Abstract

This study adopts a competitive dynamics perspective to illuminate how and when different types of knowledge transferred by a spin-out trigger parent hostility. Specifically, I propose based on the awareness-motivation-capability framework that (1) transfers of market-related and technology-related knowledge will yield hostility and that (2) market commonality, resource similarity, and competitive intensity will exacerbate this effect. Findings from 207 spin-outs support several of my hypotheses. The study contributes to the extant literature by providing a more nuanced view on knowledge legacies, in particular regarding their interplay with a spin-out’s competitive positioning.

Plain English Summary

In a popular view, spin-outs spawn with ‘silver spoons’, i.e., performance boosting knowledge transferred from their parent firms. This study shows that such ‘knowledge legacies’ can turn into liabilities by spurring potentially harmful parent hostility. This was more likely for transfers of market-related knowledge than for transfers of technological knowledge. Moreover, the hostility impact was also contingent on the spin-out’s competitive positioning vis-à-vis the parent. Entering parents’ markets amplified the hostility effect of transferred market-related knowledge. Transferred technological knowledge only posed hostility problems if a spin-out attempted to imitate the resource base of their ‘home’ business unit or operated in a highly competitive industry. This study adds to prior work by demonstrating the flipside of knowledge legacies (thereby suggesting a more nuanced view) and by bridging the relatively disconnected literatures on knowledge-related advantages of spin-outs and on competitive dynamics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Spin-outs are widely viewed as privileged entrants that capitalize on knowledge transfers from the founders’ previous employers and thus outperform other types of entrants (Agarwal et al., 2004; Agarwal & Shah, 2014; Andersson et al., 2012; Chatterji, 2009; Yeganegi et al., forthcoming), in particular in high-tech sectors (Hunt et al., 2019). Parent firms, as “permeable repositories of knowledge” (Agarwal et al., 2004: 502), cannot perfectly shield against such knowledge leakages (Campbell et al., 2012; Ganco, 2013), their adverse performance impacts (Campbell et al., 2012; McKendrick et al., 2009; Wezel et al., 2006), and competitive entry by spin-outs (Agarwal & Shah, 2014; Klepper & Sleeper, 2005). Some parents view knowledge transfers as an opportunity for collaborating with the spin-out (Lindholm, 1997). Others condemn them as an act of ‘rapacious plundering’ (Klepper, 2001). Knowledge transfers thus pose a risk of triggering parent hostility (i.e., the degree to which an incumbent firm disapproves of the spawning of a spin-out from within its ranks) that can lead the parent and other firms to retaliate against the spin-out (Walteret al., 2014). Since anticipating the parent’s reaction to knowledge transfers is critical for spin-outs (Chen & Miller, 2012), this study addressed some fundamental questions: How do transfers of what types of knowledge stir up parent hostility? What role does the spin-out’s initial competitive positioning play in this context?

In attempting to examine these questions, this study draws on the literatures on competitive dynamics and knowledge ‘legacies’ by spin-outs.Footnote 1 For instance, scholars of competitive dynamics have demonstrated how competitive moves and countermoves influence survival and long-term performance of firms, sometimes in destructive ways (Chen & Miller, 2012; Ketchenet al., 2004). Firms have been modelled as being more likely to respond to a competitive move the more they are aware of an action, motivated to react, and capable of responding (Chen, 1996; Chen et al., 2007). These influences contribute to a potential tension between rivals and thus increase the likelihood of attacks and counterattacks (Chen et al., 2007). Competitive tension with the parent can affect a spin-out’s industry choice (Sakakibara & Balasubramanian, 2020), ability to attract corporate investments (Bae & Lee, 2021), and survival (Bahoo-Torodi & Torrisi, 2022). Studies have also demonstrated that transfers of market-related and technology-related knowledge are particularly beneficial to spin-out development (Agarwal & Shah, 2014; Agarwal et al., 2004; Chatterji, 2009). Although some knowledge can be protected, for instance via patents (Agarwal et al., 2009; Kim & Marschke, 2005), spin-outs tend to transfer difficult to protect, complex knowledge (Ganco, 2013) and possess insider knowledge enabling them to circumvent parental intellectual property protection (Klepper & Sleeper, 2005). Although some parents tend to ignore spin-outs that do not compromise the viability of their existing revenues (Klepper, 2007), knowledge leakages through spin-outs pose the highest performance risks for incumbents compared to leakage through employee mobility (Agarwal et al., 2016; Campbell et al., 2012; Ganco, 2013; Wezel et al., 2006). Moreover, parent hostility has been linked to initial strategic actions on part of the spin-out, such as offering substitute products, poaching employees, and first offering the entrepreneurial idea to the parent (Vaznyte et al., 2021). However, despite substantial scholarship in the field, a few significant gaps remain.

First, given that competitive dynamics research has focused on large incumbents—studies by Bae and Lee (2021) and Bahoo-Torodi and Torrisi (2022) are notable exceptions—there is a void in scholars’ understanding of how entrepreneurial entrants can set foot in markets without prompting hostility and retaliation by incumbents—an important oversight given that the performance and survival of entrepreneurial ventures may depend on their ability to effectively anticipate and mitigate the responses of entrenched incumbents (Chen & Miller, 2012; Fan, 2010; Markman & Waldron, 2014). Second, parent hostility impairs spin-out development by prompting competitive reactions on part of the parent and third parties (Walter et al., 2014). However, I know relatively little about why parent hostility emerges and what role the type of transferred knowledge plays in this context. Third, knowledge transfers are typically viewed as an advantage of spin-outs over other types of entrants (Agarwal et al., 2004; Chatterji, 2009) but there has been, except for some anecdotal evidence (Klepper, 2007), little systematic scrutiny on the nature of parents’ reactions to knowledge transfers. In particular, the role of different types of knowledge has not been explored in this context, although they may, from a knowledge- and resource-based perspective, have differential value to firms (Barney, 1991; Grant, 1996). This warrants further research into the link between knowledge transfers, competitive positioning, and parent hostility.

To address the above gaps, this study investigates how different types of transferred knowledge affect parent hostility and how these relationships are conditioned by interfirm competition. More specifically, I make two core arguments: (1) parent hostility increases with the extent to which the spin-out founders carry over knowledge about markets and customer needs (transferred market-related knowledge; Marvel & Lumpkin, 2007) and knowledge about key technologies (transferred technological knowledge; Marvel & Lumpkin, 2007) from previous employments; (2) three contingencies amplify these relationships, namely market commonality (i.e., the degree of presence that a spin-out manifests in the markets it overlaps with a parent firm; Chen, 1996), resource similarity (i.e., the extent to which a spin-out possesses strategic endowments comparable, in terms of both type and amount, to those of the parent firm; Chen, 1996), and competitive intensity (i.e., the behavior, resources, and ability of competitors to differentiate; Jaworski & Kohli, 1993). My findings contribute to the literature by suggesting a more nuanced view on knowledge legacies and competitive entry by spin-outs. In particular, the study demonstrates that knowledge transfers can yield disadvantages by triggering parent hostility and that the type of knowledge and the spin-out’s initial competitive positioning matter in this milieu. This study also extends the literature on competitive dynamics by providing an explanation for parents’ competitive reactions to the spawning of spin-outs.

2 Theoretical framework and hypotheses

From the competitive dynamics perspective, firms act and rivals respond to improve or defend the own competitive position.Footnote 2 A series of actions and reactions can unfold, impacting the long-term performance and survival of firms (Baum & Korn, 1999; Boyd & Bresser, 2008; Ketchen et al., 2004). One form of competitive action, new firm entry, is a salient threat to incumbents as it intensifies competition and threatens market shares and profitability (Porter, 1980). In particular spin-outs can erode the competitive advantage of the parent by transferring tacit knowledge (Agarwal et al., 2004) and replicating organizational routines (Phillips, 2002). Parents tend to react to own spin-outs in one of many ways, ranging from more friendly (e.g., by providing active support; Lindholm, 1997) to more hostile (e.g., by taking legal actions; Klepper & Sleeper, 2005). The nature of a parent’s initial reaction impacts a spin-out’s further trajectory, sets the tone for future interactions, and shapes the potential for subsequent cooperation (or rivalry) of the progeny not only with the parent but also with the parent’s partners (Chen & Miller, 2012; Walter et al., 2014). Anticipating this response and avoiding a severe retaliation is thus vital for spin-outs trying to set foot into a market (Markman & Waldron, 2014). However, to date, there is a void in scholars’ understanding of motivations triggering incumbents’ responses to competitive entry, in particular in the context of spin-outs.

