Abstract

Many entrepreneurs commercialize an idea they initially developed as employees of an incumbent firm. While some face retaliatory reactions from their (former) employer, others are left alone or even supported. It is not clear, however, why some employee spin-offs face parental hostility while others do not, and to what extent this parental hostility affects employee spin-offs’ performance. Integrating the resource-based view with insights on competition and retaliation, we propose that parental hostility increases with the (perceived) competitive threat posed by an employee spin-off. Specifically, we advance employee spin-offs’ initial strategic actions (offering substitute products, hiring employees of the parent, and attempting to first develop the idea inside the parent) as key drivers of parental hostility and consequent spin-off performance. Results from a pooled dataset of 1083 employee spin-offs in Germany confirm that these initial strategic actions trigger parental hostility, which in turn, and contrary to expectations, positively affects employee spin-offs’ innovation and economic performance. These results advance the literature on employee spin-offs in several ways and have important practical implications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Employee spin-offs, whose founders commercialize ideas they initially developed as employees of an incumbent company (Fryges et al. 2014), have increasingly attracted academics’ and policy makers’ enthusiasm. By capitalizing on technical, managerial, regulatory, and industry-specific resources from their previous employers (Chatterji 2009), employee spin-offs can become exceptional performers that outpace other new entrants (e.g., Agarwal and Shah 2014; Fackler et al. 2016). As such, they can accelerate knowledge transfer, innovation, competitiveness, and employment growth in the economy (Hellmann 2007; Klepper 2015; Moncada et al. 1999). However, whether the “parents”, or organizations from which these new ventures are formed, are equally enthusiastic about these spin-off activities, remains to be seen.

Contrary to corporate spin-offs, i.e., new ventures that are initiated and partially owned by the parent firm (Iturriaga and Cruz 2008), many employee spin-offs have no formal relationship with their parent organization. Although the popular (e.g., TechChrunch) and academic literature (e.g., Dahlstrand 1997; Fryges and Wright 2014; Garvin 1983; Somaya et al. 2008) feature several stories of employee spin-offs that are tolerated or even supported by their parent, we know that many parent organizations are in fact hostile towards the establishment of employee spin-offs (Klepper and Sleeper 2005; McKendrick et al. 2009; Walter et al. 2014). They regard them as “parasites” (Klepper 2001, on Fairchild) or “mafia” (Garrett et al. 2017, on PayPal) who steal their resources and ideas, and invoke non-compete clauses and intellectual property lawsuits to hinder their establishment (Thompson and Chen 2011).

While the study by Walter and his colleagues (2014) was among the first to investigate the effects of parental hostility—a parent’s disapproval of the spawning of a spin-off within it ranks—on employee spin-offs’ time to breakeven, and offer counter-strategies mitigating these negative effects, it did not explain why these hostile reactions occur in the first place. Given the vital role employee spin-offs play in our economy (Klepper 2015), it is important to fully understand the forces driving parental hostility towards their founding, and the implications for employee spin-offs’ subsequent performance.

Combining a resource-based perspective with insights from the literature on competition and retaliation—a stream analyzing incumbents’ defense strategies towards new market entrants—this study proposes that parental hostility increases with the (perceived) competitive threat posed by an employee spin-off. In particular, we argue that an employee spin-off’s strategic actions at the time of foundation, such as (1) offering substitute products (i.e., goods or services that perform a similar function, see Porter 1980), (2) hiring employees of the parent, and (3) attempting to first implement the business idea inside the parent, will increase the (perceived) competitive threat it poses to its parent and will thereby trigger parental hostility towards its foundation. Furthermore, we argue that this parental hostility will in turn negatively affect the employee spin-off’s subsequent innovation and economic performance. We argue that a spin-off that commercializes goods or services which are substitutes to its parent’s offering and that hires employees of its parent, expropriates a greater share of the parent’s tangible and intangible resources (Franco and Filson 2006; Klepper and Sleeper 2005; Rocha et al. 2018). This reduces the parent’s competitive advantage and increases the likelihood the employee spin-off will become a direct competitor (Campbell et al. 2012; Colombo et al. 2017; Kim and Steensma 2017; Klepper 2015; Phillips 2002; Wezel et al. 2006). At the same time, the fact that an employee spin-off first tried to implement its idea inside the parent, but did not reach an agreement towards idea implementation (e.g., Anton and Yao 1995; Klepper and Thompson 2010), may increase the likelihood the parent perceives it as a competitive threat. We argue that this increased perceived competitive threat will trigger more hostile parental reactions towards the spin-off’s foundation (Chen et al. 2007; Fan 2010), which will impair the employee spin-off’s access to its parent’s technological and complementary resources and thereby negatively affects its subsequent performance (e.g., Parhankangas and Arenius 2003).

Our analysis employs a pooled dataset from the KfW/ZEW Start-up Panel survey, conducted in Germany during 2008–2014, which includes over 6000 newly founded firms from all industries. These data allow us to distinguish employee spin-offs from other start-ups, construct measures for parental hostility and employee spin-offs’ initial strategic actions, and control for parent, spin-off, and founder characteristics. We empirically distinguish between spin-offs’ innovation and economic performance to investigate the generalizability of the results (as in Cainelli et al. 2006). Using a pooled dataset of 3082 observations on 1083 employee spin-offs, we find that an employee spin-off’s strategy at the time of its foundation—in particular its initial decision to commercialize substitute products, hire employees from the parent, and first try to develop the idea inside the parent organization—condition parental hostility towards the spin-off’s foundation, but that, contrary to expectations, this hostility in turn positively affects employee spin-offs’ innovation and economic performance.

By highlighting the importance of the employee spin-off’s initial strategy and by explicitly investigating the parent–spin-off relationship from a resource-based and competition and retaliation perspectives, we advance the literature on employee spin-offs in several ways. First, we investigate spin-offs’ initial business strategy as a trigger of the retaliatory actions taken by the parent organizations. As such, we expand the seminal work by Walter et al. (2014) by showing that the links between parental hostility, employee spin-off’s strategy and employee spin-off’s performance are in fact more complex than previously presumed, with initial strategic actions triggering parental hostility in the first place. Second, we are the first to report a positive relationship between parental hostility towards employee spin-off foundation and subsequent spin-off performance. Through additional analyses, we rule out the possibility that this result is driven by a survivorship bias, with only the best performing spin-offs surviving in the face of parental hostility. In trying to explain the robust positive effect of parental hostility on employee spin-off performance, we advance the relevance of autonomy and competence building as a potential mediator in this relationship (e.g., Chesbrough 2003; Cirillo et al. 2014; McGrath 2001). We argue that autonomy and competence building are crucial for employee spin-offs in developing a more aggressive market entry strategy, which increases their chances of successfully competing against the parent, and of surviving and performing well (e.g., Andrevski and Ferrier 2019). Also, we suggest that retaliatory parental reactions against a spin-off’s establishment, contrary to expectations, endorse a spin-off’s reputation, which may help to attract outside investors and customers. The fact that we contradict previous evidence points to the need for replication studies (Ethiraj et al. 2016) and to potential moderating factors that need to be taken into account in these replication efforts. Our results have important implications for employee spin-offs trying to optimize their initial business strategy, as well as for their parent organizations.

The remainder of the paper unfolds as follows: first, we provide a theoretical background and develop the main hypotheses. Second, we introduce data and methods. Third, we present the empirical results, and finally, we discuss the contribution of our work and provide suggestions for further research.

