Abstract

Using 30 years of data from all for-profit firms incorporated in Belgium, we show that business dynamism and entrepreneurship have been declining over recent decades. This decline set in around the year 2000 following a decade of declining start-up rates. We also observe a decreasing share of young firms that become high-growth firms and more importantly a declining propensity for small (not necessarily young) firms to experience fast growth. Interestingly, a similar decline in business dynamism occurred in the USA, where firms face a far less rigid institutional environment than in Belgium. These remarkable similarities suggest that global trends rather than country-specific changes are at the basis of this evolution. We show evidence that points to the role of ICT intensity in explaining the secular decline in business dynamism.

Similar content being viewed by others

Notes

IMD’s World Competitiveness Ranking (2015, 2016, 2017): USA (1st, 3rd, 4th) vs. Belgium (23rd, 22nd, 23rd); WEF’s Global Competitiveness Report (2016–2017): USA (3rd) vs. Belgium (17th), World Bank’s Ease of Doing Business (2017): USA (8th) vs. Belgium (42nd).

Growth rates between periods t and t − 1 are measured as the increase in the percentage of the employment at time t over the average employment at periods t and t − 1. See Section 3 for more details.

The role of firm heterogeneity has been exploited in recent work explaining fluctuations in GDP growth (Davis et al. 2006; Gabaix 2011; Acemoglu et al. 2012), unemployment (Moscarini and Postel-Vinay 2012), trade (Di Giovanni et al. 2014; Bernard et al. 2014), and aggregate (export) prices (Amiti et al. 2014).

See Reynolds et al. (2005).

Working based on unconsolidated accounts ensures that only Belgian activities and employment are taken into account. It does not allow, however, to distinguish between employment focused on the domestic market and employment linked with headquarter activity of MNCs or with export.

This includes both locally and foreign-owned firms incorporated in Belgium. Belgian annual accounts are not confidential and can be consulted at the NBB. Individual annual accounts of the past 10 years can be freely downloaded from the NBB website. Older annual accounts can be requested from the NBB at a fee. We have gathered the missing data while one of the authors was working as a research fellow at the NBB.

Financial institutions are not included in the dataset as they do not file standard annual accounts.

Small firms are defined as firms that do not exceed more than one of the following thresholds (1985 levels): average number of employees 50, turnover BEF 200 M (approx. €5M), and balance sheet total BEF 100 M (approx. €2.5M). Over the years, the monetary thresholds were gradually increased to €7.3M for turnover and €3.65M for balance sheet total (2014 levels).

This makes the result of our study not fully comparable with studies using establishment level data. The impact is expected to be limited. In 2014, 9128 FTE were employed at legal entities that disappeared due to “merger after acquisition”; this on a total job destruction rate of 147,450 FTE. In many cases, the acquiring company, in fact, keeps the legal entity of the target after changing the ownership.

To solve the 1996 change in definition, we calculate the 1995–1996 growth by comparing the average number of employees (which includes interim labor) in 1995 with the total number of employees at the end of 1996 (a reported variable) summed with the amount of interim labor in 1996 (reported separately). We annualize the growth rate as we assume this growth is over 1.5 years as it compares an average variable with an end-of-year variable. We come to an annualized growth rate of 0.64% for 1995–1996 aggregate employment in our dataset. This compares with a 0.69% growth rate for aggregate Belgian employment according to the Eurostat Labor Force Survey.

We do, however, exclude Belgium’s largest employer, the Belgian National Railway Company, from our data as, driven by EU regulation, it changes legal entity throughout the period. Since it represents approx. 4% of private sector employment, its observed entry and exit has a substantial impact on the employment weighted growth rate distribution.

The DHS growth rate expresses the percentage growth vs. the average size over the period as opposed to the conventional growth rate that expresses the percentage growth vs. the initial size of the period.

For example, a firm growing from 1 to 1.1 FTE has a DHS growth of 9.5% although only 0.1 FTE is added.

In Appendix 2, we also study dynamism based on the unweighted growth rate distribution and come to the same conclusions, i.e., a secular decline in dynamism.

Given the use of annual data, the Hodrick–Prescott smoothing parameter used is 100.

The universe of continuing firms excludes entering and exiting firms in a given year.

A recession is defined as two subsequent quarters of negative quarter-on-quarter real GDP growth. Real GDP growth figures from 1985 onwards taken from the OECD.

