Abstract

In the rapidly evolving landscape of open innovation, understanding the dynamics of learning is pivotal for corporate success. Yet, the constraints and thresholds inherent in the novel technology sourcing processes remain under-explored. We study 163 firms during the third wave of corporate venture capital activity characterized by the primary focus on innovation to investigate the effects of technology sourcing ambidexterity (the simultaneous pursuit of internal and external sources of innovative ideas) on corporate patenting and realized innovation. Acknowledging limitations of organizational learning, our results indicate the presence of the inverted U-shaped relationship between technology sourcing ambidexterity and innovation and suggest that beyond a certain threshold, increases in ambidexterity are detrimental to organizational learning and corporate innovation because boundary conditions to experimentation as a key element to learning arise. Such restrictions are alleviated by organizational slack, which enhances organizational abilities to orchestrate resources and take calculated risks to go beyond existing internal competencies.

Plain English Summary

Proponents of open innovation suggest that combining internal and external sources of innovative ideas often leads to success. We demonstrate that this may be true in some circumstances, but there is a learning threshold for organizations. We argue and demonstrate that this combination, known as technological sourcing ambidexterity, is only beneficial up to a certain point, beyond which further investments in the dual internal–external search for innovative ideas are detrimental for reasons that have to do with organizational learning. Moreover, for those same reasons, the benefits are most likely to be observed for firms with substantial organizational slack. Lean organizations that do not have much slack are less likely to gain strategically from investing in technology sourcing ambidexterity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Organizations are commonly viewed as innovation engines (Schumpeter, 1942), yet successful innovation often requires access to knowledge that is not available within organizational boundaries (Cohen & Levinthal, 1990). To access this knowledge, firms design sophisticated vehicles that allow identifying and capturing external innovative ideas. Corporate venture capital (CVC)—equity investments by incumbent firms in entrepreneurial ventures (Dushnitsky & Lenox, 2005)—is a popular strategic initiative that organizations employ to access external ideas, and the popularity of CVC programs has been on the rise.Footnote 1 The number of active CVC funds exceeds 1500, of which almost one-third are new (Corporate Finance Institute, 2020). Thus, it should be hardly surprising that inquiry into corporate venture capital has exploded over the years (Anokhin & Morgan, 2023; Benson & Ziedonis, 2009; Braune et al., 2021; Cabral et al., 2021; Chesbrough, 2002; Dushnitsky & Lenox, 2005; Dushnitsky & Shaver, 2009; Rossi et al., 2020; Wadhwa et al., 2016).

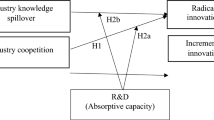

Yet, the question of the appropriate balance between internal and external sources of innovation posed by Gompers and Lerner some two decades ago (2000) remains elusive, and to date, the evidence and guidance provided by extant research are scant (Jeon & Maula, 2022; Saleh et al., 2023). Several researchers have hinted at the existence of the CVC-R&D interplay and provided (mostly well-grounded) speculations as to how the interaction between the two may look (Chesbrough & Socolof, 2000; Conti et al., 2013; Forman et al., 2008; Gompers & Lerner, 2000). Unfortunately, these speculations are not in agreement: while some suggest that the corporation has to explicitly choose between external and internal research (Forman et al., 2008; Hellmann, 2002), others maintain that the relationship is rather complementary (Braune et al., 2021; Chesbrough & Tucci, 2004; Conti et al., 2013; Drover et al., 2017). Rothaermel and Alexandre (2009) identify the ability of a corporation to simultaneously balance internal and external sources of innovative ideas as technology sourcing ambidexterity and contend that managing this trade-off is a nontrivial organizational challenge (p. 759). A recent review by Jean and Maula (2022) explicates such tensions and threats arising from CVC programs leading to paradoxical phenomena based on contradictory goals of multiple stakeholders’ expectations concerning innovation efforts. The challenge of making innovation ambidexterity manageable is often observed, and many organizations fail to strike the balance between the two sources of innovative ideas right (Saleh et al., 2023). Research still lacks an understanding of the strategic effects of technology sourcing ambidexterity and the mechanism that enables more benefits to corporate innovation through knowledge dissemination and implementation (Jeon & Maula, 2022; Sirén et al., 2017; Van de Vrande, 2013; Yuan et al., 2021).

To provide insights into this gap, we investigate the effect of technology sourcing ambidexterity on corporate innovation and explore the limitations of a firm’s learning capabilities through the lens of organizational learning. We propose the concept of organizational learning thresholds to explain and delineate the boundaries imposed by the agency theory (Eisenhardt, 1989) and resource distribution (Nason et al., 2015; Pfeffer & Salancik, 2015; Saleh et al., 2023) constraints. We suggest that the ultimate outcome of technology sourcing ambidexterity for corporate innovation is contingent on the organizations’ ability to experiment with more distant and unfamiliar ideas given the organization’s internal knowledge (Onal Vural et al., 2013; Piezunka & Dahlander, 2015). We argue that such capability can be increased with organizational slack (Bourgeois, 1981; Voss et al., 2008) and will thrive in a more prosperous environment where more resources are available for taking controlled risk projects at the CVC-R&D interplay (Einola et al., 2017; Saleh et al., 2023; Sirén et al., 2017).

We study organizational learning thresholds in the CVC-R&D interplay during a period of rapid CVC investment growth when organizations tried adopting technology sourcing ambidexterity for corporate innovation. Specifically, our research context is the third wave of CVC activity in the USA that has ended with the dot.com bubble implosion. This wave is typically placed in the period from the late 1990s to early 2000s and was the last instance in the recorded CVC history where the vast majority of corporate investors were targeting exclusively strategic benefits with their funds. As such, it is qualitatively similar to the current state of the CVC industry. Of those benefits, learning and innovation were the dominant ones (Ernst & Young, 2002). Accordingly, this context represents the ideal laboratory for the study of the effects of technology sourcing ambidexterity on firm innovation, promising strong implications for today’s challenges in mastering the open innovation paradigm.

We provide two main contributions to the literature on technology sourcing ambidexterity and to the literature on organizational learning. First, while prior research has focused on the knowledge creation view (Levinthal & March, 1993; March, 1991) in describing the complementarity of internal and external sourcing approaches (Guan & Liu, 2016; West & Bogers, 2014), our study contributes to such view by explaining organizational learning limitations and analyzing whether and how a dual approach limits effectiveness of the internal research efforts. Such effectiveness is triggered through competition that arises between internal R&D and the external route to corporate innovation, which we explain using the agency theory (Eisenhardt, 1989) together with a resource dependence perspective on how resources are distributed internally given the competition among various stakeholders (Nason et al., 2015; Pfeffer & Salancik, 2015; Saleh et al., 2023). While such competition motivates organizational members to improve their internal research efforts, excessive attention to innovative ideas from beyond corporate boundaries can turn into a liability, because costs and efforts associated with breaking narrowness to familiar knowledge exceed a firm’s potential to take risky decisions and the willingness to run experiments with uncertain outcomes (Onal Vural et al., 2013; Piezunka & Dahlander, 2015). In that, our study identifies contingencies to organizational learning in acknowledging the mechanisms of resource commitments to calculated risk experimentation when organizations face different degrees of technological sourcing ambidexterity. Although a substantial body of literature exists on organizational learning, there is a limited specific focus on the identification of optimal learning thresholds—those critical points or levels where significant learning or transformative changes become challenging. As such our study is also distinct from an absorptive capacity view (recognizing, assimilating, and applying external knowledge; Cohen & Levinthal, 1990), because this study implies how firms manage and allocate resources to foster the environment conducive to experimentation with respect to internal and external sources of knowledge.