2 Theoretical background

2.1 Characteristics of employee spin-offs

Employee spin-offs have been defined as start-ups founded by a former employee, of which the establishment relies on “critical know-how acquired during his previous professional experience in order to exploit an unused potential” (Moncada et al. 1999, p. IV). Authors have concretized this definition of employee spin-offs by applying different criteria, including that the venture has to operate in the same industry (e.g., Klepper 2015; Thompson and Chen 2011) or employ a particular share of employees from the previous company (e.g., Eriksson and Kuhn 2006; Muendler et al. 2012). However, as argued by Fryges et al. (2014), hiring employees of the incumbent company or establishing a business in the same industry does not necessarily imply a transfer of critical know-how. At the same time, the transfer of knowledge does not necessarily require the transfer of employees, because tacit knowledge resides not only in a team or routines, but also in individuals, i.e., founders (Grant 1996). Fryges et al. (2014) and Moncada et al. (1999) therefore define an employee spin-off as an entrepreneurial new venture founded by a former employee of an incumbent company, and where a new idea (i.e., a unique product, technology, production process, or management concept), which the founder developed during her work in this private company, was essential for setting up the new business.

According to the resource-based view (Barney 1991), an organization’s success is dependent on its possession of valuable, rare, inimitable, and non-substitutable resources, among which knowledge figures prominently (Dierickx and Cool 1989). In this view, the knowledge and resources that are transferred from a parent to its employee spin-off can become the spin-off’s key source of competitive advantage (Agarwal et al. 2004, 2016). On the one hand, this transfer can take place while the founder is still employed at the parent as she acquires skills and idiosyncratic knowledge about technologies (e.g., products, technologies, processes) and markets (e.g., customer demands, distribution channels, market specifications), gains access to industry-specific social and financial networks, and discovers potential market entry opportunities (e.g., Chatterji 2009; Cooper 1985; Dahl and Sorenson 2014; Franco and Filson 2006; Ganco 2013; Gompers et al. 2005; Klepper 2001; Klepper and Sleeper 2005). These endowments at birth are known to have long-term effects for spin-offs’ development and performance (Agarwal et al. 2004; Ganco and Agarwal 2009; Klepper 2015). On the other hand, this transfer can take place also after the spin-off’s foundation, when the spin-off can, for example, exploit parents’ customer and supplier networks (Gjerløv-Juel and Dahl 2012; Phillips 2002; Hallen 2008), or benefit from parents’ technological, managerial and financial support (e.g., Moncada et al. 1999; Parhankangas and Arenius 2003; Semadeni and Cannella 2011; Tübke 2004; Zahra and George 1999). However, the extent to which employee spin-offs can access and exploit these resources depends on their parents’ goodwill (e.g., Furlan and Grandinetti 2016; Garvin 1983; Hellmann 2007; Parhankangas and Arenius 2003; Semadeni and Cannella 2011), and not all parent organizations are equally supportive. In fact, the founding of an employee spin-off often elicits hostile reactions by the parent firm (Walter et al. 2014).

Integrating a resource-based perspective with insights from the literature on competition and retaliation, the next section proposes that the initial strategic actions of an employee spin-off can increase the (perceived) competitive threat it poses to its parent and thereby trigger parental hostility.

2.2 (Perceived) competitive threat and parental hostility

According to the literature on competition and retaliation (e.g., Chen and Miller 1994; Chen 1996; Chen et al. 2007; Fan 2010; Kuester et al. 1999; Gatignon et al. 1997), an incumbent who faces a new entrant (e.g., an employee spin-off) can defend itself by applying retaliation—“a counterattack to a competitive move” (Kuester et al. 1999, p. 91). It may enforce non-compete clauses (Thompson and Chen 2011), threaten with lawsuits about intellectual property infringement (Klepper and Sleeper 2005), signal readiness to retaliate (e.g., by building a reputation for toughness in patent enforcement) (Agarwal et al. 2009), enhance advertising, salesforce, or channel expenditures (Gatignon et al. 1997), reduce prices and/or compete on costs (Kuester et al. 1999), or even propagate negative information about the new entrant, in this case the employee spin-off (Walter et al. 2014). According to Porter (1980), an incumbent will retaliate if the new entrant poses a (perceived) competitive threat to its economic and non-economic performance (e.g., endangering its sales growth or reputation). We argue that certain strategic actions of employee spin-offs at founding such as (1) the commercialization of substitute goods or services, (2) employee poaching, i.e., hiring employees of the parent, and (3) intrapreneurial attempts to first implement the business idea inside the parent company, increase the (perceived) competitive threat the spin-off poses to its parent, and therefore the likelihood of a hostile parental reaction.

First of all, we argue that an employee spin-off’s initial product strategy acts as one of the key factors triggering parental hostility towards its foundation. When entering the market, employee spin-offs can decide on producing substitutes to the parents’ offering (i.e., products which the consumer perceives as similar), complementary or vertically related products, or proceed with a completely novel idea (e.g., Fan and Lang 2000). From a resource-based perspective, we can argue that spin-offs producing substitute goods or services to their parents’ offering expropriate a higher share of their parents’ firm-specific knowledge than employee spin-offs with complementary or unrelated product offerings, and therefore pose a more important (perceived) competitive threat (Klepper and Sleeper 2005). Tacit knowledge (on technologies or complementary activities), which resides within and across individuals (Grant 1996), is generally difficult to imitate by outside firms (Kogut and Zander 1992), and therefore embodies a sustainable competitive advantage (Coff 1997; Spender 1996; Wright et al. 2018). However, this competitive advantage may be impaired if an imitator is born from within a firm. While an employee spin-off entering the market with a complement to the parent’s offering also leverages its parent’s resources for its own benefit, this entry nevertheless is not as threatening as the one by a substitute product (Colombo et al. 2017). In particular, it has been noted that employee spin-offs that commercialize substitute goods or services replicate and transfer a greater share of parents’ tacit knowledge than spin-offs commercializing products that are complementary or completely unrelated to those of the parent firm, thereby reducing parents’ competitive advantage to a larger extent (Agarwal et al. 2016; Campbell et al. 2012; Garrett et al. 2017). Based on competition and retaliation literature, we can also argue that the more similar a spin-off’s substitute product is to its parent’s offering, the more direct competition it will represent, and the more hostile reactions it will trigger (e.g., Chen and Miller 1994; Chen et al. 2007). As explained by Klepper and Sleeper (2005), an employee spin-off producing substitute products becomes a direct competitor, a predator stealing its parent’s ideas and innovations, and hence poses a higher threat and competitive pressure to that parent than a spin-off developing complementary or unrelated products (Gatignon et al. 1997; Kuester et al. 1999; Phillips 2002; Wezel et al. 2006). In particular, one can expect that a parent facing a spin-off with a substitute (versus complementary or dissimilar) product strategy is more heavily affected, especially if its sales depend on that specific offering (Robertson et al. 1995), and will therefore react more negatively (Thompson and Chen 2011). For instance, an incumbent may incur negative economic consequences from a new entrant with a substitute product strategy as the latter may slow the incumbent’s sales growth, disturb the current pricing strategy, or reduce its capacity utilization (Porter 1980). This is also consistent with the hotelling model, stating that the lower the distance between an established company—in this case the parent—and the new entrant—in this case the employee spin-off—the higher the competition (Belleflame and Peitz 2010). Therefore, bringing these arguments together, we propose that:

-

Hypothesis 1: Product substitutability has a positive effect on parental hostility.

