Abstract

An emerging theme in the entrepreneurial university (EU) literature is how universities should evolve to best reconcile their different missions, particularly research and commercialization, which often require different sets of resources. This tension is evident in the development of university spin-offs (USOs). In particular, the EU literature has generally overlooked how characteristics of university research affect USO’s early-stage access to external equity. In this study, we embrace the characterization of university research offered by literature in terms of patterns, specifically, exploration and exploitation. Through the lens of the imprinting perspective, we study the effect of exploration and exploitation in university research on the early-stage equity financing of USOs on a unique dataset that covers a sample of 739 USOs from 39 Italian public universities founded from 2011 to 2019. Our results indicate that exploration (exploitation) in research has an overall positive (negative) impact on the likelihood of USOs obtaining early-stage external equity financing. Additionally, this exploratory study offers several conceptual and practical contributions to the EU literature.

Plain English Summary

Using a unique dataset of 739 university spin-offs (USOs) from 39 Italian public universities, in this paper we show how USOs’ early development in terms of early-stage equity financing is affected by research patterns in their parent universities. Entrepreneurial universities (EUs) face pressing challenges regarding the balance of different missions, particularly research and commercialization, which often require different sets of resources. To provide a better understanding of how EUs can tackle this tension, we explore how university research affects USO’s early-stage access to external equity. Our results indicate that exploration and exploitation in originating universities’ research have different and opposite effects on USOs’ likelihood of getting early-stage external equity financing (overall positive for exploration and negative for exploitation). Hence, besides advancing research on the EU, our study offers practical implications to higher education institutions on how to better align university research and commercialization activities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, due to increasing pressure from society, universities have progressively embraced an active role in the commercialization of scientific discoveries to generate economic and societal impact alongside traditional teaching and research (Guerrero et al., 2015; Guerrero & Pugh, 2022). This shift towards an entrepreneurial university (EU) paradigm presents unprecedented organizational and strategic challenges for higher education institutions (Cunningham et al., 2022; Giuri et al., 2019; Miller et al., 2021). How the EUs cope with their changing role in society has attracted the attention of scholars in recent decades (Cunningham et al., 2019; Unger et al., 2020). An emerging theme in this literature is how EUs should evolve to best reconcile their constituent missions (Guerrero & Urbano, 2012) particularly research and commercialization (Ambos et al., 2008). Research is associated with knowledge discovery and public dissemination, while commercialization is associated with the development of knowledge into marketable products and services for private commercialization (Jain et al., 2009; Knockaert et al., 2011), which often require different sets of resources, capabilities and networks (Cerver Romero et al., 2021; Klofsten et al., 2019). Such tensions are particularly manifested in the development of university spin-offs (USOs) (Fini et al., 2019), which are firms created to commercially exploit knowledge generated within universities, ranging from research results to specific methods or skills (Minola et al., 2021). The EUs can generate societal and economic impact through the USOs’ well-documented contribution to economic development in terms of job creation, innovation, and economic growth (Guerrero et al., 2015; Guerrero et al., 2016; Klofsten et al., 2019). Thus, USOs are central to the agenda of the EU aimed at contributing to society through entrepreneurial activities (Audretsch & Belitski, 2022).

While recent studies on USOs have focused on how embeddedness in a research institution uniquely affects their development (Clarysse et al., 2023; Colombo & Piva, 2012; Hahn et al., 2019; Minola et al., 2021; Roche et al., 2020), with a few exceptions (Colombo et al., 2010), the literature on EUs has generally overlooked how the characteristics of university research affect USOs beyond the creation stage (entry) (Radko et al., 2022). Consequently, little is known about the implications of university research on the post-entry development of its USOs (Mathisen & Rasmussen, 2019). This is unfortunate because how two fundamental activities (research and commercialization) of the EU can act in synergy is of great interest to capture the evolution of the EU model (Audretsch & Belitski, 2022; Cunningham et al., 2022; Thomas et al., 2023); also, the research and knowledge of the parent institution originating the USO is a key resource to understand this type of firm, as suggested, for example, by the knowledge spillover theory (Acs et al., 2013) and imprinting theory (Clarysse et al., 2023). Such a lack of knowledge severely limits our understanding of the synergies and conflicts between research and commercialization missions, a key challenge of the EU (Klofsten et al., 2019).

One particular key performance event emphasized in the literature on USOs, yet rather overlooked in research on the EUs, is USO’s early-stage access to external equity. Obtaining early-stage equity financing represents a central milestone in the development of USOs (Vohora et al., 2004) and mirrors academic founders’ early commitment to securing the resources required to grow USOs and impact society (Fini et al., 2017). Linkages with parent universities’ research is important for USOs development (Clarysse et al., 2023). Nevertheless, how university research affects the early phases of USO development trajectories, in terms of securing external equity, remains to be investigated. More specifically, to the best of our knowledge, studies have considered the EU research dimension in terms of aggregate measures of excellence or strength (Fini et al., 2017; Jelfs & Lawton Smith, 2021), thereby ignoring more nuanced dimensions such as research dynamics or configurations (Chang et al., 2016).

In this direction, literature has characterized university research in terms of patterns, specifically exploration and exploitation (Chang et al., 2016). Exploration describes “learning gained through processes of combined variation, planned experimentation, and play” (Guerrero, 2021, p.450), and is associated with the expansion of research activities towards the industrial application of knowledge and its dissemination outside academia. Exploitation refers to learning gained “via local search, experimental refinement, selection and reuse of existing knowledge” (Guerrero, 2021, p.450), and is associated with more traditional research activities performed and disseminated in academia (Chang et al., 2016). The imprinting perspective, which has recently been used to shed light on the effect of university origin on USOs’ early-stage development (Clarysse et al., 2023; Hahn et al., 2019), indicates that research patterns can be important determinants of affect USOs’ early-stage external equity financing (Chang et al., 2016; Guerrero, 2021). Our research question thus reads as follows: “What is the effect of exploration and exploitation in university research on the early-stage equity financing of USOs?”

To answer our research question, we rely on a unique dataset covering a sample of 739 USOs from 39 Italian public universities founded during 2011–2019. Italy represents a suitable context for investigating the reconciliation between research and entrepreneurial missions (Centobelli et al., 2019), as reflected in the debate regarding the compatibility between entrepreneurial and research activities in Italian universities (Barbieri et al., 2018). For these reasons, the Italian context has attracted a broad interest for studying knowledge commercialization by the EUs (Grimaldi et al., 2021), academic entrepreneurship and USOs (Civera et al., 2020).

To the best of our knowledge, our empirical analysis is the first to explore the relationship between research patterns (in terms of exploration and exploitation) and early-stage external equity financing of USOs. Our results show that these patterns have contrasting effects. Research inputs and outputs associated to exploration (exploitation) have an overall positive (negative) impact on the likelihood of USOs obtaining early-stage external equity financing. This study offers three main contributions to the EU literature. First, we add elements to understand the strategic alignment of the core activities of the EU (Audretsch & Belitski, 2022; Cerver Romero et al., 2021) using a multi-level approach that is increasingly recommended in this literature (Guerrero et al., 2016). By demonstrating how different elements of one level of analysis (university research patterns) contribute to the impact of the EU at another level (the development of USOs), we further endorse the value of a multi-level approach to explain how EUs can exploit synergies between research and commercialization, a key challenge with which confronts them (Klofsten et al., 2019; Perkmann et al., 2019). Second, our exploratory study shows how research patterns affect USO’s performance by extending our understanding of the implications of EU core activities on its ultimate proficiency in science commercialization and by illustrating how originating universities’ research matters not only in terms of entry (number of USOs created), but also in terms of USOs’ post-entry performance. Thus, we respond to recent calls to study how relevant university characteristics affect the development and performance of USOs (Klofsten et al., 2019), particularly their financing (Agyare et al., 2022; Mathisen & Rasmussen, 2019). Finally, we extend the research stream on imprinting in academic entrepreneurship (Clarysse et al., 2023; Hahn et al., 2019; Messina et al., 2020), by showing the value of using imprinting to explore the relationship between core EU activities at founding and the development of USOs.