Second, prior research has defined slack as a dynamic quantity of resource surpluses that are in excess of what a firm currently needs and that can be easily redeployed (Bradley et al., 2011; George, 2005; Mishina et al., 2004; Nohria & Gulati, 1996; Vanacker et al., 2013). It is thus considered a key variable in explaining organizational learning outcomes (Argote et al., 2021). This study contributes to understanding the CVC-R&D interplay—the balancing of technological sourcing ambidexterity—by identifying organizational slack as an enabling moderating factor that allows for the key organizational process of experimentation to take place. That is, we go beyond theorizing about slack as enabling distant search (Argote et al., 2021; Levinthal & March, 1981) and theorize that slack moderates the curvilinear relationship between technological sourcing ambidexterity and corporate innovation by decreasing management’s fear of uncertain outcomes from risky novel technology projects, which would be more sever in resource-constrained environments. We discuss that increasing resource discretion allows for experimentation that fosters forming a shared understanding given the distributed cognition in the intra- and inter-relational organizational context when interpreting information (Einola et al., 2017; Maitlis & Christianson, 2014; Secchi & Cowley, 2021; Snihur & Clarysse, 2022). For instance, we find that organizations benefit more when engaging with early-stage startups before they have committed to a specific product prototype, which can increase retention over creative discourses during technological developments. Therefore, our research sheds light on how organizations can optimize their learning efforts and navigate transformative changes more effectively.

2 Theory and hypothesis development

2.1 Hierarchical supply of innovation: an overview

To ensure above-average returns, corporations strive to innovate (Zahra, 1993), and multiple architectures of the innovative function have been considered over the years (e.g., West & Bogers, 2014; Xiao et al., 2021). Traditionally, most firms relied on the so-called closed innovation philosophy with an internal R&D unit charged with developing and introducing new combinations (Conti et al., 2013; Forman et al., 2008; Kogut & Zander, 1992; Prügl & Spitzley, 2021). Interestingly, this traditional approach to innovation lends itself to agency theory-inspired analysis whereby the R&D unit can be seen as an agent of corporate management (principal) in charge of technical advancement. As is often the case, agents do not necessarily act in principals’ best interests (Eisenhardt, 1989; Jensen & Meckling, 1976). The growing acceptance of the open innovation paradigm, in turn, provides a counterbalance to the de facto monopoly of internal R&D on producing corporate innovation (Enkel et al., 2009; Gassmann et al., 2010; West & Bogers, 2014) and thus may help align the agent’s behavior with the principal’s interests increasing corporate innovativeness, although open innovation is not without limitations either (e.g., Audretsch & Belitski, 2023; Dabić et al., 2023). That is, developing and exercising technology sourcing ambidexterity may be seen as a desired architectural decision on the part of the corporation in question.

Importantly, there is a danger in equating high internal R&D spending with high innovativeness, and bloating the R&D budget in isolation from other sources of innovative ideas may be unwise. Zahra (1996) argued that high R&D spending may simply indicate (1) internal inefficiencies and (2) high agency costs rather than aggressive risk-taking attitude or successful innovative activities. Challenging the internal monopoly on innovation by introducing CVC may prove beneficial. Without external challengers, the opportunistic behavior of the R&D unit may manifest through adverse selection (e.g., the misrepresentation of its capabilities), moral hazard (e.g., shirking due to the unobservability of its actions by the principal), and hold-up (e.g., renegotiating the terms after corporate investments into highly specialized assets) (Aghion & Tirole, 1994). Specifically, adverse selection may become an issue if the unit starts the project beyond its area of expertise. Moral hazard is a typical problem whenever the agent’s actions are not verifiable, which is often the case with highly complicated research and development projects; for this reason, rewarding the observable outcomes rather than non-verifiable behavior may be a solution (Eisenhardt, 1985). Hold-up problems occur when, apparently, unsuccessful projects are not deprived of the corporate funding even if no useful results are achieved despite significant corporate resource spending.

The presence of the CVC alternative to the purely hierarchical supply of innovation is likely to reduce the strength of such agency concerns that lead to failure in organizational learning processes. However, while establishing a CVC program may assist in addressing at least some of these concerns, such an approach introduces other types of challenges, also related to sensemaking and learning restrictions. Sensemaking is particularly relevant in the presence of ambiguity and uncertainty, that is, “the process through which individuals work to understand novel, unexpected, or confusing events” (Maitlis & Christianson, 2014, p. 58). Particularly, the codification of knowledge across organizational units (such as R&D and CVC) is difficult and subject to limitations depending on a firm’s disposition to their organizational reality (Radziwon et al., 2022; Titus et al., 2020). In fact, the individual understandings of organizational members from different units about ambiguous outcomes (such as on which technology to bet) are reflective of the constraints to learning within an organization (Boland et al., 1994).

Below, we integrate the traditional arguments of technology sourcing ambidexterity from an agency view with the restrictions elaborated upon in the resource dependence literature where managing the allocation of resources is a key element to organizational learning (e.g., McGrath, 2001; Saleh et al, 2023). Based on these, we describe the complexity of technology sourcing ambidexterity for corporate innovation and argue why slack resources are a necessity to alleviate boundaries to an organizational learning capability when facing ambidexterity.

2.2 Technology sourcing ambidexterity and corporate innovation

Through making equity investments in new technological startups and then observing their performance, corporate management creates a benchmark in terms of “innovation-per-dollar-of-corporate-funds” against which internal R&D unit performance may be evaluated. The result is increased R&D unit’s productivity and improved quality of research output, which is the economic effect of the technology sourcing ambidexterity. CVC activity thus mitigates (to an extent) shirking intentions such as the principal-agent concerns described above and creates a powerful incentive for the R&D unit to act more efficiently.

Next to the induced competition between external CVC and internal R&D activity that increases efficiency within the organization, technology sourcing ambidexterity provides other learning effects for the corporation in question. While information may be “sticky” (von Hippel, 1994), it is very rare that it could be kept completely intact by and insulated from the outer world. Regardless of the environmental tenacity—or the strength of the industry appropriability regime (Levin et al., 1987; Shane, 2001)—sooner or later, knowledge tends to diffuse. In the case of CVC investments, it is likely to happen sooner rather than later, which is why most corporations actively facilitate the spillover and seek opportunities to absorb and integrate the supported ventures’ know-how (Keil et al., 2016). Ample evidence indicates why more effective learning takes place with technology sourcing ambidexterity. For instance, often incumbents take seats on their investees’ boards and thus could observe and learn from startups, with boardrooms serving as a de facto forum for idea exchange (Anokhin et al., 2011a). Other anecdotal examples include the study of Lucent’s Bell Labs, where Chesbrough (2000) documents the organizational learning processes between external CVC and internal R&D as follows: “The …[CVC] also appears to be achieving its goal of serving as an impetus for Bell Labs technologies to move off of the shelf… [CVC’s] early interest in technologies has caused some Bell Labs technologies to move directly into the business groups that might otherwise have been overlooked by those businesses” (p. 44–45). The evidence of the positive effect of CVC on corporate innovation (Dushnitsky & Lenox, 2005, 2006; Ma, 2020; Pinkow & Iversen, 2020) provides an irrefutable evidence for the learning effect of technology sourcing ambidexterity.

At the same time, research indicates that the benefits such ambidexterity provides are necessarily counterbalanced (Rothaermel & Alexandre, 2009). Specifically, while the initial introduction of external technologies into the sourcing mix appears to improve innovative outcomes (Sørensen and Stuart, 2000) and may prevent the firm’s offerings from obsolescence, as the number of sources considered by the firm for external search of new knowledge increases, the benefits to growing technology sourcing ambidexterity diminish (Laursen & Salter, 2006). Fundamentally, this represents a challenge in learning due to the inability of managing resources appropriately for taking calculated risks to go beyond existing internal competencies, which poses constraints on organizational learning processes (McGrath, 2001). Excessive reliance on external technologies may presumably lead to the loss of competence to learn by the firm in question (Anokhin, 2006; Malerba, 1985). The more a firm sources its technology from external sources, the more likely it is that new combinations are placed beyond the boundaries of the firm’s immediate expertise in terms of technology and markets. Such distance to internal knowledge requires increased efforts for organizational members to go beyond the boundaries of their adopted technological competencies. It is rarely discussed that the endeavor to navigate technology sourcing ambidexterity requires an intense management of resource allocation (Saleh et al., 2023). This task is costly and further complicated by the constraints of organizational learning, as organizational inertia driven by firm age and size often hinders organizational learning progress (Hannan & Freeman, 1984; Sirén et al., 2017). Consequently, more labor-intensive learning opportunities are rarely afforded due to limited flexibility and specifically resource constraints.