A second mechanism that may increase the (perceived) competitive threat an employee spin-off poses to its parent, and therefore may trigger parental hostility, is employee poaching, i.e., the hiring of employees of the parent firm. Employees are often regarded as the “repositories of skills, routines, and knowledge that they carry with them from their prior employer to their new employer” (Corredoira and Rosenkopf 2010, p. 159). Together with valuable human capital, mobile employees also convey relational capital residing in teams, such as shared values, ties, and knowledge, which jointly depict an excellent opportunity for knowledge transfer and unique resources that are difficult to imitate (Rocha et al. 2018). When hiring employees of the parent, employee spin-offs can capitalize on these employees’ (a) technological and complementary knowledge, allowing the spin-offs to implement more complex business ideas (Ganco 2013), (b) colleague-specific human capital, which reduces coordination costs (Campbell et al. 2014), and (c) shared understanding, which accelerates product commercialization process (Beckman 2006); all in turn positively translating into performance outcomes (e.g., Klepper 2001; Phillips 2002; Somaya et al. 2008; Rocha et al. 2018). When a spin-off hires employees from its parent, that parent firm’s competitive advantage is reduced, as it loses not only the tacit knowledge embedded in each employee, but also the concomitant resources such as personal relationships with customers, suppliers, and complementors (Agarwal et al. 2016; Corredoira and Rosenkopf 2010; Wezel et al. 2006). This loss in turn disturbs a parent’s organizational routines (e.g., hiring and training new employees) and decreases its viability (e.g., taking away key customers) (Colombo et al. 2017; Gjerløv-Juel and Dahl 2012; Klepper 2007, 2009; McKendrick et al. 2009; Phillips 2002). Moreover, the more employees of its parent a spin-off hires, the more technological and complementary knowledge and resources it can incorporate, and the greater the competitive threat it poses to the parent (Agarwal et al. 2016; Campbell et al. 2014; Wezel et al. 2006). It is known that employees who move to a spin-off are often more motivated to transfer, and respectively to more authentically replicate, knowledge gained at the parent firm to the new spin-off than employees that move to an established firm, which is already endowed with a set of routines (Campbell et al. 2012; Wezel et al. 2006). In order to protect themselves from employee mobility and the competitive pressure it induces, parent firms may take retaliatory actions against the spin-off’s foundation (Agarwal et al. 2009). We therefore propose that:

-

Hypothesis 2: Employee poaching has a positive effect on parental hostility.

A final and more subtle reason fueling parental hostility may relate to the spin-off’s formation, and in particular, the founder’s intrapreneurial attempts to first develop the idea inside the parent organization. Anecdotal evidence suggests that founders first offer their business ideas to their parent organizations and found an independent spin-off only after being rejected by them (Hellmann 2007; Klepper 2009). This happens when the parent and the spin-off’s founder cannot reach an ex-ante or ex-post contract agreement upon the employee’s remuneration for offering the idea (Anton and Yao 1995) or when other kinds of disagreements with respect to idea implementation arise (e.g., dispute over intellectual property rights or personal tensions) (Klepper and Sleeper 2005; Klepper and Thompson 2010; Thompson and Chen 2011). However, this disagreement about the idea implementation, and the consequent formation of an employee spin-off may be perceived as a potential competitive threat to the parent organization, and thus evoke its hostility. First of all, disagreements and personal conflicts about the implementation of the idea inside the parent may carry over to the spin-off process. Second, after an employee’s unsuccessful attempt to implement the business idea internally, the parent may also become more aware of the technologies and complementary assets used, and thus may demand ownership and control of the intellectual property developed inside its organization. Finally, revelation of the idea may provide the parent with an opportunity to react (Chen et al. 2007). Even if a parent was initially not interested in the business idea, either because of bureaucratic inertia or excessive focus on the demands of existing customers (i.e., unwillingness to cannibalize its own market) (Christensen and Rosenbloom 1995; Gompers et al. 2005; Hellmann 2007; Robertson et al. 1995), employees’ efforts to implement the idea may act as an awakening signal. Overall, intrapreneurial attempts to implement the business idea inside the parent firm may make that parent more aware of the competitive threat a spin-off could pose, and may therefore elicit hostile reactions to the spin-off’s establishment. Or in other words:

-

Hypothesis 3: Intrapreneurial attempts to first implement the business idea in the parent company have a positive effect on parental hostility.

2.3 The effect of parental hostility on performance

After proposing that parental hostility is affected by a spin-off’s initial strategy, we aim to understand its effect on a spin-off’s subsequent performance. Access to parents’ technological know-how and complementary assets has been shown to be extremely beneficial for employee spin-offs (e.g., Agarwal and Shah 2014; Campbell et al. 2012; Klepper 2015). For example, spin-offs’ that have access to parents’ technological know-how (Teece 1986) are better equipped to meet (emerging) market needs (Christensen and Rosenbloom 1995) and are more likely to introduce innovations themselves (Agarwal and Shah 2014; Spulber 2012; Sullivan and Marvel 2011). At the same time, access to parents’ complementary resources (Teece 1986) such as social capital, marketing capabilities, distribution networks, or manufacturing has positive performance implications (e.g., Franco and Filson 2006; Hill et al. 2009; Dahlstrand 1997; Parhankangas and Arenius 2003). For example, access to the parent’s industry-specific social capital allows an employee spin-off to build a reputation and a network of relationships (Chatterji 2009; Dahl and Sorenson 2014; Kor et al. 2007), essential for leveraging resources, developing innovations, and achieving fruitful performance outcomes such as sales (Elfring and Hulsink 2007; Furlan and Grandinetti 2016; Somaya et al. 2008; Sullivan and Marvel 2011).

However, access to parents’ technological and complementary resources—especially after spin-off foundation—will depend heavily on the goodwill of the parent, i.e., on whether the parent is willing to collaborate with the spin-off, for example by providing or buying complementary materials (Agarwal and Shah 2014; Dahlstrand 1997; Furlan and Grandinetti 2016; Garvin 1983; Kim and Steensma 2017). Whereas corporate spin-offs whose parents are supportive or neutral towards their establishment will most likely have an easy access to their parents’ resources and networks, employee spin-offs with hostile parents will have no or restricted access to these resources. As Walter et al. (2014) explain, hostile parents will undermine spin-offs’ activities directly by refusing access to parental resources and support. Patent litigation, for example, can be extremely harmful for newly established spin-off due to its high costs and delay of the product development. A hostile parent can also damage a spin-off in an indirect way, for instance by convincing its partners not to collaborate with the spin-off or by spreading damaging information about it, and this can overshadow other useful signaling mechanisms (Walter et al. 2014). In fact, under parental hostility, spin-off founders are forced to decouple their networks from the parent company in order to lessen this potential negative influence, and rather focus on developing networks outside the parent firm’s control (Furlan and Grandinetti 2016). Therefore, building on the resource-based view, it can be argued that parental hostility towards its foundation reduces an employee spin-off’s access to technological and complementary resources inside and outside the parent firm, and this in turn undermines subsequent employee spin-off performance.

Notwithstanding the general belief that employee spin-offs can benefit substantially from access to their parents’ resources, some authors have argued that in order for spin-offs to grow and succeed in changing environments, they need to extend and adapt the resource-base and routines they inherit from their parents (e.g., Chesbrough 2003; Helfat and Lieberman 2002; Klepper 2001). While this organizational heritage at first sight appears to be opportune, it may push spin-off founders into a trap of inertia and resistance to change (Agarwal et al. 2004; Helfat and Lieberman 2002; Ferriani et al. 2012). For example, the spin-off may not sense the need to pursue new customers or applications, and this can become a barrier to learning from other partners beyond their existing network (Elfring and Hulsink 2007; Parhankangas and Arenius 2003). At the same time, continuous reliance on internal parents’ practices and heavy use of their resources may not only diminish spin-offs’ growth prospects and market value, but also impair their ability to experiment and adapt (Chesbrough 2003; Semadeni and Cannella 2011). We can expect, however, that this risk of inertia will prevail far less when spin-offs are confronted with hostile parental reactions, as hostility will not only enable but also force spin-offs to develop novel capabilities. The resulting flexibility and access to new networks is expected to lead to a more aggressive competition strategy, which in turn can contribute to a more successful market entry (e.g., Agarwal et al. 2004; Andrevski and Ferrier 2019). More precisely, as “firms with similar resource profiles are likely to have comparable capabilities and competitive stances” (Chen et al. 2007, p. 106), only by developing new capabilities employee spin-offs can reduce the effectiveness of their parents’ retaliation and fare better in competing against them (Chen 1996; Kuester et al. 1999). Without these efforts employee spin-offs, who oftentimes have limited financial resources, could not afford direct competition with their large incumbents and be deemed to failure (Fan 2010). Moreover, parents’ retaliatory actions towards employee spin-offs’ establishment may in fact send a positive signal to the market that the spin-off is valuable. Competition and retaliation literature suggests that incumbent firms are more likely to retaliate if they “feel that something important is at stake” (Chen and Miller 1994, p. 86), and the decision to retaliate may therefore be perceived as an indication of the spin-off’s potential and increase the interest of customers and outside investors (see Thiel and Masters 2014). Finally, it could be argued that parents’ retaliatory actions may introduce a survivorship bias, in the sense that only the best employee spin-offs will survive in the face of such parental hostility.