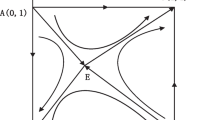

My conceptual model (Fig. 1) examines parent hostility rather than actual competitive responses for three reasons. First, competitive reactions come in various, not-well researched forms, such as price battles (Chen & Miller, 2012), lawsuits (Klepper & Sleeper, 2005), or verbal responses (He et al., 2017). Hostility as an attitudinal measure provides a reliable and parsimonious proxy of such reactions in the spin-out context (Armitage & Conner, 2001). Second, the parent could react directly (e.g., by a lawsuit) or indirectly (e.g., by motivating other actors to battle the spin-out), with a hardly predictable time lag (Luoma et al., 2017)—issues considered in the hostility concept. Hostility is thus an indicator of whether a parent will support, ignore, or fight the spin-out (Klepper & Sleeper, 2005; Lindholm, 1997). Third, hostility is a frequent and severe problem of spin-outs: In an empirical study, about half of the spin-outs encountered some form of hostility, with adverse effects on their time to breakeven (Walter et al., 2014).Footnote 3 I thus suggest that the concept of parent hostility helps understand the post-entry action-reaction sequence between parent and spin-out and that hostility is an important predictor of parents’ competitive reactions to spin-out entry.

In the following, I build on Chen’s et al. (2007: 102) concept of competitive tension (i.e., “the strain between a focal firm and a given rival that is likely to result in the firm taking action against the rival”) to suggest that a spin-out may face a dual tension with a parent. The first is knowledge-related tension, i.e., the strain between a parent firm and its own spin-out that results from knowledge transfers through the spin-out and makes the parent more likely to take actions against the spin-out. This tension is driven by the parents’ fear that failure to prevent leakages of knowledge—one of the strategically most important resources (Grant, 1996; Kogut & Zander, 1992)—will erode knowledge-based competitive advantages (Ganco, 2013; Ganco et al., 2015) and destroy opportunities to leverage on tacit knowledge (Coff et al., 2006). The second is spin-out related competitive tension, i.e., the competitive strain between a parent firm and its spin-out that is likely to result in the parent taking actions against the spin-out. This tension results from the spin-out’s initial competitive positioning and the parent’s fear that the entrant intensifies within-industry competition and undermines existing profitability. Taken together, my model in Fig. 1 predicts the highest level of hostility if knowledge-related tension (resulting from substantial knowledge transfers) coincides with competitive tension (resulting from a spin-out’s choice to enter the parent’s markets and/or to imitate the parent’s resource base).

2.1 Knowledge-related tension

A firm’s competitive advantage depends on the ability to create, appropriate, and shield critical knowledge (Grant, 1996; Kogut & Zander, 1992). Employees possess and develop knowledge that is coordinated by the firm to produce goods and services (Ganco, 2013). However, an incumbent’s knowledge base also provides a repository of entrepreneurial opportunities (Gambardella et al., 2015; Marvel & Lumpkin, 2007) and know-how to exploit them (Elfenbein et al., 2010). Some employees may opt to independently exploit these opportunities. Others may disclose them first and spin-out only after experiencing the incumbent not acting upon the opportunity (Klepper, 2001; Klepper & Thompson, 2010; Kaul et al., forthcoming) as firms often deny profitable opportunities that fall outside their core business (Hellmann, 2007).

Once committed to a spin-out, the founders engage in local and distant search in knowledge brokering from the parent (Basu et al., 2015) and make a strategic decision about how to construct the venture’s knowledge base. This refers to the extent to which they want to use existing knowledge legacies (Sahaym et al., 2016), transfer further complimentary pieces of parental knowledge, and/or integrate other external knowledge (Basu et al., 2015). Being insiders until their official resignation, it is often cost-efficient for the founders to identify critical knowledge holders in the parent firm, tap into their knowledge, or even poach them (Agarwal et al., 2016). Although access to parental knowledge can give spin-outs distinct performance advantages (Agarwal et al., 2004; Chatterji, 2009), overreliance on parental knowledge can backfire by inhibiting spin-out innovativeness (Basu et al., 2015) and growth (Klepper & Sleeper, 2005; Sapienza et al., 2004), and by deterring corporate investors (Bae & Lee, 2021).

I now argue that transfers of market-related knowledge and technological knowledge—arguably the most important types of knowledge in the spin-out context (Agarwal & Shah, 2014; Agarwal et al., 2004; Chatterji, 2009; Uzunca, 2018)—are positively related to parent hostility for two reasons. First, knowledge transfers impair the parent’s short-run innovation and financial performance.Footnote 4 Scholars have highlighted that labor mobility, in particular through spin-outs, threatens knowledge-based competitive advantage by facilitating the interorganizational transfer of know-how and routines (Campbell et al., 2012; Ganco, 2013; Wezel et al., 2006). Although firms rely on isolating mechanisms, such as patent protection (Gambardella et al., 2015), non-compete caveats (Marx et al., 2009), and distributed and socially complex knowledge (Nickerson & Zenger, 2004), to protect their knowledge, these mechanisms are less effective if the rival originates from within the firm (Agarwal et al., 2016). The parent firm loses top managers and scientists as well as any investment into their hiring and training (Ganco et al., 2015; Ioannou, 2014; Klepper & Thompson, 2010). Founder departure disrupts social routines and innovation processes at the parent and intensifies competition (Phillips, 2002). In mixing parental with external knowledge, the spin-out can develop more innovative and higher-quality products compared to the parent (Basu et al., 2015; Kogut & Zander, 1992). Moreover, some spin-outs take technologies ‘off the parent’s shelve’ and thus potentially threaten the parent’s revenue streams from existing technologies.

Second, ignoring even non-harmful transfers of proprietary knowledge can motivate followers and lead to costs and performance losses for the parent in future.Footnote 5 Some parents signal their emphasis on intellectual property protection via strict organizational routines, such as non-compete caveats (Buenstorf et al., 2016; Starr et al., 2018) and litigation (Agarwal et al., 2009; Gambardella et al., 2015). Although corporate reputation for toughness in patent enforcement curbs knowledge leakage to start-ups (Agarwal et al., 2009; Kim & Marschke, 2005), spin-outs tend to transfer less protectable, complex knowledge (Ganco, 2013) and founders often have sufficient inside knowledge to circumvent parental IP protection, for instance by drawing on diverse sources of technology or inventing around a patent (Klepper & Sleeper, 2005). Moreover, not all jurisdictions enforce non-compete agreements (Hellmann, 2007). However, attempts to enforce IP rights impose additional costs on knowledge transfers and may thus reduce the risks of followers and more knowledge leakage in the future. Thus, ceteris paribus,

-

Hypothesis 1a. The more extensive the transferred market-related knowledge, the higher the parent hostility.

-

Hypothesis 1b. The more extensive the transferred technological knowledge, the higher the parent hostility.

Transfers of market-related knowledge, as I suggest now, matter more for parent hostility than transfers of technological knowledge. This is because the prior is more likely to affect short-run financial performance valued by many top managers. Knowledge about customer preferences and buying patterns helps identify profitable opportunities and react quickly to shifts in demand (Garvin, 1983; Marvel & Lumpkin, 2007). The more agile business models of start-ups enable them to focus on the most profitable parts of the value chain, setting aside the less profitable parts of incumbents’ bundled offers (Dietz et al., 2016). In some cases, founders may carry over customers with whom they had developed close ties (Bermiss & Greenbaum, 2016), increasing spin-out performance at the parent’s expense. Moreover, market-related knowledge is more difficult to protect than technological knowledge through conventional isolating mechanisms (Rumelt, 1984). In contrast, technological knowledge involves knowledge that the parent is often reluctant or slow to exploit (Gambardella et al., 2015; Klepper & Sleeper, 2005). Such knowledge is typically the base for innovative applications (Marvel & Lumpkin, 2007) and thus long-term performance, but is preceded by time-consuming development without financial payoff. Chatterji (2009) has demonstrated that superior spin-out performance is driven by spillovers of non-technical knowledge related to marketing rather than technical know-how. Thus, ceteris paribus,

-

Hypothesis 1c. The relationship with parent hostility is stronger for transferred market-related knowledge than for transferred technological knowledge.

