Abstract

In the context of eliciting preferences for decision making under risk, we analyse the features of four different elicitation methods—pairwise choice, willingness-to-pay, willingness-to-accept, and the Becker-DeGroot-Marschak mechanism—and estimate noise, bias and risk attitudes for two different preference functionals, Expected Utility and Rank-Dependent Expected Utility. It is well-known that methods differ in terms of the bias in the elicitation; it is rather less well-known that methods differ in terms of their noisiness. It has also been reported that risk attitudes are not stable across different elicitation methods. Our results suggest that elicited preferences should only be used in the context in which they were elicited, and the bias in the certainty-equivalent methods should be kept in mind when making predictions based on the elicited preferences. Moreover, conclusions should be moderated to take into account the various methods’ noise, which is generally lowest in the case of pairwise choice.

Similar content being viewed by others

Notes

The study of Schmidt and Hey (2004) may be regarded as an exception as it analyses the role of pricing errors for explaining preference reversals.

The complete instructions can be downloaded from http://www.luiss.it/hey/hey morone and schmidt/instructions.pdf.

The GAUSS program can be downloaded from http://www.luiss.it/hey/hey morone and schmidt/rdeurq final.est.

A similar argument applies for a preference for R, but we omit this for clarity.

It is not clear why a subject should report indifference, and the modelling we have done is only one of several ways to proceed.

We have investigated other specifications—most notably that of CARA. CRRA fits significantly better. Details are available on request.

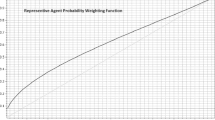

We note that this should properly be attributed to Tversky and Kahneman (1992). This form, in contrast to the power form w(p) = p g , allows the probability weighting function to be S-shaped or inverse S-shaped, which seems empirically more appropriate.

Details are available upon request.

The complete output file of our estimations containing all results can be downloaded from http://www.luiss.it/hey/hey morone and schmidt/rdeurq final.out.

We omit two of the 24 subjects (subjects 21 and 22) who answered all questions as if they were perfect expected-value maximisers. For them we always have r = 1, all the s and a values are 0, and all the b values are 1.

The program can be downloaded under www.luiss.it/hey/hey%morone%and%schmidt/rdeurq final.est

References

Anderson, L. R., & Mellor, J. M. (2009). Are risk preferences stable? Comparing an experimental measure with a validated survey-based measure. Journal of Risk and Uncertainty, 39, 137–160.

Ballinger, T. P., & Wilcox, N. (1997). Decisions, error and heterogeneity. Economic Journal, 107, 1090–1105.

Baltussen, G., Post, T., van den Assem, M. J., & Wakker, P. P. (2009). “Random Incentive Systems in a Dynamic Choice Experiment,” Working Paper, Erasmus University of Rotterdam.

Beattie, J., & Loomes, G. (1997). The impact of incentives upon risky choice. Journal of Risk and Uncertainty, 14, 155–168.

Berg, J., Dickhaut, J., & McCabe, K. (2005). Risk preference instability across institutions: a dilemma. Proceedings of the National Academy of Sciences, 201, 4209–4214.

Birnbaum, M. H. (2004). Causes of Allais common consequence paradoxes: an experimental dissection. Journal of Mathematical Psychology, 48, 87–106.

Birnbaum, M. H., & Schmidt, U. (2008). An experimental investigation of violations of transitivity in choice under uncertainty. Journal of Risk and Uncertainty, 37, 77–91.

Birnbaum, M. H., & Schmidt, U. (2009). “Testing Transitivity in Choice under Risk,”, Theory and Decision, forthcoming.

Blavatskyy, P. (2007). Stochastic expected utility theory. Journal of Risk and Uncertainty, 34, 259–286.

Blavatskyy, P. (2008). Stochastic utility theorem. Journal of Mathematical Economics, 44, 1049–1056.

Buschena, D. E., & Zilberman, D. (2000). Generalized expected utility, heteroscedastic error, and path dependence in risky choice. Journal of Risk and Uncertainty, 20, 67–88.

Camerer, C. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2, 61–104.

Carbone, E. (1997). Investigation of stochastic preference theory using experimental data. Economics Letters, 57, 305–312.