Although some arguments hence suggest that parental hostility may be less detrimental for employee spin-off performance than generally assumed, the limited empirical evidence suggests that the negative effect of parental hostility is prevailing. The findings from Walter et al.’s (2014) analysis of 144 technology-based spin-offs demonstrate that almost half of the spin-offs were confronted with parental hostility, and that this hostility substantially prolonged their time to breakeven. Therefore, we propose that:

-

Hypothesis 4: Parental hostility has a negative effect on employee spin-off performance.

As a consequence of integrating the logic behind Hypothesis 1–3 and Hypothesis 4, an indirect effect of employee spin-offs’ strategic actions at founding via parental hostility on subsequent employee spin-off performance is expected. More specifically, we argued that a spin-off’s decision to commercialize substitute products for its parent’s offering, the fact that it hires its parent’s employees, and attempts to first implement the idea inside the parent firm, will cause the parent to see its spin-off as a competitive threat. By offering substitute goods or services and by hiring employees of its parent, a spin-off can capitalize on a greater share of the parent’s tangible and intangible resources, which reduces the parent’s competitive advantage and therefore increases the likelihood the employee spin-off will be considered a direct competitor (e.g., Agarwal et al. 2016; Colombo et al. 2017; Phillips 2002; Wezel et al. 2006). At the same time, the fact that an employee spin-off first tries to implement its idea inside the parent, but does not reach an agreement towards idea implementation (e.g., Anton and Yao 1995; Klepper and Thompson 2010), may increase the likelihood the parent “spots” the spin-off and identifies it as a competitive threat. Because this perception of the new entrant (i.e., the spin-off) as a competitive threat is known to trigger retaliatory actions from the incumbent (i.e., the parent) (Chen et al. 2007; Fan 2010; Porter 1980), a spin-off’s decision to commercialize similar products as the parent, the hiring of its parent’s employees, and attempts to first implement the idea inside the parent firm can be expected to trigger parental hostility. This parental hostility, in turn, is assumed to hinder spin-off performance. This is because parental hostility will restrict an employee spin-off’s access to its parent’s technological know-how and complementary assets, which are supposedly crucial for the spin-off’s performance in terms of survival, innovation, and growth (e.g., Andersson and Klepper 2013; Fackler et al. 2016; Fryges et al. 2014). Hence, summarizing the hypothesized relationships between employee spin-offs’ initial strategic actions and parental hostility, as well as between parental hostility and spin-offs’ performance, an indirect effect of initial strategic actions on spin-offs’ performance is expected that is mediated via parental hostility. Therefore, it is posited that:

-

Hypothesis 5: There is an indirect negative effect of product substitutability on employee spin-off performance through parental hostility.

-

Hypothesis 6: There is an indirect negative effect of employee poaching on employee spin-off performance through parental hostility.

-

Hypothesis 7: There is an indirect negative effect of entrepreneurial attempts to implement the idea inside the parent on employee spin-off performance through parental hostility.

3 Methods

3.1 Sample

For the empirical hypotheses testing, we use data from the KfW/ZEW Start-up Panel survey established in 2008 by the Centre for European Economic Research (ZEW) in a collaboration with KfW Bankengruppe (the state-owned promotional bank in Germany) and Creditreform (the credit rating agency in Germany).Footnote 1 The sample of this telephone survey is randomly selected from the Mannheim Enterprise Panel, which contains information on all economically active firms in Germany and is representative of the country’s corporate landscape (Bersch et al. 2014). The start-up sample includes only legally independent firms (subsidiaries and mergers are excluded) and is stratified based on sector and year of foundation (firms have to be 3 years old or younger prior to the survey year). Each year, the start-ups from the previous waves are surveyed again until they reach an age of 8 years, while new ventures are added to the sample (for more details see Fryges et al. 2010). This results in a total sample of about 6000 start-ups per year (representing a response rate of approximately 20% for the first time interviews and approximately 56% for the follow-up interviews). In any given survey year t, start-ups are typically questioned about their foundation (unless this information is available from previous survey waves) and about their activities in the reference period t-1. An essential feature of the KfW/ZEW Start-up Panel survey is that all interviews are conducted with start-up founders or co-founders under the terms of confidentiality, which warrants data quality.

In order to distinguish employee spin-offs from other start-up companies, we apply information from a special module on venture origin which was included in the 2010 survey wave only. Overall, 6236 full interviews were conducted in this survey wave. However, start-ups participating for the first time were not surveyed about their origin, which limits the sample to 4106 firms. Our first condition to regard a venture as an employee spin-off is whether the founder has previously worked in a private company, which is the case for 3504 firms. Secondly, we regard a start-up company only as a potential employee spin-off if the founder indicates that an idea she developed while working at her previous employment was vital or of major importance for establishing the venture. If the idea was of minor or no importance at all, the start-up is not considered an employee spin-off. This step leads to a sample of 1455 ventures. In line with prior studies (e.g., Fryges and Wright 2014; Helfat and Lieberman 2002), our final criterion was that the new venture had to be initiated by the founder, and not by the parent company itself, resulting in a sample of 1357 employee spin-offs. The share of employee spin-offs in the total sample of 4106 start-ups approximates to 33%, and this proportion is in line with prior findings (c.f. Agarwal and Shah 2014). Removing observations with missing values for the variables in our analysis, results in a final sample of 1083 employee spin-offs established between 2005 and 2008.

The design of the survey offers several advantages. First, for the ventures that filled out the module on origin in the 2010 survey, we can construct a pooled dataset from the surveys conducted during the period 2008–2014, the reference period hence being 2007–2013, and test the proposed effects of spin-offs’ initial strategic actions and parental hostility on spin-off performance in several subsequent years (see Agarwal et al. 2004). In other words, a given employee spin-off can feature multiple times in our dataset, each time with the same values for initial strategic actions and parental hostility towards its founding but different values for control variables and performance (see detailed description of variables in the next section). In total, our pooled dataset contains 3082 observations representing the 1083 employee spin-offs in our sample.Footnote 2 Additionally, unlike prior research that investigates the parent–spin-off relationship in a single industry (e.g., automobiles, bio-tech, disk drives, lasers, semiconductors) (Klepper and Thompson 2010), the survey enables us to generalize the results as it covers ten different high-tech and low-tech industries and controls for a broad set of spin-off and founder characteristics. And finally, as Germany is the largest economy in Europe (Fackler et al. 2016) and the leading player in global innovation (OECD 2014), the findings may be applicable to a global context.

3.2 Variables

Dependent variables

In response to previous calls in the literature (Miller et al. 2013; Murphy et al. 1996), we focus on multiple spin-off performance indicators, namely on employee spin-offs’ innovation and economic performance (Cainelli et al. 2006; Sullivan and Marvel 2011; Zahra and George 1999). Separate indicators of performance may represent different constructs, and one specific indicator can therefore not be applied as a measurement of overall performance. For instance, start-ups may have difficulty in both introducing firm-level and market-level innovations and at the same time achieving high value like sales (Sullivan and Marvel 2011). As we want to avoid such inappropriate generalizations, we distinguish between employee spin-offs’ innovation and economic performance, and use multiple measurements for both.

