Abstract

The market, earnings, and liquidity growth combine to form a proxy for wealth growth, allowing a recursive consumption model with a low risk aversion coefficient, a risk-free rate close to historical, a high equity premium, and a reasonable elasticity of intertemporal substitution. The empirical consumption model does well against major asset pricing puzzles. Tested over 118 years it is not rejected while a forward-looking consumption model using the market alone as a wealth proxy fails. Changing liquidity and earnings forecast consumption and their ‘crashes’ precede consumption declines. We also demonstrate related stock level factors have similar economic magnitude and are significant. These models are consistent to the financial intermediary economic growth literature. Such consistency across approaches adds credence to common earnings and liquidity factors as important risks to investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

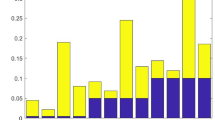

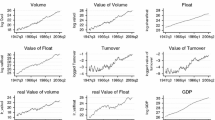

If economic growth is related to changes in wealth, and liquidity and earnings are components to both, we would expect to see evidence of this in a consumption model. We show strong evidence of liquidity and earnings components to wealth. We construct empirical consumption-based models with earnings, liquidity, and market components in the stochastic discount factor that fits the data better than previous models and solves major asset pricing puzzles. Cochrane (2017) lists a half dozen features an asset pricing model should accommodate or address; (1) a high equity premium, (2) a high enough Sharpe ratio (which includes market volatility consistent with data), (3) a low and stable risk-free rate, (4) consumption growth with reasonable mean, volatility, and some predictability, (5) a positive discount factor and (6) low-risk aversion, all of which together “so far no model has achieved…” [p. 952]. We would add to that list; (7) the model should readily tie to the cross-section, (8) have a defensible elasticity of substitution (EIS), (9) priced risk factors should be defensible economically, and (10) consumption should relate to stress in risk factors. Our main contribution is a model that meets all ten goals, referenced here forward as our ‘goals’ list. Some CCAPM models meet most of these goals, e.g., Semenov (2017), but we are unaware of another paper that meets all of these goals. We accomplish this by adding simple empirical earnings and liquidity growth measures to the stochastic discount factor in an Epstein and Zin (1989), (1991) and Weil (1989) framework (EZW from here forward). With 118 years of annual data, we show the EZW model with market as wealth fails, where our Consumption, Earnings, Liquidity, and Market (CELM) based model does not. Figure 1 previews the relationship between consumption growth and changes in earnings, turnover, and market that form our return on wealth construction, which we call ‘ETOM’, and define when we define our SDF. The attractive fit, enhanced by different scales, is somewhat marred by the high consumption, coincident with high production, during the two world wars. Consumption is well forecast by these variables individually, and when combined in a vector autoregression.

A paramount goal of financial economics is a well working consumption model based on rational actors pricing risk that solves the above puzzles. The empirical model presented here accomplishes this. It does so in a manner consistent with the intermediation risk literature. Unlike Bai et al. (2019) and other researchers who construct a CCAPM with disasters, ours is a standard CCAPM with recursive preferences. Also, we contribute to other researchers who have built theoretical models, empirically relating earnings and liquidity risk to consumption in a CCAPM framework.

Also, our consumption variables, when used as factors in a stock level cross-sectional factor model provide highly significant factors, as shown in Sect. 3. The magnitudes for factor premiums of the cross-sectional model for the market, earnings, and liquidity corroborate the relative magnitudes used in our CELM consumption model. The economic motivation of investors concerned about the covariance of earnings, liquidity, and market risk to their utility of consumption provides an attractive connection of consumption and cross-sectional modeling.

Concerning liquidity as a part of our wealth composite; Levin (1991), Holmstrom and Tirole (1993), Bencivenga et al. (1995), model liquidity externalitiesFootnote 1 arising from projects undertaken in the real economy and management monitoring which materially impact economic growth and by implication the growth in wealth. If these really are a risk concern of investors, we should be able to bring liquidity into the stochastic discount factor (SDF); part of what we test here. Levine (1991) relates liquidity to economic growth. Levine and Zervos (1998) proxy liquidity with turnover using international data to find evidence of a relationship to growth.

Acharya and Pedersen (2005) build a stock level liquidity augmented CAPM and provide empirical evidence of the existence of liquidity premiums in stock prices and flight to liquidity behavior. Lo and Wang (2006) use volume for their “portfolio that is used to hedge the risk of changing market conditions” [p. 2805] and Lagos and Zhang (2020) model a “turnover-liquidity mechanism,” in their intermediary model. Many have found volume or turnover as useful descriptors of stock level prices including, Blume, Easley and O’Hara (1994), Brennan et al. (1998), Lo and Wang (2006) for the U.S. and Rouwenhorst (1999) and Dey (2005) internationally.

Intermediary’s credit is an input to the financial sector’s production of a market: we can loosely think of this as a supply side argument, as in Levine et al., (2000). We make a complementary contribution by studying investors’ demand concerns in a consumption framework. Volume is important to investors. Market participants have followed volume information in newspaper’s daily quotes for over 100 years and developed communications technology to report both price changes and volume changes, e.g., Field (1998). Daley and Green (2016) “develop a theory in which equilibrium prices and liquidity are jointly determined and vary over time with the market belief” [p. 814], with an important role for volume of trade.

Human capital as a component to economic growth has a rich literature. Recent financial economics theoretical treatments include Heaton and Lucas (2000) and Santo and Veronesi’s (2006) human capital risk that cannot be hedged, and Sylvain (2014), and Munk (2000) and Schwartz and Tebaldi’s (2006)Footnote 2 illiquidity of earnings streams’ impact on asset pricing.

Regarding the risk of companies with high earnings exposure, quoting Sylvain [2014, p. 3] “if the stock of human capital (or alternatively labor income and labor/leisure choice) is a state variable of concern to agents in the economy and there is significant co-variation between the shocks to the human capital and the shocks to firm physical capital (and hence the firm value and its security returns), in equilibrium human capital will have important effects on expected returns of claims to the firm’s profits.” Schwartz and Tebaldi give this salient example: “Two individuals with the same wealth, the same preferences and the same horizon would invest in the same portfolio using the traditional asset allocation framework. However, if one of the individuals is a stock broker with his human wealth highly correlated with the stock market, and the other is a tenured university professor with his human wealth independent of the stock market, it would be reasonable to expect that they would have different allocations.Footnote 3” Consistent to such models, Betermier et al. (2017, p. 5) find empirically “investors with high human capital and high exposure to macroeconomic risk tilt their portfolios away from value.” We employ an EZW framework with the addition of earnings and liquidity in the SDF, as the components that covary with investors illiquid human capital. Our empirical findings make such models’ motivation fit the data and meets our ninth goal–a defensive economic rationale.

Financial and other crisis are accompanied by shocks to employment and earnings. Investors monitor earnings shocks via earnings growth. Hedging earnings growth risk via a liquid market motivates our consumption-model. CELM ties asset prices to consumption and uses easy-to-measure changes in wealth.

Regarding a ready tie-in to the cross section, goal 8 from above, while others have built liquidity factor models, Snigaroff and Wroblewski (2021) work in these same variables to provide a powerful returns-based factor description of stock returns that performs better than other benchmark factor models and subsumes the momentum factors of Jegadeesh and Titman (1993) and Cahart (1997). In this study, we compare and relate their factors and their magnitude to the consumption model. This ‘micro model’ uses security level variables of earnings-to-price, growth of earnings to price, volume, and growth in volume; these combined with the market. The consumption ‘macro model’ uses the market combined with aggregate earnings growth and changes in turnover.Footnote 4 This is advantageous as it is this change in liquidity that allows Snigaroff and Wroblewski (2021) to subsume momentum, which is a pernicious problem for rational pricing models. The change in turnover in the consumption model serves as a proxy for the changing state risk in liquidity as in Levine and Zevos (1998).