2.2 Competitive tension

Competitive dynamics researchers have highlighted the role of competitive tension that, once it has reached a ‘breaking point’, triggers a competitive attack (Chen, 1996; Chen & Miller, 2015). Competitive tension, in turn, is influenced by the extent to which a firm is aware of rival firms’ actions, motivated to react, and able to respond (awareness-motivation-capabilities [AMC] perspective; Chen et al., 2007). In the following, I will adapt the competitive dynamics perspective to the context of this study and focus on competitive tension as a contingency factor. A parent will, as I propose, react more hostile to knowledge transfers in the face of competitive tension, as proxied by market commonality, resource similarity, and competitive intensity (Chen & Miller, 2012; Jaworski & Kohli, 1993; Porter, 1979). I start with the contingent role of market commonality.

Spin-outs strategically decide where to compete, attempting to differentiate from competition, hinder easy imitation of their products and strategic moves, create causal ambiguity for rivals, and ultimately develop and sustain competitive advantage (Sahaym et al., 2016, Zahra et al., 2002). Some scholars have suggested that spin-outs tend to initially enter the parents’ markets. Knowledge transfers are a source of path-dependent capabilities that shape a spin-out’s early strategic choices (Argyres & Mostafa, 2016; Fern et al., 2012). The founders’ prior experience defines the knowledge corridor that influences opportunity identification and market choice (Shane, 2000). Some inherited capabilities are context-specific and lose value when reapplied outside the core market (Ioannou, 2014). Indeed, spin-outs were found to survive longer if they started in the same industry as the parent (Andersson et al., 2012). Other scholars do not restrict the spin-out to the same industry as the parent (Klepper & Sleeper, 2005). Instead, spin-outs develop their knowledge bases to enter into markets different from their parents’, thereby extending their knowledge legacies across industry segments (Argyres & Mostafa, 2016; Basu et al., 2015). Although historical industry experience limits strategy choices at the outset, this constraint can be overcome by building founding teams with diverse backgrounds (Fern et al., 2012). Furthermore, moving into different markets helps spin-outs avoid parents that would otherwise fight unwanted offspring close to their markets, e.g., by enforcing noncompete covenants (Buenstorf et al., 2016; Sakakibara & Balasubramanian, 2020; Starr et al., 2018). Market commonality, as I suggest now, amplifies the positive link between transferred knowledge and parent hostility for three reasons.

First, entering the parent’s market makes the spin-out and thus the transfer of knowledge more visible to the parent. Firms recognize their interdependence more closely if they compete in the same market (Chen, 1996). The parent is more likely to identify the progeny as a rival and competitive threat (Peteraf & Bergen, 2003), making a parental response to knowledge leakages more likely (Dutton & Jackson, 1987). This can spark disruptive competition, with detrimental effects on a spin-out’s survival chances (Bahoo-Torodi & Torrisi, 2022). Second, parents are more motivated to retaliate for knowledge transfers that are used to compete against them. The parent is most likely to defend its position and to not tolerate an attack with impunity, if market commonality is high and large pieces of its intellectual property are infringed (Chen, 1996). While some parents ignore knowledge-transferring spin-outs that do not threaten their revenue streams from core markets (Klepper & Sleeper, 2005; Markman & Waldron, 2014), parents tend to react decisively when attacked in their markets (Chen & Miller, 2012) and when the transfer of resources and routines compromises their financial success (Phillips, 2002). Firms compete most aggressively with competitors they only meet in one market (Baum & Korn, 1996). Since resource scarcity may keep spin-outs from engaging in multipoint competition with the parent, they are unlikely to benefit from mutual forbearance (Chen, 1996). Some spin-outs commercialize technology shelved by the parent to avoid cannibalization (Hellmann, 2007), with greater knowledge transfer and market overlap having a more negative impact on parent revenues. Third, parents may more easily activate their network partners in their home markets (Walter et al., 2014), in particular when considerable transfer of knowledge helps justify counter-spin-out maneuvers. In contrast, building on parents’ technologies without invading their product spaces enables spin-outs to leverage on connections to parents’ partners (Gaonkar & Moeen, 2023). Thus, ceteris paribus,

-

Hypothesis 2a. The higher the market commonality, the stronger the positive relationship between transferred market-related knowledge and parent hostility.

-

Hypothesis 2b. The higher the market commonality, the stronger the positive relationship between transferred technological knowledge and parent hostility.

Resource similarity is the second contingency factor in my conceptual model. The uniqueness of its resource base decides on the competitive position and advantage of a firm (Rumelt, 1984; Wernerfelt, 1984). Since resource endowments constrain a firm’s strategic maneuverability (Collis, 1991), firms with similar resource bundles also tend to have similar strategic capabilities and are more likely to attack or retaliate against one another (Chen, 1996; Chen et al., 2007). Given their founders’ previous insider status, spin-outs are more likely than other entrants to at least partially replicate parents’ ‘blueprints’ (Bhidé, 2000; Fern et al., 2012; Phillips, 2002; Wezel et al., 2006). Previous research has modelled resource similarity as conceptually distinct from mere knowledge transfers because the founders’ willingness (Basu et al., 2015; Sahaym et al., 2016; Sapienza et al., 2004) and ability (Agarwal et al., 2016; Phillips, 2002) to integrate previous experience and other parent-like resources into their resource bases determines the companies’ resource similarity.Footnote 6 I now argue that knowledge transfers are more severe, in terms of parent hostility, the higher the resource similarity between a spin-out and the parent’s business unit it originated in.Footnote 7

First, resource-side similarities draw the parent’s attention to the spawning of a spin-out and thus potential knowledge transfers involved in the process. According to competitive dynamics research, resource similarity is a second criterion, besides market commonality, to locate rivals (Chen, 1996). It supports myopic managers in identifying current and potential direct rivals who are typically prioritized over more distant competitors (Peteraf & Bergen, 2003). Resource similarity can indicate that the spin-out has positioned itself closely to its former business unit, turning it into a (potential) direct rival to the parent firm in this competitive arena (Peteraf & Bergen, 2003). This reduces the likelihood that a spin-out can over a prolonged period of time successfully ‘fly under the parent’s radar’, in particular if it also resides in close geographic proximity to the parent (Peteraf & Shanley, 1997). Second, since competitive advantage depends on the uniqueness of a firm’s resource base (Barney, 1991; Rumelt, 1984; Wernerfelt, 1984), a parent perceives the rival with the resource profile most similar to the own one as the most salient threat to its own operations (Chen et al., 2007). Competition is fiercer among companies that rely on similar resource structures (Gimeno & Woo, 1996). High resource similarity indicates that the spin-out has successfully circumvented isolating mechanisms (Rumelt, 1984) and other imitation barriers (e.g., Barney, 1991; Wernerfelt, 1984). The more salient the threat to its competitive advantage, the more likely will the parent further scrutinize and disapprove of the progeny’s knowledge transfers. Ultimately, the parent will be more motivated to strike back to prevent further competitive imitation or maximize a spin-out’s difficulties in imitating (Chen, 1996). Thus, ceteris paribus,

-

Hypothesis 3a. The higher the resource similarity, the stronger the positive relationship between transferred market-related knowledge and parent hostility.

-

Hypothesis 3b. The higher the resource similarity, the stronger the positive relationship between transferred technological knowledge and parent hostility.

A comprehensive study of competitive tension is not restricted to dyadic relationships between rivals but also considers an industry’s competitive environment (Smith et al., 2001). Fierce industry-level competition drives firms to operate aggressively and take many actions with great speed (Chen et al., 2010). The strength of competition in a firm’s chosen strategic position also affects firm performance (Argyres & Mostafa, 2016) and accelerates the erosion of competitive advantage (D'Aveni, 1994). Competitive intensity reinforces, as I propose now, the relationship between knowledge transfers and parent hostility. First, extreme competition pressures firms to engage in sophisticated competitive intelligence as quick and determined reactions are vital in this context (Chen et al., 2010; Ferrier et al., 1999). Parents are then more likely to note own spin-outs and detect knowledge appropriation on their part. Second, in the face of severe rivalry, competition turns towards innovating products and processes or differentiating from competitors in other ways (Zahra, 1993) and customers have greater choice among companies, while having to bear lower switching costs (Jaworski & Kohli, 1993). Moreover, intense competitive pressures leave companies little time to readjust their knowledge bases, for instance by recruiting experts or acquiring firms, if challenged by rivals’ innovations (Argyres & Mostafa, 2016). Since proprietary knowledge about markets and technologies is more critical in this context, parents are more concerned about shielding their intellectual property and suffer more from knowledge leakage via spin-outs. This can trigger a more severe parent reaction to knowledge transfers. Third, when competitive pressures are particularly high, incumbents may be more protective and concerned with new entrants further intensifying the already high competition. This common interest of incumbents makes a coordinated and aggressive action against entrants more likely, with the intention to drive the new competitor out of the industry (Fan, 2010). Suspected knowledge appropriation can provide a good cause for parent firms to win over allies to move against the own spin-out, so that the greater prospect of success further amplifies parent hostility. This is consistent with Porter’s (1980) notion that competitors might team up to discipline ‘bad’ competitors. Thus, ceteris paribus,

-

Hypothesis 4a. The higher the competitive intensity, the stronger the positive relationship between transferred market-related knowledge and parent hostility.