Young firms are defined as max. 5 years old.

In Belgium, a new business number is only given to a newly incorporated legal entity, with new shareholder capital. A new business number is not given when there is a change of shareholder nor location.

Geurts and Van Biesebroeck (2016) come to their findings based on entrants in the 2004–2012 period, and we assume the proportion of spurious entrants they find also holds for our time period 1985–2014.

This finding is robust to using alternative measures of dynamism, including dynamism based on the unweighted employment growth rate distribution as well as the (unweighted) turnover growth rate distribution as shown in Appendix 2.

To maximize comparability, we use the variables average employment (# heads) before 1996 and end of year employment (# heads) from 1996 onwards. The dynamism and skewness calculations of the previous chapter use FTE from 1996 onwards. As a robustness check, we also study dynamism based on employment (# heads) after 1996 in Appendix 2 and come to the same conclusion, i.e., a decline in dynamism.

See, e.g., Geroski (1995) for an extensive overview of the empirical literature on firm entry. Specifically for Belgium, to our knowledge, there is only Sleuwaegen and Dehandschutter (1991) and De Backer and Sleuwaegen (2003) who study Belgian start-up rates during the 1980s and 1990s, but limit themselves to the manufacturing industry.

Before 1986, a single-person business could only be run by a self-employed person operating without a legal entity. Profits of a single-person business were taxed according to the (in most cases less favorable) personal income tax brackets. Furthermore, entrepreneurs without a legal entity remain personally liable for the business’ debts in case of bankruptcy.

A benefit remains that, since incorporation offers far higher protection in case of bankruptcy, incorporation should encourage risk taking which is positive for subsequent dynamism.

See Table 5 in Appendix 1. The top-5 sectors are retail trade (excl. motor vehicles) (NACE 47), wholesale trade (excl. motor vehicles) (NACE 46), specialized construction (NACE 43), food and beverage service (NACE 56), and wholesale and retail of motor vehicles (NACE 45). They represent 46% of start-up employment during 1986–1992.

High-impact firm definition: \( \left({\mathrm{Emp}}_t-{\mathrm{Emp}}_{t-3}\right)\left(\frac{{\mathrm{Emp}}_t}{{\mathrm{Emp}}_{t-3}}\right)\ge 25.15968 \) if Empt − 3 > 8

Also note that Belgium, contrary to the USA, did not experience a significant Internet boom and bust around 2000.

Note that this is in line with Goldschlag and Tabarrok (2018) who show that increased regulation (which is country specific) is not to blame for the decline of US business dynamism.

We have analyzed the different measures of dynamism for different industries based on Eurostat’s classification of high-tech vs. low-tech manufacturing industries and knowledge-intensive vs. less-knowledge-intensive services. This yielded little additional insight.

See Jäger (2017) for an explanation of the EU KLEMS project and its data sources.

Several 2-digit industries are taken together resulting in 29 different industries instead of the 88 NACE 2-digit industries.

Via this methodology, we categorize the following NACE sections or industries as ICT intensive (all other industries, we regard as non-ICT intensive): IT and other information services (62–63); telecommunications (61); publishing, audiovisual, and broadcasting activities (58–60); professional, scientific, technical administrative, and support service activities (M–N); financial and insurance activities (K); wholesale and retail trade (G); arts, entertainment, and recreation (R); machinery and equipment n.e.c. (28); chemicals and chemical products (20–21); coke and refined petroleum products (19); and electricity, gas, and water supply (D–E).

We do not specifically study the possible increased Belgian employment at Belgian MNCs driven by headquarter services delivered to non-Belgian affiliates. This increased employment does show up in the employment figures we use, but we have no information on whether these employees work specifically for the Belgian market of for the foreign market.

More recent research on linkages between FDI and entry/exit rates unfortunately focuses on developing and transitional economies.

This survey is conducted since 1997. Based on, among others, annual account data, the NBB selects the surveyed firms. Response to the FDI survey is mandatory if 10% of the firm’s equity is directly or indirectly held by a foreign entity or individual.

The within-firm volatility for the balanced panel of firms that are continuously active in the studied period is not shown but declines as well. This measure is filtered of all entry and exit activity.