There are also other learning limitations. Importantly, increasing support of CVC-generated ideas by investing in more ventures with potentially useful insights puts undue stress on the firm’s resource management processes that are key to organizational learning. Inasmuch as firm resources are limited, allocating a substantial share of the corporate budget to externally sourced technologies may deprive the firm from resources needed to support their current core competencies and maintain learning from external investments. Increasing external search through CVC activity does not match the organizations’ ability to experiment and explore with more ideas that are distant from and unfamiliar to internal knowledge (Onal Vural et al., 2013; Piezunka & Dahlander, 2015). Such experimentation with external ideas from CVC investments requires new and, to this point, unmatched efforts and resources to allow for the demonstrability and test of new knowledge (Argote et al., 2021). Meaningful integration of external ideas with the internal R&D may necessitate additional hiring and training of the qualified personnel by the corporation, which—even if resource constraints are minimal—will slow down absorption and integration of external technologies because outcomes of experimentation need to be interpreted with new frames of references (Sirén et al., 2017). Such new requirements often remain unmatched and—at the same time—would need to spread over the whole organization to trigger change. Hence, the notion of time compression diseconomies widely acknowledged by the extant literature (Hawk and Pacheco-de-Almeida, 2018; Srikanth et al., 2021; García-Canal et al., 2002) applies to the technology sourcing ambidexterity space as well. This represents a strong boundary condition to leaning from technology sourcing ambidexterity limiting how organizations can realize innovation.

It thus appears that successful technology sourcing ambidexterity implies a particular kind of balance between external and internal sources of technology: Internal R&D should be augmented by only a limited number of CVC investments to improve effective organizational learning. Intensifying ambidexterity beyond this threshold is likely to pose thresholds to learning that are difficult to overcome and are detrimental to firm performance. Stated formally,

-

Hypothesis 1. There exists an inverted U-shaped relationship between technology sourcing ambidexterity and corporate innovation.

2.3 Organizational slack as a contextual contingency

When organizational actors try to combine internal and external sources of new technologies, they effectively operate with higher uncertainty about the potential outcome of such combinations (Michel, 2007). In other words, technology sourcing ambidexterity creates situations for organizational actors that are both challenging and opportunistic, requiring them to seamlessly navigate between the exploration of novel technological frontiers and the exploitation of established technological competencies (March, 1991). From a resource dependence perspective, such situations would require management to allocate necessary resources at discretion of organizational members in order for them to take calculated risks, that is, experimentation with new ideas from novel technologies given their boundaries of technological competencies (Hornsby et al., 2002). Prior research has described how firms enable such experimentation through liquid assets, that is, financial slack or unabsorbed slack—the cushion of excess liquid resources that may be used in a discretionary manner (Bourgeois, 1981).

While scholars imply that slack facilitates innovation regardless of the hierarchical arrangements chosen to pursue a particular technology (Anokhin et al., 2011b; Cheng & Kesner, 1997; Lawson, 2001), our argumentation focuses on how slack allows for experimentation with novel projects and its concertation at the organizational meso level creating new competencies. In the simplest of cases, slack may determine strategic capital outlays: When firms have extra resources, they might spend more on experimentation, matching increased CVC activity with R&D; when slack is low, they miss out on such opportunities (Chesbrough & Tucci, 2004). Therefore, organizational slack is reflective of the organization’s capability to increase cooperative action in formal structures (such as the R&D and CVC interplay) with increased resource support. In higher slack environments, individuals can take more calculated risk decisions, that is, experiments that may or may not be successful.

On the contrary, low slack limits capabilities for taking calculated risks in experimentation, because resource stringency drives the fear of unsuccessful experimentation making firms to rely more on existing competences and excessive risk management (Magnusson et al., 2020; Sirén et al., 2017). Projects that rely on established competencies are less risky than those that would require establishing new competencies. In fact, learning from technology sourcing ambidexterity in low-slack environments might by suppressed altogether, because there is no room for experimentation, which makes calculated risk-taking opportunities scarce. Concerting experimentation with novel ideas sourced from technology sourcing ambidexterity at the CVC-R&D interplay is difficult to carry out across and beyond the organizational dyads if there are no unused resource surpluses.

This alternative explanation for the use of slack resources leads us to argue that the positive effect of technology sourcing ambidexterity is likely to be more pronounced, and the levels of innovation it supports, higher, when organizational slack is abundant, and is likely to be altogether absent in situations where organizational slack is low. Stated formally,

-

Hypothesis 2. Organizational slack moderates the effect of technology sourcing ambidexterity on corporate innovation such that the inverted U-shaped relationship is more likely to be observed when slack is high.

3 Method

3.1 Data

The corporate venture capital industry is notorious for its cyclical nature, and there are substantial qualitative differences between the waves of captive VC investments (Gompers, 2002). In this study, we focus on the third wave of CVC activity, which, as explained above, represents the ideal laboratory for the study of the effects of technology sourcing ambidexterity on corporate innovation, promising strong implications for today’s challenges in mastering the open innovation paradigm where strategic motivations are dominant again.

Specifically, we study the effects of technological sourcing ambidexterity on corporate innovation in the sample of public firms engaged in CVC activity over the period from 1998 to 2001 with the innovation metrics extending to 2003 to incorporate the forward temporal lag into our models. The CVC data comes from two major sources. The primary source of the CVC investment information is the VentureXpert database used widely in prior research (Kim et al., 2019; Ma, 2020; Wei et al., 2022; Yang et al., 2014). Despite its popularity, it is reported to have a significant bias in that it may double-count individual deals, especially in more mature firms. In fact, the database is said to report 28% more investment rounds than actually occurred (Lerner, 1994). The problems are likely to be more severe in later rounds, which typically have more investors (Lerner, 1995). To address this problem, we aggregate the VentureXpert numbers to the annual level. This way, even if a particular single round has been recorded twice, the annual aggregation minimizes such occurrences. We also employ an alternative data source on CVC, Corporate Venturing Directory and Yearbook by AssetAlternatives, to cross-check the investments reported by VentureXpert and their properties. The Yearbook has been used in corporate venture capital research before as well (Baierl et al., 2016; Chesbrough & Tucci, 2004; Gompers, 2002; Hill & Birkinshaw, 2014). Galbraith (2001) makes a strong case for the use of this database in CVC research. Each database contains information on deals not included in the other source, so combining both ensures the most comprehensive account of the CVC activity during that period.

We merge the CVC data with the annual firm-level accounting and financial data from Compustat. Since the data reported in Compustat relate to financial and not calendar years, we do not use annual aggregates reported by VentureXpert and the Yearbook directly but rather look at the exact dates of particular deals to match them to appropriate financial years. Thus, for a corporation with a financial year starting in March and ending in February, we would consider a CVC investment made in January of 2000 as a part of year 1999. We follow the same procedure to align patenting data by the USPTO with the Compustat information. The merger of all data sources yields a sample of 163 firms that engaged in corporate venture capital investments during the years 1998 to 2001, and their patenting patterns through 2003. It includes reputable corporations that are known for their attention to innovation, such as Alcatel, DaimlerChrysler, Ericsson, Ford Motor Company, Corning, Johnson & Johnson, Matsushita, Medtronic, 3 M, Motorola, Microsoft, Nokia, Nortel Networks, Procter & Gamble, Philips, Sony, Sun Microsystems, Texas Instruments, Xerox, and many others.

3.2 Variables

3.2.1 Dependent variable

We operationalize corporate innovation with the number of patent applications filed by the corporation in question in a given financial year. This measure of innovation has been used widely in the prior research (Anokhin et al., 2011a). The moment that the corporation applies for a patent typically coincides with the moment it has identified a technology believed to have strategic value, thus indicating the instance of learning potentially leading to new products, services, or processes. To ensure normality, the variable is log-transformed. To allow for the effects of technology sourcing ambidexterity to manifest fully, we consider this variable with a 2-year forward temporal lag. As a robustness check, we also employ an alternative measure of innovation, the so-called realized innovation, which represents the total factor productivity change that a corporation experienced relative to the previous year. This variable is created with the help of the Malmquist productivity index decomposition (Malmquist, 1953) and reflects the de facto improvements in resource allocation efficiency over time. It has been used in conjunction with patent applications as a measure of innovation in the prior research (see, e.g., Anokhin & Wincent, 2012), and we follow this tradition. Unlike patents that indicate the potential for future innovation, this measure captures innovation that has actually taken place vis-à-vis the previous year. As with patent applications, we consider this variable with a 2-year forward temporal lag.

