Abstract

We study the formation of an entrepreneurial network in an environment, in which entrepreneurs who are contesting with each other for the development of a new venture have the possibility to collaborate. On the one hand, such bilateral knowledge collaborations are beneficial because they allow the integration of external knowledge. On the other hand, external knowledge collaborations reduce an entrepreneur’s incentive to invest in her internal knowledge. We analyze this trade-off and show that if the knowledge transfer between collaborating partners is complete, the only stable entrepreneurial network is one with exactly one collaboration of each entrepreneur. If, however, knowledge transfers are only partial, entrepreneurial networking becomes more important and entrepreneurs form more knowledge collaborations. Moreover, internal or external knowledge spillovers reduce the incentives to form knowledge collaboration. These results have several practical implication for entrepreneurs and managers of small- and medium-sized enterprises (SMEs) in their pursuit to better understand factors that influence knowledge collaborations with competitors and to devise their co-opetition strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Creating a new venture is not only the source for innovation and economic growth, but also central for every entrepreneur.Footnote 1 As argued by Belitski et al. (2019, p.523), successful entrepreneurship is crucially affected by the integration of new knowledge into the venture: “Taken together, internal investment in knowledge, knowledge spillovers, and knowledge collaboration emerges as an important mechanism to access and assimilate new knowledge for a firm.” Internal knowledge investments are entrepreneurial investments in R&D or human capital through training and education, whereas knowledge spillovers and knowledge collaborations are ways to source knowledge from external environments. Knowledge collaborations refer to voluntary knowledge transfers with external organizations in form of R&D agreements, joint patents or liaisons with universities and research labs, and knowledge spillovers are externalities that spill over from knowledge investments of third parties, such as through conference participation, patent filings, or publications.

Whereas knowledge spillovers are exogenously given by the entrepreneur’s external environment, partner selection for knowledge collaborations are the result of entrepreneurial networking. Using a series of cases of high-growth entrepreneurial firms, the study by Lechner and Dowling (2003) suggests that, while the relative importance of social and reputational networking decreases with the firms’ development, co-opetition networking increases over time.Footnote 2 In fact, several empirical studies on successful entrepreneurship show that rival entrepreneurs are an important partner for knowledge collaborations: In the biotechnology industry, for example, entrepreneurial firms collaborate with competitors to reduce the time span for R&D, see McCutchen and Swamidass (2004), or to develop their product lines and their technological diversity, see Quintana-Garcia and Benavides-Velasco (2004). According to the conceptual framework of Gnyawali and Park (2009), co-opetition is especially important for entrepreneurial firms and their ability to innovate, if the time to market is short, technological battles are intense or technologies are complex.

Motivated by the above research, the present paper combines all three sources of knowledge access in a game-theoretic model to analyze successful entrepreneurship. In particular, we consider a community of entrepreneurs who are contesting for the development of a new venture. Each entrepreneur can take the external knowledge of other competing entrepreneurs as a valuable source for her own innovative activities by forming bilateral knowledge collaborations. In this co-opetition setting we analyze the optimal formation of an entrepreneurial network and its implications for the optimal knowledge investments of entrepreneurs.

We ask the following questions: Why would anyone voluntarily share her knowledge with a competing entrepreneur, the very knowledge that could be the basis for her own future competitive advantage? And if, how much knowledge should be shared and how many of such knowledge collaborations are best? And how do knowledge spillovers affect entrepreneurial networking?

We show the following results: First, knowledge collaborations are beneficial because they allow the integration of external knowledge and therefore increase the probability of winning the contest. However, knowledge collaborations are not free of cost because they reduce the incentives of the involved entrepreneurs to invest in internal knowledge. Moreover, her knowledge investments are decreasing in the number of collaborations an entrepreneur has formed. The underlying effect is due to a free-riding problem: Knowledge sharing implies that an entrepreneur contributes with her knowledge investment to a public good in her relationship with each collaborating partner. This leads to an underinvestment in her internal knowledge. As a consequence, the probability of being successful in the contest, as well as her expected payoff, decreases with the number of knowledge collaborations. Second, concerning the formation of an entrepreneurial network, the degree of co-opetition is low: Due to the trade-off between the benefits and costs of knowledge collaborations, an entrepreneur’s incentives to form collaborations with more than one other competing entrepreneur are rather limited. This result, however, depends crucially on the degree of knowledge sharing between collaborating partners. If these knowledge transfers are only partial, entrepreneurial networking becomes more important. Third, knowledge spillovers reduce the incentives to form knowledge collaboration. This holds true for internal as well as external spillovers. External spillovers arise from the knowledge investments of all entrepreneurs within the community, whereas internal spillovers arise if an entrepreneur indirectly benefits from the knowledge investments of those entrepreneurs with whom her partners have formed collaborations.

Of course, the theoretical model presented in this paper is abstract per se, and the management of knowledge sharing in co-opetitive relationships in practice is a permanent balancing of its benefits and costs, see Ilvonen and Vuori (2013): On the benefit side, such a knowledge collaboration mainly enables a faster and more efficient innovation process and has potential to generate more creative innovations; on the cost side, knowledge sharing with a competitor at the same time creates the risk of technology leakage, may lead to conflicts or to opportunistic behavior of the partner. Nevertheless, our results substantiate several hypotheses formulated in the management literature on entrepreneurial networking: First, entrepreneurial firms should view competitors not only as pure rivals but also as a potential source of additional knowledge. In particular, entrepreneurial firms with co-opetitive networking should be more successful than those without any collaborations, see, for example, Lechner and Dowling (2003). Second, an entrepreneurial firm should not share all its knowledge with partners. Instead, it should protect some of its knowledge and, in turn, find an adequate balance between sharing and withholding knowledge with its co-opetition partners, see, for example, Carayannis and Alexander (1999). And third, the advantages of co-opetitive knowledge collaboration depend on the mode of competition. If competition is strong, as in the case of a contest, an entrepreneurial firm is better off by limiting its collaborating partners, see, for example, Bengtsson et al. (2010). In addition to this support for already known hypotheses, the present analysis can also be used to derive hypotheses for future empirical research on entrepreneurial networking: For example, entrepreneurs which operate in industries characterized by geographical concentration are more likely to engage in co-opetition than entrepreneurs in other industries where competition is spatially dispersed. Or, entrepreneurs which operate in industries where knowledge is easily codifiable are less likely to engage in co-opetition than entrepreneurs in other industries where knowledge is highly tacit.

The rest of the paper is organized as follows: Section 2 shows how our results contribute to the current literature. The basic model is presented in Section 3. Section 4 analyzes the optimal internal knowledge investments and external knowledge collaborations. In Section 5, we extend the basic model and introduce partial knowledge transfers and knowledge spillovers. Section 6 concludes. The proofs of Section 4 are delegated to the Appendix; for the proofs of Section 5, see the Online-Appendix.

2 Literature

The present paper and its results contribute to the theoretical literature on network formation as well as to the literature on knowledge management, open innovation, and co-opetition.