Equipped with this stochastic discount factor (SDF) construction along with a proxy for return on wealth, we can construct a consumption-based model that simultaneously exhibits a high equity risk premium, an upper bound for the Sharpe ratio that is consistent with historical data, a low risk-free rate, a low-risk aversion coefficient (RRA), and a reasonable elasticity of intertemporal substitution parameter (EIS). Our model also obtains a maximum allowable Sharpe ratio that exceeds historical observation which addresses the well-known equity premium puzzle of Mehra and Prescott (1985). We show that earnings growth and liquidity growth are related to consumption growth, and display ability to forecast consumption. We also note that when these variables are used to form a vector autoregressive system, one obtains significant coefficients on the market, earnings growth, and liquidity growth. The literature on liquidity in asset pricing has grown extensive and our contribution extends the EZW framework to incorporate liquidity risk in a working consumption model.

1.1 A consumption, earnings, liquidity, market, based model

Consumption asset pricing models in which return premiums are time varying or contingent have had some success in utilizing the relatively smooth consumption series; however, there are recent challenges to these models. Muir (2017) finds that high international asset price volatility during financial crisis not accompanied by high consumption volatility creates a problem for most asset pricing models of these types. His evidence is consistent with financial intermediation models, or liquidity models. Putting liquidity into the SDF helps us address goal ten, consumption related to risk factors, in our list.Footnote 5 Also, Roussanov (2014) is skeptical of conditional value premium models as value stocks' conditional expected returns do not increase more than those for growth stocks during bad economic states as conditional models predict. He argues in favor of augmenting consumption-based models with an aggregate wealth growth factor, which we do here.

In Sect. 2 of this paper, we build an EZW model with wealth portfolio returns that depend on the market return and the growth in both earnings and liquidity. Changes in investor wealth from the market return alone need augmentation by investors who are concerned with hedging their illiquid earnings. Hence, changes in these variables define our wealth portfolio returns and enter our SDF to serve as agent’s forward-looking wealth proxy.

Liu et al. (2016) model liquidity with an EZW model. However, in their return and wealth equations [(A-2) and (A-3) on pp. 139–140] and in their model conceptualization they subtract liquidity as a cost. Consistent to Levin’s (1991) liquidity externality, in the context of modeling liquidity as a component in an SDF, liquidity is a ‘risk premium to be added,’ which we do here, not a ‘cost to be subtracted’ as per their argument. The fairly large liquidity premiums in our consumption model are consistent to a liquidity externality as opposed to only a cost and are corroborated by the large stock level liquidity premium shown in Sect. 3.

Our findings do not definitively distinguish between a behavioral or rational view of asset prices. Changing volume could merely measure changes in sentiment (Baker and Wurgler (2006) use turnover as a sentiment indicator in a cross-sectional stock study), or be part state variable, part irrational behavior. The theoretical models herein cited relate volume and/or liquidity to asset prices. By featuring liquidity prominently, our work here is consistent with the financial intermediation view, where the finance sector is especially important. Large liquidity factor premiums have puzzled researchers who assume rational actors setting prices, but large liquidity premiums that vary through time are also consistent with market’s condition being an important risk to investors and we demonstrate this empirically at the aggregate macro level.

2 Liquidity adjusted consumption model and puzzles

2.1 Forward looking CELM

In this section we build our recursive, or forward looking, consumption, earnings, liquidity, and market–CELM–based model by defining the SDF under our assumed utility preferences. This ‘macro’ aggregate time series model will then be used, with different parameters, to quantify important asset pricing parameters and to address asset pricing puzzles stated in our goals. The empirical data is described in Sect. 2.4, with the resulting parameter estimates shown in 2.5.

The assumption of a stochastic discount factor (SDF), M, allows one to compute expected future returns through the following pricing equation:

with \(r_{i,t + 1} ,\,\) being the securities’ return in-excess of the risk-free rate \(R_{f}\). We follow EZW, in which we have the consumption process at time t, and the recursive utility function:

where U is utility, C is consumption, β is the investor’s subjective time discount factor, 1−α is the coefficient of relative risk aversion and \(\frac{1}{1 - \rho }\) is the elasticity of intertemporal substitution. An attractive feature of the EZW framework is the separation of risk aversion and the elasticity of intertemporal substitution. In this model utility is contingent on long-run future consumption growth which is related to the return on wealth. A proxy for the agent’s wealth W is defined by:

with \(R_{w,t + 1}\) defined as the return on all invested wealth. Epstein and Zin (1989) use the market return for the return on wealth. We also incorporate earnings and liquidity’s influence on investor’s total return on wealth. We proxy the liquidity of the market by a turnover variable TOt, which denotes the sum of the daily ratios of dollar volume to market capitalization, over year t. This measure allows us to capture the ‘state’ or level of aggregate liquidity and introduces an empirical variable to dynamically measure liquidity by considering the percentage growth of the underlying turnover series. We denote the earnings accruing to the market index over year t by Et and measure the annual percentage growth in Et. Our premise is investors’ own earnings risk motivates an interest in company earnings. But investors may be concerned about dividend flows’ relation to their income, therefore we also show results from replacing changing earnings with changing dividends.

These three terms; market return, liquidity growth, and earnings growth, all contribute to an investor’s return on wealth. The price of a security includes the earnings or expected earnings of a company and the level of liquidity in the financial instrument. We start with an equal weighted average of these three measures to compute the return on wealth. This naïve ex ante weighting is compared with other weightings in Sect. 2.5 and tested at the security level in Sect. 3. For the CELM model we define a proxy for the return on wealth process, which we denote by ETOM, as:

where RM denotes the return series of the market portfolio. The influence of changing liquidity on asset prices and the macroeconomy has an early macro theory literature including Keynes (1937) and Tobin (1958). ‘Rational view’ theorists have proposed a money value for stocks, e.g., Cochrane (2002). Other authors tie bank health to the economy, Shleifer and Vishny (2010), or model intermediary and credit theories, which can be viewed as institution’s input for their production of liquidity. ‘Behavioral view’ theorists make exuberance arguments including Shiller (2015), or the ‘animal spirits’ of Keynes (2018, 1936), Farmer and Guo (1994) and others. Edmans et al. (2015) model firm’s value as partly endogenous to trading. Our goal here is not to differentiate between these views but to build a working consumption model that solves asset pricing puzzles. In order to succeed at this task, using the market return alone as a proxy for the return on wealth as per Epstein and Zin (1989) does not suffice. Nor will using earnings or a turnover variable alone. As we demonstrate, two or three of these terms are simultaneously needed as it is how their covariance behaves that empirically aids in solving various puzzles and in pricing securities. This covariance is consistent with the theoretical research cited earlier.

Utilizing this proxy for the return on wealth as well as the utility assumption of Eq. (2) one may show, following Mehra (2012), and Epstein and Zin (1991), that the pricing kernel is given by:

with \(\Delta c_{t + 1} : = \ln \left( {\frac{{C_{t + 1} }}{{C_{t} }}} \right).\) This SDF also includes the consumption CAPM by letting α equal ρ, as well as the case of an SDF which only depends on ETOM, when one lets α equal zero. This latter case also corresponds to the CAPM in the EZW SDF when considering log returns. Armed with this explicit stochastic discount factor representation we are then able to address difficult asset pricing puzzles. The equity premium puzzle of Mehra and Prescott (1985) relates the excess return of stocks relative to the risk-free rate and the notion that the coefficient of relative risk aversion must be very large in magnitude to justify such out-performance by equities; so large in fact in the power utility case that the utilization of consumption pricing generally fails. Our wealth proxy rectifies this by allowing for a much more reasonable risk aversion parameter, we find an RRA with a value close to one. This is an order of magnitude improvement over most estimates implied by the power utility model, Cochrane (2001, 2005). We show the values of the parameters we calculate in Sect. 2.5, Table 1.