2 Theoretical background

2.1 The effect of the EU on USOs beyond creation: the importance of early-stage equity financing

The EU literature largely acknowledges the intricate relationship between traditional research activities and more recent entrepreneurial activities (Cerver Romero et al., 2021). This theme has characterized research on USOs (Clarysse et al., 2023; Fini et al., 2019), as they are one of the main manifestations of EU entrepreneurial activities (Guerrero et al., 2016), consisting of firms created to commerciale research results, methods, and skills. Several authors studied the tensions between the research environment in which USOs originated and their development (Jain et al., 2009). For example, one strand of the literature focuses on the issue that entrepreneurship may distract academic scientists from pursuing high-quality research (Sandström et al., 2018). Another stream of literature has generated some concerns regarding universities’ ability to commercialize research results (Wennberg et al., 2011) showing that the resources and networks inherited from the research environment are often inadequate for bringing scientific discoveries and knowledge to the market (Knockaert et al., 2011; Mosey & Wright, 2007). However, the picture is more nuanced and recent evidence points to several synergies between university research and entrepreneurial activities. For example, universities’ scientific productivity is associated with high levels of entrepreneurial activities, including spinoff creation, suggesting that academia’s scientific mission can be reconciled with entrepreneurship. For example, with access to updated state-of-the-art scientific knowledge, USOs have the opportunity to develop radically new products and services (Minola et al., 2021) and are more likely to absorb and take advantage of the knowledge generated within universities to achieve superior economic results (Colombo et al., 2010). To date, most research on the EU has only considered the creation of USOs as the main university entrepreneurial outcome (Guerrero et al., 2016), overlooking some calls to examine how the originating university specifically affects the development of USOs (Mathisen & Rasmussen, 2019). This limits our understanding of university research on the impact of USOs (Meoli et al., 2018; Sandström et al., 2018).

One particular aspect that is crucial is the development of USOs, which has yet to receive much attention in EU literature is obtaining equity from external investors in their first years (Vohora et al., 2004). USOs often require significant Research and Development (R&D) investment and, typically, in the absence of sufficient internally generated cash flows, they need to seek outside financing. Given the generally recognized unsuitability of debt for innovation and early-stage financing (Hahn et al., 2019), to secure external financing for R&D, USOs often rely on equity financing (Honjo & Nagaoka, 2018). Thus, obtaining external equity financing at an early-stage constitutes a critical milestone in the development of USOs, as it shows that they have passed investor scrutiny and certified that the firm has reached credibility in front of key external stakeholders, such as employees and partners (Rasmussen et al., 2011). Additionally, acquiring the financial resources required early to turn university knowledge into market-ready products and services (Shane, 2004; Vohora et al., 2004) can reduce time to market, which is critical for USOs to yield an impact (Messina et al., 2020). The literature on academic entrepreneurship acknowledges that the attraction of funding represents a key performance indicator for USOs (Fini et al., 2017; Jelfs & Lawton Smith, 2021; Mathisen & Rasmussen, 2019).

In addition to its importance in the development of USOs, early-stage equity financing can assume a central role as an impact dimension of the EU entrepreneurial mission. While the EU literature recognizes that their effectiveness in commercializing research varies considerably among USOs (Civera et al., 2020; Huyghe et al., 2016), it offers very few indicators in this regard. In particular, evidence shows that because of their dedication to academic research and attachment to scientific norms, some academic founders may decide to create USOs with limited growth prospects (Clarysse et al., 2023). Since USOs are often created by university scientists to pursue academic goals, such as increasing their reputation in the academic community or satisfying research-derived curiosity (Hayter, 2011; Lam, 2011), USO founders might lack the growth aspirations that external investors seek (Minola et al., 2017). This can make some USOs less prone to search for early-stage external equity financing, for different reasons. For example, USOs’ academic founders might be reluctant to subtract time from their academic duties to the development of the venture (Jain et al., 2009) and, in particular, to the time-consuming and lengthy process of looking for investors and negotiating. For these reasons, the seeking and attraction of external equity financing, which is typically granted to growth-oriented ventures (Block et al., 2019), can be seen as a proxy for USOs’ growth orientation from their early-stage phase, and thus represents an important metric through which EUs can monitor their USOs and judge their own impact in the entrepreneurial mission. In this respect, the earlier stages of USOs developments are particularly interesting from an EU perspective as the effect of the parent university is likely to be more pronounced in these phases characterized by liability of newness (Stinchcombe, 1965) and liability of smallness (Aldrich & Auster, 1986).

Although early-stage equity financing has been recognized as being critical to the development of USOs, empirical evidence on its antecedents remains scarce (Mathisen & Rasmussen, 2019). Some studies have examined the determinants of USO’s equity fundraising, albeit without specifically focusing on the early stages. Particularly, the contributions of an entrepreneur’s social capital, entrepreneurial capabilities, and industry experience have been recognized as fundamental to fundraising. Regarding patents, intellectual property has also been shown to appeal to early-stage equity investors (Munari & Toschi, 2011; Shane & Stuart, 2002).

While these studies offer some valuable insights into the determinants of USOs’ fundraising, they do not examine the uniqueness of USOs’ originating universities, which makes these firms distinctive (Fini et al., 2019), particularly in their earlier stages. This is because university origin offers USOs the unique technological knowledge and resources that are critical for the early stages of the commercialization process (Guerrero et al., 2015; Knockaert et al., 2011). For this reason, recent calls in academic entrepreneurship literature have suggested examining the relationship between university characteristics and the development patterns of USOs (Fini et al., 2017; Klofsten et al., 2019), particularly in terms of early-stage equity financing (Agyare et al., 2022; Mathisen & Rasmussen, 2019). Moreover, the debate around the EUs is increasingly looking for studies on how core university activities contribute to pursuing entrepreneurial missions (Klofsten et al., 2019). Hence, scholars are urged to explore the relationship between university characteristics and USOs’ early-stage equity financing (Fini et al., 2017; Mathisen & Rasmussen, 2019). Some studies offer initial evidence on the value of such an approach (Colombo et al., 2010; Fini et al., 2017; Jelfs & Lawton Smith, 2021; Munari & Toschi, 2011) for the fundraising of USOs, although they do not focus specifically on university research or the earlier stages of these firms. From a theoretical standpoint, the link between the parent university and USO development is supported by an imprinting perspective (Colombo & Piva, 2012; Hahn et al., 2019; Messina et al., 2020), which offers a theoretical lens to explain the fact that the originating context of firms has profound implications for their performance and behavior (Clarysse et al., 2023).

2.2 The role of the parent university: an imprinting perspective

Imprinting theory holds that during the sensitive period of firm formation, new ventures are exposed to the influence of the surrounding originating context (imprinter) and that such influence has long-term consequences (proximal and distal outcomes) on firm development (Simsek et al., 2015). New firms are imprinted by the conditions of “groups, institutions, laws, population characteristics, and set of social relationships that form the environment of the parent organization” present at founding (Stinchcombe, 1965, p.142). Kimberly (1979, p. 438) argues that “there is the possibility, at least, that, just as for a child, the conditions under which an organization is born and the course of its development in infancy have nontrivial consequences for later life.”

USOs inherit genetic characteristics from their parent universities in terms of the types of networks that subsequently affect the formation of alliances (Colombo & Piva, 2012). Similar to firms, founders are subject to imprinting. During sensitive periods such as childhood and early career experiences, individuals internalize specific mental models, norms, and capabilities that are later imprinted into the ventures they find. In the case of USOs, scientist founders develop a specific mindset open towards search and discovery that affects the open innovation behaviors of their USO (Hahn et al., 2019). Recognizing the long-lasting influence of universities on USOs (Wennberg et al., 2011), the imprinting perspective has gained traction in the field of academic entrepreneurship (Clarysse et al., 2023; Colombo & Piva, 2012).