Smaller NACE Rev. 2 2-digit industries are grouped together by EUKLEMS. EUKLEMS reclassifies older versions of industry classifications to NACE Rev. 2.

We also work based on unconsolidated accounts that reports turnover that includes intercompany turnover. This potentially leads to double counting of the same final turnover.

References

Acemoglu, D., Akcigit, U., Alp, H., Bloom, N., & Kerr, W. R. (2018). Innovation, reallocation, and growth. American Economic Review, 108(11), 3450–91. https://doi.org/10.1257/aer.20130470.

Acemoglu, D., Carvalho, V. M., Ozdaglar, A., & Tahbaz-Salehi, A. (2012). The network origins of aggregate fluctuations. Econometrica, 80(5), 1977–2016. https://doi.org/10.3982/ECTA9623.

Aitken, B. J., & Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605–618.

Amiti, M., Itskhoki, O., & Konings, J. (2014). Importers, exporters, and exchange rate disconnect. The American Economic Review, 104(7), 1942–1978. https://doi.org/10.1257/aer.104.7.1942.

Andrews, D., Criscuolo, C., & Gal, P. N. (2016). The best versus the rest: the global productivity slowdown, divergence across firms and the role of public policy (Vol. 2016-5; OECD productivity working papers). Paris: OECD Publishing. https://doi.org/10.1787/63629cc9-en.

Andrews, D., Criscuolo, C., Gal, P. N., & Menon, C. (2015). Firm dynamics and public policy: evidence from OECD countries. In RBA annual conference volume. Reserve Bank of Australia.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2017). The fall of the labor share and the rise of superstar firms. Discussion paper, centre for economic performance, LSE. https://doi.org/10.3386/w23396.

Bachmann, R., Bayer, C., Merkl, C., Seth, S., Stüber, H., & Wellschmied, F. (2017). Job and worker flows: new stylized facts for Germany. FAU discussion papers in economics, 2017 (2).

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130. https://doi.org/10.1257/jep.21.3.105.

Bernard, A. B., Van Beveren, I., & Vandenbussche, H. (2014). Multi-product exporters and the margins of trade. The Japanese Economic Review, 65(2), 142–157. https://doi.org/10.1111/jere.12030.

Bijnens, G., & Konings, J. (2017). An enterprise map of Belgium. A guide for industrial policy (Vives Policy Paper April 2017). KU Leuven, Vives. Available from https://feb.kuleuven.be/VIVES/publicaties/beleidspapers/BP/bp2017/an-enterprise-map-of-belgium

Boeri, T., & Cramer, U. (1992). Employment growth, incumbents and entrants: evidence from Germany. International Journal of Industrial Organization, 10(4), 545–565. https://doi.org/10.1016/0167-7187(92)90059-8.

Bottazzi, G., & Secchi, A. (2006). Explaining the distribution of firm growth rates. The Rand Journal of Economics, 37(2), 235–256. https://doi.org/10.1111/j.1756-2171.2006.tb00014.x.

Bottazzi, G., Secchi, A., & Tamagni, F. (2014). Financial constraints and firm dynamics. Small Business Economics, 42(1), 99–116. https://doi.org/10.1007/s11187-012-9465-5.

Bravo-Biosca, A. (2016). Firm growth dynamics across countries: evidence from a new database. FORA-NESTA working paper.

Bravo-Biosca, A., Criscuolo, C., & Menon, C. (2016). What drives the dynamics of business growth? Economic Policy, 31(88), 703–742. https://doi.org/10.1787/5k486qtttq46-en.

Calvino, F., Criscuolo, C., & Menon, C. (2015). Cross-country evidence on start-up dynamics. OECD science, technology and industry working papers, 2015 (6). https://doi.org/10.1787/5jrxtkb9mxtb-en.

Capasso, M., Cefis, E., & Sapio, A. (2013). Reconciling quantile autoregressions of firm size and variance–size scaling. Small Business Economics, 41(3), 609–632. https://doi.org/10.1007/s11187-012-9445-9.

Criscuolo, C., Gal, P. N., & Menon, C. (2014). The dynamics of employment growth: new evidence from 18 countries (Vol. 1274; CEP discussion paper). https://doi.org/10.1787/5jz417hj6hg6-en.

Daveri, F. (2003.) Information technology and productivity growth across countries and sectors. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.371583.

