Abstract

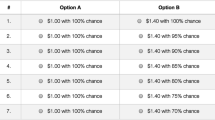

We test for a novel pattern of menu-dependent risk attitudes that forms the basis of recent theories of risky choice: Does expanding the range of potential prizes from lotteries in a choice set lead people to overweight those prizes and make riskier choices? Contrary to our hypothesis, we find no evidence of such a menu effect. Varying the potential prize offered by an actuarially unfavorable, high-risk lottery does not affect the likelihood of choosing a different, moderate-risk gamble in favor of a safer alternative. Our well-powered null results cast doubt on prominent theories of menu-dependent risk preferences.

Similar content being viewed by others

Notes

Focusing theory was developed for riskless choice, and therefore applying it to risky choice requires one to specify the attributes. Salience theory was developed for risky choice, assuming that state-contingent outcomes are the relevant attributes, but offers ambiguous predictions for choice in menus with more than two lotteries due to the proliferation of the state space. Our framework incorporates the ordering assumption while specifying the attributes to be the upside and downside of the lotteries to generate unambiguous predictions.

Our experiment also includes several attention checks that allow us to exclude inattentive participants based on preregistered criteria.

They do find that eye-tracking attention measures predict changes in lottery valuations in line with the predictions of salience theory. However, these effects are too small to translate into meaningful differences in the overall rate of preference reversals.

Our experimental tests of menu dependence focus on two-outcome lotteries and therefore we restrict our attention to this case. Extending this framework to lotteries with more than two outcomes is straightforward but requires additional assumptions about how agents code upsides and downsides relative to a reference point.

We assume that lotteries first-order stochastically dominated by another lottery in the menu are excluded from consideration. This aligns with the dominance detection operation in the editing phase of prospect theory (Kahneman & Tversky, 1979) and the assumption of consideration set in Bordalo et al. (2012) and Kőszegi and Szeidl (2013).

Proposition A1 establishes the existence and uniqueness of \(\beta ^*(\alpha )\) for all \(\alpha \in (0,2/(3\beta )].\)

Sequential effects are a particular concern when testing theories of choice-set-dependent preferences given the scope for spillovers across choice sets. For example, a participant who sees a wide range of potential upsides followed by a relatively narrow range may not fully acclimate to the new range. Somerville (2022) finds evidence for such spillovers in the context of riskless choice.

References

Alós-Ferrer, C., & Ritschel, A. (2022). Attention and salience in preference reversals. Experimental Economics, 25, 1024–1051.

Blavatskyy, P., Ortmann, A., & Panchenko, V. (2023). How common is the common-ratio effect? Experimental Economics, 26, 253–272.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2012). Salience theory of choice under risk. Quarterly Journal of Economics, 127, 1243–1285.

Bushong, B., Rabin, M., & Schwartzstein, J. (2021). A model of relative thinking. The Review of Economic Studies, 88, 162–191.

Castillo, G. (2020). The attraction effect and its explanations. Games and Economic Behavior, 119, 123–147.

Chapman, J., Snowberg, E., Wang, S., & Camerer, C. (2018). Loss attitudes in the U.S. population: Evidence from dynamically optimized sequential experimentation (DOSE). National Bureau of Economic Research Working Paper No. 25072.

Chen, D. L., Schonger, M., & Wickens, C. (2016). oTree-an open-source platform for laboratory, online, and field experiments. Journal of Behavioral and Experimental Finance, 9, 88–97.

Cohen, M., & Jaffray, J.-Y. (1988). Certainty effect versus probability distortion: An experimental analysis of decision making under risk. Journal of Experimental Psychology: Human Perception and Performance, 14, 554–560.

Conlisk, J. (1989). Three variants on the Allais example. American Economic Review, 79, 392–407.

Dertwinkel-Kalt, M., & Köster, M. (2020). Salience and skewness preferences. Journal of the European Economic Association, 18, 2057–2107.

Dertwinkel-Kalt, M., Gerhardt, H., Riener, G., Schwerter, F., & Strang, L. (2022). Concentration bias in intertemporal choice. The Review of Economic Studies, 89, 1314–1334.

Erkal, N., Gangadharan, L., & Nikiforakis, N. (2011). Relative earnings and giving in a real-effort experiment. American Economic Review, 101, 3330–3348.

Farmer, G. D., Warren, P. A., El-Deredy, W., & Howes, A. (2017). The effect of expected value on attraction effect preference reversals. Journal of Behavioral Decision Making, 30, 785–793.

Frydman, C., & Mormann, M. M. (2018). The role of salience in choice under risk: An experimental investigation. SSRN Working Paper No. 2778822.