As imprinting explains how conditions at founding (such as early-stage team composition) affect new ventures’ development, it offers a valuable theoretical lens to link USOs’ university characteristics at founding to early-stage equity financing. Recent research has shown that USOs are imprinted by specific features of their parent university in terms of the research environment and connections to ecosystem actors (Messina et al., 2020). This links our study to the recently conceptualized notion of academic entrepreneurial ecosystems (Hayter et al., 2018; Schillo, 2018). Derived from the more general concept of entrepreneurial ecosystems, academic entrepreneurial ecosystems consist of universities, technology transfer offices, entrepreneurs, and investors, and refer to how USOs position themselves within the entrepreneurial ecosystem and interact with it.

2.3 The role of university research patterns in the imprinting of USOs

Among the university-level factors that are crucial in the imprinting of USO, university research has been recognized as playing a central role (Colombo & Piva, 2012; Hahn et al., 2019). For example, during their work as scientists, the founders of USOs internalize specific norms (Mertonian norms of science) geared towards the advancement and dissemination of research, which may then be imprinted into the USOs in which they are involved (Jain et al., 2009). Because of their imprint from the research environment, USOs are often founded with the purpose of boosting their founders’ reputation in the academic community, collecting additional funds for research groups, and satisfying the curiosity derived from finding the industrial application of scientific knowledge (Hayter, 2011; Lam, 2011), while displaying weaker growth aspirations (Clarysse et al., 2023). Moreover, to further improve the competencies inherited from the research environment in which they are imprinted, USOs tend to specialize in technical and scientific functions and rely on technological alliances with research institutions (Colombo & Piva, 2012). USOs also tend to replicate the scientific logic geared towards search and openness by engaging in open innovation relationships to obtain external knowledge from various partners (Hahn et al., 2019).

Literature offers reasons that draw attention specifically to early-stage equity financing as an outcome of the imprinting generated by research conducted at the parent university. For instance, using a sample of 123 USOs established in the UK, Munari and Toschi (2011) found that the scientific quality of parent universities improved the likelihood of attracting external equity financing. Jelfs and Lawton Smith (2021) examined the fundraising performance of USOs from six universities in the West Midlands. They found that the total funding obtained from the USOs of a given university positively correlated with its research strength. This indicates that parent university research affects the fundraising ability of USOs and is likely to play a key role in early-stage equity financing.

However, even though these studies suggest that research at the parent university affects USO’s fundraising, they leave some theoretical and empirical puzzles unanswered regarding the relationship between the characteristics of university research and USO’ early-stage equity financing. From a conceptual standpoint, the relationship between university research and the fundraising is puzzling. Academic entrepreneurship literature has widely recognized that there might be tensions and synergies between scientific research and technology transfer in USOs (Chang et al., 2016; Fini et al., 2019; Jain et al., 2009). Institutions strongly focused on traditional research activities might present norms that discourage their members from fully committing to commercialization endeavors (Ambos et al., 2008; Bercovitz & Feldman, 2008). When imprinted on their founders, these norms might deter university scientists from actively developing their ventures across the development stages required to be investment-ready (Vohora et al., 2004). Moreover, institutions deeply embedded in the scientific community might not offer their members the right connections to investors, which is crucial to securing early-stage equity financing in USOs (Mosey & Wright, 2007; Nicolau & Birley, 2003). However, research can be a positive source of imprinting for the development of USOs (Hahn et al., 2019). It allows USOs to benefit from superior technological knowledge at founding (Minola et al., 2021), which is particularly appealing to venture capital investors (Shane, 2004). Additionally, the parent university’s scientific reputation can mitigate the severe information asymmetries investors face when assessing science-based firms (Colombo et al., 2019). From an empirical standpoint, capturing these nuances requires more fine-grained measures of the different dimensions of university research to shed light on how it actually affects USOs’ funding. For instance, looking at the amount of funds raised by USOs, Jelfs and Lawton Smith (2021:1968) noted that “factors other than the research strength of the parent university are in play.” This suggests the value of considering different types of input and output dimensions in university research processes.

Thus, the profile of the parent university’s research at founding might have positive and negative implications on fundraising of their USOs and a more nuanced scrutiny of the dimensions of university research is needed to understand which USOs are more likely to secure early-stage equity financing. We propose that unpacking university research patterns, considering exploration and exploitation, offers a more nuanced understanding of the imprinting effect on USO early-stage equity financing.

2.4 Exploration and exploitation in university research and USO’s early-stage equity financing

In studying the EU, scholars have recently distinguished exploration and exploitation as typologies of research patterns (Chang et al., 2016). Exploration is defined as “learning gained through processes of combined variation, planned experimentation and play” (Guerrero, 2021, p.450) and includes behaviors described by terms such as search, variation, risk taking, flexibility, discovery, and innovation. Exploitation involves the refinement of knowledge and the reduction of variation in experience, and includes behaviors described by terms such as choice, production, efficiency, implementation, and execution. Exploration and exploitation have been used more specifically to describe university research activities (Chang et al., 2016). Exploration and exploitation are both important for university research and are associated (all else being equal) with higher levels of research inputs and outputs. Additionally, under the modern view of universities as ambidextrous organizations (Ambos et al., 2008; Chang et al., 2009), and specifically, the EU (Guerrero, 2021), exploration and exploitation can coexist and are thus not mutually exclusive. Yet, there is lack of consensus and established research on the consequences of different levels of these research patterns. Hence, there is need to explore the effects of exploration and exploitation in university research on USOs’ early-stage equity financing, identify different proxies for both, and observe possible preliminary regularities in the relationship between them and USO financing.

For example, research outputs associated with exploration diverge from traditional research agendas, build on knowledge sources from outside academia (Centobelli et al., 2019), including partnerships with external actors through collaborative publications with industry, and focus on applied research through patenting. Instead, junior faculty, such as postdoctoral researchers, can be seen as illustrative examples of research inputs associated with exploration, as they are typically more open towards the commercialization of scientific knowledge (Krabel et al., 2012; Siegel & Wright, 2015).

Conversely, research outputs associated with exploitation include traditional forms of codification and dissemination of academic research (Centobelli et al., 2019), such as scientific publications and citations (Abramo et al., 2009). The research inputs associated with exploitation typically reinforce traditional university research activities: senior faculty and the number of Ph.D. programs constitute illustrative examples.

The imprinting literature applied to the EU offers specific reasons for disentangling exploration from exploitation to uncover the effects of university research on USO early-stage equity financing. Three phases lead to the establishment of the USO and constitute the sensitive period in which USOs are subject to university imprinting: the research and discovery, the conception, and the pre-entry phase (Messina et al., 2020). Exposure to the academic environment during these stages has a long-lasting effect on company development (Clarysse et al., 2023) for the good and the bad. For example, such exposure can contribute to legitimize entrepreneurial activities, encourage founders to commit themselves to commercialization activities and take the risk of doing so (Bercovitz & Feldman, 2008), and help USOs establish useful contacts with industry partners (Hayter, 2016). The academic exposure during USOs' establishment stages can also play a negative role, exacerbate barriers to academic perception regarding entrepreneurship, and push founders to be more cautious in managing USO (Messina et al., 2020). Imprinting is therefore likely to be reflected in USOs’ seeking and obtaining external equity, since fundraising typically requires academic founders to take risks and to be dedicated to the commercialization activities undertaken by USOs (Vohora et al., 2004). Since, in this specific respect (early-stage equity financing), university imprinting might have either positive or negative connotation depending on the context in which each USO is embedded (Messina et al., 2020), we explore how such connotation descends from university research patterns in terms of exploration and exploitation.