A second important implication of our model is the related puzzle that many expressions for obtaining a reasonable upper bound for the ex-post Sharpe ratio approximation require a very large risk aversion parameter. Typically, this is seen to be a problem for the consumption process, as it is not volatile enough to allow for a larger upper bound without making the RRA parameter extremely large. By using ETOM in the SDF, our approximation for the upper bound on the Sharpe ratio depends not only on the variance of the consumption process but also on the variance of ETOM and the covariance between the consumption process and ETOM.

2.2 The risk-free rate

Using the CELM framework can also potentially solve the risk-free rate puzzle of Weil (1989). The risk-free rate puzzle revolves around the idea of needing a very large risk-free rate in-order to justify a reasonable value of the risk-aversion coefficient. We show in Appendix 4 that the following expression for the risk-free rate holds:

This implies that:

This allows us to approximate the risk-free rate by estimating the pair (α, ρ).Since alpha need not equal rho, the fourth term on the right-hand side includes the variance of ETOM in the calculation, and thus allows for an adjustment in the level of the risk-free rate not only based on the current state of the markets’ levels but also based on the current state of the market’s earnings and liquidity.

2.3 The equity premium

Assuming a standard power utility function of consumption, an upper bound on the expected equity risk premium is given by the product of the risk aversion coefficient, the standard deviation of the consumption growth process, and the standard deviation of the excess return series. Using 3 for risk aversion, and respective historical values of 5% and 20%, bounds the equity risk premium at approximately 3 · 5% · 20% = 3%. However, empirically equities have returned closer to 7% per annum over the risk-free rate. Our model raises this upper bound to a more reasonable level by incorporating ETOM. In Eq. (24), of Appendix 1, we can express the equity risk-premium via the following closed form solution:

We display this relationship graphically in Fig. 2. We can solve for the risk-aversion coefficient in Eq. (8) in order to obtain the following expression for the RRA (see Appendix 1) for a given expected excess return as:

Equity risk premium. We display the equity risk premium (ERP) forecast for differing values of the relative risk aversion (RRA) coefficient and the elasticity of intertemporal substitution (EIS). The surface reperesents the ERP as a funtion of the RRA parameter and the EIS. For each pair of EIS (x-axis) and RRA coefficient (y-axis) we can approximate an expected future excess return (z-axis). To match the historical ERP, we use EIS of 1.122 and an RRA of 1.176. this is denoted by the red dot lying on the expected return surface. Under thbese reasonable parameters the historical ERP matches the estimate from out model at 6.71% per annum

Many expressions for obtaining a reasonable upper bound for the Sharpe ratio approximation require a very large risk aversion parameter. Typically, this is seen to be a problem for the consumption process, as it is not volatile enough to allow for a larger upper bound without making the risk aversion parameter extremely large. This again is rectified by using ETOM in the SDF. Our approximation for the upper bound on the Sharpe ratio is given by (see Appendix 3):

Importantly, (10) depends not only on the variance of the consumption process but also on the variance of ETOM and on the covariance between the consumption process and ETOM. This expression, using historical index data, allows one to approximate the upper bound on the Sharpe ratio with a much more reasonable level, relative to historical stock returns, of close to 0.48. Compared to a power utility model of consumption this is a tremendous improvement over the estimate [given on p. 946] in Cochrane (2017). Cochrane (2017) points out that the consumption growth standard deviation is 2% and pairing that with a risk-aversion coefficient of three implies a 0.06 Sharpe ratio, much too low of an upper bound to match historical data.

2.4 Consumption model data

CELM is a forward-looking total wealth model where representative consumption is not time separable, hence corresponding consumption data includes non-durables. Consumption cyclicality and earlier time data availability motivate our use of annual total consumption and annual asset data. Ferson and Harvey (1992) provide a good overview of consumption seasonality issues and Parker and Julliard (2005) show multi-quarter consumption measurement provides better model fits. The specific consumption series for Ct we use is A794RC0A052NBEA, Personal consumption expenditures per capita, Dollars, Annual, Not Seasonally Adjusted as reported by FRED Economic Data Service from the Federal Reserve Bank of St. Louis (using their updated July 27, 2018 data series). Prior to 1930 we use Shiller consumption data and calculate nominal growth. S&P 500 data for the earnings and dividends series: Et, Dt, and the 1-year Rf, are all from Robert Shiller’s annual data link “data long term stock, bond, interest rate and consumption data”.Footnote 6 Market returns, RM, are via calculation from Shiller’s price and dividend data. For TO, turnover data is from the Center For Research in Security Prices, Graduate School of Business, University of Chicago via WRDS (Wharton Research Data Services) and we calculate annual dollar volume and annual dollar turnover as the sum over daily: $Volumet / Market Capt.Footnote 7 For turnover data prior to 1926 we used NYSE Factbook data for which share volume turnover was available.Footnote 8 The correlation of share with dollar turnover from our overlapping data 1926-2003 is 0.99. NYSE was closed for much of 1914 when other international exchanges closed. There were very large consecutive declines in earnings and turnover during WWI and WWII but very large increases in consumption (high wartime production) and we do not make adjustments for this in our study. We use total consolidated volume which means trading volume on all exchanges, but with volume restricted to NYSE-listed ordinary common stocks which excludes closed-end funds, ETFs, REITs, and ADRs. For the market return we use the total return of the NYSE.

2.5 Parameter values and puzzles

We now bring the data to the model. Using Eqs. (7), (9), and (10) we can calculate the parameters implied by the EZW model and the CELM model for a fixed risk-free rate by using the following approach. We use historical sample moments for index returns, the return on wealth, and consumption growth in Eq. (9) which allows us to solve for α as a function of ρ and the risk-free rate so that \(\alpha = G\left( {\rho ,R_{f} } \right).\) We can then use Eq. (7) and again substitute the historical sample moment estimates along with our approximation of α to construct a function H such that following relationship holds: \(R_{f} = H\left( {\alpha ,\rho } \right) = H\left( {G\left( {\rho ,R_{f} } \right),\rho } \right).\) We may then solve this equation, via inverting this function composition, for the parameter ρ0 and then use that particular ρ0 to obtain an α0 by inverting \(\alpha = G\left( {\rho ,R_{f} } \right).\) The parameters (α0, ρ0) then allow us to estimate both the RRA and the EIS for a given model. We also substitute the pair (α0, ρ0) along with the return on wealth, and consumption growth into Eq. (10) in order to approximate the upper bound of the Sharpe ratio for a given model. We display these empirical estimates in Panel A of Table 1, by setting as the risk-free rate to the historical sample mean of the 1-year rate of 4.35% during the sample years 1901–2018. We list the return on wealth model form in the second column, following its corresponding letter label in the first column. We also display the sample mean and sample standard deviation of the corresponding return on wealth approximations in columns three and four. We list the EIS parameter, RRA coefficient, and the upper-bound on the Sharpe ratio in columns five, six, and seven respectively. The solution to the function inversion described above is given by the roots of a quadratic function of ρ. We show this computation explicitly in Appendix 5. There are two solutions to this equation. However, upon restricting each model to have a positive EIS we have a unique solution.