Carbone, E., & Hey, J. D. (2000). Which error story is best? Journal of Risk and Uncertainty, 20, 161–176.

Coppinger, V. M., Smith, V. L., & Titus, J. A. (1980). Incentives and behavior in English, Dutch and sealed-bid auctions. Economic Inquiry, 18, 1–22.

Cox, J., Roberson, B., & Smith, V. L. (1982). Theory and behavior of single object auctions. In V. L. Smith (Ed.), Research in experimental economics, vol. 2. Greenwich: JAI.

Coursey, D. L., Hovis, J. L., & Schulze, W. D. (1987). The disparity between willingness to accept and willingness to pay measures of value. Quarterly Journal of Economics, 102, 679–690.

Cubitt, R. P., Starmer, C., & Sugden, R. (1998). On the validity of the random lottery incentive system. Experimental Economics, 1, 115–131.

Harless, D. W., & Camerer, C. F. (1994). The predictive utility of generalized expected utility theories. Econometrica, 62, 1251–1289.

Harrison, G. W. (1990). Risk attitudes in first-price auction experiments: a Bayesian analysis. Review of Economics and Statistics, 72, 541–546.

Harrison, G. W., & Rutström, E. (2009). Expected utility and prospect theory: one wedding and decent funeral. Experimental Economics, 12, 133–158.

Hey, J. D., & Lee, J. (2005). Do subjects separate (or are they sophisticated)? Experimental Economics, 8, 233–265.

Hey, J. D., & Orme, C. D. (1994). Investigating generalisations of expected utility theory using experimental data. Econometrica, 62, 1291–1326.

Isaac, R. M., & James, D. (2000). Just who are you calling risk averse? Journal of Risk and Uncertainty, 20, 177–187.

Isaac, R. M., & Walker, J. M. (1985). Information and conspiracy in sealed bid auctions. Journal of Economic Behavior and Organization, 6, 139–159.

James, D. (2007). Stability of risk preference parameter estimate within the Becker-Degroot-Marschak procedure. Experimental Economics, 10, 123–141.

Knetsch, J. L., & Sinden, J. A. (1984). Willingness to pay and compensation demanded: experimental evidence of an unexpected disparity in measures of value. Quarterly Journal of Economics, 99, 507–521.

Knetsch, J. L., & Sinden, J. A. (1987). The persistence of evaluation disparities. Quarterly Journal of Economics, 102, 691–695.

Laury, S. K. (2005). “Pay One or Pay All: Random Selection of One Choice for Payment,” Working Paper 06–13, Andrew Young School of Policy Studies, Georgia State University.

Lichtenstein, S., & Slovic, P. (1971). Reversals of preferences between bids and choices in gambling decisions. Journal of Experimental Psychology, 89, 46–55.

Loomes, G., & Sugden, R. (1995). Incorporating a stochastic element into decision theories. European Economic Review, 39, 641–648.

Loomes, G., & Sugden, R. (1998). Testing alternative stochastic specifications for risky choice. Economica, 65, 581–598.

Loomes, G., Moffatt, P. G., & Sugden, R. (2002). A microeconometric test of alternative stochastic theories of risky choice. Journal of Risk and Uncertainty, 24, 103–130.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior and Organization, 3, 323–343.

Samuelson, W., & Zeckhauser, R. J. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty, 1, 7–59.

Schmidt, U., & Hey, J. D. (2004). Are preference reversals errors? An experimental investigation. Journal of Risk and Uncertainty, 29, 207–218.

Schmidt, U., & Traub, S. (2009). An experimental investigation of the disparity between WTA and WTP for lotteries. Theory and Decision, 66, 229–262.

Starmer, C. (2000). Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. Journal of Economic Literature, 38, 332–382.

Starmer, C., & Sugden, R. (1989). Probability and juxtaposition effects: an experimental investigation of the common ratio effect. Journal of Risk and Uncertainty, 2, 159–178.

Starmer, C., & Sugden, R. (1991). Does the random lottery incentive system elicit true preferences? An experimental investigation. American Economic Review, 81, 971–978.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Tversky, A., Sattath, S., & Slovic, P. (1988). Contingent weighting in judgment and choice. Psychological Review, 95, 371–384.