-

Hypothesis 4b. The higher the competitive intensity, the stronger the positive relationship between transferred technological knowledge and parent hostility.

3 Methods

3.1 Sample and procedure

To assemble a dataset, the internet and lists of exhibitors at industry fairs were searched broadly for any new firm originating from an incumbent firm. A spin-out had to meet three sampling criteria: (1) at least one founder worked at the parent directly prior to creating the spin-out, (2) the spin-out’s business model drew on technology transferred to it from the parent, and (3) the spin-out is headquartered in Germany. From an initial list of 1,168 potential spin-outs, 648 random-selected companies were called to double-check their spin-out status, to arrange interviews with confirmed spin-outs, and to request referrals to other founders of spin-outs. Face-to-face interviews with one respondent per founding team were then conducted between February 2010 and October 2011. This resulted in a final sample of 207 usable cases.Footnote 8 The spin-outs in the sample were on average seven years old (SD = 3.63) and employed 24 full-time equivalents (SD = 80.01). They operated in the fields of software (37%), nanotechnology and new materials (24%), biotechnology (10%), electronics (8%), and others (21%). The average founding team had two members (SD = 1.07). In multi-parent cases, the respondents were asked to refer to the parent firm providing the most critical technological knowledge. In 146 cases (70%), all founders had been employed by the focal parent firm before. Data on up to 180 parent firms was available. On average, these firms were 39.18 years old (SD = 47.78) and had 32,491 employees (SD = 68,098.29). The average spin-out resided within 153 km (median = 30.2, SD = 207.65) from its parent. Only six spin-outs had received minority investments from their parents in the founding year.

4 Measures

4.1 Dependent variable

Following Doucet (2004), information from case studies were used to construct a measure of parent hostility. To create the cases, the interviewers complemented our survey by documenting additional details on the parent-progeny relationships obtained from the respondent or the internet. The interviewers worked with our definition of parent hostility but, due to the complexity of the matter, were not equipped with a complete list of keywords. Using these case studies, three coders then rated parents independently of one another as either “1” for hostile if the report indicated some form of disapproval by the parent (as evidenced by words such as “lawsuit”, “litigation”, or “turmoil”) or otherwise as “0” for a neutral or friendly parent. A Fleiss’ Kappa of 0.86 indicated a high level of interrater reliability. The coders resolved any remaining discrepancies through discussion and reaching consensus. Confirming criterion validity, the measure was significantly related to post-founding collaboration with the parent (r = -0.45, p < 0.001) and to the number of parental representatives on the spin-out’s board (r = -0.23, p < 0.001). For robustness checks, a survey-based, alternate measure of hostility comprising three reverse-coded reflective items was used (α = 0.96; 7-point Likert scale,1 = does not apply at all, 7 = applies fully and completely): “The management of the parent firm has appreciated the spin-out,” “In the phase of spinning out, there has always been a benevolent posture,” and “The parent firm was open-minded about the idea of creating a spin-out.”

4.2 Independent variables

To capture knowledge transfers, the respondents were instructed to state the extent to which they transferred different types of knowledge from previous employers to the spin-out. The focus was on knowledge relevant to and thus applicable to the spin-out (e.g., “knowledge of ways customers use products/services similar to that of our company.” or “knowledge of a specific technology important for our company.”). Transferred market-related knowledge was operationalized as a composite of two scales adapted from Marvel and Lumpkin (2007). The first one, customer knowledge (originally labelled “prior knowledge of customer problems”), captured the extent to which the spin-out had carried over knowledge about the needs of customers from previous employments. The second one, market knowledge (originally referred to as “prior knowledge of markets”), reflects the extent to which the spin-out had transferred knowledge about how specific markets operate. The items were measured on 7-point Likert-scales (1 = “to a very low extent”, 7 = “to a very high extent”) and were reliable at alpha levels of 0.86 and 0.82, respectively. The Appendix provides an overview of all scales and validity information.

Transferred technological knowledge was measured with three reflective items adapted from Marvel and Lumpkin’s (2007) construct “prior knowledge of technology”. Respondents stated the extent to which the spin-out had transferred knowledge of specific key technologies. I dropped one item (“knowledge about a technology not known to the general public”) of the original scale due to poor factor loadings. The items were captured on the same scale as above and were reliable at an alpha of 0.88.

To capture market commonality, respondents rated the extent to which a spin-out and a parent served overlapping markets in the founding year (7-point Likert-scale; 1 = “very dissimilar”, 7 = “very similar”). This measure is in line with Chen’s (1996: 112) original definition of the construct as “the extent to which two firms are in direct competition in the market”.

Resource similarity was measured similar to Upson et al. (2012) as the extent to which the spin-out and its former business unit of the parent firm possessed similar amounts of different types of strategic resources in the spin-out’s founding year (7-point Likert-scale; 1 = “very dissimilar”, 7 = “very similar”). Each resource type, including “research & development”, “procurement”, “operations”, and “marketing and sales”, was measured with one item. The four items were summed up to arrive at my final measure of resource similarity.

To capture competitive intensity, I adopted Jaworski and Kohli’s (1993) original scale. However, poor factor loadings led me to drop two of the five reflective items (“There are many ‘promotion wars’ in our industry.”, “Our competitors are relatively weak.”). The final measure is reliable at an alpha of 0.71.

4.3 Control variables

I controlled for the number of employees quitting, i.e., employees leaving the parent firm within one year after spin-out formation to work full time for the spin-out. If employees leave collectively rather than individually spin-outs involve more comprehensive spillovers of routines and knowledge and thus pose higher risks to parents (Agarwal et al., 2016; Wezel et al., 2006). Knowledge diversity was measured as the ratio of the founders’ experience in the parent to their total industry experience (in years). Combining transferred knowledge with the knowledge of ‘outsiders’ can enable a spin-out to differentiate from the parent’s knowledge base (Basu et al., 2015; Sapienza et al., 2004) and therefore mitigate the suspicion of ‘knowledge theft’. Transferred product-related knowledge was measured as the extent to which the founders had transferred knowledge about ways to serve markets (7-point Likert-scale; 1 = “to a very low extent”, 7 = “to a very high extent”). This is the fourth category of prior knowledge proposed by Marvel and Lumpkin (2007) that could trigger hostility without being core to my conceptual framework. Finally, push and pull factors can trigger startup decisions (Fisher & Lewin, 2018; Patrick et al., 2016). I therefore added a dummy-variable spin-out motivation, coded “1” for ‘pull’, i.e., the founders were attracted to venturing for its opportunities and “0” for ‘push’, i.e., the founders were forced into venturing due to a lack of alternatives or due to frustrations with the parent firm.Footnote 9

4.4 Analysis

Surveys seemed to be optimal to elicit information required for my research but can be subject to biases. Non-response bias can cause a systematic exclusion of firms from the sample. Participating and non-participating firms as well as early and late respondents did not significantly differ in terms of age and size (number of employees), indicating little threat of non-response bias. Common-method bias distorts findings by neglecting method-driven spurious variance. Harman’s one-factor test and relying on different sources for the dependent and independent variables indicated a low threat of such bias. Moreover, retrospective errors, e.g., caused by a faulty memory, threaten the validity of findings if they occur systematically. Controlling for variables that can account for systematic variation in such bias across cases (spin-out age at survey and founder age) did not change my original results. Moreover, the effect sizes of transferred market-related knowledge and transferred technological knowledge did not significantly vary with the time lag between spin-out founding and survey. Thus, the threat of recall bias seems to be low.