Most of the recent theoretical articles on network formation deal with abstract network games, where agents’ efforts have spillovers on others with whom they choose to associate, see, e.g., Hellmann (2013, 2021), Sadler (2020) or Golub and Sadler (2021). Using different monotonicity assumptions and general link externality conditions on the agents’ utility, these articles investigate the architecture of pairwise stable networks. In addition, there are also theoretical articles which directly study the formation of entrepreneurial networking, see, e.g., Parker (2008), Bac and Inci (2010) or Inci and Parker (2013). However, this stream of literature either considers formal networks between entrepreneurs who share information to better screen good from bad ideas, or analyzes informal networks between entrepreneurs who convey information about the quality of start-up projects to local financiers for start-up financing. More closely connected to the present paper are contributions which also study network formation in contest models, see, e.g., Deroian and Gannon (2006), Goyal and Moraga-Gonzalez (2001), Goyal and Joshi (2006), Goyal et al. (2008) or Telloney and Vergotez (2011). Our contribution to this literature is threefold: First, we show that the endogeneity of a contestant’s investment plays a crucial role in the formation of networks. Goyal and Joshi (2006, p.326f), for example, consider a patent race between firms who invest in R&D and assume that a collaboration between two firms induces an exogenously specified effect for both firms. They show that under these circumstances either no firm forms a collaboration, or all firms are linked, or the network consists of only one group of completely connected firms while all other firms are isolated. The main difference to their model is that we study the impact of collaborations also on the incentives to invest, thus endogenizing the level of R&D investment. This endogeneity then yields different network structures. Second, our result shows that the endogenous formation of networks in contests crucially depends on the form of benefits that accrue from resource sharing between partners. Telloney and Vergotez (2011), for example, consider a contest where contestants can form bilateral collaborations to share resources and which increases their valuation of the winner prize. They find that either all contestants collaborate with each other, or that the network has a group of individuals that are fully linked with one another. Our model then shows that if knowledge sharing between partners does not influence their valuation of the winner prize but increases the effective resources available to them in the contest, the formation of pairwise collaborations differs tremendously. And thirdly, our modelling approach shows that the nature of the competition has an important influence on network formation. In the context of Cournot market competition, where firms can form collaborations which are either cost-reducing or quality-improving, Goyal and Moraga-Gonzalez (2001), Deroian and Gannon (2006), and Goyal et al. (2008) show that all firms typically have collaborations with each other. The main difference between these papers and the present one is the mode of competition. Using a contest implies that competition is of an all-or-nothing nature—either a firms wins the contest or not. Hence, a contest is a more aggressive mode of competition than the moderate Cournot competition.Footnote 3

Concerning network formation there is also a stream of theoretical articles which deals with the incentives of firms to form research joint ventures (RJVs), see Bloch (1997) for an overview. In our context, a RJV refers to an entrepreneurial network as a collaboration of two or more entrepreneurs who signed a multilateral agreement to share some of their knowledge investments. Different to the present paper, which studies the formation of bilateral knowledge collaborations, all members of a RJV are linked with each other and form a closed group. The equilibrium concept for studying the endogenous formation of RJVs therefore is completely different to the stability concept used for studying the endogenous formation of pairwise links: In the first case, all members of a RJV need to agree on the accommodation of a new member, whereas in the latter case a collaboration is formed if it is in the interests of both parties. Nevertheless, the article by Jost (2021) on the endogenous formation of RJVs nicely complements the present study. In an environment similar to the one studied in this paper, Jost (2021) shows that, in general, all RJVs have only two members. That is, each entrepreneur has exactly one collaboration with another entrepreneur. The analysis in the present paper confirms this result but shows that entrepreneurs form more collaborations if knowledge transfers are only partial.

Our analysis is also closely related to the literature on knowledge management in entrepreneurial firms and the knowledge spillover theory of entrepreneurship. The importance of internal knowledge investment and external knowledge collaboration as sources for the accumulation and creativity inside an entrepreneurial firm is emphasized, for example, in Cassiman and Valentini (2016), for knowledge spillovers, see, e.g., Jaffe et al. (1993) or Audretsch and Lehmann (2005). However, whereas most of the literature on knowledge management considers firms in other markets, universities, research labs, customers or suppliers as suitable collaborating partners of an entrepreneur, horizontal collaborations with direct competitors in the same market are less common, see, e.g., Van Beers and Zand (2014). Our results indicate that entrepreneurs can nevertheless benefit by collaborating with rival entrepreneurs in order to increase their chances of winning a new venture with the external knowledge of their partners. However, our results also indicate that partners intentionally limit their knowledge transfers. This result contributes to the research on the spillover theory of entrepreneurship. Introduced by Audretsch (1995), the spillover theory of entrepreneurship explains the formation of new entrepreneurial firms as a result of knowledge spillovers from a knowledge incubator who did not adequately commercialized this knowledge, see Audretsch and Keilbach (2007), or Acs et al. (2009, 2013). The barriers that limit the total conversion of the incubator’s knowledge into commercialized knowledge then determine the degree of entrepreneurial activities. According to Acs et al. (2003) who termed these barriers knowledge filter, the absorptive capacity of an entrepreneur determines the success of this conversion. Although the present model takes entrepreneurial actors as exogenously given, it shows that an entrepreneur as knowledge creator will limit the conversion of her knowledge by allowing only partial knowledge transfers and that her absorptive capacities determine the integration of external knowledge from collaborating partners.

Our results also contribute to the literature on open innovation research. Chesbrough (2006, p.1) defined an open innovation as “the use of purposive inflows and outflows of knowledge to accelerate internal innovation, and expand the markets for external use of innovation, respectively”. By collaborating with external organizations, a firm can utilize inbound and outbound knowledge flows to create or commercialize innovations.Footnote 4 In the context of our model, knowledge collaborations are innovation strategies, by which a firm leverages the internal knowledge of an external partner as a source for her own innovation - the inflows of knowledge—and, at the same time, hands over her own knowledge to her external partner—the outflows of knowledge. Our results then confirm the findings of Alexy et al. (2013) and show that an important potential partner for open innovation strategies could be the innovation community of its rival firms. Although outflows of knowledge help rival partners, knowledge collaborations and the corresponding inflows of knowledge render this strategy beneficial for both sides. In this way, our results contradict the traditional closed approach to innovation that a firm should retain ownership of her internal knowledge and, thereby, supports the open innovation paradigm.

Concerning the literature on co-opetition, especially in the context of knowledge sharing, most of the papers in this research stream focus on the general benefits and risks of knowledge sharing with competitors, see, e.g., Levy et al. (2003), Cassiman and Valentini (2016) and the literature cited in Section 1. Our results contribute to this literature by showing that the degree of co-opetition crucially depends on the mode of competition and the free-riding problem introduced by the corresponding cooperation. Moreover, if we interpret the degree of knowledge transfers as a measure of an entrepreneur’s absorptive capacities, our model suggests that an entrepreneur should invest first in the assimilation and integration of external knowledge in order to reduce the number of her collaborating partners.

3 The basic model

We consider a community of n entrepreneurs, n ≥ 3, who are contesting for the development of a new venture of value V. This venture can be the research for a new technology, the design of a new product, or the innovation of a new idea.

In order to win the contest, each entrepreneur \(i\in N=\left \{ 1,\ldots ,n\right \} \) invests in knowledge for the development of the venture. We denote by xi, xi ≥ 0, the amount of knowledge investment by entrepreneur i, and by \(X=\left (x_{1},....,x_{n}\right )\) the investment profile of all entrepreneurs. By investing in her internal knowledge, an entrepreneur increases her probability of winning the contest.

To benefit from the external knowledge investments of other entrepreneurs, an entrepreneur can form collaborations. Such collaborations are the result of her entrepreneurial networking which refers to her activities in creating and shaping links with other entrepreneurs. In our context, a network link between two entrepreneurs facilitates the exchange of their internal knowledge in form of a bilateral arrangement and is therefore termed knowledge collaboration. Let δij = 1 if entrepreneur i has such a link with entrepreneur j—in this case, both are termed as partners—and let δij = 0 if entrepreneur i does not have a link with entrepreneur j. The network of knowledge collaborations between entrepreneurs in the entire community then can be described by the entrepreneurial network matrix Δ:

For entrepreneur i ∈ N, let \(N_{i}=\left \{ j\in N:j\neq i,{\delta }_{ij}=1\right \} \subseteq N\) be the set of partners, and let \( k_{i}=\left \vert N_{i}\right \vert \) denote the cardinality of this set, that is, the number of knowledge collaborations formed by entrepreneur i. The number of all such collaborations in the community is denoted by \(K=\left (k_{1},....,k_{n}\right )\).