3.2.2 Independent, moderator, and control variables

We operationalize technology sourcing ambidexterity as combined ambidexterity (Cao et al., 2009). In prior research, ambidexterity is often captured with a product of exploration and exploitation indicators (Gibson and Birkinshaw, 2004; He and Wong, 2004). In the like fashion, we proxy technology sourcing ambidexterity with a product of external and internal sourcing measures. Following extant research (Sahaym et al., 2010), we proxy internal sourcing of technology with R&D intensity defined as the ratio of R&D expenses to sales. We proxy external sourcing of technology with CVC intensity, defined as the number of distinct ventures the corporation supports in a given year via CVC. Prior research maintains that there is no relation between the size of the CVC investment and strategic benefits to the corporation (Reaume, 2003). Rather, investment size merely depends on the investment round, with later rounds implying higher investments. Technology sourcing ambidexterity is thus operationalized as a product of R&D intensity and CVC intensity and captures their joint impact.

Following Singh (1986), we operationalize organizational slack as the current ratio or the ability of the firm to meet current obligations (current assets divided by current liabilities). This operationalization of slack is common for the CVC research (Anokhin et al., 2022; Chesbrough & Tucci, 2004). Fundamentally, it reflects the magnitude of the cushion of resources that the corporation has available to employ if and when the need arises, such as when taking calculated risks with respect to experimentation.

We also included a number of controls. Because organizational patenting clearly depends on the resource endowment of the corporation, we control for organizational size as a log of sales (Dushnitsky & Lenox, 2005). Simply put, larger corporations are more likely to have extensive patent portfolios regardless of their success at harvesting external ideas, and we needed to partial out this effect. Moreover, the ability of the corporation to learn from its investments is a function of distance between the knowledge base of the firm and its investees, as well as the new venture’s readiness and willingness to adjust its chosen technological approach. This distance is substantially harder to ascertain for early-stage ventures whose technological trajectory is still subject to pivoting (e.g., Riyanto & Schwienbacher, 2006). Importantly, however, the corporate investor is more likely to steer the trajectories of the startups it supports to ensure better alignment with its own capabilities when ventures are young. To partial out this unique variance, we controlled for the preferred investment round of the CVC investor with an early-stage dummy sourced from the Corporate Venturing Directory and Yearbook.Footnote 2 This preference was dichotomized into relatively risky (seed and early stages) and relatively non-risky (extension, later, and balanced stages) investments. A similar approach has been employed by the prior research (Anokhin et al., 2011a; Fredriksen & Klofsten, 2001).

CVC investments are concentrated among a relatively small number of industries. Because the level of the CVC activity in the industry creates pressure to innovate (Zajac et al., 1991), we controlled for industry effects with a set of industry dummies. Finally, there is a substantial variance in the CVC activity over the years. To account for it, we created a set of year dummies.

Descriptive statistics and correlations for the variable included into our analysis are presented in Table 1. As can be seen from the table, correlations are within conventional limits such that the threat of multicollinearity is minimal. In fact, the largest VIF is 2.38, well below the cut-off value of 10. Still, following the advice by Marquardt (1980), predictor variables were standardized to avoid non-essential ill-conditioning.

3.3 Models and estimation

Given the panel nature of our data, we needed to employ a proper econometric technique to ensure valid statistical inference. Specifically, we utilize non-parametric Driscoll-Kraay standard errors that are robust to cross-sectional and temporal dependence (Hoechle, 2007). Given the 2-year forward temporal lag, we adopted with our dependent variable, and we have incorporated autocorrelation of the second order into our models. Importantly, the finite-sample performance of the chosen estimator is said to dominate that of common alternatives even when the time dimension is short (Driscoll & Kraay, 1998, p. 550), which is the case in our data. As such, the method we employ is robust and conservative.

In all, we report seven distinct models. Models 1 through 5 utilize patent applications as a dependent variable whereas models 6 through 7 rely on realized innovation as a proxy for corporate innovation. Model 1 is a baseline comparison model that includes control variables as predictors of corporate innovation. Model 2 adds simple terms for CVC intensity and R&D intensity to the set of predictors to establish comparability and consistency of our results with those previously established in the CVC literature. Model 3 adds linear and quadratic effects of technology sourcing ambidexterity to the set of predictors to test Hypothesis 1. Models 4 and 5 retest Model 3 separately in high- and low-slack environments to provide insights into Hypothesis 2. Models 6 and 7 recreate Models 4 and 5 using realized innovation as an indicator of corporate innovation and thus also test Hypothesis 2.

At the initial analysis stages, we considered retaining the full sample for our analysis of Hypothesis 2 while adding interaction terms for the joint effect of linear and quadratic technological sourcing ambidexterity and organizational slack. The results obtained via that approach are in line with those reported in Models 4 and 5. Yet, given the way that technological sourcing ambidexterity was operationalized in this study (as a product of R&D and CVC), doing so would require us to test and interpret a three-way interaction, which, apart from its cumbersome nature, may be misleading in that it imposes specific distributional features of the residual term across subsamples (Kam & Franzese, 2005). Extant research suggests that for higher-order interactions, median split sample analysis provides a more adequate way of understanding the nature of the interaction within subgroups ((Dawson & Richter, 2006). We follow this suggestion in this paper. Table 2 summarizes the results of our models.

4 Results

All models demonstrate acceptable fit as measured by significant F-statistics. Model 1 indicates that organizational slack (β = 0.34, p < 0.001) and size (β = 1.24, p < 0.001) are positively significantly related to corporate innovation, as is the preference of the corporation to invest in early-stage ventures (β = 0.21, p < 0.001). These effects remain consistent in terms of sign, size, and significance across all the models. It thus appears that firms with abundant resources to effectuate learning that demonstrate preference for investing in early-stage ventures whose technological trajectory they may affect are advantageously positioned to innovate.

Model 2 suggests that in line with the prior research, CVC intensity is positively related to corporate innovation (β = 0.13, p < 0.001), as is R&D intensity (β = 0.52, p < 0.001). That is, both internal and external sources of innovative ideas are beneficial to corporations. Thus, external sourcing of technological ideas is indeed likely to be instrumental in effectuating innovative outcomes for corporations, which brings the need to understand the proper balance between internal and external innovation foci to the fore.

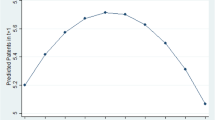

Model 3 demonstrates that in line with our conceptual development, technology sourcing ambidexterity has an inverted U-shaped relationship with corporate innovation (β = − 0.34, p < 0.001), thus lending strong support to Hypothesis 1. That is, initially, the effect of technology sourcing ambidexterity (while controlling for the direct effects of CVC intensity and R&D intensity) is indeed positive, yet the returns to ambidexterity are diminishing, and in fact, they turn negative after a certain threshold. This is in stark contrast with the arguments in support of the open innovation agenda and suggests that caution needs to be exercised when considering the depth of one’s immersion into external sources of innovative ideas.

To understand what drives the observed pattern, we analyzed the proposed relationship in high- and low-slack environments by performing the median split of our sample with respect to organizational slack. Model 4 presents the results for corporations that have high organizational slack, whereas Model 5 documents the results for low-slack corporations. As can be seen, for corporations with high availability of organizational slack, the relationship between sourcing ambidexterity and corporate innovation follows the inverted U-shaped curve (β = − 0.18, p < 0.05). The same pattern is observed for the alternative dependent variable—realized innovation—as documented in Model 6 (β = − 0.04, p < 0.05). At the same time, for corporations with low organizational slack, the quadratic relationship fails to attain statistical significance across both Model 5 and Model 7. That is, the overall curvilinear relationship observed for the full sample is driven by the population of high-slack firms and does not hold for firms with low slack. In fact, for low-slack firms, the relationship appears to follow the negative linear form reaching statistical significance when realized innovation is used as a dependent variable (β = − 0.04, p < 0.001) in Model 7 but failing to reach the significance although assuming the negative sign when predicting patent applications in Model 5 (β = − 0.13, n.s.). Taken together, our results indicate that, indeed, the relationship proposed in Hypothesis 1 is particularly pronounced in the sample of high-slack corporations, thus lending support to Hypothesis 2.