Endogeneity bias is often caused by simultaneous causality and can yield biased and inconsistent coefficients (Bascle, 2008; Greene, 2012). While I argue that knowledge transfers drive parent hostility, also a reverse logic is possible: anticipated hostility deteriorates commitment towards the parent, thereby encouraging more knowledge transfer.Footnote 10 To test for endogeneity, I identified two instrument variables for transferred market-related knowledge (‘general customer experience’ and ‘reliance on existing customer network’) and for transferred technological knowledge (‘proactivity’ and ‘innovation championing’), respectively. The instruments were significantly correlated with the potentially endogenous variables, but not with the dependent variable, and significantly related to the respective, potentially endogenous variables in the first-stage regressions. Further tests suggested that the instruments were valid and relevant.Footnote 11 Finally, a Wald test of exogeneity (X2 = 3.22, ns) suggested that the knowledge variables did not jointly create an endogeneity problem. Since these analyses indicated no need to instrument transferred market-related knowledge and transferred technological knowledge, I relied on using ordinary logistic regression.Footnote 12

5 Results

5.1 Main findings

The descriptive statistics and correlation matrix are presented in Table 1, the regression results in Table 2. For better interpretation, independent and control variables were mean-centered. Computations of the condition index (CI) and variance inflation factor (VIF) reveal no serious multicollinearity problems (CI < 2.98, VIF < 1.47).Footnote 13

My first set of hypotheses illuminated a direct knowledge transfer-hostility link. Transferred market-related knowledge was significantly and positively related to parent hostility (Model 2: b = 0.21, p < 0.01; Hypothesis 1a supported). The relationship was not significant for technological knowledge (Model 2: b =—0.14, ns; Hypothesis 1b not supported). In support of Hypothesis 1c, transferred market-related knowledge exceeded transferred technological knowledge in effect size (X2 = 4.10, p < 0.05).

The remaining hypotheses introduced contingency factors. In non-linear regression, the coefficient estimate is insufficient for inference on an interaction effect because each interaction term is a function of the interaction coefficient and the coefficients of each interacted variable and of the values of the covariates. The sign and magnitude of interaction coefficients can thus vary across observations (Hoetker, 2007). I therefore followed procedures suggested by Norton et al. (2004) to test and graph interaction terms. The positive relationship of parent hostility with transferred market-related knowledge was amplified by market commonality (average b = 0.02, average p < 0.05; Hypothesis 2a supported) but neither by resource similarity (average b =—0.01, ns; Hypothesis 3b not supported) nor by competitive intensity (average b =—0.01, ns; Hypothesis 4b not supported). In contrast, the positive relationship of parent hostility with transferred technological knowledge was contingent on resource similarity (average b = 0.04, average p < 0.05; Hypothesis 3b supported) and competitive intensity (average b = 0.01, average p < 0.05; Hypothesis 4b supported), but not on market commonality (average b = 0.00, ns; Hypothesis 2b not supported). Figures 2, 3, and 4 display the observation-specific ‘correct’ interaction effects and the ‘incorrect’ marginal effects for Hypotheses 2a, 3b, and 4b, respectively. In support of these hypotheses, the figures confirm that most of the effects were positive over the whole range of predicted values for parent hostility.Footnote 14

5.2 Robustness checks

I ran several robustness checks. First, additional influences could affect parent hostility, including founding team characteristics (industry experience, leadership experience, tenure in parent, team size, and team homogeneity), parent characteristics (age, foreignness, and geographic distance to spin-out), and environmental characteristics (market turbulence and technological turbulence). However, the pattern of my results remains unchanged when adding these variables one after another to my models. Second, my results were stable to including items dropped during scale purification. Third, I re-estimated all models using ordinary least squares regression and the alternate, survey-based measure of parent hostility. This also confirmed my original findings.

6 Discussion and implications

According to a prominent perspective in the literature, knowledge transfers from previous employers enable spin-outs to ‘kickstart’ into the market and outperform other types of entrants (e.g., Agarwal et al., 2004; Chatterji, 2009). A point relatively neglected by previous work is that such transfers can also have adverse repercussions for spin-outs: They stir-up parent hostility by undermining the parent’s competitiveness, with negative consequences for the spin-out’s further development (Walter et al., 2014). However, what types of knowledge transfers induce parent hostility and what role the spin-out’s initial competitive positioning plays in this context is, to date, not well understood. In this research, I linked the literatures on spin-outs and on competitive dynamics to posit that transfers of market-related knowledge and technological knowledge drive parent hostility (H1a and H1b), with the prior having the stronger effect (H1c). I then drew on the AMC perspective to examine the contingent role of antecedents to competitive tension. Transfers of market-related knowledge and technological knowledge yield greater hostility, as was further suggested, if they coincide with competitive tension in terms of high levels of market commonality (H2a and H2b), resource similarity (H3a and H3b), and competitive intensity (H4a and H4b).

My first key finding is that, per se, transfers of market-related knowledge matter more for parent hostility than transfers of technological knowledge. This supports my argument that an emphasis on short-run financial performance sensitizes parent managers particularly for the leakage of confidential knowledge about customers and markets. While I am not aware of previous studies on antecedents of parent hostility, my findings are consistent with related research on the performance impacts of knowledge legacies. For instance, Klepper and Sleeper (2005) observed that parents tend to ignore spin-outs not posing an immediate threat to their markets. Chatterji (2009) found that spin-outs’ success is driven by marketing know-how rather than technical know-how incorporated from their parents. However, according to a study by Agarwal et al. (2004), inherited technological know-how enhances the survival chances of spin-outs. Contingency factors could account for these conflicting findings and the non-significant finding for transferred technological knowledge—a point that I will further discuss below.

My second key finding is that market commonality intensifies the hostility effect of transferred market-related knowledge, which is in line with my arguments based on the AMC perspective: if the spin-out ‘steps into parent territory’, parents are more likely to note, more motivated, and/or more capable to respond to spillovers of market-related knowledge. Interestingly, there was no empirical support for this logic regarding technological knowledge. As one potential explanation, spin-outs high in transferred technological knowledge might have entered market niches or positions unattractive to the parent, in which they can compete via technology-driven innovation with negligible impacts on the parent’s market (Fan, 2010; Lawless & Anderson, 1996). Other explanations are that the parent ignores the spin-out’s presence on its market as it underestimates the market potential of the transferred technological knowledge (Klepper, 2001) or that the parent views the spin-out as a test vehicle with a potential for a future ‘spill-in’ (Kim & Steensma, 2017).

A third key finding is that two contingencies, resource similarity and competitive intensity, create a hostility problem for comprehensive transfers of technological knowledge. This suggests that spin-outs absorbing more technological knowledge are likely to trigger parent hostility under two conditions: they also imitate the resource base of their ‘home’ business unit in the parent firm and/or they operate in industries with fierce competition. In contrast, I found no interactive effects with market-related knowledge. To speculate, a spin-out founder could achieve resource similarity by recruiting a high number of co-founders and employees from within the parent’s workforce—a notion supported by the positive correlation between resource similarity and number of employees quitting. Since this facilitates overcoming team-based isolating mechanisms (Agarwal et al., 2016), the transferred technological knowledge (and possibly the corresponding ‘brain drain’) might exceed a threshold after which the spin-out is perceived as a competitive problem by the parent. However, these isolating mechanisms might be less relevant for market-related knowledge (Rumelt, 1984) so that resource similarity does not further escalate the hostility impact of transferred market-related knowledge.

A final key finding is that opportunity-driven, ‘pull-motivated’ spin-outs face (ceteris paribus) less parent hostility. This is a surprising finding as the higher growth potential of these spin-outs also mean a greater competitive threat to the parent. However, the dynamic capabilities framework—which has been proposed as a useful lens to understand competitive dynamics (e.g., Baden-Fuller & Teece, 2020)—offers a potential explanation. A parent that lacks dynamic capabilities and thus struggles with sensing, seizing, and/or transforming activities (Teece, 2007) creates opportunities for spin-outs, e.g., to leverage unused knowledge (Agarwal & Shah, 2014). Collaborating with (rather than fighting) a spin-out exploiting these opportunities could help compensate for lacking dynamic capabilities. Alternatively, a parent high in dynamic capabilities could see value in an idea and seek to exploit it, but an employee-inventor insists on launching their own firm (Kaul et al., forthcoming). Positive relationships of pull-motivation with post-founding parent collaboration (r = 0.31, p < 0.001) and the number of parental representatives on the spin-out’s board (r = 0.13, p = 0.07) seem to support these explanations.