Forming a bilateral agreement between two entrepreneurs implies that their knowledge investments are shared. For simplicity, we assume in the basic model that each entrepreneur completely shares her internal knowledge with her partner without external knowledge spillovers. Thus, the total amount of internal and external knowledge\(\tilde {x}_{i}\) available to entrepreneur i in the contest is given by

We call \(\tilde {x}_{i}\) the effective knowledge of entrepreneur i ∈ N and denote by \(\widetilde {X}=\left (\tilde {x}_{1},...,\tilde {x}_{n}\right )\) the profile of effective knowledge in the community.

To model the contest we assume that the probability pi of entrepreneur i being successful in the contest depends on three factors: (i) her own internal knowledge investment in the development of the venture, (ii) her access to the external knowledge of other entrepreneurs with whom she has formed knowledge collaborations, and (iii) the knowledge of all other entrepreneurs in the community. Of course, her own internal knowledge xi increases the probability of winning the contest, whereas the knowledge xj of all other entrepreneurs reduces this probability. Moreover, due to the knowledge transfers from her partners, entrepreneur i’s effective knowledge determines the probability of winning the contest. To keep the contest as simple as possible we use the functional form suggested by Tullock (1980),

The numerator shows entrepreneur i’s effective knowledge, whereas the denominator is the sum of all effective knowledge within the whole community. As we will see below, the probability of winning the contest pi is increasing in entrepreneur i’s internal knowledge xi but at a decreasing rate.

If entrepreneur i wins the contest, she will get the value V of the venture, whereas the payoffs of all other entrepreneurs in the contest are zero. Without loss of generality, we normalize V = 1.Footnote 5 Accordingly, the expected payoff of entrepreneur i is

Note that we implicitly assume here that, although networking allows entrepreneurs to share knowledge, only the winner enjoys the value of the venture. This assumption, however, is without loss of generality. We could either interpret the probability pi of winning the contest as entrepreneur i’s share of the value V of the venture, or we could assume the venture would be shared by all collaborating partners.Footnote 6 Since in equilibrium entrepreneurs’ investments in knowledge only depend on the number of collaborations, entrepreneur i’s overall expected payoff is identical to \(\pi _{i}^{\ast }\left (X,{\Delta } \right )\) in both cases.

4 Formation of the entrepreneurial network

To analyze the formation of the entrepreneurial network we proceed by backward induction: We first consider entrepreneurs’ investments in internal knowledge for a given entrepreneurial network. We then analyze the formation of knowledge collaborations such that the entrepreneurial network is stable.

4.1 Optimal internal knowledge investments

For a given entrepreneurial network matrix Δ, let \((x_{1}^{\ast },{\ldots } ,x_{n}^{\ast })\) denote the Nash equilibrium investments in internal knowledge. The optimal knowledge investment \( x_{i}^{\ast }\) of entrepreneur i ∈ N, having formed ki knowledge collaborations with other entrepreneurs, maximizes her payoff given the equilibrium investments \(x_{j}^{\ast }\) of all other entrepreneurs j≠i in the community. Assuming an interior optimum, \(x_{i}^{\ast }\) then satisfies the first-order necessary condition for a Nash equilibrium, i.e., \( x_{i}^{\ast }\) equals marginal benefits and marginal costs:

The marginal change in the probability of success on the left-hand side of Eq. (1) is determined by two factors: The first term represents the marginal increase in the winning probability of entrepreneur i due to the increase of her knowledge investment. The second term represents the marginal decrease in the winning probability due to the corresponding increase of her partners’ effective knowledge. Note that if entrepreneur i increases her internal knowledge, this investment not only affects her own effective knowledge but also the effective knowledge of all her ki partners in the contest.

Proposition 1

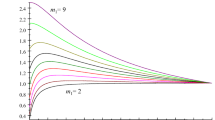

Suppose that the matrix Δ describes the entrepreneurial network in the community. Then, the optimal knowledge investment \(x_{i}^{\ast }\) of entrepreneur i, her probability of winning the contest, and her equilibrium payoff, are given by

with \({\mu } ={\sum }_{j=1}^{n}\frac {1}{1+k_{j}}\).

Proposition 1 shows that entrepreneurs’ equilibrium investments in internal knowledge as well as their equilibrium winning probabilities and payoffs only depend on the number of knowledge collaborations they have formed. As a consequence, several remarks are worth noting: First, as discussed in the introduction, the equilibrium investment of entrepreneur i in internal knowledge is decreasing in the number of collaborations she has formed. That is, if entrepreneuri has formed more collaborations than entrepreneur j , ki > kj, entrepreneur i’s equilibrium investment is lower than the one of entrepreneur j, \(x_{i}^{\ast }<x_{j}^{\ast }\). Second, the probability of success decreases with the number of knowledge collaborations. At first sight, this result might be surprising as the knowledge received from the partners ceteris paribus increases the probability of winning the contest. However, inspecting the first-order condition in Eq. (2) shows that the effective knowledge of each entrepreneur shared with her partners is constant in equilibrium, that is, the optimal effective knowledge of two entrepreneurs i and j satisfy the equilibrium property

But this implies that the effective knowledge \(\tilde {x}_{i}^{\ast }\) of entrepreneur i, and as a consequence, also her winning probability, are lower than the ones of entrepreneur j, if she has more partners, that is, for ki > kj,

And third, an entrepreneur’s expected payoff also decreases with the number of knowledge collaborations. This results from the fact, that although both the winning probability and the knowledge investments are decreasing in the number of knowledge collaborations, the first effect is smaller than the second one,

That is, for a given entrepreneurial network, entrepreneurs with more links earn lower payoffs than entrepreneurs with fewer links.

Our characterization of the equilibrium payoff of entrepreneur i can also be used to discuss her incentives to unilaterally add an additional link to her already existing knowledge collaborations. Using her equilibrium payoff \( {\pi }_{i}^{\ast }\) for a given entrepreneurial network matrix Δ, an additional link has the following effect on her profitability,

Note that \({\mu } \in \left [ 1,n\right ] \) with μ = 1 if the entrepreneurial network is complete (i.e., kj = n − 1 for all j ∈ N) and μ = n if the entrepreneurial network is empty (i.e., kj = 0 for all j ∈ N). Hence, we can interpret μ as a measure of the connectivity of an the following meaning: If μ is close to one, the number of links of each entrepreneur is high and the network is densely connected and if μ is close to n, each entrepreneur has only few links and the network is loosely connected. Concerning the effect of an additional link, entrepreneur i’s payoff is negative whenever she has already formed a link, ki ≥ 1, while it is positive if ki = 0 and the entrepreneurial network is not too densely connected, i.e., \(\mu >\frac {1 }{2}\sqrt {5}+\frac {1}{2}\). Moreover, the effect of an additional link of entrepreneur i on her competitors’ payoffs \(\pi _{r}^{\ast }\) is always positive:

4.2 Optimal external knowledge collaborations

Using the optimal internal knowledge investments for a given entrepreneurial network, we now analyze the formation of stable external knowledge collaborations. In its most general meaning, a stable entrepreneurial network denotes the outcome of a non-cooperative game of link formation between entrepreneurs. However, instead of using this strong notion of strategic stability, we follow Jackson and Wolinsky (1996) and take a weaker definition of stability: We call an entrepreneurial network matrix Δ pairwise stable, if no pair of entrepreneurs has an incentive to engage in further networking and no entrepreneur has an incentive to unilaterally terminate an existing collaboration. This definition of pairwise stability excludes, for example, the possibility that entrepreneurs form two or more additional collaborations at once. In this sense, pairwise stability is a necessary condition of strategic stability. Nevertheless, as we will see below, pairwise stability is already strong enough to substantially narrow down the set of stable entrepreneurial networks.