To ease the interpretation of our results, we plotted the significant effects of ambidexterity on corporate innovation in Fig. 1. As is evident from the figure, the curvilinear relationship between technology sourcing ambidexterity and corporate innovation—regardless of the measure of innovation chosen—is driven by corporations with high levels of organizational slack. Moreover, when it comes to realized innovation—that is, the de facto improvement in resource allocation efficiency that corporations obtain from pursuing ambidexterity—incumbents with ample slack may clearly outperform those that are limited with respect to available resources that they can deploy towards different strategic ends at will. That said, the decreasing returns to ambidexterity past a certain threshold suggest that decision-makers should not escalate their commitment to sourcing ambidexterity blindly as such moves may turn counterproductive. In the high-slack group of corporations, a one standard deviation from the optimal level of ambidexterity by incumbents results in a drop in patent application rates by over 8% of the median patent application level, thus indicating a fairly strong effect that technology sourcing ambidexterity has on corporate innovation.

5 Post hoc analysis: the role of firm size and preferred investment stage

To probe the matter of technology sourcing ambidexterity further, we have conducted an additional investigation of the effects of corporate characteristics as well as their investees on the ambidexterity-innovation outcomes. Specifically, we tested whether the relationship between ambidexterity and innovation is moderated by the firm size and preferred investment stage.

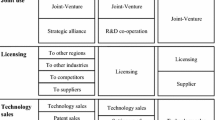

With respect to the preferred investment stage, we split the sample into firms that prefer to invest in early-stage ventures and those that prefer to invest in later-staged ones. The first group involved incumbents who invested in seed and early-stage startups, whereas firms in the second group invested in extension and later stages. The key distinction between the two groups is that the later-stage investees have at least a working prototype of the product/service that they offered, which unequivocally demonstrates technological feasibility and, in some cases, market acceptance. By the same token, however, it may be harder for corporate investors to affect the technological trajectory of later-stage ventures.

The results (documented in Models 1 and 2 in Table 3) suggest that the inverted U-shaped relationship between technology sourcing ambidexterity squared and firm innovation is only observed for companies that choose to invest in later-stage ventures (β = − 0.33, p < 0.001). For incumbents that prefer to support early-stage investees, the relationship between ambidexterity and corporate innovation is linear positive (β = 0.65, p < 0.01). It should be noted that late-stage investors outnumber early-stage investors by a factor of 5:1, so, as expected, for the majority of incumbents, the relationship mirrors what was seen in the full sample (Model 3 in Table 2).

With respect to the organizational size, we chose to split the sample along the median and conducted the analysis separately in two groups. It turns out that the inverted U-shaped relationship holds very strongly in the subsample of larger companies (β = − 0.41, p < 0.001) but fails to reach statistical significance within the smaller incumbent subsample, although the signs of the coefficients mirror those observed for the larger firms.

In all cases, the results reported for the post hoc analyses are only observed for patent applications as the dependent variable but cannot be established when looking at realized innovation. This deserves further attention in future research.

6 Discussion

Until now, scholarly investigation of ambidexterity in the context of CVC has primarily concerned itself with the interplay of exploration and exploitation (He & Wong, 2004; Hill & Birkinshaw, 2014). This study is among the first to extend the concept of ambidexterity to balancing internal and external sources of technological ideas. We propose that aligning two sources of innovative ideas is a careful balancing act and demonstrate that this relationship is non-linear in nature, in line with Rothaermel and Alexandre (2009). We test the idea of learning thresholds where learning becomes difficult. That is, beyond a certain threshold, further investments into increasing ambidexterity may be detrimental to corporate innovation. We highlight that such limits are rooted in the organizational experimentation capability and show how the abundance of organizational slack alleviates such shortcomings but also demonstrate how the scarcity of organizational slack can lead to failure in utilizing external technological ideas (Argote et al., 2021; Wang et al., 2020). Our results are fully in line with our conceptual development.

The implications for the decision-makers are crystal clear. While limited engagement in distant search via external sources of innovative ideas is indeed beneficial, overreliance on such ideas is detrimental to corporate innovation and may result in failed attempts to stimulate organizational learning. Such threshold levels exist because organizations experience limitations to their resource management capability. These limitations are rooted in an inability to take more risky experimentation projects (the fear to take on those in resource-scarce or competitive environments) introduced in this study in the context of ambidexterity, which has been absent in the prior literature on the CVC-R&D interplay.

While we acknowledge that prior literature on resource buffers such as organizational slack provided evidence related to search and organizational change (Chiu & Liaw, 2009; Woschke et al., 2017), it is important to note that in this study, we conceptualize slack as the organizational capability to increase experimentation (Teirlinck, 2020) in formal structures and across organizational units such as the R&D and CVC interplay. As such, this study is also distinct from prior studies that conceptualized an organizational slack-firm performance link with a U-shaped relationship as we focus on innovation outcomes (Chiu & Liaw, 2009). We therefore follow calls in the recent research that point to the lack of knowledge about slack specifically as a contextual factor and its relation to knowledge creation (Argote et al., 2021). The seminal work of Levinthal and March has discussed how higher levels of slack lead to so-called slack search in more distant areas from the corporations’ core activities (Levinthal & March, 1981), which has been elaborated upon in prior studies (Iyer & Miller, 2008), and found to promote open innovation search (Wang et al., 2017). In the organizational slack-innovation relationship, we viewed slack as an internal organizational capability that allows individuals to gain knowledge through chance-seeking behavior, that is, experimentation (Bardone, 2011). We believe that this has strong implications for how actors concert their actions at different levels of the organization. The challenge is that these many individuals need to make sense of experimentation outcomes with novel projects themselves, among their unit, across units, and within certain time periods (Secchi & Cowley, 2021). Such requirements do not just need experimentation but also require room for interaction among organizational actors and across units to arrive at a common understanding of how such new technological ideas can be utilized. The interpretation of knowledge is key to codify and internalize new knowledge and achieve organizational learning. A side finding of the study by Sirén et al. (2017) nicely illustrated the relevance organizational slack has for such knowledge interpretation. Failure to learn from open innovation, therefore, arises if organizations fail to build such environments, which is the case when they (are forced to) dry up resource buffers for experimentation. While our empirics may not allow to draw a direct connection from resources for experimentation to time available for sensemaking, we consider it very logical that these effects cannot accumulate in resource-scarce environments, which is what our results also indicate. Resources that have not been explicitly committed to a particular cause a priori (as is the case with resource surpluses) are needed to cultivate conditions for creative discourse opportunities that result from differences when interpreting experimentation outcomes within and across organizational boundaries. Integrating such a distributed cognition perspective is fruitful in future research to be applied, especially because the majority of work has remained qualitative (Cristofaro, 2022; Secchi & Cowley, 2021). We take our results as an approach that may feed into taking slack variants as quantifiable measures that tie into organizational sensemaking and distributed cognition perspectives (Einola et al., 2017; Maitlis & Christianson, 2014; Secchi & Cowley, 2021; Snihur & Clarysse, 2022).

The availability of such resources empowers employees to explore ideas more openly and potentially engage in experimentation periods with more distant ideas from increased CVC activity applying chance-seeking behaviors (Bardone, 2011; Guerrero et al., 2021; Levinthal, 2017). In fact, when considering the organizational practice, most CVC structures require the interaction with R&D and several business unit employees (Fels et al., 2021; Weber & Weber, 2011). Employees’ involvement with distant ideas empowers them to engage in high-level thinking and conceptualization, which increases trust and communication with CVC investees (Lee et al., 2015). The involved learning from experimentation will allow innovative efforts to be more substantiated and developed (Levinthal, 2017).