6.1 Theoretical implications

This study makes several contributions to the extant literature. First, the literature on spin-outs has focused on how and when spin-outs benefit (e.g., Agarwal et al., 2004; Chatterji, 2009) and parents suffer (e.g., Campbell et al., 2012; McKendrick et al., 2009) from interorganizational knowledge transfers. This study extends these lines of research by offering a more nuanced view on the consequences of knowledge transfers. Specially, the study shows how and when genealogical knowledge links can become a burden for spin-outs and yield a hostile posture on part of the parent, with potentially detrimental effects on the spin-out’s further development (Walter et al., 2014). In other words, knowledge ‘legacies’ do not necessarily come in the form of a ‘silver spoon’ or a ‘parting gift’ from benevolent parents but can poison the parent-progeny relationship and impair the early performance of the spin-out.

Second, competitive dynamics scholars have focused on competitive interactions of large and established firms, while being relatively agnostic of entrepreneurial ventures—organizations whose survival may depend on their ability to effectively anticipate and alleviate the competitive responses of entrenched incumbents (Chen & Miller, 2012). This study adds to this literature by illuminating the response of a parent firm to a spin-out from within its own ranks. According to my findings, the type of knowledge leaked to the progeny and its competitive positioning interactively shape the nature of the parent’s response. Thus, in bridging the literatures on competitive dynamics and spin-outs, this study models parent hostility, and arguably the ease of market entry, as a function of competitive tension and knowledge-related tension between parent and spin-out. Moreover, my findings suggest that the genealogy of an entrant can explain competitive reactions by incumbents and that own progeny is likely to be battled more fiercely, if it draws on parental knowledge.

Third, entrepreneurship scholars have examined the relatedness of the parent’s and progeny’s knowledge bases, showing that moderate overlaps maximize the progeny’s new knowledge production (Basu et al., 2015) and early growth (Sapienza et al., 2004). This work highlighted how the progeny generates, combines-recombines, and exploits knowledge inputs from diverse sources. The study adds a layer of theorizing, namely that the nature of the progeny’s knowledge legacies and the nature of its competitive entry will not only shape the future parent-progeny relationship, but may also bear on the spin-out’s standing in the industry network and ultimately, as shown elsewhere, its financial performance (Walter et al., 2014).

6.2 Managerial implications

How to avoid fierce retaliation by incumbents is a critical question for entrepreneurs, in particular for those ‘borrowing’ strategically important knowledge from former employers. The general theme of this study reminds founders to consider parental responses to knowledge transfers prior to entering a market. My findings suggest that parents are relatively unforgiving regarding the leakage of market-related knowledge, in particular if used to spawn in parent’s markets. Spin-outs pursuing this strategy should therefore prepare for a hostile posture and ultimately retaliation on part of the parent and its allies. Founders should also be aware that although transferring technological knowledge per se does not necessarily stir-up hostility, it may so, if the spin-out acts as a ‘copycat of the parent’s blueprints’ or if competitive pressures in the industry are extensive. Moreover, my adoption of the AMC framework for theorizing on the moderation effects points to potential mechanisms to avoid hostility at the outset. This is reducing the parent’s (1) awareness of the spinout (‘flying under the parent’s radar’), for instance by exploiting parental knowledge in market niches unattractive to the parent, (2) motivation to sanction knowledge transfers, e.g., by evading direct or indirect competition with the parent, and (3) capability to retaliate, e.g., by operating in markets in safe distance to the parent.

6.3 Limitations and future research

This study is not without limitations, of which some mark interesting avenues for future research. First, I sampled spin-outs headquartered in Germany. My findings are therefore conditional upon and mostly generalizable to this context. Second, my theorizing is based on and limited by my assumption of boundedly rational decision-making. However, spin-out events are also susceptive to irrational reactions, e.g., based on personal enmity of departing founders (Garvin, 1983) or managerial hubris. Future research could therefore further illuminate how irrational responses nurture parent hostility and retaliation by parents. Third, theoretical considerations led me to investigate parent hostility rather than manifest competitive responses, which are, to date, hardly researched and thus constitute fruitful areas for future studies. Fourth, my data precluded considering whether or not one party held property rights in transferred knowledge (a question often answered rather by courts than by respondents). Further research into that direction could help understand to what extent one party could defend the uniqueness of its knowledge base. Fifth, as a starting point, I focused on one parent per spin-out, namely the one providing the most critical technological knowledge. However, more research on multi-parent spin-outs can provide interesting insights, for instance, into potential collaborations between hostile co-parents or spin-out alliances with supportive parents against hostile ones. Sixth, parent hostility, in particular if conceptualized as an attitude, may change over time as a function of actions and reactions of parent and spin-out. Understanding the dynamics of hostility is beyond the scope of my data but an interesting avenue for future research. Finally, future research could illuminate how and when knowledge transfers yield greater hostility by considering aspects beyond the scope of my data, such as the strategic relevance of the transferred knowledge for the parent and parental anti-spin-out policies.

Notes

The spin-out literature tends to label knowledge transfers as ‘heritage’, ‘inheritance’, or ‘legacy’ (e.g., Agarwal et al., 2004) drawing on Huber’s (1991) seminal contribution. This neglects that many parent firms do not cease to exist after the spawning of a spin-out and that knowledge might be misappropriated by the spin-out.

An action refers to a specific and detectable competitive move initiated by a firm, whereas a reaction denotes a specific and datable countermove by a competing firm (Chen, Smith, and Grimm, 1992).

However, the hostility effect was less pronounced if the spin-outs operated in turbulent markets or effectively developed their networks (Walter, Heinrichs, and Walter, 2013).

A third argument can be made from a managerial perspective: The spin-out event questions the ability of managers to defend a firm’s intellectual property and to retain key staff. Managers are thus motivated to fight the spin-out to the extent to which a spin-out compromises their career progress.

Barney (1991: 101) offers an inclusive definition of resources as “all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness.” (cf. Peteraf and Bergen, 2003: 1032) I therefore view resource similarity as the more comprehensive concept.

In the context of spin-outs, I suggest the parental business unit as a benchmark for resource similarity for two reasons. First, the spin-out is more likely to compete with and be noted by their former business unit rather than other units of the parent firm. The business unit may then influence and mobilize the parent firm to react to the spin-out event. Second, using the parent as benchmark could create a size bias for larger parents, if resources of units without connection to a spin-out would be considered.

The sample originated in a larger spin-out dataset. A subset of this data has been used in Walter et al. (2014).

I thank an anonymous reviewer for suggesting this control variable.

Please note that a countervailing argument can be made: anticipated hostility creates fear of retaliation and leads founders to be more cautious. This implies less rather than more knowledge transfers. Thus, theory does not seem to exactly indicate how reverse causality operates and whether it constitutes a serious problem in the context of this study.

Sargan-Hansen tests of overidentifying restrictions could not reject the null hypothesis that the instruments were valid, i.e., uncorrelated with the error term (X2 < 0.02, ns). Tests of underidentification rejected the null hypothesis that the model is underidentified (Anderson canon. corr. LR statistic: X2 > 8.90, p < 0.05), suggesting that the instruments were relevant.

Although instrumental variables regression can resolve endogeneity problems, it tends to inflate standard errors (Greene, 2012: 273) and can create estimates that differ systematically from the target parameters (Angrist and Pischke, 2009: 205). I thus followed the conventional recommendation to model a variable only as endogenous if tests clearly confirm endogeneity as a statistical problem. Since my estimates of ordinary logistic regression and instrumental-variables probit regression differed, I ran additional tests to rule out weak instruments.

Calculations of CI and VIFs are based on mean-centered data. Given issues regarding mean-centering to mitigate multicollinearity, I followed recommendations by Echambadi and Hess (2007) and reran my regressions with five randomly selected subsets of my data. The resulting coefficients were plausible and stable across the subsets, indicating little threat of multicollinearity.

The figures do not reflect non-linear relationships between the variables. Instead, they illustrate how the size and even the sign of the interaction effects varies as the values of the covariates change. For inference on the hypotheses, I followed Norton et al. (2004) and estimated an average effect size and z-value from all observation-specific interaction effects.

References

Agarwal, R., & Shah, S. K. (2014). Knowledge sources of entrepreneurship: Firm formation by academic, user and employee innovators. Research Policy, 43(7), 1109–1133.

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. B. (2004). Knowledge transfer through inheritance: Spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522.