We also show several models repeated in Panel B that span 1950–2018.Footnote 9 As shown in Table 2 and as can be seen in Fig. 1, the standard deviation of consumption fell after WWII to 0.025, about half its 0.060 level for the entire span of 118 years and is 1/3 of its level of 0.088 from 1901–1949. Although long time series are attractive for sampling and parameter estimation, investor behavior may be categorically different in the modern period. Asset pricing literature often uses post-war data. A possible critique of this study is we simply add the highly volatile early consumption period to obtain a working consumption model. As we will show, this is not the case.

Table 1, Panel A presents results for the different models which are labeled A–N. The models in bold are models that do not fall outside the bounds of permissible constraints for our various parameters; they ‘solve’ puzzles 1–6 and 8 listed in the introduction. The first four models are single variable models that include as the annual return on wealth proxy growth rates from either;

A: the total return of the market, with variable labeled RM,

B: earnings growth, labeled Eg,

C: turnover, labeled TOg, and.

D: dividends growth, labeled Dg.

The models E–I have two variables and represent an equally weighted average of growth rates to form the proxy for the return on wealth. The models J–N have different weights w, assigned to each of the three variables used for that particular return on wealth. One version includes the growth of dividends, the other the growth of earnings. The final version N, replaces the market return, RM in Eq. (4), with the ratio of earnings to price. The mean return for the four single variable models (column heading x̅) are shown and the single variable returns for A: the market has an average return of 11% (subtracting the 1-year risk-free rate of 4.35% gives a 6.71% premium, and a standard deviation of returns of 19%). The annual growth rates for the other variables are smaller; Eg is 10%, TOg is 4% and Dg is 5%, but Eg and TOg have materially higher volatility. Dg volatility is low, indicative of firms’ smooth payout policies.

While the model investors use for the return on wealth may ultimately be unknowable, and while theory arguments so cited use the market, earnings, and liquidity, we do not know the relative weights investors may assign to these components. Our default is an equal weighting to each, it is the base case of the two variable models E–I, and the three variable models J, L and N. Epstein and Zin (1989) use equity returns as a return on wealth proxy and RM has a higher mean return than Eg, TOg, or Dg. We find that in the two variable models RM is always needed for a model to not be rejected. Hence, we also consider three variable model candidates where RM receives a higher weight, models K and M. In K and M the market receives a weight of 0.5 and the other variables are both weighted 0.25. In Panel A, all of the models have the same assumed level for β, investor’s subjective time discount factor used in Eq. (5), which is 1/(1 + Rf), with Rf = 4.35% gives β = 0.9583. In Panel B with data starting 1950, with Rf = 5.02% the calculated β used for all models is 0.9522.

For the first ‘Return Model’ labeled by ‘A’ we show the standard EZW model that uses the market return as the return on wealth proxy and is labeled (1 + RM). We find an EIS value of 1.580 and an RRA of 1.346 when we fix the Rf at 4.35% (the historical mean rate for our time period 1901–2018). We do not show a column with the Rf rate values as in all the Return Models we use a Rf rate equal to the historical average, i.e., all are equal to 4.35% in Panel A, and 5.02% in Panel B. We also find for Return Model A that the UB Sharpe is 0.346 which exceeds the value implied by historical observation; that is, in this parameter the model fails. While the addition of the market return to a pricing kernel consisting of consumption growth alone, allows for more volatility of stock prices and provides some resolution to the equity premium puzzle of Mehra and Prescott (1985) it does not reconcile the fact that the model violates the upper bound of the Sharpe ratio (UBS) test, also viewed as a violation of the Hansen-Jagannathan (1991) bound. Indeed, as Weil (1989) immediately noted with respect to the EZW model, we simply transfer the equity premium puzzle to a risk-free rate puzzle. We see that more is needed in the pricing kernel than the market alone to overcome this.

Indicated in italics in Table 1 are parameters that we disallow. The EIS and the RRA must have reasonable values. Mehra and Prescott’s (1985) influential paper argued for risk aversion “to be a maximum of ten” [p. 154]. In the results we show in Table 1, the RRA for some models is negative, which we assume to be outside the bounds of reasonable parameters. The RRA is larger than 10 for a few models and less than 0 in some others; we assume model failure for such values. Regarding EIS, Bansal and Yaron’s (2004) influential EZW consumption model has an EIS of 1.5 (and a risk aversion of 10). Cochrane ([2017] pp. 955–959) gives a review of the problems of this class of EZW models. They rely on a long-run risk to forward consumption that is hard to square with investor activity during actual crisis. Investors seem relatively nervous about the short-term. Barro (2009) points out difficulties of an EIS below 1, and Epstein et al. (2014) map difficulties of too low or high an EIS in such models. Regarding an EIS of 1.5 they comment: “Would you give up 25 or 30 percent of your lifetime consumption in order to have all risk resolved next month? Keep in mind that it is risk about consumption that is at issue rather than risk about income or security returns. Thus, early resolution does not have any apparent instrumental value” [p. 2686]. In Table 1 we reject models with an EIS lower than 0.5 or greater than 1.5. A low EIS is also always accompanied by negative RRA, causing double rejections. Note one useful contribution of this study is we show the EZW model with the market as a return on wealth proxy, fails both for too high an EIS and too low an upper bound on the Sharpe ratio, with data starting either 1901 or 1950.

The compelling results, shown in bold, of Table 1 are obtained via a combination of the market return with earnings growth and/or liquidity growth. As mentioned, all the single variable models A–D are rejected. Of the two variable models E and F with RM and Eg or TOg, are not rejected. The model RM with Dg fails. Also, the two variable combinations without the RM term fail. In our three variable candidates, J, L, M, and N are not rejected. The proximity of EIS to unity of E, F, L, and N make them interesting models. These models also have pleasing economic interpretation, investors are concerned about the market, but also concerned about the covariance of changing earnings and liquidity. Individuals care about covariance of wealth with their own earnings risk, but institutional investors care about earnings and liquidity risk as well. “But the primary concern of an endowments or foundation CIO is having adequate liquidity to meet operating expenses” [interview with endowment and foundation consultant Chen, by Williamsen (2020)]. Investors have always rationally seen through firms’ dividend policy, and care more about the ultimate ability of firms’ ability to make distributions via earnings. In addition to the 1/4 weights used for TOg in model L and M, we tried weights of 1/8 each for Eg and TOg, and 1/8 for TOg and 1/4 for Eg, but do not show as these models’ EIS value are above our upper bound of 1.5. With respect of the models labeled N, which replaces RM with E/P, neither of these are rejected in Panels A or B. Indeed, their performance is quite good. The level of earnings scaled by prices has the economic interpretation of investors concerned about the levels of earnings risk as well as changes in earnings. These attractive results for a consumption model are better than any competitor models that we are aware of.

So far, we have addressed goals 1–8 except for discussion on goal 4, consumption growth with reasonable mean, volatility, and some predictability. All the models A–N use the historical consumption series, i.e., its mean and volatility are not transformed in our models. Table 2 gives descriptive statistics used previously in Sect. 2.5, and in the next sections where we address their relation and predictability of consumption. Regarding goal 7, the model’s tie to the cross-section, the Fama and French (2015) model has five factors, one is the market and two are related to earnings. Snigaroff and Wroblewski (2021) provide a cross-sectional model that uses five factors even more closely related as discussed in Sect. 3. Their factors consist of the market, earnings to price, earnings growth to price, liquidity, and liquidity growth. Their work is interesting in that their liquidity growth (which is related to our turnover growth)Footnote 10 is instrumental in helping the model subsume well-known momentum factors.