To formalize pairwise stability, let Δ − ij denote the entrepreneurial network obtained from Δ by severing an existing link between entrepreneur i and j, while Δ + ij denotes the entrepreneurial network obtained by adding a new link between entrepreneur i and j in matrix Δ. Then, an entrepreneurial network Δ is pairwise stable if, for all entrepreneurs i,j ∈ N,

-

1.

δij = 1 implies \({\pi }_{i}^{\ast }\left ({\Delta } \right ) \geq {\pi }_{i}^{\ast }\left ({\Delta } -ij\right )\) and \({\pi }_{j}^{\ast }\left ({\Delta } \right ) \geq {\pi }_{j}^{\ast }\left ({\Delta } -ij\right )\),

-

2.

δij = 0 and \({\pi }_{i}^{\ast }\left ({\Delta } +ij\right ) >{\pi }_{i}^{\ast }\left ({\Delta } \right )\) implies \(\pi _{j}^{\ast }\left ({\Delta } +ij\right ) <{\pi }_{j}^{\ast }\left ({\Delta } \right ) \).

To analyze stable network formation in our model, we use Proposition 1 and the entrepreneurs’ equilibrium payoffs to characterize these two stability conditions. Consider two entrepreneurs i and j. Then, \(\pi _{i}^{\ast }\left ({\Delta } \right ) \geq {\pi }_{i}^{\ast }\left ({\Delta } -ij\right )\) iff

with \({\gamma } ={\sum }_{r=1,r\neq i,j}^{n}\frac {1}{1+k_{r}}\). Moreover, \({\pi }_{i}^{\ast }\left ({\Delta } +ij\right ) >\pi _{i}^{\ast }\left ({\Delta } \right )\) iff

Proposition 2

The only pairwise stable entrepreneurial networks depend on the number n of entrepreneurs in the community and are characterized as follows:

-

1.

If n = 3, there exist two stable entrepreneurial networks: One in which two entrepreneurs \(i\in \left \{ 1,2\right \} \) have a knowledge collaboration, \(k_{i}^{\ast }=1\) and the third entrepreneur has no collaboration, \(k_{3}^{\ast }=0\). And one in which each entrepreneur i ∈ N networks with the other two, \(k_{i}^{\ast }=2\).

-

2.

If n ≥ 4 and n even, each entrepreneur i will have exactly one knowledge collaboration, \(k_{i}^{\ast }=1\), for all i ∈ N.

-

3.

If n ≥ 4 and n odd, all but one entrepreneur j will form one knowledge collaboration, \(k_{i}^{\ast }=1\) for all \(i\in N\backslash \left \{ j\right \} \), whereas entrepreneur j does not engage in networking, \(k_{j}^{\ast }=0\).

This is a remarkable result. It shows that the set of possible pairwise stable entrepreneurial networks is fairly narrow in the sense that typically only a very limited number of knowledge collaborations with a well-defined structure can arise in equilibrium. The result stems from the trade-off discussed above: On the one hand, increasing the number of knowledge collaborations is beneficial for an entrepreneur, because it increases the probability of winning by having access to more external knowledge. On the other hand, her own internal knowledge investment decreases with the number of collaborations. The latter effect then is sufficiently strong to restrict the payoff-maximizing number of knowledge collaborations to one.

Note that, since the contest always has a winner, it would be welfare maximizing if the knowledge investments of each entrepreneur are zero. Concerning entrepreneurial networking, a socially efficient entrepreneurial network then is always complete and each entrepreneur forms knowledge collaborations with all other entrepreneurs in the community: Since this implies that ki = n − 1 for all i ∈ N, we have

and it is then optimal for an entrepreneur not to invest and her probability of winning the contest equals 1/n.

5 Extensions

We now extend the basic model and introduce partial knowledge transfers and knowledge spillovers.Footnote 7 A partial knowledge transfer refers to a situation, in which only part of the external knowledge of a collaborating partner can be assimilated into an entrepreneur’s own knowledge. Knowledge spillovers refer to situations, in which an entrepreneur sources knowledge from the external environment via involuntary knowledge diffusion. We distinguish two types of those spillovers: External knowledge spillovers, where an entrepreneur integrates knowledge from other entrepreneurs, although she does not have a knowledge collaboration with them. And local knowledge spillovers, where an entrepreneur not only benefits from the internal knowledge of her collaborating partners, but also from their external knowledge.

5.1 Partial knowledge transfers

In our basic model we assumed that if an entrepreneur has formed a knowledge collaboration with another entrepreneur, the external knowledge from her partner is completely integrated into her own knowledge. There are several reasons why in practice this knowledge transfer is rather incomplete: Tacit knowledge, i.e., knowledge which is difficult to transfer between partners, substitutive knowledge, i.e., knowledge of one partner which doubles in part the knowledge of the other, or limited absorptive capacity, i.e., one partner cannot completely assimilate the knowledge of the other.

To model partial knowledge transfers, suppose that only a fraction \({\beta }_{I}\in \left [ 0,1\right ] \) of the internal knowledge investments of her partners is shared with entrepreneur i. Then, the total amount of knowledge \(\tilde {x}_{i}\) available to entrepreneur i in the contest is given by

How do partial knowledge transfers with her partners affect the knowledge investment of entrepreneur i and her incentives to form knowledge collaborations? Concerning her knowledge investment, only a fraction βI of her internal knowledge is now transferred to her partners. Hence, whereas increasing her knowledge investment is still beneficial for her own winning probability as in the basic model, the marginal increase in the winning probabilities of all her ki partners is now not as high as with complete knowledge transfers. Hence, entrepreneur i has an incentive to invest more in her internal knowledge.

The fact that internal knowledge investments are increasing when external knowledge cannot be completely assimilated, then makes knowledge collaborations more attractive. To understand the intuition for this finding, consider the case of complete knowledge transfer as starting point. In the symmetric equilibrium of Proposition 1, each entrepreneur forms only one knowledge collaboration. Now suppose that knowledge transfer is partial instead of complete. Since knowledge investments of each entrepreneur increase, expected payoffs decrease. This is because in a symmetric equilibrium the winning probability of each entrepreneur does not change because all will increase their internal knowledge by the same amount. To reduce knowledge investments, each entrepreneur then has an incentive to form an additional knowledge collaboration. This is because she benefits from the additional external knowledge of the new partner and, at the time, can reduce her own investments due to the free-riding effect.

Proposition 3

The lower the fraction βI of partial knowledge transfer between collaborating partners, the higher the number of knowledge collaborations of each entrepreneur.

So far we assumed that the knowledge transfers within a collaboration are exogenously restricted by the institutional environment. However, even in the case in which the collaborating partners could decide on the degree of knowledge transfer, they would choose to transfer internal knowledge only partially to their partners. The reason is again due to free-riding: If all collaborating partners of an entrepreneur completely transfer their knowledge to her, she has an incentive to only partially transfer her internal knowledge to them. This is beneficial because it increases her winning probability and decreases the winning probabilities of her partners. Of course, in equilibrium each entrepreneur only partially transfers her knowledge.

Proposition 4

If the degree of knowledge transfer within a knowledge collaboration can be chosen by the collaborating partners, knowledge transfers are always partial.

5.2 External knowledge spillovers

In our basic model we assumed that an entrepreneur can integrate external knowledge from other entrepreneurs only by forming knowledge collaborations. In addition to such knowledge collaborations, however, knowledge investments of other entrepreneurs spill over without any direct collaboration. Such knowledge externalities can arise, for example, if the community of all entrepreneurs is geographically concentrated, as the empirical study by Audretsch and Feldman (1996) shows. They examine the extent to which innovative activities clusters spatially and link this geographic concentration to the existence of external knowledge spillovers. In our setup, such knowledge spillovers then are generated by the knowledge investments of all entrepreneurs and have a public good character.