Davis, S. J., & Haltiwanger, J. (1992). Gross job creation, gross job destruction, and employment reallocation. The Quarterly Journal of Economics, 107(3), 819–863. https://doi.org/10.2307/2118365.

Davis, S. J., Haltiwanger, J., Jarmin, R., Miranda, J., Foote, C., & Nagypal, E. (2006). Volatility and dispersion in business growth rates: publicly traded versus privately held firms. NBER Macroeconomics Annual, 21, 107–179. https://doi.org/10.1086/ma.21.25554954.

Davis, S. J., Haltiwanger, J. C., & Schuh, S. (1996). Job creation and destruction. MIT Press.

De Backer, K., & Sleuwaegen, L. (2003). Does foreign direct investment crowd out domestic entrepreneurship? Review of Industrial Organization, 22(1), 67–84.

Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2014). The role of entrepreneurship in US job creation and economic dynamism. Journal of Economic Perspectives, 28(3), 3–24. https://doi.org/10.1257/jep.28.3.3.

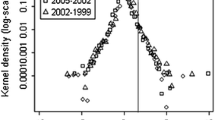

Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2016). Where has all the skewness gone? The decline in high-growth (young) firms in the US. European Economic Review, 86, 4–23. https://doi.org/10.1016/j.euroecorev.2015.12.013.

Decker, R. A., Haltiwanger, J. C., Jarmin, R. S., & Miranda, J. (2018). Changing business dynamism and productivity: shocks vs. responsiveness, finance and economics discussion series 2018–007. Washington: Board of Governors of the Federal Reserve System. https://doi.org/10.17016/FEDS.2018.007.

De Loecker, J., & Eeckhout, J. (2017). The rise of market power and the macroeconomic implications. https://doi.org/10.3386/w23687.

Dhyne, E., Konings, J., Van den bosch, J., & Vanormelingen, S. (2018) “IT and productivity: a firm level analysis”. National Bank of Belgium working paper, forthcoming.

Di Giovanni, J., Levchenko, A. A., & Mejean, I. (2014). Firms, destinations, and aggregate fluctuations. Econometrica, 82(4), 1303–1340. https://doi.org/10.3982/ecta11041.

Dumont, M., & Kegels, C. (2016). Young firms and industry dynamics in Belgium. Federal Planning Bureau working paper. https://www.plan.be/publications/publication-1596-en-young+firms+and+industry+dynamics+in+belgium

Duprez, C., & Van Nieuwenhuyze, C. (2016). Belgium’s inward and outward foreign direct investment. National Bank of Belgium Economic Review, (ii), 45–62.

Fizaine, F. (1968). Analyse statistique de la croissance des entreprises selon l'age et la taille. Revue d'Economie Politique, 78(4), 606–620.

Gabaix, X. (2011). The granular origins of aggregate fluctuations. Econometrica, 79(3), 733–772. https://doi.org/10.3982/ecta8769.

Gibrat, R. (1931). Les inégalités économiques: applications: aux inégalitês des richesses, à la concentration des entreprises, aux populations des villes, aux statistiques des familles, etc: d'une loi nouvelle: la loi de l'effet proportionnel. Librairie du Recueil Sirey.

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13(4), 421–440.

Geurts, K., & Van Biesebroeck, J. (2016). Firm creation and post-entry dynamics of de novo entrants. International Journal of Industrial Organization, 49, 59–104. https://doi.org/10.1016/j.ijindorg.2016.08.002.

Goldschlag, N., & Tabarrok, A. (2018). Is regulation to blame for the decline in American entrepreneurship? Economic Policy, 33(93), 5–44. https://doi.org/10.1093/epolic/eix019.

Haltiwanger, J., Jarmin, R. S., Kulick, R., & Miranda, J. (2016). High growth young firms: contribution to job, output, and productivity growth. In J. Haltiwanger, E. Hurst, J. Miranda, & A. Schoar (Eds.), Measuring entrepreneurial businesses: current knowledge and challenges (pp. 11–62). Chicago: University of Chicago Press.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics, 95(2), 347–361. https://doi.org/10.1162/rest_a_00288.

Haltiwanger, J., Scarpetta, S., & Schweiger, H. (2014). Cross country differences in job reallocation: the role of industry, firm size and regulations. Labour Economics, 26, 11–25. https://doi.org/10.1016/j.labeco.2013.10.001.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: a survey and interpretation of the evidence. Small Business Economics, 35(2), 227–244. https://doi.org/10.1007/s11187-009-9172-z.