2.6 Economic stress

Goal 10 requires consumption growth that relates to risk factor stress. While this could be subsumed in the combination of goals in obtaining a consumption model with working RRA, EIS, and other parameters–we add this intuitive requirement. When risk factors have crashes, they should negatively impact consumption, e.g., Allen et al. (2012). We test the hypothesis that the mean of consumption growth outside of economic stress periods for the market, earnings, or liquidity is equal to the mean of consumption growth conditional on RM, Eg, or TOg having their worst 5th, 10th, and 20th percentile outcomes. In Table 3 we use familiar percentage changes and display the results of these tests. In the 1901–2018 period RM has its lowest 5th percentile return average of –0.293, and the corresponding percentage consumption growth, defined as %C = [(Ct+1–Ct)/ Ct], for the next period averages –0.069. This consumption level is well below average, the associated p-value for a one-tailed test that this particular %C is lower than average is 0.016, i.e., we can reject the null that this %C is equal to mean consumption growth at 5 percent significance. If a ‘true crash’ is defined as the 5th percentile worst outcome, all of the three state variable candidates’ 5th percentile bins have consumption levels means such that we can reject the null that they are equal to the %C mean for non-crash years for the period of 1901–2018. This provides evidence that the three variables proxy for states that influence consumption. We cannot always reject the null of equal means for the 10th and 20th percentile crashes. In the 1950–2018 period RM does poorly. All the percentile bins for RM have corresponding next period consumption levels fairly similar to mean consumption growth outside the crash years and consequently high p-values. But Eg, and especially TOg, have lower p-values. Note that TOg has low p-values with higher %C means than those for Eg; this is helped by its low variance during its crash periods. In this sense Eg and TOg provide stronger candidates for a macro-relation between consumption growth and proxy state variables, than the market.

This is encouraging as Muir (2017) finds that financial crisis are special… “the facts instead appear more consistent with the idea that risk premia are correlated with credit conditions and the health of the financial sector” [p. 767]. Our model proposes the additional state variable TOg as a proxy for changing liquidity, consistent with financial intermediation models that, by definition, have problems in financial crisis. Changing liquidity is proxied by the change in turnover and when there are turnover crashes, consumption does fall, consistent to Muir (2017).Footnote 11 However, large negative TOg is a simple definition of financial crisis, and financial crisis are not easy to disentangle from other macro events.

2.7 Forecast consumption

We forecast year t consumption growth: Cg, with t-1 single variable regressors Cg, RM, Eg, TOg, Dg, E/P and show results in Panel A of Table 4. These variables are the natural logs of one plus their rates of growth and span the years 1901–2018. The effect of wealth on consumption has a large and complex literature. Case et al. (2005) and Bostic et al. (2009) investigate the relative size of housing (large) and financial wealth (smaller) on consumption. Steindel and Ludvigson (1999) find the response of consumption to changes in wealth are largely contemporaneous, while Poterba and Samwick (1995) disentangle responses to consumption from stock changes (for less than a year) and while they find a relation, they attribute it to the stock rise as a leading indicator of economic activity. Poterba (2000) surveys the ‘stock market wealth and consumption’ literature and points out various difficulties. As we forecast consumption changes from past year changes in the market, earnings, and liquidity; if these are part of investors’ wealth, much of the relationship may be contemporaneous, or be apparent at periods of longer than 1 year. Recognizing that consumption and our wealth proxy are jointly determined as we have shown in Sect. 2.5, and that our data is annual, notwithstanding, the below evidence indicates that our variables forecast lagged 1-year consumption.

Previous Cg is known to forecast consumption, here its t-stat is 5.23, with much higher R2 than with the other variables. However: RM, Eg, and TOg all have significant coefficient t-stats and a similar magnitude R2, while dividends, Dg, is not significant and has a low R2. The composite variables E/P and ETOM have highly significant slope t-stats. As before, because of lower Cg volatility and a potential different regime for the post war period we show the same OLS regressions for the period of 1950–2018. Except for Cg itself, most of slope coefficients t-stats fall, with TOg no longer significant and Dg of even lower significance; the latter consistent with dividends becoming less important in the post war period. These results are the part of goal 4 for obtaining “some predictability” of consumption.

We also ran one lag vector autoregressions for a dynamic analysis. In the interest of space, we do not show results. We are more interested in the forecast of consumption, which we can see in this case with the OLS regressions. All variables pass 1 percent significance levels with augmented Dicky Fuller tests for unit roots (indicating they are stationary) except E/P, which passes at 5 percent. In the VAR, when the included regressors are Cg, RM, Eg, and TOg with data from 1901 to 2018 the model shows Cg is affected by its own lagged change. With data after 1950, in addition to that same result, the model also shows Eg is significantly affected by lagged Cg, RM and TOg. In a VAR with data 1950–2018 when the regressors are Cg, Eg, TOg, and E/P (which replaces the market return, RM) the Cg equation has significant coefficients on lagged Cg, E/P, Eg and TOg, with further significant relationships between other variables as well. When data is restricted to 1950–2018 in the Cg equation lagged Cg and Eg are significant, and E/P’s relationship with prior E/P is highly significant, and Eg is significantly influenced by TOg. Note that all of these variables, except E/P, are differences, and the appropriateness of a VAR or VEC specification is contingent on such issues as whether investors are influenced by levels or changes. If investors make consumption decisions based on aggregate earnings, a changes-in-earnings variable may shear a more complex relationship. Our implicit assumption is investors are primarily concerned about changes, not the levels of economy wide share turnover, volume, or earnings.

Panel C of Table 4 shows multivariate regressions with these same regressors, with Cg as dependent, with data starting either 1901 or 1950. Panel C now shows the Adjusted R2 as a penalty for the additional regressors. We show multivariate forecasts with either RM or E/P, and the coefficient on Eg is significant in all but one forecast model, while the coefficient on TOg is significant in two of the four forecast models. This section indicates that in general, not only is the market an important forecasting variable for next period consumption, but so are the variables we use in our consumption model: Eg, TOg, and in an alternative version, E/P.

3 Stock level factor evidence

3.1 Stock characteristic definitions and factor construction

A potential critique of the CELM model concerns the ad-hoc nature of Eg, an earnings growth proxy, and TOg, a liquidity growth proxy. While these measures are imminently reasonable to the authors, other researchers could well have chosen other measures. To address this, this last section of our paper studies related stock level variables in the context of a cross-sectional factor model. The CELM model includes the growth of wealth which is modeled from the combination of the market, earnings growth, and liquidity growth. If that description represents a reasonable proxy for wealth, then similar variables, when used to construct cross-sectional factors, should produce highly significant, factors, and in combination, a factor model with small comparative pricing error.

The data used in this section is from Compustat’s Research Insight interface. The sample period covers the 604 months from February 1968 through May 2018. We use stocks listed on the NYSE, NASDAQ, or the AMEX exchanges as portfolio constituents. However, for universe breakpoints we use only the NYSE stocks. Sorting first on NYSE is standard in cross-sectional literature as this allows the factors to not be unduly influenced by difficult to trade, very small stocks.

At the stock level we construct variables for the Market, Earnings-to-Price, Liquidity, Earnings-Growth-to-Price, and Liquidity Growth. These we label by MKT, E/P, LIQ, EG/P, and LIQG. The latter two growth variables play the role of Eg, and TOg in the CELM model. In the CELM model we considered changes in turnover but noted that changes in aggregate volume work interchangeably (see footnote 4). Both the cross-sectional factor model and the CELM model have a market return component, however, we also add an E/P and LIQ component to the stock level model. Also, the SDF of Eq. (5) uses the rate of change in consumption, and rates of change in the wealth variables which ties better economically than that of levels.