Innovation performance is measured by two innovation output variables, namely Firm innovation and Market innovation, because a firm can introduce product innovations (goods or services) that are new to the firm itself (Vandenbroucke et al. 2016), but not new to the market (OECD 2009). In line with Fryges et al. (2014), we use survey information on whether or not the venture introduced any product innovation (i.e., a new or significantly improved good or service) in the reference year that was new to the firm but not new to the market to construct the binary variable Firm innovation, and on whether or not it introduced any product innovation that was new to the market (i.e., for which the spin-off was the first to introduce it on the regional, national, or global market) in the reference year to construct the binary variable Market innovation. Like Colombo and Grilli (2005, 2010), we measure employee spin-offs’ economic performance by looking at the (log of the) number of Employees and Sales at each survey reference year (adding the smallest positive value before log-transformation). Since we control for employee spin-offs’ age, these performance measures in fact represent the average yearly absolute employment and sales growth in the period in which the employee spin-off is observed (Colombo and Grilli 2010).

Independent variables

Based on the KfW/ZEW questionnaire, we construct the main explanatory variables about the parent—spin-off relationship at the time of spin-off foundation. First, in line with Walter et al. (2014), we constructed a binary variable of Parental hostility. Spin-off founders were asked whether or not the firm, in which their new idea emerged, had hampered the spin-off’s foundation. If they answered positively to this question, the variable receives a value of one, if not it receives a value of zero. About 13% of the employee spin-offs were faced with a hostile reaction of its parent towards spin-off foundation. Second, we capture Product substitutability by asking founders’ whether or not their initial products or services (a) were similar to those of the parent firm, (b) improved and refined those of the parent firm, (c) were complements to those of the parent firm, or (d) had other relations. Respondents could tick multiple options, but could also tick none of them if their products were unrelated to those of the parent firm. Based on these answers, we construct a binary variable Product substitutability which receives the value of one if the venture commercialized products similar to the parent’s offering (option a above), and zero otherwise.Footnote 3 Like prior research, our study reveals spin-offs’ heavy reliance on commercialization of similar products (e.g., Hellmann 2007; Klepper and Sleeper 2005), with 68% of the employee spin-offs in our sample offering similar products as the parent organization. Third, Employee poaching activities are captured by the number of employees that had departed from the parent to the spin-off. On average one third of the spin-offs in our sample had hired employees from their parent organization, with 3 employees being recruited on average (max 45 employees). Finally, Intrapreneurial attempts are represented by a binary variable that is equal to one if the founder had first attempted to implement the new business idea inside the parent organization (which happened in 54% of the cases), and zero otherwise.

Control variables

Several determinants of spin-off performance are included as controls in our analyses (e.g., Agarwal et al. 2004, 2016; Colombo and Grilli 2005, 2010; Fryges et al. 2014; Walter et al. 2014). First, we include venture-related controls, such as the Initial employment size representing the number of employees at the time of spin-off foundation, the spin-off’s Age and the main Industry it is active in. On the one hand, we expect the industry of the spin-off to affect parental hostility. Whereas in industries that address a stable market demand parents typically dislike spin-off activities because they increase competition, this attitude may differ if an industry is emerging and experiencing rapid growth. Then “established firms might very well encourage spin-offs” in order to meet the growing needs and retain customer interest in their products (Garvin 1983, p. 14). On the other hand, we expect to see a direct effect of industry on employee spin-off performance, as industry characteristics, such as the potential for product differentiation, and the power of suppliers and customers, are known to determine firms’ profit potential (Porter 1980, p. 143). We also control for the Number of patents at the time of a spin-off’ foundation and for prior values of its R&D spending per employee (R&Dperempt-1) as indicators of its inputs for innovation, as well as for its prior sales levels (Salest-1).

Second, we control for founder-related characteristics, in particular for the Number of founders at the time of foundation and for whether or not any of the founders held a university degree when founding the business (binary variable Education). Additionally, we control for Entrepreneurial experience measured by a binary variable indicating whether or not any of the founders had established an enterprise before founding this firm, as well as for their number of years of working experience in the industry the spin-off is mainly operating in (Industry experience) captured in the reference year. If the spin-off has multiple founders, the industry experience of the founder with most years of industry experience is used.

Lastly, we include variables associated with the parent organization, namely parent size and founders’ previous position at the parent firm. Parent size is measured as its number of employees at the time of spin-off foundation, because larger incumbent companies may be less likely to react to new competitors when challenged by a new product introduction (Kuester et al. 1999). Second, under German Commercial Code (“Handelsgesetzbuch,” section 74), non-compete covenants between firms and their employees do not fully apply to board members and managing directors as they are not regarded as regular employees. Therefore, we include a founder’s previous managerial position, i.e., whether or not a founder was a chief executive at the parent organization, as a control.

Since the control variables Age, Initial employment, Salest-1, Industry experience, Parent size, and Employee poaching are highly skewed, we log-transform them in order to normalize their distribution. If these variables contain zero values, we add the smallest positive value before log-transformation. It is important to note that the main variables of interest (Parental hostility and spin-offs’ strategic actions pertaining to Product substitutability, Employee poaching, and Intrapreneurial attempt) are captured at the time of spin-offs’ foundation and are time invariant, while spin-offs’ innovation and economic performance are observed at later points in time (see Agarwal et al. 2004). We include time dummy variables so as to control for unobserved effects associated with each year observation.

3.3 Estimation approach

We test our propositions regarding the relationship between spin-offs’ initial strategic actions, parental hostility, and employee spin-offs’ subsequent performance using a non-linear mediation analysis (e.g., Imai et al. 2010a, 2010b; Imai et al. 2011), which we implement using a mediation package in the statistical R-software (Tingley et al. 2014). Given the non-linear nature of the mediator (Parental hostility) and outcome variables (Firm innovation, Market innovation), marginal effects are no longer constant as they depend on the value of other covariates (Wooldridge 2002). This means that mediation effects cannot be simply computed by taking a product of coefficients as in a traditional (linear) mediation analysis (e.g., Baron and Kenny 1986). Non-linear mediation analysis, which is based on the potential outcomes framework (e.g., Holland 1986), overcomes this problem, as it is not tied to any specific functional or distributional form, and therefore is suitable for fitting non-linear and non-parametric models (Imai et al. 2011).

In a non-linear mediation analysis, the mediation effect is defined as the effect of the treatment variable (Ti = t) on the outcome variable (Yi) that is solely transmitted via the mediator (Mi):

for each unit i and the treatment status t = 0, 1. In other words, it is calculated as the difference between (1) the estimated value of the outcome variable under the condition of having estimated the mediator with the treatment variable, Mi(1), and (2) the estimated value of the outcome variable under the condition of omitting the treatment variable from the estimation of the mediator, Mi(0), while holding the treatment status constant at t (Imai et al. 2010a, p. 311). Because the treatment is fixed and only the mediator changes, the method allows to isolate causal mechanisms.

It should be noted however that although we observe Yi{t, Mi(t)} for units with Ti = t, we can never observe the counterfactual outcome Yi{t, Mi(1 − t)} in the common research design with one observation per unit. This makes identifying causal mechanisms difficult and requires an additional assumption known as Sequential Ignorability (SI) (Imai et al. 2010a, 2010b; Imai et al. 2011).Footnote 4 Whereas this SI assumption cannot be tested directly from the observed data, sensitivity analysis allows the researcher to evaluate how an estimated quantity would change for different degrees of violation of the key identification assumption (Hicks and Tingley 2011), and therefore to assess the likelihood that the identified relationships can indeed be interpreted as causal mechanisms.

As traditional mediation analysis is limited in terms of drawing causal inferences, non-linear mediation analysis is receiving momentum among scholars aiming to disentangle the causal relationships between their variables of interest (Keele et al. 2015). It is widely applied in different fields spanning from life sciences such as medicine (e.g., Linden and Karlson 2013) to social sciences such as psychology (e.g., Imai et al. 2010a), political sciences (e.g., Mattes and Weeks 2019), or economics (e.g., Bammens and Hünermund 2019; Emmenegger et al. 2015).

4 Results

Along with main descriptive statistics and pairwise correlation matrix (Table 1), we now provide the results from the individual models of the mediation analysis (Table 2).