Gabaix, X. (2019). Behavioral inattention. In B. D. Bernheim, S. Della Vigna, & D. Laibson (Eds.), Handbook of behavioral economics: Foundations and applications (Vol. 2, pp. 261–343). Amsterdam: North Holland.

Goette, L., Graeber, T., Kellogg, A., & Sprenger, C. (2020). Heterogeneity of gain-loss attitudes and expectations-based reference points. SSRN Working Paper No. 3589906.

Grether, D. M., & Plott, C. R. (1979). Economic theory of choice and the preference reversal phenomenon. American Economic Review, 69, 623–638.

Gul, F. (1991). A theory of disappointment aversion. Econometrica, 59, 667–686.

Herne, K. (1999). The effects of decoy gambles on individual choice. Experimental Economics, 2, 31–40.

Huber, J., Payne, J. W., & Puto, C. (1982). Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis. Journal of Consumer Research, 9, 90–98.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–292.

Kőszegi, B., & Rabin, M. (2007). Reference-dependent risk attitudes. American Economic Review, 97, 1047–1073.

Kőszegi, B., & Szeidl, A. (2013). A model of focusing in economic choice. Quarterly Journal of Economics, 128, 53–104.

Lichtenstein, S., & Slovic, P. (1971). Reversals of preference between bids and choices in gambling decisions. Journal of Experimental Psychology, 89, 46–55.

Nielsen, C. S., Sebald, A. C., & Sørensen, P. N. (2021). Testing for salience effects in choices under risk. University of Copenhagen. Working Paper.

O’Donoghue, T., & Sprenger, C. (2018). Reference-dependent preferences. In B. D. Bernheim, S. Della Vigna, & D. Laibson (Eds.), Handbook of behavioral economics: Foundations and applications (Vol. 1, pp. 1–770). Amsterdam: North Holland.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior & Organization, 3, 323–343.

Rabin, M. (2000). Risk aversion and expected-utility theory: A calibration theorem. Econometrica, 68, 1281–1292.

Schkade, D. A., & Kahneman, D. (1998). Does living in California make people happy? A focusing illusion in judgments of life satisfaction. Psychological Science, 9, 340–346.

Simonson, I. (1989). Choice based on reasons: The case of attraction and compromise effects. Journal of Consumer Research, 16, 158–174.

Simonson, I., & Tversky, A. (1992). Choice in context: Tradeoff contrast and extremeness aversion. Journal of Marketing Research, 29, 281–295.

Slovic, P. (1975). Choice between equally valued alternatives. Journal of Experimental Psychology: Human Perception and Performance, 1, 280–287.

Soltani, A., De Martino, B., & Camerer, C. (2012). A range-normalization model of context-dependent choice: a new model and evidence. PLoS Computational Biology, 8, e1002607.

Somerville, J. (2022). Range-dependent attribute weighting in consumer choice: An experimental test. Econometrica, 90, 799–830.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Tversky, A., Slovic, P., & Kahneman, D. (1990). The causes of preference reversal. The American Economic Review, 80, 204–217.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

We thank Ori Heffetz, Ted O’Donoghue, and Alex Rees-Jones for their helpful comments. The experiment reported in this paper was preregistered in the AsPredicted Registry in December 2020, under the ID #53943. The views expressed in this paper are those of the authors alone and do not necessarily reflect the views of the Federal Reserve Bank of New York or the Federal Reserve System.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Proofs

1.1 Proof of prediction 1

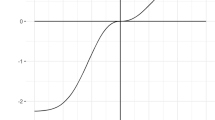

Proof: In the choice problem presented in Section 2.2, the upside-range is \((\frac{4}{3\alpha }-1)z\) when \(\alpha < 2/(3\beta )\), and the downside range is either 0 (\(p>0\)) or z (\(p=0\)), both of which are independent of \(\alpha\) and \(\beta\). Thus, for convenience we denote \(g^+(\alpha )=g(\bar{\Delta }(\mathcal {C}(\alpha ,\beta )))\) when \(\alpha < 2/(3\beta )\) and \(g^-\equiv g(\underline{\Delta }(\mathcal {C}))\). Also, we normalize \(u(0)=0\). Then \(x_1\succeq x_2(\beta )\) in menu \(\mathcal {C}(\alpha ,\beta )\) if and only if

Function \(\tau (\alpha ):=1+\frac{g^-}{pg^+(\alpha )+(2-p)g^-}\) is a increasing function of \(\alpha\) since function \(4/(3\alpha )-1\) is decreasing in \(\alpha\) but g is increasing. Thus, a smaller \(\alpha\), i.e., a larger upside range, lowers the minimum requirement of \(\beta\) to make \(x_2\) the preferred option.