Wilcox, N. T. (2009). “‘Stochastically More Risk Averse:’ A Contextual Theory of Stochastic Discrete Choice under Risk,” Journal of Econometrics, forthcoming.

Wu, G. (1994). An empirical test of ordinal independence. Journal of Risk and Uncertainty, 9, 39–60.

Acknowledgment

We thank a referee for very helpful comments and suggestions, which we believe have led to significant improvements in the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2: Technical details

This Appendix describes the mathematics lying behind the estimation and the GAUSS programs used in the estimation.Footnote 13 We concentrate on the EU estimates. Those for RDEU are the same, mutatis mutandis. We assume throughout that the subjects make monetary evaluations of the various gambles with a normally distributed error.

In the experiment there were 4 possible outcomes £0, £10, £30 and £40. We denote the utilities of these by u 1 , u 2 , u 3 and u 4 .

We assume a CRRA utility function:

where we have normalised the function so that u 1 = 0 and u 4 = 1. A risk-neutral person has r = 1. The inverse of the utility function is

2.1 Estimation using the certainty equivalent data

Denote by c j the certainty equivalent reported by the subject on question number j (j = 1,..,J) . Let us drop the subscript j to save notational clutter. Suppose the probabilities on the question are p 1 , p 2 , p 3 and p 4 . Then the Expected utility of the gamble (for given parameters) is

Hence the true certainty equivalent, t, of the gamble G is given by

The difference between the stated certainty equivalent and the true one

We assume that this difference c − t is error, normally distributed with standard deviation s. The normal pdf of this is:

The log of the pdf is therefore

It follows that the log of the probability density of the difference is:

This is the contribution to the log-likelihood from the certainty equivalent data.

2.2 Estimation using the preference data

Again we assume that subjects make normally distributed errors when evaluating lotteries. When comparing two lotteries they compare the estimated certainty equivalents. Suppose we have two gambles L and R. The Expected Utilities are EUL and EUR. Their monetary evaluations are ML = u −1 (EUL) and are MR = u −1 (EUR) The treatment is different according to whether the subject reports indifference or not.

-

1)

The subjectneverreports indifference. In this case, we have that L is reported as preferred to R if \( ML - MR + \varepsilon \geqslant 0 \) and that R is reported as preferred if \( ML - MR + \varepsilon < 0 \). Hence the probability that L is reported as preferred is \( {\text{Prob}}\left( {\varepsilon \geqslant MR - ML} \right) \) and the probability that R is reported as preferred is \( {\text{Prob}}\left( {\varepsilon < MR - ML} \right) \). Hence the probability of L (R) is:

Now we need to find expressions for the probabilities. If we denote the normal cdf by (x/s) (this is the integral of (4)) we can then write that the probability of L (R) is

Hence the log-likelihood is

-

2)

The subjectsometimesreports indifference. This is almost the same but we need some story about when the subject reports indifference. We say that L is reported as preferred if \( ML - MR + \varepsilon \geqslant \tau \), that R is reported as preferred if \( ML - MR + \varepsilon < - \tau \), and that indifference is reported when \( - \tau \leqslant ML - MR + \varepsilon < \tau \). Hence the probability that L is reported as preferred is \( {\text{Prob}}\left( {\varepsilon \geqslant MR - ML + \tau } \right) \), the probability that R is reported as preferred is \( {\text{Prob}}\left( {\varepsilon < MR - ML - \tau } \right) \), and the probability that indifference is reported is \( {\text{Prob}}\left( {MR - ML - \tau \leqslant \varepsilon < MR - ML + \tau } \right) \).

2.3 Estimating bias in the certainty equivalents

We simply assume that there is a true valuation V and a reported valuation v which are related by

Here the parameters a and b determine the bias in the reporting of the certainty equivalents. If a = 0 and b = 1 there is no bias. In the text tables we report the estimated values of a and b for each of the certainty equivalent methods. We assume no bias in the pairwise choice elicitation method.

Rights and permissions

About this article

Cite this article

Hey, J.D., Morone, A. & Schmidt, U. Noise and bias in eliciting preferences. J Risk Uncertain 39, 213–235 (2009). https://doi.org/10.1007/s11166-009-9081-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-009-9081-1