As predicted in Hypothesis 1, Product substitutability has a significant positive effect on Parental hostility at the 1% level (model 1: β = 0.350, p < 0.01). Since this equation is estimated using Probit model, we also calculate an average marginal effect of Product substitutability on the probability that Parental hostility will prevail, and this effect is positive (AME = 0.059) and significant (CI = [0.035; 0.085]) at the 95% confidence level. In other words, the likelihood of Parental hostility is on average 6 percentage points higher if an employee spin-off proceeds with a substitute product strategy. Also, in line with Hypothesis 2, spin-offs that poach employees from their parent organizations are more likely to face Parental hostility (model 1: β = 0.299, p < 0.01). Specifically, the results indicate that if a spin-off hires one additional employee from the parent, the likelihood of Parental hostility increases by 1.4% (AME = 0.055; CI = [0.036; 0.074]; taken into account the logarithmic transformation). Finally, the Intrapreneurial attempts by a spin-off’s founder to first implement the business idea within the parent company have a significant positive relationship with Parental hostility towards the spin-off’s foundation (model 1: β = 0.299, p < 0.01). These Intrapreneurial attempts on average increase the likelihood of Parental hostility by 9% (AME = 0.088, CI = [0.066; 0.111]), thus supporting Hypothesis 3. Overall, these findings strongly support the idea that initial strategic actions increasing the perceived competitive threat a spin-off poses to its parent indeed serve as key factors determining Parental hostility towards its foundation.

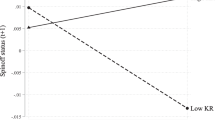

However, when looking into spin-offs’ subsequent performance outcomes, we cannot confirm the negative effect of Parental hostility. Contrary to Hypothesis 4, results indicate a significant positive effect on both spin-offs’ innovation and economic performance. In particular, employee spin-offs confronted with Parental hostility are more likely to introduce new to Firm innovation (model 2: β = 0.171, p < 0.05) and new to Market innovation (model 3: β = 0.198, p < 0.05). They also demonstrate higher absolute yearly employment (model 4: β = 0.184, p < 0.01) and sales (model 5: β = 0.195, p < 0.05) growth.

As a result of this unexpected positive effect of Parental hostility on spin-offs’ innovation and economic performance, we also cannot confirm our final Hypotheses 5, 6, and 7. When testing the effect size of the average mediation—how much of the effect of spin-offs’ initial strategic actions on spin-off performance is transmitted by the mediating variable of Parental hostility—we find that Parental hostility indeed partially mediates the relationship between initial strategic actions (namely Product substitutability, Employee poaching, and Intrapreneurial attempts) and employee spin-offs’ innovation and economic performance, but these indirect effects are positive. Even though the average mediation effects are relatively small, they are all significantly different from zero (Table 3). Thus, our findings suggest that employee spin-offs (1) starting with a substitute product strategy, (2) hiring more employees from their parent, or (3) trying to first implement their business idea inside the parent company are more likely to face parental hostility, which—contrary to our expectations—in turn makes it more likely that these spin-offs introduce innovations and achieve higher levels of absolute employment and sales growth.

Moreover, we observe that the positive indirect effects of Employee poaching and Intrapreneurial attempts are strengthened by a positive direct effect on spin-offs’ innovation and economic performance. This results in a total significant and positive effect of Employee poaching and Intrapreneurial attempts on spin-offs’ innovation and economic performance (Table 3). Whereas we find similar relationships between Product substitutability and economic performance, we observe a direct negative effect of Product substitutability on innovation performance, which outweighs its positive indirect effect.

In addition, we find that larger parent organizations are less likely to retaliate (as in Kuester et al. 1999), and respectively that this parent size is positively associated with spin-offs’ performance (as in Phillips 2002). Moreover, whether a founder held a chief executive position at the parent company, and thus was not obliged to sign non-compete agreements, is positively related to parental hostility as well as to its performance. Finally, we observe significant direct industry effects on the likelihood of parental hostility and spin-offs’ performance.

4.1 Additional analyses

In order to verify the robustness of our empirical findings, we conducted several robustness checks. First, we inspected to what extent a common method variance could be an issue in a current dataset. Following Podsakoff et al. (2003), we completed Harman’s one-factor test using exploratory factor analysis. The respective test revealed that the issue is not present, since we obtained 30 different factor loadings, among which 5 factors with eigenvalues greater than 1 jointly explained up to 61% of the total variance (with the most important single factor explaining only 16%).

Second, we performed a sensitivity analysis which enables us to inspect for violations of the Sequential Ignorability (SI) assumption—the main and yet untestable assumption needed for identification (Imai et al. 2010a, 2010b; Tingley et al. 2014)—in our mediation model. Specifically, a sensitivity analysis allows to assess the degree to which the key identifying assumption must be violated for our conclusions to be reversed. It is based on an estimation of a sensitivity parameter ρ—a correlation between the error terms of the mediation and the outcome models. If the error term correlation is equal to zero (ρ = 0), then the SI assumption holds, meaning that all relevant confounders have been conditioned on. However, if this term is not equal to zero (ρ ≠ 0), we expect the SI assumption is violated, meaning that there exist omitted variables that are related to both the mediator (Parental hostility) and the outcome variable (i.e., spin-offs’ innovation and economic performance). Sensitivity analyses, which we approximate using linear probability modeling for binary outcome variables (Tingley et al. 2014), indicate that our conclusions regarding average mediation effects are robust, and can be causally interpreted. That is, the original results would hold unless ρ > 0.1 for both innovation performance outcomes and sales growth or ρ > 0.2 for employment growth at the 95% confidence level (see Figs. 1, 2, 3 and 4 in the Appendix).

Although the sensitivity analysis with respect to the Sequential Ignorability provides us with robust evidence supporting our main findings, we also investigate endogeneity concerns using the instrumental variable approach (see discussion by Antonakis et al. 2010; Imai et al. 2011). There could be concerns about potential endogeneity, as parental hostility may force the employee spin-off to launch dissimilar products, refrain from hiring its employees, or avoid implementing the idea internally in order to avoid retaliation. However, as the relationship between these strategic actions and parental hostility are shown to be positive (instead of negative), we feel rather confident in this respect. As there may however be a concern that anticipated spin-off performance could influence a parent’s reaction (issue of reverse causality), we test the robustness of our findings by a two-stage least squares (2SLS) approach, where we use fitted probabilities as an instrument for the conceivably endogenous binary variable Parental hostility (see Wooldridge 2002, p. 621–633). As instrumental variables that can potentially explain parental hostility without having a direct effect on spin-off performance once the endogenous variable is controlled for, we propose two variables. First, parents are expected to be especially hostile to the foundation of a spin-off when the founder of that spin-off is of particular importance for their performance (Campbell et al. 2012; Moncada et al. 1999; Wezel et al. 2006). In particular, we argue that a founder who was previously working in the sales department of the parent organization (Sales position) may be especially valuable to the parent organization as she does not only have in-depth knowledge on the parent’s product, but also on the parent’s clientele and confidential market information (Boeker 1997). Whereas parents have established practices to protect their technology from imitation by imposing intellectual property rights (e.g., patenting), it is much more difficult to keep employees from creating private ties with their customers and suppliers. As suggested by Phillips (2002), a parent’s competitive position is threatened to a greater extent if an employee is capable to take away its main customers or suppliers. Although the commercial experience can contribute to the overall spin-off performance (e.g., Buenstorf 2007; Chatterji 2009), we believex this experience is far less important once other founder experiences and characteristics are taken into account. More precisely, commercial experience, in contrast to technical experience, has been shown in several studies to have no direct effect on spin-off performance once other factors influencing the knowledge transfer from incumbent to the spin-off as well as founders’ qualities and managerial experiences are accounted for (see Colombo and Grilli 2005, 2007). As Colombo and Grilli (2005, p. 975) conclude, “it is the technical work experience of founders as opposed to their commercial work experience that determines growth.” As such, the previous Sales position of the founder conceptually meets the conditions to be used as an instrumental variable. Second, we use parental hostility averaged across industries (Industry average of hostility) as an instrument explaining part of unobserved features in our model. This method is widely used in econometric settings (e.g., Hottenrott et al. 2017; Jordaan 2011). In order to assure a considerable amount of instrument variation, this industry average of parental hostility is calculated according to the year of spin-off establishment. The results of a Two-Step IV approach are consistent with our key findings (see Table 4 in the Appendix).