3 Method

3.1 EU and USOs in Italy

To empirically investigate the relationship between parent universities’ research patterns and USOs’ abilities to attract early-stage external equity financing, we focus on Italian universities and their USOs. Our choice was motivated by several factors. First, developing USOs is a key challenge for the Italian EUs. The phenomenon of USOs has been relevant in Italy since the early 2000s because of the nationwide regulatory reform on university technology transfer, which has prompted the creation of a high number of USOs and, consequently, abundant related academic research (Bonaccorsi et al., 2014; Horta et al., 2016; Meoli et al., 2019). Since then, the Italian policy framework supporting USOs has been changing rapidly (Fini et al., 2020; Muscio et al., 2016) to accommodate the new tasks of the EU regarding the commercialization of knowledge.

Second, the Italian context is suitable for studying how the EU can reconcile the traditional research mission with the more recent entrepreneurial mission (Centobelli et al., 2019). For example, prior research emphasizes that the performances of Italian USOs are remarkably heterogeneous (Civera et al., 2020), calling for more research on the drivers of their development (Sciarelli et al., 2021). Moreover, recent evidence has fueled the debate on the evolution of the EU model and, more specifically, regarding the compatibility between research and commercialization activities in Italian universities (Barbieri et al., 2018).

Finally, some peculiar characteristics of the Italian context, such as scant university-industry ties, the absence of a well-developed venture capital market, and labor market rigidities, are common to other European countries (Muscio et al., 2016). Hence, the study of Italian USOs offers results which are to some extent generalizable beyond the country borders.

3.2 Sample

The empirical analysis in this study is based on a novel dataset that relies on data from multiple sources. First, we employed a dataset of all USOs from Italian state-owned universities established between 2011 and 2019, the Spin-off Italia database. The decision to exclude USOs created before 2011 was driven by the lack of reliable financial data. We initially identified 891 USOs, which is the total number of USOs created in the period 2011–2019. From this database, we obtained firm-specific information, including the USOs’ tax code, year of incorporation, geographical location, and name of the parent university from which the firm originated. Second, to collect USOs’ financial information, we first matched our sample with the AIDA (Analisi informatizzata delle aziende) dataset by Bureau van Dijk, which provides accounting data on Italian firms. We then integrated the dataset using Crunchbase to verify the equity financing events. Crunchbase is a database of start-up companies operated by TechCrunch and is increasingly used in entrepreneurial finance studies (Signori & Vismara, 2018). We collected information on the equity financing rounds conducted by each USO. The USOs lacking financial information were excluded from the sample. Third, the Italian Ministry of Education, University, and Research (MIUR), the Academic Ranking of World Universities (ARWU) ranking,Footnote 1 the CWTS Leiden Ranking,Footnote 2 the Web of Science (WOS),Footnote 3 and the Scopus databases were used to collect information about the parent universities included in our population. Finally, we completed our dataset using regional-level data from the Eurostat database, which provides official statistics on the European Union, its member states, and sub-state regions. Our final sample comprised 739 USOs from 39 public Italian universities (approximately 57% of all Italian public universities).

3.3 Measurements

Dependent variable

Our dependent variable (Early-stage external equity financing) is a dummy variable that takes the value of 1 if the USO obtains external equity within the first 5 years since its establishment, and 0 otherwise. For each USO, we retrieved its external equity financing using the share premium account on the firms’ balance sheets as the key source of information (Jelfs & Lawton Smith, 2021). The 5-year observation windowFootnote 4 is consistent with the long-lasting effect of imprinting and focuses on young firms in the early-stage of financing literature (Audretsch et al., 2016). Information was retrieved from AIDA and double-checked using Crunchbase. Early-stage external equity investors include private investors or business angels, venture capitalists, corporate venture capitalists, crowdfunding backers, mutual funds, pension funds, and strategic partners.

Independent variables

Our explanatory variables are based on university research characteristics (input and output), which serve as proxies for exploration and exploitation in research patterns. Each variable was calculated based on a 3-year average prior to the year of the establishment of USOs, consistent with the imprinting perspective (Messina et al., 2020). For example, to calculate the variable measuring the average citations per publication for a university from which the USO founded in 2011 was generated, we used the average citations per publication in 2009, 2010, and 2011. A detailed description of the calculation of each variable is presented in Table 1.

We measured research inputs considering human capital in terms of investments (educational activities to form scholars) and assets (research personnel). Regarding the former, we used the relevance of Ph.D. programs available at the university as a proxy for exploitation, as they mirror investments in reinforcing the human capital allocated to traditional university activities. We also considered the relevance of EU-sponsored Ph.D. scholarships as a proxy for exploration because publicly funded research programs are typically meant to generate capabilities that enable innovation through the utilization of scientific knowledge by society. Thus, they depart from traditional research activities and are more geared towards applied research. In terms of human capital assets, we consider the composition of university staff human capital: percentage of professors (full professors and associate professors), percentage of assistant professors (including tenured and tenure-track professors), percentage of postdoctoral researchers, and percentage of Ph.D. studentsFootnote 5 in the overall academic staff. The relative weight of professors and assistant professors in university staff mirrors the degree to which universities commit to research exploitation, as professors’ careers typically build upon traditional research activities and reputation in the academic community (Brew, 2001). Instead, we considered postdoctoral researchers as a proxy for university orientation towards research exploration. On average, postdoctoral researchers are more open towards the commercialization of scientific knowledge than senior faculty (Krabel et al., 2012; Siegel & Wright, 2015). Hence, their relative weight among university staff might create a climate that is more favorable towards entrepreneurial activities. Furthermore, we measured university research outputs using four proxies associated with scientific production and inventive activity. In terms of scientific production, we included publication performance calculated as the total number of Scopus publications weighted by university size (calculated as the total number of enrolled students) and the average citations per publication as proxies for exploitation because they represent the outcomes of traditional research codification and dissemination activities. We also included the percentage of core publications that are collaborative with industry, as this is linked to exploration, as engagement with industry partners stimulates new questions that diverge from traditional academic inquiries. Finally, considering university inventive activity, university patenting activity was calculated as the average number of patents granted weighted by the number of STEM faculty members. Since patenting is a research output associated with applied research and typically diverges from traditional basic research agendas pursued by scholars, it mirrors the degree of exploration. For comparability, all variables are standardized (with the exception of those that are recorded as binary indicators).

Control variables

We identify controls at the (1) university, (2) firm, and (3) regional levels. All these variables (except prestige) are computed considering each USO’s establishment or the 3-year average prior to the year of USO establishment, as explained in Table 1. The first set comprised university prestige and size. Prestige influences an organization’s external perceptions. Several scholars have measured university prestige by considering the world university rankings. We adopted a similar approach to assess parent university prestige through the Academic Ranking of World Universities (ARWU) ranking (Civera et al., 2020). We used these data to build a dummy equal to 1 if the parent university was listed in the ARWU ranking at the year of the founding of the focal USO. We measured university size as the logarithm of the number of enrolled students at all (undergraduate and postgraduate) levels. The second set of variables comprises firm size (the logarithm of the first recorded revenue after founding), eight industry dummies, and the year of founding (dummies). The third set includes regional GDP (measured as the natural logarithm of the regional gross domestic product), the cumulative number of certified innovative startups, and certified incubators in the USO region in the year the focal USO was founded.

3.4 Model specification

We use probit regressions to investigate the relationship between USOs’ early-stage external equity financing and their parent universities’ research patterns in terms of exploration and exploitation.

4 Results

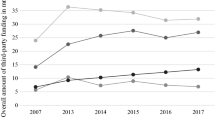

We test the effect of university research patterns—exploration and exploitation (each measured by both input and output indicators of university research)—on USOs’ likelihood to obtain early-stage external equity financing. Table 1 reports the descriptive statistics of the sample, including definitions of the variables used. Table 2 reports the pairwise correlations and significance levels for each variable. As shown in Tables 3 and 4, multicollinearity is not a concern as all our variables have a variance inflation factor (VIF) lower than 5.