To model external knowledge spillovers, we assume that although entrepreneur i has no knowledge collaboration with entrepreneur j, j∉Ni, entrepreneur i can realize a fraction \(\beta _{E}\in \left [ 0,1\right ] \) of entrepreneur j’s knowledge investment. We refer to βE as the external spillover rate. For a given entrepreneurial network Δ, the effective knowledge of entrepreneur i ∈ N is then given by

The external knowledge of entrepreneur i is now the sum of two terms: The first term is the sum of the external knowledge from all entrepreneurs with whom she has a collaboration, the second term is a fraction βE of the sum of the knowledge investments of all other entrepreneurs with whom she does not collaborate. Note that \(\left \vert N_{i}\right \vert =k_{i}\) and \(\left \vert N\backslash \left (N_{i}\cup \left \{ i\right \} \right ) \right \vert =n-k_{i}-1\).

As in our extension with partial knowledge transfers, the effect of external spillovers on knowledge investments can be seen best by considering the marginal benefits of an increase her investments. Whereas increasing her knowledge investment has the same effect on her own winning probability and the ones of her ki partners as in the basic model, an additional negative effect now occurs because the winning probabilities of all (n − 1 − ki) entrepreneurs, which are not her collaborating partners, are now increasing due to the external knowledge spillover rate βE. As a consequence, each entrepreneur has an incentive to invest less in her internal knowledge.

Before we discuss the influence of external knowledge spillovers on the formation of a stable entrepreneurial network, note that the optimal knowledge investments of each entrepreneur tend to zero, if the external spillover rate tends to one. The intuition is straightforward: Since each entrepreneur completely shares her knowledge investment with all other entrepreneurs in the community, the probability of winning the contest is independent of her own investment, identical for all entrepreneurs and equal to 1/n. But then it is optimal not to invest at all.

This limit result also points to the connection between external knowledge spillovers and the stability of an entrepreneurial network. Suppose that the spillover rate is (sufficiently) large. Then, the external knowledge an entrepreneur receives from a non-partner via external spillovers is almost as high as the ones she receives from her partners via knowledge collaborations. As a consequence, the advantage of a knowledge collaboration with other entrepreneurs vanishes. In the limit, for complete external spillovers, there is no need to collaborate with any partner. The next proposition confirms this mechanism.

Proposition 5

If the fraction βE of external knowledge spillovers between entrepreneurs is sufficiently high, no entrepreneur engages in networking for n > 3. For n = 3, the complete entrepreneurial network is always stable. Moreover, for a given spillover rate βE, no entrepreneur engages in networking, if the number n of entrepreneurs in the community becomes sufficiently large.

In light of our previous discussion, this proposition is not surprising and shows that in the presence of external knowledge spillovers the number of entrepreneurs in the community becomes a crucial factor that determines the formation of entrepreneurial networks. Of course, as soon as knowledge spillovers are relevant, the total amount of knowledge that spills over from an entrepreneur to her non-partners, depends on the number of entrepreneurs in the contest. Hence, for a given number of knowledge collaborations, the relative fraction of effective knowledge that comes from non-partners becomes greater, the higher the number of entrepreneurs in the community. But this implies that the relative advantage of forming a knowledge collaboration with other entrepreneurs is lower, the higher the amount of external knowledge the entrepreneur receives from a non-partner, i.e., the higher the number of competitors. On the other hand, the problem of underinvestment in knowledge is higher if an entrepreneur has complete access to another entrepreneur’s knowledge in case they have formed a collaboration compared to the case in which she only receives some fraction of knowledge when not collaborating. In fact, the probability of winning the contest is increasing in the spillover rate βE for entrepreneurs with few knowledge collaborations, while the winning probability is decreasing in βE for entrepreneurs with many collaborations.Footnote 8 This disadvantage of knowledge collaborations becomes more important the higher the number of entrepreneurs in the community.

5.3 Local knowledge spillovers

In our basic model we assumed that an entrepreneur, when collaborating with another entrepreneur, only benefits from the direct knowledge investment of this partner. However, given the other entrepreneur has formed knowledge collaborations with third parties, her partner accumulates additional knowledge via these collaborations. If, for example, an entrepreneur is faced with a specific problem, she can activate her partner to identify the sources that are likely to be well informed about the specific issue at hand. Using patents as a measure of innovative output, the empirical study by Ahuja (2000), for example, shows that R&D collaborations not only allow firms with access to the knowledge held by its partners but also to the knowledge held by its partner’s partners. In addition to external knowledge collaborations, we therefore extent the basic model by considering such indirect links which are termed as local knowledge spillovers by Goyal and Joshi (2006).

To model local knowledge spillovers, we assume that an entrepreneur i can indirectly benefit from other entrepreneurs’ knowledge investments because these entrepreneurs are linked to her own partners. That is, if entrepreneur j collaborates with entrepreneur i and entrepreneur k, i.e., i,k ∈ Nj, but entrepreneur i is not linked to entrepreneur k, i.e., k∉Ni, entrepreneur i not only benefits directly and fully from entrepreneur j’s knowledge investment but also indirectly from entrepreneur k’s investment. This spillover is only partial and given by a fraction \(\alpha \in \left [ 0,1\right )\). We refer to α as the local spillover rate.

Consider entrepreneur i’s effective knowledge in the contest. For a given entrepreneurial network Δ, this effective knowledge is given by

where \(N_{ii}\subseteq N\) is the set of entrepreneurs with whom all partners of entrepreneur i are linked. That is, \(N_{ii}=\bigcup _{j\in N_{i}} \) \( N_{j}\backslash \left (N_{i}\cup \left \{ i\right \} \right ) \). The external knowledge of entrepreneur i is the sum of two terms: The first term is the sum of the knowledge investments spent by all entrepreneurs with whom entrepreneur i collaborates, the second term is a fraction α of the sum of the knowledge investments of all entrepreneurs with whom a partner of entrepreneur i has formed a knowledge collaboration.

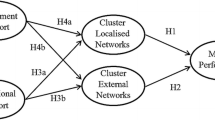

To analyze the effect of local knowledge spillovers on network formation, note that an entrepreneur only benefits from the knowledge investments of non-partners if these are linked to an entrepreneur with whom she is also collaborating. An immediate consequence of this fact is that local knowledge spillovers can only be realized if at least one entrepreneur has formed two or more knowledge collaborations with others. According to Proposition 1, such a networking, however, cannot be part of a stable entrepreneurial network, at least if knowledge transfers within collaborations are complete. In case knowledge transfers between collaborating partners are only partial, local knowledge spillovers decrease entrepreneurs’ incentives to form knowledge collaborations. Consider, for example, the following two entrepreneurial networks and suppose that both are stable, see Fig. 1:

Without local knowledge spillovers, all entrepreneurs behave identically in the entrepreneurial network on the left and right-hand side. In the presence of local knowledge spillovers, however, the behavior of entrepreneurs in both networks differ: In the entrepreneurial network on the left-hand side entrepreneurs’ behavior does not change when compared to the case without local spillovers, since each entrepreneur with whom a partner has formed a collaboration is already a partner of this entrepreneur. Hence, no entrepreneur benefits from local knowledge spillovers. This is different in the entrepreneurial network on the right-hand side. Here, each entrepreneur benefits from the other partner of her partners. This, of course, changes an entrepreneur’s incentive to invest in knowledge. Take entrepreneur i as member of this circle network. Then, her trade-off between marginal costs and benefits from increasing her knowledge investment is given by

The interpretation of the first and second terms is as in the case of partial knowledge transfers with two partners. The third term is now an additional negative effect of entrepreneur i’s increase of her knowledge investment because the winning probability of two entrepreneurs which are collaborating partners of her partners is now increasing due to the local spillover rate α. As a consequence, each entrepreneur in the entrepreneurial network on the right-hand side has an incentive to invest less in her internal knowledge, which in turn might reduce their incentives to collaborate with one of the two other entrepreneurs.

