Abstract

A cynosure of the academic literature relating to initial public offerings (IPOs) is the question of why they are “mispriced” so frequently. The large and growing literature addressing this question is evidence as to its intractability. This paper develops a theory of underwriters’ behavior suggesting that they will exploit their private information to minimize the bilateral risks to themselves of firm-commitment IPOs. That minimization may cause them to knowingly underprice the issue. The main result in this paper is based, in part, on the premise that the random character of the investors’ demand for shares in the secondary market, given the spread, is governed by an estimable conditional probability distribution. The underwriters exploit their private knowledge of that probability distribution to influence the number of shares in the offering in such a way as to minimize their expected loss function.

Similar content being viewed by others

Notes

On December 8, 2011, the New York State Appellate Division, First Department, held in EBC I, Inc. v Goldman Sachs & Co. that Goldman Sachs & Co., the lead underwriter for the IPO of common stock by EBC I, Inc., formerly known as eToys, Inc., was not eToys’ fiduciary. NY Slip Op. 08839.

“A fiduciary relationship exists between two persons when one of them is under a duty to act for or give advice for the benefit of another upon matters within the scope of the relation.” Restatement [Second] of Torts § 874, Comment a.

The New York Court’s decision did nothing to change the law that underwriters can be held criminally and/or civilly liable if they engage in acts of fraud or if they make factual misrepresentations or if they conceal significant and relevant facts.

The court’s asymmetric reasoning regarding the underwriters’ risk and incentive(s) is mirrored by similar reasoning found in the finance literature. For example, Chen and Mohan (2002) stated: “We contend that underwriter spread may represent an explicit pricing of risk for an IPO issue and we find that it is significantly correlated with underpricing, which represents an implicit pricing of risk.” That statement recognizes only one source of underwriting risk. Similar opinions are expressed in other publications of the same or later vintage. See Jones and Yeoman (2011).

A special characteristic of H-shares is that they are shares of companies incorporated in China, but are also listed abroad.

The underwriters’ gross spread is usually expressed as a percentage discount of the offering price; e.g. P i is 95 % of P o .

This paper does not address underwriting of IPOs which are fully subscribed ab initio. In those kinds of IPOs all uncertainty is eliminated. Sherman (2005) states that those fully-subscribed IPOs have increased worldwide since the early 1990s.

There have been extensive studies of the effect of public and private information on the offer price. In addition to the study by Benveniste and Spindt (1989) cited in the text, see Bradley and Jordan (2002), Edelen and Kadlac (2005), Hanley (1993), Loughran and Ritter (2002) and Lowry and Schwert (2002).

The paper by Zhang (2012) makes the same assumption as to the endogeneity of the size of the IPO. That paper expressly assumes the absence of financial intermediation. Zhang’s assumption vitiates the verisimilitude of his theory.

Adams et al. (2008) comments that the practitioners’ idiom describes the nominal loss as the “haircut” taken by the underwriters.

The mean of the Poisson distribution in the example is arbitrary.

Technically, the plaintiff was the Official Committee of Unsecured Creditors of eToys, Inc., a bankrupt internet start-up company that was incorporated in 1996. By order of the United States Bankruptcy Court for the District of Delaware, plaintiff was granted standing as a representative of eToys' bankruptcy estate and authorized to prosecute any litigation claim on behalf of eToys and the estate.

The general formula for the differentiation of an integral of a function with respect to a parameter, when the limits are also functions of the parameter, is stated below.

If \(\varphi \left( \alpha \right) = \mathop \int \limits_{a}^{b} g\left( {x, \alpha } \right)dx,\) where a and b are functions of \(\alpha\), and if some general restrictions are placed on \(g(x, \alpha )\) and \(\partial g(x, \alpha )/\partial \alpha\), then

\(\frac{d\varphi (\alpha )}{d\alpha } = \mathop \int \limits_{a}^{b} \frac{\partial }{\partial \alpha }\left[ {g(x, \alpha } \right]dx + g\left( {b,\alpha } \right)\frac{db}{d\alpha } - g(a, \alpha )\frac{da}{d\alpha }\)

References

Adams M, Thornton B, Hall G (2008) IPO pricing phenomena: empirical evidence of behavioral biases. J Bus Econ Res 6(4):35–59

Bae SC, Levy H (1990) The valuation of firm commitment underwriting contracts for seasoned new equity issues: theory and evidence. Financ Manage 19(2):48–59

Balvers RJ, Affleck-Gravesd J, Miller RE, Scanlon K (1993) The underpricing of initial public offerings: a theoretical and empirical reconstruction of the adverse selection hypothesis. Rev Quant Financ Acc 3:221–239

Baron D (1982) A model of the demand for investment banking advising and distribution services for new issues. J Finance 37:955–976

Baron DP, Holstrom B (1980) The investment banking contract for new issues under asymmetric information: delegation and the incentive problem. J Finance XXXV(5):27–55

Benveniste LM, Spindt P (1989) Information externalities and the role of underwriters in primary equity markets. J Financ Intermed 1(1):61–86

Bradley DJ, Jordan BD (2002) Partial adjustment to public information and IPO underpricing. J Financ Quant Anal 37:595–616

Chen CR, Monahan NJ (2002) Underwriter spread, underwriter reputation, and ipo underpricing: a simultaneous equation analysis. J Bus Finance Acc 29(1–4):101–129

Chen H-C, Fok RCW, Kang S-H (2010) Issuers’ incentives and tests of Baron’s model of IPO underpricing. Rev Quant Financ Acc 35:71–87