1.2 The properties of the expected-value premium

By Eq. (4), the expected-value premium \(\beta ^*(\alpha )\) is given by

This function is an increasing function of \(\alpha\) since both \(\tau (\alpha )\) and u are increasing.

Appendix B: Focusing and behavioral anomalies

This section demonstrates how the model we developed in Section 2 predicts classic behavioral anomalies in risky choices. We show how our simple model of focusing in risky choice can predict the certainty effect, preference reversals, and the common ratio effect.

1.1 Certainty effect

Numerous empirical studies have shown that there is a discontinuous change in utility when a small probability is reduced to zero (Kahneman & Tversky, 1979; Cohen & Jaffray, 1988; Conlisk, 1989). Such discontinuities can arise in the model proposed in Section 2. To see this, consider two lotteries \(x=(z_1,z_2;p)\) and \(x'(\varepsilon )=(z'_1,z'_2;1-\varepsilon )\) for some \(\varepsilon >0\). Denote by \(\mathcal {C}(\varepsilon )=\{x_1,x_2(\varepsilon )\}\), and then \(\bar{\Delta }(\mathcal {C}(\varepsilon ))=|z_1-z_1'|\) and

which is invariant to the value of \(\varepsilon\). Assume that (i) \(|z_2-z_2'| < |z_2-z_1'|\), and (ii)

Since \(u(z_1')>u(z_2')\), function

is decreasing in \(\varepsilon\). When \(\varepsilon\) approaches to 0, it gets infinitely close to, but still smaller than, \(u(z_1)=V(x;\mathcal{C}(\varepsilon ))\). Therefore, the agent chooses x in \(\mathcal {C}(\varepsilon )\) when \(\varepsilon >0\).

However, when \(\varepsilon =0\), the utility of \(x'\) approaches continuously to \(V(x';\mathcal{C}(0))=u(z_1)\), but the utility of x becomes

which is strictly smaller than \(u(z_1)\) because \(|z_2-z_2'| < |z_2-z_1'|\). Therefore, there is a discontinuous change in preference when prize \(z_2'\) shifts from an improbable prize to an impossible prize.

1.2 Preference reversal

Prior work has also demonstrated that different elicitation methods can lead to inconsistent choices (Lichtenstein & Slovic, 1971; Slovic, 1975; Grether & Plott, 1979). The model introduced in Section 2 can predict such preference reversal because different methods of elicitation led to different comparison menus.

To see how preference reversals can arise, consider the following choice problem \(\mathcal {C}=\{x_{\$},x_{P}\}\), where \(x=(z_1,z_2;p)\) and \(x_{P}=(z'_1,z'_2;p')\). \(x_{\$}\) is the “dollar bet” and \(x_P\) is the “probability bet” because we assume \(z_1>z_1'\), \(z_2>z_2'\) and \(p < p'\). When compared directly, the agent makes a choice in menu \(\mathcal {C}\) and then a preference relation \(\succeq _{\mathcal {C}}\) is revealed such that \(x\succeq _{\mathcal {C}}x'\) if x is selected in menu \(\mathcal {C}\). Alternatively, the two lotteries can also be ranked according to their certainty equivalences. Here, the certainty equivalence of lottery x is defined as a prize \(z^*(x)\) such that x and \(\delta _{z^*(x)}\) are equally likely to be chosen in menu \(\{x,z^*(x)\}\). By deriving the certainty equivalence, another preference \(\succeq _{\text {CE}}\) can be identified such that \(x\succeq _{\text {CE}}x'\) if and only if \(z^*(x)\ge z^*(x')\).Therefore, a preference reversal emerges when \(x\succeq _{\mathcal {C}}x'\) but \(x'\succ _{\text {CE}}x\).

Consider an example in which the following restrictions are imposed to \(x_{\$}\) and \(x_{P}\):

-

(a)

\(z_1-z_1'=z_2-z_2'\);

-

(b)

\(pu(z_1)+(1-p)u(z_2)=p'u(z'_1)+(1-p')u(z'_2)=0\);

-

(c)

\(p'=0.5\).

where a) and b) is sufficient to guarantee that \(x_{\$}=x_P\) are equally attractive in menu \(\mathcal {C}\), because \(\bar{\Delta }(\mathcal {C})=z_1-z_1'=z_2-z_2'=\underline{\Delta }(\mathcal {C})\). Even when the two options are indifferent when compared directly, empirical studies typically find that the minimum acceptable selling price of the dollar bet is larger than that of the probability bet; that is, \(z^*(x_{\$})\) > \(z^*(x_P)\). The following proposition outlines when this prediction arises in our framework.