Proposition 6

If knowledge transfers between collaborating partners are complete, the presence of local knowledge spillovers does not change the stable entrepreneurial network of Proposition 1. If knowledge transfers between collaborating partners are only partial and lead to a stable entrepreneurial network with more than one bilateral knowledge collaboration of each entrepreneur, see Proposition 3, the presence of local knowledge spillovers reduces networking.

6 Conclusion

In this paper we have considered the formation of entrepreneurial networks in an environment, in which a community of entrepreneurs compete for the development of a new venture and have the possibility to collaborate with each other. Such knowledge collaborations allow each entrepreneur to integrate external knowledge to her own internal knowledge investment and thereby increases the probability of winning the contest. Our analysis has shown that entrepreneurs’ knowledge investments are decreasing in the number of collaborations they have formed, due to a free-riding effect. Using this result, we then examined the formation of a pairwise stable entrepreneurial network and found that, in general, each entrepreneur networks with exactly one other entrepreneur. We then analyzed the effect of three extensions on network formation: partial knowledge transfers between collaborating partners and external, respectively local, knowledge spillovers. In the first case, we saw that the incentives for networking increase, whereas the opposite is true with local and external spillovers.

The model of entrepreneurial competition we have used in this paper is quite simple and should be regarded as a first step in the analysis of entrepreneurial networking. Several modifications are worth considering.

First, although our predictions on entrepreneurial network formation are clear-cut, our modelling does not allow for asymmetries in the entrepreneurial network structure, which are prominent in reality as well as in theory. For example, a closed group of entrepreneurs which are solely collaborating with each other, or a star network with one central entrepreneur linked to all other entrepreneurs, could not arise as an equilibrium in our model. One reason for this discrepancy could be our assumption of ex ante identical entrepreneurs with respect to their costs and outputs of their knowledge investments. Thus, a natural extension of the present model would be the introduction of ex ante asymmetric entrepreneurs. In this case, one would expect that such asymmetries also result in asymmetries in the entrepreneurial network structure. Entrepreneurs with a higher knowledge competence, for example, then might prefer to act as singletons, whereas entrepreneurs with a lower knowledge competence might have an incentive to form a completely connected sub-network. Asymmetries between entrepreneurs also make an equal sharing of the venture suboptimal, in that an entrepreneur with a higher knowledge competence might not be willing to share her knowledge on equal rate with a less competent entrepreneur. Monetary compensations might then be a necessary pre-condition for knowledge collaborations.

Second, it would be interesting to analyze how the entrepreneurial network structure depends on the properties of the underlying competition. In this paper, we considered an extreme case of competition in the sense that any increase in one entrepreneur’s probability of succeeding is exactly offset by a decrease in the other entrepreneurs’ probabilities of winning the venture. In order to model a contest with different degrees of competition one could, for example, introduce a competition parameter, which measures the effect of an entrepreneur’s investment on other entrepreneurs’ probabilities of winning the venture when they are not collaborating partners, see Godwin et al. (2006).

Thirdly, the stability concept used in this paper permits deviations by one entrepreneur only. As long as the only stable entrepreneurial network consists of exactly one knowledge collaboration for each entrepreneur, this weak notion of stability is not critical. However, if multiple network structures arise in equilibria, for example in the presence of partial knowledge transfers, a stronger notion of stability is necessary to restrict the set of equilibrium network structures. This refinement could be along the lines proposed in the industrial organization literature on endogenizing merger and research joint ventures activities, see, e.g., Gonalez-Maestre and Lopez-Cunat (2001) or Greenlee (2005): A stable entrepreneurial network is the outcome of a non-cooperative bidding game for link formation.

Notes

The literature on the link between entrepreneurship and economic growth started with Schumpeter (1934, 1939) and grew largely over the past 25 years, see Fritsch (2013) or Acs et al. (2018). For the creation of new jobs and employment, see Audretsch and Thurik (2001) or Haltiwanger et al. (2013), for the introduction of new products and markets, see Knight (2001) and for solution of social and environment problems, see Williams and Shepherd (2016) or York et al. (2016).

The term co-opetition was coined by Brandenburger and Nalebuff (1996) and refers to a situation where two or more competitors cooperate at the same time as they compete.

The different mode of competition in the development of new innovations is also the reason why the present analysis is set up in the context of entrepreneurship and not in the context of well-established firms: For entrepreneurs, competition in form of an all-or-nothing contest is central for their success whereas developments by large established firms in general build on their already existing product portfolios. Such a Cournot competition for innovations, however, implies that success builds on already existing internal knowledge. In turn, this makes networking for well-established firms less important than for entrepreneurs.

If we would take V > 0 as a parameter, the optimal internal knowledge investments as well as the equilibrium payoffs of each entrepreneur would depend linearly on V without changing the results on the optimal external knowledge collaborations.

In the latter case, the expected payoff of entrepreneur i then is

$$ \frac{\tilde{x}_{i}}{{\sum}_{j=1}^{n}\tilde{x}_{j}}\cdot \frac{1}{1+k_{i}} +\sum\limits_{k\in N_{i}}\frac{\tilde{x}_{k}}{{\sum}_{j=1}^{n}\tilde{x}_{j}}\cdot \frac{1}{1+k_{i}}-x_{i}, $$where the first term is entrepreneur i’s expected payoff if she wins the contest and shares it with all other members, and the second term is entrepreneur i’s expected payoff if she receives a share of the contest prize won by one of her partners.

In the following, we explain only the intuition of these extension. For the proofs of Section 5 see the Online-Appendix.

See the Online-Appendix for this statement.

References

Acs, Z., Audretsch, D., Braunerhjelm, P., & Carlsson, B. (2003). The missing link: the knowledge filter and endogenous growth. Stockholm: Center for Business and Policy Studies.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics, 51 (2), 501–514.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Alexy, O., George, G., & Salter, A. J. (2013). Cui bono? the selective revealing of knowledge and its implications for innovative activity. Academy of Management Review, 38(2), 270–291.

Audretsch, D.B. (1995). Innovation and industry evolution. MIT Press.

Audretsch, D. B., & Feldman, M. P. (1996). R&d spillovers and the geography of innovation and production. The American Economic Review, 86(3), 630–640.

Audretsch, D. B., & Keilbach, M. (2007). The theory of knowledge spillover entrepreneurship. Journal of Management studies, 44(7), 1242–1254.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202.

Audretsch, D. B., & Thurik, A. R. (2001). What’s new about the new economy? Sources of growth in the managed and entrepreneurial economies. Industrial and Corporate Change, 10(1), 267–315.

Bac, M., & Inci, E. (2010). The old-boy network and the quality of entrepreneurs. Journal of Economics & Management Strategy, 19(4), 889–918.

Belitski, M., Caiazza, R., & Lehmann, E. E. (2019). Knowledge frontiers and boundaries in entrepreneurship research. Small Business Economics, 1–11.

Bengtsson, M., Eriksson, J., & Vincent, J. (2010). Co-opetition: clarifying the concept and outlining an agenda for further research on co-opetitive dynamics. Competitive Review, 20(2), 194–214.

Bloch, F. (1997). Noncooperative models of coalition formation in games with spillovers. In C. Carraro D. Siniscalco (Eds.) New directions in the economic theory of the environment. Cambridge: Cambridge University Press.

Brandenburger, A. M., & Nalebuff, B. J. (1996). Co-opetition. New York: Doubleday.

Brunswicker, S., & van de Vrande, V. (2014). Exploring open innovation in small- and medium-sized enterprises. In H. Chesbrough, W. Vanhaverbeke, & J. West (Eds.) New frontiers in open innovation (pp. 135–156). Oxford: Oxford University Press.

Carayannis, E. G., & Alexander, J. (1999). The wealth of knowledge: Converting intellectual property to intellectual capital in co-opetitive research and technology management settings. International Journal of Technology Management, 18(3), 326–352.

Cassiman, B., & Valentini, G. (2016). Open innovation: are inbound and outbound knowledge flows really complementary? Strategic Management Journal, 37(6), 1034–1046.