Hölzl, W. (2009). Is the R&D behaviour of fast-growing SMEs different? Evidence from CIS III data for 16 countries. Small Business Economics, 33(1), 59–75. https://doi.org/10.1007/s11187-009-9182-x.

Hölzl, W. (2013). Persistence, survival, and growth: a closer look at 20 years of fast-growing firms in Austria. Industrial and Corporate Change, 23(1), 199–231. https://doi.org/10.1093/icc/dtt054.

Jäger, K. (2017). EU KLEMS growth and productivity accounts 2016 release (Description of methodology and general notes). EU KLEMS. http://www.euklems.net/

Jorgenson, D.W., Ho, M.S. & Stiroh, K.J., (2003). Projecting productivity growth: lessons from the U.S. growth resurgence. Technology, Growth, and the Labor Market, pp. 19–40. https://doi.org/10.1007/978-1-4615-0325-5_3.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50(3), 649. https://doi.org/10.2307/1912606.

Konings, J. (1995). Gross job flows and the evolution of size in U.K. establishments. Small Business Economics, 7(3), 213–220. https://doi.org/10.1007/bf01135366.

Konings, J., & Roodhooft, F. (1997). How elastic is the demand for labour in Belgian enterprises? Results from firm level accounts data. De Economist, 145(2), 229–241.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725. https://doi.org/10.1111/1468-0262.00467.

Moreno, F., & Coad, A. (2015). High-growth firms: stylized facts and conflicting results. In A. Corbett, J. Katz, & A. McKelvie (Eds.), Entrepreneurial growth: Individual, firm, & region. (Advances in entrepreneurship, firm emergence and growth 17) (pp. 187–230). Bingley: Emerald Group Publishing Limited. https://doi.org/10.1108/s1074-754020150000017016.

Moscarini, G., & Postel-Vinay, F. (2012). The contribution of large and small employers to job creation in times of high and low unemployment. American Economic Review, 102(6), 2509–2539. https://doi.org/10.1257/aer.102.6.2509.

OECD. (2014). OECD international direct investment statistics 2014. OECD Publishing. https://doi.org/10.1787/2307437x

OECD. (2017a). OECD economic surveys: Belgium 2017. OECD Economic Surveys: Belgium. https://doi.org/10.1787/eco_surveys-bel-2017-en.

OECD. (2017b). Business dynamics and productivity. OECD Publishing, Paris. https://doi.org/10.1787/9789264269231-en.

Reichstein, T., & Jensen, M. B. (2005). Firm size and firm growth rate distributions. The case of Denmark. Industrial and Corporate Change, 14(6), 1145–1166. https://doi.org/10.1093/icc/dth089.

Reynolds, P., Bosma, N., Autio, E., Hunt, S., De Bono, N., Servais, I., Lopez-Garcia, P., & Chin, N. (2005). Global entrepreneurship monitor: data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231. https://doi.org/10.1007/s11187-005-1980-1.

Sleuwaegen, L., & Dehandschutter, W. (1991), Entry and exit in Belgian manufacturing, in Geroski, P.A., and Schwalbach, J., (Eds), Entry and market contestability, an international comparison, Basil Blackwell (Oxford).

Van Ark, B. (2015). Productivity and digitilization in Europe: paving the road to faster growth. Digiworld Economic Journal, 100, 107 https://ssrn.com/abstract=2845368.

Van Beveren, I. & Vanormelingen, S. (2014). Human capital, firm capabilities and productivity growth. National Bank of Belgium working paper No. 257. https://doi.org/10.2139/ssrn.2434010.

Van Reenen, J., Bloom, N., Draca, M., Kretschmer, T., Sadun, R., Overman, H., et al. (2010). The economic impact of ICT (final report). London School of Economics SMART N. 2007/0020.

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, innovation and economic growth: evidence from GEM data. Small Business Economics, 24(3), 335–350. https://doi.org/10.1007/s11187-005-2000-1.

Zimmer, H. (2012). Labour market mismatches. National Bank of Belgium Economic Review, 2012(ii), 55–68.

