unjust wars: A moral argument with historical illustrations (4th ed.). Basic Books.

Williams, P. F., Jenkins, J. G., & Ingraham, L. (2006). The winnowing away of behavioral accounting research in the US: The process for anointing academic elites. Accounting, Organizations and Society, 31(8), 783–818.

Wood, D. A. (2016). Comparing the publication process in accounting, economics, finance, management, marketing, psychology, and the natural sciences. Accounting Horizons, 30(3), 341–361. https://doi.org/10.2308/acch-51443

World Bank. (2023). New World Bank country classifications by income level: 2022–2023. Retrieved from https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups

Zheng, Y., & Kaiser, H. M. (2016). Submission demand in core economics journals: A panel study. Economic Inquiry, 54(2), 1319–1338. https://doi.org/10.1111/ecin.12277

Acknowledgements

We are grateful to Brendan Bray for his quality research assistance.

Funding

There is no funding associated with this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors have no conflicts of interest or competing interests.

Appendices

Appendix 1: journal-level variable descriptions

Variable name | Variable description | Source |

|---|---|---|

Submission fee | The journal’s submission fee, in USD | Hand-collected from journal websites |

ABDC rank | Australian Business Deans Council journal ranking list transformed into a numerical score, where A* = 4, A = 3, B = 2, C = 1 | |

Time to review | Average time to review, in months | Cabell’s Journalytics |

Accept rate | Acceptance rate − the number of accepted articles divided by the number of submitted articles | Cabell’s Journalytics |

Num reviewers | Number of reviewers − The number of reviewers, internal + external | Cabell’s Journalytics |

Journal age | The age of the journal in 2019 based on its ISSN launch year | Cabell’s Journalytics |

Freq of issue | Frequency of publication per year | Cabell’s Journalytics |

Max length | Maximum length (pages). For journals with no maximum length, we assign a length a 55, which is the maximum stated length of sample journals | Cabell’s Journalytics |

Num articles | The average number of articles per issue during 2019, based on an article count then average from a sample of two issues within the year | Hand-collected from journal websites |

Appendix 2: affiliation-level variable descriptions

Variable name | Variable description & metric construction | Source |

|---|---|---|

Times research factor | Institution’s Times Higher Education Research Factor that considers an affiliated institution’s reputation for research excellence among its peers, based on the responses to Times’ annual Academic Reputation Survey. 20% of this factor is associated with an institution’s research income. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore, as more funding rich | |

Times ranking | Institution’s Times Higher Ed Ranking. A score of 10 is applied to affiliated institutions ranked between 1 and 100, … 1 to those ranked 500+, and 0 if not ranked. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore, as more funding rich | (See above) |

Times ranking, top 100 (dummy) | Dummy variable that takes on a value of 1 if the affiliated institution is listed in the top 100 of the Times Higher Education Ranking, and 0 if otherwise. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore, as more funding rich | (See above) |

QS ranking | QS World University Rankings, which is based on six metrics that captures university performance: Academic Reputation, Employer Reputation; Faculty/Student Ratio; Citations per faculty; International Faculty Ratio; and International Student Ratio. We use an echelon ranking system where a score of 10 is applied to affiliated institutions ranked between 1 and 50, … 1 to those ranked 451–500, and 0 if not ranked. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore, as more funding rich | https://www.topuniversities.com/university-rankings/world-university-rankings/2020 https://www.topuniversities.com/university-rankings/world-university-rankings/2019 https://www.topuniversities.com/university-rankings/world-university-rankings/2018 https://www.topuniversities.com/university-rankings/world-university-rankings/2017 https://www.topuniversities.com/university-rankings/world-university-rankings/2016 |

QS ranking, top 100 (dummy) | Dummy variable that takes on a value of 1 if the affiliated institution is listed in the top 100 of QS Ranking, and 0 if otherwise. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore, as more funding rich | (See above) |

National research intensity | Based on Nature Index’s top 10 research supportive countries by year. We apply a score of 10 if the institution is located in the country with the highest research intensity (U.S.) to 1 if the institution is located in the tenth most research-intensive country (Australia); otherwise, institutions are given a score of 0. We then average this score across authors on the article. We interpret higher observations as more research intensive and therefore as more funding rich |

Appendix 3: figures

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Oldford, E., Fiset, J. & Armenakyan, A. The marginalizing effect of journal submission fees in Accounting and Finance. Scientometrics 128, 4611–4650 (2023). https://doi.org/10.1007/s11192-023-04758-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11192-023-04758-7