Chesbrough, H. (2003). Open innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business Press.

Chesbrough, H. (2006). Open innovation: A new paradigm for understanding industrial innovation. In H. Chesbrough, W. Vanhaverbeke, & J. West (Eds.) Open innovation: Researching a new paradigm (pp. 1–12). Oxford: Oxford University Press.

Deroian, F., & Gannon, F. (2006). Quality-improving alliances in differentiated oligopoly. International Journal of Industrial Organization, 24, 629–637.

Fritsch, M. (2013). New business formation and regional development: A survey and assessment of the evidence. Foundations and Trends in Entrepreneurship, 9(3), 249–364.

Gnyawali, D. R., & Park, B. J. (2009). Co-opetition and technological innovation in small and medium-sized enterprises: A multilevel conceptual model. Journal of Small Business Management, 47(3), 308–330.

Godwin, R., López, E. J., & Seldon, B. J. (2006). Kenneth incorporating policymaker costs and political competition into rent-seeking games. Southern Economic Journal, 73, 37–54.

Golub, B., & Sadler, E. (2021). Games on endogenous networks. arXiv:2102.01587.

Gonalez-Maestre, M., & Lopez-Cunat, J. (2001). Delegation and mergers in oligopoly. International Journal of Industrial Organization, 19, 1263–1279.

Goyal, S., & Joshi, S. (2006). Unequal connections. International Journal of Game Theory, 34, 319–349.

Goyal, S., & Moraga-Gonzalez, J. L. (2001). R& D-networks. Rand Journal of Economics, 32, 686–707.

Goyal, S., Moraga-Gonzalez, J. L., & Konovalovz, A. (2008). Hybrid venture-seeking. Journal of the European Economic Association, 6, 1309–1338.

Greenlee, P. (2005). Endogenous formation of competitive research sharing joint ventures. Journal of Industrial Economics, 53, 355–391.

Greul, A., West, J., & Bock, S. (2018). Open at birth? Why new firms do (or don’t) use open innovation. Strategic Entrepreneurship Journal, 12(3), 392–420.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics, 95(2), 347–361.

Hellmann, T. (2013). On the existence and uniqueness of pairwise stable networks. International Journal of Game Theory, 42(1), 211–237.

Hellmann, T. (2021). Pairwise stable networks in homogeneous societies with weak link externalities. European Journal of Operational Research, 291(3), 1164–1179.

Ilvonen, I., & Vuori, V. (2013). Risks and benefits of knowledge sharing in co-opetitive knowledge networks. International Journal of Networking and Virtual Organisations, 13(3), 209–223.

Inci, E., & Parker, S. C. (2013). Financing entrepreneurship and the old-boy network. Journal of Economics & Management Strategy, 22(2), 232–258.

Jackson, M., & Wolinsky, A. (1996). A strategic model of social and economic networks. Journal of Economic Theory, 71, 44–74.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. The Quarterly journal of Economics, 108(3), 577–598.

Jost, P. J. (2021). Endogenous formation of entrepreneurial networks. Small Business Economics, 56(1), 39–64.

Knight, G. A. (2001). Entrepreneurship and strategy in the international SME. Journal of International Management, 7, 155–171.

Lechner, C., & Dowling, M. (2003). Firm networks: External relationships as sources for the growth and competitiveness of entrepreneurial firms. Entrepreneurship & Regional Development, 15(1), 1–26.

Lee, S., Park, G., Yoon, B., & Park, J. (2010). Open innovation in SMEs: An intermediated network model. Research Policy, 39(2), 290–300.

Levy, M., Loebbecke, C., & Powell, P. (2003). SMEs, co-opetition and knowledge sharing: The role of information systems. European Journal of Information Systems, 12, 3–17.

McCutchen, W.W. Jr., & Swamidass, P. M. (2004). Motivations for strategic alliances in the pharmaceutical/biotech industry: Some new findings. The Journal of High Technology Management Research, 15(2), 197–214.

Parker, S. C. (2008). The economics of formal business networks. Journal of Business Venturing, 23(6), 627–640.

Quintana-Garcia, C., & Benavides-Velasco, C. A. (2004). Cooperation, competition, and innovative capability: A panel data of European dedicated biotechnology firms. Technovation, 24(12), 927–938.

Sadler, E. (2020). Ordinal centrality. Available at SSRN 3594819.

Schumpeter, J. A. (1939). Business cycles. New York: McGraw-Hill.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge: Harvard University Press.

Telloney, D., & Vergotez, W. (2011). Endogenous network formation in Tullock contests. Discussion Paper, Facultés Universitaires Saint-Louis, CEREC, Bruxelles.

Tullock, G. (1980). Efficient venture seeking. In J.M. Buchanan, R.D. Tollison, & G. Tullock (Eds.) Toward a theory of the society. College station (pp. 97–112).

Van Beers, C., & Zand, F. (2014). R&D cooperation, partner diversity, and innovation performance: An empirical analysis. Journal of Product Innovation Management, 31(2), 292–312.

Williams, T. A., & Shepherd, D. A. (2016). Building resilience or providing sustenance: Different paths of emergent ventures in the aftermath of the Haiti earthquake. Academy of Management Journal, 59, 2069–2102.

York, J. G., Hargrave, T. J., & Pacheco, D. F. (2016). Converging winds: Logic hybridization in the Colorado wind energy field. Academy of Management Journal, 59, 579–610.

Acknowledgements

The author thanks two anonymous referees and Anna Ressi for helpful comments and suggestions. All errors remain my own.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Proof Proof of Proposition 1

Using Eq. (2) for different entrepreneurs i,j ∈ N the optimal effective investments \(\tilde {x}_{i}^{\ast }\) and \(\tilde {x}_{j}^{\ast }\) satisfy the following equilibrium property

Then, the sum of all optimal effective investments within the entire community is given by

which proves the winning probability \(p_{i}^{\ast }\). Using (A.2), the first-order condition (2) reduces to

Solving for \(\tilde {x}_{i}^{\ast }\) shows that the optimal effective investment \(\tilde {x}_{i}^{\ast }\) of entrepreneur i in the contest are given by

Note that \({\sum }_{j=1}^{n}\frac {1}{1+{\beta } k_{j}}\geq {\sum }_{j=1}^{n}\frac {1}{n }=1\) implies \(\tilde {x}_{i}^{\ast }>0\); hence, the Nash equilibrium \((x_{1}^{\ast },{\ldots } ,x_{n}^{\ast })\) is indeed an interior solution.

To calculate the equilibrium knowledge investment \(x_{i}^{\ast }\) of entrepreneur i we can use the entrepreneurial network matrix Δ to write equilibrium effective investments \(\widetilde {X}^{\ast }=\left (\tilde { x}_{1}^{\ast },...,\tilde {x}_{n}^{\ast }\right )\) as

with \(X^{\ast }=\left (x_{1}^{\ast },....,x_{n}^{\ast }\right )\). Moreover, we can write

where \((\text {\textsc {1+K}}) =\left (1+k_{1},....,1+k_{n}\right )\) and \(\left (\text {\textsc {1}}\right ) =\left (1,....,1\right ) \). From equilibrium condition (A.1) we know that \(\tilde {x}_{i}^{\ast }\cdot \left (1+k_{i}\right )\) is constant. Let \(\tilde {x}_{i}^{\ast }\cdot \left (1+k_{i}\right ) =c\), then

where E\(_{\widetilde {X}^{\ast }}\) is the n × n unit matrix E with the \(\widetilde {x}_{i}^{\ast }\)’s in the diagonal instead of Ones. Inserting (A.4) in (A.5) we have

Depending on whether the matrix Δ is invertible or not we distinguish two case:

-

1.