Acknowledgments

The authors wish to thank two anonymous referees, Cathy Lecocq, Johannes Van Biesebroeck, Stijn Vanormelingen, and all colleagues participating at the VIVES seminars for their valuable input.

Funding

This research is supported by grants from the Econopolis Chair on Firm Dynamics and the Methusalem research program established by the Flemish government.

Author information

Authors and Affiliations

Corresponding author

Appendices

Descriptive statistics of data

Alternative measures for business dynamism

We conduct robustness analysis and calculate different measures of business dynamism. A first measure is the total job reallocation rate, i.e., the sum of job creation and destruction expressed as a percentage of overall employment. This can be seen as an indication of the level of job reallocation between firms. A second measure is the cross-sectional standard deviation of the DHS growth rates as an indicator for the dispersion of the distribution. A third measure is the within-firm volatility of employment weighted growth rates within a 10-year horizon as developed in Davis et al. (2006).

We also include extra robustness checks on the calculation method of the growth rate differentials. We calculate the dispersion (90–10 differential) of the unweighted firm growth rate distribution and also study the dispersion (90–10 differential) of the turnover growth rate distribution. Finally, we also investigate using the end of year number of employees post-1996 instead of the average number of FTE.

Figure 15 shows the first four measures. We clearly observe that also these too point to a clear decline of business dynamism over the past decades. The job reallocation rate (Fig. 15a) initially goes up and clearly comes down after the mid-1990s. The standard deviation of the employment growth rate distribution (Fig. 15b) continuously declines for both the unweighted and the employment weighted distribution. The within-firm volatility shown in Fig. 15c remarkably declines as well.Footnote 39 Finally, Fig. 15d gives the 90–10 differential for the unweighted distribution of firm growth rates for both all firms and continuing firms only. Here too we see a decline.

Figure 16 shows the evolution of business dynamism measured via turnover. It shows the 90–10 differential of both the turnover weighted and the unweighted distribution of turnover DHS growth rates. We calculate dynamism based on the nominal value of turnover and based on the real value of the turnover. To come to the real value of turnover, we deflate turnover with industry specific deflators from EUKLEMS. The deflator for gross value added is used. This deflator offers NACE Rev. 2 2-digit specific estimatesFootnote 40 that cover the full length of the studied period (1985–2014). Firms categorized as “small firms” can report turnover on a voluntary basis, all other firms are required to report turnover. As shown in Appendix 1, in 1985, approx. 54,000 out of 91,000 firms reported turnover; and in 2014, 57,000 out of 407,000 firms reported turnover. In 1985, firms reporting turnover represented 1.35M employees and firms not reporting turnover represented 150,000 employees. In 2014, firms reporting turnover represented 1.51M FTEs vs. 675,000 FTEs for firms not reporting turnover. The steep growth in the number of firms and overall employment growth in the period 1985–2014 is predominantly driven by small firms that do not report turnover. Furthermore, the manufacturing sector, with on average larger firms, is overrepresented in the subsample of firm reporting turnover. Turnover dynamism can therefore not be regarded as a complete proxy for overall business dynamism.Footnote 41 Nevertheless, all measures for turnover dynamism also indicate a dynamism decline that sets in around the second half of the 1990s and early 2000s. This is a strong robustness check on the fact that there is also a clear decline in dynamism for larger and (since size is correlated with age) more established firms.

90–10 differentials for both the turnover weighted (a, c) and unweighted distribution (b, d) of DHS turnover growth rates. Both nominal (a, b) and real values (c, d) for turnover are used. Real values are obtained by using the NACE 2-digit specific deflators for gross value added from EUKLEMS. All four measures show a decline in business dynamism that starts late 1990s or early 2000 depending on the measure

Figure 17 finally shows the evolution of dynamism (90–10 differential) for two alternative calculation methods for employment. Throughout the paper, employment post-1996 is calculated based on the average number of FTEs, whereas pre-1996, the average number of employees (headcount) is used. FTE is a better measure than headcount when part-time work is rising. As explained in the paragraph on entry and exit, post-1996, a self-employed business owner active in the business is not reported anymore in a firm’s employment statistics. This leads to a drop of 0.4 employees at start-up firms leading us to believe that on average an active self-employed business owner counted as 0.4 employees. Figure 17a uses average employment, not corrected for the self-employed and Fig. 17b corrects for the self-employed by adding 0.4 employees to each firm. We see a decline in dynamism that sets in around 2000.