Agarwal, R., Ganco, M., & Ziedonis, R. H. (2009). Reputations for toughness in patent enforcement: Implications for knowledge spillovers via inventor mobility. Strategic Management Journal, 30(13), 1349–1374.

Agarwal, R., Campbell, B. A., Franco, A. M., & Ganco, M. (2016). What do i take with me? The mediating effect of spin-out team size and tenure on the founder-firm performance relationship. Academy of Management Journal, 59(3), 1060–1087.

Andersson, M., Baltzopoulos, A., & Lööf, H. (2012). R&d strategies and entrepreneurial spawning. Research Policy, 41(1), 54–68.

Angrist, J. D., & Pischke, J.-S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton.

Argyres, N., & Mostafa, R. (2016). Knowledge inheritance, vertical integration, and entrant survival in the early u.S. Auto industry. Academy of Management Journal, 59(4), 1474–1492.

Armitage, C. J., & Conner, M. (2001). Efficacy of the theory of planned behaviour: A meta-analytic review. British Journal of Social Psychology, 40(4), 471–499.

Baden-Fuller, C., & Teece, D. J. (2020). Market sensing, dynamic capability, and competitive dynamics. Industrial Marketing Management, 89, 105–106.

Bae, J., & Lee, J. M. (2021). How technological overlap between spinouts and parent firms affects corporate venture capital investments in spinouts: The role of competitive tension. Academy of Management Journal, 64(2), 643–678.

Bahoo-Torodi, A., & Torrisi, S. (2022). When do spinouts benefit from market overlap with parent firms? Journal of Business Venturing, 37(6), 106249.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Bascle, G. (2008). Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization, 6(3), 285–327.

Basu, S., Sahaym, A., Howard, M. D., & Boeker, W. (2015). Parent inheritance, founder expertise, and venture strategy: Determinants of new venture knowledge impact. Journal of Business Venturing, 30(2), 322–337.

Baum, J. A. C., & Korn, H. J. (1996). Competitive dynamics of interfirm rivalry. Academy of Management Journal, 39(2), 255–255.

Baum, J. A. C., & Korn, H. J. (1999). Dynamics of dyadic competitive interaction. Strategic Management Journal, 20(3), 251–278.

Bermiss, Y. S., & Greenbaum, B. E. (2016). Loyal to whom? The effect of relational embeddedness and managers’ mobility on market tie dissolution. Administrative Science Quarterly, 61(2), 254–290.

Bhidé, A. V. (2000). The origin and evolution of new businesses. Oxford University Press.

Boyd, J. L., & Bresser, R. K. F. (2008). Performance implications of delayed competitive responses: Evidence from the u.S. Retail industry. Strategic Management Journal, 29(10), 1077–1096.

Buenstorf, G., Engel, C., Fischer, S., & Gueth, W. (2016). Non-compete clauses, employee effort and spin-off entrepreneurship: A laboratory experiment. Research Policy, 45(10), 2113–2124.

Campbell, B. A., Ganco, M., Franco, A. M., & Agarwal, R. (2012). Who leaves, where to, and why worry? Employee mobility, entrepreneurship and effects on source firm performance. Strategic Management Journal, 33(1), 65–87.

Chatterji, A. K. (2009). Spawned with a silver spoon? Entrepreneurial performance and innovation in the medical device industry. Strategic Management Journal, 30(2), 185–206.

Chen, M.-J. (1996). Competitor analysis and interfirm rivalry: Toward a theoretical integration. Academy of Management Review, 21(1), 100–134.

Chen, M.-J., & Miller, D. (2012). Competitive dynamics: Themes, trends, and a prospective research platform. Academy of Management Annals, 6(1), 135–210.

Chen, M.-J., & Miller, D. (2015). Reconceptualizing competitive dynamics: A multidimensional framework. Strategic Management Journal, 36(5), 758–775.

Chen, M.-J., Smith, K. G., & Grimm, C. M. (1992). Action characteristics as predictors of competitive responses. Management Science, 38(3), 439–455.

Chen, M.-J., Su, K.-H., & Tsai, W. (2007). Competitive tension: The awareness-motivation-capability perspective. Academy of Management Journal, 50(1), 101–118.

Chen, M.-J., Lin, H.-C., & Michel, J. G. (2010). Navigating in a hypercompetitive environment: The roles of action aggressiveness and tmt integration. Strategic Management Journal, 31(13), 1410–1430.

Coff, R. W., Coff, D. C., & Eastvold, R. (2006). The knowledge-leveraging paradox: How to achieve scale without making knowledge imitable. Academy of Management Review, 31(2), 452–465.

Collis, D. J. (1991). A resource-based analysis of global competition: The case of the bearings industry. Strategic Management Journal, 12, 49–68.

D’Aveni, R. A. (1994). Hypercompetition: Managing the dynamics of strategic maneuvering. The Free Press.

Dietz, M., Härle, P., Khanna, S. (2016). A digital crack in banking's business model. McKinsey Quarterly, (2), 50–53.

Doucet, L. (2004). Service provider hostility and service quality. Academy of Management Journal, 47(5), 761–771.

Dutton, J. E., & Jackson, S. E. (1987). Categorizing strategic issues: Links to organizational action. Academy of Management Review, 12(1), 76–90.

Echambadi, R., & Hess, J. D. (2007). Mean-centering does not alleviate collinearity problems in moderated multiple regression models. Marketing Science, 26(3), 438–445.

Elfenbein, D. W., Hamilton, B. H., & Zenger, T. R. (2010). The small firm effect and the entrepreneurial spawning of scientists and engineers. Management Science, 56(4), 659–681.

Fan, T. P. C. (2010). De novo venture strategy: Arch incumbency at inaugural entry. Strategic Management Journal, 31(1), 19–38.

Fern, M. J., Cardinal, L. B., & O’Neill, H. M. (2012). The genesis of strategy in new ventures: Escaping the constraints of founder and team knowledge. Strategic Management Journal, 33(4), 427–447.

Ferrier, W. J., Smith, K. G., & Grimm, C. M. (1999). The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers. Academy of Management Journal, 42(4), 372–388.

Fisher, M., & Lewin, P. A. (2018). Push and pull factors and hispanic self-employment in the USA. Small Business Economics, 51(4), 1055–1070.

Gambardella, A., Ganco, M., & Honoré, F. (2015). Using what you know: Patented knowledge in incumbent firms and employee entrepreneurship. Organization Science, 26(2), 456–474.

Ganco, M. (2013). Cutting the gordian knot: The effect of knowledge complexity on employee mobility and entrepreneurship. Strategic Management Journal, 34(6), 666–686.

Ganco, M., Ziedonis, R. H., & Agarwal, R. (2015). More stars stay, but the brightest ones still leave: Job hopping in the shadow of patent enforcement. Strategic Management Journal, 36(5), 659–685.

Gaonkar, S., & Moeen, M. (2023). Standing on the parent’s shoulder or in its shadow? Alliance partner overlap between employee spinouts and their parents. Strategic Management Journal, 44(2), 415–440.

Garvin, D. A. (1983). Spin-offs and the new firm formation process. California Management Review, 25(2), 3–20.

Gimeno, J., & Woo, C. Y. (1996). Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organization Science, 7(3), 322–341.

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Greene, W. H. (2012). Econometric analysis (7th ed.). Boston et al.

He, G. A. O., Tieying, Y. U., & Cannella, A. A., Jr. (2017). Understanding word responses in competitive dynamics. Academy of Management Review, 42(1), 129–144.

Hellmann, T. (2007). When do employees become entrepreneurs? Management Science, 53(6), 919–933.

Hoetker, G. (2007). The use of logit and probit models in strategic management research: Critical issues. Strategic Management Journal, 28(4), 331–343.

Huber, G. P. (1991). Organizational learning: The contributing processes and the literatures. Organization Science, 2(1), 88–115.

Hunt, R. A., Lerner, D. A., & Townsend, D. M. (2019). Parental endowments versus business acumen: Assessing the fate of low-tech, service-sector spinouts. Strategic Entrepreneurship Journal, 13(4), 478–506.

Ioannou, I. (2014). When do spinouts enhance parent firm performance? Evidence fr6om the u.S. Automobile industry, 1890–1986. Organization Science, 25(2), 529–551.

Jaworski, B. J., & Kohli, A. K. (1993). Market orientation: Antecedents and consequences. Journal of Marketing, 57(3), 53–70.