Moreover, since our study focuses on newly established firms, we also inspected whether our main findings are affected by the survivorship bias. Similar to Cassar (2004), we conducted robustness tests by exploiting cross-sectional data with respect to the survey wave of 2010 (see Table 5 in the Appendix), and by restricting the sample to spin-offs that are up to 3 years old (i.e., sampling firms closer to their formation period; see Table 6 in the Appendix). We also compared mean differences between the spin-offs in our sample that survived until the year 2015 and those that did not (information retrieved from the Creditreform database) (see Table 7 in the Appendix). No significant differences were found. We also added a dummy variable representing this information on survival to our empirical analysis (see Table 8 in the Appendix). All these additional analyses confirm our main results, indicating that survivorship bias is not substantially affecting our findings.

We also inspected for industry differences on a more aggregated level by dividing spin-offs into manufacturing and service sectors (i.e., we constructed a binary variable equal to 1 if the spin-off is active in a manufacturing industry, and zero if it is in a service sector). We find that this variable has a positive significant effect on parental hostility as well as on spin-offs’ innovation and economic performance. Nevertheless, we observe no substantial moderating effect of manufacturing versus services on the relationship between a spin-off’s initial strategic actions and Parental hostility, nor on the relationship between Parental hostility and spin-off performance, indicating that the relationships we hypothesized hold both for spin-offs in manufacturing and in service sectors.

Finally, we also conducted additional robustness checks, such as incorporating product substitutability as a moderator of the parental hostility employee spin-off performance relationship (which turned out to be insignificant), using a different specification of product substitutability (i.e., not only similar but also improved goods or services), controlling for a broader set of variables, implementing different types of models, and using only one observation per venture (instead of pooled data). All these different specifications led to similar results, pointing to the robustness of our main findings. The results are available from the authors upon request.

5 Discussion and implications

This study clarifies the relationship between employee spin-offs’ initial strategic actions, their parents’ hostile reaction towards spin-off foundation, and the spin-offs’ subsequent performance. Our findings show that spin-offs’ initial strategic actions with respect to (1) product substitutability, (2) employee poaching, and (3) intrapreneurial attempts to first implement the business idea inside the parent organization are strong factors conditioning parental hostility, which in turn positively affects employee spin-offs’ innovation and economic performance. These findings contribute to the literature on employee spin-offs in several ways.

First, our work highlights the crucial role of employee spin-offs’ initial strategic actions for the relationship with their parent. We propose that by commercializing similar goods or services, hiring employees from the parent organization, or trying to first implement the business idea inside the parent organization, spin-offs pose a greater (perceived) competitive threat to their parent organizations, and thus are more likely to be challenged by them. We also extend the seminal work by Walter et al. (2014) investigating the effect of parental hostility on spin-offs’ performance. While Walter et al. (2014) advanced product substitutability as a potential factor aggravating the negative effect of parental hostility on performance (but could not empirically observe this effect), our study advances product substitutability (among other initial strategic actions) as a mechanism that leads to these hostile reactions in the first place. As such, we find that the links between parental hostility, spin-offs’ strategies, and spin-offs’ performance are more complex than previously assumed, with spin-offs’ initial strategic actions acting as key drivers of parental hostility towards spin-off foundation.

Second, our study advances current knowledge regarding the phenomenon of parental hostility and its effect on spin-off performance. While hostility was expected to restrict spin-offs’ access to resources (both inside and outside the parent firm) and thereby negatively affect their performance (see also empirical evidence by Walter et al. 2014), we observe a positive effect. Upon reflection, we believe that this effect can be explained partly by several reasons. First, hostility frees the spin-off from its parent’s routines—allowing it to act autonomously and flexibly—and even forces it to develop novel resources and competences that in turn contribute to its performance. This reasoning is also in line with McGrath (2001) and Cirillo et al. (2014), who found a positive effect of autonomy on the performance of incumbents’ internal innovation projects. This interpretation suggests that future work should consider flexibility and the development of novel resources and competences as a mediator between parental hostility and employee spin-off performance. At the same time, similar to competition and retaliation scholars, our findings suggest that by departing from their parental heritage and thus creating novel competencies, employee spin-offs can not only reduce the effectiveness of their parents’ retaliatory actions (Chen 1996) and thus increase their chances of survival (Fan 2010), but even improve their performance in these competitive circumstances (Andrevski and Ferrier 2019). Finally, by hindering spin-offs’ establishment parent companies may actually endorse them and spark investors’ and consumers’ interest. As Agarwal and Shah (2014, p. 114) discussed, “[t]his competition does not necessarily bode badly for employee founded firms, who often exert competitive pressures on their parents and generally outperform other firms that enter in the industry.”

Also, our study sheds light on the overall effect of employee spin-offs’ initial strategy on their performance. We find that in addition to having a positive effect via parental hostility, a spin-off’s initial strategic actions (i.e., product substitutability, employee poaching, and intrapreneurial attempts) in general also have a positive direct effect on its performance. The only exception relates to the commercialization of similar products which has a direct negative effect on the spin-off’s innovation performance. Moreover, the parent’s hostile reaction towards this product substitutability and the resulting development of novel competences and resources does not compensate for this large direct negative effect. Overall, employee spin-offs that initially launch products similar to their parents’ offering, will be less successful in developing new to firm or new to market innovations afterwards. This suggests that although spin-offs benefit from prior technical and market related knowledge (e.g., Franco and Filson 2006; Klepper and Sleeper 2005), over-reliance on products and services similar to those of the parent firm may insulate the spin-off from other sources of learning (Parhankangas and Arenius 2003), and thus negatively affect its innovation performance.

In terms of practical implications, our results suggest that employee spin-offs entering the market with a business strategy that appears to pose a threat to the competitive position of their parent organization, should expect some hostility from that parent. However, this should not discourage them from starting up. Instead, they should take advantage of this ruptured relationship to develop their own routines, decision-making structures, network, competences, and strategy to cope with the entrepreneurial challenges they are facing. Instead of relying too much on the knowledge and routines inherited from their parents, they should pursue autonomous decision-making and competence building. What is more, whereas previous work has focused on how spin-offs can react to hostile reactions from the parent, our study illustrates that spin-offs can take a proactive stance in this respect. Given their initial strategy, they can try to predict what the reaction of the parent will be, allowing them to prepare several action plans, which in the end may positively affect spin-off performance (Clark and Montgomery 1996). As for corporate parents, our results suggest that hostility towards employee spin-offs will probably not pay off, as it does not reduce spin-offs’ innovation and economic performance, but in fact makes them perform better. Instead, our study suggest that corporate parents could benefit by providing employee spin-offs with autonomy in decision-making while maintaining at the same time friendly relationships. Parents may benefit from the knowledge spill-in from their former employees’ new ventures, but only on the condition that these employee spin-offs consider them trustworthy (Kim and Steensma 2017).