Δ is invertible: When Δ is invertible, the inverse is \( {\Delta }^{-1}=\frac {1}{c}\cdot \)E\(_{\widetilde {X}^{\ast }}\). Then, Eq. (A.3) reduces to

$$ \left( X^{\ast }\right)^{t}=\frac{1}{c}\cdot \text{\textsc{E}}_{\widetilde{X }^{\ast }}\left( \widetilde{X}^{\ast }\right)^{t},\text{ that is } cx_{i}^{\ast }=\left( \tilde{x}_{i}^{\ast }\right)^{2}. $$Using the definition of c together with the characterization of optimal effective effort then proves the first part of the proposition. Inserting the optimal efforts in entrepreneurs’ payoff function proves the last part of the proposition.

-

2.

Δ is not invertible: In this case there exists at least one closed group \(C\subseteq N\) in the sense that each entrepreneur i ∈ C has formed bilateral collaborations with all other group members but not with an entrepreneur outside the group. That is, \(\left \vert C\right \vert \) columns of Δ are identical. To prove that all group members choose identical knowledge investment in equilibrium consider first the special case \(\left \vert C\right \vert =2\) and let δ13 = δ31 = 1, δ1j = 0 for j≠ 3, δ3j = 0 for j≠ 1. That is, entrepreneur i = 1, 3 form a closed group and the first and third column of Δ are identical. Consider the following network matrix \({\Delta } \left ({\varepsilon } \right )\) with an ε-link \({\delta }_{12}={\delta }_{21}={\varepsilon } \in \left [ 0,1\right ] \) and all other links of \({\Delta } \left ({\varepsilon } \right )\) identical to the ones of Δ. Then, \( {\Delta } \left ({\varepsilon } \right )\) is invertible for ε > 0 and \( {\Delta } \left (0\right ) ={\Delta } \). A similar argument as in the proof for invertible matrixes then shows that

$$ x_{i}^{\ast }=\frac{V}{\left( 1+k_{i}\right)^{2}}\cdot \frac{\left( f\left( {\varepsilon} \right) \right) -1}{\left( f\left( {\varepsilon} \right) \right)^{2}} $$for i > 3 and

$$ x_{i}^{\ast }=\frac{V}{\left( 1+k_{i}+{\varepsilon} \right)^{2}}\cdot \frac{ \left( f\left( {\varepsilon} \right) \right) -1}{\left( f\left( {\varepsilon} \right) \right)^{2}} $$for i = 1, 2, where

$$ f\left( {\varepsilon} \right) =\left( \sum\limits_{j=1}^{2}\left( \frac{1}{ 1+k_{j}+{\varepsilon} }\right) +\sum\limits_{j=3}^{n}\left( \frac{1}{1+k_{j}}\right) \right) . $$Hence, in the limit for ε = 0, efforts of entrepreneur i = 1 and i = 3 are identical,

$$ x_{1}^{\ast }=x_{3}^{\ast }=\frac{V}{4}\cdot \frac{\left( {\sum}_{j=1}^{n} \frac{1}{1+k_{j}}\right) -1}{\left( {\sum}_{j=1}^{n}\frac{1}{1+k_{j}}\right)^{2}}. $$For a closed group with more than two members, \(\left \vert C\right \vert >2, \) or with a network with several closed groups C1,..,Ck a similar argumentation can be made. In this case, \(\left \vert C_{i}\right \vert -1\) columns of Δ have to modified with ε-bilateral links.

□

Proof Proof of Proposition 2

To analyze pairwise stability we consider first the first stability condition \(\pi _{i}^{\ast }\left ({\Delta } \right ) \geq \pi _{i}^{\ast }\left ({\Delta } -ij\right )\). Rearranging this inequality implies that

has to be satisfied, with

Calculation shows that A < 0 always, B < 0 whenever kj > 2, ki > 0, and C < 0 for all \(k_{i}>2,k_{j}>\frac {k_{i}}{2}\). Hence, for ki > 2 and \( k_{j}>\frac {k_{i}}{2}\) the LHS of condition (A.6) is decreasing in γ. Note that the smallest γ is characterized by a network in which every entrepreneur \(r\in N\backslash \left \{ i,j\right \} \) has collaborations with all other entrepreneurs, that is kr = n − 1. In this case \(\gamma =\frac {n-2}{n}\). Calculation then shows that the LHS of condition (A.6) is negative for all n > 2, ki > 2 and \(k_{j}>\frac {k_{i}+1 }{2}\). Hence, condition (A.6) can only be satisfied if C > 0, that is, if \( k_{j}<\frac {k_{i}}{2}\). As condition (A.1) has to be satisfied for entrepreneur j, too, we must have \(k_{i}<\frac {k_{j}}{2}\) because of symmetry. However, \(k_{j}<\frac {k_{i}}{2}\) and \(k_{i}<\frac {k_{j}}{2}\) cannot be satisfied simultaneously. As a consequence, the RHS of condition (A.6) can only be positive if ki, kj < 3. Calculation for ki = 1 shows that the RHS of condition (A.6) is positive for all kj and γ. Moreover, the RHS of condition (A.6) is positive for ki = 2 only if kj = 2 and γ < 0.4. Note that γ < 0.4 is possible only if n = 3 and kr = 2 (then \(\gamma =\frac {1}{3})\). In sum, there are only two candidates for a stable network left: Either an entrepreneurial network in which all entrepreneurs have at most one bilateral collaboration or, in case of three entrepreneurs in the community, everyone has exactly two links.

Consider now the second stability condition \({\pi }_{i}^{\ast }\left ({\Delta } +ij\right ) >{\pi }_{i}^{\ast }\left ({\Delta } \right )\). Rearranging this condition then implies that

has to be satisfied, with

Calculation shows that \(A^{\prime }<0\) for \(k_{i}\geq 1,k_{j}\geq 0,B^{\prime }<0\) always, and \(C^{\prime }<0\) for all \(k_{i}\geq 1,k_{j}> \frac {k_{i}}{2}\). Hence, for ki > 0 and \(k_{j}>\frac {k_{i}}{2}\) the LHS of condition (A.7) is decreasing in γ. Again, the smallest γ is characterized by a network in which every entrepreneur \(r\in N\backslash \left \{ i,j\right \} \) has collaborations with all other entrepreneurs, that is kr = n − 1 and \({\gamma } =\frac {n-2}{n}\). Calculation then shows that the LHS of condition (A.6) is negative for all n > 2, ki > 0 and \(k_{j}> \frac {k_{i}+1}{2}\). Hence, condition (A.7) can only be satisfied if \( C^{\prime }>0\), that is, if \(k_{j}<\frac {k_{i}}{2}\). Now suppose, that an additional link between entrepreneur i and j would improve the payoff of both entrepreneurs. Then, condition (A.7) has to be satisfied for both entrepreneurs and \(k_{j}<\frac {k_{i}}{2}\) as well as \(k_{i}<\frac {k_{j}}{2}\). But then \(k_{j}<\frac {k_{j}}{4}\), a contradiction. As a result, if \(\pi _{i}^{\ast }\left ({\Delta } +ij\right ) >\pi _{i}^{\ast }\left ({\Delta } \right )\) is satisfied for entrepreneur i, \(\pi _{j}^{\ast }\left ({\Delta } +ij\right ) \leq {\pi }_{j}^{\ast }\left ({\Delta } \right )\) is always satisfied for entrepreneur j. That is, the second stability condition always holds. Calculation for ki = 1 shows that the RHS of condition (A.7) is negative for all kj and γ; hence, condition (A.7) is never satisfied. Moreover, the RHS of condition (A.7) is negative for ki = 2 if kj ≥ 2. Finally, for ki = 0 the RHS of condition (A.7) is positive for kj = 0. □

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Jost, PJ. Friend or foe? Co-opetition and entrepreneurial networking. Small Bus Econ 59, 1043–1059 (2022). https://doi.org/10.1007/s11187-021-00567-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-021-00567-5