Our analysis also has important implications when we consider the CVC investment stage and organizational size. Our post hoc analysis shows that investing in early-stage ventures that do not yet have product prototypes has a positive effect on corporate innovation while later-stage investments result in the inverted U-shaped relationship to innovation. Investing in ventures that do not yet have a functioning prototype may allow organizational actors to engage more creatively in the innovative milieu of startups and pick up ideas. In addition, early investment stages may allow for more influence in directing innovative initiatives and technological development of startups. Stronger bonds among CVC investees and organizational actors can be formed in earlier stages, because there exists a higher degree of dependence on increasing retention over creative discourses, which leads to relational structures important to internalizing new knowledge (Einola et al., 2017; Huikkola et al., 2013; Weick, 1995). Investing in later stages leads likewise to an inverted U-shape relationship between technology sourcing ambidexterity and corporate innovation. This is reflective of the increased complexity when external knowledge has developed at a distance from the organization, which makes increased efforts to break down those knowledge pools necessary. The more external ideas are sourced at later investment stages, the higher the need for sensemaking capabilities, because knowledge cannot evolve in parallel to the organization as would be the case in early-stage investments. As for the organizational size, it is possible that larger size reflects earlier successes of the corporation at experimentation, which leaves it with sufficient capabilities to benefit from technological sourcing ambidexterity, whereas smaller organizations may not have similar capabilities in their repertoire.

Finally, our study underscores the strategic relevance of ambidextrous technology sourcing, which once again attracts a great deal of attention. With the exogenous shock of COVID-19 and the current uncertainty in the world, organizations face radical uncertainty that at times makes incremental innovation efforts of their internal R&D departments look trivial, calling for radical business model reconfigurations (Radziwon et al., 2022). The recent research has studied and emphasized the importance of horizontally or vertically crossing organizational boundaries to achieve such radical innovations outside the firm’s comfort zone during the pandemic (Greco et al., 2022), and the organizational slack emerged to be key for building new sustainable competitive advantage in hostile environments (Wang et al., 2020). Our study is in line with this evidence but details the role of organizational slack as an enabler for concerting experimentation within and across firms and thus shows how new technologies from external search increase the firm’s productive engine, creating strategic foresight that accumulates in innovation results from collaborations with early-stage ideators such as startups prior to product prototypes. Hence, based on this study’s findings, a combination of slack resources and early-stage investments through CVC activity may appear as a winning strategy in technology sourcing ambidexterity for corporate innovation.

Moreover, because government-sponsored VC programs represent a substantial share of the VC market in many countries, including the European Union (Murtinu, 2021), policymakers may consider effective syndication policies that would promote corporate innovation by providing funding to startups supported by corporate investors that have not yet achieved the threshold levels of technology sourcing ambidexterity and withholding it from ventures supported by the over-extended corporate investors. That is, policymakers may indirectly affect the innovative trajectory of incumbents while, at the same time, providing support to technological startups. In that governments are somewhat limited with respect to directly steering the innovativeness of large corporations, this represents an important tool for them to consider.

There are also other clearly usable policy recommendations from the study. The overall recommendation is that policymakers can create an environment where established organizations are encouraged to invest in CVC activity, thereby fostering innovation. However, they may also further look at the companies’ slack resources. This is something that policy can create by providing incentives, such as tax benefits or grants. As an alternative, policymakers can establish funding programs specifically targeted towards innovation that encourage organizations to exhibit own slack resources to improve experimentation between own R&D and CVC programs.

7 Limitations and conclusions

Our results need to be considered in the light of the study’s limitations. First and foremost, the results were obtained from a sample of CVC investments during a single wave of the CVC activity and may be specific to periods where strategic and not financial considerations played the primary role in corporations’ interest in external sources of technology. Per conditions of our access to the database, we cannot, at this time, ascertain whether the results are robust to more recent data. At the same time, the chosen period represents the best laboratory to study the relationship between technology sourcing ambidexterity and innovation in the CVC context. Moreover, the fact that many corporations have abandoned their exclusive focus on strategic benefits in favor of the more balanced and pragmatic dual strategic-financial philosophy (Anokhin & Morgan, 2023) may be an indication that the drawbacks of technology sourcing ambidexterity have been recognized at the top level of corporate investors. However, the case for strategic motivation is once again brought to the fore in the wake of COVID-19 suggesting that future research would be wise to extend our study’s timeframe surrounding the recent pandemic and its aftermath.

Second, given the temporal distance between the period under study and the time of writing this paper, we could not collect qualitative information from the managers of various CVC programs to seek further insights into incumbents’ experiences with managing technology sourcing ambidexterity. While we controlled for a number of potentially relevant factors, it is possible that there may be other factors at play that bear on the studied relationship. For instance, we ignored the fact that many startups receive funding from multiple investors and our results do not provide direct insights for the financial outcomes of such investments. It is possible that some investors are better positioned to benefit strategically from supporting new firms due to their position within CVC syndicate networks or, perhaps, due to the presence of specific technology transfer capabilities honed over the years of experience in the CVC realm. Future research will be wise to look closer into such issues.

Third, the literature suggests two approaches to operationalizing our independent variable, sourcing ambidexterity. One is the so-called balanced approach, and the other one is the combined approach. We used the second option for two reasons. First, our theory relies on the notion of the combined ambidexterity in that it is the joint impact of R&D and CVC that produces the desired effect. The balanced ambidexterity (the absolute value of difference between R&D and CVC) does not match our theory. Moreover, for us to calculate the balanced ambidexterity, we would need to know the precise allocation of corporate funds to CVC investments, and one of the sources of information on CVC investments (Corporate Venturing Directory and Yearbook) does not provide the amount invested and only includes the specific ventures supported by a given CVC program within a given year. That is, even if we chose to go with the approach that does not fit our theory, we would not be able to calculate a valid measure of balanced ambidexterity methodologically. Although we believe our selection is thoughtful and valid for the study at hand, we believe that all approaches could be valid and encourage the use of both approaches in future research.

Fourth, although we believe our dependent variables capture the core of knowledge creation around the development of innovation, we realize that knowledge accumulation in the area of organizational learning and organizational learning thresholds around general knowledge creation may be different. This is something to consider in future studies. Knowledge creation or absorption is a complex phenomenon, and we also welcome the use of alternative measurements.

Nevertheless, this study demonstrates that firms may fail to learn from their external investments and that technology sourcing ambidexterity is not a universal answer to the need for augmenting one’s innovation toolkit. Only certain combinations of resources and investment choices may put organizations into advantageous positions. With this paper, we hope to invite further scholarly dialog on this important topic.

Change history

05 March 2024

A Correction to this paper has been published: https://doi.org/10.1007/s11187-024-00911-5

Notes

We thus choose not to define this distance in terms of patent portfolios of corporate investors and their investees.

References

Aghion, P., & Tirole, J. (1994). The management of innovation. The Quarterly Journal of Economics, 109(4), 1185–1209. https://doi.org/10.2307/2118360

Anokhin, S. A., & Morgan, T. (2023). CEO duality and tenure, and the adoption of goal ambidexterity in corporate venture capital. Journal of Business Venturing Insights, 19, e00367. https://doi.org/10.1016/j.jbvi.2022.e00367

Anokhin, S., & Wincent, J. (2012). Start-up rates and innovation: A cross-country examination. Journal of International Business Studies, 43(1), 41–60. https://doi.org/10.1057/jibs.2011.47

Anokhin, S., Örtqvist, D., Thorgren, S., & Wincent, J. (2011a). Corporate venturing deal syndication and innovation: The information exchange paradox. Long Range Planning, 44(2), 134–151. https://doi.org/10.1016/j.lrp.2010.12.005

Anokhin, S., Wincent, J., & Frishammar, J. (2011b). A conceptual framework for misfit technology commercialization. Technological Forecasting and Social Change, 78(6), 1060–1071. https://doi.org/10.1016/j.techfore.2010.12.005

Anokhin, S., Morgan, T., Schulze, W., & Wuebker, R. (2022). Is a reputation for misconduct harmful? Evidence from corporate venture capital. Journal of Business Research, 138, 65–76. https://doi.org/10.1016/j.jbusres.2021.09.008

Argote, L., Lee, S., & Park, J. (2021). Organizational learning processes and outcomes: Major findings and future research directions. Management Science, 67(9), 5399–5429. https://doi.org/10.1287/mnsc.2020.3693

Audretsch, B. D., & Belitski, M. (2023). The limits to open innovation and its impact on innovation performance. Technovation, 119, 102519. https://doi.org/10.1016/j.technovation.2022.102519

Baierl, R., Anokhin, S., & Grichnik, D. (2016). Coopetition in corporate venture capital: The relationship between network attributes, corporate innovativeness, and financial performance. International Journal of Technology Management, 71(1–2), 58–80. https://doi.org/10.1504/IJTM.2016.077978

Bardone, E. (2011). Seeking chances: From biased rationality to distributed cognition (Vol. 13). Springer Science & Business Media.