Proposition 1

Under assumptions a), b), and c), \(z^*(x_{\$})\) > \(z^*(x_P)\).

Proof

Consider the certainty equivalence of lottery \(x=(z_1,z_2;p)\), where \(pu(z_1)+(1-p)u(z_2)=0\). Define:

which is a decreasing function in range \([z_2,z_1]\). Thus, \(h_x(z) < 0\) if and only if z > \(\frac{z_1+z_2}{2}\); that is, the prize is larger than the mean of the two prizes. Since \(pu(z_1)=-(1-p)u(z_2)\), x, and \(z^*(x)\) are equally likely to be chosen if and only if

Let \(H(z,x):=\frac{pu(z_1)h_x(z)}{ph_x(z)+1}\), and \(H(\cdot ,x)\) is decreasing since \(h_x(\cdot )\) is decreasing. Hence, \(z^*(x)\) is the intersection of decreasing function \(H(\cdot ,x)\) and increasing function \(u(\cdot )\).

Claim 1:

The certainty equivalence of \(x_P\) is smaller than its expectation, \(\frac{z_1'+z_2'}{2}\).

Proof

To compare lotteries \(x_{\$}\) and \(x_P\), note that since \(u(\cdot )\) is concave and \(p'=0.5\), by Jensen’s inequality we have \(u(\frac{z'_1+z'_2}{2})\) > \(0=p'u(z_1')+(1-p')u(z_2')\). Meanwhile, \(H(\frac{z'_1+z'_2}{2},x_P)=0\) since \(h_{x_P}(\frac{z'_1+z'_2}{2})=0\). Thus, the certainty equivalence of \(x_P\) is smaller than \(\frac{z'_1+z'_2}{2}\) because u is increasing but \(H(\cdot ,x)\) is decreasing.

Claim 2:

\(H(z,x_{\$})\) > \(H(z,x_P)\) for all \(z\in (\frac{z_1'+z_2'}{2},z_1')\).

Proof

It is trivial that \(h_{x_{\$}}(z)\) > \(h_{x_{P}}(z)\) for all \(z\in (z_2,z_1')\). By assumption b) we have \(p'u(z_1')\) > \(pu(z_1)\). Thus, for any \(z > \frac{z_1'+z_2'}{2}\) we have \(h_{x_P}(z) < 0\), and then

which completes the proof.

By Claim 1, the certainty equivalence of \(x_P\), \(z^*(x_P)\), is greater than \(\frac{z_1'+z_2'}{2}\). Thus, by Claim 2,

Therefore, since u is increasing and \(H(\cdot ,x_{\$})\) is decreasing, \(z^*(x_P)\) < \(z^*(x_{\$})\).

1.3 Common ratio effect

In the problem 3 and 4 in Kahneman and Tversky (1979), the menus are \(\mathcal {C}=(x_1,x_2)\), where \(x_1=(\$4000,0;0.8)\) and \(x_2=(\$3000,\$3000;1)\), and \(\mathcal {C}'=(x_1',x_2')\), where \(x_1'=(\$4000,0;0.2)\) and \(x_2'=(\$3000,0;0.25)\). Then in menu \(\mathcal {C}\), \(\bar{\Delta }(\mathcal {C})=1000\) and \(\underline{\Delta }(\mathcal {C})=3000\). However, in menu \(\mathcal {C}'\), \(\bar{\Delta }(\mathcal {C}')=1000\) but \(\underline{\Delta }(\mathcal {C}')=0\). Thus, the DM is more downside-focused in menu \(\mathcal {C}\) than in menu \(\mathcal {C'}\). To simplify, normalize \(u(0)=0\). Then we have the following observation:

Observation 1

There exists a parameter environment such that the DM chooses \(x_2\) in \(\mathcal {C}\) and chooses \(x_1\) in \(\mathcal {C}'\).

Proof

By function (1) and (2), \(x_1\) is chosen in menu \(\mathcal {C}\) if

Similarly, \(x_1'\) is chosen in menu \(\mathcal {C}'\) if

It is sufficient to show the threshold in Eq. (6) is smaller than that in Eq. (7). Observe that

which holds automatically since g is increasing.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chen, Z., Golman, R. & Somerville, J. Menu-dependent risk attitudes: Theory and evidence. J Risk Uncertain 68, 77–105 (2024). https://doi.org/10.1007/s11166-023-09423-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-023-09423-1