Although we are convinced that the current study makes several contributions, it also has some limitations opening avenues for future research. Firstly, the fact that our findings on the performance effect of parental hostility contradict those of Walter et al. (2014) points to the need to improve our understanding further. One possible explanation for this contradicting finding may be related to differences in the sample. The study by Walter et al. (2014) analyzes only spin-offs that are built on a technology transfer from their parent firms, and thus looks only into technology-based spin-offs. In this regard, the access to parents’ resources may be more important than autonomy or competence building, and spin-offs confronted with parental hostility may therefore need more time to become breakeven. Our study imposes less stringent criteria and defines employee spin-offs based on the importance of a business idea developed by the founder while still working at the parent company. As such, it analyzes both technology-based and non-technology-based new ventures. The fact that our findings contradict those of Walter et al. (2014) suggests that more research is needed to understand the precise conditions under which parental hostility can have positive or negative effects on spin-off performance. In addition to the industry life-cycle (advanced by Robinson and McDougall 2001), the technology-intensity of a spin-off should thus be explored as a potential contingency factor in further studies.

Other potential explanations for our contradictory finding are that (1) the effect of parental hostility on spin-off performance may be curvilinear or that (2) different types of parental hostility, which can be either proactive (e.g., non-compete clauses) or reactive (e.g., patent litigation, propagation of negative information) may have different performance implications. Unfortunately, the current dataset does not allow us to measure the degree of parental hostility, nor to distinguish different types of it. Even though our robustness tests did not indicate any differences of the effect of parental hostility between spin-offs that survived and those that did not survive in the longer term, we cannot fully rule out a possibility that unpromising spin-offs confronted with fiercer parental hostility may not have started-up in the first place, resulting in market entry only by the most resilient ones (c.f. Klepper and Sleeper 2005). Also, we are not able to statistically rule out that parents will only react against spin-offs that truly pose a competitive threat. However, as anecdotal evidence shows that corporate venturing programs commonly fail to identify successful ventures (even among spin-offs), it seems that parent organizations, just like independent venture capitalists, have difficulties assessing the true potential of spin-offs upfront. Therefore, we believe that parental hostility will follow from the perceived competitive threat a venture poses. We hope that these concerns will inspire future scholarly work.

In addition, existing literature on competition and retaliation suggests that new entrants—and hence also spin-offs—can counter parental hostility by choosing the proper entrepreneurial strategy (e.g., Covin et al. 2000; Fan 2010). Future research could therefore move beyond our focus on spin-offs’ initial strategy at founding, and also study changes in the employee spin-off’s entrepreneurial strategy as a reaction to parental hostility. Moreover, while we study how parental hostility at the time of foundation affects employee spin-offs’ later performance, it would be interesting to observe how the parent’s reaction and its effect on spin-off performance change over time. For example, hostile parents may become more collaborative over time, or vice versa. With respect to the former evolution, the study by McKendrick et al. (2009) shows that the initially detrimental effect of an employee spin-off’s establishment on its parent’s activities is reduced and may even become positive in the long term, implying that a parent may switch from being hostile to being supportive. With respect to the latter evolution, some parents may not engage in retaliatory actions from the beginning of the spin-off, as for example the costs of spin-offs’ preemption may exceed the expected benefits, and these parents may be better off “gambling” that spin-off activities would not disturb their market share (Klepper 2009, p. 647). However, they may decide to engage in retaliation activities once the spin-off turns out to be a real competitive threat. Finally, although we attempted to eliminate concerns of potential endogeneity and survivorship bias and were able to reproduce our main findings in various robustness checks, we encourage future studies to collect more information that could be helpful in identifying other potential instrumental variables (e.g., actual reason of leaving parent company, founders’ time spent at the parent company) and different types of parental hostility as well as consider alternative approaches including panel data techniques to develop our insights further.

Notes

In 2015, the survey was renamed to the IAB/ZEW Start-up Panel, as KfW was replaced by the Research Institute of the Federal Employment Agency (IAB).

Robustness tests using only one observation per employee spin-off confirm our results.

As employee spin-offs can enter the market with multiple products, there are several cases where founders report that they produce both substitute products and complementary products (i.e., option a is marked along with option c). Therefore, we conducted several robustness tests, namely (1) a more strict operationalization of Product substitutability, where the variable takes the value 1 if the spin-off commercialized similar substitute products only (i.e., ticked option a but not option c), (2) a broader operationalisation where Product substitutability takes the value 1 if the spin-off commercialized similar or refined/improved products (i.e., ticked option a and/or option b, independent of his/her response for option c and option d), and (3) an analysis controlling for the decision to launch complementary products only (i.e., ticked option c and not option a), where we expect opposing effects to our main analyses. Robustness tests confirm our main results and are available from the authors upon request.

The Sequential Ignorability assumption requires that two ignorability conditions are met sequentially. First, it requires that the treatment assignment is exogenous given the observed pretreatment confounders, i.e., it is statistically independent of potential outcomes and potential mediators (Imai et al. 2011). The first part of assumption is also known as “exogeneity” or “no omitted variable bias.” Second, it requires that the observed mediator is ignorable given the treatment status and pretreatment confounders. That is, there are no unidentified covariates that could confound the relationship between mediator and outcome variable (Imai et al. 2011). We further discuss this assumption in the results section.

References

Agarwal, R., & Shah, S. K. (2014). Knowledge sources of entrepreneurship: firm formation by academic, user and employee innovators. Research Policy, 43(7), 1109–1133. https://doi.org/10.1016/j.respol.2014.04.012.

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. (2004). Knowledge transfer through inheritance: spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522. https://doi.org/10.5465/20159599.

Agarwal, R., Ganco, M., & Ziedonis, R. H. (2009). Reputations for toughness in patent enforcement: implications for knowledge spillovers via inventor mobility. Strategic Management Journal, 30(13), 1349–1374. https://doi.org/10.1002/smj.792.

Agarwal, R., Campbell, B., Franco, A., & Ganco, M. (2016). What do I take with me? The mediating effect of spin-out team size and tenure on the founder-firm performance relationship. Academy of Management Journal, 59(3), 1060–1087. https://doi.org/10.5465/amj.2012.0853.

Andersson, M., & Klepper, S. (2013). Characteristics and performance of new firms and spinoffs in Sweden. Industrial and Corporate Change, 22(1), 245–280. https://doi.org/10.1093/icc/dts046.

Andrevski, G., & Ferrier, W. J. (2019). Does it pay to compete aggressively? Contingent roles of internal and external resources. Journal of Management, 45(2), 620–644. https://doi.org/10.1177/0149206316673718.

Anton, J. J., & Yao, D. A. (1995). Start-ups, spin-offs, and internal projects. Journal of Law, Economics, and Organization, 11(2), 362–378. https://doi.org/10.1093/oxfordjournals.jleo.a036876.

Antonakis, J., Bendahan, S., Jacquart, P., & Lalive, R. (2010). On making causal claims: a review and recommendations. The Leadership Quarterly, 21(6), 1086–1120. https://doi.org/10.1016/j.leaqua.2010.10.010.

Bammens, Y., & Hünermund, P. (2019). Nonfinancial considerations in eco-innovation decisions: the role of family ownership and reputation concerns. Mimeo.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173.

Beckman, C. (2006). The influence of founding team company affiliations on firm behaviors. Academy of Management Journal, 49(5), 741–758. https://doi.org/10.2307/20159796.

Belleflame, P., & Peitz, M. (2010). Industrial organizations. Markets and strategies. Cambridge University Press.

Bersch, J., Gottschalk, S., Müller, B., & Niefert, M. (2014). The Mannheim Enterprise Panel (MUP) and firm statistics for Germany. ZEW Discussion Papers, No. 14-104. https://EconPapers.repec.org/RePEc:zbw:zewdip:14104

Boeker, W. (1997). Executive migration and strategic change: the effect of top manager movement on product-market entry. Administrative Science Quarterly, 42(2), 213–236. https://doi.org/10.2307/2393919.

Buenstorf, G. (2007). Evolution on the shoulders of giants: Entrepreneurship and firm survival in the German laser industry. Review of Industrial Organization, 30(3), 179–202. https://doi.org/10.1007/s11151-007-9132-1

Cainelli, G., Evangelista, R., & Savona, M. (2006). Innovation and economic performance in services: a firm-level analysis. Cambridge Journal of Economics, 30(3), 435–458. https://doi.org/10.1093/cje/bei067.