For the earnings in the E/P variable we use the trailing 12-month diluted earnings per share that includes extraordinary items (Compustat data item EPSX12). We use a standard 6-month lag. We include positive and negative earnings firms. Price is also lagged by 6-months in E/P. EG/P is calculated as the 1-year earnings per share at t–6 minus the 1-year earnings per share at t–18; this difference is divided by the price at t. LIQ is calculated for month t by multiplying the number of shares traded in the month ending at time t by end of month t share price. These do not need lags to avoid look-ahead bias. LIQG, our liquidity growth variable, is calculated for each month t as the trailing 1-year percentage change in dollar volume, LIQGt = ($Volumet–$Volumet-12) / $Volumet-12 when the cumulative return from time t-12 to time t-1 (11 months), for a stock is greater than or equal to zero or as LIQGt: = –1 × | ($Volumet–$Volumet-12) / $Volumet-12) | if the return from time t-12 to time t-1 is less than zero. It is well known by investment practitioners and by researchers (e.g., Blume, Easley and O’Hara (1994)) that large price changes either up or down, are associated with large volume. The multiplication by –1 distinguishes volume associated with good news from volume associated with bad news. We ‘linearize’ the v-shaped relationship between volume growth and returns. For LIQG, we also winsorize the cross-sectional dollar volume at 1%.

Equipped with the relevant stocks' characteristic definitions we then form the factor returns similarly to that of Fama and French (2015), although as noted previously we include the negative earnings firms, we weight all portfolios on dollar volume, and we rebalance monthly instead of annually. Stocks are sorted each month on LIQ combined with either E/P, EG/P, or LIQG. Each month all NYSE stocks on Compustat are ranked on LIQ. The median NYSE LIQ is used to divide the full universe of NYSE, AMEX, and NASDAQ stocks into illiquid and liquid. We also divide the full universe of stocks into either of three groups based on NYSE breakpoints. The bottom 30% are ‘Low,’ the middle 40% are ‘Neutral,’ and the top 30% are ‘High’ for either E/P, EG/P, or LIQG. These portfolios are formed each month and their returns are calculated as averages and labeled using the subscript R. As an example, the portfolio return E/PR (high earnings to price minus low earnings to price) is the risk factor return related to E/P and is the difference, each month, between the average returns for the two high E/P portfolios (illiquid-high E/P and liquid-high E/P) and the average return for the two low E/P portfolios (illiquid-low E/P and liquid-low E/P). E/PR is a time series of a difference of average returns on high and low E/P portfolios with similar average liquidity. The other factors EG/PR and LIQGR. are calculated similarly. This is a common 2 × 3 sort design made well known by Fama and French’s body of research. Note that each of these three variables has its own corresponding LIQ factor, since there are different intersections involved with illiquid and liquid for each of the other variables. The LIQR factor we use is the average of these three; this follows Fama and French’s (2015) averaging to obtain their SMB factor. We also form 25 test portfolios along these same dimensions using quintiles and as such, we have three sets of 25 test portfolios sorted on LIQ along with E/P, EG/P and LIQG. We also define the market factor return as MKTR, the dollar volume weighted monthly in excess of the monthly treasury bill return. There is no reason to restrict individual stock’s weighting to be capitalization based. Indeed, in addition to being a component to the SDF, liquidity weighting is motivated by investors’ ability to establish and trade positions in their portfolios. We also constructed market cap versions of our factor model (not shown) and the market cap versus liquidity weighting are not the primary driver of our results. The five-factor model description is then given by:

3.2 Factor model statistics

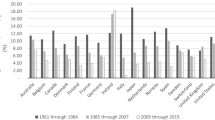

The historical factor premiums are shown in Table 5, Panel A. There are several things to note in Panel A. First, the t-stats for all of the factors are significant at the 95% level. Second, the non-market factor’s monthly arithmetic mean return ranges from 0.26 to 0.58, as compared to the market premium of 0.55. These are higher than for Fama and French’s (2015) non-market factor means which range from 0.25 to 0.33 as shown on Table 4; [p. 7, Panel A refers to the 2 × 3 sorts over a generally similar time period] and are a lower 0.18–0.33 for the time periods that exactly overlap this study.Footnote 12 An important point we seek to make here is the relative magnitude of the factors is roughly consistent with the consumption model of Sect. 2 shown in Table 1. There, RM, the market return variable was most prominent. Weights for RM ranged from 1/3 to 1/2 for models that were not rejected. The range for Eg and TOg for non-rejected models each were 1/4 to 1/2. The EG/PR and especially the LIQGR factor premium have quite large magnitudes. We do not think it unwarranted to give TOg a material weighting, more than only a trading cost weight of say, 1/8, in Table 1. This stock level factor’s magnitude is consistent to a liquidity externality, as also found in the consumption model results. The level factors of E/PR and LIQR do not have corresponding level consumption variables. Our earnings and liquidity growth variables have large economic magnitude and are significant at the 95% level. They are consistent to the variables and results of Table 1. Liquidity appears to be an important concern of investors as empirically demonstrated in both the consumption and the factor models.

The last question in this section we address is ‘how well do these factors combine to form an asset pricing model?’ A common measure of these kinds of factor models is the GRS test, so named from Gibbons et al. (1989). The GRS statistic tests the null hypothesis that all the intercepts of N time series regressions are simultaneously zero: H0: ai = 0; i = 1,2,3, …, N. We form N = 25 test portfolios by sorting the universe of stocks on LIQ with one of either E/P, EG/P, or LIQG. Table 5, Panel B, column two shows the GRS statistics for the five-factor model in (11) when each of the three sets of 25 test portfolios are considered. Column three shows the corresponding GRS p-value. A low GRS statistic and a high p-value are preferred. Usually, in these kinds of factor model designs, GRS statistics cause easy rejection for proposed factor models. In our model, this is the case with two of the sorts. However, when the test portfolios are sorted by LIQ and E/P the GRS p-value is 0.024; the model’s test statistic does not cause model rejection at the 99% level. Under the other two sorting methods the p-value rounds to 0.000 and the model is rejected.

The absolute value of the average of the intercepts and R2’s for the regressions of the test portfolios onto the five-factor model are shown in columns four and five of Panel B. These GRS statistics and p-values compare quite well to Fama and French (2015) and other models of this type.

The relation of E/PR and LIQR factors to HML and SMB of Fama and French (1993, 2015) is discussed in Snigaroff and Wroblewski (2018, 2021).Footnote 13 The main point here is the model in (11) has very competitive factor premiums and GRS-statistics in relation to other leading factor models. This gives stock level evidence that the variables used in the consumption model are risks investors price. The results in Table 5 indicate a five-factor model that not only uses factors related to our aggregate variables but also performs quite well as compared to the state-of-the-art stock level models. This corroborates our consumption model variables and helps us meet our seventh listed goal.

4 Conclusion

We build a working consumption model that ‘solves’ asset pricing puzzles. We have accomplished this with simple, robust, well-known variables that investors have cared about for over 100 years. In our CELM model the variable ETOM is a very simple measure of wealth that allows for a well fitted consumption model. A working consumption asset pricing model is a top agenda item for asset pricing theory. Our empirical model is motivated by investors who consider as part of their wealth, changes in the market price of their assets, but also earnings and liquidity changes. Earnings are important to investors because whether they are individuals, pension funds, or endowments, they have a special interest in managing the covariance of their investments’ earnings to their own earnings streams. Liquidity can be important as investors’ ability to readily buy or sell wealth is contingent on market’s condition, as in Lo and Wang (2006), the liquidity externality of Levine (1991), or for other reasons. Liquidity may become particularly scarce just when investors most need it, hence its premium.