Table 5 reports the estimates of probit regression models with input measures of university research. Model (1) reports the results of our baseline specification including the control variables. Models (2)–(6) add the effect of each input measure of university research, that is, Ph.D. programs, EU sponsored Ph.D. scholarships, percentage of professors, assistant professors, postdoctoral researchers on total academic staff. The first four measures mirror research exploitation and the remaining two, research exploration. Model (7) reports the full model, showing the combined effect of the input measures of university research.

The coefficients of all but one of the input measures tested in our model are statistically significant. The coefficients of the variables measuring Ph.D. programs and percentage of assistant professors available at the originating university (measures of exploitation) are negatively and statistically significant in the single model and more pronounced in the full model (β = − 0.215, p < 0.01 and β = − 0.764, p < 0.01, respectively). An EU-sponsored Ph.D. scholarship has no effect on the outcome variables. The coefficient of the variable measuring the percentage of professors (measure of exploitation) is negative and significant (β = − 0.455, p < 0.01) in the single model, but not in the full model. The coefficient of the variable measuring postdoctoral researchers (measure of exploration) is positive and statistically significant in the single model (β = 0.326, p < 0.01) and in the full model (β = 0.164, p < 0.1), although at a lower significance level. In summary, our input measures of university research indicate that between the two dimensions of university research patterns, the likelihood of USOs raising early-stage external equity financing is positively associated with exploration and negatively associated with exploitation in university research (input).

In Table 6, we test our research question on the output measures of university research, namely publication performance, average citations per publication, the university’s patenting activity, and collaborative publications with industry. The first two reflect research exploitation, while the latter are linked to research exploration. In model (1), we test our baseline specification, including the control variables. Models (2)–(5) report the single effect of each research output indicator on USOs’ likelihood to obtain early-stage external equity. Model (6) represents the full model. The coefficient of the variable measuring publication performance (measure of exploitation) is positive and statistically significant in the single model (β = 0.294, p < 0.01) as well as in the full model (β = 0.317, p <0 .01). Average citations per publication (a measure of exploitation) are negative and statistically significant in the single model (β = − 0.136, p <0.1) and full model (β = − 0.177, p <0.05), whereas the variable measuring university patenting activity does not exert any effect on our outcome variable. Finally, the coefficient of collaborative publications with industry (a measure of exploration) is positively and significantly significant in the single model (β = 0.192, p < 0.05) and in the full model (β = 0.198, p <0.05).

In summary, between the two dimensions of university research patterns, USOs early-stage external equity financing is overall positively associated with exploration and has a mixed relationship with exploitation in university research.

5 Discussion

A central challenge for EUs is strategically combining traditional core research activities with entrepreneurship (Ambos et al., 2008; Klofsten et al., 2019). In this study we show how these two activities can act in synergy by answering the following research question: “What is the effect of exploration and exploitation in university research on the early-stage equity financing of USOs?” We explore how the early-stage equity financing of USOs is imprinted by their parent university’s research at founding. To do so we unpacked exploration and exploitation patterns in university research (Centobelli et al., 2019; Guerrero, 2021).

Using this approach, we obtained two main findings. First, USOs imprinted by universities that employ a relatively high percentage of postdoctoral researchers and generate more collaborative publications with industry are more likely to receive early-stage equity financing. Second, USOs imprinted by universities that receive more citations per publication, have a higher number of Ph.D. programs and a relatively high percentage of their staff composed by assistant and full professors are less likely to receive early-stage equity financing. Taken together, our results suggest that research inputs and outputs associated to exploitation have negative implications on the early-stage equity financing of USO, whereas research inputs and outputs associated to exploitation yield positive consequences.

Regarding our first finding, we identified postdoctoral researchers and co-publishing with industry as enabling factors of USOs' early-stage equity financing. In a recent study, Choi et al. (2022) discussed the differences among postdoctoral researchers in government labs and universities, revealing that the presence of postdoctoral researchers provides fertile ground for technology transfer by stimulating new ideas and pushing high-profile breakthrough innovation. Postdoctoral researchers also experience tensions between scientific outputs (serving for promotion) and technology transfer, but at the same time view knowledge commercialization as serving the purpose of knowledge diffusion. According to Hayter and Parker (2019), despite being constrained by research obligations, postdoctoral researchers possess scientific knowledge that can be used to develop and commercialize new technologies. They may also be more oriented towards exploring non-academic career options. Overall, previous evidence, including the studies by Conti and Liu (2015), de Haan et al. (2020), and Huyghe et al. (2016), therefore suggests that postdoctoral researchers are associated with elements that favor science commercialization (working on new ideas and breakthrough innovation, pushing impactful scientific production, and greater awareness of technology transfer offices), even though science commercialization can lead to tensions with research production (needed for postdocs' promotion in academia). Our study informs this stream of literature on the nuanced relationship between postdocs and science commercialization in the EU. It does so by providing evidence suggesting that a greater presence of postdocs is linked with aspects that can facilitate the fundraising of USOs imprinted by a given university, such as easier access to new scientific knowledge and a more diffused awareness of the support provided by technology transfer offices.

Regarding collaborative publication with industry, we add to previous research showing that co-publication is a precursor to technology transfer and spinoff establishment (Wong & Singh, 2013). Close collaboration with industry, leading to co-publications, may lead researchers to become service providers and suppress more impactful research close to the technological frontier (Abramo et al., 2009; Banal-Estañol et al., 2015). While our findings are, to this extent, not surprising, we extend prior research by showing that co-publications affect not only the generation of USOs, but also their fundraising. Our informed supposition is that USOs imprinted by universities with more co-publications inherit more contact with the industry, more knowledge of industrial needs, and greater awareness of university support for technology transfer (Huyghe et al., 2016; Wong & Singh, 2013). All these aspects can help USOs achieve product-market fit, find investors, and raise funds.

In terms of publications, research output positively affects the likelihood of USOs raising early-stage equity financing. This is not obvious. While publications have inherent connections with traditional research activities, recent literature on academic entrepreneurship points out the exploration-oriented connotation that publications can have with respect to the downstream development of scientific knowledge into commercial applications. Publications not only necessarily advance knowledge in science (as also and more specifically reflected in citations per publication) but also represent the result of research efforts to advance state-of-the-art technology, leading to closer connections with industry. However, studies on publications suggest that research oriented towards industrial applications can lead to more publications but in less impactful journals (Abramo et al., 2009). Recent research has also emphasized the value that publications might have for science-based firms in attracting resources and investments (Hayter & Link, 2018; Rotolo et al., 2022). This adds depth to the interpretation of our findings so that imprinting from a university with more publications might help USOs more easily access knowledge that might be useful for accelerating the early-stage development of commercial applications and attracting external investors. However, USOs imprinted by universities oriented towards more impactful publications (in terms of academic citations) might inherit less knowledge and networks oriented towards commercialization, thus being less likely to get early-stage equity financing.

Our negative results, indeed, concern USOs imprinted by universities that receive more citations per publication, have a higher number of Ph.D. programs, and have a relatively high percentage of their staff composed by assistant and full professors. These factors render USOs less likely to receive early-stage equity financing. The number of citations per publication, rather than being a rough measure of the quantity of research output, captures the impact of publications on academic knowledge. Thus, it mirrors the orientation of universities towards scientific advancement. Academics imprinted in such an environment might be less likely to commit their careers to USOs’ development (Clarysse et al., 2023) and instead use them as vehicles to boost their reputation in the academic community or satisfy research-driven curiosity (Lam, 2011); this, in turn, could generate negative repercussions on early-stage equity financing.