Chong TT-L, Yuan S, Yan IK-M (2010) An examination of the underpricing of H-share IPOs in Hong Kong. Rev Pac Basin Financ Mark Polic 13(4):559–582

Coffee JC, Sale H (2009) Securities regulation: cases and materials. The fixed price offering and resale price maintenance, 11th edn. Foundation Press, St. Paul, MN, p 87

Edelen RM, Kadlec GB (2005) Issuer surplus and the partial adjustment of IPO prices to public information. J Financ Econ 77:347–373

Fleuriet Michel (2008) Investment banking explained: an insider’s guide to the industry. McGraw-Hill, New York 102

Guo Re-Jin (2005) Information collecting and IPO underpricing. Rev Quant Financ Acc 25:5–19

Habib MA, Ljungqvist AP (2001) Underpricing and entrepreneurial wealth losses in IPOs: theory and evidence. Rev Financ Stud 14(2):69–84

Hanley KW (1993) The underpricing of initial public offerings and the partial adjustment phenomenon. J Financ Econ 34:231–250

Ibbotson RG (1975) Price performance of common stock new issues. J Financ Econ 2(3):235–272

Ibbotson RG, Jaffe JF (1975) Hot issue markets. J Finance 30(4):1027–1042

Jones SL, Yeoman JC (2011) The risk of setting a fixed-offer price and underpricing from the perspective of book-building underwriters and best-efforts issuers. http://ssrn.com/abstract=1780330

Loughran T, Ritter JR (2002) Why don’t issuers get upset about leaving money on the table in IPOs? Rev Financ Stud 15:413–444

Lowry M, Schwert GW (2002) Is the IPO pricing process efficient? J Financ Econ 71:3–26

Nguyen H, Dimovski W, Brooks R (2010) Underpricing, risk management, hot issue and crowding out effects: evidence from the Australian resources sector initial public offerings. Rev Pac Basin Financ Mark Polic 134(3):333–361

Ritter JR (1991) The long-run performance of initial public offerings. J Finance 46(1):3–27

Rock K (1986) Why new issues are underpriced. J Financ Econ 15:187–212

Sherman AG (2005) Global trends in IPO methods: book building versus auctions with endogenous entry. J Financ Econ 78:615–649

Zhang F (2012) Information precision and IPO pricing. J Corp Financ 18:31–348

Acknowledgments

The author gratefully acknowledges the trenchant criticisms and suggestions offered by Aron Gottesman, Edward Shea and John Teall. Any errors are exclusively the responsibility of the author.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Define the symbol θ 1 to represent the underwriters’ spread earned on each share sold at the offering price: \(\theta_{1} = P_{o} - P_{i}\).

Define the symbol θ 2 to represent the loss per share, if any, incurred by the underwriters for each share sold in the secondary market expected to be at a price below the price paid to the issuer \(\theta_{2} = P_{i} - \bar{P}\).

I assume that the members of the syndicate estimate fixed values of the two parameters θ 1 and θ 2. The expected loss function can be rewritten as:

The expected loss in (13) is minimized for the numerical value of S that satisfies the equality \(\frac{dE[L]}{dS} = 0\) and the inequality \(\frac{{d^{2} }}{{dS^{2} }}E\left[ L \right] > 0\).

Expression 13 can be decomposed into four integral functions:

Applying the well-known formula for the differentiation of a definite integral with respect to a parameter, we have the resultFootnote 14:

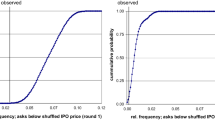

Expression 15 is simply a weighted sum of the dichotomized cumulative distribution function of f(X | P o ). Thus, by the law of total probability, \(\mathop \int \limits_{S}^{\infty } f\left( {X|P_{o} } \right)dX + \mathop \int \limits_{0}^{S} f\left( {X|P_{o} } \right)dX = 1\). The equality allows the substitution \(\mathop \int \limits_{S}^{\infty } f\left( {X|P_{o} } \right)dX = 1 - \mathop \int \limits_{0}^{S} f\left( {X|P_{o} } \right)dX\) into expression 15. The result is:

\(\frac{dE\left[ L \right]}{dS}\) is equal to zero when

The definitions of θ 1 and θ 2 imply \(\theta_{1} + \theta_{2} = P_{o} - \bar{P}\). Substituting these into Eq. 17 produces the result in the body of the text.

Appendix 2

Equation 17 can be written as:

Taking the partial derivative of Eq. 18 with respect to θ 1 results in the following inequality:

An increase in θ 1 is equivalent to an increase in the underwriting discount. If the price paid by the syndicate to the issuer is fixed and the syndicate has the contractual right to set the offering price, then we have the result:

The result in 20 proves Corollary 1.

Calculating the partial derivative of Eq. 18 with respect to θ 2 results in:

For a fixed value of the offer price, an increase in θ 2 is equivalent to a decrease in the conditional price expected in the public market if the issue is overpriced. Thus we infer that a decrease in the price expected in the after-market is associated with a decrease in the numerical value of the cdf governing the demand for shares in the market. If the underwriters’ gross spread is fixed, and if the underwriters expect the issue to be overpriced, the optimal numbers of shares in the offering will likewise diminish. This result proves Corollary 2.

Rights and permissions

About this article

Cite this article

Mantell, E.H. A theory of underwriters’ risk management in a firm-commitment initial public offering. Rev Quant Finan Acc 46, 179–193 (2016). https://doi.org/10.1007/s11156-014-0466-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0466-0