Kaul, A., Ganco, M., Raffiee, J. (forthcoming). When subjective judgments lead to spinouts: Employee entrepreneurship under uncertainty, firm specificity, and appropriability. Academy of Management Review.

Ketchen, D. J., Jr., Snow, C. C., & Hoover, V. L. (2004). Research on competitive dynamics: Recent accomplishments and future challenges. Journal of Management, 30(6), 779–804.

Kim, J., & Marschke, G. (2005). Labor mobility of scientists, technological diffusion, and the firm’s patenting decision. RAND Journal of Economics, 36(2), 298–317.

Kim, J. Y., & Steensma, H. K. (2017). Employee mobility, spin-outs, and knowledge spill-in: How incumbent firms can learn from new ventures. Strategic Management Journal, 38(8), 1626–1645.

Klepper, S. (2001). Employee startups in high-tech industries. Industrial & Corporate Change, 10(3), 639–674.

Klepper, S. (2007). Disagreements, spinoffs, and the evolution of detroit as the capital of the u.S. Automobile industry. Management Science, 53(4), 616–631.

Klepper, S., & Sleeper, S. (2005). Entry by spinoffs. Management Science, 51(8), 1291–1306.

Klepper, S., & Thompson, P. (2010). Disagreements and intra-industry spinoffs. International Journal of Industrial Organization, 28(5), 526–538.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397.

Lawless, M. W., & Anderson, P. C. (1996). Generational technological change: Effects of innovation and local rivalry on performance. Academy of Management Journal, 39(5), 1185–1217.

Lindholm, D. A. (1997). Growth and inventiveness in technology-based spin-off firms. Research Policy, 26(3), 331–344.

Luoma, J., Ruutu, S., King, A. W., & Tikkanen, H. (2017). Time delays, competitive interdependence, and firm performance. Strategic Management Journal, 38(3), 506–525.

Markman, G. D., & Waldron, T. L. (2014). Small entrants and large incumbents: A framework of micro entry. Academy of Management Perspectives, 28(2), 179–197.

Marvel, M. R., & Lumpkin, G. T. (2007). Technology entrepreneurs’ human capital and its effects on innovation radicalness. Entrepreneurship: Theory & Practice, 31(6), 807–828.

Marx, M., Strumsky, D., & Fleming, L. (2009). Mobility, skills, and the michigan non-compete experiment. Management Science, 55(6), 875–889.

McKendrick, D. G., Wade, J. B., & Jaffee, J. (2009). A good riddance? Spin-offs and the technological performance of parent firms. Organization Science, 20(6), 979–992.

Nickerson, J. A., & Zenger, T. R. (2004). A knowledge-based theory of the firm - the problem-solving perspective. Organization Science, 15(6), 617–632.

Norton, E. C., Wang, H., & Ai, C. (2004). Computing interaction effects and standard errors in logit and probit models. The Stata Journal, 4(2), 154–167.

Patrick, C., Stephens, H., & Weinstein, A. (2016). Where are all the self-employed women? Push and pull factors influencing female labor market decisions. Small Business Economics, 46(3), 365–390.

Peteraf, M. A., & Bergen, M. A. (2003). Scanning dynamic competitive landscapes: A market-based and resource-based framework. Strategic Management Journal, 24(10), 1027–1041.

Peteraf, M., & Shanley, M. (1997). Getting to know you: A theory of strategic group identity. Strategic Management Journal, 18, 165–186.

Phillips, D. J. (2002). A genealogical approach to organizational life chances: The parent-progeny transfer among silicon valley law firms, 1946–1996. Administrative Science Quarterly, 47(3), 474–506.

Porter, M. E. (1979). The structure within industries and companies’ performance. Review of Economics & Statistics, 61(2), 214–227.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

Rumelt, R. (1984). Towards a strategic theory of the firm. In R. Lamb (Ed.), Competitive strategic management (pp. 556–570). Prentice-Hall.

Sahaym, A., Howard, M. D., Basu, S., & Boeker, W. (2016). The parent’s legacy: Firm founders and technological choice. Journal of Business Research, 69(8), 2624–2633.

Sakakibara, M., & Balasubramanian, N. (2020). Human capital, parent size, and the destination industry of spinouts. Strategic Management Journal, 41(5), 815–840.

Sapienza, H. J., Parhankangas, A., & Autio, E. (2004). Knowledge relatedness and post-spin-off growth. Journal of Business Venturing, 19(6), 809–829.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Smith, K. G., Ferrier, W. J., & Ndofor, H. A. (2001). Competitive dynamics research: Critique and future directions. In M. A. Hitt, E. Freeman, & J. S. Harrison (Eds.), Handbook of strategic management (pp. 315–361). Blackwell Publishers.

Starr, E., Balasubramanian, N., & Sakakibara, M. (2018). Screening spinouts? How noncompete enforceability affects the creation, growth, and survival of new firms. Management Science, 64(2), 552–572.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350.

Upson, J. W., Ketchen, D. J., Jr., Connelly, B. L., & Ranft, A. L. (2012). Competitor analysis and foothold moves. Academy of Management Journal, 55(1), 93–110.

Uzunca, B. (2018). A competence-based view of industry evolution: The impact of submarket convergence on incumbent−entrant dynamics. Academy of Management Journal, 61(2), 738–768.

Vaznyte, E., Andries, P., & Demeulemeester, S. (2021). “Don’t leave me this way!” Drivers of parental hostility and employee spin-offs’ performance. Small Business Economics, 57(1), 265–293.

Walter, S. G., Heinrichs, S., & Walter, A. (2014). Parent hostility and spin-out performance. Strategic Management Journal, 35(13), 2031–2042.

Walter, S. G., Heinrichs, S., Walter, A. (2013). Spawned with a rusty spoon: When and how can spin-outs cope with parent hostility?. Academy of Management Proceedings, 1–6.

Wernerfelt, B. (1984). A resource based view of the firm. Strategic Management Journal, 5(2), 171–180.

Wezel, F. C., Cattani, G., & Pennings, J. M. (2006). Competitive implications of interfirm mobility. Organization Science, 17(6), 691–709.

Yeganegi S, Dass P, Laplume AO. (forthcoming). Reviewing the employee spinout literature: A cross-disciplinary approach. Journal of Economic Surveys.

Zahra, S. A. (1993). Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. Journal of Business Venturing, 8(4), 319–340.

Zahra, S. A., Neubaum, D. O., & El-Hagrassey, G. M. (2002). Competitive analysis and new venture performance: Understanding the impact of strategic uncertainty and venture origin. Entrepreneurship: Theory & Practice, 27(1), 1–28.

Acknowledgements

I thank Maksim Belitski for editorial guidance and two anonymous reviewers for constructive and helpful comments. The dataset for this study has been generated in a larger research project on spin-outs, to which Achim Walter and Simon Heinrichs substantially contributed. An earlier version of the manuscript has been published in the Academy of Management Proceedings (2020).

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 Study measures1

Factor loading | t-Value | |

|---|---|---|

Transferred customer knowledge (α = 0.87, CR = 0.83, AVE = 0.67) 2,3 | ||

(1) Knowledge of different customers' problems that our company could solve | 0.82 | 13.24 |

(2) Knowledge of ways customers use products/services similar to that of our company | 0.84 | 14.27 |

(3) First-hand interactions with customers similar to that of our company | 0.76 | 12.33 |

(4) Knowledge of lead customers similar to that of our company | 0.77 | 12.63 |

Transferred market knowledge (α = 0.82, CR = 0.83, AVE = 0.55) 2,3 | ||

(1) Knowledge of suppliers in the primary market of our company | 0.76 | 12.08 |

(2) Knowledge of manufacturers or developers in the primary market of our company | 0.83 | 13.68 |

(3) Knowledge about the market of our company not known to the general public | 0.68 | 10.33 |

(4) Knowledge about how the market of our company functions | 0.68 | 10.39 |

Transferred technological knowledge (α = 0.88, CR = 0.90, AVE = 0.75) 2 | ||

(1) Knowledge of a specific technology important for our company | 0.88 | 15.42 |

(2) Knowledge of a technology that is central to our company | 0.98 | 18.35 |

(3) Hands-on experience with a technology that is important for our company | 0.71 | 11.53 |

Product-related knowledge (α = 0.84, CR = 0.85, AVE = 0.66)2 | ||

(1) Hands-on experiences in creating products/services similar to that of our company | 0.61 | 8.09 |