A consumption model that includes the market, with changes in earnings and liquidity, meets well-known consumption parameter restrictions. The CELM model is highly intuitive and much simpler than most other consumption models, e.g., Bansal and Yaron (2004). When our proxy variables ‘crash’ subsequent consumption is lower–more so than when the market itself crashes. Our variables forecast consumption. We provide evidence that earnings and liquidity are important. Although a working consumption model can be obtained in our framework with the market along with either one of our variables, using both earnings and liquidity is consistent to human capital and intermediation theory. Also, it is when using both earnings and liquidity along with the market that these variables together tie well to a five-factor security level time series model. The factor model demonstrated here has the market, earnings-to-price, earnings-growth-to-price, liquidity, and liquidity growth. The consumption models here combine either the market or E/P with earnings growth and liquidity growth. We tie the consumption asset pricing framework to a stock-level factor model—with both showing significant importance to the market, earnings, and liquidity. This stock level evidence, and non-rejection under important model parameters, gives credence to our consumption model.

Notes

Such externalities may not necessarily benefit individual firms. Fang, Tian, and Tice (2014), for example, find increased firm liquidity leads lower individual firm patent activity.

For this example, they cite a speech by Robert Merton.

While changes in aggregate volume work interchangeably in our model, in the interest of space we do not show these results. In our preliminary work with international data turnover is more available than aggregate volume, hence our use of turnover here.

Exhibit 1 hints at larger declines in asset prices relative to consumption especially recently. This is studied in Sect. 2.6.

Available at: http://www.econ.yale.edu/~shiller/data.htm. Some data points in later years are not updated, but are obtainable with care to match, in his “U.S. Stock Markets 1871-Present and CAPE Ratio” link. We updated some later missing risk-free rate information from Bloomberg.

We cross-checked our annual NYSE dollar volume calculation results with a well-known micro-market researcher’s independent calculation and aggregation.

Which we downloaded for a previous published research paper in 2011. It appears such data is no longer free but is available at: https://www.nyse.com/market-data/historical#volume.

For modeling conservatism, we leave out of our modern period the high consumption volatility periods of 1946 – 1949.

They use dollar volume and its growth for their liquidity proxies. We studied the growth of volume in place of TOg here as well, see footnote 6.

Muir finds market returns are also lower during financial crisis than other market declines. The contemporaneous market declines during TOg crashes are well below their mean.

Data is from the Kenneth R. French data library at: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html#Research.

Snigaroff and Wroblewski (2018) give evidence showing SMB and LIQR are different in the time series, and Snigaroff and Wroblewski (2021) discuss similarities and differences in these factors. Their similarity or difference makes no difference to our work here as (1) if they are different measures of the same underlying risk then we can use either to construct the best working factor model, and (2) we are, at any rate, focused here on the growth factors EG/PR and LIQGR.

References

Acharya VV, Pedersen LH (2005) Asset pricing with liquidity risk. J Financ Econ 77(2):375–410

Allen L, Bali TG, Tang Y (2012) Does systemic risk in the financial sector predict future economic downturns? Rev Financ Studies 25(10):3000–3036

Bai H, Hou K, Kung H, Li EX, Zhang L (2019) The CAPM strikes back? an equilibrium model with disasters. J Financ Econ 131(2):269–298

Baker M, Wurgler J (2006) Investor sentiment and the cross-section of stock returns. J Financ 61(4):1645–1680

Bansal R, Yaron A (2004) Risks for the long run: a potential resolution of asset pricing puzzles. J Financ 59:1481–1509

Barro RJ (2009) Rare disasters, asset prices, and welfare costs. Am Econ Rev 99(1):243–264

Bencivenga VR, Smith BD, Starr RM (1995) Transactions costs, technological choice, and endogenous growth. J Econ Theory 67(1):153–177

Betermier S, Calvet LE, Sodini P (2017) Who are the value and growth investors? J Financ 72(1):5–46

Blume L, Easley D, O’hara M (1994) Market statistics and technical analysis: the role of volume. J Finance 49(1):153–181

Bostic R, Gabriel S, Painter G (2009) Housing wealth, financial wealth, and consumption: new evidence from micro data. Reg Sci Urban Econ 39(1):79–89

Brennan MJ, Chordia T, Subrahmanyam A (1998) Alternative factor specifications, security characteristics, and the cross-section of expected stock returns. J Financ Econ 49(3):345–373

Carhart MM (1997) On persistence in mutual fund performance. J Financ 52(1):57–82

Case KE, Quigley JM, Shiller RJ (2005) Comparing wealth effects: the stock market versus the housing market. Advances in Macroeconomics 5(1):5

Cochrane JH (2002) Stocks as money: convenience yield and the tech-stock bubble. National bureau of Economic Research (No. w8987)

Cochrane JH (2005) Asset pricing revised edition. Princeton University Press

Cochrane JH (2017) Macro-finance. Rev Finance 21(3):945–985

Daley B, Green B (2016) An information-based theory of time-varying liquidity. J Financ 71(2):809–870

Dey MK (2005) Turnover and return in global stock markets. Emerg Mark Rev 6(1):45–67

Edmans A, Goldstein I, Jiang W (2015) Feedback effects, asymmetric trading, and the limits to arbitrage. Am Econ Rev 105(12):3766–3797

Epstein LR, Zin SE (1989) Substitution risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econometrica 57:937

Epstein LG, Zin SE (1991) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: an empirical analysis. J Polit Econ 99(2):263–286

Epstein LG, Farhi E, Strzalecki T (2014) How much would you pay to resolve long-run risk? Am Econ Rev 104(9):2680–2697

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Fang VW, Tian X, Tice S (2014) Does stock liquidity enhance or impede firm innovation? J Financ 69(5):2085–2125

Farmer RE, Guo JT (1994) Real business cycles and the animal spirits hypothesis. J Econ Theory 63(1):42–72

Ferson WE, Harvey CR (1992) Seasonality and consumption-based asset pricing. J Financ 47(2):511–552

Field AJ (1998) The telegraphic transmission of financial asset prices and orders to trade: implications for economic growth, trading volume, and securities market regulation. Res Econ Hist 18:145–184

Gibbons MR, Ross SA, Shanken J (1989) A test of the efficiency of a given portfolio. Econ: J Econ Soc 234:1121–1152

Hansen LP, Jagannathan R (1991) Implications of security market data for models of dynamic economies. J Polit Econ 99(2):225–262

Heaton J, Lucas D (2000) Portfolio choice in the presence of background risk. Econ J 110(460):1–26

Holmström B, Tirole J (1993) Market liquidity and performance monitoring. J Polit Econ 101(4):678–709

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48(1):65–91

Keynes JM (1937) The general theory of employment. Q J Econ 51(2):209–223

Keynes JM (2018) (originally published in 1936) The general theory of employment, interest, and money. Springer

Lagos R, Zhang S (2020) Turnover liquidity and the transmission of monetary policy. Am Econ Rev 110(6):1635–1672

Levine R (1991) Stock markets, growth, and tax policy. J Financ 46(4):1445–1465

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Levine R, Zervos S (1998) Stock markets, banks, and economic growth. American Economic Review

Liu W, Luo D, Zhao H (2016) The epstein-zin model with liquidity extension. Financ Rev 51(1):113–146

Lo AW, Wang J (2006) Trading volume: Implications of an intertemporal capital asset pricing model. J Financ 61(6):2805–2840

Mehra R (2012) Consumption-based asset pricing models. Annu Rev Financ Econ 4(1):385–409

Mehra R, Prescott EC (1985) The equity premium: a puzzle. J Monet Econ 15(2):145–161

Muir T (2017) Financial crises and risk premia. Q J Econ 132(2):765–809

Munk C (2000) Optimal consumption/investment policies with undiversifiable income risk and liquidity constraints. J Econ Dyn Control 24(9):1315–1343

Munk C (2013) Financial asset pricing theory. OUP Oxford

Parker JA, Julliard C (2005) Consumption risk and the cross section of expected returns. J Polit Econ 113(1):185–222