Regarding the negative impact of the number of Ph.D. programs on our dependent variable, we acknowledge from prior literature that doctoral programs are generally aimed at developing Ph.D. students’ academic identities, networks, and knowledge. Our findings suggest that when university organizational attention is focused on these outcomes, USOs are less likely to raise funds. Our informed supposition for interpreting these results is based on imprinting. Academic founders socialized in an environment oriented towards academic outcomes are less likely to be growth-oriented and thus look for external funds.

Finally, the negative impact of the proportion of tenured (or tenure-track) professors might be ascribed to their internalization of academic logics, which might per se conflict with the commercialization of science. Based on this, we speculate that in universities with a greater share of professors, academics are more likely to remain anchored to an academic identity, which might limit their growth aspirations and, in turn, their orientation towards fundraising.

Overall, these results would suggest that being imprinted in a university environment excessively unbalanced towards low (relative importance of Ph.D. programs) or high (relative importance of tenured research staff) level of seniority in the staff does not pay off for USOs: the former environment is less likely to offer complementary skills and networks needed for commercialization, while the latter might fail in infusing commercial logics. It is instead at intermediate levels of seniority (relative importance of post-doc researchers) that the best of both worlds combine.

5.1 Contributions to the debate on entrepreneurial universities

Our study bridges insights from the debate on the evolving role of the EU, focusing mainly on the orchestration of the three different missions to deliver value to society (Klofsten et al., 2019), with a specific stream looking at how knowledge spillovers are enabled by the synergy between research and entrepreneurial activities, such as the creation of USOs (Guerrero et al., 2015). Furthermore, academic entrepreneurship literature is shifting its focus from the orchestration of university missions to the entrepreneurial activities undertaken by university members, for example, exploring the determinants of USO development (Mathisen & Rasmussen, 2019). We take the best of both worlds and go beyond the usual focus on the creation of USO that characterizes the EU literature to explore how the university research mission affects the actual development of USOs in terms of early-stage equity financing. This integrated approach deepens our understanding of the heterogeneous development trajectories of spin-offs and sheds light on the relationship between research and commercialization in the EU. In doing so, we offer three main contributions to our understanding of the EU.

First, prior research on academic entrepreneurship has produced a large set of valuable evidence on the micro-processes experienced by academic staff engaged in science commercialization (identity conflicts and resolution of postdoctoral researchers and professors engaged with industry or in spinoff activities, tensions and synergies between scientific production and development of commercial applications). Our results suggest that the implications of such tensions and synergies go beyond the micro level and affect organizational outcomes more broadly. Our study thus documents the importance of looking at the hybrid logic characterizing the EU using multi-level perspectives. Our findings are linked to few multi-level EU studies (Perkmann et al., 2019) that model EUs as hybrid organizations torn between academic and commercial logics, the former oriented towards disinterested scientific advancements, and the latter focused on the commercialization of knowledge. As suggested by recent literature, hybridity is reflected in USOs (Abootorabi et al., 2023; Civera et al., 2020; Horta et al., 2016). We extend this vibrant stream of research by responding to the call to consider innovation and entrepreneurship processes in universities as inherently multidimensional (as pointed out by Guerrero et al., 2016), resulting from the interaction between individuals, organizations, and the regional environment. Our conceptualization and empirical testing of exploration and exploitation research patterns show that the hybridity that characterizes USOs and science commercialization, according to the literature, is rooted in university research missions. Essentially, our results suggest that exploration (exploitation) in university research at the USO founding could have positive (negative) implications for early-stage equity financing. While exploration and exploitation are manifested at the organizational level, their antecedents and consequences pull together different levels of analysis. Regarding antecedents, we identified a set of inputs and outputs of university research related to individuals (staff composition), organizational efforts (collaboration with industry and Ph.D. programs), and broader logics characterizing the scientific profession (publications and citations). Regarding consequences, our study illustrates the consequences of research exploration and exploitation on the development trajectories of USOs. Taken together, our findings stimulate further research on how the manifestations of hybrid logics within the EU at one level of analysis generate implications at other levels. For example, future multi-level research can examine the implications of exploration and exploitation patterns based on a broad set of measures that can be used to assess the impact of university research on society.

Second, stimulated by recent calls from the academic entrepreneurship literature (Guindalini et al., 2021; Mathisen & Rasmussen, 2019), we extend our knowledge of the EU by better exploring the specific university-level antecedents of USOs’ development. Academic entrepreneurship literature focuses on how the uniqueness of university origin affects the early development trajectories of USOs for the good and bad (Fini et al., 2019; Hahn et al., 2019) and pinpoints early-stage equity financing as a key milestone in the development of USOs (Fini et al., 2017; Rasmussen & Sørheim, 2012; Vohora et al., 2004). Bridging this literature with a fine-grained appraisal of the EU research mission, we show that research exploration has positive imprinting effects on USOs’ early-stage equity financing, whereas exploitation has negative implications. Thus, our results contribute to a more nuanced understanding of the relationship between university origin and development.

Finally, the use of imprinting adds a valuable theoretical lens for understanding the complex alignment between research and third missions within the EU. In our study, imprinting explains how different patterns of university research can have lasting implications for USOs development in terms of early-stage equity financing. Thus, even though the imprinting perspective has been previously utilized to shed light on the development of USOs (Colombo & Piva, 2012; Hahn et al., 2019), we show the value of this theoretical perspective in shedding light on the relationship between the EU’s different constituting missions. Our study endorses the value of imprinting in explaining the relationship between the EU and USOs’ development trajectories, by focusing on different patterns in university research as the genesis of imprinting.

5.2 Limitations and future research directions

Before discussing the practical implications of this study, we focus on its limitations and opportunities for future research.

First, by relying on quantitative observational data on fundraising events, we cannot disentangle demand from the supply side in the fundraising obtained by USOs. As discussed in the literature review, both can influence USOs’ early-stage equity financing (Vohora et al., 2004). However, future research could rely on experimental research designs (Block et al., 2019) to observe which specific characteristics of USOs' parent universities are appealing to external equity investors.

Second, we lacked in-depth survey-based information about USOs’ founding teams, resources, goals, and strategies (Hahn et al., 2019; Minola et al., 2021) that could be imprinted by their university origin and affect the search and acquisition of early-stage equity financing. Future research could rely on longitudinal survey-based studies to examine how firm-level influences interact with university-level factors, thereby affecting USOs’ early development.

Third, we focused on university-level antecedents without deepening the elements of the broader entrepreneurial ecosystem, constituted by a set of actors, systemic elements, and institutions that support the development of entrepreneurial initiatives in a region. By merging university-level data with regional data (Civera et al., 2020), future research could study how different configurations of the local entrepreneurial ecosystem and universities jointly affect the early-stage equity financing of USOs. Connecting the vast literature on entrepreneurial ecosystems (Cao & Shi, 2021) to bridge the EU and academic entrepreneurship literature could further improve our understanding of USO development.

Fourth, while our study focuses on the Italian context to ensure that all USOs are exposed to the same national influences, future research could look at different institutional settings, such as the UK (Munari & Toschi, 2011). Our timeframe does not consider the exogenous shock caused by COVID-19 on the entrepreneurial financing landscape. Future research could use this as a natural experiment to study whether university-level factors render USOs fundraising more resilient to crises.

Finally, there are several ways in which our exploratory study could inspire future research on the EU and, more specifically, on the consequences of research patterns on the development of USOs. Our focus on university-level antecedents is motivated by the fact that USOs are affiliated with universities rather than specific departments (Fini et al., 2020). However, recognizing that some important socialization processes affecting the imprinting of USOs could occur at the department level (Rasmussen et al., 2011), future studies could link USOs to a specific department or school and consider the research patterns in that department or school. Another way to extend our study is to collect qualitative data from USOs and university administrators to dig deeper into the actual processes through which imprinting occurs (Messina et al., 2020). To achieve this, qualitative or mixed-method studies are highly appropriate. Taking advantage of our findings relating exploration and exploitation in university research to USOs’ early-stage equity financing, future studies could collect additional proxies for exploration and exploitation, not necessarily through secondary data, but also by collecting primary data from university staff (Centobelli et al., 2019). The unexpected positive effect of publications on USO’s early-stage equity financing warrants further research. While we offer an initial interpretation of the possible exploratory connotations of publications that emerged from the findings, future studies could refine our understanding of this issue. In conclusion, while this study explored the baseline relationship between different patterns in university research and the development of USOs, future work could consider some additional proxies for either exploration or exploitation and further explore university-level contingencies, such as introducing elements of the university knowledge transfer strategy as moderators.