Benson, D., & Ziedonis, R. H. (2009). Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups. Organization Science, 20(2), 329–351. https://doi.org/10.1287/orsc.1080.0386

Boland, R. J., Jr., Tenkasi, R. V., & Te’Eni, D. (1994). Designing information technology to support distributed cognition. Organization Science, 5(3), 456–475. https://doi.org/10.1287/orsc.5.3.456

Bourgeois III, L. J. (1981). On the measurement of organizational slack. Academy of Management review, 6(1), 29-39. https://doi.org/10.5465/amr.1981.4287985

Bradley, S. W., Shepherd, D. A., & Wiklund, J. (2011). The importance of slack for new organizations facing ‘tough’ environments. Journal of Management Studies, 48(5), 1071–1097. https://doi.org/10.1111/j.1467-6486.2009.00906.x

Braune, E., Lantz, J. S., Sahut, J. M., & Teulon, F. (2021). Corporate venture capital in the IT sector and relationships in VC syndication networks. Small Business Economics, 56(3), 1221–1233. https://doi.org/10.1007/s11187-019-00264-4

Cabral, J. J., Francis, B. B., & Kumar, M. S. (2021). The impact of managerial job security on corporate entrepreneurship: Evidence from corporate venture capital programs. Strategic Entrepreneurship Journal, 15(1), 28–48. https://doi.org/10.1002/sej.1357

Cao, Q., Gedajlovic, E., & Zhang, H. (2009). Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organization Science, 20(4), 781–796. https://doi.org/10.1287/orsc.1090.0426

CBInsights. (2022a, March 1). State of CVC 2021 Report. Retrieved October 19th, 2022 from https://www.cbinsights.com/research/report/corporate-venture-capital-trends-2021/

CBInsights. (2022b, July 25). State of CVC Q2'22 Report. Retrieved October 19th, 2022 from https://www.cbinsights.com/research/report/corporate-venture-capital-trends-q2-2022/

Cheng, J. L., & Kesner, I. F. (1997). Organizational slack and response to environmental shifts: The impact of resource allocation patterns. Journal of Management, 23(1), 1–18. https://doi.org/10.1016/S0149-2063(97)90003-9

Chesbrough, H. (2000). Designing corporate ventures in the shadow of private venture capital. California Management Review, 42(3), 31–49. https://doi.org/10.2307/41166041

Chesbrough, H. W. (2002). Making sense of corporate venture capital. Harvard Business Review, 80(3), 90–99.

Chesbrough, H. W., & Socolof, S. J. (2000). Creating new ventures from bell labs technologies. Research-Technology Management, 43(2), 13–17. https://doi.org/10.1080/08956308.2000.11671337

Chesbrough, H. W., & Tucci, C. (2004). Corporate venture capital in the context of corporate innovation, paper presented at the DRUID Summer Conference 2004 on Industrial Dynamics. Denmark: Innovation and Development, Elsinore.

Chiu, Y. C., & Liaw, Y. C. (2009). Organizational slack: Is more or less better? Journal of Organizational Change Management, 22(3), 321–342. https://doi.org/10.1108/09534810910951104

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative science quarterly, 128–152,. https://doi.org/10.2307/2393553

Conti, R., Gambardella, A., & Novelli, E. (2013). Research on markets for inventions and implications for R&D allocation strategies. Academy of Management Annals, 7(1), 717–774. https://doi.org/10.5465/19416520.2013.787709

Corporate Finance Institute (2020). Corporate venturing. Retrieved Jan. 6, 2022 from https://corporatefinanceinstitute.com/resources/knowledge/finance/corporate-venturing-corporate-venture-capital/

Cristofaro, M. (2022). Organizational sensemaking: A systematic review and a co-evolutionary model. European Management Journal, 40(3), 393–405. https://doi.org/10.1016/j.emj.2021.07.003

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. Prentice Hall, Englewood Cliffs, NJ.

Dabić, M., Daim, T., Bogers, M. L., & Mention, A. L. (2023). The limits of open innovation: Failures, risks, and costs in open innovation practice and theory. Technovation, 126, 102786. https://doi.org/10.1016/j.technovation.2023.102786

Dawson, J. F., & Richter, A. W. (2006). Probing three-way interactions in moderated multiple regression: Development and application of a slope difference test. Journal of Applied Psychology, 91(4), 917. https://doi.org/10.1037/0021-9010.91.4.917

Driscoll, J. C., & Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics, 80(4), 549–560. https://doi.org/10.1162/003465398557825

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A review and road map of entrepreneurial equity financing research: Venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of Management, 43(6), 1820–1853. https://doi.org/10.1177/0149206317690584

Dushnitsky, G., & Lenox, M. J. (2005). When do incumbents learn from entrepreneurial ventures?: Corporate venture capital and investing firm innovation rates. Research Policy, 34(5), 615–639. https://doi.org/10.1016/j.respol.2005.01.017

Dushnitsky, G., & Lenox, M. J. (2006). When does corporate venture capital investment create firm value? Journal of Business Venturing, 21(6), 753–772. https://doi.org/10.1016/j.jbusvent.2005.04.012

Dushnitsky, G., & Shaver, J. M. (2009). Limitations to interorganizational knowledge acquisition: The paradox of corporate venture capital. Strategic Management Journal, 30(10), 1045–1064. https://doi.org/10.1002/smj.781

Einola, S., Kohtamäki, M., Parida, V., & Wincent, J. (2017). Retrospective relational sensemaking in R&D offshoring. Industrial Marketing Management, 63, 205–216. https://doi.org/10.1016/j.indmarman.2016.10.001

Eisenhardt, K. M. (1985). Control: Organizational and economic approaches. Management Science, 31(2), 134–149. https://doi.org/10.1287/mnsc.31.2.134

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74. https://doi.org/10.5465/amr.1989.4279003

Enkel, E., Gassmann, O., & Chesbrough, H. (2009). Open R&D and open innovation: Exploring the phenomenon. R&D Management, 39(4), 311–316. https://doi.org/10.1111/j.1467-9310.2009.00570.x

Fels, G., Kronberger, M., & Gutmann, T. (2021). Revealing the underlying drivers of CVC performance—A literature review and research agenda. Venture Capital, 23(1), 67–109. https://doi.org/10.1080/13691066.2021.1873210

Forman, C., Goldfarb, A., & Greenstein, S. (2008). Understanding the inputs into innovation: Do cities substitute for internal firm resources? Journal of Economics & Management Strategy, 17(2), 295–316. https://doi.org/10.1111/j.1530-9134.2008.00179.x

Fredriksen, Ø., & Klofsten, M. (2001). Venture capitalists’ governance of their portfolio companies. Journal of Enterprising Culture, 9(02), 201–219. https://doi.org/10.1142/S0218495801000110

Galbraith, J. (2001). Corporate venturing directory and yearbook, 2000 Edition. Journal of Business and Finance Librarianship, 6(4), 92–93.