Poterba JM (2000) Stock market wealth and consumption. J Econ Perspect 14(2):99–118

Poterba JM, Samwick AA (1995) Stock ownership patterns, stock market fluctuations, and consumption. Brook Pap Econ Act 1995(2):295–372

Roussanov N (2014) Composition of wealth, conditioning information, and the cross-section of stock returns. J Financ Econ 111(2):352–380

Rouwenhorst KG (1999) Local return factors and turnover in emerging stock markets. J Financ 54(4):1439–1464

Santos T, Veronesi P (2006) Labor income and predictable stock returns. Rev Financ Studies 19(1):1–44

Schwartz ES, Tebaldi C (2006) Illiquid assets and optimal portfolio choice. National Bureau of Economic Research (No. w12633)

Semenov A (2017) Background risk in consumption and the equity risk premium. Rev Quant Financ Acc 48(2):407–439

Shiller RJ (2015) Irrational exuberance: revised and expanded, 3rd edn. Princeton University Press

Shleifer A, Vishny RW (2010) Unstable banking. J Financ Econ 97(3):306–318

Snigaroff RG, Wroblewski D (2018) An earnings, liquidity, and market model. Appl Econ 50(57):6220–6248

Snigaroff RG, Wroblewski D (2021) Earnings and liquidity factors. Q Rev Econ Finance 80:508–523

Steindel C, Ludvigson SC (1999) How important is the stock market effect on consumption? Econo Policy Rev 5(2):85

Sylvain S (2014) Does human capital risk explain the value premium puzzle? Working paper. Available at SSRN 2400593

Tobin J (1958) Liquidity preference as behavior towards risk. Rev Econ Stud 25(2):65–86

Weil P (1989) The equity premium puzzle and the risk-free rate puzzle. J Monet Econ 24(3):401–421

Williamsen C (2020) Consultants helping institutional investors stay on track with their investing agendas. Pensions & Investments, available at: https:// www.pionline.com/consultants/consultants-helping-institutional-investors-stay-track-their-investing-agendas

Author information

Authors and Affiliations

Contributions

Robert Snigaroff works at an investment advisory firm, Denali Advisors. David Wroblewski works at an investment advisory firm, EAM Investors. Neither firm offers factor investment, indexation, or ETF products. Neither firm is expected to profit from publication of this research beyond general prestige.

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Bivariate lognormal distribution facts

Define the following log normally distributed random variables:

This implies that:

And that the variance is given by:

Let a and b be constants then and further assume that the pair \(\left( {\ln (X),\ln (Y)} \right)\) is bivariate normal then we have that: \(a\ln (X) + b\ln (Y)\mathop = \limits^{d} N\left( {a\mu_{X} + b\mu_{Y} ,a^{2} \sigma_{X}^{2} + b^{2} \sigma_{Y}^{2} + 2abCov(\ln (X),\ln (Y))} \right).\) This implies:

Appendix 2: RRA coefficient computation under the recursive utility assumption

Assume we have a SDF M so that:

where P, and X are the price and payoff processes respectively. Then let \((1 + R_{t + 1} ) = \,\,\frac{{X_{t + 1} }}{{P_{t} }},\) denote the return of an asset. From this we may conclude that:

Since it holds for all payoffs, it must also hold for the risk-free rate \(R_{f}\) and thus after subtracting:

That orthogonality implies that:

with \(r_{i,t + 1} ,\,\) being the excess return. We now follow Epstein and Zin (1989), (1991) in which we have the consumption process at time t, \(C_{t}\), and the recursive utility function:

where 1−α is the coefficient of relative risk aversion and \(\frac{1}{1 - \rho }\) is the elasticity of intertemporal substitution. In this model the agent’s wealth W is defined by:

with \(R_{w,t + 1}\) defined as the return on all invested wealth. We model this return by the following measure which encompasses not only the market return but also is compensated by the growth in earnings and the growth in liquidity. We define this proxy for the return on wealth by:

This idea being that the agent is compensated by not only the market return but also by increases in earnings and liquidity. Let \(\Delta c_{t + 1} : = \ln \left( {\frac{{C_{t + 1} }}{{C_{t} }}} \right),\) and under this utility assumption Mehra (2012), and Epstein and Zin (1991), demonstrate that the pricing kernel is given by:

Using the Taylor series approximation for \(e^{x}\) centered at 0 and substituting into Eq. (19) we obtain:

This implies that the coefficient of relative risk aversion is given by:

Rewriting also yields the following approximation for \(\rho\):

Appendix 3: Equity premium puzzle inequality

We show details for a closed form expression for the upper bound of the Sharpe-Ratio. We begin with Eq. (19) and bound the expected excess return:

which also uses the fact that \(\frac{1}{{{\rm E}_{t} \left[ {M_{t + 1} } \right]}} = (1 + R_{f} ) > 0.\) This then implies:

If the portfolio also happens to lie on the mean-standard deviation frontier then this inequality becomes an equality. We now compute the right-hand side of Eq. (28) which is also known as the Hansen-Jagannathan bound, Hansen and Jagannathan (1991). We now compute the expectation and the variance of the stochastic discount factor as defined in Eq. (23) by making the following assumptions:

We suppress the t in the expectation for convenience and compute the expected value of M via Eq. (15) is as:

We next compute the variance by again using Eq. (15) to obtain:

Therefore upon substituting Eq. (30) and Eq. (31) we have found that:

Then using the Taylor series for \(e^{x}\) centered at 0 on the exponential function we may approximate to obtain:

as an approximate upper bound on the Sharpe Ratio which we note depends on ETOM and on the consumption process. This we may conclude by returning to Eq. (28) that the following approximation holds:

Appendix 4: Risk-free rate puzzle

We show a closed form expression for the risk -free rate under the following preferences. We follow Epstein and Zin (1989, 1991) and use ETOM as a proxy for the wealth portfolio. This then leads, as before, to the SDF given by:

Since \(1 = {\rm E}_{t} \left[ {M_{t + 1} \cdot (1 + R_{t + 1} )} \right],\) for all returns we may apply this identity to the wealth portfolio ETOM while using the three distributional assumptions made in that of Eq. (29), the log-normal facts from Appendix 1, as well as Munk (2013) to obtain:

Taking logs and then dividing by \(\frac{ - \alpha }{\rho }\) implies that:

We now consider the log of the risk-free rate:

by the bivariate expectation formula given in Appendix 1. Now we use Eq. (37) to write (38) as:

Simplifying further yields:

We have therefore shown that:

Appendix 5: Quadratic polynomial of Table 1

In order to obtain estimates for the EIS, RRA, and UBS given in Table 1 we use Eqs. (9) and (6) in order to compute a quadratic function of ρ that leads to an EIS. Substituting the solutions to this polynomial into Eq. (9) leads us to an RRA and utilizing Eq. (10) a UBS. Here we show that we have at most two solutions to these equations. Empirically, for all our models shown in Table 1, we can restrict the EIS to be positive and thus obtain a unique solution. Define the following for notational simplicity:

Using these definitions Eqs. (9) and (6) become:

Substituting α from Eq. (43) into Eq. (44), some algebra, and the assumptions that \(\rho \ne 0\,and\,\rho \ne 1 - \frac{G}{H},\,\) we obtain the following polynomial equation in ρ:

From this we can use the quadratic formula to find the roots and thus compute the required EIS, RRA, and UBS of Table 1.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Snigaroff, R., Wroblewski, D. Consumption with earnings, liquidity, and market based models. Rev Quant Finan Acc 60, 501–530 (2023). https://doi.org/10.1007/s11156-022-01103-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-022-01103-6