5.3 Practical implications

This study has practical implications for university leaders, scientists, academic entrepreneurs, and external investors. First, university leaders can learn that allocating resources to exploration research patterns, such as promoting research collaboration with industry, could have positive spillover effects on the fundraising of USOs. In addition to developing infrastructure that directly supports USOs, investing in exploratory research patterns could also contribute to university entrepreneurial activities.

Second, academic entrepreneurs and academic scientists interested in developing their research by founding USOs can learn that if they come from universities strong in research exploration, they might have easier time in securing funds for their company, a possible source of competitive advantage; conversely, founders of USOs coming from universities strong in research exploitation could consider relying substantially on surrogate entrepreneurs (Visintin & Pittino, 2014) or partnering with industry partners (Colombo & Piva, 2012) as these might mitigate the disadvantages coming from their university imprinting. Universities could share this information internally, as it might help academic scientists to engage in entrepreneurial activities by making them more aware of the probability of obtaining early-stage financing. Our findings could also be important, specifically for early-career scholars. The engagement of early-career scholars in entrepreneurial activity is a recurring topic in EU literature and has drawn particular attention in the Italian context. Knowing the different possibilities that exploitation and exploration in research offer to USOs, early-career scholars can more consciously plan engagement in entrepreneurial behaviors at the start of their careers.

Third, given the tension that certain elements tied to exploitation in university research might have with USOs’ development (the number of Ph.D. programs), universities could plan measures to reconcile such tensions. For instance, they could promote more awareness of technology transfer in Ph.D. programs, further legitimize the academic engagement of senior faculty, and measure the value of publications not only in terms of citations but also in terms of collaborations nurtured with industry.

Finally, investors specializing in early-stage investments in technology-based companies can learn from our findings that some universities have to be monitored because they are more likely to generate USOs that attract external equity financing. Therefore, investors should seriously consider strengthening their ties with these universities.

Notes

ARWU ranking is a yearly publication of the Jiao Tong University in Shanghai and has been recognized as the leading global university rankings since it employs transparent methodology and objective third-party data (www.shanghairanking.com).

The Leiden Ranking is based on publications in the WOS in combination with the Science Citation Index Expanded, the Social Sciences Citation Index, and the Arts & Humanities Citation Index (www.leidenranking.com).

Web of Science (WOS), previously known as Web of Knowledge, is a database of bibliographic citations.

The operationalization of the dependent variable in our main models is in line with recent studies, such as Roche et al. (2020), which looks at early-stage fundraising of USOs, using a 5-year window from firm inception. We performed, as robustness check, also an analysis using both a 3- and a 4-year event window for the dependent variable. Results remain substantially unchanged. Continuos variables are standardized when used as regressors.

The variable measuring the percentage of Ph.D. students on total academic staff was excluded from the regression model to avoid perfect multicollinearity as it is a linear combination of the other human capital variables (equal to 100 if summed up with the other human capital variables).

References

Abootorabi, H., Shankar, R. K., Rasmussen, E., & Wiklund, J. (2023). Do hybrid goals pay off? Social and economic goals in academic spin-offs. Journal of Management Studies. https://doi.org/10.1111/joms.12967

Abramo, G., D’Angelo, C. A., Di Costa, F., & Solazzi, M. (2009). University–industry collaboration in Italy: A bibliometric examination. Technovation, 29(6-7), 498–507. https://doi.org/10.1016/j.technovation.2008.11.003

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774. https://doi.org/10.1007/s11187-013-9505-9

Agyare, D., Minola, T., Hahn, D., & Vismara, S. (2022). Non-accounting drivers of innovative start-up valuation by early-stage equity investors: A literature review and future research agenda. In D. Audretsch, Khachlouf, R. Caiazza, & M. Belitski (Eds.), Entrepreneurship, finance and technology. Edward Elgar Publishers. https://doi.org/10.4337/9781800884342.00019

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165–198.

Ambos, T. C., Mäkelä, K., Birkinshaw, J., & D’Este, P. (2008). When does university research get commercialized? Creating ambidexterity in research institutions. Journal of Management Studies, 45(8), 1424–1447. https://doi.org/10.1111/j.1467-6486.2008.00804.x

Audretsch, D. B., & Belitski, M. (2022). A strategic alignment framework for the entrepreneurial university. Industry and Innovation, 29(2), 285–309. https://doi.org/10.1080/13662716.2021.1941799

Audretsch, D. B., Lehmann, E. E., Paleari, S., & Vismara, S. (2016). Entrepreneurial finance and technology transfer. Journal of Technology Transfer, 41, 1–9. https://doi.org/10.1007/s10961-014-9381-8

Banal-Estañol, A., Jofre-Bonet, M., & Lawson, C. (2015). The double-edged sword of industry collaboration: Evidence from engineering academics in the UK. Research Policy, 44(6), 1160–1175.

Barbieri, E., Rubini, L., Pollio, C., & Micozzi, A. (2018). What are the trade-offs of academic entrepreneurship? An investigation on the Italian case. The Journal of Technology Transfer, 43, 198–221. https://doi.org/10.1007/s10961-016-9482-7

Bercovitz, J., & Feldman, M. (2008). Academic entrepreneurs: Organizational change at the individual level. Organization Science, 19(1), 69–89. https://doi.org/10.1287/orsc.1070.0295

Block, J., Fisch, C., Vismara, S., & Andres, R. (2019). Private equity investment criteria: An experimental conjoint analysis of venture capital, business angels, and family offices. Journal of Corporate Finance, 58, 329–352. https://doi.org/10.1016/j.jcorpfin.2019.05.009

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The impact of local and external university knowledge on the creation of knowledge-intensive firms: Evidence from the Italian case. Small Business Economics, 43(2), 261–287. https://doi.org/10.1007/s11187-013-9536-2

Centobelli, P., Cerchione, R., & Esposito, E. (2019). Exploration and exploitation in the development of more entrepreneurial universities: A twisting learning path model of ambidexterity. Technological Forecasting and Social Change, 141, 172–194. https://doi.org/10.1016/j.techfore.2018.10.014

Cerver Romero, E., Ferreira, J. J., & Fernandes, C. I. (2021). The multiple faces of the entrepreneurial university: A review of the prevailing theoretical approaches. The Journal of Technology Transfer, 46(4), 1173–1195. https://doi.org/10.1007/s10961-020-09815-4

Chang, Y. C., Yang, P. Y., & Chen, M. H. (2009). The determinants of academic research commercial performance: Towards an organizational ambidexterity perspective. Research Policy, 38(6), 936–946. https://doi.org/10.1016/j.respol.2009.03.005

Chang, Y. C., Yang, P. Y., Martin, B. R., Chi, H. R., & Tsai-Lin, T. F. (2016). Entrepreneurial universities and research ambidexterity: A multilevel analysis. Technovation, 54, 7–21. https://doi.org/10.1016/j.technovation.2016.02.006

Choi, H., Yoon, H., Siegel, D., Waldman, D. A., & Mitchell, M. S. (2022). Assessing differences between university and federal laboratory postdoctoral scientists in technology transfer. Research Policy, 51(3), 104456. https://doi.org/10.1016/j.respol.2021.104456