García-Canal, E., Duarte, C. L., Criado, J. R., & Llaneza, A. V. (2002). Time compression diseconomies in accelerated global alliances. Management Decision. https://doi.org/10.1108/00251740210437716

Gassmann, O., Enkel, E., & Chesbrough, H. (2010). The future of open innovation. R&D Management, 40(3), 213–221. https://doi.org/10.1111/j.1467-9310.2010.00605.x

George, G. (2005). Slack resources and the performance of privately held firms. Academy of Management Journal, 48(4), 661–676. https://doi.org/10.5465/amj.2005.17843944

Gibson, C. B., & Birkinshaw, J. (2004). The antecedents, consequences, and mediating role of organizational ambidexterity. Academy of Management Journal, 47(2), 209–226. https://doi.org/10.5465/20159573

Gompers, P. A. (2002). Corporations and the financing of innovation: The corporate venturing experience. Economic Review-Federal Reserve Bank of Atlanta, 87(4), 1–18.

Gompers, P., & Lerner, J. (2000). The determinants of corporate venture capital success: Organizational structure, incentives, and complementarities. In Concentrated corporate ownership (pp. 17–54). University of Chicago Press.

Greco, M., Campagna, M., Cricelli, L., Grimaldi, M., & Strazzullo, S. (2022). COVID-19-related innovations: A study on underlying motivations and inter-organizational collaboration. Industrial Marketing Management, 106, 58–70. https://doi.org/10.1016/j.indmarman.2022.07.014

Guan, J., & Liu, N. (2016). Exploitative and exploratory innovations in knowledge network and collaboration network: A patent analysis in the technological field of nano-energy. Research Policy, 45(1), 97–112. https://doi.org/10.1016/j.respol.2015.08.002

Guerrero, M., Amorós, J. E., & Urbano, D. (2021). Do employees’ generational cohorts influence corporate venturing? A Multilevel Analysis. Small Business Economics, 57(1), 47–74. https://doi.org/10.1007/s11187-019-00304-z

Hannan, M. T., & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 149–164,. https://doi.org/10.2307/2095567

Hawk, A., & Pacheco-de-Almeida, G. (2018). Time compression (dis) economies: An empirical analysis. Strategic Management Journal, 39(9), 2489–2516. https://doi.org/10.1002/smj.2915

He, Z. L., & Wong, P. K. (2004). Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15(4), 481–494. https://doi.org/10.1287/orsc.1040.0078

Hellmann, T. (2002). A theory of strategic venture investing. Journal of Financial Economics, 64(2), 285–314. https://doi.org/10.1016/S0304-405X(02)00078-8

Hill, S. A., & Birkinshaw, J. (2014). Ambidexterity and survival in corporate venture units. Journal of Management, 40(7), 1899–1931. https://doi.org/10.1177/0149206312445925

Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. The Stata Journal, 7(3), 281–312. https://doi.org/10.1177/1536867X0700700301

Hornsby, J. S., Kuratko, D. F., & Zahra, S. A. (2002). Middle managers’ perception of the internal environment for corporate entrepreneurship: Assessing a measurement scale. Journal of Business Venturing, 17(3), 253–273. https://doi.org/10.1016/S0883-9026(00)00059-8

Huikkola, T., Ylimäki, J., & Kohtamäki, M. (2013). Joint learning in R&D collaborations and the facilitating relational practices. Industrial Marketing Management, 42(7), 1167–1180. https://doi.org/10.1016/j.indmarman.2013.07.002

Hutchins, E. (1991). The social organization of distributed cognition. In L. B. Resnick, J. M. Levine, & S. D. Teasley (Eds.), Perspectives on socially shared cognition (pp. 283–307). American Psychological Association. https://psycnet.apa.org/doi/10.1037/10096-012

Iyer, D. N., & Miller, K. D. (2008). Performance feedback, slack, and the timing of acquisitions. Academy of Management Journal, 51(4), 808–822. https://doi.org/10.5465/amr.2008.33666024

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jeon, E., & Maula, M. (2022). Progress toward understanding tensions in corporate venture capital: A systematic review. Journal of Business Venturing, 37(4), 106226. https://doi.org/10.1016/j.jbusvent.2022.106226

Kaji, S, & Peltz-Zatulove, J. (2015). Inside the minds of corporate venture capitalists. Accessed on July 28, 2022 at https://www.cbinsights.com/research/inside-corporate-vc-minds/

Kam, C. D., & Franzese, R. J., Jr. (2005). Modeling and interpreting interactive hypotheses in regression analysis. University of Michigan Press.

Keil, T., Zahra, S. A., & Maula, M. (2016). Explorative and exploitative learning from corporate venture capital: A model of program-level determinants. Edward Elgar Publishing.

Kim, J. Y., Steensma, H. K., & Park, H. D. (2019). The influence of technological links, social ties, and incumbent firm opportunistic propensity on the formation of corporate venture capital deals. Journal of Management, 45(4), 1595–1622. https://doi.org/10.1177/0149206317720722

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397. https://doi.org/10.1287/orsc.3.3.383

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131–150. https://doi.org/10.1002/smj.507

Lawson, M. B. (2001). In praise of slack: Time is of the essence. Academy of Management Perspectives, 15(3), 125–135. https://doi.org/10.5465/ame.2001.5229658

Lee, S. M., Kim, T., & Jang, S. H. (2015). Inter-organizational knowledge transfer through corporate venture capital investment. Management Decision. https://doi.org/10.1108/MD-12-2014-0668

Lerner, J. (1994). The syndication of venture capital investments. Financial Management, 23, 16–27.

Lerner, J. (1995). Venture capitalists and the oversight of private firms. The Journal of Finance, 50(1), 301–318.

Levin, R. C., Klevorick, A. K., Nelson, R. R., Winter, S. G., Gilbert, R., & Griliches, Z. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity, 1987(3), 783–831.

Levinthal, D. A. (2017). Resource allocation and firm boundaries. Journal of Management, 43(8), 2580–2587. https://doi.org/10.1177/0149206316667458

Levinthal, D., & March, J. G. (1981). A model of adaptive organizational search. Journal of Economic Behavior & Organization, 2(4), 307–333. https://doi.org/10.1016/0167-2681(81)90012-3

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14(S2), 95–112. https://doi.org/10.1002/smj.4250141009

Ma, S. (2020). The life cycle of corporate venture capital. The Review of Financial Studies, 33(1), 358–394. https://doi.org/10.1093/rfs/hhz042

Magnusson, J., Koutsikouri, D., & Päivärinta, T. (2020). Efficiency creep and shadow innovation: Enacting ambidextrous IT governance in the public sector. European Journal of Information Systems, 29(4), 329–349. https://doi.org/10.1080/0960085X.2020.1740617

Maitlis, S., & Christianson, M. (2014). Sensemaking in organizations: Taking stock and moving forward. Academy of Management Annals, 8(1), 57–125. https://doi.org/10.5465/19416520.2014.873177

Malerba, F. (1985). The semiconductor business: The economics of rapid growth and decline. Univ of Wisconsin Press.

Malmquist, S. (1953). Index numbers and indifference surfaces. Trabajos De Estadística, 4(2), 209–242.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87. https://doi.org/10.1287/orsc.2.1.71

Marquardt, D. W. (1980). Comment: You should standardize the predictor variables in your regression models. Journal of the American Statistical Association, 75(369), 87–91. https://doi.org/10.1080/01621459.1980.10477430

McGrath, R. G. (2001). Exploratory learning, innovative capacity, and managerial oversight. Academy of Management Journal, 44(1), 118–131. https://doi.org/10.5465/3069340

Michel, A. A. (2007). A distributed cognition perspective on newcomers’ change processes: The management of cognitive uncertainty in two investment banks. Administrative Science Quarterly, 52(4), 507–557. https://doi.org/10.2189/asqu.52.4.507

Mishina, Y., Pollock, T. G., & Porac, J. F. (2004). Are more resources always better for growth? Resource stickiness in market and product expansion. Strategic Management Journal, 25(12), 1179–1197. https://doi.org/10.1002/smj.424

Murtinu, S. (2021). The government whispering to entrepreneurs: Public venture capital, policy shifts, and firm productivity. Strategic Entrepreneurship Journal, 15(2), 279–308. https://doi.org/10.1002/sej.1374

Nason, R. S., McKelvie, A., & Lumpkin, G. T. (2015). The role of organizational size in the heterogeneous nature of corporate entrepreneurship. Small Business Economics, 45, 279–304. https://doi.org/10.1007/s11187-015-9632-6