a, b 90–10 differentials for weighted employment growth rates distribution. At the end of the year, the number of employees is used to calculate employment post-1996. b Corrects for the fact the self-employed business owner is not counted as an employee post-1996 by adding 0.4 employees to each firm. We see a dynamism trend change around the year 2000

The role of compositional shifts

In this section, we quantify the contribution of compositional shifts to the change in business dynamism. Bijnens and Konings (2017) described the significant shift in the structure of the Belgian firm landscape throughout the previous decades: jobs flow from the manufacturing to the services industry, from smaller to larger and from younger to older firms. It could well be that the change in overall dynamism is not driven by an intrinsic change in dynamism of a certain type of firms, but driven by the fact that jobs are shifted toward less dynamics parts of the economy without these parts becoming less dynamic per se.

Reallocation rate in the services industry is significantly higher than the one for the manufacturing industry. A shift of jobs to the more dynamic services industry would hence increase the overall dynamism of the economy. This shift works in the opposite direction compared to the overall decline in dynamism. Younger firms experience reallocation rates that lie substantially above the rate of older firms. As discussed in the main body of this paper, firm age is also linked with firm size. Overall, a shift of jobs away from smaller, younger firms toward bigger and older firms will have a negative impact on dynamism. The questions remains, however, how big this impact is.

We conduct a simple shift share decomposition analysis. We allocate all firms to different cells defined by 88 NACE 2-digit industries, 8 firm age groups (0 to 5 years, 6—10 years, and 10+ years) and 8 firm size groups based on the number of employees (1–9, 10–19, 20–49, 50–99, 100–249, 250–499, 500–999, and 1000+). We focus on the change in job flows, more specifically the overall change and the within-cell component of the decomposition. The within-cell component yields the change in the overall flow rate if every cell would have kept the same level of employment. The difference between these two indicate to what extent compositional changes drive the overall change as opposed to the within-cell changes. We do this for the change in job reallocation, creation, and destruction rates between the extreme values before the technology crisis of 2000 and the financial crisis of 2008. We use a 3-year moving average to minimize the impact of short-term variations.

The 90–10 differential is also decomposed. It is, however, not possible to have an exact decomposition of a nonparametrical measure. We follow a simplified approach similar to the shift cell decomposition and calculate the dispersion of each cell in both time periods and take the employment weighted average over the cells. We also calculate the cell value for the second time period and weigh these based on the employment shares of the first period and calculate the within-cell change. The remainder yields the impact of the compositional change.

Table 7 summarizes the result. We see that the job reallocation rate dropped with 2.66 percentage points between its peak in 1998 and the bottom in 2007. The impact of the shift between sectors (i.e., mainly the shift from manufacturing to services industries) is 0.48 percentage points positive. This means that the drop in reallocation rate would have actually been 18% higher if jobs were not shifted between sectors. For the job destruction rate and the 90–10 differential, shifts between sectors actually strengthen the decrease of the dynamism measure. Shifts between firm sizes have a positive, though smaller impact on the flow rates. Firm age is an important factor and actually the only factor that has a consistent negative impact on the studied flow rates; 19% of the drop in job reallocation, 30% of the drop of the 90–10 differential, and even 33% of the drop in job creation rate can be attributed to a shift of jobs toward older, less dynamic firms. This is consistent with the findings in the main body of this paper that the loss in business dynamism is linked with the decreased activity of younger firms.

For the job reallocation rate, the structural shifts in the economy actually work in opposite directions. While shifts between sectors and firms sizes lower the drop in reallocation rate, shifts between firms with different ages increase the drop in reallocation rate. This leads to the fact that the combined effects cancel out and actually are very modest. Only a small part of the job reallocation rate can be attributed to the changing composition of the Belgian firm landscape. For the 90–10 differential, the impact is higher as both sector and age changes strengthen the decrease. Nevertheless, we can in any case conclude that changing firm composition only partially explains the drop in dynamism and a significant part of the decrease remains unexplained.

Rights and permissions

About this article

Cite this article

Bijnens, G., Konings, J. Declining business dynamism in Belgium. Small Bus Econ 54, 1201–1239 (2020). https://doi.org/10.1007/s11187-018-0123-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-018-0123-4