Civera, A., Meoli, M., & Vismara, S. (2020). Engagement of academics in university technology transfer: Opportunity and necessity academic entrepreneurship. European Economic Review, 123, 103376. https://doi.org/10.1016/j.euroecorev.2020.103376

Clarysse, B., Andries, P., Boone, S., & Roelandt, J. (2023). Institutional logics and founders’ identity orientation: Why academic entrepreneurs aspire lower venture growth. Research Policy, 52(3), 104713. https://doi.org/10.1016/j.respol.2022.104713

Colombo, M. G., & Piva, E. (2012). Firms’ genetic characteristics and competence-enlarging strategies: A comparison between academic and non-academic high-tech start-ups. Research Policy, 41(1), 79–92. https://doi.org/10.1016/j.respol.2011.08.010

Colombo, M. G., D’Adda, D., & Piva, E. (2010). The contribution of university research to the growth of academic start-ups: an empirical analysis. The Journal of Technology Transfer, 35(1), 113–140. https://doi.org/10.1007/s10961-009-9111-9

Colombo, M. G., Meoli, M., & Vismara, S. (2019). Signaling in science-based IPOs: The combined effect of affiliation with prestigious universities, underwriters, and venture capitalists. Journal of Business Venturing, 34(1), 141–177. https://doi.org/10.1016/j.jbusvent.2018.04.009

Conti, A., & Liu, C. C. (2015). Bringing the lab back in: Personnel composition and scientific output at the MIT Department of Biology. Research Policy, 44(9), 1633–1644. https://doi.org/10.1016/j.respol.2015.01.001

Cunningham, J. A., Lehmann, E. E., & Menter, M. (2022). The organizational architecture of entrepreneurial universities across the stages of entrepreneurship: A conceptual framework. Small Business Economics, 59(1), 11–27. https://doi.org/10.1007/s11187-021-00513-5

Cunningham, J. A., Lehmann, E. E., Menter, M., & Seitz, N. (2019). The impact of university focused technology transfer policies on regional innovation and entrepreneurship. The Journal of Technology Transfer, 44, 1451–1475. https://doi.org/10.1007/s10961-019-09733-0

de Haan, U., Shwartz, S. C., & Gómez-Baquero, F. (2020). A startup postdoc program as a channel for university technology transfer: The case of the Runway Startup Postdoc Program at the Jacobs Technion–Cornell Institute at Cornell Tech. The Journal of Technology Transfer, 45(6), 1611–1633. https://doi.org/10.1007/s10961-019-09764-7

Fini, R., Fu, K., Mathisen, M. T., Rasmussen, E., & Wright, M. (2017). Institutional determinants of university spin-off quantity and quality: A longitudinal, multilevel, cross-country study. Small Business Economics, 48(2), 361–391. https://doi.org/10.1007/s11187-016-9779-9

Fini, R., Grimaldi, R., & Meoli, A. (2020). The effectiveness of university regulations to foster science-based entrepreneurship. Research Policy, 49(10), 104048. https://doi.org/10.1016/j.respol.2020.104048

Fini, R., Rasmussen, E., Wiklund, J., & Wright, M. (2019). Theories from the lab: How research on science commercialization can contribute to management studies. Journal of Management Studies, 56(5), 865–894. https://doi.org/10.1111/joms.12424

Giuri, P., Munari, F., Scandura, A., & Toschi, L. (2019). The strategic orientation of universities in knowledge transfer activities. Technological Forecasting and Social Change, 138, 261–278. https://doi.org/10.1016/j.techfore.2018.09.030

Grimaldi, R., Kenney, M., & Piccaluga, A. (2021). University technology transfer, regional specialization and local dynamics: Lessons from Italy. The Journal of Technology Transfer, 46, 855–865. https://doi.org/10.1007/s10961-020-09804-7

Guerrero, M. (2021). Ambidexterity and entrepreneurship studies: A literature review and research agenda. Foundations and Trends in Entrepreneurship, 17(5–6), 436–650. https://doi.org/10.1561/0300000097

Guerrero, M., & Pugh, R. (2022). Entrepreneurial universities’ metamorphosis: Encountering technological and emotional disruptions in the COVID-19 ERA. Technovation, 118, 102584. https://doi.org/10.1016/j.technovation.2022.102584

Guerrero, M., & Urbano, D. (2012). The development of an entrepreneurial university. The Journal of Technology Transfer, 37(1), 43–74. https://doi.org/10.1007/s10961-010-9171-x

Guerrero, M., Cunningham, J. A., & Urbano, D. (2015). Economic impact of entrepreneurial universities’ activities: An exploratory study of the United Kingdom. Research Policy, 44(3), 748–764. https://doi.org/10.1016/j.respol.2014.10.008

Guerrero, M., Urbano, D., Fayolle, A., Klofsten, M., & Mian, S. (2016). Entrepreneurial universities: Emerging models in the new social and economic landscape. Small Business Economics, 47(3), 551–563. https://doi.org/10.1007/s11187-016-9755-4

Hahn, D., Minola, T., & Eddleston, K. A. (2019). How do scientists contribute to the performance of innovative start-ups? An imprinting perspective on open innovation. Journal of Management Studies, 56(5), 895–928. https://doi.org/10.1111/joms.12418

Hahn, D., Minola, T., Vismara, S., & De Stasio, V. (2019). Financing innovation: Challenges, opportunities, and trends. Foundations and Trends in Entrepreneurship, 15(3-4), 328–367. https://doi.org/10.1561/0300000085-1

Hayter, C. S. (2011). In search of the profit-maximizing actor: Motivations and definitions of success from nascent academic entrepreneurs. Journal of Technology Transfer, 36(3), 340–352. https://doi.org/10.1007/s10961-010-9196-1

Hayter, C. S. (2016). Constraining entrepreneurial development: A knowledge-based view of social networks among academic entrepreneurs. Research Policy, 45(2), 475–490. https://doi.org/10.1016/j.respol.2015.11.003

Hayter, C. S., & Link, A. N. (2018). Why do knowledge-intensive entrepreneurial firms publish their innovative ideas? Academy of Management Perspectives, 32(1), 141–155. https://doi.org/10.5465/amp.2016.0128

Hayter, C. S., Nelson, A. J., Zayed, S., & O’Connor, A. C. (2018). Conceptualizing academic entrepreneurship ecosystems: A review, analysis and extension of the literature. Journal of Technology Transfer, 43(4), 1039–1082. https://doi.org/10.1007/s10961-018-9657-5

Hayter, C. S., & Parker, M. A. (2019). Factors that influence the transition of university postdocs to non-academic scientific careers: An exploratory study. Research Policy, 48(3), 556–570. https://doi.org/10.1016/j.respol.2018.09.009

Honjo, Y., & Nagaoka, S. (2018). Initial public offering and financing of biotechnology start-ups: Evidence from Japan. Research Policy, 47(1), 180–193. https://doi.org/10.1016/j.respol.2017.10.009

Horta, H., Meoli, M., & Vismara, S. (2016). Skilled unemployment and the creation of academic spin-offs: A recession-push hypothesis. The Journal of Technology Transfer, 41(4), 798–817. https://doi.org/10.1007/s10961-015-9405-z

Huyghe, A., Knockaert, M., & Obschonka, M. (2016). Unraveling the “passion orchestra” in academia. Journal of Business Venturing, 31(3), 344–364. https://doi.org/10.1016/j.jbusvent.2016.03.002

Huyghe, A., Knockaert, M., Piva, E., & Wright, M. (2016). Are researchers deliberately bypassing the technology transfer office? An analysis of TTO awareness. Small Business Economics, 47, 589–607. https://doi.org/10.1007/s11187-016-9757-2

Jain, S., George, G., & Maltarich, M. (2009). Academics or entrepreneurs? Investigating role identity modification of university scientists involved in commercialization activity. Research Policy, 38(6), 922–935. https://doi.org/10.1016/j.respol.2009.02.007